- School of Foreign Languages, Zhejiang University of Finance and Economics, Hangzhou, China

Industrial enterprises are the core subjects to reduce carbon emissions. Their innovations for low-carbon production are the key to determine the effect of carbon emission reduction. This paper examines the impact of executive experience, especially the overseas experience, on enterprise innovations across 3559 enterprises in low-carbon, medium-carbon and high-carbon industries respectively. Interestingly, it shows that the executive experience has only played a significant role in enterprise innovations of high-carbon industrial enterprises, indicating that the executive’s international vision might help to promote innovation in high-carbon industry. Then, it’s also discovered that there is a mediating effect of international strategy which helps to better understand the impact mechanism of executive experience on enterprise innovation in high-carbon industry.

1 Introduction

Industrial enterprises, especially high-carbon enterprises, are the main source of carbon emissions (Ren et al., 2021). To achieve independent emission reduction target, controlling carbon emissions of industrial enterprises is the top priority. The innovation on low-carbon production is the key factor to determine the low-carbon behavior and emission reduction effect of enterprises (Chen et al., 2020). Extensive literature has examined a mass of impact factors of enterprise innovations (Aghion et al., 2013; Acharya and Xu, 2017; Bronzini and Piselli, 2017; Zhang et al., 2020). Among them, executive experience and enterprise internationalization strategies may have particular roles in explaining the enterprise innovation, which may also be different across enterprises in high-carbon industry and low-carbon industry.

Existing literature shows that personal cognitive structure will have an important impact on their behavioral decisions and some decisions often cannot be explained by expected utility theory. The upper echelon theory (Hambrick and Mason, 1984) also states that executives are not completely rational and have limited cognition, and they often filter out decisions that are beyond their own cognitive scope. Therefore, executives’ cognitive structure may influence enterprise decision-making. A large number of studies have found that the experience of executives, such as military background, disaster experience, academic experience and overseas experience, can significantly affect enterprise decision-making. For example, Benmelech and Frydman (2015) point out that the companies of CEOs with military backgrounds have lower investment levels and are less likely to be involved in fraud. Especially in a downturn, these companies perform even better. Quan et al. (2019) point out that executives with military experience have a tougher management style, which can promote enterprise innovation. Bernile et al. (2017) find a non-monotonic relationship between the intensity of executives’ disaster experience and enterprise risk-taking. Xu and Li (2016) find that executives with “Great Famine” will make more charity. In terms of academic experience, Huang et al. (2019) point out that executives who have taught in universities can reduce information asymmetry inside enterprise, attract more attention from analysts and promote enterprise innovation. With the deepening of globalization, high-level executives begin to move across borders frequently. More interestingly, Giannetti et al. (2015) find that executives’ overseas experience can reduce earnings management of the company. Yuan and Wen (2018) find that executives’ overseas experience will promote enterprise innovation. Therefore, in this paper, we first examine the impact of executives’ overseas experience and language ability on the enterprise innovation. We focus on comparing the results among Chinese enterprises in high-carbon, medium-carbon and low-carbon industries, considering the differences in innovations of different levels of carbon emissions.

Moreover, according to existing studies, enterprises can obtain a variety of potential benefits through internationalization, such as establishing economies of scale, enhancing market power, and diversifying operation risks (Lin, 2012). To achieve nationally determined contribution targets, China is increasingly launching a series of low-carbon development plans for heavy industry to reduce carbon emissions (Dong et al., 2021; Zheng et al., 2021; Wen et al., 2020). Meanwhile the delicate bond between internationalization strategies and low-carbon emission goals remains unrevealed. Thus, this paper further investigates another interesting question: whether the internationalization strategies have impacts on the above relationship between executive experience and enterprise innovation.

This paper contributes to the literature by finding following results. First, internationalized executives significantly impact enterprise innovation in high-carbon industry. Secondly, the impact of internationalized executives on enterprise innovation is realized by enhancing the enterprise internationalization strategy. That is, enterprises will have more opportunities to get in touch with scarce knowledge and technology, which significantly promotes enterprise innovation. Moreover, our findings suggest that Chinese governments’ efforts in attracting internationalized talents seem to have generated positive impact on enterprise innovation. Our results are consistent when some robustness checks have been implemented.

The structure of this paper is as follows. Section 2 develops the hypotheses. Section 3 illustrates sample and research design. Section 4 explains main empirical results about the impact of executive experience on enterprise innovation, and the potential mediating effect of internationalization strategies. Section 5 concludes.

2 Research Hypotheses

2.1 Foreign-Language Executive and Enterprise Innovation

Innovation is risky, unpredictable, long-term, multistage, labor intensive, and idiosyncratic, which is different from general production activities. Most of the literatures are based on the legal environment (Atanassov, 2013; He and Tian, 2015; Ni and Zhu, 2016), tax environment (Mukherjee et al., 2017), industrial environment (Li and Zheng, 2016), internal enterprise governance factors (Ederer and Manso, 2013; Balsmeier et al., 2017), and internal company financial factors (Manso, 2011) to study the influencing factors of innovation. Their perspectives focus on the framework of traditional economics, this paper takes a different approach to study the influence of executives’ foreign language competence on enterprise innovation. We suppose, compared with Chinese executives without foreign-language competence, executives with foreign-language proficiency or overseas experience, called internationalized executives hereafter, have relatively two advantages. The first is excellent foreign language communication and the second is the overseas background. From these two advantages, we discuss the impact of internationalized executives on enterprise innovation.

First of all, internationalized executives have excellent foreign language communication competence. Theoretically speaking, the improvement of enterprise innovation comes from no more than two aspects, the one is introduction of foreign advanced technology and another is relying on independent innovation (Tang et al., 2014). In China, limited by the short development time, lack of innovation resources, imperfect Chinese system and other factors, the innovations among enterprises are generally weak. In contrast, the west has sophisticated technological know-how, advanced management skills and a global innovation network, their level of enterprise innovation is generally high. Therefore, communication and cooperation with foreign enterprises is a strategic choice to promote enterprise innovation. However, due to a series of problems such as language barriers, cultural and legal differences, disadvantage of outsiders and so on, this external communication and cooperation is often meaningless and cannot bring substantial improvement to enterprise innovation. But for internationalized executives, these problems are where they come in. Their advantage in foreign languages can help enterprises overcome these difficulties and promote the in-depth communication with foreign enterprises so as to obtain high-quality innovation resources.

Secondly, although Chinese executives with foreign language teaching experience and foreign language major are included in the definition of internationalized executives in this paper, it cannot be denied that a considerable proportion of internationalized executives have overseas background. Therefore, compared with Chinese executives, internationalized executives’ overseas experience is also an advantage that cannot be ignored. Generally speaking, these executives with overseas background are more willing to innovate than the Chinese executives. Here are the reasons. First, executives with overseas experience have good scientific and cultural literacy and advanced management experience, which will encourage them to increase innovation (Chen and Tang, 2012). And due to the strict patent protection system in foreign countries, executives with overseas experience will pay more attention to patent application and protection while increasing innovation efforts. Second, innovation is highly dependent on resources, overseas-experience executives with international resources, social networks and relationships can help enterprises build bridges and channels with the holders of the advanced technology to acquire high quality resources. It will greatly increase enterprise innovation. Last but not least, executives with oversea experience have a higher tolerance for innovation. Unlike routine tasks, innovation involves a long multi-stage process that is full of uncertainty (Holmstrom, 1989). Most successful innovation opportunities result from a conscious and purposeful search and unexpected failure may be an important step towards a company’s later success. Due to the future contingencies and intrinsically risky processes, exceptional tolerance for failure is necessary for effective innovation. Compared with Chinese executives, they have seen more failures abroad and they tend to focus more on the process of innovation than on the results of failure.

Therefore, based on the above analysis, we propose Hypothesis 1.

H1: Internationalized executives can significantly promote enterprise innovation by their advantages in language and overseas experience.

2.2 Mediating Effect of Internationalization Strategy

According to existing studies, enterprises can obtain a variety of potential benefits through internationalization, such as establishing economies of scale, enhancing market power, and diversifying operation risks (Lin, 2012). However, at the same time, the disadvantage of outsiders, the trap of new entrants, the lack of international market information and language barriers also hinder the formulation and implementation of enterprise internationalization strategy (Lin, 2012; Song et al., 2017). How to solve these potential problems is the key to the implementation of enterprise internationalization strategy. We believe that training and introducing a group of internationalized executives can help enterprises to promote the implementation of internationalization strategy.

Here are the reasons. First, according to psychological research, internationalized executives may have an international preference. Internationalized executives have excellent foreign language communication competence, and it may play an important role in the promotion of internationalization strategy which makes them psychologically satisfying. Second, internationalized executives have the advantage of information spillover. On the one hand, due to their foreign language advantages, internationalized executives tend to pay special attention to all kinds of foreign language reports in daily life and they can easily understand the policy trends of a certain country. This information is important to internationalization strategy. On the other hand, as mentioned above, a large proportion of internationalized executives have overseas experience. Such experience can help enterprises identify opportunities and risks in the international market, and have a deeper understanding of the culture, business rules, laws and regulations of the host country. Therefore, for those enterprises with internationalized executives, the probability of their internationalization strategy implementation will be greatly improved.

Furthermore, in the context of globalization, internationalization strategy will significantly promote enterprise innovation. First of all, after the implementation of enterprise internationalization strategy, enterprises are bound to scan, create and learn from the international market strategy, which can promote enterprises’ ability of opportunity identification and utilization. With the improvement of opportunity identification and utilization, enterprises will acquire more innovative knowledge, put forward more innovative options, or grasp the innovation opportunities by internal resource integration and organizational restructuring, and ultimately improve the enterprise innovation. Second, by internationalization strategy, enterprises have more opportunities to get in touch with scarce knowledge and technology in the Chinese market. By using such knowledge and technology, enterprises will eventually improve their own innovation.

Therefore, we propose the Hypothesis 2.

H2: Internationalization strategy plays a mediating role in the influence of internationalized executives on enterprise innovation.

Given the stronger requirements by China’s green policies, the carbon emission of an enterprise may have significant impacts on the motivation of enterprise innovations as well as the international strategies (Dou et al., 2021; Duan et al., 2021). We re-examine both two hypotheses across enterprises of low-carbon, medium-carbon and high-carbon industries.

3 Data and Research Design

3.1 Data Sample

Our sample is comprised of listed firms on the Shanghai Stock Exchange (SHSE) and Shenzhen Stock Exchange (SZSE) during the period 2010–2018. We exclude financial firms (e.g., banks, insurance companies and investment trusts) as they have different structures from other companies. We then exclude observations with missing variables and get a final sample of 23808 observations.

Then we select new energy vehicles, photovoltaic, wind energy, nuclear energy, biological intelligence and circular economy as low-carbon industries, obtaining 4873 observations of 738 enterprises. According to the method of Jie et al. (2014), we select mining industry (B), textile industry (C17), paper industry (C22), petroleum processing industry (C25), chemical manufacturing industry (C26), metal smelting industry (C31, C32), thermal production and supply industry (D44) as high-carbon industries, obtaining 5190 observations of 667 enterprises. The remaining 2,154 enterprises with 13745 observations are taken as medium-carbon industries.

Enterprise innovation data are mainly from CNRDS database, which is supplemented with the website of China National Intellectual Property Administration. The data of foreign language competence of executives are mainly extracted from executives’ resumes, which are derived from CSMAR database. In addition, we manually collect some executives’ resumes in the company’s annual report to complete the missing data. Other financial and enterprise data used in this study are obtained from the China Stock Market & Accounting Research (CSMAR) system. All the data are cross-checked for consistency.

3.2 Variables

3.2.1 Dependent Variable: Innovation

In China, there are three types of patent applications, including invention patents, design patents, and utility model patents. Following prior studies (Fang et al., 2014; Cornaggia et al., 2015; Jiang, 2016), we take the natural logarithm of plus 1 the number of invention patents to measure enterprise innovation, because invention patents have the highest technical content.

3.2.2 Test Variable: Internationalized Executives

According to the upper echelon theory (Hambrick and Mason, 1984), we suppose that senior executives include chairmen and general managers, because they have more power of decision. When defining an internationalized executive, we follow two principles: (1) The executive has experience of studying abroad. (2) The executive has experience of working abroad. We suppose that when at least one of the chairmen or general managers meets at least one of the above two conditions, this executive is considered an internationalized executive, and the dummy variable of the enterprise is 1, 0 otherwise.

3.2.3 Control Variables

Following prior studies (e.g., He and Tian, 2013; Chang et al., 2015; Yuan et al., 2015), we control for a vector of firm characteristics shown to affect innovation activities. The control variables include firm size (the natural logarithm of assets), ROA (net income divided by total assets), firm age, ownership concentration (the percentage of shares owned by the top 10 shareholder), proportion of independent directors (the proportion of independent directors in a board), CEO duality (The CEO and the chairman are the same person), ownership structure and industry competition (Herfindahl-Hirschman Index). Moreover, we add industry and year dummies to control for the industrial fixed effect and dynamic changes in the macroeconomic environment common to all firms over the sample period, respectively.

Table 1 provides definitions of all variables used in our analysis and all continuous variables are winsorized at 1% at both tails to mitigate the undue influence of extreme values.

3.3 Models

Following prior studies (He and Tian, 2013; Chemmanur et al., 2014; Fang et al., 2014; Yu et al., 2018; Yuan and Wen, 2018), we employ the OLS model to examine our hypotheses. To mitigate the potential endogeneity, we regress the contemporaneous innovation measures on the one-period lag values of managers with foreign experience and other explanatory variables. The basic empirical model employed is:

where

4 Empirical Analyses

4.1 Descriptive Statistics

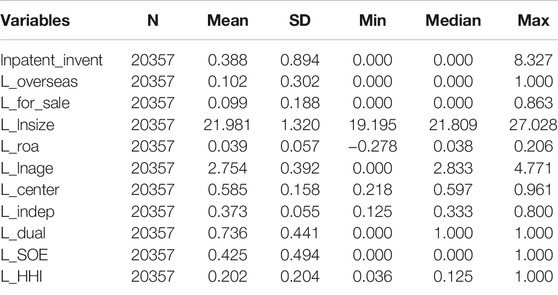

Table 2 presents the descriptive statistics for the variables used in our regressions. The mean and standard deviation of lnpatent_invent are 0.388 and 0.894, which demonstrate that there is a big difference in the outputs of innovation among sample firms. On average, only 10.2% of firm-year observations have at least one internationalized executive, which indicates internationalized executives are still relatively rare in China.

TABLE 2. Descriptive statistics. This table reports descriptive statistics of the main variables defined in Table 1 during the sample period 2010–2018. All continuous variables are winsorized at 1% at both tails. L_ represents one-period lag.

As for control variables, the firms in our sample have an average lnsize of 21.981, ROA of 0.039, lnage of 2.754, center of 0.585, indep of 0.373, dual of 0.736, SOE of 0.425, and HHI of 0.202.

4.2 Multivariate Results

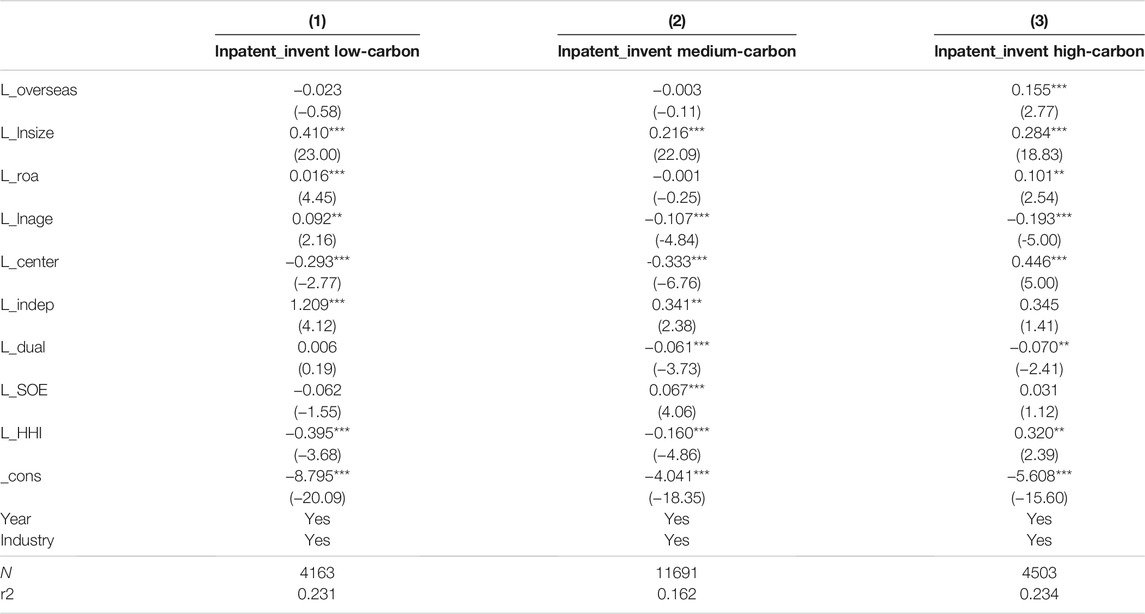

Table 3 reports the results of the impact of internationalized executives on enterprise innovation in different industries. We can find the coefficient of internationalized executives is 0.155, significant at the 1% level, indicating that compared with high-carbon firms that do not have internationalized executives, high-carbon firms that hire internationalized executives have higher innovations. But in low-carbon and medium-carbon industries, the coefficients of internationalized executives are not significant, which indicates there is no evidence to prove that internationalized executives can promote enterprise innovation in low-carbon and medium-carbon industries. Hypothesis 1 is confirmed.

TABLE 3. Internationalized executives and enterprise innovation. This table reports the impact of internationalized executives on innovation in different industries. t-Statistics in the brackets are based on standard errors adjusted for clustering at the firm level.*, ** and *** indicate significance at the 0.10, 0.05 and 0.01 level (two-tailed), respectively.

In terms of control variables, the coefficients are generally consistent with prior studies (Song et al., 2017; Yuan and Wen, 2018; He et al., 2019). In high-carbon industry, firm size and ROA are positively and significantly related to enterprise innovation, which indicates that the larger the enterprise scale and the more sufficient the capital, the stronger the motivation for innovation. After all, innovation is a highly resource-dependent activity. Firm age and dual are significantly and negatively related to innovation. The former indicates that older and more matured firms lack the incentives to innovate and the latter shows that the CEO and the chairman are the same person is not good to enterprise innovation. Ownership concentration and the industry competition also affect the enterprise innovation.

4.3 Endogeneity

Our evidence above indicates that a positive relation between internationalized executives and enterprise innovation in high-carbon industry. However, the results can be driven by an endogeneity bias. For example, it may not be random that a firm appoints internationalized executives and this may cause a self-selection bias. Moreover, there is a reverse causality concern that firms with high innovation potential attract internationalized executives. Thus, in addition to using lagged internationalized executives and control variables in the main model, in this section, we further address the potential endogeneity issue in several alternative ways, including PSM procedure and instrumental variable.

4.3.1 PSM Procedure

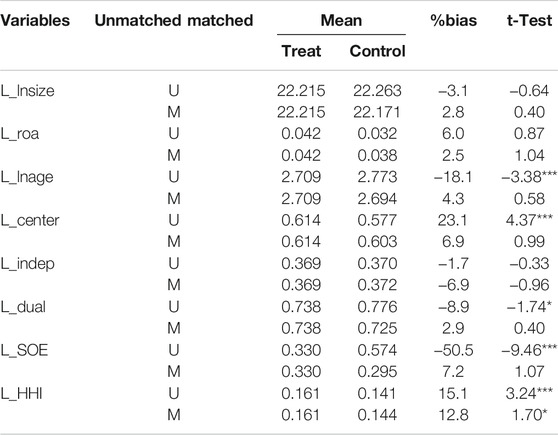

To mitigate the potential endogeneity arising from reverse causality, we compare firms having at least one internationalized executives (i.e., treatment firms) to a sample of control firms having no internationalized executives (i.e., control firms) matched on the propensity for a firm to appoint internationalized executives. The primary benefit of using a control sample matched on propensity scores is that it allows us to more clearly attribute any observed effects to the appointment of internationalized executives itself, rather than to the firm characteristics associated with the appointment of internationalized executives. Specifically, we estimate a logit model using the high-carbon industry sample and calculate a propensity score for each firm. For each treatment firm, we select one control firm with the closest propensity score. Finally, these firms constitute the propensity-score matched sample (i.e., PSM Sample). To ensure that the matching is satisfactory, we assess covariate balance by testing whether the means of the covariates differ between the treatment firms and matched control firms and report the results in Table 4. We can find there are no significant differences in the means of any covariates, indicating that the propensity-score matched control sample resembles the treatment firms along virtually all dimensions.

TABLE 4. PSM procedure. This table reports the results of covariate balance checks (pstest) on the mean difference in the covariates used in the logit model between the treatment firms and the control firms in high-carbon industry, matched on PSM approach. t-Statistics in the brackets are based on standard errors adjusted for clustering at the firm level.*, ** and *** indicate significance at the 0.10, 0.05 and 0.01 level (two-tailed), respectively.

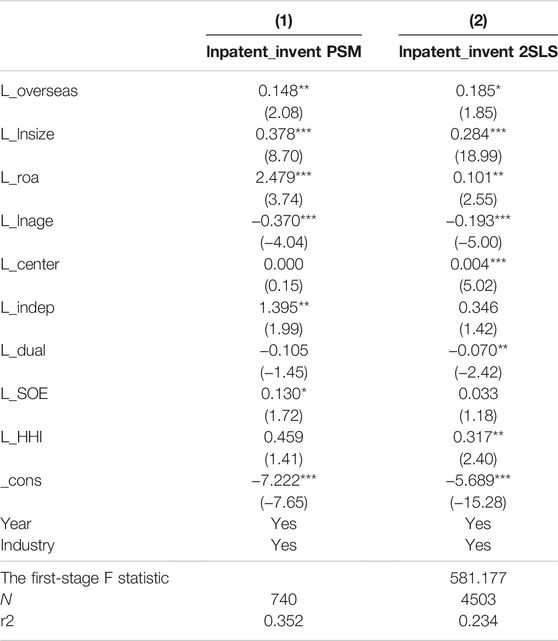

We then re-estimate model (1) using the PSM sample, and report the results in column 1 of Table 5. The results show that the coefficient on internationalized executives is significantly positive at the 5% level, suggesting a positive association between internationalized executive and enterprise innovation in high-carbon industry.

TABLE 5. PSM and 2SLS. This table reports the result of PSM procedure and 2SLS model. t-Statistics in the brackets are based on standard errors adjusted for clustering at the firm level.*, ** and *** indicate significance at the 0.10, 0.05 and 0.01 level (two-tailed), respectively.

4.3.2 Instrumental Variable

Then we further use 2SLS model to estimate the impact of internationalized executives on enterprise innovation. The instrumental variable we used is average number of internationalized executives industry as suggested by Meng et al. (2019), which has significant correlation with enterprise internationalized executives but has no direct impact on enterprise innovation. The F-value of the first stage of 2SLS is much greater than 10, which indicates the selected instrumental variables are not weak instrumental variables. The second-stage results are shown in Table 4 columns (2). The coefficients on overseas is 0.185, significant at the 10% level, which is consistent with OLS model (described in Section 4.2). The findings further confirm the above results.

4.4 Robustness Test

In addition to considering the endogeneity, we further do some other robustness tests, such as replacing the model and replacing the dependent variable.

Considering patent have the feature of counting, we use the poisson model to study the impact of internationalized executives on enterprise innovation (Aghion et al., 2013; Jiang and Yuan, 2018). The result is reported in Column 1) of Table 6. The coefficient of internationalized executives is 0.22, significant at 5% level, which confirms the above result.

TABLE 6. Robustness test. This table reports the result of three kinds of robustness test. t-Statistics in the brackets are based on standard errors adjusted for clustering at the firm level.*, ** and *** indicate significance at the 0.10, 0.05, and 0.01 level (two-tailed), respectively.

We further use the tobit model to study the relationship between the above two. The result is in Table 6 column (2). The coefficient of internationalized executives is still significant. The above results remain valid.

Finally, we change the measure of innovation and use the total number of patents as an innovation indicator, which includes invention patents, design patents, and utility model patents (Yuan and Wen, 2018). The above results remain valid.

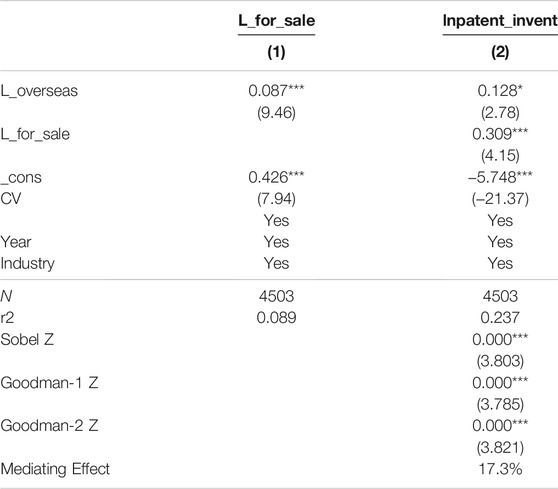

4.5 The Mediating Effect of Internationalization Strategy

In order to test whether the impact of internationalized executives on enterprise innovation is realized through the path of internationalization strategy, this paper uses the Sobel mediation factor test method of Baron and Kenny, (1986), and sets the model as follows:

Following prior studies (Sun et al., 2015; Song et al., 2017), we define the proportion of enterprise foreign income as the enterprise’s internationalization strategy. Then, we use the method of Baron and Kenny, (1986) to test whether the internationalization strategy has a mediating effect on the relationship between the internationalized executives and enterprise innovation. This method concludes three steps. Specifically, we use model (1) described in Section 3.3 to estimate the impact of internationalized executives on enterprise innovation. And in the second step, we use model (2) to estimate the impact of internationalized executives on internationalization strategy. Finally, we put internationalized executives and internationalization strategy into model together, as model (3) shows.

Table 7 reports the mediating effect results. The coefficients on internationalized executives in Columns (1) are 0.087, significant at the 1% level, which indicates that internationalized executives can comprehensively improve the enterprise internationalization strategy. Then, Column (2) shows that when internationalization strategy is added to model (1), the coefficient of overseas decreases and the Sobel value is significantly positive, indicating that internationalization strategy does play a mediating role in the impact of internationalized executives on enterprise innovation. Finally, in the proportion of mediating effect, the internationalization strategy accounts for about 17.3%. This result is consistent with the expected results. According to the upper echelon theory, executives, as decision-makers of enterprises, prefer to guide the development of enterprises in the fields they are familiar with. Internationalized executives have excellent language communication skills and advanced concepts, which can help enterprises better grasp the risks of overseas investment and optimize the decision-making of enterprises in the international environment. So internationalized executives prefer to promote internationalization strategy.

TABLE 7. The mediating effect of internationalization strategy in high-carbon industry. This table reports the mediating effect results. The first step is to estimate the impact of internationalized executives on enterprise innovation (see model (1)). The second step is to estimate the impact of internationalized executives on enterprise internationalization strategy (see model (2)). The last step is to estimate the impact of internationalized executives on enterprise innovation after joining internationalization strategy (see model (3)).

5 Conclusion

In the context of globalization, the cross-border flow of capital, technology and other factors of production becomes more and more frequent, and the corresponding internationalized executives are gradually pursued by the capital market. So we take Chinese-listed companies from 2010 to 2018 as the research object and analyze the impact of internationalized executives on enterprise innovation. To sum up, we contribute to the literature from the following aspects.

Firstly, internationalized executives have an incentive effect on enterprise innovation in high-carbon industry. This is because internationalized executives have excellent foreign language communication skills and advanced concepts, which can facilitate enterprises to establish bridge of cooperation with foreign enterprises and acquire advanced resources. However, the internationalized executives have no real impact on enterprise innovation in low-carbon and medium-carbon industries. The possible reason is that the low-carbon and medium-carbon industries have certain advantages in the world compared to higher-carbon industries, and Chinese talents continue to emerge, which reduces the role of internationalized executives in promoting innovation.

Secondly, the impact of internationalized executives on enterprise innovation is realized by enhancing the enterprise internationalization strategy. According to the upper echelon theory, internationalized executives may prefer to promote the implementation of the internationalization strategy. Moreover, in the international market, enterprises will have more opportunities to get in touch with scarce knowledge and technology, which are also the key elements of enterprise innovation.

Finally, the results are beneficial to enterprises and governments interested in promoting innovation. Those entities, especially high-carbon firms, can pay more attention to the internationalized executives. In addition, our findings suggest that Chinese governments’ efforts in attracting internationalized talents seem to have generated positive impact on enterprise innovation.

Data Availability Statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author Contributions

The author confirms being the sole contributor of this work and has approved it for publication.

Conflict of Interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Acharya, V., and Xu, Z. (2017). Financial Dependence and Innovation: The Case of Public versus Private Firms. J. Financial Econ. 124 (2), 223–243. doi:10.1016/j.jfineco.2016.02.010

Aghion, P., Van Reenen, J., and Zingales, L. (2013). Innovation and Institutional Ownership. Am. Econ. Rev. 103 (1), 277–304. doi:10.1257/aer.103.1.277

Atanassov, J. (2013). Do Hostile Takeovers Stifle Innovation? Evidence from Antitakeover Legislation and Corporate Patenting. J. Finance 68 (3), 1097–1131. doi:10.1111/jofi.12019

Balsmeier, B., Fleming, L., and Manso, G. (2017). Independent Boards and Innovation. J. Financial Econ. 123 (3), 536–557. doi:10.1016/j.jfineco.2016.12.005

Baron, R. M., and Kenny, D. A. (1986). The Moderator-Mediator Variable Distinction in Social Psychological Research: Conceptual, Strategic, and Statistical Considerations. J. Personal. Soc. Psychol. 51 (6), 1173–1182. doi:10.1037/0022-3514.51.6.1173

Benmelech, E., and Frydman, C. (2015). Military CEOs. J. Financial Econ. 117 (1), 43–59. doi:10.1016/j.jfineco.2014.04.009

Bernile, G., Bhagwat, V., and Rau, P. R. (2017). What Doesn't Kill You Will Only Make You More Risk‐Loving: Early‐Life Disasters and CEO Behavior. J. Finance 72 (1), 167–206. doi:10.1111/jofi.12432

Bronzini, R., and Piselli, P. (2017). The Impact of R&D Subsidies on Firm Innovation. Res. Pol. 45 (2), 442–457.

Chang, X., Fu, K., Low, A., and Zhang, W. (2015). Non-Executive Employee Stock Options and Corporate Innovation. J. Financial Econ. 115 (1), 168–188. doi:10.1016/j.jfineco.2014.09.002

Chemmanur, T. J., Loutskina, E., and Tian, X. (2014). Corporate Venture Capital, Value Creation, and Innovation. Rev. Financ. Stud. 27 (8), 2434–2473. doi:10.1093/rfs/hhu033

Chen, S., and Tang, B. (2012). The Moderating Role of Managerial Freedom. Stud. Sci. Sci. 030 (011), 1723–1734. (in Chinese).

Chen, X., Li, Y., Xiao, J., and Wen, F. (2020). Oil Shocks, Competition, and Corporate Investment: Evidence from China. Energ. Econ. 89, 104819. doi:10.1016/j.eneco.2020.104819

Cornaggia, J., Mao., Y., Tian, X., and Wolfe, B. (2015). Does Banking Competition Affect. Innovation J. Financial Econ. 115 (1), 189∼209. doi:10.1016/j.jfineco.2014.09.001

Dong, K., Ren, K., and Zhao, J. (2021). How Does Low-Carbon Energy Transition Alleviate Energy Poverty in China? A Nonparametric Panel Causality Analysis. Energy Econ. 8, 105620. doi:10.1016/j.eneco.2021.105620

Dou, Y., Li, Y., Dong, Y., and Ren, X. (2021). Dynamic Linkages between Economic Policy Uncertainty and the Carbon Futures Market: Does Covid-19 Pandemic Matter?. Resour. Policy 75, 102455. doi:10.1016/j.resourpol.2021.102455

Duan, K., Ren, X., Shi, Y., Mishra, T., and Yan, C. (2021). The Marginal Impacts of Energy Prices on Carbon Price Variations: Evidence from a Quantile-On-Quantile Approach Energ. Econ. 95, 105131. doi:10.1016/j.eneco.2021.105131

Ederer, F., and Manso, G. (2013). Is Pay for Performance Detrimental to Innovation? Manage. Sci. 59 (7), 1496–1513. doi:10.1287/mnsc.1120.1683

Fang, V. W., Tian, X., and Tice, S. (2014). Does Stock Liquidity Enhance or Impede Firm Innovation? J. Finance 69 (5), 2085∼2125. doi:10.1111/jofi.12187

Giannetti, M., Liao, G., and Yu, X. (2015). The Brain Gain of Corporate Boards: Evidence from China. J. Finance 70 (4), 1629–1682. doi:10.1111/jofi.12198

Hambrick, D. C., and Mason, P. A. (1984). Upper Echelons: The Organization as a Reflection of its Top Managers. Amr 9 (2), 193–206. doi:10.5465/amr.1984.4277628

He, J., and Tian, X. (2015). SHO Time for Innovation: The Real Effects of Short Sellers. Bloomington, Indiana: Kelley School of Business Research Paper.

He, J., and Tian, X. (2013). The Dark Side of Analyst Coverage: the Case of Innovation. J. Financial Econ. 109, 856–878. doi:10.1016/j.jfineco.2013.04.001

He, Y., Yu, W., Dai, Y., and Wang, Y. (2019). Professional Experience of Executives and Corporate Innovation. Manag. World 35 (11), 174–192. (in Chinese).

Holmstrom, B. (1989). Agency Costs and Innovation. J. Econ. Behav. Organ. 12 (3), 305–327. doi:10.1016/0167-2681(89)90025-5

Huang, C., Rongwei, N., Jiang, Q., and Zheng, H. (2019). Will Literati Going to Sea_ Promote Corporate Innovation? J. Econ. Res. 045 (005), 111–124. (in Chinese).

Jiang, X. (2016). Government Decentralization and State-owned Enterprise Innovation: A Research Based on the Perspective of the Pyramid Structure of Local State-owned Enterprises. Manag. World 4 (9), 120–135. (in Chinese)

Jiang, X., and Yuan, Q. (2018). Institutional Investors’ Corporate Site Visits and Corporate Innovation. J. Corp. Finance 48, 148–168. doi:10.1016/j.jcorpfin.2017.09.019

Jie, M., Wang, J., and Liu, D. (2014). Environmental Regulation, Technological Innovation and Business Performance. Nankai Bus. Rev. Int. 17 (6), 106–113. (in Chinese).

Li, W., and Zheng, M. (2016). Substances and Strategic Innovation: The Impact of Macro-Industrial Policy on Micro-firm Innovation. Econ. Res. J. (4), 60–73. (in Chinese).

Lin, W.-T. (2012). Family Ownership and Internationalization Processes: Internationalization Pace, Internationalization Scope, and Internationalization Rhythm. Eur. Manage. J. 30 (1), 47–56. doi:10.1016/j.emj.2011.10.003

Manso, G. (2011). Motivating Innovation. J. Finance 66 (5), 1823–1860. doi:10.1111/j.1540-6261.2011.01688.x

Meng, Q., Li, X., and Zhang, P. (2019). Do employee Stock Ownership Plans Promote enterprise Innovation?-- Empirical Evidence from the Perspective of Employees. Manage. World 35 (11), 20.

Mukherjee, A., Singh, M., and Žaldokas, A. (2017). Do Corporate Taxes Hinder Innovation? J. Financial Econ. 124 (1), 195–221. doi:10.1016/j.jfineco.2017.01.004

Ni, X., and Zhu, Y. (2016). Labor Protection, Labor Intensification and Firm Innovation: Evidence from the Implementation of the Labor Contract Law in 2008. Manage. World (7), 154–167. (in Chinese).

Quan, X., Bai, W., and Yin, H. (2019). Senior Management Experience, Management Style and Company Innovation. Nankai Manage. Rev. 022 (006), 140–151. (in Chinese).

Ren, X., Cheng, C., Wang, Z., and Yan, C. (2021). Spillover and Dynamic Effects of Energy Transition and Economic Growth on Carbon Dioxide Emissions for the European Union: A Dynamic Spatial Panel Model. Sustain. Dev. 29 (1), 228–242. doi:10.1002/sd.2144

Song, J., Wen, W., and Wang, D. (2017). Can Overseas Returnees Promote Enterprise Risk Taking -- Empirical Evidence from China's A-Share Listed Companies. Finance Trade Econ. 38 (012), 111–126. (in Chinese).

Song, T., Zhong, X., and Chen, W. (2017). Expectation gap and Firm Internationalization Speed: Evidence from China's Manufacturing Industry. China Ind. Econ. (6). (in Chinese).

Sun, S. L., Peng, M. W., Lee, R. P., and Tan, W. (2015). Institutional Open Access at Home and Outward Internationalization. J. World Business 50, 234–246. doi:10.1016/j.jwb.2014.04.003

Tang, W., Fu, Y., and Wang, Z. (2014). Technological Innovation, Technology Import and Economic Growth Mode Transformation. Econ. Res. J. (7), 31–43. (in Chinese).

Wen, F., Zhao, L., He, S., and Yang, G. (2020). Asymmetric Relationship between Carbon Emission Trading Market and Stock Market: Evidences from China. Energ. Econ. 91, 104850. doi:10.1016/j.eneco.2020.104850

Xu, N., and Li, Z. (2016). Executive Poverty Experience and Corporate Charitable Giving. Econ. Res. J. 051 (012), 133–146. (in Chinese).

Yu, Y., Zhao, Q., and Ju, X. (2018). Inventor Executives and Enterprise Innovation. China Ind. Econ. 000 (003), 136–154. (in Chinese).

Yuan, J., Hou, Q., and Chen, C. (2015). The Curse Effect of Enterprise Political Resources: Based on the Investigation of Political Connection and Enterprise Technological Innovation. Manage. World (1), 139–155. (in Chinese).

Yuan, R., and Wen, W. (2018). Managerial Foreign Experience and Corporate Innovation. J. Corporate Finance 48, 752–770. doi:10.1016/j.jcorpfin.2017.12.015

Zhang, Y. J., Shi, W., and Jiang, L. (2020). Does China's Carbon Emissions Trading Policy Improve the Technology Innovation of Relevant Enterprises? Bus Strat Env 29 (3), 872–885. doi:10.1002/bse.2404

Keywords: enterprise innovation, executive experience, internationalization strategy, high-carbon industry, low-carbon industry, mediating effect

Citation: Cui S (2022) Enterprise Innovation, Executive Experience and Internationalization Strategy: Evidence From High-Carbon Industrial Enterprises Versus Low-Carbon Industrial Enterprises in China. Front. Energy Res. 9:821269. doi: 10.3389/fenrg.2021.821269

Received: 24 November 2021; Accepted: 02 December 2021;

Published: 03 January 2022.

Edited by:

Xiaohang Ren, Central South University, ChinaCopyright © 2022 Cui. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Shuangchang Cui, Y3Vpc2h1YW5nY2hhbmdAb3V0bG9vay5jb20=

Shuangchang Cui

Shuangchang Cui