- 1Department of Rural Development and Agricultural Innovations, Wolaita Sodo University, Sodo, Ethiopia

- 2Addis Ababa University, Addis Ababa, Ethiopia

- 3Center for Food Security and Development, CORDAID Ethiopia, Addis Ababa, Ethiopia

Livestock insurance, an important risk management tool, is gaining popularity in Ethiopia. Proper investigation is needed to expand its adaptability throughout the country. This study was designed to explore the willingness and payment capacity of farmers in Southern Ethiopia to pay for index-based livestock insurance as an alternative solution to climate risk mitigation. A mixed research method was employed to gather data from primary and secondary sources. Cross-sectional data were obtained from 157 cattle farmers, drawn randomly from the study area. The study also used key informant interviews and focus group discussions to collect qualitative data. Descriptive statistics, inferential tests, and double-hurdle model were used to analyze quantitative data. Word descriptions and thematic analysis were employed for qualitative data analysis. The results of the study showed that a significant proportion of farmers were willing to pay for IBLI services. The findings also suggested that the demand for index-based livestock insurance seemed to be influenced by a number of factors. Those households that are headed by a men, who are better educated, who are better experienced in farming system, and those who have access to credit and training are more likely to pay for the insurance. Farmers’ perception of weather-related risks and awareness about insurance also influenced farmers’ willingness to pay positively. Furthermore, farmers with larger assets, such as land and livestock, have more confidence in paying capacity for insurance. Farmers with mass media access were more likely to pay for IBLI. However, households with larger number of household members and those who perceived the cost of the insurance premium as unaffordable are less likely to purchase the IBLI. These significant factors impacting households’ willingness to pay for the insurance services must be considered in adaptation pathways. The Dasenech district case study suggests that IBLI can effectively mitigate climate risks and be applied to other regions with similar socioeconomic characteristics and production systems.

1 Introduction

As in other Horn of African countries, Ethiopian pastoralists are exposed to a variety of natural, economic, and climate risks (Kahsay et al., 2020; Melketo et al., 2021). Pastoralists in Ethiopia continue to be vulnerable to complex challenges caused by both natural and policy factors, despite the fact that the livestock production sector is a vital source of stability and support for the nation’s socioeconomic state (Jing et al., 2018), accounting for 12–16% of the national Gross Domestic Product and 30–35% of the agricultural GDP (Gebrekidan et al., 2019). The continued dependence on rain-fed dryland production systems, coupled with the lack of well-developed infrastructure and credit and insurance markets intensifies the effects of these risks (Ejeta, 2019).

It is now known that climate change-induced drought events push dry land systems to cross biophysical thresholds, causing a long-term drop in livestock productivity (Guo and Bohara, 2015) and substantial loss of livestock (Castellani and Viganò, 2017; Ejeta, 2019). Periodic droughts which aggravate the dry seasons, loss of pastures, and widespread cattle deaths have become a common feature. Ethiopian farmers experienced multiple drought patterns and significant deaths from 1973/74 to 2015/16, illustrating the severity of the issue (Desta and Coppock, 2004; Angassa and Oba, 2007; Berhanu and Fayissa, 2010; Tadesse et al., 2017).

Governance issues also increase the vulnerability of pastoralists. Instead of being inclusive, the few modern development initiatives in the region are extractive (Kahsay et al., 2020). Even though it is claimed to be a vital component of the national economy, the large-scale investments’ appropriation of communal resources like land, forests, and water led to development-induced displacement, the loss of pasture and grazing land, and unhealthy ecosystem for Ethiopia’s pastoralists and agro-pastoralists (Fonjong and Gyapong, 2021; Kahsay et al., 2020; Melketo et al., 2021). Additionally, the livestock industry is riskier due to poor access to information systems, sustainable markets, veterinarian and consulting services, and animal health infrastructure (Gebrekidan et al., 2019). The majority of livestock hazards are linked to illnesses and the rising death rate of cattle and small ruminants, primarily due to consecutive droughts (Jing et al., 2018). One of the recommended risk mitigation strategies in such a vulnerable environment is the index-based livestock insurance product (IBLI) (Banerjee et al., 2019; Bertram-Huemmer and Kraehnert, 2015; Bertram-Huemmer and Kraehnert, 2018).

Recently, index-based insurance is increasingly being considered as an instrument to mitigate uninsured covariate risk in rural areas lacking commercial insurance access. Over the past decade, researchers, multilateral organizations, and governments have been exploring the use of microinsurance to cover the potential losses of smallholder farmers due to weather shocks (Lu et al., 2022). This alternative form of microinsurance, insurance tailored to the needs of the poor, has been offered to stimulate rural development by allowing smallholder farmers to better adapt to climate change (Mhella, 2024). Index-based insurance offers advantages over traditional insurance by reducing transaction costs, eliminating structural problems like moral hazard and adverse selection, and allowing insurance companies and insured clients to monitor the index (Mahul and Skees, 2007).

The primary ways in which index-based insurance positively impacts different dimensions of life of the poor are highlighted in the growing body of literature (Amare et al., 2019; Jensen et al., 2024; Islam et al., 2024). Insurance provides alternative risk mitigation strategies by adjusting households’ ability to handle ex-post risks, potentially influencing optimal behavior before a shock is actually experienced. Cole et al.’s (2012) systematic review reveals that index-based insurance, particularly microinsurance, positively influences investment in high-risk activities, leading to higher expected profits. Haruna (2015) shows that farmers who purchase rainfall index insurance in Ghana increase agricultural investment. Belissa (2019) uses experimental methods to show that in a game setting, insurance induces farmers in rural Ethiopia to take greater, yet profitable risks, by increasing the purchase of fertilizers. Recent impact evaluations of the original IBLI pilot in northern Kenya nonetheless find income and productivity gains, on average, for IBLI policyholders he initial IBLI pilot in northern Kenya has shown an average increase in income and productivity for policyholders, according to recent impact evaluations (Jensen et al., 2015).

In East Africa, initially, IBLI was introduced to northern Kenya in 2010 (Chantarat et al., 2013; Mude et al., 2009; Mude et al., 2010; Sina and Jacobi, 2012), and then to the Borana zone of Oromia region, Ethiopia (Castellani and Viganò, 2017). However, it is evident that the demand for the IBLI is generally low and its uptake continues to be below expectations in Africa (Giné, 2009; Jensen et al., 2015). In fact, previous studies attempted to pinpoint the major reasons for the low consumption of IBLI in other African countries. Constraints such as start-up costs of premium and low financial support of government, difficulties in transferring covariance risk to international reinsurance markets, inappropriate and/or expensive delivery mechanisms, lack of a favorable environment, and ignorance of the insurance market are among the common predicaments from the supply side (Sina and Jacobi, 2012; Mahul and Stutley, 2010; Cole et al., 2009). From the demand side, premium affordability (Carter, 2012), trust in insurance providers (Cole et al., 2009), financial illiteracy (Giné and Yang, 2009), and cognitive failure (Skees, 2008; Skees and Collier, 2008) are among the major constraints. Given the heterogeneity in socioeconomic and institutional contexts, however, extrapolating these results to Ethiopian context is difficult.

Existing studies on index-based insurance adoption in Ethiopia are based on the experience of crop insurance programs that shield farmers against yield loss brought on by climate change and associated hazards (Bogale, 2015). The assumption here is that the adoption and lessons learned from the index-based insurance products would vary between crop-based and livestock-based production systems to the degree that livelihood systems, risk mitigation techniques, and the long-term welfare outcomes linked to shocks differ in both contexts. In addition, the existing study on IBLI in Ethiopia (Amare et al., 2019) focused on the causes of failure and low uptake of the insurance. However, studies that examine farmers’ willingness and ability to pay for IBLI services in Ethiopia remain non-existent.

Therefore, this study would fill the knowledge gap on the area of livestock insurance and would pinpoint key lessons that help for upscaling the microinsurance as alternative means of mitigating climate risks. Hence, the central objective of this study is to examine the determinants of farmer’s willingness to pay (WTP) and purchasing power for index-based livestock insurance in livestock-based farming systems of Dasenech district, south Ethiopia.

2 The context and index-based livestock insurance adoption

2.1 The context

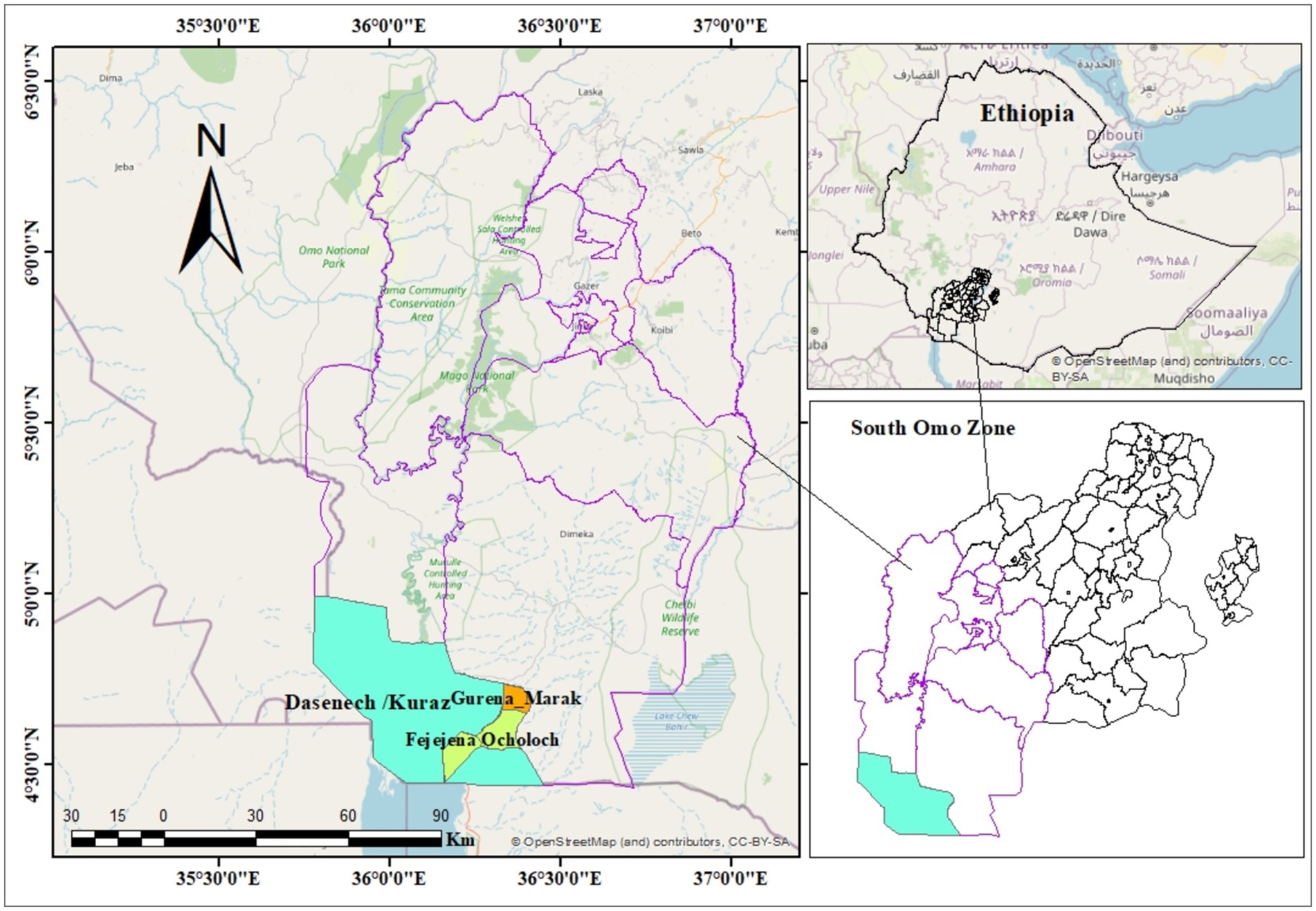

This study is undertaken in Dasenech district of South Omo zone of the South Ethiopia regional state located 189 km away from the border with Kenya. The landscape is an arid low-land with average annual precipitation of 250 mm and temperatures averaging 42°C (Tadesse, 2023).

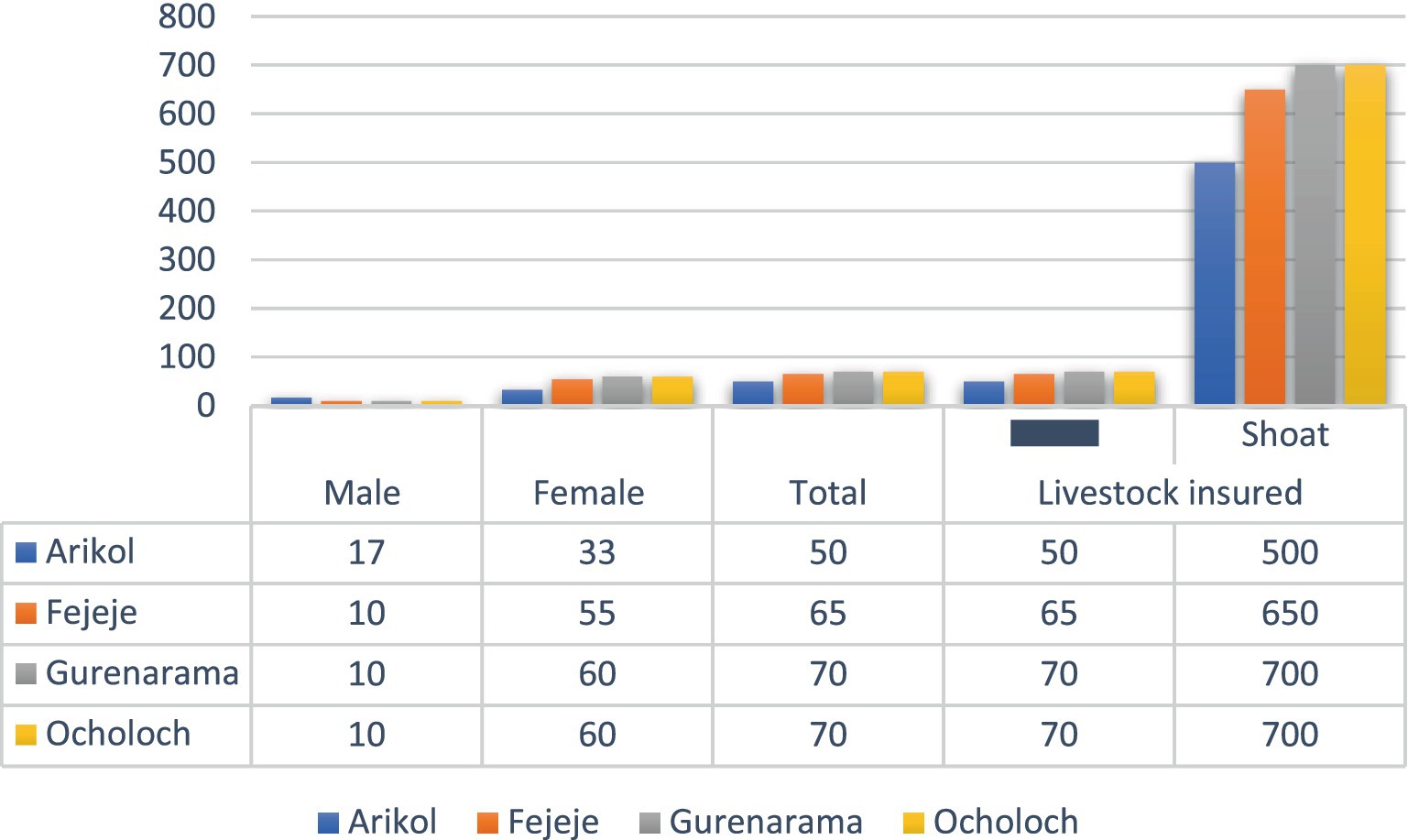

Three of the four targeted kebeles by the Resilience for Innovation (R4I) project (Figure 1), Fejej, Ocholoch and Gurenamarak, are pastoral, whereas Aricol, which is located closer to the Omo River, is agro-pastoral where small-scale crop production of mainly sorghum, maize, and vegetables supplement livelihoods (Getachew and Mebrahtu, 2017). The district experiences 8 months of food and nutrition security gap per annum due to the reliance on livestock as the only reliable livelihood option for most households (Tadesse, 2023). In 2016, a severe drought led to the loss of 355,622 livestock in Dasenech (Yoseph, 2022). Inadequate rainfall and water scarcity lead to malnourished livestock, increasing disease risk and mortality. Limited resources and veterinary drugs make it difficult for local communities to address these issues, leading to migration and livestock sales.

2.2 Overview of index-based livestock insurance adoption

Traditional production systems struggle to address societal challenges such as climate risks, especially in nomadic and semi-nomadic pastoralist communities. Inclusive social innovations are, therefore, required to build resilience and ensure sustainable development (Kalkanci et al., 2019). The EU has committed resources to initiate EU-Resilient Ethiopia (RESET Plus Innovation funded) projects, including the innovation for resilience (I4R) project at Dasenech district. This project introduced IBLI as a novel climate risk mitigation strategy. IBLI Dasenech’s index is determined at the district level by calculating the cumulative deviation of Normalized Differential Vegetation Index (NDVI) measures, a crucial indicator for drought monitoring in Africa. The IBLI scheme, underwritten by Oromia Insurance and Sinqe bank, utilizes satellite imagery to calculate the NDVI to assess forage/vegetation scarcity. If the NDVI falls below a trigger point, payouts are made to protect core herds, based on nutritional requirements.

The I4R project trained village insurance promoters (VIPs) to serve as community advocates for IBLI and facilitate awareness creation campaigns. The project also subsidized 50–75% of insurance premiums to boost participation and included IBLI premium payments in the safety-net package, enhancing drought-affected communities’ resilience and expanding insurance products. Not all the farmers at the district use IBLI, and for those who do, they do not buy for all their livestock. There are factors that underlie the decision to pay, which are what this study seeks to explore.

3 Materials and methods

3.1 Research approach

This article is part of a bigger research which involving a comprehensive household-level surveys using a mix of qualitative and quantitative methods to assess the socioeconomic and resilience capacity changes and impacts brought about by social innovations. Out of the 13 innovative projects funded by the EU-RESET Plus, this action research covered innovative project situated at the South Omo cluster. Based on Roger’s (Rogers et al., 2014) innovation diffusion theory, attempts were made to analyze the extent to which communities recognize and embrace innovation. In short, it describes the extent to which beneficiaries adopt innovative technologies for societal change.

3.2 Sampling frame

The study utilized random sampling technique to select participants from four target kebeles (the smallest admirative units) in the district, determining a total sample size using a published table (Israel, 2013) with ±7 level of precision. This yields a sample size of 143 households out of the total population involving a list of both beneficiaries and non-beneficiaries of the innovative project being implemented in the target district. Thus, with a non-response rate of 10% and the final sample size for the study was 157 households. Then, probability proportional to size (PPS) sampling was employed to get the sample size in each kebele.

Sixty-nine percent of the sample households were men-headed and 31% women-headed. In terms of respondents, however, 59% were men and 41% men. The high proportion of women respondents was due to widowed households and husbands away for casual employment or mobility. In households (10%) where the husbands were away from the house for a long time, their wives were making decisions on important household issues relating to livestock production and IBLI payout issues. All the respondents were livestock herders and only a few (15%) were agro-pastoralists practicing dryland crop farming. Before the introduction of IBLI schemes as alternative climate risk mitigation innovations, traditional adaptation strategies such as destocking and restocking of livestock after severe catastrophes like droughts, food and cash aid, and engagement on productive safety-net programs were among the efforts taken by the respondent households in the study area.

3.3 Data collection methods

Both primary and secondary data were gathered and used for this study. Cognizant of the research goal, and the nature of the information needed on various aspects of this study, employing a single type of data and data acquisition technique is insufficient to satisfy the data requirements. This research, therefore, employed mixed methods to collect data from primary and secondary sources as described below:

3.3.1 Desk review

Here, attempts were made to access and critically review the field practices in line with the theory of change of the implemented pilot project, government policies, and strategic guidelines; strategic documents of the EU-RESET innovation-funded project; the project design and implementation guidelines, and project performance reports. The desk review helped examining the livestock farmers’ payment trends for IBLI services and identify good practices, challenges, and lessons learned from the pilot project in Dasench district.

3.3.2 Household survey

A semi-structured interview schedule with different modules related to demographic, socioeconomic, institutional, and psychosocial factors was prepared and agreed upon with the funding agency, the Cordaid Ethiopia, and implementing NGOs before departing for fieldwork. Twenty randomly selected respondents (50% men and 50% women) comprised of five households per kebele who were not participants in the sample households for the major survey at the district were given the interview schedule in order to pre-test it before the actual survey was performed. On the basis of the results obtained from the pre-test survey, necessary modifications were made in the interview schedule. Training on Kobo Tool data gathering methods and the contents of the interview schedule were given to selected enumerators. Finally, the questionnaires were administered to 157 sampled households in the study area in the period September 10–17, 2023.

3.3.3 Focus group discussions (FGDs)

Four FGDs (one FGD per a kebele comprising six to seven participants) were conducted to gather qualitative data on farmers’ adoption of IBLI, its limitations, good practices, and local knowledge on climate change and livestock production systems.

3.3.4 Key informant interview

In-depth interviews were conducted with 17 key informants. These key informants included district-level rural and pastoral development experts, development agents, Kebele administrators, and clan leaders. These people included community elders and religious leaders who were well-versed in the climate conditions, mitigation and adaptation plans, and livestock production methods of the district. The respondents were mainly heads of households (usually men) in the kebele. However, when the household head was not present at the time of the visit, the spouse was interviewed. Given that men were mobile with their herds and less available at home during the study period, the majority of the interviewees were women. Local guides assisted the interviewers in identifying the selected households.

3.4 Methods of data processing and analysis

3.4.1 Analytical technique

A review of literature on willingness to pay for agricultural insurance indicates that there are three ways of estimating farmer’s willingness to pay for insurance. One is contingent valuation method, which is highly recommended in the instances where there is no or little market information (Taneja et al., 2014). However, the contingent valuation method was not used in this study because there have been different advocacy platforms that have been established and utilized for promoting the adoption of the IBLI technology and its importance for livestock headers particularly by the implementing NGOs in the context of Dasenech district.

Various studies have used either the double-hurdle model or the Heckman’s sample selection model in determining the willingness to pay for insurance (Gabre-Madhin et al., 2003; Wodjao, 2008; Yu and Abler, 2010). In this study, the double-hurdle model was adopted based on its advantage over the Heckman’s selection model. The Heckman sample selection model assumes that no zero response will be present in the second hurdle of the analysis once the first hurdle is passed while the double-hurdle, on the other hand, recognizes the possibility of zero observations in the second stage (Wodjao, 2008). The possibility of zero response is as a result of the fact that the livestock farmer may refuse to answer due to a lack of knowledge or how complex the questions are perceived to be. In addition, some pastoralist household heads may only have partial information concerning their willingness to pay (Yu and Abler, 2010). For such a case, it is possible that respondents cannot give a number representing their WTP but may recognize the fact that they have a positive WTP.

Smith (2002) and Smith and Watts (2019) suggested a double-hurdle model in which adoption behavior consists of two decisions: an adoption decision, which is a binary choice, modelled using a Logit; and a WTP amount decision, which is a truncated regression model. The double-hurdle is used in a situation where an event may occur or not and when it does, it takes on continuous positive values (Gabre-Madhin et al., 2003). It is assumed that the livestock farmer is faced with hurdles in the decision-making process. Hence, the decision to pay is made first followed by the decision on how much to pay for the insurance. The two equations are assumed to be independent.

This study focuses on utility maximization, a theory that suggests farmers make decisions based on maximizing utility rather than just profit from the index-based insurance (McConnell et al. 2009). The utility of a pastoral household is given as , from choosing alternative . A pastoralist household will choose whether or not to adopt livestock insurance depending on the relative utility levels associated with the two choices. Therefore, the probability that alternative will be chosen is given by

where is the observed outcome for the th observation. indexed the livestock farmer, and are the alternatives being considered, is a vector of livestock farmer, farm and institutional characteristics, is a vector of parameters to be estimated, and is the stochastic random error. Even though the difference in utilities of adoption and non-adoption are unobserved,

The decision of a farmer is taken as a binary outcome such that

The assumption here is that livestock herders choose index-based livestock insurance adoption or non-adoption based on their highest utility level, deciding on the option that enhances their highest level of utility.

Accordingly, the first equation in the double-hurdle relates to the willingness to adopt livestock insurance scheme. A probit regression on the willingness to adopt or not is modeled as:

is a dichotomous variable, which assumes a value of 1 and 0 otherwise, z is a vector of a livestock farmer, farm and institutional characteristics, is a vector of parameters, and is the error term.

The empirical model for livestock farmer’s willingness to adopt index-based livestock insurance is specified for this study as.

+

WTI is the probability that an ith livestock farmer is willing to adopt the livestock insurance. are the coefficients of the explanatory variables. is the error term.

The second hurdle which estimates the amount (premium) livestock farmers are willing to pay is estimated using a regression truncated at zero. It is expressed as

WTPamti = WTPamti*, if WTPamti* > 0 and if WTPamti* = 0 otherwise WTPamti* = x’iβ+ui

where WTP is the observed response on how much livestock farmers are willing to pay for livestock insurance. χ is the vector of farmer, farm and institutional characteristics, is a vector of parameters, and is the error term which is randomly distributed.

The empirical model of the truncated regression model (tobit model) is specified for this study as

where is the amount an ith livestock farmer is willing to pay, are parameters to be estimated, and is the error term.

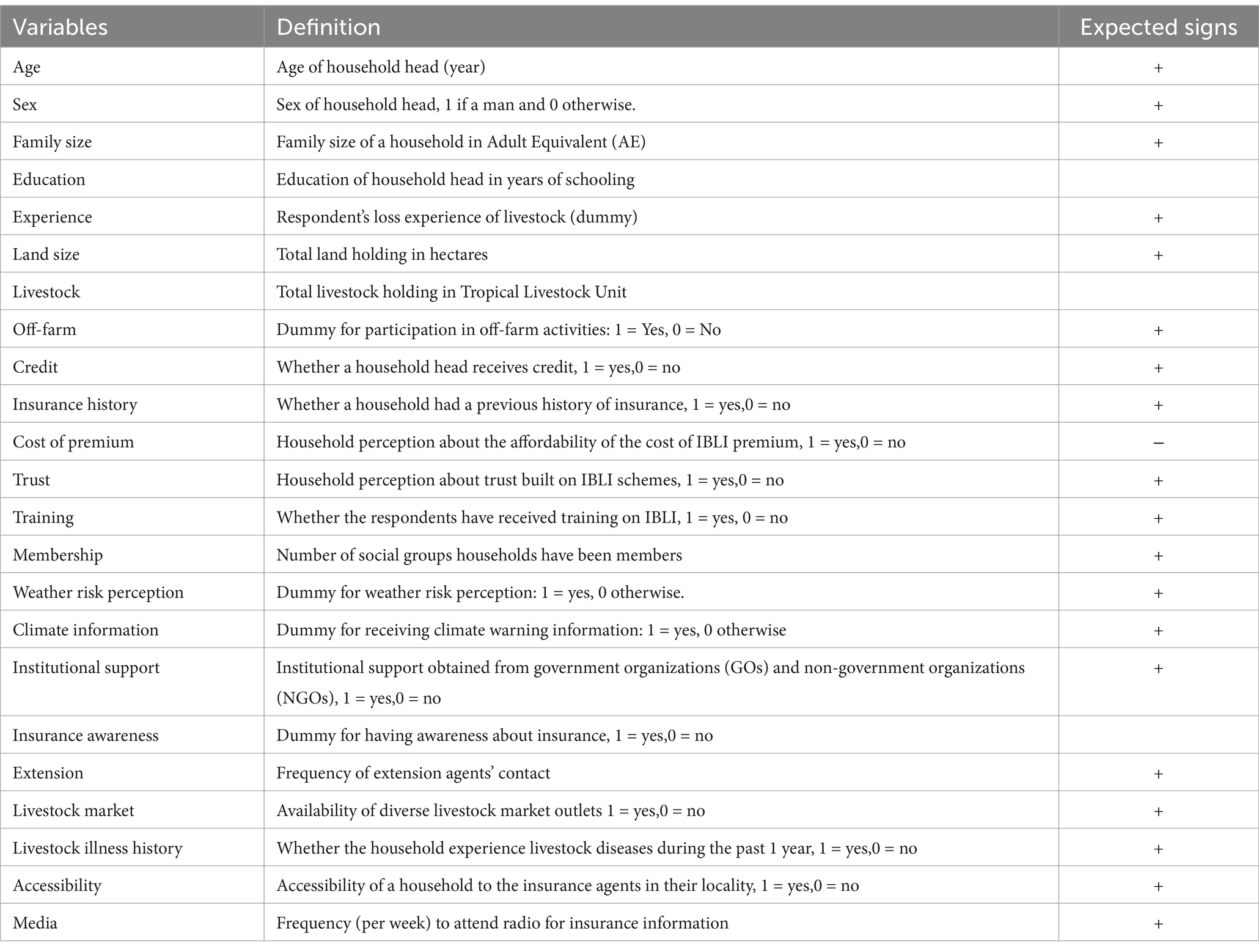

3.5 Definition of variables and hypothesis

The potential explanatory variables expected to influence the decision to adopt IBLI and their expected sign of influence are summarized in Table 1.

4 Results and discussion

4.1 Results of the descriptive statistics

4.1.1 Demographic and socioeconomic characteristics of the respondents

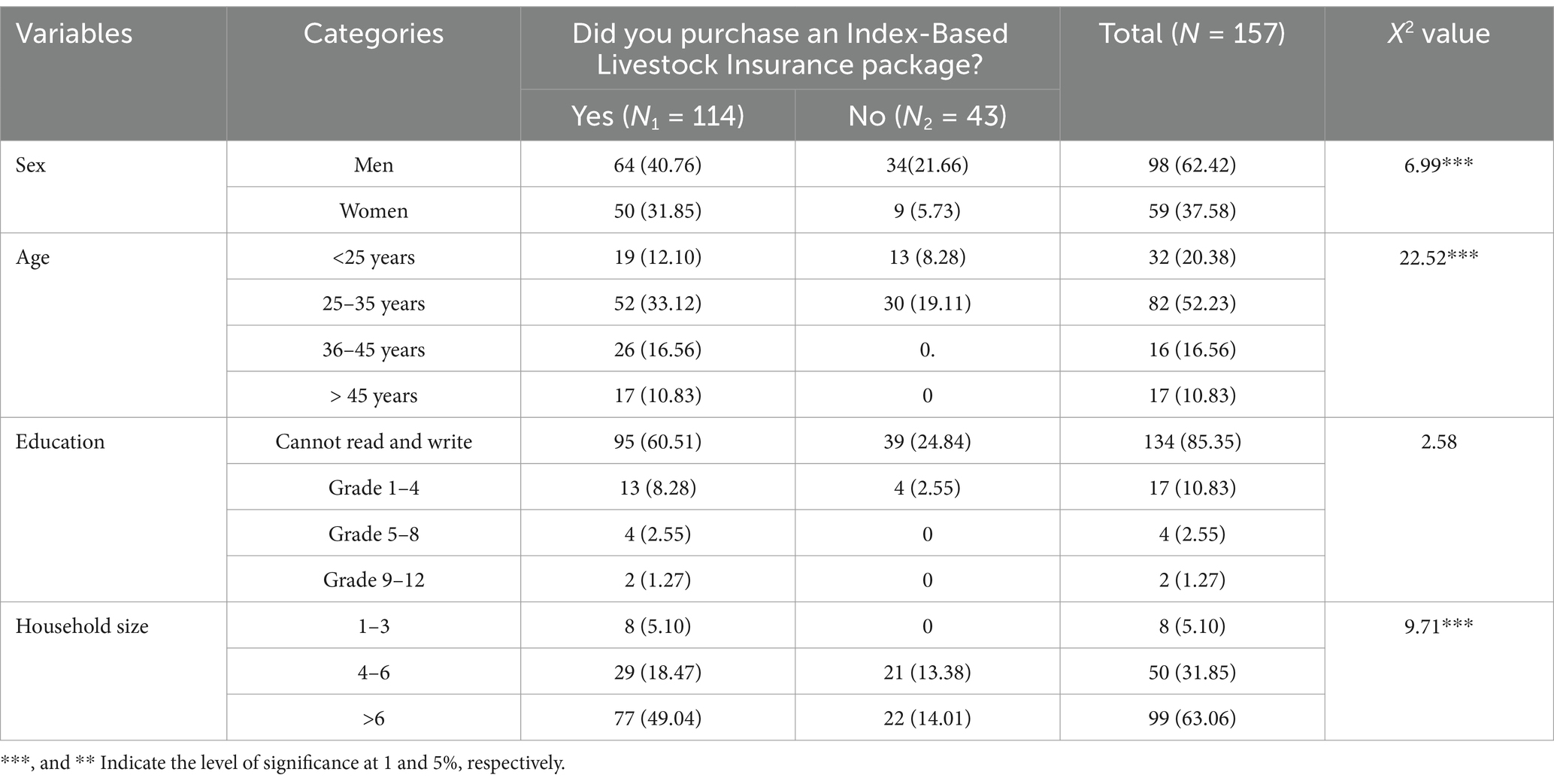

A deliberate effort was made to consider gender in the sampling process when choosing respondents in the survey. This was based on the rationale that women and men might interact differently with pastoral and agro-pastoral life systems and the associated difference in the decisions to pay for IBLI packages. Concerning the gender distribution, women represent 37.58% of the total respondents to the survey questions, and the positive responses to adopt IBLI package overweigh by both sex categories, as illustrated on Table 2. The calculated p-value indicated a statistically significant association between gender and farmer willingness to pay for insurance at a 0.05 significance level. The study reveals that the willingness to pay for IBLI services significantly differs based on the gender differences among farm household heads.

Four age categories were used to analyze the age data. More than half of the respondents (52.23%) fall under the age range of 25–35 years, 20.38% were below 25 years, 16.56% were adults under the age category 36–45 years, and the rest 10.83% of the respondents comprise older people groups whose age is more than 45 years. It was found that the vast majority of pastoralist and agro-pastorlist households in Dasenech (85.35%) were illiterate, who cannot read and write. It indicates that access to education is among the pressing challenges that Dasenech communities are facing. Over half of the sample households (63.66%) had large families with six or more members, indicating high food and sustenance demands. The p-value strongly suggests that the existence of significant association between the age difference and farmer’s willingness to pay for the index-based insurance.

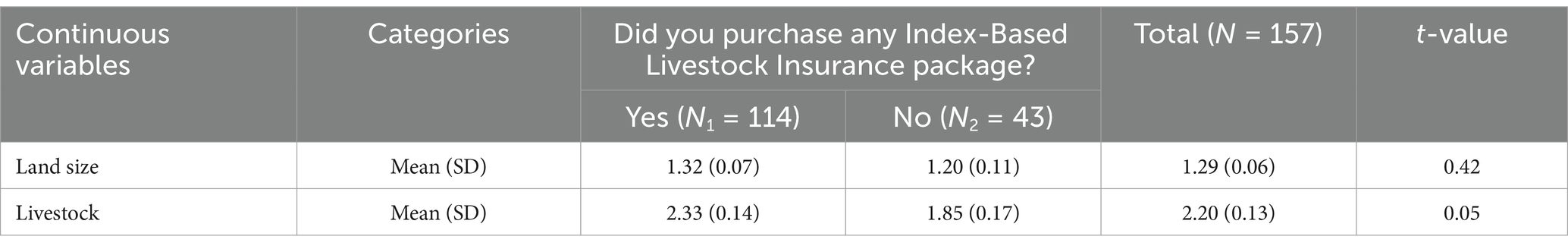

The average land holding size of agro-pastoral communities of Dasenech is 1.29 ha per household (Table 3) whereas the average farm land size of the households who purchased the index-based insurance is 1.32 ha per household, which overweighs the land size of those who did not purchase the insurance (1.20 ha). This implies that land size has a positive association with the household’s decision and/or willingness to pay for the insurance. The average herd size per household is 2.20 in Topical Livestock Unit. It is worth mentioning that households with an average larger livestock size showed better willingness to pay for the insurance than those who had averagely lower herd size.

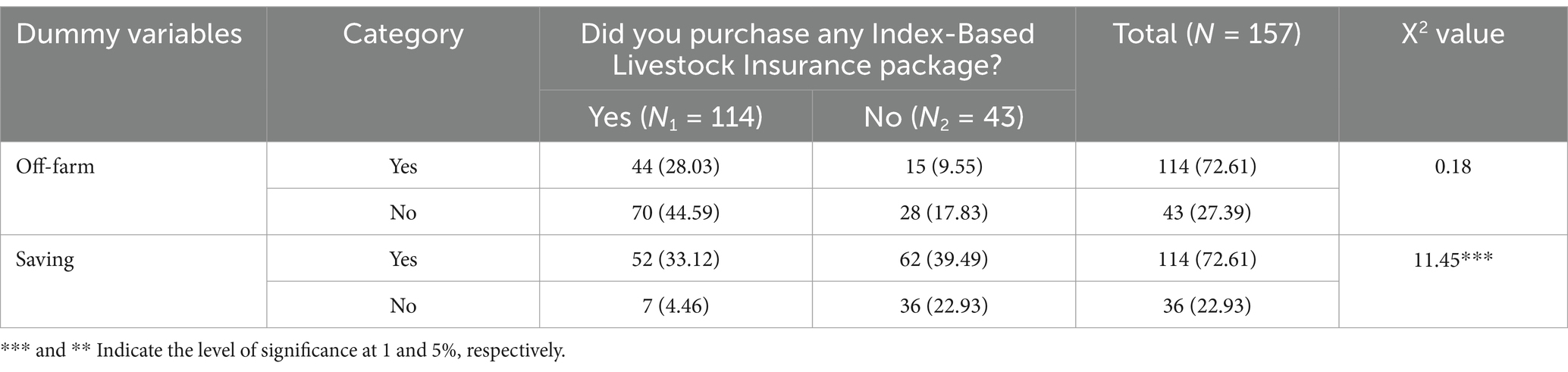

The study revealed that households who are not diversifying their livelihoods from livestock dependence to off-farm income-generating activities (44.59%) outperformed those participating in off-farm activities (28.03%) in purchasing insurance (Table 4). The implication is that participation on off-farm activities had a negative association with willingness to purchase the insurance. The calculated p-value, however, showed that the difference in farmer’s willingness to pay for the insurance between off-farm participant and non-participant households is insignificant. On the contrary, the analysis revealed that household saving culture positively influences the farmer’s willingness to pay for the insurance, as indicated in Table 4. The willingness to pay for insurance varies significantly between those who practice saving and those who do not.

Table 4. Socioeconomic characteristics of respondents with their willingness to pay for the insurance.

4.2 Payout trends for index-based livestock insurance at Dasenech

In this section, an attempt was made to examine farmer’s experience in purchasing IBLI at Dasench district of South Omo zone, Ethiopia. To understand this, data on the sales of IBLI during the I4R project pilot period were obtained from CST Ethiopia (CAF + D + SCIAF Trocaire) interim and endline reports and were reviewed. BLI insurance contracts were sold during two sales periods—January to February and August to September—before the start of both short and long rainy seasons. Index readings for each sales period were announced, and indemnity payments were made to policyholders if a strike rate is triggered at the end of the season.

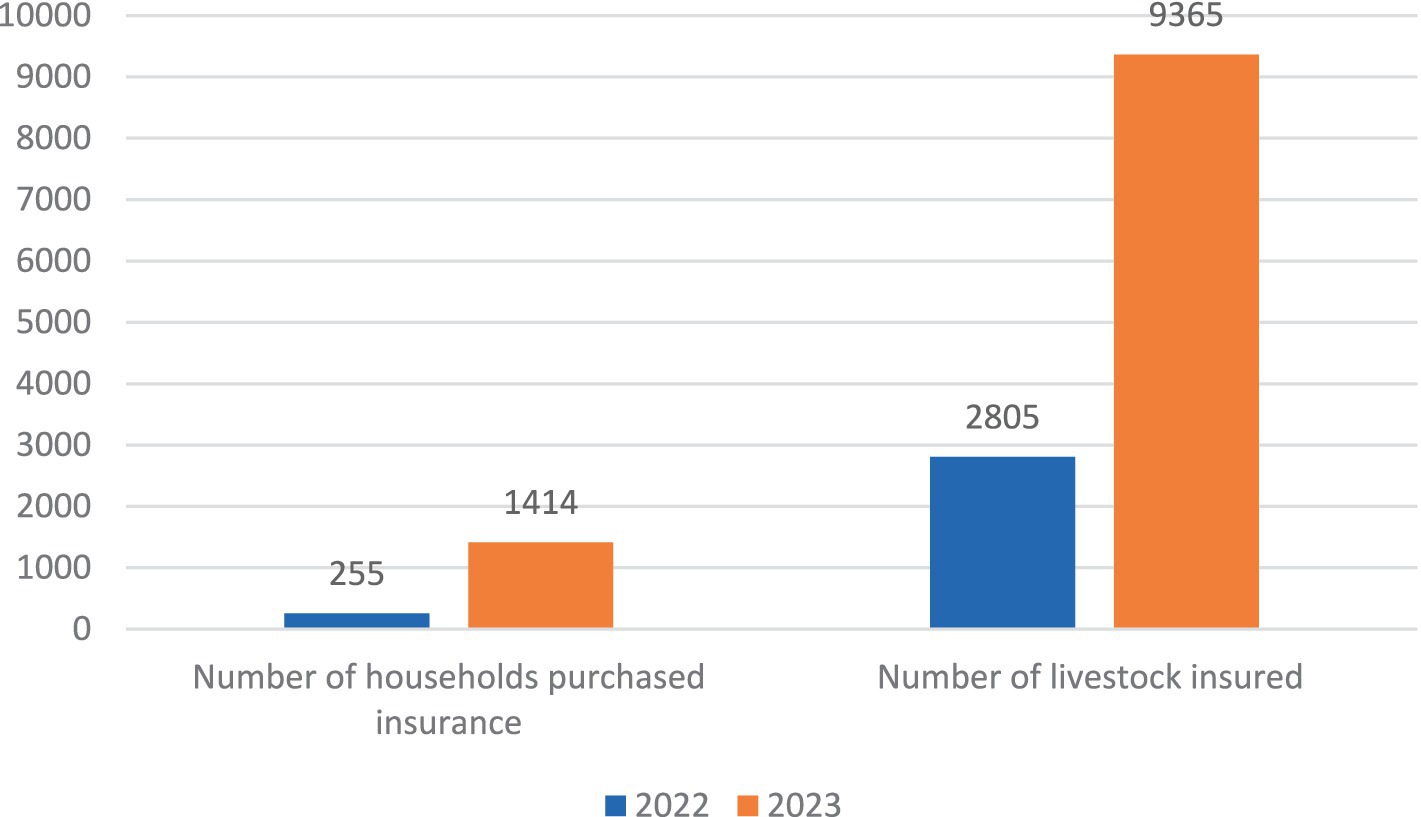

Within the four project kebeles, a total of 1,414 households purchased IBLI insurance (Figure 2) during the first and second sales windows (January–February and August–September 2022). Out of these, 255 (45 M, 210F) households were subsidized 50% of the premium by the project to cover the insurance premium. The community faced hardships due to drought and fluctuating food costs in the district during the second sales window. The field office, therefore, decided to increase the size of subsidy to 70% as well as the number of households to get the subsidy to 439.

The general trends observed during the period of 2022–2023 in Figure 3 is an increase in the number of households that participated in IBLI and the number of livestock insured under the insurance product. Between the two piloting years, the number of households participating in the IBLI and the number of livestock insured increased from 255 to 1,414 and 2,805 to 9,365, respectively. This shows that over time the pastoralists/agro-pastoralists had become more acquainted with the importance of the IBLI and hence demanded more insurance service. The information acquired from the key informant interviews also confirmed the increasing demand for IBLI in their locality.

This can be explained by the extensive awareness-raising done on IBLI at kebele level by village insurance promoters throughout the project period. This is also probably due to the fact that the drought occurred in 2022 and 2023 in the area influenced farmers to participate in the insurance and increase the number of their livestock to be covered under the insurance scheme. The result also indicates the relevance of the insurance scheme for pastoralist/agro-pastoralists as it protects their main livelihood asset from drought which has been recurring in the district.

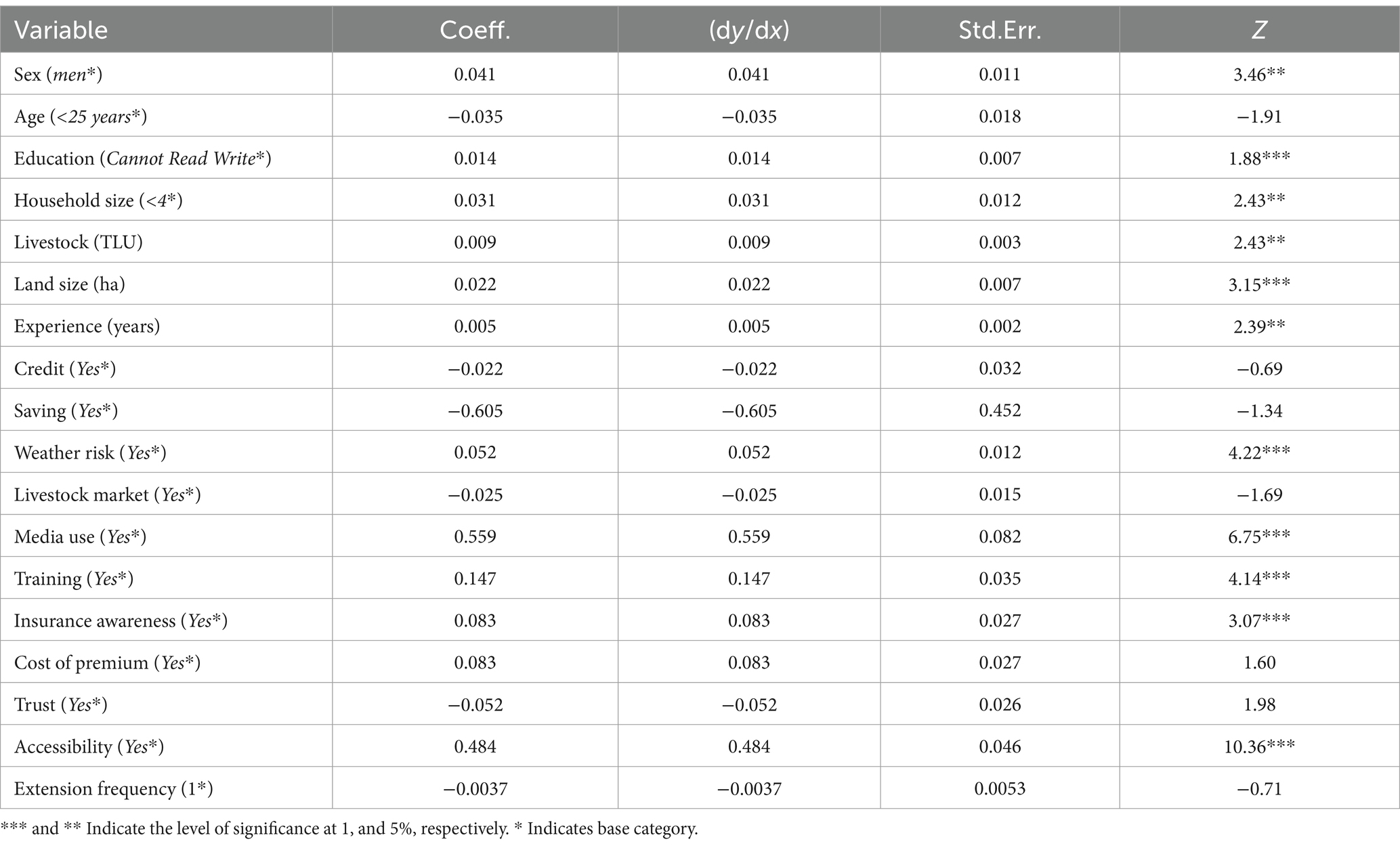

4.3 Factors affecting agro-pastoralists’ WTP for the index-based livestock insurance

Agro-pastoralists’ WTP for the IBLI was influenced by various individual, farm level, and institutional factors. The double-hurdle model structure is advantageous as it can handle multicollinearity or overestimation in variables, as it could identify and remove variables with similar problems during estimation. Out of the variables put into the double-hurdle model, livestock illness history and the constant were dropped from the first stage model due to multicollinearity problem. The results were set and discussed under categories of individual, institutional, and farm-related factors for convenience and to facilitate understanding.

The results indicated that (Table 5) WTP for the insurance was found to be better among men-headed households than their counterparts. This association was positive and significant at a 5% probability level. This is an indication that farm households headed by men are more likely to adopt and pay for the IBLI. Being a man-headed household would increase the likelihood of household’s willingness to pay for the insurance by 4.1%. This is probably because traditionally men in such a patriarchal community are favored to have better access to information about the IBLI as an alternative solution and have better decision-making power at the household level than their counterparts do. This finding is in line with Castellani and Viganò (2017) who stated that farmers with men-headed households showed better willingness to pay for productive technologies including index-based insurance to manage risks associated with crops and livestock failure.

Table 5. First-stage results on maximum likelihood estimates of willingness to pay for livestock insurance.

The results also indicated that pastorlists/agro-pastoralists who were better educated were better willing to pay for the insurance than those who were less educated do. Farmers’ education status positively and significantly affected their WTP for the index-based insurance at a 1% probability level. A change in 1 year of educational status would bring a change in farm household’s WTP by 1.4%, considering other things are constant. Agro-pastoralists who are better educated would have better awareness and decision-making power to adopt alternative solutions like IBLI to mitigate livestock losses and related climate risks.

The implication for this finding is that households with better access to education are more likely to pay for indexed-based livestock insurance, which has a potential to reduce the adverse effect of extreme droughts on livestock production and productivity, particularly in the moisture-stressed areas like Dasenech. First, education helps farmers find and use information related to livestock production. Therefore, education can facilitate the dissemination and enhanced use of new technology through informed decision-making. Second, education helps farmers anticipate the effects of climate change and understand the potential benefits of IBLI to minimize the adverse impacts of climate change. IBLI products can be challenging for low-literate farmers, but education can help reduce their vulnerability to climate change and variability. It also reduces cognitive failure, which could happen probably due to malnutrition and stunting in the poor households, which in turn affects their willingness to invest in the poorly tailored, risk-related microinsurance (Skees et al., 2008). This result supports the view of numerous studies that show the positive impact of education on farmer’s decision to adopt crop and livestock insurance. While studying the willingness to pay for crop insurance, Abebe and Bogale (2014) from Ethiopia reported that farmers with more literacy rates were more interested in rainfall-based insurance and willing to pay higher amount. More educated farmers are likely to appreciate crop insurance issues better than their less educated counterparts.

Household size is the other demographic characteristics found to positively and significantly influence WTP of the households at a 5% probability level (Table 5). A unit increase in family size by Adult Equivalent would result in 3.1% increase in family’s WTP for the IBLI, provided that other things remain constant. Empirical studies have reported diverse relationships between family size and WTP for microinsurance. According to Atino (2020), Castellani and Viganò (2017), for instance, negative relationship was reported between family size and WTP of households for crop insurance in Kenya. In contrast, big family size was reported as positively influencing household’s WTP for livestock insurance in the same country — Kenya (Ouya et al., 2023), and Burkina Faso (Fonta et al., 2018). Similarities in the insurance types and context of pastoralist production systems may therefore account for the congruence between the results of the current study in Ethiopia and those of the later empirical studies in Kenya and Burkina Faso.

The econometrics result further showed that agro-pastoralists’ previous insurance history positively and significantly influenced the farmer’s WTP for the insurance. For one-year previous experience of household on insurance, the odds ratio in favor of households’ WTP for IBLI will increase by the factor of 0.005 (Table 5). This might be due to the fact that a household that has previous history of insurance would have some basic information about the program’s benefits and would develop better tendency to accept and pay for IBLI than the one who lacks the experience and prior knowledge about insurance. This result suggests a strong and continuous need for awareness creation and training on this insurance product. The result supports the findings of earlier studies on the effect of insurance history of a household on the uptake and willingness to pay for health insurance (Mude et al., 2010).

Farmers’ loss experience of livestock was also identified as a significant variable influencing their WTP for IBLI among pastoralist/agro-pastoralist communities. A unit increase in livestock loss experience of a farm household would result in a 0.5% change in the farmers’ WTP for the IBLI services. A handful of empirical literature (Aheeyar et al., 2023) agrees with this findings. The more a farmer experiences loss of livestock due to drought and related calamities, the more he or she could sense about risks of livestock and/or crop loss in the drought-prone environments like Dasenech. This experiential knowledge would boost the farmer’s decision to look for innovative solutions like IBLI and influences the decision on making investments like purchasing insurance as a gateway out of the risk.

It is recognized that two types of land rights — communal and private land rights — being exercised in the pastoral and agro-pastoral areas of the country. This study only considered the land that individual pastoralist/agro-pastoralist household posesses. Land ownership is a critical factor for both crop and livestock production systems, and adoption of agricultural innovations for the farming community is highly influenced by the landholding size of the farmer. The results of this study indicated that the size of cultivated land is positively and significantly related to the farmer’s WTP for IBLI in response to climate variability and change in the study area. The econometric results further revealed that the odds ratio in favor of purchasing IBLI increases by factor of 2.2 (P ⪯ 0.01) (Table 5). This is probably due to the fact that large land size would empower the farmers as it gives them enough pasture for grazing their herds and practicing crop production. Similarly, a positive correlation was reported between the farmer’s WTP for agricultural insurances and farm size (Osipenko et al., 2015). This is probably because farmers with larger farm sizes tend to have more advantage for the adoption of innovations due to economies of scale.

Livestock holding in TLU positively influences the household’s decision to purchase IBLI at a 1% significance level (Table 5). First, this might be attributed to the fact that farmers having larger herd size relatively feeling highly vulnerable to risks emanating from climate change and variability; second, having large number of livestock enhances herders’ financial capacity and so that they can make a decision to purchase insurance for their livestock. Under a situation where there is a decline in natural pastures due to climate change and variability, many pastoralists opt to store forage and save water using the indexed livestock insurance. This result is inconsistent with prior expectation and inconsistent with previous studies (Chantarat et al., 2013; Arshad et al., 2016).

The results presented that a farmer’s WTP for IBLI increases by factor of 5.2 (P ⪯ 0.01) with a unit increase in farmer’s perception of risks related to climate change (Table 5). This implies household heads who perceived that the weather-related risk will often exert pressure on their livelihoods and drought experienced in the near past were more likely to pay for index insurance as a protective measure. Pastoralists/agro-pastoralists who perceived the changing climate favors the use of IBLI as a risk transfer measure and as an important means for mitigating climate change-related livestock death. The result is in conformity with the earlier studies (Aidoo et al., 2014; Bogale, 2015).

The qualitative result further supports the notion that households who perceived the changing climate tend to adopt the IBLI. During a case story narration, a 58-year-old agro-pastoralist with rich experience at Fejej kebele explained that:

“Climate is changing over years. Like 20/30 years ago in my age, drought was not frequent. Drought occurs every 5 or 6 years. Nowadays, however, drought is very frequent. Rain is not coming in the expected seasons. It is very erratic; it comes late, but goes early. Heat-induced livestock diseases are occurring frequently. Reduced livestock productivity and even complete loss due to death caused by frequent and long drought are highly affecting my family livelihood. This pushed me to look for relatively sustainable adaptation mechanism. I found and understood the very importance of IBLI that is promoted in our district. I personally purchased this insurance since the introduction of the project.”

The study also revealed that a unit increase in awareness about livestock insurance would increase the farmer’s WTP for insurance by factor of 8.3. In the study, the respondents were considered aware if they had received information on agricultural insurance through different sources like insurance companies/agents, visiting the extension officials, media, groups/cooperatives, and neighbors/relatives. These sources, particularly government offices and insurance companies/agents, have played an important role in livestock insurance adoption by creating awareness among the farmers. Insurance companies/agents have participated actively in the program because the insurance procedure for livestock insurance is scientific and possesses less chance of moral hazards, for instance, tagging of insured animals ensures insurance companies identify the right insured animals. Moral hazards arise from asymmetric information that changes the insured farmer behavior after taking insurance policy in such a way that the probability of receiving indemnity payment increases. Awareness helped agro-pastoralists to realize the need for insurance and understand the procedures of livestock insurance. The results of this study agree with the previous research findings, which pinpointed that awareness greatly influences the community’s willingness to pay for health insurance as a risk management strategy (Esan et al., 2020).

As expected, access to media (defined in average frequency that a household head attends news and information on radio per a week) affected the WTP for index-based insurance positively and significantly at 1% probability. The insurer also undertakes to provide weather information through radio in the insured local language. The results indicated that listening to a radio to access information at least once a week were found to have a greater likelihood to pay for the index-based livestock insurance (P ⪯ 0.01). This might be due to the fact that the household with media access can utilize it to easily communicate and have basic information about the benefits of IBLI, so that they are better off in terms of their tendency to accept and pay for IBLI than one who do not have access to and the utilization of mass media. This result supports the findings of earlier research in Kenya, which reported the positive effect of media access on farmer’s willingness to pay for microinsurance (Mude et al., 2010).

As hypothesized earlier, it was found that training access for the farmers would positively and significantly affect the farmer’s WTP for insurance. The result indicated that the odds ratio in favor of WTP for livestock insurance will increase by factor of 14.3 with a unit increase in access to training, holding other variables constant. The review of the project interim report also indicated that successive training had been arranged by the project implementors on different topics including IBLI strategies, types of insurance, scope of IBLI parameters, and the claiming aspects. These training programs help the pastorlists/agro-pastoralists to realize the need for insurance and understand the procedures of livestock insurance. Thus, farmer’s access to training greatly influences WTP for the livestock insurance as a risk mitigating strategy.

The econometric results (Table 5) revealed that a unit increase in accessibility of a household to insurance agents will result in an increase of the farmer’s WTP for IBLI by 48.4% (P ⪯ 0.01). The probable reason is that access to insurance agents helped farmers in better understanding the insurance procedure and its benefits, ultimately motivating them to purchase livestock insurance. Livestock farmers in remote areas lack access to microinsurance and climate information, undermining the benefits of purchasing IBLI to reduce climate variability and change-induced livestock production risk. Improved road infrastructure and climate information for mobile pastoralists and agro-pastoralists can increase their WTP for insurance products, as indicated in previous empirical literature (Bogale, 2015; Arshad et al., 2016). The adoption of agricultural insurance in Nepal is significantly hindered by the lack of access to insurance service providers (Ghimire et al., 2024). Low insurance service procurement and WTP can be attributed to insurance agents’ inability to access and effectively communicate policies to farmers (Jokhio et al., 2016).

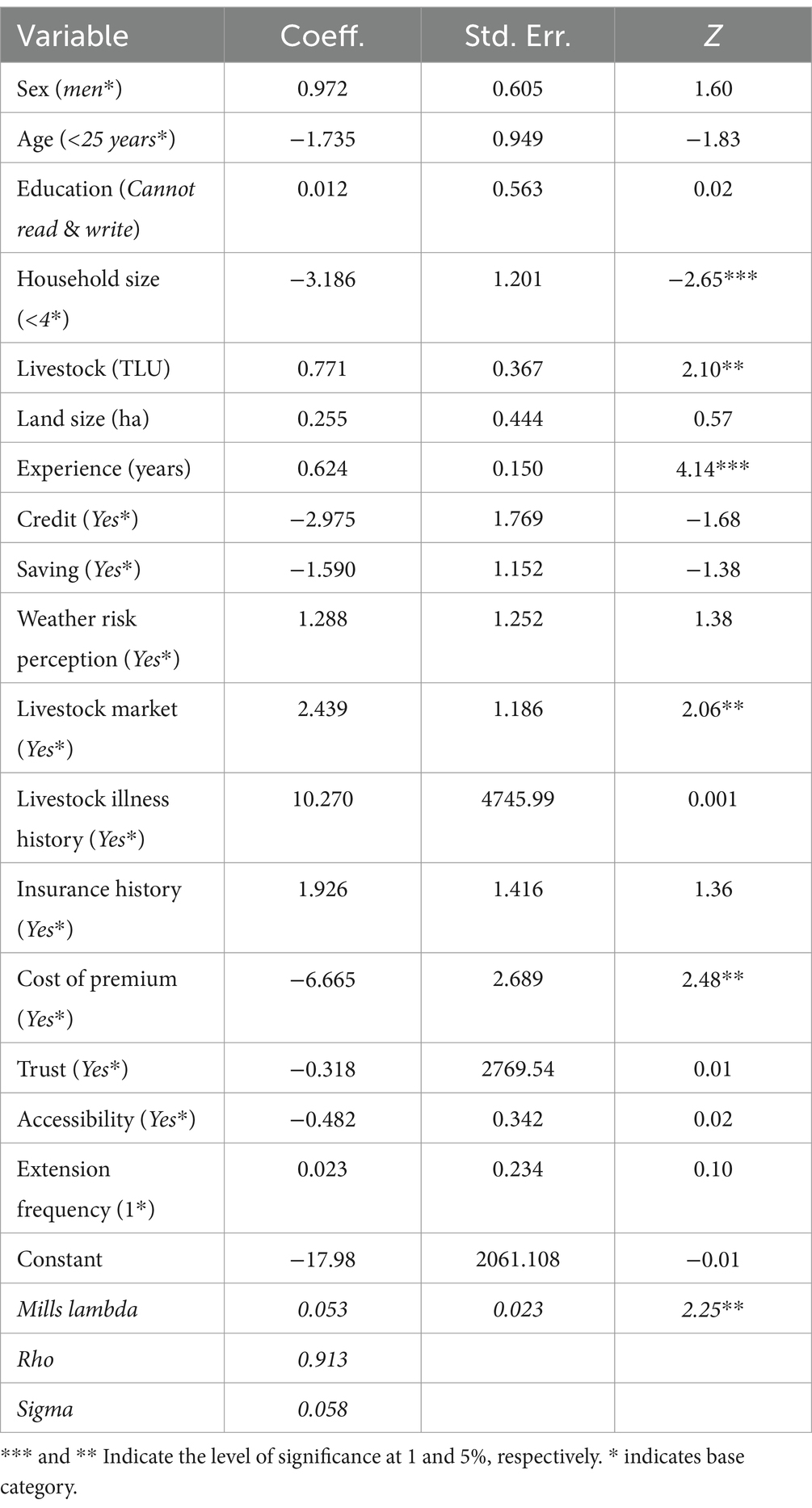

4.4 Determinants of household’s payment amount for a given livestock insurance value

Table 6 presents those factors influenced the pastoralist/agro-pastoralists’ payment capacity (household’s WTP amount of a given offered price or bid value) for the index-based livestock insurance. Out of the variables put into the double-hurdle model, media use and training access were dropped from the second stage model results due to multicollinearity problem.

Unlike the first-stage double-hurdle model likelihood estimates, the results of the second-stage model estimates (Table 6) show that large family size has a negative and significant effect on household’s WTP amount of a given offered price or bid value for IBLI. A household’s WTP bigger amounts of a given bid value of IBLI service was found to be negatively associated with large family size of the farm households (P ⪯ 0.01) (Table 6). A unit increase in family size in Adult Equivalent would result in a decrease in household’s paying capacity of the bid value by 3.186 birr, holding other variables are constant. This may be linked to the household decision-making process in the context of big family size and relatively high living costs prioritizing the food and other consumption needs of the family (i.e., budgetary constraints). This finding is similar to the results of the previous studies reported in different countries such as Ethiopia (Ayenew et al., 2019); Nigeria (Oyawole et al., 2016; Esan et al., 2020); Nepal (Maskey and Singh, 2017) and Ghana (Awunyo-Vitor et al., 2013).

From the double-hurdle maximum likelihood second estimates (Table 6) of amount paid for the insurance, we could infer that the household’s paying capacity is positively and significantly influenced by the herd size in TLU. The regression coefficient of herd size was also significant (below 5%) and positively affects household’s paying capacity. This is probably because households with bigger herd stock could sell large number of livestock and thus generate sound income, which helps them to invest large amount of money for the livestock insurance. This finding is particularly true for the households that offtake livestock at a proper timing where the market has relatively strong demand. This finding agrees with the empirical evidence at Mongolia (Bertram-Huemmer and Kraehnert, 2018), which indicated that the more a household owns herd size, the more it is willing to pay large amount of money for microinsurance.

Similar to the first model estimations, a positive and significant relationship was reported between farmer’s paying capacity for IBLI and their past experience with livestock loss. The amount farmers pay for the bid value of IBLI services would increase by 62.4% for every year rise in livestock loss experience. Numerous empirical studies (Aheeyar et al., 2023; Bertram-Huemmer and Kraehnert, 2015) support this result. A farmer’s experience with the hazards of livestock loss in drought-prone areas would encourage farmers to adopt alternative solutions such as IBLI and inform their investment decisions, such as buying more size of insurance as a means of exiting the risk.

The robust estimations of the second stage model exhibited a significant and positive relationship between livestock market access and household’s capacity to pay for the insurance. Similar to our expectation, a unit increase in market access for the livestock sales would increase the household decision on the amount to pay for the insurance by 2.439 birr. The finding is compatible with findings of previous studies in West Africa (Aina and Omonona, 2012; Aina et al., 2018).

The cost of premium is a significant factor negatively affecting (P ⪯ 0.05) payment amount for livestock insurance. The results indicated that, keeping the influence of other variables constant, an increase in one birr on the IBLI premium cost would decrease the household’s WTP the given amounts of bid values for the insurance by 6.66% (Table 6). The high cost of the premium is the most important limiting factor to adopt insurance (Jokhio et al., 2016; Kandel and Timilsena, 2017).

In order to make the premium of the insurance more affordable to farmers, various approaches were recommended by the key informants, one of which is reducing the premium (supply side). A key informant among the IBLI promoter vendors at Fejeje kebele confirmed this line of thought stating:

During the first-round premium sales window, largest number of the community purchased the premium, because the project subsidized 75% of the total premium. During the second sale windows, however, the subsidy rate was minimized from 75 to 50% for the purpose of increasing the adaptability of the community to purchase premium even after the project phases out. During the second sales window, the majority could not pay for the insurance, and hence many were requesting the project office to support the premium of an animal subsidy. The cost of the premium is a decisive limiting factor for the farmers. So, the Government should think of substantial premium subsidy.

This alternative, however, is seemingly unlikely because it requires the government to allocate more budget for premium subsidies, but financial constraints prevent further subsidies from being relied upon. Furthermore, NGO-based subsidies, such as the I4R project, are not sustainable and cannot provide continuous solutions due to their time-bounded nature. Therefore, practical strategies to increase farmers’ awareness and WTP (demand side) are strongly recommended.

Overall, the findings showed that pastoralists and agro-pastoralists were aware of the negative consequences that climate change have on their livelihood and production system. They observed that over time, their ability to withstand the negative consequences was diminished by climate change. Throughout the focus group discussions, they underlined that they have no control over climate change. This is mostly because of the recurrent drought in the district, which causes a shortage of water and pasture for their animals. Further, depending on their primary source of income, this effect resulted in livestock death. Worst of all, the effects of climate change made it harder for herders to pay for the insurance necessary to mitigate the rate of cattle mortality from climate change-related causes. As a matter of fact, the poor tailored index-based livestock insurance is a crucial instrument to support the powerless herders and to sustain their livelihoods system in the changing climate.

5 Conclusion and policy recommendations

The study examined the willingness and payout amounts of livestock farmers in Dasenech district, South Ethiopia, to pay for index-based livestock insurance as an alternative climate risk mitigation measure. The data collected through a cross-sectional survey was analyzed using both parametric and non-parametric techniques. During the pilot project implementation years, there was a significant increase in the sales of IBLI and livestock covered by the insurance. The results highlight the importance of insurance schemes for pastoralists and agro-pastoralists, indicating potential interest in IBLI use and potential for scaling up the programs in Ethiopia and similar contexts.

A significant number of district residents, however, are still not paying for microinsurance, indicating the need for further efforts to promote farmer’s WTP for insurance coverage. Farmers’ WTP for livestock insurance can be increased through a few amendments. The first is to change the pricing and payout methodologies used for premium determination from a region-wide basis to the district level. Therefore, each district might have different premiums that would reflect its level of risks. A district with lower risk will have a lower premium, and farmers in this district might be more interested in purchasing the insurance. Also, rangeland dominance, forage availability, seasonality, and drought history need to be considered. The second requirement is to improve farmers’ access to information. According to the results of the double-hurdle model, farmers’ WTP had a strong positive correlation with variables such as insurance awareness, training access to farmers, and media access. The awareness creation schemes can include the utilization of different platforms involving facilities, farmers’ training opportunities, and campaigns, which provide farmers with information concerning the benefit of insurance and remove their doubts about insurance as an ex-ante risk coping strategy. The third is to educate farmers concerning IBLI. This includes what index-based insurance is, what they get, and what the cost is. When farmers are aware and understand the insurance, they decide to participate in it.

6 Limitations and further research

The study’s limitations include limited data and sample size, and its scope only focuses on farmers’ willingness to pay for insurance index and premium chargeable. The payout trends observed for IBLI are limited, and a region-wide and longer-term coverage of sales seasons could have improved its comprehensiveness. This study suggests using comprehensive time series data at wider levels for further refinement. If unavailable, a longitudinal study could obtain annual primary data. Future research should cover actuarial issues, projections of drought events, livestock losses, basis risks, prospects of IBLI design and implementation in Ethiopia, and issues of affordable premiums to pay.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Ethics statement

Ethical approval was not required for the studies involving humans because the funding organization did not require it. The studies were conducted in accordance with the local legislation and institutional requirements. Wolaita Sodo University Research Review Board waived the requirement of written informed consent for participation from the participants or the participants’ legal guardians/next of kin because Oral consent with respondents was taken before data collection.

Author contributions

TM: Conceptualization, Data curation, Formal analysis, Investigation, Methodology, Project administration, Software, Writing – original draft, Writing – review & editing. DT: Conceptualization, Supervision, Validation, Writing – review & editing. MA: Conceptualization, Supervision, Validation, Writing – review & editing. SB: Software, Supervision, Validation, Writing – review & editing. TF: Funding acquisition, Resources, Supervision, Validation, Visualization, Writing – review & editing.

Funding

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. This publication was funded by the EU-RESET Plus Innovation Fund. The RESET Plus Innovation Program is funded by European Union and implemented by the Cordaid Ethiopia in collaboration with Fair and Sustainable Ethiopia (Grant No. 550363-4).

Acknowledgments

The authors thank the Cordaid Ethiopia, the lead implementor of RESET Plus Innovation Program in Ethiopia for their generous financial support of the action research.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abebe, T. H., and Bogale, A. (2014). Willingness to pay for rainfall-based insurance by smallholder farmers in Central Rift Valley of Ethiopia: The case of Dugda and Mieso Woredas. Asia Pac. J. Energy Environ. 1, 121–155.

Aheeyar, M., Amarasinghe, U., Amarnath, G., and Alahacoon, N. (2023). Factors affecting willingness to adopt climate insurance among smallholder farmers in Sri Lanka. Clim. Risk Manag. 42:100575. doi: 10.1016/j.crm.2023.100575

Aidoo, R., Mensah, J. O., Wie, P., and Awunyo-Vitor, D. (2014). Prospects of crop insurance as a risk management tool among arable crop farmers in Ghana. Asian Econ. Financial Rev. 4:341.

Aina, B. C., and Omonona, B. T. (2012). Adoption of improved cassava varieties and its welfare impact on rural farming households in Edo State. Nigeria J. Agric Food Info 7, 39–55.

Aina, I., Ayinde, O. E., Thiam, D., and Miranda, M. (2018). Willingness to pay for index-based livestock insurance: Perspectives from West Africa. International Association of Agricultural Economists.

Amare, A., Belay, S., Julius, N., Akalu, D., Dereje, H., and Biriki, G. (2019). Index-based livestock insurance to manage climate risks in Borena zone of southern Oromia, Ethiopia. Clim. Risk Manag. 25:100191.

Angassa, A., and Oba, G. (2007). Relating long-term rainfall variability to cattle population dynamics in communal rangelands and a government ranch in southern Ethiopia. Agric. Syst. 94, 715–725.

Arshad, M., Amjath-Babu, T. S., Kächele, H., and Müller, K. (2016). What drives the willingness to pay for crop insurance against extreme weather events (flood and drought) in Pakistan? A hypothetical market approach. Clim. Dev. 8, 234–244. doi: 10.1080/17565529.2015.1034232

Atino, N. A. (2020). Influence of marketing strategies on implementation of weather index in insurance companies in Kenya. University of Nairobi.

Awunyo-Vitor, D., Ishak, S., and Seidu, J. G. (2013). Urban households’ willingness to pay for improved solid waste disposal services in Kumasi Metropolis, Ghana. Urban Stud Res 2013, 1–8. doi: 10.1155/2013/659425

Ayenew, B., Tilahun, A., Erifo, S., and Tesfaye, P. (2019). Household willingness to pay for improved solid waste management in Shashemene town, Ethiopia. Afr. J. Environ. Sci. Technol. 13, 162–171. doi: 10.5897/AJEST2019.2663

Banerjee, R., Hall, A., Mude, A., Wandera, B., and Kelly, J. (2019). Emerging research practice for impact in the CGIAR: The case of Index-Based Livestock Insurance (IBLI). Outlook Agric. 48, 255–267.

Belissa, T. K. (2019). Shocks, insurance and welfare: Evidence from field experiments in Ethiopia. Doctoral dissertation, Wageningen University and Research.

Berhanu, W., and Fayissa, B. (2010). Analysis of the household economy and expenditure patterns of a traditional pastoralist society in southern Ethiopia. Department Of Economics and Finance Working Paper Series.

Bertram-Huemmer, V., and Kraehnert, K. (2015). Does index insurance help households recover from disaster. Evidence from IBLI Mongolia. DIW Discussion Papers, (1515).

Bertram-Huemmer, V., and Kraehnert, K. (2018). Does index insurance help households recover from disaster? Evidence from IBLI Mongolia. Am. J. Agric. Conom. 100, 145–171. doi: 10.1093/ajae/aax069

Bogale, A. (2015). Weather-indexed insurance: an elusive or achievable adaptation strategy to climate variability and change for smallholder farmers in Ethiopia. Clim. Dev. 7, 246–256. doi: 10.1080/17565529.2014.934769

Carter, M. (2012). Designed for development impact: Next generation approaches to index insurance for smallholder farmers. MunichRe Microinsurance. Compendium 2.

Castellani, D., and Viganò, L. (2017). Does willingness-to-pay for weather index-based insurance follow covariant shocks? Int. J. Bank Mark. 35, 516–539. doi: 10.1108/IJBM-10-2016-0155

Chantarat, S., Mude, A. G., Barrett, C. B., and Carter, M. R. (2013). Designing index-based livestock insurance for managing asset risk in northern Kenya. J. Risk Insurance 80, 205–237. doi: 10.1111/j.1539-6975.2012.01463.x

Cole, S. A., Gine, X., Tobacma, J., Topalova, P., Townsend, R., and Vickery, I. J., (2009). Barriers to household risk management: evidence from India. Working paper No. 09–116. Harvard Business School Finance. FRB of New York Staff Report No. 373.

Cole, S., Bastian, G., Vyas, S., Wendel, C., and Stein, D. (2012). The effectiveness of index-based micro-insurance in helping smallholders manage weather-related risks. London: EPPI-Centre, Social Science Research Unit, Institute of Education, University of London, 59.

Desta, S., and Coppock, D. L. (2004). Pastoralism under pressure: tracking system change in southern Ethiopia. Human Ecol 32, 465–486.

Ejeta, G. (2019). Smallholder Farmers’willingness to pay for weather index based crop Insurance in Mieso, West Hararghe, Oromia National State. Doctoral dissertation, Haramaya University.

Esan, O. T., Opeloye, R. O., Oyeniyi, T. W., Joseph, A. O., Oluwalana, I. B., Babalola, S. B., et al. (2020). Willingness to participate and pay into a community-based health insurance scheme in Imesi-Ile, a rural Community in Osun State, Nigeria. Asian J. Med. Health 18, 73–84. doi: 10.9734/ajmah/2020/v18i1030255

Fonjong, L. N., and Gyapong, A. Y. (2021). Plantations, women, and food security in Africa: interrogating the investment pathway towards zero hunger in Cameroon and Ghana. World Dev. 138:105293. doi: 10.1016/j.worlddev.2020.105293

Fonta, W. M., Sanfo, S., Kedir, A. M., and Thiam, D. R. (2018). Estimating farmers’ willingness to pay for weather index-based crop insurance uptake in West Africa: insight from a pilot initiative in southwestern Burkina Faso. Agric. Food Econ. 6, 1–20. doi: 10.1186/s40100-018-0104-6

Gabre-Madhin, E, Barret, CB, and Dorosh, P (2003) Technological change and price effects in agriculture: conceptual and comparative perspectives. (No. MTID discussion paper no. 62, IFPRI). Washington, DC, USA.

Gebrekidan, T., Guo, Y., Bi, S., Wang, J., Zhang, C., Wang, J., et al. (2019). Effect of index-based livestock insurance on herd offtake: Evidence from the Borena zone of southern Ethiopia. Climate Risk Manage 23, 67–77.

Getachew, S., and Mebrahtu, K. (2017). Tegegn Tesfaye DVM)* southern agricultural research institute (SARI), Jinka agricultural research center PO box:-96, Jinka Ethiopia.

Ghimire, S., Ghimire, S., Singh, D. R., Sagtani, R. A., and Paudel, S. (2024). Factors influencing the utilisation of national health insurance program in urban areas of Nepal: insights from qualitative study. PLOS Global Public Health 4:e0003538. doi: 10.1371/journal.pgph.0003538

Giné, X. (2009). Innovations in insuring the poor: Experience with weather index-based insurance in India and Malawi.

Giné, X., and Yang, D. (2009). Insurance, credit, and technology adoption: Field experimental evidence from Malawi. J. Dev. Econ. 89, 1–11.

Guo, W., and Bohara, A. (2015). Farmers’ perception of climate change and willingness to pay for weather-index insurance in Bahunepati, Nepal. Himalayan Research Papers Archive 9. Available at: https://digitalrepository.unm.edu/cgi/viewcontent.cgi

Haruna, B. (2015). Measuring the effects of weather-index insurance purchase on farm investment and yield among smallholder farmers in northern Ghana. Master’s thesis, The Ohio State University.

Islam, M. M., Ahamed, T., Matsushita, S., and Noguchi, R. (2024). “A damage-based crop insurance system for flash flooding: a satellite remote sensing and econometric approach” in Remote sensing application II: A climate change perspective in agriculture (Springer Nature Singapore: Singapore), 121–163.

Israel, G. D. (2013). Determining sample size, program evaluation and organizational development, IFAS. PEOD-6. Florida (FL): University of Florida, 1992-B.

Jensen, N. D., Barrett, C. B., and Mude, A. G. (2015). The favourable impacts of index-based livestock insurance: evaluation results from Ethiopia and Kenya. ILRI research brief.

Jensen, N. D., Fava, F. P., Mude, A. G., Barrett, C. B., Wandera-Gache, B., Vrieling, A., et al. (2024). Escaping poverty traps and unlocking prosperity in the face of climate risk: Lessons from index-based livestock insurance. Cambridge: Cambridge University Press.

Jing, X., Ding, L., Zhou, J., Huang, X., Degen, A., and Long, R. (2018). The adaptive strategies of yaks to live in the Asian highlands. Anim. Nutr. 9, 249–258.

Jokhio, S., Abro, M. M. Q., and Alaali, L. (2016). Managing risk in livestock farming: the role of insurance companies. Int. J. Financial Res. 7, 64–72. doi: 10.5430/ijfr.v7n2p64

Kahsay, S. T., Reda, G. K., and Hailu, A. M. (2020). Food security status and its determinants in pastoral and agro-pastoral districts of Afar regional state, Ethiopia. Afr. J. Sci. Technol. Innov. Dev. 12, 333–341. doi: 10.1080/20421338.2019.1640429

Kalkanci, B., Rahmani, M., and Toktay, L. B. (2019). The role of inclusive innovation in promoting social sustainability. Prod. Oper. Manag. 28, 2960–2982. doi: 10.1111/poms.13112

Kandel, G., and Timilsena, R. H. (2017). “Factors affecting adoption of livestock insurance as a risk management tool in Nawalparasi district, Nepal” in Second international conference on mountains in the changing world (Kathmandu, Nepal), 27–28.

Lu, Y., Yu, L., Li, W. J., and Aleksandrova, M. (2022). Impacts and synergies of weather index insurance and microcredit in rural areas: a systematic review. Environ. Res. Lett. 17:103002. doi: 10.1088/1748-9326/ac9244

Mahul, O., and Skees, J. (2007). Managing agricultural risk at the country level: The case of index-based livestock insurance in

Mahul, O., and Stutley, C. J. (2010). Government support to agricultural insurance: challenges and options for developing countries. World Bank Publications.

Maskey, B., and Singh, M. (2017). Households’ willingness to pay for improved waste collection service in Gorkha municipality of Nepal. Environments 4:77. doi: 10.3390/environments4040077

Melketo, T., Schmidt, M., Bonatti, M., Sieber, S., Müller, K., and Lana, M. (2021). Determinants of pastoral household resilience to food insecurity in Afar region, Northeast Ethiopia. J. Arid Environ. 188:104454. doi: 10.1016/j.jaridenv.2021.104454

Mhella, D. J. (2024). Exploring the role of microinsurance in financial inclusion: a Tanzanian case study. Perspect. Global Develop. Technol. 22, 321–368.

Mude, A., Barrett, C. B., Carter, M. R., Chantarat, S., Ikegami, M., and McPeak, J. G. (2009). Index based livestock insurance for northern Kenya’s arid and semi-arid lands: the Marsabit pilot. Available at SSRN 1844758.

Mude, A. G., Chantarat, S., Barrett, C. B., Carter, M. R., Ikegami, M., and McPeak, J. G. (2010). Insuring against drought-related livestock mortality: Piloting index based livestock insurance in northern Kenya.

Osipenko, M., Shen, Z., and Odening, M. (2015). Is there a demand for multi-year crop insurance? Agric. Finance Rev. 75, 92–102. doi: 10.1108/AFR-12-2014-0043

Ouya, F. O., Bett, E., Nguhiu, P., Makokha, S., Lutta, H., Abwao, W. A., et al. (2023). Determinants of agro-pastoralists’ willingness to pay for improved contagious caprine pleuropneumonia vaccine in Kenya. Pastoralism 13:19. doi: 10.1186/s13570-023-00282-8

Oyawole, F. P., Ajayi, O. P., Aminu, R. O., and Akerele, D. (2016). Willingness to pay for improved solid waste management services in an urbanizing area in south-East Nigeria. Ethiopian J. Environ. Stud. Manag. 9, 793–803. doi: 10.4314/ejesm.v9i6.11

Rogers, E. M., Singhal, A., and Quinlan, M. M. (2014). “Diffusion of innovations” in An integrated approach to communication theory and research (Routledge), 432–448.

Sina, J., and Jacobi, P. (2012). Index-based weather insurance—international & Kenyan experiences. Kenya: Adaptation to Climate Change and Insurance (ACCI).

Skees, J. R. (2008). Innovations in index insurance for the poor in lower income countries. Agric. Resource Econ. Rev. 37, 1–15. doi: 10.1017/S1068280500002094

Skees, J. R., and Collier, B. (2008). The potential of weather index insurance for spurring a green revolution in Africa.

Skees, J., Murphy, A., Collier, B., McCord, M., and Roth, J. (2008). Scaling up index insurance: What is needed for the next big step forward. Microinsurance Centre, LLC & GlobalAgRisk, Inc [online]. Available at: http://globalagrisk.com/Pubs

Smith, M. D. (2002). “On specifying double-hurdle models” in Handbook of applied econometrics and statistical inference (New York: CRC Press), 557–574.

Smith, V. H., and Watts, M. (2019). Index based agricultural insurance in developing countries: feasibility, scalability and sustainability. Gates Open Res 3:65.

Tadesse, A. (2023). Participatory variety evaluation of lowland rice (Oryza sativa L.) under irrigation conditions at Dasenech District, south Omo zone, southern Ethiopia. Innov. Agric. 6:1.

Tadesse, M. A., Alfnes, F., Erenstein, O., and Holden, S. T. (2017). Demand for a labor-based drought insurance scheme in Ethiopia: a stated choice experiment approach. Agric. Econ. 48, 501–511. doi: 10.1111/agec.12351

Taneja, G, Pal, BD, Joshi, PK, Aggarwal, PK, and Tyagi, NK (2014) Farmers’ preferences for climate- smart agriculture an assessment in the indo-Gangetic plain (no. IFPRI discussion paper 01337).

Wodjao, TB (2008) A double-hurdle model of computer and internet use in American households. Department of Economics, Western Michigan University, Michigan

Yoseph, T. (2022). Performance evaluation of mung bean [Vigna radiata (L.) Wilczek] varieties in pastoral areas of south Omo zone, southern Ethiopia. Int. J. Agric. Res. Innov. Technol. 12, 141–144. doi: 10.3329/ijarit.v12i1.61044

Keywords: index-based livestock insurance, climate risk mitigation, willingness to pay, normalized differential vegetation index, double-hurdle model

Citation: Melketo T, Tolossa D, Abi M, Bedeke S and Fentaw T (2025) Index-based livestock insurance schemes to manage climate risks in Ethiopia: determinants of farmer’s willingness to pay and lessons learned from Dasenech district, South Omo. Front. Clim. 6:1476202. doi: 10.3389/fclim.2024.1476202

Edited by:

Victoria Anthony Uyanga, Lincoln University, United StatesReviewed by:

Francesca Larosa, Royal Institute of Technology, SwedenKojo Ahiakpa, Research Desk Consulting Limited, Ghana

Sulistya Rini Pratiwi, Borneo Tarakan University, Indonesia

Copyright © 2025 Melketo, Tolossa, Abi, Bedeke and Fentaw. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Tagesse Melketo, dGFnZXNzZS5tZWxrZXRvQHdzdS5lZHUuZXQ=

Tagesse Melketo

Tagesse Melketo Degefa Tolossa2

Degefa Tolossa2 Meskerem Abi

Meskerem Abi Sisay Bedeke

Sisay Bedeke Tenaw Fentaw

Tenaw Fentaw