- 1School of Economics, Fujian Normal University, Fuzhou, China

- 2Department of Agricultural and Resource Economics, University of California, Berkeley, CA, United States

- 3Department of Trade and Finance, Faculty of Economics and Management, Czech University of Life Sciences Prague, Prague, Czechia

- 4Overseas Education College, Fujian Business University, Fuzhou, China

- 5Department of Earth & Environment, Boston University, Boston, MA, United States

- 6School of Statistics and Applied Mathematics, Anhui University of Finance and Economics, Bengbu, China

Forest management has become a critical strategic action because of forests’ diverse role in the nature conservation and bio-economic benefits. Forest-title mortgage loan (hereafter abbreviated as “the loan”) which is one of forest management methods not only transforms the “sleeping” resources of a forester in her/his forest into assets mortgageable for cash, but also plays a key role in alleviating the shortage of funds that a forester might encounter, promoting financial innovations, and protecting forest resources. As such, this paper examines the problem of the low limit placed on this loan in China, and draws the following conclusion from employing the dynamic game method comprising complete information: in the actual mortgage market where banks hold an absolute advantage in issuing mortgage loans to the borrower (whether or not a forester acting as the borrower here applies for this loan from the bank through using an asset-appraisal agency) the amount of loan approved for the forester is going to be lower than the actual market value of the forest-resource assets that the forester owns. At the same time, based on the above conclusion, this paper proposes certain suggestions regarding how to raise the limit of this loan for the forester. These suggestions include proposals pertinent to the governmental policy support, introduction of innovative credit products developed by the banks, as well as the elaboration on how foresters could integrate their forest-resource assets by using cooperatives and launching scaled productions.

Introduction

Due to forests’ diversified roles in nature conservation and bio-economic effect that enhances social, ecological, and economic benefits, forest management has become a critical strategic action (Farooq et al., 2019, 2021; Zou et al., 2022). Forest-title mortgage loan which is one of forest management methods not only transforms the “sleeping” resources of a forester in her/his forest into assets mortgageable for cash, but also plays a key role in alleviating the shortage of funds that a forester might encounter, promoting financial innovations, and protecting forest resources. The forest-title mortgage loan refers to a type of a loan which a borrower takes out from a financial institution using her/his ownership of, or the right to use her/his forest or forestland as the collateral for repaying the loan. Its innovational aspect lies in the fact that it has broken up the single pattern formed long ago in which a bank uses a borrower’s real estate(s) as the collateral(s) for the loan. Hence, this type of loan has transformed the resources previously sleeping in the forester’s forest into assets mortgageable for cash. Zhou and Li (2014) believe that forest-title certificates exist only in China; all other countries adopt the small mortgage loan scheme in their rural areas. From a global perspective, most developed countries are highly experienced in operating forestry financing. For example, the U.S. provides special, low-interest microloans to their mini foresters. At the same time, it subsidizes forestry practitioners through fiscal aid to compensate for the risk and loss incurred to them due to forestry’s long growth period (Metodi et al., 2020). France also provides long-term and low-interest forestry loans to its foresters with a term of over 20 years and an annual interest rate of less than 3%. As for Japan, it even provides long-term and interest-free loans to its forestry operators. Even among the developing countries, there are also cases where some of them explore and implement the eco-forest loan system. For example, in Costa Rica, there is a Nectandra Institute, a small non-profit organization, which has launched a zero-interest eco-forest loan program. Abbreviated as ELF (Eco-loan Financing), this program aims to support local forest conservation and restoration efforts (Lennette et al., 2011). In addition, based on the recommendations of the United Nations Conference on Environment and Development and Ministerial Conference on the Protection of Forests in Europe, Turkey began preparing for its National Forestry Programme (NFP) in 2001 (Canan and Koray, 2022).

In 2013, the Chinese government formally approved and enacted a series of policies regarding the operation of forest-title mortgage loans and standardized their disbursement system, the measure of which enabled this loan to develop initially in China. The disbursement of this loan to the foresters plays a key role in alleviating the shortage of funds that these foresters might have, promoting financial innovations, and protecting forest resources. However, China is at a preliminary stage of exploring this loan system with certain problems inevitably arising in the course of its implementation process. As such, this paper looks into the problem of low limit placed on this type of loan in China and figure out some solution. We draw the following conclusion through use of dynamic game methods embodying complete information: in the real market where banks hold an absolute advantage in issuing mortgage loans (whether or not foresters apply for this loan through asset-appraisal agencies from the bank), the amount of loan that they get is going to be lower than the actual market value of their forest-resource assets. Furthermore, based on our results of “Gameplay process between the forester and bank” and “Game process among forester, bank, and asset-appraisal intermediary,” the paper also proposes some suggestions regarding how to raise the limit of this loan for the foresters, including elaborating on relevant governmental policies, innovation of credit-related products produced by the banks. Moreover, it provides some suggestions of how to have foresters integrate her/his forest-resource assets and launch scaled productions through cooperatives. This study is significant for solving the problem of low limit placed on this type of loan and some improvement in forestry management in China.

The rest of this paper is organized as follows: Chapter 2 is literature review, Chapter 3 presents gameplay process between the forester and bank, Chapter 4 presents the game process among forester, bank, and asset-appraisal intermediary, Chapter 5 provides countermeasures and suggestions, Chapter 6 is the conclusion.

Literature review

When scholars study agricultural loans, most of them evaluate the loans from the perspective of banks. Bryant (2001) developed an Agricultural Loan Evaluation Professional System (ALEES) to help banks and other financial institutions to evaluate the agricultural loan applications they received. Bruce and Hagan (1973) believed that in order to determine the current quality of loans and assess the current financial status of each borrower, agricultural lending institutions were faced with the long-term task of regularly assessing the personal and financial attributes of borrowers and proposing new credit-scoring items for them.

China has uniquely adopted the forest-title mortgage loan system making it possible to turn the “sleeping” assets of forest resources into cash, which could not only effectively protect the forest resources, but would also alleviate the financing difficulty that foresters may be having to an extent. It could help them acquire wealth without them cutting down the trees they own, hence it would promote rapid rural economic development. Since 2003, China has operated under the forest-ownership mortgage mode (Liu et al., 2020). This mode refers to the loan system in which the lending institution uses certificates of ownership of forests or forestlands from the enterprise or forester as collateral for the loan. Around 2013, this mode was empirically confirmed to be in line with the Chinese market mechanism and subsequently gradually improved. However, the operational mode of this loan geared towards the foresters only covers a low loan amount and was subject to further improvement (Zhou and Li, 2014). This loan has opened up a new business operational field for the financial institutions, improved their operational efficiency, and fully realized the “triple-win” of forestry, foresters, and banks. However, this loan amid the foresters is still during its exploratory phase in China. As it is being implemented, there has emerged problems of foresters unable to get their desired amount of loan. In other words, it is difficult for the foresters to meet the financing needs they are having through taking out this loan (Ding and Zhang, 2012; Xie et al., 2014; Zou, 2020). The approval of loan applications filed by the foresters may face many restrictions (Lu et al., 2018). For example, commercial banks may impose some sort of restriction on it since the term of the loan is shorter than the period of production and operation of the forestry of the forester, or the forester’s mortgage ratio of the loan is too low (Yu and Liu, 2011). At the same time, some common problems exist over this loan: low approved amount, short repayment terms, and high interest rates, to name only a few (Xiao and Fan, 2011; Jiang and Yu, 2019). Scholars have done a lot of research with respect to the causes for such problems. Most scholars believe that the great risk associated with the financing process of this loan is what restricts the financing development of it. Forest resources have some special traits. For example, they have a long growth cycle and are easily impacted by natural disasters. These special traits make up the important reason for this type of loan to face high financing risk (Duan et al., 2021). Ochoa-gaona (2001) and Chen and Innes (2013) pointed out that forest resource assets are often operated with the backward technology, they are poorly managed, and have certain inherent limitations. These characteristics of the forest resource assets usually lead to the foresters bearing high risks while managing them. Thence, it is difficult for the foresters to get financed using such assets as collateral. Zhou and Li (2014) and Duan et al. (2022) pointed out that forest resource assets are characterized by their long production cycle, slow investment return, slow capital turnover, and vulnerability to natural disasters, which restrict the supply of forest-related funds by banks and other financial institutions, at least to some extent. In addition, many scholars believe that the lack of the effective evaluation on the collateral with forest titles, which is the forest-resource assets in effect, is an important reason behind the low approved loan amount among other difficulties (Li and Chen, 2021). Wu (2018) pointed out that the asset value evaluation system of forest titles has not yet been established, so it is difficult to fairly and rationally assess the value of forest-title resource assets being mortgaged. Cai and Zeng (2011) and Wang et al. (2014) believed that the difficulty in assessing the forest-title resource assets being mortgaged and the high risk involved in disposing of them were the important factors leading to the low loan amount being approved of. At the same time, related supporting measures such as forest resource asset appraisal are not yet mature, and there is a lack of erection of professional forest-asset appraisal institutions. As a result, the assessed value often deviates from the actual value of forest-resource assets, resulting in a small loan amount being disbursed to the borrowers (Lei, 2020; Ma et al., 2021). Therefore, in the light of the above problems, many scholars put forward some suggestions regarding how to optimize the valuation of forest-title assets. Qiu et al. (2018) and Xie and Su (2020) argue that the asset-appraisal intermediary makes up an important part of the evaluation system correctly assessing the value of forest-title assets. Strengthening the construction of such intermediaries is beneficial towards improving this system. Hence, it can reduce the deviation between the real value of assets and their assessed value, and guarantee the proper loan amount. At the same time, Xu (2018) and Xie (2019) proposed that forest-resource asset-appraisal intermediaries should not only increase in number, but also strengthen their professional and market-oriented construction, and foster a group of high-quality forest-resource asset appraisers. Through professional evaluations performed by the forest-resource asset appraisers, the value of forest-resource assets is determined scientifically to ensure the accuracy of such evaluations.

The above research results on the forest-title mortgage loan provide materials and experience for us to understand the current situation under which this type of loan operates in China. From the perspective of research content, it focuses on the loan difficulty and low loan-limit existing in the forest-title mortgage loans and the reasons behind the formation of these problems. At the same time, we propose that forest-resource assets should be evaluated by intermediaries in charge of appraising the respective forest-resource assets to ensure that the loan quota of the mortgaged property is equivalent to the actual value of the forest-resource assets. Therefore, based on the previous research results of many scholars, this paper studies the loan quota of foresters in the absence and presence of asset-appraisal intermediaries. Our research shows that in either case, the loan amount that foresters get through the mortgaging of their forest-title assets is lower than the actual market value of such assets.

With respect to the method of research, this paper adopts the dynamic game-playing method embodying complete information. It studies the issue of forest-title mortgage loan limit reflecting the forest-resource’s asset value that exist between the foresters and the banks, or among the foresters, banks, and intermediary asset-evaluation agencies. In addition, it sorts out the application of game theory towards the forest-title mortgage loans. Most scholars use the game theory to study the behavior of both lenders and borrowers within this framework. Jin (2017a) used the static game model embodying complete information to find the fact that financial institutions could not fully grasp the effective information of foresters’ management of forest-resource assets. In order to reduce the adverse selection and moral hazard caused by the information asymmetry, credit-rationing measures would be adopted to guarantee the credit security, leading to the difficulty in ensuring the availability of credit for foresters. In the meantime, Jin (2017b) used dynamic and repeated game analysis to conclude that financial institutions should adopt credit contracts to reduce credit risks to foresters or other credit seekers. Zhang and Zhang (2015) applied evolutionary games and imperfect information motion, respectively. The availability and the interest rate of forest-title mortgage loans are analyzed by the state game. The results show that the most important factor affecting the availability of loan is the realization ability of forest title, and strengthening the effectiveness of guarantee of forest-title can improve the availability of loan. Meanwhile, the interest rate of the loan is directly proportional to the degree of information asymmetry between the lenders and borrowers. Liu and Yang (2011) used game theory to simulate the objective situation and behavior of both lenders and borrowers. They studied the risks of default and other influencing factors faced by financial institutions in issuing forest-title mortgage loans. The results show that the loan amount and interest rate are in direct proportion to the risk of default, but if the financial institutions increase the penalty for borrowers to get defaulted of their loans, it could reduce their risk of default. Liao et al. (2011) drew the conclusion by setting up the game behavior model among foresters, forestry enterprises, and financial institutions that loan interest, mortgage value, and credit mechanism are the important factors affecting the behaviors of both lenders and borrowers of the forest-title mortgage loan. Deng et al. (2022) constructed an internal financing model that the purchaser acts as the core leading enterprise to provide loans when the farmer has fixed assets as collateral. The result shows that fixed assets would increase the expected profit of the farmer and redistribute risk and profit between the purchaser and the farmer. Zheng and Xie (2021) found out through analyzing the process of gameplay by banks and foresters regarding forestry loans that banks were more willing to issue loans to foresters with high credit. When faced with an imperfect credit system in the market where low-credit foresters are situated everywhere, banks would choose not to grant loans to such foresters. This would influence the development of the whole loan market. Chen et al. (2021) analyzed the mechanism of cooperative-guarantee mode on forest-title mortgage loan by establishing a two-stage game model involving cooperatives, foresters, and financial institutions. Results show that the cooperatives’ support for loans to foresters has a positive effect on the demand for this loan. The increase in penalties to foresters for defaulting the loan has a positive influence on guaranteeing the loan’s repayment rate during the repayment period, but has a negative influence on the demand of loans made by the foresters. The study also shows that the cooperative assumes too much responsibility for repaying the loan, which is not conducive to the overall social utility of this loan. At the same time, a few scholars used the game theory to study the behaviors of governments and financial institutions with respect to this loan. Wang et al. (2021) through constructing the model of gameplay by local governments and financial institutions, analyzed the evolutionary process of this behavior. The result shows that policies implemented by local governments in support of issuance of this loan is necessary and feasible towards compelling the commercial banks to launch business pertinent to this loan. Some latest studies illustrate that the government should play a significant role in the operation of Forest-title mortgage loans.

The above research results on applications of the game methods provide materials and experience which we can understand in the context of forest-title mortgage loan. However, from the perspective of the research content, most of them are limited to the game of different behaviors between the lender and borrower of the loan. Although there are also discussions regarding the game of interests of all parties in the loan, such as the loan’s interest rate, mortgage value, and risk of default, in general there are almost no research results on the game of interest between lenders and borrowers, as well as the asset-appraisal intermediaries of the loan. Therefore, based on the idea of social welfare maximization and Pareto optimum, this paper applies the method of dynamic game comprising complete information to provide a theoretical explanation of the reasonable pricing of forest-resource assets, which is equivalent to the loan amount, between the lenders and borrowers and between the lenders and asset appraisal intermediaries of this loan. The equilibrium solution of social welfare and individual surplus maximization and Pareto optimum is obtained by deducing the game model to explain the phenomenon as to why the amount of this loan is generally low in reality.

Gameplay process between the forester and bank

We assume that there are two players in the market of borrowing and lending of forest-title mortgage loan: the forester and the bank. They play a game on the evaluation of assets of forest resources owned by the forester, which directly affects the amount of loan to be approved of by the bank. We suggest that there are two situations of gameplay process between the forester and bank. One is the forester and bank are equally powerful in the mortgage market, and the other is banks are more powerful in the mortgage market. We do not believe that the forester has more powerful in the mortgage market, because forester has limited channels to obtain mortgage loans but bank has many different types of customers.

The forester and bank are equally powerful in the mortgage market

As the information on forest-title mortgage loans is fully public in the market, we build dynamic game models comprising complete information that based on the idea of social welfare maximization and Pareto optimum to provide a theoretical explanation of the reasonable pricing of forest-resource assets. In the situation where both parties are equally powerful in the market, the bank will be the first to quote the value of assets of forest resources, which is equivalent to the amount of loan that the bank is willing to grant to the forester. In other words, the bank will give an initial quotation of P1. If the forester is dissatisfied with the bank’s quotation of P1, he gives a counteroffer. If the bank is not satisfied with the forester’s counteroffer, the bank will give a new quote. In the case of the forester who is unsatisfied with the bank’s new quote, she/he will make a new counteroffer again, and so on. In the bargaining process of the two parties in question, there is a reserve price of Pb to the bank. When the negotiated price is higher than this reserve price of Pb of the bank, the bank would rather choose not to grant the loan to the forester. On the other hand, the forester also has a reserve price of Pf. When the negotiated price is lower than this reserve price of Pf of the forester, the forester would rather not take out this loan from the bank. Figure 1 shows the relationship between the offered and reserved prices obtained by both parties of the game according to their judgment of the value of assets owned by the forester. Among them, Pf and Pb are the reserve prices of the forester and the bank on the loan amount, respectively. P1 and P2 represent the initial and second quotations of the bank regarding the approved loan amount, respectively. and are the first and second counteroffers of the forester on her/his desired loan amount, respectively. It can be seen from Figure 1 that only when the reserve price of the forester is less than that of the bank can both parties bargain successfully. The range between the reserve price of the forester and that of the bank is called the agreement-reaching range.

In the “bargaining game” played between the forester and bank regarding the amount of loan to be granted by the latter to the former, if we assume that the reserve price of the forester to be 100 and that of the bank to be 200, then [100,200] would be the range where an amount agreed upon by both sides may appear. As the transaction price P gets closer to 100, the bank’s surplus is larger, and the forester’s surplus is smaller. As the transaction price P gets closer to 200, the forester’s surplus is larger, and the bank’s surplus is smaller. Thus, the bank’s surplus can be expressed as 200-P, while the forester’s surplus can be expressed as P-100.

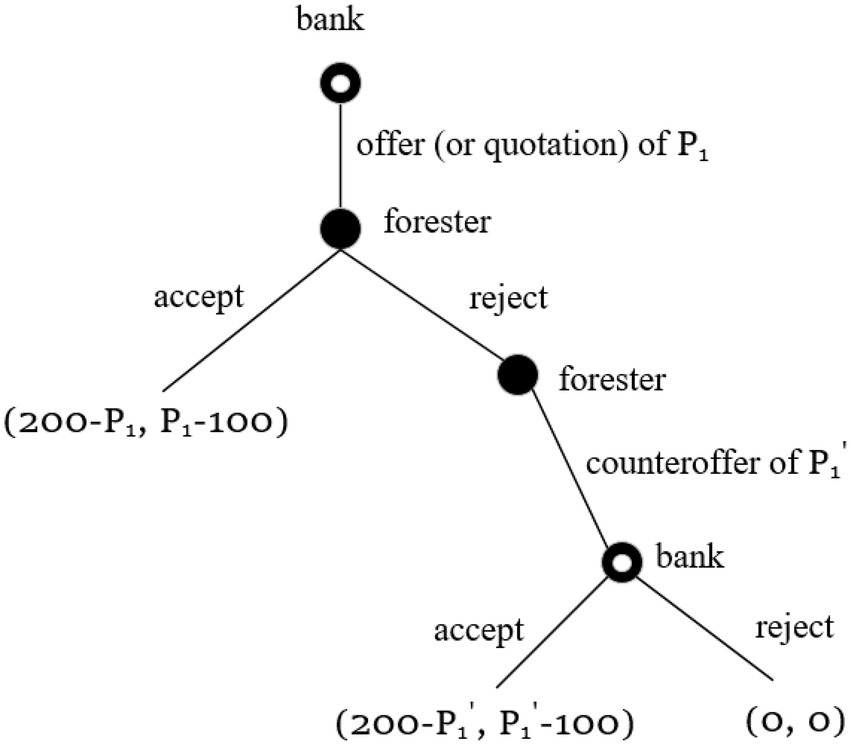

Considering the characteristics of a “bargaining game” played by the two parties in question, we could use a dynamic game consisting of complete information to explain this game process: the bank takes the lead in giving the value that it considers equal to that of the forest-resource assets, which is the price P1, or the actual loan amount, that the bank is willing to pay. If the forester accepts this initial offer from the bank, the game ends, and the forester can borrow this amount from the bank according to the offer P1 of the bank. In this case, the bank’s surplus is 200-P1, and the forester’s surplus is P1-100. If the forester does not agree with this initial offer of the bank, she/he will make another offer, which is . At that point, the bank has two choices to make: accept or reject it. If the bank accepts the forester’s offer, the bank will grant the amount to the forester according to the forester’s offer, and the game ends. In this case, the bank’s surplus is 200- , and the forester’s is -100. If the bank rejects the forester’s offer , then the game is over, and the result is that the loan transaction fails, and both sides of the game get zero return. This game process is shown in Figure 2.

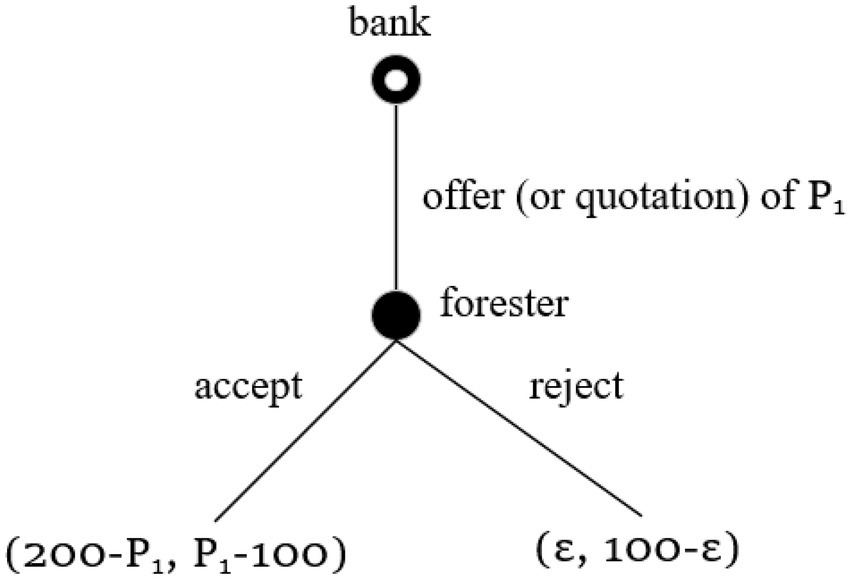

The game shown in Figure 2 is a dynamic game consisting of complete information. We could solve for this game’s subgame by using “backward induction” and refine it as Nash equilibrium. In the last round of the game, if the bank accepts the forester’s offer , then the bank’s surplus is 200- ; if the bank does not accept the forester’s offer, then it is surplus is 0. Thus, when 200- > 0, or < 200, the bank will accept the forester’s offer. A rational forester would set his offered price as = 200–ε, where ε is an arbitrarily small positive number, so as to maximize her/his surplus. The forester’s surplus is 100–ε, and the bank’s is ε. Therefore, the game tree previously shown in Figure 2 has now become the one shown in Figure 3.

In the game shown in Figure 3, if the forester accepts the initial offer of P1 from the bank as the loan amount, the forester’s surplus is P1–100. If the forester rejects the bank’s initial offer of P1, her/his surplus will be reduced to 100–ε. Therefore, if the initial offer P1 of the loan amount of the bank meets the following formula, then the forester will accept the bank’s offer, and the game ends:

That is to say, if the bank’s initial offer of the loan of P1 is close enough to 200, the forester will consider accepting the bank’s offer, and the game ends. If the bank’s initial offer is not close enough to 200, then the forester will rationally choose to reject the bank’s offer P1 and makes her/his own offer. The forester’s offer will be close to 200, and the bank will either accept or reject it. According to the game rules, even if the bank rejects the forester’s offer, it will no longer have the opportunity to make a new offer. The bank could only give up the loan transaction altogether and get zero income. Thence, the forester needs only to offer just under 200 to make the bank’s surplus greater than 0.

Therefore, in the game shown in Figure 2, when the market powers of the forester and bank are equal to each other, it is obvious that the forester will have more market advantages than the bank does, and the final transaction price of the loan will be close to the reserve price of the bank, which is 200. The bank’s surplus is just over zero, and forester’s is close to 100.

Banks are more powerful in the mortgage market

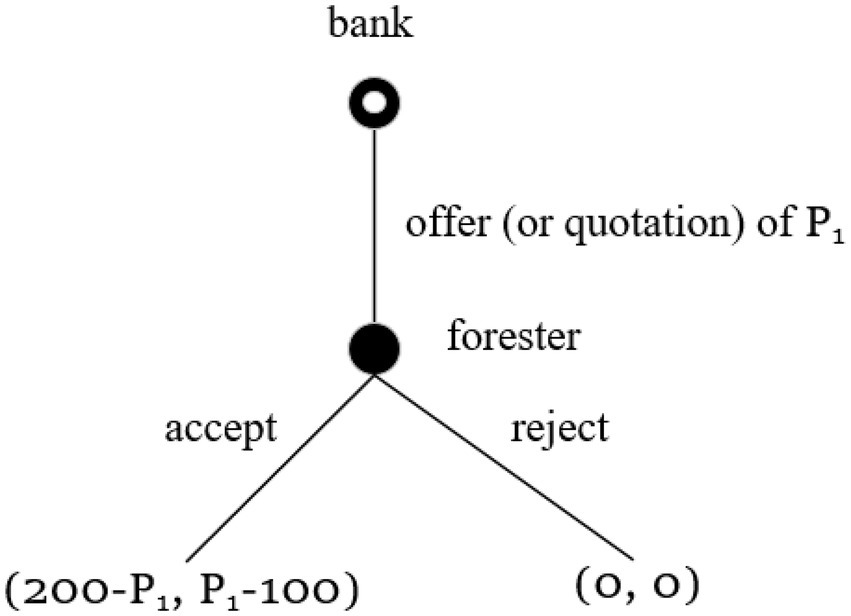

In the real world of transactions of forest-title mortgage loans, banks have more advantages over foresters on the market. Because of the limited financing channels available to foresters at the present time, the financing market dominated by loan providers is formed. Meanwhile, forest-resource assets have the characteristics of long growth cycle and high operational risk; they are easily influenced by relevant policies, so that the risk of cashability of forest-resource assets being mortgaged is relatively high. Therefore, in reality, after the bank offers the loan amount that it is willing to grant to the forester, the forester would have no chance to bargain with it one again and can only choose to accept it or give it up altogether. Therefore, the “bargaining game” in the case of equal market power between the two parties in question is transformed into the one in the mode of “one price.” The bank holds an absolute advantage in the gameplay and can attain a higher surplus consequently.

In Figure 4, the bank is still the first party to quote. The price offered by the bank is P1. Because of the disadvantageous position that the forester stands in the mortgage market, the forester has no choice but to either accept the initial price offered by the bank or reject the loan transaction in its entirety. Therefore, the bank’s initial offer needs only to make the forester’s surplus greater than zero. This scenario can be expressed by using the following equation:

According to the above equation, as long as the bank’s initial offer is 100 + ε (where ε is an arbitrarily small positive number), the forester will choose to accept it. At that point, the bank’s surplus is 100-ε, and the forester’s surplus is ε. In the game shown in Figure 4, the bank is the first and last party to make the offer, so the bank gets a higher surplus, while the forester gets a lower surplus.

To sum up the above points made, when the forester and bank are equally powerful in the mortgage market, the amount of forest-title mortgage loan that the forester is granted by the bank is going to be equivalent to the market value of forest-resource assets that she/he owns, which is equal to 200-ε, and the surplus that she/he gets is 100-ε. When the bank is more powerful in the mortgage market, the forester will only get the loan amount below the market value of forest-resource assets that she/he owns, which is 100 + ε, and she/he will only get a surplus of ε. Therefore, in reality, the loan amount that the forester obtains is going to be lower than the market price of forest-resource assets that he owns. The difference between the market price and the actual loan amount that the forester gets is 100, and the forester’s difference in surplus is 100-2ε. The larger the range is for reaching an agreement, the greater the loss of surplus that the forester will undergo.

Game process among forester, bank, and asset-appraisal intermediary

In reality, since the bank holds more advantage than the forester does in the mortgage market, the forester may call upon an asset-appraisal intermediary to assess the value of his forest-resource assets, and then apply for the loan from the bank based on that assessed value. Therefore, the respective game has transformed into the one played by three parties: the forester, the bank, and the asset-appraisal intermediary (Li, 2013).

In this gameplay process, the primary participants of economic behavior switch from two to three parties, namely the forester, the bank, and the asset-appraisal intermediary. The forester would want to use a higher than market value of his assets to obtain a larger amount of the loan, although doing so would greatly increase her/his risk of default of the loan. The bank, on the other hand, would want to multiply this market value by a relatively low discount rate to arrive at the approved loan amount, which is close to the forester’s reserve price of the loan. As for the asset-evaluation intermediary, safeguarding the legitimate rights and interests of both other parties is the main purpose of its evaluation of assets. Firstly and most importantly, it must ensure full repayment of the loan granted by the bank to the forester. Secondly, it should see to it that the capital needed to operate the forester’s resources be met by the loan. Thirdly, it must also maximize its own business volume, scientifically estimate the value of forest-resource assets owned by the forester, and take the responsibilities that it is supposed to take as an asset-evaluation intermediary.

To continue with the above outcome of the game played by the forester and bank, we assume that 100 + ε is the minimum acceptable loan amount equivalent to the value of the forester’s forest-resource assets (where ε is an arbitrarily small positive number), and 200-ε is the maximum acceptable loan amount by the bank. Then, the value of assets P which is owned by the forester and evaluated by the asset-appraisal intermediary is:

When constructing the utility functions of the forester, bank, and asset-appraisal intermediary, we need to consider the following three premises: First, the utility of the forester is related to the p value; the larger the p value is, the greater the utility of forester is. Therefore, the first derivative of the forester’s utility function is greater than zero. When the p value increases to a certain range, the growth rate of utility decreases, hence its second derivative is less than zero. Secondly, the bank’s utility is also related to the p value. However, for the bank, the larger the p value is, the smaller the utility of it to the bank. Therefore, the first derivative of the bank’s utility function is less than zero. When the p value increases to a certain range, the growth rate of utility decreases, so its second derivative is also less than zero. Finally, as for the asset-appraisal intermediary, its utility is related to that of the forester and bank. The more satisfied both of the other parties are with the transaction results, the higher the utility of asset-appraisal intermediary will be. Therefore, the utility function of the asset-appraisal intermediary is the same as that of the forester and bank. This utility increases with the increase of utilities of the forester and bank, but the marginal cross utility of both parties is negative. Specifically, the utility functions of three primary parties involved in this economic behavior are as follows:

The goal of asset-appraisal intermediary is to maximize its utility. For this reason, we let its first derivative equal to zero and solve for its utility maximization value. The respective calculation can be done as follows:

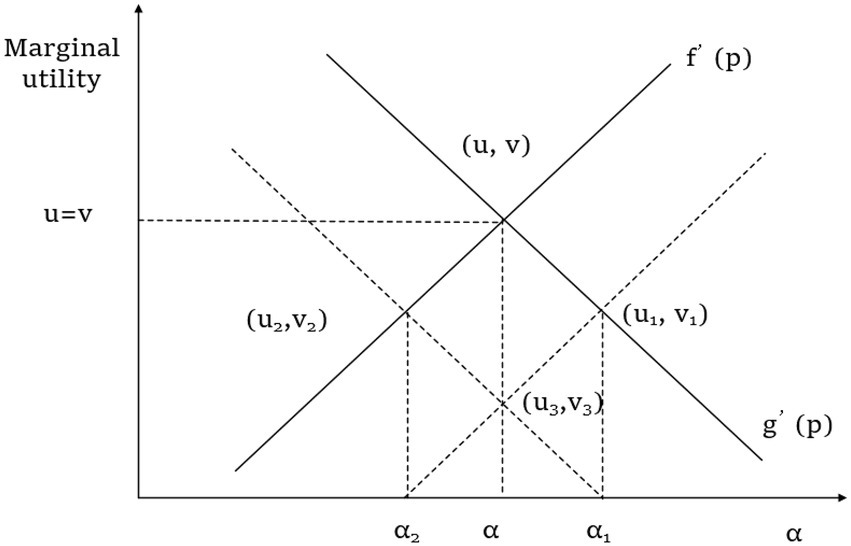

The closer is value of “ ” to 1, the closer the assessed value of forest resources is to the maximum acceptable loan amount by the bank, while the forester’s surplus is also larger.

The closer is the value of “ ” to 0, the closer the assessed value of forest resources is to the minimum acceptable loan amount by the forester, while the bank’s surplus is also larger.

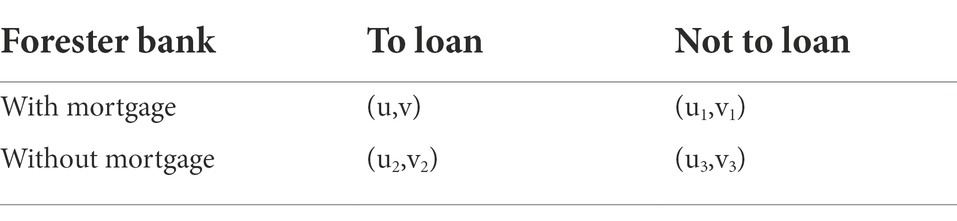

As shown in Figure 5 above, (u, v) is the maximum value of utility. When the utility is (u1, v1), it means that the bank believes that the asset-appraisal intermediary has overvalued the forest-resource assets that the forester owns, so it would be unwilling to provide the loan in question to the forester, while the forester would be willing to accept it. When the utility is (u2, v2), it means that the forester believes that the asset-appraisal intermediary has undervalued the forest-resource assets that she/he owns, so she/he would be unwilling to accept the loan in question from the bank, while the bank would be willing to issue it to the forester. When the utility is (u3, v3), it indicates that the value assessed by the intermediary falls into no common interval with that of the forester and bank. That is to say, there is no room for reaching any agreement between the forester and the bank.

As shown in Table 1, (u, v) is the optimal situation of the loan transaction in question, which, in theory, achieves Pareto optimization. However, in reality, we must also take into account the power level of primary parties involved in the economic behavior in the mortgage market. The party with a stronger market power can obtain a more favorable transaction price. Among the current actual transactions of mortgage loans, banks are generally in a stronger position for this. As such, would usually move to the left, forming an actual Nash equilibrium of (u2, v2). To summarize the above points, the fairly appraised forest-resource asset value obtained by the forester, bank, and asset-appraisal intermediary through game-playing is called the mortgage value, which is lower than its theoretically Pareto-optimal market value. This value is situated at a low point as its market value changes continuously in the future in reality. It is a conservative and cautious value assessed by the bank which is in a stronger position in the respective mortgage market. While this value is assessed by taking into account the prosperously sustainable operation and cashability of forest-resource assets, it commonly leads to an overly low amount of the loan granted by the bank to the forester in the market, and hence can seriously affect the enthusiasm of foresters applying for this loan. At the same time, it has caused a lack of rural-forestry developmental funds to a certain extent.

Countermeasures and suggestions

Based on the above research findings, we can know the forester is in the lower level than the bank. If the forester would tend to gain mortgage, they need some assistance from social. We intend to make the following suggestions regarding how to increase the limit of forest-title mortgage loan for the forester:

First of all, the government should introduce relevant policies to support the issuance of forest-title mortgage loan. It needs to include this loan into the business category of each of the large commercial banks, and coordinate with the People’s Bank of China, China Banking Regulatory Commission, and Insurance Regulatory Bureau in making this type of loan as an area of assessment to the banks. It should also provide the necessary incentive to the banks which have previously launched this type of loan business before. At the same time, it should allow legal and qualified third-party lending institutions to open up such business scopes. In addition, the government should standardize and guide the promotion and development of insurances towards forests through setting up the relevant system. Specifically, this system should consist of the new afforestation, tree seedlings, characteristic economic forests, and under-forest economy, all of which should be included into the subsidy scope of policy-based forest insurance as soon as possible. Furthermore, it’ should better continuously improve the policy-based risk compensation mechanism to avoid adverse selection and moral hazard which might occur in the process of issuance of forest-title mortgage loan. With respect to the government’s financial policy support, it should further standardize and implement policies regarding discounted interest rates to forestry loans, and constantly increase the depth and breadth of support from central and local governments towards this discounting. Some recent studies show the government should play its main role in the credit risk control of Forest-title mortgage loans, improve the relevant legal system, regulate the behavior of borrowers and lenders, and reduce the profitability and liquidity risks in forest tenure mortgage loans through government encouragement and support. More than that, the government should also improve the compensation and accountability mechanism for the credit risk of forest right mortgage loans, encourage the enthusiasm of forest right mortgage loans through government subsidies, forest insurance and other policies, and ease the problem of forestry financing. According to National Forestry and Grassland Administration, China has issued more than 100 million Forest-title certificates currently. Chinese government is promoting the “separation of ownership, contracting right and management right” of collective forest land, standardizing the transfer of forest rights, innovating the financing mode of forest rights, and improving forest insurance policies.

Secondly, the bank needs to continuously carry on the innovations of credit to be granted to the foresters. In terms of banking products, the bank should enhance its innovation of characteristic forestry loans, and explore the 5-in-1 loan model, which comprises governmental coordination, encouraging enterprises to borrow, encouraging cooperatives to guarantee the loan, encouraging banks disburse the loan, and encouraging foresters to participate in borrowing, so as to reduce the risks that foresters face as they seek finances for their business through taking the loan of forest-title mortgage from the bank. In terms of management, the bank should actively cooperate with village-level cooperative organizations to reduce the cost of bank investigation and improve the efficiency of bank management. In areas with abundant forest resources, the bank could extend its authority of forestry-loan examination and approval to its branches, so as to improve its efficiency of service for issuing forestry credit effectively. Until September 2022, China Development Bank and Agricultural Development Bank granted more than 400 billion yuan of credit, and more than 160 billion yuan of loans to national reserve forest and other forestry loan projects. Forest-title mortgage loans totaled more than 600 billion yuan, and the loan balance was nearly 90 billion yuan.

Finally, foresters can rely on the village-level cooperative organizations to integrate their forest-resource assets and launch scaled operation of them through cooperatives. With an ongoing penetration of China’s collective forest-title reform, foresters who independently manage their family-based business gradually realize that this mode of management displays the characteristics of insufficient funds, low profit level, poor risk-prevention ability, and so on. Only through scaled management of their forest-resource assets can they realize the optimal allocation of such resources. Therefore, we should give full play to the role that village cooperative organizations can play in forestry’s industrial development and financial services, and stimulate the enthusiasm of cooperative members. In the meantime, by having cooperatives take the lead, we could encourage the foresters to make products and services for the leading forestry enterprises so as to integrate forest-resource assets and form an industrial chain of forestry production and operation. Doing so would also give full play to the core role that leading forestry enterprises will be playing in providing technical support, information service, and scientific management to foresters in the up and downstream of industrial chains. Most importantly, we could provide forest-title mortgage loans to foresters by means of having leading enterprises undertake the loan and cooperatives guarantee it.

Conclusion

In conclusion, this paper first analyzes the game played by the forester and the bank. Then it draws the conclusion as follows: when the forester and the bank have equal power in the market of mortgage loan, the forester will obtain the loan amount equal to the market value of her/his forest-resource assets. When the bank is more powerful in the mortgage market, the forester will only get a loan amount below the market value of his forest-resource assets. After drawing this conclusion, we introduce a new party of asset-appraisal intermediary into our study. Through studying the game played by the forester, the bank, and the asset-appraisal intermediary, we believe that the fair appraisal value of forest-resource assets obtained through gameplay by the 3 parties in question is lower than its original, theoretically Pareto-optimal market value. This lower value is called the mortgage value. It is a conservative and cautious value assessed by the bank which is in a strong position in the forest-title mortgage market. While this value is assessed by taking into account the prosperously sustainable operation and cashability of forest-resource assets, it commonly leads to an overly low amount of the loan granted by the bank to the forester in the market, and hence can seriously affect the enthusiasm of foresters applying for this loan. At the same time, it has caused a lack of rural-forestry developmental funds to a certain extent. Based on the above research findings, we proposes some suggestions regarding how to raise the limit of this loan for the foresters, including elaborating on relevant governmental policies, innovation of credit-related products produced by the banks and relying on the village-level cooperative organizations to integrate forest-resource assets.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary material, further inquiries can be directed to the corresponding author.

Ethics statement

Ethical review and approval was not required for the study on human participants in accordance with the local legislation and institutional requirements. Written informed consent for participation was not required for this study in accordance with the national legislation and the institutional requirements. The patients/participants provided their online informed consent to participate in this study, which stated the voluntary nature of participation, and assurance of confidentiality and anonymity.

Author contributions

LX: conceptualization, methodology, data curation, and analysis. WS: writing—original draft preparation, validation, and formal analysis. XL: writing—review and editing. NS: supervision. XZ: investigation and funding acquisition. All authors contributed to the article and approved the submitted version.

Funding

This work was supported by the Ministry of Education Humanities and Social Sciences Youth Program (Grant No. 22YJC910014).

Acknowledgments

The authors would like to thank the article editor and reviewers for their thoughtful comments that greatly improved the article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Bruce, J. R., and Hagan, A. R. (1973). Agricultural loan evaluation with discriminant analysis. South. J. Agric. Econ. 5, 57–62. doi: 10.1017/S0081305200011249

Bryant, K. (2001). ALEES: an agricultural loan evaluation expert system. Expert Syst. Appl. 21, 75–85. doi: 10.1016/S0957-4174(01)00028-8

Cai, X., and Zeng, W. (2011). On Farmer’s willingness to small Forest tenure mortgage loans —a case study on Yibin of Sichuan. Int. J. Bus. Manag. 6, 272–276. doi: 10.5539/ijbm.v6n3p272

Canan, E. I., and Koray, A. (2022). Linking actors and scales by green grabbing in Bozbük and Kazıklı. Land Use Policy 120:106297. doi: 10.1016/j.landusepol.2022.106297

Chen, N., Feng, X., and Xu, Z. (2021). Game analysis of forest rights mortgage loan under cooperative guarantee mode: taking “Fulin loan” as an example. Issues For. Econ. 41, 651–657. doi: 10.16832/j.cnki.1005-9709.20200363

Chen, J., and Innes, J. L. (2013). The implications of new forest tenure reforms and forestry property markets for sustainable forest management and forest certification in China. J. Environ. Manag. 129, 206–215. doi: 10.1016/j.jenvman.2013.07.007

Deng, L., Wang, S., Wen, Y., and Li, Y. (2022). Incorporating ‘mortgage-loan’ contracts into an agricultural supply chain model under stochastic output. Mathematics 10, 1–22. doi: 10.3390/math10010085

Ding, H., and Zhang, H. (2012). Analysis on the impact of forest rights mortgage loan on farmers’ financing afforestation—a case study of Anfu county, Jiangxi Province. China For. Econ., 29–31+39. doi: 10.13691/j.cnki.cn23-1539/f.2012.04.011

Duan, W., Hogarth, N., Jiang, Y., and Chen, Q. (2022). How do Forest owners’ risk preferences affect harvesting decisions? A case-study in Fujian Province, China. J. For. Econ. 37, 259–293. doi: 10.1561/112.00000547

Duan, W., Shen, J., Hogarth, N., and Chen, Q. (2021). Risk preferences significantly affect household investment in timber forestry: empirical evidence from Fujian, China. For. Policy Econ. 125:102421. doi: 10.1016/j.forpol.2021.102421

Farooq, T. H., Shakoor, A., Wu, X., Li, Y., Rashid, M. H. U., Zhang, X., et al. (2021). Perspectives of plantation forests in the sustainable forest development of China. For. Biogeosci. For. 14, 166–174. doi: 10.3832/ifor3551-014

Farooq, T. H., Yan, W., Rashid, M. H. U., Tigabu, M., Gilani, M. M., Zou, X. H., et al. (2019). Chinese fir (Cunninghamia lanceolata) a green gold of China with continues decline in its productivity over the successive rotations: a review. Appl. Ecol. Environ. Res. 17, 11055–11067. doi: 10.15666/aeer/1705_1105511067

Jiang, Y., and Yu, X. (2019). Innovative practices and suggestions on promoting forest rights mortgage loan in Suichang County. Land Resources, 10, 34–35. doi: 10.16724/j.cnki.cn33-1290/p.2019.10.013

Jin, Y. (2017a). The forest rights mortgage, credit rationing and credit availability of farmers, based on static game model (in Chinese). J. Tech. Econ. Manag. 4, 29–32.

Jin, Y. (2017b). Forest rights mortgage, credit constraint and farmers’ credit availability: based on a static game model. Issues of forestry. Economics 37: 51-54+105. doi: 10.16832/j.cnki.1005-9709.2017.03.009

Lei, J. (2020). Reforming the natural resource auditing system from the ecological civilization perspective. Chin. J. Popul. Resour. Environ. 18, 87–96. doi: 10.1016/j.cjpre.2019.01.001

Lennette, E. T., Villa, L. V., Chaves, R. V., Villalobos, M. E., and Viquez, A. U. (2011). Forest conservation and restoration using eco-loan financing (elf) in Costa Rica: report on a working model. Conserv. Lett. 4, 402–407. doi: 10.1111/j.1755-263X.2011.00193.x

Li, Z. (2013). Study on evaluation of mortagage lending value of forestry assets. doctoral dissertation (Hebei Agricultural University, Baoding) (In Chinese).

Li, Y., and Chen, W. (2021). Entropy method of constructing a combined model for improving loan default prediction: a case study in China. J. Oper. Res. Soc. 72, 1099–1109. doi: 10.1080/01605682.2019.1702905

Liao, W., Jin, Z., and Cao, J. (2011). On game behavior of both sides on forest rights mortgage loan. J. Jiangxi Agric. Univ. 10, 14–19. doi: 10.16195/j.cnki.cn36-1328/f.2011.04.001

Liu, J., Dong, J., Long, H., Xu, T., and Putzel, L. (2020). Private vs. community management responses to de-collectivization: illustrative cases from China. Int. J. Commons 14, 445–464. doi: 10.5334/ijc.971

Liu, X., and Yang, L. (2011). Default risk game analysis of forest rights mortgage loan. Guangdong Agric. Sci. 38, 209–211. doi: 10.16768/j.issn.1004-874x.2011.16.033

Lu, S., Chen, N., Zhong, X., Huang, J., and Guan, X. (2018). Factors affecting forestland production efficiency in collective forest areas: a case study of 703 forestland plots and 290 rural households in Liaoning, China. J. Clean. Prod. 204, 573–585. doi: 10.1016/j.jclepro.2018.09.013

Ma, X., Shahbaz, M., and Song, M. (2021). Off-office audit of natural resource assets and water pollution: a quasi-natural experiment in China. J. Enterp. Inf. Manag. 4, 1–21. doi: 10.1108/JEIM-09-2020-0366

Metodi, S., Benno, P., Daniela, K., and Peter, K. (2020). International forest governance and policy: institutional architecture and pathways of influence in global sustainability. Sustainability 12:7010. doi: 10.3390/su12177010

Ochoa-Gaona, S. (2001). Traditional land-use systems and patterns of forest fragmentation in the highlands of Chiapas, Mexico. Environ. Manag. 27, 571–586. doi: 10.1007/s002670010171

Qiu, X., Huang, L., and Liu, F. (2018). Analysis on the development strategy of county inclusive forestry finance in southern collective Forest region – a case study of “Fulin loan” in Youxi County, Fujian Province. China For. Econ. 6, 5–8. doi: 10.13691/j.cnki.cn23-1539/f.2018.06.002

Wang, Y., Bai, G., Shao, G., and Cao, Y. (2014). An analysis of potential investment returns and their determinants of poplar plantations in state-owned forest enterprises of China. New For. 45, 251–264. doi: 10.1007/s11056-014-9406-z

Wang, Q., Dai, Y., Liu, F., Wu, Q., and Sun, Y. (2021). Evolutionary game analysis of forest rights mortgage loan promoted by local government. Issues For. Econ. 41, 424–431. doi: 10.16832/j.cnki.1005-9709.20200204

Wu, Q. (2018). Risk prevention and control of forest rights mortgage loan of commercial banks. China Natl. Conditions Strength 3, 18–21. doi: 10.13561/j.cnki.zggqgl.2018.03.006

Xiao, J., and Fan, Y. (2011). Research on carrying out forest rights mortgage loan business. J. Cent. South Univ. For. Technol. (Soc. Sci.) 5, 59–61. doi: 10.14067/j.cnki.1673-9272.2011.01.035

Xie, M. (2019). Research and exploration of forest rights mortgage loan in Hengyang City. Fin. Econ. 16, 89–91. doi: 10.14057/j.cnki.cn43-1156/f.2019.16.038

Xie, Y., Gong, P., Han, X., and Wen, Y. (2014). The effect of collective forestland tenure reform in China: does land parcelization reduce forest management intensity. J. For. Econ. 20, 126–140. doi: 10.1016/j.jfe.2014.03.001

Xie, D., and Su, B. (2020). Risk identification, evaluation and prevention and control of forestry rights mortgage loan under background of rural revitalization. J. Shenyang Normal Univ. (Nat. Sci. Edn.) 38, 505–511. doi: 10.3969/j.issn.1673-5862.2020.06.006

Xu, X. (2018). Study on practice and countermeasure of deepening the reform of collective forest tenure system in Zhejiang Province. For. Econ. 40, 30–35. doi: 10.13843/j.cnki.lyjj.2018.08.006

Yu, L., and Liu, G. (2011). Research on the exploration and practice on Forest property mortgage loan of Liaoning Province in China. Manag. Des. Eng. 03, 74–77. doi: 10.5503/J.ME.2011.03.013

Zhang, H., and Zhang, D. (2015). Study on the availability and interest rate of forest rights mortgage loan. Forestry. Economics 37:57-60+74. doi: 10.13843/j.cnki.lyjj.2015.06.012

Zheng, J., and Xie, Z. (2021). Research on the innovation of forestry financial products in Fujian Province – from the perspective of game analysis method (In Chinese). Sci-Tech & Development of Enterprise 474, 146–149.

Zhou, L., and Li, Y. (2014). A review of rural policy-favored petty loan forest property certificate mortgage. Asian Agric. Res. 6, 8–17. doi: 10.22004/ag.econ.186469

Zou, X. (2020). Plight and countermeasures of petty credit loan in rural financial institutions in the context of rural revitalization strategy. Asian Agric. Res. 12, 12–14+21. doi: 10.19601/j.enki.issn1943-99012020.07.004

Keywords: forest management, forest-title mortgage loan, game theory, asset appraisal, China

Citation: Xu L, Strielkowski W, Liu X, Schneider N and Zhao X (2022) A sequential game-play modelling on forest-title mortgage loans based on Chinese forester resource and assets valuation. Front. Ecol. Evol. 10:1060681. doi: 10.3389/fevo.2022.1060681

Edited by:

Awais Shakoor, Universitat de Lleida, SpainReviewed by:

Magdalena Radulescu, University of Pitesti, RomaniaSuleman Sarwar, Jeddah University, Saudi Arabia

Grzegorz Mentel, Rzeszów University of Technology, Poland

Copyright © 2022 Xu, Strielkowski, Liu, Schneider and Zhao. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Xin Zhao, emhhb3NoaW5fMTk5M0AxNjMuY29t

Lu Xu

Lu Xu Wadim Strielkowski

Wadim Strielkowski Xijing Liu4

Xijing Liu4 Xin Zhao

Xin Zhao