- 1College of Control Science and Engineering, Zhejiang University, Hangzhou, China

- 2State Grid Zhejiang Hangzhou Xiaoshan Power Supply Company, Hangzhou, China

- 3Zhejiang Zhongxin Power Engineering Construction Co., Ltd., Hangzhou, China

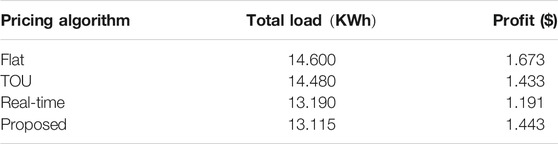

Demand response (DR) is a powerful tool to maintain the stability of the power system and maximize the profit of the electricity market, where the customers engage in the pricing scheme and adjust their electricity demand proactively based on the price. In DR programs, most existing works are based on the assumption that the prediction of the electricity demand from customers is always accurate and trustworthy, which will lead to high cost and fluctuation of the electricity market once the prediction is obeyed. In this paper, we design a reward and punishment mechanism to constrain customers’ dishonest behaviors and propose a novel pricing algorithm based on the reward and punishment mechanism to relax the assumption, which guarantees the total electricity demands of all customers are within a secure range and obtain the maximum profit of the supplier. Meanwhile, we obtain the optimal demand and provide a upper and lower bound of the proposed price for the electricity market. In addition to a single type of customer, we also consider multiple types of customers, each of whom has different characteristics to prices. Extensive simulation results are constructed to demonstrate the effectiveness of the proposed algorithm compared with other pricing algorithms. It also shows that the average electricity consumption of a whole community is mostly affected by the residents’ electricity consumption and the balance of the supply and all types of customers is achieved under the proposed pricing algorithm.

1 Introduction

Demand-side resource management (DSM) is a new means to explore and solve the balance between the supply and demand of electricity at the customer end (Gellings, 1985). Demand response (DR), as one of the important and powerful solutions to DSM, can achieve win-win results for both the supplier and the customers where the customers are stimulated by the price to participate in the maintenance of the electricity balance proactively and adjust its electricity consumption (Albadi and El-Saadany, 2007; Deng et al., 2017; Paterakis et al., 2017; Wang et al., 2020). Therefore, it is meaningful and promising to consider how to reasonably schedule the enthusiasm of customers to participate in the power market supply and demand balance and avoid power waste.

Numerous efforts have been devoted to design price-based demand response, which can be divided into three categories, including time-of-use pricing (TOU) (Celebi and Fuller, 2012; Wang and Li, 2015; He et al., 2018; Cui and Yang, 2019), real-time pricing (RTP) (Mohsenian-Rad and Leon-Garcia, 2010; Roozbehani et al., 2012; Tsui and Chan, 2012; Finck et al., 2020) and critical peak pricing (Herter, 2007; Herter and Wayland, 2010; Jang et al., 2015; Li et al., 2018). TOU pricing scheme, where the price is designed by the time splintered into multiple time-slots, is more widely used because it can reduce the inefficiency of the single pricing scheme while being more practical for customers than real-time pricing. In DR, the control platform needs to design reasonable and effective pricing schemes to reach certain objectives, such as profit maximization and user utility maximization. For example, under the TOU pricing scheme, Cheng et al. (2019) solved an energy cost optimization problem in two-machine Bernoulli serial line, and Zhou and Li( 2015) researched the optimization problem of residential load scheduling and achieved the minimization of electricity cost of the customers and peak-valley difference of the supplier. To minimize the mean price paid by the customers, Hung and Michailidis (2018) discussed a general stochastic modeling framework for customer’s power demand based on which TOU contract characteristics can be selected.

Most existing pricing schemes are designed based on the consideration of two sides (Li et al., 2011; Paschalidis et al., 2012; Kii et al., 2014; Wang and Paranjape 2017). One is the supply side that the fluctuation of the total electricity demand is small and control platform designs the pricing scheme to achieve the maximization of the profit based on the demand prediction. The other is the demand side that the customers adjust their electricity demand flexibly to minimize their cost with the given pricing. Connecting two sides, there exists a tradeoff in achieving profit maximization and keeping the balance of the supply and the demand between the supplier and the customers. Meanwhile, it is worth noting that the accurate prediction of the electricity demand is critical to the design of the pricing scheme on the above existing pricing schemes. Once the prediction is not right or the customers obey their pre-committed electricity demand, the cost will be higher if the pricing scheme is still fixed and there exists lots of waste of the power.

Based on above problem, we consider to design a reward and punishment mechanism (RPM) to constrain the behavior of the customers such that all customers will reach their pre-set electricity demand rigorously. Then, the dynamic pricing scheme is proposed to achieve the win-win results of both the supplier and the customers. The main contribution of this paper is summarized as follows.

• We consider the problem of supply and demand balancing from the perspective of the customer demand side rather than the supply side and construct a novel and practical balancing framework where the customers can adjust their electricity demand proactively.

• We design a heuristic reward and punishment mechanism (RPM) to stimulate the customers to participate in the demand response scheduling spontaneously where the phenomenon of breaking promises is avoided. Then, the pricing algorithm is proposed such that the power tension is relieved and the win-win result for both the supplier and the customers is achieved.

• Extensive simulations are conducted to demonstrate the effectiveness of the proposed algorithm. It shows that RPM can decrease the cost of suppliers and customers simultaneously than that without the involvement of customers.

The rest of the paper is organized as follows. Section 2 introduces the system model and customer demand model in smart grid. In Section 3, the heuristic pricing algorithm based on RPM is proposed. Section 4 shows the simulation results. Finally, we summarize our work in Section 5.

2 Modeling and Problem Setup

2.1 System Modeling

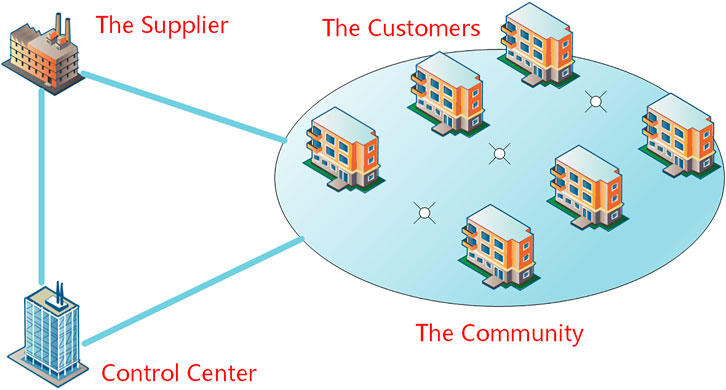

Considering the potential customers with peak clipping demand response in the community, the load reduction mode of such the customers participating in demand response scheduling is studied. There exist three characters including electricity supplier (supply side), customers (demand side), and a control platform in smart grid, as shown in Figure 1. For the supplier, it generates the electricity for the customers and makes money. For each customer, it purchases the electricity from the supplier to complete its electricity requirement of production. The control platform is an organization that designs responsible pricing and relevant measures to balance the supply and demand Roozbehani et al. (2010).

Assume that both the supplier and the customers can interact with the control platform to exchange the price and the demand information. In this paper, we divide the time of each day into N periods where

2.2 Customer Demand Modeling

Due to different load properties and production requirements for different typical customers, the electricity demand of customers will differ from each other. Consider that there are mainly five typical types of customers in a residential power system, which include residents, charging pile, storage battery, illumination, and elevators on the demand side. For each type of customer, we model the random demand of a single type of customer i as

where

In the electricity market, the customers engage in the electricity demand response scheduling by clipping the electricity peak to maintain the supply and demand in balance, such as changing electricity usage patterns and controlling electrical equipment. Assume that the customer i sends its pre-committed electricity demand

where convex function

On the supply side, the supplier can generate a certain amount of electricity

where

2.3 Problem Formulation

The control platform, as a not-profit character who balances the electricity market, determines how to design the reward and punishment mechanism such that the electricity demand of the customers is close to the pre-committed value and the win-win results of the supplier and the customers are achieved, which are also our objectives in this paper. We set the profit function of both the supplier and the customers as the objective function. Let

Note that the profit of the supplier should include the payment of all types of customers because there are mainly five typical types of customers in the community, i.e., the residential power system, including residents, charging pile, storage battery, illumination, and elevators. Furthermore, considering the pricing depends on the total guaranteed demand

When the profit of the customers is maximized, the optimization problem in this paper can also be simply formulated as follows

3 The Design of Heuristic Pricing Algorithm

In this section, we first analyze the weakness of the lack of customer involvement. Then, the reward and punishment mechanism is designed to encourage the customers to adjust their flexible demands to sustain the balance of the supply and demand. Finally, we propose the pricing algorithm to maximize the profit of the supplier and the customers.

3.1 High Cost Without Involvement of Customers

Without the involvement of the customers, the profit function 2) is rewritten as

Then, the objective function

where

Compared with the involvement of customers, there exist two problems deserving attention from the perspective of the supply and demand balancing. One is that the profit function

Note that the difference of the profit gain with/without customers’ involvement partly depends on the convex function

3.2 The Design of RPM With Involvement of Customers

In this part, we design the dynamic reward and punishment mechanism (RPM) by introducing convex function

The basic idea of RPM is that the control platform will give certain rewards to those customers who keep their promise, i.e., the practical demand is up to the pre-committed demand. Otherwise, the punishment will be added to them so that the behavior of the customers will be normalized in a controllable range. As described earlier, the customers send the pre-committed demand

where

According to the reward and punishment rule, the convex function

(1) If

(2) If

(3) If

Therefore, the structure of RPM is established as follows

where

If

Making Eq. 10 equal to zero, we determine that

The second-order derivative of

where

3.3 The Pricing Algorithm With RPM

Making full use of the knowledge including elasticity matrix of electricity price, customer psychology and principle of statistics, we can obtain an optimal pricing structure given by the certain index. Based on the previous investigation and pertinent literature, the existing pricing structure in He et al. (2018) is shown as follows

where

With Eq. 11, the profit of the supplier 3) is transformed as

Given the optimal customer electricity demand as the function of electricity price, we obtain the different price with respect to actual load. The optimal price can be attained by optimizing the following optimization problem

The constraints on prices result from the optimal electricity demand. From Eq. 11, the price is also denoted by

Furthermore, the constraints on customer electricity demand and price can be written as

and

where

4 Simulation Results

In this section, we conduct extensive simulations in MATLAB to evaluate the performance of the proposed algorithm, and compare it with the flat pricing algorithm, TOU block pricing algorithm and real-time pricing algorithm (Samadi et al., 2010).

4.1 Example With a Single Type of Customer

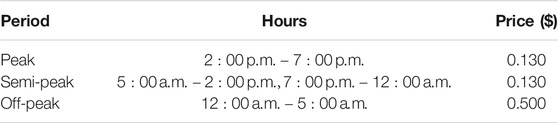

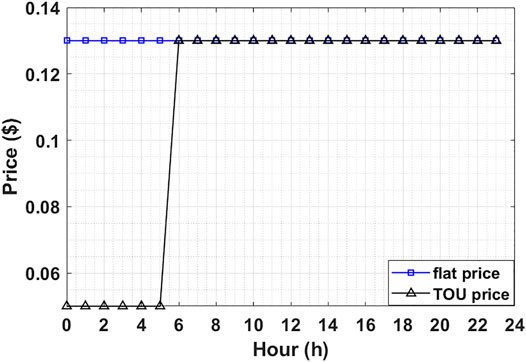

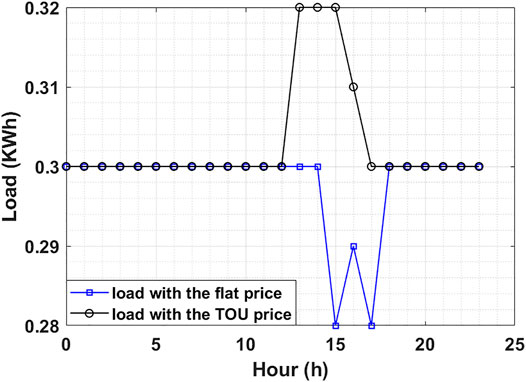

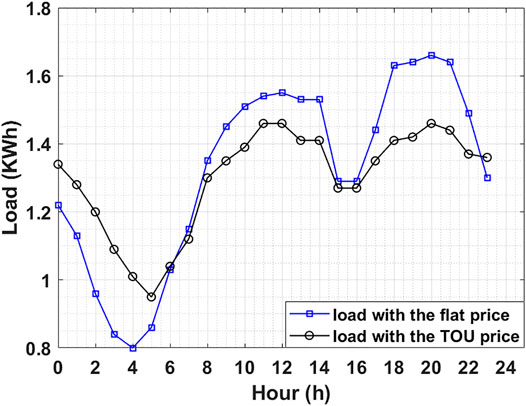

In this part, we consider a single type of customer, i.e., residents, where the characteristic of electricity demand for all residents is almost identical. The electricity consumption of residents is sensitive to the electricity price since they are more willing to adjust their electricity demands to attain the maximum profit and decrease the cost. We adopt hourly based pricing and divide a day into four time blocks. The time block division for TOU pricing is shown in Table 2 (Yang et al., 2013). For different pricing algorithm, their electricity demand differs from each other. The comparison of price between flat price and TOU block price is shown in Figure 2, and the pre-committed customers’ electricity demand

In real applications, the cost function is carefully estimated based on historical data. The optimal price is set as

4.2 Example With Multiple Types of Customers

Herein, we take the five types of customers mentioned earlier into account. Besides residents, there are mainly charging piles, storage batteries, illumination, and elevators on the demand side in a residential power system. The above four types of customers belong to the common electricity scope. However, they have different characteristics of electricity demand, which is worth further considering.

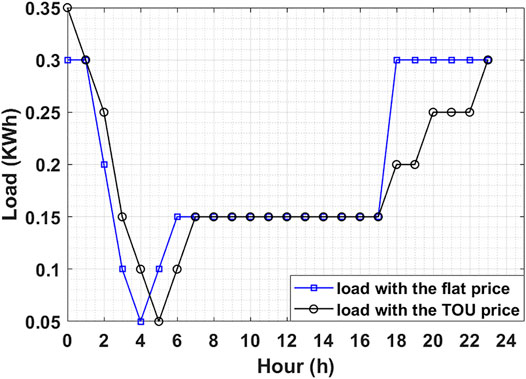

4.2.1 Charging Pile

For each charging pile, it takes 10 h to charge electric vehicles and consumes a maximum of

4.2.2 Storage Battery

Storage battery can be utilized when the electricity consumption of all types of customers is not consistent with the pre-committed electricity demand

4.2.3 Illumination

In public areas, the demand for electricity for lighting is indispensable in the day, especially in the evening. For most communities, the electricity consumption of lighting is less during the day and more at night. Based on the property, we can adjust the electricity demand properly by limiting the number of electric lights in use. Moreover, the electricity demand is affected by the price relatively low. Compared with the flexible electricity consumption of the whole community, the proportion of the flexible electricity consumption in the electricity demand of illumination is too small, shown in Figure 7.

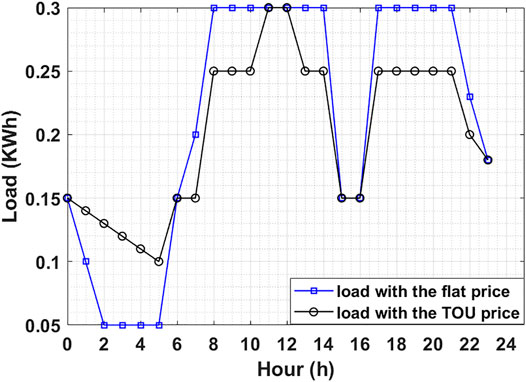

4.2.4 The Elevator

As for the elevator, it consumes

In summary, the electricity consumption behavior of different types of customers will affect the power consumption of the whole community, but it only differs from the degree of influence. As shown in Figure 9, it is the average electricity consumption per household in a neighborhood with a flat price and a simple TOU price. We can conclude that the average electricity consumption of the whole community is mostly affected by the residents’ electricity consumption, and the electricity consumption of the elevator controlled by the residents’ artificial consciousness occupies second place on the total power consumption of the community. However, customers with more fixed electricity demand and little flexible power consumption, such as charging pile and lighting, have little influence on the composite power consumption characteristics of the whole community, and their influence can hardly be considered. In accordance with the storage battery whose electricity demand is influenced by the sum of power consumption of all types of customers, its flexible electricity demand can be dynamically adjusted by the process of charging and discharging and keeps within a tolerable range (i.e., the difference between the sum of total power consumption and the promised power consumption in a community).

From the above research results in a community, we know that the customers, especially for residents, will proactively adjust their actual demand such that the difference between pre-committed demand and actual demand is limited in a tolerable range under the proposed pricing algorithm. When we consider the power consumption for industrial users, the proposed algorithm is also applicable since the industrial users are more sensitive to electricity prices. Thus, whether the customers in the community or in the industry, all customers will be normalized to keep their promises and the stability of power system will be achieved with small tolerable fluctuation as well as the profit maximization for the supplier.

5 Conclusion

In this paper, we relax the condition that all customers will reach their pre-committed electricity demands and design a reward and punishment mechanism to restrict the opportunistic behavior of customers. Based on the reward and punishment mechanism, a heuristic pricing algorithm is proposed, which guarantees the total electricity demand is within a secure range and the stability of the power system is achieved. With our proposed pricing algorithm, the price motivates customers to adjust their electricity demand so that the actual load is close to the pre-committed electricity demand and the profit maximization of the supplier is obtained. Meanwhile, we calculate the optimal demand for the supplier to provide and find the upper and lower bound of the proposed price so that the balance of the supply and demand is maintained. Furthermore, considering multiple types of customers, we find that the change of electricity prices does have a huge impact on the electricity demands of the residents while the electricity demand of the other four types of customers including charging pile, storage battery, illumination and elevators are not sensitive to the prices. In the future, we will continue to explore how to adjust all types of customers dynamically to guarantee the pre-committed electricity demand so that the profit of the supplier is maximized. Moreover, the demand response model needs to be further optimized.

Data Availability Statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author Contributions

XC was responsible for writing and formatting the article. LW wrote and communicated the manuscript. HZ and DL supervised and wrote the manuscript.

Conflict of Interest

Authors LW and DL were employed by the company State Grid Zhejiang Hangzhou Xiaoshan Power Supply Company. Author HZ was Zhejiang Zhongxin Power Engineering Construction Co., Ltd.

The remaining authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Supplementary Material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenrg.2021.682300/full#supplementary-material

References

Albadi, M. H., and El-Saadany, E. F. (2007). Demand Response in Electricity Markets: An Overview. IEEE Power Eng. Soc. Gen. Meet. (Ieee)2007, 1–5.

Celebi, E., and Fuller, J. D. (2012). Time-of-use Pricing in Electricity Markets under Different Market Structures. IEEE Trans. Power Syst.27, 1170–1181. doi:10.1109/tpwrs.2011.2180935

Cheng, X., Yan, C. B., and Gao, F. (2019). Energy Cost Optimization in Two-Machine Bernoulli Serial Lines under Time-Of-Use Pricing. In IEEE CASE.

Cui, W., and Yang, Y. (2019). Optimization of Tou Pricing for the Utility with the Consumers in the Manufacturing Sector. Proced. Manufacturing39, 1250–1258. doi:10.1016/j.promfg.2020.01.344

Deng, R., Yang, Z., Chow, M. Y., and Chen, J. (2017). A Survey on Demand Response in Smart Grids: Mathematical Models and Approaches. IEEE Trans. Ind. Inform.11, 570–582.

Finck, C., Li, R., and Zeiler, W. (2020). Optimal Control of Demand Flexibility under Real-Time Pricing for Heating Systems in Buildings: A Real-Life Demonstration. Appl. Energ.263, 114671. doi:10.1016/j.apenergy.2020.114671

Gellings, C. W. (1985). The Concept of Demand-Side Management for Electric Utilities. Proc. IEEE73, 1468–1470. doi:10.1109/proc.1985.13318

He, J., Zhao, C., Cai, L., Cheng, P., and Shi, L. (2018). Practical Closed-Loop Dynamic Pricing in Smart Grid for Supply and Demand Balancing. Automatica89, 92–102. doi:10.1016/j.automatica.2017.11.011

Herter, K. (2007). Residential Implementation of Critical-Peak Pricing of Electricity. Energy policy35, 2121–2130. doi:10.1016/j.enpol.2006.06.019

Herter, K., and Wayland, S. (2010). Residential Response to Critical-Peak Pricing of Electricity: California Evidence. Energy35, 1561–1567. doi:10.1016/j.energy.2009.07.022

Hung, Y. C., and Michailidis, G. (2018). Modeling and Optimization of Time-Of-Use Electricity Pricing Systems. IEEE Trans. Smart Grid10, 4116–4127. doi:10.1109/tsg.2018.2850326

Jang, D., Eom, J., Kim, M. G., and Rho, J. J. (2015). Demand Responses of Korean Commercial and Industrial Businesses to Critical Peak Pricing of Electricity. J. Clean. Prod.90, 275–290. doi:10.1016/j.jclepro.2014.11.052

Kii, M., Sakamoto, K., Hangai, Y., and Doi, K. (2014). The Effects of Critical Peak Pricing for Electricity Demand Management on home-based Trip Generation. IATSS Res.37, 89–97. doi:10.1016/j.iatssr.2013.12.001

Li, N., Chen, L., and Low, S. H. (2011). Optimal Demand Response Based on Utility Maximization in Power Networks. IEEE Power Energ. Soc. Gen. Meet.2011, 1–8.

Li, Y., Gao, W., Ruan, Y., and Ushifusa, Y. (2018). Demand Response of Customers in Kitakyushu Smart Community Project to Critical Peak Pricing of Electricity. Energy and Buildings168, 251–260. doi:10.1016/j.enbuild.2018.03.029

Mohsenian-Rad, A.-H., and Leon-Garcia, A. (2010). Optimal Residential Load Control with price Prediction in Real-Time Electricity Pricing Environments. IEEE Trans. Smart Grid1, 120–133. doi:10.1109/tsg.2010.2055903

Paschalidis, I. C., Li, B., and Caramanis, M. C. (2012). Demand-side Management for Regulation Service Provisioning through Internal Pricing. IEEE Trans. Power Syst.27, 1531–1539. doi:10.1109/tpwrs.2012.2183007

Paterakis, N. G., Erdinç, O., and Catalão, J. P. S. (2017). An Overview of Demand Response: Key-Elements and International Experience. Renew. Sust. Energ. Rev.69, 871–891. doi:10.1016/j.rser.2016.11.167

Roozbehani, M., Dahleh, M. A., and Mitter, S. K. (2012). Volatility of Power Grids under Real-Time Pricing. IEEE Trans. Power Syst.27, 1926–1940. doi:10.1109/tpwrs.2012.2195037

Roozbehani, M., Dahleh, M., and Mitter, S. (2010). Dynamic Pricing and Stabilization of Supply and Demand in Modern Electric Power Grids. IEEE Int. Conf. Smart Grid Commun.2010, 543–548.

Samadi, P., Mohsenian-Rad, A.-H., Schober, R., Wong, V. W., and Jatskevich, J. (2010). Optimal Real-Time Pricing Algorithm Based on Utility Maximization for Smart Grid. In IEEE International Conference on Smart Grid Communications. IEEE, 415–420.

Tsui, K. M., and Chan, S. C. (2012). Demand Response Optimization for Smart Home Scheduling under Real-Time Pricing. IEEE Trans. Smart Grid3, 1812–1821. doi:10.1109/tsg.2012.2218835

Wang, L., Chen, J., Zeng, S., Liu, L., and Peng, K. (2020). Reward-punishment Based User Utility Maximization Model for Optimal Real-Time Pricing in Electricity Energy Supply. In IEEE Power Energy Society Innovative Smart Grid Technologies Conference (ISGT), 1–5.

Wang, Y., and Li, L. (2015). Time-of-use Electricity Pricing for Industrial Customers: A Survey of U.S. Utilities. Appl. Energ.149, 89–103. doi:10.1016/j.apenergy.2015.03.118

Wang, Z., and Paranjape, R. (2017). Optimal Residential Demand Response for Multiple Heterogeneous Homes with Real-Time price Prediction in a Multiagent Framework. IEEE Trans. Smart Grid8, 1173–1184. doi:10.1109/tsg.2015.2479557

Yang, P., Tang, G., and Nehorai, A. (2013). A Game-Theoretic Approach for Optimal Time-Of-Use Electricity Pricing. IEEE Trans. Power Syst.28, 884–892. doi:10.1109/tpwrs.2012.2207134

Keywords: smart grid, supply and demand balancing, reward and punishment mechanism, optimization, pricing algorithm

Citation: Chen X, Weng L, Zhu H and Lian D (2021) A Novel Pricing Algorithm Based on Reward-Punishment Mechanism for Supply and Demand Balancing. Front. Energy Res. 9:682300. doi: 10.3389/fenrg.2021.682300

Received: 18 March 2021; Accepted: 24 May 2021;

Published: 18 June 2021.

Edited by:

Fengji Luo, The University of Sydney, AustraliaReviewed by:

Md. Abdur Razzak, Independent University, Bangladesh, BangladeshNarottam Das, Central Queensland University, Australia

Copyright © 2021 Chen, Weng, Zhu and Lian. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Xiaofei Chen, MTE4MzIwNTdAemp1LmVkdS5jbg==

Xiaofei Chen

Xiaofei Chen Liguo Weng2

Liguo Weng2