- 1Department of Computer Science, University of Duhok, Duhok, Iraq

- 2Quality Assurance Directorate, Duhok Polytechnic University, Duhok, Iraq

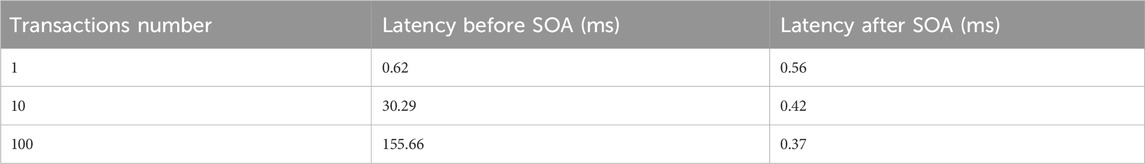

Scalability remains a critical challenge for blockchain technology, limiting its potential for widespread adoption in high-demand transactional systems. This paper proposes an innovative solution to this challenge by applying the Snake Optimization Algorithm (SOA) to a blockchain framework, aimed at enhancing transaction throughput and reducing latency. A thorough literature review contextualizes our work within the current state of blockchain scalability efforts. We introduce a methodology that integrates SOA into the transaction validation process of a blockchain network. The effectiveness of this approach is empirically evaluated by comparing transaction processing times before and after the implementation of SOA. The results show a substantial reduction in latency, with the optimized system achieving lower average transaction times across various transaction volumes. Notably, the latency for processing batches of 10 and 100 transactions decreased from 30.29 ms to 155.66 ms–0.42 ms and 0.37 ms, respectively, post optimization. These findings indicate that SOA is exceptionally efficient in batch transaction scenarios, presenting an inverse scalability behavior that defies typical system performance degradation with increased load. Our research contributes a significant advancement in blockchain scalability, with implications for the development of more efficient and adaptable blockchain systems suitable for high throughput enterprise applications.

1 Introduction

Decentralization has become a pivotal concept in the evolution of computing systems, finding applications across various fields such as the Industrial Internet of Things (IIoT), autonomous vehicles, supply chain management, and finance. This trend is further propelled by advanced computing frameworks like Cyber-Physical Systems (CPS). In these systems, the automated interaction among diverse and geographically spread entities is essential for their widespread adoption. In this context, Distributed Ledger Technologies (DLTs) have emerged as a fundamental enabler of decentralization in computing systems. DLTs facilitate the involvement of participants from varied networks to collaboratively record and share data on a synchronized ledger. These technologies are characterized by their public availability (in most cases) and the immutability (resistance to tampering) of the data, making them ideal for establishing trust in otherwise untrustworthy environments (Aitzhan and Svetinovic, 2016). Blockchain systems, a prime example of distributed ledger technologies, enable the recording of digital transactions in a chain of blocks. In these systems, each participant maintains a record of transactions in these interconnected blocks, with transaction inclusion dependent on the consensus of validating nodes, commonly known as miners. Blockchain-based systems are characterized by decentralization, transparency, a form of trust known as trustless-trust, immutability, and traceability. This is because they allow every participating node an equal chance to influence the ledger. The transparency and immutability of the system are maintained by allowing nodes to view and keep up the ledger, which can only be modified with the consensus of other mining nodes (Nakamoto, 2008). While Bitcoin (Nakamoto, 2008) remains the most well-known application of blockchain technology, its usage has expanded significantly into various domains such as healthcare, finance, e-government (Khan et al., 2018), and supply chain management (Nizamuddin et al., 2019), largely due to its security, immutability, and decentralization features. The broader adoption of blockchain has been driven by research extending beyond cryptocurrencies, focusing on various business models, domain applicability, and optimization for different uses. Platforms like Ethereum (Ranganthan et al., 2018), Multichain (Ismailisufi et al., 2020), and Hyperledger (Ucbas et al., 2023) have been instrumental in broadening the use of blockchain technology beyond cryptocurrency, significantly impacting its widespread adoption.

Despite the inherent advantages of blockchain, its increasing application across diverse fields has highlighted several challenges that need addressing for broader adoption. One such challenge is transaction malleability (Khan et al., 2020a), a notable threat for blockchain based applications, necessitating effective protection mechanisms to counteract it. Blockchain is potential for widespread adoption is greatly influenced by its capability to handle a large number of transactions, necessitating scalable solutions. Empirical analysis shows that Bitcoin, for example, manages about seven transactions per second, a figure that pales in comparison to VISA’s 2000 transactions per second (Morillon, 2022). This limitation becomes evident in applications requiring simultaneous processing of numerous transactions, such as public voting systems (Khan et al., 2020b). These situations underscore the need for focused research on enhancing the scalability of blockchain technology and addressing the associated challenges.

There is a prevailing notion to perceive blockchain as a “black box” for developing efficient decentralized applications. However, achieving efficiency in decentralized applications using blockchain technology requires a detailed examination of various characteristics. These include block size, transaction processing speed, and block generation rate. For example, Bitcoin’s block size is set at 1 MB, and it takes, on average, 10 min to generate a block (Morillon, 2022). Increasing the block size could improve throughput by accommodating more transactions in each block, but this also leads to longer block propagation times. Conversely, decreasing block size might reduce latency but risks creating multiple branches of the chain, known as forks (McConaghy, 2016). This delicate balance highlights the complexity of optimizing blockchain technology for enhanced performance and scalability.

Scalability in blockchain technology offers several key advantages, particularly in enhancing the performance and broadening the application of blockchain systems. Three main advantages of improved scalability in blockchain are:

1. Increased Transaction Throughput: One of the most significant advantages of scalability in blockchain is the ability to process a higher number of transactions per second. This is crucial for blockchain applications that aim to compete with or surpass traditional transaction processing systems, like those used by credit card companies. Improved scalability can bridge this gap, allowing blockchain systems to be more viable for high volume transaction environments, such as financial markets, large-scale retail, and online services.

2. Enhanced Efficiency in Diverse Applications: Scalable blockchain systems can effectively support a wide range of applications beyond cryptocurrencies, including large-scale supply chain management, voting systems, and complex financial services. These applications often require the concurrent processing of numerous transactions, which scalable blockchain systems can handle more efficiently. By enhancing the capacity to process and record vast amounts of data quickly, blockchain can become a more practical solution in sectors like healthcare for patient record management, government for e-governance, and logistics for real-time tracking.

3. Reduced Latency and Improved User Experience: Scalability improvements in blockchain can lead to reduced transaction confirmation times, thereby enhancing the overall user experience. In systems like Bitcoin, where block generation takes an average of 10 min, scalability enhancements could significantly reduce this time, leading to quicker verifications and more responsive systems. This reduction in latency is crucial for applications that rely on real-time data processing or need instant transaction confirmations, such as in trading platforms or instant payment services.

Scalability is a critical factor in the evolution and adoption of blockchain technology, as it directly impacts the system’s efficiency, application range, and user satisfaction. Recent advancements have been predominantly focused on improving consensus algorithms and transaction verification processes. However, scalability remains a bottleneck for widespread blockchain adoption, particularly in high-throughput environments. Traditional methods of enhancing scalability often lead to increased latency, creating a trade-off that is unacceptable for real-time transaction processing. It is within this context that we introduce the concept of applying a Snake Optimization Algorithm (SOA) to blockchain systems. SOA, inspired by the foraging behavior of snakes, is an optimization strategy known for its agility and precision in navigating complex landscapes. By adapting SOA to blockchain, we propose a method that not only addresses the latency issues inherent in scalability but also optimizes the transaction-processing pipeline.

This paper will elucidate the application of SOA within blockchain, detailing our proposed methodology and the subsequent impact on scalability. We will review existing literature to contextualize our approach within the current state of research and present empirical results that demonstrate the efficacy of SOA in enhancing blockchain transaction throughput. By bridging the gap between theoretical optimization strategies and practical blockchain scalability solutions, we aim to contribute a novel perspective to the ongoing discourse in blockchain performance optimization. Our findings suggest that SOA can significantly reduce transaction latency, thereby enabling a scalable blockchain architecture that can adapt to the increasing demands of modern digital transactions.

2 Literature review

The study in (Wang et al., 2019), the researcher applied two methodologies: attribute-driven design (ADD) and quality attribute workshop (QAW). These were used to address specific requirements of a system aimed at enhancing security and availability. The approach involved three key tactics: active redundancy for fault recovery, identification of actors to authenticate access, and encryption of data to maintain privacy. These tactics were integral to the system’s design to ensure robust security and reliable availability.

Further, in (Wood, 2014), a novel transaction model tailored for a high-speed permissioned blockchain was introduced. This model, named Dual channel Parallel Broadcast (DCPB), incorporates three innovative approaches: a dual channel model (DCM), parallel pipeline technology (PPT), and block generation and broadcast backup (BGBB). The research revealed that DCPB significantly enhances transaction speeds by 4–5 times compared to PPT and outperforms traditional methods in overall performance. Additionally, the BGBB method was found to boost processing efficiency by 25%.

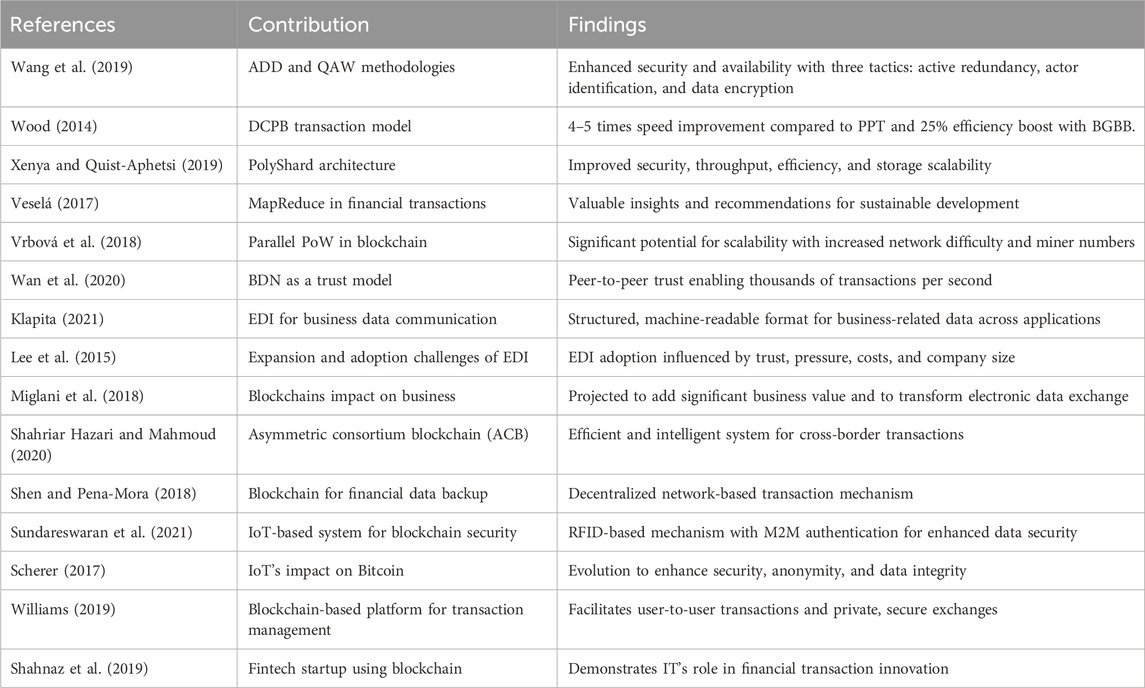

In another development, described in (Xenya and Quist-Aphetsi, 2019), researchers proposed the PolyShard architecture, which offers a blend of security, throughput efficiency, and scalable storage. Unlike traditional methods that store and process a single uncoded shard, PolyShard utilizes coded shards of equivalent size created by linearly combining uncoded shards. This architecture safeguards against false results from malicious nodes through the use of noisy polynomial interpolation techniques. An analysis of existing literature indicates a strong emphasis on blockchain technology, alongside EDI, IoT, AI, and cloud computing, to enhance the security of financial transactions. Most current models use blockchain for this purpose, as demonstrated in Table 1, which compares the blockchain features achieved in the studies mentioned. Additionally, there has been significant application of IoT, AI, and machine learning in this field.

The study in (Yao et al., 2019) explores advanced optimization techniques, focusing on multi-objective particle swarm optimization (PSO) with an emphasis on feature selection using fuzzy cost. It also delves into dual-surrogate assisted cooperative particle swarm optimization, particularly for addressing complex multimodal problems that involve high computational expenses. Multi-objective optimization problems (MOPs) are characterized by having multiple, often conflicting objectives that need to be addressed simultaneously. To effectively solve these MOPs, researchers have developed a variety of multi-objective evolutionary algorithms (MOEAs). These MOEAs are categorized into three main types: those based on dominance, decomposition, and indicators. Each category represents a different approach to handling the complexities and challenges inherent in multi-objective optimization. This classification provides a structured framework for understanding and applying MOEAs to a range of optimization challenges in various fields.

In (Veselá, 2017), the authors focused on exploring the use of MapReduce technology in the context of financial transactions. They conducted an in-depth analysis of MapReduce’s characteristics and its application in the financial sector. The study aimed to understand how MapReduce could be utilized for processing financial data transactions. It provided valuable insights and recommendations on implementing MapReduce in financial transaction systems to support sustainable development.

The research in (Vrbová et al., 2018) introduced a novel approach to enhance scalability in permission less blockchain networks through the use of proof-of-work (PoW) consensus mechanisms. This method incorporated a parallel PoW system, enabling equal participation from all miners in the network. This equality in competition ensures a balance in speed and computational power. The study found that as the network’s difficulty and the number of miners increased, the parallel PoW system showed significant potential for scalability.

In (Wan et al., 2020), the authors proposed the blockchain distribution network (BDN) as a trust model to address scalability challenges in blockchain systems. This model was designed to foster peer-to-peer trust and enable blockchain systems to handle thousands of transactions per second. The research suggested that utilizing a global infrastructure to support distributed blockchain systems in a neutral manner could simultaneously scale blockchain technology and cryptocurrencies.

The rapid growth of businesses has necessitated more efficient and automated methods for document sharing. Electronic Data Interchange (EDI), as mentioned in (Klapita, 2021), is a key technology facilitating this need. EDI enables the communication of business related data across applications in a structured, machine readable format. When two business partners utilize EDI for document exchange, the necessary information is retrieved from each partner’s Enterprise Resource Planning (ERP) system, converted into an EDI message standard agreed upon by both parties, and then automatically exchanged for transaction processing. The underlying infrastructure of EDI is quite complex, involving data processing, data management, and networking capabilities to efficiently transform data into electronic format. Moreover, reliable data transmission between remote parties and controlled data access are essential, as stated in (Kumari and Farheen, 2020). To ensure compatibility in EDI communication, a global standard known as UN/ED-IFACT is often used, as referenced in (Kuzmanovic, 2019).

Communication effectiveness and efficiency are crucial for business success, and EDI provides a standardized and structured way of electronic communication. Despite the rapid expansion of EDI, as noted in (Lee et al., 2015), its adoption still faces challenges, as indicated in (Nordrum, 2017). Factors such as inter organizational trust, external pressure, costs, and the size of the adopting companies significantly influence EDI adoption, as detailed in (Mertz, 2018). While EDI is an effective method for routine automated data exchange between long-term business partners, its utility diminishes when multiple parties, especially those not using EDI, are involved in the process, as the chain of documentation becomes fragmented.

The potential impact of blockchain technology in this context is noteworthy. According to a projection in (Miglani et al., 2018), blockchain could add over $175 billion in annual business value by 2025 and over $3 trillion by 2030. Another study in (Nakamoto, 2008) suggests that by 2030, blockchain technology could underpin 10%–20% of the world’s economic infrastructure. Researchers in (Nordrum, 2017) assert that blockchain will fundamentally transform the exchange of electronic data, contributing to the growing business interest in this technology over recent years.

In the study documented in (Shahriar Hazari and Mahmoud, 2020), the authors focused on enhancing cross-border transactions using a novel blockchain concept named asymmetric consortium blockchain (ACB). This system, leveraging a super node, effectively oversees all transactions over time. The team also developed an innovative smart contract aimed at reducing opportunity losses for individual nodes and creating a more quitable profit distribution system. Their approach was validated through numerical experiments using transaction data from Shenzhen and Hong Kong, demonstrating the efficiency and intelligence of the ACB system in managing new cross-border transactions.

The research presented in (Shen and Pena-Mora, 2018) introduced a blockchain-based solution for decentralized network-based transaction mechanisms, specifically for financial data backup. This approach employs a decentralized distributed blockchain ledger, where each node holds a copy of the transactional data, ensuring that a single node’s failure does not lead to total data loss. The system relies on an account ledger component that records credit and debit transactions with timestamps and transaction IDs. Additionally, each block contains hashes of both the previous and current blocks, further securing the data within the chain along with the account ledger information.

In (Sundareswaran et al., 2021), the researchers proposed an IoT-based system for securing blockchain systems, incorporating various techniques. This system includes a Radio Frequency Identification (RFID)-based mechanism for financial transactions, allowing only authorized users to access the collected data. The first layer of security is provided through Machine to Machine (M2M) authentication, which verifies legitimate clients. Once a user is authenticated, they can access the transaction system. The model employs hashing to safeguard the stored transaction data and utilizes blockchain technology. Experimental validation of the model indicated that it meets data security standards by implementing multiple security techniques to enhance the privacy of the generated hashes.

In the study referenced as (Scherer, 2017), the researchers discussed how the Internet of Things (IoT) is evolving to enhance the security, anonymity, and data integrity aspects of Bitcoin. They noted that while smart cards are at the forefront of technology and highly profitable, their high cost limits their widespread adoption across various industries. The study emphasized that blockchain, a decentralized system for data and transactions, is particularly tailored for cryptocurrencies like Bitcoin. The key attributes of Bitcoin that are highlighted include its ability to provide security, anonymity, and data integrity without compromising transaction processes.

In another research (Williams, 2019), the authors proposed a blockchain-based platform designed to allow multiple authorized users to own and manage network nodes. This platform eliminates the need for a third party to oversee transactions and financial data, thus promoting direct user-to-user transactions. Before incorporating bank transaction data into the blockchain, the platform facilitates these direct exchanges. This approach enables customers to conduct private, secure transactions at reduced costs and without limitations on foreign exchange.

The research in (Shahnaz et al., 2019) introduced a financial technology (fintech) start-up concept, utilizing blockchain technology and cryptocurrency to facilitate financial transactions in the realm of digital marketing for users. The study underscored fintech as an innovative tool capable of revitalizing traditional financial markets. It demonstrated how information technology is instrumental in fostering innovation in financial transactions, positioning fintech as a new paradigm in the financial sector.

This paper’s literature review provides a comprehensive backdrop against which our research is situated, underscoring the ongoing efforts and challenges in enhancing blockchain scalability and efficiency. Previous studies, such as the implementation of attribute-driven design for system security (Wang et al., 2019), the development of the Dual-channel Parallel Broadcast model for faster transaction processing (Wood, 2014), and the novel PolyShard architecture for improved storage scalability (Xenya and Quist-Aphetsi, 2019), all contribute to the foundational understanding of blockchain’s potential and limitations. Our work extends this discourse by introducing the Snake Optimization Algorithm (SOA) as a novel solution to the scalability challenge. While existing research primarily focuses on structural and procedural enhancements to blockchain frameworks, our approach leverages algorithmic optimization to address the critical issue of transaction throughput and latency. By empirically demonstrating SOA’s effectiveness in reducing transaction times, especially in batch processing scenarios, our paper contributes a unique perspective to the ongoing dialogue on blockchain scalability. This positions our research not only as a response to the identified gaps in current methodologies but also as a forward thinking approach that could reshape how scalability is addressed in future blockchain developments.

In the context of enhancing blockchain’s transaction verification speed, one noteworthy approach employs optimization algorithms to manage computational resources more efficiently. In particular, a strategy that pivots around the utilization of parallel mining, introduced in a seminal paper (Saqib and AL-Talla, 2023), reflects a concerted effort to boost transaction processing speeds. The proposed Particle Swarm Optimization Proof of Work (PSO-POW) model articulates a framework whereby miners engage in parallel rather than solo mining, strategically reducing the time and computational power expended per verified transaction. Furthermore, this model emphasizes the use of the Particle Swarm Optimization (PSO) algorithm to automatically select the optimal manager among miners, mitigating waiting time issues if a manager becomes non-responsive, and streamlining both the reward system and distribution of work within the blockchain. Through a juxtaposition of various mining scenarios, this research underlines the PSO-POW model’s capability to enhance blockchain scalability notably, attesting to its practicality in live environments.

On a related note, the pursuit of improving blockchain performance through consensus algorithms has been another focal point of research, as epitomized in another study (Wu et al., 2020). Here, the exploration of a hybrid consensus algorithm, amalgamating the advantages of Proof of Stake (POS) and Practical Byzantine Fault Tolerance (PBFT) algorithms, brings forth a two-stage strategy, encompassing sortition and witness phases, aimed at amplifying throughput, reducing latency, and enhancing scalability. The novel hybrid consensus algorithm accentuates reducing the number of consensus nodes through verifiable pseudorandom sortition and conducting transaction witness procedures between nodes, showcasing a marked improvement over prior singular algorithms and yielding enhanced scalability, throughput, and latency.

Meanwhile, the intersectionality of blockchain technology with big data in optimizing supply chain strategies has also witnessed innovative approaches. A pertinent research endeavor (Devi and Rammohan, 2023) introduced a new framework that not only harnesses blockchain for securing data storage within a supply system but also leans on an Enhanced Particle Swarm Optimization Algorithm to upgrade network scalability. The research prioritizes the security and scheduling of nodes by employing a Precedence Partition Scheduling Algorithm, coupled with the Delegated Proof of Stake consensus protocol to validate nodes. Furthermore, the study employed the message digest-5 hash method to convert input entities into defined-length output entities, affirming the scalability and effectiveness of the methodology against conventional approaches in a supply system context.

Our pioneering work, dedicated to optimizing blockchain scalability through the Snake Optimization Algorithm (SOA), distinguishes itself by leveraging a novel nature-inspired metaheuristics algorithm which has its roots in the specialized mating behavior of snakes. This unique approach endeavors to minimize transaction latency in the blockchain by optimizing the number of shards, presenting a new pathway in the ongoing quest to enhance blockchain scalability.

3 Proposed method

3.1 Scalability

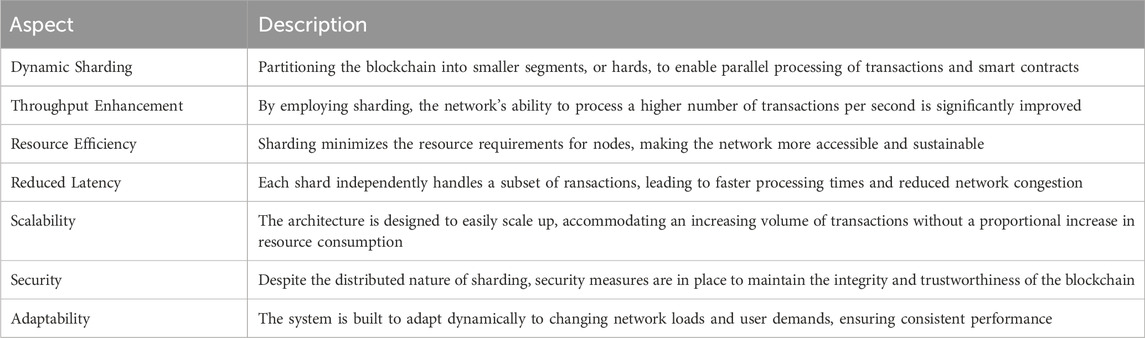

In our approach to enhancing scalability, we have adopted dynamic sharding as a pivotal strategy. Dynamic sharding involves partitioning the blockchain into smaller, more manageable segments, known as shards. This method allows parallel processing of transactions and smart contracts, significantly boosting the throughput and efficiency of our blockchain network. Each shard operates independently, handling a subset of transactions, which leads to a substantial reduction in the latency and resource requirements traditionally associated with blockchain scalability. By implementing dynamic sharding, we aim to address the prevalent scalability challenges, ensuring that our blockchain network can accommodate a growing number of transactions without compromising on speed or security as shown in Table 2. This scalable architecture is crucial for adapting to the evolving demands of our users and for maintaining robust performance in a decentralized environment.

3.2 Snake optimization algorithm (SOA)

The Snake Optimization (SO) algorithm draws inspiration from the natural behaviors of snakes (Hashim and Hussien, 2022). This algorithm can be outlined through several key steps:

3.2.1 Initialization

The SO algorithm begins by creating a set of random solutions within the search space. This is achieved using the formula:

Here, Snakei represents the position of the ith solution in the swarm, rand is a random number between 0 and 1, and Snakemax and Snakemin are the maximum and minimum values for the problem being solved.

3.2.2 Population division

The population is evenly split into male and female segments, as per the following equations:

In these equations, Num denotes the total population size, while Nummale and Numfemale represent the numbers of male and female solutions, respectively.

3.2.3 Best solution selection

The algorithm identifies the best solutions from both male (Snakebestmale) and female (Snakebestfemale) groups. Additionally, it determines the location of the food Lfood. Two more parameters, temperature (Temperature) and food quantity (Quantity), are introduced and defined by:

Here, Curiter is the current iteration, Totiter is the total number of iterations, and Const1 is a constant set at 0.5.

3.2.4 Exploration and exploitation

Depending on whether food is found, the solutions either explore or exploit the search space. If Quantity < 0.25, a global search is conducted by updating their locations. Conversely, if Quantity > 0.25, the responses vary based on temperature. If the temperature is high (>0.6), the solutions move directly to the food. If it is low, different modes like fighting or mating are activated, changing how the solutions update their positions.

3.2.5 Location updates

The locations of solutions are updated based on the mode (ex-ploration, fighting, mating). This involves complex mathematical calculations using constants and parameters like the ability to find food (AB), fighting ability (FA), and mating ability (MA), among others.

3.2.6 Egg hatching and replacement

Upon the hatching of eggs, the worst male and female solutions are identified and replaced using specific formulas.

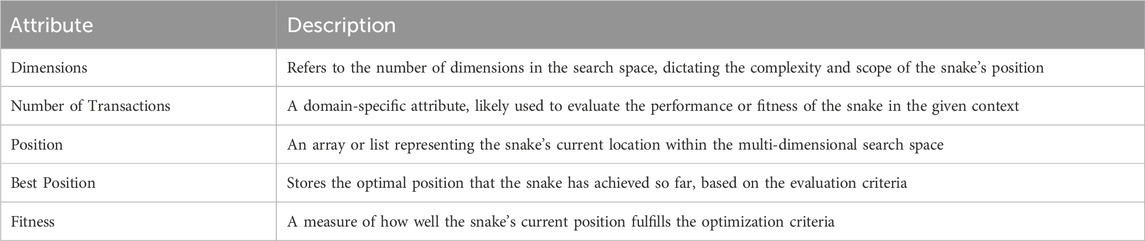

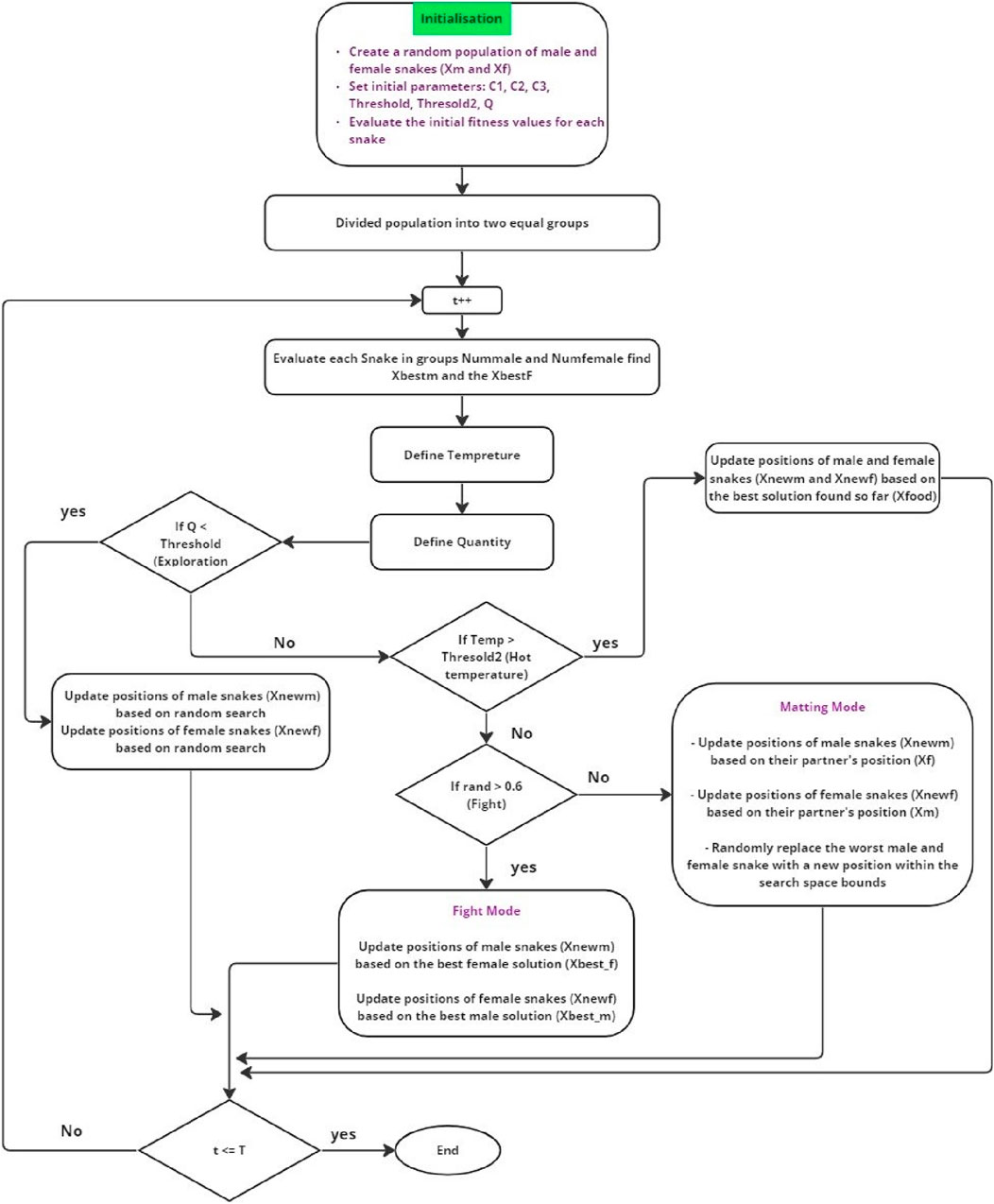

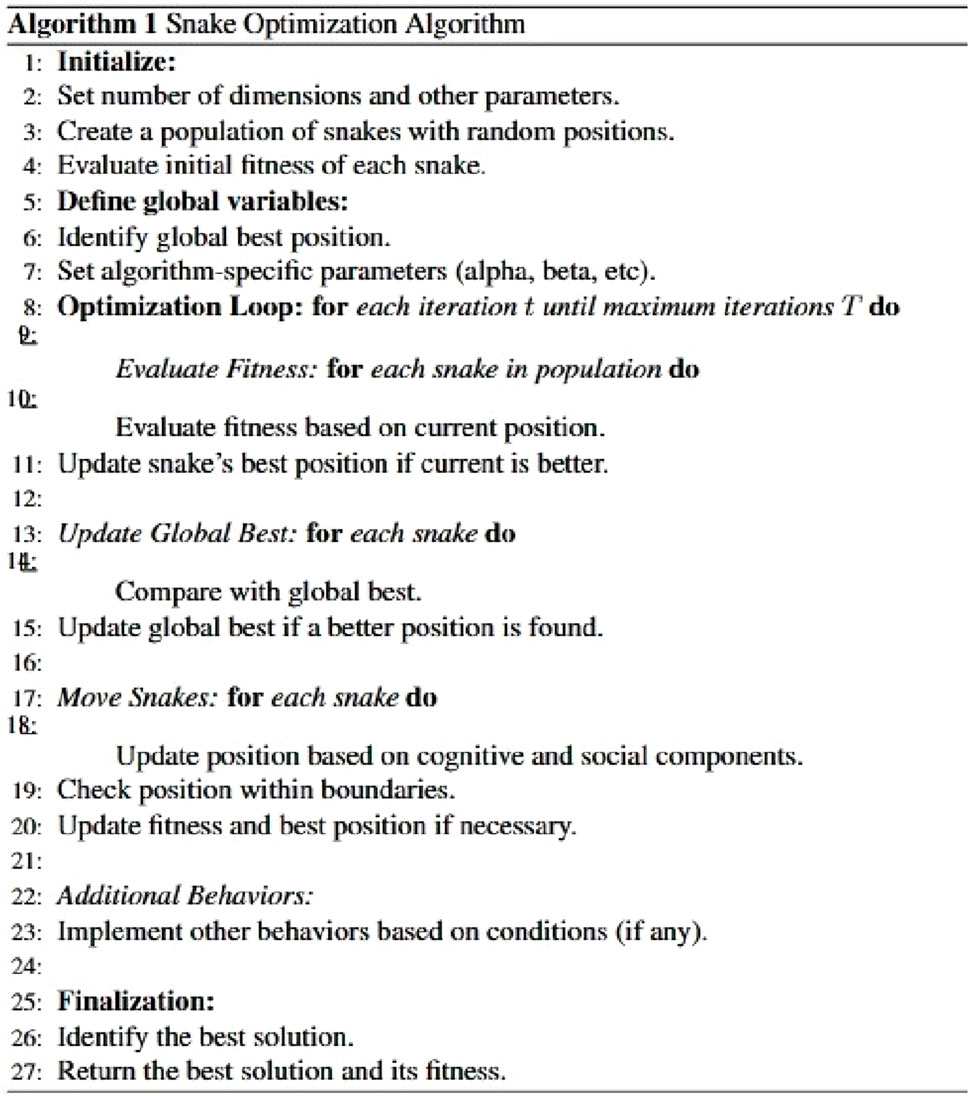

Each of these steps incorporates complex equations and algorithms that collectively define the behavior of the solutions within the SO algorithm. The proposed SOA characterize presents in Table 3 a comprehensive overview of the key attributes of our snake optimizer and Figure 1 shown the main architecture of SOA.

In our design, each “snake” represents a potential solution within the multi-dimensional search space of the optimization problem. The “Dimensions” attribute signifies the complexity of the search space, defining the extent of the solution landscape that our snakes navigate. “Number of Transactions” is a crucial attribute tailored to the specific requirements of our optimization domain, providing a context-dependent metric for evaluating the efficacy of each snake. The “Position” attribute is a dynamic representation of each snake’s current location in the search space, highlighting the fluid nature of our optimization process. “Best Position” is a testament to the adaptive capability of our snakes, marking the most effective solution they have encountered. Lastly, “Fitness” is a quantifiable measure of a snake’s performance, guiding their movement towards optimal solutions. Collectively, these attributes form the backbone of our snake optimizer, driving its ability to effectively navigate and resolve complex optimization challenges.

To address the concerns raised by your supervisor about the explanation of the Snake Optimization Algorithm (SOA), a more detailed, continuous narrative is needed. Here is an expanded description that elaborates on the SOA’s mechanisms and functionalities:

The Snake Optimization Algorithm (SOA) is an innovative approach inspired by the natural behaviors of snakes, particularly their strategies for hunting and survival. This algorithm’s design and functionality are crafted to mimic these behaviors, adapting them to solve complex optimization problems (Hashim and Hussien, 2022). Figure 2 shows the pseudocode Snake Optimization algorithm.

At the core of SOA lies the concept of simulating a population of snakes, each repre-senting a potential solution in a multi-dimensional search space. The initialization phase of the algorithm is crucial, where a set of random solutions (snakes) are generated. The positions of these snakes are determined by a formula that ensures they are spread across the entire search space, giving the algorithm a comprehensive starting point for exploration.

The population of snakes is then divided into male and female segments, a nod to the natural world where different behaviors are exhibited based on gender roles. This division is more than a mere structural aspect; it influences how the solutions evolve over the course of the algorithm. The best solutions from both segments are identified, and these “elite” snakes guide the rest of the population in their search for the optimal solution.

An interesting aspect of SOA is how it simulates the natural environment of snakes. It introduces parameters like temperature and food quantity, which are metaphors for the dynamics of the search space. These parameters are not static; they change as the algorithm progresses, mimicking the natural fluctuations in a snake’s environment. This dynamism forces the snakes to adapt their strategies, just as they would in nature.

Exploration and exploitation are key phases in the SOA. Depending on the food quantity (which represents the availability of good solutions), the snakes either explore the search space more broadly or exploit the areas around the best solutions found so far. The behavior of the snakes also varies with temperature, a factor that influences their level of activity. High temperatures, akin to favorable search conditions, lead the snakes directly towards the food (optimal solutions). In contrast, lower temperatures trigger more complex behaviors such as mating or fighting, which in the context of the algorithm, translate to different methods of combining or competing solutions.

The final step involves updating the locations of the solutions, a process that is influenced by various factors including the snakes’ ability to find food, their fighting ability, and mating ability. These factors are represented by mathematical constants and parameters, adding layers of complexity to the algorithm. The process of egg hatching and replacing the worst solutions in the population ensures that the algorithm is continually evolving, mirroring the natural selection process.

In conclusion, the Snake Optimization Algorithm is a sophisticated and dynamic approach to optimization. Its design, inspired by the behaviors and environmental interactions of snakes, offers a novel way to navigate complex search spaces. By continuously adapting to changing conditions and employing diverse strategies for exploration and exploitation, SOA presents a robust tool for tackling challenging optimization problems.

3.3 Proposed methodology

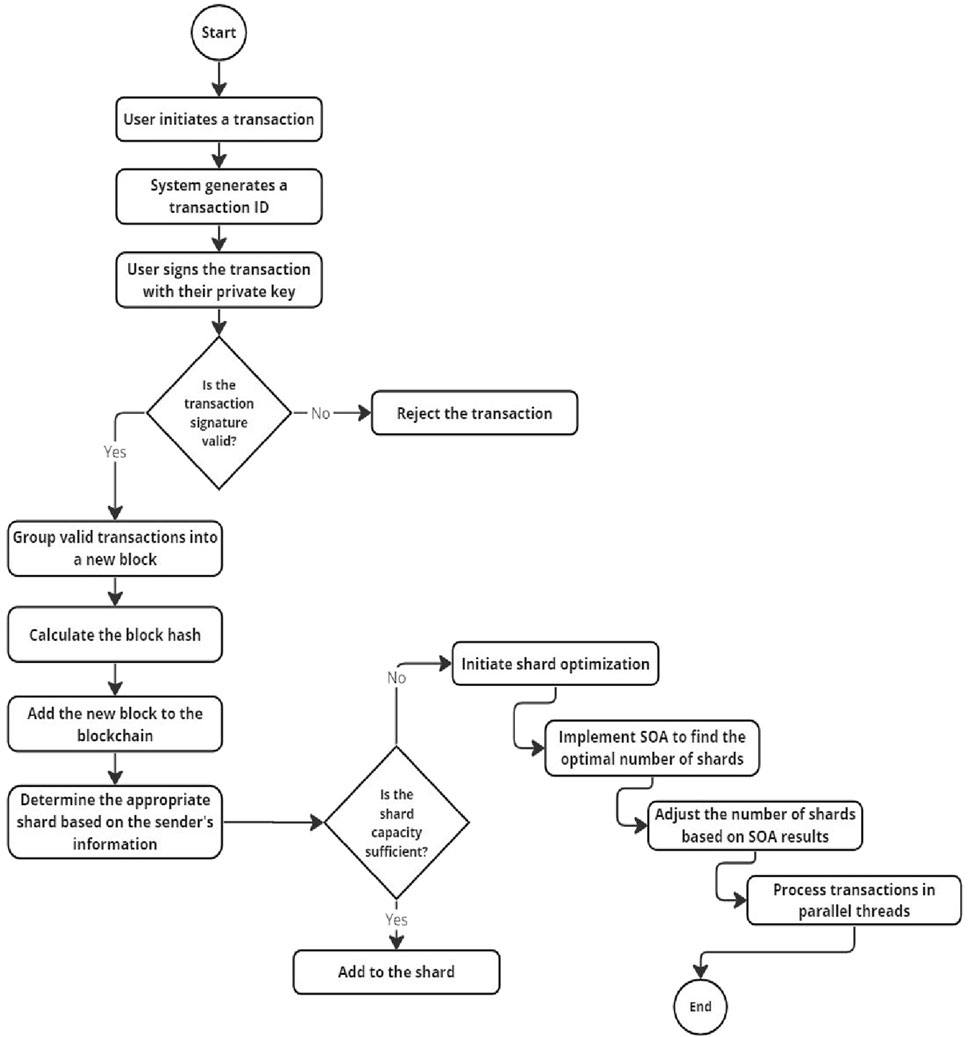

Our methodology we delineate our bespoke approach, designed to enhance the scalability and efficiency of blockchain transactions. This approach, which we have named “Snakechain” is a novel integration of a custom developed blockchain system with the principles of the Snake Optimization Algorithm (SOA). Our aim is to significantly reduce transaction latency, a critical aspect in the widespread adoption and functionality of blockchain technology. Our proposed approach of our blockchain with SOA as shown in Figure 3.

The process begins with a user initiating a transaction. This transaction is assigned a unique identifier and is securely authenticated using the user’s private key. A key feature of our blockchain system is its robust verification process, where the validity of each transaction’s signature is thoroughly checked. Transactions with invalid signatures are automatically rejected, ensuring the security and integrity of the blockchain.

Valid transactions are then aggregated into new blocks. In this step, our system computes a cryptographic hash for each block, which is subsequently appended to the blockchain, maintaining a secure and tamper proof record of transactions. This hashing process is essential for the immutability of the blockchain, a core feature that underpins trust in the system.

A critical aspect of our methodology is its dynamic shard allocation process. The system determines the appropriate shard for each transaction based on the sender’s details. In scenarios where the current shard capacity is insufficient to handle the transaction volume, our methodology activates an optimization process within Snakechain. Here, the SOA comes into play, calculating the optimal number of shards required to minimize latency effectively. The shard count is then adjusted accordingly, facilitating parallel processing of transactions and significantly enhancing the system’s efficiency and scalability.

Our approach represents a significant departure from traditional blockchain models. By incorporating SOA into the transaction validation process, we not only address the challenges of scalability but also open avenues for more adaptive and responsive blockchain systems. This methodology is particularly advantageous for high throughput enterprise applications, where transaction speed and system responsiveness are paramount.

In summary, our proposed methodology offers a comprehensive and innovative solution to the pressing issue of blockchain scalability. By melding the agility of SOA with the robustness of blockchain technology, we present a system capable of handling large scale transactional demands with reduced latency, thus paving the way for broader blockchain adoption in various high demand sectors.

4 Results

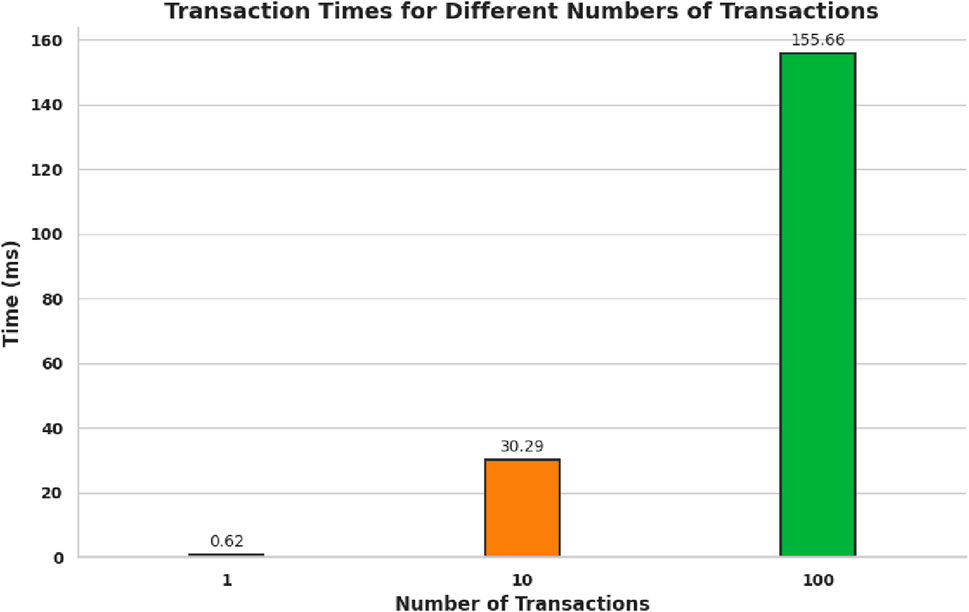

In our study, we assessed the scalability of the blockchain system before optimization by conducting transactions at three different scales: singular, tenfold, and hundredfold. Figure 4 graphically represents the latency observed across these transaction volumes. We found that for a single transaction, the latency was minimal, only 0.62 ms, indicating a highly responsive system at low transaction loads. However, as we increased the number of transactions to ten, the latency rose to 30.29 ms, revealing a noticeable delay that suggests a linear scaling of latency with the number of transactions. A further increase to one hundred transactions resulted in a significant latency of 155.66 ms, which underscores a potential scalability issue in the system as transaction volume increases. This illustration serves as a benchmark for the scalability of our blockchain system before any optimization techniques were applied.

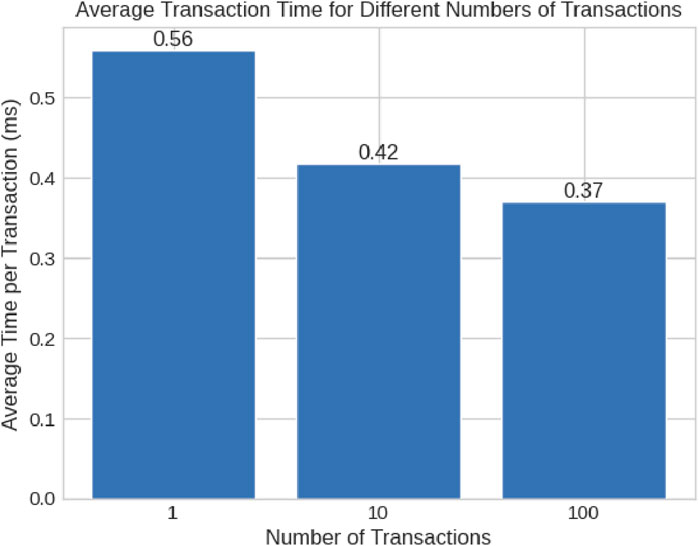

Following the application of the snake optimization technique to our blockchain system, Figure 5 details the changes in average transaction time for different numbers of transactions, post-optimization. We observed that the average time for processing a single transaction marginally decreased to 0.56 ms, signifying a slight improvement. Notably, for ten transactions, the average time per transaction was reduced to 0.42 ms, illustrating more significant efficiency gains. The optimization had a pronounced impact when handling one hundred transactions, with the average time per transaction dropping to 0.37 ms. This demonstrates that our optimization not only improved overall latency but also achieved better scalability, as indicated by reduced average transaction times even as the number of transactions increased. It suggests that the system became more adept at handling larger volumes of transactions with diminishing average time per transaction, showcasing the effectiveness of the snake optimization technique in enhancing blockchain performance.

Before the implementation of SOA, the latency inherent in our system exhibited a predictable pattern; as the volume of transactions increased, so too did the latency. This ascending trend aligns with conventional system behavior, where higher numbers of transactions naturally prolong processing time as mentioned in Table 4. In stark contrast, the introduction of SOA marked a substantial decline in latency across all levels of transactional activity. Intriguingly, the application of SOA led to an unexpected occurrence where the latency for a solitary transaction was marginally higher than that for ten or even a hundred transactions. This peculiar finding implies that the SOA is particularly adept at managing transaction batches, as opposed to individual transactions. The suggestion is that the SOA optimization is more finely tuned for bulk transaction processing, where it can disseminate the fixed overheads across multiple transactions, thus diminishing the average processing time per transaction. This optimization characteristic could offer substantial benefits in scenarios typified by batch transactions, but it may not cater as effectively to contexts where transactions predominantly occur in isolation. It underscores the SOA’s profound impact on performance, though it also highlights an optimization that favors batch processing over the acceleration of single transactions.

Our pioneering Result, dedicated to optimizing blockchain scalability through the Snake Optimization Algorithm (SOA), distinguishes itself by leveraging a novel nature-inspired metaheuristics algorithm which has its roots in the specialized mating behavior of snakes. This unique approach endeavors to minimize transaction latency in the blockchain by optimizing the number of shards, presenting a new pathway in the ongoing quest to enhance blockchain scalability.

In contrast to the PSO-POW model delineated in the first piece of related work (Saqib and AL-Talla, 2023), which advocates for a parallel mining approach in combination with the Particle Swarm Optimization (PSO) algorithm, our work with the Snake Optimization Algorithm highlights a marked departure. While the PSO-POW model is concentrated on selecting an optimal manager among miners and conducting parallel mining to expedite transaction verification, our SOA-based methodology is singularly focused on optimizing sharding numbers, thus providing a direct, impactful measure to mitigate transaction latency. This differential approach not only offers a fresh perspective in addressing blockchain scalability but also provides a pathway that directly influences transaction processing speeds by improving data management through strategic sharding.

Furthermore, the second related work (Wu et al., 2020) presents a blockchain hybrid consensus algorithm, blending the virtues of POS and PBFT algorithms in a two-stage strategy. While this approach fundamentally revolves around consensus algorithms to enhance throughput, reduce latency, and amplify scalability, our SOA-guided methodology diverges significantly by addressing scalability through an entirely different lens: optimizing sharding numbers to minimize transaction latency. In essence, while the hybrid consensus algorithm modulates the consensus mechanism to streamline transaction verification, the Snake Optimization Algorithm aims to make the blockchain network more efficient by strategically managing its data storage and retrieval mechanisms, which, in turn, expedites transaction verification times.

Lastly, the third piece of related literature (Devi and Rammohan, 2023) extends a framework that intertwines blockchain technology with big data for scalable and secured data storage in a supply system context. This approach, while notable for its application of the Enhanced Particle Swarm Optimization Algorithm to uplift network scalability and the employment of a Precedence Partition Scheduling Algorithm for securing and scheduling nodes, does not directly engage with the specific challenge of minimizing transaction latency through sharding optimization as our work does. The SOA technique, with its distinctive nature-inspired heuristic, provides a uniquely targeted strategy to directly minimize transaction latencies, thereby offering a specific, measurable, and direct impact on blockchain scalability in contrast to the broader, multi-faceted approach of the aforementioned work.

Before the application of the Snake Optimization Algorithm, the system’s latency increased proportionally with the number of transactions, which is a common trait in many systems; the processing time extends with a higher quantity of transactions. Post the implementation of SOA, there was a noticeable decrease in latency for all transaction counts. However, it is peculiar to observe that processing a single transaction after SOA application is slightly slower compared to batches of 10 or 100 transactions. This suggests that SOA is more efficient when dealing with multiple transactions simultaneously. Such an outcome may indicate that the SOA has a certain overhead that, when spread over several transactions, does not significantly impact the average processing time. Conversely, this overhead becomes more noticeable when processing individual transactions. This behavior might be advantageous for systems that frequently handle batches of transactions but could be less optimal for those dealing with one transaction at a time. The SOA has evidently enhanced the system’s performance, particularly favoring situations where transactions are not occurring in isolation but rather in groups.

5 Conclusion

In conclusion, this paper has presented a detailed exploration of the challenges associated with blockchain scalability and the potential of optimization algorithms to address these challenges. Through a comprehensive literature review, we identified that the scalability issue is a critical bottleneck for the widespread adoption of blockchain technology. Our proposed method introduced an innovative application of the Snake Optimization Algorithm (SOA) to enhance the scalability of blockchain systems.

The SOA, applied to our blockchain model, demonstrated a significant reduction in latency, particularly when managing multiple transactions. This reduction suggests that SOA is highly effective in scenarios where the system is required to handle batches of transactions. The results of our experiments post-SOA implementation highlighted an unusual yet beneficial behavior of the algorithm, where it performed better with a larger number of transactions, effectively inverting the typical performance degradation seen with increased load.

Our proposed methodology, therefore, stands out as a robust solution to the scalability problem, offering a novel perspective on optimizing blockchain systems. It not only improves transaction processing times but also ensures that the system becomes more efficient as the transaction volume grows. This characteristic is particularly important for blockchain applications that need to maintain high throughput under heavy loads.

As blockchain technology continues to evolve and find new applications in various sectors, the importance of scalability cannot be overstated. Our research contributes to this field by providing a practical solution to improve performance and by opening new avenues for future research on blockchain optimization.

Future studies may focus on refining the SOA for even greater efficiency, exploring its application in different blockchain architectures, and comparing it with other optimization techniques. The ultimate goal is to develop blockchain systems that are not only secure and decentralized but also scalable and efficient to meet the demands of modern digital transactions.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author contributions

ST: Writing–original draft, Writing–review and editing. SA: Writing–original draft, Writing–review and editing. JA: Writing–original draft, Writing–review and editing.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Aitzhan, N. Z., and Svetinovic, D. (2016). Security and privacy in decentralized energy trading through multi-signatures, blockchain and anonymous messaging streams. IEEE Trans. Dependable Secur. Comput. 15 (5), 840–852. doi:10.1109/tdsc.2016.2616861

Devi, V. S., and Rammohan, S. R. (2023). A secure and scalable blockchain using hybrid consensus algorithm with smart contract for supply system. J. Data Acquis. Process. 38 (2), 4476.

Hashim, F. A., and Hussien, A. G. (2022). Snake Optimizer: a novel meta-heuristic optimization algorithm. Knowledge-Based Syst. 242, 108320. doi:10.1016/j.knosys.2022.108320

Ismailisufi, A., Popović, T., Gligorić, N., Radonjic, S., and Šandi, S. (2020). “A private blockchain implementation using multichain open source platform,” in 2020 24th International Conference on Information Technology (IT), Zabljak, Montenegro, 1–4.

Khan, K. M., Arshad, J., and Khan, M. M. (2018). Secure digital voting system based on blockchain technology. Int. J. Electron. Gov. Res. 14 (1), 53–62. doi:10.4018/ijegr.2018010103

Khan, K. M., Arshad, J., and Khan, M. M. (2020a). Simulation of transaction malleability attack for blockchain-based e-voting. Comput. Electr. Eng. 83, 106583. doi:10.1016/j.compeleceng.2020.106583

Khan, K. M., Arshad, J., and Khan, M. M. (2020b). Investigating performance constraints for blockchain based secure e-voting system. Futur. Gener. Comput. Syst. 105, 13–26. doi:10.1016/j.future.2019.11.005

Klapita, V. (2021). Implementation of electronic data interchange as a method of communication between customers and transport company. Transp. Res. Procedia 53, 174–179. doi:10.1016/j.trpro.2021.02.023

Kumari, S., and Farheen, S. (2020). “Blockchain based data security for financial transaction system,” in 2020 4th International Conference on Intelligent Computing and Control Systems (ICICCS), Madurai, India 829–833.

Kuzmanovic, A. (2019). Net neutrality: unexpected solution to blockchain scaling. Commun. ACM 62 (5), 50–55. doi:10.1145/3312525

Lee, S. L., Ainin, S., Dezdar, S., and Mallasi, H. (2015). Electronic data interchange adoption from technological, organisational and environmental perspectives. Int. J. Bus. Inf. Syst. 18 (3), 299–320. doi:10.1504/ijbis.2015.068166

McConaghy, T., (2016). “Bigchaindb: a scalable blockchain database,” in White pap. BigChainDB, Bigchaindb, Berlin, Germany 53–72.

Mertz, L. (2018). (Block) chain reaction: a blockchain revolution sweeps into health care, offering the possibility for a much-needed data solution. IEEE Pulse 9 (3), 4–7. doi:10.1109/mpul.2018.2814879

Miglani, A., Gupta, H., and Khatri, S. K. (August 2018). “A security model to enhance online transactions using blockchain technology,” in 2018 2nd International Conference on I-SMAC (IoT in Social, Mobile, Analytics and Cloud)(I-SMAC) I-SMAC (IoT in Social, Mobile, Analytics and Cloud)(I-SMAC), Palladam, India 229–234.

Morillon, T. (2022). Bitcoin’s value proposition: shorting expansionary monetary policies. Stud. Econ. Financ. 39 (1), 20–44. doi:10.1108/sef-03-2021-0107

Nakamoto, S. (2008). Bitcoin: a peer-to-peer electronic cash system. San Francisco, CA, USA: Bitcoin.

Nizamuddin, N., Salah, K., Azad, M. A., Arshad, J., and Rehman, M. H. (2019). Decentralized document version control using ethereum blockchain and IPFS. Comput. Electr. Eng. 76, 183–197. doi:10.1016/j.compeleceng.2019.03.014

Nordrum, A. (2017). Govern by blockchain dubai wants one platform to rule them all, while Illinois will try anything. IEEE Spectr. 54 (10), 54–55. doi:10.1109/mspec.2017.8048841

Ranganthan, V. P., Dantu, R., Paul, A., Mears, P., and Morozov, K. (October 2018). “A decentralized marketplace application on the ethereum blockchain,” in 2018 IEEE 4th International Conference on Collaboration and Internet Computing (CIC), Philadelphia, PA, USA, 90–97.

Saqib, N. A., and Al-Talla, S. T. (2023). Scaling up security and efficiency in financial transactions and blockchain systems. J. Sens. Actuator Netw. 12 (2), 31. doi:10.3390/jsan12020031

Scherer, M. (2017). Performance and scalability of blockchain networks and smart contracts, Umeå universitet, Umeå, Sweden.

Shahnaz, A., Qamar, U., and Khalid, A. (2019). Using blockchain for electronic health records. IEEE access 7, 147782–147795. doi:10.1109/access.2019.2946373

Shahriar Hazari, S., and Mahmoud, Q. H. (2020). Improving transaction speed and scalability of blockchain systems via parallel proof of work. Futur. internet 12 (8), 125. doi:10.3390/fi12080125

Shen, C., and Pena-Mora, F. (2018). Blockchain for cities—a systematic literature review. Ieee Access 6, 76787–76819. doi:10.1109/access.2018.2880744

Sundareswaran, N., Sasirekha, S., Shanmugapriya, T., Paul, I., and Sharma, S. (2021). Secure banking transaction using Blockchain. AIP Conf. Proc. 2336 (1).

Ucbas, Y., Eleyan, A., Hammoudeh, M., and Alohaly, M. (2023). Performance and scalability analysis of Ethereum and Hyperledger fabric. IEEE Access 11, 67156–67167. doi:10.1109/access.2023.3291618

Veselá, L. (2017). Factors affecting the adoption of electronic data interchange. Brno, Czech Republic, Acta Univ. Agric. Silvic. Mendelianae Brun.

Vrbová, P., Cempírek, V., Stopková, M., and Bartuška, L. (2018). Various electronic data interchange (EDI) usage options and possible substitution. NAŠE MORE Znan. časopis za more i Pomor. 65 (4 Special issue), 187–191. doi:10.17818/nm/2018/4si.4

Wan, N., Liu, Y., and Xiao, W. (2020). “A financial transaction methods based on mapreduce technology and blockchain,” in 2020 3rd International Conference on Smart BlockChain (SmartBlock), Zhengzhou, China, 109–113.

Wang, G., Shi, Z. J., Nixon, M., and Han, S. (October 2019). “Sharding on blockchain,” in Proceedings of the 1st ACM Conference on Advances in Financial Technologies, Zurich, Switzerland 41–61.

Wood, G. (2014). Ethereum: a secure decentralised generalised transaction ledger. Ethereum Proj. yellow Pap. 151 (2014), 1–32.

Wu, Y., Song, P., and Wang, F. (2020). Hybrid consensus algorithm optimization: a mathematical method based on POS and PBFT and its application in blockchain. Math. Probl. Eng. 2020, 1–13. doi:10.1155/2020/7270624

Xenya, M. C., and Quist-Aphetsi, K. (2019). “Decentralized distributed blockchain ledger for financial transaction backup data,” in 2019 International Conference on Cyber Security and Internet of Things (ICSIoT), Accra, Ghana, 34–36.

Keywords: blockchain, Scalability, Snake Optimization, Efficiency, dynamic sharding

Citation: Taher SSH, Ameen SY and Ahmed JA (2024) Enhancing blockchain scalability with snake optimization algorithm: a novel approach. Front. Blockchain 7:1361659. doi: 10.3389/fbloc.2024.1361659

Received: 26 December 2023; Accepted: 08 February 2024;

Published: 28 February 2024.

Edited by:

Avishek Nag, University College Dublin, IrelandReviewed by:

Eranga Herath, Old Dominion University, United StatesDejan Vujičić, University of Kragujevac Faculty of Technical Sciences, Serbia

Copyright © 2024 Taher, Ameen and Ahmed. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Shimal S. H. Taher, U2hpbWFsLnRhaGVyQHVvZC5hYw==

Shimal S. H. Taher

Shimal S. H. Taher Siddeeq Y. Ameen2

Siddeeq Y. Ameen2