94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Clim. , 25 March 2025

Sec. Climate Adaptation

Volume 7 - 2025 | https://doi.org/10.3389/fclim.2025.1543732

This article is part of the Research Topic Rethinking Climate Governance: Integrating Monitoring and Evaluation for Effective Adaptation View all articles

Progressing climate change is causing a growing need for policy domains to adapt to its effects. Especially cross-border impacts of climate change are only beginning to be recognised in trade and finance. Through a qualitative analysis of 15 semi-structured interviews and 30 policy documents and reports, we examine adaptation policy integration and coherence in the European Union. Specifically, we investigate how policy actors in the trade and finance domains recognise adaptation needs and whether progress is being made. Our findings show that there has been progress mostly at the level of policy objectives and informal coordination between domains, whereas formalised actions and instruments promoting integration and coherence are emerging slowly. Moreover, we find that managing the cross-border impacts of climate change and adapting to them is demanding due to (1) the complex and interconnected ways in which impacts are transmitted, (2) the detailed understanding of the impact and response transmission systems needed for policy responses, and (3) the lack of formal integration of the climate change adaptation policy within EU trade and finance policies. Given these challenges, and the rapid advance of climate change, there is a need for high-level political commitment to progress with the preparedness for cross-border climate change impacts in trade and finance.

The direct impacts of climate change such as local floods, droughts or heatwaves, can cause complex chain reactions that cross national borders and sectors, including impacts on and through trade, finance, or human migration (Carter et al., 2021). Responding to these impacts requires a wide array of actions horizontally across different administrative sectors and policy domains (Kettner and Kletzan-Slamanig, 2020). Adaptation to climate change, defined as “any deliberate social adjustment that aims to safeguard against actual or expected harmful impacts associated with climate change” (Remling, 2018, p. 478), is thus more than reactions to locally identifiable impacts in the physical environment.

To promote climate change adaptation as a policy objective, the European Union (EU) released its first strategy on adaptation for climate change in 2013 (EC, 2013), followed by a new strategy in 2021 (EC, 2021). The 2021 strategy aims at smarter, faster, and more systemic adaptation as well as stepping up international action for climate resilience. The European Commission (EC) must therefore focus on integrating adaptation objectives into policy areas where it has formal competences (Biesbroek and Swart, 2019). Consequently, the 2021 EU adaptation strategy emphasises the need for integration of adaptation action in all policies to ensure coherent responses to climate change (EC, 2021). This also implies a need for policy coherence between climate policy and other policy sectors.

Policy integration refers generally to the inclusion of specific policy objectives of one domain (in this case climate change adaptation) into another, aiming at bridging often separated or siloed policy domains (see Tosun and Lang, 2017). It can improve the alignment of policy objectives, instruments, and processes (Kivimaa, 2022). Integration is inherently connected to policy coherence as the latter requires coordination between policy domains. Such coordination is facilitated by policy integration. Coherence is defined by Nilsson et al. (2012, p. 396) as “an attribute of policy that systematically reduces conflicts and promotes synergies between and within different policy areas to achieve the outcomes associated with jointly agreed policy objectives.” In general, policy coherence refers to how well policies work together. Incoherence between policy domains gives societal actors conflicting signals and may, in the case of adaptation to climate change, lead to maladaptation. Maladaptation refers to a situation where responses to climate change yield unintended effects, ultimately exacerbating climate risks (Magnan et al., 2020).

Research has offered frameworks and guiding principles for achieving effective adaptation across sectors (e.g., Berrang-Ford et al., 2019; Singh et al., 2022). Yet, the lack of integration of adaptation policies across policy sectors has been identified as a key challenge for adaptation (Bauer et al., 2012). Moreover, the introduction of cross-border considerations to climate change adaptation policy complicates policy integration significantly.

There is emerging research on how cross-border impacts of climate change may affect the EU and its member states by impacting flows of capital, goods and resources, and what policy responses would best mitigate such impacts (Benzie et al., 2019). The EU is of interest here, as it has engaged in ambitious, horizontally applied climate change mitigation policies, such as the EU Green Deal, but has focused less on adaptation to climate change. In addition, analyses of policy integration and coherence in domains that have a cross-border character are currently lacking. In this article, we explore to what extent and how EU finance and trade policy domains have begun to note the cross-border impacts of climate change. We do this by examining how climate adaptation policies in the EU-level decision-making have been integrated in and cohere with trade and finance policies.

Trade and finance policies cover significant parts of global economic activities. They also connect different regions and continents to each other, therefore making locations susceptible to impacts of climate change independently of where the direct impacts occur (West et al., 2021). For example, the trade of agricultural products is increasingly affected by climate change, because agricultural production suffers globally from extreme weather conditions and slow onset climate change (EC, 2021). Analyses of climate change adaptation have, however, paid too little attention to risks that propagate across borders via financial flows and trade (Benzie and Persson, 2019). The trade and finance sectors have on the other hand, in general been deeply concerned with disruptions in cross border flows, but mainly due to other factors than climate change (Brunnermeier et al., 2012; Attinasi et al., 2021; Lai et al., 2023; Brutger and Marple, 2024). Although there is a growing literature dealing with climate change issues in trade and finance policies (Gallagher and Barakatt, 2016; Bolton et al., 2020), the interaction between climate policies on one hand and trade and finance policies on the other in dealing with challenges related to cross border impacts of climate change is still understudied. Our analysis addresses this gap. Based on a qualitative analysis of interviews with policy actors affected by these policies and key policy documents, we aim to answer the following research questions:

RQ1: What kinds of examples of and obstacles to the integration of climate adaptation policy into EU trade and finance “policies” were identified in expert interviews and policy documents during 2021–2024, and how have they emerged?

RQ2: How can policy integration contribute to coherence in trade and finance policy responses to cross-border impacts of climate change?

In the following sections, we describe the cross-border impacts of climate change and their governance (Section 2), present our methodology (Section 3) and results (Section 4), ending with discussion (Section 5) and conclusions (Section 6).

The adaptation to cross-border impacts of climate change creates new challenges for all policy domains, including those that have traditionally dealt with cross-border issues, indicating the importance of policy coherence and integration. In policy integration, “recipient” policy domains, to the integrated policy objective, are expected to adapt and renew their operations and engage in collaborative processes (Lafferty and Hovden, 2003; Tosun and Lang, 2017), including continuous learning and reflection (Biesbroek, 2021; Plank et al., 2021). Policy integration can be seen as a complex problem-solving exercise for the public administration (Cejudo and Michel, 2017). In the case of climate policy integration (CPI), climate policies have the task of linking together traditionally separate policy domains, leading to coherence between sectoral goals and reconciling sectoral interests (Adelle and Russel, 2013; Rietig, 2013; Von Lüpke and Well, 2020). Much of the CPI research has focused on mitigation, while some have also explored adaptation, pointing out that CPI for adaptation is affected by political ideologies, institutional alignment, and issue attention and framing (Biesbroek, 2021; see also Biesbroek and Candel, 2020).

Policy integration and coherence can be advanced by multiple means, such as encouragement, policy appraisal, cross-domain collaboration (Tosun and Lang, 2017), and shared visions (May et al., 2006). It is relevant to distinguish different levels of policymaking alongside different domains when examining integration and coherence. The recognition of cross-border issues is a first step for improved integration of cross-border climate change adaptation but requires also more concrete changes in policy objectives and instruments (Kivimaa et al., 2025). Nilsson et al. (2012) note that policies are sometimes compatible at the level of objectives, but conflicts emerge as policies are instrumentalised and implemented.

Policy integration and coherence can be difficult to achieve due to underlying political reasons causing conflicts in policymaking, for example, when advocators of specific interests promote their own policies that may not be compatible with other policies (Harrinkari et al., 2016; Sotirov et al., 2021). Literature has also pointed out that the concept of policy coherence can be seen to be “anti-political”; coherence may be used as a way of reducing underlying political disagreements to a matter of technical reconciliation (Yunita et al., 2022). It is crucial to keep in mind that policy incoherence is, in part, caused by the strategic promotion of policies by actor groups whose actions are not motivated by a successful alignment of policy domains but by winning a political struggle. Knowledge can become politicised in environmental disputes and actors may use lack of knowledge to argue for their own priorities (Jokinen et al., 2018).

Actors may describe improved coordination and policy integration as their objectives at a general level whilst promoting sectoral interests in policy implementation processes (Winkel and Sotirov, 2016). There are likely to be problems in pursuing policy coherence because policy sectors are also guided by different worldviews (Kivimaa, 2022). We utilise these notions by not only examining strategic objectives but analysing how they are implemented and what tensions arise in the process.

In the policy domains that we have examined, cross-border policy coherence has been an important topic. The focus has largely been on achieving coherence between trade and financial policies across states (and wider regions) (see Bryant, 2003). Such coherence would ensure that differences in policies, and the responses to external chocks, would not interfere negatively with the functioning of free markets and financial flows. In finance there is an increasing recognition that perfect coherence may be an unattainable goal and that second best solutions, in which countries primarily design frameworks that mitigate the risks affecting cross-border flows at the national level, would the main objective (Brunnermeier et al., 2012). Grabel (2017) has even argued that some incoherence may not only be unavoidable but actually beneficial for developing innovative and functioning responses to external chocks. In recent years the trade and finance sectors have started to pay attention to policy areas beyond those focusing on their “own” domains. For example, Bolton et al. (2020) stress the need to coordinate fiscal, monetary, prudential and carbon regulations to support the environmental transition and that that the financial system needs to integrate policy elements such as climate scenarios into stress tests and Porterfield (2016) has identified the links between trade rules and climate policies, where there is a particular need for coherence. Baer et al. (2021) argue that major obstacles to the integration of climate policy elements in financial policies are due to structural factors such as a weak public control on private financial markets; and the presence of strong independent technical authorities with delegations concerning financial markets but limited mandate to consider climate policy objectives. These studies demonstrate that there is a need to explore further how the integration and policy coherence can be advanced.

Previous studies have noted that policy strategy documents tend to avoid addressing (in)coherence specifically—it is typical that they do not mention coordinating mechanisms to align the different objectives that the strategies state (Schulz et al., 2021; Kivimaa and Sivonen, 2021). Therefore, analyses of the practices of policy preparation and implementation is important (often gauged via interview-based studies). Organisational tools, such as network management, new agencies or reorganisation, and reviews by ad hoc task forces or commissions have been mentioned to improve coherence (Giest and Mukherjee, 2022). We see the organisational arrangements for policy integration and coherence (e.g., organisational tools and resource allocation) as one important element to examine when analysing climate change adaptation in trade and finance policy.

Specific policy integration and coherence efforts have been found to rely on informal coordination mechanisms such as persuasion and leadership (Furness and Gänzle, 2017; Van Assche and Djanibekov, 2012). For instance, when measures needed for policy integration exceed the mandates of organisations or the competence of the European Commission (2024), they cannot depend on legally binding governance measures (Biesbroek, 2021; Schoenefeld and Jordan, 2020). Informality does not necessarily mean that policy coordination is not effective but can offer ways to introduce, translate, reflect on, and help implement new ideas into public practice (Roberts and King, 1991; Voß et al., 2009).

Policy coherence and integration are particularly complex in cross-border contexts due to the presence of multiple jurisdictions and governance levels, as actions in one country can generate impacts in another (Howlett et al., 2017). Different regions may have conflicting or incoherent policies regarding resource use, adaptation strategies, trade or finance. For example, while one region may focus on adapting to drier climatic conditions by using drought-resistant crops, a neighbouring region might still prioritise cash crops requiring high water usage. Coherence and integration can be evaluated by examining specific mechanisms, such as inter-ministerial groups or international agreements, and by assessing the extent to which policies are aligned across borders (Kivimaa et al., 2025).

Scientific and research-based knowledge is central in the ways environmental challenges are framed and understood (Wesselink et al., 2012). For climate change adaptation, knowledge is needed about the likely effects of climate change to design needed adaptation. Early views of climate change governance saw mitigation as a global issue but adaptation as a primarily local matter (Edvardsson Björnberg and Hansson, 2011; Fünfgeld, 2015). For trade and finance policies it is obvious that not only local, but also international and cross-border impacts matter (West et al., 2021), but there is still the question of how and at what level policies should be modified. For example, Dewulf et al. (2015, p. 1) emphasised that one should consider at which governance level(s) the responsibility for climate change adaptation should be institutionalised. Huitema et al. (2016, p. 2) note that “[a]daptation governance refers to the patterns that emerge from the governing activities of social, political, and administrative actors […] combined efforts to adapt to climate change, […] [reflecting] ideas about appropriate normative underpinnings for the way climate change adaptation should be governed, taking into account wider social and political beliefs and systems.”

The recognition that local bio-physical impacts of climate change can have cross-border impacts through various mechanisms and pathways (Benzie et al., 2019) widens the considerations further. Thus, when a local effect of climate change affects various activities and policy domains that extend across state and regional boundaries (Benzie and Persson, 2019), the governance of climate change adaptation needs to consider these effects (Carter et al., 2021). A neglect of cross-border effects would leave a country or region poorly prepared for many potential impacts induced by climate change.

Recently, frameworks have been developed for systematic analyses of cross-border impacts. For example, Carter et al. (2021) conceptualised an impact transmission system and a response transmission system of cascading climate change impacts. In the impact transmission system, a climate trigger creates an initial impact in a specific region which is affected by non-climatic triggers (e.g., economic or geopolitical shocks). The initial impact “may have downstream consequences that can propagate across spaces (sometimes crossing borders) and through time” via physical (e.g., raw materials), information (e.g., data) or natural (e.g., species) flows (Carter et al., 2021, p. 3). The response transmission system involves anticipatory or reactive responses that may target the initial impact or propagating impacts. Public policies and governance structures are a part of the response transmission system which can be improved by policy coherence and integration (Carter et al., 2021; Kivimaa et al., 2025).

In the financial sector the propagation of impacts from one region to another has been recognised for long, since the economic crises of the 1930s (Lee et al., 2011), with focus on the finance sector itself and its policies (Brunnermeier et al., 2012; Bruno and Shin, 2013; Gallagher, 2015). The difficulties of cross border coordination of policies steering the finance sector are well recognised, including the fact that global coordination may generate tensions at the national level (Brunnermeier et al., 2012). Trade has likewise been an area where the governance of cross-border trade issues has been fundamentally important, both for responding to crises and achieving stability (Eberlein, 2003). These experiences underline the need to consider several complementary approaches in the governance of cross-border systems. Eberlein (2003, p. 137) notes that “informal or soft modes of governance are often combined with formal avenues of EU decision making.”

This paper uses qualitative content analysis of interviews and document material as a research approach (Magaldi and Berler, 2020). During May 2021–January 2022, we conducted 15 semi-structured online interviews with policy actors working in connection to EU adaptation, trade, and finance policies (Table 1), to gain an understanding of how climate change adaptation policy has been integrated into and coheres with trade and finance policies. First, we identified trade, finance, and adaptation-related organisations that deal with climate policy integration in the EU, and the organisations then helped us identify suitable experts on the topic. A snowball sampling method allowed interviewees to refer us to additional participants. Most interviewees had experience working with either finance and/or trade, while the rest were approaching the topic from the perspective of adaptation policy. The interviewees represented various organizations, such as the European Commission (EC), international agencies, and private actors mainly at the EU and some at national levels. To ensure the interviewees remain anonymous and that the views expressed do not expose their representative organisations and their operations, we do not link any of the statements with the organisations.

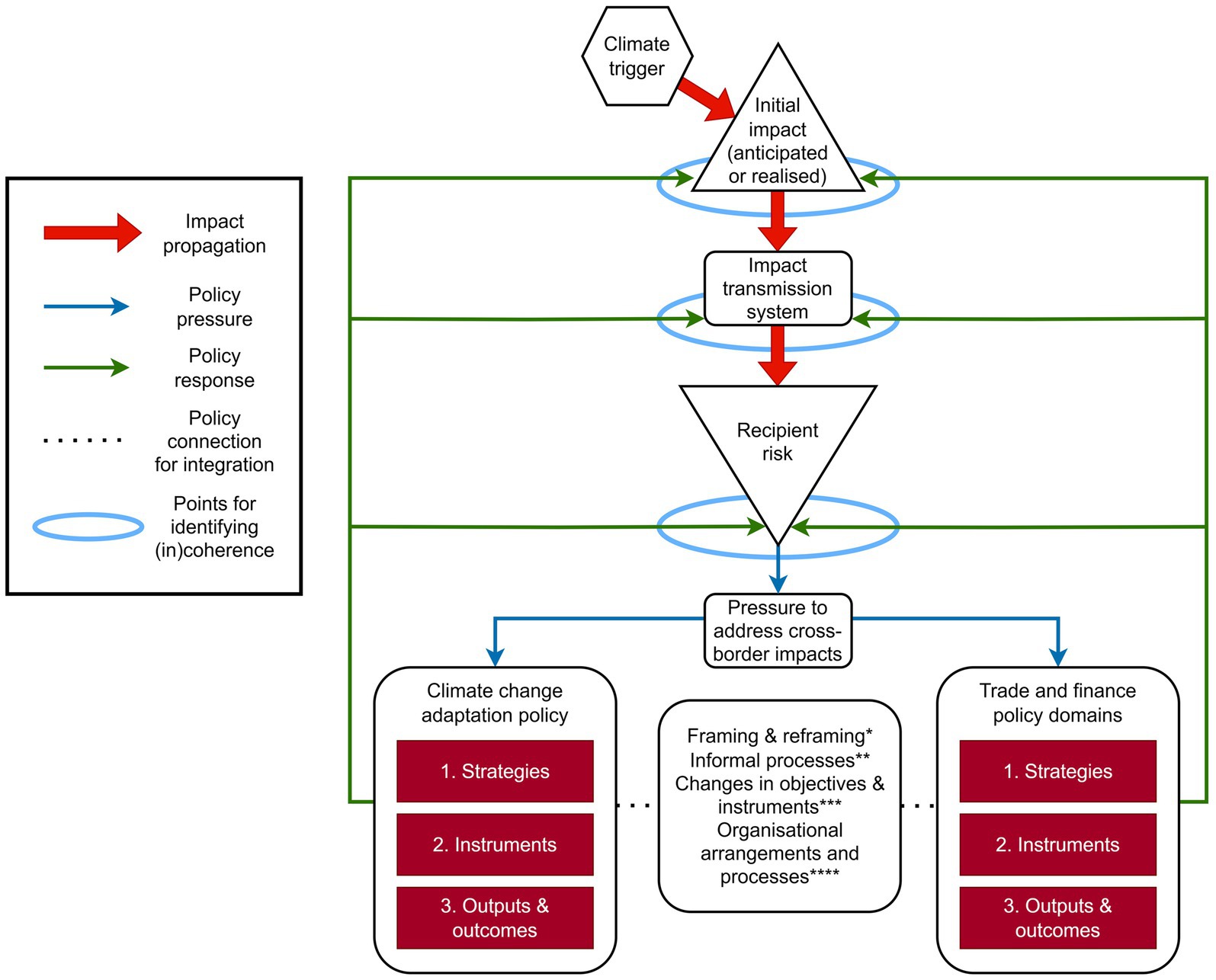

Our interview questions, protocol and the coding structure were guided by a framework for policy coherence and policy integration, including the perspective of cross-border impacts of climate change (adapted from Kivimaa et al., 2025; see Figure 1). The framework takes into consideration the broader context of the impact transmission system but focuses on policy interplay of adaptation policy with trade and finance policies and associated organisational structures. Policy integration as presented in the figure reflects an ideal concept of the process that can become complicated due to several factors that we explore in this article.

Figure 1. Analytical framework: policy integration and coherence between climate change adaptation and trade and finance policies (adapted from Kivimaa et al., 2025). * Understanding of climate change adaptation and cross-border risks. ** Informal ways of advancing coherence and integration, e.g., learning, increasing awareness, knowledge exchange. *** Changes to existing policy objectives/instruments or introduction of new ones that advance climate change adaptation in the policy domains of focus (also budget allocations). **** Organisational tools, resource allocation and assessment of climate change adaptation and cross-border risks.

Trade and finance were chosen as focal policy areas due to their cross-border nature. Further, they have been examined less from a climate change perspective than foreign and security policies (for studies focusing on those, see Lahn and Shapland, 2022; Detges and Foong, 2022; West et al., 2021; Bourekba, 2021; Cepero et al., 2021; Knaepen, 2021; Desmidt, 2021). Before each interview, we tailored our prepared set of questions to accommodate the interviewees’ expertise and domain-specific interactions. Space was left for exploration and allowing unexpected flows of conversation.

Qualitative content analysis (Krippendorff, 2004; Schreier, 2012) was applied based on the analytical framework. The interview material was transcribed, anonymised, and coded using NVivo software. The process followed this order: (1) Joint creation of the first version of a coding tree based on the analytical framework; (2) four authors coded a selected interview separately to test the coding tree and inter-coder reliability, (3) the coding tree was substantially revised based on test coding and discussion, and (4) step 2 was repeated to ensure reliability followed by further minor revisions to the coding tree. (5) Once we deemed the reliability of the coding tree (Appendix 1) to be sufficient, we continued with the rest of the interviews. (6) After all the interviews were coded by two authors, we compiled Excel files of the main results of the interviews, based on the coding, and merged them together for easy comparison. This was to ensure not only that we shared a similar understanding of the data but also that important findings would not be missed. The main content of the interviews is shown in Table 2.

We specifically aimed at recognising interactions between policy domains. The analysis considered policy objectives, policy instruments and their implementation, and policy outputs and outcomes related to climate change (Figure 1). We also examined what institutional arrangements and procedural instruments organisations have employed, how climate change adaptation has been (re)framed, and what kinds of learning have occurred. A distinction was made between formal and informal policy coordination. By formal, we refer to actualised instruments for promoting coherence and integration (e.g., official strategies, legislation, and economic instruments). Informal coordination refers to, e.g., changes in organizational culture, informal interaction, and leadership towards adaptation. While this division serves us analytically, the difference between formal and informal coordination is not always distinguishable as some promotional measures such as organizational tools and funding decisions may fall somewhere in between.

To strengthen the validity of our results and expand and update on the findings, we used triangulation by supplementing the interview material with a reading of official policy documents and report material (Appendix 2). For the document analysis, recent reports, and policies relevant to climate change adaptation in the domains of trade and finance were identified based on the interviews, and documents and literature outlining EU policies. The documents included, e.g., official policy documents and reports by the EU and other relevant publishers. We identified 30 potentially relevant documents published during 2021–2024. The document material was used to analyse to which extent informal adaptation efforts that appeared in the interviews had become formalised by the autumn of 2024. Qualitative content analysis was used on the document material, but the analytical framework was not applied to them. Rather, our guiding questions were “Have trade and finance actors progressed with climate change adaptation, and if so, how?” and “Have climate change adaptation efforts become formalised as official policies?” The findings of the document analysis are examined vis-à-vis the interview material and referred to with an identification [D1–D30].

The interviewees shared an understanding that climate change will affect various activities in different geographical regions, but they did not fully agree on whether climate risks were sufficiently accounted for and when and where they will materialise. However, everyone considered adaptation efforts a substantial challenge.

The interviews showed that some key concepts were interpreted loosely. For example, some interviewees did not make a distinction between climate change mitigation and adaptation. Others bundled adaptation efforts together with other activities or terminology, such as greening policies and circular economy. The connection of climate change adaptation to other policies and actions was not always explicitly recognised. This suggests that the topic was still new for many in trade and finance.

Broadly, the European economy was described as being comparatively resilient to external shocks. Climate change was understood as threatening the security of supply of commodities such as agricultural products and critical raw materials. An interviewee representing the European Commission (EC) considered the EU agricultural system generally resilient to climate change impacts but observed the availability of fertilizers and phosphorus to be a weak point, which highlights that climate change impacts affecting mining or transport are relevant. In the document material, concern over the resilience of European agriculture was also expressed. The European Climate Risk Assessment [D1] identifies agriculture as directly affected by major climate risks in Europe which calls for urgent action, and the notion is echoed in reports by JRC [D2] and EEA [D7].

Increasing public pressure to address climate policy was mentioned as an important driver of policy integration. The strategic objective of ensuring the global competitiveness and technological leadership of the EU was seen to potentially benefit from integration and coherence: the EU could become a leader in climate policy endeavours and a setter of the level of ambition. Albeit more recently, it has become evident that the EU struggles in competitiveness against China and the United States in many areas, but there are still some clean technology fields where leadership potential exists [D30].

The fact that trade and finance are dominated by private actors affects their governance. For example, an interviewee representing the finance sector stressed that profit was the main driver of changing policies for banks, making policy coherence and integration different in the finance sector, compared to, for instance, the energy sector. A study by JRC [D25] exemplifies how financial institutions adjust policies, such as charging higher interest rates in flood-prone areas, based on profit motives and risk management. This shows a focus on financial gain and risk mitigation rather than alignment with wider societal interests. The interviews showed that the EC has been pushing for change in financial institutions. Moreover, interviewees noted that public involvement might be necessary to balance out the varying capacities of different actors, which has also been emphasised in recent documents [D21, D22, D23, D24].

To explore formal integration and promotion of coherence, we examined how adaptation to climate change has been incorporated into EU trade and finance policy objectives and strategies, as well as the strategic objectives of the organisations included in the interviews. Our focus was on the emergence of new strategies and the existence of already formalised plans and objectives.

The overall objective of the EU adaptation strategy is to prepare the EU for climate change and to increase resilience (EC, 2021). In the interviews, climate policy integration was described as a balancing act between reaching as many areas as possible and achieving as deep an integration as possible. When the interviews took place, actors in the financial and trade sectors were not deeply familiar with the, then, new strategy. They noted that climate change adaptation policies should be recognised by financial institutions, also making the adaptation strategy more influential. However, it was also noted that adaptation to climate change develops so quickly that the new strategy should already be updated with a wider scope and more resources.

The EU adaptation strategy aims at general guidance. The European Central Bank and OECD were in the process of formulating their own organisation-specific adaptation plans or had done so already to help pinpoint their own adaptation challenges. The EU strategy was seen as providing inspiration for this work.

Other strategies and policy objectives were mentioned as advancing policy integration and coherence more directly than the adaptation strategy. For example, the monetary policy strategy review of the European Central Bank with climate action plan (ECB, 2021) was published in July 2020 and approved by its governing council. Its main objectives for the finance sector included having a resilient financial system, sustainable financial instruments, and regulation of the insurance sector. The Green Deal was also recognised for other parts beyond the adaptation strategy. It was felt that it had made trade policy a major area for climate change adaptation. The Green Deal also mobilised the Farm to Fork Strategy, which an interviewee argued should lead to increasing the resilience of agricultural trade. Overall, the interviews stressed the importance of a general framing for policy integration and coherence that can then lead to more specific actions.

Since the interviews, the EU has launched the Critical Raw Materials Act [D15] emphasising the critical role of access to raw materials for the EU’s economy and the functioning of the internal market; Corporate Sustainability Reporting Directive [D16] setting requirements for financial institutions to align their business models with climate neutrality goals, addressing how climate-related factors pose financial risks; and European Sustainability Reporting Standards [D17] to enforce a “double materiality” approach, requiring companies to report on their environmental and social impacts and how these factors influence financial risks and opportunities.

The interviews showed that by 2021–2022 efforts to promote climate change adaptation had not resulted in many new policy instruments or changes to existing instruments (such as trade agreements or financial models) relevant for cross-border aspects in trade and finance policies. This finding is concurred by a report by EEA [D7] suggesting that in trade policy, adaptation measures remained in 2021 largely dependent on private actors rather than formal public policy interventions. Some interviewees saw positive changes made to existing instruments or new instruments promoting climate change adaptation, while others thought that not enough had been or was being done. The EU taxonomy for sustainable activities1 was mentioned by several interviewees as an instrument of finance policy that could stimulate investments supporting adaptation. However, the robustness of the sustainability assessment of the taxonomy was questioned.

In trade policy, integration of adaptation was described to happen on a case-by-case basis, because a great deal of trade policy consists of bilateral and multilateral trade agreements. Therefore, the integration depends on negotiating each agreement individually. In addition, proposed measures need to be accepted by each party, which necessitates balancing between acceptance and ambition. It was further noted that third countries may perceive the EU climate ambitions as protectionism, especially in the case of mitigation with the Carbon Border Adjustment Mechanism.2 It was noted, however, that trade agreements could play a bigger role in CPI. For instance, an interviewee stated that the EU should move into partnerships with a mix of development cooperation, sustainable trade agreements, technology transfer, together with assessment of key political conditions.

The Horizon Europe Mission on adaptation was highlighted as a positive example of implementing the EU Adaptation strategy with a focus on regions. However, the Mission is primarily focused on localised impacts (as opposed to cross-border impacts), although general resilience is referred to (EC, n.d.).

Several interviewees reported that their organisations had developed specific measures and tools for adaptation to climate change. Resource allocation and change in organisational structures to integrate climate considerations was highlighted. An interviewee described their organisational operation becoming more aligned due to commitment to climate actions:

“Well, I would say the work has changed quite substantially in the sense that we moved from zero to a commitment that now I would say involves at least… I don’t want to give here random numbers, but I would say that 10 percent of [our] staff is now somehow in a way working on climate. So, talking about big institutions such as [organization], this is a big thing. I think there is no other topic inside the [organization] on which so many people are working together in a very coordinated way.”

Some interviewees mentioned adding climate change considerations to their existing work, such as assessing the impacts of climate change on trade or finance. An EC interviewee noted that this helps their strategic work of convincing and aligning other actors with their CPI work. It is noteworthy that policymakers and target groups are likely to advance at a differing pace. For example, as a governing body, the EC is expected to be at the forefront of CPI, whereas actors at the receiving end of policies can have varying rates of policy adoption depending on how binding the policies are. Many interviewees referred to wider climate goals of the organisation whilst not making concrete plans for adaptation explicit. An EC interviewee highlighted that many organisations have made plans for integration, but these have not resulted in real-world progress, pointing to the limited role of the EU and lack of coherence between member states.

The interview findings regarding lacking real-world progress among trade and finance actors are echoed in the Global Transboundary Climate Risk Report (2023) by IDDRI [D4], noting that current adaptation efforts are not equipped to meet the challenges posed by interconnected trade and financial systems. In addition, the Climate Change and Trade in the European Union report (2023) by Adaptation Without Borders [D12] finds that many businesses do not yet consider climate risks to be significant to their operations, and notes challenges in accessing data, which hinders adaptation efforts and slows down the development of necessary policy instruments.

For new policies to gain legitimacy and acceptance, it is important that concrete positive outcomes can be identified. A finance domain interviewee saw that a high degree of insurance coverage has effectively reduced the economic impact of climate shocks. This finding had, according to the interviewee, led the organisation to stress the degree of insurance coverage in their promotion of climate change adaptation, in line with the objectives of the EU adaptation strategy.

Within the organisations whose representatives we interviewed, and in their interaction with other organisations, informal processes were the most prevalent form of integration and coherence. In some cases, legal mandates set boundaries for the roles organisations may take, restricting possibilities for formal policy integration, leaving informal processes as the main way to promote coherence. The importance of cooperation and knowledge exchange was emphasised. Networks discussing climate change, its impacts, and governance, and cooperation between different levels of governance (EU, member states, third countries) were seen as key to advancing integration. An EC interviewee described their efforts to convince DG Trade to incorporate adaptation thinking, mentioning awareness-raising via EU-funded research projects, and using the trade policy review as an opportunity to argue for the importance of adaptation. This exemplifies that while the EC and national ministries are tasked with establishing formal interactions with external organizations, they also rely on informal processes to strategically find common ground – an essential first step toward more structured collaboration.

The interviewees mentioned many concepts and ideas in the finance sector that were being considered and discussed in their institutions. Several of these could be relevant in a cross-border context, such as a market shaping approach using negative or positive incentives for promoting investments for adaptation. Analogous developments were raised in the trade sector with discussions on an “infratrade network,” an environmental goods agreement, and ways to ensure an equitable supply of critical raw materials. The Critical Raw Materials Act (2024) [D15] indeed touches on fair access to resources and mitigating negative environmental and social impacts caused by increased demand for these materials but does not define linkages between these issues and climate change adaptation. Debates within informal processes, however, seem crucial for policy coherence via their ability to allow deliberation of instruments and tools before they are formalised. This is connected to reflexive policy experimentation that makes space for new kinds of governance solutions.

Incremental development toward increasing the consideration of climate change adaptation and understanding the cross-border impacts of climate change was also described by the interviewees as part of informal processes and work that is already being done. It was highlighted that “international spillover,” or cross-border impacts of climate change, are increasingly considered in the work of the financial stability board and banking supervision. The EC was also establishing green alliances with third countries with increasing adaptation considerations as adaptation was getting policy attention in the EU. In this, actors can influence the policy landscape via developing existing structures without formal or explicitly stated policy objectives that are communicated to third parties.

Arguably, a key interest for the trade and finance domains is safeguarding resilience and stability of their operation in the face of external disruptions. The interviewees provided different accounts regarding the EU’s resilience toward cross-border climate impacts, but few specific examples of coherence between adaptation policies and trade and finance in a cross-border context. The interviews reflected a view that the EU is exposed to all financial systems but is resilient to cascading climate impacts. The general perception was that the biggest risks were related to goods and trade rather than finance. For example, climate impacts could threaten supply chains. The EU’s active political influence outside of its own region was seen to be a way to safeguard its own economic stability. The EU’s trade relations with third countries were perceived to be diverse boosting resilience by reducing dependence on individual trade partners. The Global Transboundary Climate Risk Report (2024) by IDDRI [D4] finds the EU as particularly vulnerable to trade-related climate risks but to maintain some resilience through diversification of trade partners and digital finance improvements.

Many interviewees focused on the international connections of the EU and its potential leadership role. The European approach using soft power, building alliances, and having great ambitions was seen to allow for more resources to be allocated to external actions, affecting policies in partner countries. Thus, the interviewees recognised that the EU should not only strive to be resilient against the impacts of climate change, but also promote climate-positive policies actively in other regions. There were, however, reservations about the EU’s capacity to push economies to adopt climate-positive policies as advancement also depends on domestic politics in the partner countries.

In general, our interviews suggested that most effort and thinking regarding adaptation to climate change in trade and finance have focused on matters within EU borders and between its member states. The EU’s ability to integrate adaptation in international contexts of trade and finance was largely thought to be about influencing extra-EU countries to adopt climate policies more generally or diversifying trade relations. Better anticipation and assessment of cross-border risks originating outside the EU with the intention of modifying EU policies was given less attention.

The interviews demonstrated that there are challenges to the integration and coherence of cross-border climate change adaptation in trade and finance, although cross-border issues are central to both policy domains. In the following, we identify structural obstacles.

The interviewees stated that lack of knowledge hindered integration of climate adaptation in their work. In finance organisations, the commonly used models were not considered good at identifying climate risks, with many sectors missing. In addition, models and climate stress tests did not consider adaptation, and the insurance sector was seen to be overlooked. The Climate Change and Trade in the European Union report (2023) by Adaptation Without Borders [D12] finds that businesses lack access to relevant climate risk and adaptation data. Without sufficient data, they struggle to assess the costs of inaction and the benefits of adaptation, making it difficult to justify investments in adaptation strategies. A white paper by the World Economic Forum (2023) [D13] echoes this finding, saying that businesses may over-rely on risk transfer mechanisms (e.g., insurance) instead of proactively engaging in adaptation, which points to a gap in understanding the full scope of risks posed by climate change.

Institutional boundaries and the logic of financial actors also affected the integration work within finance. According to an interviewee representing the finance domain, adaptation was not well integrated into monetary policy as central bankers were restricted by their mandate, saying “it is for fiscal authorities to deal with.” It was also pointed out that financial actors tend to look at climate risks regarding their own operations, and not how they could increase resilience in the wider system. Mostly, financial players were seen to safeguard their freedom and prioritise short-term gains. In the insurance sector, the recognition of increasing climate risks may lead to higher premiums or refusals to provide insurance, making it more difficult for vulnerable economies to adapt, thereby increasing the risk of cross-border impacts.

Trade policies have traditionally been seen to ensure the flow of goods at favourable conditions. Introducing conditions that would advance resilience to climate risks does not easily fit into this logic. In the case of climate mitigation, conditions on the production have even been perceived as a form of protectionism. Efforts to encourage adaptation by changing for example farming practices through trade policies may also be regarded by farmers or politicians as inappropriate interference in the economy. If the adaptation actions are seen to increase (short-term) production costs and food prices, concern for social unrest may arise where such adaptation action is expected to be introduced. Trade policies are thus blunt instruments for adaptation to climate change. Through policy integration they can raise the issue at a general level, but the implementation of adaptation requires detailed context sensitive actions that are coherent across other policies such as development co-operation and climate change adaptation. These links are, however, still seen to be only emerging.

Trade and finance are sectors that are naturally inclined to recognise the significance of events that affect them indirectly. Far reaching impacts of climate change are, however, new, and the awareness of various impact transmission systems (Carter et al., 2021) is only emerging. At the time of the interviews, the integration of climate change adaptation in trade and finance policies was not based on formal criteria or procedures as suggested by our analytical frame (Figure 1). Instead, the interviewees mainly described informal processes and policy objectives around climate change adaptation, whereas few raised actual policy instruments, their implementation, or the assessments of policy outcomes. These findings are supported by the document material, which mention few formal instruments for policy integration and express concerns over the slow pace of progress. Informal encouragement and cooperation are often the beginning of, or support for, more formal integration (Eberlein, 2003). However, pure informality often suffers from lack of accountability, transparency and coherent strategy (Kivimaa, 2022).

The identified informal processes have contributed to progress at the level of policy strategies, whereas the actual implementation level of policy instruments was only emerging (see Figure 1). Moreover, the interviewees tended to see climate change adaptation as a part of general-level policy objectives and concepts such as “greening,” while more in-depth consideration of climate change adaptation in a cross-border perspective was lacking.

The mandates of the institutions naturally affected the interviewees’ understanding of possible roles and actions in climate change adaptation. However, many recognised that the assigned roles of different actors are evolving to better integrate adaptation into trade and finance policies. This will ultimately make adaptation issues visible in organisational practices. For example, regarding finance, the Basel Committee on Banking Supervision has compiled “Frequently asked questions on climate related financial risks” (Birn, 2022). The next step would be to develop specific criteria for banking, explicitly recognising the diversity that arises in a cross-border context. The literature also argues that ultimately stronger regulatory interventions may be needed (Chenet et al., 2021).

Our findings indicate several challenges for cross-border adaptation governance. For instance, as the complexity of cross-border climate impact transmissions has been recognised, tools and, in some cases, also mandates are lacking to address them in a way that would make responses coherent across borders and across organisations and policy domains. This means that policy coherence and integration has had somewhat of an ad hoc problem-solving character (Cejudo and Michel, 2017) instead of a systematic pursuit of synergies and reduction of conflicts that would signal formalised or institutionalised coherence (Nilsson et al., 2012). The complex and knowledge-intensive nature of the governance challenge complicates progress further, as scientific evidence and detailed models are needed to accurately anticipate required responses. Actors may have difficulties in pinpointing specific adaptation needs, appropriate policy objectives and instruments, as well as evaluating their expected or realised impacts. It seems clear that climate change adaptation policy integration within relevant organisations is a prerequisite for more effective policy coherence, so that a common understanding of terms, concepts and processes is achieved. This also involves the development of appraisal processes (Jordan et al., 2013).

Nevertheless, many organisations in trade and finance have laid out their own adaptation strategies. These make specific interpretations of general global objectives to promote adaptation to cross-border impacts of climate change. Such adaptation efforts largely focus on ways to safeguard operations in the short term. For complex cross-border impacts, wider policy integration, and hence coordination between policy domains, is needed to support the overall effectiveness of implementation. However, as climate change adaptation is also a political issue (Yunita et al., 2022), some policy incoherence is likely to be unavoidable. Especially trade and finance policies are dealing with powerful interests for which adaptation to climate change is a secondary matter unless it affects the business model directly, as in the insurance business.

The uneven distribution of costs and the question of fairness pose additional challenges for cross-border adaptation in trade and finance. Resilience to climate change impacts varies greatly between regions and economies (IPCC, 2022), and it correlates with the stability of the economy and the diversity of trade. Our interviews portrayed the EU as a resilient economy that is likely to suffer comparatively little from climate change impacts. Although this narrow view neglects the cascading cross-border impacts, the strength and diversity of the EU’s economy and geography help maintain adaptive capacity for the EU as a whole. In contrast, island nations and developing regions can be massively affected by both direct and cross-border impacts of climate change, as their economies are small and lack sufficient resources for climate change adaptation. To support climate change adaptation globally and reduce cascading risks to the EU, trade and finance policies in the EU need to develop means to support adaptation actions in the most affected regions. Because context and the nature of the risks vary this will require experimentation and piloting, and therefore also the acceptance of some incoherence as Grabel (2017) has argued. Baer et al.’s (2021) call for political and delegated authorities to cooperate in adjusting the institutional settings also hints in the same direction and emphasise the need to initiate changes through informal contacts across policy domains.

Implementing a working and effective policy response framework to deal with cross-border and cascading impacts is not only resource-intensive but requires a functional institutional environment. The EU adaptation strategy has delivered an EU-wide climate risk assessment that is expected to create a base for future responses (European Environment Agency, 2024). Based on the findings of this study, the strategy itself does not appear to be strong enough to achieve integration. Many interviewees perceived little effect from the strategy in their specific domains and activities. The EU-wide climate risk assessment and the Commission’s response to it (EC, 2024) may, however, incentivise also trade and finance policy actors to become actively involved in paying adequate attention to (cross-border) impacts of climate change.

Although financial instruments, such as insurance, can create buffers against impacts, they may also increase inequalities as the poorest lack the means to pay for insurance. The creation of institutions such as the EU Solidarity Fund ((EC) 2012/2002) to complement private finance in preparing for risks is also demanding. Establishing such a mechanism requires clarification of its relationship with other instruments, the fund’s financing model, potential beneficiaries, and the role of adaptation plans in guiding the use of the funds. There are also possible adverse consequences, such as moral hazards (Mcleman and Smit, 2006) that need to be considered.

Overall, our findings have shown that there is a growing awareness of the need to integrate adaptation to climate change in trade and finance policies. The informal connections that many interviewees reported, as well as subsequent policy documents, suggest potential progress towards implementation. In finance specifically, there is a growing acceptance that the threats deriving from climate change are significant to the mandates of central banks and financial supervisors, justifying a precautionary approach to financial policy (Chenet et al., 2021). Literature on adaptation within trade policy, on the other hand, underscores the need for international coordination mechanisms (Bednar-Friedl et al., 2022). Preferential trade agreements, specifically, could have untapped potential for climate policy integration within trade (Morin and Jinnah, 2018; Laurens et al., 2021).

Research has begun to pay attention to the resilience of EU trade and finance policies in the face of cross-border climate risks, but the mechanisms through which the complex policy mixes of the EU can achieve coherent responses to cascading climate risks are only emerging. This article contributes to the discussion by identifying some of the needed resources to effectively prepare for the complex governance challenge. Our findings highlight the knowledge-intensive nature of policy integration which is magnified in a cross-border context. While Nilsson et al. (2012) conceptualise knowledge as a policy input that feeds into policy making, our findings show that its effective use needs structures and processes for dialogues as well as capacity among key actors to make it salient in the policy domains we have addressed. Knowledge and understanding of climate change and its relation to trade and finance affect the urgency with which actors address the governance challenge. They also shape how trade and finance actors can incorporate anticipated climate impacts into models and organizational practices. Informal processes can greatly help in making knowledge actionable, thereby supporting further policy integration.

There are limitations to this research, especially pertaining to the pool of interviews. At the time of the interviews, the topic of cross-border climate risks appeared to be a very new in the area of trade and finance policy. This meant that finding expert interviews was difficult, with many rejections of our interview requests. The EU-level interviews were complemented with some national perspectives, which suffer from a lack of broader representation of EU member states besides Finland and France. National views were not actively sought, but they were added to the pool of interviews due to an otherwise limited sample and suggestions from others interviewed and the professional networks of the authors. The limitations related to the interviews are, to an extent, accounted for and relieved by using the report data, but we encourage future studies with more comprehensive interview material. Further research is needed for an updated view on how cross-border risks and climate change adaptation have subsequently been implemented at the EU-level, especially in the context of the new European Commission that began operating in January 2025 and focuses on the triple challenge of competitiveness, security and climate change. Moreover, research investigating and comparing national approaches to the integration of cross-border risks would be needed. The topic of cross-border climate risks and trade and finance policy sits at the interface of different research fields (e.g., climate policy studies, trade policy studies, finance policy studies, international relations). This study was written from the perspective of climate policy studies, while further studies could pursue multi-disciplinary collaboration to develop this area.

There is a need for systematic evaluations of coherence in actual policy implementation and policy outcomes responding to cross-border impacts of climate change. Lack of resources and knowledge may still hamper progress within the interviewed organisations and especially on the ground in those countries and regions which suffer acutely from direct and cross-border impacts of climate change. This underlines the need to develop support for fair coverage of the costs of adaptation. Trade and finance policies have an important role to play. Policy domains need to work in unison to find coherent approaches to governing the cross-border impacts of climate change, recognising the need for global justice in climate policy (Newell et al., 2021). In particular, climate change adaptation policy needs to be integrated into EU policies in a manner that helps societies outside Europe to become more resilient and responsive to the effects of climate change.

Formal integration of climate change adaptation policy (and the perspective of cross-border impacts) into EU trade and finance policies is in a relatively early stage. However, there is increasing activity in this area. We show that the first steps in pursuing policy integration and coherence in the context of adaptation and cross-border climate risks involves informal processes which policy actors use strategically to find common ground. They should be encouraged as they help in overcoming barriers created by a lack of awareness of the issue and are therefore necessary in further processes for institutionalising integration and ensuring coherence between climate change adaptation and EU trade and finance policies. The informal processes may be particularly effective in trade and finance policies that, by their nature, deal with cross-border issues. In other policy areas, the informal processes may need to be initiated by top-down decisions.

The importance of informal coherence and integration work has so far received rather little attention in the literature on policy integration and coherence. Further work is needed to evaluate the outcomes of these informal activities. Full reliance on informal processes may lead to ad hoc problem-solving-oriented policymaking that cannot ensure effective and transparent policy coherence under changing conditions. Formalisation that supports timely and focused action to strengthen adaptive capacity is particularly pertinent in a cross-border context. It is justified in the context of rapidly expanding impacts of climate change, with an increasing number of severe climate change impacts around the world that may lead to unprecedented effects also on trade and finance.

The datasets presented in this article are not readily available due to concerns regarding participant/patient anonymity. Requests to access the anonymised participant data should be directed to the corresponding author.

SP: Conceptualization, Data curation, Formal analysis, Investigation, Methodology, Validation, Visualization, Writing – original draft, Writing – review & editing. PK: Conceptualization, Data curation, Formal analysis, Funding acquisition, Investigation, Methodology, Project administration, Resources, Validation, Visualization, Writing – original draft, Writing – review & editing. MH: Conceptualization, Data curation, Formal analysis, Investigation, Methodology, Validation, Visualization, Writing – original draft, Writing – review & editing. CM: Data curation, Formal analysis, Investigation, Validation, Writing – original draft.

The author(s) declare that financial support was received for the research and/or publication of this article. The present study was funded by the European Commission Horizon2020 CASCADES (CAScading Climate risks: towards ADaptive and resilient European Societies) project, grant ID: 821010. The revision of the paper by PK was also supported by funding of the green transition by the European Union (number 151, P5C1I2, NextGenerationEU), in the RePower-CEST project.

The authors would like to thank their colleagues in the project for helpful and critical comments on the findings and analysis. Special thanks belong to Christopher Reyer, Magnus Benzie, Mikael Mikaelsson, and Hetty Saes-Heibel. We also thank the interviewees for their contributions to the study. In addition, the corresponding author would like to thank his PhD supervisors Pekka Jokinen and Ari Jokinen for their help and support along the writing process.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

The authors declare that Gen AI was used in the creation of this manuscript. Generative AI was used to assist analysis by pinpointing which documents discussed specific points highlighted by interviewees. In addition, generative AI was used to help format the references list and enhance the readability of the text.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

1. ^Regulation (EU) (2019) of the European Parliament and of the Council on the establishment of a framework to facilitate sustainable investment.

2. ^https://taxation-customs.ec.europa.eu/carbon-border-adjustment-mechanism_en (the aim is to ensure the carbon price of imports is equivalent to the carbon price of domestic production, and that the EU’s climate objectives are not undermined).

Adelle, C., and Russel, D. (2013). Climate policy integration: a case of Déjà vu? Environ. Policy Gov. 23, 1–12. doi: 10.1002/eet.1601

Attinasi, M. G., Balatti, M., Mancini, M., and Metell, L. (2021). Supply chain disruptions and the effects on the global economy. Econ. Bull. Available at: https://www.ecb.europa.eu/press/economic-bulletin/html/eb202108.en.html (Accessed December 12, 2024).

Baer, M., Campiglio, E., and Deyris, J. (2021). It takes two to dance: institutional dynamics and climate-related financial policies. Ecol. Econ. 190:107210. doi: 10.1016/j.ecolecon.2021.107210

Bauer, A., Feichtinger, J., and Steurer, R. (2012). The governance of climate change adaptation in 10 OECD countries: challenges and approaches. J. Environ. Policy Plan. 14, 279–304. doi: 10.1080/1523908X.2012.707406

Bednar-Friedl, B., Knittel, N., Raich, J., and Adams, K. M. (2022). Adaptation to transboundary climate risks in trade: investigating actors and strategies for an emerging challenge. Wiley Interdiscip. Rev. Clim. Chang. 13, 1–12. doi: 10.1002/wcc.758

Benzie, M., Carter, T. R., Carlsen, H., and Taylor, R. (2019). Cross-border climate change impacts: implications for the European Union. Reg. Environ. Chang. 19, 763–776. doi: 10.1007/s10113-018-1436-1

Benzie, M., and Persson, Å. (2019). Governing borderless climate risks: moving beyond the territorial framing of adaptation. Int. Environ. Agreem. Politics Law Econ. 19, 369–393. doi: 10.1007/s10784-019-09441-y

Berrang-Ford, L., Biesbroek, R., Ford, J. D., Lesnikowski, A., Tanabe, A., Wang, F. M., et al. (2019). Tracking global climate change adaptation among governments. Nat. Clim. Chang. 9, 440–449. doi: 10.1038/s41558-019-0490-0

Biesbroek, R. (2021). Policy integration and climate change adaptation. Curr. Opin. Environ. Sustain. 52, 75–81. doi: 10.1016/j.cosust.2021.07.003

Biesbroek, R., and Candel, J. J. L. (2020). Mechanisms for policy (dis)integration: explaining food policy and climate change adaptation policy in the Netherlands. Policy. Sci. 53, 61–84. doi: 10.1007/s11077-019-09354-2

Biesbroek, R., and Swart, R. (2019). “Adaptation policy at supranational level? Evidence from the European Union” in Research handbook on climate change adaptation policy. eds. E. C. H. Keskitalo and B. L. Preston (New York, NY: Edward Elgar Publishing), 194–211.

Bolton, P., Despres, M., Pereira da Silva, L. A., Samana, F., and Swartzman, R. (2020). The green swan—Central banking and financial stability in the age of climate change. Basel: Bank for International Settlements.

Bourekba, M. (2021). Climate change and violent extremism in North Africa. Barcelona: Barcelona Centre for International Affairs.

Brunnermeier, M., De Gregorio, J., Eichengreen, B., El-Erian, M., Fraga, A., and Ito, T. (2012). Banks and cross-border capital flows: policy challenges and regulatory responses. Available online at: https://trinhkimtrunghieu.wordpress.com/wp-content/uploads/2014/04/3-brunnermeierc2a0mdec2a0gregorioc2a0jc2a0etc2a0al-c2a02012-banksc2a0andc2a0crosse28090borderc2a0capitalc2a0flowsc2a0policyc2a0-challengesc2a0andc2a0regulatoryc2a0r.pdf (accessed April 3, 2014).

Bruno, V., and Shin, H. S. (2013). Cross-border banking and global liquidity. Available online at: https://www.bis.org/publ/work458.pdf (Accessed December 12, 2024).

Brutger, R., and Marple, T. (2024). Butterfly effects in global trade: international borders, disputes, and trade disruption and diversion. J. Peace Res. 61, 903–916. doi: 10.1177/00223433231180928

Bryant, R. C. (2003). Turbulent Waters—Cross-border finance and international governance. Brookings Institution Press.

Carter, T. R., Benzie, M., Campiglio, E., Carlsen, H., Fronzek, S., Hildén, M., et al. (2021). A conceptual framework for cross-border impacts of climate change. Glob. Environ. Chang. 69:102307. doi: 10.1016/j.gloenvcha.2021.102307

Cejudo, G. M., and Michel, C. L. (2017). Addressing fragmented government action: coordination, coherence, and integration. Policy. Sci. 50, 745–767. doi: 10.1007/s11077-017-9281-5

Cepero, O. P., Desmidt, S., Detges, A., Tondel, F., Van Ackern, P., Foong, A., et al. (2021). Climate change, development and security in the central Sahel. CASCADES.

Chenet, H., Ryan-Collins, J., and van Lerven, F. (2021). Finance, climate-change and radical uncertainty: towards a precautionary approach to financial policy. Ecol. Econ. 183:106957. doi: 10.1016/j.ecolecon.2021.106957

Desmidt, S. (2021). Climate change and security in North Africa: Focus on Algeria, Morocco and Tunisia. CASCADES research paper. Available online at: https://www.cascades.eu/wp-content/uploads/2021/02/CASCADES-Research-paper-Climate-change-and-security-in-North-Africa-1.pdf (Accessed December 12, 2024).

Detges, A., and Foong, A. (2022). Foreign policy implications of climate change in focus regions of European external action. Available online at: https://www.cascades.eu/wp-content/uploads/2022/02/Detges-and-Foong-2022-Foreign-Policy-Implications-European-External-Action.pdf (Accessed December 12, 2024).

Dewulf, A., Meijerink, S., and Runhaar, H. (2015). The governance of adaptation to climate change as a multi-level, multi-sector and multi-actor challenge: a European comparative perspective. J. Water Clim. Change 6, 1–8. doi: 10.2166/wcc.2014.000

Eberlein, B. (2003). Regulating cross-border trade by soft law? The "Florence process" in the supranational governance of electricity markets. Compet. Regul. Netw. Ind. 4, 137–155. doi: 10.1177/178359170300400202

EC (n.d.). EU Mission: Adaptation to Climate Change. https://research-and-innovation.ec.europa.eu/funding/funding-opportunities/funding-programmes-and-open-calls/horizon-europe/eu-missions-horizon-europe/adaptation-climate-change_en.

EC (2013). An EU strategy on adaptation to climate change. COM/2013/216. Available online at: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:52013DC0216&from=EN (Accessed December 12, 2024).

EC (2021). Forging a climate-resilient Europe – the new EU strategy on adaptation to climate change. COM/2021/82. Available online at: https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=COM:2021:82:FIN (Accessed December 12, 2024).

EC (2024). EU Mission: adaptation to climate change. Available online at: https://research-and-innovation.ec.europa.eu/funding/funding-opportunities/funding-programmes-and-open-calls/horizon-europe/eu-missions-horizon-europe/adaptation-climate-change_en (Accessed December 12, 2024).

ECB (2021). ECB presents action plan to include climate change considerations in its monetary policy strategy. Available online at: https://www.ecb.europa.eu/press/pr/date/2021/html/ecb.pr210708_1~f104919225.en.html (Accessed December 12, 2024).

Edvardsson Björnberg, K., and Hansson, S. O. (2011). Five areas of value judgement in local adaptation to climate change. Local Gov. Stud. 37, 671–687. doi: 10.1080/03003930.2011.623159

European Commission. (2024). Managing climate risks – protecting people and prosperity. Communication from the commission to the European Parliament, the council, the European economic and social committee and the Committee of the Regions. Strasbourg, 12.3.2024 COM (2024) 91 final.

European Environment Agency. (2024). European climate risk assessment. Available online at: https://www.eea.europa.eu/publications/european-climate-risk-assessment (accessed December 11, 2024).

Fünfgeld, H. (2015). Facilitating local climate change adaptation through transnational municipal networks. Curr. Opin. Environ. Sustain. 12, 67–73. doi: 10.1016/j.cosust.2014.10.011

Furness, M., and Gänzle, S. (2017). The security–development nexus in European Union foreign relations after Lisbon: policy coherence at last? Dev. Policy Rev. 35, 475–492. doi: 10.1111/dpr.12191

Gallagher, K. P., and Barakatt, C. (eds.). (2016). Trade in the Balance: Reconciling Trade and Climate Policy. Trustees of Boston University.

Gallagher, K. (2015). Ruling capital: Emerging markets and the reregulation of cross-border finance. Cornell studies in money. Ithaca, NY: Cornell University Press.

Giest, S., and Mukherjee, I. (2022). Evidence integration for coherent nexus policy design: a Mediterranean perspective on managing water-energy interactions. J. Environ. Policy Plan. 24, 553–567. doi: 10.1080/1523908X.2022.2049221

Grabel, I. (2017). When things don’t fall apart—global financial governance and development finance in an age of productive incoherence. Cambridge: MIT Press.

Harrinkari, T., Katila, P., and Karppinen, H. (2016). Stakeholder coalitions in forest politics: revision of Finnish Forest act. Environ. Plan. C: Politics Space. 35, 30–37. doi: 10.1016/j.forpol.2016.02.006

Howlett, T., Vince, P., and Del Rio, P. (2017). Policy integration and multi-level governance: Dealing with the vertical dimension of policy mix designs. Forest Policy Econ. 35, 775–791. doi: 10.17645/pag.v5i2.928

Huitema, D., Adger, W. N., Berkhout, F., Massey, E., and Mazmanian, D. (2016). The governance of adaptation: choices, reasons, and effects. Introduction to the special feature. Ecol. Soc. 21:337. doi: 10.5751/ES-08797-210337

IPCC (2022). “Climate change 2022: impacts, adaptation and vulnerability” in Contribution of working group II to the sixth assessment report of the intergovernmental panel on climate change. eds. H.-O. Pörtner, D. C. Roberts, M. Tignor, E. S. Poloczanska, and K. Mintenbeck (Cambridge: Cambridge University Press).

Jokinen, P., Blicharska, M., Primmer, E., Van Herzele, A., Kopperoinen, L., and Ratamäki, O. (2018). How does biodiversity conservation argumentation generate effects in policy cycles? Biodivers. Conserv. 27, 1725–1740. doi: 10.1007/s10531-016-1216-5

Jordan, A., Rayner, T., Schroeder, H., Adger, N., Anderson, K., Bows, A., et al. (2013). Going beyond two degrees? The risks and opportunities of alternative options. Clim. Pol. 13, 751–769. doi: 10.1080/14693062.2013.835705

Kettner, C., and Kletzan‐Slamanig, D. (2020). Is there climate policy integration in European Union energy efficiency and renewable energy policies? Yes, no, maybe. Environmental Policy and Governance 30, 141–150.

Kivimaa, P. (2022). Policy and political (in)coherence, security, and Nordic-Baltic energy transitions. Oxford Open Energy 1:oiac009. doi: 10.1093/ooenergy/oiac009

Kivimaa, P., Hildén, M., Carter, T. R., Mosoni, C., Pitzén, S., and Sivonen, M. H. (2025). Evaluating policy coherence and integration for adaptation: the case of EU policies and Arctic cross-border climate change impacts. Clim. Pol. 25, 59–75. doi: 10.1080/14693062.2024.2337168

Kivimaa, P., and Sivonen, M. H. (2021). Interplay between low-carbon energy transitions and national security: an analysis of policy integration and coherence in Estonia, Finland and Scotland. Energy Res. Soc. Sci. 75:102024. doi: 10.1016/j.erss.2021.102024

Knaepen, H. (2021). Climate risks in Tunisia: challenges to adaptation in the Agri-food system. CASCADES research paper. Available online at: https://www.cascades.eu/wp-content/uploads/2021/02/Climate-risks-in-Tunisia-Challenges-to-adaptation-in-the-agri-food-system-1.pdf (Accessed December 12, 2024).

Krippendorff, K. (2004). Content analysis: An introduction to its methodology. 2nd Edn. London: Sage Publications.

Lafferty, W., and Hovden, E. (2003). Environmental policy integration: towards an analytical framework. Environ. Politic. 12, 1–22. doi: 10.1080/09644010412331308254

Lahn, G., and Shapland, G. (2022). Cascading climate risks and options for resilience and adaptation in the Middle East and North Africa. Available online at: https://www.cascades.eu/wp-content/uploads/2022/03/CASJ9418-MENA-Report-220328-v2.pdf

Lai, X., Chen, Z., Wang, X., and Chiu, C.-H. (2023). Risk propagation and mitigation mechanisms of disruption and trade risks for a global production network. Transp. Res. Part E Logist. Transp. Rev. 170:103013. doi: 10.1016/j.tre.2022.103013

Laurens, N., Brandi, C., and Morin, J. F. (2021). Climate and trade policies: from silos to integration. Clim. Pol. 22, 248–253. doi: 10.1080/14693062.2021.2009433

Lee, K. M., Yang, J. S., Kim, G., Lee, J., Goh, K. I., and Kim, I. (2011). Impact of the topology of global macroeconomic network on the spreading of economic crises. PLoS One 6:e18443. doi: 10.1371/journal.pone.0018443

Magaldi, D., and Berler, M. (2020). “Semi-structured interviews” in Encyclopedia of personality and individual differences. eds. V. Zeigler-Hill and T. K. Shackelford (Cham: Springer), 1–6.

Magnan, A. K., Schipper, E. L. F., and Duvat, V. K. E. (2020). Frontiers in climate change adaptation science: advancing guidelines to design adaptation pathways. Curr. Clim. Chang. Rep. 6, 166–177. doi: 10.1007/s40641-020-00166-8

May, P. J., Sapotichne, J., and Workman, S. (2006). Policy Coherence and Policy Domains. Policy Studies Journal, 34, 381–403. doi: 10.1111/j.1541-0072.2006.00178.x

McLeman, R., and Smit, B. (2006). Vulnerability to climate change hazards and risks: crop and flood insurance. Can. Geographer 50, 217–226. doi: 10.1111/j.0008-3658.2006.00136.x

Morin, J. F., and Jinnah, S. (2018). The untapped potential of preferential trade agreements for climate governance. Environ. Politics 27, 541–565. doi: 10.1080/09644016.2017.1421399

Newell, P., Shrivastava, S., et al. (2021). Toward transformative climate justice: an emerging research agenda. WIREs. Climate Change 12:733. doi: 10.1002/wcc.733

Nilsson, M., Zamparutti, T., Petersen, J. E., Nykvist, B., Rudberg, P., and Mcguinn, J. (2012). Understanding policy coherence: analytical framework and examples of sector-environment policy interactions in the EU. Environ. Policy Gov. 22, 395–423. doi: 10.1002/eet.1589

Plank, C., Haas, W., Schreuer, A., Irshaid, J., Barben, D., and Görg, C. (2021). Climate policy integration viewed through the stakeholders' eyes: A co-production of knowledge in social-ecological transformation research. Environ. Policy Gov. 31, 387–399. doi: 10.1002/eet.1938

Porterfield, M. C. (2016). “Reconciling trade rules and climate policy” in Trade in the balance: Reconciling trade and climate policy. eds. K. P. Gallagher and C. Barakatt (Boston, MA: Trustees of Boston University), 43–49.

Regulation (EU) (2019). Regulation (EU) 2020/852 of the European Parliament and of the Council of 18 June 2020 on the establishment of a framework to facilitate sustainable investment, and amending. Available online at: https://eur-lex.europa.eu/legal-content/EN/TXT/PDF/?uri=CELEX:32020R0852&from=EN (Accessed December 12, 2024).

Remling, E. (2018). Depoliticizing adaptation: a critical analysis of EU climate adaptation policy. Environ. Polit. 27, 477–497. doi: 10.1080/09644016.2018.1429207

Rietig, K. (2013). Sustainable climate policy integration in the European Union. Environ. Policy Gov. 23, 297–310. doi: 10.1002/eet.1616

Roberts, N. C., and King, P. (1991). Policy entrepreneurs: their activity structure and function in the policy process. J. Public Adm. Res. Theory 1, 147–175. doi: 10.1093/oxfordjournals.jpart.a037081

Schoenefeld, J. J., and Jordan, A. J. (2020). Towards harder soft governance? Monitoring climate policy in the EU. J. Environ. Policy Plan. 22, 774–786. doi: 10.1080/1523908X.2020.1792861

Schulz, T., Lieberherr, E., and Zabel, A. (2021). How national bioeconomy strategies address governance challenges arising from forest-related trade-offs. J. Environ. Policy Plan. 24, 123–136. doi: 10.1080/1523908X.2021.1967731

Singh, C., Iyer, S., New, M. G., Few, R., Kuchimanchi, B., Segnon, A. C., et al. (2022). Interrogating ‘effectiveness’ in climate change adaptation: 11 guiding principles for adaptation research and practice. Clim. Dev. 14, 650–664. doi: 10.1080/17565529.2021.1964937

Sotirov, M., Winkel, G., and Eckerberg, K. (2021). The coalitional politics of the European Union’s environmental forest policy: biodiversity conservation, timber legality, and climate protection. Ambio 50, 2153–2167. doi: 10.1007/s13280-021-01644-5