- 1School of Economics and Management, China University of Geosciences (Beijing), Beijing, China

- 2School of Economics, Central University of Finance and Economics, Beijing, China

- 3Research Center for Rural Economy, Ministry of Agriculture and Rural Affairs, Beijing, China

Promoting green investment is the inevitable choice for sustainable economics against climate change. We examine how the COVID-19 pandemic affected corporate green investment. Using a sample of publicly listed firms in China, we document the negative and significant effect of the COVID-19 pandemic on corporate green investment. Further analyses suggest that the COVID-19 pandemic impeded corporate green investment by exacerbating firms’ financial constraints. We also find that the COVID-19 pandemic had no significant effect on total investment, suggesting that the pandemic shock only changed investment structure. In summary, our findings reveal the real effects of the COVID-19 pandemic on green development at the firm level.

1 Introduction

Global health crises such as COVID-19, SARS, or MERS seriously threaten the economy (Ferguson et al., 2006; Chen et al., 2020; Hassan et al., 2023; Ru et al., 2020). For example, the COVID-19 pandemic is predicted to shrink the global economy by 3% (International Monetary Fund, 2020). This decline is described as the worst since the Great Depression in the 1930s. Meanwhile, the outbreak of the pandemic has once again triggered people to think about the relationship between human beings and nature. Green and low carbon have become inevitable choices for sustainable development. The outbreak of the COVID-19 pandemic has raised urgent questions about the real effects of the pandemic on the green economy.

As a large economy-wide and unexpected shock, the pandemic has attracted a great deal of attention from economists and policymakers (e.g., Fan, 2003; Chen et al., 2005; Ferguson et al., 2006; Keogh-Brown and Smith, 2008; Chen et al., 2020). However, little research has explored the effect of pandemics on firms’ green investments. Corporate green investment contributes to combating climate change and promoting sustainable economic development. Zheng and Jin (2023) find firms’ green investments help to reduce carbon emissions. We address this gap by examining how the COVID-19 pandemic affected firms’ investment decisions. In particular, we ask the following questions: How did firms determine their green investment in response to the COVID-19 pandemic shock? Which channels can explain the relation? By addressing these questions, we hope to enhance the understanding of the impact of the pandemic and appropriate policy responses.

We focus on exploring the effects of the COVID-19 pandemic on corporate green investment. The main reasons are: first, the environment is closely related to human health. It has been proved that large-scale epidemics, such as SARS, originate from animal-to-human transmission. Improving the environment can reduce public health risks; secondly, the pandemic has rekindled people’s concern for environmental safety and the need for sustainable development. We argue that the direction of the pandemic’s impact on green investment is uncertain. On the one hand, we posit that the COVID-19 pandemic negatively influenced green investment through financial constraints. In terms of financial restrictions, the heightened uncertainty linked to the spread of the disease and governmental responses during the pandemic may have made banks more risk-averse, reducing the supply of capital or raising its costs (Easley and O’Hara, 2010; Shleifer and Vishny, 2010). On the other hand, the pandemic resulted in many provincial interventions, such as restricted business hours, cancellation of the May Day holiday, and bans on public gatherings. Thus, the COVID-19 pandemic has changed people’s lifestyles (Chen et al., 2020), such as telecommuting and virtual meetings, bringing opportunities for firms to go green. At the same time, the pandemic has increased the attention to green development. Enterprises may actively promote green transformation to gain long-term profits and growth. The COVID-19 pandemic may positively influence green investment.

Using a sample of Chinese listed firms in 2020-2021, we find that the COVID-19 pandemic significantly negatively impacts green investment, suggesting that the COVID-19 pandemic reduces firms’ willingness to invest in green. In other words, the COVID-19 pandemic stalls the process of greening the economy. The main results are robust to tests that address endogeneity concerns. We further investigate the channel through which the pandemic affects corporate green investment. We find that the negative effect of the COVID-19 pandemic on green investment is more substantial for firms with a younger age, with no dividends, with a higher WW index, or ownership by non-government entities, supporting the financial constraints channel. Meanwhile, the results show the effect of the COVID-19 pandemic on total investment is not significant.

Given the similarity between the coronaviruses causing SARS and COVID-19, and importantly, the similar impact of SARS and COVID-19 on human activities (i.e., social distancing and business shutdown), we study and compare the economic effect of the SARS epidemic on total investment and green investment. We find SARS negatively impacts total investment but does not affect green investment, possibly due to insufficient attention to green development and low corporate green investment in China in 2003.

Our paper contributes to the extant literature in two ways. First, our study adds to the literature on the economic consequences of the pandemic (e.g., Ferguson et al., 2006; Chen et al., 2020; Hassan et al., 2020; Ru et al., 2020). However, while most prior studies focus on the impact of the pandemic on consumption, economic growth, and stock price crashes, there needs to be more evidence on how firms react to pandemic shocks. We extend the literature by showing that the COVID-19 pandemic shock impedes firms’ green investment, with financial constraints playing an essential role in reducing firms’ green investment.

Second, our study contributes to the literature on the determinants of firm green investment. Prior literature identifies various factors affecting firms’ green investment, for example, media coverage (Chang et al., 2020), provincial green governance (Wang and Wang, 2023), and green capital (Tran et al., 2020). Ma et al. (2024) find green credit policy could stimulate firms’ green investment. However, little attention has been paid to economy-wide shocks such as pandemics. Recently, with increased urbanization and globalization, high-risk infectious diseases (e.g., SARS, HINI, MERS, COVID-19) have appeared frequently around the globe, and society is facing unprecedented public health threats. Harmony between humans and the natural environment and sustainable economic development have become the focus of attention. How to make green transition decisions in the face of pandemics has important policy implications for sustainable economic growth.

2 Data

2.1 Sample selection

Our sample consists of all Chinese A-share firms listed on the Shanghai Stock Exchange and the Shenzhen Stock Exchange in 2020-2021. We measure the COVID-19 pandemic using the newly confirmed cases obtained from the China Healthcare Commission (CHC). Green investment and financial information are obtained from the China Stock Market and Accounting Research database. We obtain firm headquarters information from the Resset database. In line with common practice, we exclude observations with missing values and winsorize all continuous variables at the top and bottom 1%.

2.2 Variable definition

Green investment () refers to environmentally friendly investment, which helps firms transfer to green. Following Chang et al. (2020), we construct the green investment variable based on the term of projects under construction in the financial report. We extract the construction in progress related to green investments, such as the “desulphurization project,” “purification project,” “eco-project,” and so on. Thus, we sum up these projects to present the green investment. We construct the green investment variable () as the natural log of one plus green investment, obtained from the term of projects under construction.

Our key independent variable is exposure to the COVID-19 pandemic (), defined as the natural log of one plus the number of newly confirmed in the city of the year. We match the COVID-19 pandemic measure according to the firms’ registered cities.

Following Yu et al. (2014), Shen et al. (2012), and Shen et al. (2010), we control for a series of variables that have been proven to influence firm green investment. Firm size () is defined as the natural log of total assets. We compute firm leverage () using the ratio of total debts to total assets. Tobin’s Q () represents investment opportunities, calculated as the ratio of the market value of equity plus the book value of debts to total assets. We control for firm cash flow () as the net operating cash flow, scaled by the year’s beginning total assets. represents firm equity structure, calculated as the percentage of shares held by the largest shareholder. is defined as the years since the firm was first listed on the Shanghai or Shenzhen Stock Exchange. is calculated as the return on assets.

2.3 Descriptive statistics

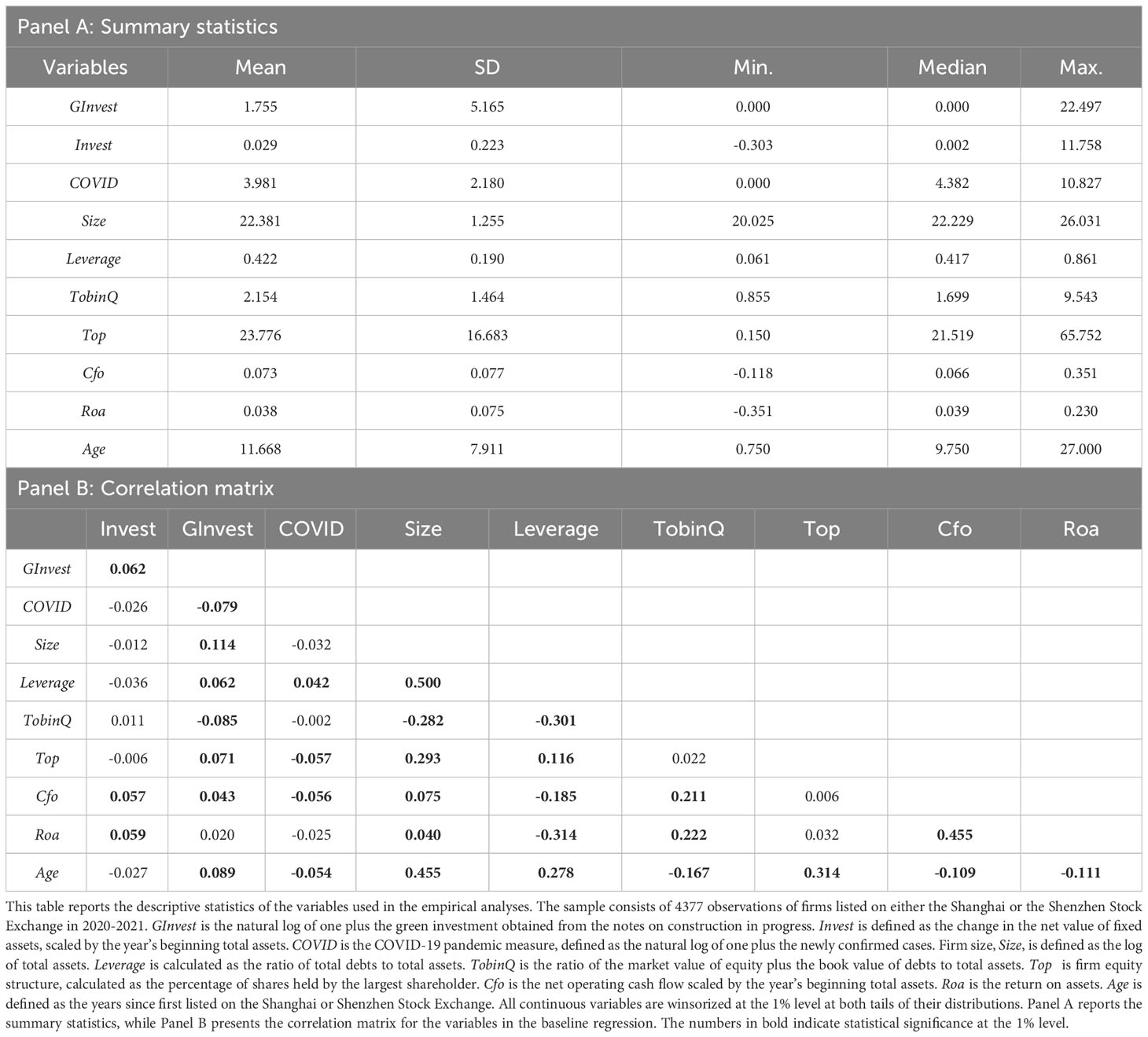

Panel A of Table 1 shows the descriptive statistics. The mean and maximum of green investment, defined as the natural log of one plus green investment, are 1.755 and 22.497, respectively. The standard deviation of the COVID-19 pandemic measure is 2.180, which suggests that different cities experienced different exposure to the COVID-19 pandemic. Panel B of Table 1 presents the correlation matrix of variables used in the main regression. The correlation coefficient of the COVID-19 pandemic and firm green investment is -0.079, and statistically significant at the 1% level, suggesting that firms in cities where the exposure to COVID-19 pandemic invest in green less. Firm green investment is negatively related to the COVID-19 pandemic. Larger firms with greater leverage were likely to have more green investment. The following section describes the regressions conducted to explore the relationship between the COVID-19 pandemic and firm green investment.

3 Main findings

3.1 Baseline results

To investigate the relationship between the COVID-19 pandemic and firm green investment, we conduct multivariate regression analysis using the equation below:

where is green investment for firm at the end of 2020 and 2021, is our city-level COVID-19 pandemic measure for firm located in city . is a series of control variables: , , , , , , and . Industry fixed effects () are included to account for the industry heterogeneity in investment. is the standard error item. The standard errors of the estimated coefficients are corrected for heteroscedasticity. Our conclusion is not affected if we allow for clustering by city or by province.

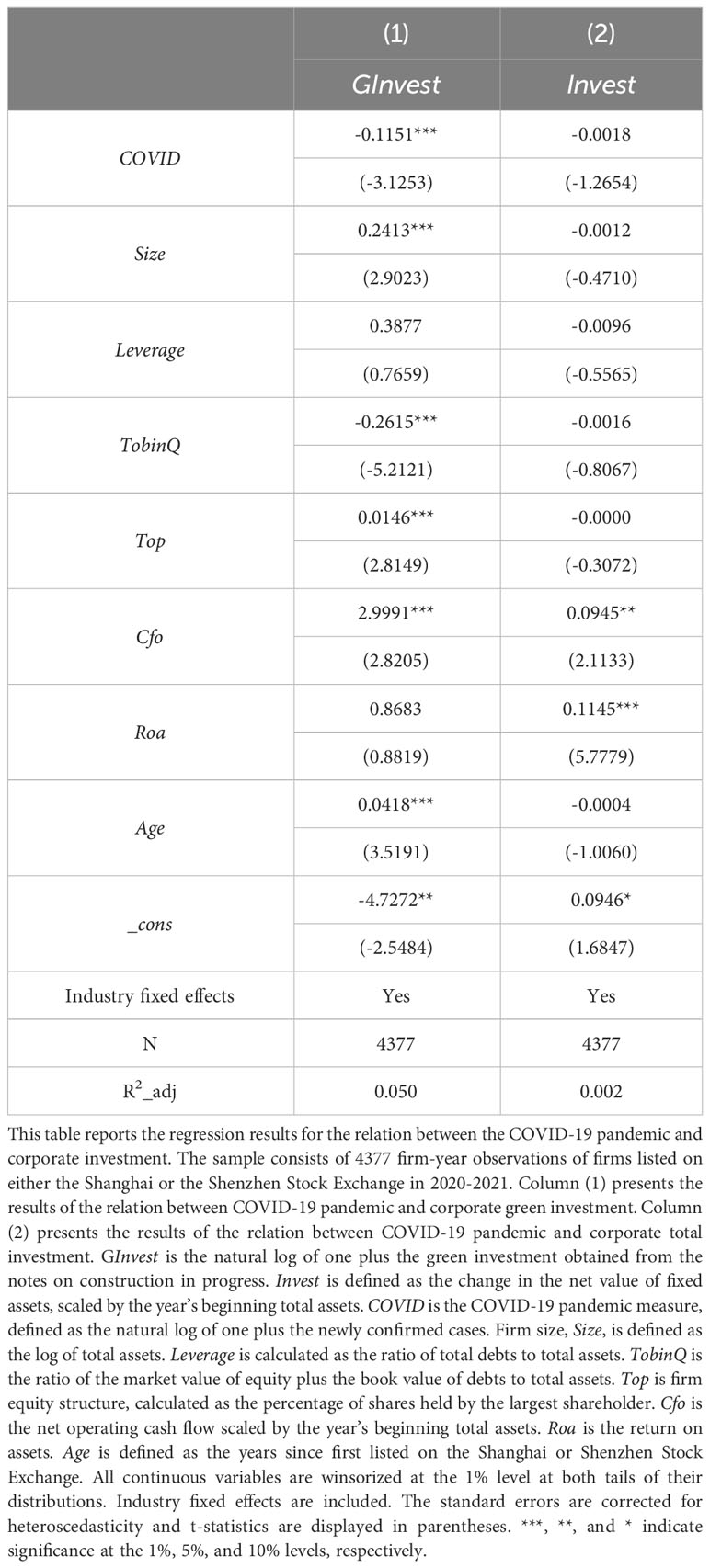

We first estimate the relation between the COVID-19 pandemic and firm green investment. The results are presented in Column (1) of Table 2. The coefficient of our COVID-19 pandemic measure is negative and significant at 1% (coefficient=−0.1151, t-statistics=−3.1253). The results suggest that firms in regions where the COVID-19 pandemic was severe have a lower willingness to make a green investment. Economically, a 1%in the number of confirmed cases in the city would result in a 0.12% decrease in green investment. The sign of coefficients of the control variables is largely consistent with prior studies. The coefficients of firm size (), equity structure (), and firm age () are positive and significant, indicating that larger and older firms, firms with bigger stockholders, make more green investments. Cash flow () is positively related to firm green investment, suggesting that green investment is limited to the firm’s cash flow.

In order to verify whether the reduction in green investment is caused by a reduction in the total amount of investment in the general sense of the term. We explore the effect of the COVID-19 pandemic on firm total investment. We define firm investment () as the ratio of the change of net value of fixed assets, to the year’s beginning total assets. The associated results are presented in Column (2) of Table 2. The coefficient of our city-level COVID-19 pandemic measure is negative, but it is not significant statistically (coefficient = −0.0018, t -statistics = −1.2654). This suggests that the COVID-19 pandemic did not have a significant negative impact on total investment.

Taken together, our baseline results in Table 2 suggest that firms in regions where the exposure to the COVID-19 pandemic was higher tended not to make green investments. Meanwhile, the effect of the COVID-19 pandemic on total investment is not significant. This suggests that under the shock of the COVID-19 pandemic, firms first reduce environmentally friendly investments such as green investment. Alessio and Simona (2024) show firm environmental performance was related to lower returns during the period of the COVID-19 pandemic. Because the higher cost of green projects makes firms more exposed to uncertainty. This may be related to the characteristics of green investment, which, in the short term, generates more social than economic benefits. The negative relationship between the COVID-19 pandemic and firm green investment shows that the outbreak of COVID-19 damaged sustainable economic development, causing a decrease in firm green investment.

3.2 Robustness and endogeneity tests

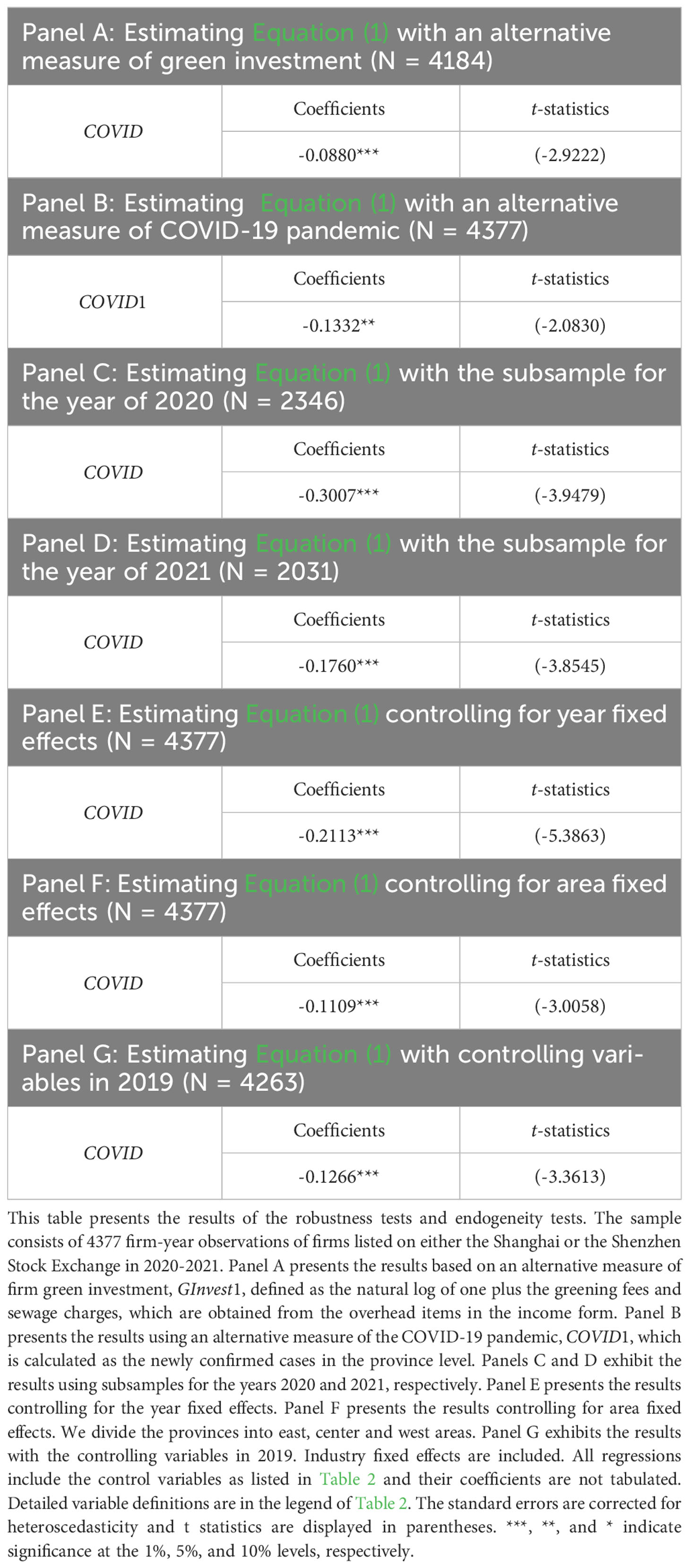

We conduct further analyses to ensure the negative relationship between the COVID-19 pandemic and firm green investment is robust to alternative green investment measures, COVID-19 pandemic measures, and sample constructions. We present the results in Table 3. For the sake of brevity, we only show the coefficient of the COVID-19 pandemic measure.

We start by examining whether our results are sensitive to alternative green investment measures. Following Zhang et al. (2019), we measure firm green investment using , defined as natural log of one plus the greening fees and sewage charges. Panel A in Table 3 presents the results, consistent with the baseline results. The coefficient of is −0.0880, which is negative and significant at the 1% level.

In our baseline regression, we measure the COVID-19 pandemic using the city-level confirmed cases. We further adjust our COVID-19 pandemic measure using province-level confirmed cases. We name this adjusted variable , which then replaces in Equation (1). We present the results in Panel B of Table 3. We find that the negative coefficient of is significant, suggesting that our main findings are robust to different measures of the COVID-19 pandemic.

Last, we redefine the period of the sample to test whether our results are sensitive to subsamples. We estimate the relationship between the COVID-19 pandemic and green investment for 2020 and 2021 separately. We present the results in Panels C and D of Table 3, respectively. We find that the coefficients of the COVID-19 pandemic are negative and significant for the subsamples.

While we have shown a robust negative relationship between the COVID-19 pandemic and firm green investment, its causal interpretation could be subject to endogeneity resulting from omitted variables. The type of reverse causal maybe not an endogeneity issue in our paper because the COVID-19 pandemic was an external shock that could not be affected by firm green investment. To remove endogeneity concerns arising from omitted variable bias, our strategy is to control for several variables that could be correlated with both the COVID-19 pandemic and firm green investment.

We include year-fixed effects in the regression to account for time effects and show the results in Panel E. The negative relationship between COVID-19 and green investment remains. We further include area fixed effects (i.e., East area, Central area, and West area) in the regression to account for cross-area differences in corporate green investment and re-estimate the effects of the COVID-19 pandemic on firm green investment. The results are presented in Panel F of Table 3. The coefficient of is negative and significant at the 1% (coefficient = −0.1109, t-statistics = −3.0058), consistent with the baseline results. Concerning the COVID-19 pandemic may affect firm operations, the controlling variables may be related to the COVID-19 pandemic. To deal with the concerns, we replace the controlling variables using the controls in 2019 and re-estimate the Equation (1). The results presented in Panel G of Table 3 show COVID-19 pandemic has negative impact on firm green investment, consistent with baseline regression.

4 Further analysis

4.1 Cross-sectional heterogeneity in results

Our baseline results imply a negative and causal relation between the COVID-19 pandemic and firm green investment. In this section, we conduct cross-sectional tests to explore the channels through which the COVID-19 pandemic impeded firm green investment. On the basis of prior literature (e.g., Kahle and Stulz, 2013; Liu et al., 2016; Tang et al., 2020), we posit that the COVID-19 pandemic negatively influenced firm green investment by increasing firm financial constraints. For the financial constraints channel, crises increase uncertainty about firm prospects and/or government policies, thereby decreasing the willingness of capital suppliers (e.g., banks) to fund corporate green investment (Shleifer and Vishny, 2010). Moreover, pandemic may cause panic in the credit market, raising the cost of debt (Easley and O’Hara, 2010). The lower availability and higher cost of loans during the COVID-19 pandemic increased firms’ financial constraints, thereby impeding their green investment. Further, if the negative effect of the COVID-19 pandemic on firm green investment was felt through the financial constraints channel, the effect should be stronger for firms with higher financial constraints.

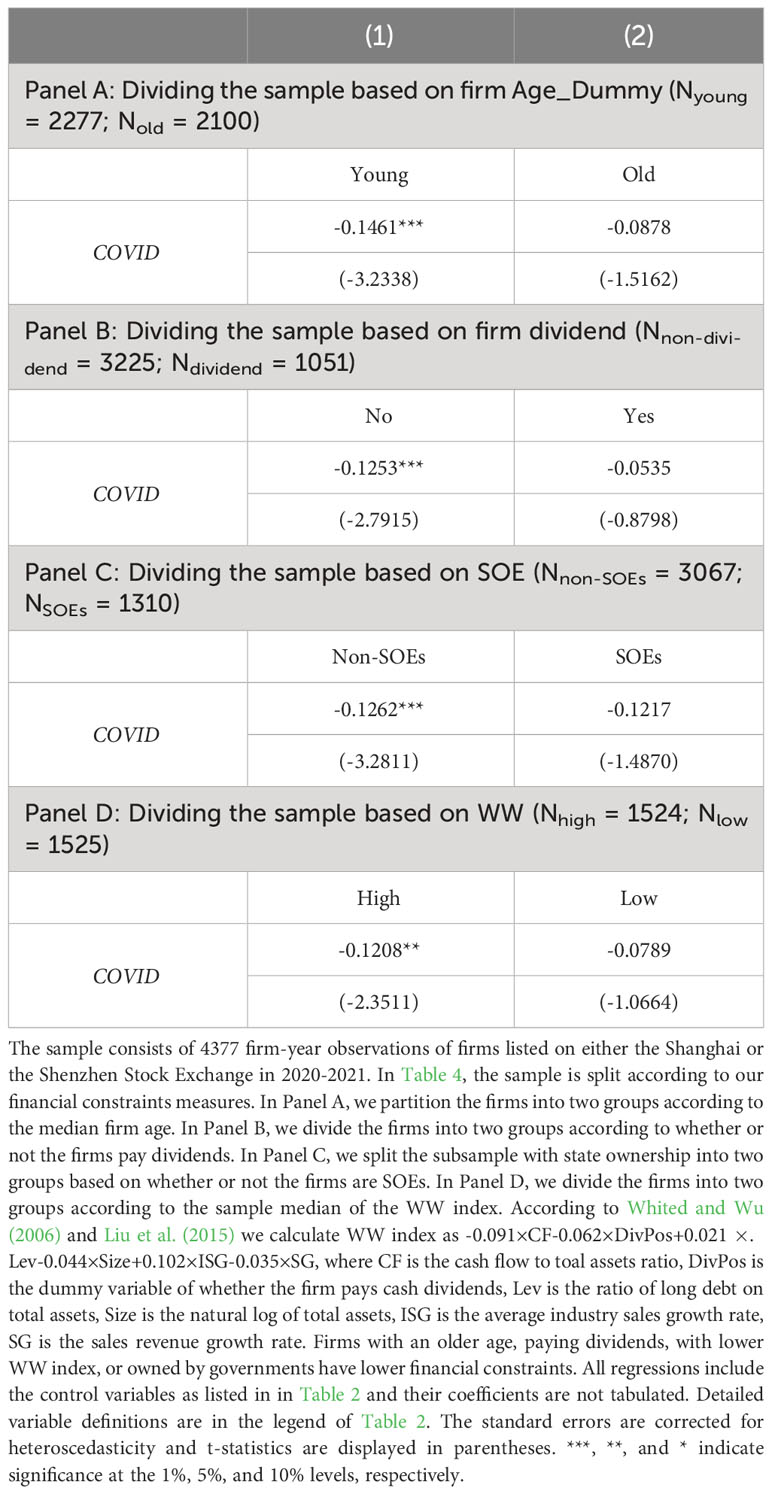

To test the financial constraints channel, in this section, we explore how the relationship between the COVID-19 pandemic and firm green investment varies according to financial constraints. Specifically, we measure financial constraints at the firm level with four variables, namely firm age, dividend, state ownership, and WW index. Older firms and firms paying dividends have lower financial constraints. State ownership of enterprises affects firms’ financing ability. Chang et al. (2019) show that the top managers of SOEs in China are often high-ranking party cadres, and consequently, SOEs have the advantage of financial resources. Thus, SOEs have greater access to capital than non-SOEs. According to Whited and Wu (2006) and Liu et al. (2015) we also calculate WW index to measure firm financial constraints. The WW index equals -0.091×CF-0.062×DivPos+0.021×Lev-0.044×Size+0.102×ISG-0.035×SG, where CF is the cash flow to total assets ratio, DivPos is the dummy variable of whether the firm pays cash dividends, Lev is the ratio of long debt on total assets, Size is the natural log of total assets, ISG is the average industry sales growth rate, SG is the sales revenue growth rate. Higher WW index indicates higher financial constraints. We divide the sample into two groups according to the median level of age, whether firms paying dividends, state ownership, and median of WW index, respectively.

We re-estimate the regression for these subsamples and present the results in Table 4. Consistent with the financial constraints channel, the negative effect of the COVID-19 pandemic is stronger for firms with higher financial constraints (i.e., younger firms, non-dividend, non-SOEs, or higher WW index). The coefficients of the COVID-19 pandemic for the older firms, firms with dividends, SOEs, and lower WW index, are much smaller or not significantly different from zero. Collectively, our cross-sectional analysis in Table 4 supports our argument that the COVID-19 pandemic impeded corporate green investment by increasing firms’ financial constraints.

Table 4 Cross-sectional differences in the effects of COVID-19 pandemic on corporate green investment.

4.2 SARS epidemic and investment

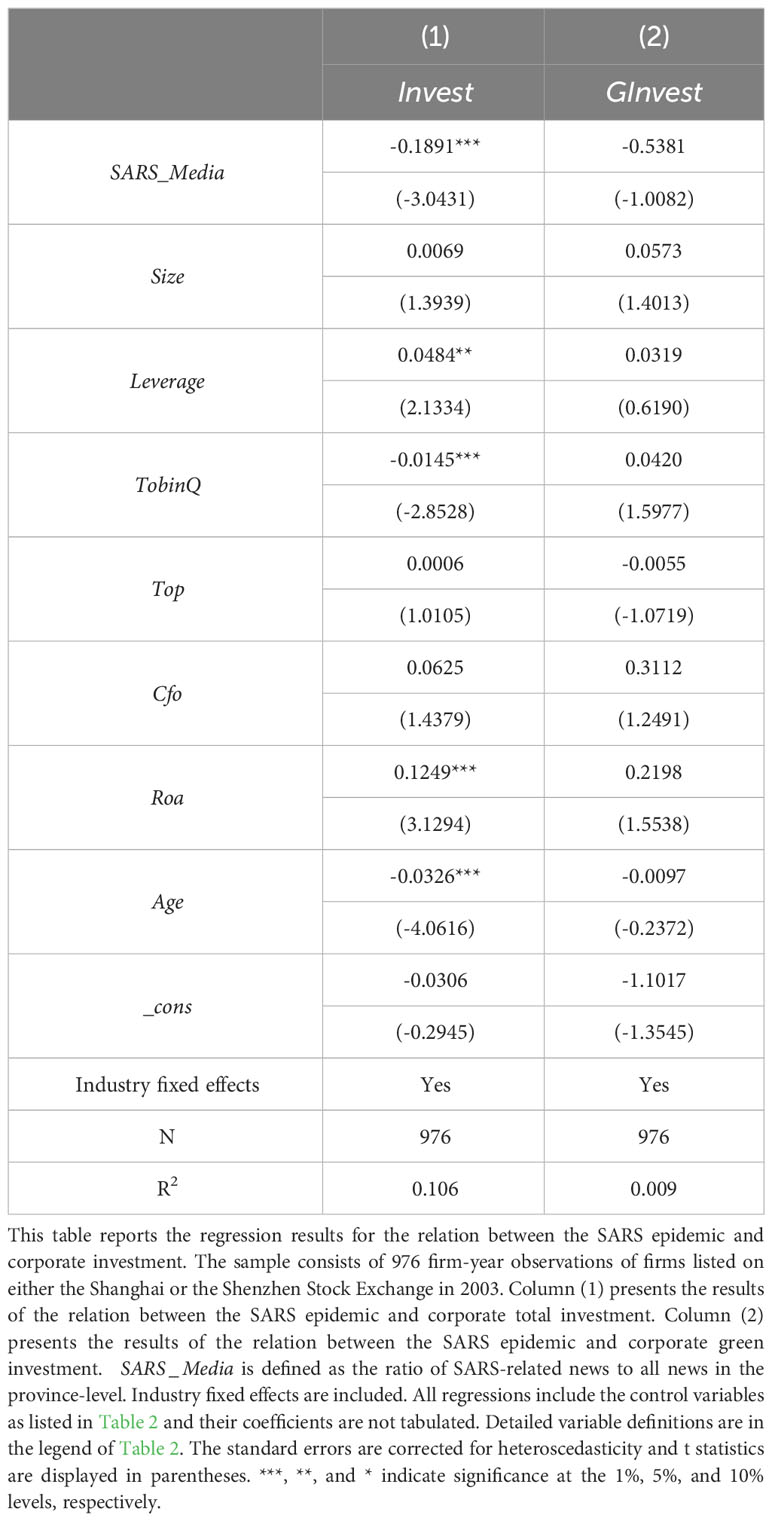

In this section, we explore the economic effect of the SARS epidemic on total investment and green investment. We measure the exposure of the SARS epidemic based on SARS-related news published by China’s provincial official party newspapers. In comparison with confirmed cases or deaths variables, our media-based variable is better suited to capturing the province-level exposure to SARS. Because SARS outbreaks are concentrated in some provinces, each province implemented strict controlling policies to prevent the spread of the virus. It is difficult to capture differences in exposure to the SARS epidemic using confirmed cases almost all provinces. In line with prior literature (e.g., Baker et al., 2016; Chang et al., 2020), we measure media-based SARS epidemic variables using the dictionary method. This method classifies documents into different categories based on a pre-specified dictionary (Stone et al., 1967). The procedure for measuring the media-based SARS epidemic is as follows. We first create a list of words used to refer to the SARS epidemic. Specifically, we use different names for SARS to identify SARS-related news. Next, we use “jieba,” a popular word segmentation package used to analyze Chinese text data, to break down sentences into words. We add the eight SARS names to the “jieba” list to extract the dictionary words from the news. We remove the “stop words” (e.g., “is”, “of”, and “then”), from the news. We then use the standard dictionary method to classify the news published in China’s provincial official newspapers between November 2002 and July 2003 into SARS-related and non-SARS-related categories. SARS-related news is that containing the dictionary words in the news. We compute the media-based SARS epidemic measure using the following ratio: .

We use the sample of all Chinese A-share firms listed on the Shanghai Stock Exchange and the Shenzhen Stock Exchange in 2003 and explore the relation between SARS and investment (i.e. total investment and green investment). The results presented in Table 5 show that SARS epidemic has significantly negative effects on total investment. When we control for the confirmed cases in the baseline regression, the results remain. The results are consistent with financial constraints channel. Besides the financial constraints channel, we think the demand shocks may be another channel. According to the literature (e.g., Kahle and Stulz, 2013; Liu et al., 2016; Tang et al., 2020), the outbreak of the SARS epidemic led regions to take mandatory quarantine measures, which restricted people’s spending power. Chen et al. (2020) show that the COVID-19 pandemic has caused daily offline consumption to fall by 32%. The decrease in demand for firms’ products can reduce investments (Kahle and Stulz, 2013; Tang et al., 2020). Liu and Zhang (2020) explore the effect of the SARS epidemic on macroeconomics and show the SARS epidemic heat economics, especially the tertiary sector. Such decreases in demand drive down corporate investment. However, the coefficient of SARS epidemic is not significant when the dependent variable is green investment. The results suggest that firms in regions where the exposure to SARS was higher tended not to invest. But SARS epidemic has not yet crowded out corporate green investment, possibly at a lower level of green development itself in 2003.

5 Conclusion

Corporate green investment is an environmentally friendly investment, which is a major tool for combating climate change. With the outbreak of COVID-19, scholars and policymakers are paying more attention to sustainable economic development. It is necessary to better understand the real economic impact of such large-scale health crisis shocks as the COVID-19 pandemic. While some have debated the effects of the pandemic on macroeconomics, such as consumption and economic growth, little is known about its firm-level impact. In this study, we examine the relationship between the COVID-19 pandemic and firm green investment.

Using a sample of Chinese listed firms, we show that the COVID-19 pandemic negatively affected firms’ green investments. However, the COVID-19 pandemic has no significant effects on total investment. The results are robust to a variety of tests on variable measures, subsamples, and endogeneity issues. We also find that increased financial constraints account for the negative relation between the COVID-19 pandemic and firm green investment. Further analysis reveals that the SARS epidemic has no significant effects on firm green investment.

Collectively, our findings suggest that the COVID-19 pandemic had a negative effect on firm green investment and policymakers can rely on these findings to support economic recovery and sustainable development from the shock of the health crisis. Thus, our study offers new evidence about the firm-level effects of the COVID-19 pandemic, indicating that financial constraints played an important role in accounting for the negative shock of the pandemic. In the future, it is necessary to research on how to mitigate the negative effects of the pandemic on green development.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material. Further inquiries can be directed to the corresponding authors.

Author contributions

YH: Methodology, Writing – original draft. LF: Writing – review & editing. TL: Conceptualization, Supervision, Writing – original draft. RW: Formal analysis, Software, Writing – original draft.

Funding

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. This research was funded by Beijing Outstanding Talent Training Foundation (grant No. BJJWZYJH01201910034034), and the Fundamental Research Funds for the Central Universities (grant No. 2-9-2022-027).

Acknowledgments

All authors contributed equally to the project.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Alessio B., Simona F. (2024). Does firm environmental performance mitigate the market reaction to COVID-19 uncertainty? Res. Int. Business Finance. 68, 102193. doi: 10.1016/j.ribaf.2023.102193

Baker S. R., Bloom N., Davis S. J. (2016). Measuring economic policy uncertainty. Q. J. Economics. 131, 1593–1636. doi: 10.1093/qje/qjw024

Chang Y., He Y., Jin X., Li T., Shih C. M. (2020). Media coverage of environmental pollution and the investment of polluting companies. Asia-Pacific J. Financial Stud. 49, 750–771. doi: 10.1111/ajfs.12315

Chang X., Li S., Liu C., Sun L., Zhang W. (2019). Local political corruption and financial reporting conservatism (Working Paper).

Chen H., Qian W., Wen Q. (2020). The impact of the COVID-19 pandemic on consumption: Learning from high frequency transaction data. 3568574.

Chen K. T., Twu S. J., Chang H. L., Wu Y. C., Chen C. T., Lin T. H., et al. (2005). SARS in Taiwan: An overview and lessons learned. Int. J. Infect. Diseases. 9, 77–85. doi: 10.1016/j.ijid.2004.04.015

Easley D., O’Hara M. (2010). Liquidity and valuation in an uncertain world. J. Financial Economics. 97, 1–11. doi: 10.1016/j.jfineco.2010.03.004

Ferguson N. M., Cummings D. A., Fraser C., Cajka J. C., Cooley P. C., Burke D. S. (2006). Strategies for mitigating an influenza pandemic. Nature 442, 448–452. doi: 10.1038/nature04795

Hassan T. A., Hollander S., van Lent L., Tahoun A. (2023). Firm-level exposure to epidemic diseases: Covid-19, SARS, and H1N1 (No. w26971) (National Bureau of Economic Research).

International Monetary Fund (2020). World economic outlook. Washington, DC: International Monetary Fund.

Kahle K. M., Stulz R. M. (2013). Access to capital, investment, and the financial crisis. J. Financial Economics. 110, 280–299. doi: 10.1016/j.jfineco.2013.02.014

Keogh-Brown M. R., Smith R. D. (2008). The economic impact of SARS: How does the reality match the predictions? Health policy. 88, 110–120. doi: 10.1016/j.healthpol.2008.03.003

Liu L. Y., He Y. L., Wang Z. F., Cheng T. X. (2015). Will financial constraints affect Chinese firms’ OFDI? J. Financial Res. 8, 124–140.

Liu X. L., Zhang X. J. (2020). Epidemic shocks and economic growth——An empirical analysis of SARS and the potential impact of COVID-19. Rev. Ind. Economics. 4, 5–25. doi: 10.19313/j.cnki.cn10-1223/f.2020.04.002

Liu X., Zhang C., Xin Q. (2016). Financial constraints or demand shocks? An examination on corporate investment in China’s listed firms during the financial crisis. J. Financial Res. 11, 80–95.

Ma Y. B., Lu L., Cui J. B., Shi X. P. (2024). Can green credit policy stimulate firms’ green investments? International Review of Economics and Finance.

Ru H., Yang E., Zou K. (2020). What do we learn from SARS-CoV-1 to SARS-CoV-2: Evidence from global stock markets. 3569330.

Shen H., Kou H., Zhang C. (2010). Empirical research on financial development, financial constraints and corporate investment. China Ind. Economics. 6, 55–64. doi: 10.19581/j.cnki.ciejournal.2010.06.006

Shen H., Yu P., Wu L. (2012). State ownership, environmental uncertainty, and investment efficiency. Economic Res. J. 7, 113–126.

Shleifer A., Vishny R. W. (2010). Unstable banking. J. Financial Economics. 97, 306–318. doi: 10.1016/j.jfineco.2009.10.007

Stone P. J., Dunphy D., Smith M. S. (1967). The general inquirer: A computer approach to content analysis. Am. Educ. Res. J. 4, 397. doi: 10.2307/1161774

Tang Y., Chen Z., Liu K. (2020). Effects of demand and supply shocks on firm investment and the global value chain: A study based on unexpected events. J. Financial Res. 6, 40–59.

Tran T. T. T., Do H. N., Vu T. H., Minh N. N. (2020). The factors affecting green investment for sustainable development. Decision Sci. Letters. 9, 365–386. doi: 10.5267/j.dsl.2020.4.002

Wang W. H., Wang X. (2023). Does provincial green governance promote enterprise green investment? Based on the perspective of government vertical management. J. Cleaner Production. 396, 136519. doi: 10.1016/j.jclepro.2023.136519

Whited T. M., Wu G. (2006). Financial constraints risk. Rev. Financial Stud. 19, 531–559. doi: 10.1093/rfs/hhj012

Yu K., Li Z., Zhang X., Xu J. (2014). The riddle of enterprise investment efficiency: Financial constraints hypothesis and monetary policy shock. Economic Res. J. 5, 106–120.

Zhang Q., Zheng Y., Kong D. M. (2019). Regional environmental governance pressures, executive experiences and corporate environmental investments: A quasi-natural experiment based on the Ambient Air Quality Standards, (2012). Economic Res. J. 54, 183–198.

Keywords: COVID-19 pandemic, green investment, total investment, financial constraints, sustainable development

Citation: He Y, Fu L, Li T and Wei R (2024) Sustainable development in the context of pandemic: the impact of COVID-19 pandemic on green investment. Front. Ecol. Evol. 12:1363842. doi: 10.3389/fevo.2024.1363842

Received: 31 December 2023; Accepted: 01 February 2024;

Published: 16 February 2024.

Edited by:

Tsun Se Cheong, Hang Seng University of Hong Kong, Hong Kong SAR, ChinaReviewed by:

Xiaomin Jiang, Henan University of Economic and Law, ChinaKe Jiang, Shandong University, China

Copyright © 2024 He, Fu, Li and Wei. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Lin Fu, ZnVsaW4wN0BnbWFpbC5jb20=; Ran Wei, d2VpcmFuX2N1ZmVAMTYzLmNvbQ==

Yu He

Yu He Lin Fu

Lin Fu Tao Li2

Tao Li2