95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Clim. , 18 January 2024

Sec. Climate Risk Management

Volume 5 - 2023 | https://doi.org/10.3389/fclim.2023.1295592

This article is part of the Research Topic Building Flood Resilience Under Climate Change View all 6 articles

Ehab Gnan1†‡

Ehab Gnan1†‡ Rubayet Bin Mostafiz2,3,4*‡

Rubayet Bin Mostafiz2,3,4*‡ Md Adilur Rahim3,4,5‡

Md Adilur Rahim3,4,5‡ Carol J. Friedland3,4

Carol J. Friedland3,4 Robert V. Rohli2,3

Robert V. Rohli2,3 Arash Taghinezhad1,4,6

Arash Taghinezhad1,4,6 Ayat Al Assi1,3,4

Ayat Al Assi1,3,4Flood risk to single-family rental housing remains poorly understood, leaving a large and increasing population underinformed to protect themselves, including regarding insurance. This research introduces a life-cycle benefit-cost analysis for the landlord, tenant, and insurer [i.e., (U.S.) National Flood Insurance Program (NFIP)] to optimize freeboard [i.e., additional first-floor height above the base flood elevation (BFE)] selection for a rental single-family home. Flood insurance premium; apportioned flood risk among the landlord, tenant, and NFIP by insurance coverage and deductible; rental loss; moving and displacement costs; freeboard construction cost; and rent increase upon freeboard implementation are considered in estimating net benefit (NB) by freeboard. For a 2,500 square-foot case study home in Metairie, Louisiana, a two-foot freeboard optimizes the combined savings for landlord and tenant, with joint life-cycle NB of $23,658 and $14,978, for a 3% and 7% real discount rate, respectively. Any freeboard up to 2.5 feet benefits the tenant and NFIP, while the landlord benefits for freeboards up to 4.0 feet. Collectively, results suggest that at the time of construction, even minimal freeboard provides substantial savings for the landlord, tenant, and NFIP. The research provides actionable information, supporting the decision-making process for landlords, tenants, and others, thereby enhancing investment and occupation decisions.

Flood is considered as one of the most destructive natural hazards, which causes injuries and fatalities, social disruptions, infrastructural damages, and economic losses across the world (Rosser et al., 2017; Termeh et al., 2018; Das and Gupta, 2021). These losses are projected to increase worldwide as a combined result of climatic change, rapid urbanization, and improper land use managements (Caruso, 2017; Hino and Hall, 2017; Mangini et al., 2018; Zadeh et al., 2020). Notably, these losses differ depending on whether individuals are homeowners, landlords, or renters. However, existing research on residential flood risk assessment has predominantly focused on the losses faced by homeowners neglecting the losses borne by landlords and renters (Gnan, 2021; Al Assi et al., 2023).

Yet, flood risk to single-family rental housing has been largely neglected by the scientific community. Federal Emergency Management Agency (FEMA) has acknowledged that the nation's flood policies neglect rental housing and focus only on owner-occupied housing (Hamideh et al., 2018). While the FEMA (2013) Hazus-MH tool and FEMA (2009) BCA Reference Guide provide useful benefit-cost analyses (BCA), they consider losses to landlords only instead of disaggregating losses among the affected parties – landlords, tenants, and the (U.S.) National Flood Insurance Program (NFIP; FEMA, 2019). The dearth of studies conducted on rental housing leaves a large segment of the population without adequate information to protect them, with landlords and tenants unaware of their flood risk (Hollar, 2017) even as they invest substantial sums (Warren-Myers et al., 2018). This necessitates development of a comprehensive flood risk assessment that quantifies flood losses for single-family rentals and provides actionable information (Mostafiz et al., 2022a) to landlords, tenants, and insurers.

The impact of flooding on single-family rental homes is important to understand because of the large and increasing share of rentals within the housing industry in the U.S (Charles, 2020), with 14.9 million renter-occupied, single-family homes as of 2017 (Rosen, 2018), and many millions of homes in multi-family buildings. Moreover, many of the inhabitants of rental homes are among the most vulnerable to economic and social impacts from flood (Pelling, 1997, 1999; Masozera et al., 2007; Mee et al., 2014; Deria et al., 2020; Larson et al., 2021). Thus, understanding the true risk of flooding, the possible mitigation measures, and the economic implications of flooding in renter-occupied single-family homes is likely to influence investment choices and occupation decisions (Warren-Myers et al., 2018).

In this research, life-cycle BCA (LCBCA) is conducted separately from the perspective of the landlord, tenant, and insurer (i.e., NFIP), over the home's 30-year mortgage period, for comprehensive evaluation of the most economically advantageous option at the time of construction regarding implementation of freeboard – elevation above the base flood elevation (BFE) – with multiple scenarios evaluated. The expected benefits and costs over the useful life of the home for each freeboard height are estimated and discounted to the present value (DPV). In these calculations, net benefit (NB) is the difference between the life-cycle benefits and costs for each freeboard scenario compared to “at BFE, no action” scenario. The optimal scenario is the freeboard with the largest joint life-cycle NB for landlord and tenant. The NB-to-cost ratio (NBCR) is defined as NB divided by the cost of the freeboard. The optimal freeboard scenario is the one that maximizes NBCR when NB is similar for multiple freeboard scenarios.

For the landlord, the NB and NBCR of implementing freeboard is evaluated through LCBCA considering freeboard cost, increase in rent, building flood insurance premiums, building average annual loss (AAL), and loss of rental income when the rental unit is withdrawn from the market. For the tenant, the benefit-cost of freeboard is evaluated through consideration of content AAL, content flood premiums, displacement cost, moving cost, and increase in rent. Additionally, the LCBCA is calculated separately for the flood insurance policyholder and the NFIP, as the policyholder is liable for the deductible and loss above coverage of flood loss while the NFIP covers the remainder of the loss within coverage.

Here, LCBCA is conducted on a micro-scale (i.e., single-building-level) basis, which allows for a greater level of detail than in bulk calculations (Bubeck et al., 2011; Lorente, 2019). A one-story, single-family residence in Metairie, Louisiana, is used to demonstrate the method presented. The study is motivated by the need to establish a methodology for estimating freeboard LCBCA for the landlord, the tenant, and NFIP. The methodology delivers actionable information and supports the decision-making process.

The methodology consists of estimating the freeboard life-cycle benefit-cost for the landlord, tenant, and insurer determined through LCBCA, performed for each 0.5-foot increment of freeboard above the BFE up to 4.0 feet, evaluated over a 30-year period – the expected useful life of a mitigation project (FEMA, 2009).

It is assumed here that as the flood risk will decrease with increasing freeboard, the landlord will increase the rent of the home, and the tenant will accept the rent increase. Table 1 summarizes the benefits and costs from the perspectives of the landlord, tenant, and NFIP. For landlords, the benefit of freeboard is the decrease in the building insurance premium, landlord portion of the building's AAL, and rental income loss, and increased in the rental income. The cost to the landlord is the freeboard construction cost (CUI). For tenants, the benefit of freeboard is the decrease in the content insurance premium, portion of content AAL, displacement cost, and moving cost. The tenant cost is the increase in rent. For the NFIP, the benefit of freeboard is the decrease in the NFIP portion of the building and content AAL. The cost to the NFIP is the decrease in building and content insurance premium.

The methodology consists of the following steps: (i) determining the expected benefits and costs at BFE vs. the benefits and costs of each freeboard scenario for the landlord, tenant, and NFIP, considered separately; with all benefits and costs estimated on an annualized basis; (ii) conducting LCBCA.

Benefits of freeboard are generally defined here as the future costs prevented or reduced and future income increased by implementing freeboard at the time of construction. These are determined by comparing the DPV of all costs and income over the useful life of the building with vs. without freeboard.

For buildings with federally-backed loans located in a special flood hazard area (SFHA), the landlord is required to have flood insurance on the building only, but not the contents (Federal Deposit Insurance Corporation, 2016). The annual building insurance premium (Pb) for each freeboard increment (I) is calculated using the NFIP (2021) Flood Insurance Manual's post-FIRM (i.e., flood insurance rate map) rates for a single-family residence. For single-family homes, $60,000 is the basic building coverage, with a limit of $250,000. A minimum deductible of $1,250 is required for coverage above $100,000 (NFIP, 2021).

The building AAL (AALb) is estimated using the method presented in Gnan (2021) and Gnan et al. (2022a). Flood depths derived from Monte Carlo simulations (e.g., Rahman et al., 2002; Brodie, 2013; Qi et al., 2013; Yu et al., 2013; Kind, 2014; Hennequin et al., 2018; Kind et al., 2020; Taghinezhad et al., 2020; Rahim et al., 2021, 2023) with the fitted Gumbel extreme value distribution (e.g., Singh et al., 2018; Bhat et al., 2019; Kim and Lee, 2021; Manfreda et al., 2021; Mostafiz et al., 2021, 2022b; Gnan et al., 2022b; Mostafiz, 2022; Rahim et al., 2022; Al Assi et al., 2023) are translated to building loss percentages using the U.S. Army Corps of Engineers (USACE, 2000) depth-damage function (DDF) designed for the home's attributes (e.g., one-story or two-or-more stories, with or without basement). The loss percentages are then multiplied by the structure replacement cost [i.e., building value (BV)], and the average of the resulting losses of all Monte Carlo-simulated flooding events is the AAL. It is important to note that the variability in AAL based on DDF choice is a primary concern in assessing flood losses (Wing et al., 2020). Thus, a sensitivity analysis was conducted on the same site used by Gnan et al. (2022a) to examine the variability in AAL based on DDF choice between USACE (2000), which is an empirical DDF based on flood loss observation from 1996 to 1998 across the U.S. and applicable nationwide; USACE (2006), which uses DDFs customized for New Orleans during post-Hurricane Katrina assessment; along with specialized approaches developed by Nofal et al. (2020) and Wing et al. (2020). AAL differences were observed based on DDF choice. The finding underscores the need for more research on DDFs and the effects of climate change.

While the USACE DDFs assign losses to the structure below the first-floor elevation (FFE) (i.e., at negative flood depths – below the building's first floor), it is assumed that when flood depths are below the FFE, the tenant will not relocate and there is no loss of rental income. However, losses are assumed to occur and are estimated for flood depths at −1 feet and greater.

The flood premium deductible for a building is represented within the flood loss, as the policyholder is liable for the specified deductible and loss above coverage while NFIP covers the remaining balance within coverage. Thus, the building AAL is apportioned as either landlord loss (AALbL) or NFIP loss (AALbNFIP) using the methodology presented in Gnan (2021) and Gnan et al. (2022a).

The magnitude of rental loss (Rl) is a function of restoration time (St), the latter of which is derived from the FEMA (2013) depth-time (in months) function (Supplementary Table 1). To estimate Rl, flood depths derived from Monte Carlo simulations are used to estimate St for each simulated event (Sti), which is divided by 12 months per year. Next, BV is divided by the price to rent ratio (RR, U.S. Census Bureau, 2019) to calculate the annual rent (AR) of the home. The AR is multiplied by the annual restoration time to derive the Rl for each simulation (Rli). The average of the resulting Rli of all simulated flooding events is the annual Rl, such that

where i is the Monte-Carlo-simulated event among N total events.

The increase in rental income to the landlord (RI) is attributed to implementation of freeboard, which reduces the impact of flood loss and makes the rental more attractive to renters. For a risk-neutral decision, the rental rate of a home with flood risk should be lower than the reduced risk alternative. This is calculated by subtracting the AR of the home for the BFE and freeboard scenario I (Equation 2). The BV for each freeboard scenario (BVI) equals the BV at BFE (BVBFE) plus the freeboard construction cost (CUI; Equation 3), which is described in Section 2.2.1.

The annual landlord benefit for each freeboard scenario (LBI) is estimated as the difference between the sum of the building insurance premium (Pb), building AAL for the landlord (AALbL), and loss of rental income (Rl), for the BFE scenario and freeboard scenario I; plus the RII (Equation 4).

For the tenant, the benefit of freeboard is evaluated through consideration of content flood insurance premiums, content AAL, and displacement and moving costs, for the BFE and freeboard scenarios. Although it is unlikely that the tenant will relocate when flood depths are below FFE, any greater depth is likely to cause the tenant to be displaced. Tenants bear displacement costs due to flood damage to the residence (Arcadis, 2019). However, the tenant likely will cease rent payment to the landlord and instead seek another rental (Arcadis, 2017). Displacement and moving costs are considered in addition to the content loss and content insurance premium.

In this study, tenants are assumed to have a separate content-only flood policy, because standard renters' insurance generally does not cover flood loss (FEMA, 2020) and tenants are responsible for any flood loss to their personal belongings (Federal Deposit Insurance Corporation, 2016). Annual content insurance premiums (Pc) are calculated using the NFIP (2021) Flood Insurance Manual's post-FIRM rates for a single-family residence. For single-family homes, $25,000 is the basic content coverage, with a limit of $100,000. A minimum deductible of $1,000 is required for coverage of $100,000 or less (NFIP, 2021). NFIP (2021) covers the actual cash value (ACV) of contents, which is the replacement cost minus the depreciation value at the time of loss. On average, ACV is half of the replacement cost over the contents' useful life, assuming here a linear depreciation and replacement of the contents after their useful life expires (Supplementary Table 3).

Average annual content loss (AALc) is estimated using the method presented in Gnan (2021) and Gnan et al. (2022a). To estimate AALc, depths derived from Monte Carlo simulations are translated to content loss percentages using the appropriate USACE (2000) DDF, with the estimate then partitioned between the tenant (AALcT) and NFIP (AALcNFIP) for each simulation (Gnan, 2021; Gnan et al., 2022a). The loss percentages are then multiplied by BV, and the average of all the simulated events is the AALc.

Tenants victimized by flood damage to their residence will be displaced temporarily and seek a shelter until finding another place to live. While some tenants may use public shelters or reside with families or friends, others will resort to lodging. This study considers only lodging in the loss assessment.

Berger (2017) assumed the displacement cost to be linearly proportional to the flooded residence's rental cost, where the displacement cost is estimated also as a one-time (1 month) cost on the basis of square-footage of the damaged residence. The displacement cost in this study is estimated as a one-time cost equivalent to 1 month – the minimum time required to find another place (Chaplin, 2019) – based on lodging rate, which is more reflective of variable lodging costs than the cost based on the residence's square footage (FEMA, 2016). This study uses the U.S. General Service Administration (2021) current lodging per day rates for each state with a current national average of $140 per day. This value for a given simulated event (Ddi) is converted to a monthly rate to estimate the one-time displacement cost for each simulated event. The average of the resulting displacement cost of all simulated flooding events is the expected annual displacement cost (Dc; Equation 5), such that

Moving cost is associated with relocating the contents from the flooded residence. It is estimated based on the square footage of the flooded residence. A moving cost of $1.20 per-square-foot (Arkin, 2021) is used in this study. The moving cost-per-square-foot (Mcqi) is multiplied by the building's total square footage (Bq) to estimate the moving cost for each simulated event. The average of the resulting moving costs of all simulated flooding events is the annual moving cost (Mc; Equation 6), or

The annual tenant benefit for each freeboard scenario (TBI; Equation 7) is the difference between the sum of the content annual insurance premium (Pc), the tenant's share of the content AAL (AALcT− 100 percent of the AALc if the tenant does not have insurance), annual expected displacement cost (DC), and annual expected moving cost (MC), for the BFE and freeboard scenarios.

NFIP benefit for each freeboard scenario (NFIPBI) is calculated as the difference in the NFIP portion of AAL for building (AALbNFIP) and content (AALcNFIP), for the BFE and freeboard scenarios (Gnan, 2021; Gnan et al., 2022a).

The landlord cost for freeboard is estimated as a percentage of BV and is based on FEMA (2008) guidance for new, single-family residences. While FEMA (2008) reports the cost for each freeboard increment (I) as a range of percentage estimates of total building cost, this work applies the upper limit as a conservative measure (Supplementary Table 2). Landlord annual freeboard cost (LCI) and total upfront freeboard cost (CUI) are calculated using the methodology presented in Gnan (2021) and Gnan et al. (2022a).

Tenant freeboard cost (TC) is calculated based on the difference between the tenant rent for freeboard scenario (TRI) and the BFE scenario (TRBFE; Equation 8). The landlord rental income and tenant rent will increase with the increasing freeboard.

NFIP freeboard cost (NFIPC) is calculated based on the difference between the insurance premiums [building (Pb) and content (Pc)] at BFE and in freeboard scenario I (Equation 9). The NFIP insurance premium will decrease with increasing freeboard.

To determine whether incorporating freeboard results in life-cycle benefit, all annualized benefits and costs are discounted to the present value (DPV) using a discount rate, thus enabling the comparison of mitigation costs with the expected future benefits (Tate et al., 2016) by transforming the expected future costs and benefits to present-value terms (Frank, 2000). The discount rate used can be nominal or real. A nominal discount rate is usually higher than the real discount rate as it incorporates an inflation component. In contrast, the real discount rate is adjusted (i.e., inflation removed from its figure), and the impact of the expected inflation is eliminated (U.S. Office of Management and Budget, 1992). In this work, the real discount rate is used for several reasons. Using the real discount rate removes inflation from the present value estimations and eliminates the need to calculate its rate (Fuller and Petersen, 1996; van den Boomen et al., 2017). Also, due to the high uncertainty associated with inflation, the U.S. Office of Management and Budget (1992) recommends avoiding the inflation assumption whenever possible in LCBCA. Thus, such estimates are less affected by uncertainty and subjective influences (Zimmerman et al., 2000). In addition, using a constant inflation rate while applying various nominal discount rates can result in inconsistency because the proportion of the inflation component within different nominal discount rates varies. These factors, together with the fact that both discount rates yield similar present value results when applied properly (Fuller and Petersen, 1996; Babusiaux and Pierru, 2005) support the decision to use real discount rates.

LCBCA is performed through consideration of NB and NBCR. The scenario with largest positive life-cycle NB is the optimal option. In contrast, NBCR expresses the life-cycle cost effectiveness of the mitigation scenario by showing the ratio between NB and cost.

The DPV of generalized benefits (BDPV; Equation 10) or costs (CDPV; Equation 11) is the discounted annualized benefits (Bt) or costs (Ct) using a discount rate (RD) over a time horizon in years (t), or

A sensitivity analysis is conducted to contrast results that assume a 7% real discount rate with those generated assuming a 3% real discount rate. This approach is consistent with the requirements of the U.S. Office of Management and Budget (1992) for BCA analyses.

The NB to the landlord (LNB), tenant (TNB), and NFIP (NFIPNB) of including freeboard is the difference between the benefit to the landlord (LB), tenant (TB), and NFIP (NFIPB) and cost to the landlord (LC), tenant (TC), and NFIP (NFIPC), for each freeboard scenario I (Equations 12–14).

The life-cycle cost effectiveness of the freeboard (i.e., benefit per dollar spent) is expressed by NBCR to the landlord (LNBCR), tenant (TNBCR), and NFIP (NFIPNBCR), which is the total NB of a freeboard scenario divided by its total cost (Equations 15–17).

A one-story, single-family residence with 2,500 ft2 of living area within the AE flood zone, located in Metairie, Louisiana, at coordinates 29°5'39”N, 90°1'05”W, is used to demonstrate the presented methodology. It is essential to note that AE Zones are the areas subject to inundation from the 1% annual chance flood (also known as the 100-year flood) and are defined with BFEs that reflect the combined influence of still water flood elevations and wave effects <3 feet (Dean et al., 2005). Furthermore, it is vital to acknowledge that the metropolitan New Orleans area is protected by various flood protection systems, such as levees, pumping stations, and flood gates (Wilkins et al., 2008), so our analysis incorporates the effect of the current flood protection infrastructure. The ground elevation of the site is −7.0 feet (NAVD88), with −4 feet BFE (NAVD88). Using the area's average construction cost of $92.47 per square foot (Moselle, 2019), the total estimated construction cost is $231,175.

The site's flood elevations are determined from FEMA's Risk Mapping, Assessment and Planning (Risk MAP) project (FEMA, 2022), and the corresponding flood depths above ground are shown in Table 2. The Flood Risk Database provides flood depth grid data to assist community officials in gaining a better understanding, investigating, and communicating the variations in flood depths within flood-prone areas (FEMA, 2023a). These grids depict the flood depth, measured in feet above the ground surface, and are often more comprehensible than the base 1-percent-annual-chance flood elevations. Flood depth grids are generated for different design flood events, including the 10%, 4%, 2%, 1%, and 0.2% annual-chance floods (FEMA, 2023b).

Results are presented in two steps: (i) annual benefits and costs for landlord, tenant, and NFIP are calculated, with all annual estimates discounted to the PV for the life cycle of the building; (ii) the LCBCA is conducted, where NBs and NBCRs are obtained for multiple freeboard scenarios and real discount rates, with NB and NBCR also apportioned between landlord, tenant, and NFIP. LCBCA of freeboard insurance savings is performed separately.

The difference in life-cycle benefits and costs with vs. without adding freeboard is the freeboard benefit. LCBCA is conducted for the landlord, tenant, and NFIP.

The landlord total annual benefit ranges from 0 (at BFE+0 ft. of freeboard) to $2,310 (at BFE+4.0 ft. of freeboard); benefit increases with increasing freeboard (Table 3). The landlord total annual benefits shown in Table 3 must be compared against the costs to identify the NB. The cost for each freeboard increment is estimated based on a total construction cost of $231,175 paid over a 30-year mortgage with fixed rate of 3.375%, and 7% payment-related fees. The corresponding annual flood insurance building premiums are calculated based on maximum BV of $231,175, with the minimum deductible of $1,250 and Community Rating System (NFIP, 2020) discount of 25% (rating of 5). The building AAL is apportioned as landlord and NFIP AAL.

As shown in Table 4, annual losses (i.e., landlord building AAL and rental loss) are reduced with each additional freeboard increment. The landlord annual building insurance premium decreases with one foot of freeboard (Table 4). Annual rent increases with freeboard increment (Table 4) as freeboard reduces flood risk and carries extra cost. Greater avoided losses occur with smaller freeboard because the largest proportion of losses occurs at lesser flood depths. Loss of rental income is based on the time required to restore the building and increases with the severity of the expected damage. However, it is limited to flood depths above the FFE.

In addition to the previously discussed benefits including increase in rental income, the landlord will experience other benefits from avoiding or reducing flood losses. Increased flood risk to the rental house can result in a loss of demand, increased vacancy, and decreased property value due to the expected risk cost liabilities associated with owning or occupying such a property (Warren-Myers et al., 2018).

For the tenant, the annual content premiums are calculated based on a maximum content value of $100,000, with the minimum deductible of $1,250 and CRS discount of 25%. The content AAL is apportioned between the tenant and the NFIP. Displacement cost is estimated as a one-time, 1 month cost, assuming a conservative one-room estimate with a two-member household. The tenant total benefit ranges from 0 (at BFE+0 ft. of freeboard) to $621 (at BFE+4.0 ft. of freeboard); benefit increases with increasing freeboard (Table 5). The tenant benefit is always lower than the landlord's benefit, except for the 0.5 ft. freeboard scenario (Tables 3, 5). On an average, the tenant benefit is 35% of the landlord benefit.

Tenants also experience indirect benefits from the added level of safety and loss reduction, avoiding temporary relocation. Avoiding a forced displacement on short notice relieves possible insecurity and stress, both emotionally and physically (Hollar, 2017). Moreover, stability in housing avoids possible displacement of individual and families from their communities in cases in which relocation within their immediate area is impossible (Hollar, 2017).

Tenant annual losses (i.e., content AAL, displacement and moving cost) are reduced with each additional freeboard increment (Table 6) and are relatively smaller than those for the landlord (Tables 4, 6). Content AAL is almost eliminated at the second foot of freeboard and displacement cost and moving cost are almost eliminated with the first foot of freeboard (Table 6). The content annual insurance premium decreases only with 1.0 and 2.0 ft. of freeboard and it remains constant after 2.0 ft. of freeboard (Table 6). Tenant's annual rent increases with increase of freeboard (Table 6) as it reduces the flood risk and carries additional cost.

NFIP's expected annual benefits (i.e., aggregated NFIP's building and content annual benefits from flood loss reduction) is increases with freeboard increment (Table 7). Although results show that incorporating freeboard yields substantial benefits to landlord, tenant, and NFIP, it is evident that the losses are primarily borne by the NFIP.

While landlord and tenant annual freeboard costs increase with each increment of freeboard, the NFIP annual freeboard cost increases only with each additional one-foot increment above BFE (Table 8). This is because there are no premium savings for half-foot increments (NFIP, 2021).

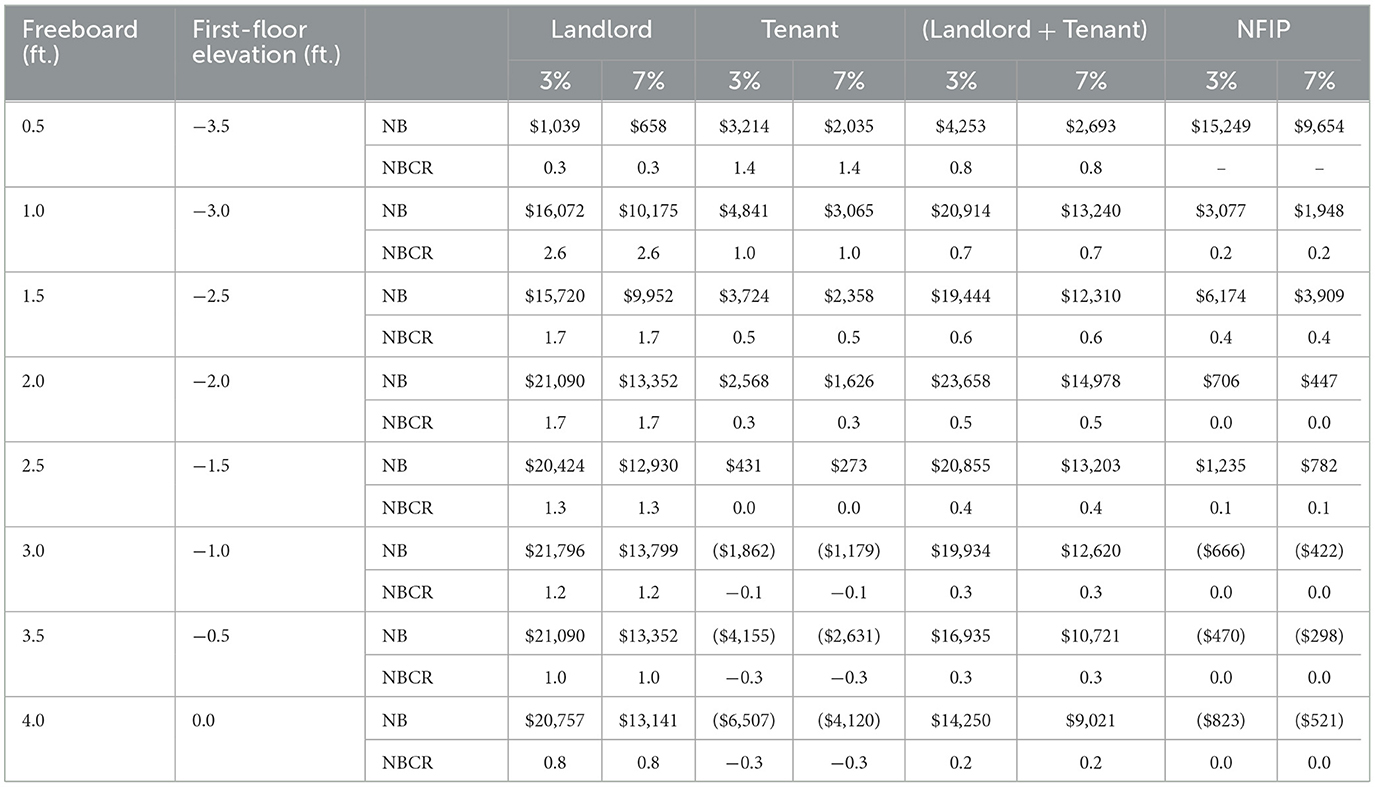

Once all annual benefit and cost estimates are discounted to the PV for the life of the building, the cumulative DPVs of benefits and cost are calculated for the “at BFE no action” scenario and for each freeboard scenario. The LCBCA calculations are carried out using a baseline 7% real discount rate, with 3% real discount rate also calculated, to test the sensitivity of results. LCBCA results are presented as NB and NBCR for each freeboard scenario using both real discount rates (Table 9).

Table 9. LCBCA results for each freeboard scenario by stakeholder and real discount rate, with optimal freeboard shown in boldface.

The landlord life-cycle NBs of freeboard range between $658 (0.5 ft. of freeboard) and $13,799 (3.0 ft. of freeboard), with total NBCRs ranging from 0.3 (0.5 ft. of freeboard) to 2.6 (1.0 ft. of freeboard), when assuming the baseline real discount rate of 7%, and between $1,039 (0.5 ft. of freeboard) and $21,796 (3.0 ft. of freeboard), when assuming a 3% real discount rate (Table 9). The NB for landlord, tenant, and NFIP are greatest at 3.0, 1.0, and 0.5 feet of freeboard, respectively (Table 9). Beyond 2.5 feet of freeboard, the tenant experiences negative NB as few or no further reductions are realized in content annual premium, content AAL, displacement, and moving costs. Therefore, annual rent increase outweighs the reductions in this case study, resulting in a negative NB. Likewise, there are no further reductions in NFIP's building and content losses beyond 2.5 feet of freeboard, and estimates depend only on NFIP cost, resulting in a negative NB.

All freeboard scenarios outperform the “at BFE no action scenario.” The landlord and tenant combined/joint life-cycle NBs of freeboard ranges between $2,693 (for 0.5 feet) and $14,978 (for 2.0 feet), with total NBCRs ranging from 0.2 (at 4.0 feet) to 0.8 (at 0.5 feet), when assuming the baseline real discount rate of 7%, and between $4,253 (for 0.5 feet) and $23,658 (for 2.0 feet), when assuming a 3% real discount rate. The peak NB for landlord and tenant combined/joint at 2.0 feet of freeboard indicates that the economically optimal freeboard is 2.0 feet. The NB is $14,978 when applying a 7% real discount rate, and $23,658 when assuming a real discount rate of 3%. However, at that increment, total life-cycle NBCR is 0.5 at either real discount rate, so this freeboard scenario is less preferred than the 0.5- and 1.0-foot scenarios when considering the NBCR metric (Table 9). The largest NBCR is observed in the smallest freeboard scenario and then shows an incremental decrease, indicating that benefit per dollar of cost declines as FFE increases, likely because the largest share of flood losses occurs for lower FFEs.

Even if the other benefits are neglected, the savings in annual flood insurance premiums alone are sufficient to offset the freeboard construction cost. Except for the first half-foot increment for which no premiums savings are realized, the life-cycle NB from flood premium savings ranges between $10,920 and $16,715, with NBCRs ranging from 1.1 to 2.8 when assuming a 7% real discount rate, and from $17,248 to $26,402 when using a 3% real discount rate (Table 10).

This research offers a comprehensive, customized flood risk assessment to landlords and tenants, by quantifying flood losses and actionable information, to enhance their awareness of their flood risk and the possible benefits from mitigation measures. Being aware of the full flood risk, mitigation options, and economic implications enhances investment and occupation decisions. To that end, an LCBCA methodology is demonstrated to determine the life-cycle benefits of adding freeboard for landlord, tenant, and NFIP in single-family rental housing. Major results for a case study home in Metairie, Louisiana, include:

• The landlord and tenant combined/joint life-cycle NB is $14,978 with NBCR of 0.5 for baseline real discount rate of 7% and $23,658 for a 3% real discount rate.

• Elevation to the optimal height of 2.0 feet reduces annual building premiums by 60% and annual content premiums by 40%.

• In addition to savings on insurance premiums, landlords and tenants would also enjoy benefits by reducing direct physical loss and the other costs due to loss of function.

• Elevating a home to the optimal height significantly reduces annual building and rental losses for the landlord, and annual content, displacement, and moving losses for the tenant.

Several assumptions have been made in this analysis. It is assumed that as soon as the building is restored, it will be rented immediately. Further, although this study is comprehensive in its assessment of the economic impacts of including freeboard in avoiding direct losses (building and contents) and indirect losses (rent, displacement cost, and move cost) for the different constituents, the environmental, social, and psychological impacts of enhanced home security, increased future asset values, and buffering against the potential negative effects of climate change are not considered here. Thus, the estimates likely underrepresent the true benefits of adding freeboard.

Also, these flood loss assessments rely on uncertain variables such as the unpredictable nature of flood and the generality of flood loss and restoration time functions. Furthermore, these types of analyses are strongly constrained by flood data quality and availability. LCBCA requires future projections of real discount rates that are also uncertain. In addition, the implicit assumption when using a real discount rate (the same thing with nominal discount rate) is that inflation increases at the same rate. Unexpected severe and rapid inflation may result in considerable decrease in NBs as the PV of calculated future costs could be less than the real costs.

Despite the limitations and the fact that our study's findings may not be applicable everywhere, the methodology proposed in this study provides a novel framework for quantifying life-cycle benefit of freeboard for single-family rentals through LCBCA. To the best knowledge of the authors, there are no studies available applying a life-cycle cost-benefit analysis for the landlord, tenant, and insurer. The results highlight the need to evaluate the life-cycle benefits of freeboard at a single-building level, to allow for a more localized and detailed assessment. Extending this method to multi-family rentals and upscaling to estimate community-level will further assist in enhancing resilience to the flood hazard.

The original contributions presented in the study are included in the article/Supplementary material, further inquiries can be directed to the corresponding author.

EG: Formal analysis, Investigation, Methodology, Visualization, Writing – original draft. RM: Conceptualization, Data curation, Formal analysis, Investigation, Methodology, Project administration, Validation, Writing – original draft, Writing – review & editing. MR: Data curation, Software, Writing – review & editing. CF: Conceptualization, Funding acquisition, Methodology, Project administration, Resources, Supervision, Writing – review & editing. RR: Supervision, Writing – review & editing. AT: Supervision, Writing – review & editing. AA: Writing – review & editing.

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. This research was funded by the Department of Defense/Department of the Army under contract no. W912HZ2220005, USDA National Institute of Food and Agriculture, Hatch project LAB 94873, accession number 7008346, U.S. Department of Homeland Security (award number: 2015-ST-061-ND0001-01), the Louisiana Sea Grant College Program (Omnibus cycle 2020–2022; award number: NA18OAR4170098; project number: R/CH-03; Omnibus cycle 2022–2024; award number: NA22OAR4710105; project number: R/CH-05), the Gulf Research Program of the National Academies of Sciences, Engineering, and Medicine under the grant agreement number: 200010880 “The New First Line of Defense: Building Community Resilience through Residential Risk Disclosure,” and the U.S. Department of Housing and Urban Development (HUD; 2019–2022; award no. H21679CA, subaward no. S01227-1). The publication of this article was supported by the LSU AgCenter LaHouse Research and Education Center and subsidized by the LSU Libraries Open Access Author Fund.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Any opinions, findings, conclusions, and recommendations expressed in this manuscript are those of the author and do not necessarily reflect the official policy or position of the funders.

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fclim.2023.1295592/full#supplementary-material

Al Assi, A., Mostafiz, R. B., Friedland, C. J., Rahim, M. A., and Rohli, R. V. (2023). Flood risk assessment for residences at the neighborhood scale by owner/occupant type and first-floor height. Front. Big Data 5, 997447. doi: 10.3389/fdata.2022.997447

Arcadis (2017). Resilient Bridgeport, Benefit Cost Analysis Methodology Report. Connecticut Department of Housing. Available online at: https://portal.ct.gov/-/media/DOH/Sandy_Relief_Docs/AP-BCA.pdf?la=en (accessed April 21, 2017).

Arcadis (2019). East Side Coastal Resiliency: Beneft Cost Analysis. New York City Department of Design and Construction. Available online at: https://www1.nyc.gov/assets/cdbgdr/documents/amendments/ESCR_BCA_082019.pdf (aaccessed August 2, 2018).

Arkin, G. (2021). Top Long Distance Moving Companies for 2021. Nexuus. Available online at: https://nexusautotransport.com/top-long-distance-moving-companies-for-2021/ (acccessed September 8, 2021).

Babusiaux, D., and Pierru, A. (2005). Corporate Investment Decisions and Economic Analysis: Exercises and Case Studies. Paris: Editions Technip.

Berger, L. (2017). Rebuild by Design Living Breakwaters Project: Benefit Cost Analysis. New York Governor's Office of Storm Recovery. Available online at: https://stormrecovery.ny.gov/sites/default/files/crp/community/documents/Appendix%20D%20-%20Breakwaters%20Project%20Benefit%20Cost%20Analysis.pdf (accessed December 22, 2023).

Bhat, M. S., Alam, A., Ahmad, B., Kotlia, B. S., Farooq, H., Taloor, A. K., et al. (2019). Flood frequency analysis of river Jhelum in Kashmir basin. Q. Int. 507, 288–294. doi: 10.1016/j.quaint.2018.09.039

Brodie, I. M. (2013). Rational monte carlo method for flood frequency analysis in urban catchments. J. Hydrol. 486, 306–314. doi: 10.1016/j.jhydrol.2013.01.039

Bubeck, P., De Moel, D., Bouwer, H. L. M., and Aerts, J. H. (2011). How reliable are projections of future flood damage? NHESS 11, 3293–3306. doi: 10.5194/nhess-11-3293-2011

Caruso, G. D. (2017). The legacy of natural disasters: the intergenerational impact of 100 years of disasters in Latin America. J. Dev. Econ. 127, 209–233. doi: 10.1016/j.jdeveco.2017.03.007

Chaplin, J. (2019). How Long Does it Take to Find an Apartment? Retrieved Apartment List. Available online at: https://www.apartmentlist.com/renter-life/how-long-to-find-an-apartment (accessed March 20, 2019).

Charles, S. L. (2020). The financialization of single-family rental housing: an examination of real estate investment trusts' ownership of single-family houses in the Atlanta metropolitan area. J. Urb. Affairs 42, 1321–1341. doi: 10.1080/07352166.2019.1662728

Das, S., and Gupta, A. (2021). Multi-criteria decision based geospatial mapping of flood susceptibility and temporal hydro-geomorphic changes in the Subarnarekha basin, India. Geosci. Front. 12, 101206. doi: 10.1016/j.gsf.2021.101206

Dean, R., Collins, I., Divoky, D., Hatheway, D., and Scheffner, N. (2005). Wave Setup: FEMA Coastal Flood Hazard Analysis and Mapping Guidelines. Focused Study Report. Washington, DC: Federal Emergency Management Agency.

Deria, A., Ghannad, P., and Lee, Y. C. (2020). Evaluating implications of flood vulnerability factors with respect to income levels for building long-term disaster resilience of low-income communities. Int. J. Disast. Risk Reduc. 48, 101608. doi: 10.1016/j.ijdrr.2020.101608

Federal Deposit Insurance Corporation (2016). Flood Insurance. Federal Deposit Insurance Corporation. Available online at: https://www.fdic.gov/regulations/resources/director/technical/flood/flood-4.pdf (accessed December 22, 2023).

FEMA (2008). Supplement to the 2006 Evaluation of the National Flood Insurance Program's Building Standards. Available online at: https://www.wbdg.org/ffc/dhs/criteria/fema-2008-supp-2006-eval-nfip-stand (accessed January 22, 2023).

FEMA (2009). BCA Reference Guide. Available online at: https://www.fema.gov/sites/default/files/2020-04/fema_bca_reference-guide.pdf (accessed November 7, 2009).

FEMA (2013). Multi-hazard Loss Estimation Methodology: Flood Model Hazus-MH Technical Manual. Department of Homeland Security, Federal Emergency Management Agency Mitigation Division. Available online at: https://www.fema.gov/sites/default/files/2020-09/fema_hazus_flood-model_technical-manual_2.1.pdf (accessed December 22, 2023).

FEMA (2016). Benefit-Cost Sustainment and Enhancements. Available online at: http://nhma.info/wp-content/uploads/2017/01/BCA_Toolkit_v5_ReleaseNotes.pdf (accessed December 22, 2023).

FEMA (2019). Basic Concepts in Benefit-Cost Analysis (BCA) Unit 3— Instructor Guide. Federal Emergency Management Agency. Available online at: https://www.fema.gov/sites/default/files/2020-04/fema_bca_instructor-guide_unit-3.pdf (accessed December 22, 2023).

FEMA (2020). Flood Insurance: One Small Action can Protect you From a Huge Problem. Federal Emergency Management Agency. Available online at: https://agents.floodsmart.gov/sites/default/files/preferred-risk-policy-homeowners-renters_fact-sheet_jul20.pdf (accessed February 22, 2023).

FEMA (2022). Risk Mapping, Assessment and Planning (Risk MAP). Available online at: https://www.fema.gov/flood-maps/tools-resources/risk-map (accessed December 22, 2023).

FEMA (2023a). Using the Flood Depth Grids to Identify Risk. Available online at: https://www.fema.gov/sites/default/files/documents/fema_depth-grids-technical.pdf (accessed December 22, 2023).

FEMA (2023b). Flood Depth Grids. Available online at: https://www.fema.gov/sites/default/files/documents/fema_flood-depth-grids.pdf (accessed December 22, 2023).

Frank, R. H. (2000). Why is cost-benefit analysis so controversial? The J. Leg. Stu. 29, 913–930. doi: 10.1086/468099

Fuller, S., and Petersen, S. (1996). Life-Cycle Costing Manual for the Federal Energy Management Program, NIST Handbook 135, 1995. Gaithersburg, MD: National Institute of Standards and Technology.

Gnan, E. (2021). Single-Family Residential Flood Loss Reduction Through Freeboard [PhD Dissertation Lousiana State University]. Batn Rouge, LA: Lousiana State University.

Gnan, E., Friedland, C. J., Mostafiz, R. B., Rahim, M. A., Gentimis, T., Taghinezhad, A., et al. (2022a). Economically optimizing elevation of new, single-family residences for flood mitigation via life-cycle benefit-cost analysis. Fron. Environ. Sci. 12, 889239. doi: 10.1002/essoar.10510798.3

Gnan, E., Friedland, C. J., Rahim, M. A., Mostafiz, R. B., Rohli, R. V., Orooji, F., et al. (2022b). Improved building-specific flood risk assessment and implications for depth-damage function selection. Front. Water 10, 919726. doi: 10.3389/frwa.2022.919726

Hamideh, S., Peacock, W. G., and van Zandt, S. (2018). Housing recovery after disasters: primary versus seasonal/vacation housing markets in coastal communities. Nat. Hazards Rev. 9, 287. doi: 10.1061/(ASCE)NH.1527-6996.0000287

Hennequin, T., Sørup, H. J. D., Dong, Y., and Arnbjerg-Nielsen, K. (2018). A framework for performing comparative LCA between repairing flooded houses and construction of dikes in non-stationary climate with changing risk of flooding. Sci. Total Environ. 642, 473–484. doi: 10.1016/j.scitotenv.2018.05.404

Hino, M., and Hall, J. W. (2017). Real options analysis of adaptation to changing flood risk: Structural and nonstructural measures. ASCE-ASME J. Risk Uncertain. Eng. Syst. Civil Eng. 3, 905. doi: 10.1061/AJRUA6.0000905

Hollar, M. K. (2017). Reducing the flood hazard exposure of HUD-assisted properties. Cityscape 19, 281–300.

Kim, S. U., and Lee, C. E. (2021). Incorporation of cost-benefit analysis considering epistemic uncertainty for calculating the optimal design flood. Water Resour. Manage. 35, 757−774. doi: 10.1007/s11269-021-02764-z

Kind, J., Botzen, W. W., and Aerts, J. C. (2020). Social vulnerability in cost-benefit analysis for flood risk management. Environ. Dev. Econ. 25, 115.−134. doi: 10.1017/S1355770X19000275

Kind, J. M. (2014). Economically efficient flood protection standards for the Netherlands. J. Flood Risk Manage. 7, 103.−117. doi: 10.1111/jfr3.12026

Larson, P. S., Gronlund, C., Thompson, L., Sampson, N., Washington, R., Steis Thorsby, J., et al. (2021). Recurrent home flooding in Detroit, MI 2012–2020: results of a household survey. Int. J. Environ. Res. Pub. Health 18, 7659. doi: 10.3390/ijerph18147659

Lorente, P. (2019). A spatial analytical approach for evaluating flood risk and property damages: Methodological improvements to modelling. J. Flood Risk Manage. 12, e12483. doi: 10.1111/jfr3.12483

Manfreda, S., Miglino, D., and Albertini, C. (2021). Impact of detention dams on the probability distribution of floods. Hydrol. Earth Syst. Sci. 25, 4231−4242. doi: 10.5194/hess-25-4231-2021

Mangini, W., Viglione, A., Hall, J., Hundecha, Y., Ceola, S., Montanari, A., et al. (2018). Detection of trends in magnitude and frequency of flood peaks across Europe. Hydrol. Sci. J. 63, 493–512. doi: 10.1080/02626667.2018.1444766

Masozera, M., Bailey, M., and Kerchner, C. (2007). Distribution of impacts of natural disasters across income groups: a case study of New Orleans. Ecol. Econ. 63, 299–306. doi: 10.1016/j.ecolecon.2006.06.013

Mee, K. J., Instone, L., Williams, M., Palmer, J., and Vaughan, N. (2014). Renting over troubled waters: an urban political ecology of rental housing. Geograph. Res. 52, 365–376. doi: 10.1111/1745-5871.12058

Mostafiz, R. B. (2022). Estimation of Economic Risk From Coastal Natural Hazards in Louisiana. Batn Rouge, LA: Lousiana State University

Mostafiz, R. B., Assi, A. A., Friedland, C., Rohli, R. V., and Rahim, M. A. (2022b). “A Numerically-integrated approach for residential flood loss estimation at the community level,” in EGU General Assembly 2022. Vienna, Austria.

Mostafiz, R. B., Friedland, C., Rahim, M. A., Rohli, R. V., and Bushra, N. (2021). A data-driven, probabilistic, multiple return period method of flood depth estimation. Am. Geophys. Union Fall Meeting 2021, H35I−1131. doi: 10.1002/essoar.10509337.1

Mostafiz, R. B., Rohli, R. V., Friedland, C. J., and Lee, Y. C. (2022a). Actionable Information in Flood risk communications and the potential for new web-based tools for long-term planning for individuals and community. Front. Earth Sci. 10, 840250. doi: 10.3389/feart.2022.840250

NFIP (2020). NFIP Flood Insurance Manual. Appendix F: Community Rating System. Washington, DC. Available online at: https://www.fema.gov/sites/default/files/2020-05/fim_appendix-f-community-rating-system_apr2020.pdf (accessed December 22, 2023).

NFIP (2021). NFIP Flood Insurance Manual. Appendix J: Rate Tables. Washington, DC. Available online at: https://www.fema.gov/sites/default/files/documents/fema_nfip-all-flood-insurance-manual-apr-2021.pdf (accessed December 22, 2023).

Nofal, O. M., van de Lindt, J. W., and Do, T. Q. (2020). Multi-variate and singlevariable flood fragility and loss approaches for buildings. Reliab. Eng. Syst. Saf. 202, 106971. doi: 10.1016/j.ress.2020.106971

Pelling, M. (1997). What determines vulnerability to floods; a case study in Georgetown, Guyana. Environ. Urb. 9, 203–226. doi: 10.1177/095624789700900116

Pelling, M. (1999). The political ecology of flood hazard in urban Guyana. Geoforum 30, 249–261. doi: 10.1016/S0016-7185(99)00015-9

Qi, H., Qi, P., and Altinakar, M. S. (2013). GIS-based spatial Monte Carlo analysis for integrated flood management with two dimensional flood simulation. Water Resour. Manage. 27, 3631–3645. doi: 10.1007/s11269-013-0370-8

Rahim, M. A., Friedland, C. J., Mostafiz, R. B., Rohli, R. V., and Bushra, N. (2023). Analytical advances in homeowner flood risk quantification considering insurance, building replacement value, and freeboard. Front. Environ. Sci. 11, 1180942. doi: 10.3389/fenvs.2023.1180942

Rahim, M. A., Friedland, C. J., Rohli, R. V., Bushra, N., and Mostafiz, R. B. (2021). “A data-intensive approach to allocating owner vs. NFIP portion of average annual flood losses,” in AGU 2021 Fall Meeting. New Orleans, LA.

Rahim, M. A., Gnan, E. S., Friedland, C. J., Mostafiz, R. B., and Rohli, R. V. (2022). “An improved micro scale average annual flood loss implementation approach,” in EGU General Assembly 2022. Vienna, Austria.

Rahman, A., Weinmann, P. E., Hoang, T. M. T., and Laurenson, E. M. (2002). Monte Carlo simulation of flood frequency curves from rainfall. J. Hydrol. 256, 196–210. doi: 10.1016/S0022-1694(01)00533-9

Rosen, K. T. (2018). The Case for Preserving Costa-Hawkins: The Potential Impacts of Rent Control on Single Family Homes. Available online at: https://escholarship.org/content/qt8wt9p088/qt8wt9p088.pdf (accessed December 22, 2023).

Rosser, J. F., Leibovici, D. G., and Jackson, M. J. (2017). Rapid flood inundation mapping using social media, remote sensing and topographic data. Nat. Haz. 87, 103–120. doi: 10.1007/s11069-017-2755-0

Singh, P., Sinha, V. S. P., Vijhani, A., and Pahuja, N. (2018). Vulnerability assessment of urban road network from urban flood. Int. J. Disaster Risk Reduc. 28, 237–250. doi: 10.1016/j.ijdrr.2018.03.017

Taghinezhad, A., Friedland, C. J., and Rohli, R. V. (2020). Benefit-cost analysis of flood-mitigated residential buildings in Louisiana. Housing Soc. 48, 185–202. doi: 10.1080/08882746.2020.1796120

Tate, E., Strong, A., Kraus, T., and Xiong, H. (2016). Flood recovery and property acquisition in Cedar Rapids, Iowa. Nat. Hazards 80, 2055–2079. doi: 10.1007/s11069-015-2060-8

Termeh, S. V. R., Kornejady, A., Pourghasemi, H. R., and Keesstra, S. (2018). Flood susceptibility mapping using novel ensembles of adaptive neuro fuzzy inference system and metaheuristic algorithms. Sci. Total Environ. 615, 438–451. doi: 10.1016/j.scitotenv.2017.09.262

U.S. Census Bureau (2019). Census Bureau's 2019 1-year American Community Survey. Available online at: https://data.census.gov/cedsci/table?q=United%20States%20rent%20cost%20ratioandg=1600000US2250115andy=2019andd=ACS%201-Year%20Supplemental%20Estimatesandtid=ACSSE2019.K202511 (accessed December 22, 2023).

U.S. General Service Administration (2021). Per Diem Rates. Available online at: https://www.gsa.gov/travel/plan-book/per-diem-rates (accessed December 22, 2023).

U.S. Office of Management and Budget (1992). Guidelines and Discount Rates for Benefit-Cost Analysis of Federal Programs. Circular No. A-94. Available online at: https://www.whitehouse.gov/wp-content/uploads/legacy_drupal_files/omb/circulars/A94/a094.pdf (accessed December 22, 2023).

USACE (2000). Economic Guidance Memorandum (EGM) 01-03, Generic Depth Damage Relationships. Washington, DC: US Army Corps of Engineers.

USACE (2006). Depth-Damage Relationships for Structures, Contents, and Vehicles and Content-to-Structure Value Ratios (CSVR) in Support of the Donaldsonville to the Gulf. Louisiana, Feasibility Study. Washington, DC: US Army Corps of Engineers.

van den Boomen, M., Schoenmaker, R., Verlaan, J. G., and Wolfert, A. R. M. (2017). “Common misunderstandings in life cycle costing analyses and how to avoid them,” in Life-Cycle of Engineering Systems: Emphasis on Sustainable Civil Infrastructure: Proceedings of the 5th International Symposium on Life-Cycle Engineering, Delft, Netherlands, eds J. Bakker, D. M. Frangopol, and K. van Breugel (New York, NY: Taylor and Francis), 1729–1735.

Warren-Myers, G., Aschwanden, G., Fuerst, F., and Krause, A. (2018). Estimating the potential risks of sea level rise for public and private property ownership, occupation and management. Risks 6, 37. doi: 10.3390/risks6020037

Wilkins, J. G., Emmer, R. E., Hwang, D., Kemp, G. P., Kennedy, B., Mashriqui, H., et al. (2008). Louisiana Coastal Hazard Mitigation Guidebook. Baton Rouge, LA: Louisiana Sea Grant College Program.

Wing, O. E., Pinter, N., Bates, P. D., and Kousky, C. (2020). New insights into US flood vulnerability revealed from flood insurance big data. Nat. Commun. 11, 1–10. doi: 10.1038/s41467-020-15264-2

Yu, J. J., Qin, X. S., and Larsen, O. (2013). Joint Monte Carlo and possibilistic simulation for flood damage assessment. Stochastic Environ. Res. Risk Assess. 27, 725–735. doi: 10.1007/s00477-012-0635-4

Zadeh, S. M., Burn, D. H., and O'Brien, N. (2020). Detection of trends in flood magnitude and frequency in Canada. J. Hydrol. Reg. Stu. 28, 100673. doi: 10.1016/j.ejrh.2020.100673

Keywords: life-cycle benefit-cost analysis (LCBCA), net benefit-cost ratio (NBCR), National Flood Insurance Program (NFIP), base flood elevation (BFE), annual exceedance probability (AEP), Gumbel extreme value distribution, average annual loss (AAL), discounted present value (DPV)

Citation: Gnan E, Mostafiz RB, Rahim MA, Friedland CJ, Rohli RV, Taghinezhad A and Al Assi A (2024) Freeboard life-cycle benefit-cost analysis of a rental single-family residence for landlord, tenant, and insurer. Front. Clim. 5:1295592. doi: 10.3389/fclim.2023.1295592

Received: 18 September 2023; Accepted: 12 December 2023;

Published: 18 January 2024.

Edited by:

Xander Wang, University of Prince Edward Island, CanadaReviewed by:

Richard S. John, University of Southern California, United StatesCopyright © 2024 Gnan, Mostafiz, Rahim, Friedland, Rohli, Taghinezhad and Al Assi. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Rubayet Bin Mostafiz, cmJpbm1vMUBsc3UuZWR1

†Present address: Ehab Gnan, Department of Architecture and Urban Planning, College of Engineering, Nalut University, Nalut, Libya

‡These authors have contributed equally to this work

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.