- 1Southampton Business School, University of Southampton, Southampton, United Kingdom

- 2PSL University, Paris, France

- 3School of Economics and Management, University of Science and Technology Beijing, Beijing, China

Cryptocurrencies’ popularity is growing despite short-term fluctuations. Peer-reviewed research into trust in cryptocurrency payments started in 2014. While the model created then, is based on proven theories from psychology and supported by empirical research, a-lot has changed in the past 10 years. This research finds that the original model is still valid, but it is extended to capture the current situation better. A quantitative methodology is used to validate the updated model proposed. The results from the quantitative survey show that (1) personal innovativeness in technology and (2) finance, influence (3) disposition to trust. Disposition to trust influences six variables from the specific context of the payment. Three variables related to the cryptocurrency itself are (4) stability in the value, (5) transaction fees, and (6) reputation. Institutional trust is influenced by (7) regulation, and (8) payment intermediaries. The last contextual factor is (9) trust in the retailer. The six variables from the context influence (10) trust in the payment which, finally, influences (11) the likelihood of making the cryptocurrency payment.

1 Introduction

Cryptocurrencies have been on a fascinating journey over the past 10 years with many twists and turns, and never too far away from controversy. If someone was wondering what their role will be 10 years ago, they may still not be entirely sure. For example, is Bitcoin a replacement for payments, or a store of value? Will the value of Bitcoin break new records or depreciate? While there are many questions that remain unanswered, it is clear that cryptocurrencies are used extensively by various types of consumers for various purposes (Schmeling et al., 2023). The value of all the cryptocurrencies in use, often referred to as market capitalization, is increasing, the amount traded is increasing, and more solutions utilizing cryptocurrencies are being developed (Schmeling et al., 2023). Many stakeholders influence the success of an innovation, but the consumer’s perspective is often decisive. Ten years ago, an important question to answer was how the consumer trusts cryptocurrencies. This question was answered at the time but given the many changes in the technology cryptocurrencies use, and the general environment they are used in, the answers found 10 years ago must be re-evaluated (García-Monleón et al., 2023). This research re-evaluates and updates the first model of trust in cryptocurrencies published in peer reviewed research (Zarifis et al., 2014; Zarifis et al., 2015).

The first cryptocurrency, Bitcoin, started as far back as 2009 but it really started to gain popularity from around 2016 (Huber and Sornette, 2022). Since then a variety of cryptocurrencies and other cryptoassets such as NFTs have emerged. In addition to these new cryptocurrencies and cryptoassets, new services that utilize them emerged. Whole ecosystems of Decentralized Finace (DeFi) have emerged. While cryptocurrencies, other cryptoassets, and the services they enable, have not been entirely embraced by traditional finance, there is an increasing overlap, with Bitcoin ETFs being a recent example (Ligon, 2023).

Cryptocurrencies are first and foremost, a technology. The technology that delivers them has evolved over the years. In some cases, there have been forks, splitting Bitcoin into Bitcoin and Bitcoin cash, in other cases, such as Ethereum, mining has been replaced by a proof-of-stake mechanism (Wendl et al., 2023). With more choices between several cryptocurrencies, stablecoins, Central Bank Digital Currencies (CBDC) and other digital payments solutions, the consumer is becoming more discerning. The regulation of cryptocurrencies has also come a long way in the past 10 years with some regions actively encouraging them, while others ban them. Therefore, on the 10-year anniversary of the first research into trust in cryptocurrencies (Zarifis et al., 2014; Zarifis et al., 2015), it is a good time to re-evaluate the model with a current sample.

Trust in a cryptocurrency is a multifaceted issue. There is a spectrum of beliefs on trust in cryptocurrencies with the one extreme suggesting that the consumer does not need to trust cryptocurrencies because they utilize blockchain. While this view has been discussed extensively, most people today seem to appreciate that you must trust cryptocurrencies, just as you must trust any other technology you use that involves some risk (Priem, 2020; Aquilina et al., 2023). Therefore, the research question is.

1) How does the consumer trust cryptocurrencies? Does the first peer-reviewed model on consumer trust in cryptocurrency need to be updated to capture the current context better?

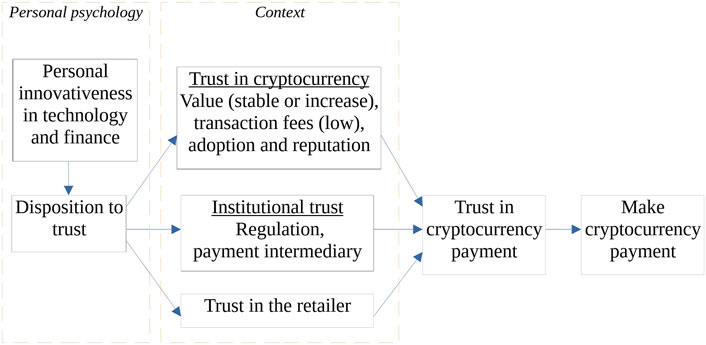

This research re-evaluates and extends the first peer-reviewed published model on this (Zarifis et al., 2014; Zarifis et al., 2015). The extended model includes twelve variables in seven groups. The first three variables come from the individual’s psychology. Personal innovativeness is divided into (1) personal innovativeness in technology and (2) personal innovativeness in finance. These two influence (3) personal disposition to trust. There are then six variables that come from the specific context, and not the person’s psychology. The first three are related to the cryptocurrency itself. These are (4) the stability in the cryptocurrency value, (5) the transaction fees and (6) reputation. Institutional trust is shaped by (7) regulation and (8) payment intermediaries that may be involved in fulfilling the transaction. The last contextual factor is (9) trust in the retailer. The six variables from the context influence (10) trust in the cryptocurrency payment which then, finally, influences (11) the likelihood of making the cryptocurrency payment.

Previous research into trust in cryptocurrencies either used one cryptocurrency in the research, typically Bitcoin, or asked generally about cryptocurrencies without specifying one (Ostern, 2018). Both of these methods have their limitations. If a study tests one cryptocurrency, then the findings only apply to that cryptocurrency. If participants are asked generally about cryptocurrencies, then the question is too vague. A second limitation is that the largest cryptocurrencies’ names are far better known than the term cryptocurrency. As the names of the most popular cryptocurrencies are better known than the term, using a specific cryptocurrency is the most effective way to communicate with the participant. Therefore, this research asked participants about their beliefs on the largest cryptocurrency, Bitcoin.

The theoretic foundation that follows identifies the theory that can be used to extend the original model, and then puts forward an extended model. The methodology section outlines how data is collected and how Structural Equation Modeling (SEM) is applied. The next section presents the detailed results. This is followed by a discussion of the theoretical and practical implications and finally the conclusion.

2 Theoretical foundation

The theoretic foundation starts by identifying the relevant literature on trust in cryptocurrency payments and concludes with the research model.

2.1 Trust in cryptocurrencies

This research evaluates trust in a cryptocurrency from the perspective of a consumer intending to use it to make a payment. There are many cryptocurrencies that utilize different technologies, but Bitcoin and Ethereum are the most significant based on their popularity. Bitcoin is closer to the original decentralized vision put forward (Nakamoto, 2008) while Ethereum is more centralized with some different functionalities. Purchasing a cryptocurrency as an investor or a trader does not involve the same motivation or process, so it is outside the scope of this research. Purchasing a cryptocurrency as an investor or a trader would involve other criteria such as the state of the economy and the relative strength of stocks, bonds, gold and other assets. The term digital currency is broader and it does not necessarily mean blockchain technology is used. Central Bank Digital Currencies (CBDCs) have many differences to cryptocurrencies such as Bitcoin, notably they are issued by a government, so trust in them is very different (Auer and Böhme, 2020). So-called stablecoins build trust with the consumer differently, by reassuring them that they will remain tethered to something valuable from traditional finance such as a fiat currency, so they are also outside the scope of the literature review.

While both Bitcoin and Ethereum use blockchain technology, which can increase security and support trust, several studies show that blockchain does not reduce risk sufficiently to take away the need for trust (Abramova et al., 2021; Suleman and Lemieux, 2023).

It could be argued that most of the literature on cryptocurrencies such as Bitcoin focus on the new functionality of this technology, the “newness”, as opposed to the “sameness” The “sameness” of a cryptocurrency like Bitcoin or Ethreeum is the fact that it is a technology that needs to be trusted by an individual to be adopted. Considering cryptocurrencies such as Bitcoin as a technology that needs to be trusted for it to be adopted, allows the literature from the area of trust in technology to be utilized (McKnight et al., 2011; Lankton et al., 2015). The importance of trust in cryptocurrencies has been supported (Zarifis et al., 2014; Zarifis et al., 2015; Knittel et al., 2019) despite the perspective of some, that they are “trustless” due to the blockchain technology. There are several different conceptualizations and definitions of trust. This research focuses on the initial trust formation where the consumer makes a judgment about the competence, benevolence and integrity, of those they will have to be vulnerable to when making a payment with the cryptoasset (McKnight and Chervany, 2002). This definition suggests the consumer is aware that they are taking on some risk, and are not naive.

The original model of trust in digital currencies identified five variables that affect trust (1) personal innovativeness, (2) disposition to trust, (3) institution-based trust, (4) trusting beliefs, and (5) trusting intentions (Zarifis et al., 2014; Zarifis et al., 2015). The literature review covered subsequent developments to either reject, further validate or extend the original model. In addition to the original model, subsequent research found support for several aspects of it. Firstly, the literature of trust in technology adoption, (McKnight et al., 2002b; McKnight and Chervany, 2002), is relevant to Bitcoin (Sadhya et al., 2018; Marella et al., 2020). The importance of institutional trust in Bitcoin use is supported in the literature (Duan et al., 2023). When someone hears the word institution in the context of a financial transaction, their mind may go to traditional financial institutions such as central banks. In the context of cryptocurrencies, some institutions that exist in traditional finance such as regulators are equally important, while the network that supports the functioning, maintaining, upgrading, mining and governance of a cryptocurrency may also be considered an institution (Simser, 2015). Therefore, there is some support in the literature that the model is valid, but it should be re-evaluated and updated, as a-lot has changed in this area since 2014.

Trust in Bitcoin: There may be many reasons that influence trust in Bitcoin for some people, but the factors that influence trust for a large percentage of people may be far less. One of the main influences of trust for most people is the blockchain technology (Tönnissen et al., 2020; Wan et al., 2022). Blockchain technology is believed to support transparency and trust, to some degree, but there are still vulnerabilities and risks, as the many cases of financial fraud and cybersecurity breaches show (Xu et al., 2020; Jalan and Matkovskyy, 2023).

Both Bitcoin and Ethereum can be part of a more extended value chain or ecosystem when delivering services to a consumer. For Bitcoin, one additional technology used alongside it in payments is the Lightning Network, a blockchain technology that operates as a layer above the blockchain layer. For a consumer the payment process with Bitcoin requires a digital wallet. If they will use the Lightening Network for the payment, they must use an electronic wallet that is compatible.

The fluctuations in the price of cryptocurrencies have been a reason for concern and criticism. Most cryptocurrencies, including Bitcoin and Ethereum, face volatility in their price (Wang et al., 2022). While stablecoins may have the potential to be more stable (Gadzinski et al., 2023), they can also be volatile and collapse to a value close to zero (Jalan and Matkovskyy, 2023), something that has not happened with Bitcoin. The variety and unpredictability of the sources of the volatility increase the uncertainty, the risk, and therefore the need for trust.

Trust in Ethereum: Both Bitcoin and Ethereum are popular for making payments, but there are key differences between the two crytocurrencies, with Ethereum being very popular for smart contracts (Wang et al., 2021). Smart contracts are being utilized in an increasing number of ways offering many services. Ethereum smart contracts underpin many of the services of Decentralized Finance. The recent move from mining to proof-of-stake made it arguably more sustainable than Bitcoin, gaining favor with some people (De Vries, 2023). Nevertheless, despite taking a different approach to Bitcoin in terms of proof of stake, and having more centralized decision making, Ethereum faces many security threats (Xu et al., 2020). Despite some important differences between the way Bitcoin and Ethereum blockchain work, it is not clear if, from the consumers perspective, trust in them is fundamentally different.

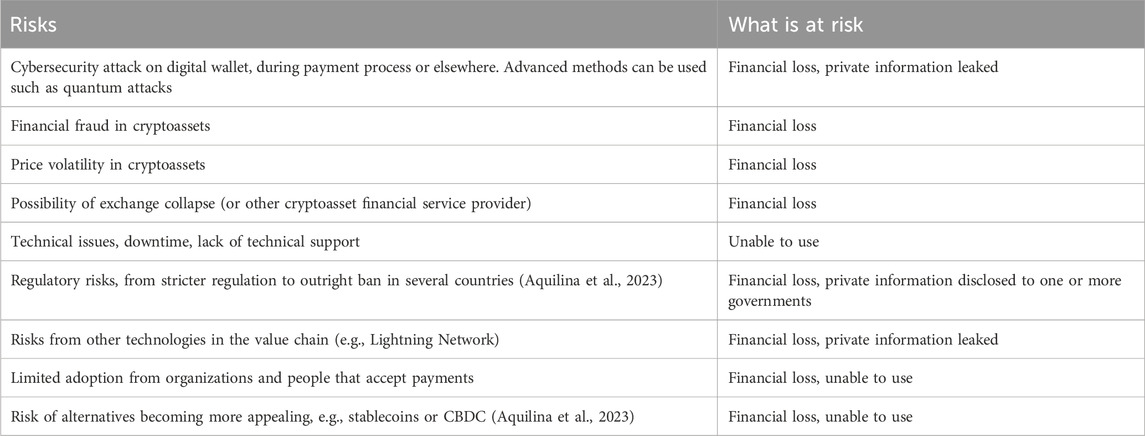

Despite the promise of a payment system that is secure due to the technology used, and therefore without a need to be trusted, many risks have been documented for Bitcoin, Ethereum and the other major cryptocurrencies. There is still risk of financial loss, personal information leaked or the payment process simply not working. The risks when making a cryptocurrency payment outlined in this literature review are grouped and summarized in Table 1. It is interesting that for what was referred to as a “trust free” technology it is perceived to be better suited for people with a high tolerance to risk. The phrases “in code we trust”, “trust-less technology”, meaning trust is not required, and “do not trust verify” (with blockchain) are familiar but the literature overwhelmingly shows that consumer trust is needed in cryptocurrency payments despite the use of blockchain.

2.2 Research model and hypotheses

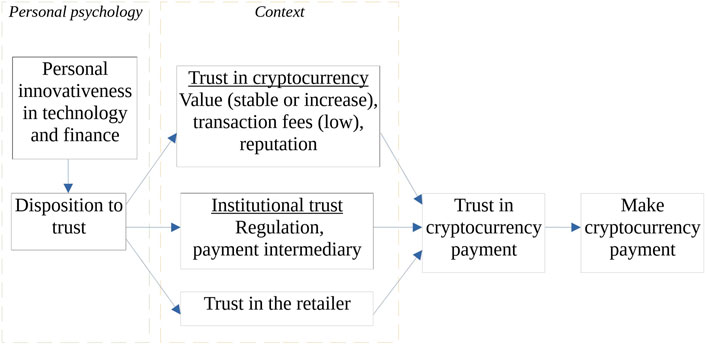

Based on the literature review there is no clear evidence that there is a more comprehensive model of trust in cryptocurrency payments than the original one (Zarifis et al., 2014; Zarifis et al., 2015). Furthermore, the original model has been cited extensively and aspects of it have been verified in subsequent research (Steinmetz et al., 2021; Solberg Söilen and Benhayoun, 2022). The literature review indicates that both the sources of risk, and the variables that influence trust in cryptocurrency payments, have not fundamentally changed. Nevertheless, despite the lack of a new factor for risk or for trust, the existing factors have evolved. Therefore, the literature review supports the need to update and re-evaluate the original model to ensure its continuing validity after 10 years. The initial research model of trust in cryptocurrency payments put forward by this research is presented in Figure 1.

While the variables that influence trust come from more general models of psychology and technology adoption, the way they are operationalized in the context of cryptocurrencies is different. The first and second variables come initially from psychology but they have been used extensively to understand technology adoption and trust in technology (McKnight et al., 2004). Based on the literature, the first variable of the model, personal innovativeness is further developed here. The second, disposition to trust, remains the same. Institutional trust and trust in the retailer are simplified. These improvements are possible now, because there is more evidence on how this technology is used compared to 2014 when the model was first created. The last decade has clarified some things as the following paragraphs discuss.

Personal innovativeness: There is a personal, psychological trait of personal innovativeness that influences how willing a person is to use new technology (Agarwal and Prasad, 1998; Kim et al., 2010). While personal innovativeness in technology will have an influence, adding personal innovativeness in finance should give more accurate results.

H1a: Personal innovativeness in technology positively influences disposition to trust.

H1b: Personal innovativeness in finance positively influences disposition to trust.

Disposition to trust: Disposition to trust is a person’s long held beliefs on trust (McKnight et al., 2004). Their inclination or propensity to trust. These are based on their faith in humanity which is shaped by competence, benevolence, and integrity. A person that has a very positive disposition to trust may be more willing to trust in many different situations. An individual’s psychology influences how they trust the cryptocurrency, the institutions involved and the retailer:

H2: Disposition to trust positively influences trust in the (a) cryptocurrency stable value, (b) stable fees, (c) extensive adoption and (d) reputation.

H3: Disposition to trust positively influences trust in institutions that support the cryptocurrency payment such as (a) regulation and (b) payment intermediaries.

H4: Disposition to trust positively influences the consumer’s trust in the retailer they will make a payment to.

Trust in cryptocurrency: There are four issues that influence trust in a cryptocurrency in this context. One of the longstanding challenges for cryptocurrencies is volatility (Baur and Dimpfl, 2021; Wang et al., 2022). The volatility may be different for cryptocurrencies such as Bitcoin and Ethereum, but it is high enough to be a concern for all the main cryptocurrencies that are not stablecoins or CBDCs. While a price increasing dramatically can cause some difficulties when making a payment, the biggest concern is when it drops in value. A large drop in value may mean the cryptocurrency owner cannot afford what they planned on purchasing, or their new worse financial situation may make them reconsider their purchase. Therefore, trust in the cryptocurrency holding its value or increasing in value will increase trust in the transaction. A second concern is transactions fees. The transaction fees also have some fluctuation (Ilk et al., 2021). If they are stable or decrease this will increase trust. An increasing cryptocurrency adoption and a positive reputation also increase trust in several ways (Faria, 2019; Knittel et al., 2019). Therefore, the following four hypotheses are.

H5a: Stable or higher cryptocurrency value increases trust in a cryptocurrency payment.

H5b: Stable or lower cryptocurrency transaction fees increases trust in a cryptocurrency payment.

H5c: Increasing cryptocurrency adoption increases trust in a cryptocurrency payment.

H5d: A positive reputation in the cryptocurrency increases trust in the cryptocurrency payment.

Institutional trust: Institutional trust is the individual’s trust in the institutions that are involved in the process of making a cryptocurrency transaction (McKnight et al., 2002a; Patnasingham et al., 2005). The institutions that are regulating cryptocurrencies and the payment intermediaries involved play an important role.

H6a: Increasing cryptocurrency regulation increases trust in a cryptocurrency payment.

H6b: Higher trust in a cryptocurrency payment intermediary increases trust in a cryptocurrency payment.

Trust in the retailer: Despite cryptocurrencies such as Bitcoin and Ethereum utilizing blockchain technology that can support trust in some ways, trust in the retailer still reinforces trust in the transaction (McKnight et al., 2002b). To trust the retailer the consumer must make a positive judgment on the retailer’s competence, benevolence, and integrity. All three must be positive. For example, a retailer may be benevolent but cause problems to the transaction due to their incompetence. Therefore, the seventh hypothesis is.

H7: Trust in the retailer has a positive effect on trust in the cryptocurrency payment.

Trust in cryptocurrency payment: Using a cryptocurrency to make a purchase requires trust in the aspects of the payment outlined above such as trust in the cryptocurrency, trust in the institutions and trust in the retailer (McKnight et al., 2002b; Zarifis et al., 2014; 2015). The widely used theory of planned behavior shows that beliefs influence behavior (Ajzen, 1991; Pavlou and Fygenson, 2006). If there is trust in the cryptocurrency payment, this should increase the likelihood of the payment being made.

H8: Trust in the cryptocurrency payment has a positive effect on making the cryptocurrency payment.

3 Methods

This research applies a quantitative analysis to test an extended version of the model of trust in cryptocurrency payments (Zarifis et al., 2014; Zarifis et al., 2015).

3.1 Data collection

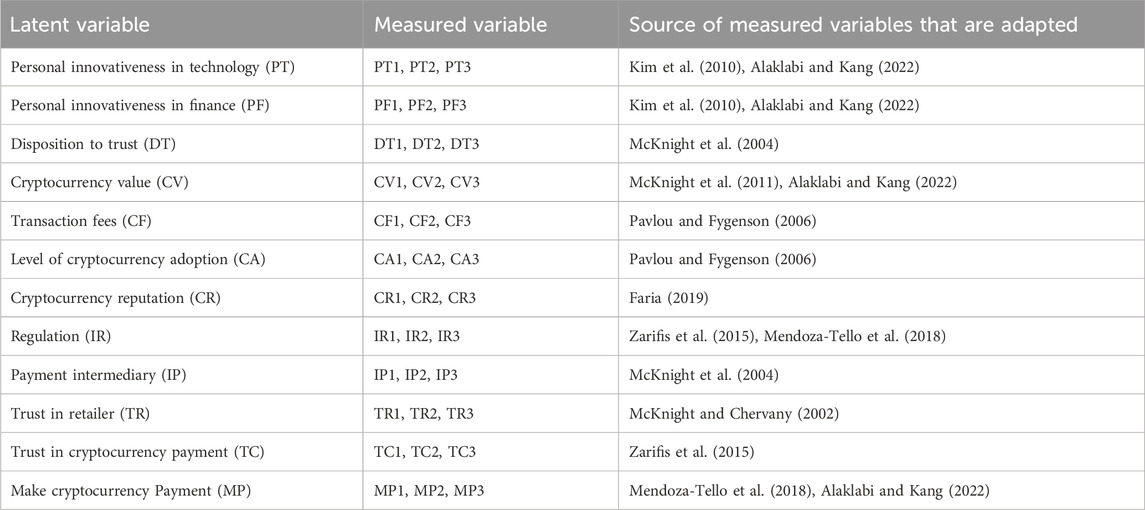

The survey questions are based on existing validated questions as illustrated in Table 2. The platform SoSci Survey was used to distribute the survey. This platform meets GDPR requirements which is necessary as this research was implemented in the EU. The participants needed to meet certain criteria to be allowed to take the survey. Only adults over 18 years old were allowed, as adults have broader experiences making payments, in more situations, over more years, making their beliefs more refined. The participants were German residents. This was achieved by targeting German residents for the survey and by having a question asking them to confirm that they live in that country. One country was chosen because there are some regional differences that can influence a person’s beliefs, the most obvious being that Bitcoin and other cryptocurrencies are banned in some parts of the world (Shi et al., 2021). Participants had to have experience using both Bitcoin and Ethereum to be allowed to take the survey. No financial reward was offered for the completion of the survey.

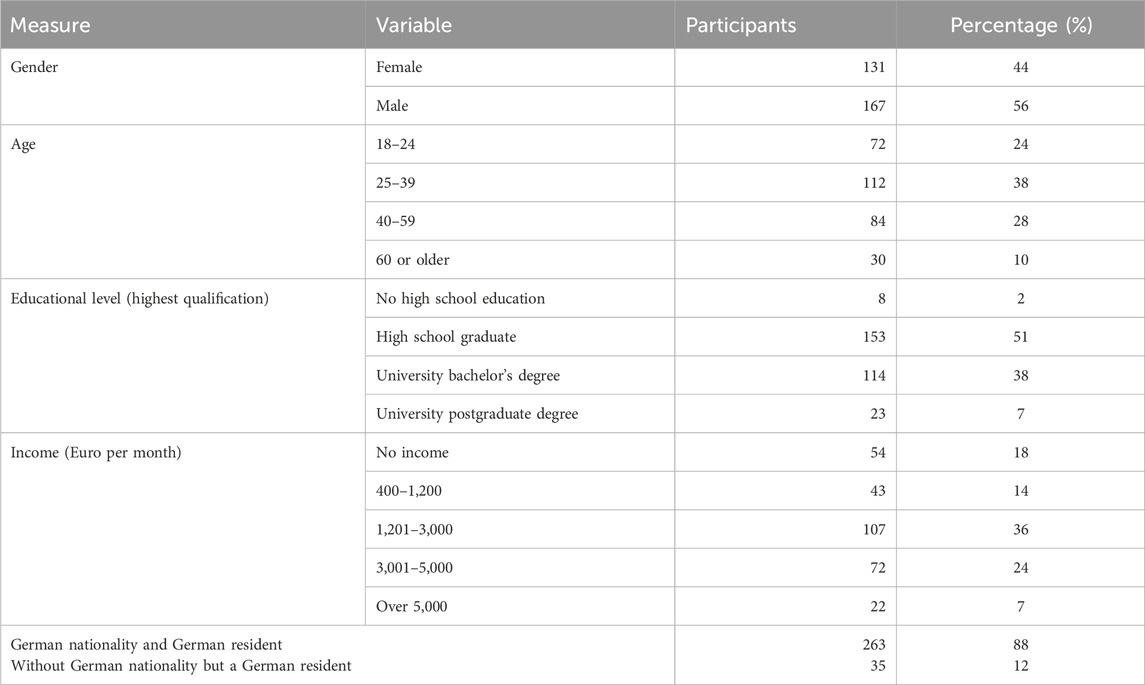

Based on the seminal book on how to implement Partial Least Squares-Structural Equation Modelling (PLS-SEM) (Hair et al., 2021), given the maximum number of arrows in the model being three, for a significance level of 1% and a minimum R2 of 0.10 the minimum sample size is 191. Using the G*Power software, the minimum sample size for a model with twelve latent variables, 36 measured variables, and a statistical power of 95% is 185. The survey was completed 347 times. After some checks to rule out invalid attempts the valid completed surveys are 298. The participants are spread evenly across different genders, ages, education levels and incomes as illustrated in Table 3.

3.2 Data analysis technique

Partial Least Squares-Structural Equation Modeling (PLS-SEM) is applied using the SmartPLS 4.0 software. This method is suitable for exploring complex models. The process of applying this method can also reveal new ways to further develop and improve a model. It is also suitable when latent variables are needed. Latent variables are often needed in social sciences when attempting to model human behavior because many beliefs, such as trust, cannot always be measured accurately and comprehensively with one variable. In such situations having a latent variable with several measured variables can capture human beliefs better (Hair et al., 2021).

4 Analysis and results

This method is suitable for exploring a model and refining it. Adjustments can be made to the model based on the results and a new version can be re-evaluated. The first time the PLS-SEM analysis was applied with the data collected, the influence of the cryptocurrency adoption rate (CA) level on trust was not supported. Firstly, the measured variables of CA do not have the sufficient discriminant validity with cryptocurrency reputation (CR) based on the Fornell–Larker criterion, and secondly the relationship with trust (TC) was not supported either as the path coefficient was close to zero. Therefore, the related hypothesis H3c is not supported. The variable of the cryptocurrency adoption (CA) was therefore taken out, so the model could be tested without it. Taking unsupported variables out and rerunning the model is one of the options available with PLS-SEM (Hair et al., 2021). The results of the analysis, after the cryptocurrency adoption rate (CA) was taken out, are presented below. SmartPLS is applied in two stages. The measurement model is presented first, followed by the structural model.

4.1 Measurement model

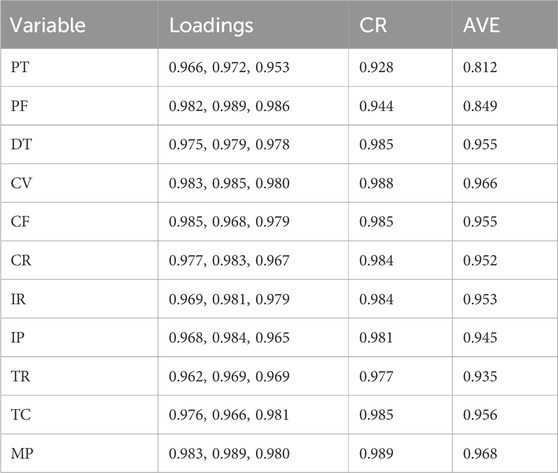

The first stage of the analysis is the measurement model where several tests attempt to establish how well the measured variables capture their latent variable (Hair et al., 2021). The first two tests evaluate the convergent validity. The factor loadings are over the minimum of 0.7 with the lowest being 0.865. The Average Variance Extracted (AVE) is 0.935 which is higher than the minimum accepted that is 0.5. The third test, composite reliability (CR) evaluates the consistency and reliability of the latent variables. The lowest composite reliability is 0.981, which is higher than the minimum accepted that is 0.7 as shown in Table 4. The fourth test, the Fornell-Larcker criterion evaluates if there is sufficient discriminant validity between the measured variables of each latent variable. As illustrated in Table 5, all the latent variables are sufficiently different from each other. Based on the tests implemented, the measurement model is supported.

4.2 Structural model

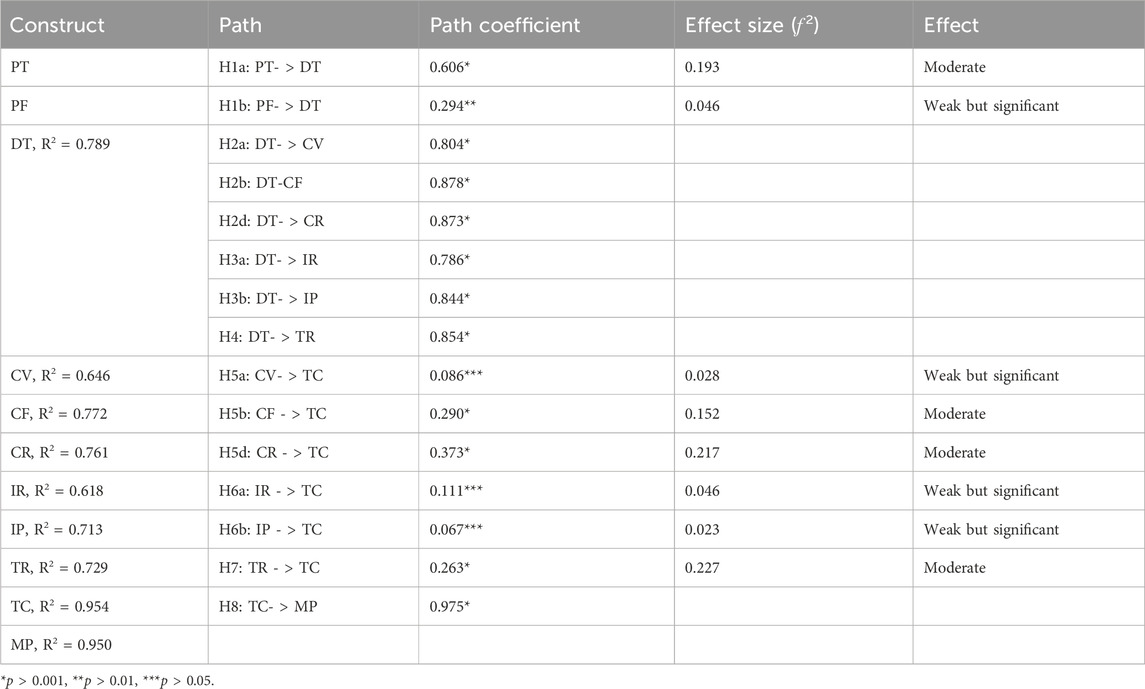

The structural model involves several tests on the relationships between the latent variables (Hair et al., 2021). For the endogenous latent variables, the coefficient of determination, R-square is above 0.75 and strong for DT (0.789), CF (0.772), CR (0.761), TR (0.729), TC (0.954) and MP (0.950). It is between 0.50 and 0.75 and moderate for CV (0.646), IP (0.713) and IR (0.618). None of the endogenous variables have a weak coefficient of determination (Chin, 1998).

The effect size (ƒ2) of the paths is insignificant if it is under 0.02, weak between 0.02 and 0.15, moderate between 0.15 and 0.35 and strong if it is above 0.35. As the results in Table 6 show, no paths are insignificant. All the paths are moderate, or weak but significant. Considering that a model with many variables will typically have lower effect sizes for each variable, these results support the model as all effect sizes are significant (Hair et al., 2021). Endogenous latent variables that only have one arrow to them are not tested for effect size, as the test for effect size involves taking one variable out and testing the effect again without it. For the latent variables with one arrow to them there would be no arrows left to them, if one variable was taken out, so the test is not helpful in this case (Hair et al., 2021). The bootstrapping method was also applied with 5,500 samples, and it offers the additional insight such as the p-values of the path coefficients presented in Table 6.

The model fit is strong based on several measures. The Normed Fit Index (NFI) is 0.866 which is close to 0.900, which is an indication of a strong model fit (Hair et al., 2021). The standardized root mean square residual (SRMR) is 0.010, which is below 0.050 indicating a strong model fit (Hair et al., 2021).

5 Discussion

This research re-evaluates and extends the first model of trust in cryptocurrencies (Zarifis et al., 2014; Zarifis et al., 2015) and delivers the second extended model of consumer trust in cryptocurrencies CRYPTOTRUST 2 as seen in Figure 2. The extended model is tested and supported after some additional refinements. Personal innovativeness is separated into personal innovativeness in technology and finance. The role of cryptocurrency value stability, stable or low transaction fees and reputation are supported. However, the role of the extent of the cryptocurrency adoption on trust, is not supported. The close correlation between adoption and reputation suggests that adoption may influence reputation but it is not a significant factor on its own.

5.1 Theoretical contribution

This research makes two main theoretic contributions. The first theoretic contribution is supporting an extended version of the first model of trust in a cryptocurrency (Zarifis et al., 2014; Zarifis et al., 2015). For the new model, CRYPTOTRUST2, personal innovativeness is divided into (1) personal innovativeness in technology, and (2) personal innovativeness in finance. These two influence the (3) personal disposition to trust. There are then six variables that come from the specific context, and not the person’s psychology. The first three are related to the cryptocurrency itself. These are (4) the stability in the cryptocurrency value, (5) the transaction fees and (6) reputation (Faria, 2019). Institutional trust is shaped by (7) regulation and (8) payment intermediaries that are involved in fulfilling the transaction. The last contextual factor is (9) trust in the retailer. The six variables from the context influence (10) trust in the cryptocurrency payment which finally, influences (11) the likelihood of making the cryptocurrency payment.

Separating personal innovativeness to personal innovativeness in (1) technology and (2) finance, is a useful theoretic contribution made by the model. This distinction is useful as some consumers may have different levels of personal innovativeness for technology and finance. The analysis here supports that these are separate constructs.

Updating and improving the understanding of the role a cryptocurrency, and institutions, play in building trust are important contributions. The contextual factors of the cryptocurrency, regulators, intermediaries and the retailer all play a role. All the main actors in the value chain play a role in building trust. This supports the broader trend in appreciating the value of ecosystems as a whole, as opposed to the role of individual organizations. The processes of organizations collaborating are often too interrelated to separate out.

The second theoretic contribution is that this research gives additional support to the role of trust in using cryptocurrencies to make transactions. This is important as cryptocurrencies and other blockchain based technologies may have features that support trust, but they still need to be trusted (Mendoza-Tello et al., 2018; Ostern, 2018).

5.2 Practical contribution

The model of trust in cryptocurrencies, CRYPTOTRUST2, presented here can inform technical and business decisions across the payment value chain including the cryptocurrency, regulators, payment intermediaries and the retailer receiving the payment.

This research shows that trust in cryptocurrencies has not changed fundamentally, but it has evolved. There is more emphasis from the consumer on having a stable value and low transaction fees. This may be because consumers now have more experience with cryptocurrencies, and they are better informed. It may also be because there are more cryptocurrencies available, and other alternatives such as CBDCs, so consumers can review the many alternatives and try to identify the best one.

While there is a belief among some in the cryptocurrency community that cryptocurrencies should not be regulated, and they should stay separate from the traditional financial system, this research shows that regulation builds trust. Therefore, organizations involved in the cryptocurrency payment process such as those involved in supporting the cryptocurrencies themselves, and payment intermediaries, should engage with regulators and pursue effective regulation. Where effective and fair regulation can be achieved, it will enhance trust in using cryptocurrencies.

Separating personal innovativeness into personal innovativeness in (1) technology, and (2) finance, offers insight into the psychology of the consumer that uses cryptocurrencies to make payments. This can inform how the services are designed. For example, as many consumers making cryptocurrency payments are interested in innovation in technology and finance, more innovative services can be provided such as Decentralised Finance (DeFi), or personal insurance utilizing wearable devices and other sensors.

5.3 Limitations and future research

The model supported here applies to making payments with cryptocurrencies utilizing blockchain technology and therefore does not apply to (1) digital currencies that do not utilise blockchain, (2) so-called stablecoins and (3) CBDCs. The model does not apply to making investment decisions in cryptocurrencies either, as the factors in those decisions are different and the timescale of the investment may be much longer than that of a payment. The model was tested with a sample from Germany and the survey questions ask about the consumer’s beliefs on Bitcoin. Future research can test the model in additional regions and with different cryptocurrencies. Future research can also explore how consumers estimate risk in this context, and if there are different psychological profiles that play a role.

6 Conclusion

This research evaluates trust in a cryptocurrency from the perspective of a consumer intending to use it to make a payment. The second extended model of consumer trust in cryptocurrency payments, CRYPTOTRUST 2, is developed based on the first peer-reviewed published model of trust in cryptocurrencies (Zarifis et al., 2014; Zarifis et al., 2015). This approach has the benefit of utilizing a model that has been supported for over a decade and is based on principles of trust in technology adoption.

The model supports that (1) personal innovativeness in technology and (2) personal innovativeness in finance influence the (3) personal disposition to trust. There are then six variables that come from the specific context and not the person’s psychology. The first three are related to the cryptocurrency itself. These are (4) the stability in the cryptocurrency value, (5) the transaction fees and (6) reputation. Institutional trust is shaped by (7) regulation and (8) payment intermediaries that are involved in fulfilling the transaction. The last contextual factor is (9) trust in the retailer. The six variables from the context influence (10) trust in the cryptocurrency payment which finally, influences (11) the likelihood of making the cryptocurrency payment.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Ethics statement

The studies involving humans were approved by Evaluation, PSL University, France, EU. The studies were conducted in accordance with the local legislation and institutional requirements. The participants provided their written informed consent to participate in this study.

Author contributions

AZ: Conceptualization, writing–original draft, investigation, model analysis. SF: writing–review and editing, model analysis.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Acknowledgments

We would like to thank the editors and reviewers for their comments.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abramova, S., Böhme, R., Elsinger, H., Stix, H., and Summer, M. (2021). Working paper 241: what can CBDC designers learn from asking potential users? Results from a survey of Austrian residents. Vienna: Oesterreichische Nationalbank (OeNB).

Agarwal, R., and Prasad, J. (1998). A conceptual and operational definition of personal innovativeness in the domain of information technology. Inf. Syst. Res. 9, 204–215. doi:10.1287/isre.9.2.204

Ajzen, I. (1991). The theory of planned behavior. Organ Behav. Hum. Decis. Process 50, 179–211. doi:10.1016/0749-5978(91)90020-t

Alaklabi, S., and Kang, K. (2022). The extended TRA model for the assessment of factors driving individuals’ behavioral intention to use cryptocurrency. Interdiscip. J. Inf. Knowl. Manag. 17, 125–149. doi:10.28945/4948

Aquilina, M., Frost, J., and Schrimpf, A. (2023). Addressing the risks in crypto: laying out the options. Basel: Bank of International Settlements Bulletin.

Baur, D. G., and Dimpfl, T. (2021). The volatility of Bitcoin and its role as a medium of exchange and a store of value. Empir. Econ. 61, 2663–2683. doi:10.1007/s00181-020-01990-5

Chin, W. W. (1998). “The partial least squares approach to structural equation modelling. In Marcoulides G. A. (Ed.),” in Modern methods for business research (Mahwah, NJ: Lawrence Erlbaum Associates), 295–336.

De Vries, A. (2023). Cryptocurrencies on the road to sustainability: Ethereum paving the way for Bitcoin. Ethereum paving way Bitcoin 4, 100633. doi:10.1016/j.patter.2022.100633

Duan, K., Gao, Y., Mishra, T., and Satchell, S. (2023). Efficiency dynamics across segmented Bitcoin Markets: evidence from a decomposition strategy. J. Int. Financial Mark. Institutions Money 83, 101742. doi:10.1016/j.intfin.2023.101742

Faria, I. (2019). Trust, reputation and ambiguous freedoms: financial institutions and subversive libertarians navigating blockchain, markets, and regulation. J. Cult. Econ. 12, 119–132. doi:10.1080/17530350.2018.1547986

Gadzinski, G., Castello, A., and Mazzorana, F. (2023). Stablecoins: does design affect stability? Financ. Res. Lett. 53, 103611. doi:10.1016/j.frl.2022.103611

García-Monleón, F., Erdmann, A., and Arilla, R. (2023). A value-based approach to the adoption of cryptocurrencies. J. Innovation Knowl. 8, 100342. doi:10.1016/j.jik.2023.100342

Hair, J., Hult, T., Ringle, C., and Sarstedt, M. (2021). A primer on partial Least squares structural equation modeling (PLS-SEM). 3rd ed. Thousand Oaks, CA: Sage Publishing.

Huber, T. A., and Sornette, D. (2022). Boom, bust, and bitcoin: bitcoin-bubbles as innovation accelerators. J. Econ. Issues, Inf. U. K. Ltd. 56 (1), 113–136. doi:10.1080/00213624.2022.2020023

Ilk, N., Shang, G., Fan, S., and Leon Zhao, J. (2021). Stability of transaction fees in bitcoin: a supply and demand perspective. MIS Q. 45, 563–692. doi:10.25300/MISQ/2021/15718

Jalan, A., and Matkovskyy, R. (2023). Systemic risks in the cryptocurrency market: evidence from the FTX collapse. Financ. Res. Lett. 53, 103670. doi:10.1016/j.frl.2023.103670

Kim, C., Mirusmonov, M., and Lee, I. (2010). An empirical examination of factors influencing the intention to use mobile payment. Comput. Hum. Behav. 26, 310–322. doi:10.1016/j.chb.2009.10.013

Knittel, M., Pitts, S., and Wash, R. (2019). “The most trustworthy coin”: how ideology builds and maintains trust in bitcoin. Proc. ACM Hum. Comput. Interact. 3, 1–23. doi:10.1145/3359138

Lankton, N., McKnight, H., and Tripp, J. (2015). Technology, humanness, and trust: rethinking trust in technology. J. Assoc. Inf. Technol. 16, 880–918. doi:10.17705/1jais.00411

Ligon, C. (2023). What ’s behind BlackRock ’s spot bitcoin ETF timing? surprise application sets off mad scramble among financial services firms. Pensions and Investments, 1–4.

Marella, V., Upreti, B., Merikivi, J., and Tuunainen, V. K. (2020). Understanding the creation of trust in cryptocurrencies: the case of Bitcoin. Electron. Mark. 30, 259–271. doi:10.1007/s12525-019-00392-5

McKnight, H., Carter, M., Thatcher, J. B., and Clay, P. (2011). Trust in a specific technology: an investigation of its components and measures. ACM Trans. Manag. Inf. Syst. 2, 1–25. doi:10.1145/1985347.1985353

McKnight, H., and Chervany, N. L. (2002). What trust means in E-commerce customer relationships: an interdisciplinary conceptual typology. Int. J. Electron. Commer. 6, 35–59. doi:10.1080/10864415.2001.11044235

McKnight, H., Choudhury, V., and Kacmar, C. (2002a). Developing and validating trust measures for e-commerce: an integrative typology. Inf. Syst. Res. 13, 334–359. doi:10.1287/isre.13.3.334.81

McKnight, H., Choudhury, V., and Kacmar, C. (2002b). The impact of initial consumer trust on intentions to transact with a web site: a trust building model. J. Strategic Inf. Syst. 11, 297–323. doi:10.1016/s0963-8687(02)00020-3

McKnight, K., Choudhury, H., and Choudhury, L. (2004). Dispositional trust and distrust distinctions in predicting high- and low-risk internet expert advice site perceptions. e-Service J. 3, 35. doi:10.2979/esj.2004.3.2.35

Mendoza-Tello, J. C., Mora, H., Pujol-López, F. A., and Lytras, M. D. (2018). Social commerce as a driver to enhance trust and intention to use cryptocurrencies for electronic payments. IEEE Access 6, 50737–50751. doi:10.1109/ACCESS.2018.2869359

Nakamoto, S. (2008). Bitcoin: a peer-to-peer electronic cash system. Available at: www.bitcoin.org.

Ostern, N. (2018). “Do you trust a trust-free technology? Toward a trust framework model for blockchain technology,” in Proceedings of the 39th International Conference on Information Systems, ICIS 2018, San Francisco.

Patnasingham, P., Gefen, D., and Pavlou, P. A. (2005). The role of facilitating conditions and institutional trust in electronic markets. J. Electron. Commer. Organ. 14, 69–82.

Pavlou, P. A., and Fygenson, M. (2006). Understanding and predicting electronic commerce adoption: an extension of the theory of planned behavior. MIS Q. 30, 115. doi:10.2307/25148720

Priem, R. (2020). Distributed ledger technology for securities clearing and settlement: benefits, risks, and regulatory implications. Financ. Innov. 6, 11. doi:10.1186/s40854-019-0169-6

Sadhya, V., Sadhya, H., Hirschheim, R., and Watson, E. (2018). “Exploring technology trust in bitcoin: the blockchain exemplar,” in European Conference on Information Systems ECIS 2018 Proceedings, USA, June 23-28, 2018. Available at: https://aisel.aisnet.org/ecis2018_rp.

Schmeling, M., Schrimpf, A., and Todorov, K. (2023). Crypto carry. Available at: www.bis.org.

Shi, S., and Shi, Y. (2021). Bitcoin futures: trade it or ban it? Eur. J. Finance 27, 381–396. doi:10.1080/1351847X.2019.1647865

Simser, J. (2015). Bitcoin and modern alchemy: in code we trust. J. Financ. Crime. 22, 156–169. doi:10.1108/JFC-11-2013-0067

Solberg Söilen, K., and Benhayoun, L. (2022). Household acceptance of central bank digital currency: the role of institutional trust. Int. J. Bank Mark. 40, 172–196. doi:10.1108/IJBM-04-2021-0156

Steinmetz, F., von Meduna, M., Ante, L., and Fiedler, I. (2021). Ownership, uses and perceptions of cryptocurrency: results from a population survey. Technol. Forecast Soc. Change 173, 121073. doi:10.1016/j.techfore.2021.121073

Suleman, Z. J., and Lemieux, V. L. (2023). “Learning to trust: exploring the relationship between trust and user experience in blockchain systems,” in Blockchain in healthcare, future of business and finance. Editors C. Lu, and M. Tanniru (China: IEEE), 119–144. doi:10.1007/978-3-031-45339-7_6

Tönnissen, S., Beinke, J. H., and Teuteberg, F. (2020). Understanding token-based ecosystems – a taxonomy of blockchain-based business models of start-ups. Electron. Mark. 30, 307–323. doi:10.1007/s12525-020-00396-6

Wan, Y., Gao, Y., and Hu, Y. (2022). Blockchain application and collaborative innovation in the manufacturing industry: based on the perspective of social trust. Technol. Forecast Soc. Change 177, 121540. doi:10.1016/j.techfore.2022.121540

Wang, J., Ma, F., Bouri, E., and Guo, Y. (2022). Which factors drive Bitcoin volatility: macroeconomic, technical, or both? J. Forecast 42, 970–988. doi:10.1002/for.2930

Wang, Z., Jin, H., Dai, W., Choo, K. K. R., and Zou, D. (2021). Ethereum smart contract security research: survey and future research opportunities. Front. Comput. Sci. 15, 152802. doi:10.1007/s11704-020-9284-9

Wendl, M., Doan, M. H., and Sassen, R. (2023). The environmental impact of cryptocurrencies using proof of work and proof of stake consensus algorithms: a systematic review. J. Environ. Manage 326, 116530. doi:10.1016/j.jenvman.2022.116530

Xu, G., Guo, B., Su, C., Zheng, X., Liang, K., Wong, D. S., et al. (2020). Am I eclipsed? A smart detector of eclipse attacks for Ethereum. Comput. Secur 88, 101604. doi:10.1016/j.cose.2019.101604

Zarifis, A., Cheng, X., Dimitriou, S., and Efthymiou, L. (2015). “Trust in digital currency enabled transactions model,” in Mediterranean Conference on Information Systems (MCIS), China, September 6th-9th, 2023, 1–8. Available at: http://aisel.aisnet.org/cgi/viewcontent.cgi?article=1034&context=mcis2015.

Keywords: trust, cryptocurrency, digital currency, payment, FinTech, institutional trust, ethereum, bitcoin

Citation: Zarifis A and Fu S (2024) The second extended model of consumer trust in cryptocurrency payments, CRYPTOTRUST 2. Front. Blockchain 7:1220031. doi: 10.3389/fbloc.2024.1220031

Received: 09 May 2023; Accepted: 31 July 2024;

Published: 16 August 2024.

Edited by:

Raul Zambrano, Independent Researcher, New York, United StatesReviewed by:

Victoria L. Lemieux, University of British Columbia, CanadaWenqi Wei, University of Surrey, United Kingdom

Copyright © 2024 Zarifis and Fu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Alex Zarifis, YS56YXJpZmlzQHNvdG9uLmFjLnVr

Alex Zarifis

Alex Zarifis Shixuan Fu

Shixuan Fu