- 1College of Economics and Management, Shanghai University of Electric Power, Shanghai, China

- 2State Grid Energy Research Institute Co., Ltd., Beijing, China

Energy transition, especially in the power industry, will lead to a significant promotion in energy sustainable development. Lots of emphases have been focused on the impact of policy on the energy transition; however, there were little studies on the role of the market. This paper will be devoted to the theoretical basis of market design comprehensively and discusses the obstacles restricting China’s energy transition by using an Institution-Economics-Technology-Behavior (IETB) analysis framework (four dimensions including Institution, Economics, Technology, and Behavior). In addition, the paper provides an overview of research findings on some available market designs related to the energy transition. Of note, power spot market, power capacity market, power futures market, carbon emission market, and Tradable Green Certificate (TGC) market are highlighted and discussed with emphasis. And the effects of implementing each market on overcoming those obstacles in the energy transition process are analyzed. The review results show that the market design is as important as the policy-making; hence, it is unwise for energy transition to focus on policies and ignore markets, and the market design should be pertinent and objective. Finally, some policy recommendations and market design suggestions are put forward.

Introduction

Many industrialized countries are pursuing energy transition, but their focuses are different, which has led to differences in the approaches they take. For example, the United States promotes its energy transition by making some preferential policies on the development of fossil energy (shale gas resources) and renewable energy, and the European countries are more inclined to implement a series of policies, plans, and schemes to develop a renewable economy, while Japan demonstrates a commitment to clean energy, such as the nuclear power and the offshore wind power, by improving the policy framework. Since the beginning of the 1990s, the major industrialized countries in the world have successively carried out a series of Electricity Market Reform or Power Market Liberalization Reform effectively in response to the obstacles to developing the energy and power sector (Grubb and Newbery, 2018; Letova et al., 2018). Since 2002, China has implemented two rounds of power system optimization and adjustment which are defined as China’s Power System Reformation (Yang, 2015). Especially in the second round of China’s Power System Reform, one of the priorities is to build a competitive market environment (Wang, 2019). While exploring ways to allocate power resources efficiently, China has ushered in another profound change—energy transition—a gradual and long-term process (Li and Wang, 2019). Currently, China is still in the low efficient and poor benefit Coal Age (Zhang and Jiao, 2018). Because of the difference with most other countries in the resource endowments, the economic-social development, and the goals of energy transition, China needs to achieve a leapfrog development from the Coal Era to the Renewables Era directly without experiencing the Oil Era (Li and Wang, 2019). Especially under the dual pressure of energy security and environmental protection, how to promote the sustainable energy transition has become a hot issue for China and even all the countries around the world (Sun, 2017; Yang et al., 2020). Meanwhile, the energy development mode with “sustainable transition” as the core has attracted the attention of governments, enterprises, and scholars of various countries (Shi and Wang, 2015; Staden, 2017; Safari et al., 2019). As the energy strategic thinking of “Four Revolutions” (Energy Consumption Revolution, Energy Supply Revolution, Energy Technology Revolution, and Energy System Revolution) has been improved since 2014, the Chinese government attaches great importance to the task of energy transition. In 2015, China put forward the five development concepts of “Innovation, Coordination, Green, Openness, and Sharing” which pointed out the direction for solving the worldwide problems of energy resources shortage and environmental constraints. From the perspective of institutional change, both market design and energy transition have become two parallel systems that China’s power sector must adapt to at this stage. These two systems have brought both opportunities and challenges for the development of China’s power industry from different levels.

In order to demonstrate the above problems, we first use the Institution-Economics-Technology-Behavior (IETB) analysis framework to study the obstacles to China’s energy transition from the aspects of Institution, Economics, Technology, and Behavior (Liu and Wang, 2019; Zhang and Andrews-Speed, 2020). We also analyze the five market mechanisms including the power spot market, the power capacity market, the power futures market, the carbon emission market, and the Tradable Green Certificate (TGC) market and then consider the effects of implementing those five markets focusing on whether the five markets mentioned in this article can solve the obstacles encountered in China’s energy transition process. At the same time, we hope that this research can provide some practical methods and approaches for the sustainable development of power industry.

Literature Review

Worldwide, there are many mechanisms for promoting the energy transition (especially for advancing clean energy development). Some of the experienced countries pin their hopes on the electric power market design since the issue of clean energy consumption has already been fully considered in the design process of power markets (Shi et al., 2017). However, most of the current research on the driving factors of energy transition just focuses on the supporting policies (Matthew and Jennie, 2017; Shi, 2017; Munro and Cairney, 2020). For example, in terms of investment and financing policies, Fan and Hao (2020) studied the relationship between investment and renewable energy consumption by the Vector Error-Correction Model, believing that targeted direct investment will make a significant boost on renewable energy and accelerate China’s energy transition process (Fan and Hao, 2020). Will and Strachan (2012) focused on the relationship between energy investments and energy service demands by adopting the Two-stage Stochastic Energy System Model, pointing out that large energy investments will be required in the United Kingdom to meet the needs for new energy in the future development process (Will and Strachan, 2012). Based on the subsidy, by considering the 92 renewable energy listed enterprises of China between 2007 and 2016 as samples, Yang et al. (2019) used the Panel Threshold Effect Model to explore the effects and differences regarding both government subsidy types and enterprise sizes, proving that government subsidies are the main force supporting China’s energy transition (Yang et al., 2019). Monasterolo and Raberto (2019) also had a discussion on the negative socioeconomic and environmental externalities associated with fossil fuel subsidies, finding that renewable subsidies contribute to foster the low-carbon transition (Monasterolo and Raberto, 2019). With respect to the tax policy, Lin and Jia (2019) used the dynamic recursive Computable General Equilibrium model to analyze the impact of the energy tax on the energy-economy-environment (3E) system, showing that taxes on energy production sectors may be an effective way to reduce CO2 emissions, and promote clean energy development (Lin and Jia, 2019). Wang et al. (2019) used a Differential Game Model to conduct a research on the possibility of the carbon tax affecting the strategy and performance of low-carbon technology sharing among enterprises, believing that carbon tax policy is the key to China’s emission reduction and energy transition (Wang et al., 2019a). In addition, some scholars discussed the impact of price support policies on energy transition as well. For example, Wei and Dong (2016) summarized the historical experience of energy transition in the past three decades, finding that the price of energy services played a crucial role in creating the incentives to stimulate energy transition (Wei and Dong, 2016). Li et al. (2018) exemplified China’s eight economic zones, quantified the impact of energy prices on carbon emissions, and proved that energy prices can suppress carbon emissions through some relevant factors which include economic development, industrial structure, energy efficiency, energy investment, and energy consumption (Li et al., 2018).

To make the research objective clear, we must consider the following four points: 1) “Energy Transition” is aimed at solving the energy security and environmental protection issue to promote high-quality economic and social development (Jin, 2016). 2) “Energy Transition” is supposed to promote a steady increase in the shares of new energy production and consumption in the total energy output and the total consumption (Xie et al., 2017). 3) “Energy Transition” should rationally enhance the cost advantage or the competitive advantage of renewable energy (Sun, 2018). 4) While the process exhibits the attributes of permanency, systematicness, and complexity (Solano-Rodríguez et al., 2018), “Energy Transition” should also make a difference to a synergistic, orderly, and high-quality development of energy sector (Baležentis and Štreimikienė, 2019). In addition, even if we can effectively intervene in the transition through policies, China still faces problems, such as high power consumption, large infrastructure investment, unreasonable energy structure, and high reform costs (Shi et al., 2017), which directly lead to the difficulty of accelerating the pace in the short term. Therefore, a market-oriented optimization for adjusting energy structure, reducing inefficient supplies, and expanding effective demands will become the consensus. At the same time, from the long-term perspective of China’s institutional changes and social development, both the market design and the related institutional arrangements have become an important tool to promote the power transition and advance the synergistic, orderly, and high-quality development.

The remainder of this paper is organized as follows: Section 3 presents the development status of China’s power market and some current obstacles to China’s energy transition. The emphasis is laid in Section 4 which discusses the five market mechanisms and their implementation effects to reflect the importance of market design on promoting the energy transition. At last, Section 5 displays the conclusions and policy recommendations.

Current Situation

Development Status

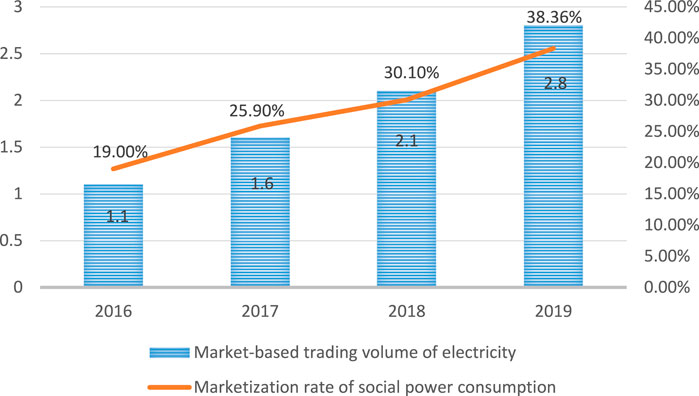

The most active transaction mode in China has gradually shifted from the medium- and long-term contract transactions to the power spot (day-ahead) market transactions already. The transaction volume via China’s power market (including power generation trading volume) totaled 2.1 trillion kWh with a 29% year-on-year growth in 2018 and reached 2.8 trillion kWh in 2019. Figure 1 shows the transaction volume in China’s power market from 2016 to 2019.

FIGURE 1. 2016–2019 power market traded electricity and its share in the nation’s power consumption (unit: trillion kWh, %).

Power spot market: At the beginning of the Reform, the Chinese government tentatively selected eight provinces as the power spot market pilots which have been put into operation in June 2019. Among all the pilots, Guangdong Province has made the fastest progress, releasing its spot market design scheme in August 2018. China’s cross-regional spot markets for renewable energy have started to operate since 2017, but the transaction scale of renewable energy is relatively small. In 2017, the spot market for renewable energy achieved 6.0 billion kWh of renewable power transaction (the electricity consumption of the whole society in 2017 was 6.3 trillion kWh). In particular, Gansu Province is the largest trader with electricity sales of 2.4 billion kWh in the first half of 2018.

Electricity capacity market: There are some countries, such as the United States, the United Kingdom, and France, which have launched the electricity capacity market transactions. At present, China is also actively building the power capacity market, starting from the basic national conditions of China’s market construction (Chen et al., 2020). Therefore, China is trying to learn the successful experience from those industrialized countries and construct the capacity market as soon as possible. This is not only a solution to the reduction in the reform costs but also a requirement to ensure the long-term safe supply of electricity in the future (Chen, 2018 ).

Power futures market: At present, the development of China’s power futures market is still in the preliminary stage. The common view in politics, academia, and business is that China’s power futures market will be helpful to reduce the risk of energy transition. Currently, the focus on China’s power futures market is mainly about the operation principle, unfortunately without enough research or practice on the power market futures trading mechanism, rules, or risk management (Du et al., 2018).

Carbon emissions market: In 2012, the Chinese department of National Development and Reform Commission (NDRC) decided to launch carbon emissions trading (ET) pilots across the country, and identified Beijing City, Tianjin City, Shanghai City, Chongqing City, Guangdong Province, Hubei Province, and Shenzhen City as the seven carbon ET pilots. In 2013, Shenzhen took the lead in launching actual transactions. Subsequently, other pilot provinces and cities also started the operation as well. As of the end of October 2019, the trading volume of carbon emission allowances in the pilots reached 347 million tons of carbon dioxide equivalent, with a transaction volume of approximately $1,077 million1. On December 19, 2017, the NDRC issued the “National Carbon Emissions Trading Market Construction Plan (Power Generation Industry)” which officially launched the construction process of the carbon ET market.

TGC market: As early as around 2012, China began to conceive of this market as well as the Renewable Portfolio Standard. In 2017, China established a voluntary subscription market for Green Certificates, but there was no renewable energy quota system supporting the voluntary subscription market. As of February 2020, China has issued a total of 27,161,607 green certificates. In particular, wind power projects issued a total of 23,315,779 wind power green certificates, and photovoltaic projects issued a total of 3,845,828 photovoltaic green certificates.

Barriers to Transition

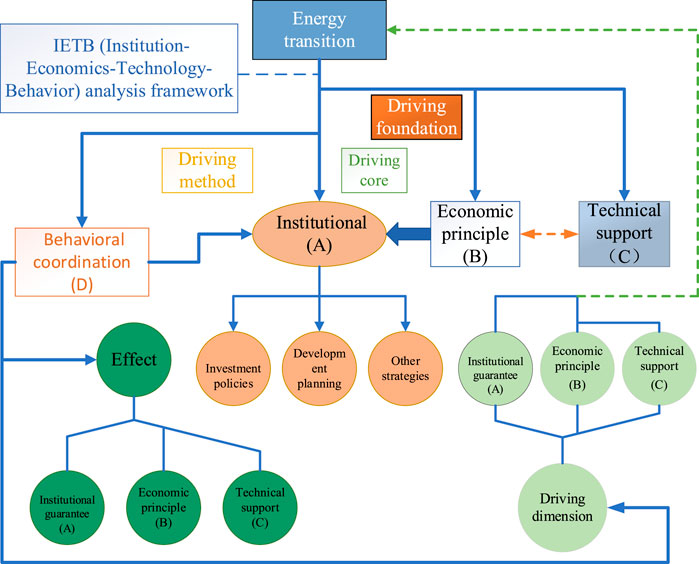

Liu et al. (2019) built an IETB analysis framework (Figure 2) for discussing the energy transition issue (Liu et al., 2019). The institutional is the driving core for energy transition, which is mainly reflected in investment policies, development planning, and other strategies. In addition, the institutional guarantee also constitutes an important link connecting the technical support, the economic principle, and the behavioral coordination. The technical support and the economic principle form the driving foundation of energy transition, and both of them have a significant interaction relationship. The behavioral coordination, as the driving method of energy transition, not only can reflect the effect of the technical support, the economic principle, and the institutional guarantee but also can feedback the driving dimension of three of them.

Institutional Barrier

1) Supervision of industry is not sufficient (Ding, 2020). The “Renewable Energy Law of the People’s Republic of China” (2006) stipulates the rights and obligations of the related government departments and the enterprises concerned (power grid enterprises, gas and heat pipe network enterprises, and oil sales enterprises). However, due to the ineffective supervision of the main responsibilities (Ding, 2020), it is difficult to impose fines on those irresponsible enterprises in the specific implementation. Since the implementation of this Law, no administrative penalty has been given to either the enterprises or the relevant departments for violation of the Law.

2) The enduring-effect system is not perfect (Li and Cai, 2016). At this stage, in the renewables’ development, some renewables enterprises have always been pursuing high returns on investment blindly owing to the lag in electricity price adjustment and the deficiency in market function, which makes the irrational investment issues become increasingly prominent (Ding, 2020). Some localities have not effectively controlled the scale of renewable energy development in accordance with national plans, which leads to lots of difficulties for some renewable energy enterprises to operate without government subsidies.

3) The ability to plan as a whole is poor (Cao and Zhou, 2017). Without constraints on renewables development goals or overall plans, some localities have been misled by not strictly following the national target for the development and utilization of renewables. Some development goals of local plans exceed the development goal of the superior plan. And even the construction scale, the industrial layout, and the development speed are also inconsistent with the superior planning (Ding, 2020). For example, the national “13th Five-Year Plan (2016–2020)” determined that the wind power development target in the Xinjiang Uygur Autonomous Region should be 18 million kilowatts, while the local “Xinjiang’s Renewable Energy 13th Five-Year Plan” (2016–2020) determined that wind power development target should be 36.5 million kilowatts.

4) The interprovincial transactions are not smooth (Wu et al., 2019). The barriers are mainly formed by institution, system, and the like. The interprovincial barriers to power trading not only hinder the cross-regional flow of power resources but also lead to the bad phenomenon of local segregation and market blockade (Zhou, 2019). In 2017, the share of new energy curtailment caused by the interprovincial barriers accounted for more than 40% of the total curtailment. Specifically in 2018, the total electricity quantity traded in the national power market was about 2.1 trillion kWh. The electricity quantity traded in the provincial market was 1,688.5 billion kWh, while the quantity traded in the interprovincial (including the cross-regional) market was 347.1 billion kWh (accounting for 16.8% of the total quantity traded in the national market). Hence, there is still a large room for interprovincial electricity transactions. The interprovincial barriers have resulted in the division of power markets in various provinces, which is greatly restricting the unified development.

Economic Barrier

1) The government finance is overburdened (Cao and Zhou, 2017). The rapid increase in installed capacity of wind power and photovoltaic power has caused a huge gap in the renewable energy development fund. China’s renewable energy subsidy gap has exceeded $9.815 billion in 2016, $14.022 billion in 2017, and $16.827 billion in 2018 and has further expanded in 2019. During 2016–2020, more than 90 percent of the subsidies for new renewables projects have not yet been implemented. Without the timely support of government transfer payment, the financial difficulties have plagued the survival and development of renewables enterprises, which makes the energy transition suffer badly.

2) The investment in power supply is insufficient (Zhang and Tang, 2016). There always are power shortages or power surpluses during the evolution of China’s power system. Policymakers, businessmen, and experts always have certain concerns; that is, if the market system changes from fair dispatch to economic dispatch rapidly, the existing coal-fired power plants in the system will bear great pressure. Meanwhile, such a change may also lead to insufficient power investment in the future, and thus a systemic power shortage will occur again. China’s power investment would be $743.182 billion during the “12th Five-Year Plan period” (2011–2015) and $813.229 billion during the “13th Five-Year Plan period” (2016–2020), which means that the “13th Five-Year Plan” investment increased just by 9.4% compared with the “12th Five-Year Plan” one. How to maintain sufficient investment in the power system with a high share of renewables is an important task to ensure the sustainability of China’s energy transition.

3) The private capital is active without rational reasons (Lin, 2016). Since 2009, the Chinese government has continuously launched a series of support policies for new energy, which fully reflects the government’s ambition to develop the new energy industry. However, these policies have also led to the rapid growth of private investment in the new energy sector, which has caused a disorderly development of new energy to a certain extent. For example, the great majority of investment projects are directly in the wind power plants and the solar power plants, while the minority of investment projects is in the biomass power and others. Enthusiastic private capital, in the absence of rational regulation, is easy to cause imbalance in the development and utilization of new energy (Zhao, 2016a).

4) The new mode of economic development could bring new challenges (Ma and Li, 2019). Data from 1991 to 2015 as a sample show that the growth of new energy consumption has a positive relationship with China’s economic growth (Xu, 2017). China’s economic development mode has shifted from the extensive growth of scale and speed to the intensive growth of quality and efficiency. And the economic growth rate has rationally slowed down. However, the new energy industry needs huge capital and labor input in the early stage of construction. Therefore, the high costs and low benefits will inevitably become the biggest obstacle restricting the further energy transition of China’s new energy industry (Chen, 2015).

Technical Barrier

1) The ability of power system access and grid connection is still weak (Sun et al., 2017). China’s current electricity pricing mechanism requires that the Grid Corporation should pay a local-benchmark electricity-price-based feed-in tariff to the grid-connected wind power plants and the photovoltaic power ones, and the governments make up the difference between the subsidized renewable electricity price and the coal-fired electricity price. Therefore, the Grid Corporation cannot increase its profitability by absorbing more renewables. On the contrary, receiving volatile renewable energy connecting the grid may affect the stability and safety of grid operation. Wind power and photovoltaic power generation have strong volatility and unpredictability. Hence, the wind/photovoltaic power generation technology conflicts with the current China’s power system under strong constraints on power demand and transmission lines (Yin et al., 2015).

2) Power grid construction lags behind the renewable energy development (Li, 2019). The unsynchronized construction progress leads to the insufficient scale of transmission channels. Meanwhile, the capacity of some transmission channels has not reached the desired level, which hinders the output of renewable energy power (Guo et al., 2020). For example, at the end of 2018, the installed capacity of new energy in China’s Three North Regions (Northeast China, North China, Northwest China) reached 230 million kilowatts. However, due to the limited local market, it was difficult to fully accommodate so much new energy power generation in the short term. Even though the load could be transmitted across regions, the transmission capacity was only 42 million kilowatts which accounted for only 18% of the total new energy installed capacity. And what was worse, the ratio of flexible power supply in power grid is unreasonably low, while the planning and construction of storage power stations is lagging, which affects not only the stability of power grid but also the accommodation of renewable energy (Ding, 2020).

3) The issue of new energy generation curtailment is outstanding in a bad way (Li and Wang, 2019). According to the data from the China Statistics Bureau (2019), on the power supply side, China’s average wind curtailment rate reached 8.7% in 2018, solar curtailment rate 3.6%, and hydro curtailment rate 5.2%. In particular, the wind and the solar curtailment have become worst in Xinjiang Uygur Autonomous Region and Gansu Province. Yunnan and Sichuan provinces have the most serious water curtailment (with the rates reaching 37.6 and 20.2%, respectively). The nationwide renewable curtailment not only caused a huge waste of energy resources but also increased the cost of new energy power generation. It objectively impeded the progress of energy transition.

Behavioral Barrier

1) The contradiction between the central government and local governments has gradually emerged (Zhou, 2019). China’s thermal power projects are mature in technology and efficient in economy; hence, lots of provinces are vigorously promoting the construction of thermal power projects, which makes the current coal-fired power generation capacity severely surplus. At the same time, these projects cannot be replaced by new energy power generation projects in a short time because the newly-built coal-fired power projects are still in the debt repayment period. Additionally, the unreasonable policy incentives system and the uneven distribution of interests among governments are also the main reasons for the large deviations between the central and local energy systems. Such policy deviations also make the energy transition difficult in terms of national planning, local dispatching, and energy pricing (Cao and Zhou, 2017).

2) The conflict of interests between enterprises and governments is unsettled (Xie et al., 2014). Usually, the local governments will transfer the contradiction to the power enterprises. The sharp rise in coal prices has compressed the profitability of coal-fired power plants, thereby further increasing the contradiction between coal-fired power generation enterprises and renewable energy power generation enterprises (Ni, 2018). Some local power grid firms refused to get the new energy access to the grid just to reduce short-term investment, resulting in the fact that the nonfossil energy power output cannot be used timely and effectively. Due to the information asymmetry, some of the renewable energy power generation could get subsidized without being consumed, which not only wasted national finances but also violated the original intention of subsidy policy.

Analysis and Discussion

Energy clean transition is a huge systematic project, which requires us to give full play to the role of the market in resource allocation and jointly promote the transformation of energy production and consumption patterns. By constructing a reasonable power market mechanism, it can fully tap the entire grid’s consumption space, encourage traditional thermal power to undergo flexible transformation, release power-side regulation capabilities, change users’ energy consumption habits, promote clean energy consumption, and promote energy-efficient transformation (Niu et al., 2014). This section will focus on analyzing the practical significance of the following five power market trading mechanisms, and discussing how market mechanisms can solve the obstacles in the process of China’s energy transition.

Power Spot Market

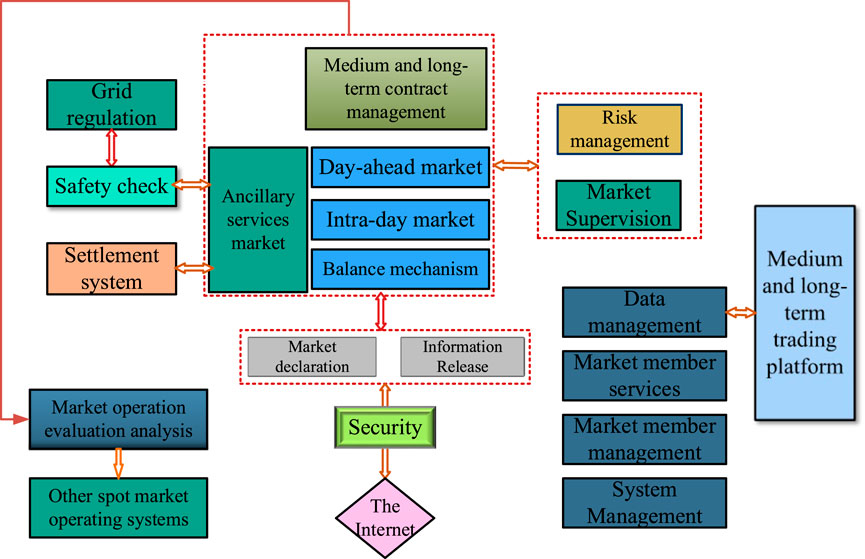

The power spot market (Figure 3) in the market design framework is the core module, referring to a resource allocation platform where power suppliers and demanders search the power price and the equilibrium quantity (Gong et al., 2018). The power spot market operation system is mainly composed of the day-ahead market, balance mechanism, market risk control, and system management subsystems. It can provide an auxiliary service market subsystem, which is suitable for areas that develop auxiliary service markets such as frequency modulation and backup. Established on the basis of certain economic transactions, the power spot market design must strictly abide by the principles of mutual benefit and fair competition (Tang and Zhang, 2020). Since this type of power trading venue in the power system can connect the transmission side, distribution side, and power consumption side effectively, the power spot market will be able to guarantee the demand for energy transition in terms of new energy accommodation and energy structure adjustment (Zhou et al., 2019).

1) Breaking down the interprovincial trading barriers and solving the volatility issue of new energy access to grid: The main role of the intraday market in the power spot market system is to provide a trading platform for market participants. After the closure of the day-ahead market, the intraday market can fine-tune the power generation plan. In addition, the intraday market can cope with various intraday forecast deviations and unplanned problems, although the transaction size is often small (Ma et al., 2019). As more intermittent renewable energy sources are connected to power grid, the uncertainty of the renewable power generation capacities within the day will also increase greatly. The existence of the intraday market can provide institutional support for such renewable energy to participate in market competition (Zhou et al., 2019). A market-oriented renewable energy utilization mechanism can be formed by improving the mechanism design of spot market and expanding the scale of renewable energy power transactions (Ge et al., 2019). At the same time, the power spot market plays a decisive role in the allocation of resources. It can not only fully explore the interprovincial accommodation capacity of renewable energy through market competition but also alleviate the more serious problems of renewable curtailment (Zhang et al., 2018). Since the State Grid Corporation officially launched the interregional and interprovincial surplus renewable energy power spot trading pilot (2017), China’s renewable energy spot market has traded six billion kW hours of renewable energy power generation in 2017. And by the end of 2018, the cumulative trading volume exceeded nine billion kWh. Hence, the power spot market can provide a commercial platform for the cross-provincial flow of new energy as well.

2) Adjusting the energy structure: The power spot market is an important module of a complete power market transaction system and also a vital measure of price discovery and resource optimization (Gong, 2018). At the end of 2017, the NDRC announced that the FIT for photovoltaic power trading in the market was $0.091 to $0.119/kWh, and the FIT for wind power trading was $0.056 to $0.08/kWh. In contrast, the FIT of thermal power was generally maintained at $0.042–0.07/kWh. In such a situation, the renewable power plants selling photovoltaic or wind power at higher prices naturally would rather generate more clean electricity after ensuring that their generation can be sold through the spot market. Hence, the power spot market can achieve the purpose of expanding a clean energy market and squeezing the thermal power market, which has already been proven that the power spot market can promote the development of energy structure toward a green and clean direction through the price-driven user interaction (Peng and Tao, 2018).

Power Capacity Market

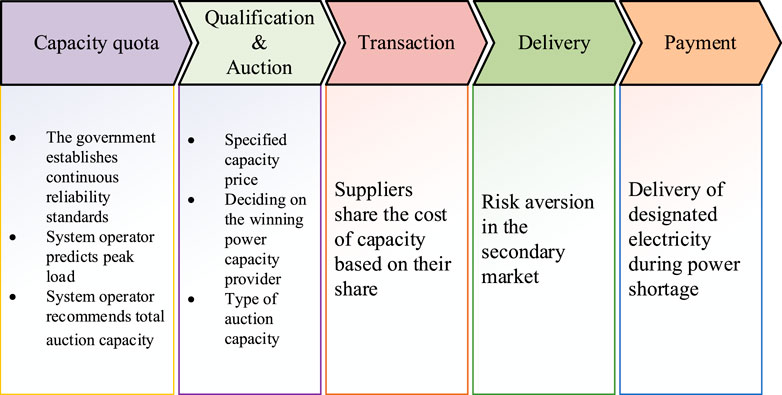

The power capacity market becomes the assistant module designed to ensure the available power load capacity during the market design. In that case, the power capacity market is an incentive mechanism (Ashokkumar Parmar and Pranav B Darji, 2020) in which a reliable power supply commitment can be offered by load demanders providing stable contract payments to capacity providers to encourage the continued investment in capacity at an affordable price (Figure 4). The structure design of the capacity market includes five stages: capacity quota, qualification and auction, transaction, delivery, and payment. The government conducts market guidance in the capacity quota and delivery stage, and the realization of qualifications, auctions, and transactions is completely subject to market competition. Theoretically, the power capacity market will promote a sustainable energy transition by meeting the needs of power investment incentives and promoting the optimal allocation of incremental power generation resources (Chen et al.,2020 ).

1) Meeting the needs of power investment incentives: It will lead to huge power generation risks if the electric quantity market is used to regulate the shortfall of power generation capacity without the coordination with the capacity market (Li et al., 2019). The advantages of capacity market are characterized by using the investment as a variable and replacing the short-term prices with the long-term equilibrium costs, which can effectively reduce market risks (Lockwood et al., 2019). The capacity market is a mechanism that grants certain subsidies and investment recovery based on the generation capacity of power generation enterprises. Such a market mechanism is able to ensure sufficient investment in power generation capacity, avoid the risk of investment uncertainty caused by the long power construction period, and correspondingly increase the investment enthusiasm of power generation enterprises (Brown, 2018). The United Kingdom’s transmission grid operator, National Grid Great Britain, needs to determine the capacity demand 3 years in advance. In December 2014, the National Grid Great Britain auctioned the 1-year reserve capacity demand starting from October 2018. In this auction, the United Kingdom government obtained 49.26 GW of capacity at a clearance price of $24.39/(kW a)2. Such a mechanism stimulates new investment to build new capacities (Hou et al., 2015). As a lesson learned from the successful experience of the United Kingdom’s capacity market, the power capacity market can provide solutions and ideas for solving the problem of insufficient investment in the energy transition process.

2) Optimizing the incremental resource allocation and solving the power safety problem caused by the connection of volatile new energy to the grid: For a long time, China’s power generation resource allocation has mainly relied on the planned economy mode. Even the “Plant-Grid Separation” scheme was basically realized during 2005–2012, the FIT of power generation enterprises still generally implemented a benchmark electricity pricing mechanism or an approved pricing model. The existence of such a situation not only makes the power generation industry blindly seek investment regardless of its own needs and interests but also objectively leads to a phased excess production capacity of power supply. On the contrary, introducing market competition through the construction of a sound capacity market will help discover the true cost of incremental power generation resources, guide the incremental power generation resources for optimal allocation, and ultimately achieve the goal of saving the overall energy cost of society. In addition, by scientifically and rationally planning the total amount and structure of power capacity demand, the capacity market is also able to guide the transition of power supply to a green and low-carbon direction (Chen, 2018 ). The rapid development of renewable energy sources has put forward higher requirements for the system’s reserve capacity of power supply, so the capacity market is one of the mainstream methods to optimize the allocation of power generation resources and increase the share of volatile new energy in power generation resources (Ashokkumar Parmar and Pranav B Darji, 2020).

Power Futures Market

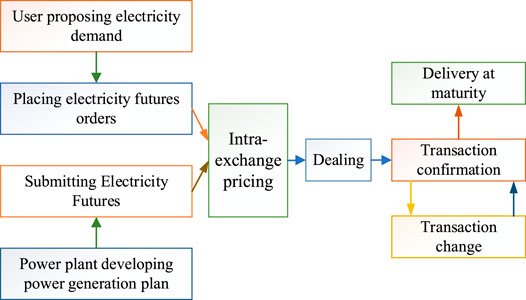

The power futures transaction is a secondary market expressed as a type of risk management mechanism in which a specific quantity and quality of electricity commodity standard contracts can be delivered (Figure 5). In the trading process of power futures trading, auction trading is often used, which is also the basic trading method in the process of power futures trading. In the process of bidding transactions, a large number of trading members, including both sellers and buyers, are gathered on the trading platform. Then, under the guidance of the rules and regulations of the exchange, bidding transactions are completed separately for various types of power futures. Developed on the basis of electricity forward contract transactions, the power futures contracts are highly standardized during power futures trading (Spodniak and Bertsch, 2020). An advanced power futures market always has comprehensive functions of price discovery, resource allocation optimization, and risk aversion (Matthäus, 2010; Kalantzis and Milonas, 2013), and thus, it will guarantee China’s energy transition in terms of energy structure optimization and market risk control (Zhang and Farnoosh, 2019).

1) Controlling the risks and ensuring the energy security: A mature and perfect power market should include the power futures market which is an effective supplement to the existing wholesale and retail power markets (Wang et al., 2019b). The power futures market can provide a platform for the price fluctuation management and the risk reduction in power market transactions (Nakajima, 2019). Of note, the development of futures trading in the power market will play a positive role in the risk management and control, which can help enterprises avoid risks to a certain extent through hedging and other applications (Du et al., 2018). The power futures market has the market function of price discovery which can guide the power market investment rationally (Nakajima, 2019). In addition, both the electricity producers and the consumers can have a relatively accurate estimate of both the future production costs and the future consumption costs since participants can sign long-term power futures contracts in advance. This trading mechanism reduces the risks of production and consumption to a certain extent and will help improve the safety of the entire power system. For example, Singapore Power Futures has helped competitive electricity users reduce the cost of retail electricity contracts by more than 10% since it began operations in April 2015. At the same time, the construction of power futures market is of great significance to the energy security.

2) Optimizing the energy structure: A single price in the spot market can easily deviate from its actual value, and it cannot achieve the effects of energy conservation, emission reduction, and resource allocation optimization efficiently (Stephanía and Nursimulu, 2019). The power grid system can use the price discovery function of the power futures market to scientifically and reasonably budget and plan the future power spot market (Kallabis et al., 2016). In the context of overall oversupply in the power market, low-efficiency generators can still obtain some of the planned power generation, which prevents those high-efficiency environment-protection generators from obtaining chances with a high power generation when the overall electricity consumption decreases. As a result, the utilization rate of efficient coal-fired generators is reduced. In the power futures market, the high-efficiency generators have the attributes of low coal consumption, low fuel costs, and advantages in the quotations, so they will be given priority in concentrated bidding transactions. The transaction order of low-efficiency generators should be in the back, and their transaction volume is not guaranteed, which make the low-efficiency generators gradually withdraw from the market competition (Ren, 2019). This shows that the power futures market can finally achieve the purpose of saving coal, reducing emissions, and optimizing power structure through market-oriented means.

Carbon Emission Market

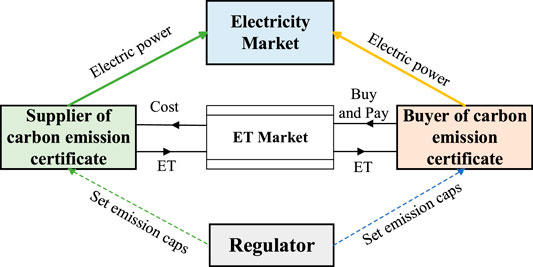

The carbon emission market in the market design framework is a kind of auxiliary module in which the carbon emission right accepting the guidance and supervision with specific environmental protection objectives can be exchanged and circulated as valuable assets and scarce commodities (Figure 6). In the carbon emission market, carbon emission regulators set relevant carbon dioxide emission cap standards for thermal power manufacturers. Among thermal power manufacturers, those whose carbon emissions are lower than the upper limit of carbon dioxide emissions prescribed by the regulator are suppliers of carbon emission rights certificates; those whose carbon emissions are higher than the upper limit of carbon dioxide emissions prescribed by the regulators are those who demand carbon emission rights certificates. Suppliers of carbon emission rights certificates sell their surplus carbon emission rights certificates and obtain corresponding benefits at the same time, while carbon emission rights certificate demanders must choose to purchase corresponding carbon emission rights certificates in the carbon emission rights certificate market to meet the requirements of regulators. The essence of carbon ET is to realize the re-distribution of carbon emission responsibilities in a market-oriented way (Lin and Jia, 2020). The carbon emission market is of great significance for advancing the adjustment of energy structure and promoting the accommodation of new energy (Weng and Xu, 2018).

1) Adjusting the energy structure: The establishment of the carbon trading mechanism not only helps to mobilize the enthusiasm of enterprises to produce clean power but also can promote the continuous increase in the share of clean energy power generation (Zhu, 2019). In terms of the carbon emission right, the implementation of carbon emission right trading system can increase the generation costs of traditional energy power generation plants, which in turn will reduce the investment in the traditional energy sector (Feng, 2016). Accordingly, the carbon emission market is conducive to the energy transition by adjusting the power supply structure and reducing carbon emissions. Some evidence suggests that the implementation of carbon trading can significantly promote the structural transformation of high-carbon energy markets and the carbon emission market can also gradually reduce the coal consumption (Yi et al., 2019). With the reduction in low-efficiency coal resource consumption and the widespread use of clean energy, the efficiency of energy use will be further improved, which is more conducive to achieving the goal of energy-saving as well as emission reduction and promoting the energy market reform (Zhang et al., 2020).

2) Promoting the accommodation of new energy: In the carbon trading mechanism, enterprises using traditional fossil energy are required to pay carbon emission taxes which can force high-energy-consuming enterprises to use clean energy to a certain extent. This mandatory carbon emission tax payment mechanism can also control the total regional energy consumption and transform the energy demand into clean energy consumption (Feng, 2016; Lin and Jia, 2020; Zhang et al., 2020). Shanghai Stock Exchange is the largest carbon trading exchange in China. In 2012, the Shanghai Stock Exchange realized a carbon trading volume of more than $981.5 million. In particular, the number of individual accounts opened for voluntary carbon emission reduction projects exceeded 210,000, and the trading volume accounted for about 70% of the national trading market. As of the end of 2018, China’s cumulative carbon ET volume was close to 800 million tons, and its cumulative carbon ET volume exceeded $1.542 billion. The successful implementation of the carbon emission market will help the traditional fossil energy consumers transform their energy needs into clean energy (Wang et al., 2019c).

TGC Market

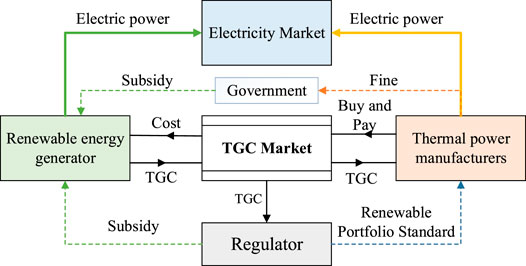

The TGC market is another auxiliary module in which the TGC issued by the government is to realize both the renewable power production and the consumption as planned and expected (Song et al., 2020). Generally, a green certificate trading system is composed of green certificates, issuing agencies, transaction management agencies, management systems, and registration agencies. In the trading system, the regulator first stipulates the relevant quota standards for thermal power manufacturers, and then renewable energy generators put green certificates equivalent to their own electricity production on the green certificate market for sales; in order to meet the quota requirements of the regulatory agencies, thermal power manufacturers can either choose to purchase a corresponding number of green certificates in the green certificate market or choose to pay a certain fine to the government. Through the voluntary subscription transactions of TGC, power enterprises can complete their obligations in the TGC market (Figure 7) based on the Renewable Portfolio Standard (RPS) (Hustveit et al., 2015). Theoretically, the TGC market will help promote China’s energy transition by reducing the government’s financial burden and optimizing resource allocation (Finjord et al., 2018).

1) Reducing the government’s financial burden: Both the implementation of RPS and the establishment of the TGC market are conducive to reducing the regulatory costs and reducing the government’s financial burden (Zhao, 2016b). The introduction of market-based measures can enable the TGCs to be traded freely, which means that the government no longer needs to directly transfer the financial subsidies to support the renewable energy industry (An et al., 2019). The TGC system is a major measure to improve some renewable energy support policies and even construct some renewables development mechanisms (Tang, 2017). The TGC market not only is conducive to promoting the efficient use of clean energy and reducing the direct subsidy intensity of national financial funds but also has a positive significance for consolidating social consensus and promoting energy transition. Some research results showed that the TGC program can not only achieve the goal of renewable electricity but also reduce both the regulatory costs and the financial burden (Ciarreta et al., 2017). As of the end of May 2018, the cumulative number of China’s TGC issued was 22 million, and the cumulative number of subscriptions reached 27,190. Such an achievement directly helped the government retain $0.645 million by saving the renewable energy subsidies.

2) Optimizing the resource allocation and alleviating the contradiction between coal-fired power generation and renewable one: If the government only adopts the RPS system without implementing the TGC transactions to stimulate the development of renewable energy market, this kind of imperfection will lead to a significant increase in the cost of enterprises. In a policy system simply implementing the RPS, all related enterprises and market entities will be assigned consistent quotas but not allowed to trade them. At this time, different power enterprises with different marginal costs will inevitably cause terrible waste, market inefficiency. After the establishment of the TGC market, the external costs of the power industry will be internalized, and the total cost becomes the sum of production costs and external costs (Liu, 2017). Meanwhile, the equilibrium price in the power market can truly reflect the actual value of electricity commodities, which can effectively solve the problem of inefficient resource allocation. The mutual conversion of renewable energy power generation and TGCs will be able to encourage the enthusiasm of those superior renewable energy enterprises and make those disadvantaged renewable energy enterprises complete the quotas at a lower cost (Jiang et al., 2014). In addition, the very small scale of mandatory quotas can easily cause the underutilization of resources. On the contrary, the TGC market can accurately avoid such a problem and ease the contradiction between the coal-fired plants and the renewable ones. The establishment of a TGC market can promote the accommodation of renewables and increase the revenue of power generators significantly (Helgesen and Tomasgard, 2018). According to the real-time statistics of the TGC’s subscription platform, as of May 31, 2019, in China, a total of 2,138 participants had subscribed for a total of 33,140 TGCs, and each TGC representing 1,000 kWh green electric power came from either the onshore wind power project or photovoltaic power plant project.

Conclusion and Policy Implication

This article comprehensively analyzed the theoretical basis of market design for promoting the energy transition and then discussed the goals and the obstacles related to China’s energy transition. Accordingly, the function and role of market design have been discussed on five typical markets. In summary, the conclusions are as follows:

1) The market design is as important as the policy-making; hence, it is unwise for energy transition to focus on policies and ignore markets. The energy transition is characterized by permanency, systematicness, and complexity. The Chinese government has already successively issued a series of policies; however, China’s energy transition still lack the necessary market incentives due to the imbalance in the distribution of energy endowments, the expansion of fiscal subsidy gap, the high cost of new energy technology, and especially the difficulty in implementing the policies. Many scholars and enterprises have proved the role of market design which shows a much more stable and durable effect than the role of policy-making. Of note, the market design for energy transition in electric power industry is not only to promote the vigorous development of new energy (such as the power spot market, the power futures market, and the TGC market) but also to advance the sustainable and clean evolution of traditional energy (such as the power capacity market and the carbon emission market).

2) Market design should be pertinent and objective; hence, there are at least five types of markets that can promote the energy transition of electric power sector. There are four main sources of obstacles to China’s energy transition. In particular, the institutional barriers have always been the principal contradictions, and the economic barriers and the technical barriers are the core troubles, while the behavioral barriers are the important links. The spot market is an effective way to solve the volatility of new energy and realize the economic dispatch of renewables in the meantime and it can fully exploit the interprovincial accommodation space through market competition to alleviate the increasingly serious issue of renewable curtailment. The power capacity market can meet the needs of power investment incentives and promote the optimal allocation of incremental power generation resources. The power futures market is able to optimize the energy structure and control risks. The carbon emission market is an effective way to arrange the energy structure scientifically and promote the accommodation of new energy rationally. The TGC market can reduce the government’s financial burden and optimize the resource allocation.

3) As far as the current situation of China’s energy development is concerned, it is still far from the achievement of China’s energy development goals. China should pay more attention to promoting the energy transition to not only innovate on the basis of the characteristics of its own development but also draw on the advanced experience of other industrialized countries in the field of market design. The share of nonfossil energy in primary energy consumption is a very core indicator in the process of China’s energy transition, and the realization of that indicator mainly depends on the nonfossil energy power generation in the power system. Therefore, to achieve the goal of China’s national energy transition, the power system must be sustainably transformed first.

Based on the conclusions above, we offer the following recommendations:

In the market design, China firstly should explore the establishment of a diversified market structure that includes a competitive power market, a cross-regional and interprovincial power trading market, and an ancillary service market. Secondly, sufficient market choices and space should be provided for the profitability of both the new energy and the conventional power sources. Finally, the design should be to promote the energy transition in electric power industry in light of a high share of new energy access. In the design of specific market rules, the volatility, uncertainty, and marginal cost of new energy power generation should be fully considered. On the one hand, it is possible to mobilize the enthusiasm of various types of power investment, especially of the flexible power supply investment, through a reasonable investment protection mechanism to ensure the long-term, safe, and reliable operation of the power system. On the other hand, the potential of flexible resources can be fully mobilized through the design of rules during the operation phase. The research on the market design is supposed to help the energy transition by providing some management, mechanism, and policy guarantees in building a formal and unified power market trading system.

Data Availability Statement

The original contributions presented in the study are included in the article/Supplementary Material; further inquiries can be directed to the corresponding author.

Author Contributions

LP: supervision, conceptualization, methodology, writing, and editing. GP: data collection, writing, and reviewing. ZC: investigation and reviewing.

Funding

This paper is supported by the National Natural Science Foundation of China (Grant No. 72103128) and the Key Projects in Soft Science Research of Shanghai Science and Technology Commission (Grant No. 21692109400). This study received funding from the Technological Project of State Grid Corporation of China. The funder was not involved in the study design, collection, analysis, interpretation of data, the writing of this article or the decision to submit it for publication.

Conflict of Interest

Author ZC was employed by company State Grid Energy Research Institute Co., Ltd.

The remaining authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Footnotes

11 USD = 7.1315 RMB.

21 USD ≈ 0.7954 GBP.

References

An, X., Zhang, S., Li, X., and Du, D. (2019). Two-stage Joint Equilibrium Model of Electricity Market with Tradable green Certificates. Trans. Inst. Meas. Control. 41 (6), 1615–1626. doi:10.1177/0142331217718619

Ashokkumar Parmar, A., and Pranav B Darji, B. (2020). Capacity Market Functioning with Renewable Capacity Integration and Global Practices[J]. Electricity J. 33 (2), 106708. doi:10.1016/j.tej.2019.106708

Baležentis, T., and Štreimikienė, D. (2019). Sustainability in the Electricity Sector through Advanced Technologies: Energy Mix Transition and Smart Grid Technology in China[J]. Energies 12 (6), 1–21. doi:10.3390/en12061142

Brown, D. P. (2018). Capacity Payment Mechanisms and Investment Incentives in Restructured Electricity Markets[J]. Energ. Econ. 74. doi:10.1016/j.eneco.2018.05.033

Cao, L. P., and Zhou, F. Q. (2017). Research on Challenges and Countermeasures of Energy System Transition in China in the Context of Energy Revolution[J]. Chin. J. Environ. Manage. 9 (05), 84–89. doi:10.16868/j.cnki.1674-6252.2017.05.084

Chen, H. (2015). Analysis of the Development of China's New Energy Industry under the New normal [J]. China Stat. 405 (09), 55–56.

Chen, Y. G., Zhang, X., and Zhang, L. (2020). Discussion on Mechanism Design of Southern China (Starting from Guangdong) Power Capacity Market[J]. Guangdong Electric Power 33 (02), 45–53. doi:10.3969/j.issn.1007-290X.2020.002.006

Chen, Z. (2018). Electricity Industry Capacity Market Urgently Needs to Be Established [N]. Beijing: CHINA ENERGY NEWS. 2018-01-29(004).

Chen, Z., Zhang, X., and Ma, Z. M. (2020). A Capacity Market Design Guiding the Long-Term Effective Balance of Power Supply and Demand[J/OL]. Electric Power:1-7[2020-02-17]. Available at: http://kns.cnki.net/kcms/detail/11.3265.TM.20190905.1134.008.html. doi:10.11930/j.issn.1004-9649.201906029

Ciarreta, A., Espinosa, M. P., and Pizarro-Irizar, C. (2017). Optimal Regulation of Renewable Energy: A Comparison of Feed-In Tariffs and Tradable Green Certificates in the Spanish Electricity System. Energ. Econ. 67 (67), 387–399. doi:10.1016/j.eneco.2017.08.028

Ding, Z. L. (2020). Report of the Law Enforcement Inspection Group of the Standing Committee of the National People's Congress on the Inspection of the Implementation of the "Renewable Energy Law of the People's Republic of China"-December 15, 2019 at the 15th Meeting of the Standing Committee of the 13th National People's Congress [J]. The People’s Congress of China (02), 11–16.

Du, J., Dong, C., and Di, P. Y. (2018). Analysis and Application of Futures Trading in Electricity Market [J]. Mech. Electr. Inf. 564 (30), 114–115+117.

Fan, W. Y., and Hao, Y. (2020). An Empirical Research on the Relationship Amongst Renewable Energy Consumption, Economic Growth and Foreign Direct Investment in China[J]. Renew. Energ. 146, 598–609. doi:10.1016/j.renene.2019.06.170

Feng, T. T. (2016). Coupling Induction Analysis Model of Tradable Green Certificate and Carbon Emission Trading Acting on Electricity Market in China[D]. Beijing): North Chinese Electronic Power University.

Finjord, F., Hagspiel, V., Lavrutich, M., and Tangen, M. (2018). The Impact of Norwegian-Swedish green Certificate Scheme on Investment Behavior: A Wind Energy Case Study. Energy Policy 123 (DEC), 373–389. doi:10.1016/j.enpol.2018.09.004

Ge, R., Chen, L. X., and Tang, J. (2019). Design and Practice of Cross-Regional Incremental Spot Market for Renewable Energy[J]. electric power construction 40 (1), 11–18. doi:10.3969/j.issn.1000-7229.2019.01.002

Gong, G. J. (2018). Spot Market Accelerates Service Change[J]. China Power Enterprise Manage. (27), 1.

Gong, G. J., Wang, H., Zhang, T., and Chen, Z. (2018). Research on Electricity Market about Spot Trading Based on Blockchain[J]. proceedings see 38, 6955–6966. (in Chinese). doi:10.13334/j.0258-8013.pcsee.172645

Grubb, M., and Newbery, D. (2018). UK Electricity Market Reform and the Energy Transition: Emerging Lessons[J]. United States: Cambridge Working Papers in Economics.

Guo, L., Wu, C., and Chen, L. (2020). Analysis on Transmission Congestion Mechanism of Cross-Region Renewable Energy Integration in Receiving-End Power Grid[J]. Electric Power Construction 41 (2), 21–29. (in Chinese). doi:10.3969/j.issn.1000-7229.2020.02.003

Helgesen, P. I., and Tomasgard, A. (2018). An Equilibrium Market Power Model for Power Markets and Tradable green Certificates, Including Kirchhoff's Laws and Nash-Cournot Competition[J]. Energ. Econ. 70, 270–288. doi:10.1016/j.eneco.2018.01.013

Hou, F. R., Wang, X. L., and Suo, T. (2015). Capacity Market Design in the United Kingdom and Revelation to China's Electricity Market Reform[J]. Automation Electric Power Syst. 39 (24), 1–7. doi:10.7500/AEPS20150322002

Hustveit, M., Frognerj, S., and Fleten, S. (2015). “Toward a Model Forthe Sw Edish-Norw Egian Electricity Certificate Market[C],” in 2015 12thInternational Conference on the European Energy Market ( EEM ) (New York,USA: IEEE).

Jiang, J. J., Ye, B., and Ma, X. M. (2014). The Construction of Shenzhen׳s Carbon Emission Trading Scheme. Energy Policy 75 (dec), 17–21. doi:10.1016/j.enpol.2014.02.030

Jin, L. Q. (2016). The Goal and Path of Energy Structure Transformation: Comparison and Enlightenment from America and Germany[J]. Inq. into Econ. Issues (2), 166–172.

Kalantzis, F. G., and Milonas, N. T. (2013). Analyzing the Impact of Futures Trading on Spot price Volatility: Evidence from the Spot Electricity Market in France and Germany. Energ. Econ. 36 (Mar.), 454–463. doi:10.1016/j.eneco.2012.09.017

Kallabis, T., Christian, P., and Christoph, W. (2016). The Plunge in German Electricity Futures Prices – Analysis Using a Parsimonious Fundamental Model[J]. Energy Policy 95, 280–290. doi:10.1016/j.enpol.2016.04.025

Letova, K., Yao, R., Davidson, M., and Afanasyeva, E. (2018). A Review of Electricity Markets and Reforms in Russia[J], 53. United Kingdom: Utilities Policy. doi:10.1016/j.jup.2018.06.010

Li, J. F., and Cai, Q. M. (2016). Discussion on the Key Problems and Policy Suggestions of Energy Transformation in China [J]. Environ. Prot. 44 (09), 16–21.

Li, J. J., and Wang, N. (2019). China's Energy Transition and Path Selection[J]. Adm. Reform 117 (05), 65–73.

Li, L. S. (2019). Research on Dispatching and Planning of Integrated Energy Systems Considering Differences of Multiple Functional Areas [D]. Zhejiang: Zhejiang University.

Li, P., Huang, L., and Chen, H. Y. (2019). Enlightenment of Japan's Power Market Construction to China [J]. South. Power Syst. Technol. 13 (09), 67–74. doi:10.13648/j.cnki.issn1674-0629.2019.09.011

Li, W., Sun, W., Li, G. M., Jin, B., Wu, W., Cui, P., et al. (2018). Transmission Mechanism between Energy Prices and Carbon Emissions Using Geographically Weighted Regression[J]. Energy Policy 115, 434–442. doi:10.1016/j.enpol.2018.01.005

Lin, B., and Jia, Z. (2020). Why Do We Suggest Small Sectoral Coverage in China's Carbon Trading Market?. J. Clean. Prod. 257, 120557. doi:10.1016/j.jclepro.2020.120557

Lin, B. Q., and Jia, Z. J. (2019). How Does Tax System on Energy Industries Affect Energy Demand, CO 2 Emissions, and Economy in China?, 84. Netherlands: Elsevier B.V. doi:10.1016/j.eneco.2019.104496

Lin, F. P. (2016). Research on Legal Issues of My Country's New Energy Market Access System [D]. Jiangxi: Jiangxi University of Science and Technology.

Liu, D. N. (2017). Coordinated Development of Electricity Market, Carbon Emission Rights Market and green Certificate Market [J]. China Electr. Equipment Industry (07), 44–46. doi:10.3969/j.issn.1009-5578.2017.07.014

Liu, P. K., Peng, H., and Luo, S. (2019). Research on Structural Characteristics of Driving Forces of China Energy Transition[J. ]. China Population, Resour. Environ. 29 (12), 45–56. (in Chinese). doi:10.12062/cpre.20190811

Liu, P. K., and Wang, Z. W. (2019). Is it Reasonable for China to Promote “Energy Transition” Now? ——An Empirical Study on the Substitution-Complementation Relationship Among Energy Resources [J]. China Soft Sci. 344 (8), 19–135.

Lockwood, M., Mitchell, C., and Hoggett, R. (2019). Unpacking ‘regime Resistance’ in Low-Carbon Transitions: The Case of the British Capacity Market. Energ Res. Soc. Sci. 58, 101278. ISSN 2214-6296. doi:10.1016/j.erss.2019.101278

Ma, H., Liu, W. T., and Chen, Y. (2019). Power Market Mechanism Design and System Architecture Adapted to My Country's National Conditions [J]. Electric Age (05), 78–81.

Ma, Q. L., and Li, Q. (2019). Case Study on Relationship between CHINA’S Economic Growth and New/Traditional Energies [J]. Resour. Industries 452 (02), 85–94.

Matthäus, P. (2010). “Risk Premia in the German Electricity Futures Market[C],” in International Conference on Energy & Environment (IEEE).

Matthew, J. B., and Jennie, C. S. (2017). Energy Democracy: Goals and Policy Instruments for Sociotechnical Transitions[J]. Energ. Res. Soc. Sci. 33, 35–48. doi:10.1016/j.erss.2017.09.024

Monasterolo, I., and Raberto, M. (2019). The Impact of Phasing Out Fossil Fuel Subsidies on the Low-Carbon Transition[J]. Energy Policy 124, 355–370. doi:10.1016/j.enpol.2018.08.05

Munro, F. R., and Cairney, P. (2020). A Systematic Review of Energy Systems: The Role of Policymaking in Sustainable Transitions[J]. Renew. Sustain. Energ. Rev. 119, 109598.1–109598.10. doi:10.1016/j.rser.2019.109598

Nakajima, T . (2019). Expectations for Statistical Arbitrage in Energy Futures Markets[J]. J. Risk Financial Manage. 12 (1). doi:10.3390/jrfm12010014

Ni, W. D. (2018). Improving Coal Power Operation Cost and Promoting the Marketization of New Energy Generation [J]. Electric Power Equipment Manage. 24 (09), 5.

Niu, W. J., Li, Y., and Wang, B. B. (2014). Demand Response Based Virtual Power Plant Modeling Considering Uncertainty[J]. Proc. CSEE 34 (22), 3630–3637. (in Chinese). doi:10.13334/j.0258-8013.pcsee.2014.22.007

Peng, X., and Tao, X. (2018). Cooperative Game of Electricity Retailers in China's Spot Electricity Market. Energy 145, 152–170. doi:10.1016/j.energy.2017.12.122

Ren, M. Y. (2019). Impact of Electricity Futures Market on Thermal Power Enterprises [J]. China Power Enterprise Manage. 559 (10), 78–79.

Safari, A., Das, N., Langhelle, O., Roy, J., and Assadi, M. (2019). Natural Gas: A Transition Fuel for Sustainable Energy System Transformation? Energy Sci. Eng. 7 (4), 1075–1094. doi:10.1002/ese3.380

Shi, D., and Wang, L. (2015). Energy Revolution and its Effects on Economic Development [J]. Ind. Econ. Res. (1), 1–8. doi:10.13269/j.cnki.ier.2015.01.001

Shi, L. J., Zhou, L., Pang, B., Yan, Y., Zhang, F., and Liu, J. (2017). Design Ideas of Electricity Market Mechanism to Improve Accommodation of Clean Energy in China[J]. Automation Electric Power Syst. 41 (24), 83–89. doi:10.7500/AEPS20170614002

Solano-Rodríguez, B., Pizarro-Alonso, A., Vaillancourt, K., and Martin-del-Campo, C. (2018). “Mexico's Transition to a Net-Zero Emissions Energy System: Near Term Implications of Long Term Stringent Climate Targets,” in Limiting Global Warming to Well below 2°C: Energy System Modelling and Policy Development. Germany: Springer, 315–331. doi:10.1007/978-3-319-74424-7_19

Song, X. H., Han, J. J., Shan, Y. Q., Zhao, C., Liu, J., and Koub, Y. (2020). Efficiency of Tradable green Certificate Markets in China[J]. J. Clean. Prod. 264, 121518. doi:10.1016/j.jclepro.2020.121518

Spodniak, P., and Bertsch, V. (2020). Is Flexible and Dispatchable Generation Capacity Rewarded in Electricity Futures Markets? A Multinational Impact Analysis[J]. Energy 196, 117050.1–117050.11. doi:10.1016/j.energy.2020.117050

Staden, M. V. (2017). Sustainable Energy Transition: Local Governments as Key Actors[J]. Towards 100% Renewable Energy. Germany: Springer, 17–25.

Stephanía, M. L., and Nursimulu, A. (2019). Drivers of Electricity price Dynamics: Comparative Analysis of Spot and Futures Markets[J]. Energy Policy 126, 76–87. doi:10.1016/j.enpol.2018.11.020

Sun, L. L. (2018). Research on Power Generation Cost———Based on the analysis of life cycle assessment theory [J]. Price: Theor. Pract. 407 (05), 153–156.

Sun, X. Y. (2017). Research on China's Energy Transition and Policies[D]. Beijing): China University of Petroleum.

Sun, Y. Z., Bao, Y., Xu, J., Zha, X. M., Li, X., Ke, D. P., et al. (2017). Discussion on strategy of stabilizing high proportion of renewable energy power fluctuation [J]. Chin. Sci. Bull. (10), 111–121. doi:10.1360/N972016-00484

Tang, C., and Zhang, F. (2020). Mechanism of wind power and solar photovoltaic power participation in the electricity spot market considering the guaranteed capacity factor. IOP Conf. Ser. Earth Environ. Sci. 446, 022031. doi:10.1088/1755-1315/446/2/022031

Tang, J. P. (2017). The Impact of green power certificate trading on the operation and development of new energy power generation Enterprises[J]. Solar Energy (05), 16–18+22.

Wang, F. (2019). History of China's power industry regulatory Reform[J]. China Collective Economy (23), 57–58.

Wang, H., Chen, Z. P., and Wu, X. Y. (2019). Can a carbon trading system promote the transformation of a low-carbon economy under the framework of the porter hypothesis? —Empirical analysis based on the PSM-DID Method[J]. Energy Policy 129, 930–938. doi:10.1016/j.enpol.2019.03.007

Wang, M. Y., Li, Y. M., Li, M. M., and Shi, W. (2019). Will carbon tax affect the strategy and performance of low-carbon technology sharing between enterprises?[J]. J. Clean. Prod. 210, 724–737. doi:10.1016/j.jclepro.2018.10.321

Wang, X., Hong, Z. Z., and Pang, J. Y. (2019). Formation and Development of Singapore Electricity Future Market [J]. Zhejiang Electric Power 38 (09), 22–26. doi:10.19585/j.zjdl.201909004

Wei, W., and Dong, A. P. (2016). The Mechanism Analysis and Policy Recommendations of Energy Taxation to Promote the Development of Renewable Energy. Old District Construction 000 014, 8–10.

Weng, Q., and Xu, H. (2018). A review of China's carbon trading market. Renew. Sustain. Energ. Rev. 91 (aug), 613–619. doi:10.1016/j.rser.2018.04.026

Will, U., and Strachan, N. (2012). Critical mid-term uncertainties in long-term decarbonisation Pathways[J]. Energy Policy 433, 444–619. doi:10.1016/j.enpol.2011.11.004

Wu, J., Chang, L., and Cao, B. (2019). Design and Implementation of Renewable Energy Inter-regional Spot Market Operation Support System[J]. Shandong Electric Power 046 (003), 13–18. doi:10.3969/j.issn.1007-9904.2019.03.004

Xie, X. X., Ren, D. M., and Zhao, Y. Q. (2014). Initial Analysis of Promoting China's Energy Revolution System and Mechanism Reform [J]. Energy of China 36 (04), 16–19+44. doi:10.3969/j.issn.1003-2355.2014.04.004

Xie, Z. M., Yan, K., and Zhou, L. M. (2017). Research of Long-run Equilibrium between Economic Growth/Energy Transformation and CO2 Emissions——An Empirical Study Based on Provincial Panel Data Analysis [J]. Theor. Pract. Finance Econ. 38 (06), 116–121. doi:10.3969/j.issn.1003-7217.2017.06.018

Xu, Y. (2017). An Empirical Study on the Relationship between New Energy Consumption and China's Economic Growth [J]. Econ. Rev. (05), 69–74. doi:10.16528/j.cnki.22-1054/f.201705069

Yang, N. (2015). Thoughts on Deepening the Reform of China's Electric Power System[J]. Enterprise Reform Manage. 268 (23), 194+196. doi:10.13768/j.cnki.cn11-3793/f.2015.5927

Yang, T., Zhao, L. Y., Li, W., and Zomaya, A. Y. (2020). Reinforcement learning in sustainable energy and electric systems: a Survey[J]. Annu. Rev. Control. 49, 145–163. doi:10.1016/j.arcontrol.2020.03.001

Yang, X. L., He, L. Y., Xia, Y. F., and Chen, Y. (2019). Effect of government subsidies on renewable energy investments: The threshold Effect[J]. Energy Policy 132, 156–166. doi:10.1016/j.enpol.2019.05.039

Yi, L., Bai, N., and Yang, L. (2019). Evaluation on the Effectiveness of China’s Pilot Carbon Market Policy[J]. J. Clean. Prod. 246, 119039. doi:10.1016/j.jclepro.2019.119039

Yin, G. L., Zhang, X., Cao, D. D., and Liu, J. (2015). Determination of Optimal Spinning Reserve Capacity of Power System Considering Wind and Photovoltaic Power Affects[J]. Power Syst. Technol. 39 (No.38512), 191–198. doi:10.13335/j.1000-3673.pst.2015.12.025

Zhang, k., and Jiao, Y. (2018). Strategy of China's Diversified and Flexible Energy Structure: Evidences from the Alternation of Energy Eras and the Gas Shortage [J]. Sino-Global Energy 023 (006), 1–19.

Zhang, L. Z., and Tang, C. P. (2016). Applicability Analysis of British Capacity Market Mode in China[J]. Electric Power Construction 37 (03), 124–128. doi:10.3969/j.issn.1000-7229.2016.03.019

Zhang, S., Andrews-Speed, P., and Li, S. (2018). To what extent will China's ongoing electricity market reforms assist the integration of renewable energy?. Energy Policy 114 (mar), 165–172. doi:10.1016/j.enpol.2017.12.002

Zhang, S., and Andrews-Speed, P. (2020). State versus market in China's low-carbon energy transition: An institutional perspective. Energ. Res. Soc. Sci. 66, 101503. doi:10.1016/j.erss.2020.101503

Zhang, W., Li, J., and Li, G. X. (2020). Emission reduction effect and carbon market efficiency of carbon emissions trading policy in China[J]. Energy 196, 117117.1–117117.9. doi:10.1016/j.energy.2020.117117

Zhang, Y., and Farnoosh, A. (2019). Analyzing the dynamic impact of electricity futures on revenue and risk of renewable energy in China[J]. Energy Policy 132, 678–690.

Zhao, Q. Y. (2016). Research on the Renewable Energy Quota System in China [D]. Liaoning: LIAONING UNIVERSITY.

Zhao, T. Y. (2016). New energy industry over-investment phenomenon and governance suggestions [J]. Enterprise Reform Manage. (8X), Beijing, 173–173. doi:10.13768/j.cnki.cn11-3793/f.2016.3160

Zhou, M., Wu, Z. Y., and He, Y. h. (2019). A day-ahead electricity market-clearing model considering medium- and long-term transactions and wind producer Participation[J]. scientia sinica (informationis). (in Chinese) 49 (8), 1050–1065.

Keywords: energy transition, IETB analysis framework, obstacles to transition, market design, Sustainable development

Citation: Pingkuo L, Pengbo G and Chen Z (2021) How to Promote Energy Transition With Market Design: A Review on China’s Electric Power Sector. Front. Energy Res. 9:709272. doi: 10.3389/fenrg.2021.709272

Received: 13 May 2021; Accepted: 23 July 2021;

Published: 30 August 2021.

Edited by:

Chan Wang, Guangdong University of Finance and Economics, ChinaReviewed by:

Jay Zarnikau, University of Texas at Austin, United StatesXiong Xiong, Tianjin University, China

Copyright © 2021 Pingkuo, Pengbo and Chen. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Liu Pingkuo, cGluZ29mb3JldmVyQHNpbmEuY29t

Liu Pingkuo

Liu Pingkuo Gao Pengbo1

Gao Pengbo1