- 1The University of Sydney, Darlington, NSW, Australia

- 2Economic History Association, Tucson, AZ, United States

This article will argue that the development of Chinese financial technology, or ‘fintech’, over the past decade, is primarily motivated to safeguard Chinese monetary sovereignty, which is threatened by the proliferation of non-state cryptocurrencies, like Bitcoin, that have exacerbated the problem of capital flight, not only for China, but for other non-Western countries that have lost fortunes to outflows seeking access Western financial assets. This raises the question, how is China responding to the emergence of cryptocurrencies as a development that reinforces US financial hegemony? The answer to be explored by this paper is by embracing elements of cryptocurrency technology in the form of digital payment systems and blockchain technology. These Chinese fintech developments pose a serious unprecedented challenge to the financial hegemony of the US insofar as it compels other countries to copy the Chinese response because they desire the tools to limit illegal outflows of capital that have historically propped up the US Dollar.

Introduction

The rapid development of Chinese financial technology poses a major unprecedented challenge to the hegemony of the US Dollar, which is currently experiencing inflationary pressures that have not been witnessed since 1981. This technology can be divided into two categories, 1) the currently operating Chinese CBDC (Central Bank Digital Currency) network, which is a digital payments system that is rapidly eliminating physical cash, and 2) Project mBridge, which is an ambitious plan, led by China, to interlink the world’s central banks in a decentralised manner using blockchain technology. CBDCs are issued by central banks as the digital equivalent of cash using elements of the blockchain technology that underpin the world’s first cryptocurrency, Bitcoin. From a Chinese perspective, these developments are defensive means of countering the financial hegemony of the US and the weaponization of the US Dollar through the imposition of financial sanctions, however, from a US perspective, China is leading the way towards the de-Dollarization of the global economy.

The Chinese CBDC is the digital version of the existing Chinese currency, the Renminbi, and has been referred to by different names, including the digital Renminbi, e-Renminbi, e-CNY, e-RMB, e-Yuan, or Digital Currency Electronic Payment (DCEP), however, this e-CNY is not built on blockchain technology, rather it is an electronic payment system (Turrin, 2021, 131). The pioneering of CBDC technology by China can help developing countries around the Global South manage their balance of payments, especially to prevent capital flight, which over the decades has played an important role in propping up global demand for the US Dollar. Additionally, the rise of digital currencies that operate over the internet, combined with Project mBridge, will enable countries around the world to evade US financial sanctions by establishing payment networks that are outside the control of the Western Belgium-based Society for Worldwide Interbank Financial Telecommunication (SWIFT).

The proliferation of CBDC technology faces major obstacles to adoption within the US for two reasons. Firstly, because it threatens the established institutional power of the traditional financial intermediaries that sit between the American public and their own money supply at the level of the Federal Reserve (aka “the Fed”), which could be made redundant by the introduction of a CBDC. Secondly, the technology raises ethical concerns that it could further concentrate political power in the hands of elites, allowing them to engage in social engineering in ways that are harmful to the public good. This paper will argue that value judgements about the technology ultimately depends on the balance of class forces within the nations implementing it, thereby opening up the possibility for such technology to serve utilitarian, meritocratic, and egalitarian objectives.

Context: declining US Dollar hegemony

The United States established currency hegemony in 1944 following the Bretton Woods conference, where all forty-four participating nations agreed to peg their currency at a fixed exchange rate to the US Dollar (including the USSR), which in turn the US government promised to exchange at $35 per ounce of gold (Eichengreen, 1990, 667). However, this agreement eventually broke down in 1971 when the US government under President Nixon ended the convertibility of its currency to gold, also known as the ‘Nixon shock’. Regardless, the US Dollar maintained its role as the world reserve currency for the simple reason that there was no alternative. This is because for a global economy to function, there must be a single “measure of value,” to invoke Marx, against which all commodities and currencies are measured (Marx, 1867, 66-90).

The reason the US could establish currency hegemony in the first place was because of its industrial capacity and technological monopolies on the production of advanced manufactured goods. This enabled the US to post current account surpluses until 1977, following which the US has only posted current account deficits, reaching an unprecedented $821 billion in 2021 (World Bank, 2022). The foundation of US industrial prowess also enabled the US to be a net-creditor until 1985 (Kilborn, 1985), following which the US has become a net-debtor to the sum of $14 trillion with the rest of the world (IMF, 2022a). To back their currency, the US negotiated a deal with the Saudis and OPEC by 1975 in which the latter would price oil in US Dollars, hence the “petrodollar” (Clark, 2005, 33), as well as opened up trade and investment relations with China, which in turn proceeded to produce growing export surpluses in exchange for the US Dollar following the 1972 resumption of US-China relations (Bader, 2012).

Although these policies succeeded in propping up demand for the US Dollar, they also coincided with the deindustrialisation of the US, thereby undermining the very foundations that propelled the US to the status of issuing the world reserve currency in the first place. To be sure, the US Dollar is still backed by some technologically advanced US industries that produce, for example, military hardware, semi-conductor chips, and commercial airlines manufactured by American corporations and sold in US Dollars. However, it is also the case that in the battle of production, the US has lost significant ground to China, which in turn appears destined to achieve technological parity with the US in areas where it has not done so already. For example, in semi-conductor manufacturing, China is now only “one generation” behind industry leaders Taiwan and South Korea, prompting the US to ban transfers of technology that could help China in this regard (Hille, 2022). In 1990 the world’s largest trade-partners were the US, Germany, France, and Britain, whereas today, that distinction belongs to China alone (Sundell, 2022).

So long as the rest of the world needs US Dollars to import a range of commodities from around the world that are priced in US Dollars for reasons of inherited convention, the US can run up the world’s largest debts and deficits in absolute terms without experiencing too serious inflation. However, in recent years, the inflation has “come home to roost,” hitting an annual rate of 9.1 percent by June 2022, a level not seen since 1981 (USBLS, 2022). This is the logical consequence of long-term US de-industrialisation, combined with unprecedented money printing by the US Federal Reserve given that around 80% of all US Dollars were printed in the period from March 2020 to November 2021 (Levi, 2021). The inflationary surge is also a consequence of the reality that the punitive Western sanctions imposed on Russia (for invading Ukraine in February 2022) have backfired given that the Russian Ruble has strengthened instead of weakening (Shakhnov, 2022; XE, 2022). This is unprecedented in the history of US sanctions, which far from isolating Russia, has intensified de-Dollarization among non-Western states, which includes one-quarter of the world’s population living in countries under US economic sanctions of varying severity (Springfield, 2022).

The challenge posed by Chinese fintech begins with the launching of CIPS, the Cross-Border Interbank Payment System, by the People’s Bank of China (PBoC), China’s reserve bank. In 2015, CIPS processed $500 billion worth of transactions (Kida et al., 2023), which grew to roughly $14 trillion (96.7 trillion RMB) in 2022 according to the PBoC (PBoC, 2022, p. 9). By launching CIPS, China began building the fintech architecture needed to rival the US-led financial order after decades of conforming to that order. Although this represented a significant development, CIPS is not technologically superior to SWIFT, indeed it relies on SWIFT to conduct transactions outside China (Jin, 2022), and thus has limited potential to challenge US currency hegemony. Moving beyond CIPS, this article is about the opportunities and challenges of the next stage in the evolution of Chinese fintech, which is through the adaption of certain elements of blockchain technology.

In this context, this paper will argue that the proliferation of CBDCs around the world will accelerate de-Dollarization. This is because CBDCs are programmable, meaning that central banks can “code” money with rules to govern their usage in unprecedented ways, thereby giving Global South governments that are attempting dirigiste policies new tools to control the spending of their residents in accordance with state planning objectives. This has the potential to stem capital flight from the non-West (Russia and the post-colonial world), and because CBDCs operate over the internet, their proliferation will allow countries to bypass the SWIFT network, thereby undermining the credibility of US threats to impose sanctions by cutting states off from that network.

How capital flight props up the US Dollar

To keep inflation under control, the US needs to pursue policies that will maintain demand for US Dollars, including encouraging countries around the world to adopt “neoliberal” economic policies, that involve liberalising trade and capital flows. Gruin (2021, 587) recognises that the term “neoliberalism” is difficult to define while also acknowledging its association with the “Washington Consensus,” which is how this article uses the term, namely, as one of many strategies for maintaining US Dollar hegemony. Because of these policies, from 1980 to 2012, capital flight from the developing world amounted to $16.3 trillion, which is roughly comparable to the contemporary US net-external debt. Of that capital flight, the Chinese share is the largest at around $4.6 trillion (Clough, 2016). More recent data shows that roughly $3.8 trillion left China from 2007 to 2017 (Gunter et al., 2017). Similarly, according to Sergei Glazyev, an advisor to Russian president Vladimir Putin, from the Soviet collapse in 1991 to 2019, capital flight from Russia reached $1 trillion (The Moscow Times, 2019). To be sure, not all this money was converted into US Dollars, however, given the status of the US Dollar as world reserve currency, it would not be unreasonable to assume that a significant portion of this capital flight bought US Dollar denominated assets.

Unlike the financial hegemony of Britain that relied on expropriating wealth from extractive colonies like India (Patnaik and Patnaik, 2021, 169-70), US currency hegemony was originally premised on quid pro quo trade relations between nations, which came about because formal imperialism ended. Therefore, it must be acknowledged that there are important voluntary pillars that have underscored US Dollar hegemony, including persuading countries to adhere to neoliberal policies.

Referring to such voluntarism, Salvatore Babones uses the Chinese term “tianxia” to describe the US-led world order based on a concept borrowed from Chinese philosopher Zhao Tingyang, who revived the term from its ancient roots (Babones, 2017, 25). By itself, the term “tianxia” refers to a global order that implies a “a common or public choice made by all peoples in the world, truly representing the general will” in the form of “a universal political system for the world” (Babones, 2017, 4). According to Babones, “the American Tianxia is inexorably expansionary while nonetheless maintaining a voluntary approach,” so that the “more people put their individual interests ahead of those of their countries of birth, they come into alignment with the American Tianxia” (Babones, 2017, 22). This strategy of leveraging the interests of individuals within nations against the more general collective interests of that nation is also central to the neoliberal policies promoted by the US for other countries to follow.

The breakdown of the dirigiste model as advocated by neoliberal policies and as adopted by many Global South states after WW2 represents the success of this strategy. Under the dirigiste strategy of many Global South nations, the short-term individual interests of the wealthier classes to emulate the ‘first world’ lifestyles prevalent across the US-led alliance by importing high-value added consumer goods, i.e., “conspicuous consumption,” were deliberately curtailed by state planners in order to serve long-term collective goals of independent industrial development. However, as a consequence of the wealthier classes in these countries being enticed by “opening up” to the US through monetary liberalisation, the influx of imports for “conspicuous consumption” not only undermined “infant” industries, leading to de-industrialisation, they also necessitated the outflow of “hard currency,” especially US Dollars, to pay for those imports, thereby depreciating the Global South currency in question against the US Dollar.

This pattern was identified by Utsa Patnaik (1996, 5) as important social factors that led India down the path of abandoning dirigiste economic planning and implementing neoliberal policies from 1991 onwards. Similarly, according to Prabhat Patnaik, under conditions of capital mobility, the “preference” of the “third world elite” for “assets located in the first world,” creates the conditions for a downward spiral in the purchasing power of the third world currency in question, so that inflation frightens the elites into selling their currency for US Dollars, which then causes the sold Global South currency to depreciate, which then causes further inflation in that currency as a consequence of imports becoming more expensive, which then causes further elite capital flight (Patnaik, 2013, 1-2). Furthermore, the cheapening of third world currencies against the US Dollars translates to the cheapening of third world exports, thereby keeping US Dollar inflation under control.

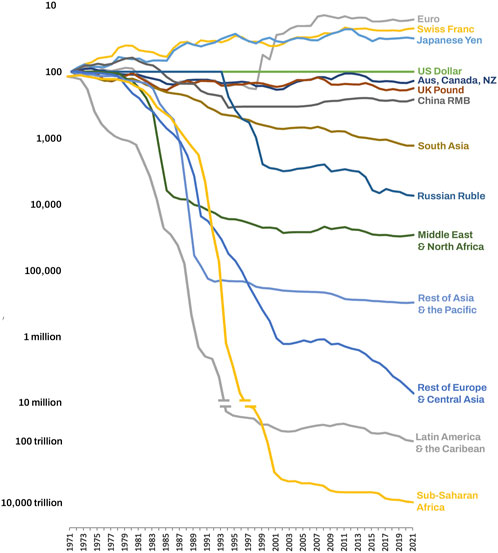

To demonstrate the scale of depreciation against the US Dollar, if all currencies were indexed to 100 in 1971 and measured against the US Dollar until 2021 (see Figure 1), then only a small number of currencies appreciated against the US Dollar such as the Euro (16), the currencies of oil-exporting OPEC states like Saudi Arabia (83), Kuwait (86), Bahrain (79), the UAE (77), and Qatar (76), as well as the currencies of Japan (31), Switzerland (22), and Singapore (45). An index value of less than 100 implies the appreciation of that currency against the US Dollar, as it means that since 1971, a smaller quantity of that currency unit is needed to purchase 100 US Dollars. The vast majority of world currencies, which generally overlaps with the Global South, have depreciated by several orders of magnitude (note the logarithmic scale), meaning that larger quantities of exports are needed to offset expensive imports and capital flight. Therefore, while the US Dollar has experienced inflation since 1971, the currencies issued by Global South periphery states have experienced even worse inflation.

FIGURE 1. World Currencies vs. the US Dollars (World Bank, 2021a; World Bank, 2021b).

Given that the US Dollar gains from maximal capital mobility, it follows that the US has an interest in promoting economic liberalism, while disparaging countries as “authoritarian” should they attempt to control imports, exports, and capital flight. Consider the civil unrest in Hong Kong against the proposal by the Hong Kong parliament to introduce legislation that would make it easier for the Chinese government to “grab” alleged financial criminals in particular and extradite them back to the mainland. This raised concerns among financial industry stakeholders in Hong Kong who worried that the new laws would frighten capital into leaving China, suggesting therefore that the Chinese government would use the proposed law to prevent capital flight from China via Hong Kong (Chatterjee and Murdoch, 2020).

For investment banks in Hong Kong, getting money out of China has always been a major pr-occupation—according to Ion Pacific executive Itamar Har-Even in April 2017, “we’ve spent an inordinate amount of time trying to figure out how to get cash out of China” (Weinland, 2017). In March 2019, the business community in Hong Kong signalled opposition to the inclusion of “economic and financial crimes in the bill” (Pang and Sin, 2019), and elites had already “started moving personal wealth offshore” (Torode, 2019). The proposed law was withdrawn in October 2019 (Pang and Siu, 2019), following which, in June 2020, then US president Trump announced he would freeze funding to the Hong Kong protesters (Perigo, 2020). Here US support for the protests was logical insofar as the US has an interest in undermining economic authoritarianism of the kind that would seek to prevent capital flight.

The logic of the US “tianxia” strategy, which is to entice wealth holders to financially defect, is an example of leveraging the interests of individuals in nations around the world against the collective interests of their nation, which in turn is to pursue dirigiste policies. Therefore, a counterstrategy is required, especially in developing countries, that can prevent domestic elites from bringing down the dirigiste state in the service of their own individual interests. This is where CBDCs can help Global South states implement “neostatist” policies, which indeed will pose major challenges to the neoliberal policies that the US wants those states to adhere to.

The rise of cryptocurrency and the Chinese response

In the spirit of acknowledging that there are some events in history that are recognised for their significance only in hindsight, the 3rd of January 2009 should be recognised for its significance because on this day, the “genesis” block of Bitcoin was mined, birthing the first cryptocurrency into existence. Created in the aftermath of the 2007/08 financial crisis, for the first time in history, it became possible to transfer a purely digital asset from one user to another without needing to trust a centralised third-party as in the case of banks, which keep databases or ledgers that contain records of transactions made by their depositors (Ward, Rochemont, 2019, 15). Bitcoin revolutionised this transfer process by pioneering “blockchain” technology, which eliminates the need for a centralised and trusted third-party. This created a “decentralized monetary system without a middleman” (Hyoung-kyu, 2022, 3) in which every transaction is recorded on what is known as a block, and joined together in a chain, hence blockchain.

Cryptocurrencies are confronted with the blockchain trilemma, which is that although they aspire to offer 1) decentralisation, 2) speed or scalability, and 3) security, they can realistically only offer two of these attributes at the expense of the third because of the nature of the technology (Shukla, 2022). Bitcoin offers decentralisation and security but sacrifices speed, which is why its network can only process 7 transactions per second (TPS), whereas for comparison, VISA, which uses non-blockchain legacy technology, can process 1,700 TPS but is highly centralised (Sedgwick, 2018). Bitcoin is slow because decentralised verification involves complex consensus mechanisms to verify transactions, or to draw an analogy from political statecraft, making decisions through consensus typically takes more time and energy than through the decrees of a dictator. Stealing Bitcoin by verifying false transactions through a false consensus, is theoretically possible, but it would involve bad actors acquiring control over most of the computing or “hashing” power on the network, which is extremely costly and therefore unlikely (Mcshane, 2021).

If the defining essence of blockchain is the ability to facilitate transactions without a governing authority using trustless consensus mechanisms, then the Chinese e-CNY does not fit within the definitional bounds of blockchain technology (Turrin, 2021, 165-66). Indeed, according to Chinese PBoC official Mu Changchun, blockchain technology could not form the technological foundation for the e-CNY because the technology at present is incapable of achieving transaction speeds of 300,000 per second. However, Chinese legislator Huang Qifan has described the e-CNY as “blockchain-based” (Chenli, 2020), perhaps because it borrows aspects of blockchain technology, including that the fundamental design of the e-CNY is token-based rather than account-based, and uses cryptography to verify transactions (Turrin, 2021, 165-66). Unlike the account-based legacy banking system that moves money by debiting the sender account and crediting the receiver account, the e-CNY is token-based, meaning it is the digital equivalent of transferring a tangible asset, in this case a digital asset that users can take custody of like Bitcoin (Turrin, 2021, 152-3).

This characterisation of the e-CNY as “token-based” may prompt disagreement given that the e-CNY White paper authored by the PBoC, titled Progress of Research & Development of E-CNY in China and published in 2021, refers to the e-CNY as “account-based, quasi-account-based and value-based” (emphasis added, PBoC 2, 2021, 3). However, the fact that “those without bank accounts can enjoy basic financial services provided via e-CNY wallet” (emphasis added) is evidence that the e-CNY is indeed a token, which is what “value-based” alludes to (PBoC 2, 2021, 5). However, there are limits on the total amount of e-CNY that can be held in a digital wallet without needing a bank account, and on the transaction limits from that wallet. For example, with just a mobile phone number, 10,000 e-CNY tokens can be held, and up to 2,000 e-CNY tokens can be transferred in a single transaction. By providing personal identification, these limits can be increased to 20,000 and 5,000 e-CNY respectively (Xu, 2022). To hold and transfer e-CNY above those amounts, personal bank accounts are required, at which point, user experience becomes “account-based”. In this manner, the overall system can be described as “quasi-account-based” because of its tiered limitations on account-free token transfers.

The e-CNY is not blockchain, but it does borrow elements from pioneering blockchains like Bitcoin, namely, that it transfers tokens using cryptography. That said, China is playing a leading role in Project mBridge, which promises to interlink the world’s central banks using permissioned blockchain technology so that participating central banks can verify CBDC transactions and achieve consensus among themselves without trusting each other (BIS Innovation Hub, 2022, 26-7). In other words, the CBDCs themselves may be completely centralised and non-blockchain, but the mechanism for transferring them among central banks promises to be decentralised (BIS Innovation Hub, 2022, 34).

The Chinese government has also launched the Blockchain Service Network (BSN), which is to blockchain what TCP/IP is to the internet (Turrin, 2021, 193), that is, protocols for developing interoperable blockchain-based applications that can interact with the e-CNY. BSN will operate two networks, one permissioned, meaning that it hosts applications that can be traced back to a central authority, and another permission-less, meaning that it can host genuinely decentralised applications, however, only the former will be available within China (BSN Development Association, 2020, 2). Therefore, blockchain application developers globally will be incentivised to adhere to BSN protocols, not only because they would be joining an interoperable ecosystem, but also because building BSN-compliant applications is cheaper, costing roughly 2-3000 RMB per month to operate as opposed to building an application “from scratch,” which would cost around 100,000 RMB per month (BSN Development Association, 2020, 6-7).

According to Yao Qian, the director-general of the PBoC’s Institute of Digital Money, the BSN will host blockchain applications that will “link natural resources, intangible assets, financial assets, and physical assets”, thereby creating a “data sharing platform that breaks down various information barriers, unifies information entry, avoids a lot of duplicate work, and reduces the error rate of data validation” (Gruin, 2021, 596). Another possibility is that real estate across China can be turned into Non-Fungible Tokens (NFTs) that represent a digital copy of China’s geography. NFTs are blockchain-based digital assets that can be used to claim ownership over digital items (i.e., video, audio, image, and text files), cannot be divided like money (hence their non-fungibility), and could possibly be used to demonstrate proof-of-ownership over real-world assets corresponding to their digital representation on a blockchain (Leech, 2022). This could allow Chinese authorities to visualise how much real estate is owned by foreigners, and to effectively enforce existing laws on foreign ownership of landed assets.

Project mBridge: interlinking the world’s central banks

The weaponisation of the US Dollar through the imposition of sanctions has exposed an overlooked feature of US Dollar hegemony, which is that the US Federal Reserve (Fed) has effective custody over Dollars not held in cash. This is because all non-physical US Dollars held in bank accounts outside the US are ultimately liabilities of the Fed with foreign central banks, which means the Fed can theoretically default on its US Dollar obligations to those central banks, although this would be a blunt instrument against entire nations. This happened following the US withdrawal from Afghanistan in August 2021 when the Fed stole $9.5 billion USD worth of Afghanistan’s central bank assets (Mohsin, 2021), and in the following year, following the Russian invasion of Ukraine in February 2022, Russia had over $300 billion USD frozen by the US Fed, the European Central Bank, and the Bank of Japan (Paris AFP, 2023).

The hegemony of the US Dollar is also upheld by SWIFT, the messaging network that enables over eleven thousand banks and corporations to communicate updates to their debit and credit ledgers in accordance with the wishes of their clients. SWIFT obeys US sanctions by cutting off targeted countries as mentioned earlier (Al Jazeera, 2018), not only because it is based in Belgium, which is embedded in the US-led West, but also because of the outsized representation of the US Dollar in global trade. According to the latest figures from SWIFT, 84% of the total payment volume for trade in goods and services initiated in February 2023 was settled in US Dollars, even though only around 12% of that volume was for US goods and services. This gives the US the most leverage in getting countries and their banks kicked off SWIFT, however, the balance of power has shifted significantly over the past 2 years. In February 2021, the equivalent figure for RMB was 1.3%, placing China fourth, however, in February 2023, the RMB rose to third place at 4.47%, an increase of 243%, making it the fastest growing trading currency on the SWIFT network (SWIFT, 2023).

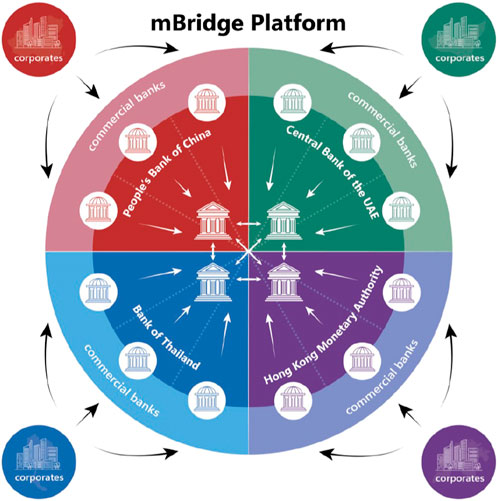

In response to the weaponisation of the US Dollar, the PBoC is playing a leading role in developing the Multiple CBDC Bridge Project in partnership with the Bank of International Settlements (BIS), which calls it Project mBridge, and also the central banks of Hong Kong, the UAE, and Thailand. The project promises to interlink the world’s central banks using permissioned blockchain technology (see Figure 2) in ways that make it difficult for some central banks to seize the reserves of other central banks (BIS Innovation Hub, 2022, 25-6). This poses an unprecedented technological challenge to the hegemony of the US Dollar and legacy financial system. According to Credit Suisse analyst Zoltan Pozsar (2022), “the global East and South are going the CBDC route because the U.S. dollar was weaponized”, which, aside from compelling central banks to reduce their US Dollar denominated holdings with the Fed, also makes the design features of Project mBridge very appealing.

FIGURE 2. How the platform works (BIS Innovation Hub, 2022, 25).

Project mBridge appeals to central banks of the non-West because its design would allow them to take custody of foreign CBDCs depending on their design standards, whereas under the present system, all non-physical currencies are liabilities under the custody of their issuing central bank, which is why the Fed can steal the reserves of other countries. According to the BIS, “each of the central banks could become a participant on the platform, host the platform on multiple nodes in a decentralised manner and play certain governance roles that the platform will define and agree on” (BIS Innovation Hub, 2022, 34). However, the project faces many challenges, the main one being that CBDCs around the world are not built to the same design standards, thereby precluding the possibility of interoperability between them. For example, Turrin notes that Sweden issues an account-based CBDC whereas the Chinese CBDC is token-based, which is why standards are currently being devised to ‘bridge’ these differences.

Perhaps the most enticing feature of the project for developing nations is that it “respects the monetary sovereignty and policies of each participating central bank” by providing them “with the tools needed to allow this foreign access without compromising control of their currency” (BIS Innovation Hub, 2022, 31), including the tools needed to control national spending and eliminate capital flight. Additionally, unlike SWIFT, which always complies with US demands to eject countries from the network, the mBridge platform can be called “sanctions agnostic,” meaning that the ability to impose sanctions lies with the central banks that use the platform, and not with the platform itself.

The relationship between the mBridge platform and the CBDCs that it proposes to host raises the following question. Will the platform enshrine minimum design standards to ensure that only CBDCs that cannot be seized when held by foreign central bank wallets are allowed to cross the “bridge”? This is one question that countries under sanctions have an interest in being answered. For example, even if the central bank of country A cannot seize their e-A currency from the central bank of country B, according to Turrin, it would still be possible to apply digital tags to the e-A currency held by central bank B so that it cannot be spent to buy goods/services from country A, which would then disincentivise other central banks from accepting that tagged currency.

According to Pozsar, mBridge is a revolutionary challenge to US-led multipolarity, which is why the US must not digitise its currency, because doing so would force it to compete on a level playing field with the e-currencies of the growing multipolar CBDC ecosystem. Accordingly, the US should not digitise its currency, because doing so would tear apart the legacy system, which is a “hierarchical network of G-SIBs [Globally Systemically Important Banks] and correspondent banks” that keeps currencies around the world dependent. For example, Pozsar notes that if someone in Hungary needs to pay someone in Singapore, it would have to “go through a chain of transactions and intermediaries that involve selling HUF for EUR, EUR for USD, and USD for SGD,” whereas with mBridge and CBDCs, HUF could be exchanged for SGD directly (Pozsar, 2022, 5).

Opportunities and challenges

The e-CNY: a model for the Global South?

The logic of this US strategy raises the plausible necessity within developing nations of having a counter-strategy capable of preventing domestic elites from undermining dirigiste planning in the service of their own interests by any means necessary. This is where the proliferation of Chinese-style CBDC infrastructure across Russia and the Global South presents a real threat to US Dollar hegemony insofar as it offers new technocratic solutions for regulating national spending and tackling capital flight.

From its founding in 1949, China has followed dirigiste policies on trade, that have been hampered by the problem of capital flight caused by the historic preference of Chinese elites for assets located in the Anglo-American banking system. The development of the e-CNY may very quickly evaporate this source of income for the United States insofar as it bolsters the capacity of the People’s Bank of China to conduct dirigiste monetary policy, thereby stemming the bleeding process of Chinese capital flight that helps prop up the US Dollar. Indeed, according to Turrin, “capital can be deployed with embedded programming that controls its use and eliminates capital flight” (Turrin, 2021, 243).

In 2014, China had begun programming into existence the prototype of the Digital Renminbi or e-Renminbi under the visionary leadership of the People’s Bank of China (People’s Bank of China, 2021) Governor Zhou Xiaochuan, who Richard Turrin, author of Cashless: China’s Digital Currency Revolution, has called “China’s most able technocrat” and “the father of modern fintech,” particularly for his role in producing the world’s first CBDC (Turrin, 2021, 91). By April 2021 the e-Renminbi was being rolled out for public use, and most recently in February 2022, at the height of the Winter Olympics in Beijing, the e-CNY network surpassed VISA in the number of processed transactions (Wright, 2022).

Of the multitude of reasons why China has committed to banning non-state-issued crypto-currencies like Bitcoin, capital flight and energy consumption are at the top of the list. Bitcoin and other crypto currencies made it very easy for people in China to sell Renminbi for BTC, make capital gains, then ‘cash out’ in another national currency, especially US Dollars, while evading capital controls in the process. According to Hu, Lee, and Putnins (2021, 2), from 2011 to 2018, “one-quarter of trading volume in Chinese Bitcoin exchanges is estimated to be involved in circumventing China’s capital controls” and “the capital flight out of China via Bitcoin during the sample period is approximately $4.6 billion,” which is “around 8.78 million Bitcoin” or around $176 billion USD in terms of the current USD price of Bitcoin at around $20,000.

These Chinese capital controls are to ensure that inflows and outflows of capital are directed towards productive investments that serve the Chinese Communist party’s five-year plan. Inflows of capital are barred from investing in Chinese assets that feature on the “Negative List” and encouraged to purchase Chinese assets that feature on the “Encouraged List” (Zhang, 2019). Typically, outflows of capital are only allowed if they contribute towards providing China with raw materials and technology (Briefings, 2012), or towards infrastructure projects like the Belt and Road Initiative (Jiao, Kuijken, and Gu, 2017).

Chinese efforts to impose restrictions on outbound monetary flows have been frustrated by the problem of capital flight, which contributed towards the PBoC burning through $1 trillion in foreign exchange reserves, which fell from its all-time peak of $4 trillion USD in mid-2014 to $3 trillion USD by December 2016 (Wei, 2017). Chinese citizens are prohibited by capital controls from buying more than $50,000 USD worth of foreign currency per year, however, enforcing this limit was always difficult. According to the results of a confidential survey published by the Financial Times in April 2017, 81.7% of surveyed households and 88.6% of bankers thought it was possible to circumvent this limit (FT Confidential Research, 2017). To stem these outflows, the PBoC tightened capital controls by introducing a “a great wall of paperwork” (Mitchell, 2017) intended to scrutinise outflows, “ranging from university admission letters to overseas corporate licences” (FT Confidential Research, 2017). For example, one Chinese firm was denied the right to export $2.5 million USD because it was only registered for 1 year with only a market capitalisation of around $145 thousand USD (FT Confidential Research, 2017).

Cryptocurrencies like Bitcoin greatly facilitated the capital flight witnessed during this period, as evidenced by the growing share of Renminbi in global Bitcoin trading volume from 2014. According to available on-chain data, the percentage of Bitcoin purchased with Renminbi increased from around 10% in April 2013 to over 95% by January 2017 (Lauer et al., 2017). By late 2017, the Chinese government banned crypto currency exchanges to frustrate the ability of Renminbi to be sold for crypto currencies like Bitcoin (Sergeenkov, 2022), which coincided with, if not contributed towards, the price of Bitcoin crashing from its then all-time high of $19,500 in December 2017 to $3,000 by December 2018 (Rich, 2019).

Attempts by China to ban the purchase of crypto currencies as part of their struggle against capital flight has always been frustrated by the existence of a huge cash economy, allowing residents to buy Bitcoin with cash directly from Chinese Bitcoin miners (Browne, 2017). To demonstrate the ubiquity of cash in China’s recent past, according to Turrin, when he moved to China in 2010, even at high-end consumer electronics outlets in China like Apple, cash-counting machines were always busy processing large bags of paper cash (Turrin, 2021, 73). The Chinese answer to these problems was to aggressively eliminate paper money, which was first achieved by fostering the growth of private sector fintech payment gateways like WeChat and Alipay that work on smartphones, which contributed towards cash transactions at the point-of-sale declining from 74.7% in 2012 to 25.4% in 2020 (De Best et al., 2022). Now the goal is to transform all online deposits into e-Renminbi, which will make it programmable and give the PBoC far greater oversight over national spending.

The PBoC is currently involved in erecting this digital ‘great wall’ around China so the state will have the tools needed to prevent any illegal emigration of Chinese capital and to identify large suspicious transactions more easily. The e-Renminbi will invariably operate by the logic of a Chinese finger trap, so that Chinese residents will find it easy to pull money into the country (i.e., if they’re exporters), but hard to take money out (i.e., capital flight by permanent emigrants). Furthermore, the programmable nature of digital currencies allows a token to “think for itself”, transforming money from simply a “carrier of value” into a token that can be embedded with programs devised by central authorities for which “the possibilities are endless”. For example, Turrin points out that holders of the e-Renminbi can be restricted from spending more than a certain amount per day (Turrin, 2021, 174). The traceability and programmability of CBDCs could allow states to offer tax cuts to businesses whose accounts reveal a net-credit to the balance of payments (i.e., if their exports exceed their imports), while import-oriented businesses could be punished with additional taxes, thereby encouraging import-substitution industrialisation.

Although the concentration of power in the hands of central banks to program currencies has dystopian potential, that power also has the potential to become an important technocratic tool for the central banks of developing countries to enact the very dirigiste policies of “delinking” from global capital flows that are advocated by Utsa and Prabhat Patnaik. According to the Patnaiks, it “takes courage to delink from globalization through capital controls” and would involve significant “transitional difficulties,” such as the ability to enforce those controls. They argue that the inability of states to implement these controls limits their capacity to pursue “alternative trajectories of development” that run contrary to the interests of the free mobility of money (Patnaik and Patnaik, 2021, 94).

In this context, the nature of CBDC technology suggests that the countries around the world that succeed in upgrading their capacity to enforce capital controls by digitising their currencies will have greater success in combating capital flight (thereby undermining the US Dollar) while the states that fail to implement these upgrades will continue experiencing severe capital flight that reinforces the US Dollar. Therefore, these financial innovations offer a model for Russia and the Global South to follow and gives egalitarian populist political forces within these countries the technocratic tools needed to control the spending of the wealthier sections of society.

The Anglo-American world is lagging behind in CBDC development. According to one report, “of the G7 economies, the US and UK are the furthest behind on CBDC development” (Kumar et al., 2022) as they are currently only in the research stage, however, as will be argued later, this is not because these countries lack the technological capacity to develop CBDCs, but because of the dominance of private banking within these countries that would be threatened by CBDCs and because digitising their currencies could accelerate de-Dollarisation. Another reason why non-Western economies are leading the way on CBDCs is because they are the ones most severely affected by US-led Western financial sanctions, including being cut off from the SWIFT system, as has been done to Venezuela, Iran, Russia, and North Korea. According to the CEO of Mastercard, Michael Miebach, SWIFT could become redundant in 5 years (by 2027) due to states settling payments with each other using CBDCs (Wu, 2022).

Under the pre-eminent US dominated legacy system centred around SWIFT, Global South countries were encouraged to liberalise their trade and investment with the outside world on the promise that guaranteeing mobility for foreign investors would incentivise foreign investment in their economies. This raised the problem of wealthier classes in these countries taking advantage of the liberalised capital account in their countries by defecting to the West with their money, or these classes imported expensive consumer goods, leading to trade deficits, and currency devaluation. However, with CBDCs, developing nations can potentially control spending in smarter, more effective ways, by programming their currencies in accordance with their own national planning priorities. Ultimately, whether the technology is implemented in a utilitarian, meritocratic, and egalitarian manner depends on the balance of class forces within each nation state.

Why US banks don’t want CBDCs

In US discussions about CBDCs, fears of financial disintermediation refer to the fears of private banks that the introduction of CBDCs could undermine their role as intermediaries between the central bank and the public. In the conventional account-based model of banking, customers do not have custody over their deposits, which allows banks to invest or lend from those deposits. However, if money is a token that can be taken into the custody of the customer, then banks become concerned that they could be deprived of the deposits needed to lend and invest, thereby drying up liquidity for the productive economy. China addresses these concerns in two ways, firstly by setting limits the amounts of e-CNY that can be held and transferred without a bank account (discussed earlier), and secondly, by not paying interest on e-CNY tokens held in wallets (PBoC 2, 2022, 7), thereby incentivising customers to keep most of their savings in bank accounts.

While the PBoC is presiding over the relatively smooth transition from a heavily cash-based economy to a cashless CBDC payments system among residents in China, there are major obstacles to the Federal Reserve establishing a CBDC version of the US Dollar. This is because doing so would undermine the role of private banks as financial intermediaries that sit between central banks and the public, and also because CBDC capabilities are bound to be met with suspicion from the American people. As it currently operates, the Federal Reserve lends money to private banks at a higher rate than what it pays on deposits from those banks, with the gap between the two rates being the targeted Fed Funds Rate, however, banks do not merely lend money out of their deposits, or out of their borrowings from the Federal Reserve, they also create money when they issue loans (Kumhof and Jakab, 2016).

This structure was inherited from the era of bullion-based monetary standards, when paper money was backed by gold, thereby implying the disconnection between physical money (bullion) and symbolic money (paper notes). During this era, lending by central banks and private banks were limited by supplies of physical bullion, or in other words, the expansion of symbolic money was limited by physical money, at least in theory. However, following the 1971 Nixon shock, those limits were removed, especially with the rise of cashless payment (i.e., debit/credit cards), which eased the pressure on banks to redeem deposits with physical cash, thereby incentivising banks to expand the supply of money by issuing more loans. For banks, this incentive has strengthened in recent years with the rise of cashless transactions (Williams-Grut, 2019), especially in the post-Covid era due to fears that handling physical cash makes the virus spread faster, thereby hastening the gradual extinction of ATMs globally (BIS, 2021).

The CBDC fintech revolution could potentially eliminate the duality between symbolic and physical money by homogenising or collapsing them into one and the same thing. Because CBDCs can only be issued by the central bank, this could undermine the ability of private banks to create money, or in other words, in a scenario where only the state can create money, private banks lose that capability.

Instead of depositors placing their savings (and trust) in these intermediaries, they could alternatively take custody of their funds by storing them in digital wallets that have been either issued or authorised by the Federal Reserve. Existing financial intermediaries could adapt by producing digital wallets that can be downloaded onto smartphones, however, this would significantly downgrade their role in the economy, transforming them from money creators to glorified digital ‘piggy banks’. For this reason, private banks in the US are genuinely worried about the CBDC revolution, which could potentially introduce a new era of customers banking directly with their central bank. This is the current trend in China, where 261 million residents as of January 2022 (Liao, 2022) use digital wallets authorised by the PBoC, a feat made possible by the reality that private banks have relatively less political power in China than their counterparts in Western countries.

According to an opinion piece in the Financial Times by Facebook co-founder and current Roosevelt Institute researcher Chris Hughes, the argument against the Fed rolling its own CBDC is that doing so would trigger the “disintermediation of the commercial banking sector in the US,” that is, it would undermine the “middle-man” role of private banks. This would happen because “depositors would likely shift many of their commercial bank deposits to CBDC accounts, particularly in moments of financial anxiety,” and as a result, “commercial banks could find themselves in a position where they have to significantly contract their own loan portfolios or raise additional debt or equity financing” (emphasis added, Hughes, 2022). Therefore, Hughes is against introducing a US Fed-issued CBDC because it would undermine the ability of private banks to create money when they issue loans and argues only for the existing Fed-operated payments system to be made faster.

The same argument against CBDCs raised by Hughes is also being made by former IMF economist Eswar S. Prasad, who in his book The Future of Money (2021) argued against the introduction by the Fed of a US Dollar CBDC because it would pose “direct competition with bank deposits, in turn threatening the viability of commercial banks” (Prasad, 2021, 266). If financial intermediaries operated the way they are commonly thought to operate, that is, by lending only what they borrow from their depositors and from the central bank, then they would have no reason to fear CBDCs. However, if banks create money when they issue loans (which they do), and if that money gets redeemed for CBDCs by borrowers in large enough quantities, then the bank can only lend what it borrows from the Federal Reserve, otherwise, it will fail.

In addition to opposition from US banking interests, there is also considerable opposition to CBDCs from a civil liberties perspective, with the libertarian publication ZeroHedge invoking the dystopia of being “locked out of your digital wallet for not being a good citizen, for eating too unhealthily, for criticising the government online, for running a red light, or for not taking the latest experimental gene therapy”. Citing the programmable character of CBDCs, the publication alleges that the technology will lead to “a final destination of total monetary enslavement” (TDB, 2022) at the hands of “internationalist technocommunist banksters”—an accusation they substantiate with reference to the “centralization of credit in the hands of the state” as advocated by the Communist Manifesto (Durden, 2022). CBDCs do indeed promise the “centralization of credit in the hands of the state,” in addition to empowering the state to program legislation into the money they issue. Therefore, the desirability of CBDCs depends on whether state policy reflects the will of the people, which raises another glaring contrast between the US and China.

According to the latest Edelman Trust Barometer, which aims to measure how much trust people in countries around the world have in their government and media (based on a sample of at least 1,150 people per country), the percentage of US Americans who trust their government and media is 39% and 39% respectively, whereas the percentage of Chinese who trust their government and media is 91% and 80% respectively (Edelman, 2022, 24). Therefore, the lack of trust in the US government from the US American people is another reason why the US is likely to lag behind other countries in digitizing its own currency, whereas the rest of the world is likely to forge ahead with CBDCs because doing so would allow them greater independence from the US-dominated global financial system, including the ability to conduct international transactions outside SWIFT, using just the internet.

Conclusion

Cryptocurrencies like Bitcoin certainly have functioned as a force of US financial hegemony insofar as they have facilitated capital flight from the Global South to the US-led Western financial system, thereby undermining the monetary sovereignty of the Global South. The Chinese response has not been to simply ban cryptocurrencies, but also to adopt certain technological elements of cryptocurrencies, like distributed ledger technology, consensus mechanisms, token programmability, and also blockchain, not only to defend China’s own monetary sovereignty, but to create an alternative global payment network to the preeminent US dominated financial system.

The prospect of more nations across the globe developing their own CBDC infrastructure to digitize their own currencies, could undermine the stream of capital flight into the Anglo-American banking system, especially when considering that the amount of capital flight from the Global South since 1980 (mentioned earlier) is roughly equivalent to the current US net-external debt, which sits at $14 trillion USD (IMF, 2022b). According to a report by the Atlantic Council, by May 2022, aside from China, 50 countries or currency unions have either launched, piloted, or are currently developing CBDCs (Kumar et al., 2022), with the furthest progress being made by the non-Western world. In Africa, Nigeria was the first to launch a CBDC, and South Africa is at the pilot stage of digitising its currency. In Latin America, Brazil and Venezuela are the development stages of their respective CBDCs. In Eurasia, aside from China, CBDCs are being piloted by Russia, Kazakhstan, Ukraine, Saudi Arabia, the UAE, Thailand, Malaysia, and Singapore, and are being developed by India, Indonesia, Iran, Turkey, and Indonesia (Kumar et al., 2022).

The emergence of CBDCs coupled with Project mBridge, both of which China pioneered, threatens to accelerate the decline of the US Dollar because it would give countries around the world the monetary tools to control national spending, prevent capital flight, and conduct trade outside SWIFT. This context helps explain the intensification of tensions between the US and China over Hong Kong, in which the US supported protests against policies that, if enacted, would have stemmed the outflow of capital from China. Parallel to this conflict, the Chinese development of CBDC infrastructure has been working towards the same goals as the policies it tried and failed to introduce in Hong Kong, and now the Chinese model is being carefully watched, studied, and implemented around the world.

For decades, Marxist development economists, like Utsa and Prabhat Patnaik, have advocated for Global South nations to delink from global financial flows in order to maximise the efficacy of their dirigiste policies. In this context, everything about CBDCs that makes them potentially dystopian as per the fears of ZeroHedge, can also potentially address the very real problems of attempted dirigiste Global South development. The US Dollar embodies and inherits the economic advantages won by successive Western European empires throughout history at the expense of the formerly colonised nations across Asia, Africa, and Latin America, however, China is leading the way in unravelling those advantages.

Data availability statement

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

Author contributions

All material was written by JT.

Conflict of interest

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Al Jazeera, (2018). What SWIFT is and why it matters in the US-Iran spat. https://www.aljazeera.com/economy/2018/11/5/what-swift-is-and-why-it-matters-in-the-us-iran-spat.

Babones, Salvatore. (2017). American tianxia: Chinese money, American power, and the end of history. Bristol, England: Policy Press, University of Bristol.

Bader, Jeffrey A. (2012). China and the United States: Nixon’s legacy after 40 years. Washington, D.C., United States: Brookings Institute.

BIS (Bank of International Settlements), (2021). Covid-19 accelerated the digitalisation of payments. Bank of international settlements, committee on payments and market infrastructures. https://www.bis.org/statistics/payment_stats/commentary2112.htm.

BIS Innovation Hub, (2022). Project mBridge: connecting economies through CBDC. https://www.bis.org/about/bisih/topics/cbdc/mcbdc_bridge.htm.

Briefings, China (2012). Chinese outbound foreign direct investment faces rigorous scrutiny. https://www.china-briefing.com/news/chinese-outbound-foreign-direct-investment-faces-rigorous-scrutiny-2/#:∼:text=As%20such%20non%2DSOE%20Chinese,demanding%20on%2Dgoing%20annual%20review.

Browne, Ryan. (2017). Bitcoin price falls again on reports that China is shutting down local exchanges. CNBC. https://www.cnbc.com/2017/09/11/bitcoin-price-falls-on-reports-that-china-is-closing-local-exchanges.html#:∼:text=China’s%20clampdown%20on%20cryptocurrencies%20has,more%20than%20%24100%20since%20Friday.

BSN Development Association (2020). Blockchain-based service network (BSN): Introductory white paper. PR China: BSN Development Association.

Campbell-Verduyn, Malcolm (2018). in Bitcoin and beyond: Cryptocurrencies, blockchains, and global governance (England, UK: Routledge).

Chatterjee, Sumeet, and Murdoch, Scott (2020). Hong Kong bankers worry that new laws could lead to capital flight. Reuters. https://www.reuters.com/article/china-parliament-hongkong-finance-idUSL4N2D41GI#:∼:text=Hong%20Kong%20bankers%20worry%20that%20new%20laws%20could%20lead%20to%20capital%20flight,-By%20Sumeet%20Chatterjee&text=HONG%20KONG%2C%20May%2022%20(Reuters,hub%2C%20bankers%20and%20headhunters%20said.

Chenli, Shuhong. (2020). China's national digital currency, DCEP, is on the way – but will it involve blockchain? https://equalocean.com/analysis/2020021513599.

Clark, William R. (2005). Petrodollar warfare: Oil, Iraq, and the future of the dollar. Gabriola, British Columbia, Canada: New Society Publishers.

Clough, Christine (2016). New report on unrecorded capital flight finds developing countries are net-creditors to the rest of the world. https://gfintegrity.org/press-release/new-report-on-unrecorded-capital-flight-finds-developing-countries-are-net-creditors-to-the-rest-of-the-world/#:∼:text=Titled%20%E2%80%9CFinancial%20Flows%20and%20Tax,the%20flight%20of%20unrecorded%20capital.

De Best, R. (2022). Share of cash estimate at point of sale (POS) in China from 2012 to 2020. Statista. https://www.statista.com/statistics/1306790/cash-use-in-china/.

Durden, Tyler. (2022). How technocommunism will Institute the CBDC: the central bank game plan in under 3 minutes. https://www.zerohedge.com/geopolitical/how-technocommunism-will-institute-cbdc-central-bank-game-plan-under-3-min.

Edelman, (2022). Edelman trust barometer 2022: china-u.s. trust divergence widens to all-time high. https://www.edelman.com/sites/g/files/aatuss191/files/2022-01/2022%20Edelman%20Trust%20Barometer_FullReport.pdf.

Eichengreen, Barry. (1990). Golden fetters: The gold standard and the great depression. United Kingdom: Cambridge University Press.

FT Confidential Research, (2017). Fears of weak renminbi fuel Chinese household forex demand. https://www.ft.com/content/1c5fb35a-ca52-11e9-a1f4-3669401ba76f.

Gruin, Julian. (2021). The epistemic evolution of market authority: big data, blockchain and china’s neostatist challenge to neoliberalism. Compet. Change 25 (5), 580–604. doi:10.1177/1024529420965524

Gunter, , and Frank, R. (2017). Why China lost about $3.8 trillion to capital flight in the last decade. Forbes. https://www.forbes.com/sites/insideasia/2017/02/22/china-capital-flight-migration/#:∼:text=Over%20the%20last%20decade%2C%20an,complex%20system%20of%20capital%20controls.

Hille, Kathrin (2022). China’s chip breakthrough poses strategic dilemma. https://www.ft.com/content/f0ddae61-a8a3-456d-8768-971c71ccb6dd.

Hu, Maggie., Lee, Adrian D., and Putnins, Talis J. (2021). Evading capital controls via cryptocurrencies: evidence from the blockchain. Available at SSRN https://ssrn.com/abstract=3956933.

Hughes, Chris. (2022). An American CBDC is not the way to fight China’s financial might. https://www.ft.com/content/400830df-3412-48ef-8f0e-e63021cf33cb.

Hyoung-kyu, Chey (2022). Cryptocurrencies and the IPE of money: an agenda for research. Rev. Int. Political Econ. 30, 1605–1620. doi:10.1080/09692290.2022.2109188

International Monetary Fund (Imf), (2022a). International investment position by indicator. Washington, DC, United States: IMF.

International Monetary Fund (Imf), (2022b). International investment position by indicator. Washington, DC, United States: IMF.

Jiao, Li., Kuijken, Iris., and Gu, Ivan. (2017). China’s new policy on outbound investment. https://www.burenlegal.com/sites/default/files/usercontent/content-files/Chinas%20new%20policy%20on%20outbound%20investment.pdf.

Jin, Emily (2022). Why China’s CIPS matters (and not for the reasons you think). https://www.lawfaremedia.org/article/why-chinas-cips-matters-and-not-reasons-you-think.

Kida, Kazuhiro., Kubota, Masayuki., and Cho, Yusho (2023). Rise of the yuan: china-based payment settlements jump 80%. https://asia.nikkei.com/Business/Markets/Rise-of-the-yuan-China-based-payment-settlements-jump-80#:∼:text=TOKYO%2FSHANGHAI%20%2D%2D%20A%20Chinese,hegemony%20of%20the%20U.S.%20dollar.

Kilborn, Peter T. (1985). U.S. Turns into debtor nation. https://www.nytimes.com/1985/09/17/business/us-turns-into-debtor-nation.html.

Kumar, Ananya., Biyani, Nitya., de Villiers, Stefan., and Goodman, Matt. (2022). Central Bank digital currency tracker. https://www.atlanticcouncil.org/cbdctracker/.

Kumhof, Michael., and Jakab, Zoltán. (2016). The truth about banks: finance & development. https://www.imf.org/external/pubs/ft/fandd/2016/03/kumhof.htm#:∼:text=Lending%2C%20in%20this%20narrative%2C%20starts,exist%20in%20the%20real%20world.

Lauer, Dave (2017). Dramatic chart out of DB showing Bitcoin transformation from US-based crypto to Chinese-based speculation/asset shelter. Twitter, Data.bitcoinity.org. https://www.ft.com/content/38c54959-6df1-351a-93d3-b286a33f1394.

Leech, Ollie (2022). What are NFTs and how do they work? Coindesk. https://www.coindesk.com/learn/what-are-dynamic-nfts-understanding-the-evolving-nft/#:∼:text=An%20NFT%20is%20a%20unique,contract%20address%20and%20token%20ID.

Levi, Daniel. (2021). 80% of all US dollars in existence were printed in the last 22 months (from $4 trillion in January 2020 to $20 trillion in October 2021). https://techstartups.com/2021/12/18/80-us-dollars-existence-printed-january-2020-october-2021/.

Liao, Rita. (2022). China’s digital yuan wallet now has 260 million individual users. https://techcrunch.com/2022/01/18/chinas-digital-yuan-wallet-now-has-260-million-individual-users/#:∼:text=One%20of%20the%20fastest%2Dgrowing,has%20been%20made%20using%20the.

Mcshane, Griffin. (2021). What is a 51% attack? https://www.coindesk.com/learn/what-is-a-51-attack/#:∼:text=A%2051%25%20attack%2C%20also%20known,power%20from%20a%20third%20party.

Mohsin, Saleha (2021). US freezes Afghan central bank’s assets of $9.5bn. https://www.aljazeera.com/economy/2021/8/18/us-freezes-afghan-central-banks-assets-of-9-5bn#:∼:text=The%20U.S.%20has%20frozen%20nearly,an%20administration%20official%20confirmed%20Tuesday.

Pang, Jesse, and Sin, Noah (2019). Thousands march in Hong Kong over proposed extradition law changes. Canary Wharf, London, United Kingdom: Reuters.

Pang, Jesse, and Siu, Twinnie (2019). Hong Kong extradition bill officially killed, but more unrest likely. https://www.reuters.com/article/us-hongkong-protests-idUSKBN1X20OF.

Paris, A. F. P. (2023). Seizing Russian assets is easier said than done. https://www.france24.com/en/live-news/20230212-seizing-russian-assets-is-easier-said-than-done.

Patnaik, Prabhat. (2013). A secular decline in third world exchange rates. https://www.bcra.gob.ar/Pdfs/BCRA/JMB_2013_Patnaik.pdf.

Patnaik, Utsa (1996). Export-oriented agriculture and food security in developing countries and India. https://www.epw.in/journal/1996/35-36-37/globalisation-and-agriculture-specials/export-oriented-agriculture-and-food.

Patnaik, Utsa, and Patnaik, Prabhat (2021). Capital and imperialism: Theory history and the present. New York, NY, USA: Monthly Review Press.

PboC, (2022). Payment systems report. http://www.pbc.gov.cn/en/3688247/3688978/3709143/4830432/2023032714461871866.pdf.

People’s Bank of China, (2021). Progress of research & development of E-CNY in China. http://www.pbc.gov.cn/en/3688110/3688172/4157443/4293696/2021071614584691871.pdf.

Perigo, Bill. (2020). Trump administration freezes funds intended to benefit Hong Kong protesters. https://time.com/5860163/trump-hong-kong-funding-freeze/#:∼:text=The%20Trump%20Administration%20has,will%20erode%20civil%20liberties%20there.

Pozsar, Zoltan (2022). War and currency statecraft. Credit Suisse, investment solutions & sustainability. https://www.exunoplures.hu/wp-content/uploads/2023/06/48.pdf.

Prasad, Eswar S. (2021). The future of money: How the digital revolution is transforming currencies and finance. Cambridge, Massachusetts, United States: Belknap Press, Harvard University Press.

Rich, Bryan (2019). Bitcoin is all about Chinese capital flight. https://www.forbes.com/sites/bryanrich/2019/05/14/bitcoin-is-all-about-chinese-capital-flight/?sh=6674b1b176d6.

Sedgwick, Kai. (2018). No, visa doesn’t handle 24,000 TPS and neither does your pet blockchain. https://news.bitcoin.com/no-visa-doesnt-handle-24000-tps-and-neither-does-your-pet-blockchain/.

Sergeenkov, Andrey. (2022). China crypto bans: A complete history. https://www.coindesk.com/learn/china-crypto-bans-a-complete-history/.

Shakhnov, Kirill. (2022). Russia’s rouble is now stronger than before the war – western sanctions are partly to blame. https://theconversation.com/russias-rouble-is-now-stronger-than-before-the-war-western-sanctions-are-partly-to-blame-184700.

Shukla, Sidharta. (2022). The ‘blockchain trilemma’ that’s holding back crypto. https://theblockchaintest.com/uploads/resources/SEBA%20-%20The%20Blockchain%20Trilema%20-%202020%20-%20Oct.pdf.

Springfield, Cary. (2022). We are witnessing a global de-dollarisation spree. https://internationalbanker.com/finance/we-are-witnessing-a-global-de-dollarisation-spree/.

Sundell, Anders. (2022). Visualizing countries grouped by their largest trading partner (1960-2020). https://www.visualcapitalist.com/cp/biggest-trade-partner-of-each-country-1960-2020/.

SWIFT (2023).RMB Tracker Monthly reporting and statistics on renminbi (RMB) progress towards becoming an international currency La Hulpe, Belgium: SWIFT.

TDB (2022). Intersecting globalist agendas: CBDCs. https://www.zerohedge.com/news/2022-08-23/intersecting-globalist-agendas-cbdcs.

The Moscow Times, (2019).Russia has lost $1 trillion in capital flight since fall of U.S.S.R., says putin’s economist . https://www.themoscowtimes.com/2019/10/24/russia-capital-outflow-trillion-ussr-putin-economist-a67891.

Torode, Greg. (2019). Exclusive: hong kong tycoons start moving assets offshore as fears rise over new extradition law. https://www.reuters.com/article/us-hongkong-extradition-capitalflight-ex/exclusive-hong-kong-tycoons-start-moving-assets-offshore-as-fears-rise-over-new-extradition-law-idUKKCN1TF1DZ.

Turrin, Richard. (2021). Cashless: China’s digital currency revolution. Gold River, CA, USA: Authority Publishing.

USBLS (Bureau of Labor Statistics) (2022). Consumer prices up 9.1 percent over the year ended June 2022, largest increase in 40 years. US Bureau of Labor Statistics. https://www.bls.gov/opub/ted/2022/consumer-prices-up-9-1-percent-over-the-year-ended-june-2022-largest-increase-in-40-years.htm#:∼:text=Over%20the%2012%20months%20ended,month%20period%20ending%20November%201981.

Ward, Orla, and Rochemont, Sabrina (2019). An addendum to “A cashless society – benefits, risks, and issues (interim paper)”: understanding central bank digital currencies (CBDC). https://www.actuaries.org.uk/system/files/field/document/Digital-currency%20adoption%20by%20life%20and%20pension%20industries%20-%20disc.pdf.

Wei, Lingling. (2017). China foreign-exchange reserves keep dropping. https://www.wsj.com/economy/chinas-forex-reserves-fell-in-august-467d5c05#:∼:text=China’s%20foreign%2Dexchange%20reserves%20dropped,released%20by%20the%20central%20bank.

Weinland, Don. (2017). China’s capital controls dent inbound investment. https://www.ft.com/content/07392a72-241b-11e7-a34a-538b4cb30025.

Williams-Grut, Oscar. (2019). Number of ATMs falls globally as cash continues to die. https://uk.finance.yahoo.com/news/cashless-atm-decline-cash-rbr-100337878.html#:∼:text=Number%20of%20ATMs%20falls%20globally%20as%20cash%20declines,cash%20is%20on%20the%20decline.

World Bank (2022). Current account balance (BoP, current US$). https://data.worldbank.org/indicator/BN.CAB.XOKA.CD.

World Bank (2021a). Official exchange rate (LCU per US$, period average. https://data.worldbank.org/indicator/PA.NUS.FCRF.

World Bank (2021b). Population, total. https://data.worldbank.org/indicator/SP.POP.TOTL.

Wright, Turner. (2022). Digital yuan transactions beat out visa at winter Olympics venue: report. https://cointelegraph.com/news/digital-yuan-transactions-beat-out-visa-at-winter-olympics-venue-report.

Wu, P. (2022). Wef 2022: SWIFT probably won’t exist in 5 years, says mastercard CEO. https://cointelegraph.com/news/swift-probably-won-t-exist-in-5-years-mastercard-ceo#:∼:text=May%2026%2C%202022-,WEF%202022%3A%20SWIFT%20probably%20won’t%20exist%20in%205%20years,little%20as%20five%20years'%20time.

XE (2022). 1 RUB to USD - convert Russian rubles to US dollars. https://www.xe.com/currencyconverter/convert/?Amount=1&From=RUB&To=USD.

Xu, Kevin (2022). E-CNY: the product. https://interconnected.blog/e-cny-the-product/.

Zhang, Z. Y. (2019). China’s 2019 negative lists and encouraged catalogue for foreign investment. https://www.china-briefing.com/news/chinas-2019-negative-lists-encouraged-catalogue-foreign-investment/#:∼:text=The%202019%20editions%20of%20China’s,restricts%20or%20encourages%20foreign%20investments.

Keywords: e-CNY, China, US Dollar, Global South, capital flight

Citation: Tharappel J (2023) How Chinese fintech threatens US Dollar hegemony. Front. Blockchain 6:1148315. doi: 10.3389/fbloc.2023.1148315

Received: 19 January 2023; Accepted: 01 September 2023;

Published: 29 September 2023.

Edited by:

Olinga Taeed, Enterprise and Governance, United KingdomReviewed by:

Raul Zambrano, Independent Researcher, New York, United StatesAlan Freeman, University of Manitoba, Canada

Copyright © 2023 Tharappel. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jayanth Tharappel, amF5LnRoYXJhcHBlbEBnbWFpbC5jb20=

Jayanth Tharappel

Jayanth Tharappel