- 1SIMAD University, Mogadishu, Somalia

- 2Sayid Mohamed Technical Education College, Beledhawo, Somalia

- 3Sayid Mohamed Technical Education College, Buula-Hawo, Somalia

Introduction: This research investigates into the complex dynamics of climate finance in Somalia, a vulnerable region facing the dire consequences of climate change. The study aims to assess how financial inputs for climate-related projects align with the actual needs and identify critical factors that influence funding effectiveness.

Methods: A dual-methodological approach was employed, integrating both multiple regression analysis and Support Vector Machine (SVM) techniques. This mixed-method analysis facilitates a robust examination of climate finance data to dissect the relationships and impacts of various determinants on funding effectiveness.

Results: The results indicate that adaptation finance, robust governance, and the scale of financial interventions significantly enhance the effectiveness of climate finance flows. However, mitigation finance and aspects related to gender equality displayed less significant impacts. Notably, the study identifies a pervasive underfinancing of climate projects in Somalia, illustrating a significant gap between the needed and actual funds disbursed.

Discussion: The findings underscore the need for enhanced governance frameworks and targeted large-scale financial interventions to optimize the allocation and impact of climate finance in vulnerable regions like Somalia. By quantifying the influence of adaptation finance and governance, this study contributes new insights to the literature on climate finance effectiveness and suggests practical strategies for policymakers and practitioners to improve climate resilience initiatives.

Introduction

Climate change has emerged as one of the most formidable global challenges of the 21st century, significantly affecting socio-economic and environmental systems across the world. Particularly for countries like Somalia, located in a region prone to climatic extremes, the implications of climate variability are profound and multifaceted (Warsame et al., 2021). Long-term shifts in weather patterns exacerbate existing vulnerabilities, disrupting livelihoods and escalating conflict over scarce resources, thereby undermining regional stability and development prospects (Morriss et al., 2011; Mohamed and Mohamud, 2023; Regasa et al., 2023). The situation in Somalia illustrates a critical junction where climate change intersects with socio-economic fragility, making the population highly susceptible to recurring droughts and floods (Chaudhry and Ouda, 2021; Ali Warsame and Hassan Abdi, 2023). These environmental stressors not only lead to direct losses in terms of agriculture and livelihood but also trigger broader socio-economic disruptions, including mass displacements and intensified competition for resources, which could potentially escalate into conflict (Nor and Masron, 2019; Aminga and Krampe, 2020; Kamta and Scheffran, 2022).

In Somalia, the climate crisis is not merely an environmental issue but a complex socio-economic challenge that exacerbates food insecurity, water scarcity, and inter-communal conflict. The existing climate adaptation and mitigation strategies are hindered by a chronic lack of financial resources and institutional support, making effective response mechanisms difficult to implement and sustain (Botta et al., 2021; Fujiwara and Mahajan, 2023; Mohamed and Mohamud, 2023). Moreover, the allocation and utilization of climate finance in Somalia have been fraught with inefficiencies and inequities, often failing to reach the most vulnerable populations or to address the root causes of climate vulnerability. This misalignment of resources reflects a broader systemic failure to integrate climate resilience into national development agendas, thus perpetuating the cycle of vulnerability and crisis (Harvey et al., 2018; Mohamed and Nor, 2023; Nor, 2024).

Climate change poses a unique and urgent threat to Somalia, with its impacts severely affecting the livelihoods and security of its population. The current strategies and financial mechanisms in place to address these impacts are insufficient and often misaligned with the actual needs of vulnerable communities, leading to inadequate responses that fail to foster long-term resilience or address the underlying socio-economic vulnerabilities (Warsame et al., 2021; Papa et al., 2023; Warsame et al., 2023; Nor, 2024). The problem is compounded by a lack of comprehensive data and research on the effectiveness of climate finance in Somalia, which hampers the ability of policymakers and international donors to make informed decisions about resource allocation and program design. This gap in knowledge and understanding limits the potential for impactful interventions and perpetuates a state of environmental and socio-economic instability.

Climate change poses an existential threat to Somalia, with tangible impacts already being felt across the country. According to a report by the Food and Agriculture Organization (FAO), recurrent droughts exacerbated by climate change have led to a 70% reduction in crop yields in key agricultural regions, contributing to widespread food insecurity affecting over 6 million Somalis. Additionally, climate-induced shifts have devastated the pastoral sector, with livestock losses estimated at 40% during prolonged drought periods, leading to significant job losses and exacerbating poverty levels. The World Bank estimates that climate change could push an additional 3 million Somalis into extreme poverty by 2030 if current trends continue. These statistics underscore the critical need for climate-resilient policies and interventions to mitigate the severe economic and social impacts on the country.

Understanding the dynamics of climate finance in Somalia is crucial for developing effective interventions that can address both immediate needs and long-term challenges. This study is motivated by the pressing need to enhance the efficacy and reach of financial flows dedicated to climate resilience in Somalia, ensuring that they contribute effectively to mitigating the adverse effects of climate change and enhancing adaptive capacities (Campiglio et al., 2018; Samuwai and Hills, 2019). The motivation for this research also stems from the urgent need to provide empirical evidence and strategic insights that can inform policy decisions and guide international aid allocations. By focusing on the intersections of climate finance, adaptation, and socio-economic resilience, this study aims to contribute to a more nuanced understanding of how financial mechanisms can be optimized to support sustainable development goals in climate-vulnerable contexts like Somalia.

The urgency of studying climate finance in Somalia is underscored by the rapid environmental degradation and the increasing frequency of climatic events that threaten to destabilize the region further. The theoretical framework of this study is built on the premise that effective climate finance can act as a catalyst for building resilience and promoting sustainable development, particularly in settings that are geopolitically and economically fragile (Baldwin and Lenton, 2020; Molua, 2022). This research is important as it delves into the theoretical underpinnings of climate finance, exploring the relationship between financial flows, policy frameworks, and community resilience. It seeks to understand how well-aligned funding mechanisms can help bridge the gap between current capabilities and the needed responses to climate impacts, thereby contributing to the theoretical discourse on climate adaptation and mitigation in developing countries.

While there is a growing body of literature on the allocation and effectiveness of climate finance in Somalia, many existing studies primarily focus on broad regional analyses or specific aspects such as project-level implementation or donor perspectives. However, there remains a gap in critically assessing how these allocations align with the unique needs and vulnerabilities of Somalia’s local communities, particularly in the context of sustainable, long-term development. This paper seeks to build upon existing research by offering a comprehensive analysis that not only examines the effectiveness of climate finance at the national level but also explores the local-level impacts and challenges in disbursement. Our study aims to fill this gap by providing an integrative framework that connects climate finance with community resilience, highlighting areas where current approaches May fall short and suggesting pathways for more effective resource allocation.

The potential contributions of this research extend beyond the academic sphere, offering actionable insights that are directly relevant to policymakers. Specifically, this paper provides a detailed analysis of the alignment between climate finance allocations and the unique vulnerabilities faced by local communities in Somalia. The findings underscore the need for a more targeted and context-sensitive approach to climate finance, which can be instrumental in informing policy decisions. Key recommendations include enhancing the transparency and accountability of fund disbursements, prioritizing investments in community-led resilience initiatives, and fostering stronger partnerships between national and local governments. These insights are not only grounded in rigorous analysis but are also designed to be immediately applicable to ongoing policy discussions. Furthermore, while the introduction highlights a gap in the literature concerning the critical assessment of climate finance in Somalia, this does not imply an absence of relevant studies. Instead, it reflects the need for a more nuanced examination that bridges existing research with practical policy implications. By integrating findings from previous studies and presenting novel recommendations, this paper seeks to advance the discourse and offer policymakers concrete strategies to enhance the effectiveness of climate finance in Somalia.

This study argues that enhancing the effectiveness of climate finance is crucial for building resilience and addressing the urgent challenges of climate change in Somalia. It highlights a significant research gap in the critical analysis of financial flows dedicated to climate initiatives within Somalia, an area that has received limited scholarly attention despite its critical importance. Hence, the purpose of this study is to explore the reliability, adequacy, and sustainability of climate finance for Somalia’s climate initiatives, aiming to offer insights that can improve the strategic deployment of funds. The expected contributions of this research include the development of better-informed policies and strategies that can significantly enhance the effectiveness of climate finance in fostering long-term resilience and sustainability in vulnerable regions like Somalia.

Literature review

Sub-Saharan Africa (SSA) is more vulnerable to climate change impacts than other regions (Adzawla et al., 2019), with adaptation costs estimated at $18 billion annually between 2010 and 2050 (Narain et al., 2011). Agriculture, health, and water are negatively impacted by climate change, posing a major threat to development (Nhemachena et al., 2020; Kogo et al., 2021). Climate aid promises of $100 billion have not been met by developed countries, and the deadline for mobilizing funds has been extended through 2025 (Pauw et al., 2022). Africa needs $2.8 trillion between 2020 and 2030 to implement its National Development Goals, with mitigation accounting for the largest share, whereas adaptation is only 24% of the total (Sengupta, 2023).

Climate researchers have studied the impact of competing preferences among climate finance donors and domestic players on climate finance coordination at national and subnational levels in Zambia (Funder and Dupuy, 2022; Shawoo et al., 2022). This study stated that despite the World Bank’s early effect on implementing coordination standards, domestic players have gradually weakened and restructured coordination arrangements to reflect their preferences better (Chelminski, 2022). They found that domestic players have gradually weakened and restructured coordination arrangements to reflect their preferences better. Climate finance mechanisms, such as utility modifiers, social learning, and capacity building, significantly impact the financial, regulatory, and technical barriers to geothermal development in Indonesia and the Philippines (Chelminski, 2022). However, political will and energy shocks also play an important role in the success of climate funding and the deployment of renewable energy technologies in emerging nations (Azhgaliyeva and Liddle, 2020; Guild, 2020; Setyowati, 2020; Bhatnagar and Sharma, 2022; Huang et al., 2022).

Climate finance is a crucial part of the climate accords since 2009, promoting commitment and ambition among emerging markets and developing countries (Bhattacharya et al., 2020). With a $100 billion commitment, it can mobilize private capital on a new level (Suroso et al., 2022). According to Article 2.1c of the Paris Agreement, parties must align finance flows with climate-resilient development and low greenhouse gas emissions (Gebel et al., 2022). Transformative climate finance is essential for accelerated and sustained transformations to climate-resilient growth (Leal Filho et al., 2021). Implementing sustainable investments can enhance productivity and generate co-benefits, including reduced co-benefits and ecosystem and biodiversity protection (Dafermos et al., 2018). Economic decision-makers can create comprehensive stimulus packages to drive recovery and build a better future (Bhattacharya et al., 2020). Climate finance gaps include inadequate grant funding, underfunding of adaptation, lack of funding for Least Developed Countries, and fast-track access obstacles (Savvidou et al., 2021). Improving predictability, trust, country ownership, gender responsiveness, and addressing loss and damage is crucial for improving future climate finance flows (Bhattacharya et al., 2020).

Wealthy countries are providing increased funding to developing countries to combat greenhouse gas pollution and enhance climate change resilience (Pickering and Mitchell, 2017). However, low-income countries are concerned about the predictability of current financial flows, which must increase dramatically by 2020 to mobilize $100 billion annually (Qian et al., 2023). This lack of predictability can undermine trust in negotiations and hinder long-term climate policy development (Pickering et al., 2017; Bracking and Leffel, 2021). National discretion is a factor contributing to climate finance fragmentation and uncertainty, but little is known about factors influencing climate finance volume and predictability among contributor countries (Pickering and Mitchell, 2017). The Copenhagen Accord mandates developed countries to provide adequate financial resources for developing countries’ adaptation needs. ‘Adequacy’ refers to meeting these needs or covering costs (Pauw et al., 2016). Predictable funding is crucial for developing countries to develop strategies and implement activities (Kissinger et al., 2019). The Accra Agenda for Action (2008) encourages donor countries to provide timely information about annual expenditure and develop a three-to five-year plan in advance (Organization for Economic Co-operation and Development, 2008). Predictability is about recipients’ expectation of future adaptation funding (Pauw et al., 2016).

Global greenhouse gas mitigation measures are projected to cost $200 billion to 210 billion by 2030 (Afful-Koomson, 2015). Africans’ share of global GDP between 2005 and 2010 was 5 billion dollars per year. Between 2008 and 2012, 2.5 billion US dollars were approved for mitigation projects in Africa, with 510 million allocated annually (Amighini et al., 2022). Africa needs at least 18 billion US dollars annually for climate change adaptation between 2010 and 2050, with the African Development Bank stating that financial flows are inadequate (Savvidou et al., 2021). Climate funds are used to fund projects in Africa, but the consistency of the amounts committed, deposited, approved, and disbursed is a topic of academic debate (Afful-Koomson, 2015; Gutierrez and Gutierrez, 2019). Bilateral projects have a mean disbursement ratio of 35%, while multilateral projects have a mean disbursement ratio of 50% (Afful-Koomson, 2015; Savvidou et al., 2021). Bilateral projects take about 1.2 years to receive their first payment, while multilateral funds May have better financial flow predictability due to bureaucratic delays (Afful-Koomson, 2015; Cao et al., 2021; Savvidou et al., 2021). Multilateral projects are primarily implemented by international organizations and non-governmental organizations, with the World Bank and the AfDB managing 14 and 9% of the projects, respectively (Afful-Koomson, 2015; Cao et al., 2021; Savvidou et al., 2021).

In 2025, developed countries must set new financing goals to ensure adequate and predictable climate finance, avoiding group differentiation (Zhang and Pan, 2016; Khan and Munira, 2021). They can leverage links between mitigation, adaptation, and financial demand developed by other countries (Khan et al., 2020). A new climate finance target of $100 billion per year is set for developed countries (Zhang and Pan, 2016; Khan et al., 2020). Non-Annex I parties emphasize the international community’s role in providing predictable and sustainable financial resources, capacity-building, and technical support for national climate change plans (Zhang and Pan, 2016; Lee et al., 2022). Enhancing climate finance availability and efficiency by integrating private sector sources, ensuring transparent distribution, and increasing efficiency are also crucial. During the 2009 Copenhagen climate negotiations, developing countries demanded funding to reduce greenhouse gas emissions and cope with climate impacts (Roberts et al., 2021). To achieve a goal of $100 billion per year by 2020, developed nations committed to providing new, predictable, and adequate funding (Roberts et al., 2021; Bian and Xia, 2022). However, these promises have flaws, making it difficult to determine if they have been met (Roberts and Weikmans, 2017; Roberts et al., 2021). As national treasuries continue to make annual decisions, new global financing mechanisms are needed to meet the promises made in Copenhagen (Khan et al., 2020; Roberts et al., 2021).

Hof et al. (2011) evaluated four climate funding proposals in developing economies using three criteria: adequacy, predictability, and equity. They calculated the revenue of the proposals using three mitigation scenarios to assess adequacy and predictability. They assessed climate funding predictability from a broader perspective, focusing on the revenue generated by financing proposals of three different mitigation scenarios (Hof et al., 2011). They used the Framework to Assess International Regimes (FAIR) framework, which analyzes climate regimes’ environmental and economic impacts, costs of environmental and abatement measures, and Kyoto mechanisms in linking long-term climate targets with regional emission allowances and abatement costs (Gu et al., 2011; Hof et al., 2011). The Paris Agreement requires substantial investment, with developed countries committing $100 billion annually up to 2025 (Egli and Stünzi, 2019). Post-2025 commitments are likely to exceed this amount, but no guidance is provided on how contributions should be allocated (Egli and Stünzi, 2019). A dynamic burden-sharing mechanism has been developed to assess governments’ climate finance contributions, allowing civil society and countries to check if they are adequate, leading to more effective international collaboration (Egli and Stünzi, 2019, Warren, 2020).

Materials and methods

Data and sampling technique

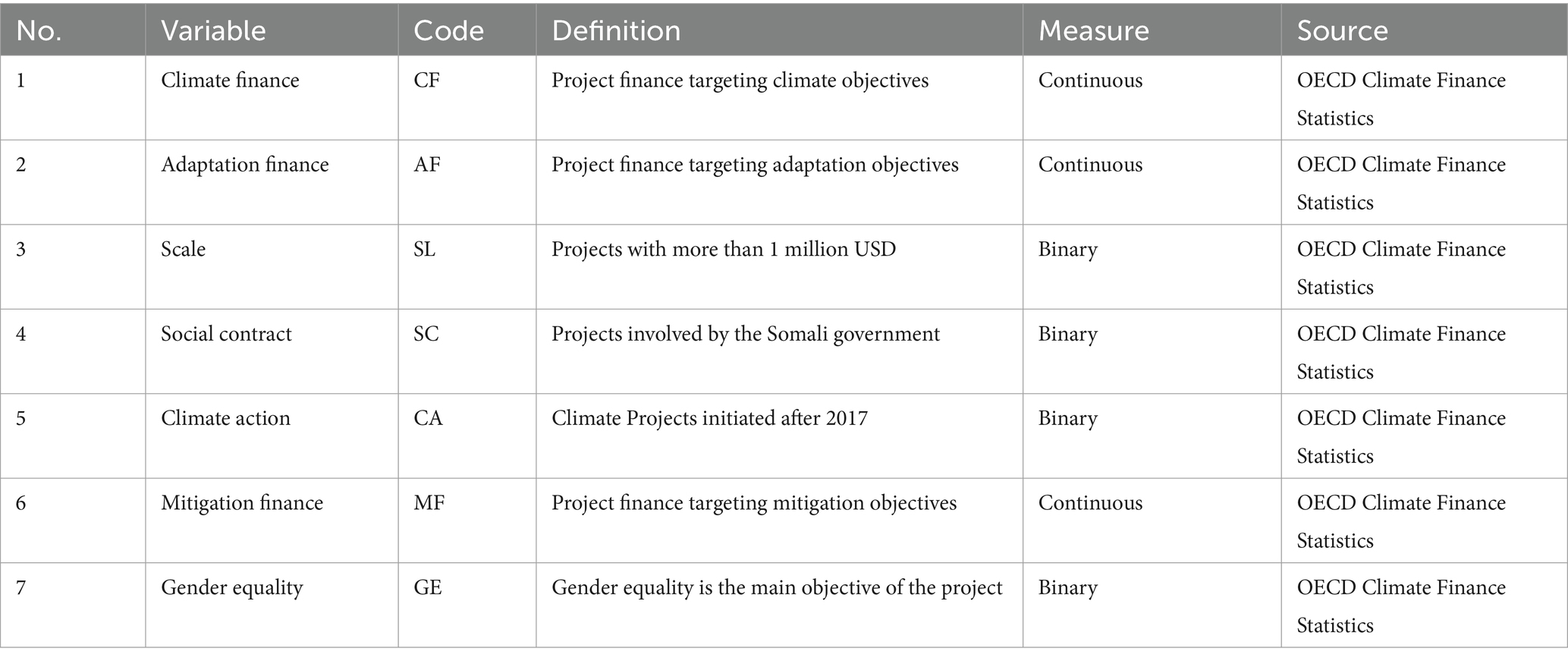

Somalia climate finance data were retrieved from OECD Climate Finance Statistics. The data, which ranges from 2006 to 2020, covers couple of financial indicators including climate finance flow, climate finance providers, climate finance instruments, sectors invested, and other indicators. The objective of this research is to explore the effectiveness of climate finance for Somalia’s climate initiatives. The following table outlines the variables and their definitions used in this study.

Summary of the data

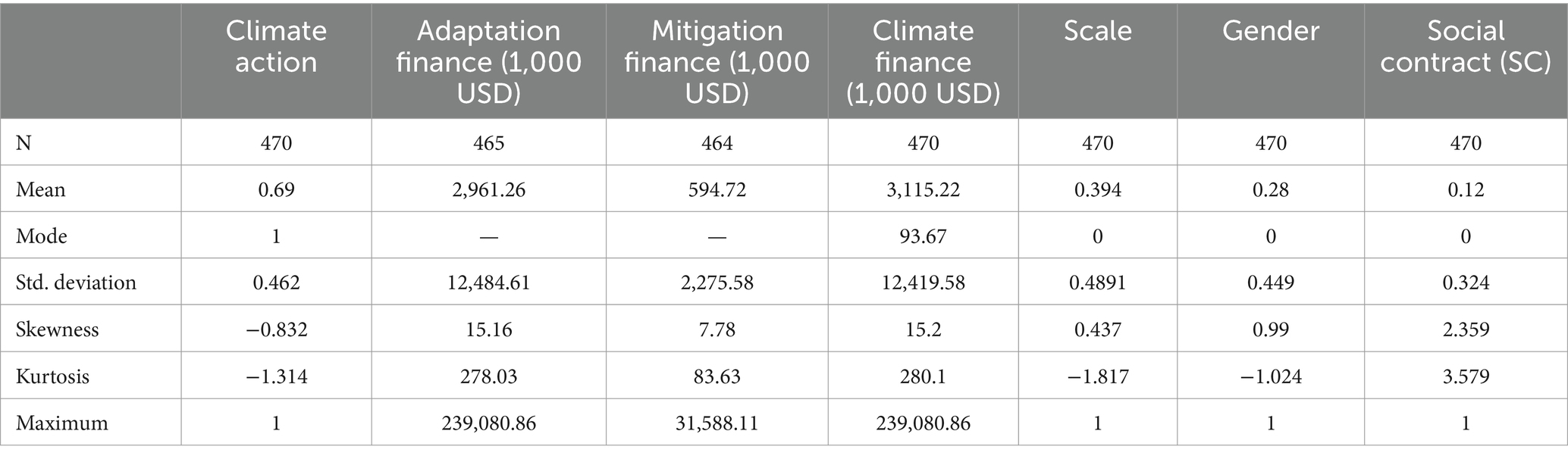

The research findings provide a comprehensive overview of the current state of climate finance in Somalia, revealing several key insights. These insights are pivotal for shaping policy responses and strategic planning to optimize the effectiveness and impact of climate finance in Somalia, addressing both existing challenges and capitalizing on recent advancements in funding and awareness.

Skewed funding distributions

There is a significant disparity between the maximum climate finance flow to Somalia ($239,080,860) and the average flow ($3,115,218), suggesting that occasional large inflows, potentially from specific projects or external sources, greatly skew the average. This pattern is consistent across both general and adaptation-specific finance flows.

Mitigation finance variability

The maximum mitigation finance flow ($31,588,110) far exceeds the average ($594,720), indicating sporadic larger investments in this area, which suggests that mitigation initiatives might receive substantial but inconsistent funding.

Stability in funding

The Coefficient of Variation (C.V.) at 0.488 reflects a moderate degree of stability in climate finance relative to its mean, implying that dramatic increases in future climate finance are unlikely. This could signal concerns regarding the sustainability and adequacy of funding.

Small-scale projects and limited government involvement

Most climate finance projects are small, typically under $1 million, and often do not involve the Somali government directly. This points to a prevalence of smaller initiatives with minimal governmental engagement.

Gender inequality in climate projects

The data reveals a lack of prioritization of gender equality in climate-related projects, identifying a crucial area for improvement to ensure inclusivity and effectiveness in project impacts.

Recent growth in climate finance

Between 2017 and 2020, there was a notable increase in climate finance, with significant portions of grants and their total values disbursed in this period, reflecting heightened climate change awareness and international support.

Recommendations for future action

The findings underscore the necessity for enhanced sustainability, diversified project sizes, increased government participation, and integration of gender considerations into climate finance strategies.

Two-stage modeling approach

This study uses a two-stage modeling approach, employing a multiple regression model at the first stage and a support vector machine (SVM) model at the second to produce reliable results. By integrating the two approaches, the limitations of both methodologies are effectively addressed. Given the data-driven nature of Support Vector Machines (SVM), it is imperative to contrast it with a theory-driven approach, such as the multiple regression model.

Multiple regression

Multiple regression was used in this study to examine the relationship between independent and dependent variables. By conducting an examination of various predictors, it becomes feasible to acquire a more profound comprehension of complex nature and trends. This approach involves quantifying the specific impacts of individuals while taking into account confounding factors, thereby uncovering concealed causal relationships and patterns. A multiple regression analysis was conducted to examine the reliability, adequacy, and sustainability of Climate Finance in Somalia for the country’s Climate Initiatives. The regression model is modeled in the following form:

Where;

CF = climate finance.

SL = scale.

AF = adaptation finance.

SC = social contract.

CA = climate action.

MF = mitigation finance.

GE = gender equality.

Justification for methodology

The adoption of multiple regression analysis in this study is grounded in its ability to comprehensively examine the simultaneous effects of multiple independent variables on a single dependent variable, a necessity for exploring the effectiveness of climate finance in Somalia’s climate initiatives. This methodology is particularly advantageous as it allows for the control of potential confounding variables, ensuring that the influence of each factor is accurately isolated and estimated. By providing quantitative estimates, multiple regression enables the precise measurement of the magnitude and direction of relationships, thereby facilitating the formulation of empirically grounded policy recommendations. Moreover, its robustness in hypothesis testing not only supports the exploration of correlations but also aids in establishing causal links where applicable, enhancing the study’s ability to draw meaningful and actionable conclusions within the complex context of climate finance effectiveness.

Support vector machine

Support Vector Machine (SVM) is a powerful machine-learning algorithm widely recognized for its prowess in handling complex datasets (Teles et al., 2021). Its strength lies in its ability to find optimal decision boundaries, making it particularly valuable for classification problems. SVMs can transform input data into a higher-dimensional feature space, simplifying the process of finding linear separations or effectively classifying complex datasets. They excel in various domains, including text and image classification, gene expression analysis, and anomaly detection, thanks to their adaptability and efficiency in managing high-dimensional data and nonlinear relationships. However, SVMs tend to perform best on smaller datasets due to their memory-efficient approach, where they focus on a subset of training points known as support vectors. Despite their effectiveness, SVMs come with certain limitations, such as the need to avoid overfitting in high-dimensional feature spaces and the relatively costly calculation of probability estimates (Melgani and Bruzzone, 2004).

Support Vector Regression (SVR) is a supervised learning algorithm that extends the principles of SVMs to predict continuous values (Zhang and O'Donnell, 2020). SVR, akin to its classification counterpart, strives to maximize margins while accommodating as many data points as possible. It identifies a hyperplane that best fits the data while maintaining a balance between fitting the data precisely and avoiding overfitting. This property makes SVR an invaluable tool for predicting discrete values with accuracy. In SVR, the goal is to find the hyperplane that can capture the maximum number of data points, allowing it to excel in regression tasks. By leveraging the core concepts of SVMs, SVR provides a robust framework for addressing real-world problems requiring precise predictions of continuous variables.

Support Vector Regression shares similarities with Linear Regression in terms of the equation representing the line, which is given as:

However, in Support Vector Regression, this linear relationship is denoted as a hyperplane. The data points situated on either side of this hyperplane and closest to it are referred to as Support Vectors, and they play a crucial role in defining the boundary line for SVR. Support Vector Regression (SVR) differs from other regression models in its objective. While other models aim to minimize the error between actual and predicted values, SVR takes a unique approach by seeking to establish the optimal line within a predefined threshold distance (referred to as ‘a’) between the hyperplane and the boundary line. Hence, the SVR model can be characterized as striving to satisfy the condition of:

The predictions are based on the data points located within this boundary.

Support Vector Machine (SVM) can be used as a regression method, maintaining its main features of maximum margin. Support Vector Regression (SVR) uses the same principles as SVM for classification, with minor differences. The output is a real number, making it difficult to predict infinite possibilities. A margin of tolerance (epsilon) is set in regression to approximate the SVM. The algorithm is more complicated, but the main idea is to minimize error by individualizing the hyperplane that maximizes the margin, while tolerating some part of the error.

The kernel functions serve the purpose of converting the data into a feature space of higher dimensions, enabling the achievement of linear separation.

Kernel functions

Empirical results

The study’s findings are organized into two distinct sections. The initial section delves into the results derived from the multiple regression analysis, while the subsequent section addresses the findings generated through the application of the support vector machine (SVM) methodology.

The results of the multiple regression

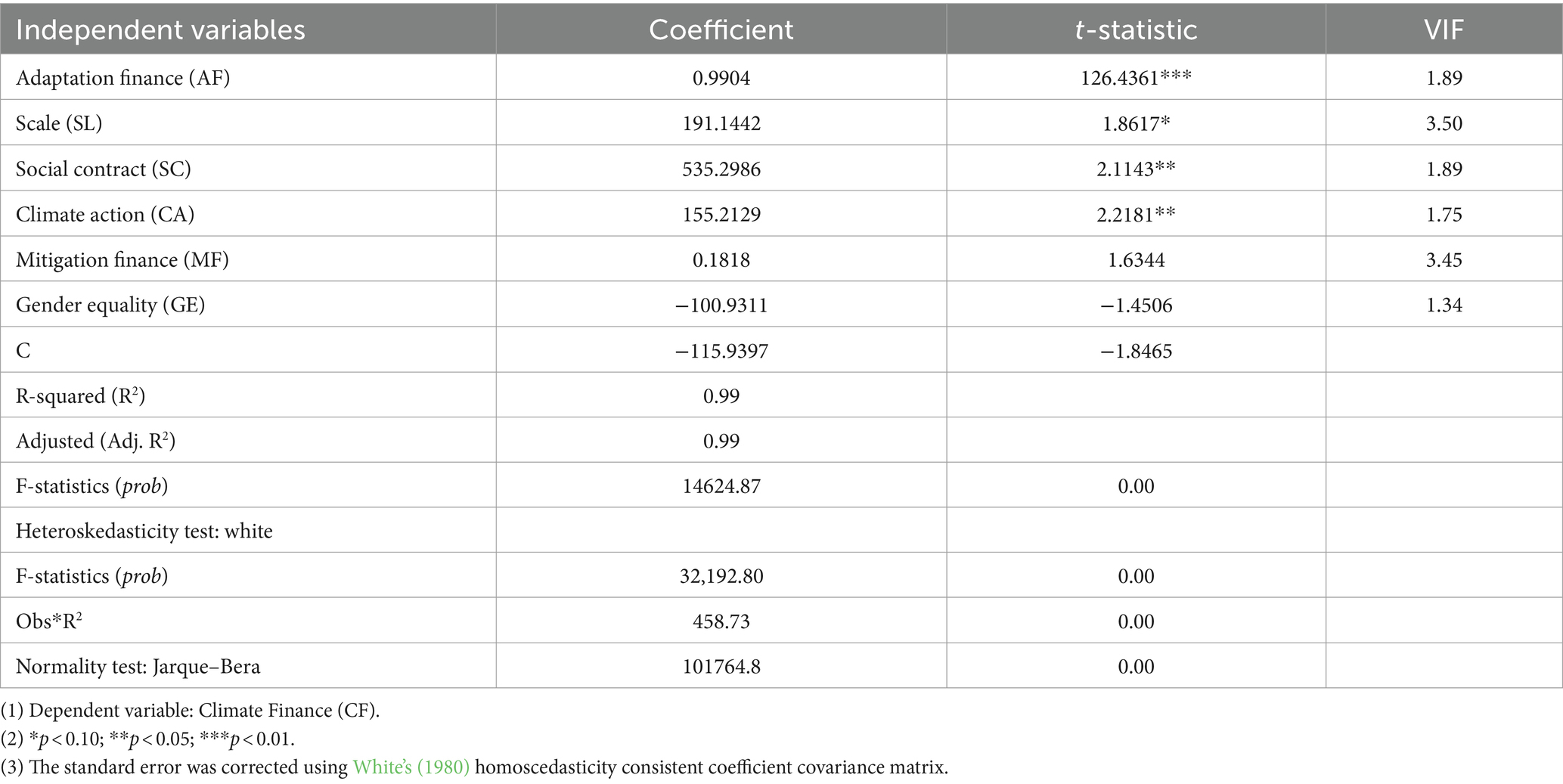

The regression analysis of climate finance in Somalia has revealed insightful trends and relationships. The R-squared value of 0.99 is exceptionally high. R-squared measures the proportion of the variance in the dependent variable that is explained by the independent variables in the model. In this case, an R-squared of 0.99 means that 99% of the variance in the dependent variable (the outcome being predicted) is accounted for by the independent variables included in the model. This is an extremely strong goodness-of-fit, indicating that the model fits the data very well. However, it is essential to be cautious of overfitting, as an R-squared close to 1.0 can sometimes indicate an overly complex model that May not generalize well to new data. On the other hand, the F-statistic is highly significant with a p-value of 0.00. This suggests that the overall model is statistically significant. The F-statistic tests the null hypothesis that all the coefficients of the independent variables are equal to zero. Since the p-value is very low, we can reject the null hypothesis, indicating that there is a relationship between the independent variables and the dependent variable. In summary, the model appears to be an excellent fit for the data, explaining a very high percentage of the variance in the dependent variable. The model, as a whole, is statistically significant, indicating that it provides valuable information for predicting the dependent variable. These findings suggest that the multiple regression model has strong predictive power and is likely capturing meaningful relationships between the independent and dependent variables. However, it’s essential to conduct a more detailed analysis of the individual regression coefficients to understand the specific effects of each independent variable on the dependent variable (see Tables 1, 2).

As shown in the multiple regression results (see Table 3), the multiple regression model found that adaptation funding (b = 0.9904 and t-value = 126.4361), the scale of financial interventions (b = 191.1442 and t-value = 1.8617), establishment of a robust social contract (b = 0.9904 and t-value = 126.4361), and climate action measures (b = 155.2129 and t-value = 2.2181) have significant positive effect on the flow of climate-related funds, whereas mitigation funding (b = 0.1818 and t-value = 1.6344) and gender equality (b = −100.9311 and t-value = −1.4506) have no significant effect on the flow of climate-related funds. In the context of climate finance in Somalia, these findings offer valuable insights into the determinants of the flow of climate-related funds. Notably, Adaptation Finance and the presence of a robust Social Contract emerge as the strongest drivers of fund flow, underscoring the critical importance of directing resources toward climate adaptation efforts and establishing transparent governance frameworks. Additionally, Climate Action measures are shown to have a positive and statistically significant impact, affirming the significance of proactive climate initiatives in a region vulnerable to climate-related challenges. Similarly, the scale of financial interventions has positive and statistically significant impact on the flow of climate-related funds. While Mitigation Finance exhibit positive influence, its statistical significance suggests that its impact May be less evident. Furthermore, while Gender Equality appears to have a negative effect on fund flow, the lack of statistical significance implies the need for further exploration of gender-related dynamics within climate finance projects. These findings illuminate key factors that policymakers and stakeholders can consider to optimize climate finance strategies for Somalia, with a particular emphasis on adaptation, governance, and targeted climate action measures.

Climate finance plays a crucial role in supporting climate adaptation and mitigation efforts in countries like Somalia, which are vulnerable to the impacts of climate change (Nor and Mohamed, 2024). These findings provide insights into the factors that influence the flow of climate-related funds in the Somali context. The positive and highly significant coefficient for Adaptation Finance suggests that increasing funding dedicated to adaptation projects and initiatives in Somalia has a substantial and positive impact on the flow of climate-related funds. In a context like Somalia, where climate adaptation is critical due to vulnerabilities to extreme climate shocks, this finding underscores the importance of directing resources toward adaptation efforts. The positive coefficient for Scale indicates that larger-scale financial interventions have a positive effect on the flow of climate-related funds in Somalia. In the Somali context, this finding suggests that larger-scale projects contribute to fund flow significantly. Similar to Adaptation Finance, a robust social contract has a highly significant positive effect on fund flow. This suggests that when there is a well-established and effective social contract, it can facilitate the allocation and utilization of climate-related funds effectively in Somalia. A stable and transparent governance framework is crucial in ensuring that funds are used efficiently and reach the intended beneficiaries. Climate action measures have a positive and statistically significant impact on fund flow. This finding indicates that investing in climate action initiatives, such as renewable energy projects or climate resilience programs, is associated with an increased flow of climate-related funds in Somalia. Given Somalia’s vulnerability to climate-related challenges, this underscores the importance of proactive climate action.

While mitigation finance has a positive coefficient, it is not highly statistically significant. This suggests that directing funds specifically toward mitigation projects, such as emissions reduction efforts, May not be a strong driver of fund flow in Somalia, at least within the context of this model. Gender equality has a negative coefficient, but it is not statistically significant. This suggests that the gender equality aspect does not significantly affect the flow of climate-related funds in Somalia according to the model. However, it is important to note that gender equality and social inclusion are critical aspects of climate finance, and addressing gender disparities should remain a priority in climate-related projects. After accounting for the influence of various other covariates, the results of our regression analysis reveal significant associations between specific factors and the allocation of climate-related funds. Notably, large-scale climate-related projects exhibit a statistically significant positive effect, contributing an estimated $1.8617 million USD more to the flow of climate-related funds than their small-scale counterparts. Furthermore, climate-related projects executed or overseen by recipient governments demonstrate a substantial positive impact, contributing approximately $126.4361 million USD more compared to projects managed by other partners, including NGOs, donor governments, or third parties. Additionally, climate action measures initiated after 2017 exhibit a marked influence, contributing an estimated $2.2181 million USD more to climate-related fund allocation than those enacted prior to 2017. These findings underscore the importance of project scale, governance involvement, and temporal considerations in shaping the distribution of climate-related financial resources, thereby informing policy and resource allocation strategies in the context of climate action initiatives.

Model diagnostics

The model diagnostics provide essential insights into the suitability and potential issues of the multiple regression analysis conducted in the context of Climate Finance in Somalia. The absence of multicollinearity among the independent variables, as indicated by the variance inflation factor (VIF) results (see Table 3), is a positive finding. A VIF less than 5 for all explanatory variables suggests that they are not highly correlated or redundant. In the context of Somalia, this means that the chosen independent variables do not suffer from high interdependence, allowing for more accurate interpretation of their individual effects on climate-related fund flow. This is particularly important for policymakers and stakeholders as they consider how to allocate and prioritize resources effectively. The presence of heteroscedasticity, which violates the homoscedasticity assumption, is identified in the model. Heteroscedasticity implies that the variance of the residuals is not constant across different levels of the independent variables. In the context of climate finance in Somalia, this May reflect the inherent variability and unpredictability of climate-related challenges. However, it’s positive that you have applied White’s (1980) homoscedasticity-consistent coefficient covariance matrix correction, which is a widely accepted method to address heteroscedasticity. This correction helps ensure that the standard errors of coefficient estimates are appropriately adjusted, resulting in reliable statistical inference, even when the homoscedasticity assumption is violated. The Jarque–Bera normality test indicates that the residuals are not normally distributed, with a very low p-value of 0.00. This implies that the residuals do not follow a normal distribution pattern. While this finding May raise concerns, it’s important to recognize that regression models are not always required to have normally distributed residuals. The significance of this finding largely depends on the specific purposes and assumptions of the analysis.

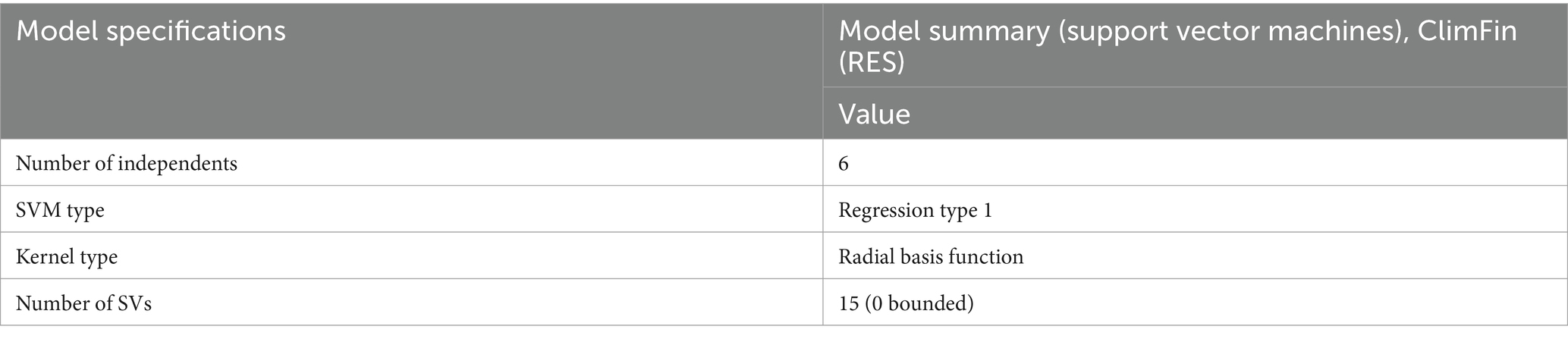

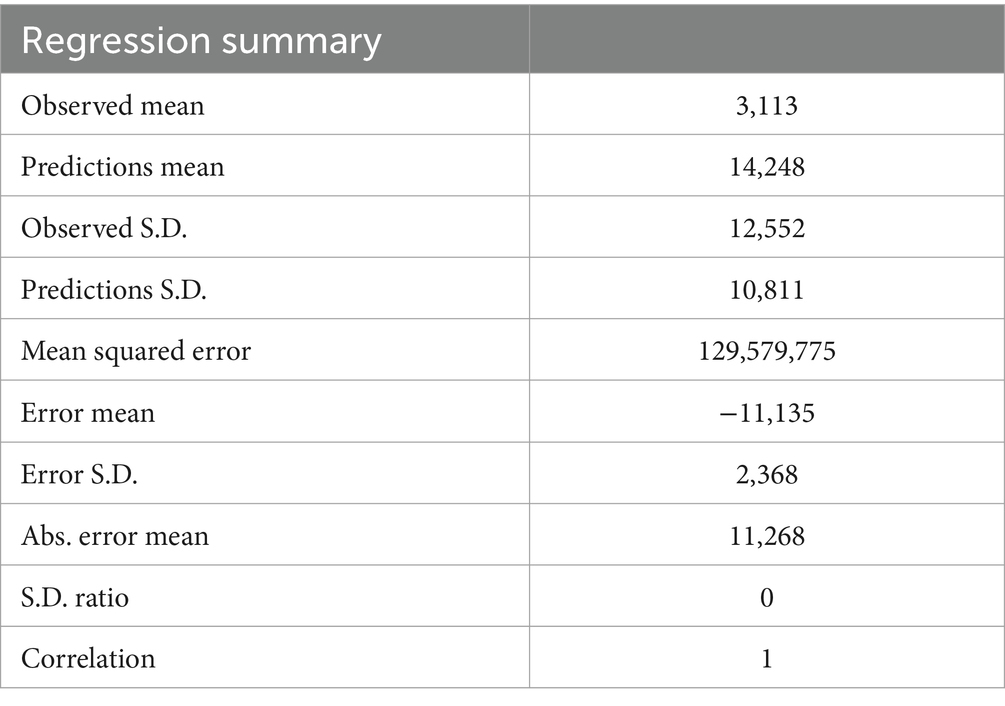

The results of support vector regression model

As shown in the model summary (see Table 4), the SVM model employed 6 input variables, Radial Basis Function as Kernel type, and 15 (0 bounded) number of SVs. The following table illustrate the regression summary of the SVM, where the necessary parameters of the model are presented. The following findings were uncovered by the SVR model. These findings provide important insights into the to the flow of climate-related funding in Somalia:

Discrepancy in predicted and actual funding

The initial finding underscores a pronounced incongruity between projected and actual funding allocation within the context of climate-related projects. Within the dataset of 458 projects subjected to analysis, a minuscule fraction, representing less than 1%, found themselves in a situation of over-financing, wherein they received a surplus of financial resources relative to their initial forecasts. Conversely, a significant majority, comprising 99.13% of the projects, experienced a substantial deficit in funding vis-à-vis their anticipated financial requisites, thereby elucidating a discernible and persistent pattern of projects consistently falling short of their projected financial support levels. This revelation underscores the imperative for a more comprehensive examination of the mechanisms governing funding disbursement in the climate-related project domain, as well as the potential ramifications of this chronic underfinancing phenomenon on the realization of climate-related objectives and targets (see Table 5).

Significance of underfinancing

The second key finding emphasizes a matter of considerable import, wherein the underfinancing of climate-related projects emerges as a matter of pronounced gravity. In a substantial majority of instances, exceeding 90% of the cases under scrutiny, the extent of underfunding surpasses an average of approximately 300%. This staggering statistic not only substantiates the pervasive nature of the funding deficit but also accentuates the magnitude of the financial chasm confronting these projects. Such substantial underfunding can have far-reaching repercussions, compromising the capacity of climate-related initiatives to effectively mitigate environmental challenges and fulfill their intended objectives. Consequently, it underscores the urgent need for an in-depth appraisal of the underlying factors contributing to this substantial underfinancing, alongside concerted efforts to bridge the funding gap and fortify the resilience of climate-related projects in Somalia.

Enormous funding gap

The third salient finding unveils an astonishingly substantial funding deficit that has unfolded over a comprehensive 14-year timeframe. When examining the aggregate projections for the 458 projects in question, the forecasted funding reached an impressive sum of $6.541 billion, in stark contrast to the actual financial disbursements, which amounted to a mere $1.428 billion. Consequently, a glaring discrepancy emerges, as elucidated by the Support Vector Regression (SVR) model, revealing a colossal funding shortfall of $5.113 billion. This glaring disparity serves as a compelling testament to the acute inadequacy of financial support currently allocated to climate-related endeavors in Somalia, thus accentuating the imperative for a substantial augmentation in financial resources to bridge this formidable funding gap.

Alarming funding gap percentage

The fourth consequential finding underscores a deeply disconcerting reality within the flow of climate finance in Somalia, where the overall funding gap endured by Somalia over the 14-year timeframe stands at an alarming magnitude of approximately 358 percent. This strikingly high percentage serves as a stark indicator of the systemic inability of Somalia’s climate initiatives to secure the requisite, substantial, and enduring financial backing essential for the efficacious mitigation of climate-induced threats and the fortification of climate resilience within the nation. This sobering revelation not only highlights a formidable obstacle in the successful implementation and longevity of climate-related projects in Somalia but also accentuates the pressing need for a comprehensive reevaluation of funding mechanisms and the formulation of strategies aimed at rectifying this glaring deficiency in climate financing.

Discussion

The primary objective of this study is to explore the reliability, adequacy, and sustainability of climate finance for Somalia’s climate initiatives, using both multiple regression and support vector machine (SVM). The multiple regression analysis revealed that adaptation finance, a robust social contract, and the scale of financial interventions significantly enhance fund flows, whereas mitigation efforts and gender equality had less impact. The SVM analysis, on the other hand, exposed a significant underfinancing of climate projects, with a large majority facing a funding shortfall, emphasizing the discrepancy between needed and actual funds received. The analysis underscored adaptation finance as a pivotal driver of climate fund allocation, reflecting its critical role in climate-vulnerable regions like Somalia. The importance of a robust social contract suggests that effective governance structures are essential for the efficient use of funds. The scale of interventions highlighted the effectiveness of larger financial projects in securing funds, contrasting with the less significant role of mitigation finance and gender equality, which suggests these areas May require different strategies or more focused attention.

This study is set against Somalia’s backdrop of climate vulnerability and socio-economic instability, where governance structures are often weak, and climate impacts are severe. These factors are crucial in understanding the study’s findings, as they influence both the need for climate finance and the effectiveness of its deployment. The context underlines the importance of tailored financial strategies that address both immediate and systemic challenges. The findings have profound implications for climate finance policy and practices, particularly in regions similar to Somalia. Policymakers should consider enhancing mechanisms for adaptation finance and strengthening governance structures to ensure effective fund deployment. Additionally, the importance of large-scale interventions suggests that policies should encourage substantial projects that can achieve significant impacts, while also reconsidering strategies for areas like mitigation finance and gender equality where impacts were less discernible.

The results of this investigation are consistent with established literature that underscores the critical role of adaptation finance in regions susceptible to climate adversity. Prior research has repeatedly emphasized the necessity of allocating sufficient resources to adaptation initiatives to mitigate the impacts of climate change, particularly in vulnerable areas (see for instance, Narain et al., 2016; Duguma et al., 2014; Karki et al., 2021; Susskind and Kim, 2022; Ahenkan et al., 2021; Manuamorn et al., 2020). These studies advocate for increased funding as a fundamental requirement for developing resilience against environmental shocks. The current study enhances this body of knowledge by providing quantitative evidence that supports the substantial influence of adaptation finance on the flow of climate-related funds in Somalia, affirming the theory that targeted financial allocations are indeed pivotal for effective climate adaptation. Furthermore, this study extends the academic discourse by revealing the significant roles of governance and financial scale in the effectiveness of climate finance. While the correlation between governance quality and climate finance efficiency has been suggested by researchers such as Bracking and Leffel (2021), Chaum et al. (2011), Schalatek (2012), Teng and Wang (2021), and Doku et al. (2021), this study quantitatively demonstrates how robust governance mechanisms are instrumental in enhancing fund allocation and utilization in Somalia.

Additionally, the impact of the scale of financial interventions, highlighted through this research, supports resolutions posited by Prowse and Snilstveit (2010), Kato et al. (2014), Songwe et al. (2022), Kato et al. (2014), and Fenton et al. (2017), who argued that larger-scale financial interventions are more likely to secure necessary funding and achieve impactful outcomes. By integrating these elements into a cohesive analysis, this study offers a more comprehensive understanding of the dynamics influencing climate finance, thereby contributing significantly to the strategic planning and policy formulation essential for optimizing climate finance in similar contexts.

Theoretically, this research enriches the discourse on climate finance by demonstrating the multifaceted impacts of governance, scale, and specific financial streams on fund allocation. It suggests a complex interplay between these variables, challenging simpler economic models of climate finance and suggesting a more nuanced approach is necessary to understand and enhance the effectiveness of climate finance. This study introduces a novel approach by combining multiple regression and SVM methodologies to provide a comprehensive analysis of climate finance determinants and their real-world implications. This dual-methodology not only confirms the robustness of the findings but also unveils the nuances of fund allocation and utilization in a challenging environment like Somalia, offering a broader methodological framework for future research. The study makes a substantial contribution to the literature by providing detailed empirical evidence on how adaptation finance, governance, and the scale of financial interventions influence climate-related funding in a highly vulnerable context. It extends the understanding of climate finance by incorporating complex models and comparative analysis, offering new insights into how funds are allocated and the significant gaps between funding needs and actual disbursements in regions like Somalia.

The findings of this study, while deeply rooted in the specific context of Somalia, also carry potential implications for other regions facing similar climate vulnerabilities. The critical determinants of climate finance effectiveness—such as robust governance, the scale of financial interventions, and the emphasis on adaptation finance—are likely to resonate in other fragile states or regions where climate change poses a severe threat. However, it is important to recognize that the unique socio-political dynamics of Somalia, including its governance challenges and specific climate risks, May influence the applicability of these results elsewhere. Therefore, while the methodological framework combining multiple regression analysis and support vector machine (SVM) techniques offers a robust tool for assessing climate finance in vulnerable contexts, its generalizability should be approached with caution. Future research could explore the transferability of these findings to other regions, adapting the model to account for local variables, and thus broadening the relevance of this study’s conclusions to a wider array of climate-vulnerable areas. This would not only strengthen the study’s contribution to global climate finance discourse but also provide a more comprehensive understanding of how these dynamics play out across different contexts.

Conclusion

This study highlights the pivotal roles of adaptation finance, robust governance, and the scale of financial interventions in determining the effectiveness of climate finance in Somalia. The multiple regression analysis provided a strong statistical confirmation that these factors significantly enhance the flow of climate-related funds. Moreover, the support vector machine (SVM) analysis revealed a widespread underfinancing of climate projects, illustrating a significant discrepancy between projected financial needs and actual funding received. Theoretically, this research enriches the discourse on climate finance by illustrating how adaptation initiatives, governance quality, and intervention scale can profoundly influence fund allocation and effectiveness. This study not only supports but also expands existing theories by providing a nuanced understanding of the multifaceted impacts of these variables in a vulnerable region, thereby offering a more complex and detailed model of climate finance.

The findings suggest that policymakers should prioritize strengthening governance frameworks and scaling up financial interventions to enhance the effectiveness of climate finance. There is a clear indication that robust policies promoting transparency and accountability in fund management and allocation are crucial for maximizing the impact of financial resources in climate-vulnerable regions. Practically, this study underscores the importance of targeted adaptation finance and the need for large-scale projects that can make substantial impacts on climate resilience. The insights provided can help guide NGOs, government bodies, and international donors in structuring their financial strategies to ensure that funds are both efficiently allocated and adequately meet the extensive needs posed by climate challenges.

The overall significance of this study lies in its comprehensive analysis and robust methodology, which provide crucial insights into the dynamics of climate finance in a region highly susceptible to climate change. By uncovering the critical factors influencing the effectiveness of climate finance, this research contributes to a more strategic and informed approach to managing climate risks. While the findings are insightful, the study acknowledges limitations, including the potential for overfitting in the regression model given the high R-squared value and the limited generalizability of the SVM results to other regions without similar socio-economic and environmental contexts. Future research should focus on exploring the causal relationships between governance mechanisms and fund allocation in different contexts to validate and expand upon the findings. Additionally, investigating the role of gender equality and mitigation finance as factors in climate finance could provide deeper insights into how to structure comprehensive financial strategies that address all dimensions of climate challenges.

In conclusion, this study makes significant contributions to understanding the determinants of effective climate finance in Somalia, providing critical insights that can aid in the formulation of more effective strategies to tackle climate change. It lays a solid foundation for further research and offers actionable recommendations for improving climate finance strategies globally, particularly in regions that are most vulnerable to climate impacts.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

MN: Conceptualization, Data curation, Formal analysis, Investigation, Methodology, Software, Writing – original draft. MM: Funding acquisition, Project administration, Writing – review & editing, Investigation.

Funding

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. The study was made possible by the generous funding from SIMAD University’s center for research and development (CRD). Their support was instrumental in executing the study and enabling a thorough investigation, contributing to the valuable insights presented in this publication.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Adzawla, W., Sawaneh, M., and Yusuf, A. M. (2019). Greenhouse gasses emission and economic growth nexus of sub-Saharan Africa. Sci. Afr. 3:e00065. doi: 10.1016/j.sciaf.2019.e00065

Afful-Koomson, T. (2015). The green climate Fund in Africa: what should be different? Clim. Dev. 7, 367–379. doi: 10.1080/17565529.2014.951015

Ahenkan, A., Chutab, D. N., and Boon, E. K. (2021). Mainstreaming climate change adaptation into pro-poor development initiatives: evidence from local economic development programmes in Ghana. Clim. Dev. 13, 603–615. doi: 10.1080/17565529.2020.1844611

Ali Warsame, A., and Hassan Abdi, A. (2023). Towards sustainable crop production in Somalia: examining the role of environmental pollution and degradation. Cogent Food Agri. 9:2161776. doi: 10.1080/23311932.2022.2161776

Amighini, A., Giudici, P., and Ruet, J. (2022). Green finance: an empirical analysis of the green climate fund portfolio structure. J. Clean. Prod. 350:131383. doi: 10.1016/j.jclepro.2022.131383

Aminga, V. M., and Krampe, F. (2020). Climate-related security risks and the African union : Stockholm International Peace Research Institute.

Azhgaliyeva, D., and Liddle, B. (2020). Introduction to the special issue: scaling up green finance in Asia, vol. 10: Taylor & Francis, 83–91.

Baldwin, M. P., and Lenton, T. M. (2020). Solving the climate crisis: lessons from ozone depletion and COVID-19. Global Sustain. 3:e29. doi: 10.1017/sus.2020.25

Bhatnagar, S., and Sharma, D. (2022). Evolution of green finance and its enablers: a bibliometric analysis. Renew. Sust. Energ. Rev. 162:112405. doi: 10.1016/j.rser.2022.112405

Bhattacharya, A., Calland, R., Averchenkova, A., González, L., Martinez-Diaz, L., and Van Rooij, J. (2020). "delivering on the $100 billion climate finance commitment and transforming climate finance." independent group on climate financing (December 2020). Available at: https://www.un.org/sites/un2. Un. Org/files/100_billion_climate_finance_report. Pdf.

Bian, L., and Xia, L. Q. (2022). China’s international role in navigating the climate–trade nexus. London: Grantham Research Institute on Climate Change and the Environment, London School of Economics and Political Science.

Botta, A., Caverzasi, E., Russo, A., Gallegati, M., and Stiglitz, J. E. (2021). Inequality and finance in a rent economy. J. Econ. Behav. Organ. 183, 998–1029. doi: 10.1016/j.jebo.2019.02.013

Bracking, S., and Leffel, B. (2021). Climate finance governance: fit for purpose? Wiley Interdiscip. Rev. Clim. Chang. 12:e709. doi: 10.1002/wcc.709

Campiglio, E., Dafermos, Y., Monnin, P., Ryan-Collins, J., Schotten, G., and Tanaka, M. (2018). Climate change challenges for central banks and financial regulators. Nat. Clim. Chang. 8, 462–468. doi: 10.1038/s41558-018-0175-0

Cao, Y., Alcayna, T., Quevedo, A., and Jarvie, J. (2021). "Exploring the conflict blind spots in climate adaptation finance." Synthesis report. London: Overseas Development Institute Available at: www.odi.org/en/publications/exploring-the-conflict-blind-spots-in-climate-adaptationfinance/

Chaudhry, S., and Ouda, J. (2021). Perspectives on the rights of climate migrants in the horn of Africa: a case study of Somalia. J. Somali Stud. 8, 13–40. doi: 10.31920/2056-5682/2021/v8n1a1

Chaum, M., Faris, C., Wagner, G., Buchner, B., Falconer, A., and Trabacchi, C. (2011). Improving the effectiveness of climate finance: Key lessons. Washington, DC: Brookings.

Chelminski, K. (2022). Climate finance effectiveness: a comparative analysis of geothermal development in Indonesia and the Philippines. J. Environ. Dev. 31, 139–167. doi: 10.1177/10704965211070034

Dafermos, Y., Nikolaidi, M., and Galanis, G. (2018). Climate change, financial stability and monetary policy. Ecol. Econ. 152, 219–234. doi: 10.1016/j.ecolecon.2018.05.011

Doku, I., Ncwadi, R., and Phiri, A. (2021). Determinants of climate finance: analysis of recipient characteristics in sub-Sahara Africa. Cogent Econ. Finance 9:1964212. doi: 10.1080/23322039.2021.1964212

Duguma, L. A., Wambugu, S. W., Minang, P. A., and van Noordwijk, M. (2014). A systematic analysis of enabling conditions for synergy between climate change mitigation and adaptation measures in developing countries. Environ. Sci. Pol. 42, 138–148. doi: 10.1016/j.envsci.2014.06.003

Egli, F., and Stünzi, A. (2019). A dynamic climate finance allocation mechanism reflecting the Paris agreement. Environ. Res. Lett. 14:114024. doi: 10.1088/1748-9326/ab443b

Fenton, A., Gallagher, D., Wright, H., Huq, S., and Nyandiga, C. (2017). “Up-scaling finance for community-based adaptation” in Community-based adaptation (Routledge), 110–120.

Fujiwara, A., and Mahajan, R. (2023). “Innovative ways to mobilise private sector Capital in Climate Change Adaptation Investments in developing countries—mechanisms and forward-looking vision from practitioners’ standpoint” in Climate Change Strategies: Handling the Challenges of Adapting to a Changing Climate (Springer), 345–364.

Funder, M., and Dupuy, K. (2022). Climate finance coordination from the global to the local: norm localization and the politics of climate finance coordination in Zambia. J. Dev. Stud., 1–18. doi: 10.1080/00220388.2022.2055467

Gebel, A. C., Kachi, A., and Sidner, L. (2022). “Aligning finance flows with the Paris agreement: the role of multilateral development banks” in Handbook of international climate finance (Edward Elgar Publishing), 256–292.

Gu, A., Teng, F., and Wang, Y. (2011). Sector mitigation policies and methods in China: measurable, reportable, and verifiable mechanisms. Adv. Clim. Chang. Res. 2, 115–123. doi: 10.3724/SP.J.1248.2011.00115

Guild, J. (2020). The political and institutional constraints on green finance in Indonesia. J. Sustain. Financ. Invest. 10, 157–170. doi: 10.1080/20430795.2019.1706312

Gutierrez, M., and Gutierrez, G. (2019). Climate finance: perspectives on climate finance from the bottom up. Development 62, 136–146. doi: 10.1057/s41301-019-00204-5

Harvey, C. A., Saborio-Rodríguez, M., Martinez-Rodríguez, M. R., Viguera, B., Chain-Guadarrama, A., Vignola, R., et al. (2018). Climate change impacts and adaptation among smallholder farmers in Central America. Agric. Food Secur. 7, 1–20. doi: 10.1186/s40066-018-0209-x

Hof, A. F., den Elzen, M. G. J., and Mendoza Beltran, A. (2011). Predictability, equitability and adequacy of post-2012 international climate financing proposals. Environ. Sci. Pol. 14, 615–627. doi: 10.1016/j.envsci.2011.05.006

Huang, H., Chau, K. Y., Iqbal, W., and Fatima, A. (2022). Assessing the role of financing in sustainable business environment. Environ. Sci. Pollut. Res. 29, 7889–7906. doi: 10.1007/s11356-021-16118-0

Kamta, F. N., and Scheffran, J. (2022). A social network analysis of internally displaced communities in Northeast Nigeria: potential conflicts with host communities in the Lake Chad region. Geo J. 87, 4251–4268. doi: 10.1007/s10708-021-10500-8

Karki, G., Bhatta, B., Devkota, N. R., Acharya, R. P., and Kunwar, R. M. (2021). Climate change adaptation (CCA) interventions and indicators in Nepal: implications for sustainable adaptation. Sustain. For. 13:13195. doi: 10.3390/su132313195

Kato, T., Ellis, J., Pauw, P., and Caruso, R. (2014). "Scaling up and replicating effective climate finance interventions."

Khan, M. R., and Munira, S. (2021). Climate change adaptation as a global public good: implications for financing. Clim. Chang. 167:50. doi: 10.1007/s10584-021-03195-w

Khan, M., Robinson, S. A., Weikmans, R., Ciplet, D., and Roberts, J. T. (2020). Twenty-five years of adaptation finance through a climate justice lens. Clim. Chang. 161, 251–269. doi: 10.1007/s10584-019-02563-x

Kissinger, G., Gupta, A., Mulder, I., and Unterstell, N. (2019). Climate financing needs in the land sector under the Paris agreement: an assessment of developing country perspectives. Land Use Policy 83, 256–269. doi: 10.1016/j.landusepol.2019.02.007

Kogo, B. K., Kumar, L., and Koech, R. (2021). Climate change and variability in Kenya: a review of impacts on agriculture and food security. Environ. Dev. Sustain. 23, 23–43. doi: 10.1007/s10668-020-00589-1

Leal Filho, W., Stringer, L. C., Totin, E., Djalante, R., Pinho, P., Mach, K. J., et al. (2021). Whose voices, whose choices? Pursuing climate resilient trajectories for the poor. Environ. Sci. Pol. 121, 18–23. doi: 10.1016/j.envsci.2021.02.018

Lee, S., Paavola, J., and Dessai, S. (2022). Towards a deeper understanding of barriers to national climate change adaptation policy: a systematic review. Clim. Risk Manag. 100414. doi: 10.1007/s10668-023-03594-2

Manuamorn, O. P., Biesbroek, R., and Cebotari, V. (2020). What makes internationally-financed climate change adaptation projects focus on local communities? A configurational analysis of 30 adaptation fund projects. Glob. Environ. Chang. 61:102035. doi: 10.1016/j.gloenvcha.2020.102035

Melgani, F., and Bruzzone, L. (2004). Classification of hyperspectral remote sensing images with support vector machines. IEEE Trans. Geosci. Remote Sens. 42, 1778–1790. doi: 10.1109/TGRS.2004.831865

Mohamed, A. A., and Mohamud, F. A. S. (2023). The power of financial innovation in neutralizing carbon emissions: the case of mobile money in Somalia. Environ. Dev. Sustain., 1–24. doi: 10.1007/s43508-023-00062-5

Mohamed, A. A., and Nor, M. I. (2023). The macroeconomic impacts of the mobile money: empirical evidence from EVC plus in Somalia. J. Finan. Econ. Policy 15, 1–15. doi: 10.1108/JFEP-06-2022-0152

Molua, E. L. (2022). Private farmland autonomous adaptation to climate variability and change in Cameroon. Rural. Soc. 31, 115–135. doi: 10.1080/10371656.2022.2086223

Morriss, A., Bogart, W. T., Meiners, R. E., and Dorchak, A. (2011). The false promise of green energy : Cato Institute.

Narain, U., Margulis, S., and Essam, T. (2011). Estimating costs of adaptation to climate change. Clim. Pol. 11, 1001–1019. doi: 10.1080/14693062.2011.582387

Narain, U., Margulis, S., and Essam, T. (2016). “Estimating costs of adaptation to climate change” in International Climate Finance (Routledge), 90–113.

Nhemachena, C., Nhamo, L., Matchaya, G., Nhemachena, C. R., Muchara, B., Karuaihe, S. T., et al. (2020). Climate change impacts on water and agriculture sectors in southern Africa: threats and opportunities for sustainable development. Water 12:2673. doi: 10.3390/w12102673

Nor, M. I. (2024). "Beyond debt relief: navigating Somalia's path to sustainable economic resilience and growth in the post-HIPC era.

Nor, M. I., and Masron, T. A. (2019). Investigating the informal mode of financing utilized for construction financing in Somalia: some evidence. Afr. J. Sci. Technol. Innov. Dev. 11, 223–233. doi: 10.1080/20421338.2018.1551755

Nor, M. I., and Mohamed, A. A. (2024). Investigating the complex landscape of climate finance in least developed countries (LDCs). Dis. Environ. 2:76. doi: 10.1007/s44274-024-00102-9

Organization for Economic Co-operation and Development (2008). Accra agenda for action : OECD Publishing.

Papa, F., Crétaux, J. F., Grippa, M., Robert, E., Trigg, M., Tshimanga, R. M., et al. (2023). Water resources in Africa under global change: monitoring surface waters from space. Surv. Geophys. 44, 43–93. doi: 10.1007/s10712-022-09700-9

Pauw, W. P., Klein, R. J. T., Vellinga, P., and Biermann, F. (2016). Private finance for adaptation: do private realities meet public ambitions? Clim. Chang. 134, 489–503. doi: 10.1007/s10584-015-1539-3

Pauw, W., Moslener, U., Zamarioli, L. H., Amerasinghe, N., Atela, J., Affana, J. P. B., et al. (2022). Post-2025 climate finance target: how much more and how much better? Clim. Pol. 22, 1241–1251. doi: 10.1080/14693062.2022.2114985

Pickering, J., and Mitchell, P. (2017). What drives national support for multilateral climate finance? International and domestic influences on Australia’s shifting stance. Int. Environ. Agreem.: Politics Law Econ. 17, 107–125. doi: 10.1007/s10784-016-9346-5

Pickering, J., Betzold, C., and Skovgaard, J. (2017). Managing fragmentation and complexity in the emerging system of international climate finance, vol. 17: Springer, 1–16.

Prowse, M., and Snilstveit, B. (2010). Impact evaluation and interventions to address climate change: a scoping study. J. Dev. Eff. 2, 228–262. doi: 10.1080/19439341003786729

Qian, H., Qi, J., and Gao, X. (2023). What determines international climate finance? Payment capability, self-interests and political commitment. Glob. Public Policy Gov., 1–19. doi: 10.1007/s43508-023-00062-5

Regasa, D., Godesso, A., and Lietaert, I. (2023). LIVING ON THE MARGINS: THE socio-spatial representation of urban internally displaced persons in Ethiopia. Int. J. Urban Reg. Res. 47, 369–385. doi: 10.1111/1468-2427.13176

Roberts, J. T., and Weikmans, R. (2017). Postface: fragmentation, failing trust and enduring tensions over what counts as climate finance. Int. Environ. Agreem. 17, 129–137. doi: 10.1007/s10784-016-9347-4

Roberts, J. T., Weikmans, R., Robinson, S. A., Ciplet, D., Khan, M., and Falzon, D. (2021). Rebooting a failed promise of climate finance. Nat. Clim. Chang. 11, 180–182. doi: 10.1038/s41558-021-00990-2

Samuwai, J., and Hills, J. M. (2019). Gazing over the horizon: will an equitable green climate fund allocation policy be significant for the Pacific post-2020? Pac. Journal. Rev. 25, 158–172. doi: 10.24135/pjr.v25i1.393

Savvidou, G., Atteridge, A., Omari-Motsumi, K., and Trisos, C. H. (2021). Quantifying international public finance for climate change adaptation in Africa. Clim. Pol. 21, 1020–1036. doi: 10.1080/14693062.2021.1978053

Schalatek, L. (2012). Democratizing climate finance governance and the public funding of climate action. Democratization 19, 951–973. doi: 10.1080/13510347.2012.709690

Sengupta, S. (2023). Climate change, international justice and global order. Int. Aff. 99, 121–140. doi: 10.1093/ia/iiac264

Setyowati, A. B. (2020). Governing sustainable finance: insights from Indonesia. Clim. Pol., 1–14. doi: 10.1080/14693062.2020.1858741

Shawoo, Z., Dzebo, A., Funder, M., and Dupuy, K. (2022). Country ownership in climate finance coordination: a comparative assessment of Kenya and Zambia. Clim. Pol., 1–15.

Songwe, V., Stern, N., and Bhattacharya, A. (2022). Finance for climate action: Scaling up investment for climate and development. London: Grantham Research Institute on Climate Change and the Environment, London School of Economics and Political Science.

Suroso, D. S. A., Setiawan, B., Pradono, P., Iskandar, Z. S., and Hastari, M. A. (2022). Revisiting the role of international climate finance (ICF) towards achieving the nationally determined contribution (NDC) target: a case study of the Indonesian energy sector. Environ. Sci. Pol. 131, 188–195. doi: 10.1016/j.envsci.2022.01.022

Susskind, L., and Kim, A. (2022). Building local capacity to adapt to climate change. Clim. Pol. 22, 593–606. doi: 10.1080/14693062.2021.1874860

Teles, G., Rodrigues, J. J., Rabelo, R. A., and Kozlov, S. A. (2021). Comparative study of support vector machines and random forests machine learning algorithms on credit operation. Softw. Pract. Experience 51, 2492–2500. doi: 10.1002/spe.2842

Teng, F., and Wang, P. (2021). The evolution of climate governance in China: drivers, features, and effectiveness. Environ. Politics 30, 141–161. doi: 10.1080/09644016.2021.1985221

Warren, P. (2020). Blind spots in climate finance for innovation. Adv. Clim. Chang. Res. 11, 60–64. doi: 10.1016/j.accre.2020.05.001

Warsame, A. A., Sheik-Ali, I. A., Ali, A. O., and Sarkodie, S. A. (2021). Climate change and crop production nexus in Somalia: an empirical evidence from ARDL technique. Environ. Sci. Pollut. Res. 28, 19838–19850. doi: 10.1007/s11356-020-11739-3

Warsame, A. A., Sheik-Ali, I. A., Hussein, H. A., and Barre, G. M. (2023). Assessing the long-and short-run effects of climate change and institutional quality on economic growth in Somalia. Environ. Res. Commun. 5:055010. doi: 10.1088/2515-7620/accf03

White, H. (1980). A heteroskedasticity-consistent covariance matrix estimator and a direct test for heteroskedasticity. Econometrica: J. Econom. Soc. 817–838.

Zhang, F., and O'Donnell, L. J. (2020). “Support vector regression” in Machine learning (Elsevier), 123–140.

Keywords: climate finance, governance, adaptation funding, financial scale, climate resilience

Citation: Nor MI and Mussa MB (2024) Discovering the effectiveness of climate finance for Somalia’s climate initiatives: a dual-modeling approach with multiple regression and support vector machine. Front. Clim. 6:1449311. doi: 10.3389/fclim.2024.1449311

Edited by:

Pradyot Ranjan Jena, National Institute of Technology, IndiaReviewed by:

Sukanya Das, TERI School of Advanced Studies (TERI SAS), IndiaZainab Asif, Queensland University of Technology, Australia

Copyright © 2024 Nor and Mussa. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Mohamed Ibrahim Nor, bS5pYnJhaGltQHNpbWFkLmVkdS5zbw==

Mohamed Ibrahim Nor

Mohamed Ibrahim Nor Mohamed Barre Mussa2,3

Mohamed Barre Mussa2,3