- 1Grantham Institute, Imperial College London, London, United Kingdom

- 2Chemical Engineering Department, Imperial College London, London, United Kingdom

To achieve ambitious United Kingdom decarbonization targets, consumers will need to engage with energy services more so than they have done to date. This engagement could be active or delegated, where in the latter consumers pass responsibility for engagement to a third party in return for ceding some control over decisions. To date, insight into the barriers to consumer adoption of future business models has been limited. To address this gap this study explored benefits, risks and enabling conditions using two extreme consumer-centric business models, third Party Control and Shared Economy. The approach yielded information from stakeholders on what would have to be true for one of the business models to dominate the market. The results show substantial agreement across the expert groups on five key issues that will need to be addressed in the near-term to enable energy business model innovation in the United Kingdom market. These are: 1) Create space to enable business model innovation; 2) Ensure smart devices and data are interoperable and secure; 3) Improve the service standards of energy businesses; 4) Ensure business models work for consumers in all situations; and 5) Implement targeted carbon regulation.

Introduction

Globally, energy systems are undergoing transformations (Midttun and Piccini, 2017). The drivers of change for transformation include technological breakthroughs, climate change, demographic and social change, a shift in global economic power, and rapid urbanization (PwC, 2017). This is increasingly framed as the 3-Ds of energy, decentralization, electrification, digitalization (IEA, 2017; World Economic Forum, 2017). More recently, a 4th D has been added, the trend of democratization (Soutar and Mitchell, 2018).

Energy system transformation has received increasing attention in recent years because of the multi-faceted threat it poses to incumbent energy utility business models (Castaneda et al., 2017a; Bryant, Straker and Wrigley, 2018). Low cost-renewables are replacing legacy fossil fuel plant (Hawker et al., 2017). Energy prosumers, agents that both consume and produce energy, are reducing predictability and demand for volume sales of energy (Parag and Sovacool, 2016; Lavrijssen and Parra, 2017). Energy suppliers are facing increasing competition in markets where the consumer base and energy demand is relatively static (Britton et al., 2019a). New business models are competing with incumbent energy utilities for grid services revenue (Burger et al., 2017). For some utilities this “death spiral” created by energy system transformation is an existential threat (Blyth et al., 2015; Castaneda et al., 2017b; Laws et al., 2017).

However, energy system transformation is also an opportunity for energy utilities to capture a share of new value streams. Accenture estimate “€135 to €225 billion in saved and avoided costs and €110 to €155 billion in new revenue for the electricity sector worldwide in 2030” (Accenture, 2015). In a United Kingdom study (Wegner et al., 2017), new revenue for electricity utilities of up to £21 billion per year by 2050 was identified, including significant revenue delivering “energy services (Fell, 2017).” Previous work by the authors of this paper has shown that while the technologies required by businesses to access new revenue are already available (Mazur et al., 2019), the underpinning utility business models will need to change to deliver new benefits and access new value (Richter, 2012; Hall and Roelich, 2016; Sioshansi, 2016; Frei et al., 2018).

Consumer engagement with energy markets today is low. In the Great Britain (GB) gas and electricity markets, according the regulator Ofgem, in 2017–18 54% of consumers were on a default tariff, 19% of consumers switched their supplier and 61% of consumers reporting never having switched (Ofgem, 2019). This finding is consistent with theories of consumer confusion and information-overload (Wilson and Price, 2005).

Energy system transformation also has impacts for future consumers. In the United Kingdom, the Committee on Climate Change recently published their advice on achieving net zero carbon target by 2050 (Committee on Climate Change, 2019). The net zero target implies significant change for consumers, including complete decarbonization of energy services, such as heat and transport. Given low consumer engagement with energy markets today it is unclear how consumers and traditional energy utilities will engage with the level of energy service transformation implied by a net zero target (Apajalahti et al., 2015).

In United Kingdom, publics are supportive of a transition to a low carbon energy system and are willing to accept some of the cost, but assign primary responsibility for paying for energy transitions to energy companies and government (Demsky et al., 2019). Thus, consumers expect the brunt of action, resources and risk in energy system transformation to be borne by businesses and governments. This creates an issue, because a net zero target implies significant changes to lifestyle, including decarbonization of home heating and mobility. Consumers need to be engaged in this transformation, but how might that engagement manifest?

New consumer centric and service-based energy business models, are cited as a potential way to help consumers through this net zero transformation, because they have the potential to deliver energy services with minimal environmental impact of both consumption and production (Hamwi and Lizarralde, 2017).

An element of the future consumer-business relationship in energy is the degree to which consumers wish to take- or cede-control of their personal low-carbon transformation. For some consumers this could be a hands-on activity, as prosumers1 (Parag and Sovacool, 2016; Lavrijssen and Parra, 2017), or through collective local energy schemes, like community energy (Kellett, 2007; Lopes et al., 2016). For others, they may want a business to take away market and service complexity in exchange for ceding some control over energy, and other, decisions (for example, through direct load control of appliances) to an energy service provider (Fell et al., 2015; Hamwi and Lizarralde, 2017; Britton et al., 2019b).

If future consumers need to engage to greater extent with their energy services, then energy businesses will need to facilitate this. This could mean energy business need to develop new approaches that enable consumers to directly engage or do so on behalf of their consumers.

To achieve ambitious United Kingdom decarbonization targets, it is clear that consumers will need to engage with energy services more so than they have to date. This engagement could be active or delegated, where in the latter consumers pass responsibility for engagement to a third party in return for ceding some control over decisions. These both represent opportunities for energy business model innovation to enable such active (for example facilitating community energy) or delegated (for example, delivering energy as a service including some control over home appliances) consumer engagement.

While there is recognition of the need for such energy business model innovation in United Kingdom little is known about how rapidly new business could emerge, and their impacts, risks and benefits to consumers and the wider energy system (Ofgem, 2015; Clarke, 2018). It is important that this evidence gap is filled as policy- and regulatory decision makers will need to make decisions on how create the space for new business models to emerge (or indeed how to regulate businesses that unexpectedly emerge) and also how such businesses could be regulated to protect the interests of consumers.

This study aims to start to fill this gap by addressing the question “What are the impacts, risks and benefits of business models that engage consumers in the low-carbon transformation, and how can market entry for innovative businesses be enabled?.”

The study revolved around three workshops with an elite participant sample of energy stakeholders. In the workshops, participants examined two plausible but extreme future scenarios developed by the authors. Each scenario focused on a future where one of two consumer-centric energy business models dominate the energy market. The business models represented extremes of active or delegated energy consumer engagement. In the workshops the participants undertook a facilitated process to address the question: “What would have to happen for this scenario to be true?.” Areas of participant consensus and contention across the workshops gave insight into: What is driving new business models; their impacts, risks and benefits; and insight into the decisions that can be taken to enable new businesses to thrive while protecting the interests of their customers.

The study focuses on the United Kingdom energy system which as outlined above is undergoing a significant transformation in terms of decarbonization, decentralization and digitalization. This is expected to lead to significant business model innovation if the regulatory and market structures permit it. Consequently, the outputs of this work are timely for United Kingdom decision-makers. The findings are also relevant to other countries, particularly where energy system challenges and regulatory approaches share similarities with the United Kingdom.

These participant responses are analyzed in the results section and common and specific issues arising are discussed. Key themes arising are outlined in the discussion section and we conclude with the implications for current energy policy.

Materials and Methods

Process Design

The focus of this study was identifying the issues, barriers and enablers for consumer engagement by future energy businesses. We adopted a descriptive scenarios based approach because such business models do not exist today, their desirability is unknown and it is uncertain how energy system, including the market structures and associated policies and rules, might change in the future (Miola, 2008; Bolton et al., 2015). This study was particularly focused on the policy and regulatory issues, barriers and enablers, where it is recognized that the complexity of the system makes delivering outcomes difficult and unexpected consequences are common (Shove and Walker, 2007).

The Process Used Summarized Below

(1) The authors created two scenarios focused on a future where one of two consumer-centric energy business models dominate the energy market (see The Process Used Summarized Below and Workshop Participant Choice)

(2) Stakeholders were enrolled for workshops (see Choice of Scenarios for enrollment approach)

(3) Three workshops were run between January and April 2017 where participants critiqued the scenarios, discussed drivers and timelines, and then undertook a facilitated exercise to that explore what issues would need to be addressed for the scenario to be true (see Workshop Participant Choice)

(4) Authors analyzed the workshop outputs (see Workshop Participant Choice, Results and Analysis, Discussion, Conclusions)

Choice of Scenarios

In this study, two future scenarios were developed by the authors. The purpose of these scenarios was to provoke workshop participants plausible but extreme futures of consumer engagement in the context of future low-carbon energy systems to reveal policy and regulatory challenges. The extremes studied were “active consumer engagement” through active individual and/or community participation in local energy schemes and “delegated engagement” where consumers give responsibility for engagement to a third party in return for ceding some control over decisions. These forms of consumer engagement were identified in Ofgem’s consultation on non-traditional business models identified as future regulatory challenges (Ofgem, 2015).

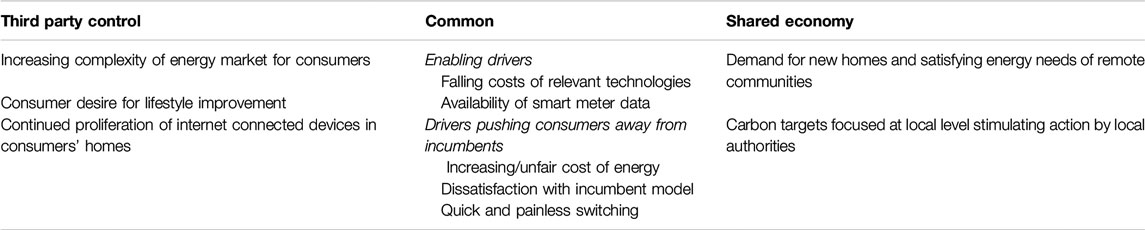

Two future business model scenarios, Shared Economy and third Party Control, were developed. These represented a balance between exploring the extremes of future consumer engagement and being a manageable number to elicit sufficient feedback within workshops.

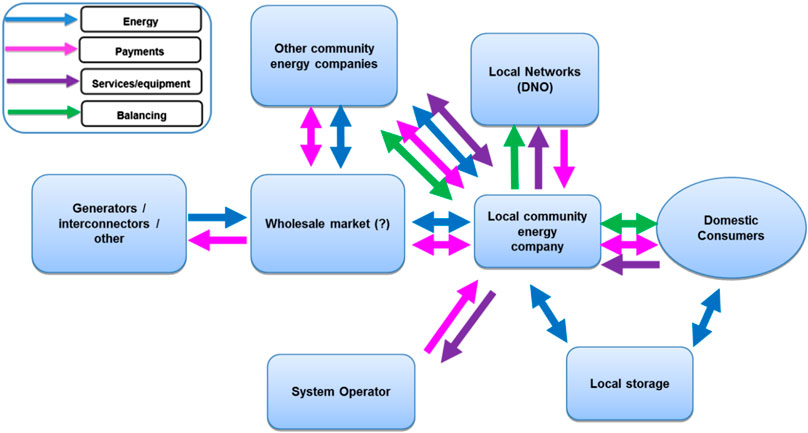

The first, Shared Economy combined themes of local energy and prosumers and the scenario was extrapolated from work by Stephen Hall and Katy Roelich in (Hall and Roelich, 2016) and work by the authors in the Utility 2050 project (Hall et al., 2020) through combining elements of Energy Service Company (ESCo) and peer-to-peer business model archetypes to combine individual and collective direct engagement.

The second, third Party Control explored the bundled products theme and the scenario was extrapolated from Hardy’s work in a report for Smart Energy GB (Hardy, 2017) and the third party control business model in the Utility 2050 project (Hall et al., 2020).

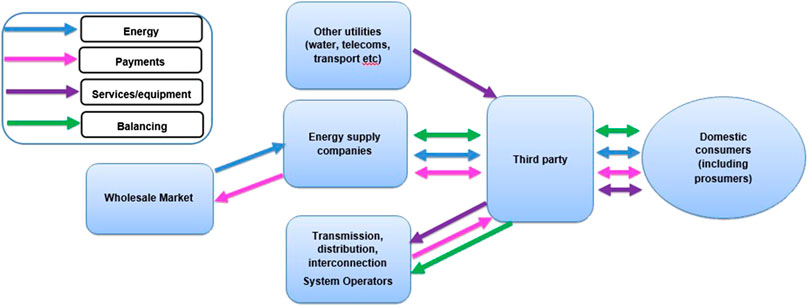

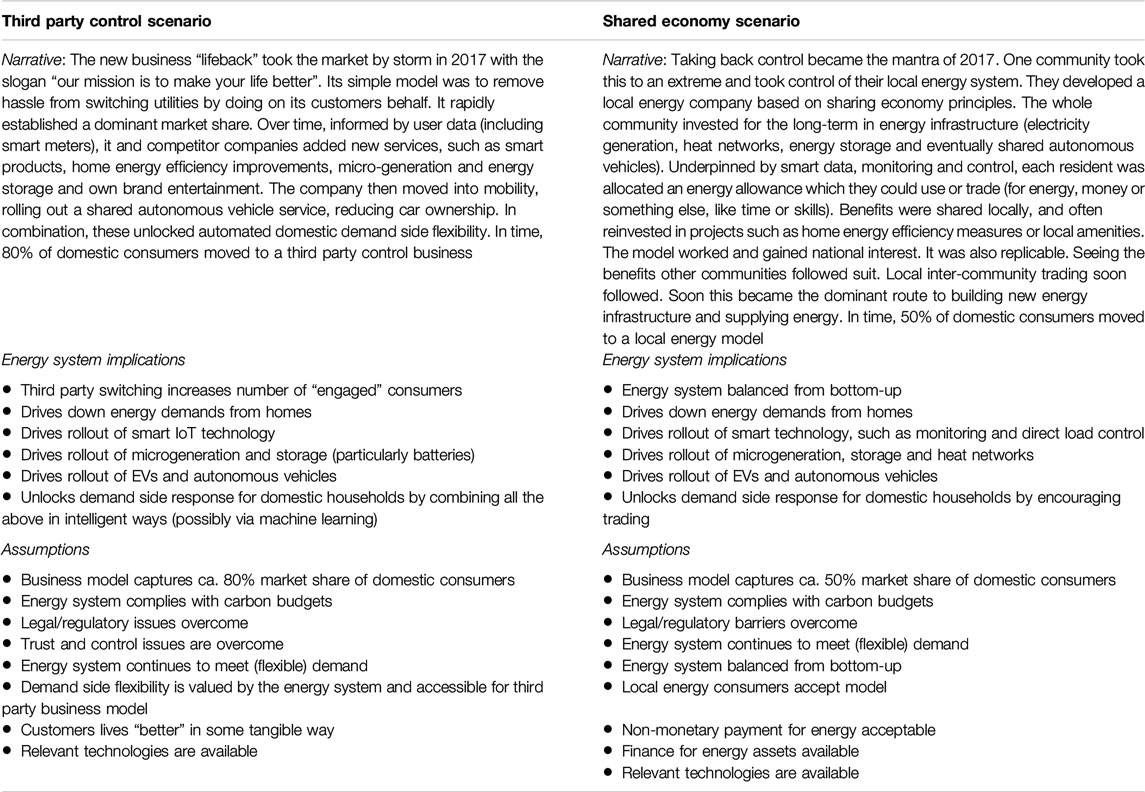

The information made available to participants in advance of the workshop comprised a narrative description of a future business model market disruption, energy system implications and underlying assumptions. Visual depiction of the two business model archetypes were also created, based on methodology developed by Stephen Hall and Katy Roelich (Hall and Roelich, 2016). The scenarios are described in detail in Workshop Participant Choice.

Workshop Participant Choice

Key to workshop design was to enroll stakeholders active in identifying, pursuing, enabling or regulating energy business model innovation. Three workshops were designed to engage three different stakeholder groups:

• Five policy and innovation staff from a large energy utility company (January 2017)

• Seven policy and regulatory experts (February 2017)

• Nine energy system innovation experts (April 2017)

Our sampling strategy required respondents involved in decision making and decision influencing for energy business models in the United Kingdom market. As such we used a non-probability sample of elites from the policy, regulatory, innovation and commercial sectors in the United Kingdom (Etikan et al., 2016). In this way our sample was an elite, purposive sample (Tansey, 2007) in the United Kingdom context, as our aim was to identify a small pool of elites in a position to comment the trajectory of the United Kingdom energy market, the opportunities for business model innovation within it, and policy and regulatory issues emerging from innovative business models.

Recruitment was through combination of the authors professional networks and snowballing, the latter particularly within organisations, to ensure a good mix of participants on the basis of knowledge and specialism. Representatives of the large utility company included both the core (incumbent) retail and wholesale energy parts of the business as well as the innovation lab where new energy business models were being trialled. Policy and regulatory experts comprised consumer experts, compliance and enforcement experts and those working on future regulation. The energy system innovation experts all worked for one organization, but represented expertize in customer insight, business model innovation, energy policy and regulation, data, modeling and electricity networks. So, while participants only represented a few organisations, the skills and experience covered a broad cross-section of the energy value chain.

We recognize that this sampling strategy cannot eliminate selection bias therefore we only claim that the common themes emerging are the priorities of an important but not representative set of elite decision makers and influencers.

Input Data and Workshop Methodology Used in this Study

A common methodology was followed for each workshop. Participants were introduced to the information about each of the two business models (Table 1; Figures 1 and 2) and asked to record on post-it notes immediate reactions about them, including issues identified with the scenarios (described in Discussion and Critique of Business Models). They were also asked to record current drivers that could lead to the two scenarios (described in Facilitating Drivers). Finally, they were asked to consider the timelines for the scenario–in particular what constituted a feasible date for the scenario to be true and to take that into account in the subsequent exercise.

TABLE 1. Workshop materials - narrative description, energy system implications and assumptions of the two scenarios.

Participants then were asked to undertake a facilitated exercise for each scenario separately. Specifically, they were asked to work backwards (backcast) from the scenario toward the present and list important issues that related to users (e.g., consumers), technology, governance and finance, that would need to be addressed for the scenario to be true. For each issue identified participants were asked to differentiate it in terms of difficulty—red (very difficult to overcome)/amber (moderately difficult to overcome)/green (easy to overcome) and timeliness (now, within a decade, later). Where possible participants were also asked to identify which actor should be responsible for acting on the issue (described in Facilitating Drivers and Drivers Pushing Consumers Away From Incumbent Models).

Workshop outputs were analyzed using NVivo to cluster issues raised across the three workshops into themes of business model drivers, issues and facilitating interventions.

Results and Analysis

This section presents the results from the workshops. Discussion and Critique of Business Models summarizes the discussion and critique of the business models. Drivers for the Scenarios–Drivers Pushing Consumers Away From Incumbent Models examine the drivers, issues to be overcome, and responsibility and timing for issues respectively. What Decisions Are Required and by When? presents an analysis of the differences between the workshops.

Discussion and Critique of Business Models

At the start of each workshop, participants were introduced to the business models and encouraged to discuss and critique them. A summary of the discussions for each of the business models follows. An overarching point was that ad hoc conversations with participants indicated that participants felt that the third Party Control model was more likely to happen than the Shared Economy model.

Third Party Control

Issues of trust and control were the most common. Many of these issues permeated the subsequent exercise. Key points included how the third Party Control would establish trust with its customers over issues such as data, automation of devices and dealing with problems. This was considered an important issue for whether such a model could achieve an 80% market penetration.

Another commonly raised issue was whether the third Party Control company was a licensed supplier with responsibility balancing electricity and gas, or whether it would need to partner with a licensed energy supplier as shown in Figure 1. In all three workshops, participants were encouraged to consider both models.

Participants questioned the slogan in Table 1 “Our mission is to make your life better.” Particularly, how a customer or a regulator would be able to verify such a subjective claim, especially if the service offer was complex.

A final consistent critique was that the third Party Control model implies taking away all the hassle from consumers, however, participants struggled to see how consumers could be completely passive. An example was in reducing consumer demand for energy would require some behavior change by the consumer (for example, not opening windows).

In terms of timeline, participants across the workshop agreed that such a business model could emerge by 2030 and that elements of this model were apparent today in the energy sector and more so in other sectors.

Shared Economy

The most common issue raised related to the level of engagement required by the business model. The model was described as “egalitarian” by one participant, which sums up several criticisms. There was skepticism over whole communities buying into the model, the capacity of individuals to provide the requisite investment and the availability of skills to make the model happen.

A related concern was whether the model would be mandatory for a community, whereby the opt-out option would be to move away from the community. There were also issues raised about the barrier it could cause should a member of the scheme choose to move away, specifically would the incoming resident need to opt-in to the community model.

Another discussion focused on the definition of community, including whether it was exclusive to communities of place, or could be applicable to communities of interest–the example used was crowdfunding of renewable energy schemes. Another query was whether community included business as well as domestic consumers.

Finally, the issue of finance for local energy infrastructure was raised, specifically how communities would fund the investments and whether the business model was for profit or not.

In terms of timeline, participants across the workshop agreed that such a business model could emerge by 2050. This model was felt to be slower to emerge than third Party Control because of the substantial buy-in, complexity and level of engagement required. However, it was noted that Community Energy projects already demonstrate elements of the model in the United Kingdom now.

Drivers for the Scenarios

Prior to the scenarios exercise, participants were asked to consider the drivers of change that could make one or both scenarios more likely. Across the workshops there was some consensus on drivers that could result in new business models entering and disrupting the market. Some of these drivers identified, summarized in Table 2, were common to both business models, others are specific drivers for either third Party Control or Shared Economy.

Common Drivers

Common drivers fell into two categories: Drivers that are facilitating new business models and those that are potentially driving consumers away from incumbent models.

Facilitating Drivers

A range of important technologies were identified where costs are falling, and the technologies are becoming mainstream. These included solar photovoltaic systems, batteries, electric vehicles, low-carbon heating solutions and smart meters. Production technologies, such as solar photovoltaic systems, enable consumers to become producers as well as consumers, so-called prosumers. Other technologies create new drivers of energy demand, including switching from one fuel to another, for example an electric heat pump could entail fuel switching from heating oil or (liquefied) natural gas to electricity.

Alongside technologies, smart meters were cited as facilitating greater understanding of energy use and opening the opportunity for novel tariffs, including tariffs where energy companies have direct load control of in-home appliances. The granularity of data available was considered critical for facilitating targeted smarter switching. In both cases, it was observed there is an opportunity for new business models to use data to better understand and serve new consumer archetypes.

Drivers Pushing Consumers Away From Incumbent Models

Stakeholders stated that consumers have been poorly served by the incumbent business model, evidenced by low consumer satisfaction levels, particularly the six largest suppliers in the United Kingdom (Ofgem, 2018c).

In addition, participants noted energy prices have been consistently high profile politically in recent years and as a consequence price caps are currently in place for around 11 million consumers (Ofgem, 2018a).

Both were postulated as drivers for consumers to move away from the incumbent business models.

Specific Drivers for Third Party Control

Drivers for third party control focused on emerging opportunities to assist modern consumers.

Energy market complexity was cited as a key challenge to consumer switching their energy supplier. The direction of travel was felt to be toward increased energy market complexity, with half-hourly time-of-use tariffs and new products such as electric vehicle tariffs, coming to market. While other sectors, such as mobile phone tariffs were also cited as complex, it was felt that consumers have embraced such complexity more in other services compared to energy. The importance of third parties such as switching sites to aid consumers through the complexity was raised as a trigger for third parties to gain more prominence in the market.

Some consumers were described by participants as pleasure seekers and business models that have led to lifestyle improvements, including saving time, in other sectors, for example Uber in mobility, have proven popular.

The proliferation of internet connected devices in consumers’ homes, alongside consumer presence and information on social media provides a rich and granular data, across multiple aspects of consumer behavior, creating opportunities for businesses to offer consumers products tailored to their lifestyle.

Specific Drivers for Shared Economy

Drivers for Shared Economy focused on creating enabling conditions for the model to gain a foothold in the market.

Stakeholders suggested an opportunity for shared local energy schemes are new housing developments, for developing new heat networks and integrated local energy systems. Also, existing communities in remote locations, such as islands, where there are grid or fuel availability issues, but abundant renewable energy resources are an opportunity.

Local Authorities were cited as a trusted intermediary for representing local community interests and maximizing local benefits of energy projects. A driver for Local Authority action would be if responsibility for national carbon targets was delegated to a local level.

What Is Required for the Business Model Scenario to be True?

The previous section outlined the drivers and enablers deemed to be creating the conditions for energy market transformation. This section explores views on what would need to be in place for market disruption to occur.

Stakeholders discussed important issues that would need to be addressed for the business model scenario to be “true.” They ranked these subjectively in terms of how difficult they are–from relatively easy, moderately hard to very hard to address. Only the issues ranked as hard and moderate issues are discussed here as stakeholders felt action was already underway on the easy issues. These issues are summarized in Supplementary Table 1. We found that these naturally cluster into six themes, which we present in this section. Some issues within these themes were common to both business models and others were specific to one of the business models. The six themes are:

• General consumer protection issues

• Consumers in vulnerable situations

• Facilitating business model innovation

• Regulating new business models

• System issues

• Skills

Consumer Protection

A range of common and specific consumer protection issues were raised covering consumers in different circumstances, switching, capital intensive models, supplier failure and service level agreements (the latter being specific to third Party Control).

In both business model scenarios, it was noted that there is a market penetration of 50% or more energy consumers,2 and thus customers are likely to comprise both homeowners and those who rent.3 Consequently, the models would have to work for consumers in different circumstances.

For both business models scenarios, a concern was that today’s gas and electricity retail markets are set up to encourage competition between suppliers by driving switching. However, historically there has been low rates of switching, with many consumers remaining on higher priced standard variable tariffs (SVTs4) despite savings being available. This has been a driver for the establishment of the price cap, described earlier. The issue was that this level of disengagement could disfavour new business models requiring high engagement, such as regular switching.

Another concern was that both business models potentially deliver energy services that require companies to install equipment in homes with high capital outlay upfront requiring long-term contracts with consumers to pay this back. This is a risk for both suppliers and consumers. For suppliers the risk is that their customers switch to another service provider, creating issues on ownership of the installed equipment and increasing business model risk, which would have a knock-on effect on the cost of capital the business would be able to attract. For consumers, a key risk is being locked into long-term contracts which are uncompetitive or unsuitable in the event of their circumstances changing.

Company failure and the issue of supplier of last resort5 was felt to be a complex issue for both business models. In the case of third Party Control this was because the energy services were tangled up within a wider range of bundled services, thus making it hard for the consumer to be guaranteed the same service with a different provider. For Shared Economy, a key issue was that the customers energy supply was also linked with capital investment, thus the customer may still have to contribute to the paying back the capital owed, even if the assets were no longer used to produce their energy.

A specific issue for third Party Control was that the business model requires the customer to cede significant control over household services to the company, participants identified the necessity for clear service level agreements (SLAs) between the company and the customer. Examples cited included: the actions customers allow the company to take on their behalf, the customer data they can access and; the power of control over customer’s financial decisions. A second issue relating to SLAs was around whether each “new” service would require a new SLA between the company and the customer or could there be a “blanket” SLA. A concern raised was whether customers would understand the SLAs or whether “they would just scroll through and click accept, like we do with Apple’s terms and conditions.”

Consumers in Vulnerable Situations

The issue of consumers in vulnerable situations6 was raised in all workshops. There were two distinct themes.

First, whether vulnerable consumers would be “attractive” or “visible” customers for new businesses. Vulnerability is complex and multidimensional; there are a range of circumstances that can put consumers in vulnerable situations. Questions were raised on whether new business models would want to avoid “difficult” or “unprofitable” consumers in vulnerable situations, for example those: with low incomes; no internet access; living off the gas grid; and living in cold, inefficient homes. The key issue was whether vulnerable consumers would be able to access and benefit from new business models.

Second, whether the business models will treat consumers in vulnerable situations “fairly.” This was based on concerns that new business models could take advantage of consumers in vulnerable situations, given that such consumers may be unable to protect or represent their interests in the energy market and more likely than other consumers to suffer detriment. There was concern about vulnerable consumers being locked into unfavourable contracts. More broadly, switching and long-term contracts were also considered to be issues.

Facilitating Business Model Innovation

A strong theme emerging was historically it has been difficult for innovative business models to enter the market, due to regulatory barriers including prescriptive licences and industry codes. It was noted that the Office for the Gas and Electricity Markets, Ofgem, has recently taken steps to address this by launching an Innovation Link and Regulatory Sandbox (Ofgem, 2016c).

Participants raised two issues as being important for facilitating business model innovation in both scenarios: data and device operability; and data security and ownership. Both business models imply new smart devices in homes, such as home energy management systems, and the benefits, such as local energy system optimization or service optimization, are predicated on being able to access data.

On data and device interoperability a key issue was that value to consumer and the wider energy system would be curtailed if data is not accessible and devices are not interoperable. An example consistently raised was hard- and soft-lock-in. Hard lock-in was defined as where a consumer enters into an exclusive relationship with a service provider under a long-term contract in return for services and wider perks, such as smart devices. Under this relationship, the service provider would have a monopoly over its customers services, devices and data. Soft lock-in was described as “Apple vs. Android,” where a consumer can switch but cannot necessarily get the same services with the new service provider. An example cited was moving homes and whether the outgoing occupant be able to take their service package (including any associated devices and data) with them. Also, whether the incoming occupant have the option to take over the service package, including the data built up over time on the building.

On data security and ownership, it was observed that both business models are predicated upon deep and symbiotic relationships with consumers, including understanding, through data, consumer behavior. In both cases, companies would derive value from consumer data which raised issues on data ownership (including where international companies are involved), value of data, data access and data security. There was a strong consensus that the service level agreements between the consumer and business would be crucial to clarify these issues.

Regulating New Businesses

In addition to facilitating business model innovation, participants also noted that new business models raise challenges of regulation, including monopoly position, carbon regulation, cross-cutting regulation and transnational regulation.

There were concerns over the potential monopoly position of both business models. In the case of Shared Economy, it was felt that the whole community would need to “opt-in.” This raised consumer issues including fair treatment, good service and provisions if someone wishes to opt-out or leave the community. For third Party Control, it was perceived likely that these businesses could create a monopoly or oligopoly position over services to consumers. Two key issues came from discussions. First, was around issues of market power and consumer exploitation, akin to other monopolies. Second, that companies would have “significant power,” particularly over energy system services like consumer demand side flexibility. The key question on the latter was around what incentives or regulation would be required to get the company to “do the right thing for the energy system.”

Another important issue raised was around effective carbon regulation. As these new business models are significantly different to incumbent energy utilities, participants asked how they would be incentivized to “do the right thing” on carbon emission reduction, in line with United Kingdom targets.7

On third Party Control participants felt it would bundle together numerous utilities into one service, blurring the lines between traditional regulatory boundaries such as electricity, gas, water and communications. This raised questions about what needs to be regulated specifically, and what can be left to cross-cutting regulation, such as consumer protection law.

Two specific issues arose in relation to transnational third Party Control companies where the company is predominately a data rather than an energy company. Such a company could have a minimal footprint in the United Kingdom, but could have many customers, including access to their data and ability to control services to homes. The first concern was about a non-UK based company acquiring United Kingdom data, including that which could potentially be sensitive consumer and United Kingdom infrastructure data, creating issues of data privacy and cyber security. The second was how to ensure that the value the company is creating flows to United Kingdom, rather than flowing offshore.

System Issues

Participants identified wider energy system issues for the Shared Economy model including local energy balancing, grid defection and sensitivity to national infrastructure decisions.

To make the Shared Economy model work, it was felt that there would need to be a shift from national toward local electricity balancing to incentivize communities to self-consume energy generated locally.

Alongside local balancing, the impact of “grid-defection” by communities was consistently raised for Shared Economy. It was felt that communities would “sort themselves out,” maximizing utilization of local resources and trading locally when required. This could result in reduced utilization of national transmission grid and transmission connected generation. In essence, the communities are “disconnecting” from the grid. Two issues arising from this were raised. First, if fewer people are “paying” for the national grid, the costs would be placed those customers still “connected.” Second, if the national grid becomes an “insurance policy” for communities, for example when local resources could not meet local demand, there would need to consideration of how it is paid for.

Participants felt that the Shared Economy model was particularly sensitive to national infrastructure decisions. For example, continued and enhanced support for local district heat networks could reinforce the model, providing impetus for integrating energy at a local level. However, a decision to adopt a national hydrogen network, enabling relatively simple fuel switching for heating and transport, could have the opposite impact as it would enable homes and businesses to continue with traditional approaches to heating, albeit with a different gas flowing through the pipes.

Skills

Specific to Shared Economy, participants suggested that the model would require technical skills in the local community, such as knowledge of energy technologies, systems integration and participating in energy markets. The key discussion was around whether communities could and should develop them locally, maximizing job creation and local value, or outsource them, losing some value but gaining competence more quickly. No conclusion was raised, other than developing the skills locally could be challenging for communities where such skills did not currently exist.

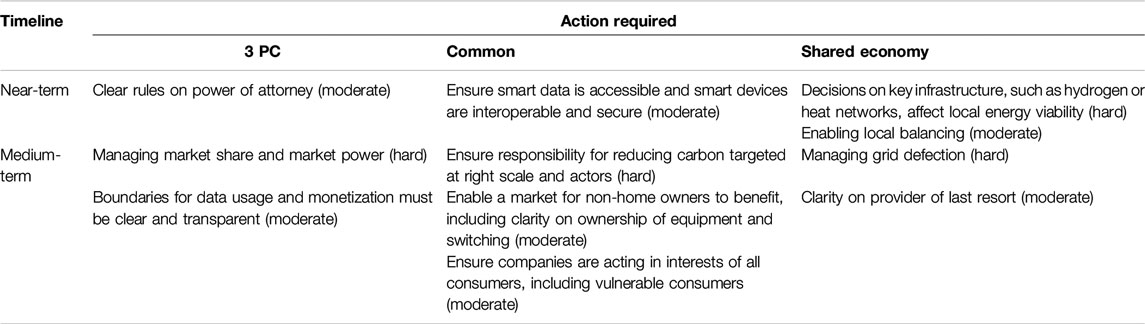

What Decisions Are Required and by When?

During the workshops, stakeholders were asked to consider what decisions would need to be taken by who and by when to address the issues raised. Participants were asked to grade whether these actions were easy, moderate or hard to achieve. This section focuses on the moderate and hard actions, as the easy actions were considered already to be underway or non-problematic in the future. It also focuses on actions in the near- (e.g., now) and medium-term (within a decade), as actions in the longer-term will be contingent upon these actions. Once again, the actions fall into common actions and those specific to a scenario. These are summarized in Table 3.

TABLE 3. Summary of common and scenario specific near- and medium-term actions identified (actions labeled as Hard or Moderate in brackets).

For consistency, we have grouped these actions against the themes of issues identified in Facilitating Drivers. Participants did not identify decisions for all of the issues identified. For example, no decisions on skills for the Shared Economy were stated.

General Consumer Protection Issues

Clarity on Provider of Last Resort

Participants noted that Ofgem’s current approach on supplier of last resort (Ofgem, 2016b) could be challenging should a Shared Economy scheme fail, particularly if scheme is partially or completely disconnected from the grid and owns significant local physical infrastructure (such as electricity generation and heat networks). Key questions raised included how would become the supplier of last resort and importantly what would happen to the locally owned infrastructure, particularly the capital invested by the community. This is applicable to other sorts of schemes where infrastructure is owned locally, for example broadband.

Clear Rules on Power of Attorney

Many participants felt that the third Party Control model could happen imminently given increasing trends toward bundling and servitisation in other sectors. Consequently, it was suggested that now is the time to start work on the regulatory framework, particularly, on how aspects like power of attorney over consumer decisions (like automation of equipment or financial decisions, like automated switching) are treated in consumer protection and wider market regulation.

Consumers in Vulnerable Situations

Ensure Companies Are Acting in Interests of all Consumers, Including Vulnerable Consumers

The key action was on ensuring that the business models work for all consumer types, particularly those in vulnerable situations. The concern was that businesses are likely to segment consumers into those that have the highest value and/or are most exploitable. Thus, there is a risk of either consumers in vulnerable circumstances being exploited by businesses or being locked-out of the market for the best offers because of their circumstances. Participants suggested that exploitation of consumers was an action for energy or general consumer protection regulation to monitor market developments and act if issues arise.

Facilitating Business Model Innovation

Ensure Smart Data Accessible and Smart Devices Are Interoperable and Secure

Two key actions raised relating to hard- and soft-lock-in. Clarity on these issues was considered important to give confidence to industry to pursue and innovate around smart data driven business models.

The first, to avoid “hard lock-in,” government and regulators should seek to avoid new monopolies being formed around capturing customers’ data and connected devices. In the view of participants, consumers should always own their own data and have the right to withdraw its access from an organisation.

On “soft lock-in” participants identified that given that consumers may be giving power of attorney or permissions for businesses to act of their behalf, it needs to be clear what the consumer is signing up for and if new services are added that it should be explicit in the service level agreement. Another issue to be resolved was that clarity on what the process for changing address must be clear on what happens with equipment and contract installed by one of the business models. On this, participants felt that in both scenarios, the nature of the agreement could be long-term and potentially include equipment installed in homes, which could cause issues if the customer needs to move. On this participants raised several questions: “What happens to the kit?”; “Does the new incoming tenant or homeowner have the choice to take over the contract?”; and “Is there a penalty in breaking long-term contracts early?”

In both forms of lock-in, this was considered an action for the energy regulator (for an energy only business) or for general consumer protection law (for a business selling bundled products). The action was considered urgent because of the proliferation of connected devices in homes.

Boundaries for Data Usage and Monetization Must be Clear and Transparent

Third Party Control was identified as a data driven business model and participants felt that energy costs might not be visible if there are blurred lines between different utilities. Therefore, consideration of how consumer data is being used and monetized will be required. This was not a clear-cut issue though, as some participants postulated whether the consumer might not care they are not realizing the value of their data if they are receiving a “great service.” In either case, there was a question of which regulator or body would be responsible for managing (and how they would manage) these issues, given than they could span multiple products and services (this is in part picked up in the next action).

Regulating New Business Models

Managing Market Share and Market Power

Participants felt that third Party Control in particular could be a successful model and could lead to new monopolies or oligopolies, creating new market power risks. It was suggested that since Ofgem is may already be considering this issue as part of their review of the future of the supplier hub model.

Ensure Responsibility for Reducing Carbon Targeted at Right Scale and Actors

The key issue raised was how to place responsibility for carbon emissions onto energy companies. Participants felt that this was an action for national government to translate national carbon targets into tangible targets for businesses, with early action on stating the intention to set targets so that industry has chance to plan.

System Issues

Decisions relating to energy system issues were specific for the Shared Economy model.

Enabling Local Balancing

Local balancing8 could enable the model by valorizing the actions taken locally in sorting out supply and demand and the wider system benefits. It was noted that enabling local balancing requires changes to the industry codes which often take years to implement. It could be speeded by the energy regulator initiating a Significant Code Review.9

Managing Grid Defection

A key challenge raised by participants is that the shared economy model could develop to stage where local communities could partially, mostly or completely disconnect from the grid. This could leave fewer participants paying for the grid infrastructure. Consequently policy-makers and regulators may need to re-think how such infrastructure is paid for.

Decisions on Key Infrastructure, Such as Hydrogen or Heat Networks, Affect Local Energy Viability

Participants suggested government decisions on infrastructure could reduce the case for shared economy model. For example, a decision to develop a national hydrogen infrastructure would in effect remove the business case to remove in home gas boilers, because the point source emissions from combustion for heating are zero. This could remove the business case for investments in local assets such as district heat networks and thus weaken the case for the shared economy business model.

Differences Between Workshops

While there was some commonality on barriers, issues and actions identified in all the workshops there were also distinct themes of discussions at each. These are discussed briefly below.

The workshop with policy and regulatory experts focused on regulatory, policy and consumer protection issues. These included discussions on the principles of energy regulation, such as fairness, trust and universal service obligation. It also led to detailed conversations on specific issues, such as protecting consumers in vulnerable situations, data protection and security and fairness in allocation of energy system costs.

The business workshop focused on commercial (such as monetizing data and open standards), cost of energy and regulatory issues. There was focus on creating space for innovation and opening opportunities through data. A theme running throughout was a need for “forgiving” smart regulation that allowed space for innovation. There was also a consistent worry business cannot trust that government will not intervene because energy is an essential service and thus political in nature.

The energy innovators shared themes with the business workshops, particularly around creating space for innovation. The difference was that workshop had greater focus than the others on innovative business models and discussions were framed around the surrounding enabling conditions for these to succeed including enabling technologies, relationships with third parties, carbon targets, service level agreements and cost of finance and insurance.

Discussion

Across the workshops there was significant agreement on common and specific issues. Each workshop had a distinct lens through which key issues were viewed as discussed in What Decisions Are Required and by When? above.

The workshops provide insight into decisions that are needed to create space for new energy business models to emerge and for their implications to be managed for the benefit of consumers and the wider energy system. Here we focus on the near-term decisions that could stimulate new business models to emerge. These are: 1) Create space to enable business model innovation; 2) Ensure smart devices and data are interoperable and secure; 3) Improve the service standards of energy businesses; 4) Ensure business models work for consumers in all situations; and 5) Implement targeted carbon regulation.

Creating space enable business model innovation was consistently raised and comprised two interrelated issues.

First, that the current combination of regulation and industry codes stifles innovation by essentially prescribing the business models of existing electricity and gas suppliers. While Ofgem has responded by creating a Regulatory Sandbox to enable “…innovators to trial new products, services and business models without some of the usual rules applying (Ofgem, 2017b),” this has created limited space for specific time-limited incarnations of businesses models such as peer-to-peer energy. This issue has been recognized by the United Kingdom Government in speech by Business Secretary Greg Clark, that announced several reviews including one into “industry codes and code governance,” and an “Engineering Standards Review” (Clarke, 2018). These sit alongside Ofgem review of supply market arrangements, which concludes that the “the current supplier hub model may not be fit for purpose for energy consumers over the longer term” (Ofgem, 2018b).

Second, that the future energy market could be more complex from a consumer perspective. This includes increased bundling of energy and non-energy services together, blurring lines between regulated sectors and complex models where community’s own assets and supply energy. These issues pose questions over current arrangements such as supplier of last resort and around the boundaries between service regulators. The issues of cross-sector regulation has recently been raised by the United Kingdom National Infrastructure Commission in their call for evidence on Future of Regulation, which includes a question “What is the case for or against a multi-utility regulator covering energy, digital and water?” (National Infrastructure Commission, 2019).

This clear message from the workshops was for a non-prescriptive regulatory regime that enables a myriad of different business models to deliver energy, and wider services and local and national benefits, in innovative ways.

That smart devices and data must be interoperable and secure was a consistent theme throughout the workshops.

Interoperability was considered essential for new business model to avoid hard- and soft consumer lock-in. For example, because aspects of consumer data are not portable to a new supplier, or the service provider has monopoly over an aspect of service provision.

Security had two aspects. First, that consumers are trusting businesses with personal data and potentially with automation of devices in homes. Data breaches would erode trust in business models. Second, energy data and automated devices could create new energy system security issues, as in principle could enable malicious parties to control devices and cause system issues, for example by compelling all electric vehicles to charge simultaneously.

No conclusion was reached on how these issues should be addressed and by whom. Some participants suggested that it should be for industry to agree interoperability standards between them, akin to other sectors (for example mobile phones). For system security, it was felt that this should be for government and/or the regulator to address as a matter of national security.

On energy data, the government and Ofgem has recognized this as an issue and established an Energy Data Taskforce with a remit to “…deliver recommendations for how industry and the public sector can work together to reduce costs and facilitate competition, innovation and new business models in the energy sector, through improving data availability and transparency” (Energy Systems Catapult, 2019a).

The need for energy businesses need to improve service standards came through strongly in all workshops.

This is related to the data and interoperability conclusion above in that businesses are likely to permeate consumer homes and businesses more so than today. This includes accessing consumer data and having direct control over devices, services and possibly financial transactions. Thus, when things go wrong, for example an electric vehicle is not charged as promised or bills are much higher than expected, the level customer service available to rectify the issue could make or break business models.

A conclusion from the workshop was that those businesses that are customer-centric and deliver excellent customer service are likely to succeed in the future. Alongside this, the regulator will need the tools and data to be able to monitor consumer issues in a radically different market.

A strong conclusion from the workshops was that solutions are required for consumers in all situations.

In a future market where data enables businesses to segment consumers in new ways and offer bespoke services, there is potential for winners and losers. For example, through businesses excluding certain consumer groups from offers (such as those who rent homes) or targeting and exploiting consumers in vulnerable situations. This could be exacerbated if companies are able to lock-in consumers based on installed devices or monopoly over data (as discussed above).

A recommendation arising was that the regulator needs to carefully consider market rules and principles so that as far as is practicable consumers can access energy service offers and are able to switch between service providers. This may require the regulator to have powers to address poor behaviors in the market, including where services are bundled together.

Targeted carbon regulation is required to ensure that businesses act on carbon. Given that there could be numerous business models operating in the market, engaging different consumers in different ways, participants felt that there would need to be an action to compel the businesses “to do the right thing on carbon.” The key question was how to place responsibility for carbon emissions onto these companies (or indeed onto the consumer).

The United Kingdom Energy Systems Catapult has studied this issue, concluding that “Our analysis suggests promise in exploring the design of an outcome-based (technology neutral) decarbonization obligation approach for incentivizing decarbonization policy. This has the potential to drive emission reductions, by setting the right incentives along the supply chain and leaving open flexibility for innovation in technology or business models.” (Energy Systems Catapult, 2019b). This is an area of potential future research.

Conclusions

This study explored the question “What are the impacts, risks and benefits of business models that ‘engage’ consumers in the low-carbon transformation, and can such innovative businesses enter the market?.” It employed a scenarios-based methodology in three workshops with energy policy, business and innovation experts. The outcomes indicate significant agreement on common and scenario specific issues that will need to be addressed. There were also differences between the workshops, relating to the expertize and perspectives in the rooms. Five near-term key recommendations to address issues arising from business models that engage consumers:

• Create space to enable business model innovation

• Ensure smart devices and data are interoperable and secure

• Improve the service standards of energy businesses

• Ensure business models work for consumers in all situations

• Implement targeted carbon regulation.

The recommendations focus on how to enable energy market innovation to unlock consumer-centric models and actions to ensure consumers are protected and businesses are compelled to do the right thing, for example on carbon. While there is action underway on each of the above recommendations, there are also substantial gaps that would benefit from further research.

In terms of contributions to the literature on methodology we have shown that our approach is an effective way to gather stakeholder feedback on given (and potentially undesirable) plausible but extreme futures. In terms of positive developments arising from the method, introducing pre-designed common scenarios to each of the workshops enabled comparability between the outputs and insight on the nature and biases of the stakeholder groups. It enabled the identification of pathway independent decisions that would create space for energy business model innovation, without prescribing or locking-out future options. It demonstrated that different communities, with different interests, share common views. Feedback from participants indicated that focusing on future scenarios avoided discussions getting bogged down in the plethora of issues and minutia of today’s energy system.

A weakness of this approach was that the participants were not involved in creating the scenarios which is often a feature of futures methodologies. This was somewhat alleviated by allowing participants to interrogate and critique the scenarios before the scenarios exercise, allowing issues to be aired and socialized. In this study, the approach was driven by project timelines and objectives that did not allow for the co-creation of scenarios and business models. If the study were repeated, this would be an interesting extension to apply to see what scenarios the participants derived.

Data Availability Statement

All datasets generated for this study are included in the manuscript/Supplementary Material.

Ethics Statement

Ethical review and approval was not required for the study on human participants in accordance with the local legislation and institutional requirements. The patients/participants provided their written informed consent to participate in this study.

Author Contributions

JH led the conceptualization, methodology design, workshops, formal analysis and writing of this paper. CM provided feedback on the analysis, writing, review and editing of the paper.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Funding

This research was funded by ESRC Impact Acceleration Account grant ES/M500562/1.

Acknowledgments

The authors would acknowledge the support of colleagues in the Grantham Institute for support in the workshops and in preparation of communication materials for work. Jeffrey Hardy thanks the Grantham Institute for hosting him during his Fellowship.

Supplementary Material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fenrg.2020.528415/full#supplementary-material

Footnotes

1Active customers (also called “prosumers”) are defined in the European Commission Electricity Directive. Article 2(6) as: “a customer or a groupof jointly acting customers who consume, store or sell electricity generated on their premises, including through aggregators, or participate in demand response or energy efficiency schemes provided that these activities do not constitute their primary commercial or professional activity” (Lavrijssen and Parra, 2017).

2According to BEIS figures there were around 28 million electricity and 22 million gas customers in 2016 (DECC, 2014).

3Of the estimated 22.8 million households in England, 14.3 million or 63% were owner occupiers. The proportion of households in owner occupation increased steadily from the 1980s to 2003 when it reached its peak of 71%. Since then, owner occupation gradually declined to its current level. However, the rate of owner occupation has not changed since 2013–14 (DCLG, 2015).

4Ofgem’s State of Energy Market Report 2017 indicates 60% of consumers are still on standard variable tariffs SVTs (Ofgem, 2017a).

5Ofgem has the powers to undertake a supplier of last resort process to protect energy consumers if a supplier has its license revoked (Ofgem, 2016b).

6Ofgem define vulnerability as when a consumer’s personal circumstances and characteristics combine with aspects of the market to create situations where he or she is: Significantly less able than a typical consumer to protect or represent his or her interests in the energy market; and/or Significantly more likely than a typical consumer to suffer detriment, or that detriment is likely to be more substantial (Office of Gas and Electricity Markets, 2013).

7The Climate Change Act 2008 states “It is the duty of the Secretary of State to ensure that the net United Kingdom carbon account for the year 2050 is at least 100% lower than the 1990 baseline.” (HM UK Parliament, 2008).

8Elexon define local balancing as “…[balancing] within a Grid Supply Point (GSP) Group unique to a locality to be consolidated on its own” (Elexon, 2015).

9A Significant Code Review provides a role for Ofgem to holistically review a code-based issue (for the main commercial industry codes) and speed up industry reform (Ofgem, 2016a).

References

Accenture (2015). Do you have the power to transform?. Available at: https://www.accenture.com/_acnmedia/Accenture/Conversion-Assets/DotCom/Documents/Global/PDF/Strategy_7/Accenture-Strategy-Low-Carbon-High-Stakes.pdf (Accessed May 10, 2019).

Apajalahti, E. L., Lovio, R., and Heiskanen, E. (2015). From demand side management (DSM) to energy efficiency services: a finnish case study. Energy Policy 81, 76–85. doi:10.1016/j.enpol.2015.02.013.

Blyth, W. W., McCarthy, R., and Gross, R. (2015). Financing the UK power sector: is the money available?. Energy Policy 87, 607–622. doi:10.1016/j.enpol.2015.08.028.

Bolton, R., Foxon, T. J., and Hall, S. (2015). Energy transitions and uncertainty: creating low carbon investment opportunities in the UK electricity sector. Environ. Plann. C 37, 1387–1403. doi:10.1177/0263774X15619628.

Britton, J., Hardy, J., Mitchell, C., and Hoggett, R. (2019a). Changing actor dynamics and emerging value propositions in the UK electricity retail market. Available at: www.exeter.ac.uk/igov (Accessed May 6, 2019).

Britton, J., Hardy, J., Mitchell, C., and Hoggett, R. (2019b). Changing actor dynamics and emerging value propositions in the UK electricity retail market. Available at: www.exeter.ac.uk/igov (Accessed February 1, 2019).

Bryant, S. T., Straker, K., and Wrigley, C. (2018). The typologies of power: energy utility business models in an increasingly renewable sector. J. Clean. Prod. 195, 1032–1046. doi:10.1016/j.jclepro.2018.05.233

Burger, S., Chaves, Á., Jose, P., Batlle,, , Carlos, , Pérez, A., et al. (2017). A review of the value of aggregators in electricity systems. Renew. Sust. Energ. Rev. 77, 395–405. doi:10.1016/j.rser.2017.04.014

Castaneda, M., Franco, C. J., and Dyner, I. (2017a). Evaluating the effect of technology transformation on the electricity utility industry. Renew. Sust. Energ. Rev. 80, 341–351. doi:10.1016/J.RSER.2017.05.179

Castaneda, M., Jimenez, M., Zapata, S., Franco, C. J., and Dyner, I. (2017b). Myths and facts of the utility death spiral. Energy Policy 110, 105–116. doi:10.1016/j.enpol.2017.07.063

Clarke, G. (2018). After the trilemma - 4 principles for the power sector. HM Government webpages. Available at: https://www.gov.uk/government/speeches/after-the-trilemma-4-principles-for-the-power-sector (Accessed April 14, 2019).

Committee on Climate Change (2019). Net Zero: the UK’s contribution to stopping global warming. Available at: www.theccc.org.uk/publications (Accessed May 10, 2019).

DCLG (2015). English housing survey. Communities. doi:10.1017/CBO9781107415324.004.Google Scholar

DECC (2014). Quarterly domestic energy switching statistics. Available at: https://www.gov.uk/government/statistical-data-sets/quarterly-domestic-energy-switching-statistics (Accessed January 4, 2018).

Demsky, C., Pidgeon, N., Evensen, D., Becker, S. (2019). Paying for energy transitions: public perspectives and acceptability. Available at: https://d2e1qxpsswcpgz.cloudfront.net/uploads/2020/03/ukerc_paying-for-energy-transitions_public-perceptions-and-acceptability.pdf.Google Scholar

Elexon, (2015). Encouraging local energy supply through a local balancing unit. Available at: www.elexon.co.uk (Accessed May 15, 2019).

Energy Systems Catapult (2019a). Energy data taskforce. Available at: https://www.gov.uk/government/groups/energy-data-taskforce (Accessed April 14, 2019).

Energy Systems Catapult (2019b). Smart energy services for low carbon heat smart systems and heat programme: phase 2 summary of key insights and emerging capabilities. Available at: https://es.catapult.org.uk/wp-content/uploads/2019/03/20190320-SSH2-Insight-Report-FINAL.pdf (Accessed April 14, 2019).

Etikan, I., Musa, S. A., Alkassim, R. S. (2016). Comparison of convenience sampling and purposive sampling. Am. J. Theor. Appl. Stat. 5 (1), 1–4. doi:10.11648/j.ajtas.20160501.11.

Fell, M. J. (2017). Energy services: a conceptual review. Energy Res. Soc. Sci. 27, 129–140. doi:10.1016/j.erss.2017.02.010

Fell, M. J., Shipworth, D., Huebner, G. M., Elwell, C. A. (2015). Public acceptability of domestic demand-side response in Great Britain: the role of automation and direct load control. Energy Res. Soc. Sci. 9, 72–84. doi:10.1016/j.erss.2015.08.023.

Frei, F., Simon, R. S., Ahmed, H., Joern, H. (2018). Leaders or laggards? The evolution of electric utilities’ business portfolios during the energy transition. Energy Policy 120, 655–665. doi:10.1016/j.enpol.2018.04.043.

Hall, S., Mazur, C., Hardy, J., Workman, M., Powell, M. (2020). Prioritising business model innovation: what needs to change in the United Kingdom energy system to grow low carbon entrepreneurship?. Energy Res. Soc. Sci. 60, 1–11. doi:10.1016/j.erss.2019.101317.

Hall, S., Roelich, K. (2016). Business model innovation in electricity supply markets: the role of complex value in the United Kingdom. Energy Policy 92, 286–298. doi:10.1016/j.enpol.2016.02.019.

Hamwi, M., Lizarralde, I. (2017). A review of business models towards service-oriented electricity systems. Procedia CIRP 64, 109–114. doi:10.1016/j.procir.2017.03.032

Hardy, J. (2017). How could we buy energy in the smart future? Available at: https://www.smartenergygb.org/en/resources/press-centre/press-releases-folder/future-energy-white-paper (Accessed April 14, 2019).

Hawker, G., Bell, K., Gill, S. (2017). Electricity security in the European union—the conflict between national capacity mechanisms and the single market. Energy Res. Soc. Sci. 24, 51–58. doi:10.1016/j.erss.2016.12.009.

HM UK Parliament (2008). Climate change act 2008. Statute Law Database. doi:10.1136/bmj.39469.569815.47.

IEA (2017). Digitalization & energy. Available at: http://www.iea.org/publications/freepublications/publication/DigitalizationandEnergy3.pdf (Accessed December 20, 2017).

Kellett, J. (2007). Community-based energy policy: a practical approach to carbon reduction. J. Environ. Plann. Manag. 50 (3), 381–396. doi:10.1080/09640560701261679.

Lavrijssen, S., Parra, A. C. (2017). Radical prosumer innovations in the electricity sector and the impact on prosumer regulation. Sustainability 9 (7), 1207. doi:10.3390/su9071207.

Laws, N. D., Brenden, P. E., Steven, O. P., Mark, S. L., Wanjiru, G. K. (2017). On the utility death spiral and the impact of utility rate structures on the adoption of residential solar photovoltaics and energy storage. Appl. Energy 185, 627–641. doi:10.1016/j.apenergy.2016.10.123.

Lopes, R. A., João, J., Aelenei, D., and Lima, C. P. (2016). A cooperative net zero energy community to improve load matching. Renew. Energy 93, 1–13. doi:10.1016/j.renene.2016.02.044.

Mazur, C., Hall, S., Hardy, J., and Workman, M. (2019). Technology is not a Barrier: A Survey of Energy System Technologies Required for Innovative Electricity Business Models Driving the Low Carbon Energy Revolution. Energies 12 (3), 428. doi:10.3390/en12030428

Midttun, A., and Piccini, P. B. (2017). Facing the climate and digital challenge: European energy industry from boom to crisis and transformation. Energy Policy 108, 330–343. doi:10.1016/j.enpol.2017.05.046.

Miola, A. (2008). Backcasting approach for sustainable mobility. JRC Scientific and Technical Reports. doi:10.2788/77831.Google Scholar

National Infrastructure Commission (2019). National infrastructure commission the future OF regulation study. Available at: https://www.nic.org.uk/publications/future-of-regulation-study-call-for-evidence/ (Accessed April 14, 2019).

Office of Gas and Electricity Markets (2013). OFGEM’s consumer vulnerability strategy. Available at: https://www.ofgem.gov.uk/sites/default/files/docs/2013/07/consumer-vulnerability-strategy_0.pdf (Accessed January 4, 2018).

Ofgem (2015). Non-traditional business models: supporting transformative change in the energy market. Available at: https://www.ofgem.gov.uk/publications-and-updates/non-traditional-business-models-supporting-transformative-change-energy-market (Accessed March 26, 2018).

Ofgem (2016a). Ofgem guidance on the launch and conduct of significant code reviews. Available at: https://www.ofgem.gov.uk/publications-and-updates/ofgem-guidance-launch-and-conduct-significant-code-reviews (Accessed July 12, 2019).

Ofgem (2016b). Guidance on supplier of last resort and energy supply company administration orders. Available at: https://www.ofgem.gov.uk/system/files/docs/2017/09/solr_revised_guidance_final_21-10-2016.pdf (Accessed April 12, 2019).

Ofgem (2016c). The innovation Link. Available at: https://www.ofgem.gov.uk/about-us/how-we-engage/innovation-link (Accessed January 4, 2018).

Ofgem (2017a). State of the energy market. Available at: https://www.ofgem.gov.uk/system/files/docs/2017/10/state_of_the_market_report_2017_web_1.pdf (Accessed January 4, 2018).

Ofgem (2017b). The innovation Link: update on regulatory Sandbox. Available at: https://www.ofgem.gov.uk/system/files/docs/2017/07/update_on_regulatory_sandbox.pdf.Google Scholar

Ofgem (2018a). Energy price cap will give 11 million a fairer deal from 1 January, 2018. Available at: https://www.ofgem.gov.uk/publications-and-updates/ofgem-proposes-price-cap-give-11-million-customers-fairer-deal-their-energy (Accessed April 14, 2019).

Ofgem (2018b). Future supply market arrangements – call for evidence. Available at: www.ofgem.gov.uk (Accessed April 14, 2019).

Ofgem (2018c). State of the energy market 2018 report. Available at: https://www.ofgem.gov.uk/system/files/docs/2018/10/state_of_the_energy_market_report_2018.pdf (Accessed July 7, 2019).

Ofgem (2019). State of the energy market. Available at: https://www.ofgem.gov.uk/publications-and-updates/state-energy-market-2018 (Accessed May 13, 2019).

Parag, Y., Sovacool, B. K. (2016). Electricity market design for the prosumer era. Nat. Energy 1 (4), 16032. doi:10.1038/nenergy.2016.32.Google Scholar

PwC (2017). Megatrends - Issues - PwC UK, pwc.co.uk. Available at: https://www.pwc.co.uk/issues/megatrends.html (Accessed December 20, 2017).

Richter, M. (2012). Utilities' business models for renewable energy: a review. Renew. Sustain. Energy Rev. 16 (5), 2483–2493. doi:10.1016/j.rser.2012.01.072.

Shove, E., Walker, G. (2007). Caution! Transitions ahead: politics, practice, and sustainable transition management. Environ. Plan. A 39, 763–770. doi:10.1068/a39310.Google Scholar

Sioshansi, F. P. (2016). “Chapter 1–what is the future of the electric power sector?,” in Future of utilities—utilities of the future. New York, NY: Elsevier, 1–21.Google Scholar

Soutar, I., Mitchell, C. (2018). Towards pragmatic narratives of societal engagement in the UK energy system. Energy Res. Soc. Sci. 35, 132–139. doi:10.1016/j.erss.2017.10.041.

Tansey, O. (2007). “Process tracing and elite interviewing: a case for non-probability sampling,” in PS–political science and politics. Cambridge, England: Cambridge University Press, 765–772.Google Scholar

Taylor, C. M., Price, C. W. (2005). “‘Irrationality in consumers ’ switching decisions : when more firms may mean less benefit,” in New economics papers. Germany, GE. 1–28.Google Scholar

Wegner, M.-S., Stephen, H., Hardy, J., Workman, M. (2017). Valuing energy futures; a comparative analysis of value pools across UK energy system scenarios. Appl. Energy 206, 815–828. doi:10.1016/j.apenergy.2017.08.200.

World Economic Forum (2017). The future of electricity: new technologies transforming the grid edge, World economic forum. Available at: http://www3.weforum.org/docs/WEF_Future_of_Electricity_2017.pdf (Accessed December 20, 2017).

Keywords: low-carbon, business model, engagement, scenarios, markets, energy, innovation

Citation: Hardy J and Mazur C (2020) Enabling Conditions for Consumer-Centric Business Models in the United Kingdom Energy Market. Front. Energy Res. 8:528415. doi: 10.3389/fenrg.2020.528415

Received: 20 January 2020; Accepted: 31 August 2020;

Published: 25 September 2020.

Edited by:

Simone Bastianoni, University of Siena, ItalyReviewed by:

Apel Mahmud, Deakin University, AustraliaJohn M. Polimeni, Albany College of Pharmacy and Health Sciences, United States

Copyright © 2020 Hardy and Mazur. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jeffrey Hardy, amVmZi5oYXJkeUBpbXBlcmlhbC5hYy51aw==

Jeffrey Hardy

Jeffrey Hardy Christoph Mazur2

Christoph Mazur2