- Business School, Hohai University, Nanjing, China

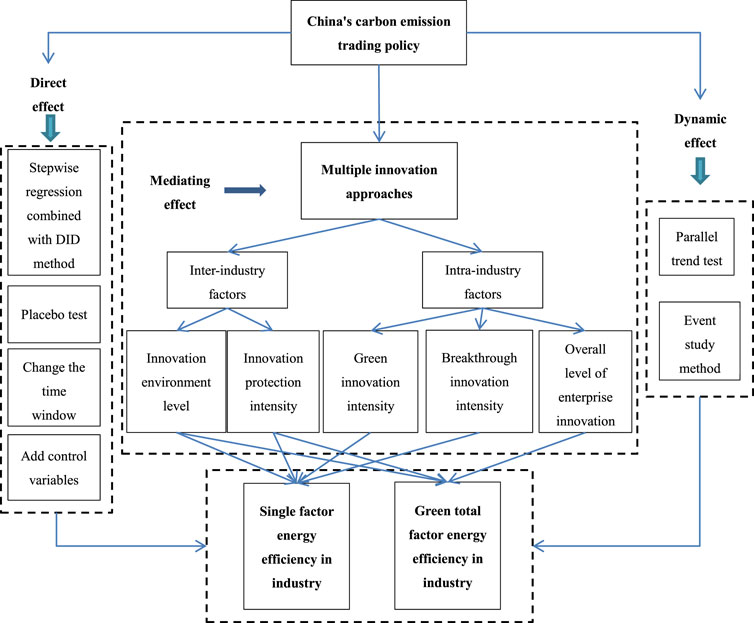

Under the “dual carbon” background, carbon emission trading policy, as an important means of environmental regulation for energy conservation, emission reduction and green development, has a very important impact on energy efficiency. We take China’s pilot carbon trading policy, which began in 2013, as an example, and the energy efficiency of industrial enterprises from 2008 to 2019 as a study sample. In this paper, the single factor industrial energy efficiency (ISE) and the green total factor industrial energy efficiency (IGTE) in China are both included in the influence category of carbon emission trading. The SUPER-EBM method is used to measure IGTE. The direct effects of carbon emission trading policy on the two types of industrial energy efficiency are investigated by Difference-in-difference model combined with stepwise regression method. The dynamic effects are studied by event study method. In order to verify how the “Porter effect” plays a role in this process, this paper examines the influence paths of five important innovation-related intermediate mechanisms. The study find that after a series of robustness tests, such as parallel trend test, placebo test, changing the time window frame and adding control variables, carbon emission trading policy significantly improved the two energy efficiency. The effect of carbon trading policy gradually increased and reached its maximum in the fifth year, but then began to decline. Under multiple innovation approaches, innovation environment level and innovation protection intensity can significantly improve the two energy efficiency. Green innovation intensity and breakthrough innovation intensity improved ISE. The overall level of enterprise innovation improved IGTE. Heterogeneity analysis shows that carbon trading policy has a greater impact on the eastern region, but a smaller impact on the central and western regions. This paper provides differentiated policy inspiration for the overall promotion of China’s national carbon market in the future.

Introduction

Energy efficiency is the key research problem of harmonious development of economy and environment at home and abroad. In recent years, air pollution issues represented by haze and global warming are gradually coming into people’s view and getting wide attention. As a large energy consumer, the negative impact of industrial sector on the atmospheric environment cannot be ignored. The fifth Plenary Session of the 18th Communist Party of China (CPC) Central Committee clearly proposed that during the 13th Five-Year Plan period, the development concept of “innovation, coordination, green, open and sharing” should be implemented, and the road of sustainable development should be taken in the construction process of new industrialization. In 2020, China set a “dual carbon” goal, making green and low-carbon the main theme of China’s energy development. From the perspective of micro market players, the “double carbon” target is conducive to the green and low-carbon transformation of industrial enterprises and new development opportunities of related green industries, and plays an important role in promoting the high-quality development of China’s economy.

Carbon emission trading policy is an important environmental regulation tool for industrial carbon emissions under the background of “double carbon”. From the theory of property right, the root of market failure lies in property right failure. Carbon emission is a negative public good with externality and exclusivity. Spontaneous price mechanism cannot solve the external dis-economic problem of environmental pollution generated in the process of economic activities. Carbon emission trading policy comes into being for the government to solve this problem. Carbon trading can internalize the external costs of environmental pollution by clarifying property rights, and make carbon emissions become non-public goods. The industrial power sector accounts for more than half of the carbon reductions in the carbon trading system. Potential emerging markets will lead investment into green and low-carbon sectors. As an important means of market incentive, carbon emission trading policy will trigger the “Porter effect” to play multiple roles. It can dynamically adjust the carbon emission pricing, promote industrial enterprises to actively carry out technological innovation and industrial transformation, promote the society to improve the regional innovation environment, and formulate diversified innovation protection measures to improve the overall energy utilization efficiency of industrial enterprises.

China’s carbon emission trading pilot policy covers most industrial enterprises. Its goal is to deal with climate change and environmental problems through market mechanism, improve comprehensive energy efficiency by promoting energy-saving and emission reduction activities of high-carbon emission enterprises, and finally achieve the ultimate goal of reducing greenhouse gas emissions. Carbon emission trading, as an environmental regulation means, encourages industrial enterprises to pursue economic benefits while actively improving the ability of rational allocation of various resources. It not only encourages industrial enterprises to actively save energy in the production process, but also encourages them to continuously improve the production level and service level through technological innovation, so as to improve the final value of the overall economic output. Thus, the single factor energy efficiency of industrial enterprises is improved.

In the process of carbon emission trading policy actively improving industrial enterprises’ ability to rationally allocate resources, industrial enterprises will not only pay attention to energy saving and increasing industrial economic output, but also strive to improve their total factor productivity under the impetus of the overall “green development consciousness” of the society. They will not only pay attention to energy use and management, but also pay attention to internal total factor management. It includes improving the overall quality of employees, making efficient use of all kinds of capital input, constantly improving environmental awareness, and actively reducing all kinds of environmental pollutants to avoid the risk of environmental regulation policies, thus improving the green total factor energy efficiency of industrial enterprises from both the input and output ends.

This paper mainly studies the influence mechanism of carbon emission trading policy on industrial energy efficiency and the multiple innovation intermediate mechanism between them. This paper can provide a theoretical basis for the economic management of government departments and industrial enterprises, such as energy saving and emission reduction, improving economic and environmental performance.

This paper defines two kinds of industrial energy efficiency, both of which have very important theoretical research value. At the same time, many scholars (You and Gao, 2013; Shi and Li, 2020; Chen et al., 2021; Gao and Teng, 2022) realized the importance of incorporating the two energy efficiency into the same research category, and conducted a comparative study on single-factor energy efficiency and green total factor energy efficiency, which is beneficial to government departments to formulate targeted energy efficiency control policies according to the evaluation of different energy efficiency indicators. However, there are few researches specifically on the energy utilization efficiency of industrial enterprises.

Industrial single factor energy Efficiency (ISE) is designed in this paper, which represents the energy consumption intensity of enterprises. As a traditional and representative index used to measure the energy use efficiency of enterprises, it is usually applied by scholars in various academic researches on energy efficiency. At the same time, this index has been widely used in national statistics and production practice, and is also an important indicator basis for the government to formulate energy policies. It is often regarded as a binding indicator for the government to save energy and reduce consumption. Industrial single factor energy efficiency can directly reflect the relationship between energy consumption and economic output of industrial enterprises without considering environmental factors and other factors, which has very important economic and statistical significance. The other is industrial green total factor energy efficiency (IGTE) (considering industrial capital, manpower, energy, environment and economic factors at the same time). This paper calculates through the SUPER-EBM model, which combines a variety of inputs and environmental negative output, and has a very important impact on the sustainable economic development of industrial enterprises and a country or region.

At the same time, this paper includes industrial single factor energy efficiency and industrial green total factor energy efficiency into the impact analysis of carbon emission trading, so as to study the heterogeneity of China’s carbon emission trading mechanism on them. Five important and different intermediate innovation mechanisms, including innovation environment level, innovation protection intensity, green innovation intensity, breakthrough innovation intensity and overall enterprise innovation level, are fully considered.

This paper expands the research on the intermediate channels through which the carbon emission trading scheme exerts institutional dividends, and expounds the role of “Porter effect” in this process. This paper makes up for the shortcomings of the existing literature on the multiple impact mechanisms of carbon emission trading on industrial energy efficiency.

At present, China’s national carbon market has been carried out. The research content of this paper will provide policy enlightenment for the comprehensive promotion of China’s national carbon market in the future. In addition, the research content and conclusions of this paper can also be used as the basis to discuss the future system design and development trend of China’s carbon emission trading. This paper can promote China to establish a typical representative with Chinese characteristics in the world carbon emission trading market, and provide practical reference for the design and long-term development of carbon emission trading system in other countries.

Literature review

Carbon emission trading policy has a wide range of impacts on the macro economy and society and micro enterprise subjects. There are many arguments about the effect of carbon emission trading on various research objects, such as “suppression theory”, “promotion theory” and “nonlinearity theory”. According to the research object, the relevant Frontier literature is mainly divided into four aspects: macro economy, environmental governance, micro enterprise technology innovation, production and operation activities.

The impact of carbon emission trading policy on macroeconomic activities

The impact of carbon emission trading on macroeconomic activities is a hot topic in academic research. Scholars have found that carbon emission trading has different effects on employment, income equality and operation efficiency of different industries.

In terms of the impact on population employment, Yu and Li (2021) found that the carbon emission trading policy had produced certain employment dividends, with the total effect reaching 11.5%. With the passage of time, the effect on employment also gradually increased, and the employment effect of carbon trading policy in different regions was different. In terms of the impact on urban income, Yu et al. (2021) found that the implementation of carbon emission trading was conducive to reducing the income inequality between urban and rural areas, and the reduction effect reached 8.11%, which remained long-term. Meanwhile, for regions with different CO2 emission levels and per capita gross domestic product (GDP) levels, the impact of carbon trading on income inequality was different.

There are many researches on the influence of different industries, mainly focusing on the field of energy consumption industry. Scholars have studied the positive effects of carbon trading market on fossil energy market (Nie et al., 2021; Jiang et al., 2022a), non-fossil energy industry (Liu J. Y et al., 2021) and steel industry (Duan et al., 2021).

In other areas of economic activities, scholars found that the carbon trading price distortion would seriously affect the effect of the carbon trading market, which would have a negative impact on the economic benefits, environmental benefits and policy acceptance of the carbon trading market (Wu, 2021). In addition, the current economic environment in China lacked immediate investment in carbon capture, utilization and storage projects (CCUS), but the introduction of carbon trading mechanism would significantly improve the potential value of such projects (Lin and Tan, 2021).

The effect of carbon emission trading policy on environmental governance

The impact of carbon emission trading on environmental governance is another hot topic in academic research. The research content is relatively rich, mainly focusing on the governance effects and governance channels of various environmental pollutants.

Among them, the most researches are on the effect and channels of carbon dioxide emission (CO2) reduction. Xia et al. (2021), for example, found that carbon trading policies significantly reduced the carbon emissions of land use in pilot areas. This mechanism occurred through the intermediate effect of energy structure. Wang et al. (2021) found that carbon trading policies significantly reduced regional carbon emissions. The mediating mechanism included adjusting energy consumption structure and promoting technological innovation level. Chen and Lin (2021) verified the role of carbon trading scheme in promoting energy conservation and emission reduction. Peng et al. (2021) found that the carbon trading mechanism would lead to the simultaneous reduction of carbon emission and emission intensity. The reduction of carbon emissions was due to the improvement of energy efficiency. Tang et al. (2021) found that the pilot carbon trading policy effectively reduced the carbon emissions of pilot industries. The intermediate mechanism of emission reduction was the adjustment of industrial structure and the promotion of technological innovation. Zhang et al. (2021) found that carbon trading policy significantly improved regional green development efficiency and regional carbon equality. The intermediate mechanism was to increase green total factor productivity (GTFP) and reduce investment in carbon-intensive industries. Shen et al. (2021) found that the implementation of carbon trading was conducive to regional sustainable development. At the same time, the improvement of carbon productivity could be promoted by controlling the improvement of environmental governance intensity. Wu and Zhu (2021) found that the carbon trading mechanism significantly promoted the process of carbon peaking.

In addition to the major industrial environmental pollutants such as carbon dioxide, in terms of the treatment effect of other environmental pollutants, scholars have found that carbon emission trading policies can reduce sulfur dioxide (SO2) (Kou et al., 2022), particulate matter 2.5 (PM2.5) (Liu B et al., 2021), and achieve collaborative emission reduction of CO2 and SO2 (Wu et al., 2021). It could also promote coordinated emission reductions of CO2 and other atmospheric pollutants including nitrogen oxides (NOX), Dust pollutants (Dust) (Li et al., 2021; Jiang et al., 2022b).

Some other scholars found that the regional porter effect of carbon emission trading was not stimulated (Nie et al., 2021), but caused the marginal CO2 emission reduction cost in the pilot region to fluctuate up (Duan et al., 2021).

The impact of carbon emission trading policy on technological innovation of enterprises

In terms of the impact of carbon emission trading on enterprise technological innovation, most studies support the “facilitation theory”, acknowledge the role of “porter effect”, and analyze various intermediate channels and heterogeneity of carbon emission trading in promoting enterprise technological innovation (Cai and Ye, 2022; Qi et al., 2021; Tan and Lin, 2022; Fang and Ma, 2021; Liu J. Y et al., 2021).

In addition, a few representative scholars of the “inhibition theory”, such as Chen et al. (2021), found that in China’s current carbon trading market, carbon trading policy significantly reduced the proportion of green patents, and the reduction effect was as high as 9.26%. Porter’s hypothesis had not been realized. At the same time, this effect of inhibiting enterprises’ green innovation had obvious lag effect, and enterprises were mainly choosing to reduce output to achieve emission reduction targets.

The impact of carbon emission trading policy on production and operation activities of enterprises

In terms of the impact of carbon emission trading on enterprise’ production and business activities, relevant studies mainly involve enterprise investment and financing, operation process, production efficiency and comprehensive competitiveness.

In terms of enterprise investment and financing activities, Zhang and Wang (2021) found that the carbon trading policy significantly reduced the investment expenditure of enterprises covered by the carbon trading policy, and the reduction ratio reached 0.2449%.

In terms of enterprise operation process, Liao et al. (2021) found that a modest increase in environmental rigor could increase the overall efficiency of a firm’s production by more than 50 percent. Luo et al. (2021) found that the carbon trading policy in Guangdong had a positive impact on the competitiveness of enterprises in the power industry. Che et al. (2021) found that under the effect of carbon trading mechanism, the carbon emission reduction level of manufacturers was inversely proportional to the relevant price, and the profits and market demand of the two channels increased in tandem with the emission reduction.

In terms of enterprise production efficiency, Cao et al. (2021) found that the carbon emission trading system had no effect on the change of coal-fired efficiency of regulated coal-fired power plants. Chen et al. (2021) found that carbon emission trading policies can significantly improve energy efficiency, including single-factor energy efficiency and all-factor energy efficiency. Yang et al. (2021) found that the carbon emission trading scheme’s role in improving the green production performance (GPP) of all provinces will increase over time. Li et al. (2022) found that in the short term, carbon trading policy would not immediately promote the improvement of green total factor productivity (GTFP), but had a significant and positive impact on the technological progress effect decomposed by it.

Deficiencies of existing literature and our contribution

By summarizing the existing literature, we find that its shortcomings mainly lie in the following aspects: There is no literature on the impact of carbon emission trading on industrial energy utilization efficiency. Existing efficiency measurement tools are limited to traditional stochastic Frontier method (with strong subjectivity) or SBM model, super-SBM model, etc. (ignoring non-radial slack variables). It fails to clearly define industrial single factor energy efficiency and industrial green total factor energy efficiency, to distinguish the differences between them, and to distinguish the heterogeneous impact of carbon emissions trading on them. It does not reflect how the carbon emission trading system plays a role in improving the two types of industrial energy efficiency through the intermediate mechanism of important multiple innovation factors inside and outside the industry.

Based on the above analysis, the contribution of this paper mainly lies in:

(1) Innovation in the research field.

In the research field of energy efficiency, there are few researches on China’s industrial energy efficiency, but the importance of energy efficiency of industrial enterprises as large energy consumers is beyond doubt. In this regard, based on the data of industrial enterprises in China, this paper clearly defines the industrial single factor energy efficiency and the industrial green total factor energy efficiency for the first time, and constructs an index framework for the green total factor energy efficiency of China’s industrial industry from the perspective of green development, which comprehensively considers various inputs and outputs, including important factors such as resource utilization, economic output and various environmental pollution. In addition, in the research field of carbon emission trading, this paper makes up the research gap in the impact of carbon emission trading policy on industrial energy efficiency.

(2) Innovation of research methods.

For the first time in this paper, the SUPER-EBM model, which has more advantages than other efficiency evaluation models, is applied to measure industrial green total factor energy efficiency. This method overcomes the defect that the traditional SBM model neglects the non-radial relaxation variables, and the efficiency measure is more scientific and effective. At the same time, this paper includes two kinds of industrial energy efficiency into the same analysis category, through the advantages of the stepwise regression method combined with the Bootstrap method which can deal with complex intermediary effects, to study the heterogeneity of the carbon emission trading mechanism on the two.

(3) In the depth of the research topic.

This paper further studies five important innovation-related intermediate mechanisms with different characteristics, including innovation environment level, innovation protection intensity, green innovation intensity, breakthrough innovation intensity and corporate overall innovation level, in the process of carbon emission trading policy’s influence on the two industrial energy efficiency. This paper expands the research on the intermediate channels through which the carbon emission trading scheme exerts institutional dividends, expounds how the “porter effect” plays a role in this process. It makes up for the lack of existing studies on the mechanism of multiple intermediate effects of carbon emission trading on industrial energy efficiency.

Theoretical analysis and research hypothesis

The impact of carbon emission trading on industrial energy efficiency

China’s carbon emission trading pilot policy covers most industrial enterprises. Its goal is to deal with climate change and environmental problems through market mechanism, improve comprehensive energy utilization efficiency by promoting energy-saving and emission reduction activities of high-carbon emission enterprises, and finally achieve the ultimate goal of reducing greenhouse gas emissions. Carbon emission trading, as an environmental regulation means, encourages industrial enterprises to pursue economic benefits while actively improving the ability of rational allocation of various resources. It not only encourages industrial enterprises to actively save energy in the production process, but also encourages them to continuously improve the production level and service level through technological innovation, so as to improve the final value of the overall economic output. Thus, the single factor energy efficiency of industrial enterprises is improved. In the process of carbon emission trading policy actively improving industrial enterprises’ ability to rationally allocate resources, industrial enterprises will not only pay attention to energy saving and increasing industrial economic output, but also strive to improve their total factor productivity under the impetus of the overall “green development consciousness” of the society. They will not only pay attention to energy use and management, but also pay attention to internal total factor management. It includes improving the overall quality of employees, making efficient use of all kinds of capital input, constantly improving environmental awareness, and actively reducing all kinds of environmental pollutants to avoid the risk of environmental regulation policies, thus improving the green total factor energy efficiency of industrial enterprises from both the input and output ends.

As the carbon emission trading policy is an important environmental regulation tool of government departments, the implementation of the policy needs to go through the process of question raising, plan consultation, policy experiment, experimental feedback, policy adjustment, etc., which takes a long time. Government departments also need to adjust the policies again according to the practical feedback of the actual carbon emission reduction of industrial enterprises in policy practice, revise the previous unreasonable policy settings, and introduce new supplementary policies in terms of the social impact not taken into account, such as raising the threshold of carbon emission trading for large industrial areas. New emission control industry categories should be added, models and illegal trading behaviors in various carbon markets should be distinguished, and corresponding incentives and punishments should be formulated to encourage all emission reduction subjects to better play their initiative, and carbon emission trading policies in each region should better adapt to regional characteristics and play a role in carbon emission reduction. Therefore, the effect of carbon emission trading policy on improving the two industrial energy efficiency may have a certain lag.

In view of this, this paper proposes:

Hypothesis 1: Carbon emission trading policy promotes the improvement of industrial energy utilization efficiency, but its effect has a certain lag.

The impact mechanism of carbon emission trading on industrial energy efficiency under multiple innovation approaches

In the literature review of this paper, most of the scholars of “promotion theory” put forward the mediating role of technological innovation in the process of positive impact of carbon trading on macro or micro subjects, and believe that carbon emission trading can achieve economic growth and improve comprehensive production efficiency of enterprises through technological innovation. Based on industrial theory, this paper considers five important innovation-related intermediate mechanisms and distinguishes important factors inside and outside the industry, including the level of innovation environment, the intensity of innovation protection, the intensity of green innovation, the intensity of breakthrough innovation and the overall innovation level of enterprises. The former belongs to the external environment and institutional factors of technological innovation, while the latter belongs to the internal technological innovation ability and overall efficiency factors of the micro enterprise. The infrastructure, market environment, labor quality, financial environment and entrepreneurial level of a region constitute the innovation environment. The optimization of innovation environment can promote industrial enterprises to have external driving force for innovation. The improvement of intellectual property protection will help industrial enterprises to use a sound legal system to further promote innovation. With the implementation of the concept of green development, industrial enterprises are more aware of the importance of green and low-carbon cycle technology. The government guide funds into green and low-carbon industries through policy means, which improves the risk and return expectation of industrial enterprises’ innovation, urges enterprises to develop more green technologies, improve the level of technological innovation, carry out breakthrough technological innovation, and improve the comprehensive innovation ability of enterprises. In order to obtain higher profits, industrial enterprises with higher energy utilization efficiency can bid and trade the excess carbon quota in the carbon trading market to obtain additional profits, which will promote industrial enterprises to carry out the next round of technological innovation to improve energy utilization efficiency. In view of this, this paper proposes:

In view of this, this paper proposes:

Hypothesis 2: Carbon emission trading policy promotes the improvement of industrial energy efficiency through the improvement of inter-industrial factors, including the level of innovation environment and the intensity of innovation protection.

Hypothesis 3: Carbon emission trading policy promotes the improvement of industrial energy efficiency through the improvement of intra-industry factors including green innovation intensity, breakthrough innovation intensity and overall innovation level of enterprises.

The logical structure diagram for this article is shown in Figure 1.

Study design and data sources

Super-EBM model

Traditional DEA models are divided into radial DEA model and non-radial DEA model. BBC, CCR (radial model), SBM (non-radial model) are widely used. However, the radial DEA model only considers the proportional changes of input or output variables when reporting the efficiency score, but ignores the non-radial relaxation variables, and lacks the consideration of the non-expected output indicators. The non-radial DEA model, such as SBM model, ignores the radial proportional relationship between the original input or output value and the target value, although the non-expected output index and the non-radial relaxation variable are added. Both of them have obvious defects, which will lead to bias in the evaluation results. For this reason, Tone and Tsutsui (2010) proposed a new DEA model, which can combine radial and non-radial distances to comprehensively measure production efficiency, giving full play to the advantages of the two models, and can include unexpected output variables. Because ε parameter is used in the model, it is called Epsilon-based Measure.

The general definition of EBM model defined by input orientation is as follows:

In (1), γ* is the optimal solution for the measured industrial energy efficiency value. θ is the radial efficiency value. X、Y、λ、

In this paper, the advantages of EBM model and Super-efficiency model are combined and applied, which is integrated into SUPER-EBM model. In the measurement process of industrial energy efficiency, each province is regarded as a DMU unit. In this paper, the input index (industrial fixed capital stock, industrial employment number, industrial energy input), undesired output (comprehensive pollution index calculated by five kinds of industrial environmental pollutants) and expected output index (industrial economic development level) are equally assigned. The Frontier efficiency with efficiency value greater than one can be further distinguished, and the industrial energy efficiency can be evaluated more scientifically and accurately. Based on the effectiveness of this model, it has been widely promoted in the measurement of economic efficiency in recent years (Sun et al., 2020; Li et al., 2021).

The Super-EBM model based on undesired super-efficiency is defined as follows:

In formula (2),

Difference-in-difference model

Difference-in-difference method (DID) is a classic policy effect evaluation method. This paper uses the difference-in-difference model to study the impact of China’s carbon emission trading policy on industrial energy efficiency. As the seven carbon emission trading pilots correspond to six provinces, six experimental groups and 24 control groups are set in the model. The experimental group is the carbon trading pilot region, including Beijing, Shanghai, Chongqing, Guangdong, Tianjin and Hubei. The model Settings are as follows:

Where,

Data source

The main research object of this paper is industrial energy efficiency. This paper defines two kinds of industrial energy efficiency innovatively. One is industrial single factor energy efficiency (ISE), which is expressed by the ratio of industrial gross output value to industrial energy consumption. The other is the industrial green total factor energy efficiency (IGTE). In terms of the selection of component indicators, this paper selects the industrial fixed capital stock, the number of industrial employment at the end of the year, and the total amount of industrial energy consumption as the input variables. At the same time, five major industrial environmental pollutants are selected as the adverse output, including carbon dioxide emissions, sulfur dioxide emissions, industrial smoke (powder) dust emissions, industrial waste water emissions, industrial solid waste production. In addition, industrial regional GDP is selected as the expected output. The carbon dioxide emissions are calculated according to the calculation method of carbon dioxide emissions in IPCC Guidelines for National Greenhouse Gas Emission Inventory 2006. Since the industrial enterprises covered by China’s carbon emission trading policy are those with high emissions and large space for emission reduction and have reached a certain scale, we use the data of industrial enterprises above the scale.

In terms of control variables, we refer to scholars and select variables closely related to industrial energy efficiency (Xiong et al., 2019; MacDonald et al., 2020; Liu et al., 2019; Zhao et al., 2020; Liu B et al., 2020). The governance structure (GOV), measured by the ratio of total assets of state-owned holding industrial enterprises to total assets of industrial enterprises. A high ratio means that the region is dominated by administrative governance, while a low one means that the region is dominated by economic governance. Industrial structure (IS), measured by the ratio of the added value of the secondary industry to the gross regional product, represents the overall regional industrial structure. The degree of opening-up (OPE), measured by the ratio of foreign direct investment to regional GDP, represents the degree of openness of regional economy. Policy support (PS), measured by the ratio of fiscal expenditure to regional GDP, represents the support degree of local finance to economic development. Carbon dioxide emissions, measured by the region’s overall carbon dioxide emissions, represent the region’s overall pollution level.

All data relating to prices are adjusted from the year 2000. Data sources mainly include China Labor Statistics Yearbook, China Statistical Yearbook, China Urban Statistical Yearbook, China Energy Statistical Yearbook and statistical yearbook of various provinces. In view of the availability of data, our research interval is from 2008 to 2019. Before 2008, there are many missing data of industrial enterprises above designated size. However, the launch of China’s national carbon market after 2020 has a great impact on the pilot carbon trading market in 2013. The research area is 30 provinces of China (Tibet, Hong Kong, Macao and Taiwan are not included in the sample due to the lack of data).

Empirical results

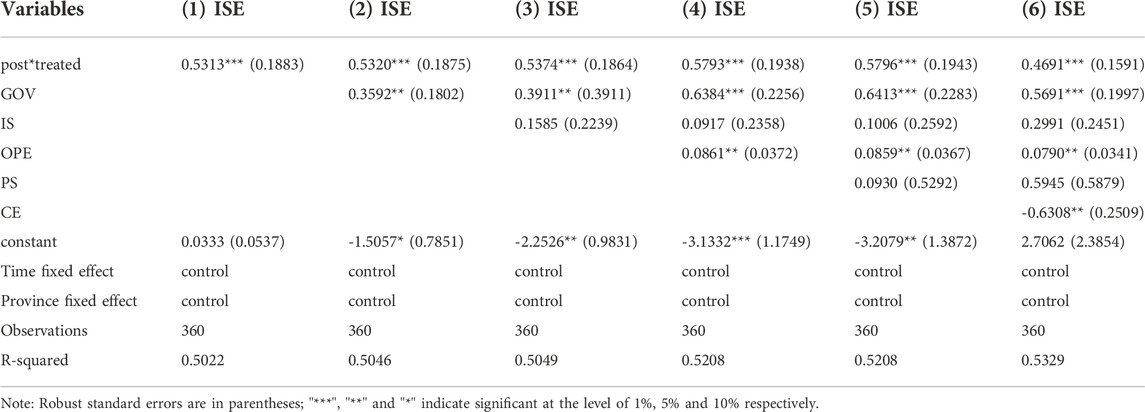

Result of DID method combined with stepwise regression method

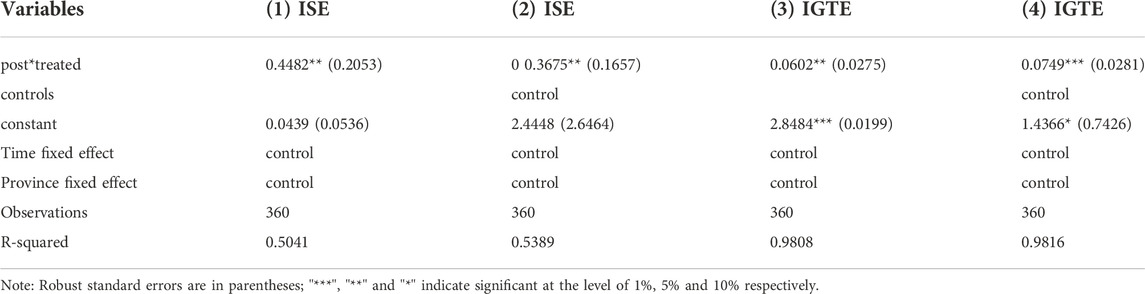

In this study, a bidirectional fixed effect model was adopted to improve the overall fit and robustness of the model by using the DID method combined with stepwise regression method, and the baseline regression of ETS policy on the two types of industrial energy efficiency was analyzed. Table 1 and Table 2 show the regression results. Columns 1) to 6) list the results without control variables, and then gradually add control variables such as governance structure (GOV), industrial structure (IS), openness (OPE), policy support (PS), and CARBON dioxide emissions (CE). It can be seen that the coefficients of the main explanatory variable (treated*time) are positive regardless of whether control variables are added, and they all pass the significance test. It shows that the two types of industrial energy efficiency improved significantly and steadily by carbon emission right exchange. In the process of gradually increasing the control variables, the direction of the coefficient of the control variables does not change, and the value of R-squared of the model keeps increasing, indicating that the fitting degree of the model is increasing and the explanatory ability of the model is gradually improving.

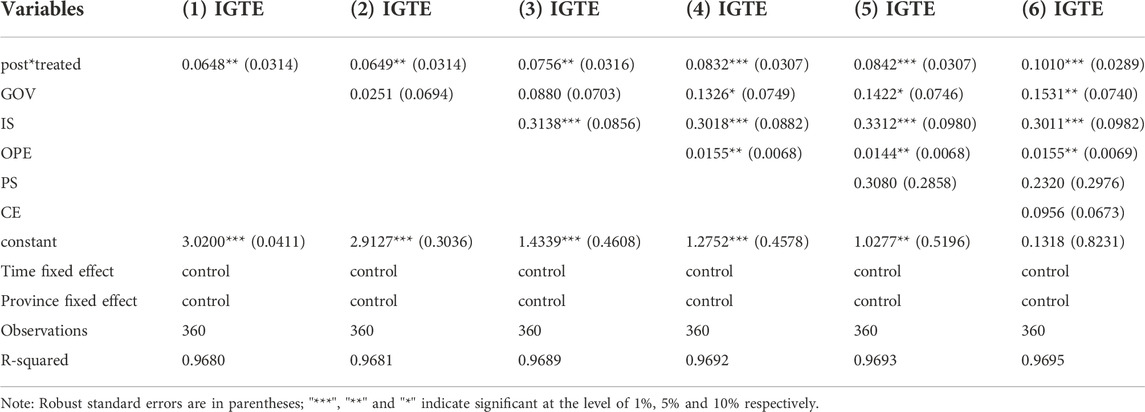

Dynamic effect analysis

The results of baseline regression show the average effect of carbon emission trading policy on the two types of industrial energy efficiency. In order to further investigate the difference of impacts of carbon trading policies on pilot areas in different periods, this paper analyzes the dynamic effects of carbon emission trading policies by referring to the event research method of scholars (Li et al., 2016). The model is set as follows:

Among them, the year 2013 is the base period of carbon emission trading pilot.

Table 3 shows the dynamic effect results of each period after the implementation of carbon emission trading policy. The test results of dynamic effects without control variables are listed in (1) and 3 of Table 3, and the test results of dynamic effects with control variables are listed in 2) and 4) of Table 3. The fitting degree of the model is significantly improved after the addition of control variables. On the whole, with the implementation of the carbon emission trading policy, the estimated coefficients of two types of industrial energy efficiency began to become significant and gradually increased from 2014. It shows that carbon emission trading policy, as a typical market-oriented means of environmental regulation, has a lag effect on industrial energy efficiency due to the aftereffect of scientific research and development. However, as the total amount of carbon emissions trading increases year by year, the market influence of carbon trading policy is gradually expanding, and its promoting effect on industrial energy efficiency is increasing year by year. According to the test results of the addition of control variables, for ISE, the effect of carbon trading policy began to be significant from 2017, the fourth year after the implementation of the policy, and reached the maximum in 2018, the fifth year, but then the significant effect decreased. For IGTE, the effect of carbon trading policy began to be gradually significant from 2014, the first year after the implementation of the policy, and reached the maximum in 2018, the fifth year, but then the significant effect became insignificant.

After the implementation of the pilot carbon trading policy, China attached great importance to green development and had launched various environmental assessment indicators to support green development. For example, the Ministry of Industry and Information Technology of China had launched the Implementation Plan of the Special Action on Industrial Energy Conservation and Green Development in 2013, which had a great impact on the social economy. Each carbon trading pilot area began to pay more attention to the improvement of green energy efficiency including environmental factors, which made the industrial green total factor energy efficiency improve faster, while the industrial single factor energy efficiency paid less attention, resulting in a slower improvement speed. Therefore, the dynamic effects of carbon emission trading policy on the two kind of industrial energy efficiency will also be different.

Based on the above analysis, Hypothesis 1 is verified.

Robustness test

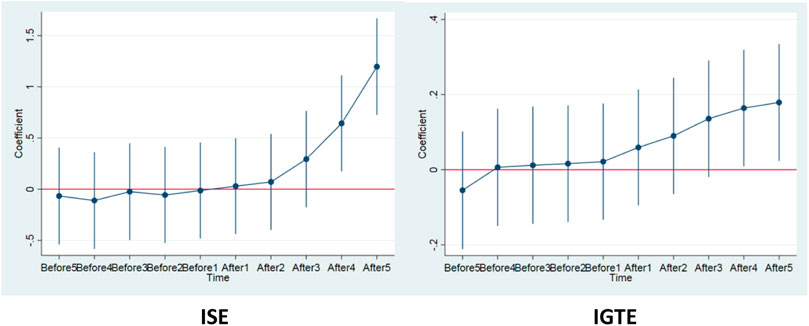

Parallel trend test

To satisfy the assumption of parallel trend is an important prerequisite for using the DID model. Only when the development trend of the experimental group and the control group is sufficiently similar before the implementation of the policy, can we ensure that the result estimated by the DID model is the causal effect of the carbon trading policy. We use the regression equation of event study method to test the parallel trend hypothesis, and use STATA software to show the test results, as shown in Figure 2.

According to the results of our parallel trend chart, at the policy time point in 2013, China’s pilot carbon trading policy did not immediately improve ISE or IGTE, which is because China’s pilot carbon trading policy is not perfect, and the effect of policy implementation lags behind. However, in each period after the implementation of the policy, this enhancement effect is gradually very significant, indicating that the carbon trading policy has a significant positive processing effect on ISE and IGTE.

It can be seen that the coefficients of dummy variables in both ISE and IGTE before the implementation of carbon trading policy have no significant difference with 0 in each phase of Before5, Before4, Before3, Before2 and Before1. In each period after the implementation of the policy, the coefficient of the dummy variable in each period keeps increasing and is gradually greater than 0, which is significant at the level of 1% or 5%. The results show that carbon trading policy has a significant positive effect on both types of industrial energy use efficiency, indicating that the DID meets the parallel trend hypothesis.

Placebo test

If in all kinds of fictional situation, the coefficients of the estimated dummy variables in the regression results are still significant, it shows that the results of the estimation error. The change of our explained variable industrial energy efficiency may not be influenced by carbon trading policies, but by other policies or random factors.

The method of placebo test in this paper is to randomly select six provinces out of 30 provinces as virtual experimental group, assume that these six provinces are carbon trading pilot, and the remaining 24 provinces as virtual control group for regression analysis. Next, we conducted 500 repetitions of the two types of industrial energy efficiency respectively, and obtained the corresponding 500 regression results. The result contains the estimated coefficient, standard error, and p-value of the dummy variable. Most estimates have p-values greater than 0.1 (indicating that they are not significant at the 10% level). This indicates that the estimated results of our carbon emission trading policy have a small probability of being obtained by chance, and are not affected by other policies or other random factors.

Change the time window width

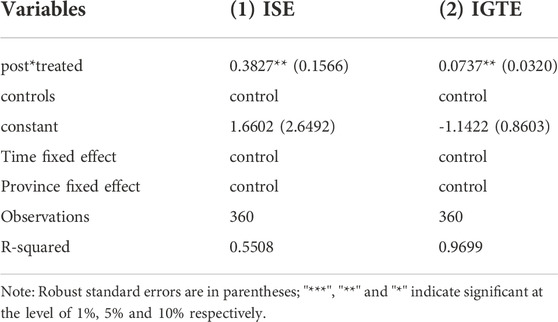

In this paper, the baseline regression interval of carbon trading policy on industrial energy efficiency is from 2008 to 2019. In order to prove the robustness of the conclusion, the time interval is shortened to 2010-2018. The regression results are shown in Table 4. The results show that the coefficient of post*treated is still significant regardless of the addition of control variables, indicating that the empirical results are robust.

Add control variables

We further verify the robustness of the test results of the basic regression equation by adding control variables. We added three control variables, including regional wealth level (PG), population density (PD) and pollution control level (PR), related to industrial energy efficiency. In this paper, the ratio of regional GDP to total population represents the wealth level (PG). The ratio of permanent population to the total land area of a region represents population density (PD). The ratio of investment in industrial pollution control to gross regional product represents the pollution control level (PR). As can be seen from the test results in Table 5, after the addition of three control variables, the coefficient of post*treated of the key explanatory variable under the two models is significantly positive at the 5% level, indicating that the model results are robust.

Analysis of heterogeneity

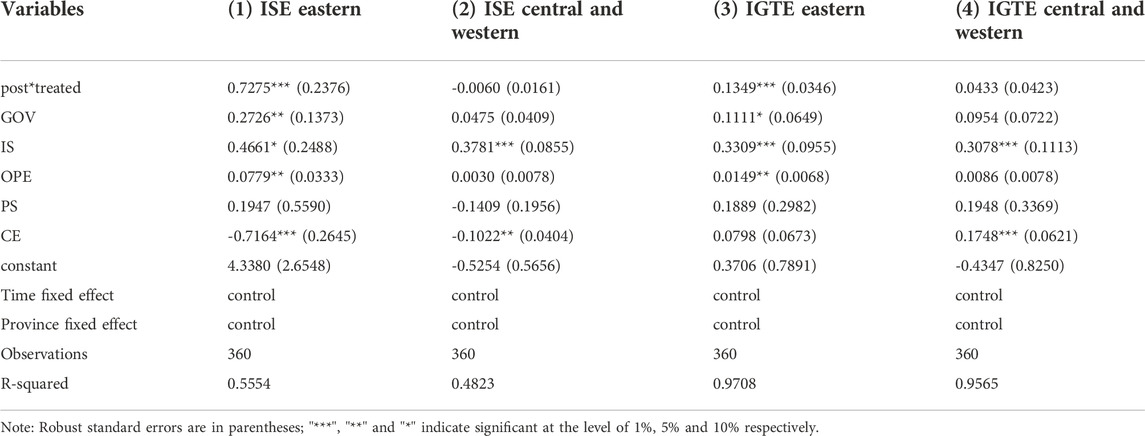

China’s first seven carbon emission trading pilot projects are located in different regions, each with different natural endowments and economic and social environments, as well as different carbon trading system designs, carbon quota allocation methods and industrial sectors. Therefore, the effect mode and extent of carbon emission trading policy on industrial energy efficiency in different pilot regions are also very different. According to the classification standards of the National Bureau of Statistics, China can be divided into three regions: eastern, central and western. Of the seven carbon trading pilot cities, Beijing, Shanghai, Guangdong and Tianjin are in the eastern region. Hubei and Chongqing belong to the central and western regions. The economic development level of the eastern region is obviously higher than that of the central and western regions. In view of this, this paper further investigates the difference of the impact of carbon emission trading policies on the two types of industrial energy efficiency in different regions. The results are shown in Table 6.

According to the empirical results of regional heterogeneity analysis in Table 6, DID coefficients in columns 1) and 3) of Table 6 are significantly positive, while DID coefficients in columns 2) and 4) of Table 6 are not significant. This shows that the carbon trading pilot policy has a greater impact on the two types of industrial energy efficiency in the eastern region, but a smaller impact on the central and western regions. In terms of natural endowments of energy and other resources, the eastern region is relatively scarce, while the central and western regions are relatively rich, increasing from east to west. In terms of economic development, economic benefits, science and technology, and management level, the eastern region is higher and the western region is lower, decreasing from east to west. How does technological innovation play a role in the “Porter effect” of carbon emission trading policy on industrial energy efficiency in each region? Is the driving force of technological innovation derived from the improvement of innovation institutional environment between industries or the improvement of technological innovation level of industrial enterprises within industries? The next part analyzes the influence mechanism of multiple technological innovation approaches.

Influence mechanism analysis under multiple innovation approaches

The DID regression results show that the carbon emission trading policy does improve the two types of industrial energy efficiency. In this policy process, how does the innovation mechanism play a role? Does the Porter effect exist? Based on industry theory, we consider five important innovation-related intermediates. To distinguish the important factors inside and outside the industry, these mechanisms include inter-industry elements including innovation environment level (IE) and innovation protection intensity (IP), and intra-industry elements including green innovation intensity (GI), breakthrough innovation intensity (BI) and overall enterprise innovation level (OI).

The purpose of mediation effect analysis is to study the specific process in which independent variable X affects dependent variable Y, how the mediation variable works, and whether the relationship between X and Y is partly or entirely attributable to the mediation variable. This study takes carbon emission trading as independent variable, two industrial energy efficiency as dependent variable, and five innovation-related intermediate mechanisms as intermediate variables.

The classic mediating effect model, namely stepwise regression combined with Sobel test (Baron and Kenny, 1986). The stepwise regression method can be divided into three steps to detect the mediation effect. The first step is to detect the influence of carbon emission trading on industrial energy efficiency and test whether the regression coefficient

Where,

However, the above methods are not applicable to the case of complex mediation effects. When there are multiple mediating variables in this study, the Bootstrap method should be used to address complex mediating effects (Preacher and Hayes, 2008). This method can analyze the mediating effect of all the simultaneous multiple mediating variables, and is suitable for medium and small samples. This method can study the effect of a single mediating variable, decompose it into direct effect and indirect effect, and compare the size and significant difference of different mediating effects simultaneously. According to the above process, we tested the mediating effect of five innovation mechanisms.

Test of intermediate influence mechanism: Innovation environment and innovation protection

First, we examine the process of the intermediate mechanism of two innovation factors (innovation environment and innovation protection intensity) between industries.

Among them, the level of innovation environment (IE) comes from the Evaluation Report of China’s Regional Innovation Capability written by China Science and Technology Development Strategy Research Group, which measures the ability of a region to provide the corresponding environment for the generation, flow and application of technology. The factors include innovation infrastructure, market environment, quality of workers, financial environment and entrepreneurship level.

Innovation protection intensity (IP) is the product of regional intellectual property protection level and regional law enforcement intensity. This paper refers to the research of Wei and Wu (2018), in which, the level of regional intellectual property protection adopts five categories of indicators, including coverage of intellectual property protection, membership of international treaties, the degree of protection for loss of rights, the severity of law enforcement measures, and duration of intellectual property protection. The five indexes can be further divided into 17 secondary indexes. We assign scores to the second-level indicators. If those that meet the conditions are given a score of 1, and those that do not meet the conditions are given a score of 0. Then, comprehensive scoring method is adopted to measure the level of intellectual property protection in each region. The intensity of enforcement in each region is calculated by calculating the arithmetic average of the proportion of lawyers, the rate of patent infringement cases being settled and the rate of patents not being infringed. Data sources are collected and sorted out by the Ministry of Justice, provincial justice departments, Chinese Social Statistics Yearbook and Guotai Junan database.

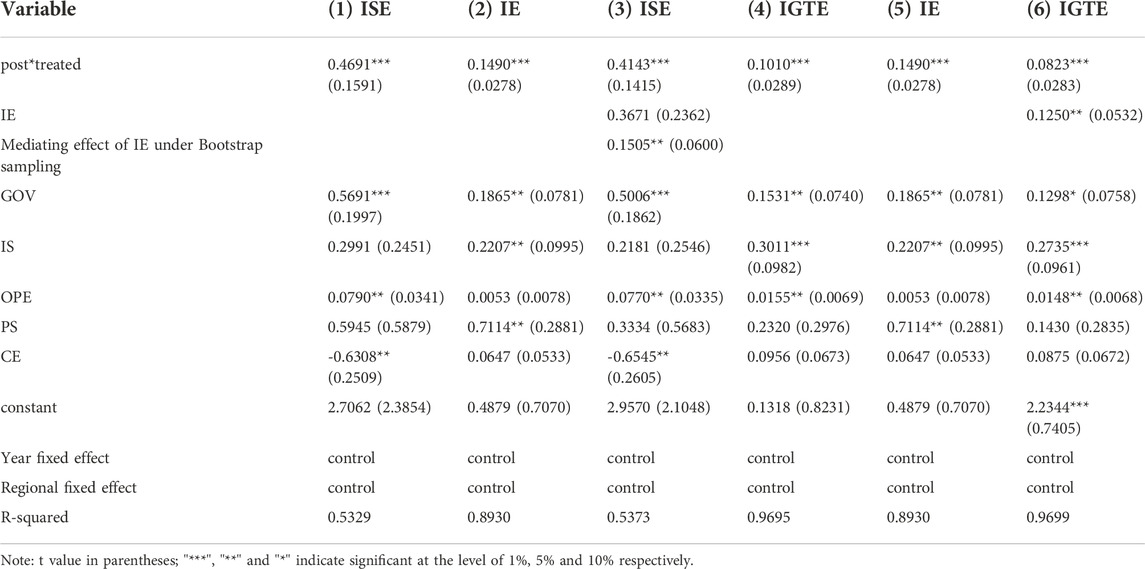

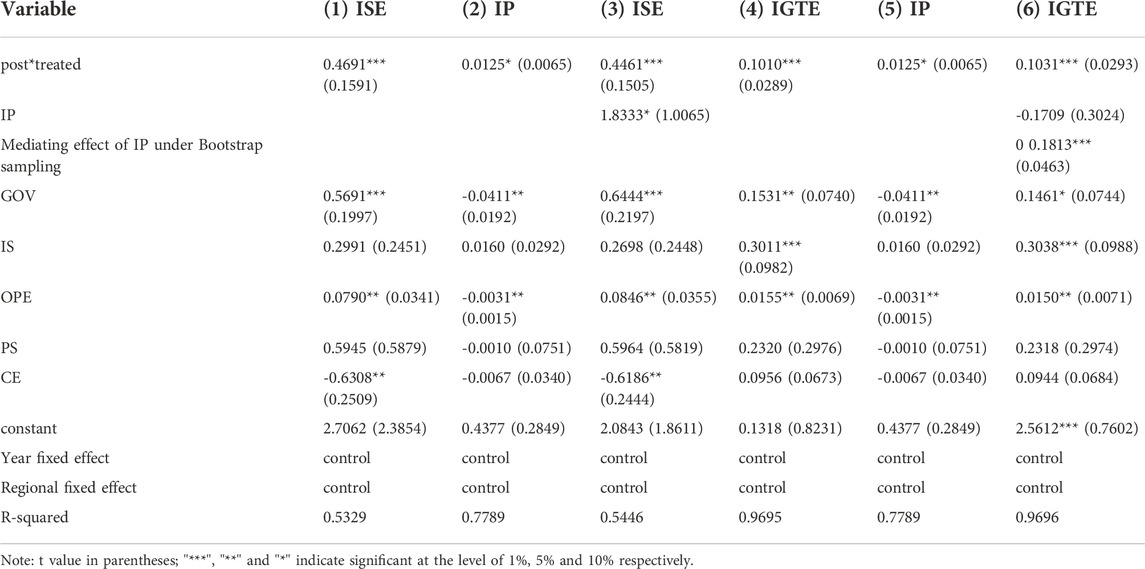

Table 7 (1)–6) shows the testing process and results of the mediating effect of innovation environment level. For ISE, the test results of stepwise regression method show that the mediating effect of innovation environment is not significant. In order to further verify whether the innovation environment has a mediating effect on the impact of carbon emission trading policy on ISE, Bootstrap sampling method is used to further test. Bootstrap sampling show that the indirect effect of the mediating variable of innovation environment is 0.1505 and significant at the level of 5%. It shows that the mediating variable innovation environment has a mediating effect on the impact of carbon emission trading policy on ISE. As for IGTE, the test results of stepwise regression method show that the mediating effect of innovation environment on the influence of carbon emission trading policy on IGTE is 0.1250, which is significant at 5% level. It shows that carbon emission trading policy can improve ISE and IGTE through the improvement of innovation environment. Strengthening the regional innovation infrastructure, optimizing the market environment, improving the quality of workers, cultivating a good financial environment and enhancing the level of regional entrepreneurship are all conducive to the ultimate realization of this intermediary path.

Table 8 (1)–6) shows the testing process and results of the mediating effect of innovation protection intensity. For ISE, the test results under stepwise regression method show that the mediating effect of innovation protection intensity on the influence of carbon emission trading policy on ISE is 1.8333 and significant. For IGTE, stepwise regression test results show that the mediating effect of innovation protection intensity is not significant. In order to further verify whether the intensity of innovation protection has a mediating effect on the impact of carbon emission trading policy on IGTE, Bootstrap sampling method is used for further test. Bootstrap sampling show that the indirect effect of the mediating variable of innovation protection intensity is 0.1813 and significant at 1% level. It shows that the mediating variable of innovation protection intensity has a mediating effect on the influence of carbon emission trading policy on IGTE. It shows that carbon emission trading policy can improve ISE and IGTE by improving the protection intensity of innovation. Strengthening the level of regional intellectual property protection and the intensity of regional law enforcement are conducive to the ultimate realization of this intermediary path.

Innovation environment and innovation protection are external institutional conditions for enterprise innovation. Government departments’ support and construction of regional innovation system are conducive to the long-term development of industrial enterprises, and can promote industrial enterprises to carry out technological innovation activities with external motivation through technological protection means and favorable market environment, thus playing a significant intermediary role in the process of carbon trading to improve industrial energy efficiency.

Based on the above analysis, Hypothesis 2 is verified.

Intermediate influence mechanism test: Green innovation intensity, breakthrough innovation intensity, overall innovation level of enterprises

Then, we examine the action process of the intermediate mechanism of three innovation factors within the industry, including green innovation intensity (GI), breakthrough innovation intensity (BI) and the overall innovation level of the enterprise (OI).

Green innovation intensity is expressed by the ratio of the number of green patent applications to the total number of patent applications. For the collection of green patent data, this paper identifies the international patent classification number of each domestic patent according to the Green List of International Patent Classification. The list of green patents was launched by the World Intellectual Property Organization (WIPO) in 2010 and generated according to the standards for green patents set by the United Nations Framework Convention on Climate Change. It mainly includes seven categories: Transportation, Waste Management, Energy Conservation, Alternative Energy Production, Administrative Regulatory or Design Aspects, Agriculture or Forestry and Nuclear Power Generation.

The intensity of breakthrough innovation is expressed as the ratio of the number of invention patent applications to the total number of patent applications. In this paper, patent application data are divided into invention patent, utility model patent and appearance patent. Invention patent represents the core innovation capability of an enterprise, and its innovation is higher than the latter. Patent data come from the State Intellectual Property Office of the People’s Republic of China.

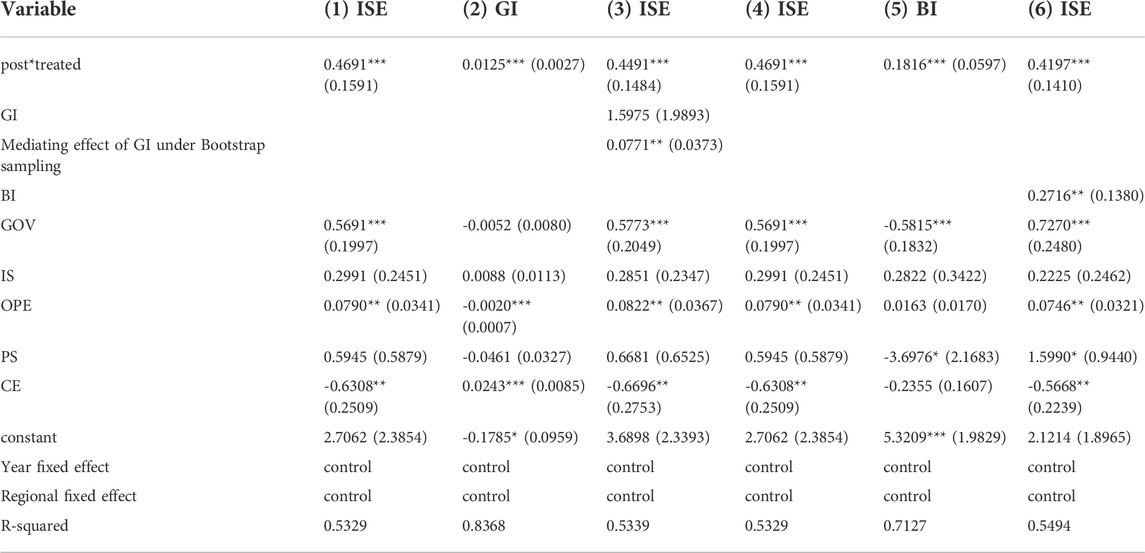

Table 9 (1)–6) shows the testing process and results of the mediating effect of green innovation intensity and breakthrough innovation intensity. The role of these two intermediary mechanisms is mainly reflected in the influence of carbon emission trading policies on ISE. As for the intensity of green innovation, the test results under the stepwise regression method show that the mediating effect of green innovation intensity is not significant. In order to further verify whether the intensity of green innovation has a mediating effect in the impact of carbon emission trading policy on ISE, Bootstrap sampling method is used for further test. Bootstrap sampling method showed that the indirect effect of the mediating variable of green innovation intensity was 0.0771 and significant at the level of 5%. The results indicate that green innovation intensity has a mediating effect on the impact of carbon emission trading policy on ISE. As for breakthrough innovation intensity, the test results of stepwise regression method show that the mediating effect of breakthrough innovation intensity on the impact of carbon emission trading policy on ISE is 0.2716, and it is significant at 5% level. It shows that carbon emission trading policy can improve ISE through the improvement of green innovation intensity and breakthrough innovation intensity. Provinces should pay attention to two important dimensions of technological innovation of enterprises in the region, namely, through the dual promotion path of green innovation and invention patent, which is conducive to the “Porter effect” of technological innovation.

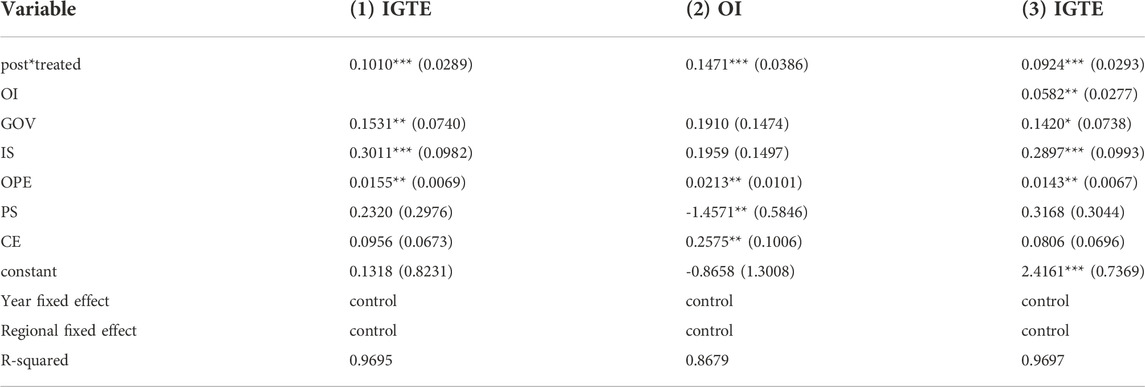

Table 10 (1)–3) shows the testing process and results of the mediating effect of the overall innovation level of enterprises. For IGTE, the test results under the stepwise regression method show that the mediating effect of the overall innovation level of enterprises on the influence of carbon emission trading policy on IGTE is 0.0582, which is significant at the level of 5%. It shows that the overall innovation level of enterprises has a mediating effect on the influence of carbon emission trading policy on IGTE. It shows that the carbon emission trading policy can improve IGTE through the improvement of the overall innovation level of enterprises. It is beneficial to the final realization of this intermediary path to comprehensively strengthen the ability of enterprises in the region to apply new knowledge, develop new technology, utilize new technology and manufacture new products, increase the investment of enterprises in research and development, pay attention to the training of comprehensive design ability, technology improvement ability and actively develop new products.

Three kinds of innovation factors (enterprise green innovation intensity, enterprise breakthrough innovation intensity, enterprise overall innovation level) represent the three kinds of internal innovation capability of industrial enterprises. With the “awakening of green consciousness” in China, the government has issued more green policies and provided better funding for innovation. All these conditions promote industrial enterprises to increase the proportion of green innovation and high-quality invention patents, and improve the internal innovation motivation and overall innovation level of enterprises, and create more advantageous energy saving and emission reduction technologies. Finally, these factors promote the overall improvement of industrial energy efficiency.

Based on the above analysis, Hypothesis 3 is verified.

Conclusion and recommendations

In this paper, industrial single factor energy efficiency and industrial green total factor energy efficiency are included in the same analysis category. The SUPER-EBM method is used to measure IGTE. Based on the data of 30 provinces in China from 2008 to 2019, the direct effects of carbon emission trading policies on the two types of industrial energy efficiency are investigated by using the DID method combined with the stepwise regression method, and the dynamic effects are studied by the event study method. To examine how the “Porter effect” plays a role in this process, this paper examines the influence paths of five important innovation-related intermediates within and outside the industry. The study found that after a series of robustness tests, such as parallel trend test, placebo test, changing the time window frame and adding control variables, carbon emission trading policies significantly improved the two types of industrial energy efficiency. The effect of carbon trading policies gradually increased and reached its maximum in the fifth year, but then began to decline. Under multiple innovation approaches, innovation environment level and innovation protection intensity can significantly improve the two types of industrial energy efficiency. Green innovation intensity and breakthrough innovation intensity improved ISE. The overall level of enterprise innovation has improved IGTE. Heterogeneity analysis shows that carbon trading policy has a greater impact on the eastern region, but a smaller impact on the central and western regions.

Based on the above conclusions, the following policy recommendations are put forward.

(1) Regional governments should have the values of sustainable development in the process of industrial energy development and formulate corresponding assessment and supervision indicators. We should not only promote the improvement of industrial single-factor energy efficiency, but also actively promote green values and strive to improve industrial green total factor energy efficiency. Provinces that have achieved high industrial energy efficiency can actively exert the “benchmarking effect” and publicize the energy-saving and emission reduction technologies and internal management methods of outstanding industrial enterprises by setting up examples. We can combine excellent government experience in carbon trading management to strengthen regional exchanges and interactions and drive the overall improvement of energy efficiency in other provinces.

(2) Government departments need to make efforts to improve the laws and regulations and the overall operation mechanism of the carbon trading market. We need to continue to strengthen the supervision of industrial sectors with high emissions. At the same time, we need to expand the coverage of carbon trading on the basis of the regions and sectors covered by carbon trading during the pilot period, and use the price mechanism to activate the carbon market and increase the overall trading volume of industrial enterprises. The government also needs to consider the different industrial energy efficiency comprehensively when setting regulatory targets. In addition, it is necessary to actively improve the efficiency of the implementation of carbon trading policies. We can promote the timely role of carbon trading policies in promoting industrial energy efficiency by establishing the feedback and communication mechanism of the government and improving the specialization level and technical capacity of policymakers.

(3) In the process of making carbon trading policies, the government needs to fully consider the differences between regions. It can set the inclusion types of carbon trading industries and the entry thresholds of carbon trading enterprises in different regions by combining the resource endowment conditions and the differences in energy utilization efficiency in different regions. At the same time, industrial enterprises also need to start from their own internal conditions, take full account of the two different components of energy efficiency, and make efforts from the input and output end to optimize the allocation of internal resources, improve the utilization efficiency of internal factors and improve economic output capacity and environmental awareness. It is necessary to actively use green technology to reduce environmental pollution while pursuing profit improvement, so as to ultimately improve the comprehensive energy utilization efficiency of industrial enterprises.

(4) In terms of the external innovation intermediary mechanism of carbon trading on the energy efficiency of industrial enterprises, we need to actively create an external economic and social environment conducive to enterprise innovation, and pay attention to the comprehensive construction of innovation infrastructure, market environment, labor quality, financial environment, entrepreneurial level and other aspects. It is necessary to enhance the whole society’s awareness of intellectual property protection, and protect intellectual property rights through relevant laws and national judicial and administrative enforcement, and strictly stop and crack down on a series of behaviors that infringe intellectual property rights. It is necessary to protect trade secrets, safeguard the legitimate rights and interests of intellectual property inventors, improve the quality and efficiency of intellectual property examination, introduce a punitive compensation system, and significantly raise the cost of violating the law. Thus, people are more willing to improve industrial energy efficiency through technological innovation.

(5) In terms of the internal innovation intermediary mechanism of carbon trading on the energy efficiency of industrial enterprises, we need to give full play to the role of carbon market in controlling greenhouse gas emissions, promoting green and low-carbon technological innovation of industrial enterprises, and guiding climate investment and financing. The role of market mechanisms should be strengthened to guide investment into the green and low-carbon sectors of enterprises through the huge market potential. It is necessary to expand enterprises’ strong demand for energy saving and emission reduction technologies through carbon trading policies and market incentives, and promote enterprises’ green innovation and breakthrough innovation to actively carry out industrial transformation. On the other hand, from the perspective of the components of an enterprise’s overall innovation capability, it is helpful to improve the efficiency of industrial green total factor energy utilization by focusing on the overall improvement of the enterprise’s research and development investment, design capability, technology upgrading capability and new product sales revenue.

The limitation of this paper is that only five types of innovative intermediate mechanisms are considered in the study of the intermediate mechanisms of China’s pilot carbon market policy on industrial energy efficiency, but other intermediate mechanisms are not considered.

Future research directions are as follows: After 2020, China has launched a national carbon emission trading market. Based on China’s national carbon emission trading market data, the impact of national carbon emission trading policy on the industrial energy efficiency can be studied in the future, and other intermediate mechanisms between the two can be further studied.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

JL: Propose research ideas and methods, Data collection and collation, Empirical analysis, Paper writing and verify papers. DH: Supervision.

Funding

This work was supported by Major Project of National Social Science Foundation of China. Research on the Coordinated Development and Security Strategy of Water-Energy-Food in China under Green Development, 19ZDA084.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Andersen, P., and Petersen, N. C. (1993). A procedure for ranking efficient units in data envelopment analysis. Manag. Sci. 39 (10), 1261–1264. doi:10.1287/mnsc.39.10.1261

Baron, R. M., and Kenny, D. A. (1986). The moderator–mediator variable distinction in social psychological research: Conceptual, strategic, and statistical considerations. J. personality Soc. Psychol. 51 (6), 1173–1182. doi:10.1037/0022-3514.51.6.1173

Cao, J., Ho, M. S., Ma, R., and Teng, F. (2021). When carbon emission trading meets a regulated industry: Evidence from the electricity sector of China. J. Public Econ. 200, 104470. doi:10.1016/j.jpubeco.2021.104470

Chen, Z., Song, P., and Wang, B. (2021). Carbon emissions trading scheme, energy efficiency and rebound effect–Evidence from China's provincial data. Energy Policy 157, 112507. doi:10.1016/j.enpol.2021.112507

Duan, Y., Han, Z., Zhang, H., and Wang, H. (2021). Research on the applicability and impact of CO2 emission reduction policies on China’s steel industry. Int. J. Clim. Chang. Strateg. Manag. 13, 352–374. doi:10.1108/ijccsm-02-2021-0020

Fang, C., and Ma, T. (2021). Technology adoption with carbon emission trading mechanism: Modeling with heterogeneous agents and uncertain carbon price. Ann. Oper. Res. 300 (2), 577–600. doi:10.1007/s10479-019-03297-w

Gao, F. P., and Teng, D. W. (2022). Carbon emission trading system and green total factor energy efficiency. Finance Theory Pract. 02, 60

Jiang, H. D., Liu, L. J., Dong, K., and Fu, Y. W. (2022a). How will sectoral coverage in the carbon trading system affect the total oil consumption in China? A CGE-based analysis. Energy Econ. 110, 105996. doi:10.1016/j.eneco.2022.105996

Jiang, H. D., Purohit, P., Liang, Q. M., Dong, K., and Liu, L. J. (2022b). The cost-benefit comparisons of China's and India's NDCs based on carbon marginal abatement cost curves. Energy Econ. 109, 105946. doi:10.1016/j.eneco.2022.105946

Kou, P., Han, Y., Qi, X., and Li, Y. (2022). Does China's policy of carbon emission trading deliver sulfur dioxide reduction co-benefits? Environ. Dev. Sustain. 24 (5), 6224–6245. doi:10.1007/s10668-021-01699-0

Li, C. Y., Zhang, Y. M., Zhang, S. Q., and Wang, J. M. (2021). Applying the super-EBM model and spatial durbin model to examining total-factor ecological efficiency from a multi-dimensional perspective: Evidence from China. Environ. Sci. Pollut. Res. 29, 2183–2202. doi:10.1007/s11356-021-15770-w

Li, P., Lu, Y., and Wang, J. (2016). Does flattening government improve economic performance? Evidence from China. J. Dev. Econ. 123, 18–37. doi:10.1016/j.jdeveco.2016.07.002

Li, X., Shu, Y., and Jin, X. (2022). Environmental regulation, carbon emissions and green total factor productivity: A case study of China. Environ. Dev. Sustain. 24 (2), 2577–2597. doi:10.1007/s10668-021-01546-2

Liao, H., Li, C., Nie, Y., Tan, J., and Liu, K. (2021). Environmental efficiency assessment for remanufacture of end of life machine and multi-objective optimization under carbon trading mechanism. J. Clean. Prod. 308, 127168. doi:10.1016/j.jclepro.2021.127168

Lin, B., and Tan, Z. (2021). How much impact will low oil price and carbon trading mechanism have on the value of carbon capture utilization and storage (CCUS) project? Analysis based on real option method. J. Clean. Prod. 298, 126768. doi:10.1016/j.jclepro.2021.126768

Liu, B, B., Sun, Z., and Li, H. (2021). Can carbon trading policies promote regional green innovation efficiency? Empirical data from pilot regions in China. Sustainability 13 (5), 2891. doi:10.3390/su13052891

Liu, J. Y, J. Y., Woodward, R. T., and Zhang, Y. J. (2021). Has carbon emissions trading reduced PM2. 5 in China? Environ. Sci. Technol. 55 (10), 6631–6643. doi:10.1021/acs.est.1c00248

Luo, Y., Li, X., Qi, X., and Zhao, D. (2021). The impact of emission trading schemes on firm competitiveness: Evidence of the mediating effects of firm behaviors from the guangdong ETS. J. Environ. Manag. 290, 112633. doi:10.1016/j.jenvman.2021.112633

Nie, D., Li, Y., and Li, X. (2021). Dynamic spillovers and asymmetric spillover effect between the carbon emission trading market, fossil energy market, and new energy stock market in China. Energies 14 (19), 6438. doi:10.3390/en14196438

Peng, H., Qi, S., and Cui, J. (2021). The environmental and economic effects of the carbon emissions trading scheme in China: The role of alternative allowance allocation. Sustain. Prod. Consum. 28, 105–115. doi:10.1016/j.spc.2021.03.031

Preacher, K. J., and Hayes, A. F. (2008). Asymptotic and resampling strategies for assessing and comparing indirect effects in multiple mediator models. Behav. Res. methods 40 (3), 879–891. doi:10.3758/brm.40.3.879

Qi, S. Z., Zhou, C. B., Li, K., and Tang, S. Y. (2021). Influence of a pilot carbon trading policy on enterprises’ low-carbon innovation in China. Clim. Policy 21 (3), 318–336. doi:10.1080/14693062.2020.1864268

Shen, L., Wang, X., Liu, Q., Wang, Y., Lv, L., and Tang, R. (2021). Carbon trading mechanism, low-carbon e-commerce supply chain and sustainable development. Mathematics 9 (15), 1717. doi:10.3390/math9151717

Shi, D., and Li, S. L. (2020). Emission trading system and energy efficiency - Measurement and demonstration of cities at prefecture level and above. Chin. Ind. Econ. 09, 5

Sun, Y., Hou, G., Huang, Z., and Zhong, Y. (2020). Spatial-temporal differences and influencing factors of tourism eco-efficiency in China’s three major urban agglomerations based on the Super-EBM model. Sustainability 12 (10), 4156. doi:10.3390/su12104156

Tan, R., and Lin, B. (2022). The long term effects of carbon trading markets in China: Evidence from energy intensive industries. Sci. Total Environ. 806, 150311. doi:10.1016/j.scitotenv.2021.150311

Tang, K., Zhou, Y., Liang, X., and Zhou, D. (2021). The effectiveness and heterogeneity of carbon emissions trading scheme in China. Environ. Sci. Pollut. Res. 28 (14), 17306–17318. doi:10.1007/s11356-020-12182-0

Tone, K., and Tsutsui, M. (2010). An epsilon-based measure of efficiency in DEA–a third pole of technical efficiency. Eur. J. Operational Res. 207 (3), 1554–1563. doi:10.1016/j.ejor.2010.07.014

Wei, H., and Wu, J. (2018). Intellectual property protection, import trade and innovation of innovation-leading enterprises. Financial Res. 459 (09), 91

Wu, L. (2021). How can carbon trading price distortion be corrected? An empirical study from China’s carbon trading pilot markets. Environ. Sci. Pollut. Res. 28 (46), 66253–66271. doi:10.1007/s11356-021-15524-8

Wu, L., and Zhu, Q. (2021). Impacts of the carbon emission trading system on China’s carbon emission peak: A new data-driven approach. Nat. Hazards (Dordr). 107 (3), 2487–2515. doi:10.1007/s11069-020-04469-9

Wu, Q., Tambunlertchai, K., and Pornchaiwiseskul, P. (2021). Examining the impact and influencing channels of carbon emission trading pilot markets in China. Sustainability 13 (10), 5664. doi:10.3390/su13105664

Yang, L., Li, Y., and Liu, H. (2021). Did carbon trade improve green production performance? Evidence from China. Energy Econ. 96, 105185. doi:10.1016/j.eneco.2021.105185

You, J. H., and Gao, Z. G. (2013). An empirical study on the impact of government environmental regulation on energy efficiency: A case study of xinjiang. Resour. Sci. 6, 99

Yu, D. J., and Li, J. (2021). Evaluating the employment effect of China’s carbon emission trading policy: Based on the perspective of spatial spillover. J. Clean. Prod. 292, 126052. doi:10.1016/j.jclepro.2021.126052

Yu, F., Xiao, D., and Chang, M. S. (2021). The impact of carbon emission trading schemes on urban-rural income inequality in China: A multi-period difference-in-differences method. Energy Policy 159, 112652. doi:10.1016/j.enpol.2021.112652

Zhang, S., Wang, Y., Hao, Y., and Liu, Z. (2021). Shooting two hawks with one arrow: Could China's emission trading scheme promote green development efficiency and regional carbon equality? Energy Econ. 101, 105412. doi:10.1016/j.eneco.2021.105412

Keywords: carbon emission trading, multiple innovation approaches, industrial energy efficiency, super-EBM, difference-in-difference model

Citation: Li J and Huang D (2023) The impact mechanism of China’s carbon emission trading policy on industrial energy efficiency under multiple innovation approaches. Front. Energy Res. 10:1000429. doi: 10.3389/fenrg.2022.1000429

Received: 22 July 2022; Accepted: 16 November 2022;

Published: 18 January 2023.

Edited by:

Alberto-Jesus Perea-Moreno, University of Cordoba, SpainReviewed by:

Hong-Dian Jiang, China University of Geosciences, ChinaWei Shao, Zhejiang University of Finance and Economics, China

Copyright © 2023 Li and Huang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jinqiu Li, MTgwMjEzMTIwMDA1QGhodS5lZHUuY24=

Jinqiu Li

Jinqiu Li Dechun Huang

Dechun Huang