95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Ecol. Evol. , 01 December 2022

Sec. Interdisciplinary Climate Studies

Volume 10 - 2022 | https://doi.org/10.3389/fevo.2022.1063736

This article is part of the Research Topic Environmental Risk and Corporate Behaviour View all 30 articles

Currently, environmental, social, and corporate governance (ESG) has become an all-pervasive term in the industrial sector, owing to its significant impact on corporate decision-making. While most of the studies provide evidence that the ESG significantly improves a firm's performance and value in the long run, few studies quantitatively analyzed the linkage between ESG and total factor productivity (TFP). Using the data of Chinese-listed companies during 2010–2020, we found that there is a positive relationship between ESG performance and TFP. ESG also improves the corporate TFP by reducing the financial constraints and improving the innovation input. Our extended analysis revealed that this beneficial effect tends to be stronger for SOEs (state-owned enterprises) and industries with high pollution levels. This study also brought to light some implications for Chinese firms in relation to their ESG practices and sustainable development.

Environmental, social, and corporate governance are abbreviated as ESG, which was proposed by the United Nations (UN) in 2004. In recent years, the issues of sustainability and ESG activities are getting growing attention. For example, Lins et al. (2017) investigated the performance of ESG firms during periods when the trust in corporations was at its low ebb. They arrived at the conclusion that firms that have ESG show higher performance and fetch higher returns than firms that lack ESG. Bruna et al. (2022) and Huang et al. (2022) noted that the enterprise's ESG strategies have a positive and significant impact on the enterprise value and financial performance. In emerging and developing countries, especially, ESG reduces the cost of capital and increases the value of companies (Wong et al., 2021). Meanwhile, any adverse ESG information also has a significant positive impact on the evaluation of enterprises (Wong and Zhang, 2022). ESG's importance in enterprises is steadily increasing and is gradually being applied to the process of enterprise governance, such as agency costs (Lambert et al., 2007), investment efficiency (Zhong and Gao, 2017), financial constraints (Fafaliou et al., 2022), cost of capital (Cheng et al., 2014; Capelle-Blancard and Petit, 2019), cost of debt (Gerwanski, 2020), and innovation capabilities of enterprises (Broadstock et al., 2021). The findings highlight the fact that the effect caused by firms' ESG has a long provenance in financial economics and enterprise governance.

With a continuous implementation of China's sustainable development strategy, the economy is shifting to the stage of high-quality development. Improving total factor productivity (TFP) is the best way to promote high-quality economic growth (Glawe and Wagner, 2019). TFP is an important indicator of enterprise production efficiency (Schoar, 2002; Barth et al., 2005) and a key determinant of the enterprise value (Tian and Twite, 2011). As a pillar of economy, TFP plays a crucial role in promoting corporate sustainable development. The previous literature examined the factors influencing TFP from the perspective of internal and external corporate governance. TFP is mainly influenced by financial constraints (Caggese and Cunat, 2013), R&D (Research and Development) (Sheu and Yang, 2005; Chiang and Lin, 2007), uncertainty in economic policies (Li et al., 2021), digital financial inclusion (Chen et al., 2022), value-added tax reforms (Peng et al., 2021), and so on. However, limited attention has been paid to the mechanism of ESG performance and TFP. In this context, what exactly is the impact of ESG on TFP? How does ESG affect TFP? The present study discusses the above two aspects to explore the factors affecting the change in total factor productivity (TFP).

We empirically studied the impact of ESG on TFP using data from Chinese-listed companies. Our sample includes 15,757 firm-year observations from 2010 to 2020. The data are derived from the China Stock Market & Accounting Research (CSMAR) database. We investigated whether ESG is related to TFP or not. We studied the potential channels whose technological innovation and financial constraints have an effect on the TFP by the mediating effect. We found that the ESG can significantly increase the TFP. The analyses of endogeneity, self-selection bias, and robustness tests support our conclusions further. From the mediating effect analysis, ESG increases TFP by enhancing the innovation capacity of enterprises and easing their financial constraints. From further analyses, we found that this significant effect is stronger among state-owned enterprises (SOEs) and heavy pollution firms.

The present study offers three major contributions to the research on ESG, which are given as follows: first, our research discusses the impact of ESG on TFP, enriching the existing literature on the influence of ESG. The existing literature focuses on the impact of ESG on the firm value (Azmi et al., 2021; Wong et al., 2021; Bofinger et al., 2022), idiosyncratic risk (He et al., 2022), financial risk (Shakil, 2021), cash flow (Gregory, 2022), default risk (Li et al., 2022), and costs of raising capital (Luo, 2022). However, the impact of ESG on TFP has not been given due attention. Second, our results indicate that ESG has a positive impact on TFP through the mediating effect of innovation capacity and financial constraints and contribute to the understanding of TFP. Given the significant impact of ESG on corporate governance, our research highlights the importance of ESG in corporate sustainable development.

The remaining of the present study is organized as follows. The next section shows a review of the literature and the hypotheses proposed. In the third section of research design, data, variables, and model design are described. In the fourth section, the empirical results, the robustness tests, and heterogeneity analysis are present. The final section presents the conclusion of the present study.

In recent years, environmental, social, and governance (ESG) is increasingly involved in planning and implementing corporate strategies (Durand et al., 2019; Huang et al., 2022). Hence, an increasing number of scholars and managers are beginning to pay extra attention to the impact of sustainability strategy on corporate performance (Margolis and Walsh, 2003; Shen and Chang, 2009; Fiandrino et al., 2019; Li et al., 2019). In addition, several bodies of literature have documented the positive impact of ESG strategies on a firm's performance, such as financial performance (Rettab et al., 2009; Hernández et al., 2020), innovation (Inigo and Albareda, 2019), financial constraints (Samet and Jarboui, 2017), and corporate reputation (Liu et al., 2014). At the same time, these factors affect TFP even further. TFP is an effective indicator to measure an enterprise's performance (Barth et al., 2005; Tian and Twite, 2011).

The existing literature suggests several possible channels through which ESG performance has a positive impact on total factor productivity. First, a high-quality ESG performance helps a firm to increase the steps taken toward innovation in the process of firm operation and development. The impact of promoting corporate social responsibility (CSR) activities on corporate performance originates from the enhancement of R&D (Research & Development) efforts (Lioui and Sharma, 2012), which too has a significant positive impact on TFP (Sheu and Yang, 2005; Chiang and Lin, 2007). A firm's ESG strategy initially enhances its ability to pursue innovative activities and then ultimately and positively impacts its financial/operational performance (Broadstock et al., 2021), thus improving the TFP of enterprises (Chang and Tang, 2021). Second, firms with a high-quality ESG performance are more effective in mitigating financial constraints and increasing TFP. Firms with a good performance of ESG have a lower default risk, lower financing costs, and higher cash holdings of enterprises (Li et al., 2022). For corporate managers, ESG is a good tool that reduces the cost of raising capital in the capital markets (Luo, 2022), which in turn enhance the firm's TFP. This leads to the first hypothesis.

Hypothesis 1. There is a positive association between ESG performance and total factor productivity (TFP).

ESG has become an important standard for the international community to measure the level of green and sustainable development of enterprises. Some people believe that environmental and social issues should be managed only by governments, and not companies, because governments alone are more capable of tackling such overwhelming issues. There are some differences between state-owned enterprises (SOEs) and non-state-owned enterprises with regard to business operation, management structure, and external environment. Hsu et al. (2021) considered firms from 45 countries that include state ownership companies. Their results showed that state-owned firms play a greater role and are more engaged in environmental and social issues than other firms and are even concentrated in energy firms and firms in emerging economies. Franceschelli et al. (2019) confirmed that ESG has a positive effect on an SOE's financial performance. Thus, the beneficial effect tends to be stronger for SOEs than for non-SOEs. This leads to the second hypothesis.

Hypothesis 2. The effect of ESG on TFP tends to be more evident for SOEs than for non-SOEs.

Environment has a profound impact on TFP, which serves as an important indicator of enterprise development. Environmental regulation presents a positive effect on TFP (Ai et al., 2020) and shows a much greater influence on heavy pollution industries when compared with non-heavy pollution industries (Yang et al., 2022). In heavy pollution industries, environmental regulation reduces the ability of the enterprise to introduce novel technological innovations (Shen et al., 2019). In addition, Doshi et al. (2013) found that heavy pollution enterprises face higher financing costs. In that case, better ESG engagement alone encourages heavy pollution enterprises to pursue R&D investment and decrease consequent financial constraints. Besides, for sustainable development, enterprises will further increase the disclosure of ESG information. Resource disclosure of ESG information will increase the free cash flow of an enterprise, decrease the financing cost (Plumlee et al., 2015), and increase the ability to bring in technological innovation. Thus, the beneficial effect of linking environmental regulation and TFP, which entails a decrease in cost factor, tends to be stronger for heavy pollution enterprises than for non-heavy pollution enterprises. This leads to the third hypothesis.

Hypothesis 3. The effect of ESG on TFP tends to be even more evident for heavy pollution enterprises than for non-heavy pollution enterprises.

In our study, we used the data of Chinese A-share-listed firms during the period 2010–2020. All financial data, ESG data, and TFP data were obtained from the China Stock Market and Accounting Research (CSMAR) database. The year 2010 was chosen as the beginning year of the sample period. The samples were screened according to the following criteria: (1) Financial firms and insurance firms were excluded from the sample; (2) the special treatment (ST and ST*) firms were excluded; and (3) the variables were winsorized at both the top and bottom 1% quantiles to reduce the potential impact of outliers. Following these criteria, the final sample comprised 15,757 firm-year observations.

To investigate the effect of ESG performance on TFP, we used the following model:

where for firm i and year t, the dependent variable is total factor productivity TFP, which is measured by the LP method (Levinsohn and Petrin, 2003). We also followed the method of Olley and Pakes (1996) to calculate the (log) level of TFP of firm i at year t using the non-parametric method to proxy TFP in the robustness test. The independent variable is ESG performance. Following Lin et al. (2021), we employed the ESG index to proxy ESG performance and transfer the ESG rating from AAA to C to numbers 1 to 9. A higher number in ESG rating means a higher ESG performance. This index has been developed by the Sino-Securities Index Information Service (Shanghai) Co. Ltd. for all listed firms in China.

The control variables Control include firm size (Size), return on assets (ROA), leverage (Lev), growth opportunity (Growth), and firm age (FirmAge). To compute the characteristics of corporate governance, we included the percentage of independent directors (Indep), duality of the chairman and CEO (Dual), the shareholding ratio of the top shareholder (Top1), and whether the firm is a state-owned firm (SOE). In addition, the industry and year are included in the model.

To test the mediating effect of financial constraint and R&D on the relationship between the ESG and the TFP, we estimated the following regression:

where KZ(RD)i,t represents the mediating variable. KZ is the mediating variable, and we used the KZ index as a quantitative indicator to measure the degree of financial constraint of the listed firm. The other mediating variable is the R&D intensity RD, which is measured by the ratio of R&D investment to operating income. Appendix A provides definitions of all variables that are used in our analysis.

Table 1 presents the descriptive statistics for the key variables. The mean value of TFP is 16.317, the standard deviation is 1.086, the maximum value is 20.518, and the minimum value is 12.954, which demonstrate that TFP is different among sample firms, but it is a normal distribution. The mean value of ESG is 6.444, which demonstrates that the level of ESG is between BBB and A. From Table 1, the average firm has a level of total assets (Size) of 22.24, ROA has an average (median) of 4.1% (4.1%), while the leverage (Lev) has a mean (median) of 0.416 (0.41). In addition, the firms of the sample have an average annual sales growth (Growth) of 0.177 and an average sum of cash scaled by total assets (Cash) of 0.049.

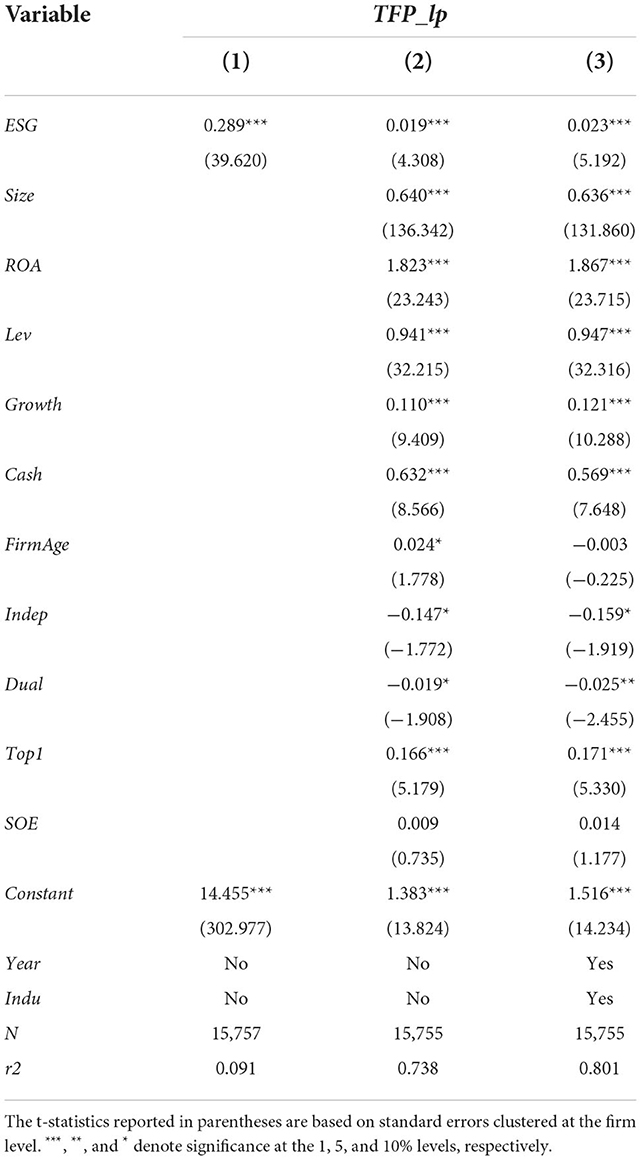

First, the main results, which show the influence of ESG on TFP, are discussed in Table 2. The control variables, year and industry effects, were added in eq. (1). The coefficient of ESG is 0.289 at the 1% significance level in Column (1), indicating that the ESG increases the TFP significantly. When we added the control variables only, Column (2) shows that the coefficient of ESG is 0.0.019 at the 1% significance level. After controlling for both the year and industry effects, as shown in Column (3) of Table 2, the coefficient of ESG is 0.023 at the 1% significance level in Column (3), indicating that the ESG increases the TFP significantly. This proves Hypothesis 1. For the control variables, the results in Table 2 show that firm's size, ROA, Lev, Growth, and Cash are significantly and positively related to TFP.

Table 2. The effect of environmental, social, and corporate governance (ESG) on total factor productivity (TFP).

In China, the actual situation in which state-owned enterprises (SOEs) are different from non-state-owned enterprises in terms of ESG needs to be taken into consideration. The state-owned firms are more engaged in environmental and social issues than other non-state-owned firms (Hsu et al., 2021). Meanwhile, ESG has a positive influence on a firm's financial performance (Franceschelli et al., 2019).

The sample is divided into SOEs and non-SOEs. From the regression model (1), we established whether the impact of ESG on the TFP is going to be relatively different in different ownership types. In Columns (1) and (2) of Table 3, the regression results demonstrate that ESG in SOEs can play a much better role in increasing TFP than those in non-SOEs. From the above results, Hypothesis 2 is verified.

Environment has a significant impact on TFP. Heavy pollution enterprises have a lower ability of introducing technological innovations in their enterprises (Shen et al., 2019) and thereby face higher financing costs, according to Doshi et al. (2013). Heavy pollution enterprises have to first strengthen the disclosure of ESG information so as to alleviate financial constraints (Luo, 2022), promote technological innovation (Broadstock et al., 2021), and thus have a positive impact on TFP. From Columns (3) and (4) of Table 3, the regression results show that ESG in heavy pollution enterprises has to play a more important role in increasing TFP than non-heavy pollution enterprises. Therefore, hypothesis 3 is verified.

With the continuous implementation of the sustainable development strategy, the disclosure of ESG information becomes particularly important from the enterprises' value point of view. ESG can alleviate the financial constraints of enterprises (Samet and Jarboui, 2017), improve the innovation ability of enterprises (Inigo and Albareda, 2019), and then augment the TFP. Furthermore, we examined the mediating role of technological innovation and financial constraints underlying the effect of ESG on TFP. In Table 4, from Column (1), the coefficient of ESG is 0.023 at the 1% significance level, which is consistent with the basic regression results. From Column (2), the coefficient of ESG is −0.020 at the 1% significance level. In Column (3), we added the ESG and financial constraints in our model and found that the coefficient of ESG is positive and significant at the 1% significance level and that the coefficient of financial constraints is negative and significant at the 1% significance level. It shows that ESG increases TFP by easing financial constraints. Columns (4)–(6) show the results that the mediating variable is a technological innovation. From Column (5), the coefficient of ESG is 0.001 at the 1% significance level. In Column (6), the ESG and technological innovation are added to our model, and the coefficient of ESG and technological innovation are positive and significant at the 1% significance level. It shows that ESG increases TFP by promoting technological innovation.

In the present study, an investigation on the relationship between ESG and TFP showed that it may be affected by other unobservable factors, which may result in endogeneity problems. To address the potential endogeneity issue, we performed TFP lags by one-stage, propensity score matching (PSM) procedure, firm fixed-effects model, and instrumental variables (IV) approach.

To solve the endogeneity issue, the present study adopted the method of lagging the dependent variable by one period. Column (1) of Table 5 show that the coefficient of ESG is 0.020 at the 1% significance level. The results are consistent with those given previously.

To mitigate potential problems that arise from omitting time-invariant firm-specific characteristics, we reestimated the regressions of model (1) using the firm fixed effects model, when TFP is adopted as the dependent variable. The regression results of the fixed effects model are shown in Panel A of Table 5. In Column (2), the coefficient of ESG is 0.008 at the 1% significance level. It implies that our results are not driven by any time-invariant firm-specific characteristic, and the results are robust for endogeneity issues.

Propensity score matching (PSM) procedure was used to reduce the influence of sample firms' characteristics on conclusions. The firm size (Size), return on assets (ROA), leverage (Lev), growth opportunity (Growth), firm age (FirmAge), year, and industry were matched one to one. The mean ESG performance was taken as the critical value to construct the experimental group and the control group. After the ESG was matched and from Column (3) of Panel A of Table 5, the estimated coefficient of ESG is still positive and significant at the 1% significance level, which does not change the original conclusion.

Next, we used the method of instrumental variables to solve the endogeneity problem. We attempted to construct a group of instrumental variables (IV). In the previous literature, the ESG level at the industry or region level was used as the instrumental variable (IV) of ESG of the firm (Breuer et al., 2018).

To solve the endogeneity issue further, we chose the average value of ESG in the same region or industry as the instrumental variable. From Panel B of Table 5, Column (1) shows that the coefficient of IV is 0.866 at the 1% significance level. It indicates that the IV we selected is highly correlated with ESG. The results of Column (2) showed that the coefficient of IV is 0.039 at the 1% significance level. It indicates that, after controlling for the endogeneity problems of ESG, the conclusion of the present study still holds.

We confirm the robustness of our results by two alternative approaches. First, the alternative methods of identifying independent variables for ESG are used. Following (Lin et al., 2021), the proportional variable (ESG_dum) is used as a new identifying method for ESG. Column (2) of Table 6 shows that the coefficient of ESG_dum is still significantly positive at the level of 1%. After changing the independent variable identifying method, we find that ESG increases TFP significantly.

From Column (2) of Table 6, the new regression analysis results of changing the dependent variable TFP calculation method are obtained. Following Olley and Pakes (1996), we recalculated the TFP. The regression analysis results prove that the results of the above mentioned basic regression analysis are robust.

The present study details various factors as to whether and how ESG affects TFP. Using the data of Chinese-listed companies from 2010 to 2020, it has been proved that ESG has a significantly positive impact on TFP. Through the mediating effect analysis, we found that the positive impact of ESG on TFP is mainly brought about by promoting technological innovation and easing financial constraints, which are consistent with previous studies. At the same time, we also found that ESG has a more significant impact on TFP for state-owned enterprises (SOEs) and heavy pollution enterprises. The robustness test also further supports our conclusion.

Our research emphasizes the importance of ESG to the TFP of enterprises and shows that increasing the R&D investment of listed companies in ESG is conducive to promoting the sustainable growth and development of enterprises. Based on our research, we propose the following three suggestions. First, enterprises should promote the implementation of ESG responsibilities as a strategy to drive the long-term value of enterprises. We should further strengthened the awareness of ESG responsibility and placed the improvement of environmental protection, social responsibilities, and corporate governance in an important position to promote the sustainable development of enterprises. Second, the government should improve the mechanism of evaluation and information disclosure for an enterprise's ESG, provide effective data to support the decision-making of stakeholders, and further promote the high-quality development of economy and enterprises. Third, in the context of sustainable development, institutional investors and individual investors, who are outside the enterprise, should not only pay attention to the financial performance of the enterprise but also focus on the ESG performance of the enterprise in the process of investment so as to obtain greater benefits.

The original contributions presented in the study are included in the article/Supplementary material, further inquiries can be directed to the corresponding author.

JM and DG contributed to the conception, design of the study, and performed the statistical analysis. DG and JS organized the database. JM, DG, and JS wrote the draft of the manuscript and contributed to writing–review and editing. All authors contributed to manuscript revision, read, and approved the submitted version.

This work was supported by the National Natural Science Foundation of China (Grant No. 72202181).

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fevo.2022.1063736/full#supplementary-material

Ai, H. S., Hu, S. L., and Li, K., Shao, S. (2020). Environmental regulation, total factor productivity, and enterprise duration: evidence from China. Bus Strat Env. 29, 2284–2296. doi: 10.1002/bse.2502

Azmi, W., Kabir, H. M., Reza, H., and Mohammad, S. K. (2021). ESG activities and banking performance: International evidence from emerging economies. J. Int. Financ. Markets Inst. Money. 70, 101277. doi: 10.1016/j.intfin.2020.101277

Barth, E., Gulbrandsen, T., and Schønea, P. (2005). Family ownership and productivity: the role of owner-management. J. Corp Financ. 11, 107–127. doi: 10.1016/j.jcorpfin.2004.02.001

Bofinger, Y., Kim, J. H., and Björn, R. (2022). Corporate social responsibility and market efficiency: evidence from ESG and misvaluation measures. J. Bank Financ.134, 106322. doi: 10.1016/j.jbankfin.2021.106322

Breuer, W., Müller, T., Rosenbach, D., and Salzmann, A. (2018). Corporate social responsibility, investor protection, and cost of equity, a cross-country comparison. J. Bank Financ. 96, 34–55. doi: 10.1016/j.jbankfin.2018.07.018

Broadstock, D. C., Matousek, R., Meyer, M., and Tzeremes, N. G. (2021). Does corporate social responsibility impact firms' innovation capacity? The indirect link between environmental and social governance implementation and innovation performance. J. Bus. Res. 119, 99–110. doi: 10.1016/j.jbusres.2019.07.014

Bruna, M. G., Loprevite, S., Raucci, D., Ricca, B., and Rupo, D. (2022). Investigating the marginal impact of ESG results on corporate financial performance. Financ. Res. Lett. 47, 102828. doi: 10.1016/j.frl.2022.102828

Caggese, A., and Cunat, V, (2013). Financing constraints, firm dynamics, export decisions, and aggregate productivity. Rev. Econ. Dyn. 16, 177–193. doi: 10.1016/j.red.2012.10.004

Capelle-Blancard, G., and Petit, A. (2019). Every little helps? ESG news and stock market reaction. J. Bus. Ethics. 157, 543–565. doi: 10.1007/s10551-017-3667-3

Chang, C. C., and Tang, H. W. (2021). Corporate cash holdings and total factor productivity- a global analysis. N. Am. J. Econ. Financ. 55, 101316. doi: 10.1016/j.najef.2020.101316

Chen, Y., Yang, S. Q., and Li, Q. (2022). How does the development of digital financial inclusion affect the total factor productivity of listed companies? Evidence from China. Financ. Res. Lett. 47, 102956. doi: 10.1016/j.frl.2022.102956

Cheng, B., Ioannou, I., Serafeim, G. (2014). Corporate social responsibility and access to finance. Strateg. Manag. 35, 1–23. doi: 10.1002/smj.2131

Chiang, M.-H., and Lin, J.-H. (2007). The relationship between corporate governance and firm productivity: evidence from Taiwan's manufacturing firms. Corp. Gov. Oxford. 15, 768–779. doi: 10.1111/j.1467-8683.2007.00605.x

Doshi, A. R., Dowell, G. W. S., and Toffel, M. W. (2013). How firms respond to mandatory information disclosure. Strateg. Manag. J. 34, 1209–1231. doi: 10.1002/smj.2055

Durand, R., Paugam, L., and Stolowy, H. (2019). Do investors actually value sustainability indices? Replication, development, and new evidence on CSR visibility. Strateg. Manag. J. 40, 1471–1490. doi: 10.1002/smj.3035

Fafaliou, I., Giaka, M., Konstantios, D., and Polemis, M. (2022). Firms' ESG reputational risk and market longevity: a firm-level analysis for the United States. J. Bus. Res. 149, 161–177. doi: 10.1016/j.jbusres.2022.05.010

Fiandrino, S., Busso, D., and Vrontis, D. (2019). Sustainable responsible conduct beyond the boundaries of compliance:: Lessons from Italian listed food and beverage companies. Br. Food J. 121, 1035–1049. doi: 10.1108/BFJ-03-2019-0182

Franceschelli, M. V., Santoro, G., Giacosa, E., and Quaglia, R. (2019). Assessing the determinants of performance in the recycling business: evidence from the Italian context. Corp. Soc. Responsib. Environ. Manag. 26, 1086–1099. doi: 10.1002/csr.1788

Gerwanski, J. (2020). Does it pay off? Integrated reporting and cost of debt: European evidence. Corp. Soc. Responsib. Environ. Manag. 27, 2299–2319. doi: 10.1002/csr.1965

Glawe, L., and Wagner, H. (2019). China in the middle-income trap? China Econ. Rev. 60, 101264. doi: 10.1016/j.chieco.2019.01.003

Gregory, R. P. (2022). ESG activities and firm cash flow. Glob. Financ J. 52, 100698. doi: 10.1016/j.gfj.2021.100698

He, F., Qin, S. Q., Liu, Y. Y., and Wu, J. (2022). CSR and idiosyncratic risk: Evidence from ESG information disclosure. Financ Res. Lett. 49, 102936. doi: 10.1016/j.frl.2022.102936

Hernández, J. P. S. I., Yañez-Araque, B., and Moreno-García, J. (2020). Moderating effect of firm size on the influence of corporate social responsibility in the economic performance of micro-, small- and medium-sized enterprises. Technol. Forecast. Soc. Change. 151, 119774. doi: 10.1016/j.techfore.2019.119774

Hsu, P. H., Liang, H., and Matos, P. (2021). Leviathan inc. and corporate environmental engagement. Manag. Sci. 1–41. doi: 10.1287/mnsc.2021.4064

Huang, W., Luo, Y., Wang, X. H., and Xiao, L. F. (2022). Controlling shareholder pledging and corporate ESG behavior. Res. Int. Bus. Financ. 61, 101655. doi: 10.1016/j.ribaf.2022.101655

Inigo, E. A., and Albareda, L. (2019). Sustainability oriented innovation dynamics: levels of dynamic capabilities and their path-dependent and self-reinforcing logics. Technol. Forecast. Soc. Change 139, 334–351. doi: 10.1016/j.techfore.2018.11.023

Kaplan, S. N., and Zingales, L. (1997). Do investment-cash flow sensitivities provide useful measures of financing constraints? Q. J. Econ. 112, 169–215. doi: 10.1162/003355397555163

Lambert, R., Leuz, C., and Verrecchia, R. E. (2007). Accounting information, disclosure, and the cost of capital. J. Account Res. 45, 385–420. doi: 10.1111/j.1475-679X.2007.00238.x

Levinsohn, J., and Petrin, A. (2003). Estimating production functions using inputs to control for unobservables. Rev. Econ. Stud. 70, 317–341. doi: 10.1111/1467-937X.00246

Li, H., Zhang, X., and Zhao, Y. (2022). ESG and firm's default risk. Financ Res. Lett. 47, 102713. doi: 10.1016/j.frl.2022.102713

Li, J., Haider, Z. A., Jin, X., and Yuan, W. (2019). Corporate controversy, social responsibility and market performance: international evidence. J. Int. Financ Mark. I. 60, 1–18. doi: 10.1016/j.intfin.2018.11.013

Li, K. F., Guo, Z. X., and Chen, Q. (2021). The effect of economic policy uncertainty on enterprise total factor productivity based on financial mismatch: Evidence from China. Pac. Basin Financ. J. 68, 101613. doi: 10.1016/j.pacfin.2021.101613

Lin, Y. J., Fu, X. Q., and Fu, X. L. (2021). Varieties in state capitalism and corporate innovation: Evidence from an emerging economy. J. Corp. Financ. 67, 101919. doi: 10.1016/j.jcorpfin.2021.101919

Lins, K. V., Servaes, H., and Tamayo, A. (2017). Social capital, trust, and firm performance: the value of corporate social responsibility during the financial crisis. J. Financ. 72, 1785–1824. doi: 10.1111/jofi.12505

Lioui, A., and Sharma, Z. (2012). Environmental corporate social responsibility and financial performance: disentangling direct and indirect effects. Ecol. Econ. 78, 100–111. doi: 10.1016/j.ecolecon.2012.04.004

Liu, M. T., Wong, I. A., Shi, G., Chu, R., and Brock, J. L. (2014). The impact of corporate social responsibility (CSR) performance and perceived brand quality on customer-based brand preference. J. Serv. Mark. 28, 181–194. doi: 10.1108/JSM-09-2012-0171

Luo, D. (2022). ESG, liquidity, and stock returns. J. Int. Financ Mark. I. 78, 101526. doi: 10.1016/j.intfin.2022.101526

Margolis, J. D., and Walsh, J. P. (2003). Misery loves companies: rethinking social initiatives by business. Admin. Sci. Q. 48, 268–305. doi: 10.2307/3556659

Olley, G. S., and Pakes, A. (1996). The dynamics of productivity in the telecommunications equipment industry. Econometrica. 64, 1263–1297. doi: 10.2307/2171831

Peng, F., Peng, L. C., and Wang, Z. (2021). How do VAT reforms in the service sectors impact TFP in the manufacturing sector: firm-level evidence from China. Econ. Model. 99, 105483. doi: 10.1016/j.econmod.2021.03.002

Plumlee, M., Brown, D., Hayes, R. M., and Marshall, R. S. (2015). Voluntary environmental disclosure quality and firm value: Further evidence. J. Account. Public Pol. 34, 336–361. doi: 10.1016/j.jaccpubpol.2015.04.004

Rettab, B., Brik, A. B., and Mellahi, K. (2009). A study of management perceptions of the impact of corporate social responsibility on organisational performance in emerging economies: the case of Dubai. J. Bus. Ethics. 89, 371–390. doi: 10.1007/s10551-008-0005-9

Samet, M., and Jarboui, A. (2017). How does corporate social responsibility contribute to investment efficiency? J. Multinatl. Financ M. 40, 33–46. doi: 10.1016/j.mulfin.2017.05.007

Schoar, A. (2002). Effects of corporate diversification on productivity. J Financ. 57, 2379–2403. doi: 10.1111/1540-6261.00500

Shakil, M. H. (2021). Environmental, social and governance performance and financial risk: Moderating role of ESG controversies and board gender diversity. Resour Policy. 72, 10214. doi: 10.1016/j.resourpol.2021.102144

Shen, C. H., and Chang, Y. (2009). Ambition versus conscience, does corporate social responsibility pay off? The application of matching methods. J. Bus. Ethics. 88, 133–153. doi: 10.1007/s10551-008-9826-9

Shen, N., Liao, H. L., Deng, R. M., and Wang, Q. W. (2019). Different types of environmental regulations and the heterogeneous influence on the environmental total factor productivity: empirical analysis of China's industry. J. Clean. Prod. 211, 171–184. doi: 10.1016/j.jclepro.2018.11.170

Sheu, H.-J., and Yang, C.-Y. (2005). Insider ownership structure and firm performance: a productivity perspective study in Taiwan's electronics industry. Corp. Gov. Oxford. 13, 326–337. doi: 10.1111/j.1467-8683.2005.00426.x

Tian, G. Y., and Twite, G. (2011). Corporate governance, external market discipline and firm productivity. J. Corp. Financ. 17, 403–417. doi: 10.1016/j.jcorpfin.2010.12.004

Wong, J. B., and Zhang, Q. (2022). Stock market reactions to adverse ESG disclosure via media channels. Br. Account. Rev. 54, 101045. doi: 10.1016/j.bar.2021.101045

Wong, W. C. Y., Batten, J. A., Ahmad, A. H., Mohamed-Arshad, S. B., Nordin, S., and Adzis, A. A. (2021). Does ESG certification add firm value? Financ Res. Lett. 39, 101593. doi: 10.1016/j.frl.2020.101593

Yang, G. Q., Ding, Z. Y., Wang, H. S., and Zou, L. L. (2022). Can environmental regulation improve firm total factor productivity? The mediating effects of credit resource allocation. Environ. Dev. Sustain. doi: 10.1007/s10668-022-02336-0

Zhong, M., and Gao, L. (2017). Does corporate social responsibility disclosure improve firm investment efficiency? Rev. Account Financ. 16, 348–365. doi: 10.1108/RAF-06-2016-0095

Keywords: ESG performance, total factor productivity, financial constraints, R&D investment, corporate sustainable development

Citation: Ma J, Gao D and Sun J (2022) Does ESG performance promote total factor productivity? Evidence from China. Front. Ecol. Evol. 10:1063736. doi: 10.3389/fevo.2022.1063736

Received: 07 October 2022; Accepted: 07 November 2022;

Published: 01 December 2022.

Edited by:

Rui Xue, Macquarie University, AustraliaReviewed by:

Shen Yun, Sichuan Agricultural University, ChinaCopyright © 2022 Ma, Gao and Sun. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Di Gao, Z2FvZGkxNTkzQDE2My5jb20=

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.