- 1Research Center of Management Science and Engineering, Jiangxi Normal University, Nanchang, China

- 2School of Mathematics and Statistics, Jiangxi Normal University, Nanchang, China

Introduction: China’s environmental protection tax policy has emerged as a pivotal force in steering the country towards reduced pollution and carbon emissions. This study focuses on evaluating the impact of the environmental protection tax on carbon unlocking within the manufacturing industry, offering crucial insights to address the dual challenges of industry development and carbon emission reduction.

Methods: Utilizing Chinese provincial panel data spanning from 2004 to 2020, we gauge the carbon unlocking efficiency of the manufacturing industry using the super-efficiency slacks-based measure (SBM) model with undesired outputs. Additionally, we empirically examine the impact of the environmental protection tax policy on manufacturing carbon unlocking through the propensity score matching difference-in-differences (PSM-DID) model.

Results: Our findings indicate a significant enhancement in the carbon unlocking efficiency of the manufacturing industry due to the implementation of the environmental protection tax policy. Compared with the provinces (municipalities) that did not raise the environmental protection tax rate standard, the carbon unlocking efficiency of manufacturing in the provinces (municipalities) that raised the environmental protection tax rate standard increased by 11.6%, and the dynamic effect shows that the policy effect increases gradually over time. Further mechanism tests reveal that an environmental protection tax improves manufacturing carbon unlocking efficiency mainly by stimulating manufacturing firms to increase environmental protection investment and green technology innovation. Moreover, there is heterogeneity in the policy effect of the environmental protection tax, and its impact on manufacturing carbon unlocking is more significant in the central and western regions and regions with higher levels of legalization.

Discussion: Therefore, we should adhere to the policy orientation of low-carbon development in manufacturing, accelerate green technological innovation in manufacturing, and coordinate the special advantages of each region according to local conditions to bring into play the role of an environmental protection tax in reducing carbon and improving efficiency.

1 Introduction

Global warming and other environmental pollution problems caused by carbon emissions have aroused widespread concern (Li et al., 2023). The Fifth Global Climate Assessment Report from the Intergovernmental Panel on Climate Change (IPCC, 2013) shows that the increase in carbon emissions is mainly due to the massive consumption of fossil energy by humans since the industrial revolution, which is also the main cause of global warming. As the world’s largest carbon emitter (IEA, 2008), China has successively introduced many supporting policies to promote the development of low-carbon economy in response to the global climate change crisis. As a pillar industry of China’s economy, the manufacturing industry provides important support for economic growth. However, the manufacturing industry is also a key industry of energy consumption, and its long-term dependence on high energy consumption has caused it to fall into the so-called “carbon locking” dilemma (Jin et al., 2022; Liu et al., 2023; Zhu et al., 2023). At present, China’s manufacturing industry is mainly responsible for processing, assembly and other low-end links in the global value chain, which is to a certain extent locked in the fossil fuel-based energy system, characterized by high resource input, high energy consumption and high pollution emissions (Jin and Han, 2021; Peng et al., 2022). In 2019, the total energy consumption of China’s manufacturing industry was 2.586 billion tons of standard coal, accounting for approximately 55% of China’s total energy consumption and 36% of the country’s total carbon dioxide emissions from energy activities1. The extensive development mode leads to severe resource and environmental constraints on the development of the manufacturing industry, which seriously affects the sustainable development of this industry (Gopal et al., 2023). Therefore, based on an in-depth understanding of the formation mechanism of the manufacturing carbon lock, how to break the manufacturing carbon lock, seek national or regional carbon unlocking paths, and realize the decoupling and unlocking of carbon emissions and economic growth has become a realistic problem that countries around the world urgently need to solve.

As an important tool for the government to regulate environmental pollution, the environmental protection tax system has a positive role in promoting the harmonious development of the economy, society and nature (Chiroleu-Assouline and Fodha, 2014; Hettich, 1998; André et al., 2005; Fang et al., 2022; Fang et al., 2023a). Before the implementation of the Environmental Protection Tax Law, China had long implemented a system of pollutant discharge charges (Fang et al., 2023b). There are some system defects in the sewage fee system, such as excessive administrative intervention and unreasonable charging structures, which lead to insufficient incentives for the green and low-carbon development of enterprises. To fundamentally solve the various drawbacks of the sewage fee system, China has implemented the “fee to tax” of environmental protection, moving from the sewage fee system to the environmental protection tax system, to better play the important role of the environmental protection tax policy in environmental governance and economic growth. On December 25, 2016, the Chinese government passed the Environmental Protection Tax Law, which came into effect on January 1, 2018. Some scholars’ empirical evidence shows that environmental tax system not only has a positive effect on reducing pollution and carbon emissions but also has a positive impact on economic development (Abdullah and Morley, 2014; Alexeev et al., 2016; Freire-González, 2018; Klenert et al., 2018). For example, Creutzig and Mattauch (2013) believes that carbon locking is caused by technology and policy failure, the most effective policy measures to avoid carbon locking are environmental taxes and compensation, and adjustment through economic costs and benefits is crucial to promoting low-carbon transition. Mattauch et al. (2015) uses a general equilibrium model to study the interaction between clean and nonclean sectors to assess the feasibility of policies preventing carbon lock-in. However, does China’s environmental protection tax policy have an impact on manufacturing carbon unlocking? How can this impact be quantitatively and accurately identified? What is the mechanism of its effect? Is there heterogeneity? These questions have not been directly addressed in the literature and need to be further explored.

The current research on carbon unlocking mainly focuses on the connotation and inner mechanism of carbon unlocking, unlocking paths and unlocking policies. Carbon unlocking was first proposed by Spanish scholar Unruh (2002). He believed that technology and systems reinforce each other to form a “techno-institutional complex”, causing the modern industrial economy to be “locked” in the carbon-based energy system. This situation is not only difficult for developed countries to eliminate but also spreading soon to developing countries under the promotion of economic globalization. The phenomenon of “carbon replication” occurs. Later, based on the Indian experience and other studies, some scholars found that developing countries tend to copy the development model of developed countries to achieve rapid industrialization, and “carbon locking” does have a global trend (Unruh, 2000; Berkhout et al., 2010). Chinese scholars have begun to study carbon unlocking in recent years, mainly from the perspective of technological progress and systems, to examine the possibility of China’s carbon unlocking path (Wang et al., 2022; Li et al., 2023; Zhao et al., 2023). In terms of technological progress, the promotion and application of low-carbon technology and clean energy have decoupled carbon emissions from economic growth to a certain extent. In terms of system, the role of the government in the system is mainly emphasized, affirming the guiding role of the government from policy formulation to the formation of a low-carbon technology system. Xie (2009) traced the concept of carbon locking and its connotation, deeply expounded the connotation and formation mechanism of carbon locking and carbon unlocking, and proposed that developing countries should pay more attention to international technical cooperation to strengthen the incentive for participation and compliance. Since then, scholars have used various analysis methods and economic models to discuss the path of carbon unlocking in China from both theoretical and empirical perspectives, mainly focusing on the relationship between China’s gross domestic product (GDP) and carbon dioxide emissions as well as the unlocking status of various industrial sectors. In addition, research on policy and carbon unlocking mainly focuses on environmental taxes, subsidies, agreements, etc. Unruh and Carrillo-Hermosilla (2006) discuss four policy approaches that seem to have advantages under carbon lock-in conditions, proposing that governments act as a coordinator to diversify technology options and enhance cross-sectoral and interdisciplinary cooperation to take action to avoid carbon lock-in. Sanden and Azar (2005) believe that technology policies can effectively mitigate the carbon locking effect, and the divestment of fossil energy can be used to effectively eliminate carbon locking.

In summary, existing studies have provided a series of academic foundations with important value for research on the effects of environmental protection tax policies and carbon unlocking in manufacturing. However, through a literature review, it is found that there are still gaps to be improved and supplemented. First, despite there being some literature on carbon unlocking policies, research specifically addressing the manufacturing industry and investigating the policy effects and mechanisms of environmental protection tax on carbon unlocking in manufacturing is still lacking. Second, the impact of environmental protection tax policy on carbon unlocking of manufacturing industry in different regions varies due to its resources, regions and other aspects, but no heterogeneity analysis of these differences has been conducted in the literature. In light of this, the present study utilizes a sample comprising 30 provinces (municipalities) in China from 2004 to 2020. With a focus on policy variations, the research investigates the impact of the environmental protection tax policy, particularly following the enactment of the Environmental Protection Tax Law, on carbon unlocking within the manufacturing industry. The objective is to offer a more precise and nuanced evaluation of the interplay between these factors in the Chinese context. Compared to existing research, this paper aims to make several noteworthy contributions. First, it adopts a novel research perspective by integrating China’s environmental protection tax policy, an independent green tax, into the analysis. Recognizing the environmental protection tax as an effective, preventive, and long-term environmental economic policy with profound implications for China’s low-carbon sustainable development, the study focuses on the manufacturing sector. Importantly, existing literature has not explored the simultaneous analysis of China’s environmental protection tax policy and manufacturing carbon unlocking efficiency within the same research framework. By taking the manufacturing industry as the research subject and employing the PSM-DID method, the paper seeks to evaluate the impact of the environmental protection tax policy on China’s manufacturing industry’s carbon unlocking efficiency. This approach provides valuable insights for the assessment and research of environmental protection policies in developing countries. Second, beyond elucidating the association between the environmental protection tax and carbon unlocking in the manufacturing industry, the study delves into the transmission mechanism. It uncovers how the environmental protection tax influences carbon unlocking in the manufacturing industry through two key channels: green technology innovation and increased environmental protection investment. This contributes theoretical support and empirical evidence, providing a foundation for a precise mechanism analysis. Finally, the manuscript employs econometric analysis by combining the Propensity Score Matching (PSM) and Difference-in-Differences (DID) methods. This approach effectively addresses the issues of self-selection bias in the treatment group and endogeneity in the model at a technical level. By eliminating the influence of unobservable variables, the study analyzes the heterogeneity of the policy effects of the Environmental Protection Tax Law in different subsamples, thereby enhancing the reliability and accuracy of the research conclusions. In summary, the innovative aspects of this paper lie in its unique research perspective, the exploration of the transmission mechanism, and the advanced econometric methodology employed, collectively providing a comprehensive and insightful analysis of the impact of China’s environmental protection tax policy on carbon unlocking in the manufacturing industry.

The rest of the paper is structured as follows. Section 2 introduces the policy background and theoretical analysis. Section 3 provides the model setup. Section 4 describes the data sources and variable selection. Section 5 presents the empirical analysis results and robustness test. Section 6 provides mechanism analysis, heterogeneity test and spatial spillover effects. Section 7 provides discussion and section 8 presents conclusions and policy recommendations.

2 Policy background and research hypotheses

2.1 Background of China’s environmental protection tax policy

China legally established the pollution charging system in 1979, and later introduced a series of legal systems to levy fees on enterprises’ emissions to control the emission levels of major pollutants from industrial enterprises. Existing studies have found that pollution charges actively promote the reduction of pollution emissions. However, due to the low collection standard of pollution charges and the high number of administrative interventions, the government and all sectors of society have raised concerns and even doubts about the effect of pollution control of the pollution charging system (Maung et al., 2016). To promote the formation of an internal restraint mechanism for enterprises to control pollution, reduce emissions and promote the construction of ecological civilization, China’s first “green tax law”, the “Environmental Protection Tax Law”, was officially implemented on January 1, 2018. The environmental protection tax law is of great significance in protecting and improving the environment, reducing pollutant emissions and promoting the construction of ecological civilization, helping to form a distinct green development orientation in Chinese society, stimulating the majority of industrial enterprises to take the initiative to transform and upgrade, and helping to promote the green and low-carbon development of the Chinese economy.

To ensure a smooth transition from the pollutant discharge fee system to the environmental protection tax, the Environmental Protection Tax Law follows the principle of “tax shift”, which is consistent with the pollutant discharge fee system in terms of the collection object, collection scope and tax calculation method. At the same time, there are many differences between the environmental protection tax and the pollutant discharge fee system so that the internal restraint and positive incentive function of pollution control and emission reduction can be better exerted. First, the legislative level has been upgraded. The Environmental Protection Tax Law was the first tax law adopted by China after the implementation of the principle of statutory taxation. Compared with the administrative charge of the “pollution discharge fee”, the environmental protection tax has a clearer legal basis and authority and is mandatory, which is conducive to improving taxpayers’ environmental protection awareness and compliance and strengthening enterprises’ responsibility for pollution control and emission reduction. Second, there is the principle of shifting taxes and fees. The environmental protection tax law follows the principle of smooth transfer from the pollutant discharge charging system to the environmental protection tax system, which mainly shows that the payer of pollutant discharge fees is regarded as the taxpayer of the environmental protection tax. In accordance with the emission charge items, charging methods and charging standards, the tax items, tax basis and tax standard of the environmental protection tax are set up to reduce the impact of the reform on the macroeconomy and avoid a substantial increase in the tax burden of enterprises. Third, regions have the right to determine their own standards for pollution collection. In essence, the environmental protection tax law is a further development of the sewage fee system. When the environmental protection tax law is implemented in some areas, it is stricter in the scope and standards of collection compared with the sewage fee system. According to the provisions of the Environmental Protection Tax Law, the state sets minimum standards for major pollutants, and local governments can raise the standards within ten times the minimum standards; that is, provinces, autonomous regions and municipalities have the right to choose their own standards for major pollutants according to their local conditions. After the environmental protection tax policy was implemented in 2018, some regions maintained the original discharge fee standard, and some regions adopted a levy standard that was higher than the original discharge fee standard. This is equivalent to a “natural experiment” carried out in the field of economics, with obvious exogenous characteristics, providing a rare opportunity to effectively identify the impact of China’s environmental protection tax on the carbon unlocking efficiency of the manufacturing industry.

2.2 Theoretical analysis and research hypotheses

Manufacturing is an important engine of economic growth in many developing countries, as well as a major sector of energy consumption and carbon dioxide emissions (Vieira et al., 2021; Zhu et al., 2022). Most of China’s manufacturing industry has high emissions and high pollution, and its development is to some extent locked in the pattern of fossil fuel-based energy system (Liu et al., 2015). To break this carbon lock-in, the Chinese government has implemented a series of environmental regulations to facilitate the low-carbon transition of manufacturing. As an environmental regulation, the environmental protection tax law can facilitate the green and low-carbon development of the manufacturing industry through the choice of “opportunity cost” by enterprises. For pilot areas with higher tax standards, the pressure on carbon emissions forces them to choose between expanding production and reducing emissions. On the one hand, to avoid the high cost of carbon quotas, enterprises pass on the increase in product prices to consumers. When product prices increase to the benefit of enterprises, enterprises will continue to expand production (Tu and Wang, 2021), but the increase in carbon emissions will be brought about by expanding production. This will cause the cost to rise again, and penalties from government departments may even be incurred. On the other hand, if enterprises choose to reduce and control emissions within the scope of government quotas, enterprises will give up expanding production and lose their profit opportunities before realizing emission reduction technological innovation. The opportunity cost of expanding production is the benefit of reducing emissions, and the opportunity cost of reducing emissions is the benefit of expanding production. That is, under the regulation of the environmental protection tax law pilot policy, enterprises choose opportunity costs to ensure their own development while achieving a balance between social and economic benefits and ecological and environmental benefits, thus promoting the improvement of carbon unlocking efficiency in the manufacturing industry. Based on the above analysis, the research hypothesis H1 is proposed.

H1: The environmental protection tax policy can drive carbon unlocking in manufacturing in pilot areas.

According to Porter’s hypothesis, the environmental protection tax increases enterprise costs and forces enterprises to reduce cost pressure through technological innovation (Porter and Vanderlinde, 1995). Compared with the pollution charge, environmental protection tax is a more effective market-incentivized environmental regulation tool. On the one hand, it forces the manufacturing industry to reduce pollution and carbon emissions by means of green technological innovation by raising the legal level and tax rate (Zhang and Li, 2022). On the other hand, environmental protection tax reduces the risk concerns of enterprises’ innovation through tax relief and provides a fairer competitive environment. It is conducive to guiding the manufacturing industry to increase innovation investment, encouraging enterprises with high innovation ability to carry out new green innovation on the basis of the original innovation, thereby driving the green innovation of the entire manufacturing industry and improving the efficiency of carbon unlocking. Sun (2011) used a quantitative method to discuss the main factors affecting the carbon dioxide emissions of 30 subindustries in the manufacturing industry from 2003 to 2008, and the results showed that the reduction in energy intensity caused by technological progress was the most important factor for the reduction in carbon emissions in the manufacturing industry, which fully confirmed that technological progress has a significant carbon emission reduction effect. Unruh (2002) believes that in the process of industrialization, the energy structure of developed countries is heavily dependent on high-carbon fossil energy, and innovation in the existing energy technology system is needed to solve the carbon lock state. Based on green technology innovation, enterprises innovate energy use technology and clean production technology at the input end to reduce the generation of pollutants. At the output end, pollutant emissions can be reduced by installing and improving pollutant treatment equipment to achieve an overall reduction in the carbon emissions of enterprises (Li et al., 2021). It can be seen that green technology innovation can help the manufacturing industry break the carbon lock state. Based on the above analysis, the research hypothesis H2 is proposed.

H2: The environmental protection tax policy can improve carbon unlocking efficiency in manufacturing by promoting green technology innovation.

The environmental protection investment of manufacturing enterprises is a noneconomic project with obvious externalities, which requires a large amount of capital investment and will increase the production cost of enterprises (Fan et al., 2019). Before the introduction of the Environmental Protection Tax Law, the environmental risk was small. When the market valuation is low or the financial risk is high, enterprises are more willing to invest in projects that can obtain profits in the short term to improve the valuation level or reduce the financial risk, so the motivation of environmental protection investment is relatively weak. Since the Environmental Protection Tax Law was promulgated, the environmental risks caused by environmental problems have increased, the cost of pollution has increased significantly, and the negative impact on the social image and market value of enterprises has increased. Through the purchase of emission reduction and pollution control equipment, investment in green production methods and other end pollution control methods has become an important choice for enterprises to cope with the environmental protection “fee to tax” policy, especially for high-pollution manufacturing enterprises that have difficulty carrying out technological innovation at the source. (He et al., 2020; Cheng et al., 2022; Tian et al., 2022). In addition, the environmental protection “fee to tax” operates by providing local tax revenue ownership and increasing tax incentives, which gives manufacturing enterprises the tax expectation and pressure of environmental governance, prompting them to increase investment in environmental pollution control, reduce carbon emissions while ensuring their own economic development, and achieve a balance between economic benefits and environmental benefits (Zhang et al., 2022; Xie et al., 2023). Based on the above analysis, the research hypothesis H3 is proposed.

H3: The environmental protection tax policy can improve carbon unlocking efficiency in manufacturing by encouraging enterprises to increase their environmental protection investment.

3 Methodology

The difference-in-differences (DID) method is now widely used to evaluate policy effects. In this paper, the implementation of the environmental protection tax policy is regarded as a “quasinatural experiment” to study the impact of the environmental protection tax on the carbon unlocking efficiency of the manufacturing industry. However, a direct comparison of the differences in carbon unlocking efficiency between the provinces (municipalities) that raised the tax standard and the provinces (municipalities) that did not raise the tax standard may lead to estimation bias. On the one hand, provinces (municipalities) choose their own collection standards for major pollutants according to their local conditions, which is nonrandom and therefore generates “selective bias”. On the other hand, the difference in manufacturing carbon unlocking efficiency between the treatment and control groups may be due to unobservable, time-invariant factors other than environmental protection taxes. Therefore, the PSM-DID method, which was proposed and developed by Heckman et al (1997; 1998), is used to address this problem. Specifically, the propensity score matching (PSM) method was first used to select the control group with conditions similar to the treatment group to eliminate the selectivity bias problem. Second, the matched treatment group and the control group were evaluated by using difference-in-differences to eliminate the influence of unobservable variables and reduce the bias of the estimation results. That is, the method of combining PSM and DID was finally selected for this paper to evaluate the policy effect of an environmental protection tax on carbon unlocking in the manufacturing industry more accurately.

3.1 Propensity score matching

The purpose of PSM is to find individuals from the control group with similar characteristics to those in the treatment group, thus constructing counterfactual results. First, the total samples were divided into treatment group and control group , representing provinces (municipalities) that raised tax standards and provinces (municipalities) that did not raise tax standards, respectively. The sample set was . Second, the conditional probability of each province (municipality) entering the treatment group is estimated by logit regression using covariates, that is, the propensity score of individual . Finally, matching was performed according to propensity score values, the province (municipality) of the matched control group was denoted as , and a new sample set was obtained. In , the control group and the treatment group have similar characteristics, which eliminates the sample selection bias. The specific propensity score model is as follows.

where indicates that individual is in the treatment group, represents the covariate vector, and is the corresponding parameter. PSM matching methods include nearest neighbor matching, minimum radius matching, kernel matching, etc. In this paper, kernel matching is adopted in the baseline regression.

3.2 PSM-DID

Although the PSM method can be used to eliminate the selective bias problem, it cannot solve the bias caused by unobservable factors. Therefore, based on PSM, the matched samples are tested by the DID method to evaluate the policy effect of an environmental protection tax on carbon unlocking in the manufacturing industry. Market-based environmental regulation in China has experienced an important transition from pollutant discharge fees to environmental protection taxes. In July 2003, China implemented the pollutant discharge fee system, which has achieved certain carbon reduction results, but due to the lack of mandatory and normative regulations, administrative law enforcement efficiency is not high, resulting in its environmental treatment effectiveness not being significant, and the expenditure on sewage treatment is greater than the income. To overcome the drawbacks of pollutant discharge fees, the Chinese government officially implemented the Environmental Protection Tax Law on January 1, 2018. After the Environmental Protection Tax Law was implemented in 2018, some regions maintained the original discharge fee standards, and some regions adopted standards that were higher than the original discharge fee standards. This is equivalent to a “natural experiment” carried out in the field of economics, with obvious exogenous characteristics, providing an opportunity to effectively identify the impact of China’s environmental protection tax on the carbon unlocking efficiency of the manufacturing industry. In this paper, 2018 is taken as the policy implementation node, provinces (municipalities) with increased environmental protection tax rates are selected as the treatment group, provinces (municipalities) with unchanged environmental protection tax rates are chosen as the control group, and the PSM-DID empirical method is used to identify the policy effects of environmental protection tax law on carbon unlocking in the manufacturing industry. Based on the research of Deschenes et al. (2017), the baseline regression model is set as follows.

In Equation (2), and represent province (municipality) and year; is the explained variable, namely, carbon unlocking efficiency of manufacturing industry. denotes the core explanatory variable, representing the interaction term between policy and time dummy variable. is the key coefficient of this study, which measures the average difference in carbon unlocking efficiency change between the treatment group and the control group before and after the implementation of environmental protection tax policy. is a series of relevant control variables, including economic development level, factor endowment structure, industrial structure, industrialization level, urbanization level and foreign investment level. is the year fixed effect. is the province (municipality) individual fixed effect, and is the random disturbance term.

3.3 Mediating mechanism

The mediating effect model is applied to examine the mechanism of the environmental protection tax policy on the carbon unlocking efficiency of the manufacturing industry. The sequential test method proposed by Baron and Kenny (1986) is used to test whether green technological innovation and environmental protection investment have a significant mediating effect between the environmental protection tax policy and the carbon unlocking efficiency of the manufacturing industry. On the basis of Equation (2), Equations (3) and (4) are constructed to test the logical relationship among the environmental protection tax policy, mechanism variables and the carbon unlocking efficiency of the manufacturing industry. Equation (3) represents the impact of the environmental protection tax policy on the mechanism variables. Equation (4) represents the impact of the environmental protection tax policy and mechanism variables on the carbon unlocking efficiency of the manufacturing industry.

In Equations (3) and (4), represents the mediating variables, representing green technology innovation and environmental protection investment respectively, and the other variables are defined as described in Equation (2). The total effect of the policy is , the direct effect is , and the indirect effect (mediating effect) is .

According to Equations (2) to (4), the mediating effect is tested as follows. The first step is to test the significance of the coefficient . If is significant, the next step is to continue the test; otherwise, the mediating effect does not exist. The second step is to test the coefficients and . If both are significant, it can be considered that the mediation effect of is significant. On this basis, if the coefficient is significant and lower than the total effect , there is a partial mediating effect. If is not significant, there is a complete mediating effect. Third, if at least one of the coefficients and is not significant, a Sobel test is needed to judge the significance of the mediating effect.

In addition, considering that the policy effects of the environmental protection tax policy on different subsamples may be heterogeneous, the samples are further subdivided in this paper according to geographical location and legal environment, and the PSM-DID method is used again to test for classification comparison.

4 Data sources and variables selection

4.1 Data sources

In this paper, panel data from 30 provinces (municipalities) in China (excluding Tibet, Hong Kong, Macao and Taiwan) from 2004 to 2020 were selected as the sample for the study. The year 2004 is chosen as the starting point of the study because prior to the implementation of the Environmental Protection Tax Law, the Regulation on the Collection and Use of Pollution Discharge Fees was implemented in China. The Regulations on the Collection and Use of Pollution Discharge Fees were implemented in July 2003, so it is reasonable to use 2004 as the starting point for the study. The data on the environmental protection tax policy are mainly obtained from documents on the adjustment of levy standards in various provinces (municipalities) in China and collated by the author. Other data were obtained from the China Statistical Yearbook, China Industrial Economic Statistical Yearbook, China Environmental Statistical Yearbook, CSMAR database and China Carbon Emission Accounts & Datasets (CEADs). Data with particularly noticeable missing values were removed. Some of the missing data were filled in by interpolation, and to avoid the effect of extreme values, the continuous variables were trailed at the 1% and 99% quartiles using the winsor2 command in Stata.

4.2 Variables selection

4.2.1 Explained variable

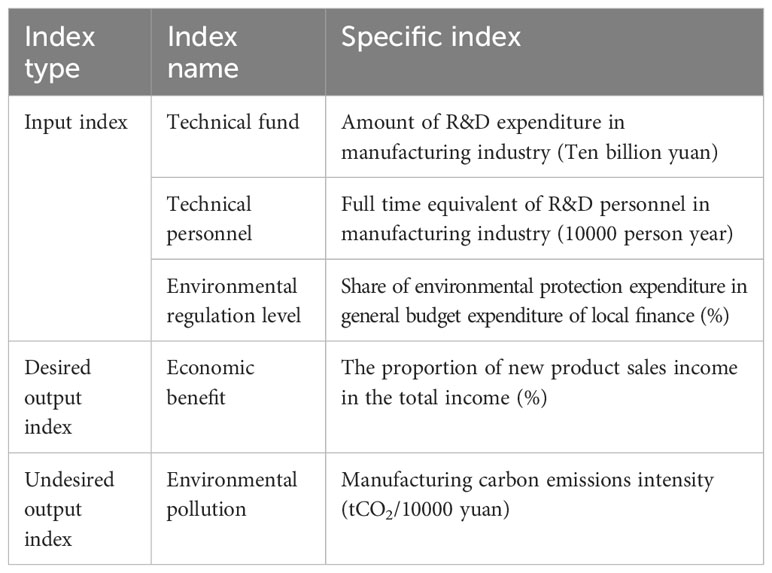

The explained variable of this paper is the carbon unlocking efficiency of the manufacturing industry. Carbon unlocking efficiency refers to the extent to which the relevant sectors can “get rid” of carbon locking after providing certain institutional and technological inputs. Its connotation is to pursue the balance between socioeconomic benefits and environmental benefits based on the “input−output” perspective. In this paper, the index system of carbon unlocking efficiency in the manufacturing industry is constructed from the two dimensions of input and output. The input index is divided into technical fund input, technical personnel input and environmental regulation level input. The output index is divided into economic benefit and environmental pollution, of which environmental pollution is “bad output”, that is, undesired output. Economic benefit is “good output”, that is, the desired output. Data on technology funds, technical talents and economic benefits are mainly from the China Statistical Yearbook and the China Industrial Economic Statistics Yearbook. Data on the level of environmental regulation and environmental pollution are mainly from the China Environmental Statistics Yearbook and the China Carbon Accounting Databases (CEADs). The specific indicator system is shown in Table 1.

In evaluating efficiency, the super-efficiency slacks-based measure (SBM) model is more accurate than the traditional data envelopment analysis (DEA) model, and can reflect the slack improvement value of each input and output, and can distinguish the magnitude of the efficiency value of the decision making unit (DMU) when the efficiency value is 1 (Tone, 2002). Therefore, in this paper, the relationship between input, desired output and undesired output is taken into account, and the super-efficient SBM model with undesired output proposed by Tone is used to measure the carbon unlocking efficiency of the manufacturing industry. The specific model is as follows.

where is the value of carbon unlocking efficiency in manufacturing; , and denote the number of input, desirable output, and undesirable output elements, respectively; , , denote the input, desired output and undesired output values of DMU respectively; is the number of DMU; , and are the relaxation vectors of inputs, desirable outputs and undesirable outputs, respectively; and is the weight vector of the decision unit.

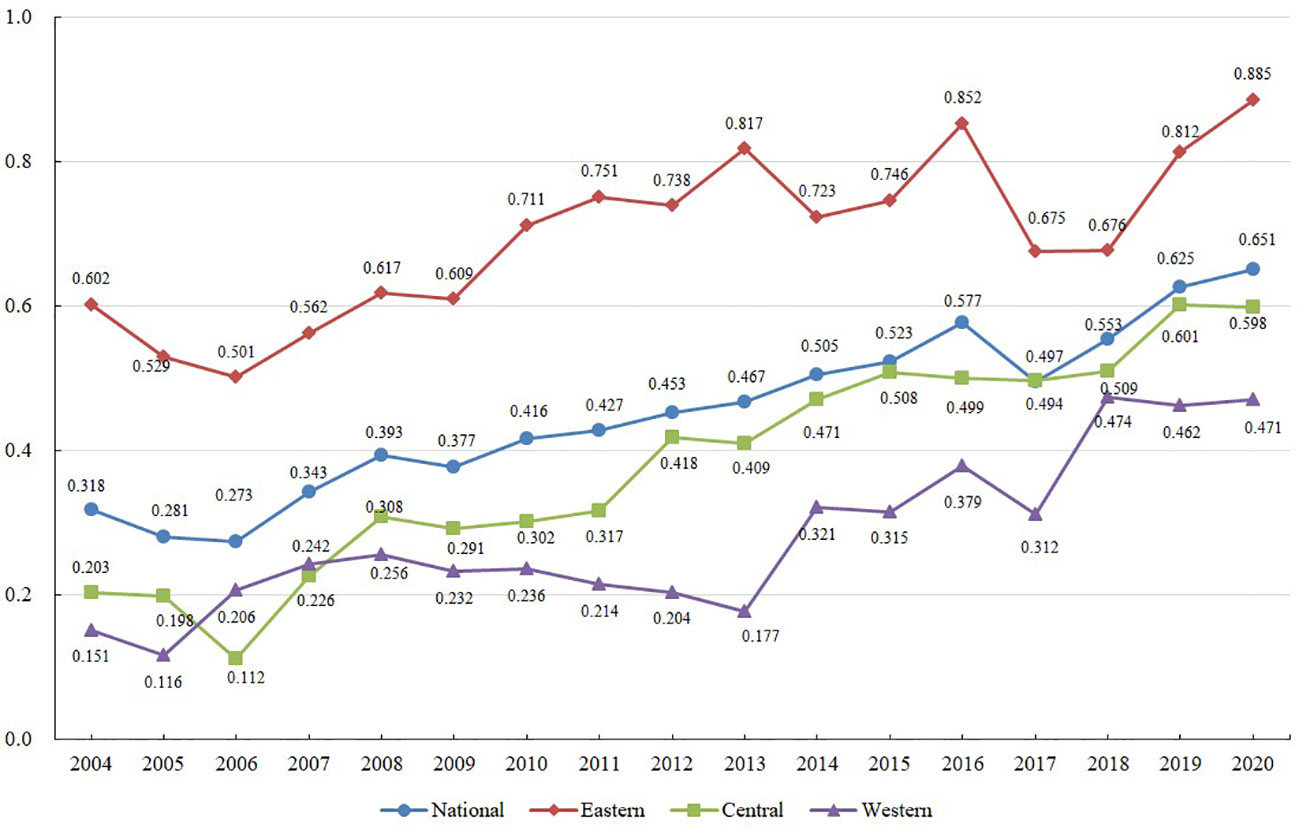

According to the above model, the data were processed to estimate the carbon unlocking efficiency level of manufacturing industry in China’s provinces (municipalities). Figure 1 shows the average carbon unlocking efficiency of China’s manufacturing industry from 2004 to 2020. At the national level, the carbon unlocking efficiency of China’s manufacturing industry as a whole shows a fluctuating upward trend, with its average value rising from 0.318 in 2004 to 0.651 in 2020. During the study period, the carbon unlocking efficiency of manufacturing industry in the eastern, central and western regions showed obvious regional differences. The carbon unlocking efficiency of the manufacturing industry shows a decreasing distribution from east to central and then to west.

Figure 1 Trends in the mean value of carbon unlocking efficiency in China’s manufacturing industry from 2004 to 2020.

4.2.2 Core explanatory variable

The interaction term of the policy and time dummy variables is the core explanatory variable in this paper. In the environmental protection tax policy, only the upper and lower limits of the environmental protection tax rate are limited, and local governments can independently determine the tax rate according to the local environmental situation and the ability of enterprises to bear the tax burden. During the implementation of the policy, 12 provinces (municipalities), including Beijing, Hebei, Shanxi, Jiangsu, Shandong, Henan, Hunan, Guangxi, Hainan, Chongqing, Sichuan and Guizhou, raised the emission tax rate standard, while the remaining 18 provinces (municipalities) adopted the original pollution discharge fee rate standard as the environmental protection tax rate standard. Therefore, this paper sets the dummy variable for policy implementation and sets the provinces (municipalities) that have raised the environmental protection tax rate standard as the treatment group, ; provinces (municipalities) that have not raised the environmental protection tax rate standard are set as the control group, . We set the policy implementation time dummy variable , taking 2004 to 2017 as the period before the policy implementation, ; Taking 2018 to 2020 as the years after the implementation of the policy, . According to the principle of DID, the coefficient of is actually the policy effect of the environmental protection tax policy on the carbon unlocking efficiency of the manufacturing industry, if and only if province (municipality directly under the Central government) implement the policy, and the , , otherwise .

4.2.3 Mechanism variables

Referring to previous studies (Tian et al., 2022; Zhang and Li, 2022), environmental protection investment and green technology innovation are selected as the mechanism variables in this paper. Among them, environmental protection investment is measured by the proportion of environmental pollution control and mitigation technology research and development in GDP. and is denoted as . Green technology innovation is measured by the ratio of the number of green patents granted to the number of applications, which is denoted as .

4.2.4 Control variables

Considering the impact of other factors on carbon unlocking efficiency in the manufacturing industry, and drawing on the studies of Jin and Han (2021) and Liu et al. (2015), the following variables are selected as control variables, i.e., covariates. The level of economic development, measured by the logarithm of the per capita GDP of the province (municipality), which is denoted as . Factor endowment structure, measured logarithmically by the ratio of fixed assets of industrial enterprises above designated size to the number of employees at the end of the year, which is denoted as . The level of urbanization is measured by the number of permanent urban residents in the total population of the region, which is denoted as . The intensity of environmental regulation, measured as the ratio of completed investment in industrial pollution control to GDP, which is denoted as . The industrial structure, measured by the share of secondary industry value added in GDP, which is denoted as . The level of foreign investment, measured by the proportion of actual foreign capital used to provincial (municipality) GDP, which is denoted as .

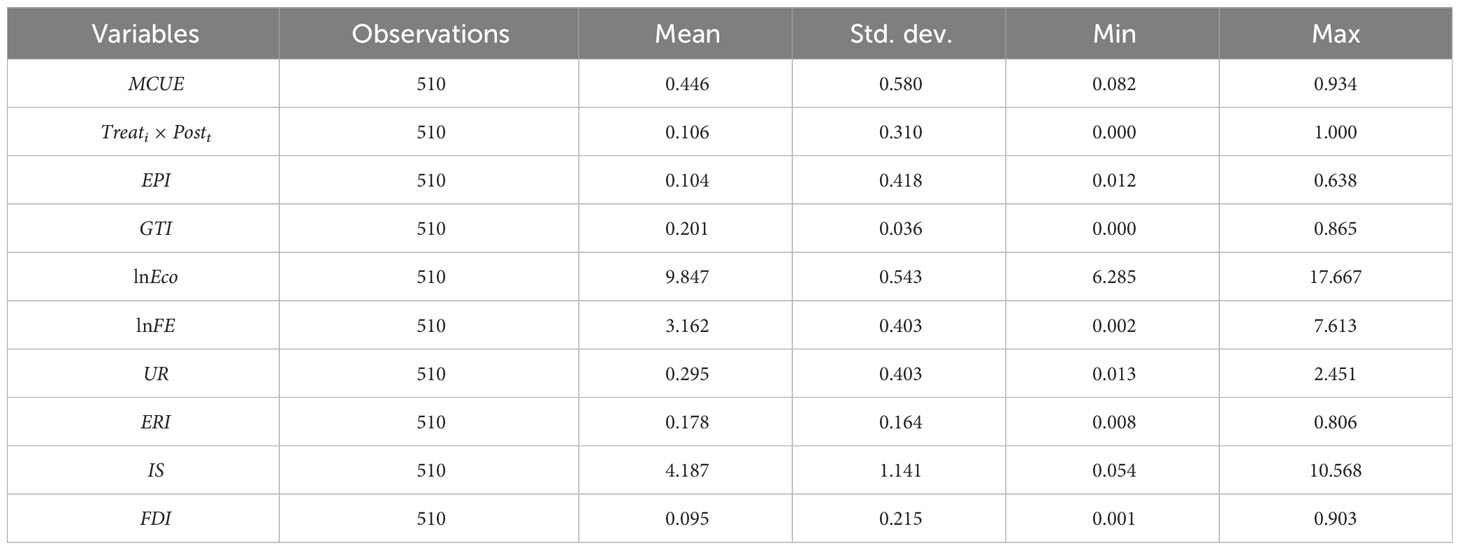

4.3 Descriptive statistics

The descriptive statistics presented in Table 2 depict the characteristics of the main variables. The mean carbon unlocking efficiency in manufacturing is 0.446, with a standard deviation of 0.594. While the mean provides an overall measure, the standard deviation reveals that there is a certain degree of variation in carbon unlocking efficiency. The difference between the maximum value (0.934) and the minimum value (0.082) further emphasizes this variation. The mean value of the interaction term is 0.106, indicating that the sample proportion of provinces (municipalities) that raised the environmental protection tax rate standard after the implementation of the policy is 10.6%.

5 Empirical results analysis and robustness test

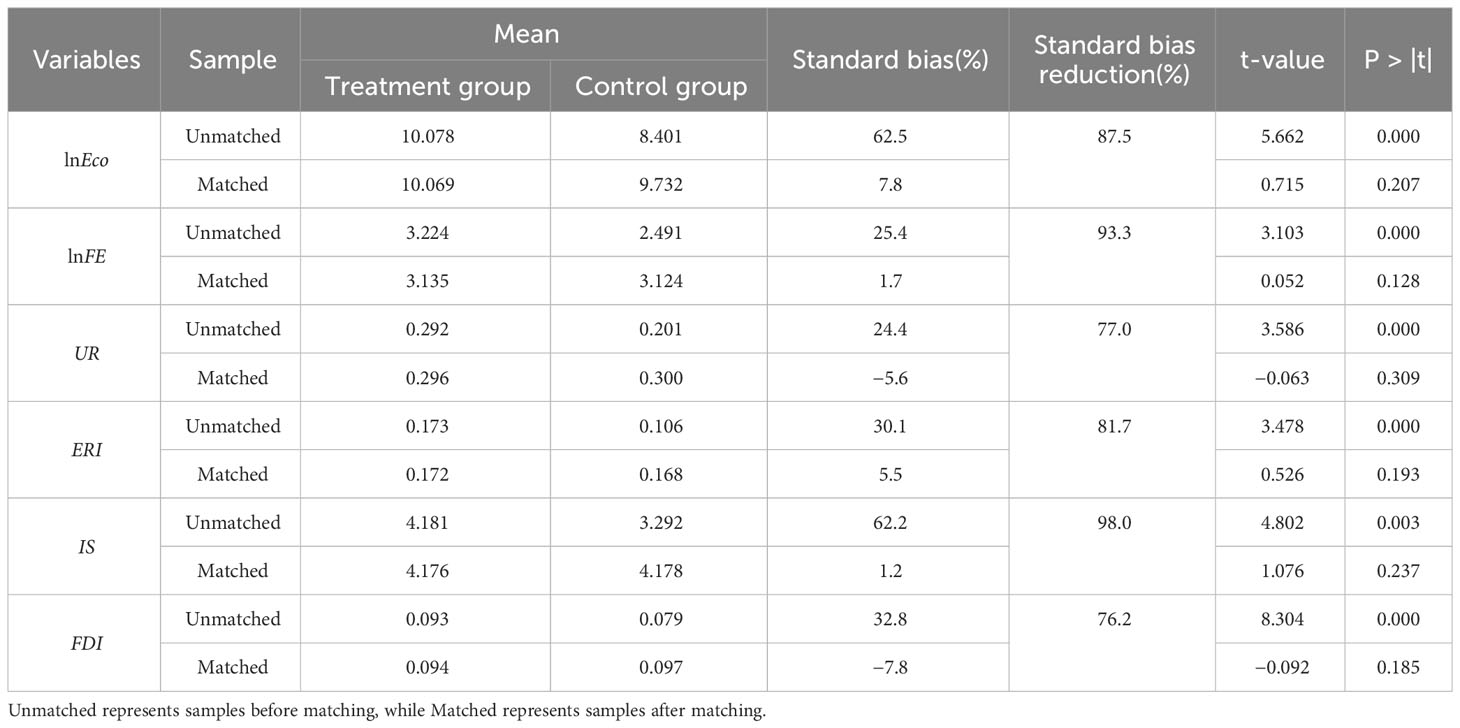

5.1 Propensity score matching and testing

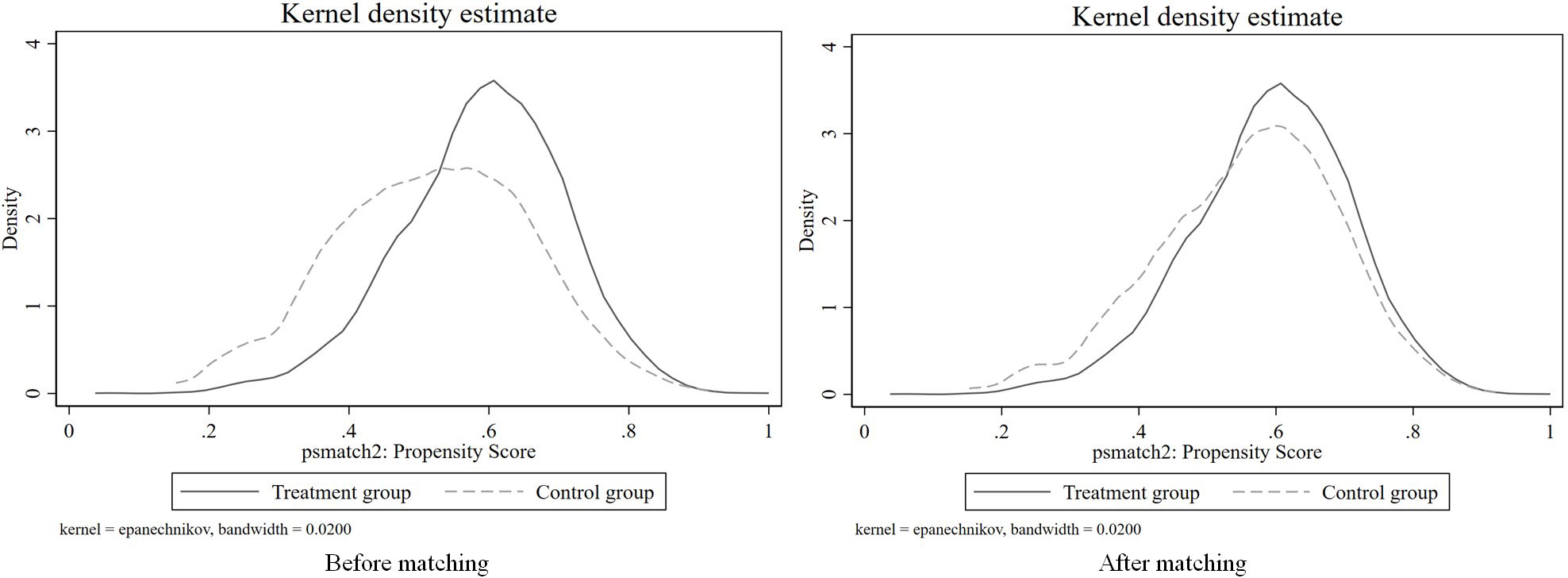

The kernel matching method was used for PSM. After the propensity score was obtained, a balance test was needed to verify whether the matching results eliminated the systematic differences between the treatment group and the control group. As seen from the test results in Table 3, there were significant differences in covariates between the treatment group and the control group before matching. The absolute values of the mean differences of covariates after matching are both less than 10% and lower than the differences before matching, and the t statistics are not significant. This shows that after matching, there is no systematic difference between the treatment group and the control group, and the matching effect is good, and the balance test is passed.

PSM also needs to meet the common support conditions and eliminate some samples outside the overlapping region to improve the quality of sample matching and increase the effectiveness of PSM. Figure 2 shows that the probability distribution of propensity scores between the prematching treatment group and the control group is significantly different and the overlap area is small. Compared with before matching, the probability distribution between the two groups was more consistent, and the overlap area between the two groups was smaller than that before matching. Through the balance test and common support test, it can be seen that the samples obtained after matching eliminate systematic differences and selective bias, and a more suitable matching sample is obtained, and the PSM strategy is effective.

Figure 2 Propensity score kernel density distribution between the treatment group and control group before and after matching.

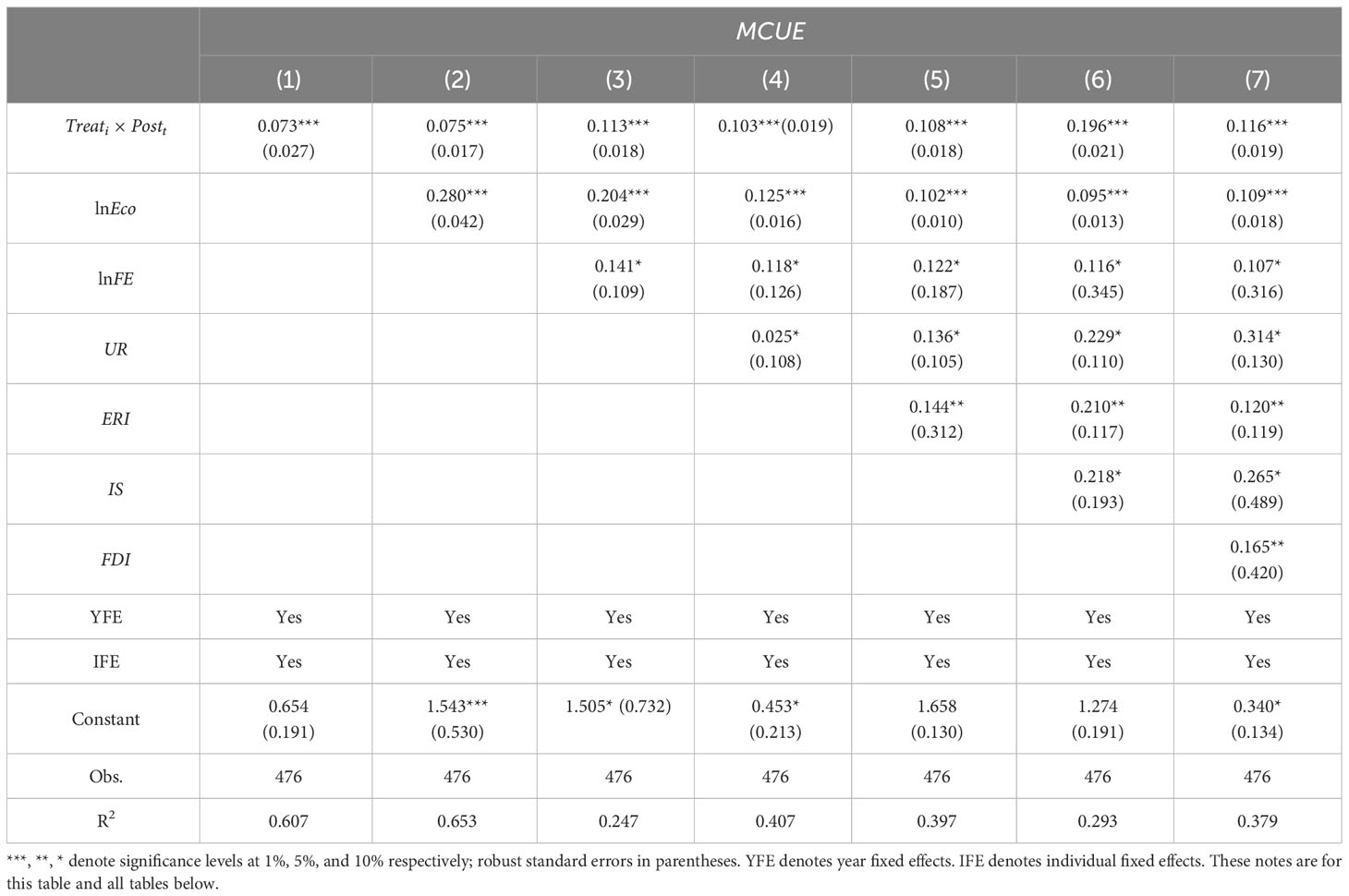

5.2 PSM-DID regression results and analysis

To test the impact of the environmental protection tax policy on the carbon unlocking efficiency of manufacturing, the PSM-DID model is adopted in this paper for regression estimation according to Equation (2), and the estimated results are shown in Table 4. The results in Column (1) of Table 4 show that the estimated coefficient of is positive at the significance level of 1% when only individual fixed effects and time fixed effects are controlled and no other control variables are included. The estimated coefficient of is still positive at the significance level of 1% when the control variables affecting the carbon unlocking efficiency of manufacturing are gradually added in Columns (2) to (7). In Column (7), after adding all control variables, the estimated coefficient of is 0.097. This shows that with other conditions unchanged, compared with the provinces (municipalities) that did not raise the environmental protection tax rate standard, the manufacturing carbon unlocking efficiency level of the provinces (municipalities) that raised the tax rate standard increased by approximately 9.7% on average. This means that the environmental protection tax policy can drive carbon unlocking in manufacturing industry, which preliminarily validates the research hypothesis H1 proposed in this paper.

5.3 Parallel trend test and dynamic effect analysis

An important prerequisite for the use of DID is that the treatment group and the control group meet the parallel trend hypothesis; that is, in the absence of environmental protection tax policy intervention, the change trend of carbon unlocking efficiency in manufacturing in the treatment group and the control group is consistent. The event study method is adopted in this paper to conduct a parallel trend test, and the model is constructed as follows.

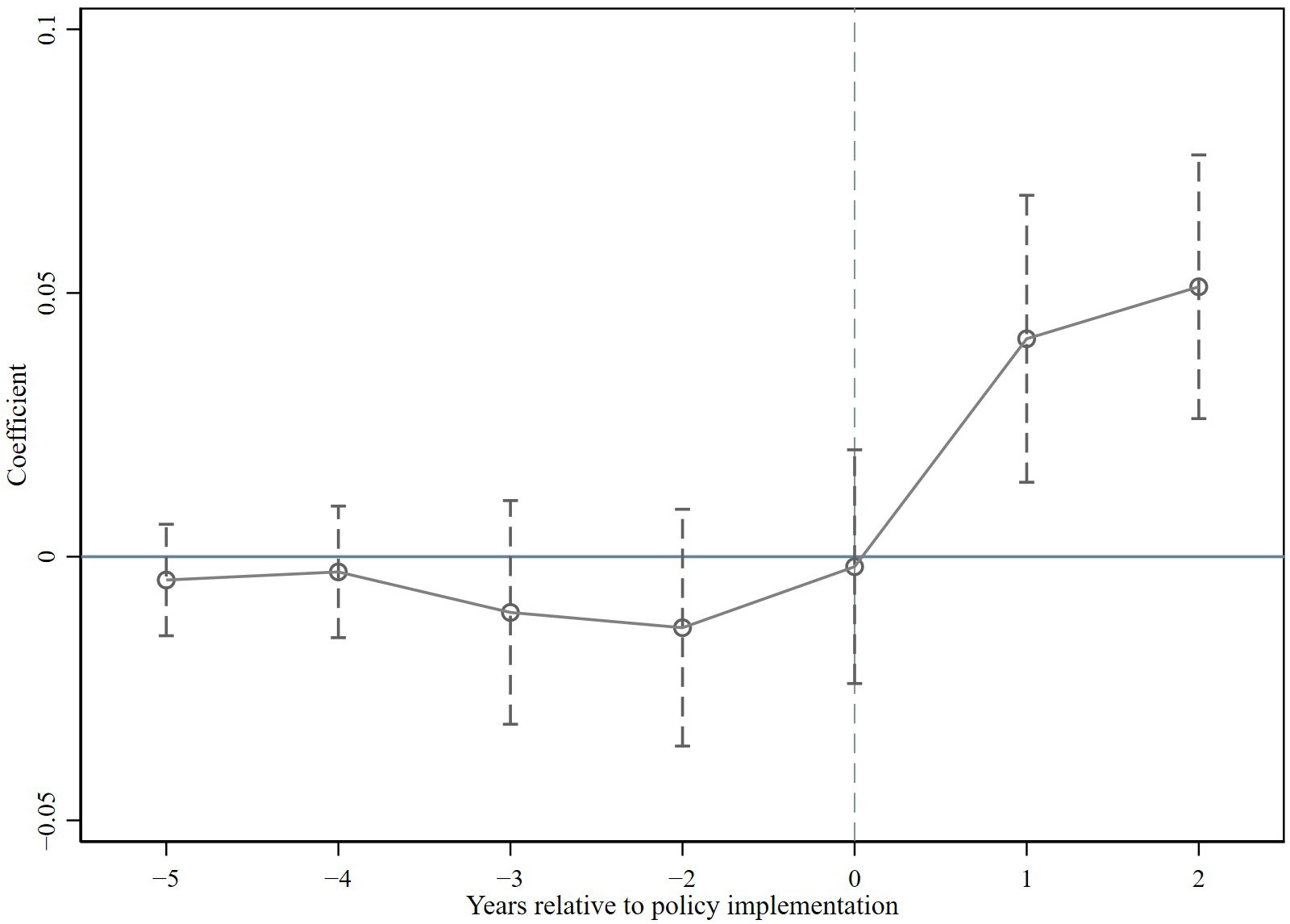

In Equation (7), is a dummy variable, representing the event of the implementation of the environmental protection tax policy. denotes the year in which province (municipality) implemented the environmental protection tax policy. A negative number of represents years before the implementation of China’s environmental protection tax policy, and a positive number represents years after the implementation of China’s environmental protection tax policy. The coefficient is the difference between the treatment and control groups in a given year. To avoid the problem of complete collinearity, the first period before the implementation of the policy is taken as the base group, so the data is missing in Figure 3, and more than 5 periods before and after the implementation of the policy are merged into the fifth period. As shown in Figure 3, before the implementation of the environmental protection tax policy, the differences between the treatment group and the control group were not significant and fluctuated around 0, that is, there was no systematic difference in the carbon unlocking efficiency of manufacturing between the treatment group and the control group. Therefore, the model passes the parallel trend test. In addition, the regression coefficient began to increase gradually after the implementation of the policy, indicating that the policy effect of the environmental protection tax on the carbon unlocking efficiency of manufacturing has become increasingly stronger over time.

5.4 Robustness tests

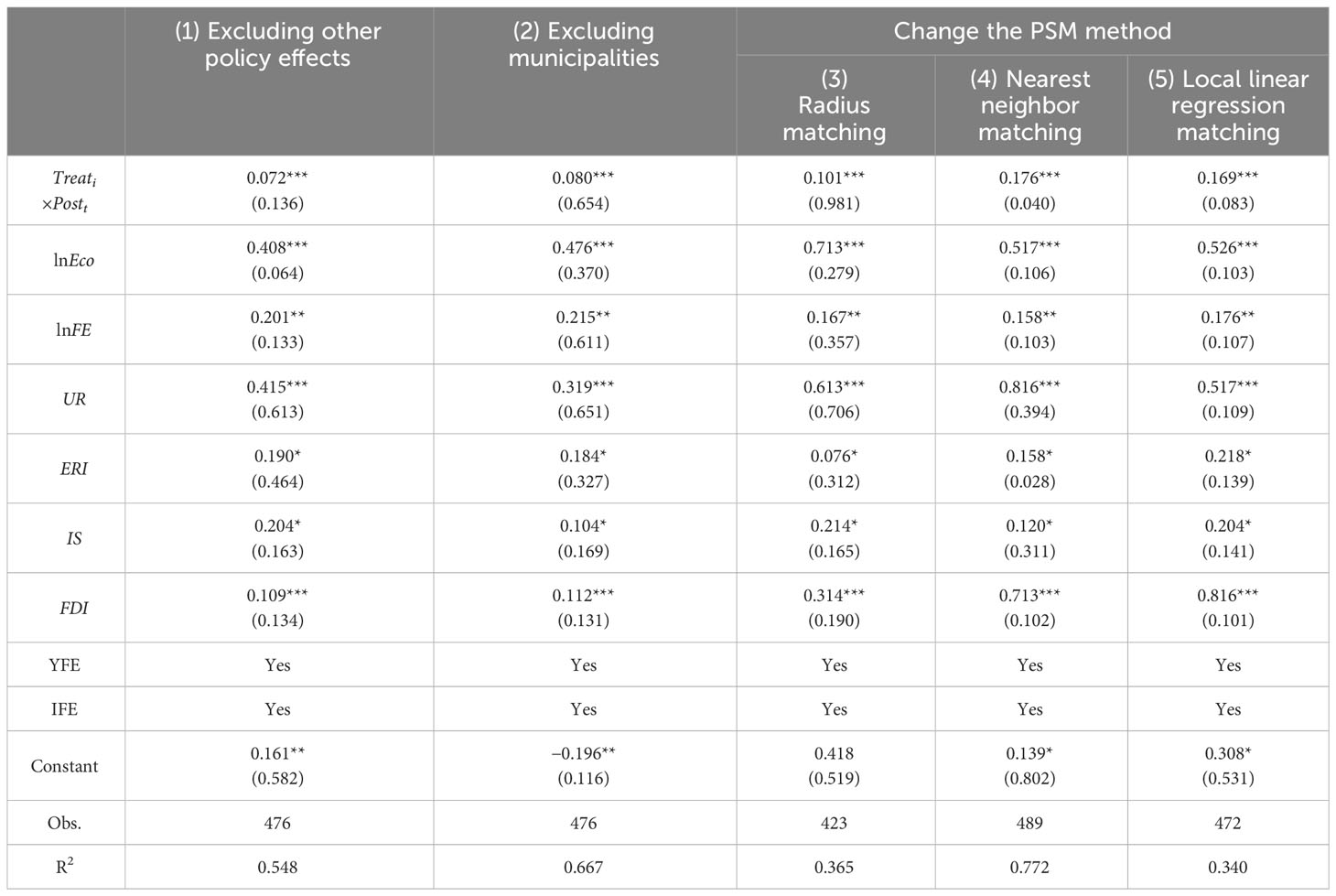

5.4.1 Excluding other policy effects

To further ensure the robustness of the baseline regression results, other policies that may affect carbon unlocking in manufacturing are discussed in this study to exclude the effect of other policies on the results. Since 2011, China has implemented the carbon emission trading system in seven provinces (municipalities), including Beijing and Tianjin. The carbon emission trading system may have a certain effect on the carbon unlocking efficiency of manufacturing. In this paper, carbon emission trading pilot areas are deleted for testing to eliminate possible estimation biases. The test results are shown in Column (1) of Table 5. It is found that the coefficient of core explanatory variable is always significantly positive. This suggests that competitive policy has no effect on the significance of the baseline regression results, thus excluding other policy effects.

5.4.2 Excluding municipalities directly under the central government

In China’s provincial administrative units, considering the special status and policy bias of municipalities directly under the central government, the samples of Beijing, Shanghai, Tianjin and Chongqing are excluded. Then the PSM-DID test was conducted again, and the test results were shown in Column (2) of Table 5. The regression results show that the coefficient of the core explanatory variable is significantly positive at the statistical level of 5%. It further proves that environmental protection tax policy has a positive impact on carbon unlocking efficiency of manufacturing industry.

5.4.3 Changing the PSM method

The weights and matching values corresponding to different PSM methods were different, resulting in differences in matching results. Therefore, in this paper, the matching method was changed, and radius matching, nearest neighbor matching and local linear regression matching were used to rematch the samples of the treatment group and the control group; then, DID regression was carried out. The results are shown in Columns (3) to (5) of Table 5. The results show that the coefficients of the core explanatory variables are significantly positive regardless of the matching method adopted, which further indicates that the baseline regression results are robust.

6 Further discussion: mechanism analysis, heterogeneity test and spatial spillover effects

6.1 Mechanism analysis

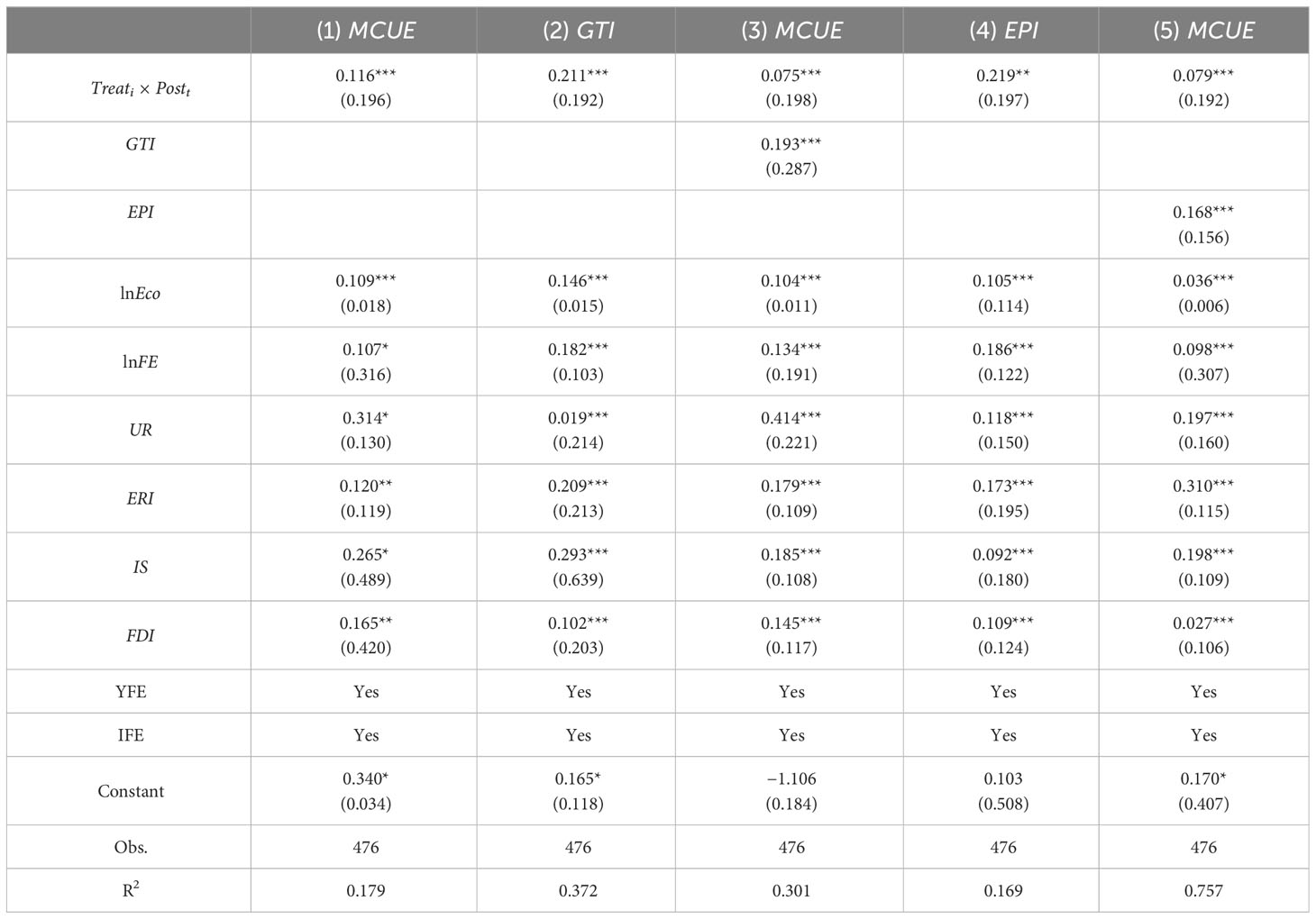

In the theoretical analysis section of this paper, green technology innovation and environmental protection investment were analyzed as the transmission mechanisms through which the environmental protection tax policy affects the carbon unlocking efficiency of manufacturing. An empirical analysis was conducted through Equations (2) to (4) to test the transmission mechanism hypothesis, and the test results are shown in Table 6. According to the idea of the step-by-step test, Column (1) of Table 6 confirms that China’s environmental protection tax policy can significantly improve the carbon unlocking efficiency of manufacturing. Column (2) of Table 6 verifies the impact of the environmental protection tax policy on the mechanism variable green technology innovation. The results show that the coefficient of is 0.211 and is significantly positive at 1% level, indicating that China’s environmental protection tax policy has a positive effect on green technology innovation. In Column (3) of Table 6, after adding green technology innovation, the coefficient is 0.075, which is lower than the core explanatory variable coefficient in the benchmark regression, indicating that there is a partial mediating effect of green technology innovation in the pathway of China’s environmental protection tax policy to improve the efficiency of carbon unlocking in manufacturing. The mediating effect is 0.040, which accounts for 35.106% of the total effect. This indicates that green technology innovation is an important mechanism for China’s environmental protection tax policy to improve the carbon unlocking efficiency of manufacturing, and the research hypothesis H2 is supported.

Similarly, on the premise that Column (1) of Table 6 has proven that China’s environmental protection tax policy has a significant impact on the carbon unlocking efficiency of manufacturing, Column (4) of Table 6 verifies the impact of the environmental protection tax policy on the mediating variable environmental protection investment. The results show that the coefficient of is 0.219 and significantly positive at the 5% level. This shows that the environmental protection tax policy has a positive promoting effect on environmental protection investment. In Column (5) of Table 6, when environmental protection investment variables are added, the coefficient is 0.079, which is lower than the benchmark regression, indicating that environmental protection investment has a partial mediating effect. Among them, the mediating effect is 0.036, accounting for 31.717% of the total effect. This shows that increasing environmental protection investment is an important mechanism for the environmental protection tax to improve the carbon unlocking efficiency of manufacturing, and the research hypothesis H3 is supported.

6.2 Heterogeneity test

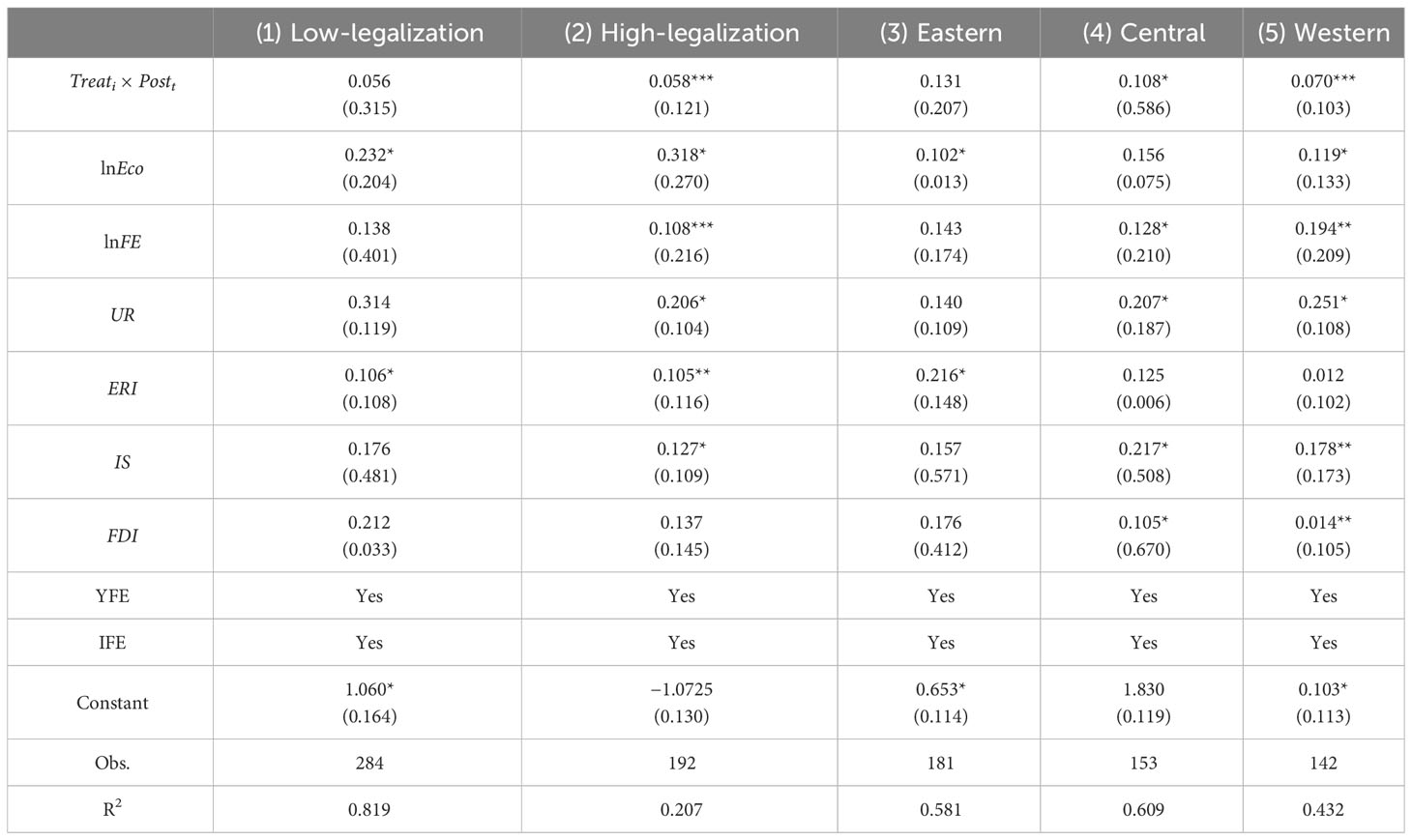

6.2.1 Heterogeneity of the legal environment

The process of legalization varies widely across regions of China and is influenced by factors such as the level of economic development, history and culture. The environment of the legal system affects the efficiency of law enforcement, and thus affects the impact of the environmental protection tax policy. The “Development of market intermediary organizations and legal system Environment Index” in China’s Provincial Marketization Index Report by Wang et al. (2020) is adopted as a surrogate variable for the process of provincial (municipal) legalization. Based on the annual mean value of the score index, the whole sample was divided into samples from regions with high legalization processes and samples from regions with low legalization processes, and then subsample PSM-DID test was conducted. The specific results are shown in Columns (1) and (2) of Table 7. The results show that the coefficient of the core explanatory variable is significantly positive in the area of high legalization process, while the coefficient of is positive but not significant in the area of low legalization process. This shows that in areas with high legalization, the environmental protection tax policy has a more significant effect on the carbon unlocking efficiency of manufacturing. The reason may be that in areas with a poor legal system environment, the enforcement of laws and regulations is relatively small, resulting in a small effect of the environmental protection tax policy on the carbon unlocking efficiency of manufacturing. In areas with environmentally friendly legal systems, the efficiency of law enforcement is higher, the principle of handling affairs in accordance with rules and regulations is stronger, and the effect of the environmental protection tax policy on improving the carbon unlocking efficiency of manufacturing is more significant. Therefore, optimizing the legal environment can support China’s environmental protection tax to improve the carbon unlocking efficiency of manufacturing.

6.2.2 Geographical location heterogeneity

There are great differences in economic development level and resource endowment among the regions in China, which may lead to regional heterogeneity in the impact of China’s environmental protection tax policy on the carbon unlocking efficiency of manufacturing. In this paper, the total sample was divided into three subsamples in the eastern, central and western regions, and then PSM-DID regression analysis was performed. The regression results are shown in Columns (3) to (5) of Table 7. The results show that the impact of China’s environmental protection tax policy on carbon unlocking in manufacturing is significantly positive in the central and western regions but not significant in the eastern region. The reason may be that the central and western regions mainly use traditional energy, so the environmental protection tax policy has a significant effect on reducing pollution and carbon emissions in the central and western regions. In the relatively developed eastern part of the economy, economic development is more dependent on manufacturing with high energy consumption and high pollution, which increases the unexpected output in the development process of manufacturing, making the effect of China’s environmental protection tax policy on carbon unlocking in manufacturing insignificant. Therefore, it is of great significance to exert the effect of the environmental protection tax policy according to local conditions. In the relatively developed eastern part of the economy, economic development is more dependent on manufacturing with high energy consumption and high pollution, which increases the undesirable output in the development process of manufacturing, making the effect of China’s environmental protection tax policy on carbon unlocking in manufacturing insignificant. Therefore, it is of great significance to exert the effect of the environmental protection tax policy according to local conditions.

6.3 Spatial spillover effects of environmental protection tax policy

6.3.1 Spatial econometric modelling

It is confirmed above that environmental protection tax policy significantly drives carbon unlocking in manufacturing industry, but its impact on neighboring provinces (municipalities) is uncertain. In order to further evaluate whether environmental protection tax policy brings carbon unlocking effect in manufacturing industry to neighboring provinces (municipalities), this paper establishes a spatial Durbin model to test the carbon unlocking effect of environmental protection tax policy in manufacturing industry. The specific model is as follows:

where is the spatial weight matrix and represents the spatial autoregressive coefficient. and are the elasticity coefficients of the core explanatory variables as well as the spatial interaction terms of the control variables. The other variable definitions are set to be consistent with Equation (2).

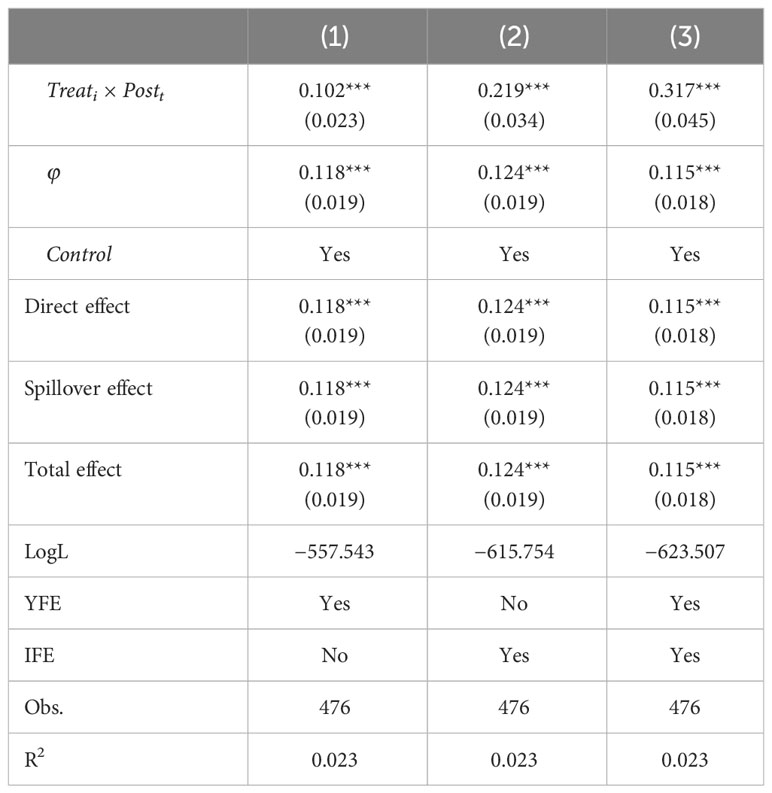

6.3.2 Regression results of spatial Durbin model and analysis of game competition among local governments

The regression results of the spatial Durbin model are shown in Table 8, columns (1) to (3) are the regression results controlling for individual fixed effects, time fixed effects and individual time double fixed, respectively, the spatial autocorrelation coefficient is positive and significant at 1% level, indicating that the environmental protection tax policy has a strong spatial spillover effect. The coefficients of the interaction term are 0.102, 0.219 and 0.317, respectively, and all of them are significant at the 5% level. This result indicates that the environmental protection tax policy promotes the carbon unlocking of manufacturing industries in neighbouring provinces (municipalities).

The implementation of the environmental protection tax policy may lead high-emission manufacturing enterprises to consider relocating to neighbouring provinces (municipalities) with lower tax burdens in the face of increased tax burdens. In order to compete for the relocation of manufacturing enterprises, local governments in neighbouring provinces (municipalities) may adopt a series of measures, such as lowering taxes and providing favorable conditions such as land and infrastructure, to attract enterprises to settle. This will trigger competition among local governments for the settlement and investment of manufacturing enterprises. In addition, the implementation of the environmental protection tax law will help improve environmental quality and reduce pollution emissions. If neighbouring provinces (municipalities) do not invest enough in environmental governance or have relatively poor environmental quality, manufacturing enterprises may choose to move to areas with better environmental quality. This will lead to increased competition from neighbouring provinces (municipalities), and local governments may increase investment in environmental governance and improve environmental quality to attract firms to settle. In the game of competition between local governments, factors such as economic development, environmental protection and social stability need to be considered comprehensively. Local governments can attract manufacturing firms to settle and stay in their localities by formulating favorable policies, providing infrastructure and talent support, and promoting economic development and employment growth. At the same time, local governments need to strengthen collaboration and cooperation to promote interregional synergistic development and avoid excessive competition and waste of resources.

7 Discussion

The essence of carbon unlocking is to reduce carbon emissions while maintaining sustained and stable economic growth, which includes the meaning of ecological and environmental and socio-economic benefits. This study takes the implementation of China’s environmental protection tax law as a quasi-natural experiment to examine the policy effect of environmental protection tax on carbon unlocking in manufacturing. The empirical results show that environmental protection tax can significantly improve the carbon unlocking efficiency of manufacturing industry. Previous studies mainly focused on the impact of environmental protection tax on green development, environmental pollution and economic development (Abdullah and Morley, 2014; Alexeev et al., 2016; Freire-González, 2018; Klenert et al., 2018). In addition, research on carbon unlocking mainly focuses on the connotation, internal mechanism, unlocking path and unlocking policy of carbon unlocking (Berkhout et al., 2010; Unruh, 2000; Wang et al., 2022; Li et al., 2023; Zhao et al., 2023). There are no studies that incorporate environmental protection taxes and manufacturing carbon unlocking into the same research framework. Closer to this study, some scholars have explored the impact of China’s environmental protection tax policy on carbon emissions (Li and Masui, 2019; Gao et al., 2022). This paper examines the policy effect of environmental protection tax on carbon unlocking from the perspective of manufacturing industry, which fills the research gap on the impact of environmental protection tax on carbon unlocking efficiency of manufacturing industry, and finds a new way to improve the efficiency of carbon unlocking in manufacturing industry. In addition, the policy effect of environmental protection tax is significantly heterogeneous across samples, and is more significant in western regions and regions with high legalization process. The mechanism test shows that green technology innovation and increased environmental protection investment are important channels for environmental protection tax to enhance the carbon unlocking efficiency of manufacturing industry. The findings provide strong support for clarifying the underlying mechanisms of the impact of environmental protection tax on carbon unlocking in the manufacturing industry, as well as for the Chinese government to formulate carbon unlocking policies.

However, there are several limitations in this study. First, the measurement of carbon unlocking efficiency in the manufacturing industry has not formed a unified standard, and the index system of carbon unlocking efficiency in the manufacturing industry can be further enriched in future research. Second, the research of transmission mechanism in this paper is an empirical analysis from the two aspects of green technology innovation and increasing investment in environmental protection. Whether environmental protection tax policy can affect the carbon unlocking efficiency of manufacturing industry through other transmission mechanisms remains to be further discussed. Third, because relevant data are not available after 2020, it is impossible to examine the long-term effects of the policy, which needs to be further studied in the future.

8 Conclusions and policy implications

Promoting the green and low-carbon development of the manufacturing industry has become a major issue in achieving the “double carbon” goal and implementing the strategy of China’s manufacturing power. Manufacturing is an important engine of national economic growth but also a major sector of energy consumption and carbon emissions. As a green tax system, whether China’s environmental protection tax policy can effectively promote carbon unlocking in manufacturing industry needs to be further discussed. Based on provincial panel data from 2004 to 2020, this paper uses the PSM-DID method to explore the impact of environmental protection tax policies on carbon unlocking efficiency in the manufacturing industry. The conclusions are as follows. First, the environmental protection tax policy has a significant positive impact on the carbon unlocking efficiency of manufacturing, and with the passage of time, this positive impact shows a gradually increasing trend. Second, the impact mechanism of the environmental protection tax policy on the carbon unlocking efficiency of the manufacturing industry lies in green technology innovation and an increase in environmental protection investment; that is, the environmental protection tax policy can enhance the carbon unlocking efficiency of the manufacturing industry by stimulating enterprises to innovate green technology and increase environmental protection investment. Third, the impact of the environmental protection tax policy on the carbon unlocking efficiency of manufacturing is more significant in the central and western regions and regions with high legalization processes.

The above research findings provide useful implications for the government to optimize the environmental protection tax system and improve the carbon unlocking efficiency of the manufacturing industry to achieve low-carbon sustainable development. First, the environmental protection tax system should be optimized and improved, more reasonable environmental protection tax standards should be formulated, polluters should be encouraged to innovate in reducing pollution and carbon emissions, and the policy effect of environmental protection taxes should be given full play to improve the carbon unlocking efficiency of manufacturing. Second, there is the driving mechanism design of the environmental protection tax system on the carbon unlocking efficiency of the manufacturing industry. On the one hand, the government can give differentiated investment in environmental protection for areas with a weak economic foundation and more dependence on manufacturing, give more local financial investment, and provide more adequate funds for the local manufacturing industry to increase environmental protection investment, purchase emission reduction and pollution control equipment, and invest in green production methods. On the other hand, the environmental protection tax policy dominated by the innovation and research and development system of manufacturing enterprises should be improved. We will focus on increasing tax incentives and deductions for substantive innovation in industries such as clean industries, high-tech industries, and reproducible industries, stimulate the impetus for green innovation through fiscal policies such as tax cuts and subsidies, guide the continuous iteration of relevant technologies, and realize the transformation of pollutants from the end to the source of carbon reduction and efficiency improvement. Third, there is heterogeneity in the impact of environmental protection tax policies on carbon unlocking efficiency in manufacturing. The heterogeneous characteristics of enterprises should be fully considered. On the one hand, for enterprises in different regions, the setting of environmental protection tax rules according to local conditions can increase the tax rate of the manufacturing industry in the central and eastern regions to a certain extent, promote its transformation and development, and stimulate it to improve the carbon unlocking efficiency of the manufacturing industry. On the other hand, reasonable enforcement of environmental protection taxes should be set up to ensure that local governments independently have higher ownership of tax revenue and discretion over tax collection standards, optimize the legal environment and business environment, and create favorable conditions for improving the carbon unlocking efficiency of manufacturing.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

LW: Conceptualization, Formal analysis, Writing – review & editing. SS: Data curation, Methodology, Writing – original draft.

Funding

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. This article is supported by the National Natural Science Foundation of China (72263019), the Ganpo Juncai Support Program – Cultural Leading Talent Training Project (2023), and the Jiangxi Provincial Natural Science Foundation (No. 20224BCD41001).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

- ^ The energy consumption data of the manufacturing industry is obtained from the China Energy Statistical Yearbook; the carbon emission data of the manufacturing industry is estimated by using IPCC guidelines.

References

Abdullah S., Morley B. (2014). Environmental taxes and economic growth: Evidence from panel causality tests. Energy Econ. 42, 27–33. doi: 10.1016/j.eneco.2013.11.013

Alexeev A., Good D. H., Krutilla K. (2016). Environmental taxation and the double dividend in decentralized jurisdictions. Ecol. Econ. 122, 90–100. doi: 10.1016/j.ecolecon.2015.12.004

André F. J., Cardenete M. A., Velázquez E. (2005). Performing an environmental tax reform in a regional economy: A computable general equilibrium approach. Ann. Reg. Sci. 39, 375–392. doi: 10.1007/s00168-005-0231-3

Baron R. M., Kenny D. A. (1986). The moderator-mediator variable distinction in social psychological research: conceptual, strategic, and statistical considerations. J. Pers. Soc Psychol. 51, 1173–1182. doi: 10.1037/0022-3514.51.6.1173

Berkhout F., Verbong G., Wieczorek A. J., Raven R., Lebel L., Bai X. M. (2010). Sustainability experiments in Asia: innovations shaping alternative development pathways? Environ. Sci. Policy 13, 261–271. doi: 10.1016/j.envsci.2010.03.010

Cheng Z. C., Chen X. Y., Wen H. W. (2022). How does environmental protection tax affect corporate environmental investment? Evidence from chinese listed enterprises. Sustainability 14 (5), 2932. doi: 10.3390/su14052932

Chiroleu-Assouline M., Fodha M. (2014). From regressive pollution taxes to progressive environmental tax reforms. Eur. Econ. Rev. 69, 126–142. doi: 10.1016/j.euroecorev.2013.12.006

Creutzig F., Mattauch L. (2013). Beyond GDP: measuring welfare and assessing sustainability. Ecol. Econ. 94, 164–165. doi: 10.1016/j.ecolecon.2013.06.006

Deschenes O., Greenstone M., Shapiro J. S. (2017). Defensive Investments and the Demand for Air Quality: Evidence from the NOx Budget Program. Am. Econ. Rev. .107 (10), 2958–2989. doi: 10.1257/aer.20131002

Fan Y., Wu S. Z., Lu Y. T., Zhao Y. H. (2019). Study on the effect of the environmental protection industry and investment for the national economy: An input-output perspective. J. Cleaner Prod. 227, 1093–1106. doi: 10.1016/j.jclepro.2019.04.266

Fang G. C., Chen G., Yang K., Yin W., Tian L. (2023a). Can green tax policy promote China’s energy transformation?—A nonlinear analysis from production and consumption perspectives. Energy 269, 126818. doi: 10.1016/j.energy.2023.126818

Fang G. C., Yang K., Chen G., Tian L. X. (2023b). Environmental protection tax superseded pollution fees, does China effectively abate ecological footprints? J. Cleaner Prod. 388, 135846. doi: 10.1016/j.jclepro.2023.135846

Fang G. C., Yang K., Tian L. X., Ma Y. T. (2022). Can environmental tax promote renewable energy consumption?—An empirical study from the typical countries along the Belt and Road. Energy 260, 125193. doi: 10.1016/j.energy.2022.125193

Freire-González J. (2018). Environmental taxation and the double dividend hypothesis in CGE modelling literature: A critical review. J. Policy Model. 40, 194–223. doi: 10.1016/j.jpolmod.2017.11.002

Gao X. W., Liu N., Hua Y. J. (2022). Environmental Protection Tax Law on the synergy of pollution reduction and carbon reduction in China: Evidence from a panel data of 107 cities. Sustain. Prod. Consumption 33, 425–437. doi: 10.1016/j.spc.2022.07.006

Gopal M., Lemu H. G., Gutema E. M. (2023). Sustainable additive manufacturing and environmental implications: literature review. Sustainability 15, 504. doi: 10.3390/su15010504

He Y., Wen C. H., Zheng H. (2020). Does China’s environmental protection tax law effectively influence firms? Evidence from stock markets. Emerging Mark. Finance Trade 57 (15), 4436–4447. doi: 10.1080/1540496X.2020.1822810

Heckman J. J., Ichimura H., Todd P. E. (1997). Matching as an Econometric Evaluation Estimator: Evidence from Evaluating a job training program. Rev. Econ. Stud. 64, 605–654. doi: 10.2307/2971733

Heckman J. J., Ichimura H., Todd P. E. (1998). Matching as an economic evaluation estimator. Rev. Econ. Stud. 65, 261–294. doi: 10.1111/1467-937X.00044

Hettich F. (1998). Growth effects of a revenue-neutral environmental tax reform. J. Econ. 67, 287–316. doi: 10.1007/BF01234647

Jin B. L., Han Y. (2021). Influencing factors and decoupling analysis of carbon emissions in China’s manufacturing industry. Environ. Sci. pollut. Res. 28, 64719–64738. doi: 10.1007/s11356-021-15548-0

Jin Z. D., Li Z., Yang M. (2022). Producer services development and manufacturing carbon intensity: Evidence from an international perspective. Energy Policy 170, 113253. doi: 10.1016/j.enpol.2022.113253

Klenert D., Schwerhoff G., Edenhofer O., Mattauch L. (2018). Environmental taxation, inequality and Engel’s law: The double dividend of redistribution. Environ. Resour. Econ. 71, 605–624. doi: 10.1007/s10640-016-0070-y

Li D. L., Zhou Z. H., Cao L. J., Zhao K. K., Li B., Ding C. (2023). What drives the change in China’s provincial industrial carbon unlocking efficiency? Evidence from a geographically and temporally weighted regression model. Sci. Total Environ. 856, 158971. doi: 10.1016/j.scitotenv.2022.158971

Li F. S., Xu X. L., Li Z. W., Du P. C., Ye J. F. (2021). Can low-carbon technological innovation truly improve enterprise performance? The case of Chinese manufacturing companies. J. Cleaner Prod. 293, 125949. doi: 10.1016/j.jclepro.2021.125949

Li G., Masui T. (2019). Assessing the impacts of China’s environmental tax using a dynamic computable general equilibrium model. J. Cleaner Prod. 208, 316–324. doi: 10.1016/j.jclepro.2018.10.016

Liu M. Z., Wen J. X., Meng Y. D., Yang X. T., Wang J. F., Wu J. X., et al. (2023). Carbon emission structure decomposition analysis of manufacturing industry from the perspective of input-output subsystem: a case study of China. Environ. Sci. pollut. Res. 30, 19012–19029. doi: 10.1007/s11356-022-23334-9

Liu Q. C., Liu S. F., Kong L. Q. (2015). Decomposition and decoupling analysis of energy-related carbon emissions from China manufacturing. Math. Probl. Eng. 2015, 268286. doi: 10.1155/2015/268286

Mattauch L., Creutzig F., Edenhofer O. (2015). Avoiding carbon lock-in: Policy options for advancing structural change. Econ. Model. 50, 49–63. doi: 10.1016/j.econmod.2015.06.002

Maung M., Wilson C., Tang X. (2016). Political connections and industrial pollution: evidence based on state ownership and environmental levies in China. J. Bus. Ethics 138, 649–659. doi: 10.1007/s10551-015-2771-5

Peng C., Guo X. L., Long H. (2022). Carbon intensity and green transition in the chinese manufacturing industry. Energies 15, 6012. doi: 10.3390/en15166012

Porter M. E., Vanderlinde C. (1995). Toward a new conception of the environment-competitiveness relationship. J. Econ. Perspect. 9, 97–118. doi: 10.1257/jep.9.4.97

Sanden B. A., Azar C. (2005). Near-term technology policies for long-term climate targets economy wide versus technology specific approaches. Energy Policy 33, 1557–1576. doi: 10.1016/j.enpol.2004.01.012

Sun N. (2011). Carbon emission reduction of manufacturing rely on technical progress. Forum Sci. Technol. China 04, 44–48. doi: 10.13580/j.cnki.fstc.2011.04.008

Tian L. H., Guan X., Li Z., Li X. (2022). Reform of environmental protection fee-to-tax and enterprise environmental protection investment: A quasi-natural experiment based on the implementation of the environmental protection tax law. J. Finance Econ. 48, 32–46. doi: 10.16538/j.cnki.jfe.20220317.102

Tone K. (2002). A slacks-based measure of super-efficiency in data envelopment analysis. Eur. J. Oper. Res. 143, 32–41. doi: 10.1016/S0377-2217(01)00324-1

Tu Q. Y., Wang Y. (2021). New environmental protection taxes in China from the perspective of environmental economics. Discrete Dyn. Nat. Soc 2021, 8622081. doi: 10.1155/2021/8622081

Unruh G. C. (2000). Understanding carbon lock-in. Energy Policy 28, 817–830. doi: 10.1016/S0301-4215(00)00070-7

Unruh G. C. (2002). Escaping carbon lock-in. Energy Policy 30, 317–325. doi: 10.1016/S0301-4215(01)00098-2

Unruh G. C., Carrillo-Hermosilla J. (2006). Globalizing carbon lock-in. Energy Policy 34, 1185–1197. doi: 10.1016/j.enpol.2004.10.013

Vieira L. C., Longo M., Mura M. (2021). Are the European manufacturing and energy sectors on track for achieving net-zero emissions in 2050? An empirical analysis. Energy Policy 156, 112464. doi: 10.1016/j.enpol.2021.112464

Wang X. L., Fan G., Li X. P. (2020). China's Provincial Marketization Index Report. China Reform Yearbook, 739–746. doi: 10.42054/y.cnki.ytrqq.2020.001101

Wang X. Y., Du Q., Lu C., Li J. T. (2022). Exploration in carbon emission reduction effect of low-carbon practices in prefabricated building supply chain. J. Cleaner Prod. 368, 133153. doi: 10.1016/j.jclepro.2022.133153

Xie L. H. (2009). Carbon Lock-in, Unlocking and Low Carbon Development. China Opening Herald 5, 8–14. doi: 10.19625/j.cnki.cn44-1338/f.2009.05.002

Xie L. L., Zuo S. Y., Xie Z. Q. (2023). Environmental protection fee-to-tax and enterprise investment efficiency: Evidence from China. Res. Int. Bus. Fin. 66, 102057. doi: 10.1016/j.ribaf.2023.102057