- Global Environmental Policy Laboratory, Graduate School of Global Environmental Studies, Kyoto University, Kyoto, Japan

Climate change poses numerous risks to businesses, leading to growing attention from governments and stakeholders toward corporate climate change disclosures. However, whether these disclosures can effectively drive companies to enhance their carbon reduction efforts remains an urgent question. Using panel data from heavily polluting companies in China, this study employs generalized structural equation modeling (GSEM) to empirically examine the moderating effects of government-level climate governance and corporate-level environmental governance on the relationship between climate change disclosure and carbon performance. The results indicate that the interaction between climate governance and climate change disclosure significantly promotes improvements in carbon performance, whereas the impact of corporate environmental governance is comparatively limited. These findings underscore the critical role of government-driven climate governance in enhancing the effectiveness of climate change disclosures and provide practical recommendations for policymakers and corporations to improve climate disclosure practices and advance carbon reduction efforts.

1 Introduction

In corporate sustainable practices, addressing climate change issues is a crucial foundational element. With the exacerbation of global warming, this issue becomes particularly crucial for economies characterized by significant greenhouse gas emissions during phases of rapid economic expansion, necessitating an urgent transition toward a sustainable, green economy. As the world's first largest emitter, with a total share of 25.88% in 2021 (Climate Watch, 2023), China plays a significant role in addressing climate change issues. China's current Nationally Determined Contribution (NDC) climate plan aims to reach the highest levels of carbon dioxide emissions before 2030 and achieve carbon neutrality by 2060. Meanwhile, it has committed to lowering its carbon intensity by over 65% in 2030 from the 2005 level (Ministry of Ecology and Environment, PRC, 2022).

According to IEA (2023), global industrial emissions saw a decline of 1.7% in 2022, largely attributed to China's reduction in industrial emissions. This significant reduction underscores the influential role of China's industrial sector in improving global carbon emission reduction performance and addressing climate change issues. To substantially reduce industrial emissions, China's National Development and Reform Commission (NDRC) issued the “Action Plan for Reaching Peak Carbon Emissions by 2030” and the “Policy Framework for Carbon Peaking and Carbon Neutrality Goals” in 2021. Both documents provide policy guidance and direction for reducing industrial emissions through specific action plans. Additionally, the Ministry of Ecology and Environment of the People's Republic of China released the “14th Five-Year Plan for Ecological and Environmental Protection” in the same year, addressing related issues. This document also includes requirements for industrial carbon reduction and corresponding policy measures. Additionally, the government has actively utilized climate governance methods to address climate change issues, with the most effective and widespread being the use of market mechanisms, specifically the emission trading mechanism (ETS). In 2013, several provinces and cities officially began implementing ETS pilot policies. Subsequently, in 2017, the NDRC published guidelines for constructing a national carbon market for the power sector. In 2020, the Ministry of Ecology and Environment proposed goals and plans for establishing a national carbon market. This national carbon trading market was officially launched in 2021, and now more than 2,200 companies are participating.

Climate change resulting from global warming is considered a financially material risk for listed companies that account for two-thirds of global market capitalization (OECD, 2022). The hazards associated with climate change can lead to substantial financial losses. For example, assets susceptible to becoming stranded, such as those related to fossil fuels, face obsolescence when enterprises contend with new environmental regulations. Investors focusing on corporate sustainability performance pay particular attention to this kind of issue.

Nevertheless, numerous financial standards lack a mandated structured disclosure on climate-related strategies, risk management, and non-financial information encompassing emission reduction initiatives, low greenhouse gas (GHG) emission products, and potential business impacts. These aspects, crucial for investors in evaluating a company's business risks, are not consistently required by prevailing financial frameworks. Consequently, in recent years, various countries and organizations have implemented new measures to facilitate the disclosure of such information. In 2014, the European Union (EU) introduced the Non-Financial Reporting Directive (NFRD), which requires large companies to disclose information on environmental, social responsibility, human rights, and other areas in their corporate reports. Subsequently, in 2019, the European Commission's Technical Expert Group (TEG) on Sustainable Finance published guidelines on climate change disclosure, building on this directive and the recommendations of the TCFD. The UK government has explicitly mandated adherence to TCFD recommendations in its “Green Finance Strategy” policy guidance. The U.S. Securities and Exchange Commission (SEC) issued and revised its climate change disclosure guidance in 2010 and 2022, providing detailed regulations on the climate change-related information that companies should disclose. Initially, China set requirements for environmental protection information disclosure in the “Guidelines for Corporate Social Responsibility Reporting.” And to progressively build a nationwide carbon market, regulations on corporate carbon emissions disclosure have become increasingly specific in recent years.

Moreover, non-profit organizations (NPOs) or non-governmental organizations (NGOs), such as the Carbon Disclosure Project, have devised questionnaires and assessment systems to compile information on corporate practices addressing climate change and its associated considerations. In China, very few companies currently disclose their Scope 3 emissions from purchased goods and services because Scope 3 accounting requires a significant investment of time and resources by businesses to ensure the dependability of the data. Despite that, according to CDP China and PwC China (2024), there has been significant progress in climate change disclosure. And the percentage of Chinese companies disclosing Scope 3 emissions has already increased.

Due to the rising demand for climate change-related information both internally and externally, increased disclosure on climate change may enhance carbon reduction or carbon performance. Therefore, further analysis of the influence of climate change disclosure practices on corporate carbon reduction is crucial. It is important to emphasize here that, in many cases, decreasing carbon intensity is considered a crucial pathway for achieving reductions in overall emissions. As companies enhance their operational efficiency and gradually dissociate growth from emissions, they become increasingly capable of realizing absolute reductions in output over time.

Yet, a limited number of previous literature explored the connection between non-financial disclosure and non-financial performance, as well as the correlation between carbon emission-related disclosure and carbon reduction practices. Monteiro et al. (2023) confirmed the positive impact of social reporting on corporate social performance. Dagestani and Qing (2022) stated that environmental disclosure positively affects environmental performance. Qian and Schaltegger (2017) analyzed the correlation between emission disclosure and emissions reduction or carbon performance. Their research indicates that as disclosure improves, companies become more motivated and capable of leveraging it as an opportunity to drive change from external perspectives and enhance their carbon performance. This confirmed a tendency for corporations to move from seeking legitimacy and compensation to real carbon reductions and improving performance. According to Downar et al. (2021), listed companies in the UK reduced carbon emissions following the disclosure mandate for GHG emissions. The underlying reason might be that disclosure practices incentivize emission reduction efforts. When companies disclose information about their non-financial performance, internal actors tend to be more focused on managing these related areas. Consequently, the pressure to enhance the quality and breadth of emission-related disclosure fosters corporate dedication to reducing carbon emissions (Jiang et al., 2023).

But there is a lack of empirical research on the carbon performance effect of climate change disclosure, especially in the context of China. Previous studies largely explore how corporate carbon performance influences environmental or carbon disclosures. Even though, whether disclosure practices can further encourage firms to intensify their efforts in emission reduction has not been thoroughly investigated. Moreover, most studies discussing climate disclosure practices focus on aspects of carbon emissions and mitigation efforts, with very limited research on climate change-related information. Due to the current lack of clarity regarding the influence of disclosures on carbon performance, to elucidate the causal relationship between the two and the underlying mechanisms through which this relationship operates, we investigated whether there are other significant factors influencing this relationship.

Previous studies suggest that climate governance can enhance corporate carbon performance (Hu et al., 2020; Siddique et al., 2023; Zheng et al., 2021). A few studies suggest that it may also positively influence a company's disclosure behavior (Flammer et al., 2021; Knox-Hayes and Levy, 2011; H. Shen et al., 2020), although there is a lack of empirical research in this field. Based on these points of view, climate governance is expected to moderate the relationship between disclosure and carbon performance.

Some studies have proven that factors related to boardroom decisions and corporate-level climate governance may have a positive impact on a company's disclosure behavior or carbon performance (Ben-Amar and Mcilkenny, 2014; Bui et al., 2020a; Oyewo, 2023). Ultimately, decisions regarding the enforcement of environmental protection and CSR practices must be made by the company's top management. These factors are likely to play a moderating role in the association between disclosure and carbon performance.

However, no prior research has explored the role of these two types of factors in the relationship above. Thus, the main objective of this study is to investigate the effect of corporate climate change disclosure on carbon performance, looking at both government and corporate factors. Through empirical analysis, we discuss the role of government-level climate governance and corporate-level environmental governance factors in influencing the correlation between corporate climate change disclosure and carbon performance.

There are three questions that need to be answered in this research:

• Will the actions taken by companies in climate change disclosure drive them to enhance their carbon performance?

• Can government-level climate governance further promote the impact of disclosure on carbon performance?

• Can corporate-level environmental governance further promote the impact of disclosure on carbon performance?

This paper is structured as follows: Section 2 explains the theoretical framework and hypotheses development. Section 3 introduces the research methods, including the quantitative research model, variables, measurements and data. Section 4 presents the analyses results and the discussion of findings. In the final section, we present the conclusions and provide several practical implications for the government and companies regarding climate disclosure and carbon reduction practices.

2 Theoretical mechanisms and hypotheses

2.1 Theoretical mechanisms

In the research field concerning non-financial disclosure and corporate non-financial performance, the predominant theoretical frameworks include legitimacy theory, institutional theory, and stakeholder theory. Here, we establish the theoretical framework for this study by discussing the application contexts of these three theories.

Institutional theory explains the impact of social, political or technical environments on organizational behavior, such as environmental protection efforts (Zhu and Sarkis, 2007; Lister, 2018; Luo and Liu, 2020). This theory's mechanism examines organizational structures and elucidates why organizations within the same field exhibit homogeneous characteristics or forms (Fernando and Lawrence, 2014). In other words, this theory emphasizes that organizations, including corporations, tend to adhere to regulatory norms and intensify their efforts in social responsibility or environmental protection when they operate within an institutional environment.

On the other hand, according to previous studies, voluntary disclosures and environmental protection efforts are usually better explained by the legitimacy theory, which states that organizations often attempt to ensure that they are perceived as adhering to the societal norms and standards in which they operate (Deegan, 2002). Organizations aim to convey their legitimization efforts through CSR or environmental disclosures (Deegan, 2002; Ieng Chu et al., 2013). In China, enterprises provide social or environmental information mainly to alleviate the government's concerns.

Stakeholder theory is also commonly used to explain corporate disclosure behavior and social or environmental practices. It provides insights into issues such as stakeholder identification, rights, management, and power (Deegan and Shelly, 2014). It can better explain requested disclosure because managers of an organization attempt to meet the expectations of stakeholders who possess the essential resources necessary for the organization (Deegan, 2009). In the strategic management field, the primary goal of corporate stakeholder management is to balance and harmonize the relationships and interests of shareholders, employees, customers, suppliers, communities, and other groups, thereby ensuring the company's long-term success.

In this study, we use institutional theory and legitimacy theory to explain the influence of climate change disclosure on carbon performance and the moderate effect of government-level climate governance. In China, market-based instruments, particularly Emission Trading Schemes (ETS), are recognized as vital components of climate policy based on carbon pricing. While ETS itself is not a climate governance mechanism, it serves as a critical tool within the broader framework of market-based climate governance. Furthermore, we employ stakeholder theory to explain the moderating effect of corporate-level environmental governance.

2.2 Hypotheses

In most studies that explore the association between non-financial disclosure and non-financial performance, researchers focus on the correlation between the two or the impact of performance on disclosure. Some studies conclude that companies with relatively better environmental performance tend to reveal more information related to their environmental practices (Al-Tuwaijri et al., 2004; Clarkson et al., 2008). According to Siddique et al. (2021), companies demonstrating superior carbon performance are willing to disclose more information related to emissions. showing their efforts in emission reduction and portraying themselves as high-quality entities in the market. This practice not only demonstrates the company's commitment to environmental stewardship but also enhances its image and market value.

However, some other studies argue that companies with poor environmental performance may actually be more proactive in disclosing relevant information to demonstrate their legitimacy (Doan and Sassen, 2020; Liu et al., 2011; Patten, 2002). We believe that when corporate decision-makers choose to enhance disclosure efforts, they will likely allocate more resources toward improving actual environmental performance. This approach ensures that the information disclosed in the following year reflects better performance, garnering greater social recognition and acceptance. According to Chen et al. (2018), CSR disclosure has a positive effect on social externalities. Disclosure practices increase CSR spending and lead to higher pollution reduction performance (Giannarakis et al., 2020). Clarkson et al. (2008) drew a conclusion that there is a positive association between environmental disclosure and environmental performance. Their study emphasized that companies whose environmental legitimacy is threatened make soft claims to be committed to the environment. Based on legitimacy theory, their conclusion is also applicable in explaining the efforts made by companies to improve actual environmental performance under the pressure of environmental legitimacy.

Drawing from the above explanations, we propose the first hypothesis:

Hypothesis 1. When companies demonstrate relatively high performance in climate change disclosure, their carbon performance in the following year will increase.

Dagestani and Qing (2022) emphasized that the effect of disclosure on environmental performance in China is moderated by enterprises' participation in fostering environmental governance. Meanwhile, although Siddique et al. (2023) also proved that Market-based regulations significantly and positively affect corporate carbon performance, they do not significantly affect corporate carbon disclosure. On the other hand, Patten (2002) argues that the level of social disclosure is a function of the exposure a company faces to the social/political environment. The adoption of climate governance tools such as ETS may influence the practices of climate disclosure by companies (de Aguiar and Bebbington, 2014), which can be understood within the framework of institutional theory. This theory emphasizes how political environments shape organizational behavior, affecting non-financial disclosure performance (Zhu and Sarkis, 2007; Luo and Liu, 2020).

Similarly, within the institutional environment created by ETS policies, companies' efforts toward emission reduction are also likely to be fostered. Numerous empirical studies have substantiated this perspective (Cui et al., 2021; Shen et al., 2020; Zheng et al., 2021). However, drawing on Cadez and Czerny (2016), we contend that due to the initial allocation of carbon allowances to firms at the outset of policy implementation, companies that have recently received these allowances may require a period of time to enhance their carbon management practices.

Considering the potential effects of carbon market mechanisms, ETS, as a climate governance tool, is likely to play a regulatory role in the relationship between climate disclosure and carbon reduction efforts. Since the policy had already been publicly announced before the allocation of carbon quotas began, companies may seek to demonstrate their commitment to carbon emissions control through proactive disclosure, aiming to secure favorable quota allocations or policy support in the future. Therefore, what we need to consider is the interaction between ETS and disclosure performance in the same year and its relationship with carbon performance in the following year.

Drawing from the above explanations, we propose the second hypothesis:

Hypothesis 2. The impact of climate change disclosure on carbon performance in the following year is strengthened under the influence of ETS.

According to stakeholder theory, firms need to fulfill expectations and garner stakeholder support to ensure their sustainability. As mentioned in Section 1, an organization's managers strive to fulfill the expectations of stakeholders who possess the essential resources necessary for the organization (Deegan, 2009). Direct communication between the company and its stakeholders will allow the organization to integrate stakeholders more effectively (Polonsky, 1995), and climate change disclosure is regarded as one of these important means of communication.

Increasing stakeholder demand for environmental consciousness underscores that carbon performance is crucial for the long-term survival of most companies (Ganda, 2018). Seman et al. (2018) explained a similar mechanism in their study, suggesting that there is a positive correlation between stakeholders' pressures and the adoption of corporate environmental practices such as green supply chain management (GSCM) or green innovation. Each stakeholder's influence plays a crucial role in shaping the company's environmental strategy, indirectly fostering various initiatives in corporate environmental practices. Moreover, boardroom decisions can promote corporate response to social or environmental issues. There is considerable research potential in these areas, given that only a limited number of studies have offered valuable policy insights (Ma et al., 2023). In addition, management will integrate enhanced environmental performance decisions into their strategic plans to effectively address the expectations of stakeholders (Elijido-Ten, 2007), and it is expected that companies will simultaneously strengthen environmental governance and information disclosure when responding to external pressure from stakeholders. Since listed companies usually have annual evaluation and reporting systems for environmental management or governance, the implementation of governance measures and disclosures is often based on the same period's annual summaries and reports. Meanwhile, due to the complexity of internal organizational environments and other factors, environmental strategies do not lead to immediate improvements in environmental performance; instead, there is often a delay in their effects (Czerny and Letmathe, 2024). Therefore, what we need to explore is the interaction between environmental governance and disclosure and its relationship with carbon performance in the following year.

Drawing from the above explanations, we propose the third hypothesis:

Hypothesis 3. The impact of climate change disclosure on carbon performance in the following year is strengthened under the influence of corporate environmental governance.

3 Research methodology

3.1 Empirical model

A generalized structural equation model (GSEM) (Yin et al., 2020; Zhang et al., 2018) was applied to the quantitative analysis in this study because it can better explain the various complex direct and indirect relationships between variables. The model combines Generalized Linear Models (GLM) and general Structural Equation Models (SEM), with GLM being an extension of linear models (Skrondal and Rabe-Hesketh, 2004). Therefore, GSEM not only allows for the analysis of complex relationships involving latent variables but also handles various types of variables (Huber, 2013), such as categorical and ordinal variables, while accommodating non-normal distributions. This addresses the limitations of general SEM. Normally, a general structural equation model (SEM) is more suitable for analyzing data with a normal distribution, but some of the variables in this study are not. Considering the context of this study, this approach is particularly suitable for analysis. GSEM allows analyses of multilevel data structures.

3.2 Measurements

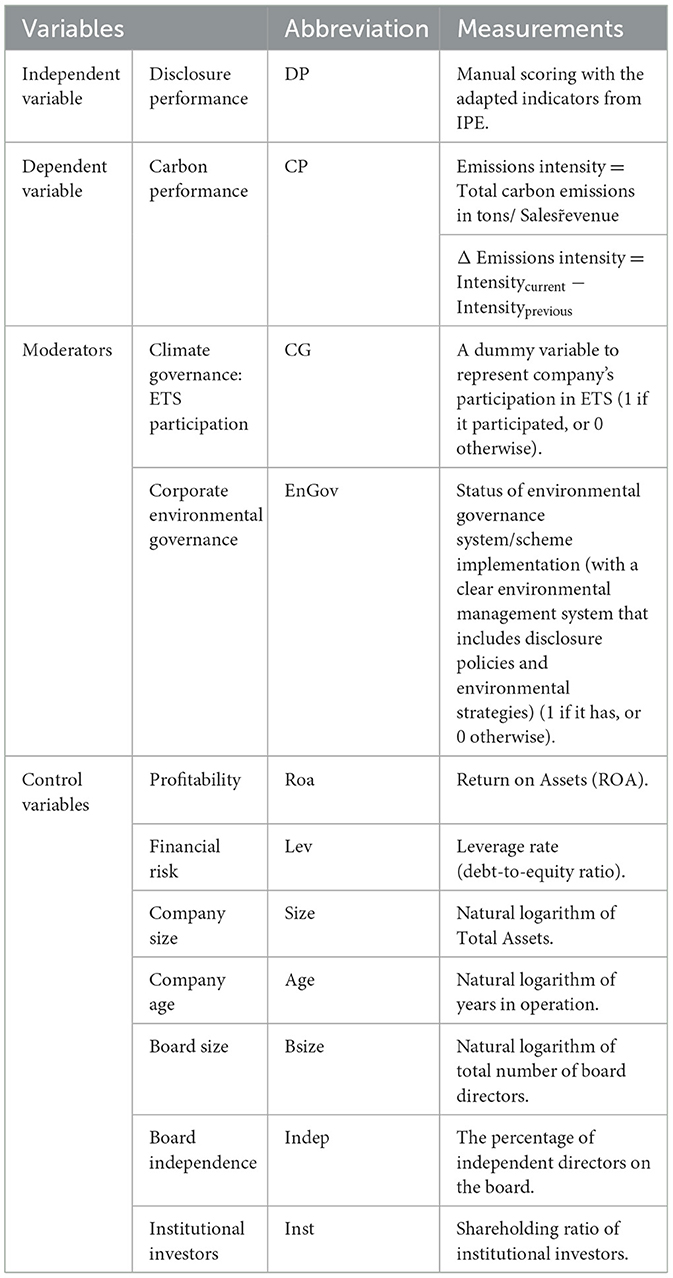

3.2.1 Dependent variables

Carbon performance (CP) is usually measured by carbon emission (Shi et al., 2023), carbon emission intensity, or the changes in emissions or intensity compared to the previous year (Alsaifi, 2021; Bui et al., 2020a). In the context of examining efficiency and performance relative to production activities, using carbon intensity as a measure of improvement in a firm's carbon emissions is considered more reasonable. Emissions intensity provides a static measure that reflects a company's carbon efficiency at a specific point in time. Carbon intensity shows a company's current carbon performance, while changes in carbon intensity illustrate the ongoing efforts and trends in reducing carbon emissions per unit of revenue.

In addition, the changes in intensity offer a dynamic measure, showing the company's progress over time. Combining both allows for a comprehensive assessment of a company's carbon performance. According to Cadez et al. (2019) and Cadez and Guilding (2017), improvements in carbon efficiency do not necessarily equate to reductions in emissions, particularly when firms are focused on growth. The reduction in carbon intensity may serve as an indicator of a company's long-term commitment to carbon management and its strategic direction for future improvement, thereby suggesting a potential impetus for enhanced carbon performance over the long term.

In this study, carbon emissions intensity is calculated as total carbon emissions (in tons) per unit of revenue (CNY) and the changes in emissions intensity compared to the previous year. GSEM allows for the simultaneous use of both carbon intensity and the change in carbon intensity as observed variables to explain the latent variable CP. Improvement in carbon performance is indicated by a reduction in the values of both variables. The relationship between each of the other variables and CP will be represented by the correlation coefficient between the variable and the latent variable CP, rather than the two observed variables.

3.2.2 Independent variables

Previous studies have primarily used text mining and scoring methods to evaluate carbon-related disclosure or environmental disclosure. Researchers extracted keywords and data related to climate change or carbon emissions from corporate reports and scored them based on how frequently or extensively these details were presented (Borghei Ghomi and Leung, 2013; Monteiro et al., 2023). Many previous studies have adopted scoring criteria from the CDP's evaluation system (Cotter and Najah, 2012; Ganda, 2018; Alsaifi, 2021; Bui et al., 2020b). In China, some research has utilized CDP's questionnaire results, which quantitatively assess disclosure performance for companies responding to the questionnaire (He et al., 2019; Ma et al., 2023). Despite the growing influence of CDP in China, its acceptance remains low compared to the global average. The CDP framework's Western origins and China's economic and cultural environment, industrial structure, and regulations contribute to these differences.

Given these challenges, we aim to use the evaluation indicators adapted from the evaluation framework provided by The Institute of Public and Environmental Affairs (IPE). This Beijing-based non-profit organization offers evaluation indicators that integrate international standards like the GRI Sustainability Reporting Standards with the specific characteristics of Chinese enterprises. Since its establishment in 2006, IPE has focused on compiling and analyzing environmental data from government and corporate sources, creating an extensive database. The organization collaborates with CDP to promote corporate environmental disclosure practices.

We adopted IPE's evaluation indicators to measure disclosure performance (DP) using an unweighted scoring method, where disclosed items receive a score of 1 and undisclosed items score 0. The specific measurement items are shown in Table 1. This method ensures objectivity and transparency, providing an intuitive comparison of corporate climate disclosure performance. Due to the inherent challenges in calculating Scope 3 emissions, we have included only the disclosure of Scope 1 and Scope 2 emissions in our assessment criteria to improve the relevance and applicability of our evaluation framework. In fact, there is considerable debate both domestically in China and globally regarding the inclusion of Scope 3 emissions as a core evaluation criterion. The U.S. Securities and Exchange Commission (SEC), in its 2022 and 2024 disclosure guidelines, did not mandate the disclosure of Scope 3 emissions. In 2024, the SEC even relaxed the disclosure requirements for Scope 1 and Scope 2 emissions.

Additionally, the contents of climate change disclosure should also incorporate the TCFD recommendations, so we have supplemented the assessment items based on corresponding corporate climate change trends and TCFD recommendations, considering strategic aspects and climate risk awareness by companies.

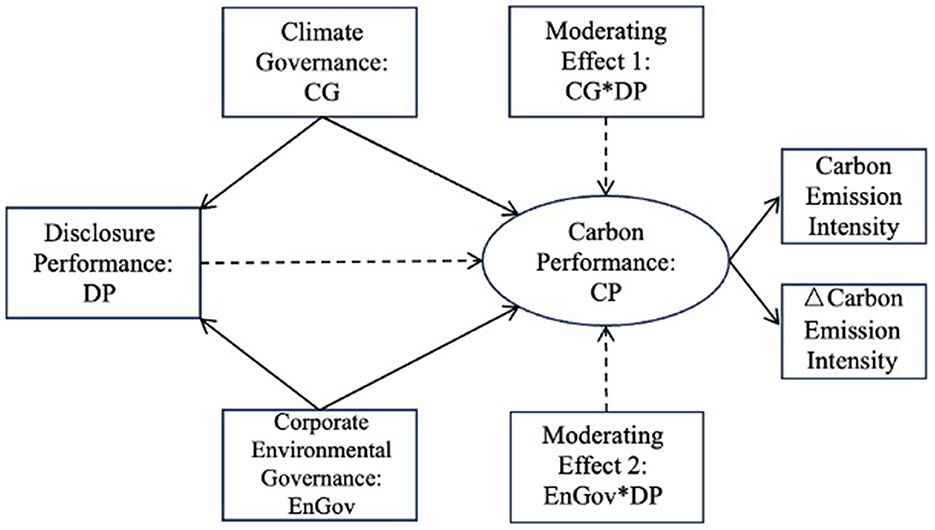

3.2.3 Moderating variables

Governmental climate governance and corporate environmental governance are two moderating variables in the empirical model (Figure 1). We aim to investigate their interactive effects with climate change disclosure, the independent variable, on corporate carbon performance. As previously discussed, governmental climate governance tools encompass various emission reduction policies. In China, the most widely adopted and proven effective policy is the Emissions Trading Scheme (ETS). Following the implementation of the CN-ETS, carbon allowances were allocated to companies through an officially designated process. Participation in the ETS entails the assignment of carbon allowances, along with an obligation to comply within a specified timeframe. This methodology remained the prevailing framework at the inception of the nationwide carbon trading market in 2021. Therefore, we intend to use whether a company operates under CN-ETS regulation as a metric for climate governance. This will be represented as a binary variable (0 and 1), with 0 indicating no regulation under the policy and 1 indicating regulated compliance. The data is sourced from provincial ETS carbon quota control lists and extracted from local government and environmental departments' official websites.

Existing research has not strictly defined the scope of corporate environmental governance. Companies adopt varied governance measures in environmental practices. Generally, the attainment of ISO 14001 certification is often used in empirical research to assess the environmental management practices of businesses (González-Benito and González-Benito, 2005; Potoski and Prakash, 2005). Nevertheless, the attainment of ISO 14001 certification does not necessarily represent the entirety of a company's environmental governance scheme. Because environmental management systems and environmental governance are not entirely synonymous concepts. Nevertheless, corporate climate governance frameworks share common features: they establish clear environmental management systems, have management commitment to environmental governance, possess explicit environmental protection philosophies and strategies, engage in specific environmental investment actions, and adhere to defined environmental disclosure systems (Melnyk et al., 2003; Bui et al., 2020a; Shen et al., 2020; Oyewo, 2023). In this study, we consider the environmental governance of businesses as the status of environmental governance systems or schemes implementation, encompassing clear environmental management systems that include disclosure policies and environmental strategies. Due to the absence of a standardized quantitative evaluation framework for corporate environmental governance and the incomplete disclosure of relevant information by businesses, we manually reviewed and analyzed annual reports, corporate social responsibility reports, environmental reports, and sustainability reports. This assessment would classify the status of environmental governance systems as binary: a score of 1 if the criteria mentioned above are met and 0 if they are not.

3.2.4 Control variables

To control for the impact of other factors related to corporate attributes on the accuracy of model estimates, we incorporate variables such as company size (Yu H.-C. et al., 2020), profitability and financial risk (Eleftheriadis and Anagnostopoulou, 2015; Shonhadji, 2018), firm age (years in operation), and corporate governance, including board size, board independence (Kiliç and Kuzey, 2018; Giannarakis et al., 2020), and institutional investors (Cotter and Najah, 2012; Akbaş and Canikli, 2019), as control variables. The size of company is measured by the natural logarithm of total assets, and financial risk is assessed using financial leverage (total liabilities to total assets ratio). Corporate governance variables encompass the size of board, the percentage of independent directors on the board, and the percentage of shares held by institutional investors.

The definitions and measurement methods for all variables are shown in Table 2.

3.2.5 Data collection and processing

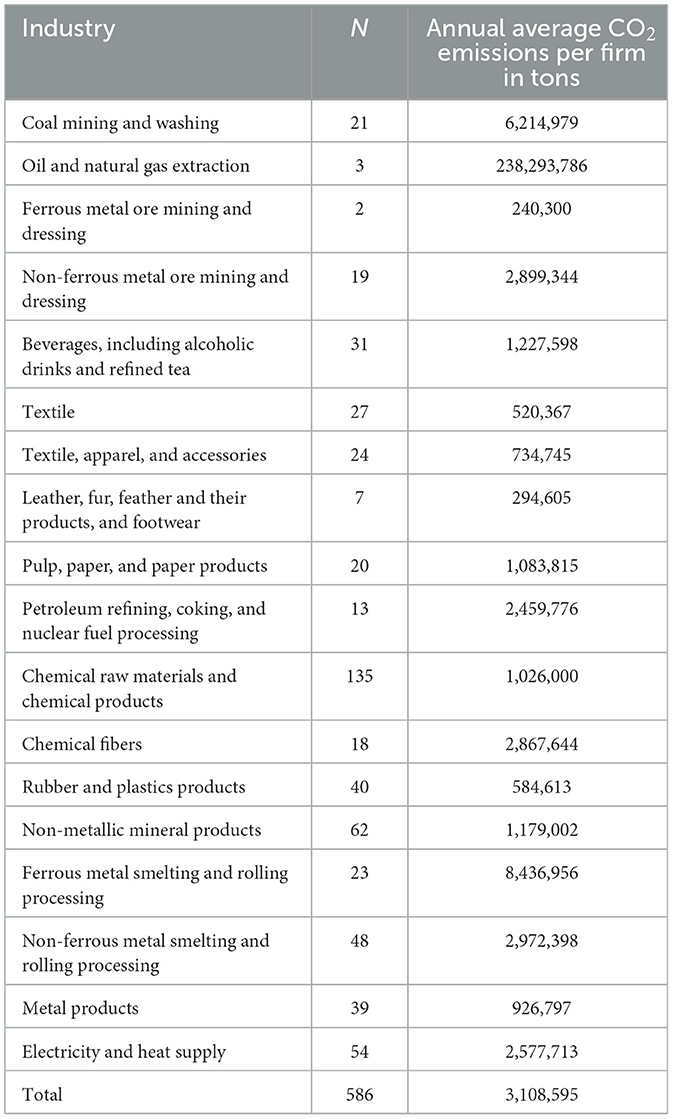

Listed companies in heavily polluting industries were chosen as the research targets. This is because such companies exhibit more pronounced responses to institutional pressures and legitimacy pressures concerning environmental regulatory frameworks and compliance. The China Securities Regulatory Commission categorizes listed companies in China into 19 major industries, subdivided into several secondary industry classifications. In this study, to more precisely define the industrial attributes of each company, we used secondary industry classification codes. We chose the target companies based on the “List of Industry Categories for Environmental Protection Inspection of Listed Companies,” which was established in 2008 by the Ministry of Ecology and Environment (formerly known as the Ministry of Environmental Protection). We extracted all heavily polluting companies among over 5,000 listed firms From the CSMAR database and collected data on company characteristics and control variables, such as financial and corporate governance data. Samples with missing data or delisting risks were removed.

Then, we collected carbon emissions information from publicly available sources, including environmental and corporate social responsibility reports, and excluded companies that lacked carbon emissions data. This process resulted in a final sample of 586 companies from 18 heavily polluting industries. The distribution of industries within the sample and the annual average carbon emissions per company in each industry are shown in Table 3. These samples cover a broad range of sectors, from energy and mineral extraction to light industries such as textiles and leather. This allows for a relatively comprehensive reflection of climate change disclosure and carbon emissions across industries among Chinese listed companies. Sectors related to petroleum and natural gas extraction, coal mining, and metal smelting hold significant positions in China's industry carbon emissions. For instance, Table 3 shows that the annual average emissions in the petroleum and natural gas extraction industry are substantially higher than in other industries (238,293,786 tons of CO2), consistent with the actual emissions profile of these sectors. Heavily polluting industries with relatively lower emissions, such as leather and textiles, have fewer individual cases in the sample, which may affect its comprehensiveness. Additional control variables could be included in subsequent analyses to supplement the research findings. Overall, the sample data aligns well with the industry distribution of carbon emissions across China's industrial sectors.

To calculate the carbon intensity of each company, we extracted sales revenue-related data from financial data. To enhance model interpretability, we applied natural logarithm transformations to the data of two indicators of dependent variable CP. Specifically, negative values of changes in carbon intensity underwent a pre-transformation shift before logarithmic conversion since in generalized SEM (GSEM), latent variables need to be clear and consistent in meaning, and variables with both positive and negative values can make the interpretation of latent variables unclear.

The data on climate change disclosure were manually collected using stock codes to access annual, environmental, and CSR reports, avoiding reliance solely on keywords like carbon reduction, energy combustion or consumption, which might compromise the accuracy of the evaluation. Although this approach be costly in terms of time and efforts, and could introduce occasional subjective biases, it provides a robust solution to potential issues. These include instances where companies report their emission reduction practices without providing precise numerical data or simply replicate the previous year's contents, thus ensuring a more reliable and transparent assessment of carbon performance and climate strategies.

In addition, to eliminate the influence of various external factors on corporate production activities and carbon emission performance during the COVID-19 pandemic, this study utilized data from the three-year period preceding the onset of the pandemic. The observation period of panel data is 2017–2019. Considering that this study focuses on the influence of disclosure practices on subsequent carbon reduction practices, the values of the independent variables, control variables, and moderators are all lagged by 1 year.

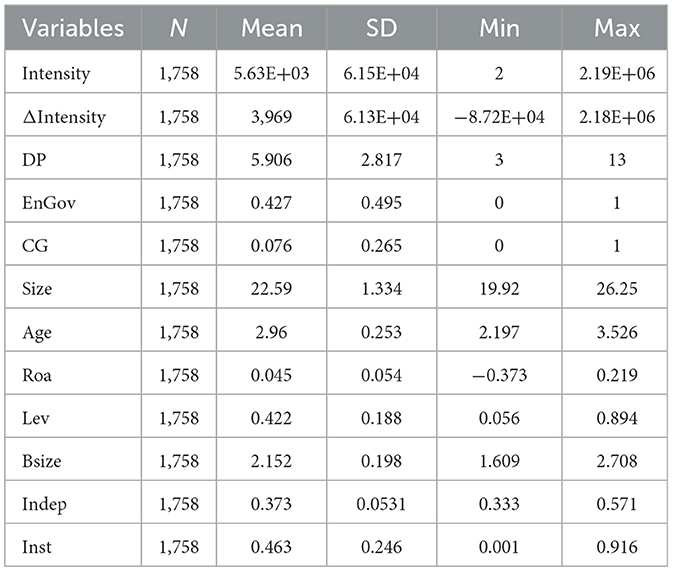

3.3 Descriptive statistics

This study first conducted descriptive statistics and observed the results. A set of balanced panel data was used for the analysis, including 586 companies with 1758 firm-year observations. According to the descriptive statistics results in Table 4, there is a noticeable disparity in carbon emission intensity and climate change disclosure among companies. In environmental governance, differences between companies are generally more pronounced compared to climate governance. The positive mean value of delta intensity indicates that, on average, these companies experienced an increasing trend in carbon intensity during the observation period, which means that many have increased their emissions at a faster rate than their revenue growth. While this might seem concerning, it does not diminish the validity of the research since our focus is on understanding how climate change disclosure influences carbon performance.

The difference in firm size is also significant. Among the companies studied, variables related to corporate governance do not exhibit significantly apparent differences. However, the differences in the ratio of institutional investors among companies are relatively pronounced. In summary, the research data employed in our study are conducive to enhancing the interpretive robustness of the model.

4 Results and discussion

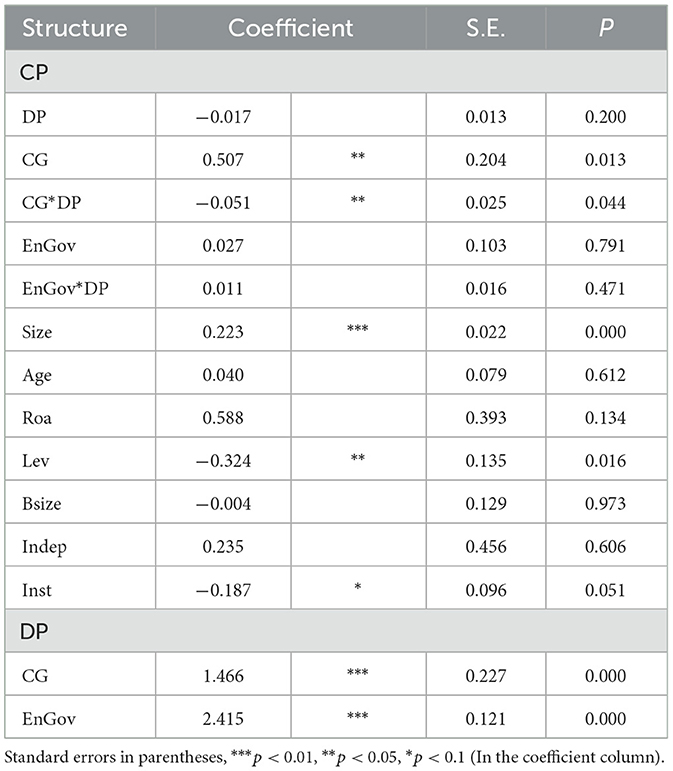

4.1 GSEM analysis results

4.1.1 Climate change disclosure and carbon performance

In the analysis results of the GSEM model (Table 5), climate change disclosure does not significantly impact carbon performance directly. Hypothesis 1 is not supported. This result contradicts prior research suggesting that non-financial disclosure may enhance corporate social or environmental performance (Giannarakis et al., 2020; Downar et al., 2021). Firstly, we considered the possibility that the discrepancy may be due to the potential for climate disclosure to motivate companies still to actively pursue carbon reduction, albeit with a possible time lag. Because investing significant funds and resources into carbon reduction activities within a year generally imposes a heavy burden on companies (Zhang and Wang, 2014), corporate managers require time to make informed decisions regarding these investments.

Given that the theoretical foundation of the hypothesis requires further exploration, a more rigorous explanation also needs to be discussed. We developed Hypothesis 1 based on the discussion by Clarkson et al. (2008) regarding environmental legitimacy and legitimacy theory, suggesting that companies, in pursuit of their environmental legitimacy, would make more substantial efforts in environmental protection to demonstrate better environmental performance. Meanwhile, issues related to information asymmetry may have been overlooked. From the perspectives of agency theory and signaling theory, as agents, corporate decision-makers are typically required to provide internal information to external stakeholders (Mio et al., 2020). Alternatively, as the party with relatively more information, firms may show their environmental practices and performance as positive signals to the external stakeholders. While this can help alleviate uncertainty arising from information asymmetry, the signals communicated by the firm may not always align with the actual situation (Connelly et al., 2011). This misalignment can lead stakeholders to develop a distorted understanding of the company's true circumstances. More specifically, decision-makers can choose to disclose only selected information that paints a favorable picture of their sustainability efforts, even if their actual practices do not reflect a strong commitment to improving carbon performance. The main reason is that corporate climate strategies generally include strategic mechanisms or systems for advancing corporate carbon management practices, while disclosures typically refer to the specific content related to the results and measures that companies communicate externally.

Some companies may not disclose all their carbon management practices and outcomes due to unclear disclosure frameworks, inadequate verification systems, or other reasons. On the other hand, based on signaling theory, some companies may engage in extensive disclosures to enhance their corporate image, showcasing their carbon management practices as exemplary, even though they may not genuinely strive to promote these practices, which suggests a possibility of greenwashing (Yu E. P. et al., 2020; Bernini and La Rosa, 2024). In theoretical terms, the lack of support for Hypothesis 1 indicates the issue discussed above and, to some extent, shows that the core argument in Hypothesis 1 cannot be fully supported by legitimacy theory.

4.1.2 Climate change disclosure, climate governance, and carbon performance

The variables in Hypothesis 2, CG and its interaction with the dependent variable DP, were found to have a significant impact on CP. However, since the relationship between DP and CP, which represents the main effect in Hypothesis 1, was not significant, we cannot conclude that CG moderates the relationship between DP and CP. On the other hand, the interaction term between CG and DP still shows significance in a mathematical sense, suggesting the presence of their interaction. At the same time, numerous prior studies have shown that public climate governance tools, such as ETS, can have either a positive or negative effect on carbon reduction or carbon performance (Cadez and Czerny, 2010; Zhang et al., 2015; Cui et al., 2021; Green, 2021; Zhang et al., 2022). Lemos and Agrawal (2006) also stated that challenges in implementing traditional regulatory measures partly explain why governments are inclined to explore market-based approaches. Given that there is also a significant relationship between CG and CP, based on Sharma et al. (1981), we may regard CG as a quasi-moderator, and it should not be ruled out that, in comparable studies, CG could also function as an independent variable.

It is important to note that in this study, CG led to a decrease in CP (an increase in observed variable values). One possible reason is that, after being allocated carbon credits, companies may reduce their emission reduction efforts in the short term. The conclusion drawn by Cainelli et al. (2012) is similar to this result. If the emissions from their production and business activities do not exceed the allocated quotas, companies may lose the motivation to reduce emissions in the short term. Another possible explanation is that the carbon price in the market may not provide sufficient economic incentives for companies. In summary, although DP does not directly affect CP, the significant negative correlation between the interaction term of CG and DP and CP indicates that ETS alone may not improve carbon performance. We might argue that, through the collaborative effect of CG and DP, companies may enhance their carbon performance by strengthening carbon management practices. Under the carbon market mechanism, external stakeholders, such as investors, governments, and the public, can have a clearer understanding of a company's carbon reduction efforts, which creates greater external pressure for the company to improve its actual carbon performance or advance carbon reduction efforts. This view aligns with Downar et al. (2021), who noted that listed companies in the UK reduced carbon emissions following the enhancement of disclosure. Undoubtedly, expecting all companies to voluntarily improve disclosure performance is idealistic and requires stronger supervision mechanisms for disclosures or at least clearer guidance on the contents of disclosure.

4.1.3 Climate change disclosure, corporate environmental governance, and carbon performance

The moderating effect in Hypothesis 3 was not supported in the analysis results. This finding suggests that corporate carbon performance may not be enhanced through the combined effect of corporate environmental governance and climate change disclosure. First, in line with the discussion on Hypothesis 2, it is challenging to examine the interaction effect between EnGov and DP or whether EnGov can indeed moderate the relationship between DP and CP, when the main effect of DP on CP is not significant. Nonetheless, it is essential to assess this outcome from the perspective of institutional theory and stakeholder theory. Regulatory pressures often exert a greater influence on corporate environmental behaviors than voluntary carbon reduction efforts or related disclosure practices, especially in high-polluting industries. Within the context of China's policy, the stricter regulatory environment created by climate policies and standards for high-polluting industries leads companies in these sectors to prioritize meeting regulatory requirements over addressing other external stakeholder expectations. This emphasis on regulatory compliance may limit the interaction effect of EnGov and DP, making it less likely that EnGov would enhance CP or effectively moderate the relationship between DP and CP. Meanwhile, some companies may find it challenging to intensify their management and investment efforts in environmental protection in the short term due to fierce market competition and economic pressures (Duanmu et al., 2018). While climate change disclosure serves as a communication tool for companies with their stakeholders (Polonsky, 1995), the pressure these companies face from stakeholders may still be relatively limited.

4.2 Further analysis

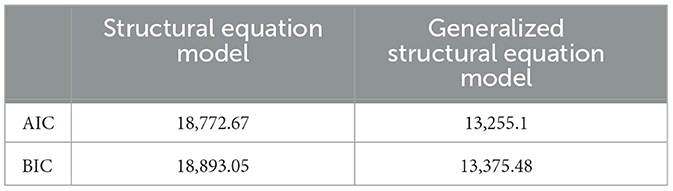

4.2.1 Akaike Information Criterion (AIC) and the Bayesian Information Criterion (BIC)

This study employed the Akaike Information Criterion (AIC) and the Bayesian Information Criterion (BIC) (Chakrabarti and Ghosh, 2011) to compare the original Structural Equation Model (SEM) with the Generalized Structural Equation Model (GSEM). In scenarios involving model complexity, both criteria provide precise assessments of model fit. Typically, smaller values of AIC and BIC indicate higher levels of model fit (Burnham et al., 2011). The calculation methods for AIC and BIC are as follows:

In the equations above, n represents the sample size, k is the number of model parameters, and L is the likelihood function value under the estimated parameters. The results in Table 6 show that when using the GSEM, both AIC and BIC values were relatively smaller, indicating that the GSEM is more suitable for this study.

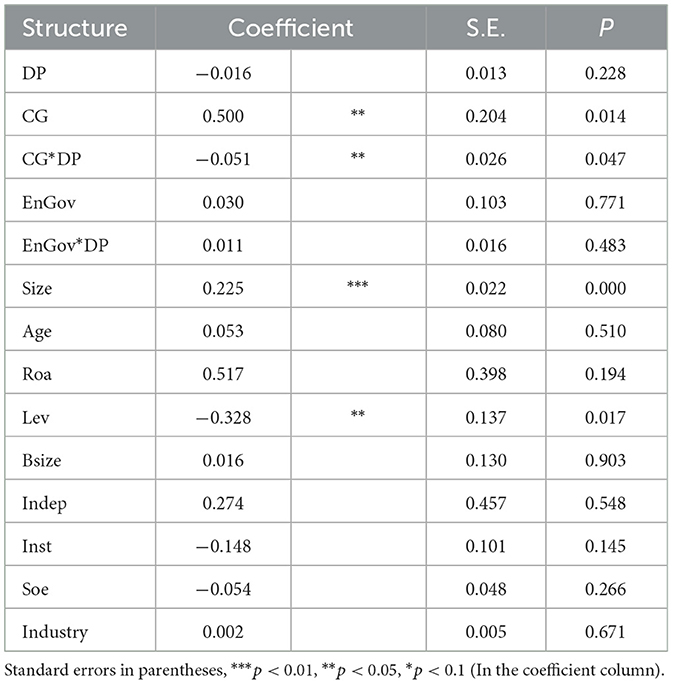

4.2.2 Further estimation with additional controls

Due to the non-normal distribution of some variables used in this study and the inclusion of different types of observed variables in the model, traditional robustness tests such as the chi-square test are not applicable. Therefore, building on the comparison of AIC and BIC results in Table 6, we further estimated the GSEM in this study. To ensure the reliability of the empirical model, we introduced additional control variables for a subsequent analysis. Drawing on the conclusion of He et al. (2019), which indicates that state-owned enterprises (SOEs) demonstrate a higher level of proactiveness in carbon reduction practices, we incorporated this characteristic as a dummy variable: 1 for SOEs and 0 for non-SOEs. We also included the industry sector as an additional control variable. The main results in Table 7 indicate that the significance of the correlation coefficients in the model remained largely unchanged, and the variations in the coefficients were minimal. This suggests that the quantitative model employed in this research is relatively stable.

5 Conclusions and implications

In this study, we explored the impact of climate change disclosure on carbon performance of Chinese companies through empirical analysis, grounded in the frameworks of institutional theory, legitimacy, and stakeholder theory. We particularly focus on the moderating roles of governmental climate governance and corporate environmental governance in this relationship. The results indicate that the interaction between climate governance and climate change disclosure did not have a significant effect on carbon performance, indicating that climate governance cannot be regarded as an effective moderator in this study. However, it remains possible that even if disclosure does not impact carbon performance, interactions between climate governance tools, such as ETS, and disclosure could, under certain circumstances, enhance carbon performance by advancing corporate carbon strategies. Thus, further exploration of these variable relationships in future research is necessary, potentially incorporating additional relevant factors or theoretical frameworks. Additionally, the moderating effect of corporate environmental governance was also not supported, which indicates that the role of corporate environmental governance is relatively limited.

Based on these results, these are some conclusions and implications. Firstly, the ETS regulatory framework provides an external pressure and incentive mechanism, while climate disclosure enhances internal management and external transparency, collectively promoting companies' efforts to reduce carbon emissions. So, further refinement of the ETS policy framework and climate change disclosure guidance is necessary. More robust public oversight and market competition mechanisms are needed to encourage businesses to comply more actively with disclosure requirements and ETS policies. However, it is essential to note that within carbon emissions trading schemes, there may be instances where companies deliberately underestimate actual emissions when calculating and reporting their own emissions or employ other means to evade required emission limits (Anderson and Di Maria, 2011), thereby obtaining additional allowances and further reducing their incentive to reduce emissions. To prevent this situation, a clear system for monitoring and auditing corporate carbon emissions accounting needs to be established.

Additionally, while the focus in our study has primarily been on Scope 1 and Scope 2 emissions during the assessment of emissions and related disclosure, understanding and addressing Scope 3 emissions is crucial for a comprehensive approach to carbon reduction. Scope 3 emissions include indirect emissions occurring in a company's value chain and can represent a significant portion of total emissions. Companies should prioritize transparency in disclosing the related information, as it can enhance accountability and drive improvements across the value chain. While it is currently challenging for Chinese companies to provide such information, future policies that promote more comprehensive emissions reporting, including Scope 3 emissions, could facilitate more integrated climate strategies and improve corporate carbon performance.

In conclusion, maximizing the collaborative effects between climate governance and climate change disclosure to further promote carbon management practices and enhance carbon performance is important for corporate climate adaptation. Furthermore, with the official launch of China's Carbon Emission Rights Trading (CCER) in 2024, expectations for the effectiveness of carbon market mechanisms in corporate climate change disclosure and carbon reduction are further elevated.

On the other hand, the government can provide more policy support and guidance for the construction and improvement of corporate environmental governance frameworks. Moreover, the influence of environmental governance on the association between climate change disclosure and carbon performance may require the collaborative interaction of additional internal or external factors within companies. Regarding the internal management and governance of companies, with increasing societal scrutiny on corporate responses to climate change issues, top executives of the companies must promptly and actively respond to external environmental changes. They should engage proactively in internal decision-making and discussions concerning these issues, particularly focusing on the transparency and completeness of related disclosures.

Simultaneously, the occurrence of greenwashing may also account for why disclosure cannot become an effective driver for emissions reduction or improvements in carbon performance. Legal regulations addressing greenwashing are anticipated to be developed and gradually refined, though this is likely to be a more protracted process.

Our study has the following limitations: Firstly, it relies on a three-year panel dataset, adequate for testing the study's hypotheses but potentially overlooking temporal dynamics and interactions among variables. Future research could enhance robustness by expanding the dataset to include additional years. Secondly, due to the absence of standardized assessment frameworks for climate change disclosure and corporate environmental governance specific to Chinese enterprises, this study employed manual data collection from public disclosures, which may introduce inherent judgment biases. Thus, future studies should explore and refine measurement methodologies and evaluation frameworks. Moreover, this research predominantly draws on legitimacy theory, institutional theory, and stakeholder theory to explore the roles of climate governance and corporate environmental governance in the relationship between climate disclosure and carbon emissions. Future studies could integrate additional theoretical perspectives and variables to further enrich empirical investigations.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

SZ: Conceptualization, Data curation, Formal analysis, Investigation, Methodology, Software, Validation, Visualization, Writing – original draft, Writing – review & editing.

Funding

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. This work was supported by JST SPRING, Grant Number JPMJSP2110; and Graduate School of Global Environmental Studies (GSGES), Kyoto University, Japan.

Acknowledgments

I thank my academic supervisor, Professor Makoto Usami, for his valuable guidance and comments.

Conflict of interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fclim.2024.1469899/full#supplementary-material

References

Akbaş, H. E., and Canikli, S. (2019). Determinants of voluntary greenhouse gas emission disclosure: an empirical investigation on Turkish firms. Sustainability 11:107. doi: 10.3390/su11010107

Alsaifi, K. (2021). Carbon disclosure and carbon performance: evidence from the UK's listed companies. 117–128. doi: 10.5267/j.msl.2020.8.023

Al-Tuwaijri, S. A., Christensen, T. E., and Hughes, K. E. (2004). The relations among environmental disclosure, environmental performance, and economic performance: a simultaneous equations approach. Account. Organ. Soc. 29, 447–471. doi: 10.1016/S0361-3682(03)00032-1

Anderson, B., and Di Maria, C. (2011). Abatement and allocation in the pilot phase of the EU ETS. Environ. Resource. Econ. 48, 83–103. doi: 10.1007/s10640-010-9399-9

Ben-Amar, W., and Mcilkenny, P. (2014). Board effectiveness and the voluntary disclosure of climate change information. Bus. Strateg. Environ. 24. doi: 10.1002/bse.1840

Bernini, F., and La Rosa, F. (2024). Research in the greenwashing field: concepts, theories, and potential impacts on economic and social value. J. Manag. Gov. 28, 405–444. doi: 10.1007/s10997-023-09686-5

Borghei Ghomi, Z., and Leung, P. (2013). An empirical analysis of the determinants of greenhouse gas voluntary disclosure in Australia. Account. Financ. 2, 110–124. doi: 10.5430/afr.v2n1p110

Bui, B., Houqe, M. N., and Zaman, M. (2020a). Climate governance effects on carbon disclosure and performance. Br. Account. Rev. 52:100880. doi: 10.1016/j.bar.2019.100880

Bui, B., Moses, O., and Houqe, M. N. (2020b). Carbon disclosure, emission intensity and cost of equity capital: multi-country evidence. Account. Financ. 60, 47–71. doi: 10.1111/acfi.12492

Burnham, K. P., Anderson, D. R., and Huyvaert, K. P. (2011). AIC model selection and multimodel inference in behavioral ecology: some background, observations, and comparisons. Behav. Ecol. Sociobiol. 65, 23–35. doi: 10.1007/s00265-010-1029-6

Cadez, S., and Czerny, A. (2010). Carbon management strategies in manufacturing companies: An exploratory note. J. East Eur. Manag. Stud. 15, 348–360. doi: 10.5771/0949-6181-2010-4-348

Cadez, S., and Czerny, A. (2016). Climate change mitigation strategies in carbon-intensive firms. J. Clean. Prod. 112, 4132–4143. doi: 10.1016/j.jclepro.2015.07.099

Cadez, S., Czerny, A., and Letmathe, P. (2019). Stakeholder pressures and corporate climate change mitigation strategies. Bus. Strategy Environ. 28, 1–14. doi: 10.1002/bse.2070

Cadez, S., and Guilding, C. (2017). Examining distinct carbon cost structures and climate change abatement strategies in CO2 polluting firms. Account. Audit. Account. J. 30, 1041–1064. doi: 10.1108/AAAJ-03-2015-2009

Cainelli, G., Mazzanti, M., and Borghesi, S. (2012). “The European Emission Trading Scheme and environmental innovation diffusion: empirical analyses using Italian CIS data,” in Working Papers 201201. Available at: https://ideas.repec.org//p/udf/wpaper/201201.html (accessed July 14, 2024).

CDP China and PwC China (2024). CDP: Embracing New Standards for Climate Information Disclosure - Integrating into the Mainstream Global Sustainability Reporting Process (unofficial translation). Available at: https://cdn.cdp.net/cdp-production/cms/reports/documents/000/007/706/original/CDP_%E6%8B%A5%E6%8A%B1%E6%B0%94%E5%80%99%E4%BF%A1%E6%81%AF%E6%8A%AB%E9%9C%B2%E6%96%B0%E6%A0%87%E5%87%86__%E8%9E%8D%E5%85%A5%E5%85%A8%E7%90%83%E5%8F%AF%E6%8C%81%E7%BB%AD%E6%8A%A5%E5%91%8A%E4%B8%BB%E6%B5%81%E5%8C%96%E8%BF%9B%E7%A8%8B_0429.pdf?1715246051 (accessed July 13, 2024).

Chakrabarti, A., and Ghosh, J. K. (2011). “AIC, BIC and recent advances in model selection,” in Philosophy of Statistics, eds. P. S. Bandyopadhyay and M. R. Forster (Amsterdam: North-Holland), 583–605.

Chen, Y.-C., Hung, M., and Wang, Y. (2018). The effect of mandatory CSR disclosure on firm profitability and social externalities: evidence from China. J. Account. Econ. 65, 169–190. doi: 10.1016/j.jacceco.2017.11.009

Clarkson, P. M., Li, Y., Richardson, G. D., and Vasvari, F. P. (2008). Revisiting the relation between environmental performance and environmental disclosure: an empirical analysis. Account. Organ. Soc. 33, 303–327. doi: 10.1016/j.aos.2007.05.003

Climate Watch (2023). China Climate Change Data | Emissions and Policies | Climate Watch. Available at: https://www.climatewatchdata.org/ (accessed January 17, 2024).

Connelly, B. L., Certo, S. T., Ireland, R. D., and Reutzel, C. R. (2011). Signaling theory: a review and assessment. J. Manag. 37, 39–67. doi: 10.1177/0149206310388419

Cotter, J., and Najah, M. M. (2012). Institutional investor influence on global climate change disclosure practices. Aust. J. Manag. 37, 169–187. doi: 10.1177/0312896211423945

Cui, J., Wang, C., Zhang, J., and Zheng, Y. (2021). The effectiveness of China's regional carbon market pilots in reducing firm emissions. Proc. Natl. Acad. Sci. 118:e2109912118. doi: 10.1073/pnas.2109912118

Czerny, A., and Letmathe, P. (2024). The productivity paradox in carbon-intensive companies: How eco-innovation affects corporate environmental and financial performance. Bus. Strategy Environ. 33, 5900–5919. doi: 10.1002/bse.3776

Dagestani, A. A., and Qing, L. (2022). the impact of environmental information disclosure on Chinese firms' environmental and economic performance in the 21st century: a systematic review. IEEE Eng. Manag. Rev. 50, 203–214. doi: 10.1109/EMR.2022.3210465

de Aguiar, T. R. S., and Bebbington, J. (2014). Disclosure on climate change: Analysing the UK ETS effects. Account. Forum. 38, 227–240. doi: 10.1016/j.accfor.2014.10.002

Deegan, C. (2002). Introduction: the legitimising effect of social and environmental disclosures – a theoretical foundation. Account. Audit. Account. J. 15, 282–311. doi: 10.1108/09513570210435852

Deegan, C., and Shelly, M. (2014). Corporate social responsibilities: alternative perspectives about the need to legislate. J. Bus. Ethics. 121, 499–526. doi: 10.1007/s10551-013-1730-2

Doan, M. H., and Sassen, R. (2020). The relationship between environmental performance and environmental disclosure: a meta-analysis. J. Ind. Ecol. 24, 1140–1157. doi: 10.1111/jiec.13002

Downar, B., Ernstberger, J., Reichelstein, S., Schwenen, S., and Zaklan, A. (2021). The impact of carbon disclosure mandates on emissions and financial operating performance. Rev. Acc. Stud. 26, 1137–1175. doi: 10.1007/s11142-021-09611-x

Duanmu, J.-L., Bu, M., and Pittman, R. (2018). Does market competition dampen environmental performance? Evidence from China. Strateg. Manage. J. 39, 3006–3030. doi: 10.1002/smj.2948

Eleftheriadis, I. M., and Anagnostopoulou, E. G. (2015). relationship between corporate climate change disclosures and firm factors. Bus. Strateg. Envrion. 24, 780–789. doi: 10.1002/bse.1845

Elijido-Ten, E. (2007). Applying stakeholder theory to analyze corporate environmental performance: evidence from Australian listed companies. Asian. Rev. Account. 15, 164–184. doi: 10.1108/13217340710823378

Fernando, S., and Lawrence, S. (2014). A theoretical framework for CSR practices: integrating legitimacy theory, stakeholder theory and institutional theory. J. Theoret. Account. Res. 10, 149–178.

Flammer, C., Toffel, M. W., and Viswanathan, K. (2021). Shareholder activism and firms' voluntary disclosure of climate change risks. Strateg. Manag. J. 42, 1850–1879. doi: 10.1002/smj.3313

Ganda, F. (2018). The effect of carbon performance on corporate financial performance in a growing economy. Soc. Responsib. J. 14, 895–916. doi: 10.1108/SRJ-12-2016-0212

Giannarakis, G., Andronikidis, A., and Sariannidis, N. (2020). Determinants of environmental disclosure: investigating new and conventional corporate governance characteristics. Ann. Oper. Res. 294, 87–105. doi: 10.1007/s10479-019-03323-x

González-Benito, J., and González-Benito, O. (2005). An analysis of the relationship between environmental motivations and ISO14001 certification. Br. J. Manag. 16, 133–148. doi: 10.1111/j.1467-8551.2005.00436.x

Green, J. F. (2021). Does carbon pricing reduce emissions? A review of ex-post analyses. Environ. Res. Lett. 16:043004. doi: 10.1088/1748-9326/abdae9

He, P., Shen, H., Zhang, Y., and Ren, J. (2019). External pressure, corporate governance, and voluntary carbon disclosure: evidence from China. Sustainability 11:2901. doi: 10.3390/su11102901

Hu, Y., Ren, S., Wang, Y., and Chen, X. (2020). Can carbon emission trading scheme achieve energy conservation and emission reduction? Evidence from the industrial sector in China. Energy Econ. 85:104590. doi: 10.1016/j.eneco.2019.104590

Huber, C. (2013). “Generalized structural equation modeling in Stata,” in Italian Stata Users' Group Meetings 2013. Available at: https://ideas.repec.org//p/boc/isug13/06.html (accessed July 14, 2024).

IEA (2023). “CO2 emissions in 2022 – analysis,” in IEA. Available at: https://www.iea.org/reports/co2-emissions-in-2022 (accessed September 25, 2023).

Ieng Chu, C., Chatterjee, B., and Brown, A. (2013). The current status of greenhouse gas reporting by Chinese companies: a test of legitimacy theory. Manag. Audit. J. 28, 114–139. doi: 10.1108/02686901311284531

IPE (2021). A&H Shares Climate Information Disclosure Research Report. Available at: https://www.ipe.org.cn/reports/report_21055.html (accessed November 22, 2023).

Jiang, Y., Fan, H., Zhu, Y., and Xu, J. F. (2023). Carbon disclosure: A legitimizing tool or a governance tool? Evidence from listed US companies. J. Int. Financ. Managem. Account. 34, 36–70. doi: 10.1111/jifm.12161

Kiliç, M., and Kuzey, C. (2018). The effect of corporate governance on carbon emission disclosures: evidence from Turkey. Int. J. Clim. Chang. Strateg. Manag. 11, 35–53. doi: 10.1108/IJCCSM-07-2017-0144

Knox-Hayes, J., and Levy, D. L. (2011). The politics of carbon disclosure as climate governance. Strateg. Organ. 9, 91–99. doi: 10.1177/1476127010395066

Lemos, M. C., and Agrawal, A. (2006). Environmental governance. Annu. Rev. Environ. Resour. 31, 297–325. doi: 10.1146/annurev.energy.31.042605.135621

Lister, J. (2018). The policy role of corporate carbon management: co-regulating ecological effectiveness. Glob. Policy 9, 538–548. doi: 10.1111/1758-5899.12618

Liu, Z. G., Liu, T. T., McConkey, B. G., and Li, X. (2011). Empirical analysis on environmental disclosure and environmental performance level of listed steel companies. Energy Procedia 5, 2211–2218. doi: 10.1016/j.egypro.2011.03.382

Luo, J., and Liu, Q. (2020). Corporate social responsibility disclosure in China: do managerial professional connections and social attention matter? Emerg. Mark. Rev. 43, 100679. doi: 10.1016/j.ememar.2020.100679

Ma, B., Lin, S., Bashir, M. F., Sun, H., and Zafar, M. (2023). Revisiting the role of firm-level carbon disclosure in sustainable development goals: research agenda and policy implications. Gondwana Res. 117, 230–242. doi: 10.1016/j.gr.2023.02.002

Melnyk, S. A., Sroufe, R. P., and Calantone, R. (2003). Assessing the impact of environmental management systems on corporate and environmental performance. J. Oper. Manag. 21, 329–351. doi: 10.1016/S0272-6963(02)00109-2

Ministry of Ecology and Environment PRC. (2022). China Submits “Progress Report on the Implementation of China's Nationally Determined Contributions (2022)” - Ministry of Ecology and Environment of the People's Republic of China. Available at: https://www.mee.gov.cn/ywgz/ydqhbh/qhbhlf/202211/t20221111_1004576.shtml (accessed July 13, 2024).

Mio, C., Fasan, M., Marcon, C., and Panfilo, S. (2020). The predictive ability of legitimacy and agency theory after the implementation of the EU directive on non-financial information. Corp. Soc. Responsib. Environ. Manag. 27, 2465–2476. doi: 10.1002/csr.1968

Monteiro, A. P., García-Sánchez, I.-M., and Aibar-Guzmán, B. (2023). Can social disclosure induce a better corporate social performance? Ekon. Istraz. 36:2217885. doi: 10.1080/1331677X.2023.2217885

Oyewo, B. (2023). Corporate governance and carbon emissions performance: international evidence on curvilinear relationships. J. Environ. Manage. 334:117474. doi: 10.1016/j.jenvman.2023.117474

Patten, D. M. (2002). The relation between environmental performance and environmental disclosure: a research note. Account. Organ. Soc. 27, 763–773. doi: 10.1016/S0361-3682(02)00028-4

Polonsky, M. J. (1995). A stakeholder theory approach to designing environmental marketing strategy. J. Bus. Ind. Mark. 10, 29–46. doi: 10.1108/08858629510096201

Potoski, M., and Prakash, A. (2005). Green Clubs and Voluntary Governance: ISO 14001 and firms' regulatory compliance. Am. J. Political Sci. 49, 235–248. doi: 10.1111/j.0092-5853.2005.00120.x

Qian, W., and Schaltegger, S. (2017). Revisiting carbon disclosure and performance: legitimacy and management views. Br. Account. Rev. 49, 365–379. doi: 10.1016/j.bar.2017.05.005

Seman, N., Zakuan, N., Rashid, U. K., Nasuredin, J., and Ahmad, N. (2018). Understanding stakeholder pressures in adopting environmental management practices based on stakeholder theory: a review. Int. J. Res. 05, 1530–1545.

Sharma, S., Durand, R. M., and Gur-Arie, O. (1981). Identification and analysis of moderator variables. J. Mark. Res. 18, 291–300. doi: 10.1177/002224378101800303

Shen, J., Tang, P., and Zeng, H. (2020). Does China's carbon emission trading reduce carbon emissions? Evidence from listed firms. Energy Sustain. Dev. 59, 120–129. doi: 10.1016/j.esd.2020.09.007

Shi, W., Sang, J., Zhou, J., Ding, X., and Li, Z. (2023). Can carbon emission trading improve carbon emission performance? Evidence from a quasi-natural experiment in China. Environ. Sci. Pollut. Res. 30, 124028–124040. doi: 10.1007/s11356-023-31060-z

Shonhadji, N. (2018). Financial performance to environmental disclosure with environmental performance as moderation. IJSRM 5, 183–191.

Siddique, M. A., Akhtaruzzaman, M., Rashid, A., and Hammami, H. (2021). Carbon disclosure, carbon performance and financial performance: international evidence. Int. Rev. Financ. Anal. 75, 101734. doi: 10.1016/j.irfa.2021.101734

Siddique, M. A., Aljifri, K., Hossain, S., and Choudhury, T. (2023). Effect of market-based regulations on corporate carbon disclosure and carbon performance: global evidence. J. Appl. Account. Res. doi: 10.1108/JAAR-08-2022-0215

Skrondal, A., and Rabe-Hesketh, S. (2004). Generalized Latent Variable Modeling: Multilevel, Longitudinal, and Structural Equation Models. New York: Chapman and Hall/CRC.

Yin, C., Zhang, J., and Shao, C. (2020). Relationships of the multi-scale built environment with active commuting, body mass index, and life satisfaction in China: a GSEM-based analysis. Travel Behav. Soc. 21, 69–78. doi: 10.1016/j.tbs.2020.05.010

Yu, E. P., Luu, B. V., and Chen, C. H. (2020). Greenwashing in environmental, social and governance disclosures. Res. Int. Bus. Finance. 52:101192. doi: 10.1016/j.ribaf.2020.101192

Yu, H.-C., Kuo, L., and Ma, B. (2020). The drivers of carbon disclosure: evidence from China's sustainability plans. Carbon Manag. 11, 399–414. doi: 10.1080/17583004.2020.1796142

Zhang, B., and Wang, Z. (2014). Inter-firm collaborations on carbon emission reduction within industrial chains in China: practices, drivers and effects on firms' performances. Energy Econ. 42, 115–131. doi: 10.1016/j.eneco.2013.12.006

Zhang, L., Song, L., Wang, B., Shao, H., Zhang, L., and Qin, X. (2018). Co-effects of salinity and moisture on CO2 and N2O emissions of laboratory-incubated salt-affected soils from different vegetation types. Geoderma 332, 109–120. doi: 10.1016/j.geoderma.2018.06.025

Zhang, S. (2024). The impact of emission trading schemes and government pressure on corporate climate change disclosure in China. Environ. Chall. 16:100979. doi: 10.1016/j.envc.2024.100979

Zhang, Y., Qi, L., Lin, X., Pan, H., and Sharp, B. (2022). Synergistic effect of carbon ETS and carbon tax under China's peak emission target: a dynamic CGE analysis. Sci. Total Environ. 825, 154076. doi: 10.1016/j.scitotenv.2022.154076

Zhang, Y.-J., Wang, A.-D., and Tan, W. (2015). The impact of China's carbon allowance allocation rules on the product prices and emission reduction behaviors of ETS-covered enterprises. Energy Pol. 86, 176–185. doi: 10.1016/j.enpol.2015.07.004

Zheng, Y., Sun, X., Zhang, C., Wang, D., and Mao, J. (2021). Can emission trading scheme improve carbon emission performance? Evidence from China. Front. Energy Res. 9. doi: 10.3389/fenrg.2021.759572

Keywords: climate change disclosure, climate governance, corporate environmental governance, carbon performance, China, generalized structural equation model

Citation: Zhang S (2024) Climate change disclosure and carbon performance of Chinese listed companies: exploring the moderating effects of climate governance and corporate environmental governance. Front. Clim. 6:1469899. doi: 10.3389/fclim.2024.1469899

Received: 24 July 2024; Accepted: 30 November 2024;

Published: 18 December 2024.

Edited by:

Otilia Manta, Romanian Academy, RomaniaReviewed by:

Izzet Ari, Social Sciences University of Ankara, TürkiyeSimon Cadez, University of Ljubljana, Slovenia

Copyright © 2024 Zhang. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Sailu Zhang, emhhbmcuc2FpbHUuMzVwQHN0Lmt5b3RvLXUuYWMuanA=

Sailu Zhang

Sailu Zhang