- 1School of Economics and Management, Jiangxi Teachers College, Yingtan, China

- 2School of Economics and Management, East China Jiaotong University, Nanchang, China

Against the backdrop of global climate change, corporate carbon emissions have increasingly become a focal point, making carbon reduction by companies a pivotal issue. Based on data from Chinese listed manufacturing companies from 2010 to 2020, this paper explores the impact of ESG performance on carbon reduction. The results indicate that ESG performance significantly reduce corporate carbon emissions. Green technology innovation, corporate efficiency, and managerial short-sightedness are vital channels through which ESG promotes corporate carbon reduction. For companies with different environmental regulations, industry competition intensities, and capital intensities, the relationship between ESG performance and carbon reduction varies significantly. Notably, we found that in companies with strict environmental regulations, intense industry competition, and high capital intensity, the carbon-reducing effect of ESG performance is more pronounced. Furthermore, digital transformation positively moderates the relationship between ESG performance and carbon reduction. This study not only provides new empirical evidence for understanding the impact of ESG performance on carbon reduction but also offers valuable insights for businesses and policymakers to promote corporate efforts in carbon reduction and achieve China’s “Dual Carbon” goals.

1 Introduction

With the climate change and issues of income inequality on the rise recently, sustainability has taken center stage in the growth of the world. All facets of society should take notice as serious concerns to human health, social cohesiveness, and economic growth are posed by issues of environmental degradation. Corporations, which are vital to economic activity, have a duty to push society toward sustainable development. This means that businesses must develop business models that balance economic efficiency and sustainable growth while pursuing profit maximization, actively adopting the ESG (Environmental, Social, and Governance) concept. ESG is the idea of incorporating environmental, social, and corporate governance considerations into financial and operational choices. It acts as a benchmark for businesses to track and manage their performance and a crucial criterion for investors to gauge and assess the social responsibility and capacity for sustainable development of businesses (Pulino et al., 2022; Zhou et al., 2023). In delving deeper into the ESG framework, it is essential to understand how each of its components—Environmental, Social, and Governance—uniquely contributes to carbon reduction and sustainable development. The environmental aspect of ESG emphasizes a company’s role in stewarding natural resources and minimizing ecological footprints, directly impacting carbon emissions through practices like energy efficiency, waste reduction, and sustainable resource utilization. The social dimension focuses on a company’s management of relationships with employees, suppliers, customers, and communities where it operates, indirectly affecting carbon emissions by promoting a broader culture of sustainability and responsible consumption. Lastly, the governance component, involving management structures, policies, and procedures, ensures accountability and transparency in environmental and social practices, supporting carbon reduction goals through sustainable decision-making processes.

The basic tenet of ESG stresses that businesses should prioritize social responsibility, environmental protection, and improved corporate governance in addition to pursuing financial goals like profit. Additionally, it tries to help investors assess a company’s sustainability to make wise investment choices. The ESG idea is currently growing quickly in the business, regulatory, and financial sectors worldwide (Agliardi et al., 2023; Liu et al., 2023; Zhang et al., 2023b). Global ESG assets were predicted to be at $22.839 trillion in 2016 and will rise to $35.3 trillion in 2020, a rise of 54.56 percent from 2016. This is according to the Global Sustainable Investment Alliance (GSIA). In addition, the number of parties who have ratified the PRI (Principles for Responsible Investment) and the size of managed assets both keep expanding. 3,826 institutions signed the PRI as of 2021, controlling $121.3 trillion in total assets. In contrast, only 890 institutions signed the PRI in 2011 and only $24 trillion worth of assets were under their management (Mao and Wang, 2023).

Since the proposal of the “carbon peak and carbon neutrality” goals, China’s emphasis on ESG has increased as society has become more aware of the ESG performance of corporations. The China Securities Regulatory Commission (CSRC) amended the “Corporate Governance Guidelines for Listed Businesses” in 2018, which stipulates that listed companies must disclose information about corporate governance, social responsibility, and environmental protection. ESG data is one of the items for communication between listed firms and investors in investor relations management, according to the “Guidelines for Investor Relations Management of Listed Companies” published by the CSRC in April 2022. Statistics from the China Listed Businesses Association on information disclosure show that over 1,700 companies produced and disseminated ESG-related reports for 2022, accounting for 34%, a major increase from the prior year. The economic performance and social implications of ESG will be more apparent as Chinese companies increase their focus on it, which will help to improve their long-term competitiveness and reputation abroad. The “dual carbon” strategy and high-quality development goals of China are also closely aligned with ESG, which is a key factor in accelerating China’s sustainable economic development and achieving the “carbon peak” and “carbon neutrality” targets (Yan et al., 2020; Li et al., 2023a; Zheng et al., 2023).

Addressing global climate change and achieving low-carbon development are shared goals of the international community. The “14th Five-Year Carbon Reduction Action Plan” clearly states that promoting low-carbon technology innovation and industrial upgrading during the “14th Five-Year Plan” period is the core task for realizing green development and building an ecological civilization. It’s also a crucial path to practice the concept of sustainable development and advance the global ecological civilization construction (Wen et al., 2023). The report of the 20th National Congress of the Communist Party emphasizes the need to vigorously develop a green, low-carbon economy, improve energy efficiency, and strive to achieve carbon peak and carbon neutrality goals. The “Government Work Report” of 2022 further points out the necessity to accelerate the green, low-carbon transition, deepen the national carbon emission rights trading market and promote adjustments in industrial and energy structures to achieve carbon emission reductions. In this context, the ESG performance of enterprises plays a pivotal role in their efforts towards carbon reduction and addressing climate change. Companies with good ESG performance typically excel in areas like environmental protection, resource utilization, and energy efficiency, helping them reach carbon reduction goals (Sun et al., 2023; Li et al., 2023c). These companies also tend to have more investment and financing opportunities, as many investors and financial institutions now lean towards supporting businesses with commendable ESG records (Long et al., 2023; Xu et al., 2023; Zhang et al., 2023b). However, despite the widely acknowledged importance of ESG, how companies can ensure effective carbon reduction and other ESG goals while pursuing economic gains remains a challenge in practice. Moreover, there may be significant disparities in carbon reduction and ESG practices across different companies, industries, and regions. Thus, against the backdrop of China’s pursuit of carbon neutrality and sustainable development goals, it’s imperative to explore how corporate ESG performance assist in achieving carbon reduction targets, enhance energy efficiency, provide robust support for a low-carbon economy, and contribute to social and economic development. This article will delve into this critical topic, combining theoretical frameworks with empirical data.

ESG is rapidly developing globally and has received widespread attention from scholars both domestically and internationally. ESG performance significantly impacts corporate value and performance (Yu and Xiao, 2022), reduces corporate financing costs (El Ghoul et al., 2011; Fang and Hu, 2023; Ning and Zhang, 2023), lowers corporate risks (Albuquerque et al., 2019; Yu and Xiao, 2022), and promotes foreign direct investment (Zhang et al., 2022). Although corporate social responsibility and sustainable development topics have garnered widespread attention, research on whether and how ESG performance influence corporate carbon reduction remains relatively limited. In terms of carbon reduction research, most existing literature focuses on the impact of policy tools and technological advancement on corporate carbon emissions. In contrast, literature related to the environmental factors in the ESG topic primarily focuses on the relationship between environmental performance and corporate performance. For instance, Pei et al. examined the impact of environmental regulations on corporate carbon emission efficiency (Pei et al., 2019); and Zhang et al. (2022) explored the potential impact of corporate social responsibility on carbon reduction. Nevertheless, these studies did not systematically explore the impact of ESG performance on corporate carbon reduction. Therefore, this research aims to investigate from a fresh perspective of ESG performance, utilizing data from Chinese listed manufacturing companies from 2010 to 2020, to deeply examine how ESG performance impact corporate carbon reduction behaviors and their underlying mechanisms. This research helps reveal the role of ESG performance in propelling corporations to achieve carbon neutrality, providing strategic recommendations for governments and corporations. Simultaneously, it offers a novel theoretical and empirical perspective on the relationship between ESG and corporate carbon emissions.

Compared to existing research, this paper may have made marginal contributions in the following areas.

Firstly, this paper is among the first to explore how ESG performance influence corporate carbon reduction behaviors. Although ESG in relation to corporate sustainability and social responsibility has become a hot research topic, most literature mainly focuses on how ESG impacts corporate value, performance, financing costs, risks, and foreign direct investments, among others (El Ghoul et al., 2011; Albuquerque et al., 2019; Wu et al., 2022; Xie et al., 2022; Xie et al., 2022; Li et al., 2023a; Wang et al., 2023a). The specific impact of ESG performance on corporate carbon reduction behaviors remains largely unexplored. Thus, from the perspective of corporate carbon reduction behaviors, this paper provides new insights into the relationship between ESG and climate change.

Secondly, this paper further enriches and enhances research on carbon reduction and corporate behaviors. Most relevant to the research theme is how sustainable or green development affects corporate carbon emissions. However, most literature typically discusses the impact of green development on carbon emissions indirectly from a macro perspective, such as from the angle of environmental regulatory policies (Chen, 2022; Cong et al., 2022; Cahyono et al., 2023; Chen et al., 2023; Chen et al., 2023; Deng et al., 2023). Unlike the aforementioned literature, this paper directly analyzes the impact of corporate ESG performance on their carbon reduction behaviors from a micro perspective. More importantly, most existing literature usually only focuses on the environmental factors (E) in ESG, while the core metric in this paper (ESG performance) encompasses corporate performances in environmental protection, social responsibility, and corporate governance, offering a more comprehensive and systematic perspective for the research on carbon emissions and corporate behaviors.

Thirdly, in terms of influencing mechanisms, although some literature has explored from various angles how ESG impacts corporate carbon reduction, these studies mainly concentrate on a single or dual dimensions. In contrast, this paper systematically delves into how ESG performance influence corporate carbon reduction behaviors from three core dimensions: financing constraints, innovation efficiency, and risk-taking. Specifically, this paper discovers that ESG performance can promote corporate carbon reduction goals by alleviating corporate financing constraints, enhancing innovation efficiency, and rationalizing risk-taking. The exploration of these three mechanisms helps to understand more comprehensively and deeply the intrinsic connection between ESG performance and corporate carbon reduction behaviors.

Fourthly, in addition to exploring the impact of ESG performance on corporate carbon reduction behaviors, this paper further investigates from the perspective of digital transformation how ESG assists corporations in achieving low-carbon goals in the digital age. With the rapid development of digital technology, corporations face different carbon emission pressures and opportunities compared to traditional models. This paper finds that ESG performance not only enable corporations to better utilize digital technologies to optimize their operations and production, thereby achieving carbon reduction but also help ensure continuity and consistency of their low-carbon strategies during digital transformation. This part of the research provides a fresh perspective and empirical evidence on how to maintain low-carbon development in the digital age.

Lastly, in terms of policy implications, facing the dual challenges of deepening ecological civilization construction in China and implementing strict carbon peak and carbon neutrality goals, deeply exploring how ESG performance assist corporate carbon reduction holds profound practical and strategic significance. This paper confirms the positive role of ESG performance in reducing corporate carbon emissions, revealing that by actively fulfilling their environmental, social, and governance responsibilities, corporations can not only enhance their sustainability and social responsibility but also make significant contributions to national and even global carbon reduction goals. This implies that for China in the process of achieving the “dual carbon” goals, strengthening corporate ESG practices and enhancing their ESG levels are vitally important. Simultaneously, this also provides crucial policy recommendations for the government and decision-makers on how to promote national carbon reduction and low-carbon development goals by encouraging and supporting corporations to strengthen ESG practices.

In summary, this paper primarily contributes by articulating how ESG performance impacts corporate carbon reduction behaviors and examining the mechanisms behind this impact. While the influence of ESG on aspects such as corporate value, performance, and risk has garnered extensive attention, research specifically addressing how ESG performance affects corporate carbon reduction is relatively sparse. This study fills this gap by analyzing data from Chinese listed manufacturing companies from 2010 to 2020, revealing that ESG performance positively influences corporate carbon reduction behaviors through multiple channels such as alleviating financing constraints, enhancing innovation efficiency, and rationalizing risk-taking decisions. Additionally, this paper explores how digital transformation moderates the relationship between ESG performance and carbon reduction in the current digital era, offering new insights and empirical evidence for understanding low-carbon development against a backdrop of digitalization. Moreover, our research delves into the heterogeneity of the ESG performance and carbon reduction relationship across companies with different environmental regulatory intensities, industry competition, and capital intensities, thereby enriching the understanding of how ESG performance impacts corporate carbon reduction.

The remainder of the paper is organized as follows: Section 2 provides a comprehensive literature review and develops the research hypotheses. Section 3 details the research methodology and the data sources utilized in the study. Section 4 reports on the empirical results and conducts a thorough analysis of the findings. Section 5 explores the mechanisms and heterogeneity of ESG impacts, while Section 6 investigates the moderating role of digital transformation in this context. Finally, Section 7 concludes the paper, summarizing the main findings and discussing their policy implications, limitations, and avenues for future research.

2 Theoretical analysis and research hypothesis

2.1 Impact effect analysis

ESG performance play a crucial role in connecting businesses with the market, providing effective market-driven governance impetus for corporate carbon reduction (Zhang et al., 2022; Zhang, 2023). With the increasing severity of global climate change, corporate carbon emissions have become a societal focal point (Lee et al., 2022). The carbon reduction behaviors of companies directly relate to the global effectiveness of addressing climate change (Pei et al., 2019). ESG performance emerged in this context. They not only measure corporate performance in environmental, social, and governance aspects but more importantly, they provide businesses with a clear direction to emphasize environmental protection and commitment to carbon reduction while pursuing economic benefits. On the one hand, ESG performance promote the operation of market incentive mechanisms, driving businesses to take the initiative in carbon reduction (Apergis et al., 2022; Wang et al., 2022; Zheng et al., 2023; Ren et al., 2023a). In the capital market, as investors increasingly focus on sustainable investments, companies with high ESG performance tend to attract more investments. Such companies are seen as having better management and reduction strategies against climate risks (Cho, 2022; Bai et al., 2023). Additionally, financial institutions in credit decisions also favor companies that excel in ESG performance because these companies are more likely to have a competitive edge in future environmental regulations.

On the other hand, ESG performance strengthen the supervisory role of stakeholders, compelling businesses to undertake carbon reduction. When a company emits excessive carbon or lacks action in reduction, a low ESG rating quickly sends a negative signal to the market. Such transparency can prompt investors, consumers, and other stakeholders to reassess their relationships with that company and might attract public attention and criticism (Cong et al., 2022; Ge et al., 2022; Pan et al., 2022). In conclusion, ESG performance, through both market incentives and stakeholder supervision mechanisms, effectively drive companies to take proactive measures for carbon reduction, thereby enhancing the long-term sustainability and competitiveness of companies. Based on this, we propose the following Research Hypothesis. Furthermore, drawing on the research by Li and Wen (2023), we should also consider the impact of cultural and social factors, such as local government and public participation, on corporate low-carbon behavior. The policy of civilized cities, as a mechanism to promote local government and public engagement in green development, underscores the significance of these factors in driving low-carbon practices in businesses. Thus, in addition to the direct mechanisms of market incentives and stakeholder supervision, our study extends to exploring the potential indirect influences on corporate carbon emissions through cultural and social mechanisms.

Hypothesis 1. ESG performance can promote corporate carbon reduction.

2.2 Impact mechanism analysis

With the increasing severity of global climate change and environmental issues, corporate ESG performance has garnered widespread attention. Many scholars and practitioners believe there is a close relationship between a company’s ESG practices and its carbon emissions. However, the nature and mechanism of this relationship remain unclear. To better understand how ESG impacts corporate carbon emissions, this paper delves deep into the effects of green technology innovation, corporate efficiency improvement, and curbing managerial short-sightedness from three different angles.

2.2.1 Green technology innovation effect

First, from the perspective of signal transmission theory, showcasing good ESG performance sends a message to the public and stakeholders about the company’s commitment to environmental responsibility and its willingness to invest in green technologies (Ma et al., 2022; Xie and Lv, 2022; Zheng et al., 2023). Such positive environmental performance not only helps establish a leading position for the company in environmental protection but also attracts more consumers and investors who increasingly value green and sustainable practices of companies (Li et al., 2023b). This positive market feedback further encourages companies to invest in green technology research and innovation. Secondly, based on stakeholder theory, the interaction and relationships between a company and its employees, customers, suppliers, government, and other stakeholders play a crucial role in driving green technology innovation (Yuan et al., 2022). As described by Lin et al. (2021), Freeman’s view in 1984 emphasized the importance of maintaining good relationships with stakeholders (Lin et al., 2021). Especially for environmental issues and notably for reducing carbon emissions, establishing close cooperation with external stakeholders such as governments, environmental organizations, and research institutions can provide companies with more resources for green technology and innovation (Cho, 2022). Resource sharing and collaboration expedite the development of green technology, advancing technological progress, leading to effective carbon emission reduction (Xu et al., 2023). Furthermore, with the deepening of green technology innovation and application, companies can directly reduce their carbon emissions and, by improving production efficiency and reducing energy and resource consumption, achieve dual growth in economic and environmental benefits (Li et al., 2023b; Wang et al., 2023b). In this way, companies not only contribute to global carbon reduction goals but also lay a solid foundation for their long-term development and competitive advantage. Therefore, we propose the following hypotheses:

Hypothesis 2. ESG performance can significantly reduce companies’ carbon emission intensity by fostering green technology innovation.

2.2.2 Corporate efficiency improvement effect

Corporate efficiency is an essential factor affecting the level of corporate carbon emissions. Exceptional ESG performance can drive companies to improve their operational efficiency, which in turn has a positive effect on carbon emissions (El Ghoul et al., 2011; Xie and Lv, 2022; Xiao et al., 2023). The reason is that, from the perspective of signal transmission theory, companies with good ESG performance actively convey their advantages in areas such as environment, society, and governance to the external world. This can attract more investors and partners, thereby helping the company gain more resources and technological support, enhancing production and operational efficiency (Hu and Guo, 2023). Firstly, according to signal transmission theory, companies with excellent ESG performance are more inclined to actively disclose their achievements in green technology and energy-saving emissions reduction, signaling their commitment to low-carbon, environmental protection, and sustainable development to the public and investors. Research has also pointed out that ESG information disclosure can increase corporate transparency, attracting more investors and consumers concerned about the environment and sustainable development (Lin et al., 2021). This will bring more financial and technological support to companies, boosting their production efficiency and reducing carbon emissions. Secondly, based on resource dependency theory, companies with high ESG performance are more likely to obtain external resources like funding, technology, and partners. These resources positively impact the production and operational efficiency of companies, leading to reduced carbon emissions (Garel and Petit-Romec, 2022). For instance, companies might acquire more efficient production technologies, advanced energy-saving equipment, or engage in green collaborations. Moreover, under the broader backdrop of the Chinese government’s encouragement of low-carbon, green, and sustainable development, companies with good ESG performance are more likely to receive government support and favorable policies. This further aids companies in enhancing their efficiency and reducing carbon emissions (Houston and Shan, 2022). An improvement in corporate efficiency means producing more products or services with fewer resources, directly leading to a reduction in carbon emissions. Researches also indicates that enhancing corporate efficiency can reduce production costs, subsequently decreasing carbon emissions (Hu et al., 2021; Zhong and Ma, 2022).

Therefore, from the perspective of corporate efficiency, ESG performance can directly or indirectly promote companies to reduce carbon emissions, driving low-carbon and sustainable development.

Hypothesis 3. ESG performance can significantly reduce companies’ carbon emission intensity by enhancing operational efficiency.

2.2.3 Managerial myopia curtailment effect

The decision-making orientation of managers largely determines the level of corporate carbon emissions. Compared to traditional short-term profit orientations, good ESG performance often reflects a company’s commitment to long-term and sustainable development. Managerial myopia can lead to the neglect or delay of necessary green technology investments and updates, thereby increasing carbon emissions (Hu et al., 2021; Wang et al., 2022; Xu et al., 2023). Firstly, according to behavioral finance theory, managerial myopia often causes them to have exaggerated expectations of immediate returns, overlooking or inadequately considering long-term and sustainable investments. In contrast, companies with good ESG performance tend to adopt a long-term perspective, focusing on investments in environmental, social, and governance areas, which helps reduce the company’s carbon footprint. Secondly, based on agency theory, there might be a conflict of interest between managers and shareholders, especially concerning carbon emissions and environmental protection investments. However, when a company implements robust ESG measures, it can serve as a mechanism to ensure the long-term commitment of managers to environmental and social issues, thereby reducing carbon emissions (Cong et al., 2022). Additionally, for large enterprises operating globally, the international pressures and expectations they face make ESG performance especially crucial. International organizations and multinational companies are increasingly demanding that members of their supply chains meet strict ESG standards, further prompting companies to reduce carbon emissions to meet these standards and expectations. overall, the effect of managerial myopia might increase corporate carbon emissions, while good ESG performance can alleviate this effect. This assists companies in adopting more sustainable strategies and actions, reducing carbon emissions. In summary, this paper further proposes the following research hypotheses.

Hypothesis 4. ESG performance can significantly mitigate companies’ carbon emission intensity by curtailing managerial myopia, facilitating the adoption of long-term, sustainable carbon reduction strategies.

2.3 Moderating role of digital transformation

Digital transformation is a critical trend in today’s corporate development, involving a fundamental transformation of a company’s operational model, production processes, and organizational structure through the application of technology and data. Against the broader context of sustainable development and environmental management, digital transformation gains a new dimension of importance. In regions like Pakistan, where agricultural practices and water management are central to both the economy and ecological sustainability, digital innovation plays a crucial role in shaping sustainable practices (Rajpar et al., 2019). As highlighted in recent studies, the interaction between technology and sustainable practices can significantly influence the environmental impact of economic activities (Saqib et al., 2020; Razzaq et al., 2022a; Razzaq et al., 2022b).

Against the backdrop of ESG promoting corporate carbon reduction, digital transformation may play a pivotal moderating role. Firstly, digital transformation can help companies monitor, manage, and report their carbon emission data more accurately (Chen and Zhang, 2023). Through advanced sensor technology, the Internet of Things, and big data analysis, companies can obtain detailed real-time data on their carbon emissions, allowing for more accurate calculations of their carbon footprint, ensuring accurate reflection of their efforts in carbon reduction. Secondly, digital transformation can optimize a company’s production and supply chain management, thereby reducing carbon emissions (Ma and Yang, 2023). For example, advanced supply chain optimization algorithms can reduce unnecessary logistics activities, subsequently reducing carbon emissions. Additionally, digital transformation can help companies better predict market demands, reducing overproduction and waste, and further lowering carbon emissions. Lastly, digital transformation can also promote innovation and R&D in companies, leading to the development of more eco-friendly products and services (Zhang et al., 2023a). Through digital technologies, such as machine learning and artificial intelligence, companies can accelerate product prototyping and testing, speeding up the R&D and commercialization process of green technologies. Therefore, while ESG itself already aids corporate carbon reduction, this effect might be further strengthened in the context of digital transformation. Specifically, digital transformation might enhance the positive impact of ESG on corporate carbon reduction. Based on the above analysis, we propose the following hypothesis.

Hypothesis 5. Digital transformation has a positive moderating role in the promotion of corporate carbon reduction by ESG.

3 Research design

3.1 Model specification

This study aims to examine the impact of ESG performance on corporate carbon emissions. Following the approach used in similar studies (Lee et al., 2022; Li and Wen, 2023), we set up the following basic regression model:

In Equation 1, and respectively represent the company and the year; represents the intensity of corporate carbon emissions; represents the ESG performance; is a series of company-level control variables selected in this study; and respectively indicate that the model controls for individual fixed effects and time fixed effects, and is the random error term. Among them, is the core result that this study focuses on. If is significantly less than zero, then H1 will be verified, implying that ESG can significantly inhibit the increase in the carbon emission intensity of manufacturing companies.

To explore the mechanism by which ESG affects the carbon emission intensity of manufacturing companies, we utilize the mediation effect model as suggested by Liu and Lyu (2022) and Qing et al. (2022):

In Equations 2 and 3, represents the mediating variable, and the meanings of the other variables are the same as in formula (1). In the case where is discernibly positive, it can be inferred that there is a positive correlation between ESG performance and the intermediary variable. Conversely, a significantly negative underscores the inverse relationship between the intermediary variable and corporate carbon emissions. Collectively, these findings suggest a mechanism through which ESG performance attenuates corporate carbon emissions intensity, mediated by its influential role on the intermediary variable.

To further examine the moderating effect of digital transformation on the suppression of carbon emissions by ESG, we introduced an interaction term between ESG and digital transformation (Dig) into the baseline regression model, as recommended by Luo et al. (2023):

In Equation 4, if is observed to be significantly negative, it provides evidence that digital transformation exerts a moderating effect in the relationship under study.

3.2 Variable selection

(1) Dependent variable: Corporate carbon emission intensity (). When evaluating the carbon emission level of companies in this study, it was found that few companies voluntarily disclose carbon emission data in their annual reports. Due to the limitations of the availability of micro-level company data, this study adopts the research method of (Lee et al., 2022; Cahyono et al., 2023), estimating the corporate carbon emissions based on the proportion of operating costs.

(2) Explanatory variable: ESG performance. The core explanatory variable in this study is the corporate ESG performance, which is measured using the Huazheng Index’s ESG rating. The development of the Huazheng ESG rating involved an extensive analysis of ESG practices specific to the Chinese market, incorporating a balance of environmental, social, and governance factors tailored to local corporate contexts. The Huazheng ESG evaluation data has characteristics such as being close to the Chinese market, having a wide coverage, and high timeliness. Currently, this index has been widely recognized and applied by both the industry and academia (Chen and Zhang, 2023; Zhang et al., 2023b). For data updates, the Huazheng ESG index adopts a combination of quarterly regular evaluations and dynamic tracking for data adjustments, classifying corporate ESG into 9 levels: C, CC, CCC, B, BB, BBB, A, AA, AAA. Following the method of Liu and Zhang (2023), this study assigns values from 1 to 9 in ascending order according to the ratings. A higher value indicates a greater ESG performance of the listed company. Compared to other ESG metrics in the literature, the Huazheng Index’s strength lies in its real-time adaptability and comprehensive scope, while its limitation might be its relative novelty and focused applicability primarily within the Chinese market.

(3) Control variables. Control variables are used to further improve research accuracy. Based on previous literature, this study selects a series of control variables suitable for listed manufacturing companies. These include: (1) Company size (Size) represented by the logarithm of the company’s total annual operating income; (2) Company age (Age), represented by the logarithm of the length of time since the company’s establishment; (3) Profitability (ROE), the company’s annual return on net assets; (4) Debt repayment ability (Lev), the company’s debt-to-asset ratio, representing the level of the company’s financial leverage; (5) Shareholding concentration (Top1), measured by the shareholding ratio of the largest shareholder of the listed company; (6) Shareholding stability (Top2), represented by the difference in shareholding ratios between the second-largest and the largest shareholder. Generally, the smaller this difference, the higher the possibility that the second-largest shareholder could replace the largest shareholder, indicating a more unstable shareholding structure of the listed company; (7) R&D investment (RD), represented by the ratio of company’s R&D investment to its operating income.

(4) Mediator Variables: This study examines the role of Green Technology Innovation (GTI), measured by green patent authorizations, Firm Efficiency (Efficiency), indicated by total factor productivity, and Managerial Myopia (Myopia), an index reflecting short-term focus in management. These mediators help understand how ESG performance impacts corporate carbon emissions.

(5) Moderating Variable: The study also considers Digital Transformation (Dig), represented by the digitalization index of manufacturing enterprises, as a moderating factor. This examines the influence of digitalization on the effectiveness of ESG strategies in reducing carbon emissions.

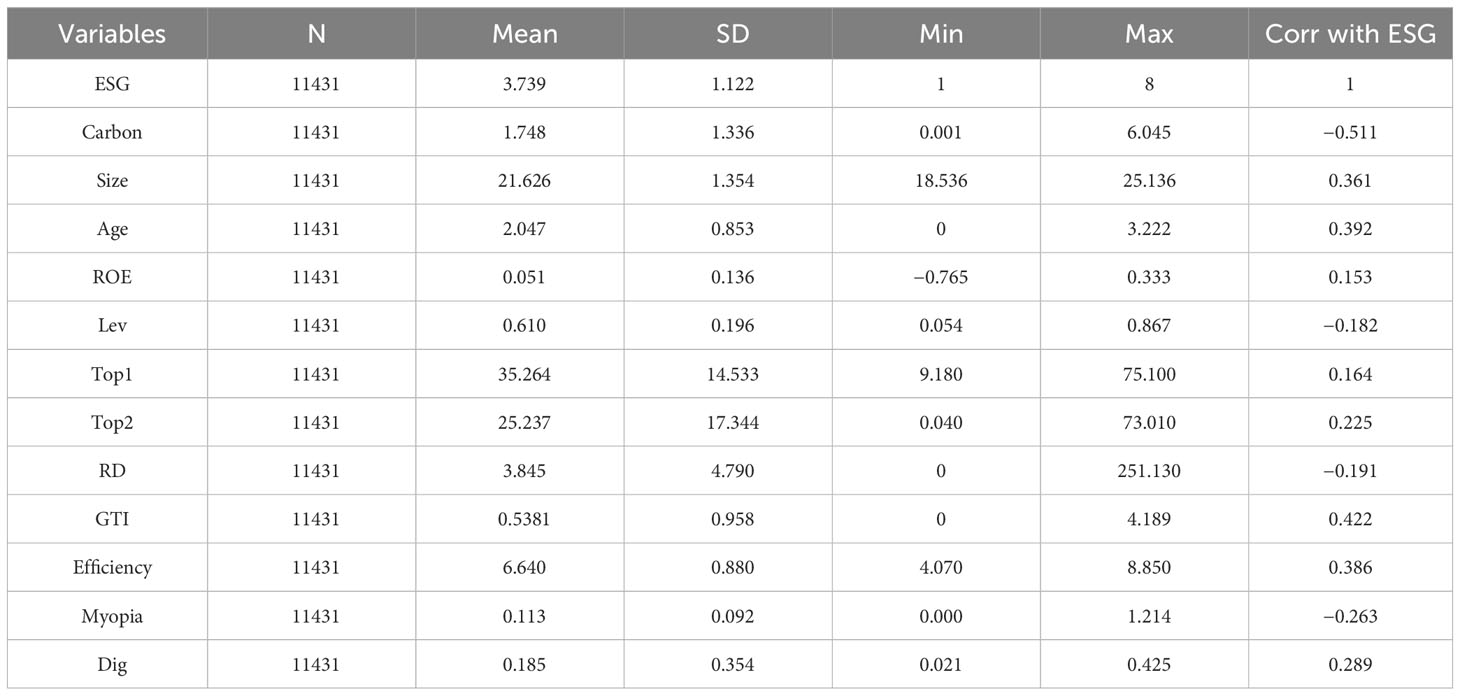

A detailed definition of all the variables involved in this study is provided in Table 1.

3.3 Data sources and processing

Given the relatively large number of listed companies in the industrial sector, their longer listing duration, and the abundance and completeness of data available in their annual reports, this study selects listed manufacturing companies from the Shanghai and Shenzhen A-shares from 2010 to 2020 as the research subjects. The choice of the manufacturing sector is due to its significant contribution to China’s economy and the stable, comprehensive data it offers. The period from 2010 to 2020 encompasses a crucial phase in China’s economic development, providing a valuable temporal scope for analysis. The data processing involves the following steps: (1) Excluding companies labeled ST, ST*, and PT. (2) To ensure consistency across all variable data, the financial metrics published in the annual consolidated reports of listed companies are used. Companies with obviously unreasonable financial metrics are also excluded. (3) Considering the accessibility of data from the Tibet region, companies with their registered offices in Tibet are excluded. (4) To mitigate the impact of outliers on the regression results, a 1% and 99% tail-trimming process is applied to all continuous variables at the company level.

Ultimately, the study focuses on 28 industries, encompassing 1,825 companies, amounting to 11,431 company-year observations. This extensive dataset from a key sector over a significant period allows for a robust analysis of trends and practices that are indicative of wider economic conditions. The primary raw data at the company level used in this study mainly comes from the CSMAR database and WIND database. The descriptive statistics for the main variables used in this study are detailed in Table 2.

4 Empirical results and analysis

4.1 Baseline result analysis

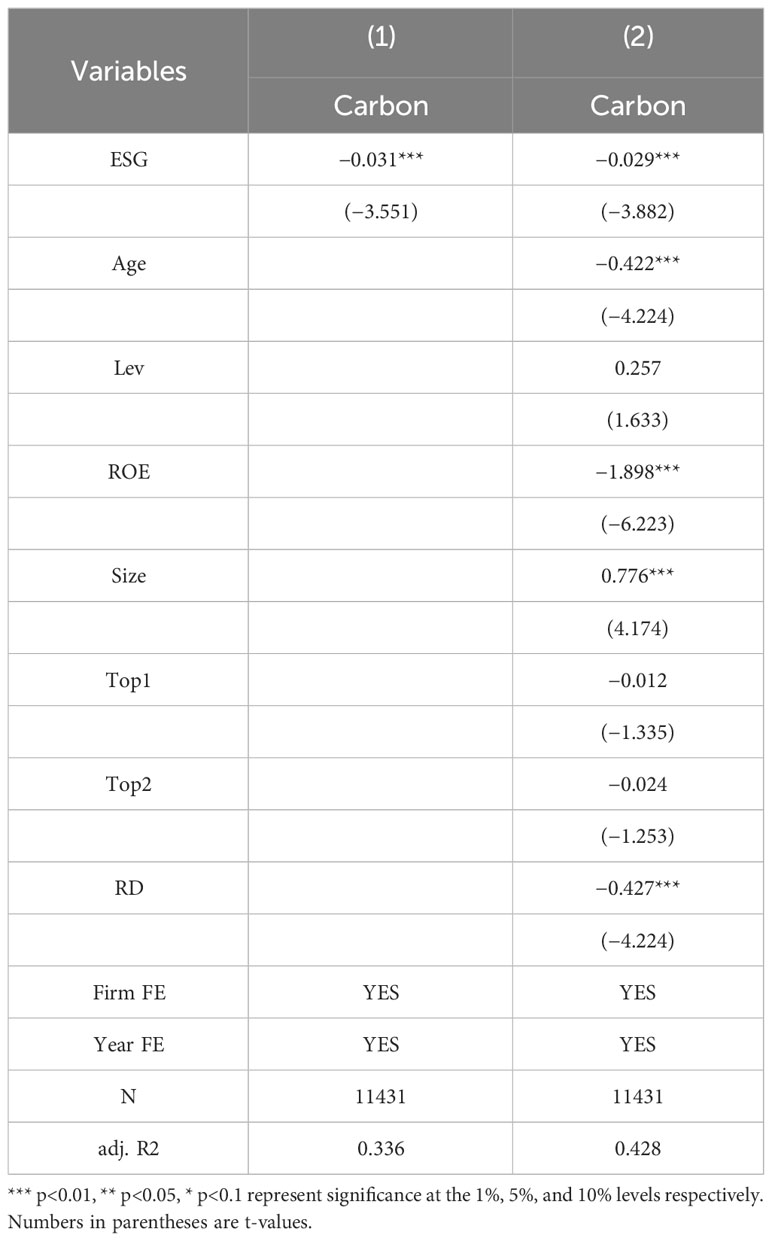

Table 3 reports the baseline regression results of the impact of ESG performance on corporate carbon emission intensity. In column (1), while controlling for company fixed effects and year fixed effects, only the core explanatory variable ESG is added. The results indicate that the coefficient of ESG performance is −0.031, and it is significantly negative at the 1% significance level. This suggests that a higher ESG rating is significantly negatively associated with a lower carbon emission intensity. In column (2), after other control variables are incorporated, the coefficient of ESG performance is −0.029 and remains significantly negative at the 1% significance level. Specifically, holding other conditions constant, for every one-level increase in the ESG rating, the company’s carbon emission intensity will decrease by approximately 2.9%. When benchmarking these findings against comparable literature, several similarities and differences emerge. Studies such as Cong et al. (2022) and Lee et al. (2022) have also observed a negative relationship between ESG performance and carbon emission intensity. Cong et al. reported a slightly lower effect size (1.5% decrease in emissions per ESG rating increase), potentially due to their sample including companies from a broader range of sectors with varying ESG maturity levels. This further confirms the significant negative relationship between ESG performance and corporate carbon emission intensity, demonstrating the crucial role of ESG performance in reducing corporate carbon emissions.

Regarding the control variables, the coefficient for company size (Size) is significantly positive, implying that larger companies tend to have higher carbon emission intensities. The coefficient for profitability (ROE) is significantly negative, suggesting that companies with stronger profitability often have lower carbon emission intensities. The coefficient for company age (Age) is significantly negative, indicating that as the company’s age increases, its carbon emission intensity decreases. The coefficient for R&D investment (RD) is significantly negative, implying that companies with higher R&D investments typically have lower carbon emission intensities. For instance, the negative coefficient of R&D investment on carbon emissions is in line with research by Fang and Hu (2023), reinforcing the notion that investment in innovation is crucial for reducing environmental impact. Overall, these results support our research hypothesis, namely, that a company’s ESG performance can significantly reduce its carbon emission intensity. This further reflects the positive impact of corporate attention and investment in environmental, social, and corporate governance aspects on carbon emission reduction.

4.2 Endogeneity treatment

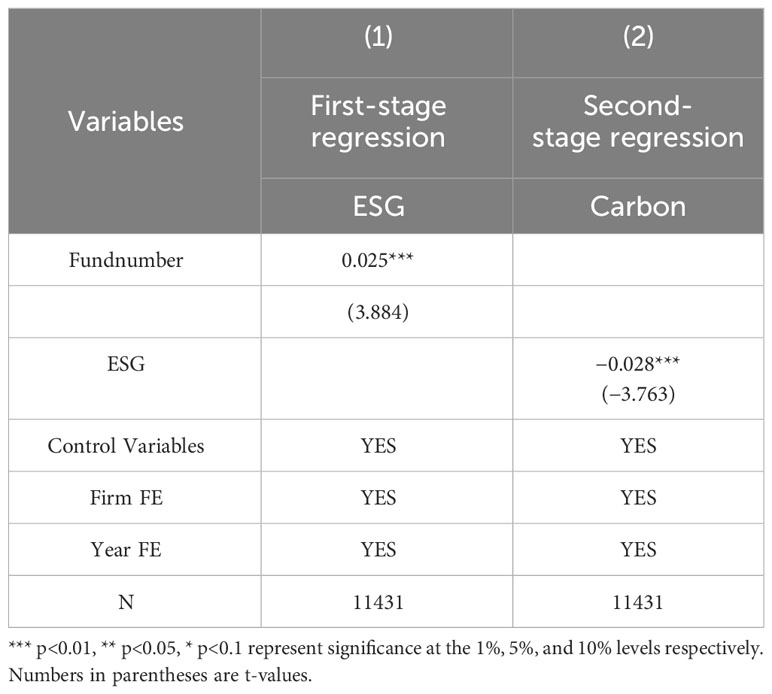

Endogeneity is a prominent issue in economic research, mainly arising from omitted variable bias and mutual causality. To address this, our study employs a two-stage least squares (2SLS) approach using a suitable instrument variable. Following the methodology of (Xie and Lv, 2022), we chose the number of “ESG investment funds” holding the firm (Fundnumber) as the instrumental variable for the company’s ESG performance. Regarding the relevance of this instrument, institutional investors such as fund companies can participate in a company’s decision-making process and optimize its governance structure, thus positively influencing its overall performance. A study by Wu et al. (2022) shows a clear positive relationship between the equity of institutional investors and the ESG performance of firms. This relationship might be due to institutional investors expressing their preference for enhanced ESG performance through direct communication with firms. This establishes the relevance between ESG investment funds and a company’s ESG performance. From an exogeneity perspective, the establishment and shareholding information of ESG investment funds are based on independent decisions by fund companies and fund managers, unrelated directly to the employment level of companies. Such funds aim to integrate the three factors of Environment (E), Social Responsibility (S), and Corporate Governance (G) into investment analysis to assess firms’ sustainability and societal benefits, thereby achieving long-term stable returns. Given our study’s endogenous variable ESG, we chose the number of “ESG investment funds” holding the firm (i.e., Fundnumber) as its instrumental variable.

Table 4 presents the 2SLS regression results using Fundnumber as the instrumental variable, aiming to mitigate potential endogeneity between ESG performance and corporate carbon emission intensity. Endogeneity could arise from omitted variable bias, simultaneity bias, or bi-directional causality. Column (1) showcases the first-stage regression results. This stage mainly examines the relationship between the instrumental variable Fundnumber (the lagged value of the number of “ESG investment funds” holding the firm) and the endogenous explanatory variable ESG. The results indicate that the coefficient of Fundnumber is 0.025, significantly positive at the 1% level. This suggests a significant positive association between firms held by more “ESG investment funds” and their higher ESG performance. Column (2) displays the second-stage regression results. In this stage, we use the ESG values predicted from the first stage as the explanatory variable to estimate the effect of ESG performance on corporate carbon emission intensity. The results show that the coefficient for ESG is −0.028, significantly negative at the 1% level. This further confirms our primary finding: that there’s a significant negative relationship between ESG performance and corporate carbon emission intensity. Overall, the 2SLS estimates using Fundnumber as an instrumental variable further substantiate the significant negative effect of ESG performance on corporate carbon emission intensity. This implies that our main conclusion remains valid when considering potential endogeneity issues.

4.3 Additional robustness tests

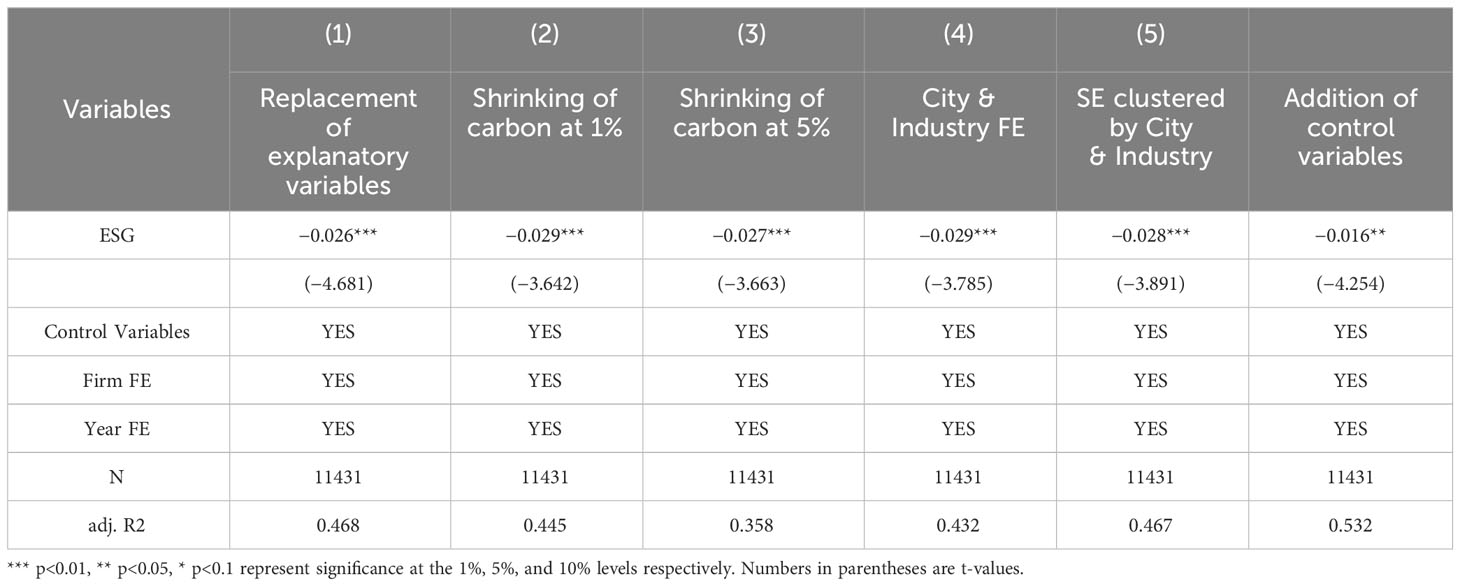

To ensure the stability of our research findings, we conducted the following series of tests: (1) We utilized the Wind ESG performance and composite scores to measure a company’s ESG performance. (2) To minimize the impact of extreme values, we adjusted the dependent variable at both 1% and 5% levels. (3) We modified the fixed effects controls by adding regional-year and industry-year FE. (4) We handled the standard errors with various clustering methods, including clustering at the regional and industry levels. (5) In the regression analysis, we incorporated more control variables, such as the scale of the company’s fixed assets, the shareholding ratio of the top ten shareholders, and the company’s profitability rate. The related results are presented in Table 5. In conclusion, all these tests consistently confirm the robustness of our research findings.

5 Mechanism test and heterogeneity analysis

5.1 Mechanism test

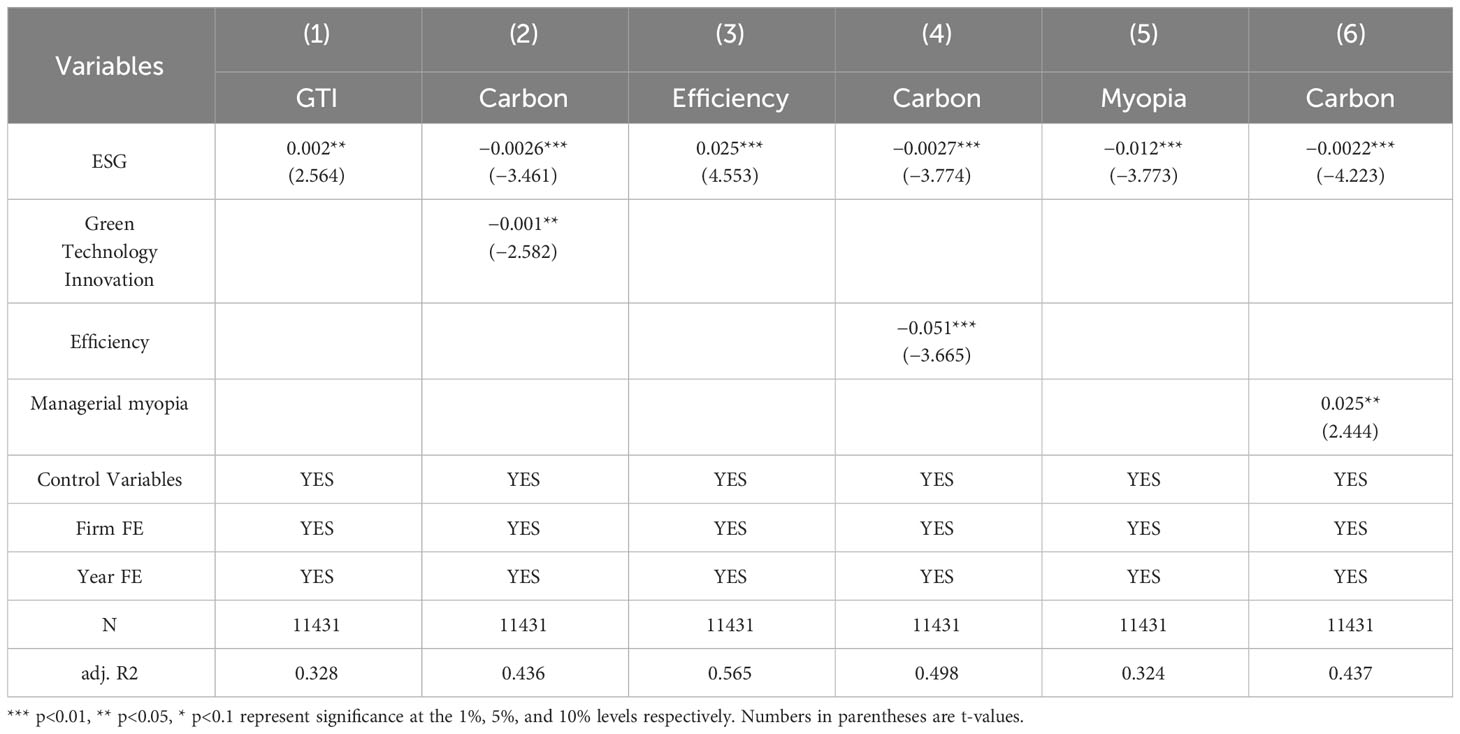

Following the theoretical analysis presented earlier, we will now delve into the mechanisms through which ESG impacts carbon emission reduction in manufacturing companies from three perspectives: Green technology innovation, firm efficiency, and managerial perspective. The detailed results are presented in Table 6.

5.1.1 Green technology innovation effect

Following the research strategy similar to that of Liu and Zhang (Liu and Zhang, 2023), this study uses ESG performance to investigate its impact on green technological innovation. In column (1), the coefficient for ESG on green technological innovation is 0.002, which is positively related at the 5% significance level. This implies that an ESG advantage might promote green technological innovation. Data analysis across multiple sectors shows a trend where companies with higher ESG ratings consistently increase their investments in sustainable technologies and green product development, leading to notable advancements in eco-friendly innovations.

In column (2), we see that the coefficient for green technological innovation on carbon emissions is −0.001, which is negatively related at the 5% significance level. This means that green technological innovation helps reduce carbon emissions. An aggregate analysis of industry data indicates a clear trend: companies with higher investments in green technologies report a more significant reduction in carbon emissions over time. Overall, the ESG performance not only promotes green technological innovation but also this innovation further assists companies in reducing their carbon emissions (Qing et al., 2022).

5.1.2 Firm efficiency effect

This study estimates the total factor productivity of companies using the LP method, serving as a proxy for firm efficiency. The data reveal a correlation between higher ESG scores and improvements in operational efficiency metrics, such as reduced waste and lower energy consumption. In column (3), the coefficient for ESG on efficiency is 0.025, which is positively related at the 1% significance level. This suggests that an ESG advantage can enhance a firm’s operational efficiency. In column (4), the relationship between improved efficiency and carbon emissions is −0.005, which is negatively related at the 1% significance level, indicating that improved efficiency helps reduce carbon emissions. This is further supported by data showing that companies with enhanced efficiency metrics tend to have a lower carbon footprint. These results further validate our theoretical anticipation that a firm’s ESG performance can reduce carbon emissions by enhancing efficiency (Cho, 2022).

5.1.3 Managerial perspective effect

Referring to the approach of Hu et al. (2021), we conduct a textual analysis of the MD&A section in the annual reports, identify a set of short-term horizon words, and then use a lexicon-based method to construct an indicator for managerial myopia (Hu et al., 2021). In column (5), the coefficient for ESG on managerial myopia is −0.012, which is negatively related at the 1% significance level. This means that companies with an ESG performance are more likely to have managers adopting a long-term perspective. In column (6), the relationship between managerial myopia and carbon emissions is 0.025, which is positively related at the 5% significance level, suggesting that managerial myopia might lead to higher carbon emissions. These findings align with our previous theoretical expectations, i.e., a firm’s ESG performance can reduce its carbon emissions by mitigating managerial short-sighted behaviors.

5.2 Heterogeneity analysis

5.2.1 Environmental regulation intensity

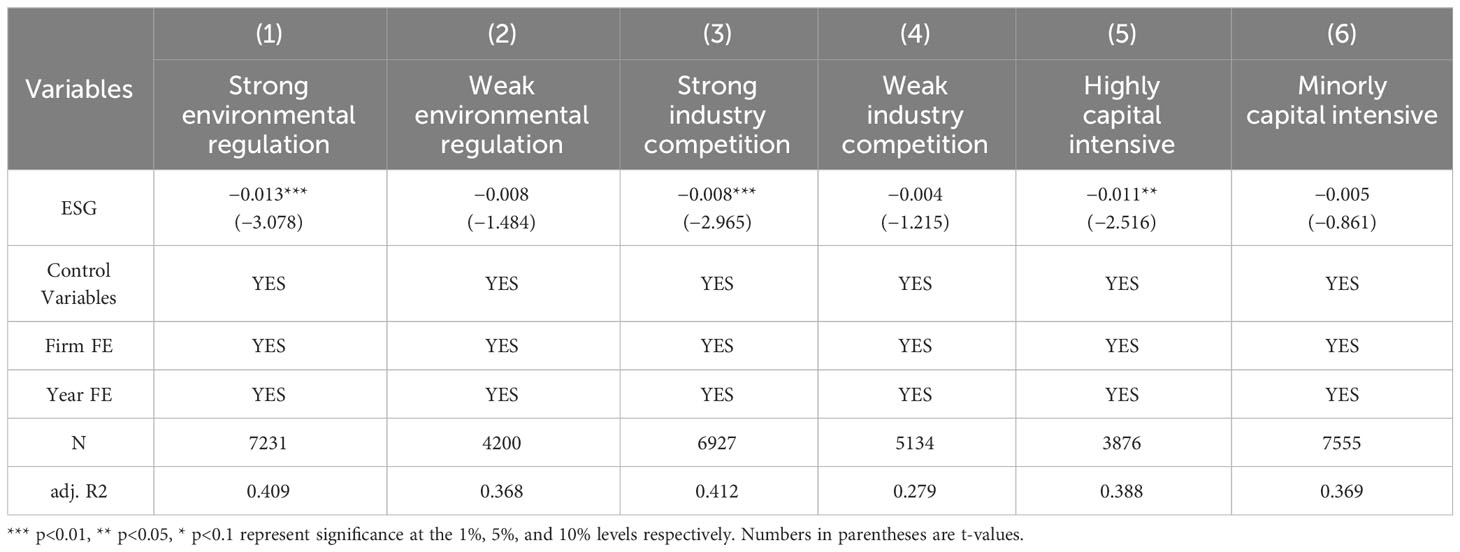

Carbon emission reduction, as a significant challenge faced by businesses, is closely related to their environmental regulations. When analyzing the relationship between ESG and carbon reduction for companies under different environmental regulatory intensities, we used the proportion of environmental vocabulary in the region where the company is located as a proxy for environmental regulation and classified accordingly (Pei et al., 2019). As shown in column (1) of Table 7, for companies in areas with strong environmental regulations, the ESG performance significantly reduces their carbon emissions. This may be because, under stricter environmental regulations, companies pay more attention to environmental protection and take more measures to reduce carbon emissions to meet government environmental requirements and avoid associated economic penalties. However, for companies in areas with weaker environmental regulations, as shown in column (2), the relationship between ESG and carbon reduction is not significant. This implies that in areas with more lenient environmental oversight, companies may not value their ESG performance as much, and thus the impact of ESG performance on carbon reduction is not as pronounced as in areas with stricter regulations.

5.2.2 Industry competition intensity

Drawing from past studies (Bai et al., 2023), the industry competition intensity (HHI) is usually measured using the Herfindahl-Hirschman Index, calculated as , where XX is the total main business income of all companies in the industry, and XiXi is the main business income of company i in the industry. The larger the HHI value, the lower the competition intensity of the industry. Industry competition has a significant impact on a company’s business strategy and behavior, especially in carbon emission management. As shown in column (3) of Table 7, for companies in competitive industries, the ESG performance significantly reduces their carbon emissions. This might be because, in competitive industries, companies are more inclined to adopt more environmentally friendly strategies to gain a competitive market edge and attract more consumers and shareholders. However, as shown in column (4), for companies in less competitive industries, the relationship between ESG and carbon reduction is not significant. This may be because companies in these industries might focus more on their core business rather than environmental responsibility.

5.2.3 Capital intensity

Capital intensity represents the degree to which a company relies on fixed assets (calculated as fixed assets/total assets) and is closely related to the company’s operational strategy and carbon emission strategy. As shown in column (5) of Table 7, in companies with high capital intensity, the relationship between ESG performance and carbon reduction is negative and relatively significant. This might be because, in these companies, environmental responsibility and social responsibility are crucial for their long-term success and profitability. However, as shown in column (6), for companies with low capital intensity, the relationship between ESG and carbon reduction is not significant. This suggests that companies with low capital intensity might focus more on their current assets and short-term returns rather than long-term environmental responsibilities.

6 Further research: the moderating role of digital transformation

Recent studies have highlighted the critical role of digital transformation in enhancing corporate sustainability and environmental strategies. For instance, Ren et al. (2023a) argued that digital transformation offers new pathways for companies to improve their environmental performance by facilitating more efficient resource utilization and enabling the adoption of cleaner technologies. Similarly, Luo et al. (2023) found that companies undergoing digital transformation were better positioned to integrate their ESG goals into their business models, leading to more effective sustainability practices. These findings align with the notion that digital transformation can significantly impact how companies approach and implement their ESG strategies, especially in the context of carbon emissions reduction. Building on this foundation, our research aims to empirically test how digital transformation moderates the relationship between ESG investment and corporate carbon emissions.

As companies increasingly invest in and prioritize environmental, social, and governance (ESG) factors, the rapid advancement of technology and the deep integration of the global economy have made digital transformation a core topic for business development. Digital transformation refers to the fundamental changes in internal and external business, culture, and customer experience brought about by the use of digital technology. With the rise of the internet, big data, artificial intelligence, and other technologies, companies must rethink their business models and operational strategies to adapt to the demands of this digital age. The reasons for this transformation vary and include changes in consumer demand, technological innovation, and intensified global competition. Against this backdrop, digital transformation not only helps companies improve efficiency and create new sources of value but may also impact their sustainability strategies, especially strategies related to carbon emissions and environmental protection. Therefore, when examining the relationship between ESG investment and corporate carbon emissions, it is crucial to introduce digital transformation as a moderating mechanism into the analysis. This is because digital transformation may influence the extent to which companies prioritize ESG and the intensity of their actions in carbon reduction. For instance, through advanced data analytics and technology, companies might more easily identify their carbon footprint and discover effective methods to reduce carbon emissions. Similarly, digital transformation may facilitate better communication with stakeholders, allowing companies to better address their environmental and social responsibilities.

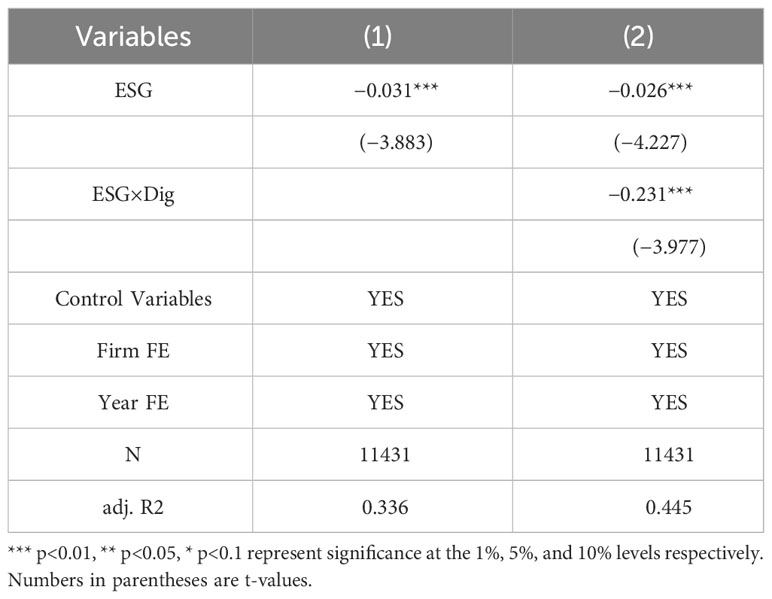

In Model (1) of Table 8, the coefficient of ESG is −0.031 and is significant at the 1% level, indicating that as companies increase their ESG investments, their carbon emissions significantly decrease. This result is consistent with expectations, as when companies place greater emphasis on environmental and social responsibilities, they will take more measures to reduce their carbon footprint to meet the expectations and needs of various stakeholders.

In Model (2) of Table 8, we further added an interaction term between ESG and digital transformation. The coefficient of this interaction term is −0.231 and is significant at the 1% level. This suggests that in the context of digital transformation, the role of ESG in reducing carbon emissions becomes even more pronounced. In other words, digital transformation amplifies the negative impact of ESG on carbon emissions. This might be because digital transformation aids companies in managing their resources and operations more effectively (Ma and Yang, 2023), further reducing their carbon emissions. Additionally, digital transformation might also encourage companies to adopt cleaner technologies and solutions, reducing their reliance on fossil fuels (Ren et al., 2023b). In summary, our results demonstrate that ESG investments have a distinct positive effect on reducing corporate carbon emissions, and this effect is further strengthened in the context of digital transformation. This provides a crucial insight for companies: digital transformation can serve as an effective tool and strategy when pursuing sustainability and carbon reduction goals.

7 Conclusions and policy implications

Faced with the challenges of global climate change, corporate carbon emissions have become a central issue of global concern. Against this backdrop, this study delves into the actual impact of ESG performance on corporate carbon reduction by analyzing data from listed manufacturing companies in China from 2010 to 2020. After an in-depth research analysis, we arrive at several core conclusions: First, ESG performance have a significant positive effect on reducing corporate carbon emissions. Secondly, green technology innovation, corporate efficiency, and managerial shortsightedness have all been proven to be key channels through which ESG performance promote carbon reduction. Furthermore, our heterogeneity tests reveal significant variations in the relationship between ESG performance and carbon reduction under different environmental regulations, industry competition, and capital intensity contexts. Notably, the positive moderating role of digital transformation in the relationship between ESG performance and carbon reduction provides companies with a new perspective: enhancing their ESG performance through digital transformation to better tackle the challenges of carbon reduction.

To strengthen our conclusions, it is valuable to compare our findings with relevant studies conducted in other major economies. For instance, research conducted in the European Union (EU) and the United States shows similar trends, where companies with higher ESG scores are more likely to engage in practices that reduce carbon emissions. A study by Asl et al. (2022) in the EU context found a comparable effect of ESG performance on carbon emissions, underscoring the global relevance of ESG in corporate environmental responsibility. However, there are differences too. For example, in the US, the integration of ESG into corporate strategy has been more market-driven, whereas in China, it is more policy-driven. This difference in drivers could affect the implementation and impact of ESG initiatives.

The conclusions of this study have important policy implications. The climate change and environmental pollution issues have heightened the emphasis on ESG both domestically and internationally. ESG has become a crucial force in promoting corporate adherence to new development concepts and achieving sustainable development. The report from the 20th National Congress of the Communist Party of China proposes accelerating the green transformation of development modes, stressing that greening and decarbonizing economic and social development are key to achieving high-quality development. At present, as China has entered a stage of high-quality development, establishing and perfecting an ESG system suitable for China’s national conditions will help achieve the “dual carbon” goals and sustainable development. Additionally, with the accelerated internationalization of ESG, it has become an essential content of international market cooperation. Therefore, advancing the construction of the ESG policy system will not only help China promote global sustainable development and build a community with a shared future for humanity but will also benefit China’s foreign trade and investment. This study reveals the positive impact of ESG performance on promoting corporate carbon reduction, which has significant policy implications for corporations to actively fulfill their social responsibilities, promote China’s high-quality development, and assist the country in achieving its “dual carbon” goals.

7.1 Policy implications

From a policy implication perspective, this study offers the following suggestions for policymakers and corporate decision-makers: (1) Policy Support and Guidance: Government departments should further strengthen support and guidance for corporate ESG practices, such as providing tax incentives, subsidies, and other motivating measures, encouraging companies to enhance green technology innovation and improve operational efficiency. Additionally, the government can formulate specific market incentives, like carbon credits and environmental rewards, to encourage improvement in ESG performance. These incentives can help businesses secure better financing conditions in capital markets, enhancing their competitive advantage. (2) Perfecting ESG Information Disclosure System: The government should establish and perfect the ESG information disclosure system to ensure transparency and authenticity, guiding companies to better fulfill their social responsibilities. Furthermore, raising investor awareness of ESG investments and emphasizing their focus on corporate social responsibility and environmental sustainability can be achieved through investor education campaigns and publicity, thus increasing capital market recognition of high ESG performing companies. (3) Promoting Digital Transformation: Encourage enterprises to undergo digital transformation, using advanced technological means to monitor and manage carbon emissions while strengthening corporate ESG practices. (4) Industry and Corporate Collaboration: Strengthen collaboration among the government, industries, and corporations, jointly promoting the deepening of ESG practices, thereby better addressing the challenges of global climate change. (5) Internal Training and Capacity Building in Enterprises: Encourage businesses to strengthen internal staff understanding and training on ESG to improve overall ESG management levels. This includes providing training on sustainable development, environmental protection, and social responsibility, as well as expertise in ESG reporting and analysis. (6) Integrating ESG and Financial Performance: Encourage businesses to more closely align ESG performance with financial performance assessment, demonstrating the impact of ESG investments on long-term company value. This involves developing and using more sophisticated tools to assess the direct and indirect effects of ESG performance on financial outcomes.

7.2 Limitations and future research

The study’s scope, primarily focused on China’s manufacturing sector from 2010 to 2020, poses a limitation to its applicability in other geographical contexts and time periods. This geographic and temporal confinement might not fully capture the diverse global landscape of ESG impacts. Additionally, the exclusive concentration on the manufacturing industry may not adequately represent the varied ESG challenges and opportunities present in other sectors, each with its unique environmental footprint.

A significant limitation of this study is the reliance on carbon emissions proxies in lieu of directly reported emissions data from the sampled firms. This approach, while necessary due to data availability constraints, may not accurately capture the true carbon emissions of each company. Proxies, based on industry averages or standardized metrics, might lead to over- or under-estimation of actual emissions, thus impacting the precision of our conclusions regarding ESG performance and carbon emission intensity.

Future research should aim to broaden the scope, both in terms of industry and geography. Exploring a variety of sectors will provide a more holistic understanding of how ESG performance influences carbon reduction across different business landscapes. Moreover, extending the research to include longitudinal studies across a wider range of countries and time frames is crucial. Such studies would capture the evolving nature of ESG standards and their varied impacts on corporate carbon reduction strategies in a global context. Incorporating directly reported emissions data, where available, would significantly enhance the accuracy and relevance of future research in this field.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material. Further inquiries can be directed to the corresponding author.

Author contributions

JY: Conceptualization, Formal Analysis, Supervision, Writing – review & editing. WX: Methodology, Software, Writing – original draft.

Funding

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. This research was funded by the Social Science Foundation of Jiangxi Province, China (grant No. 22YJ27) and the Science and Technology Research Project of the Jiangxi Provincial Department of Education, China (grant No. GJJ171220).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Agliardi E., Alexopoulos T., Karvelas K. (2023). The environmental pillar of ESG and financial performance: A portfolio analysis. Energy Econ. 120, 106598. doi: 10.1016/j.eneco.2023.106598

Albuquerque R., Koskinen Y., Zhang C. (2019). Corporate social responsibility and firm risk: Theory and empirical evidence. Manage. Sci. 65, 4451–4469. doi: 10.1287/mnsc.2018.3043

Apergis N., Poufinas T., Antonopoulos A. (2022). ESG scores and cost of debt. Energy Econ. 112, 106186. doi: 10.1016/j.eneco.2022.106186

Asl M. G., Adekoya O. B., Oliyide J. A. (2022). Carbon market and the conventional and islamic equity markets: where lays the environmental cleanliness of their utilities, energy, and ESG sectoral stocks? J. Clean. Prod. 351, 131523. doi: 10.1016/j.jclepro.2022.131523

Bai C., Liu H., Zhang R., Feng C. (2023). Blessing or curse? Market-driven environmental regulation and enterprises’ total factor productivity: Evidence from China’s carbon market pilots. Energy Econ. 117, 106432. doi: 10.1016/j.eneco.2022.106432

Cahyono S., Harymawan I., Kamarudin K. A. (2023). The impacts of tenure diversity on boardroom and corporate carbon emission performance: Exploring from the moderating role of corporate innovation. Corp. Soc Responsib. Environ. Manag. 30, 2507–2535. doi: 10.1002/csr.2500

Chen P. (2022). Relationship between the digital economy, resource allocation and corporate carbon emission intensity: New evidence from listed Chinese companies. Environ. Res. Commun. 4, 075005. doi: 10.1088/2515-7620/ac7ea3

Chen Y., Xu Z., Wang X., Yang Y. (2023). How does green credit policy improve corporate social responsibility in China? An analysis based on carbon-intensive listed firms. Corp. Soc Responsib. Environ. Manage. 30, 889–904. doi: 10.1002/csr.2395

Chen H., Zhang L. (2023). ESG performance, digital transformation and enterprise value enhancement. J. Zhongnan Univ. Econ. Law 136–149. doi: 10.19639/j.cnki.issn1003-5230.2023.0030

Cho Y. (2022). ESG and Firm Performance: Focusing on the environmental strategy. sustainability 14, 7857. doi: 10.3390/su14137857

Cong Y., Zhu C., Hou Y., Tian S., Cai X. (2022). Does ESG investment reduce carbon emissions in China? Front. Environ. Sci. 10. doi: 10.3389/fenvs.2022.977049

Deng J., Zhang R., Qiu Q. (2023). Spatial impact of industrial structure upgrading and corporate social responsibility on carbon emissions: Evidence from China. sustainability 15, 10421. doi: 10.3390/su151310421

El Ghoul S., Guedhami O., Kwok C. C. Y., Mishra D. R. (2011). Does corporate social responsibility affect the cost of capital? J. Bank. finance 35, 2388–2406. doi: 10.1016/j.jbankfin.2011.02.007

Fang X., Hu D. (2023). Corporate ESG performance and innovation: Empirical evidence from a-share listed companies. Econ. Res. J. 58, 91–106.

Garel A., Petit-Romec A. (2022). CEO exposure to abnormally hot temperature and corporate carbon emissions. Econ. Lett. 210, 110156. doi: 10.1016/j.econlet.2021.110156

Ge G., Xiao X., Li Z., Dai Q. (2022). Does ESG performance promote high-quality development of enterprises in China? The mediating role of innovation Input. sustainability 14, 3843. doi: 10.3390/su14073843

Houston J. F., Shan H. (2022). Corporate ESG profiles and banking relationships. Rev. Financ. Stud. 35, 3373–3417. doi: 10.1093/rfs/hhab125

Hu Y., Guo C. (2023). Impact of digitalization on carbon emission intensity of manufacturing enterprises: Theoretical modeling and mechanism test. J. Beijing Univ. Technol. Sci. Ed. 23, 153–168.

Hu N., Xue F., Wang H. (2021). Does managerial myopia affect long-term investment? Based on text analysis and machine learning. J. Manage. World 37, 139–156+11+19-21. doi: 10.19744/j.cnki.11-1235/f.2021.0070

Lee C.-C., Chang Y.-F., Wang E.-Z. (2022). Crossing the rivers by feeling the stones: The effect of China’s green credit policy on manufacturing firms’ carbon emission intensity. Energy Econ. 116, 106413. doi: 10.1016/j.eneco.2022.106413

Li C., Ba S., Ma K., Xu Y., Huang W., Huang N. (2023a). ESG rating events, financial investment behavior and corporate innovation. Econ. Anal. Policy 77, 372–387. doi: 10.1016/j.eap.2022.11.013

Li K., Huang L., Zhang J., Huang Z., Fang L. (2023b). Can ESG performance alleviate the constraints of green financing for Chinese enterprises: Empirical evidence from China’s A-Share manufacturing companies. Sustainability 15, 10970. doi: 10.3390/su151410970

Li S., Liu Y., Xu Y. (2023c). Does ESG performance improve the quantity and quality of innovation? The mediating role of internal control effectiveness and analyst coverage. sustainability 15, 104. doi: 10.3390/su15010104

Li G., Wen H. (2023). The low-carbon effect of pursuing the honor of civilization? A quasi-experiment in Chinese cities. Econ. Anal. Policy 78, 343–357. doi: 10.1016/j.eap.2023.03.014

Lin Y., Fu X., Fu X. (2021). Varieties in state capitalism and corporate innovation: evidence from an emerging economy. J. Corp. Finance 67, 101919. doi: 10.1016/j.jcorpfin.2021.101919

Liu M., Guo T., Ping W., Luo L. (2023). Sustainability and Stability: Will ESG investment reduce the return and volatility spillover effects across the Chinese financial market? Energy Econ 121, 106674. doi: 10.1016/j.eneco.2023.106674

Liu H., Lyu C. (2022). Can ESG ratings stimulate corporate green innovation? Evidence from China. sustainability 14, 12516. doi: 10.3390/su141912516

Liu H., Zhang Z. (2023). The impact of managerial myopia on environmental, social and governance (ESG) engagement: Evidence from Chinese firms. Energy Econ. 122, 106705. doi: 10.1016/j.eneco.2023.106705

Long H., Feng G.-F., Chang C.-P. (2023). How does ESG performance promote corporate green innovation? Econ. Change Restruct. 56, 2889–2913. doi: 10.1007/s10644-023-09536-2

Luo G., Guo J., Yang F., Wang C. (2023). Environmental regulation, green innovation and high-quality development of enterprise: evidence from China. J. Clean. Prod. 418, 138112. doi: 10.1016/j.jclepro.2023.138112

Ma J., Gao D., Sun J. (2022). Does ESG performance promote total factor productivity? Evidence from China. Front. Ecol. Evol. 10. doi: 10.3389/fevo.2022.1063736

Ma C., Yang J. (2023). The Carbon reduction effect of enterprise digital transformation: Theoretical mechanism and empirical testing. J. Nanjing Univ. Finance Econ. 76–85.

Mao Q., Wang Y. (2023). Employment effects of ESG: Evidence from Chinese listed companies. Econ. Res. J. 58, 86–103.

Ning Y., Zhang Y. (2023). Does digital finance improve corporate ESG performance? An intermediary role based on financing constraints. Sustainability 15, 10685. doi: 10.3390/su151310685

Pan X., Pu C., Yuan S., Xu H. (2022). Effect of Chinese pilots carbon emission trading scheme on enterprises’ total factor productivity: The moderating role of government participation and carbon trading market efficiency. J. Environ. Manage. 316, 115228. doi: 10.1016/j.jenvman.2022.115228

Pei Y., Zhu Y., Liu S., Wang X., Cao J. (2019). Environmental regulation and carbon emission: The mediation effect of technical efficiency. J. Clean. Prod. 236, 117599. doi: 10.1016/j.jclepro.2019.07.074

Pulino S. C., Ciaburri M., Magnanelli B. S., Nasta L. (2022). Does ESG disclosure influence firm performance? sustainability 14, 7595. doi: 10.3390/su14137595

Qing L., Chun D., Dagestani A. A., Li P. (2022). Does proactive green technology innovation improve financial performance? Evidence from listed companies with semiconductor concepts stock in China. Sustainability 14, 4600. doi: 10.3390/su14084600

Rajpar H., Zhang A., Razzaq A., Mehmood K., Pirzado M. B., Hu W. (2019). Agricultural land abandonment and farmers’ Perceptions of land use change in the Indus plains of Pakistan: A case study of Sindh province. Sustainability 11, 4663. doi: 10.3390/su11174663

Razzaq A., Liu H., Zhou Y., Xiao M., Qing P. (2022a). The competitiveness, bargaining power, and contract choice in agricultural water markets in Pakistan: implications for price discrimination and environmental sustainability. Front. Environ. Sci. 10. doi: 10.3389/fenvs.2022.917984

Razzaq A., Xiao M., Zhou Y., Anwar M., Liu H., Luo F. (2022b). Towards sustainable water use: factors influencing farmers’ Participation in the informal groundwater markets in Pakistan. Front. Environ. Sci. 10. doi: 10.3389/fenvs.2022.944156

Ren X., Zeng G., Sun X. (2023a). The peer effect of digital transformation and corporate environmental performance: empirical evidence from listed companies in China. Econ. Model. 128, 106515. doi: 10.1016/j.econmod.2023.106515

Ren X., Zeng G., Zhao Y. (2023b). Digital finance and corporate ESG performance: Empirical evidence from listed companies in China. Pac.-Basin Finance J. 79, 102019. doi: 10.1016/j.pacfin.2023.102019

Saqib Z. A., Zhang Q., Ou J., Saqib K. A., Majeed S., Razzaq A. (2020). Education for sustainable development in Pakistani higher education institutions: an exploratory study of students’ and teachers’ Perceptions. Int. J. Sustain. High. Educ. 21, 1249–1267. doi: 10.1108/IJSHE-01-2020-0036

Sun H., Zhu L., Wang A., Wang S., Ma H. (2023). Analysis of regional social capital, enterprise green innovation and green total factor productivity-based on Chinese A-Share listed companies from 2011 to 2019. Sustainability 15, 34. doi: 10.3390/su15010034

Wang J., Ma M., Dong T., Zhang Z. (2023a). Do ESG ratings promote corporate green innovation? A quasi-natural experiment based on SynTao Green Finance’s ESG Ratings. Int. Rev. Financ. Anal. 87, 102623. doi: 10.1016/j.irfa.2023.102623

Wang S., Tian Y., Dang L. (2022). ESG implementation, competition strategy and financial performance of industrial enterprises. Account. Res. 77–92.

Wang C., Wang L., Wang W., Xiong Y., Du C. (2023b). Does carbon emission trading policy promote the corporate technological innovation? Empirical evidence from China’s High-Carbon industries. J. Clean. Prod. 411, 137286. doi: 10.1016/j.jclepro.2023.137286

Wen H., Liang W., Lee C.-C. (2023). China’s progress toward sustainable development in pursuit of carbon neutrality: Regional differences and dynamic evolution. Environ. Impact Assess. Rev. 98, 106959. doi: 10.1016/j.eiar.2022.106959

Wu S., Li X., Du X., Li Z. (2022). The impact of ESG performance on firm value: The moderating role of ownership structure. sustainability 14, 14507. doi: 10.3390/su142114507

Xiao X., Liu X., Liu J. (2023). ESG rating dispersion and expected stock return in China. Emerg. Mark. Finance Trade. 59, 3422–3437. doi: 10.1080/1540496X.2023.2223933

Xie H., Lv X. (2022). Responsible multinational investment: ESG and Chinese OFDI. Econ. Res. J. 57, 83–99.

Xie H., Wen J., Wang X. (2022). Digital finance and high-quality development of State-Owned enterprises-A financing constraints Perspective. sustainability 14, 15333. doi: 10.3390/su142215333

Xu P., Ye P., Jahanger A., Huang S., Zhao F. (2023). Can green credit policy reduce corporate carbon emission intensity: Evidence from China’s listed firms. Corp. Soc. Responsib. Environ. Manag. 30, 2623–2638. doi: 10.1002/csr.2506

Yan H., Li X., Huang Y., Li Y. (2020). The Impact of the consistency of carbon performance and carbon information disclosure on enterprise value. finance Res. Lett. 37, 101680. doi: 10.1016/j.frl.2020.101680

Yu X., Xiao K. (2022). Does ESG performance affect firm value? Evidence from a new ESG-Scoring approach for Chinese enterprises. sustainability 14, 16940. doi: 10.3390/su142416940

Yuan X., Li Z., Xu J., Shang L. (2022). ESG Disclosure and corporate financial irregularities-Evidence from Chinese listed firms. J. Clean. Prod. 332, 129992. doi: 10.1016/j.jclepro.2021.129992

Zhang D. (2023). Can digital finance empowerment reduce extreme ESG hypocrisy resistance to improve green innovation? Energy Econ. 106756. doi: 10.1016/j.eneco.2023.106756

Zhang D., Guo Y., Taghizadeh-Hesary F. (2023a). Green finance and energy transition to achieve net-zero emission target. Energy Econ. 126, 106936. doi: 10.1016/j.eneco.2023.106936

Zhang B., Yu L., Sun C. (2022). How does urban environmental legislation guide the green transition of enterprises? Based on the perspective of enterprises’ green total factor productivity. Energy Econ. 110, 106032. doi: 10.1016/j.eneco.2022.106032

Zhang Y., Zhang Y., Sun Z. (2023b). The impact of carbon emission trading policy on enterprise ESG performance: Evidence from China. sustainability 15, 8279. doi: 10.3390/su15108279

Zheng L., Omori A., Cao J., Guo X. (2023). Environmental regulation and corporate environmental performance: Evidence from Chinese Carbon emission trading pilot. sustainability 15, 8518. doi: 10.3390/su15118518