- 1School of Architecture, Construction Economics and Management, Ardhi University, Dar es Salaam, Tanzania

- 2School of Built Environment, Engineering and Computing, Leeds Beckett University, Leeds, United Kingdom

- 3School of Built Environment, Copperbelt University, Kitwe, Zambia

- 4Faculty of Engineering and the Built Environment, University of Johannesburg, Johannesburg, South Africa

- 5Edinburgh Napier University, Edinburgh, United Kingdom

- 6UniSA STEM, Sustainable Infrastructure and Resource Management (SIRM), University of South Australia, Adelaide, SA, Australia

While governments remain accountable for the delivery of infrastructure services, given the paucity of public resources, studies have recommended the use of private sector finance (PSF) as an alternative approach to delivering sustainable infrastructure both in developed and developing economies. Despite the recommendation, there has been very little use of PSF in delivering public projects, particularly in sub-Saharan Africa. Therefore, this study explores the constraining factors for the use of PSF in the delivery of public infrastructure in Tanzania and proposes recommendations. A total of 10 semi-structured interviews were conducted with different stakeholders delivering public infrastructure services. Interviewees were purposefully selected. Data were analyzed through conceptual content analysis. The findings reveal that the top five constraining factors were inadequate knowledge and skills, lack of policy to support or suffice PSF, bureaucracy or delays of approvals, lack of proper models for PSF, and lack of skilled people or existence of a big national skill gap. Thus, the identified constraints provided useful insights and were used as a road map for suggesting appropriate solutions to enhance the use of PSF. Furthermore, this is the first study to empirically explore the constraining factors for PSF in delivering infrastructure projects in the Tanzanian context.

1 Introduction

Most governments in developing countries have inadequate resources to finance large-scale infrastructure projects. This is supported by the OECD. (2018) report which pinpointed that there is a widening gap between the required future infrastructure investment and the public sector capacity. Equally, the World Bank’s (2016) report highlighted that most countries, especially developing economies, are not investing enough in infrastructure projects to achieve their strategic objectives. According to Fay et al. (2021), attracting private financing is at the top of the agenda of policymakers concerned with bridging the infrastructure gap in developing countries. For instance, currently, nearly one-third of the world’s population is using poor sanitation facilities, one billion do not have access to electricity, and 660 million have no access to water supply in most developing countries in Africa and Asia (Fay et al., 2021).

The existence of poor infrastructure due to a financial deficit has largely hindered Africa’s economic and social development. As a result, most African countries are currently depending on China as an alternative source of financing. For example, the China Development Bank has become a major financier of infrastructure projects across SSA (Muchapondwa et al., 2016). However, most Chinese loans are tied to the procurement of Chinese goods and services (Konijn and van Tulder, 2015), hence creating concerns for local businesses in African countries.

Despite the identified concerns, there have been very few private sector involvements in the delivery of sustainable infrastructure (SI), especially to sub-Saharan Africa (SSA) (Dithebe, et al., 2019b). Such limited participation continues to affect the economic growth of developing countries like Tanzania. Moreover, Prakash and Sethi (2021) emphasized that the participation of the private sector is indispensable to bridging the financing gap. Engaging the private sector can contribute significantly to attaining the 2030 agenda. Besides, there is a paucity of studies in this subject area, particularly in the SSA. The majority of recent studies focused on studying how to mobilize PSF (Bielenberg, et al., 2016); the involvement of the private sector in water projects (Chan and Ameyaw, 2013); infrastructure financing challenges (Dithebe et al., 2019a); and the joint use of private financing (Fay et al., 2021). Studies related to barriers/constraining factors have been undertaken in other countries such as the Netherlands (Janssen et al., 2016), India (Sinha and Jha, 2021), and the Middle East (Tamošaitienė et al., 2021). Therefore, the limited studies and poor involvement of the private sector in infrastructure projects call for the need to explore the constraining factors for the use of the PSF in the delivery of public infrastructure (PI) in Tanzania to bridge the knowledge gap and suggest solutions to enhance their involvement.

2 Literature review

Several studies (Dithebe et al., 2019a; Fay et al., 2021) have reported on the importance of infrastructure development and how public–private partnerships (PPPs) might be used as a vehicle for delivering SI in both developed and developing economies. However, to date, the majority of the studies have focused more on the critical success factors, (Osei-Kyei and Chan, 2015), drivers ((Janssen et al., 2016; Babatunde and Perera, 2017), and barriers (Osei-Kyei, and Chan, 2017) to the implementation of the PPPs. In this literature review, the focus and emphasis are on identifying several studies on the barriers to the use of PSF in the delivery of PI in the developing countries. The importance of infrastructure within the developing countries’ context is well acknowledged.

Governments are also obligated to provide the much-needed infrastructure in developing countries. However, as observed by Chan and Effah Ameyaw (2013) and using Ghana as an example, under-investment by the government is the major cause of the ill-performance of sectors such as water, necessitating private sector involvement through financing. As a result, in Ghana, water sector financing depends on two main sources: 1) external funding from donors; and 2) domestic funding from the payment of tariffs by consumers and some support from the national government. However, the same study acknowledged the private sector’s involvement in the water sector as crucial to the development of developing economies. Furthermore, despite the government’s obligations for providing infrastructure, its inability to honor its financial obligations both in urban and small-town sectors in Ghana led to private sector involvement. Similarly, in Kenya, the private sector is acknowledged in PPP transactions as a mechanism for bringing innovative technology, finance, and efficiency, while the government brings its assets, such as land, and other regulations for long-term contracts. Whilst seminal studies such as Moles and Williams. (1995), had highlighted how PSF could be hard to mobilize due to the perceived levels of risk and uncertainty, recent studies such as Baumli and Jamasb. (2020) have considered PSF as a necessary ingredient to remedy Africa’s energy challenges and to stimulate the adoption of renewable energy.

In South Africa, municipalities lacking the institutional and financial capacity to address development challenges have previously raised PSFs to supplement their resources and government grants (Jackson and Hlahla, 1999). Likewise, a study by Tamošaitienė et al. (2021) aimed at assessing the barriers and risks to private sector participation in infrastructure construction projects in developing countries of the Middle East singled out that governments are often unable to implement urban infrastructure construction projects (UICPs) on their own, mainly due to budget and financial resource limitations. Other barriers identified in this study were categorized into technical, organizational, economic, political, and financial. These barriers in each category were prioritized using the Friedman test, and the results revealed the top-most barriers to be a lack of management knowledge and control of construction projects in private companies, lack of attention to cost reduction methods among contractors, a lack of systematic cooperation between the public and private sectors, and a lack of use of novel financing tools and methods.

Irrespective of the different funding mechanisms by the private sector for infrastructure projects, such as the build-operate-transfer (BOT) model (Cheung and Chan, 2009); taxpayer approach (de Vries, 2007); project bonds (Hutchison et al., 2016); project financing structures (Annamalai and Jain, 2013); PSF Initiative (PFI) (Wang, 2014); PPP mode (Chotia and Rao, 2018); innovative bond instruments (Prakash and Sethi, 2021); municipal banks and bond banks (Dollery et al., 2021); they are all facing implementation challenges. For instance, the dependence on uninnovetive (public) financing has led to low-income urban housing in Kenya being underdeveloped due to inadequate financing from the public sector, hence high housing supply backlogs, leading to the growth of slums and informal settlements (Giti et al., 2020). Despite the proliferation of funding mechanisms, there are different schools of thought about which is the most desirable option. For instance, of these different modes of private financing, according to Chotia and Rao (2018), the public, private, or public–private partnership (PPP)—has the maximum positive impact on the overall GDP of India. This is because, as per their empirical results, PPP had an impact on the GDP per capita when shocks were given to each of the study variables (i.e., public, private, and PPP) using a structural vector autoregressive approach. In contrast, the BOT was initially found to be the preferred financing model for several major infrastructure projects in the Hong Kong Special Administrative Region (HKSAR), according to Cheung and Chan. (2009). Equally, the use of PPPs for infrastructure provision at the local government level has been questioned due to a number of barriers (Janssen et al., 2016). According to ibid, the following major barriers were found to prevent local governments from applying PPPs to their road development projects: 1) failure of local government to adapt current PPP working methods; 2) a belief by local government that PPP will exclude local contractors from project involvement; and 3) local government’s experience of the whole PPP approach and PPP contract as overly complicated.

Similarly, a number of studies have been undertaken in developing countries aimed at exploring the constraints or barriers facing the lending institutions in the quest for funding infrastructure projects (Dithebe et al., 2019a; Dithebe et al., 2019b; Bolomope et al., 2021; Sinha and Jha, 2021). For instance, within the Indian context, a study by Sihna and Jha (2021) aimed at identifying the problems (constraints) faced by banks, lenders, financial institutions, public authorities, developers, and concessionaires in the course of financing PPP road projects established that whilst the commercial banks in India dominated in providing debt to the PPP infrastructure projects, especially in the road sector, the financing problems faced by the developers resulted in unwarranted time and cost overruns emanating from delay in land acquisition and grant of approvals, hence discouraging private sector participation. Likewise, within the South African context, a study by Dithebe et al. (2019a) aimed at identifying the challenges of funding water infrastructure projects found that out of the 15 challenges established in the literature, the following were considered critical: Corruption, limited private participation, weak project structuring, high fiscal deficits, cost recovery constraints, high credit risk as well as unreliable planning and procurement systems were major challenges affecting water infrastructure financing. Furthermore, insufficient municipal revenues, financial sector obstacles, insufficient subsidies, and political instability equally negatively affected the financing of water infrastructure projects. A subsequent study by the same authors, Dithebe et al. (2019b), aimed at determining the perceived occurrence of challenges delaying the delivery of water infrastructure assets and the role of both public and private financing for infrastructure development found that corruption, hostility, weak project structuring, high fiscal deficits by state governments, cost recovery constraints, high credit risk for private financing, and unreliable planning and procurement processes are major challenges delaying the delivery of water infrastructure assets.

Challenges of access to finance from local financial institutions (LFIs) in developing countries have equally being investigated. Bolomope et al. (2021) study identified significant factors affecting access to local finance for PPP infrastructure projects in Nigeria: 1) low capital bases by LFIs, 2) weak project viability, 3) lack of capacity to manage PPP-related activities, 4) inconsistent government policy, 5) a poor legal framework, and 6) public perception of PPP. Another study by Muleya et al. (2020) investigated the role of the PPP Act on Zambian PPP projects and reported that, the PPP Act had not played a significant role in influencing private sector decisions to participate in PPP projects, hence the recommendation for immediate revision of the PPP Act to remove identified barriers.

The challenges to PFI are not only confined to developing countries but to developed ones as well. For instance, within the developed countries, and United Kingdom to be specific, the seminal study by Dixon et al. (2005) identified the large-scale nature of PFI projects as frequently acting as a barrier to entry. Barnett. (1989) had also earlier pointed to the Dartford Bridge in 1986 as the first major infrastructure project in modern times in the United Kingdom to receive a PSF contract through the build-own-operate-transfer projects. However, despite these challenges, the significance of the PSF is equally acknowledged in developed countries. These have been used to harness private funds to alleviate the Australian local government infrastructure backlog.

This review highlighted a number of constraints to the use of PSF in delivery of PI in both developed and developing countries. However, the majority of those studies in sub-Saharan Africa have largely been drawn from South Africa and West Africa. Thus, there are inadequate studies investigating constraining factors (CFs) for private sector participation in financing infrastructure projects within the broader developing countries of SSA. In contrast, whilst a number of Tanzanian specific studies exist, these have largely been around readiness assessment (Chileshe and Kavishe, 2021); capacity building challenges (Chileshe et al., 2021); critical success factors (Kavishe and Chileshe, 2019; Chileshe et al., 2020); Policy and regulator issues (Kavishe et al., 2018); and delivery challenges (Kavishe et al., 2018) of public-private partnership in housing delivery projects. Besides, the studies in Tanzania which researched on the challenges or barriers to PPP, they only focused on delivering housing projects only and these studies focused on using rigorous quantitative methods but these studies hence lacking examination of the CFs in depth due to their cross-sectional nature. An in-depth exploration to answer how these CFs impact the use of private sector participation is missing and can be addressed thoroughly by a qualitative study. In the quest to bridge this gap, the researchers carried out a qualitative, in-depth study to explore the CFs for the use of PSF in the delivery of PI in Tanzania and propose solutions in categories of themes derived by open coding through content analysis.

3 Research methodology

This study adopted a qualitative research methodology. The main steps associated with undertaking research tasks are as follows: 1) literature review; 2) semi-structured interviews; 3) data analysis; 4) identification of the constraining factor and mapping of solutions; 5) results; and 6) discussions. This methodology has also been used in a similar study by Kavishe and Chileshe (2019). In step 1, a literature review was conducted to determine previous similar research and identify knowledge gaps. Semi-structured interviews in step 2 were used to achieve a further objective, namely, to validate the findings from the literature review undertaken in step 1. Furthermore, semi-structured interviews provide the interviewer with the ability to judge non-verbal behavior of the respondent such as body language while giving a room for spontaneity. Semi-structured interviews were chosen over structured and unstructured because of their flexibility; they also possess the strengths of both structured and unstructured interviews and counterbalance their weaknesses.

3.1 Research approach

This study adopted a qualitative exploratory approach. This was considered appropriate for the study due to the exploratory nature of the topic. Here, the researcher was positioned to explore and comprehend the meaning individuals ascribe to a social or human problem (Creswell, 2013), such as CFs for the use of PSF in the delivery of SI projects. The process of research included data typically collected in the participant’s setting, data analysis inductively building from particulars to general themes (directed content analysis), and the researcher making interpretations of the meaning of the data (ibid). Content analysis was used because it is known to be a good and widely used method of analyzing qualitative data (Hsieh and Shannon, 2005).

3.2 Criteria for selection of interviewees

This study has focused on private financing of PI projects. The respondents included stakeholders who were purposely selected from infrastructure-related organizations in Tanzania. Purposive sampling is used because as Smith. (2017) contended, in qualitative research, purposive sampling is used when a small number of respondents are required to be selected in order to have a rich and contextualized understanding of a phenomenon. Therefore, the nominated respondents had to meet the following criteria:

1) Willingness to participate in the study

2) Work with PI organizations, for example, energy, water, and roads

3) Work in the PPP units/department in Tanzania

4) Have been involved in private financing of infrastructure projects

3.3 Data collection and confirmation procedure

The interview duration was between 25 and 60 min. A total of 10 semi-structured interviews were conducted between June and July 2021. By the 10th interview, there was no new information gathered, Ashe researcher was hearing the same comments again and again, an indication that data saturation was being reached. However, a sample size of 10 interviews was considered adequate because, as per Patton (2002), a threshold of between 5 and 50 interviews is sufficient for the purpose of reaching saturation. It is acknowledged that large sample sizes are not critical determinants of the quality of results in qualitative studies in comparison to the requirements in quantitative studies (Zulu and Khosrowshahi, 2021). The developed interview protocol was used for the purpose of recording and keeping information. In order to ensure the correctness of the transcribed data, an interactive cyclic process of “checking” and “confirming” (Creswell, 2013) was carried out between the end of transcribing data and the beginning of data analysis. The reliability and validity of the collected qualitative data were enhanced by confirming the correctness of the transcriptions from the interviewees, as per Ardichvili et al. (2003).

3.4 Data analysis

The study adopted a directed content analysis to analyze qualitative data while partially supplemented with the summative technique for quantitative counting of phrases in course of analysis (Hsieh and Shannon, op. cit). In this approach, patterns and themes regarding constraining factors (CFs) and proposed solutions were derived by hand-coding findings from interview data as depicted from the transcripts, similarly like Kavishe and Chileshe. (2020).

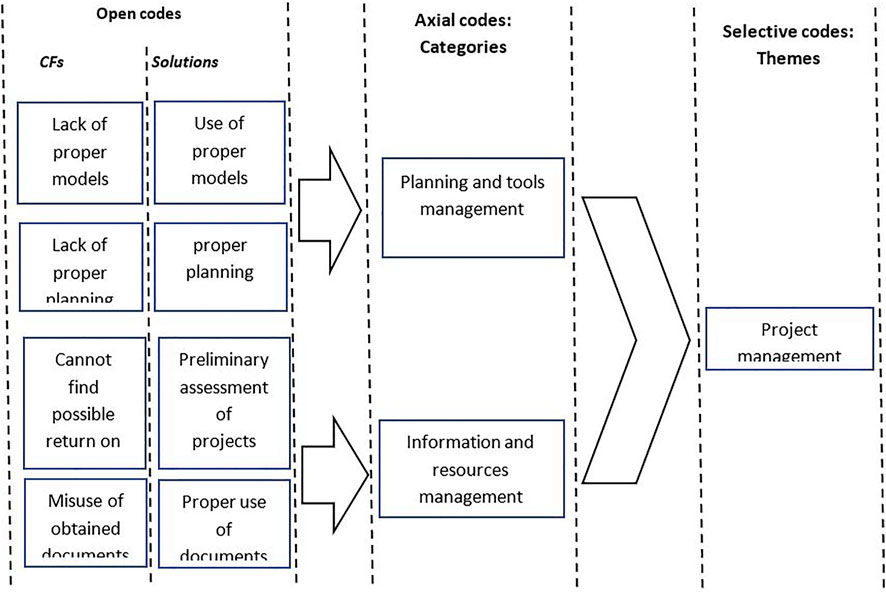

The coding process was carried out at three levels, as asserted by Williams and Moser. (2019): First, it began with the development of open codes, then transitioned open codes to axial codes, and finally integrated axial codes to selective codes into form themes. In order to attain the efficacy of open coding in this study, the researchers read and re-read interview transcriptions and field notes in pursuit for thematic connectivity that led to identify open codes from findings. Axial coding is followed by combining interrelated codes among identified open codes to form categories of codes (axial codes). Finally, in selective coding, the researchers integrated the categories from axial coding to form cohesive themes. Figure 1 shows an extract from a coding process undertaken in this research.

3.5 Trustworthness of the study

In order to attain trustworthiness of the study or the degree of confidence (rigorous) in data, interpretations, and the methods used, the researchers ensured the quality of the research in terms of credibility, transferability, dependability and conformability, member checking was used as the validity procedure where each participant was given an opportunity to check the raw data collected and comment on their accuracy as per Creswell and Miller (2000); Lincoln and Guba (1985) and Nowell et al. (2017).

Profile of interviewees: Individual characteristics

Table 1 presents the profile of the respondent among the interviewees at the individual characteristic level. This includes characteristics such as your current position, experience, and educational qualifications.

An examination of Table 1 shows that out of the ten interviewees, the majority, six (60.0%), had postgraduate qualifications, of which four (40%) had master’s degrees and two (20%) were PhD holders. With regard to the level of experience, half (50.0%) of the interviewees had 6–10 years of experience, three (30.0%) had over 20 years, and two (20%) had less than 5 years of experience.

3.6 Profile of interviewees: Organizational characteristics

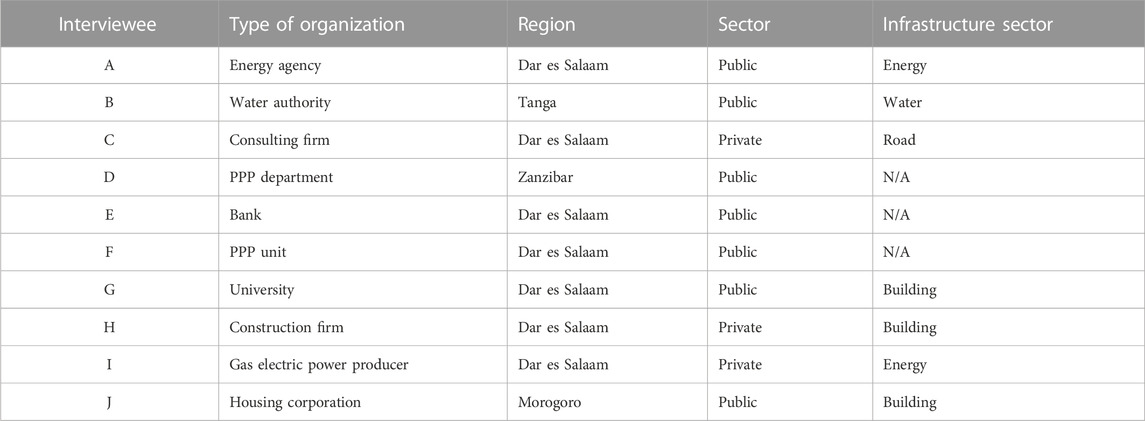

In addition to the individual characteristics discussed above, it was deemed important to include organizational characteristics. Table 2 presents the profile of the interviewees according to the organizational characteristics.

Examination of Table 2 shows that the majority of respondents (7 out of 10) are located in the Dar es Salaam region, two out of 10 are from other regions of Tanzania’s main land, and 1 out of 10 interviewees is from Zanzibar (Zanzibar is an island in Tanzania). Sector-wise, the majority of interviewees 7 out of 10 were serving in the public sector, and 3 out of 10 interviewees were working in the private sector. With exception to interviewees D, E, and F, all the remaining interviewees were allied with a specific type of infrastructure sector in the economy, ranging from the building sector (n = 3; 30%), energy sector (n = 2; 20%), road sector (n = 1; 10%), and the water sector (n = 1; 10%). The explanation of non-alignment of interviewees D, E, and F to project sectors has to do with the types of organizations and the nature of the businesses which they are involved. The nature of business of these organizations is allied across in more than one infrastructure sectors in Tanzania.

4 Findings

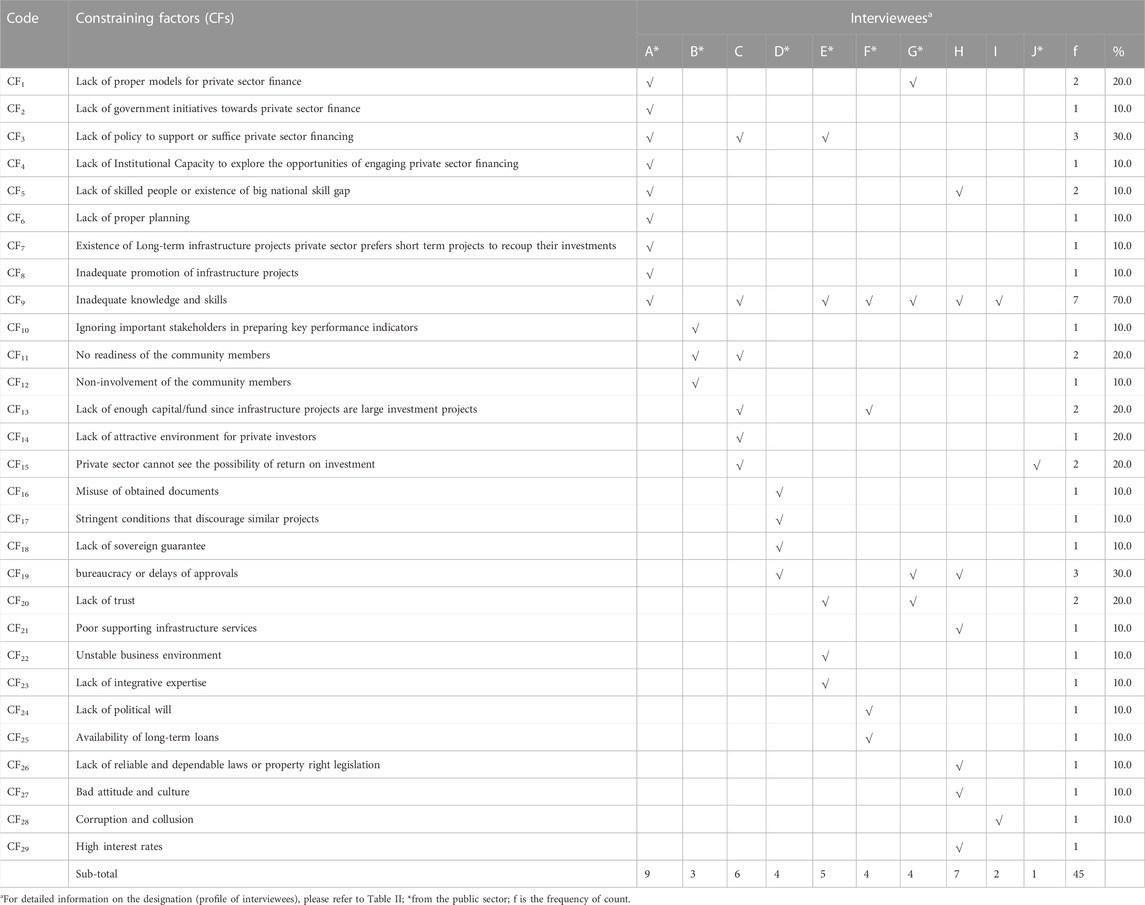

Based on interviews with key informants, various CFs have been uncovered with regard to the use of PSF in the delivery of PI projects in Tanzania. The major question that the interviewees were asked was, “What are the constraining factors for the use of PSF in the delivery of PI in Tanzania?” The qualitative findings from interview data summarized and presented in Table 3 illustrate various CFs for the use of PSF. The responses were tallied based on the number of times they were cited (frequency of count). When a response was mentioned only once by the respondents, it was deemed less significant. Conversely, a factor was regarded as more significant for the responses given more than once. This criterion has also been used in previous studies (Osei-Kyei and Chan (2017); Kavishe and Chileshe, 2019; Kavishe and Chileshe, 2020).

It can be noted from Table 3 that a total of 29 CFs were identified by the interviewees. These CFs were mentioned in different total frequency of counts for a total of 45 times (aggregate of total frequency of counts). Table 3 shows that out of the 29 CFs found, only one ‘inadequate knowledge and skills’ was deemed the most significant based on frequency of counts (n = 7 out of 10, which is equal to 70% of the total response counts). Two of the remaining 28 CF, “lack of policy to support or suffice PSF” and “bureaucracy or delay of approvals,” were tallied thrice (n = 3 out of 10 which is equal to 30% of the total counts). Also, six out of the remaining 26 CF were cited twice (n = 2 out of 10, which is equal to 20% of the total response counts). These CFs included “lack of proper models for PSF,” “no readiness of the community members,” “lack of enough capital or fund,” “lack of skilled people or existence of big national skill gap,” “private sector cannot see the possibility of return on investment,” and “lack of trust.” The remaining 20 CFs were each tallied once. The top five CFs are discussed in more depth.

4.1 Inadequate knowledge and skills

The majority of interviewees (70%) declared the most significant CF to be “inadequate knowledge and skills,” as indicated by the number of times this CF was mentioned (seven times). This factor was found to be the most significant among the CFs in different ways. Some interviewees mentioned it as a constraint that faces different actors when it comes to the use of PSF, while others considered it to lean on the government side. For example, interviewee A acknowledged that there is “ a lack of adequate skill sets such as project identification skills, legal skills, monitoring and evaluation skills, and financial skills.” The interviewee further explained that there is lack of knowledge to the side of financial institutions who do not understand these infrastructure types of projects. In that discourse, he also stated the following.

Financial institutions need to acquire the skills and capacity to appraise and assess energy projects. This is because banks lack the understanding of these types of projects therefore, they refuse to offer loans, or the process becomes too long. Currently the only bank that is capable is xxx Bank and not the commercial banks. I can give a vivid example: We once gave money to commercial banks to lend to developers, but these banks were not ready, and even when they accepted, the process was too long.

This finding is consistent with the CFs literature in developing economies (Muleya et al., 2020; Bolomope et al., 2021). For example, within the context of Nigeria, a study by Bolomope et al. (2021) focused on local finance for PPP infrastructure in Nigeria and established that the majority of financial institutions in Nigeria do not have specific staff or personnel who are familiar with PPP operations. As a result, they are more riskaverse and unable to fully participate in the procurement and implementation of PPP projects. Some of the consulted banks agree that they are learning on the job (ibid).

Likewise, interviewee B said that there is a lack of knowledge on private sector financial economics and skills in technical aspects of contracts. Likewise, interviewee F pointed out the inadequate skill set, such as project identification skills, legal skills, monitoring and evaluation skills, and financial skills. Also, lack of understanding appropriate models for private financing was considered as “inadequate knowledge and skills” by interviewee G. Another example of “inadequate knowledge and skills” was given by interviewee H, who, when asked about the CFs, said the following.

The government doesn't know that partnering with the private sector can be helpful. Like some regimes in the past have used equity financing to finance some requirements in the transportation sector, while you could borrow or even support the private sector to do that. So, they could even partner with the private sector, which is able to invest in air transport. So, I think that knowledge is also important to understand issues of equity and debt financing.

To sum up, the issue of inadequate knowledge and skills has also been conceded as among major CFs of PSF in most developing countries. For instance, the World Bank (2017) portrayed that, lack of internal capacity remain as a challenge in developing countries for engaging PSF in PI. Unlike Tanzania and other developing countries, Hong Kong has a strong experience and skills when it comes to PSF in PI delivery (Osei-Kyei and Chan, 2017).

4.2 Lack of policy to support PSF

The issue of “lack of policy to support PSF” (f = 3 counts) has been mentioned as being among the second most significant CFs for the use of PSF in Tanzania. An examination of Table 3 shows that interviewees A, C, and E considered this factor to be a restraint to the use of PSF in delivery of infrastructure projects in Tanzania. While some of the interviewees argue that there is a lack of policy, others do not, but contend that it is about unfavorable policy rather than a lack of policy. For example, while interviewee A argued that “there is no policy offering an opportunity to the private sector to be involved as a financer” this was equally cited by interviewee C who claimed that, “there is lack of policy in place to facilitate the private sector involvement by encouraging toll roads”, interviewee E was of the opinion that the policy environment with regard to PSF has never been friendly. These findings are also supported by Ismail and Harris. (2014); Osei-Kyei and Chan. (2017). Tanzania similar to other developing countries like Malaysia, Nigeria, and Ghana, launched PPP policy guideline but they are not adequate and comprehensive (Osei-Kyei and Chan, 2017). Preferably, the presence of comprehensive PPP policy provides a good enabling environment, hence attracting more PSF. Example: Tanzania acquired its PPP policy in 2009, despite its presence, there has been very little private sector involvement in PI delivery, and in some projects there have been failures, thereby discouraging the private sector. As cited by interviewee E, regarding an unfriendly policy environment, this could be associated with the problem of policy implementation.

4.3 Bureaucracy or delays in approvals

Bureaucracy is related to many negative aspects of organizations, such as operational delays, action based on ambiguous standards, extensive documentation requests, and even countless obstacles in meeting users’ or customers’ requests (Godoi et al., 2017). In the present study, bureaucracy or delays in approvals from the government was another CF that was jointly mentioned as the second most significant with regard to the use of PSF in the delivery of infrastructure projects. For instance, interviewee D stated that there are delays from the government, which include late issuing of government approvals. In support of this CF, interviewee H cited the following typical example from the past experience of one private investor in Tanzania.

Bureaucracy was a problem to xxx project. One private investor had to register for an incorporation license but also had to have a license to do business with the municipals. She thought, “Once I have done this, I can start the business,” but then she was told no! you have to have a communication commission license in order to do business in communication, and she said, “I think I have done it” and when she started, she was using some public yyy company’s infrastructure, so they told her, you have got to have yyy license, lastly, she ended up having like five licenses to do one business.

Therefore, in this case, as evidenced by interviewee H bureaucracy is discouraging the private sector to finance PI projects in Tanzania. A similar study by Sinha and Jha. (2021) reported that delays in land acquisition, environmental clearance, and grant approvals were the major bureaucratic related issues discouraging private financing of PPP infrastructure projects in India.

4.4 Lack of a proper model for PSF

The issue of “lack of a proper model for PSF” (n = 2 counts) has been mentioned to be among the third most CF for the use of PSF in Tanzania. interviewee A said there is a lack of proper models to engage the private sector in financing these projects. Similarly, interviewee G pointed out that “lack of understanding of appropriate models of private financing is a major concern, which leads to the use of inappropriate models for PSF.” These findings are supported with literature such as, Bielenberg et al. (2016) who emphasized the use of appropriate models to encourage private financing in SI.

4.5 Lack of skilled people or existence of a big national skill gap

Examination of Table 3 shows that lack of skilled people or the existence of a big national skill gap was the fifth-ranked CF (f = 2). According to interviewee A, the government lacks strong, skilled people to deal with resource mobilization in order to capture all the opportunities or sources of funding. In a similar way, interviewee H also argued that, for the private sector to commit their finances to PI projects, they need assurance that they will get the skills they need to make their respective investments.

More so, interviewee H added that the national skill gap in engineering and technical studies is very big at the moment and thus it makes infrastructure financing very expensive because one investing in infrastructure projects will be required also to use technicians, tradesmen or artisans from outside the country. So, in expounding the magnitude of these CFs, he said the following.

There is a very big skill gap! …, the ratio between an engineer, a technician, and a trade’s person is 1:5:25, which means one (1) engineer should have five (5) technicians and twenty-five (25) tradesmen but currently in Tanzania, it is the other way round. We have 25 engineers, five trades men and 1 technician. Because if you want to employ an engineer … , I can get an engineer in half an hour, but if you ask me to give you a technician, it might take me 3 months.

Previous studies (Moskalyk, 2011; Akintoye and Kumaraswamy, 2016; Dithebe et al., 2019a; Muleya et al., 2020) identified that lack of skills is among CFs that deprive private infrastructure financing. For instance, a study by Dithebe et al. (2019a) that aimed to determine the role of the state towards infrastructure development by holistically planning and engaging with the private sector found that, inter alia, lack of skills contributed to the deprivation of such needed infrastructure, which implies even the sought engagement of the private sector in financing such projects was deprived.

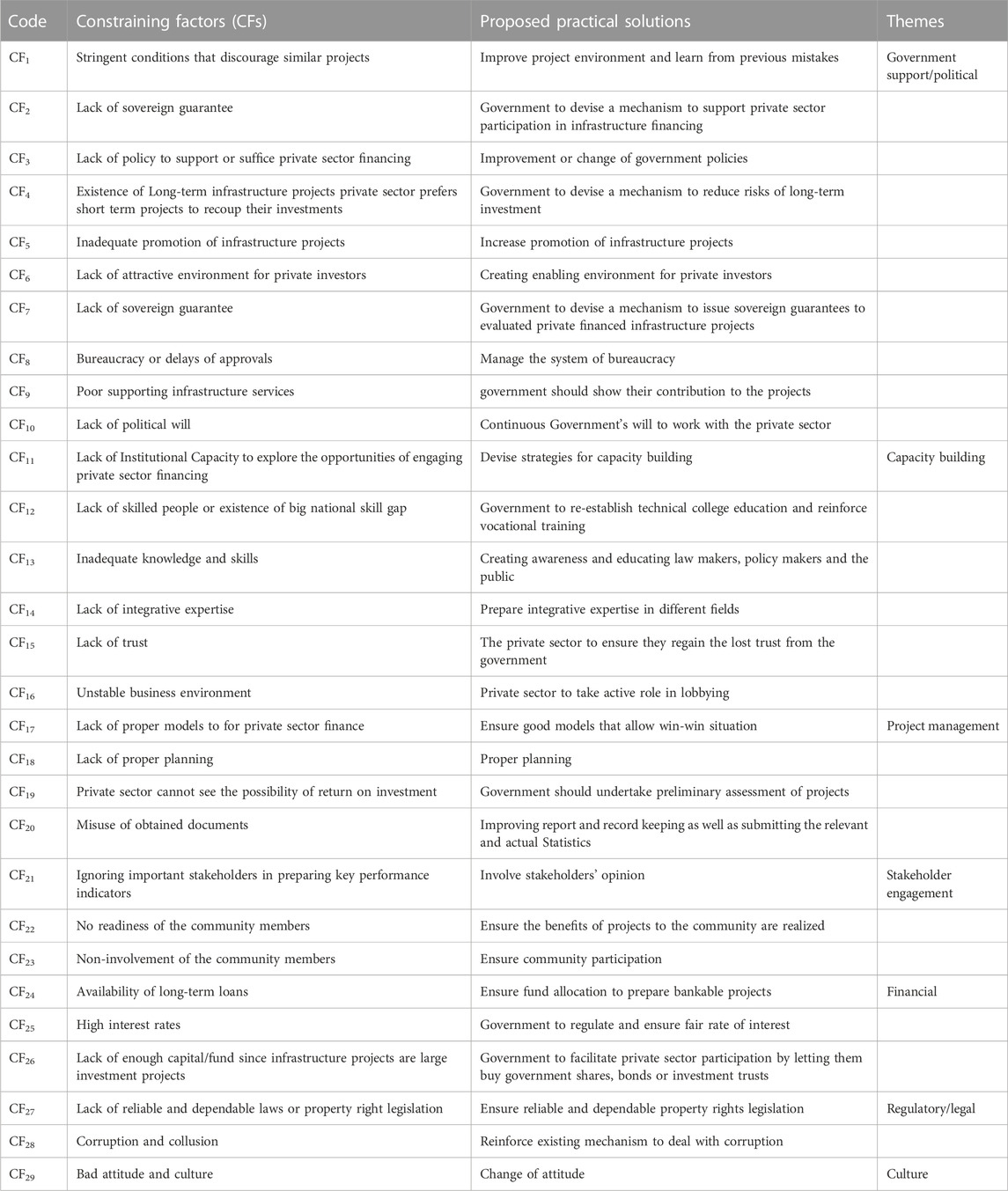

4.6 Solutions

Based on the analysis of interviewee perspectives regarding CFs for the use of PSF in the delivery of infrastructure projects in Tanzania, Table 4 summarizes the 29 proposed solutions and maps them to the identified CFs. Through content analysis, open coding was used to derive themes from the qualitative data so as to generate more meaningful information from the data. The authors reviewed the codes in the proposed solutions and came up with a total of seven themes. The derived themes include i) government support, ii)capacity building, iii) project management, iv)stakeholder engagement, v) financial vi) regulatory/legal framework and vii) culture. The identified themes eased the understanding and generation of knowledge. An examination of Table 4 demonstrates that the majority of the proposed solutions fell under government support theme, indicating that the government has a major role to play in order to enhance the PSF of the PI project. This finding is consistent with past PPP studies (Osei-Kyei and Chan, 2015; World Bank, 2016; Kavishe et al., 2018), which investigated the critical success factors for PPP projects in developing countries and reported that government support was identified and ranked among the highest factors. For developed countries like the United Kingdom and Hong Kong, PPP has existed for decades and has thus matured; therefore, their governments have facilitated and provided guarantees in order to attract private financing. Li et al. (2005) supports this by highlighting that Government guarantee/support is important in the initial stages of PPP development.

TABLE 4. Summary of practical solutions categorized into themes and as mapped to the respective CFs.

The second identified major theme is capacity building, within which the majority of the proposed solutions were nested within. Based on the identified CFs, there is a need to improve capacity for both parties. According to the World Bank (2017) report, private financiers have choices about where to invest their resources, but among other things, they will assess the government’s internal capacity to implement such projects.

Project management is the third identified theme under the proposed solutions intended to address the CFs. This is not a surprise, as most developing countries like Tanzania have been reported to have inadequate project management skills (Chileshe and Kikwasi. (2014). The public sector should be able to prepare bankable projects, undertake adequate planning, and adopt good models so as to stimulate private financing.

Stakeholder engagement/involvement is also among the key emergent theme comprised of involvement of stakeholders’ opinion, ensure the benefits of projects to the community are realized and Ensuring community participation. It is clearly known that PPP projects involve many stakeholders with different goals. It is thus vital to engage them all at an early stage of the project because stakeholder engagement related solutions are a key to managing the issues in PPP projects (Jayasuriya et al., 2020).

Financial systems, regulatory/legal frameworks, and culture were other emergent themes identified. These findings are supported by Babatunde and Perera’s (2017) study, which indicated the need for improved financial markets and packages so as to enhance PSF. Furthermore, the identified theme of regulatory/legal framework was another extracted theme under the proposed solutions. This is an important aspect as it sets out the rules for how PPPs should be executed; therefore, they should be coherent, unambiguous, predictable, and stable (World Bank, 2017). Lastly, the aspect of culture emerged as a theme, whereby a change of attitude was put forward as a solution to a bad attitude/culture.

5 Conclusion

This study employed semi-structured interviews, first, to identify and rank the CFs for the use of PSF in the delivery of infrastructure projects within Tanzania. Additionally, the study has proposed practical solutions for dealing with the CFs.

The results of the directed content analysis that was supplemented with summative techniques identified the top three (3) CFs in chronology of their significance. The first most significant factor among the CFs was inadequate knowledge and skills, which were cited by the majority of interviewees. The other two being jointly cited as the second most significant CFs were lack of policy to support PSF and bureaucracy or delays of approval, the former being refuted by proving the problem to fall in implementation of the policy rather than lack of policy.

This study not only offers new insights into the CFs (as summarized in Table III) to the use of PSF in infrastructure delivery but also provides useful information on the practical solutions (as shown in Table IV) with regard to the CFs. Some notable contributions to the study can be singled out. This study is the first research to identify the CFs for the use of PSF in Tanzanian infrastructure projects and advocate for practical solutions categorized into seven key themes. The identification of CFs through a semi-structured interview approach and the mapping of the proposed practical solutions to the project management field highly contribute to the body of knowledge, particularly in the Tanzanian context. Based on the Observation by Voordijk. (2012) the exploration of the constraining factors for the use of PSF in delivery of PI in Tanzania contributes to the reduction of tensions between western systems (i.e., constraining factors to use of PSFs—Tanzanian specific) and life world.

Similarly, this study has contributed to the SI research agenda, particularly through the proposed solutions geared towards solving the major infrastructure funding problem faced by the Tanzania construction sector in striving to plug the infrastructure gap. In this case, the study creates awareness about the existing CFs and proposes solutions in order to enhance the adoption of private financing. The created knowledge brings a practical alternative to over dependence on Chinese loans for most African countries, as reported by Muchapondwa et al. (2016). Therefore, there was a need to undertake such studies in a much less studied context like Tanzania.

5.1 Implications

Based on the findings, the study highlights important practical and policy implications for infrastructure sector practitioners and the government. By understanding the CFs for the use of PSF, both the Tanzanian private and public sectors practitioners might be in a better position to adopt devised mechanisms that would arise from the increased understanding of the CFs and their solutions.

For example, in the quest to solve the problem of the national skill gap, it was reported that most African governments have inadequate capacity to design and present projects that are financially attractive to investors (Collier, 2014). The government through capacity building as a proposed solution may re-establish technical colleges that were transformed into higher learning institutions and reinforce vocational education training. Technical colleges will help produce technicians in required influx, and vocational education training will increase the number of artisans, and by doing so, it will help improve the practice by solving the problem of a ratio imbalance between engineers, technicians, and artisans, who are crucial for infrastructure delivery. Likewise, both the public and local private financial institutions should strategically hire and train their staff to acquire integrative expertise in different fields so as to be able to assess the risks associated with the funding of large infrastructure projects.

On the other side, the government could amend some of its policy directions so as to enable smooth implementation of the policies, i.e., enabling private sector engagement in PI financing. For instance, in the Tanzania national PPP policy of 2009, the pricing for PPPs policy directive no. 3.10 states that “the government, in collaboration with stakeholders, will adopt and implement a PPPs pricing policy that provides suitable and sustainable pricing instruments.” By using the phrase “stakeholders,” this policy directive becomes too general for implementation as it expressly ignores the private sector, and for that, the government has on many occasions worked in collaboration with stakeholders who are government institutions, as evidenced in previous existing PPP projects in Tanzania such as the Kigamboni Bridge (the government collaborated with its public agency). So, for proper implementation, the amendment could be to replace the word “stakeholders” with the phrase “private sector.” Subsequently, this could lead to an increase in the adoption of PSF and enhance performance outcomes within infrastructure sectors and the economy, which was acknowledged as having earlier financing challenges to plug the infrastructure gap.

Additionally, the findings would provide the government with further policy directions for creating an enabling environment for the use of private financing. For example, the issue of a sovereign guarantee that emerged in the findings (see Table 3), if unconstrained and implemented, would assure project lenders that the government would take action in case of problems or refrain from taking action to support the projects eventually; this would address the issues of delays and burecracy. Besides, the government, through the central bank, could review the borrowing rates in order to regulate commercial banks and create an enabling business environment.

5.2 Limitations

Despite the study’s contributions, this study was limited to stakeholders in Tanzania. Interview data were collected from only private and public practitioners from infrastructure sector organizations located mainly in one city, Dar es Salaam, with the exception of only three respondents who were from other regions outside Dar es Salaam. Therefore, the results may not be generalizable to surrounding countries sharing similar economic conditions, such as the East African countries (Kenya, Uganda, Rwanda, Burundi, and South Sudan and Uganda). Thus, future studies can be undertaken to cover other parts of Tanzania as well as other similar countries. Another limitation lies in the fact that a small sample was used; therefore, the results cannot be readily generalized. However, based on the interviewees’ positions, years of experience, and educational backgrounds, the research outputs are still significant and reliable for future reference. Furthermore, Smith. (2017) asserted that the rich knowledge and small samples purposefully chosen are unique strengths of qualitative research, even if they are highlighted as limitations in some studies.

Data availability statement

The raw data supporting the conclusion of this article will be made available by the authors without undue reservation.

Author contributions

Conceptualization: NK, SZ, VL, IM, and EZ; methodology: NK and VL; validation: NK and VL; formal analysis: NK and VL; investigation: NK and VL; resources: NK and SZ; data curation: NK; writing—original draft preparation: NK and VL; writing—review and editing: SZ, IM, EZ, CM, and NC; and visualization: NK, SZ, and NC. All authors read and agreed to the published version of the manuscript.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors, and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Akintoye, A., and Kumaraswamy, M. (2016). Public private partnerships: A global review, CIB series TG72 public private partnerships, report for the international council for research and innovation in building and construction. Delft, Netherlands: CIB General Secretariat.

Annamalai, T. R., and Jain, N. (2013). Project finance and investments in risky environments: Evidence from the infrastructure sector. J. Financial Manag. Prop. Constr. 18 (3), 251–267. doi:10.1108/jfmpc-08-2012-0033

Ardichvili, A., Page, V., and Wentling, T. (2003). Motivation and barriers to participation in virtual knowledge-sharing communities of practice. J. Knowl. Manag. 7 (1), 64–77. doi:10.1108/13673270310463626

Babatunde, S. O., and Perera, S. (2017). Barriers to bond financing for public-private partnership infrastructure projects in emerging markets: A case of Nigeria. J. Financial Manag. Prop. Constr. 22 (1), 2–19. doi:10.1108/jfmpc-02-2016-0006

Barnett, M. J. N. (1989). Role of private sector finance. J. Prof. Issues Eng. Educ. Pract. 115 (1), 16–18. doi:10.1061/(asce)1052-3928(1989)115:1(16)

Baumli, K., and Jamasb, T. (2020). Assessing private investment in african renewable energy infrastructure: A multi-criteria decision analysis approach. Sustainability 12 (22), 9425. doi:10.3390/su12229425

Bielenberg, A., Kerlin, M., Oppenheinrn, J., and Roberts, M. (2016). Financing change: How to mobilize public sector infrastructure for sustainable infrastructure. Chicago: McKinsey Centre for business and environment.

Bolomope, M. T., Baffour Awuah, K. G., Amidu, A. R., and Filippova, O. (2021). The challenges of access to local finance for PPP infrastructure project delivery in Nigeria. J. Financial Manag. Prop. Constr. 26 (261), 63–86. doi:10.1108/jfmpc-10-2019-0078

Chan, A. P. C., and Effah Ameyaw, E. (2013). The private sector's involvement in the water industry of Ghana. J. Eng. Des. Technol. 11 (3), 251–275. doi:10.1108/jedt-12-2011-0080

Cheung, E., and Chan, A. P. C. (2009). Is BOT the best financing model to procure infrastructure projects? A case study of the Hong Kong-zhuhai-Macau bridge. J. Prop. Invest. Finance 27 (3), 290–302. doi:10.1108/14635780910951984

Chileshe, N., Kavishe, N., and Edwards, D. J. (2020). Critical factors influencing the bid or no-bid decision of the indigenous small building contractors in Tanzania. Constr. Innov. 21 (2), 182–202. doi:10.1108/ci-09-2019-0098

Chileshe, N., Kavishe, N., and Edwards, D. J. (2021). Identification of critical capacity building challenges in public-private partnerships (PPPs) projects: The case of Tanzania. Int. J. Constr. Manag. 1, 10. doi:10.1080/15623599.2021.1892947

Chileshe, N., and Kavishe, N. (2021). Readiness assessment of public–private partnerships (PPPs) adoption in developing countries: The case of Tanzania. Built Environ. Proj. Asset Manag. 11 (1), 71–87. doi:10.1108/bepam-12-2019-0133

Chileshe, N., and Kikwasi, G. J. (2014). Critical success factors for implementation of risk assessment and management practices within the Tanzanian construction industry. Eng. Constr. Archit. Manag. 21 (3), 291–319. doi:10.1108/ecam-01-2013-0001

Chotia, V., and Rao, N. V. M. (2018). Infrastructure financing and economic growth in India: An empirical investigation. J. Financial Manag. Prop. Constr. 23 (3), 258–273. doi:10.1108/jfmpc-12-2016-0056

Collier, P. (2014). Attracting international private finance for African infrastructure☆. J. Afr. Trade 1 (1), 37–44. doi:10.1016/j.joat.2014.09.002

Creswell, J. W., and Miller, D. L. (2000). Determining validity in qualitative inquiry. Theory into Pract. 39 (3), 124–130. doi:10.1207/s15430421tip3903_2

Creswell, J. W. (2013). Research design: Qualitative, quantitative, and mixed methods approaches. Thousand Oaks: Sage publicationsUnited States of America.

De Vries, P. (2007). The taxpayer-shareholder fallacy and private finance initiatives. J. Public Budg. Account. Financial Manag. 19 (3), 273–289. doi:10.1108/jpbafm-19-03-2007-b001

Dithebe, K., Aigbavboa, C. O., Thwala, W. D., and Oke, A. E. (2019b). Analysis on the perceived occurrence of challenges delaying the delivery of water infrastructure assets in South Africa. J. Eng. Des. Technol. 17 (3), 554–571. doi:10.1108/jedt-10-2017-0101

Dithebe, K., Aigbavboa, C., and Thwala, D. W. (2019a). “An appraisal of water infrastructure projects’ financing challenges in South Africa,” in 10th nordic conference on construction economics and organization. Editors I. Lill, and E. Witt (Bingley: Emerald Publishing Limited), 103–110. doi:10.1108/S2516-285320190000002022

Dixon, T., Pottinger, G., and Jordan, A. (2005). Lessons from the PSF initiative in the UK: Benefits, problems and critical success factors. J. Prop. Invest. Finance 23 (5), 412–423. doi:10.1108/14635780510616016

Dollery, B., Kortt, M. A., and Grant, B. (2021). Harnessing private funds to alleviate the Australian Local Government infrastructure backlog. Econ. Pap. 31 (1), 114–122. doi:10.1111/j.1759-3441.2011.00153.x

Fay, M., Martimort, D., and Straub, S. (2021). Funding and financing infrastructure: The joint-use of public and private finance. J. Dev. Econ. 150, 102629–102722. doi:10.1016/j.jdeveco.2021.102629

Giti, D. M., K'Akumu, O. A., and Ondieki, E. O. (2020). Enhanced role of private sector through public private partnerships in low income urban housing in Kenya. J. Financial Manag. Prop. Constr. 25 (2), 293–312. doi:10.1108/jfmpc-07-2019-0057

Godoi, A., Silva, L. F., and Cardoso, O. O. (2017). Ensaio teórico sobre a burocracia em weber, O conflito de agência E a governança corporativa: UMA reflexão sobre a burocracia profissionalizante. Rev. Adm. Roraima-UFRR 7 (2), 426–447. doi:10.18227/2237-8057rarr.v7i2.4034

Hsieh, H. F., and Shannon, S. E. (2005). Three approaches to qualitative content analysis. Qual. health Res. 15 (9), 1277–1288. doi:10.1177/1049732305276687

Hutchison, N., Squires, G., Adair, A., Berry, J., Lo, D., McGreal, S., et al. (2016). Financing infrastructure development: Time to unshackle the bonds? J. Prop. Invest. Finance 34 (3), 208–224. doi:10.1108/JPIF-07-2015-0047

Ismail, S., and Haris, A. F. (2014). Constraints in implementing public private partnership (PPP) in Malaysia. Built Environ. Proj. Asset Manag. 4 (3), 238–250. doi:10.1108/bepam-10-2013-0049

Jackson, B. M., and Hlahla, M. (1999). South Africa's infrastructure service delivery needs: The role and challenge for public-private partnerships. Dev. South. Afr. 16 (4), 551–563. doi:10.1080/03768359908440101

Janssen, R., Graaf, R. d., Smit, M., and Voordijk, H. (2016). Why local governments rarely use PPPs in their road development projects: Understanding the barriers. Int. J. Manag. Proj. Bus. 9 (1), 33–52. doi:10.1108/ijmpb-06-2015-0043

Jayasuriya, S., Zhang, G., and Yang, R. J. (2020). Exploring the impact of stakeholder management strategies on managing issues in PPP projects. Int. J. Constr. Manag. 20 (6), 666–678. doi:10.1080/15623599.2020.1753143

Kavishe, N., and Chileshe, N. (2019). Critical success factors in public-private partnerships (PPPs) on affordable housing schemes delivery in Tanzania: A qualitative study. J. Facil. Manag. 17 (2), 188–207. doi:10.1108/jfm-05-2018-0033

Kavishe, N., and Chileshe, N. (2020). Driving forces for adopting public–private partnerships in Tanzanian housing projects. Int. J. Constr. Manag. 20 (8), 912–927. doi:10.1080/15623599.2018.1502931

Kavishe, N., Jefferson, I., and Chileshe, N. (2018). An analysis of the delivery challenges influencing public-private partnership in housing projects: The case of Tanzania. Eng. Constr. Archit. Manag. 25 (2), 202–240. doi:10.1108/ecam-12-2016-0261

Konijn, P., and van Tulder, R. (2015). Resources-for-infrastructure (R4I) swaps: A new model for successful internationalisation strategies of rising power firms? Crit. Perspect. Int. Bus. 11 (3/4), 259–284. doi:10.1108/cpoib-02-2013-0008

Li, B., Akintoye, A., Edwards, P. J., and Hardcastle, C. (2005). Critical success factors for PPP/PFI projects in the UK construction industry Construction Management and Economics 23 (5), 459–471.

Moles, P., and Williams, G. (1995). Privately funded infrastructure in the UK: Participants' risk in the Skye Bridge project. Transp. Policy 2 (2), 129–134. doi:10.1016/0967-070x(95)91992-s

Moskalyk, A. (2011). Public-private partnerships in housing and urban development. Nairobi, Kenya: UN-HABITAT.

Muchapondwa, E., Nielson, D., Parks, B., Strange, A. M., and Tierney, M. J. (2016). ‘Ground-Truthing’Chinese development finance in Africa: Field evidence from South Africa and Uganda. J. Dev. Stud. 52 (6), 780–796. doi:10.1080/00220388.2015.1087510

Muleya, F., Zulu, S., and Nanchengwa, P. C. (2020). Investigating the role of the public private partnership act on private sector participation in PPP projects: A case of Zambia. Int. J. Constr. Manag. 20 (6), 598–612. doi:10.1080/15623599.2019.1703088

Nowell, L. S., Norris, J. M., White, D. E., and Moules, N. J. (2017). Thematic analysis: Striving to meet the trustworthiness criteria. Int. J. Qual. Methods 16, 160940691773384–13. doi:10.1177/1609406917733847

OECD (2018). Global outlook on financing for sustainable development 2019: Time to face the challenge. Paris: OECD Publishing. doi:10.1787/9789264307995-en

Osei-Kyei, R., and Chan, A. P. (2017). Implementation constraints in public-private partnership: Empirical comparison between developing and developed countries. J. Facil. Manag. 15 (1), 90–106. doi:10.1108/jfm-07-2016-0032

Osei-Kyei, R., and Chan, A. P. (2015). Review of studies on the critical success factors for public–private partnership (PPP) projects from 1990 to 2013. Int. J. Proj. Manag. 33 (6), 1335–1346. doi:10.1016/j.ijproman.2015.02.008

Prakash, N., and Sethi, M. (2021). A review of innovative bond instruments for sustainable development in Asia. Int. J. Innovation Sci. 14, 630–647. doi:10.1108/IJIS-10-2020-0213

Sinha, A. K., and Jha, K. N. (2021). Financing constraints of public–private partnership projects in India. Eng. Constr. Archit. Manag. 28 (1), 246–269. doi:10.1108/ecam-06-2018-0237

Smith, B. (2017). Generalizability in qualitative research: Misunderstandings, opportunities and recommendations for the sport and exercise sciences. Qual. Res. Sport, Exerc. Health 10, 137–49. doi:10.1080/2159676X.2017.1393221

Tamošaitienė, J., Sarvari, H., Chan, D. W. M., and Cristofaro, M. (2021). Assessing the barriers and risks to private sector participation in Infrastructure construction projects in developing countries of Middle East. Sustainability 13, 153. doi:10.3390/su13010153

Voordijk, H. (2012). Contemporary issues in construction in developing countries. Constr. Manag. Econ. 30 (4), 331–333. doi:10.1080/01446193.2012.665171

Wang, N. (2014). PSF initiative as a new way to manage public facilities: A review of literature. Facilities 32 (11/12), 584–605. doi:10.1108/f-09-2012-0069

Williams, M., and Moser, T. (2019). The art of coding and thematic exploration in qualitative research. Int. Manag. Rev. 15 (1), 45–55.

World Bank (2017). Private financing of private sector infrastructure through PPPs in Latin America and the caribbean. Washington: World Bank Group. Available at: https://openknowledge.worldbank.org/bitstream/handle/10986/26406/114418-WPLACRegionalInfrastructureFinanceReportFINALFINAL-PUBLIC.pdf.

World Bank (2016). Tanzania economic update the road less traveled unleashing public private partnerships in Tanzania, Africa region macroeconomics and fiscal management global practice. Available at: http://www.worldbank.org/tanianla/economlcupdate (Accessed August 10, 2021).

Keywords: private sector finance, infrastracture, developing countries, Tanzania, infrastructure development, constraining factors

Citation: Kavishe N, Zulu SL, Luvara V, Zulu E, Musonda I, Moobela C and Chileshe N (2023) Exploring constraining factors for use of private sector finance in delivery of public sector infrastructure in Tanzania: A qualitative study. Front. Built Environ. 9:1098490. doi: 10.3389/fbuil.2023.1098490

Received: 15 November 2022; Accepted: 10 January 2023;

Published: 26 January 2023.

Edited by:

Yongkui Li, Tongji University, ChinaReviewed by:

Ulohomuno Afieroho, Alma Mater Europaea, SloveniaAndrew Agapiou, University of Strathclyde, United Kingdom

Copyright © 2023 Kavishe, Zulu, Luvara, Zulu, Musonda, Moobela and Chileshe. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Sambo Lyson Zulu, cy56dWx1QGxlZWRzYmVja2V0dC5hYy51aw==

Neema Kavishe

Neema Kavishe Sambo Lyson Zulu

Sambo Lyson Zulu Valentine Luvara1

Valentine Luvara1 Innocent Musonda

Innocent Musonda Cletus Moobela

Cletus Moobela Nicholas Chileshe

Nicholas Chileshe