- 1Department of Philosophy, Al-Farabi Kazakh National University, Almaty, Kazakhstan

- 2Almaty University of Power Engineering and Telecommunications Named After Gumarbek, Almaty, Kazakhstan

- 3Psychology Department, Sevastopol State University, Sevastopol, Russia

- 4Research Department of Physiotherapy, Medical Climatology and Resorts Factors, Academic Research Institute of Physical Methods of Treatment, Medical Climatology and Rehabilitation Named After I.M. Sechenov, Yalta, Republic of Crimea, Russia

- 5National Engineering Academy of the Republic of Kazakhstan, Almaty, Kazakhstan

It is shown that the statistics of transactions of the Ethereum cryptocurrency obeys well-defined patterns. Log dependency

1 Introduction

The blockchain technology is gaining increasing popularity among users (Zhang, 2022; Mohanta et al., 2018; Abou Jaoude and George Saade, 2019). This is manifested, among other things, in the growth of transaction volumes (Dutta et al., 2020), as well as in the fact that such technologies are finding a wider range of applications (Alqaryouti et al., 2020).

A significant number of reports concerning the matter is dedicated to various aspects of the development of blockchain technology. In addition to the aforementioned works, attention should also be paid to the discussions devoted to the prospects for the use of cryptocurrencies in the energy sector (Andoni et al., 2019), eLearning and Online Education (Alam et al., 2022), in healthcare (Abu-elezz et al., 2020), in the agricultural sector (Chinyamunjiko et al., 2022), etc. Some reports devoted to the analysis of spreading of cryptocurrencies from the point of view of financial crimes, for example, (Song et al., 2022), are presented in current literature.

It should be emphasized that blockchain technologies have an important feature: information about transactions and anonymous “wallets” of individual users is completely open. This makes it possible to analyze the behavior of users of this technology on a planetary scale, without any limitations. Moreover, in this case, the possibility arises to use methods similar to those used in statistical physics (Agosto et al., 2022; Caferra, 2022).

The fact is of extremely importance due to next reasons.

First of all, obtaining such results allows us to draw conclusions about economic activity in general.

In addition, there are a number of works, for example, (Herman and Goldberg, 1978; Friis-Christensen and Svensmark, 1997), in which the influence of the so-called space weather on the Earth’s shells was investigated, and such studies have been going on for a very long time. This term, as a rule, refers to a complex of impacts exerted on the atmosphere, climate, weather and biosphere (including humanity) by processes whose sources lie far beyond the Earth (flares on the Sun, the appearance of high-energy particle flows from separated regions of outer space, etc.).

Of particular interest is the possible influence of space weather on social processes in general. Such studies, as a rule, are carried out by finding correlations between certain time series of data that reflect indicators of social life (Kornblueh, 1999; Grigoriev et al., 2018a; Grigoriev et al., 2018b) with similar series that characterize space weather factors. One of the most used indicators is the Ap-index of geomagnetic activity (Vaquero and Vazquez, 2009).

In recent years, there has been interest in studying the possible impact of space weather on the most important economic indicators. Very interesting results have been obtained in this area of research. For example, for most of the countries one can find that the previous week’s unusually high levels of geomagnetic activity have a negative and statistically and economically significant impact on today’s stock returns (Krivelyova and Robotti, 2003). A pronounced correlation was also found between the negative stock market indices in the modern world and the monthly values of the Ap-index of geomagnetic activity (Peng et al., 2019). Statistical parameters of the interval distributions for price bursts of consumable basket and for sunspot minimum states are similar to one another, as was reported earlier for wheat price bursts (Pustil’nik and Din, 2004). In (Burakov, 2017), a literature review was conducted with numerous references to studies supporting the links between space weather and various economic indicators. Reference (Eastwood et al., 2017) analyzes the contribution of different space weather transmission channels to economic and technological systems.

There is, however, a very non-trivial question. Obtaining statistics reflecting the economic behavior of a population of people on a global scale (and not just the largest market players) has been a rather difficult task until very recently. Initially, the collection of such statistics encountered quite definite difficulties, related, in particular, to the heterogeneity of the data.

Features of the use of cryptocurrencies, in particular, the possibility of collecting transaction statistics on a planetary scale, radically change the state of affairs, at least in relation to the study of the impact of cosmic weather factors on the economic behavior of the economically active part of the planet’s population. The proof of this assertion is one of the main goals of this paper.

The possibility of studying the impact of space weather factors on the behavior of the Earth’s population on a global scale has another important aspect that is closely related to both the ideas of J. Lovelock (the concept of Gaia (Lovelock, 2000)) and the ideas of Vernadsky (the concept of the noosphere (Jasečková et al., 2022)).

In accordance with the ideas of J. Lovelock, everything that together makes up the shells of the Earth should be considered as a systemic integrity. A similar interpretation is also valid for Vernadsky’s ideas, according to which humanity can also be considered as a systemic integrity that forms a special shell of the Earth - the noosphere, which, in the first approximation, can be interpreted as the “sphere of Mind” (from the Greek “noos” - mind).

The proof that humanity is indeed a systemic integrity with specific properties can be presented without the use of mathematical models.

Indeed, any interpersonal communication is actually reduced to the exchange of signals between neurons that belongs to different brains (Gabrielyan et al., 2022; Vitulyova et al., 2020). We emphasize that the statement “information exchanging between individuals” is in fact a very rough approximation. In fact, there is an exchange of signals between neurons, the connections between which, ultimately, are responsible for processing the signals (acoustic, optical, etc.) that individuals exchange.

Therefore, a common neural network is formed (this common neural network can be identified with Vernadsky’s noosphere), and the fact that the exchange of signals is sporadic does not affect this conclusion. For a neural network to function as a whole, it is not necessary for communication channels between its elements to physically exist at every moment in time.

The ability of a neural network with feedback connections to process information nonlinearly depends on the number of its elements. The corresponding mathematical model was presented in (Suleimenov et al., 2022). Therefore, the formation of a general neural network leads to the emergence of a new quality (in the philosophical understanding of this term).

Particularly, it is permissible to assert that the non-personal level of information processing is formed in the noosphere (Bakirov et al., 2021).

Processes occurring at this level remain poorly understood, so the opportunities provided by studying the statistics of cryptocurrency use are of undoubted interest from this point of view. Moreover, in this regard, the question of the impact of space weather factors on these statistics becomes especially interesting.

Indeed, impacts of this kind are obviously rather weak (at least in terms of the energy they carry). A pronounced reaction in this case can take place only when the object of influence is a systemic integrity.

Thus, evidence of a pronounced influence of space weather factors on the economic behavior of cryptocurrency users can be considered as an additional argument in favor of considering the global neural network (noosphere) as a system integrity.

This formulation of the question has another aspect.

Indeed, the rapid development of telecommunication technologies allows one to say that at the current stage, the noosphere is being converted into a human-machine system (Bargh and McKenna, 2004). Pairing telecommunication networks with AI can obviously only reinforce such trends, and the above applies to the use of cryptocurrencies as well (Ressi et al., 2024). This conclusion correlates with the results of numerous studies showing that the development of the Internet significantly influences the nature of processes taking place in society (Hampton et al., 2010; Lee, 2019). Similar conclusions are made regarding the use of cryptocurrencies (Caliskan, 2020; Ferretti and D'Angelo, 2020).

However, even apart from the theory of the formation of the noosphere, the establishment of regularities reflecting the functioning of cryptocurrencies in the global human-machine environment represents a significant academic interest, particularly from the standpoint of the physics of complex systems and self-organization processes. Such research is currently being conducted (Ferretti and D'Angelo, 2020; Li et al., 2020).

This study shows that transactions of cryptocurrency Ethereum as well as bitcoin, follow simple regularities that directly result from the analysis of publicly available statistical data, which creates specific prerequisites for their use, including for the purpose of analyzing the behavior of economic agents. Prerequisites are also being created for studying the influence of “space weather” factors on the economic behavior of the Earth’s population on a global scale.

2 Data sources

All data was obtained from open sources, specifically from the Google Big Query open data repository. Big Query is a cloud service from Google designed for working with big data, launched in 2011. It offers an online data storage that allows securely storing and quickly processing large amounts of information without the need to involve a separate server for these purposes. The data was generated by running SQL queries directly through the Google Big Query console.

The data source for identifying the impact of space weather on the transaction statistics of the cryptocurrency in question is the constantly updated online file https://kp.gfz-potsdam.de/app/files/Kp_ap_Ap_SN_F107_since_1932.txt of GFZ German Research Center for Geosciences. The daily data were then averaged monthly.

3 Methods

To establish patterns that reflect the statistics of cryptocurrency transactions, we used standard linear regression methods applied to the dependences of the number of users N who performed n transactions on the number n in double logarithmic coordinates.

We also used the standard model of diffusion of innovations (the Bass model (Li et al., 2020)) to construct curves approximating the increase in the number of transactions of the considered cryptocurrency over time. This model, as well as its modern modifications (Bass, 1969; Guille et al., 2013), is based on the following considerations. It is assumed that information about a new product is disseminated through two channels: through advertising and through the exchange of information between consumers (word-in-mouth). In the simplest case, this allows us to write down a differential equation of Riccati type, which contains linear (advertising) and quadratic (word-in-mouth) terms. The solution of this equation is a logistic curve.

This model is considered as a background one, i.e., the impact of space weather factors is analyzed, among other things, on the basis of a set of data, which is formed by subtracting data obtained empirically from a set of data corresponding to the background model.

To analyze the impact of space weather factors on the statistics of transactions of the considered cryptocurrency, the method of cross-correlation analysis was used, specifically, its implementation in StatSoft Statistica 12. The crosscorrelation coefficient rxy(k) represents the correlation between two series X and Y, where X is lagged by k observations. The crosscorrelation coefficient is computed following the standard formulas, as described in, for example, (Kaso, 2018). Crosscorrelation analysis is successfully used in research (including economic research), see, for example, (Box and Jenkins, 1976; Borysov and Balatsky, 2014; Zhang et al., 2021; Bonanno et al., 2001). It is useful in those studies where the time series of quantitative variables are assumed to be related with possibly non-zero time lags. In this case, the crosscorrelation method allows us to identify the values of time lags, at which the values of the correlation coefficient are extreme, and to analyze their dynamics depending on the magnitude of the shift of the time series of one variable relative to another.

4 Results

4.1 Experimentally discovered patterns of Ethereum and bitcoin cryptocurrency transaction statistics

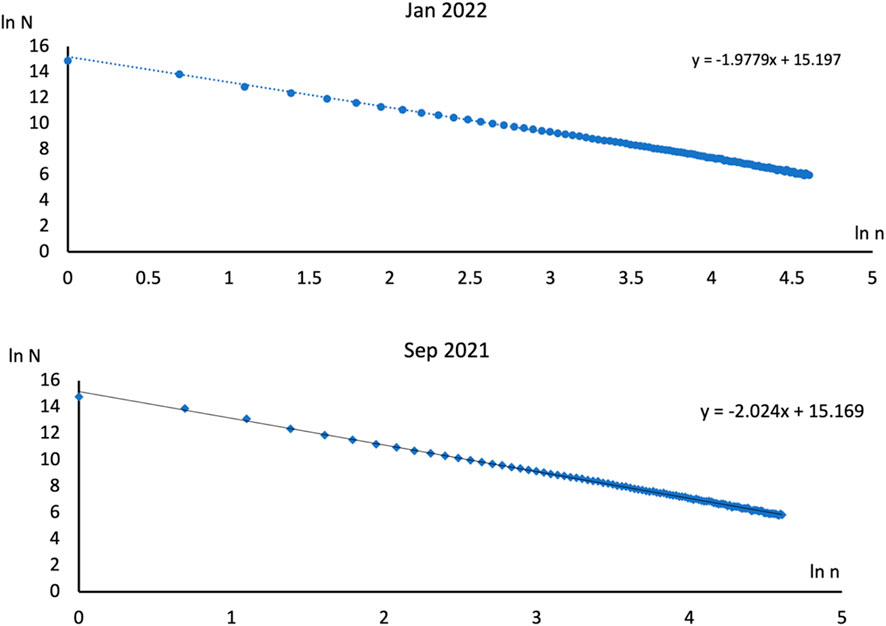

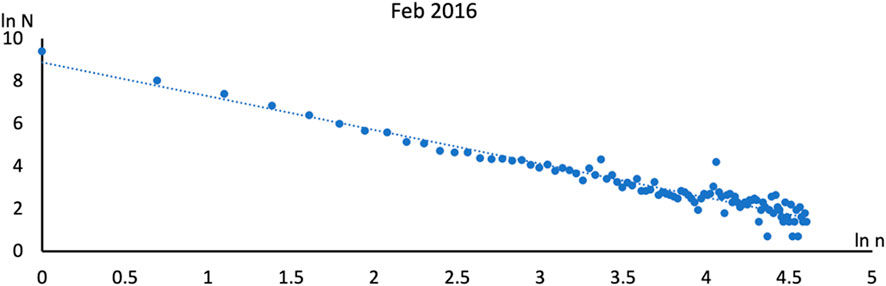

Figure 1 shows examples of dependencies reflecting monthly statistics of Ethereum cryptocurrency transactions in double logarithmic coordinates.

Figure 1. Examples of dependencies

Specifically, the values of logarithms

It can be seen the dependencies of

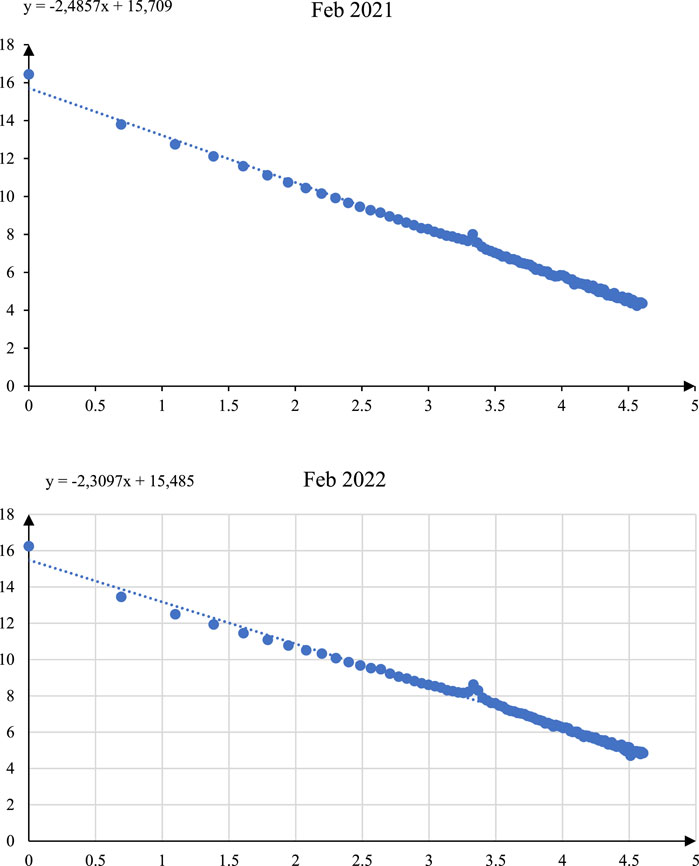

Moreover, such linear dependencies are observed for each month, starting from the moment of introduction of the Ethereum cryptocurrency into use. The only difference is that in the early stages of using the considered cryptocurrency, the accuracy of the linear law was slightly lower (Figure 2).

Figure 2. Examples of

Similar results were obtained for bitcoin (Figures 3, 4).

Figure 3. Examples of dependencies

Figure 4. Examples of

The obtained result clearly indicates that the relationship

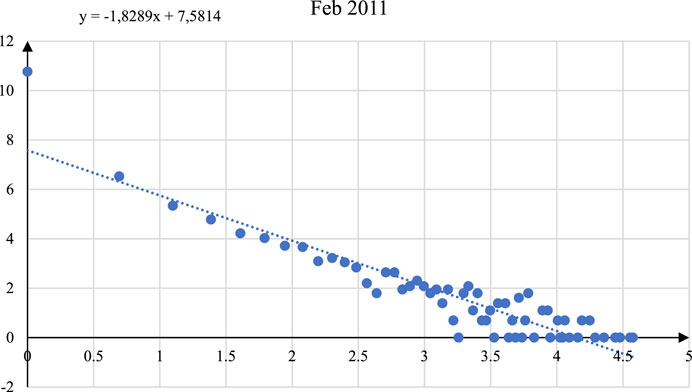

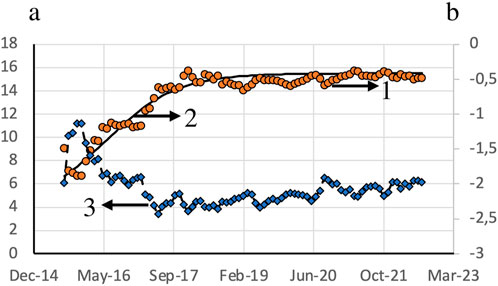

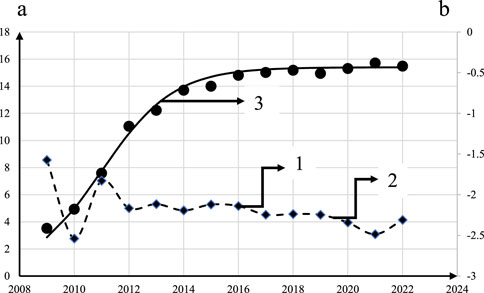

The dependencies of the parameters

Figure 5. Dependence of the parameters a (curves 1 and 2) and b (curve 3) for the Ethereum cryptocurrency on time; curve 1 (points) - experimental data, solid curve 3 - approximation by a logistic function.

The parameters appearing in this formula have the following numerical values:

Figure 6. Dependence of the parameters a (curves 1 and 3) and b (curve 2) for the bitcion on time; curve 1 (points) - experimental data, solid curve 3 - approximation by a logistic function.

The shape of the presented graphs suggests that it is reasonable to analyze the correlation between the considered parameters.

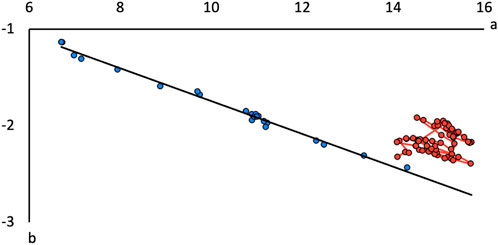

Figure 7 shows the dependence of parameter b on parameter a for the entire time interval of using the Ethereum cryptocurrency.

It can be seen that this dependence is divided into two segments. The first segment is well approximated by a straight line, while the second corresponds to fluctuations near a constant value of both parameters.

The first segment corresponds to the initial stage of the adoption of the Ethereum cryptocurrency (from August 2015 to June 2017), while the second segment (from July 2017 to September 2022) corresponds to the stage when it has already gained sufficient widespread use.

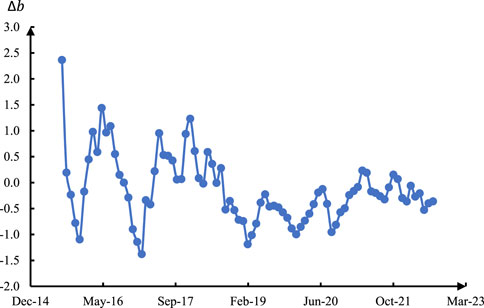

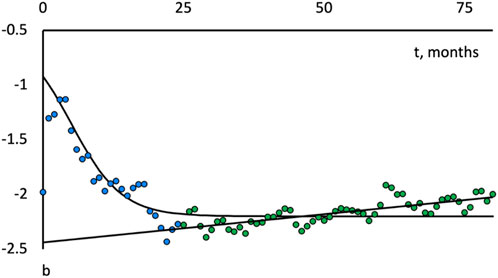

The difference in the behavior of the Ethereum cryptocurrency during the specified time intervals is also demonstrated in Figure 8.

Figure 8. The dependence of parameter b on time (dots) is shown, where curve 1 is an approximation according to Formula 2 and curve 2 is an approximation by a linear dependence.

The dependence of the parameter b on time expressed in months (points) and the approximating dependencies (curves 1 and 2, solid lines) are shown in this figure. It can be seen that during the first of the aforementioned time intervals, the behavior of the parameter under consideration is also well described by curve (2), the shape of which is typical for any transient process.

The parameters appearing in this formula have the following numerical values for this case:

The most important of these is the parameter

During the second of the intervals under consideration, the dependence of

Thus, the statistics of Ethereum cryptocurrency transactions, thanks to the identified patterns, can be reduced to two time series related to the dependencies of the coefficients characterizing straight lines, Figure 1, from time to time (when using monthly statistics).

This allows us to move on to building a methodology for identifying the impact of space weather on the economic behavior of cryptocurrency users on a global scale.

4.2 Results of applying correlation analysis

Figure 9 shows the dependence of the parameter

As expected, the values of the resulting time series oscillate around the zero value.

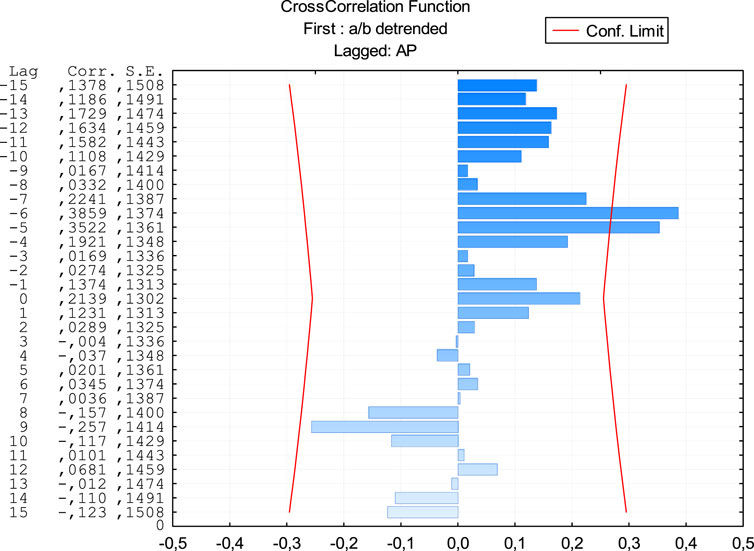

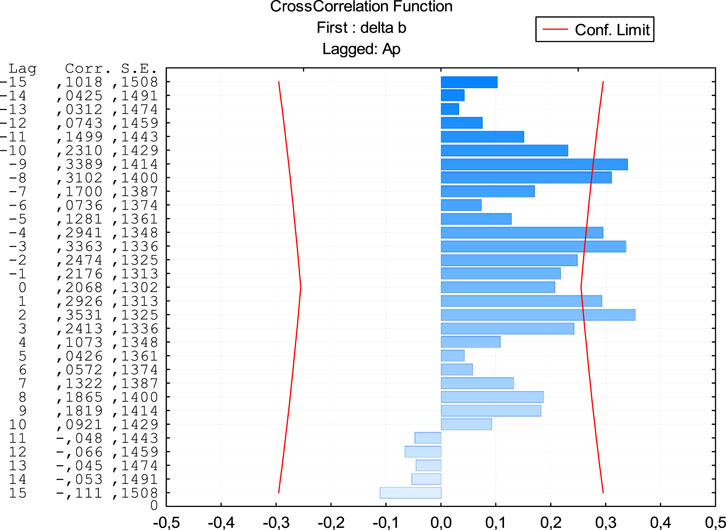

This time series was used to calculate the cross-correlation function (Figure 10) using standard software.

Figure 10. Cross-correlations between the parameter Δb and Ap-index of geomagnetic activity (averaged monthly).

It can be seen that the correlation is pronounced, there are peaks corresponding to −9, −3 and +2 months, which obviously go beyond the curves corresponding to 95% confidence intervals (solid lines in Figure 10).

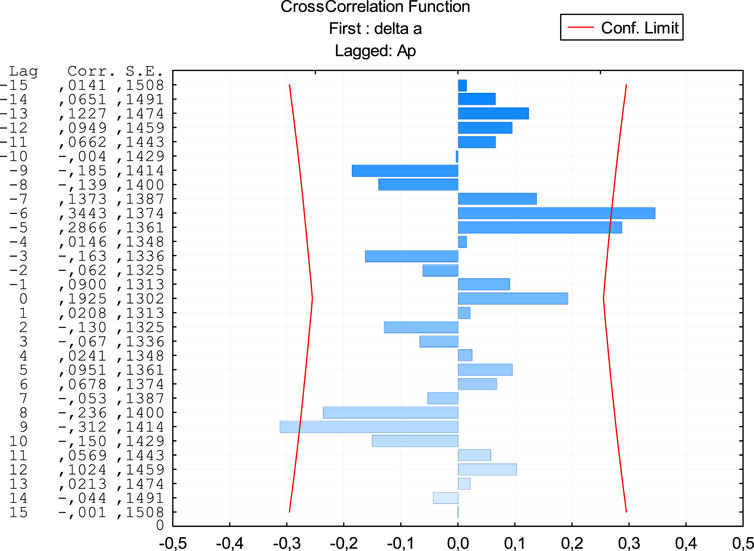

Similar calculations carried out using the second parameter Δa (these two parameters, as shown above, exhaustively characterize the transaction statistics of the cryptocurrency in question) are shown in Figure 11.

Figure 11. Cross-correlations between the parameter Δa and Ap-index of geomagnetic activity (averaged monthly).

It can be seen that in this case, too, pronounced peaks are observed, which obviously go beyond the level of statistical error.

However, a detailed consideration of the position of such peaks raises an important question related to cause-and-effect relationships. For example, the peak in Figure 11, corresponding to +9 months, can be interpreted as the reaction of the parameter Δa to the variations in the Ap index, which take place 9 months later than this reaction itself.

From the point of view of obvious considerations about causal relationships, the existence of such an “anticipatory reaction” seems very doubtful. Rather, in this case, one should speak about the existence of certain periodic processes that, for one reason or another, can be synchronized with each other.

The existence of cyclical processes in the economy has been considered in many works, but the most famous of them are the Kondratiev waves. The most important result on the centuries-old relationship of this indicator with space weather factors was obtained in (Vladimirsky, 2012).

Rhythms in the biosphere have their counterparts in terms of space weather; convincing evidence has been accumulated, the main mechanism of communication in biological and social systems with space weather factors is synchronization (Zenchenko and Breus, 2021; Martel et al., 2023).

However, to draw unambiguous conclusions based only on the data presented in such diagrams as Figures 10, 11 does not seem to be fully justified.

From a methodological point of view, it seems much more correct to study the influence of space weather factors on the relationship between parameters that reflect the real economic behavior of people. With regard to empirically obtained regularities (Figure 1), such a connection becomes especially simple.

Indeed, as follows from the data presented in Figure 7, parameters b and a have simple relationships that are revealed on the basis of empirical data. Such a relationship becomes especially simple (Figure 7, curve 2) for the case when the use of cryptocurrency reaches saturation. In this case, both parameters b and a acquire approximately constant values.

Therefore, to identify the influence of space weather factors on the behavior of cryptocurrency users, it makes sense to focus on a cross-correlation analysis of the relationship between these two parameters with the Ap index (Figure 12).

From the methodological point of view, this approach seems to be more justified than the analysis of direct correlations between the parameters describing the processes that are directly related to the economy and the parameters characterizing the factors of space weather.

Indeed, the patterns reflecting the statistics of cryptocurrency transactions are objective. This is confirmed by the linear nature of the dependencies presented in Figure 1, which, as experimental data show, is valid for the entire period of use of the considered cryptocurrency. There is every reason to believe (Figure 7, curve 2) that the relationships between the parameters that characterize the dependence are also objective and reflect, among other things, the processes taking place in the global economy. At the same time, the values of the parameters themselves may be subject to various kinds of influences, which are also of an economic nature (volatility of the global hydrocarbon market, for example,). Impacts of this kind can be uncontrollable and unpredictable, in addition, they can be cyclical, also due to purely economic reasons. Accordingly, the values of the parameters

If, however, the relationship between these parameters is of an objective nature, due to macroeconomic factors, then the violation of this relationship may well be associated with impacts that are not related to the economy.

Since the considered statistics refer to the planet as a whole, such impacts should also be of a global nature, which leads to the conclusion that the disruption of relationships between the considered parameters is primarily influenced by space weather factors.

This conclusion is directly confirmed by Figure 9, which has a single peak demonstrating that the space weather factors reflected by the Ap-index really affect the behavior of users of the cryptocurrency in question.

5 Discussion

The most reliable result of this work is reflected by the linear dependencies presented in Figures 1–4. This result is interesting in itself, as it can be considered as an additional argument in favor of the point of view, according to which the economic behavior of society members is subject to certain regularities, of an objective nature. The convenience of analyzing the statistics of cryptocurrency transactions here is that data on a global scale can be obtained, which in one way or another reflects the processes occurring in the economy.

An argument in favor of the reliability of the obtained results are also the dependencies presented in Figures 5, 6. Cryptocurrencies at the beginning of the twentieth century were clearly innovative products. Consequently, the fact that the obtained curves correspond with high accuracy to the theoretical curves derived from the model of innovation implementation provides some evidence in favor of the reliability of both the results themselves and the method used to process them.

It is also significant that the transaction statistics of both types of cryptocurrencies analyzed in this paper obey the same type of regularities (linear).

The most debatable result of this paper is obviously the correlations found between the ratio of the coefficients of the obtained linear dependencies and the Ap-index of geomagnetic activity. More precisely, this fact (as well as many other correlations found in studies on the influence of “space weather” on the biosphere) can be interpreted only on the basis of certain hypotheses that are not generally accepted.

As is known, the central problem of heliobiology is the issue related to the energy of influences coming from space, including near-Earth space. The energies associated with, say, magnetic storms, are many orders of magnitude less than the energy of those or other processes developing in the troposphere due to natural causes. It is very difficult to overcome this contradiction, however, recent achievements in the field of the theory of evolution of complex systems allow us to express some hypotheses that allow us to resolve the above contradiction, at least at the level of general methodological judgments.

Namely, in a series of works (Vanchurin et al., 2022a; Vanchurin et al., 2022b) devoted to the problems of pre-biological evolution, it was shown that evolutionary mechanisms can be realized due to the fact that physicochemical systems can be converted into analogues of neural networks. Moreover, these works advocated the viewpoint according to which it is the properties of such neural networks as a certain integrity that direct the course of evolutionary processes. Note that the point of view of the authors of these works clearly correlates with the results of (Kabdushev et al., 2023; Shaikhutdinov et al., 2024; Suleimenov et al., 2013), in which it was shown that there are conditions when a hydrophilic polymer solution is really able to convert into an analog of a neural network. Such effects can be observed at various levels of matter organization, including social (Suleimenov et al., 2016).

The results reflected in the works cited above serve at least as an indirect confirmation of V. Vanchurin’s very bold and extraordinary hypothesis formulated in (Vanchurin, 2020). In accordance with this hypothesis, the Universe as a whole is an analog of a neural network, and, consequently, it is, among other things, a quite definite system of information processing (philosophical aspects of this conclusion were considered in (Suleimenov et al., 2024)). If this hypothesis is true, then different levels of matter organization should correspond to analogues of neural networks nested in each other and forming a quite definite hierarchy. One of the levels in this hierarchy can be correlated with the noosphere, the other with Gea, understood according to Lovelock.

Accordingly, if the hypothesis (Vanchurin, 2020) is correct, Gaia can react not only to “physical” but also to informational influences. The difference between them can be demonstrated by the simplest example. A ferret smelling a chicken performs quite certain actions to satisfy its appetite. The expenditure of energy for these actions is very significant, especially if we compare them with the energy of those processes that take place in the olfactory receptors of the ferret. It is obvious that in this case we should speak about informational influence. Energy expenditures for this impact are obviously secondary.

Consequently, if the hypothesis (Vanchurin, 2020) is correct, Gaia appears to be able to process information coming from outside. The same thesis can be extended to its separate shells, in particular, the noosphere, the processes occurring in which cannot but be reflected in the economy.

There is no doubt that this thesis will remain controversial for many years to come, especially if we take into account the philosophical aspect of the problems involved (Suleimenov et al., 2024). However, it allows us to interpret the results obtained, at least from a general methodological point of view. Indeed, if the noosphere (as a subsystem of the system “Gaia”) in one way or another assimilates the information coming from outside, it cannot but affect the processes of global scale. In this sense, let us emphasize once again, the analysis of any statistics related to cryptocurrencies is undoubtedly of interest, although it is premature to draw any specific conclusions about the nature of cause-and-effect relationships.

Accordingly, in this paper we did not so much pursue the goal of identifying certain features of the impact of space weather on the economic behavior of cryptocurrency users, but rather to demonstrate that there is an additional tool for research in this area, and knowingly related to the noosphere as a whole.

There is every reason to believe that the nature of informational influences on the noosphere “from the outside” will remain unidentified for a very long time. However, since the noosphere (without regard to V. Vanchurin’s hypothesis) generates a quite definite system of information processing, such effects as those found in this paper should be considered, first of all, from the informational point of view. This, in particular, means that the real cause-and-effect relations can (and, most likely, will be) very difficult to identify, which, however, does not exclude the need to search for additional arguments that allow us to consider the noosphere (more broadly, Gaia) as a system of information processing, which is known to have some nontrivial behavior.

There is no doubt that in the foreseeable future, concepts of this kind may acquire a political dimension, just as many environmental organizations have used the concept of Gaia to justify their programs. The difference is that the consideration of the noosphere as a wholeness touches upon the informational and financial aspect, and there is every reason to believe that further work in this direction will provide additional arguments in favor of considering humanity as a single organism.

6 Conclusion

Thus, data presented in this study demonstrate that the statistics of transactions of cryptocurrency Ethereum and bitcoin obey pronounceable regularities, which in logarithmic coordinates lead to straight lines

It is essential that the statistics under cosideration (due to the peculiarities of the mechanism of functioning of cryptocurrencies) obviously cover all users cryptocurrencies on a planetary scale. This allows us to propose a new method for studying the impact of space weather factors on the economic behavior of people.

The obtained results from the general methodological point of view allow interpretation on the basis of Vanchurin’s hypothesis, according to which the Universe as a whole should be considered as an analog of a neural network. According to this hypothesis, the impact of “space weather” factors, first of all, should be considered as informational.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

YV: Funding acquisition, Formal analysis, Project administration, Visualization, Writing–original draft, Writing–review and editing. IM: Methodology, Resources, Validation, Writing–review and editing. PG: Conceptualization, Formal analysis, Methodology, Resources, Writing–original draft, Writing–review and editing. IS: Conceptualization, Writing–original draft, Writing–review and editing.

Funding

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. This research has been funded by the Committee of Science of the Ministry of Science and Higher Education of the Republic of Kazakhstan (Grant No. AP15473224).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abou Jaoude, J., and George Saade, R. (2019). Blockchain applications – usage in different domains. IEEE Access 7, 45360–45381. doi:10.1109/ACCESS.2019.2902501

Abu-elezz, I., Hassan, A., Nazeemudeen, A., Househ, M., and Abd-alrazaq, A. (2020). The benefits and threats of blockchain technology in healthcare: a scoping review. Int. J. Med. Inf. 142, 104246. doi:10.1016/j.ijmedinf.2020.104246

Agosto, A., Cerchiello, P., and Pagnottoni, P. (2022). Sentiment, Google queries and explosivity in the cryptocurrency market. Phys. A Stat. Mech. its Appl. 605, 128016. doi:10.1016/j.physa.2022.128016

Alam, A. (2022). “Platform utilising blockchain technology for eLearning and online education for open sharing of academic proficiency and progress records,” in Smart data intelligence. Algorithms for intelligent systems Editors R. Asokan, D. P. Ruiz, Z. A. Baig, and S. Piramuthu, 307–320.

Alqaryouti, O., Siyam, N., Alkashri, Z., and Shaalan, K. (2020). “Cryptocurrency usage impact on perceived benefits and users’ behaviour,” in Information systems. EMCIS 2019. Lecture notes in business information processing. Editors M. Themistocleous, and M. Papadaki, 381, 123–136. doi:10.1007/978-3-030-44322-1_10

Andoni, M., Robu, V., Flynn, D., Abram, S., Geach, D., Jenkins, D., et al. (2019). Blockchain technology in the energy sector: a systematic review of challenges and opportunities. Renew. Sustain. Energy Rev. 100, 143–174. doi:10.1016/j.rser.2018.10.014

Bakirov, A. S., Vitulyova, Y. S., Zotkin, A. A., and Suleimenov, I. E. (2021). Internet users’ behavior from the standpoint of the neural network theory of society: prerequisites for the meta-education concept formation. Int. Archives Photogrammetry, Remote Sens. Spatial Inf. Sci., 83–90. doi:10.5194/isprs-archives-XLVI-4-W5-2021-83-2021

Bargh, J. A., and McKenna, K. Y. (2004). The Internet and social life. Annu. Rev. Psychol. 55 (1), 573–590. doi:10.1146/annurev.psych.55.090902.141922

Bass, F. M. (1969). A new product growth for model consumer durables. Manag. Sci. 15, 215–227. doi:10.1287/mnsc.15.5.215

Bonanno, G., Lillo, F., and Mantegna, R. N. (2001). High-frequency cross-correlation in a set of stocks. Quant. Finance 1 (1), 96–104. doi:10.1080/713665554

Borysov, S. S., and Balatsky, A. V. (2014). Cross-correlation asymmetries and causal relationships between stock and market risk. PLoS One 9 (8), e105874. doi:10.1371/journal.pone.0105874

Box, G. E. P., and Jenkins, G. M. (1976). Time series analysis: forecasting and control. San Francisco: Holden Day.

Burakov, D. (2017). Do sunspots matter for cycles in agricultural lending: a VEC approach to Russian wheat market. AGRIS on-line Pap. Econ. Inf. 9 (1), 17–31. doi:10.7160/aol.2017.090102

Caferra, R. (2022). Sentiment spillover and price dynamics: information flow in the cryptocurrency and stock market. Phys. A Stat. Mech. its Appl. 593, 126983. doi:10.1016/j.physa.2022.126983

Caliskan, K. (2020). Data money: the socio-technical infrastructure of cryptocurrency blockchains. Econ. Soc. 49 (4), 540–561. doi:10.1080/03085147.2020.1774258

Chinyamunjiko, N., Makudza, F., and Mandongwe, L. (2022). The nexus between blockchain distributed ledger technology and financial crimes. Int. J. Financial, Account. Manag. 4 (1), 17–30. doi:10.35912/ijfam.v4i1.815

Dutta, P., Choi, T.-M., Somani, S., and Butala, R. (2020). Blockchain technology in supply chain operations: applications, challenges and research opportunities. Transp. Res. Part E Logist. Transp. Rev. 142, 102067. doi:10.1016/j.tre.2020.102067

Eastwood, J. P., Biffis, E., Hapgood, M. A., Green, L., Bisi, M. M., Bentley, R. D., et al. (2017). The economic impact of space weather: where do we stand? Risk Anal. 37 (2), 206–218. doi:10.1111/risa.12765

Ferretti, S., and D'Angelo, G. (2020). On the ethereum blockchain structure: a complex networks theory perspective. Concurrency Comput. Pract. Exp. 32 (12), e5493. doi:10.1002/cpe.5493

Friis-Christensen, E., and Svensmark, H. (1997). Variation of cosmic ray flux and global cloud coverage—a missing link in solar-climate relationships. Adv. Space Res. 20 (4/5), 913–921. doi:10.1016/s0273-1177(97)00499-7

Gabrielyan, O. A., Vitulyova, Y. S., and Suleimenov, I. E. (2022). Multi-valued logics as an advanced basis for artificial intelligence. Wisdom 1 (21), 170–181. doi:10.24231/wisdom.v21i1.721

Grigoriev, P. E., Vladimirskiy, B. M., Pobachenko, S. V., and Sokolov, M. V. (2018a). The variations in solar and geomagnetic activity modulate the dynamics of global military activity. Proc. SPIE 10833, 24th Int. Symposium Atmos. Ocean Opt. Atmos. Phys., 325. doi:10.1117/12.2504614

Grigoriev, P. E., Vladimirsky, B. M., and Luskova, Y. S. (2018b). Peculiarities of military and economic dynamics in the Middle Ages and early Modern times depending on space weather. Space Time 1-2 (31-32), 289–294. (in Russian). doi:10.24411/2226-7271-2018-11094

Guille, A., Hacid, H., Favre, C., and Zighed, D. A. (2013). Information diffusion in online social networks: a survey. ACM SIGMOD Rec. 42 (2), 17–28. doi:10.1145/2503792.2503797

Hampton, K. N., Livio, O., and Sessions Goulet, L. (2010). The social life of wireless urban spaces: Internet use, social networks, and the public realm. J. Commun. 60 (4), 701–722. doi:10.1111/j.1460-2466.2010.01510.x

Herman, J. R., and Goldberg, R. A. (1978). Sun, weather and climate, NASA SP-426; geophysics study committee, solar variability, weather and climate. Washington DC: National Academy Press.

Jasečková, G., Konvit, M., and Vartiak, L. (2022). Vernadsky's concept of the noosphere and its reflection in ethical and moral values of society. Hist. Sci. Technol. 12 (2), 231–248. doi:10.32703/2415-7422-2022-12-2-231-248

Kabdushev, S., Mun, G., Suleimenov, I., Alikulov, A., Shaikhutdinov, R., and Kopishev, E. (2023). Formation of hydrophobic–hydrophilic associates in the N-vinylpyrrolidone and vinyl propyl ether copolymer aqueous solutions. Polymers 15 (17), 3578. doi:10.3390/polym15173578

Kaso, A. (2018). Computation of the normalized cross-correlation by fast Fourier transform. Plos One 13 (9), e0203434. doi:10.1371/journal.pone.0203434

Kornblueh, I. H. (1999). In memoriam alexander leonidovich tchijevsky. Int. J. Biometeorology 9 (1), 99. doi:10.1007/BF02187321

Krivelyova, A., and Robotti, C. (2003). Playing the field: geomagnetic storms and international stock markets. Fed. Reserve Bank Atlanta, Work. Pap. No. 2003-5a.

Lee, J. Y. (2019). A decentralized token economy: how blockchain and cryptocurrency can revolutionize business. Bus. Horizons 62 (6), 773–784. doi:10.1016/j.bushor.2019.08.003

Li, Y., Islambekov, U., Akcora, C., Smirnova, E., Gel, Y. R., and Kantarcioglu, M. (2020). Dissecting ethereum blockchain analytics: what we learn from topology and geometry of the ethereum graph? Proc. 2020 SIAM Int. Conf. data Min., 523–531. doi:10.1137/1.9781611976236.59

Martel, J., Chang, S. H., Chevalier, G., Ojcius, D. M., and Young, J. D. (2023). Influence of electromagnetic fields on the circadian rhythm: implications for human health and disease. Biomed J. 46 (1), 48–59. doi:10.1016/j.bj.2023.01.003

Mohanta, B. K., Panda, S. S., and Jena, D. (2018). “An overview of smart contract and use cases in blockchain technology,” in 2018 9th International Conference on Computing, Communication and Networking Technologies (ICCCNT), 1–4. doi:10.1109/icccnt.2018.8494045

Peng, L., Li, N., and Pan, J. (2019). Effect of ap-index of geomagnetic activity on S& 500 stock market return. Adv. Astronomy 2019, 1–8. doi:10.1155/2019/2748062

Pustil’nik, L. A., and Din, G. Y. (2004). Influence of solar activity on the state of the wheat market in medieval England. Sol. Phys. 223, 335–356. doi:10.1007/s11207-004-5356-5

Ressi, D., Romanello, R., Piazza, C., and Rossi, S. (2024). AI-enhanced blockchain technology: a review of advancements and opportunities. J. Netw. Comput. Appl. 225, 103858. doi:10.1016/j.jnca.2024.103858

Shaikhutdinov, R., Mun, G., Kopishev, E., Bakirov, A., Kabdushev, S., Baipakbaeva, S., et al. (2024). Effect of the formation of hydrophilic and hydrophobic–hydrophilic associates on the behavior of copolymers of N-vinylpyrrolidone with methyl acrylate in aqueous solutions. Polymers 16 (5), 584. doi:10.3390/polym16050584

Song, L., Luo, Y., Chang, Z., Jin, C., and Nicolas, M. (2022). Blockchain adoption in agricultural supply chain for better sustainability: a game theory perspective. Sustainability 14 (3), 1470. doi:10.3390/su14031470

Suleimenov, I., Güven, O., Mun, G., Beissegul, A., Panchenko, S., and Ivlev, R. (2013). The formation of interpolymer complexes and hydrophilic associates of poly (acrylic acid) and non-ionic copolymers based on 2-hydroxyethylacrylate in aqueous solutions. Polym. Int. 62 (9), 1310–1315. doi:10.1002/pi.4422

Suleimenov, I., Panchenko, S., Gabrielyan, O., and Pak, I. (2016). Voting procedures from the perspective of theory of neural networks. Open Eng. 6 (1). doi:10.1515/eng-2016-0048

Suleimenov, I. E., Gabrielyan, O. A., Massalimova, A. R., and Vitulyova, Y. S. (2024). World Spirit form the standpoint of modern information theory. Eur. J. Sci. Theol. 20 (1), 19–31.

Suleimenov, I. E., Matrassulova, D. K., Moldakhan, I., Vitulyova, Y. S., Kabdushev, S. B., and Bakirov, A. S. (2022). Distributed memory of neural networks and the problem of the intelligence`s essence. Bull. Electr. Eng. Inf. 11 (1), 510–520. doi:10.11591/eei.v11i1.3463

Vanchurin, V., Wolf, Y. I., Katsnelson, M. I., and Koonin, E. V. (2022a). Toward a theory of evolution as multilevel learning. Proc. Natl. Acad. Sci. 119 (6), e2120037119. doi:10.1073/pnas.2120037119

Vanchurin, V., Wolf, Y. I., Koonin, E. V., and Katsnelson, M. I. (2022b). Thermodynamics of evolution and the origin of life. Proc. Natl. Acad. Sci. 119 (6), e2120042119. doi:10.1073/pnas.2120042119

Vitulyova, Y. S., Bakirov, A. S., Baipakbayeva, S. T., and Suleimenov, I. E. (2020). Interpretation of the category of complex in terms of dialectical positivism. IOP Conf. Ser. Mater. Sci. Eng. 946 (1), 012004. doi:10.1088/1757-899X/946/1/012004

Vladimirsky, B. M. (2012). Long Kondratiev's waves and cosmic climate. Geophys. Process. Biosphere 11 (2), 71–84. (in Russian).

Zenchenko, T. A., and Breus, T. K. (2021). The possible effect of space weather factors on various physiological systems of the human organism. Atmosphere 12, 346. doi:10.3390/atmos12030346

Zhang, M., Gao, F., Gao, J., Chen, W., and Lee, C. A. (2021). The cross-correlation relationship between the real estate industry and high-quality economic development. J. Syst. Sci. Inf. 9 (6), 704–720. doi:10.21078/JSSI-2021-704-17

Keywords: space weather, Ethereum cryptocurrency, blockchain, statistical distribution, transac-tions, noosphere

Citation: Vitulyova Y, Moldakhan I, Grigoriev P and Suleimenov I (2024) Some regularities of transaction statistics of cryptocurrency Ethereum: opportunities to study the impact of space weather on human economic behavior on a global scale. Front. Blockchain 7:1455451. doi: 10.3389/fbloc.2024.1455451

Received: 26 June 2024; Accepted: 11 November 2024;

Published: 29 November 2024.

Edited by:

Nicola Dimitri, University of Siena, ItalyCopyright © 2024 Vitulyova, Moldakhan, Grigoriev and Suleimenov. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yelizaveta Vitulyova, bGl6YXZpdGFAbGlzdC5ydQ==

Yelizaveta Vitulyova

Yelizaveta Vitulyova Inabat Moldakhan2

Inabat Moldakhan2