95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Blockchain , 03 January 2022

Sec. Blockchain for Good

Volume 4 - 2021 | https://doi.org/10.3389/fbloc.2021.739751

This paper presents the results of what may be the world’s first randomized control trial on community currencies, focusing on Grassroots Economics Community Inclusion Currency (CIC) model run on the xDAI blockchain. Beneficiaries in Nairobi, Kenya were sent the equivalent of $30 in cryptocurrency tokens, enabling a level of impact evaluation usually unfeasible for most cash and mobile-money based transfer programs. Results show that CIC transfers of $30 are associated with $93.51 increase in beneficiaries wallet balance, a $23.17 increase in monthly CIC income, a $16.30 increase in monthly CIC spending, a $6.31 increase in average trade size and a $28.43 increase in expenditure on food and water. However, the difference in treatment effects for males versus females suggests gender imbalances persist. This study serves as an important prototype for novel cash transfer models and presents some of the first quantitative evidence in the area of “crypto for good.”

Recently, community currency (CC) models have been explored as a more sophisticated successor to conventional cash transfer programs. While approaches vary, CCs commonly consist of non-interest bearing physical vouchers or digital tokens which are issued and honoured by members of a network and can only be spent on goods and services provided by other members in the network (Bendell et al., 2015). Currency circulation thus relies on mutual acceptance and is backed by the resources of the community. Grassroots Economics, a Kenyan non-profit, has developed a unique variant of CCs known as Community Inclusion Currencies (CICs). Instead of circulating scrip-like physical vouchers, CICs utilize a decentralized ledger on an open-source blockchain. Much in the same way that transactions on the Ethereum blockchain or Bitcoin blockchain can be tracked in real time, the movement of CIC tokens is recorded on an immutable public ledger. This creates a rare opportunity for detailed impact evaluation at the individual and community level. Even minor changes to trading networks can be mapped and visualized, offering meaningful information on how cash transfers circulate within the local economy.

Locally, Grassroots Economics CIC model is known as the Sarafu Network. Between 2018 and 2020, $147,492 was distributed in CIC transfers to over 40,000 registered users across Kenya. From these transfers, the network has seen over $3 million worth of trade of basic goods and services among vulnerable populations (Ruddick, 2021). The Sarafu Network is a good study sample for analyzing the effects of unconditional cash transfers delivered through innovative financial infrastructure. The emergence of blockchain technology has catalyzed new token economies worldwide, however it is rare to see these economies function viably in a low-infrastructure context, where most network participants do not have smartphones, let alone stable internet access.

To date, no randomized control trial (RCT) has been conducted on CICs or CCs in general. This paper documents what may be the first study of its kind, presenting the results for cash transfers delivered as CIC tokens to low-income individuals in Nairobi. In addition, the intervention coincides with the Covid-19 pandemic, making this study a useful exploration of CICs delivered as a humanitarian response tool. Two hypotheses are explored: firstly, that CIC transfers boost the location-based economic engagement of recipients, thus catalyzing individual and community-level recovery in the wake of aggregate shocks and secondly, that the positive economic impacts of CIC transfers are augmented for women.

Two months after intervention, economically and statistically significant impacts are observed for beneficiaries individual welfare and local economic engagement. Small-scale transfers of $30 sent as CIC tokens are associated with a $93.51 increase in available wallet balance, a $23.17 increase in monthly income, a $16.30 increase in monthly expenditure, $6.31 increase in average trade size and a $28.43 increase in expenditure on food and water. However, a large disparity is seen in the size of treatment effects for female versus male recipients. Impacts on women are considerably lower than those for men, thus deviating from the original hypothesis. Finally, the limitations of a closed-network study must be confronted. These results tell us about changes in CIC spending patterns but cannot be used to extrapolate the effect on expenditure of national currency.

The study should make a note of these limitations (the costs of limited data sources limiting the questions answered which limits the evidence derived from the study which limits the learning agenda to improve the use of CICs). The study does not answer critical questions around the various behavioral (incentive) mechanisms of different types of economic transactions (for example) because that would require different data sources that are more costly to collect.

The remainder of this paper is organized as follows: Section 2 provides a critique of the unconditional cash transfer model; Section 3 describes the motivating theory behind CCs; Section 4 gives a brief overview of the Sarafu Network and CICs in particular; Section 5 details the study design; Section 6 reports results; Section 7 provides further discussion, and Section 8 concludes.

In December 2018, a number of UN agencies released a joint statement identifying “cash-based assistance as one of the most significant reforms in humanitarian assistance in recent years” (UN Office for the Coordination of Humanitarian Affairs, 2018). In the late 1990’s and early 2000’s, programs like Mexico’s Progresa and Oportunidades championed the conditional cash transfer model, where the eligibility of receiving a transfer is dependent on meeting behavioural criteria such as school enrolment and vaccinations. This approach quickly became the social protection intervention of choice throughout Latin America (Handa and Davis, 2006) and later throughout sub-Saharan Africa (Davis et al., 2016). Since 2010, organizations such as GiveDirectly have also popularized unconditional cash transfers (UCTs), arguing that giving money to the poor without behavioural conditions is just as, if not more effective.

With in-kind transfers on a steady decline worldwide, UCTs have received heightened attention for being a more efficient and effective tool for poverty alleviation and humanitarian response. There are several arguments in favour of this approach. Research suggests that UCTs may offer more impactful welfare gains as beneficiaries get to use transfers according to their specific needs (Hidrobo et al., 2014). One of the biggest criticisms of in-kind transfers is that by inflating the supply of a product, they cause a decrease in local prices and may even crowd out private spending on the good provided (Cunha et al., 2019). UCTs avoid these market distortions. With the necessary administrative structures in place, UCTs can be more cost effective than in-kind transfers and even conditional cash models as the cost of providing the transfer is cheaper. Finally, UCTs do not come with the psychological stigma traditionally associated with in-kind assisstance. Agency is conferred to the hands of recipients who are empowered to make their own decisions about how to address their socio-economic challenges. A 2013 randomized control trial of GiveDirectly’s UCT program in Kenya found that households who received cash either as an initial lump sum of $287 or in the form of nine monthly installments of $32 were 58% more likely to increase their asset holdings than the control group mean (Haushofer and Shapiro, 2013). In addition, there was a 30% reduction in the likelihood of recipients having gone to bed hungry and a 42% reduction in the number of days children went without food.

With ample evidence suggesting that UCTs increase consumption, assets and food security amongst recipients, these programs have radically changed the way we think about giving money to the poor. Cash transfer models are also increasingly being used as an emergency response tool. A World Bank report shows that by June 2020, 277 cash transfer programs were in place in 131 countries–98 of these existed before the onset of Covid-19 and 179 were created in response to the pandemic (Gentilini et al., 2020).

However, evaluating the true impact of UCT interventions remains difficult. The long-term effects of these programs are still not entirely understood (Aizer et al., 2016), although one Zambian study stands out with promising results 3 years after program initiation (Handa et al., 2018). Research runs thin on how UCTs affect economic equilibria such as wages and local prices, with the exception of hypothetical simulations (Thome et al., 2016) and more recent yet unappraised experimental analysis (Egger et al., 2019). These challenges commonly stem from data constraints which limit the scope of analysis to individual welfare gains. Most UCT programs focus on poverty mitigation rather than economic empowerment, with the majority of studies using food security and consumption as the primary metric for impact evaluation.

This approach leaves numerous questions unanswered. For example, how do transfers influence financial interactions in a community? Do the majority of transfers get spent locally or elsewhere? Do transfers have a high or low velocity–in other words, how often do they change hands before exiting the market? Are women more likely to spend their transfers with other women or men, and vice versa? These questions highlight a critical lens through which most cash transfer programs are seldom evaluated: the relationship between the individual and the local economic network.

What is required is a deeper understanding of the mechanisms through which people increase their livelihoods and whether these can change in response to cash interventions. For example, economic gender interactions may shed light on the role of cash transfers as a tool for gender empowerment, which could have important implications for development policy. Literature remains ambiguous on this point either because studies target women specifically (thus ruling out direct comparability with males) or because study designs lack rigorous gender monitoring (Browne, 2014). Another area where distribution channels are of particular interest is in the context of “leaky bucket” economies (see Section 3.2). Right now, it is unclear whether UCTs address the structural gaps that give rise to stagnant economies. For this reason, observing the movement of funds from donors to recipients to trade partners may provide greater insight on first and second order effects of cash injections. This paper next turns to CCs and how their development over time addresses some of the shortfalls of the UCT model.

Lietaer and Belgin. (2011) define money as “an agreement, within a community, to use some standardized item as a medium of exchange”.In its most basic form, money is therefore a social contract that derives legitimacy from the acceptance of its users. Its value lies in its functional roles–as a medium of exchange to trade goods and services, as a unit of account, as a store of value and, increasingly, as a tool for speculation. Throughout history, when legal tender has failed to fulfil all or one of these roles, some alternative has been used in its place. Community currencies (CCs) are one such alternative: a community-driven monetary system designed to function as a more effective medium of exchange and unit of account alongside national currency.

The last decade has seen CCs receive fresh attention for their potential to mitigate the problems associated with high inflation, currency volatility and external risk (Stodder and Lietaer, 2016; Fleischman et al., 2020). The primary idea is that when people have a stable medium of exchange tied to local productive capacity, they no longer need to rely solely on national currency and volatile markets. Instead, CCs allow them to exchange goods and services or incubate businesses and community projects in such a way that value does not escape the local economy. Proponents of CCs commonly cite the following advantages:

1) A non-interest bearing medium of exchange stimulates greater local circulation of money because users either have no incentive to store their wealth or are actively disincentivized through demurrage (negative interest). This produces a higher concentration of local economic activity for the same amount of inputs.

2) CCs kickstart the local multiplier effect–the economic benefit accrued when money is spent locally as opposed to elsewhere. As demand for local resources increases (especially underutilized labour), so does local productive capacity as businesses expand their supply to meet new demand.

3) As a form of mutual credit, CCs transform what would otherwise be individual debt burdens into a collective credit clearing mechanism (Fleischman et al., 2020).

4) Alongside kickstarting stagnant economies, CC programs are effective in supporting numerous development aims such as improving food security, rewarding environmental restoration and refugee inclusion efforts.

5) CCs rely on and reinforce community trust and other social values, making them a strong tool for civic empowerment (Dini and Kioupkiolis, 2019).

Literature on CCs is filled with qualitative evidence on how these networks address liquidity problems and build bottom-up economic resilience. Some of the most comprehensive research on this topic comes from an example in the developed world. Switzerland’s Wirtschaftsring (WIR) is perhaps the most well known and oldest CC which continues today. The system of private mutual credit was founded in 1934 as a response to currency shortages and global financial instability during the interwar period. In 2013, there were 50,000 SMEs who were WIR members, accounting for 17% of all Swiss business. They moved 1.43 billion Swiss Francs in trade, or $1.59 billion USD, representing between 1 and 2% of Swiss GDP. Stodder and Lietaer. (2016) have shown strong evidence for a countercyclical effect of the WIR over a 65-year period. WIR is most used by SMEs when national currency is in short supply, such as during recessions. During times of expansion, when bank credit is more readily available, WIR members shift back to using national currency. While money supply is procyclical–it trends with and even magnifies the fluctuations of the economic cycle–complementary currency supply is countercyclical. This is why the WIR has had such a powerful stabilizing effect on the Swiss economy, by limiting the severity of the business cycle.

Since the 1980s, thousands of CCs have sprung up in both developed and developing economies, of which some of the more well known are LETS (Local Exchange Trading System) in Canada and the United Kingdom, time banks in Italy and the United Kingdom, barter clubs in Argentina, the Ithaca Hour in the United States and community banks in Brazil. Some CCs have seen more success than others. Several complementary currency projects in Japan were terminated or suspended because of circulation failure due to lack of currency acceptance (Lietaer, 2004). Analyzing complementary currencies in Poland, Sobiecki. (2018) noted that low market liquidity and a lack of market price setting mechanisms constrained the size of CC networks and deterred newcomers. Even relatively successful cases tend to resemble the process of “budding”–the project grows until it stagnates or bursts and then new projects crop up elsewhere, never developing beyond a certain threshold. Zeller. (2019) provides an argument as to why this might be the case: CCs are only successful in environments where there is insufficient liquidity, and are therefore addressing a primary financial need (for example, this supports the countercyclical uptake of the WIR). CCs that originate in the Global North, such as the Bristol Pound and New York’s Ithaca Hours do not show the same economic impact as CCs in the Global South, such as Kenya’s Bangla-Pesa (a precursor to the Sarafu Network) or Argentina’s Redes de Trueque.

The CC approach to economic development partially stems from a characterization of poverty as a liquidity problem, where money itself is the scarce asset. Most marginalized communities face a problem where cash injections such as temporary employment, remittances or aid are quickly funneled out of the economy due to a lack of key services and resources within local proximity. Money has extremely low velocity because it exits the system almost as soon as it enters. Every dollar spent elsewhere presents an opportunity cost to the growth of the local economy–decreasing business for local entrepreneurs, inhibiting potential employment and representing a flow of resources away from the community. In this way, the local economy can be likened to a leaky bucket–with new holes added by exploitative lending, climate risk, poor health, loss of assets, and misallocation of funds.

Economic shocks can augment this process in catastrophic ways because they cause existing liquidity sources to dry up. Disruptors on any scale–from a bad harvest season to the devastating effects of a global pandemic–can spell disaster for small businesses and low-income individuals who primarily work in the informal sector. Previous studies and those concerned with the immediate effect of the Covid-19 pandemic all point to one glaring problem: the economies of most low-income communities are inherently fragile because of poor liquidity retention (Lietaer and Belgin, 2011; Fleischman et al., 2020; Flögel and Gärtner, 2020). As a consequence, communities face a constant state of imperfect resource allocation, characterized by the following:

1) Decreased business efficiency. An unpredictable environment means small businesses cannot plan adequate stock volumes in advance–there is either excess supply or excess demand, with equilibrium only achieved a few times a year during peak seasons.

2) Decreased investment in local enterprises. Poor, unpredictable market conditions dampen the prospects of profitability, causing potential investors and entrepreneurs to put their money elsewhere.

3) Decreased savings. Consumers can barely meet their own day-to-day needs, so disciplined periodic saving is either an after-thought or an almost impossible goal (Carter and Barrett, 2006).

4) Decreased consumption. When there is excess demand, suppliers cannot meet the resource needs of the local community, whether that be food, healthcare or labour.

It bears emphasizing that both supply and demand exist–people still need to buy food, healthcare needs must still be met, and there is still a population of able bodies ready to be employed–but what is missing is the medium needed to achieve equilibrium. Lack of liquidity halts the exchange of goods and services through a reinforcing feedback loop, causing local markets to stagnate. This process deprives people of opportunities for growth that could exist within the community itself. Underutilized workforces combined with underutilized resources propagate chronic instability–incomes are sporadic, trade is unpredictable, and the local economy is severely vulnerable to external shocks such as poor weather, volatile national currency and financial crises.

Analyzing poverty from this angle motivates policymakers to confront systemic issues with how money circulates in marginalized communities. While most cash interventions fall short of addressing this structural lens to poverty alleviation, CCs achieve this by kickstarting a cycle of trade which, by design, remains in the local economy. CICs go a step further by mapping out this cycle of trade through an accurate, immutable record of every transaction on the network. Just as transactions on the Ethereum blockchain or Bitcoin blockchain can be publicly tracked, so the movement of CIC cryptographic tokens can be analyzed for detailed impact evaluation.

The Sarafu Network was founded in 2010 by the Grassroots Economics Foundation (GE), a Kenyan NGO whose mission is to empower marginalized communities to develop their own prospering economies. Sarafu means “currency” in Kiswahili and is the name given to the blockchain-based CIC token traded on the network.

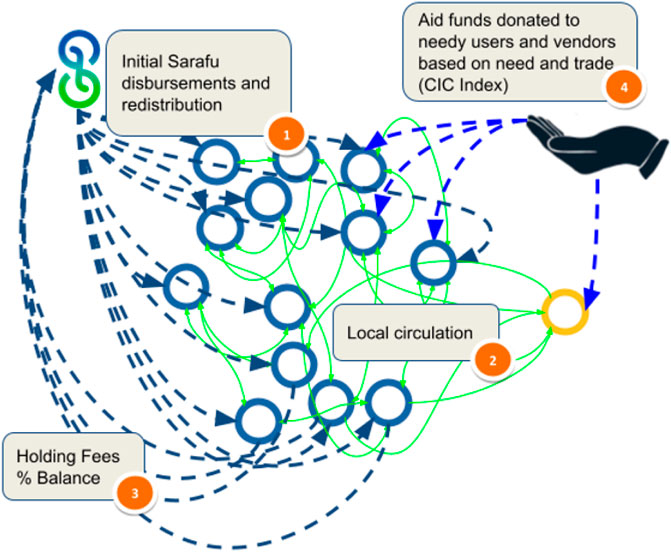

When a new community is onboarded to the network, GE typically identifies a hub such as a business, school, or community-owned social enterprise as a point of entry for integrating Sarafu into the local economy (Figure 1). The hub may receive support from GE and its donors in return for committing to offer goods and services in exchange for CIC tokens. In the past, support has included installing water tanks at schools, providing refrigerators to key food retailers or donating maize mills to agricultural co-operatives. As markets are intertwined, the circulation of Sarafu feeds directly into the livelihood of the larger community via targeted supply-chain linking. For example, GE field staff may employ the help of village elders to encourage people to join the network and use the CIC tokens to pay for food, school fees, church tithes, medical care and other local services. Registration is free and all new members receive a direct donation of 400 Sarafu (equivalent to 400 KES, $3.60 nominal or $9.73 PPP). An important criterion for joining the network is that individuals must have some product or service they can offer to the rest of the community. In this way, a single user can be likened to a self-owned business. These businesses range from women who sell vegetables grown in their backyard to boda-boda (motorcycle) drivers, hairdressers, day labourers, street food sellers and physical store owners. Users transact with each other via simple USSD codes on their feature phones, providing a similar experience to other mobile money services like M-Pesa–the difference being that these transactions are connected to a blockchain and are not denominated in national currency.

FIGURE 1. Flow of currency in the Sarafu Network. (1) Disbursements of CIC tokens are funded by donors and humanitarian organizations. Anyone is eligible to join the network and receives 400 Sarafu ($3.60 nominal or $9.73 PPP) upon mobile registration. (2) Sarafu circulation is kick-started within the community when key hubs such as businesses and schools agree to accept the currency. New users are incentivized to join through community workshops and word of mouth. (3) Holding fees (“negative tax” or “demurrage”) encourage users to spend their Sarafu. (4) Donor organizations can use anonymized trade data to target user groups in need of capacity-building e.g. female farmers, healthcare workers, teachers, etc. (Image source: Grassroots Economics, 2021).

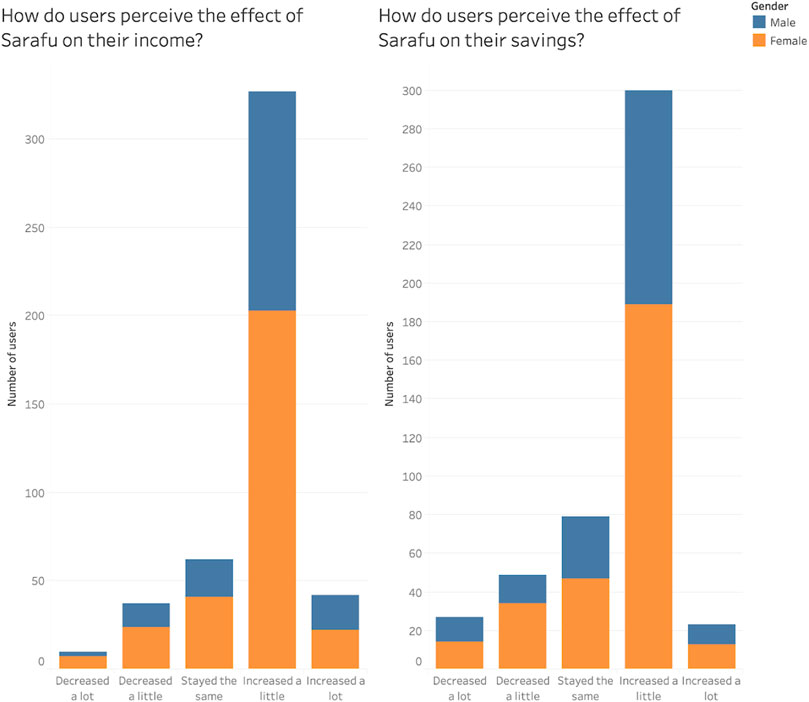

Today, the Sarafu network has over 40,000 users across Kenya in both rural and urban communities (see Figure 3). Roughly 38% of users are male, 31% are female, and 31% have unknown or “other” gender. The majority of trade goes toward food and water, communal table-banking groups (locally known as chamas), farming and labour, and retail stores (see Figure 4). Internal research by GE in 2018 concluded that the majority of users live on less than $1 per day. Results from a 2020 Kenya Red Cross survey suggest that the majority of Sarafu users are between the age of 26–36 and have a mean household size of 4 people. Figure 2 shows 70% of users believe that using Sarafu has helped them access goods they otherwise would not be able to buy, and nearly 80% believe Sarafu has helped them save more in Kenyan Shillings (Kenya Red Cross, 2020).

FIGURE 2. Perceptions of the effect of Sarafu on income and savings (Kenya Red Cross, 2020).

This study consisted of randomization at the individual level, where treatment and control units were drawn from an eligible population of Sarafu users in Nairobi. Two research questions are explored, with their relevance in the literature and accompanying hypotheses described below: First As a crisis recovery tool, what effect do CIC transfers have on the local economic engagement of recipients? If this effect is negligible, then we would expect to see no significant change in trading behaviour beyond the nominal increase equal to the transfer amount. If this effect is meaningful, it would suggest CICs are an effective tool for addressing individual welfare needs and rebuilding fragile economies in the wake of aggregate shocks. Previous studies on cash transfer programs have shown higher returns to capital for beneficiaries running small businesses (De Mel et al., 2007), larger asset holdings (Haushofer and Shapiro, 2013), a greater appetite to invest (Gertler et al., 2012) and overall higher consumption levels (Egger et al., 2019). We would expect CIC transfers to have at-least similar effects.

The impact of CIC transfers is greater than the nominal increase equal to the transfer amount and is seen in recipient’s higher trade frequency and trade volumes. Furthermore, because these impacts undergo the local multiplier effect, positive economic spillovers are distributed within the immediate community and therefore support local economic recovery. Second Do CC transfers display the same effects for women and men? If there are significant differences in treatment effects skewed against women, this may point to the role of economic gender imbalances. Alternatively, if treatment effects are higher for women, this may point to CICs as a tool for gender empowerment. Existing literature presents mixed results in this regard. It is widely acknowledged that simply receiving cash transfers does not necessarily empower female beneficiaries as financial decision making may not be an individual decision (Hagen-Zanker et al., 2017). Additionally, this study puts the question within the context of a global pandemic, where women have been hit the hardest on almost every front.

The positive economic impacts of emergency CIC transfers are augmented for women.

In addition to answering these research questions, the study aims to pilot a fully-remote RCT and illustrate the viability of low-cost, rapid interventions.

The use of publically available, anonymized blockchain data puts a twist on the traditional RCT by eliminating the need for costly user surveys. Baseline characteristics are pulled directly from the blockchain, including gender, location, and detailed spending patterns based on every transaction ever recorded. This gives an accurate map of how users interact with the Sarafu Network and makes it easier to determine treatment and control groups. Furthermore, all outcome variables of interest are also pulled from trade data, ensuring accurate impact evaluation based on actual spending data and not self-reported results. This novel application of a remote RCT illustrates what is possible when highly detailed, anonymized data is made publicly and freely available. Cost can be a constraining factor when it comes to data collection, as baseline surveys often require field work, time and money. Although it is permissible to omit this step under certain conditions, baseline surveys are still widely used to isolate the impact of a program and check that randomization was conducted appropriately. Duflo et al. (2007) note that “the alternative strategy of collecting “pre-intervention data” retrospectively in the postsurvey will usually be unacceptable, because even if the program does not affect those variables it may well affect recall of those variables. On the other hand, the authors argue administrative data (“data collected by the implementing organization as part of their normal functioning”) could introduce biases based on prior data collection methods. The cost of producing suitable baseline data together with the cost of impact evaluation can quickly drive up a study’s budget into the thousands and hundreds of thousands. For example (Speich et al., 2019), found that the median preparation cost for an RCT in 2016 was $72,600. For studies on UCTs, the numbers are even more staggering: total program costs excluding transfer amounts and evaluation expenses for a 2019 joint study by Give Directly and IDInsight cost nearly $930,000–the equivalent of giving $1,000 to approximately 900 additional households (Cook and Mukhopadhyay, 2019).

Figure 5 provides an overview of the sample selection process and Figure 6 shows the geographical distribution of the final study sample in Nairobi. Eligibility criteria were applied as follows:

1) The Sarafu population was filtered to include only users living in Nairobi County.

2) Wallets belonging to savings groups or GE system administrators were removed from the data to restrict transfers to individual wallets.

3) Wallet addresses were filtered such that only individuals who had been active for at least 30 days and traded at least once per week were eligible for participation.

4) Individuals were randomly assigned to treatment and control, with the proportion of each group determined by calculating the sample size required for a 95% confidence interval.

389 individuals were assigned to treatment and 402 were assigned to control. Within the treatment group, 186 were male (47.81%) and 203 were female (52.19%). Within the control group, 172 were male (42.78%) and 230 were female (57.21%). This shows a slight deviation from the overall gender distribution in the Sarafu Network population, where (excluding unknown gender labels) 56.05% are male and 43.95% are female.

Individuals in the treatment group received a flat transfer of 400 Sarafu CIC tokens each week for three consecutive weeks, beginning on November 20, 2020 and ending on December 4, 2020. Each round was accompanied by an SMS informing the recipient of the transfer and providing a shortcode to check their new account balance (Figure 7).

The transfer amount corresponds to the credit bonus new users receive when registering on the network for the first time as well as just lower than the average user balance in Nairobi. Since Kenya has a purchasing power parity of 41.1, this means for every $1 received, locals can buy 2.43 times the amount of goods in community currency than they would buy in the United States using United States dollars. A transfer of 400 Sarafu worth $3.60 (nominal) therefore corresponds to a purchasing power of $9.73. The total value of all transfers is 1,200 Sarafu or $29.20 PPP. Table 1 provides a rough idea of what this amount of money can buy.

Although small-scale weekly transfers were selected in favour of a large lump sum payment due to budget constraints, research suggests that the effects of smaller transfers on food consumption, asset accumulation and economic participation are comparable to graduation type programs commonly evaluated in the literature, and may even have larger multiplier effects on productivity and income (Handa et al., 2018).

The list of baseline variables used in the econometric specification in Eq. (3) are described below in Table 2. Baseline balance tests have been purposefully omitted from this analysis as there is a weight of research that suggests these methods are only informative when there is reason to believe randomization was not carried out correctly or when attrition is high. In all other cases, baseline balancing undermines the concept of randomization by attempting to assign a probability to an event that by design should occur through chance (Altman, 1985; Bruhn and McKenzie, 2008). Differences between baseline characteristics in treatment and control groups were instead analyzed using a standardized mean difference (SMD) score, reported in Table 3. SMD provides a measure of the distance between two group means, enabling a meaningful comparison across variables of different scales. This is similar to the approach proposed by (Imbens and Rubin, 2015), who argue that the focus of baseline balancing should not be on statistical significance but rather on the size of differences. An SMD greater than 0.1 is often considered a sign of important covariate imbalance. Only 2 out of 11 covariates showed values greater than 0.1. Other baseline characteristics for trade activity are fairly comparable across treatment and control, hence in the economic specification detailed in Eq. (3), the expected correlation between the error term ɛi and treatment status is zero.

CIC transfers were sent via the xDAI blockchain to specified wallet addresses, therefore all treatment units were in fact treated.

If attrition is correlated with treatment assignment, this could potentially bias estimates for program impact. Attrition is unlikely to have meaningfully biased the results of this experiment as subjects were selected from an existing group of active Sarafu users and the treatment intervention–a free disbursement of tokens–made opt-out unlikely.

Rubin’s causal model asserts that for accurate causal inference, the stable unit treatment value assumption (SUTVA) must hold–in other words, that the potential outcomes observed for one unit should not be affected by the treatment assignment of other units (Rubin, 1990). This includes effects that operate economically, such as through an increase in local trade and psychologically, such as through John Henry effects, where members of the control group behave differently because they are aware they are being compared to the experimental group. However, Thome et al. (2016) note that by design, cash transfers generate spillovers when households other than those assigned to treatment are affected by the inflow of money to the local economy. This is due to changes in “incomes, production, consumption decisions, access to information, perceptions or even social interactions.” Some flexibility must be allowed for within-region spillovers, where treated and control units are almost guaranteed to interact with each other. For example, when a transfer beneficiary buys their food from an individual in the control group, the beneficiary’s increase in expenditure corresponds with the non-beneficiary’s increase in income.

There are two general approaches in the literature to address this kind of interference. First, some programs will include a “pure control” in a different region where units are guaranteed to not have interacted with the treatment group. In this study, however, such a design feature was not possible due to the small sample size in other eligible regions. The second approach is to use some objective function to capture the distribution of these spillovers within the community. This study does not attempt to model these effects precisely and acknowledges that even existing methods such as Social Accounting Matrix (SAM) linear multipliers and Keynesian transfer multipliers are often applied with limited data in an approximate manner–see Egger et al. (2019); Thome et al. (2013), Thome et al. (2016); Sadoulet et al. (2001), etc. In the context of CICs, economy-wide multipliers are not suitable without additional data on the circulation of national currency, local labour supply and other baseline characteristics. However, it may still be useful to isolate a simple expenditure multiplier for the CIC economy based on the principles of Taylor’s “local economy-wide impact evaluation” (LEWIE) multiplier, which has been used in a number of cash transfer programs. The LEWIE model first applies Monte Carlo methods on parameter estimates to generate simulated results. The multiplier is then calculated by taking the sum of recipient’s and non-recipient’s total value change in an outcome of interest and dividing it by the total amount transferred. The multiplier therefore indicates the additional monetary value generated for an outcome of interest for each United States dollar transferred. The multiplier’s difference in magnitude between groups also indicates the treatment effect on the size of positive spillovers. A multiplier that is greater than zero for non-beneficiaries and greater than one for beneficiaries is evidence of positive feedback effects between the two groups. For example, if a treated individual’s increase in expenditure is greater than the total transfer amount, then the additional spending volume can be attributed to these positive spillover effects. In Section 6 (Results), the mean expenditure multiplier reported for each cohort is calculated as follows:

Here

Treatment and control wallets were tracked from the beginning of the study period to 2 months after the final transfer. Table 4 provides a detailed description of each outcome variable.

Marginal propensity to consume (MPC) measures the increase in consumer spending that can be attributed to a change in disposable income. The standard Keynesian formula is used, captured in Eq. (2) below:

Here ΔC is change in spending, calculated as a user’s total volume traded out measured post-treatment minus their total volume traded out at baseline. ΔI is change in disposable income, calculated as a user’s total income measured post-treatment minus their total income measured at baseline.

The treatment effect of CIC transfers is captured in Eq. (3) below:

Here yi is the outcome of interest for individual i (with each outcome described in Table 4), β0 is the constant term, Ti is a binary treatment indicator that takes the value 1 for individuals in the treatment group (i.e. Sarafu users who received CIC transfers) and 0 for individuals in the control group (i.e. Sarafu users who did not receive CIC transfers), Fi is binary sex indicator that takes the value 1 for females and 0 for males; δiB is the set of baseline controls described in Table 2,

Table 5 shows the basic treatment effect on the outcome variables detailed in Table 4 2 months after the final transfer round. Column (1) reports the coefficient β1 on the treatment indicator as described in Eq. (3). In parentheses are the upper and lower bounds for the 95% confidence interval of this treatment effect.

After 2 months, statistically significant and economically meaningful impacts of CIC transfers were found for beneficiaries wallet balance, monthly income, monthly expenditure, marginal propensity to consume, average trade size, number of sales, number of purchases and expenditure on food and water. Beneficiaries wallet balance was larger than the control group by $93.51 and their marginal propensity to consume was 0.60 points higher, with both results statistically significant at the 5% level. Beneficiaries had a monthly CIC income $23.17 higher than the control group (significant at the 5% level) and spent $16.30 more (significant at the 10% level). During the study period, beneficiaries traded more frequently and in larger amounts, showing an average trade size $6.31 higher than individuals in the control group (significant at the 10% level), with 2.97 more sales and 2.47 more purchases (both significance at the 5% level). There was also a $28.43 increase in beneficiaries’ expenditure on food and water within the CIC network, statistically significant at the 10% level.

The LEWIE transfer multiplier discussed in Section 5.5.3 divides individual expenditure during the study period by the total amount transferred. This offers a useful approximation of positive spillover effects, which are both an inevitable design feature and outcome of interest for cash transfer programs. After 2 months, beneficiaries had a mean expenditure multiplier of 8.28 while non-recipients had a mean expenditure multiplier of 6.69. This means that for every United States dollar in CIC tokens transferred, an additional $8.28 was generated by beneficiaries through local spending. Since the increase in expenditure for both groups is considerably greater than the nominal transfer amount, this is an indication of positive spillover effects. An analogous interpretation is velocity of money, which measures the number of times one unit of currency is spent to buy goods and services per unit of time. Since the primary aim of complementary currency programs is to activate stagnant economies by encouraging local spending, these results provide an important quantitative measure with which to compare future studies.

Overall, these findings support the hypothesis that CIC transfers boost the local economic engagement of recipients, thus catalyzing individual and community-level recovery in the wake of aggregate shocks. The difference in food expenditure supports previous research that highlights CICs as an effective policy tool for fighting food insecurity (Cauvet, 2018; Zeller, 2019). The results are also consistent with more recent studies on the impact of cash transfers in response to the Covid-19 pandemic–for example, Banerjee et al. (2020) found that recipients in Kenya were 4.9–10.8 percentage points less likely to experience hunger relative to the control group mean of 68%. While the results of this study do not tell us how food expenditure has affected hunger levels or nutrition, the size of the treatment effect is over two thirds the transfer amount, suggesting that recipients placed a higher level of importance on securing more food than they did on expenses such as education, healthcare or savings. These impacts suggest that CIC transfers are primarily used for consumption, echoing similar findings in the literature where short-term cash transfers tend to be correlated with increased consumption (Haushofer and Shapiro, 2016).

The coefficients in Column (2) for the relative treatment effect on female recipients suggest that gender imbalances play a strong role in determining the impact of emergency CIC transfers. This disproves the hypothesis that positive transfer impacts are amplified for female beneficiaries. Before exploring this variation in results, several constraints must be acknowledged:

1) The majority of the coefficients in Column (2) lack statistical significance and therefore limit any conclusive generalizations.

2) A natural limitation of this data is that it only tells us about treatment effects on the CIC economy. For every CIC-based outcome, there is a parallel outcome denominated in national currency whose relationship with the former remains unknown. Currently there exists little to no theory in this area; while this paper does not attempt to explain this relationship, it highlights a crucial point for further research.

After 2 months, female beneficiaries experience a positive treatment effect on their wallet balance ($85.18 or 91% lower than the treatment effect on males), a negative treatment effect on monthly CIC income, a negative treatment effect on monthly CIC expenditure, a negative treatment effect on marginal propensity to consume, a positive treatment effect on average trade size ($3.89 or 62% lower than the treatment effect on males), a positive treatment effect on number of sales (2 units lower than treated males), a negative treatment effect on number of purchases, and a negative treatment effect on food and water expenditure.

Based on their higher marginal propensity to consume, average trade volume and number of sales and purchases, it is reasonable to conclude that male beneficiaries on the whole were less conservative with how they spent their transfers, potentially amplifying positive spillover effects well after the intervention was completed. This is consistent with literature that suggests cash transfers encourage risk taking and thus an expansion of business opportunities for individuals and small enterprises (Banerjee et al., 2020).

On the other hand, while females also showed small positive treatments effects on their wallet balance and average trade size, the negative treatment effect on monthly CIC income, monthly CIC expenditure, marginal propensity to consume, and food and water expenditure is a strong indicator that female beneficiaries were more cautious than even the control group in how they chose to spend their additional income during the study period. In light of this, it may be more useful to interpret the coefficient on marginal propensity to consume as a behavioural indicator which helps partially explain the variation observed in other outcomes. Finally, it bears emphasizing that the effects on CIC income and expenditure may indicate female beneficiaries preference to trade outside of the CIC network for any number of unknown reasons. One plausible explanation is that female beneficiaries may have exhausted their transfers on immediate consumption needs (i.e. through trade with other members of the Sarafu network) and thereafter chosen to trade exclusively outside of the CIC network in search of more trade partners.

Figure 8 and Figure 9 show multiple graphs with the predicted values and mean treatment effects after running 1,000 Monte Carlo simulations on the regression coefficients in Table 5. On the left, the boxplots show the distribution of simulated values for each outcome variable by cohort. On the right, the treatment effect for the outcome variable is analyzed by gender. The discussion that follows analyzes these differences on multiple levels of analysis: first, in the context of existing gender disparities in Sarafu Network and the broader Kenyan economy, and secondly, in the context of the Covid-19 pandemic and its disproportionate impacts on women.

The variations observed in both regression and simulated results echo gender imbalances throughout Kenya’s economy and within the Sarafu network itself. Women tend to be less mobile and have lower market participation due to cultural norms and other constraints (Bergman Lodin et al., 2019). In the Sarafu network, more men tend to be shop owners than women–implying greater access to capital and more trade partners, which may explain why male beneficiaries could afford to be less conservative with their transfers. Motorcycle (“boda-boda”) drivers also tend to be dominated by men, increasing their mobility and access to trade opportunities (see Figure 10).

Finally, this study must be placed in the context of the Covid-19 pandemic, where women globally have been hit the hardest on almost every measure. Not only has this amplified existing gender disparities, but it has also influenced the financial decision making of women who must adapt to more challenging economic conditions. Ongoing data by the World Bank analyzing the effects of the pandemic on Kenyan households suggests that women have fared worse when it comes to food security and employment (World Bank, 2021). A Nairobi-based study released in late 2020 also found a stark contrast in the economic impacts of Covid-19 between young men and women (Decker and Gichangi, 2021). Females reported significantly more time spent on care giving and household work and over 54% of them reported an increase in financial reliance on others compared to 36% of men. The researchers also note that with more men facing unemployment and being confined to the household, a skewed division of household labour has constrained women’s income generating opportunities. While these results cannot be directly translated to this study sample, they illustrate the broader context in which the impacts of Covid-19 have impeded women’s ability to work and earn. Female beneficiaries lower marginal propensity to consume–in other words, their more conservative spending behaviour–suggests that these women may have opted to hold on to additional income as a necessary buffer against unpredictable future cash flows.

The results from this study echo similar findings by researchers at the World Food Organization, whose eight-country case study reveals that cash transfers and vouchers have limited effects on gender empowerment when a community has experienced a large-scale disaster, but that these effects are more noticeable when communities face a smaller-scale emergency (Berg et al., 2013). For practitioners and policymakers, this highlights the need to accompany emergency interventions with additional support targeted at females, such as temporary employment opportunities, access to microcredit and psychological services.

These findings complement a growing body of work on emergency cash transfers to the poor. Overall results support the hypothesis that CICs can catalyze greater local economic engagement within a short span of time. Coupled with the quick, low-cost turnaround of the actual study implementation, this serves as an important prototype for researchers and policymakers interested in economic-based disaster-response.

However, the unique set-up of this study poses several constraints for how it is interpreted within the broader literature. Not only did recipients receive an entirely different form of currency, but they also faced extreme aggregate shocks whose impact on day-to-day living would be difficult to replicate. It is therefore necessary to decouple general cash transfers from emergency cash transfers as well as the analysis of gender empowerment from one centered on gains to one centered on economic protection. This study has also highlighted a major caveat of doing impact evaluation on closed complementary currency networks: while the data itself is accurate, we lack contextual information on user’s spending habits outside of the CIC network. As highlighted in Section 6.2, understanding the relationship between CIC expenditure and national currency expenditure continues to be a crucial missing link in the literature and should be prioritized in future research.

The consistently stronger treatment effects for males versus females raises important questions that warrant further research. In a comprehensive overview of several programs (Browne, 2014), notes a general ambiguity in the literature regarding the impact of emergency cash transfers on women, largely due to poor study designs and inadequate gender monitoring. For example, programs that only send transfers to women cannot offer direct comparability with males, limiting the discussion on empowerment to outcomes such as financial decision making or intimate partner violence. While this analysis focuses largely on differences in CIC trading behaviour, the context of the study makes any conclusive or generalized interpretation of the results somewhat misleading. For example, the question of whether to attribute these strong gender differences to the design of CIC networks versus the impact of the pandemic is impossible to answer without additional data that could be sourced from follow-up interviews.

Another area for further probing is the study design itself. While the size of these transfers was kept small due to budget constraints, an interesting follow-up would be to test the impact of larger lump-sum CIC transfers, both during periods of relative economic calm and during aggregate shocks. Previous studies suggest that larger transfers are more likely to increase investments while small transfers have a greater impact on consumption (Haushofer and Shapiro, 2016). This study also only measured the short-term impact of CIC transfers as a crisis response tool. There is yet to be a long-term experimental study on the impact of CICs.

Finally, it is worth noting that a natural limitation of CIC networks is that because tokens can only be spent with other members of the network, recipient’s expenditure is constrained by the range of available goods and services offered by other network members within their vicinity. For example, one would not expect to see recipients open a bank account with their transfer funds because the nature of the transfer does not yet support this kind of exchangeability. Given the rapid growth of the Sarafu Network since 2018, it seems likely that with well-developed CIC networks embedded into the economy of low-income communities, future CIC transfers may show greater impacts beyond immediate spending behaviour.

The Covid-19 pandemic has exposed the fragility that underlies most local economies. It is during times such as these that we are made aware of the urgency for more effective forms of humanitarian response. Results from what is likely the first randomized control trial on community currencies suggest that even a small-scale transfer of CIC tokens can have an economically and statistically significant impact on beneficiaries, who show a $93.51 increase in available wallet balance, a $23.17 increase in monthly CIC income, a $16.30 increase in monthly CIC spending, a $6.31 increase in average trade size and a $28.43 increase in expenditure on food and water. However, the sharp difference in treatment effects between males and females indicates that economic gender imbalances are a strong determinant of how transfers get spent. The difficulty of interpreting these differences highlights the need for further research on the relationship between CIC trade behaviour and the use of national currency, especially during socio-economic crises that disproportionately affect women. Small-scale CIC transfers used as an emergency humanitarian response should therefore be seen as an important buffer rather than as a tool for gender empowerment–although large-scale transfers are likely to yield different results. Finally, the limitations of the data used in this study open the door for further research that looks simultaneously at CIC and national currency trade behaviour as well as qualitative measures.

CICs are a powerful tool for communities to change the structure of their local economy from the inside out. This model also has the potential to change how aid is administered, shifting the focus from retroactive responses to long-term liquidity retention and capacity-building. This study therefore serves as an important prototype and strengthens the case for broadening access to these models where they are needed most.

The original contributions presented in the study are included in the article/Supplementary Material, further inquiries can be directed to the corresponding author.

The author confirms being the sole contributor of this work and has approved it for publication.

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fbloc.2021.739751/full#supplementary-material

Aizer, A., Eli, S., Ferri, J., and Lleras-Muney, A. (2016). The Long-Run Impact of Cash Transfers to Poor Families. Available at: https://www.ncbi.nlm.nih.gov/pmc/articles/PMC5510957/.

Altman, D. G. (1985). Comparability of Randomised Groups. The Statistician 34 (1), 125–136. doi:10.2307/2987510

Banerjee, A., Faye, M., Krueger, A., Niehaus, P., and Suri, T. (2020). Effects of a Universal Basic Income during the Pandemic. Available at: https://econweb.ucsd.edu/∼pniehaus/papers/ubi_covid.pdf.

Bendell, J., Slater, M., and Ruddick, W. (2015). “Reimagining Money to Broaden the Future of Development Finance,”. Technical report (United Nations Research Institute for Social Development). Available at: https://www.unrisd.org/80256B3C005BCCF9/%28httpAuxPages%29/99FCA15CAF8E24F4C1257E7E00501101/$file/Bendell%20et%20al.pdf.

Berg, M., Mattinen, H., and Pattugalan, G. (2013). Examining protection and Gender in Cash and Voucher Transfers. World Food Programme and the Office of the United Nations High Commissioner for Refugees Assistance. Available at: http://documents.wfp.org/stellent/groups/public/documents/communications/wfp260028.pdf.

Bergman Lodin, J., Tegbaru, A., Bullock, R., Degrande, A., Nkengla, L. W., and Gaya, H. I. (2019). Gendered Mobilities and Immobilities: Women's and Men's Capacities for Agricultural Innovation in Kenya and Nigeria. Gend. Place Cult. 26 (12), 1759–1783. doi:10.1080/0966369X.2019.1618794

Browne, E. (2014). Evidence of Impact of Emergency Cash Transfers on Gender and Protectiongsdrc Helpdesk Research Report 1091). Birmingham, UK: GSDRC, University of Birmingham.

Bruhn, M., and McKenzie, D. (2008). “In Pursuit of Balance: Randomization in Practice in Development Field Experiments,”. Policy Research Working Paper Series (World Bank). Available at: https://econpapers.repec.org/paper/wbkwbrwps/4752.htm.

Carter, M. R., and Barrett, C. B. (2006). The Economics of Poverty Traps and Persistent Poverty: An Asset-Based Approach. J. Dev. Stud. 42 (2), 178–199. doi:10.1080/00220380500405261

Cauvet, M. (2018). Voucher Systems for Food Security a Case Study on kenya’s Sarafu-Credit. Available at: https://1fce7114-8e4a-43c5-bcbd-d2b877364fde.filesusr.com/ugd/ce30dd_ba8967bf866b4504b1f537f8a070369b.pdf.

Cook, M., and Mukhopadhyay, P. (2019). Cash Crop: Evaluating Large Cash Transfers to Coffee Farming Communities in uganda. GiveDirectly. Available at: https://www.givedirectly.org/wp-content/uploads/2019/06/Cash_Crop_Ugandan_CoffeeRCT.pdf.

Cunha, J. M., De Giorgi, G., and Jayachandran, S. (2019). The price Effects of Cash versus In-Kind Transfers. Rev. Econ. Stud. 86 (1), 240–281. doi:10.1093/restud/rdy018

Davis, B., Handa, S., Hypher, N., Rossi, N. W., Winters, P., and Yablonski, J. (2016). From Evidence to Action: The Story of Cash Transfers and Impact Evaluation in Sub-saharan Africa. Rome, Italy: Oxford University Press. Available at: https://www.unicef.org/socialpolicy/files/From_Evidence_to_Action_Story_of_Cash_Transfers_and_Impact_Evaluation_in_SubSaharan_Africa.pdf.

De Mel, S., McKenzie, D. J., and Woodruff, C. M. (2007). “Returns to Capital in Microenterprises: Evidence from a Field experiment,”. Discussion Paper No. 2934 (Institute for the Study of Labour). Available at: http://ftp.iza.org/dp2934.pdf.

Decker, M., and Gichangi, P. (2021). Covid-19 & Pma Gender: Spotlight on Youth and Young Adults in Nairobi, kenya. Performance Monitoring for Action Kenya. Available at: https://www.pmadata.org/pma-kenya-covid-19-dashboard.

Dini, P., and Kioupkiolis, A. (2019). The Alter-Politics of Complementary Currencies: The Case of Sardex. Cogent Soc. Sci. 5 (1), 1646625. doi:10.1080/23311886.2019.1646625

Duflo, E., Glennerster, R., and Kremer, M. (2007). “Chapter 61 Using Randomization in Development Economics Research: A Toolkit,” in Handbook of Development Economics. Editors T. P. Schultz, and J. A. Strauss, 4, 3895–3962. doi:10.1016/s1573-4471(07)04061-2

Egger, D., Haushofer, J., Miguel, E., Niehaus, P., and Walker, M. W. (2019). “General Equilibrium Effects of Cash Transfers: Experimental Evidence from kenya,”. Technical report. Available at: https://www.givedirectly.org/wp-content/uploads/2019/11/General-Equilibrium-Effects-of-Cash-Transfers.pdf.

Fleischman, T., Dini, P., and Littera, G. (2020). Liquidity-saving through Obligation-Clearing and Mutual Credit: an Effective Monetary Innovation for Smes in Times of Crisis. Jrfm 13 (12), 295. doi:10.3390/jrfm13120295

Flögel, F., and Gärtner, S. (2020). The Covid-19 Pandemic and Relationship Banking in germany: Will Regional banks Cushion an Economic Decline or Is a Banking Crisis Looming. Tijdschr Econ. Soc. Geogr. doi:10.1111/tesg.12440

Gentilini, U., Almenfi, M., Dale, P., Lopez, A. V., and Zafar, U. (2020). Social protection and Jobs Responses to Covid-19: A Real-Time Review of Country Measures. World Bank. Available at: http://documents1.worldbank.org/curated/en/590531592231143435/pdf/Social-Protection-and-Jobs-Responses-to-COVID-19-A-Real-Time-Review-of-Country-Measures-June-12-2020.pdf.

Gertler, P. J., Martinez, S. W., and Rubio-Codina, M. (2012). Investing Cash Transfers to Raise Long-Term Living Standards. Am. Econ. J. Appl. Econ. 4 (1), 164–192. doi:10.1257/app.4.1.164

Hagen-Zanker, J., Pellerano, L., Bastagli, F., Harman, L., Barca, V., Sturge, G., et al. (2017). The Impact of Cash Transfers on Women and Girls. ODI Briefing. Available at: https://www.odi.org/sites/odi.org.uk/files/resource-documents/11374.pdf.

Handa, S., and Davis, B. (2006). “The Experience of Conditional Cash Transfers in Latin america and the Carribean,”. ESA Working Paper No. 06-07 (The Food and Agricultural Organization of the United Nations). Available at: http://www.fao.org/3/a-ag429t.pdf.

Handa, S., Natali, L., Seidenfeld, D., Tembo, G., and Davis, B. (2018). Can Unconditional Cash Transfers Raise Long-Term Living Standards? Evidence from zambia. J. Dev. Econ. 133, 42–65. doi:10.1016/j.jdeveco.2018.01.008

Haushofer, J., and Shapiro, J. (2013). Policy Brief: Impacts of Unconditional Cash Transfers. Princeton University. Available at: https://www.princeton.edu/∼joha/publications/Haushofer_Shapiro_Policy_Brief_2013.pdf.

Hidrobo, M., Hoddinott, J., Peterman, A., Margolies, A., and Moreira, V. (2014). Cash, Food, or Vouchers? Evidence from a Randomized experiment in Northern ecuador. J. Dev. Econ. 107, 144–156. doi:10.1016/j.jdeveco.2013.11.009

Imbens, G., and Rubin, D. (2015). Causal Inference for Statistics, Social, and Biomedical Sciences: An Introduction. Cambridge University Press.

Kenya Red Cross (2020). Cic: Mukuru Kayaba Rapid Survey Analysis Brief. Available at: https://www.grassrootseconomics.org/post/red-cross-cic-pilot-survey-mukuru-kenya.

Lietaer, B. (2004). Complementary Currencies in japan Today: History, Originality and Relevance. International Journal for Community Currency Research. Available at: https://philoma.org/wp-content/uploads/docs/2009/09_10_24_-_Texte_-_Complementary_Currencies_in_Japan_-_B._Lietaer.pdf.

McKenzie, D. (2012). Beyond Baseline and Follow-Up: The Case for More T in Experiments. J. Dev. Econ. 99, 210–221. doi:10.1016/j.jdeveco.2012.01.002

Rubin, D. B. (1990). Formal Mode of Statistical Inference for Causal Effects. J. Stat. Plann. inference 25 (3), 279–292. doi:10.1016/0378-3758(90)90077-8

Sadoulet, E., Janvry, A. d., and Davis, B. (2001). Cash Transfer Programs with Income Multipliers: Procampo in mexico. World Dev. 29, 1043–1056. doi:10.1016/S0305-750X(01)00018-3

Sobiecki, G. (2018). Sustainability of Local Complementary Currencies: Conclusions from an Empirical Study in poland. Int. J. Community Currency Res. 22, 105–124. ISSN 1325-9547. doi:10.15133/j.ijccr.2018.019

Speich, B., Schur, N., Gryaznov, D., von Niederhäusern, B., Hemkens, L. G., Schandelmaier, S., et al. (2019). Resource Use, Costs, and Approval Times for Planning and Preparing a Randomized Clinical Trial before and after the Implementation of the New Swiss Human Research Legislation. PloS one 14 (1), e0210669. doi:10.1371/journal.pone.0210669

Stodder, J., and Lietaer, B. (2016). The Macro-Stability of Swiss Wir-Bank Credits: Balance, Velocity, and Leverage. Comp. Econ. Stud. 58 (4), 570–605. doi:10.1057/s41294-016-0001-5

Thome, K., Filipski, M., Kagin, J., Taylor, J. E., and Davis, B. (2013). Agricultural Spillover Effects of Cash Transfers: What Does Lewie Have to Say. Am. J. Agric. Econ. 95 (5), 1338–1344. doi:10.1093/ajae/aat039

Thome, K., Taylor, J., Filipski, M., Davis, B., and Handa, S. (2016). The Local Economy Impacts of Social Cash Transfers. Rome: Food and Agricultural Organization of the United Nations. Available at: http://www.fao.org/3/a-i5375e.pdf.

UN Office for the Coordination of Humanitarian Affairs (2018). Statement from the Principals of Ocha, Unhcr, Wfp and Unicef on Cash Assistance. Available at: https://reliefweb.int/sites/reliefweb.int/files/resources/2018-12-05-FINAL\\%20Statement\\%20on\\%20Cash.pdf.

Keywords: complementary currency, community currency, cryptocurrency, unconditional cash transfer, randomized control trial, blockchain, COVID-19, Kenya

Citation: Mqamelo R (2022) Community Currencies as Crisis Response: Results From a Randomized Control Trial in Kenya. Front. Blockchain 4:739751. doi: 10.3389/fbloc.2021.739751

Received: 11 July 2021; Accepted: 21 October 2021;

Published: 03 January 2022.

Edited by:

Gautam Srivastava, Brandon University, CanadaCopyright © 2022 Mqamelo. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Rebecca Mqamelo, cmViZWNjYS5tcWFtZWxvQHVuaS5taW5lcnZhLmVkdQ==

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.