- 1Division of Public Health Sciences, Fred Hutchinson Cancer Center, Seattle, WA, United States

- 2Kaiser Permanente Washington Health Research Institute, Seattle, WA, United States

- 3School of Medicine, University of Washington, Seattle, WA, United States

Background: Financial hardship is common after a cancer diagnosis. Current financial hardship measures have advanced the field, but assessing the dimensions of financial hardship remains challenging. We created item banks to assess four financial hardship dimensions using item response theory (IRT). IRT-based item banks can be tailored to each context and used in computerized adaptive testing (CAT) to reduce participant burden.

Methods: Cancer survivors (n = 459) were recruited from a survivorship program and online survey panel to complete an online or paper survey. Four item banks were developed based on previous studies, expert feedback, and patient interviews: financial coping: 41 items, financial consequences: 21 items, financial depression: 15 items, and financial worry: 21 items. We used the two-parameter logistic and graded response models for analysis.

Results: The IRT model fit well for all four item banks: financial coping root mean square error of approximation (RMSEA) = 0.06, financial consequences RMSEA = 0.03; financial depression RMSEA = 0.05; and financial worry RMSEA = 0.03. The accuracy parameters ranged from 1.01 to 6.53, indicating good reliability for each item. The severity parameters showed each item bank assessed financial hardship across two to three standard deviations, supporting content validity. Short forms were developed for financial consequences, depression, and worry.

Conclusion: The item banks can be used to create brief screening measures and, using CAT, efficiently screen for each dimension of financial hardship while minimizing burden. Future research is required to assess the clinical utility of using the item banks to screen for financial hardship.

Introduction

Financial hardship encompasses the negative financial effects due to cancer, cancer treatment, and the long-term effects. Estimating the prevalence of financial hardship is challenging but ranges from 30% to 80% (1). As outlined in our conceptual model (Figure 1), financial hardship is multidimensional and includes financial coping, financial consequences, symptoms of depression due to finances, and worry about affording health care and living costs (2, 3). Financial coping, often referred to as behavioral financial hardship, comprises the actions patients and their families take to afford cancer care and living costs while coping with decreases in income. Financial coping can also include asset mobilization, lifestyle-altering actions (i.e., canceling gym memberships), and health care alterations (cost-related non-adherence (4). Financial consequences are impacts or events that happen to a patient when unable to financially cope and, compared to other dimensions, are conceptualized as a more severe manifestation of financial hardship. Financial worry is future-focused and includes anxiety and thinking about how to pay for health care and living costs, as well as maintain income. Financial depression encompasses depression symptoms due to negative finances, such as a depressed mood, feeling guilty, and persistent negative thinking about finances. Financial coping focuses on tangible actions or behaviors, while financial anxiety and financial depression focus on thoughts and emotions, with anxiety being more future-focused (including problem-solving) and depression more past-focused, such as rumination. It is important to note the role of time in diagnosing these dimensions of financial hardship, with financial worry leading to financial coping but financial coping depleting resources, which leads to financial consequences and depression. All dimensions of financial hardship have been associated with a worse quality of life (5–8), and some have been associated with earlier mortality (9–11) in people with cancer.

One current barrier to addressing financial hardship in cancer is the lack of suitable, comprehensive measures. Several measures of general financial hardship exist but do not capture the unique experience of cancer-related financial hardship (12–14). Cancer-specific measures have been developed (15–17), but these do not capture each dimension of financial hardship and are not comprehensive measures of the negative effects of cancer on finances, meaning that, for clinical screening, these measures could have low sensitivity and specificity for detecting patients needing additional assistance. Measures developed for the general population would miss most of the financial hardship experienced by people with cancer. The current cancer-related financial hardship measures often assess financial consequences rather than coping or anxiety, preventing the identification and treatment of financial hardship early. As an example from our conceptual model, most measures focus on financial consequences, and as this is hypothesized to be a more severe form of financial hardship, these measures could miss patients with more moderate financial hardship who still need assistance. The lack of focus on the different dimensions of financial hardship also creates a challenge for research as studies may find no association with risk or causal factors due to measurement issues or because there is no association. More comprehensive measures of cancer-specific financial hardship are needed to move both clinical practice and research forward and address this public health concern.

To address these challenges, we developed item banks to comprehensively assess the four dimensions of financial hardship (3). In this study, we further evaluate the item banks using item response theory (IRT) (18). IRT is different from traditional methods of measure development in that it evaluates the validity and reliability of each item instead of a total score. Measures developed using IRT can also be used in computerized adaptive testing, where a computer uses the IRT model to tailor items based on a person's previous responses (19, 20). This reduces participant burden, as patients only answer the items most relevant to them. Using IRT, we tested the four item banks using a sample of cancer survivors to evaluate the psychometric properties. We also aimed to create short forms for each item bank and sum-score conversion tables to make the item banks usable for those unable to use IRT scoring and computerized adaptive testing. While the primary purpose of this study was to create comprehensive measures of cancer-related financial hardship, the short forms, pending further evaluation, may be useful as clinical screening measures.

Materials and methods

Participants and procedures

This study used a cross-sectional survey design. The study was determined to be exempt by the institutional review board. Participants were cancer survivors using the National Cancer Institute's (NCI) definition of survivor as being from diagnosis onward (21). Eligibility criteria were diagnosed with any form of cancer, including hematologic malignancies; able to read and speak English; located in the United States; age 18 or older at the time of the survey; and able to provide informed consent. Participants were recruited in two ways. First, patients of the Survivorship Program at an NCI Comprehensive Cancer Center who consented to be contacted about future research studies were invited to participate. Patients received mailed study invitation letters with a pre-incentive, a small notepad the potential participant could keep whether or not they participated, and email invitations to participate. Patients who did not respond to the initial invitations received a second mailed invitation letter and a paper survey with a business-reply envelope for returning the survey. The second recruitment method used was the Prolific online survey panel (22). Participation through the Prolific survey panel was limited to those located in the United States and reporting a cancer diagnosis. Prolific survey panel members received an email or checked the Prolific website to see the study and then completed the study online. Participants who completed the survey online had to first read an informed consent statement that included contact information for the study team if they had questions. Participants then clicked through to the survey, indicating that they consented to the study. Participants who completed a paper survey received a paper consent form with contact information for the study team that they had to read, sign, and return with the survey in a business-reply envelope. For those who completed paper surveys, the same trained study staff member verified that the consent form was complete and then entered the survey data into the database to protect participants' anonymity. The paper surveys were then stored in a locked office to which only study staff had access. Participants received either a US $10 gift card or US $10 through Prolific for completing the survey.

Measures

The survey included the four financial hardship item banks and questions on disease characteristics and demographics. As outlined in our previous study (3) and based on expert feedback and interviews with survivors of breast cancer, an item bank was developed for each of the four dimensions of financial hardship (coping, consequences/impacts, depression, and anxiety/worry). The financial coping item bank had 41 items, referenced whether each coping behavior occurred in the past year due to cancer, and used a yes/no response format. The financial consequences item bank had 21 items, referenced whether each event occurred in the past year due to cancer, and used a yes/no response format. The financial depression item bank had 15 items, referenced whether the symptoms occurred due to cancer in the past 2 weeks, and used 4-point frequency response options. The financial worry item bank referenced current health care costs and employment worries and used a 4-point Likert-type response scale.

Statistical analyses

We used IRT and classical test theory approaches to evaluate the financial hardship item banks. IRT evaluates the reliability and validity of each item, whereas classical test theory evaluates the total and subscale scores on the measure. For the financial coping and financial consequences item banks, we used the two-parameter logistic (2PL) model (23) for the IRT family of models suitable for items with dichotomous response options. For the financial depression and financial worry item banks, we used the graded response model (GRM) (24) from the IRT group of models, which is appropriate for survey items with three or more response options. Both the 2PL and GRM estimate two sets of parameters per item using the logistic model: the severity parameter and the slope parameter. The severity parameter reflects the construct's level, indicated by a “yes” response to an item or a specific response option being chosen. One severity parameter is estimated per item using the 2PL, and the GRM estimates a severity parameter for each shift to a higher response category. For example, the financial worry and financial depression items had four response options and would thus have three severity parameters estimated per item. The slope parameter reflects how accurately the item measures the underlying construct, in this case financial hardship. We used the Bock Aitkin estimation and maximization method to estimate the severity and accuracy parameters (25) and used the expected a posteriori (EAP) method to calculate the IRT scores once the parameters were estimated (26). The EAP method uses the response pattern to the items combined with the item parameters to create a point estimate and standard error of each participant's score. Model fit was evaluated using the root mean square error of approximation (RMSEA), with values under 0.08 indicating a good fit (27, 28).

After conducting the IRT analyses, the parameters were examined to ensure that each item adequately measured each corresponding dimension of financial hardship (29), similar to how factor loadings are examined in factor analysis to ensure each item adequately measures each concept. Slope parameters >1 were considered to measure the construct accurately based on prior studies (29). Severity parameters were examined to inform which levels of financial hardship were measured. For the GRM, we also evaluated the trace lines that depict the severity and slope parameters to see if some response options were not the most likely response at a level of financial hardship and therefore might not be contributing new information. We also examined the IRT standard error curves that estimate which levels of financial hardship are measured with the lowest error (highest reliability). To evaluate construct validity, we calculated Pearson r correlations between the four financial hardship item banks and combined classical test theory approaches with the IRT-based scores. Because computerized adaptive testing or the full item bank with IRT scoring is not available to every researcher or clinic, we also constructed short forms and sum-score conversion tables for both the full item banks and each short form. Items for the short forms were chosen based on the severity parameters to ensure the full range of financial hardship severity was measured (content validity). The investigative team then reviewed the selected items to ensure they would apply to most cancer survivors and added items from the bank if the construct's important parts were not included in the short form. The items included in the short forms were decided by discussion and consensus. Sum-score conversion tables provide information to translate a traditional sum score into the IRT metric.

Results

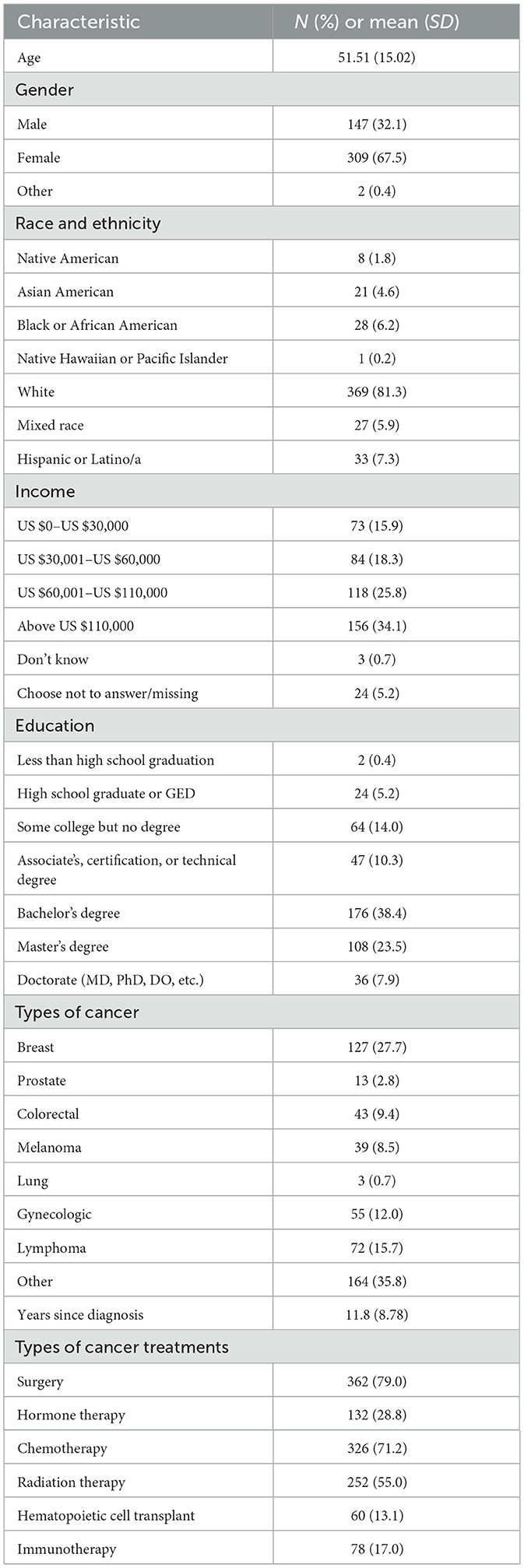

Demographics and disease characteristics for the sample are reported in Table 1. The most common cancer type was breast (28%), and on average, the participants were 11.8 years after diagnosis. Most (79%) had had surgery for their cancer. Two-thirds of the sample (68%) were female, and the average age was 51.51 years. A third of the sample (34%) reported a household yearly income over US $110,000, and more than two-thirds (69%) reported having a bachelor's degree or higher.

Participants recruited through the survivorship program and the online survey panel differed on several demographic and clinical characteristics. Survivorship program participants were significantly older (Cohen's d = 0.194, p = 0.048) and further from diagnosis (Cohen's d = 0.264, p = 0.006). The online survey panel had significantly more people of color (X2 = 46.64, p < 0.001), people with lower income (X2 = 55.89, p < 0.001), and lower levels of education (X2 = 35.91, p < 0.001). The online survey panel participants were more likely to have undergone surgery (X2 = 11.20, p = 0.004). The survivorship program participants were more likely to have undergone chemotherapy (X2 = 79.67, p < 0.001), radiation (X2 = 13.95, p < 0.001), and hematopoietic cell transplant (X2 = 34.15, p < 0.001). The two recruitment sources did not differ on receipt of hormone therapy (X2 = 0.965, p = 0.617), receipt of immunotherapy (X2 = 0.600, p = 0.741), and gender (X2 = 0.266, p = 0.606).

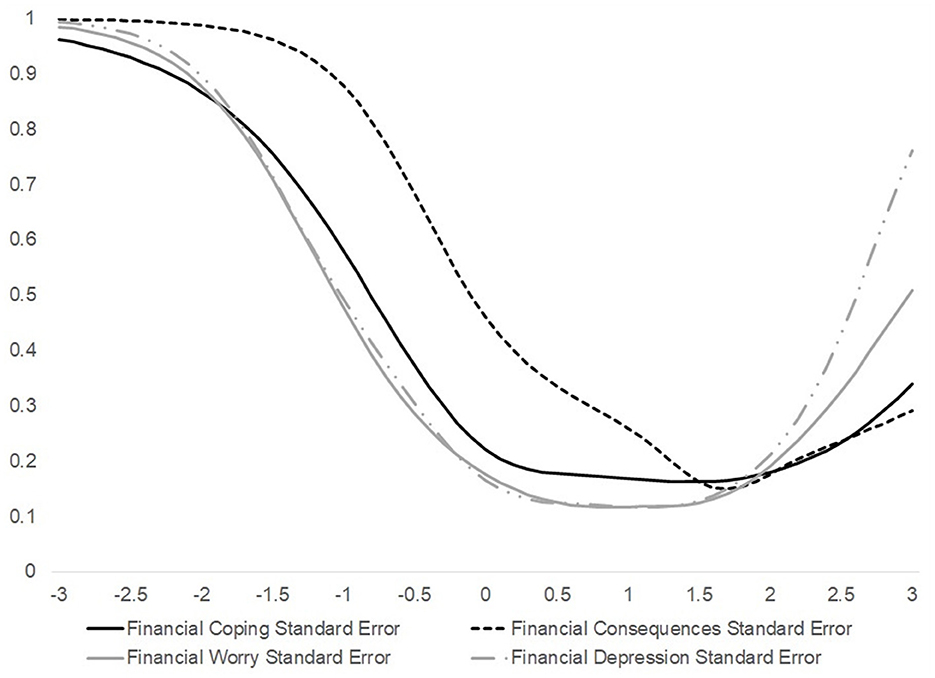

Financial worry

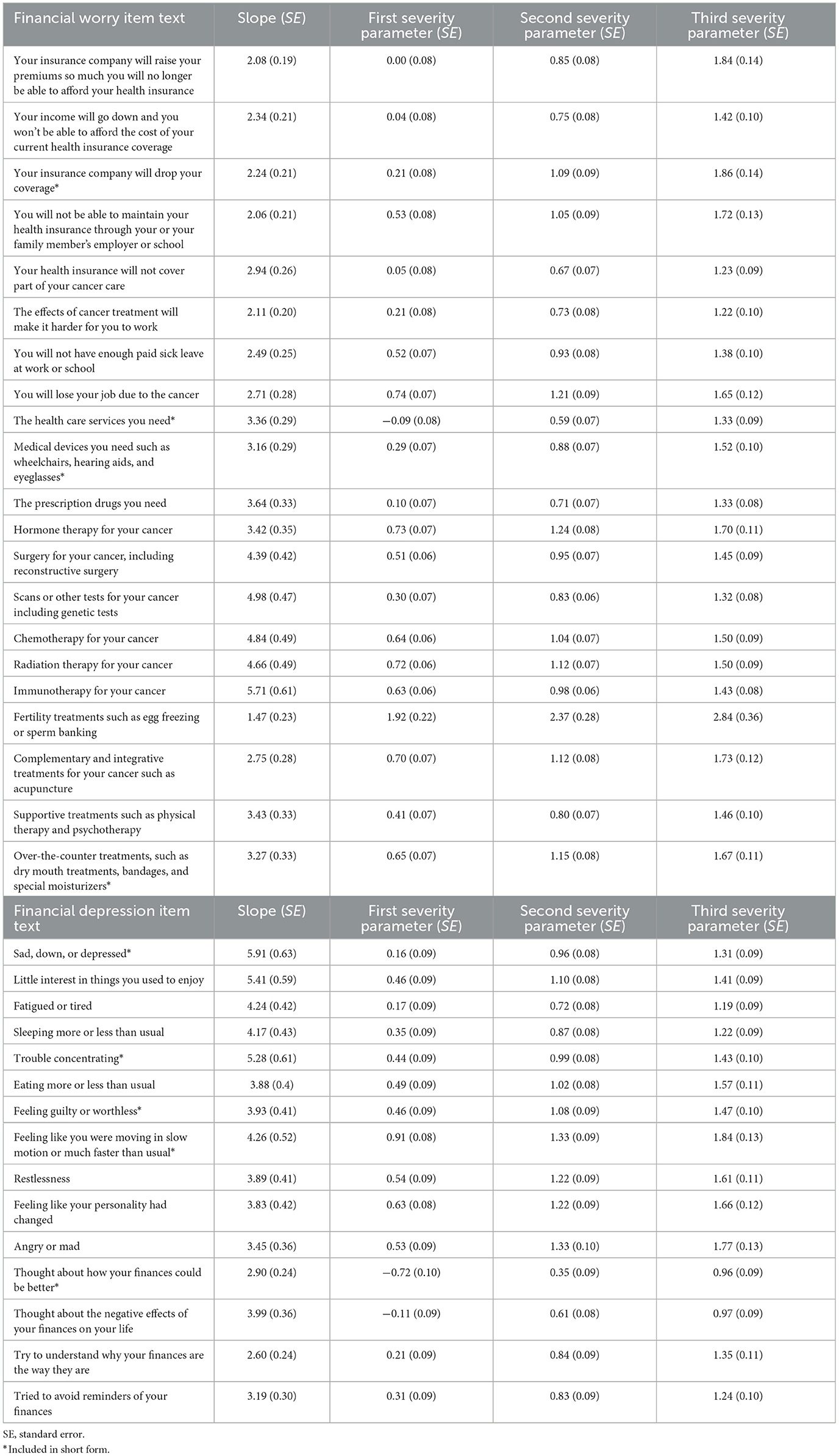

The items in the financial worry item bank all had slope parameters over 1 (Table 2). The unidimensional IRT model also fit the data well (RMSEA = 0.03). The financial worry item bank had the lowest error, with standard deviations from 0.75 below to 2 above the mean. Seven items showed that one or two middle response options may not provide information based on the trace lines, and the items mostly concerned employment or school concerns and fertility treatments. These items on employment and fertility concerns were retained as they assess important concerns for adolescents and young adults with cancer. Based on the severity parameters, four items were selected for the short form, and no items were added after discussion by the investigative team.

Table 2. Item response theory parameters for financial depression and worry about affording health care.

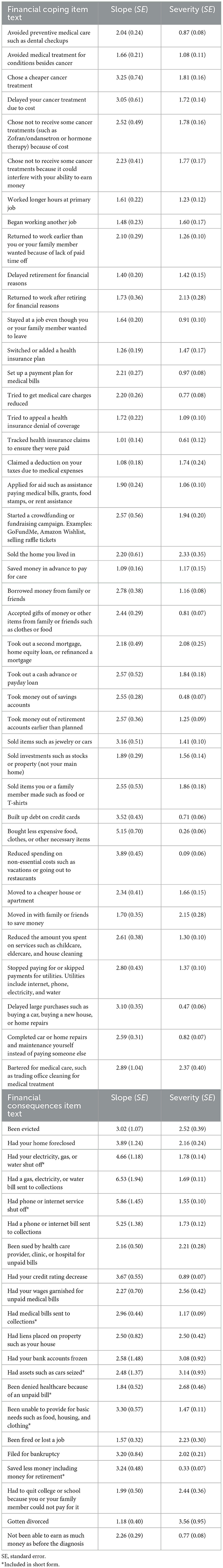

Financial coping

The severity and slope parameters for the financial coping items are reported in Table 3. The RMSEA was 0.06, indicating a good fit for the unidimensional model. All slope parameters were over 1.0, indicating all items measured financial coping accurately. Severity parameters ranged from 0.09 to 2.37. Based on the severity parameters and the standard error curve (Figure 2), the financial coping item bank measured financial hardship the best, with standard deviations between 0.5 below and 2.5 above the mean. When evaluating the potential financial coping items for a short form, the investigative team was unable to identify a small set (5–10) of items that captured the entire concept of financial coping and could apply to most cancer survivors. For example, employment coping items might be more salient for adolescent and young adult survivors. Instead, the financial coping items were divided into five conceptual subscales (see the Supplementary material for specific items): cost-related non-adherence, including those for non-cancer conditions and preventive care; employment coping; lowering health care costs, such as through reducing a bill or appealing a denial of coverage; increasing funds in the short term; and budgeting and reducing spending in the short term. The increasing funds items were further divided into borrowing; increasing cash flow without the need to repay the money, such as through crowdfunding and applying for aid; and liquidating assets. The cost-related non-adherence, lowering health care costs, and budgeting and reducing spending subscales are focused on the loss of services, goods, experiences, and time. The employment coping and increasing funds subscales are more gain-focused, where patients and their families may be able to maintain their previous level of spending.

Financial consequences

The financial consequences item bank also showed good accuracy as shown by the slope parameters over 1 (Table 3). The model fit well (RMSEA = 0.03). This item bank was most accurate from just above the mean to three standard deviations above the mean (Figure 2). Based on the severity parameters, five items were chosen for a short form. After an investigative team discussion, two more items were added to the short form: phone and internet being shut off and being unable to provide basic needs (food and clothing). The phone and internet disconnection item was added because the item on other utilities being disconnected was part of the short form and asking about both could be of interest to future researchers. The item on basic needs was added because it assessed an unfortunately common occurrence for cancer survivors and has been examined in several previous studies. Items and sum-score conversion tables are in the Supplementary material.

Financial depression

The unidimensional model had an RMSEA of 0.05, indicating a good fit for the data. All the items in the financial depression bank had slope parameters over 1 (Table 2), and the item bank assessed the construct with the least error, having a range from 0.75 below to 2 standard deviations above the mean. One item (thought about the negative effects of your finances on your life) had trace lines showing the middle response options might not provide unique information. The short form initially had four items chosen based on severity parameters to ensure the full range was covered. After an investigative team discussion, a fifth item (feeling guilty or worthless due to the financial effects of cancer) was added as this is a key symptom of clinical depression. See the Supplementary material for items and sum-score conversion tables.

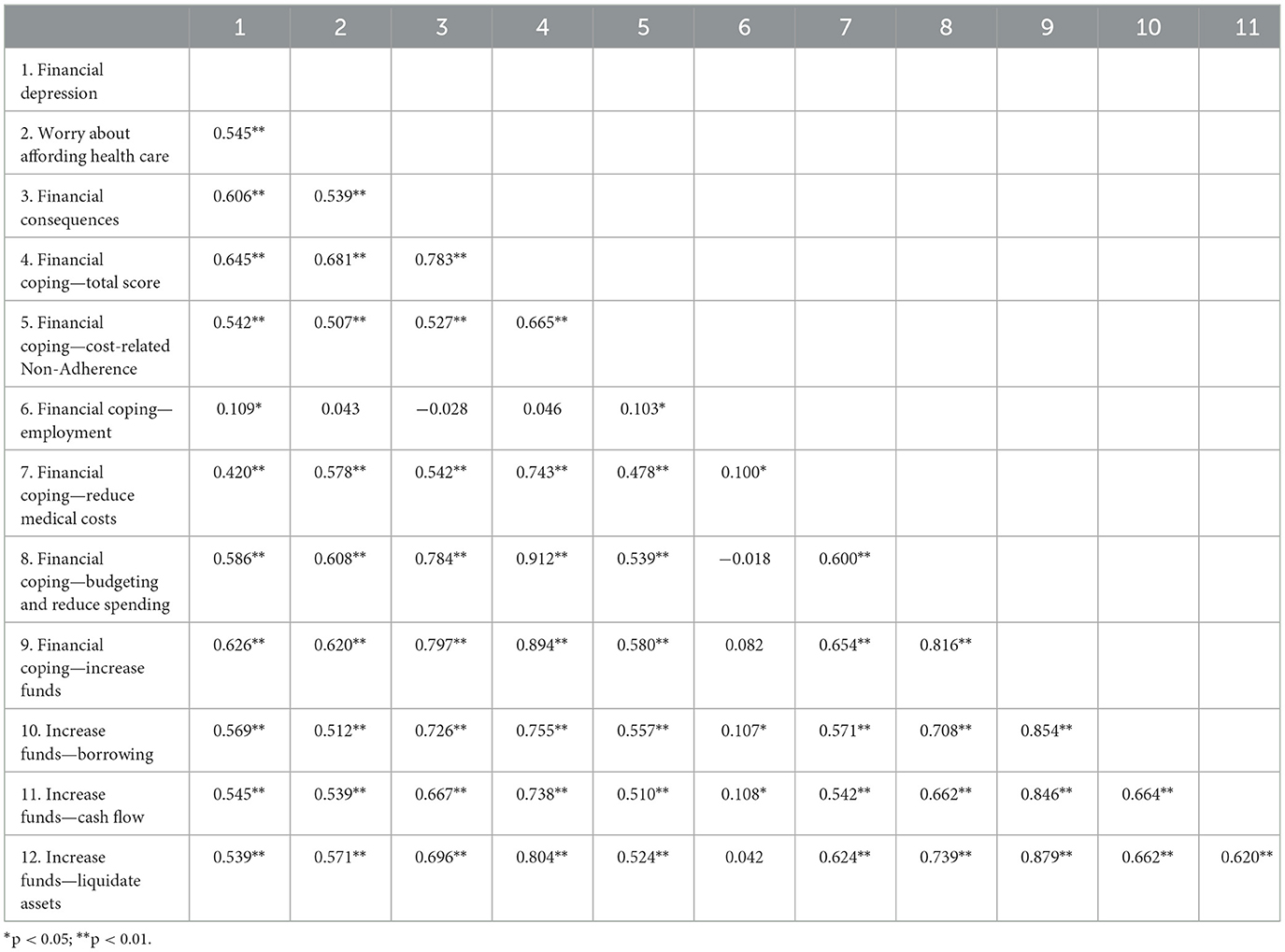

Correlations between item banks

Correlations between the financial hardship item banks were statistically significant (Table 4). Correlations between the primary dimensions (worry, coping, consequences, and depression) ranged from 0.545 to 0.783, suggesting the dimensions were related but distinct. Interestingly, the correlation between financial coping and financial consequences was fairly high (0.783). Correlations between the subscales of the financial coping item bank showed nearly all subscales were significantly correlated with the other subscales and financial hardship dimensions. However, employment coping tended to have smaller and more non-significant correlations than the other subscales.

Discussion

This study reported on using IRT to evaluate item banks to assess the four dimensions of financial hardship after cancer diagnosis. Overall, results supported the validity and reliability of the measures, and short forms or subscales were created to facilitate clinical screening and research when participant burden is a concern or computerized adaptive testing is not available. The results also support the conceptual model in two ways. First, the four dimensions were related but distinct aspects of financial hardship, as shown by the correlations between the dimensions. Second, as hypothesized in the conceptual model, IRT analyses suggested that the financial consequences item bank assessed a more severe level of financial hardship than the other three dimensions. The results support screening for financial hardship in people with cancer and suggest that screening should include different dimensions of financial hardship.

The four item banks can be used in future research studies on the causes and effects of financial hardship. Based on our results, future studies should consider including financial coping, depression, or worry when measuring financial consequences because financial consequences appeared to be a more severe form of financial hardship and may not be as sensitive to changes as the other three item banks. The item banks can be used as short forms or with computerized adaptive testing to efficiently measure all four dimensions in longitudinal observational studies to identify policies to prevent financial hardship. The item banks can also be used as trial outcomes for studies testing interventions to reduce financial hardship. The item banks can assess financial hardship more comprehensively in future research.

The financial hardship item banks can also be used to efficiently screen people with cancer. Recent pediatrics studies have shown that a single gate question leads to poor sensitivity and a negative predictive value when used to screen for financial hardship (30). However, clinical screening needs to be brief to prevent patient burden. The item banks can be combined with computerized adaptive testing to efficiently screen patients for all financial hardship dimensions. The short forms or subscales may also be an option when computerized adaptive testing is not available. In the United States, patient navigation can now be paid for by one of the largest insurers (31). The item banks could be used by patient navigators to help assess each patient's needs and direct them to tailored resources or additional services, such as financial navigation or social work. In the United States, screening for social needs is highly recommended by accrediting bodies (32–34), and these item banks could provide an option for quickly but thoroughly screening each patient. The financial hardship item banks can also be used for practice profiling to identify the unique needs of a clinic's patient population. The measures evaluated here could help improve clinical screening for financial hardship.

It is important to note the limitations of the current study. The study was cross-sectional, conducted only in English, and most of the cancer survivors were located in Washington State. Results might not generalize to populations outside the United States or other medical populations. Notably, translating the measures into Spanish or other languages was outside the study's scope, but future studies will translate the measures into Spanish. We also did not include an item on thoughts of being better off dead or suicidality due to finances. Most participants were breast cancer survivors, and while this might be understandable given the focus on survivorship, the results might not translate to other survivorship groups. Also, the sample was too small to conduct an exploratory factor analysis and a confirmatory factor analysis of the proposed subscales of the financial coping dimension. Future studies will be needed to evaluate the structural validity of the proposed subscales in financial coping. The study's strengths include using IRT and combining previous qualitative work with the quantitative work reported here.

Overall, this study speaks to the feasibility of measuring different dimensions of financial hardship in cancer. The item banks can be used for both future research studies and clinical screening. Future studies are needed to further evaluate the item banks, including in different cancer sites, countries, and languages, and evaluate potential subscales for financial coping. Additional studies are needed to assess the differences between general measures of depression and the financial depression item bank. How each financial coping behavior relates to financial consequences and outcomes (quality of life and mortality) is also an area of future investigation. Financial hardship after cancer sadly remains a public health issue. Improving how these constructs are measured is a critical step in reducing or preventing this burden.

Data availability statement

The deidentified raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Ethics statement

The studies involving humans were approved by Fred Hutchinson Cancer Center Institutional Review Office. The studies were conducted in accordance with the local legislation and institutional requirements. The participants provided their written informed consent to participate in this study.

Author contributions

SJ: Conceptualization, Formal analysis, Funding acquisition, Methodology, Writing – original draft, Writing – review & editing. JY: Conceptualization, Methodology, Writing – review & editing. NH: Conceptualization, Methodology, Writing – review & editing. LP: Conceptualization, Methodology, Writing – review & editing. VS: Conceptualization, Writing – review & editing.

Funding

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. Research reported in this publication was supported by the National Center for Complementary and Integrative Health and the Office of the Director of the National Institutes of Health under award number U24AT011310.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fcacs.2025.1452970/full#supplementary-material

References

1. Ehsan AN, Wu CA, Minasian A, Singh T, Bass M, Pace L, et al. Financial toxicity among patients with breast cancer worldwide: a systematic review and meta-analysis. JAMA Netw Open. (2023) 6:e2255388. doi: 10.1001/jamanetworkopen.2022.55388

2. Jones SM, Henrikson NB, Panattoni L, Syrjala KL, Shankaran VA. theoretical model of financial burden after cancer diagnosis. Future Oncol. (2020) 16:3095–105. doi: 10.2217/fon-2020-0547

3. Jones SMW, Yi J, Henrikson NB, Panattoni L, Shankaran V. Financial hardship after cancer: revision of a conceptual model and development of patient-reported outcome measures. Future Sci OA. (2024) 10:FSO983. doi: 10.2144/fsoa-2023-0229

4. Altice CK, Banegas MP, Tucker-Seeley RD, Yabroff KR. (2017). Financial hardships experienced by cancer survivors: a systematic review. J. Natl. Cancer Inst. (2017) 109:djw205. doi: 10.1093/jnci/djw205

5. Jones SMW, Nguyen T, Chennupati S. Association of financial burden with self-rated and mental health in older adults with cancer. J Aging Health. (2020) 32:394–400. doi: 10.1177/0898264319826428

6. Benedict C, Fisher S, Schapira L, Chao S, Sackeyfio S, Sullivan T, et al. Greater financial toxicity relates to greater distress and worse quality of life among breast and gynecologic cancer survivors. Psychooncology. (2022) 31:9–20. doi: 10.1002/pon.5763

7. Ver Hoeve ES, Ali-Akbarian L, Price SN, Lothfi NM, Hamann HA. Patient-reported financial toxicity, quality of life, and health behaviors in insured US cancer survivors. Sup Care Cancer. (2021) 29:349–58. doi: 10.1007/s00520-020-05468-z

8. Hazell SZ, Fu W, Hu C, Voong KR, Lee B, Peterson V, et al. Financial toxicity in lung cancer: an assessment of magnitude, perception, and impact on quality of life. Ann Oncol. (2020) 31:96–102. doi: 10.1016/j.annonc.2019.10.006

9. Evans LA, Go R, Warsame R, Nandakumar B, Buadi FK, Dispenzieri A, et al. The impact of socioeconomic risk factors on the survival outcomes of patients with newly diagnosed multiple myeloma: a cross-analysis of a population-based registry and a tertiary care center. Clin Lymphoma Myeloma Leuk. (2021) 21:451–60. doi: 10.1016/j.clml.2021.02.001

10. Ramsey SD, Bansal A, Fedorenko CR, Blough DK, Overstreet KA, Shankaran V, et al. Financial insolvency as a risk factor for early mortality among patients with cancer. J Clin Oncol. (2016) 34:980–6. doi: 10.1200/JCO.2015.64.6620

11. Goulart BHL, Unger JM, Chennupati S, Fedorenko CR, Ramsey SD. Out-of-pocket costs for tyrosine kinase inhibitors and patient outcomes in EGFR- and ALK-positive advanced non-small-cell lung cancer. J Oncol Pract. (2021) 17:e130–e9. doi: 10.1200/OP.20.00692

12. Consumer Financial Protection Bureau. Measuring Financial Wellbeing: A Guide to Using the CFPB Financial Well-Being Scale. Washington, DC: Consumer Financial Protection Bureau. (2015).

13. Archuleta KL, Dale A, Spann SM. College students and financial distress: exploring debt, financial satisfaction, and financial anxiety. J Finan Counsel Plann. (2013) 24:50–62.

14. Archuleta KL, Mielitz KS, Jayne D, Le V. Financial goal setting, financial anxiety, and solution-focused financial therapy (SFFT): a quasi-experimental outcome study. Contemp Family Therapy. (2020) 42:68–76. doi: 10.1007/s10591-019-09501-0

15. Riva S, Arenare L, Di Maio M, Efficace F, Montesarchio V, Frontini L, et al. Cross-sectional study to develop and describe psychometric characteristics of a patient-reported instrument (PROFFIT) for measuring financial toxicity of cancer within a public healthcare system. BMJ Open. (2021) 11:e049128. doi: 10.1136/bmjopen-2021-049128

16. de Souza JA, Yap BJ, Hlubocky FJ, Wroblewski K, Ratain MJ, Cella D, et al. The development of a financial toxicity patient-reported outcome in cancer: The COST measure. Cancer. (2014) 120:3245–53. doi: 10.1002/cncr.28814

17. de Souza JA, Yap BJ, Wroblewski K, Blinder V, Araujo FS, Hlubocky FJ, et al. Measuring financial toxicity as a clinically relevant patient-reported outcome: The validation of the COmprehensive Score for financial Toxicity (COST). Cancer. (2017) 123:476–84. doi: 10.1002/cncr.30369

18. Reise SP, Revicki DA. Handbook of Item Response Theory Modeling: Applications to Typical Performance Assessment. New York, NY: Routledge/Taylor and Francis Group. (2015) p. xvii.

19. Rafiq RB, Yount S, Jerousek S, Roth EJ, Cella D, Albert MV, et al. Feasibility of PROMIS using computerized adaptive testing during inpatient rehabilitation. J Patient Rep Outcomes. (2023) 7:44. doi: 10.1186/s41687-023-00567-x

20. Ottenhof MJ, Geerards D, Harrison C, Klassen AF, Hoogbergen MM, van der Hulst R, et al. Applying computerized adaptive testing to the FACE-Q skin cancer module: individualizing patient-reported outcome measures in facial surgery. Plast Reconstr Surg. (2021) 148:863–9. doi: 10.1097/PRS.0000000000008326

21. National Cancer Institute and Office of Cancer Survivorship Definitions. (2024). Available at: https://cancercontrol.cancer.gov/ocs/definitions (accessed March 21, 2024).

22. Palan S, Schitter C. Prolific.ac—A subject pool for online experiments. J Behav Experim Finan. (2018) 17:22–7. doi: 10.1016/j.jbef.2017.12.004

23. Birnbaum A. Some latent trait models and their use in inferring an examinee's ability. In: Lord FM, Novick MR. Statistical Theories of Mental Test Scores. Reading, MA: Addison-Wesley (1968). p. 395–479.

24. Samejima F. Estimation of latent ability using a response pattern of graded scores. Psychometrika Monog Supplem. (1969) 34:4. doi: 10.1007/BF03372160

25. Bock RD, Aitkin M. Marginal maximum likelihood estimation of item parameters: application of an EM algorithm. Psychometrika. (1981) 46:443–59. doi: 10.1007/BF02293801

26. Bock RD, Mislevy RJ. Adaptive EAP estimation of ability in a microcomputer environment. Appl Psychol Measurem. (1982) 6:431–44. doi: 10.1177/014662168200600405

27. Bentler PM. Comparative Fit Indexes in structural models. Psychol Bullet. (1990) 107:238–46. doi: 10.1037/0033-2909.107.2.238

29. Edelen MO, Reeve BB. Applying item response theory (IRT) modeling to questionnaire development, evaluation, and refinement. Qual Life Res. (2007) 16:5–18. doi: 10.1007/s11136-007-9198-0

30. Hanmer J, Ray KN, Schweiberger K, Berkowitz SA, Palakshappa D. Accuracy of a single financial security question to screen for social needs. Pediatrics. (2024) 153:1. doi: 10.1542/peds.2023-062555

31. Principal Illness Navigation Services: Centers for Medicare and Medicaid Services. (2024). Available at: https://www.medicare.gov/coverage/principal-illness-navigation-services (accessed March 21, 2024).

32. Federal Register. Medicare program; hospital inpatient prospective payment systems for acute care hospitals and the LongTerm care hospital prospective payment system and proposed policy changes and fiscal year 2023 rates; quality programs and medicare promoting interoperability program requirements for eligible hospitals and critical access hospitals; costs incurred for qualified and nonqualified deferred compensation plans; and changes to hospital and critical access hospital conditions of participation. In: Services HaH. Baltimore, MD: Centers for Medicare and Medicaid Services. (2022).

33. HEDIS. HEDIS Measurement Year 2023 Volume 2: Volume 2: Technical Specifications for Health Plans. Washington, DC: National Committee on Quality Assurance. (2023).

Keywords: financial burden, financial toxicity, economic wellbeing, economic hardship, financial anxiety

Citation: Jones SMW, Yi JC, Henrikson NB, Panattoni L and Shankaran V (2025) Development of item banks to assess financial hardship in cancer survivors using item response theory. Front. Cancer Control Soc. 3:1452970. doi: 10.3389/fcacs.2025.1452970

Received: 05 July 2024; Accepted: 13 January 2025;

Published: 05 February 2025.

Edited by:

Humphrey Cyprian Karamagi, World Health Organization - Regional Office for Africa, Republic of CongoReviewed by:

Sheila Judge Santacroce, University of North Carolina at Chapel Hill, United StatesCeleste Vaughan-Briggs, Thomas Jefferson University Hospital, United States

Copyright © 2025 Jones, Yi, Henrikson, Panattoni and Shankaran. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Salene M. W. Jones, c21qb25lczNAZnJlZGh1dGNoLm9yZw==

Salene M. W. Jones

Salene M. W. Jones Jean C. Yi1

Jean C. Yi1 Nora B. Henrikson

Nora B. Henrikson Laura Panattoni

Laura Panattoni