- 1Conservation International, Center for Oceans, Honolulu, HI, United States

- 2School of Ocean Futures, Global Futures Laboratory, Arizona State University, Tempe, AZ, United States

- 3Conservation International, Betty and Gordon Moore Center for Science, Arlington, VA, United States

Conservation in the Anthropocene requires financing that is commensurate to the scale of threats to ecosystems and the benefits they provide humanity. To meet this challenge, new financing models are needed at a diversity of scales to help support the protection of nature. Visitor green fees – or payments made by visitors to management authorities, for the explicit purpose of funding natural resource management – are an innovative conservation financing tool. In contrast to park fees, these conservation finance systems operate at the scale of an entire jurisdiction, rather than a specific protected area, park or reserve. Despite their recent proliferation worldwide, there is little to no scholarly literature on visitor green fees. In this paper, we assess ten visitor green fee programs worldwide and evaluate their fee system, governance, and management approach. Our over-arching purpose is to explore the challenges and opportunities associated with these conservation financing models, to inform both the evaluation of existing models and to aid practitioners seeking to establish systems to enhance financing for conservation and the ecosystem services that nature provides tourism-dependent destinations.

Introduction

The global biodiversity crisis is accelerating due to the escalating threats of global climate change (IPCC, 2019a,b) and a failure to adequately manage local and regional impacts such as habitat degradation, pollution, and invasive species introduction. These global and local threats continue to degrade ecosystem services, which are essential to human wellbeing, security (MEA, 2005), and the global economy (Costanza et al., 1997).

To meet these challenges, global targets have been established for climate (United Nations, 2015), biodiversity (Bhola et al., 2021), and conservation (IUCN, 2021). While there continues to be a vibrant and important discussion about how to equitably achieve these targets (Bennett et al., 2021; Sandbrook, 2021), it is generally accepted that protecting and restoring ecosystems is a priority to adapt to the global climate crisis and ameliorate local threats to ecosystem integrity (Griscom et al., 2017). Intact ecosystems provide both cost-effective climate adaptation and mitigation through their natural infrastructure protection, as well as opportunities to sequester carbon, offset emissions, and produce a wide array of benefits and services to society.

It is therefore critical to fund nature-based solutions to better equip societies with the means for adaptation and mitigation at scale. However, financing to date has been largely inadequate to achieve global targets and mitigate escalating threats to ecosystems (James et al., 2001; Berry, 2007; Credit Suisse AG, World Wildlife Fund, Inc., and McKinsey and Company, 2014; Meyers et al., 2020). The lack of inadequate finance has been a major focus for global convenings, including the recent World Conservation Congress, COP15 in Glasgow, and the Convention on Biological Diversity (Ceres, 2021; National Geographic, 2021).

Despite the critical need for financing, current investments have fallen far short of projected need. Global biodiversity and ecosystem service funding is approximately USD $124–143 billion while the global need is on the scale of USD $722–967 billion (Deutz et al., 2020), a threefold increase since 2012 that has created a gap of hundreds of billions in financing needs for conservation (Berry, 2007). The United Nations State of Finance for Nature shows that investment in nature-based solutions must quadruple by 2050 to meet critical targets (United Nations Environment Programme, 2021). The current funding portfolio that supports global conservation is predominantly supported by a diverse range of public and philanthropic funding sources, and is lacking in scale and durability (Credit Suisse Group AG and McKinsey Center for Business and Environment, 2016). This situation requires creative thinking and new finance solutions to reverse the decline in our ecosystems and the associated risks for industries and communities.

Conservation finance is defined as a set of “mechanisms and strategies that generate, manage, and deploy financial resources and align incentives to achieve nature conservation outcomes” (Meyers et al., 2020). Here, we assess a rapidly growing, yet understudied, conservation finance solution in visitor green fees. Visitor green fees are payments made by tourists to regulatory entities with the explicit purpose of funding conservation and natural resource management in a tourism destination. In contrast to park fees, these conservation finance systems operate at the scale of an entire jurisdiction, rather than a specific protected area, park, or reserve. These systems offer a solution to support conservation needs and tourism impacts across an entire jurisdiction, providing enduring financing for long-term stewardship of natural resources.

Visitor green fees are scaling rapidly as a means to offset rising tourism impacts on fragile ecosystems around the world. Some programs operate at the national level, while others are implemented by sub-national jurisdictions. Despite different assessment mechanisms, legal frameworks, and operational designs, all share the common purpose of connecting a revenue stream between visitors and the conservation of ecosystems that visitor industries and local communities alike depend on. In this article, we review ten programs, assessing the fee structures and management systems. Our overarching goal is to provide an objective assessment of the key elements of visitor green fee systems, and to aid practitioners and researchers in developing and assessing the conservation impact of these approaches in practice, in order to meet pressing global targets via locally implemented conservation financing mechanisms.

Materials and methods

Methodology

We reviewed a wide array of sources, including gray literature (from government, private and nonprofit institutions), news and media sources, and travel industry sources to identify the number of existing visitor green fee programs, as well as their assessment mechanisms, management structures, and if available, efficacies. Word searches included environmental levies, tourism taxes, green fees, green taxes, and entrance fees. While there exist additional tourism levies that fund public infrastructure and social services, we restricted our review to visitor green fees, of which all or a significant portion of the revenue supports conservation and natural resource management.

Due to the paucity of sources in academic literature, we also contacted a set of practitioners both in public and private management roles, to uncover additional information which further informed the review. Because the majority of the green fee programs exist at the municipal or regional scale and in less developed countries where data and transparency lack, data and information were limited for many programs. Our review included assessment of qualitative, quantitative, and anecdotal data. Across programs, lack of econometric analyses limited our ability to review the impact of green fees on visitor arrivals and expenditures. Below, we synthesize key information on visitor green fee systems, focusing on the key program elements of visitor perception, transparency, elasticity of demand in tourism, and efficacy, in jurisdictions where such information was available.

Results

Existing visitor green fee programs

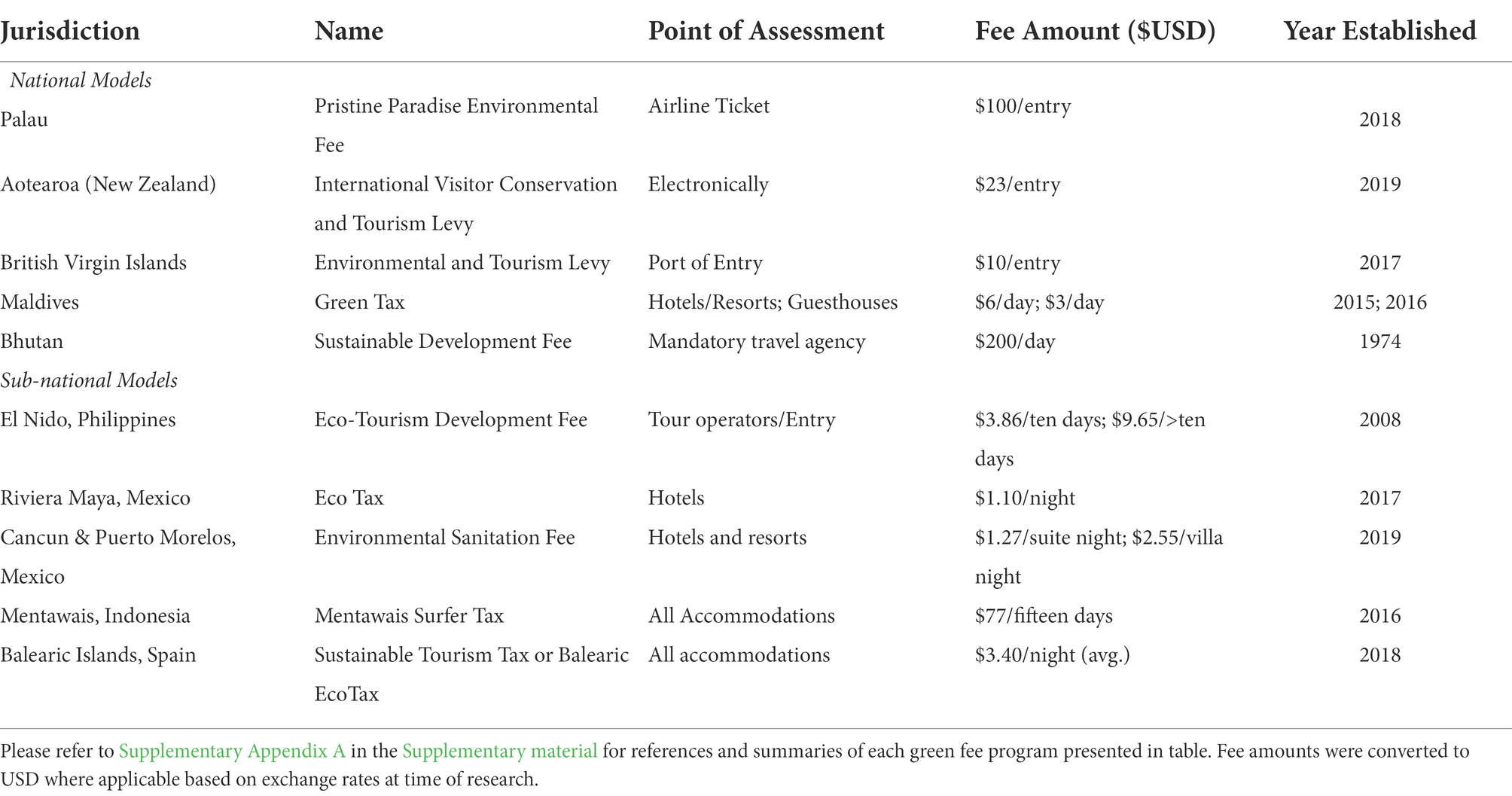

We reviewed 10 visitor green fee programs that were identified and had sufficient information at the time of research (Table 1). Our review was restricted to mandatory (versus voluntary) green fee programs, and encompassed both national-level programs and sub-national initiatives.1 Approximately 80% of the green fee programs we reviewed have been established in the past 6 years (2016 onwards), illustrating a rapid and recent proliferation of these conservation financing mechanisms around the world. Moreover, approximately 60% of these programs exist in island jurisdictions (Palau, Aotearoa [New Zealand], British Virgin Islands, Maldives, Mentawais, and Balearic Islands).

Fee amounts vary substantially across green fee programs, with fee values ranging from $1/night to $100 set entry fees. The point of assessment also varies, ranging from port of entry, purchase of airline ticket, accommodation, and electronic visa platform. See Supplementary Appendix A for a review of the literature on the individual green fee programs.

Establishment of visitor green fees often requires collaboration with the visitor industry, which may carry concerns over whether the fee amount could discourage visitor arrivals due to increased costs. While there are few econometric analyses available to determine elasticity of visitor demand to green fees in these locations, the available information on existing green fee programs suggest that cost effects on visitor arrivals and expenditures, if any, are low. Moreover, willingness to pay analyses demonstrate that visitors are willing to pay a premium for cultural preservation and/or environmental protection (Viteri Mejia, 2011; Andrade et al., 2021; Booth et al., 2022).

New Zealand International visitor conservation and tourism levy (IVL). The NZ$35 fee was determined on the premise that it would total less than 1% of average visitor spending (Davis, 2018). While New Zealand’s Cabinet Economic Development Committee identified potential risk that the IVL could reduce growth in visitor arrivals and/or visitor expenditures, they posited that the impact was likely to be low (Davis, 2018). Based on limited information, implementation could result in a NZ$8 M loss in goods and services tax. However, the Ministry of Business, Innovation, & Employment considers these risks low, given this estimate was based on the price sensitivity of air tickets rather than visas, with the latter point of assessment having lower price sensitivity (Davis, 2018).

Management design models

Visitor green fee systems require financial management and governance systems that direct revenue towards conservation and sustainability initiatives often together with visitor education and engagement strategies. The majority of fees are managed by local governments in accordance with applicable legal and policy frameworks. The exceptions are Palau and Cancun, discussed below, both of which utilize public-private governance models as a management approach, largely in order to ensure fund transparency and efficacy.

Cancun environmental sanitation fee. Cancun’s municipality formed a civic council to oversee the Environmental Sanitation Fee fund. The council is comprised of five members including the President of the Hotel Association, academics from the local university, a local NGO manager, and a legal expert. This balance of private and non-profit management over a government fund provides security for the hotel industry who markets the use of the fee to their visitors, as well as for conservationists and community members who support conservation financing efforts. Anecdotal data indicate that this structure was put in place to address concerns about transparency and to ensure efficacy of project funding toward purposes that benefit.

Palau pristine paradise environmental fee (PPEF). Palau’s PPEF revenue is partially governed by the Protected Areas Network (PAN) Fund, a non-profit organization established by the Republic of Palau to act as a financial trustee for the monies acquired from international donations and visitor arrival fees to support PAN sites (Medel, 2020). Of each $100 visitor fee, $30 is managed by the PAN Fund board and its staff ($15 goes to water and sewerage and $15 to PAN sites). Each of the 15 PAN sites is run by its corresponding state government; national governments may not control PAN site management (PAN Fund, 2021). While the PAN Fund is a non-profit entity, it was established by the government and the government maintains significant decision-power via holding several board positions. Even though the share of public oversight in the public-private partnership is significant, there is notable transparency; resultantly, anecdotal data demonstrates that visitors have a positive perception of the program, and conservation practitioners involved in the PAN Fund strongly concur that the fund expenditures align with their stated missions.

Visitor engagement and perception

Several green fee programs are integrated within broader campaigns focused on responsible tourism. For example, Palau’s Pristine Paradise Environmental Fee is one piece in a broader sustainable tourism campaign that includes a Pristine Paradise Palau mobile app for visitor education, and the Palau Pledge, which visitors are required to sign as a part of their entrance visa; in 2018 and 2019, the Palau Pledge was the most awarded communications project in the world (Palau Bureau of Tourism, 2021). New Zealand’s IVL is supported by a broader network of sustainable tourism initiatives, including sustainable tourism regional charters, partnerships with indigenous communities, improved data acquisition, and a sustainable tourism dashboard of indicators (MBIE and Department of Conservation, 2019). In Cancun and Puerto Morelos, some hoteliers endorse the program’s merit by promoting and marketing the Environmental Sanitation Fees to support positive visitor perceptions (Resorts, 2019).

While our review uncovers substantial variability among the ten visitor green fee programs, they carry similar functionality and outcomes in terms of creating a durable conservation finance approach for the locations in which they operate. The variability in these programs provides a breadth of program design models for policy makers in tourism jurisdictions seeking to implement similar policy models. At this stage it is not possible to empirically assess the performance of these programs due to data limitations, which would be a fruitful endeavor for future scholarship. However key design elements such as public-private management structures and visitor engagement initiatives appear to drive better program performance and outcomes, and are notable elements for prospective jurisdictions considering establishing visitor green fee programs.

Discussion

Visitor green fee programs are proliferating worldwide as a way to generate direct and enduring financing for local conservation initiatives. Our review focuses on the key attributes of different visitor green fee models, showing that there is considerable variability in approaches, design, and implementation and limited data analyses on their performance and economic impacts. Because the programs are implemented at a range of jurisdictional scales, there are a gamut of models for practitioners and policy makers to draw from in the development of visitor green fee programs. This brief review can serve as a blueprint for jurisdictions considering implementation of visitor green fees, providing a set of options for decision-makers and practitioners to consider and adapt to their own local conservation needs and policy and legal contexts. Below we discuss key insights from our review.

Efficacy of green fee revenue and management models

Visitor green fee programs generate annual revenue on the scale of 10s to 100s of millions, and therefore can better enable jurisdictions to achieve high impacts related to local and global sustainability targets (i.e., United Nations Sustainable Development Goals), while generating green jobs and driving a responsible tourism ethos. Existing legal systems and policies are key in determining the viable options for capturing these green fees from visitors, managing revenues, and in financing natural resource initiatives. Existing research on protected area user fees (also known as park fees) has shown that models that drive equity, trust, and information have positive perceptions among users (Nyaupane et al., 2009), which may drive overall program success and stakeholder engagement. Additional research that applies theory from appropriate fields (e.g., ecological economics) may provide further insights on the development and performance of visitor green fee systems.

In the context of visitor green fees, concerns of transparency and payer perception specifically led the municipality of Cancun to establish a public-private advisory council. Transparency concerns are not unique to the less developed world; 80% of active coral users from the U.S. mainland surveyed at various conservation sites across the Hawaiian Islands reported that they were willing to pay a green user-fee to support marine management at these sites, but only 30% chose the public as the most trusted entity to collect and allocate the funds (van Beukering et al., 2004). Public-private partnerships, such as the ones described in Management design models, provide a management design that may remedy user concerns and aid in revenue efficacy and transparency. Additional design considerations may improve visitor sector engagement, as discussed in Visitor sector engagement. Further research is needed to determine the relationship between management models and conservation outcomes. Because the majority of existing green fee programs are relatively new, there are limited program impact reports available; future research would benefit from measuring the ecological (i.e., non-market) returns from fee programs in terms of ecosystem management, restoration and recovery, as well as the efficacy of governance designs.

Visitor sector engagement

In destinations where the goals of conservation groups and the tourism sector appear at odds with one and other, green fee sustainability campaigns can provide opportunities for conservation and public sectors to engage the tourism industry in high level conservation targets, while improving the visitor experience. The role that visitor industries play in design and management varies. In some jurisdictions tourism sector leaders are highly involved in green fee advisory councils as well as marketing of the programs, while in others the industry is disengaged. In some programs, the revenue is strictly overseen by government or conservation leaders, while in others, funds are co-managed with the visitor industry. Collaboration with the visitor industry may unlock additional funding from public and private sources to leverage conservation revenues. In addition to managerial and financial roles, the tourism sector can act as an educator and liaison to foster pro-nature and culturally appropriate behaviors which may enhance visitors’ willingness to pay.

Green fees and regenerative tourism

As tourism destinations re-build in the wake of the COVID-19 pandemic, visitor green fee programs are becoming more prevalent as a policy means to support sustainable and responsible tourism recoveries that prioritize investment in natural capital and the local communities that depend on intact environments. Visitors’ willingness to pay and visitor demand has been reshaped by the COVID-19 pandemic (Andrade et al., 2021), which has increased travel barriers through new entry requirements and travel costs.

In conclusion, visitor green fee models offer solutions for practitioners in visitor-dependent jurisdictions to generate revenue for conservation priorities, which globally face major deficits in funding. Durable financing for conservation of natural resources is critical for long-term stewardship, as well as for buffering communities and economies from future shocks that originate from a range of sources, including climate change or economic and political upheavals. This short review suggests that visitor green fees may be a key solution for conservation and visitor industry sectors to support nature-positive economies and sustainable resource management.

Author contributions

JK and EvS conceived of the presented idea and design of the review process, drafted the article, and gave final approval of the version to be published. EvS led research and data collection. All authors contributed to the article and approved the submitted version.

Acknowledgments

The authors thank the H.K.L Castle Foundation and Hawai‘i Leadership Forum for supporting these research efforts. We additionally thank Chris Stone for insights, and the many practitioners in key geographies for their insights and resources.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fevo.2022.1036132/full#supplementary-material

Footnotes

1. ^Noticeably, none of the existing visitor green fee programs in Table 1 exist in the United States. There are three United States constitutional provisions and one United States federal statute that restrict states from implementing visitor-only fees or assessing fees at airports. However, states within the United States could still pursue site-based visitor green fees, or green fees assessed at point of accommodation or rental vehicle, which effectively capture a majority of visitor revenue.

References

Andrade, G., Itoga, H., Linnes, C., Agrusa, J., and Lema, J. (2021). The economic sustainability of culture in Hawai’i: tourists’ willingness to pay for Hawaiian cultural experiences. J. Risk Finan. Manag. 14:420. doi: 10.3390/jrfm14090420

Bennett, N. J., Katz, L., Yadao-Evans, W., Ahmadia, G. N., Atkinson, S., Ban, N. C., et al. (2021). Advancing social equity in and through marine conservation. Front. Mar. Sci. 8. doi: 10.3389/fmars.2021.711538

Berry, P. (2007). Adaptation options on natural ecosystems. A Report to the UNFCCC Secretariat Financial and Technical Support Division. Environmental Change Institute.

Bhola, N., Klimmek, H., Kingston, N., Burgess, N. D., van Soesbergen, A., Corrigan, C., et al. (2021). Perspectives on area-based conservation and its meaning for future biodiversity policy. Conserv. Biol. 35, 168–178. doi: 10.1111/cobi.13509

Booth, H., Mourato, S., and Milner-Gulland, E. J. (2022). Investigating acceptance of marine tourism levies, to cover the opportunity costs of conservation for coastal communities. Ecol. Econ. 201:107578. doi: 10.1016/j.ecolecon.2022.107578

Ceres (2021). Major financial institutions issue urgent plea for action addressing biodiversity loss ahead of COP15. Available at: https://www.ceres.org/news-center/press-releases/major-financial-institutions-issue-urgent-plea-action-addressing (Accessed October 24, 2021).

Costanza, R., d’Arge, R., de Groot, R., Farber, S., Grasso, M., Hannon, B., et al. (1997). The value of the world’s ecosystem services and natural capital. Nature 387, 253–260. doi: 10.1038/387253a0

Credit Suisse AG, World Wildlife Fund, Inc., and McKinsey & Company (2014). Conservation finance: moving beyond donor funding toward an investor-driven approach. WWF and credit Suisse group AG and/or its affiliates, and McKinsey & Company. Retrieved from WWF and credit Suisse group AG and/or its affiliates, and McKinsey & Company website Available at: https://www.credit-suisse.com/media/assets/corporate/docs/about-us/responsibility/environment/conservation-finance-en.pdf (Accessed on April 13, 2021)

Credit Suisse Group AG & McKinsey Center for Business and Environment (2016). Conservation finance, from niche to Mainestream: the building of an institutional asset class.

Davis, H. K. (2018). International Visitor Conservation and Tourism Levy. New Zealand: Office of the Minister of Tourism.

Deutz, A., Heal, G., Niu, R., Swanson, E., Delmar, A., Meghji, A., et al. (2020). Financing Nature: Closing the Global Biodiversity Financing Gap. The Nature Conservancy, Cornell Atkinson Center for Sustainability. Chicago: The Paulson Institute.

Griscom, B. W., Adams, J., Ellis, P. W., Houghton, R. A., Lomax, G., Miteva, D. A., et al. (2017). Natural climate solutions. Proc. Natl. Acad. Sci. U.S.A. 114, 11645–11650. doi: 10.1073/pnas.1710465114

IPCC. (2019a). Summary for policymakers Climate change and land: an IPCC special report on climate change, desertification, land, degradation, sustainable land management, food security, and greenhouse gas fluxes in terrestrial ecosystems (no. 978–92–9169-154–8). Intergovernmental Panel on Climate Change.

IPCC. (2019b). Summary for policymakers. In: IPCC special report on the ocean and cryosphere in a changing climate. Intergovernmental panel on climate change.

James, A., Gaston, K. J., and Balmford, A. (2001). Can we afford to conserve biodiversity? Bioscience 51, 43–52. doi: 10.1641/0006-3568(2001)051[0043CWATCB]2.0.CO;2

MBIE and Department of Conservation. (2019). New Zealand-Aotearoa government tourism strategy: enrich New Zealand-Aotearoa through sustainable tourism growth. Government of New Zealand Ministry of Business, Innovation, & Employment.

MEA. (2005). Living beyond our means: natural assets and human well-being. Statement from the board. Millenium Ecosystem Assessment.

Medel, I. L. (2020). The Palau legacy pledge: a case study of advertising, tourism, and the protection of the environment. Westminster Papers in Communication and Culture 15, 178–290. doi: 10.16997/wpcc.380,

Meyers, D., Bohorquez, J., Cumming, T., Emerton, L., Heuvel, O., Riva, M., et al. (2020). Conservation Finance: A Framework. Conservation Finance Alliance. Retrieved from https://www.researchgate.net/profile/John-Bohorquez-2/publication/340315276_Conservation_Finance_A_Framework/links/5e8cd6d992851c2f52885db4/Conservation-Finance-A-Framework.pdf

National Geographic (2021). Major new commitments and finance for nature ahead of global biodiversity summit from National Geographic Society Newsroom website Available at: https://blog.nationalgeographic.org/2021/09/22/major-new-commitments-and-finance-for-nature-ahead-of-global-biodiversity-summit/ (Accessed October 24, 2021).

Nyaupane, G. P., Graefe, A. R., and Burns, R. C. (2009). The role of equity, trust and information on user fee acceptance in protected areas and other public lands: a structural model. J. Sustain. Tour. 17, 501–517. doi: 10.1080/09669580802651699

Palau Bureau of Tourism. (2021). Palau Pledge. from PALAUPLEDGE.COM website Available at: https://www.palaupledge.com/ (Accessed April 24, 2021).

PAN Fund. (2021). Welcome to PAN Fund! Retrieved from Palau PAN Fund website Available at: http://www.palaupanfund.org/ (Accessed on April 13, 2021)

Resorts, R. (2019). New government environmental fees for all hotel guests in Puerto Morelos and Cancun. from Royal Resorts website Available at: https://www.royalresorts.com/blog/new-government-environmental-fees-hotel-guests-puerto-morelos-cancun/ (Accessed April 22, 2021).

Sandbrook, C. (2021). A call for constructive dialogue on the future of area-based conservation from thinking like a human website Available at: https://thinkinglikeahuman.com/2021/07/23/a-call-for-constructive-dialogue-on-the-future-of-area-based-conservation/ (Accessed October 24, 2021).

United Nations (2015). Paris Agreement. Available at: https://unfccc.int/sites/default/files/english_paris_agreement.pdf (Accessed on April 13, 2021)

United Nations Environment Programme (2021). State of Finance for Nature 2021. Nairobi. Retrieved from https://www.unep.org/resources/state-finance-nature

van Beukering, P. J. H., Cesar, H. S. J., Dierking, J., and Atinkson, S. (2004). Recreational survey in selected marine managed areas in the main Hawaiian Islands. University of Hawaii, U.S.A.: H.C.R.I. Research Program.

Keywords: conservation management, nature-based solutions, conservation finance, gobal policy, sustainable tourism, tourism fee, regenerative tourism, visitor green fee

Citation: von Saltza E and Kittinger JN (2022) Financing conservation at scale via visitor green fees. Front. Ecol. Evol. 10:1036132. doi: 10.3389/fevo.2022.1036132

Edited by:

Nallapaneni Manoj Kumar, City University of Hong Kong, Hong Kong SAR, ChinaReviewed by:

Shruti Agrawal, Malaviya National Institute of Technology, IndiaCopyright © 2022 von Saltza and Kittinger. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Emelia von Saltza, ZW1lbGlhdm9uc2FsdHphQGdtYWlsLmNvbQ==

Emelia von Saltza

Emelia von Saltza John N. Kittinger

John N. Kittinger