- 1Department of Computer Science, University College London, London, United Kingdom

- 2Business School, University of Exeter, Exeter, United Kingdom

- 3Autorite de la Concurrence, Paris, France

Blockchain is a relatively new technology that is often described as “creating trust” or “removing intermediaries.” In this paper, we posit that blockchain is a new form of digitally enabled boundary spanning that allows co-ownership models for the companies in question. Where companies have traditionally employed humans to act as interfaces to the external world, new digital technologies enable a digitized approach to many corporate operations that require interaction toward the external market and environment within which firms must operate. Blockchain is a special subset of digital technologies in this regard, enabling companies to co-operate to control parts of the market and to internalize transaction costs that until now have been a market function: using blockchain companies effectively create a new transaction boundary that means boundary spanning activities can be deeply embedded in core business functions, rather than kept as peripheral actions. This digitally enabled boundary spanning is a key attribute of the emerging digital economy. Understanding its implications is of critical importance for economics, business, and social science literature.

Introduction

Over the past few years a relatively new technology – blockchain – has emerged and started to gain traction in various industries. This technology is often touted as recreating how “trust” is enacted within the economy through removing the need for intermediaries such as banks and replacing them with mathematics or “code” (The Economist, 2015). It is one part of a complex digital landscape that is affecting how companies, markets and regulators are interacting. Blockchain allows for new means of alliance formation – ones associated with innovation and others associated with production.

Blockchain allows the creation of boundary-spanning technology-based consortia that allow companies to cordon off part of the market without internalizing the transaction costs. This is furthering the development of alliance capitalism – firms are now utilizing digital technologies increasingly deeply to manage and control the most efficient interactions with the market together with other actors in their industry. Our paper contributes to expanding the existing work on the internet and boundaries of the firm to the broader concept of digital technologies and illustrating how such innovations are shifting the transaction boundary more significantly than the internet itself.

Scope

Blockchain as a topic covers an extremely large area – from currency implications through so-called “cryptocurrencies” such as Bitcoin or Monero all the way through to supply chain consortia formed to manage and control bill of goods across international shipping chains. Within this paper, we focus solely on enterprise, corporate blockchains. Enterprise blockchains are those that focus solely on cross industrial uses such as supply chain management, remittances or similar as these are the only ones relevant for boundary spanning and are a strategic response by corporations to the market environment that they are working within.

For the purposes of this paper, we also make a key differentiation between those applications built on blockchain – cryptocurrencies – and the underlying blockchain technology itself. In platform vernacular, applications may be viewed as one type of application that is built on a blockchain – consumption, while the underlying platform in and of itself holds unique properties that enable untrusting parties in a market to co-create a permanent, unchangeable and transparent record of exchange and processing; i.e., production. Within this paper, we focus solely on the underlying platforms and their use by firms as our unit of analysis – we do not investigate the role of cryptocurrencies, ICOs or token economies.

Literature Review

Previous literature has focused on how the internet interacts with firm boundaries – i.e., how it shrinks or contracts vertical and horizontal boundaries (Afuah, 2003). Williamson (1985:1) identified that companies were “economizing on transaction costs”; with the advent of blockchain, however, the firm is no longer the only defining boundary between the organization and the market. Through the creation of strategic technology-driven alliances for production and innovation, a new boundary is identified within market structures that goes beyond traditional networks, webs or ecosystems.

What Is Blockchain?

Most of the literature associated with blockchain is technical in nature – often describing the systems themselves or modifications to them or even completely new types of blockchain. Economic analysis is starting to emerge but mainly focuses on blockchain’s role in the “removal of intermediaries” or reduction in their market power (Catalini and Gans, 2017), or the creation of a new trust paradigm in markets. Within our paper, we instead assess how blockchains are a new form of corporate strategy based on the creation of consortia that allow innovative forms of boundary spanning to occur. Blockchain relies on a decentralized “consensus” for its operations, without involving an intermediary or market maker. It is a new market design solution, since this new form removes the costs arising from the presence of a single platform operator, while still allowing marketplace participants to access and use shared infrastructure and transact with each other. “Trust in the intermediary is replaced with trust in the underlying code and consensus rules.” Catalini and Gans (2018:8) blockchain is often therefore perceived as an open system reducing or even suppressing the need for ex post validation by a central authority, be it a bank, an intermediary, a platform, etc., blockchain – as we will illustrate later – is far more than another platform, however, and it is different to both open systems and to the internet itself. To a certain extent, for example, many blockchain solutions have actually been used to increase control over supply chains via central control over its design – this is the case with Walmart and its IBM-based “Food Trust,” which is forcing suppliers to use it via a supplier mandate (Kharif, 2018).

Many previous analyses attempt to compare blockchain to the internet – often as building the “new internet” (Braendgaard, 2018; Cretin, 2018; Piore, 2018; Sharma, 2018) or the underlying protocols that define the internet (TCI/IP) (Iansiti and Lakhani, 2017; Halaburda, 2018). While the internet has dramatically lowered the cost of information exchange (Castells, 2000; Benkler, 2006) it has not altered the need for intermediaries – instead it just digitalized them. If anything, this need has been increased, with the development of portals, platforms, etc., whose function is precisely to act as brokers, validators and capture much of the value (Cusumano et al., 2019). Prior to blockchain, therefore, the internet compounded the power relationships associated with intermediaries, this is clearly seen in the aggregation of power over data in companies such as Amazon, Microsoft, and Alibaba (Mayer-Schönberger and Ramge, 2018). Blockchain is, instead, a combination of many different technologies in a new way that runs on the internet. Even though it is part of the vast category of “digital innovations,” it is of a completely different nature to the internet, and corporate strategies are very different as a result (De Filippi and Wright, 2018).

Secondly, there are three main archetypes of blockchain that are relevant to understand the difference between corporate strategies and the impact on firm boundaries. These are (1) Public, Permissionless Systems, (2) Private, Permissioned Systems, and (3) Hybrid Systems. These are illustrated in Figure 1 below.

Traditionally, transaction management within corporations has been handled within technology entities called databases (far right of Figure 1). These were housed inside a firm’s boundaries and employees needed to have permission to access and change entries in such a database. When companies were going to exchange transaction information, this was either handled through clearly delineated technical systems or sometimes through third-party intermediaries. Many of these information exchange processes were made faster up by the application of the digitalization of paper processes and communication technologies, but the line between organizations remained clear.

With the advent of blockchain the way companies are able to embed themselves within one another’s’ innovation and production processes changes. Each type of blockchain ultimately has a different type of impact on firm boundaries and elicit a different strategic response from the companies that use them.

Public, Permissionless Blockchains

Within popular media, the prototypical system used to explain blockchain is usually the Bitcoin network. Those blockchains such as Bitcoin and Ethereum have a unique design goal of being able to operate in a completely open environment – the internet – without any centralized points of trust. Any person or company can join the network, and anyone can view and verify all the transactions. In order to prevent any malicious actor submitting fraudulent transactions, this type of blockchain uses a mathematical consensus approach called “proof-of-work.” It is beyond the scope of this paper to describe the mathematical process in detail, but it is important to highlight that it is through this complex process of solving mathematical problems that the blockchains can generate “trust” between the nodes on the network that the transactions are correct; for further technical details on Bitcoin protocols readers are referred to Antonopoulos (2014). For the purposes of this paper, however, it is important to note that these types of blockchains are built by individuals and companies with a similar ideological approach to markets, which will be covered in more detail later.

Private, Permissioned Blockchains

A second type of blockchain are private and permissioned. These are based on a set of trusted transactions processors and validators who are the only parties allowed to take part in the network. They are distributed in a precisely controlled fashion and can be equally robust in rejecting unauthorized transactions or changes, so corrupting the ledger is extremely difficult. Private blockchains restrict the participants who can submit transactions and access blockchain data to an explicit whitelist of identified participants. In practice, this type of blockchain allow a very flexible approach in terms of design, with regard both to the extent of member acceptance and to the degree of control by administrator nodes. More importantly, in comparison to permissionless systems like Bitcoin, they require substantially less computational capacity and energy to run. In order to develop such a platform, multiple companies need to work together to define the rules of operation and how transactions will be enacted within the network prior to any coding and launch. In effect several companies create an enclosure around a part of the market in order to control it better.

Hybrid Systems

Hybrid systems bring together aspects of both public and private blockchains. These type of blockchains are very useful in situations where regulatory oversight may be required. As an example, if several insurance companies decided to use a blockchain as one of the data exchange mechanisms between them, national regulators may wish to ensure that there is no price collusion or other behavior that is detrimental to consumers. As a result, the rules and the transactions associated with such systems would be implemented by the companies as per a private, permissioned blockchain. Only those companies would be able to view those transactions and regulators would be able to view them as well.

Smart Contracts

One thing that all the types of blockchain have in common is the ability to use smart contracts. It is important to note, however, that smart contracts have been around for many years (Szabo, 1997) and are not dependent on a blockchain to run. In addition, blockchains do not need smart contracts in order to store transactions. In reality, smart contracts are a slight misnomer – they are neither smart, nor a contract. What they do provide is a new way to create applications that are distributed; every node in a blockchain will have a copy of the code and is able to verify that it is correct. At the same time every node on the network has a copy of all the data associated with the application. If for example a social network were housed using smart contracts, it would store all user data on every node.

They also enable unique elements of production processes to be combined between companies. Where the organization of unpredictability has often been left to managers in the analog or even internet-based worlds, these issues are instead embedded into smart contracts – creating an automated way of handling unpredictable outcomes when interacting with the market – i.e., the smart contracts form a foundational basis of the digitally enabled boundary spanning. Where previously, people would need to have been hired to manage these processes with one another, through the application of blockchain, the process is now fully digitalized.

In consortia private blockchains, smart contracts imply the creation of a commonly negotiated on and agreed set of rules that are monitored and controlled by the distributed nature of smart contracts across the blockchain. However, smart contracts are the equivalent of boilerplate contracts and therefore cannot envisage every situation. The question therefore becomes one of the proportions between uniform smart contract and node to node individual dealings.

Data Integrity, Trust and Blockchain

A key point across all types of blockchain is the issue of data integrity. In the popular press, blockchains can sometimes be confused with “security” solutions and in some cases is even called a “trust machine.” These misconceptions are based on the fact that cryptography is used to develop some parts of the consensus mechanism and that when blockchains have been used to remove intermediaries it is often described as creating trust between the actors on the blockchain.

When using blockchain, it is important to understand that it will provide irrefutable proof of whatever has been put onto it – it does not ensure that the data itself is correct or appropriate to store for the transaction in question. Blockchain, therefore, needs to be conceived of as one part of an overarching information management system, rather than one single solution. Trust, meanwhile, is an important aspect of society and contributes to the effective functioning of society (Elster, 2000). Blockchain, when used appropriately and with verified data sources can be a fundamental part of the move toward Society 5.0 and Industry 5.0 through enhancing trust and transparency (Fukuda, 2020). Blockchain will form a key part of this transformation through disrupting markets “where socially negotiated value, human capital, and less quantifiable aspects of economies provide the essential lubricant necessary to complete transactions and build relationships” (Beck et al., 2017). Within this paper, we focus on one aspect of this process – the use of blockchain in boundary spanning to enable companies to build relationships and control of part of the markets around them.

Difference Between Blockchain and Internet

Since the early 2000’s, many new digital solutions have been released on the market that enable new ways for companies to interact with the markets around them – these include concepts and functions such as big data, analytics, machine learning, and the Internet of Things (IoT) to name but a few. While these new technologies have been related to faster and more secure of exchange of data using the internet, blockchain represents something different – it is a new sharing mechanism between firms’ innovation or production processes. While previous versions of technologies were merely about an increase in the speed and type of information sharing, blockchain is a step-change because it creates a combined production mechanism. This has direct impact on both the vertical and horizontal boundaries of the firm and holds the potential to influence interfirm, intrafirm and seller-buyer interactions in ways the internet has not. Our study of blockchain therefore contributes to understanding how new digital technologies – while based on the underlying open internet – may have different market and strategy implications than the internet itself.

Theoretical Background

In order to investigate the role of these blockchains on firm boundaries, we draw on two streams of previous work: Transaction Cost Economics (TCE) and Boundary Spanning of Corporations – in particular Multi-National Corporations (MNC).

Boundaries of the Firm

What distinguishes firms and what determines a firm’s boundaries? Classically, firms are defined by production functions, cost and demand curves, etc. (Coase, 1937). A firm can save on market “transactions costs” but it must incur internal costs of control; the optimal size of the firm therefore strikes a balance between these costs. Firms’ boundaries are defined as the point at which economic activity ceases being coordinated by entrepreneurial direction and starts being coordinated by prices. Additionally, (Williamson, 1975, 1979, 1985) focused on causes of transactions costs such as uncertainty, bounded rationality and opportunism and argued that these costs tend to rise with the frequency of the transaction. He made two different distinctions namely; bounded rationality and opportunism which will affect transaction costs. In Williamson (1981) he suggests that there are three key dimensions of transaction costs – uncertainty, frequency, and durability of investments – which give rise to asset specificity and in Williamson (1985) he argued that opportunism is a troublesome form of behavioral uncertainty.

These same issues also cause contractual incompleteness. Williamson made two different distinctions; one is about human behavior namely; bounded rationality and opportunism that affect transaction costs. Whereas he suggested that there are three key dimensions of transaction costs – uncertainty, frequency, and durability of investments. This gives rise to asset specificity (Williamson, 1981) and in Williamson (1985) he argued that opportunism is a troublesome form of behavioral uncertainty.

Transaction Cost Economics researchers usually make a key assumption about production costs: that external production costs are lower than internal production costs, as external suppliers have economies of scale and specialization that internal suppliers to do not (Williamson, 1975, 1985; Monteverde and Teece, 1982; Hill, 1990; Monteverde, 1995; Chiles and McMackin, 1996; Afuah, 2003). As a result, a firm becomes a “nexus of contracts, in other words a system of long-term contracts that emerge when short-term contracts are unsatisfactory (costs collecting information and the costs of negotiating contracts is high)” (Afuah, 2003). Thus, the default governance structure for firms is built around market contracts, unless it can be shown that external transaction costs are higher.

Contracts are an important part of the costs of doing business for a company; “Parties to a transaction must negotiate contracts, agree on them, write them, monitor their execution, and enforce them. Because individuals and organizations are boundedly rational (Simon, 1957; Williamson, 1985), parties to a contract often cannot foresee all the possible contingencies. Consequently, writing, monitoring, and enforcing complete contracts can be prohibitively costly (Williamson, 1975, 1985; Grossman and Hart, 1986)” (Afuah, 2003). In the analog world, it was possible to manipulate or mislead others while developing the contract or to exploit such things as information asymmetry (Williamson, 1985).

Boundaries of Firm and Internet

The impact of technology on the boundaries of the firm has been investigated with some interest in various streams of literature. With the advent of the internet, it became apparent that there may be some impact on the boundary of the firm due to the shrinking or expanding of insourcing versus outsourcing (Afuah, 2003). Various scholars illustrated that the internet had an impact on the vertical boundaries of the firm (e.g., Brynjolfsson et al., 1994). While some authors have focused on the internet’s information sharing on the firm boundaries – other authors focused on management and control of resources – which ones are best kept within the firms boundaries in the face of technological change and why for example – (Tushman and Anderson, 1986; Barney, 1991; Peteraf, 1993; Henderson and Cockburn, 1994; Miller and Shamsie, 1996) focused on competitive advantage resting on firm specific, difficult-to- imitate, and costly-to-trade resources. Stiglitz (2002), meanwhile investigated the impact of the internet on the changing nature of intermediation. Others have focused on the internet as a standard that has allow the creation of electronic marketplaces providing prices, allowing companies to more easily find one another or what products are available or other characteristics (Malone et al., 1987; Bakos, 1997; Kaplan and Sawhney, 2000).

Afuah (2003) investigated the role of the internet in establishing “lower and upper bounds for the expected outcome of the impact of technological change on the decision to outsource or to develop an input internally depends on weighing external component production and transaction costs, on one hand, and internal component production and transaction costs, on the other hand.”

Since the early 2000’s, however, many new technologies have been released on the market – from big data analytics to machine learning and the IoT to name just a few. Many of these new technologies have been related to faster and more secure of exchange of data using the internet and therefore the previous studies of its impact on firm boundaries have been broadly applicable to their uptake, e.g., Afuah’s (2003) analysis of the internet’s impact on horizontal and vertical boundaries. A great deal of strategic management literature has looked at platform economics and how companies should create platforms to drive developers and end-users to their services. There is a critical problem with this, however, there is only enough room in the markets for an oligopolistic number of platforms – not everyone can be a platform or an intermediary.

With web 3.0 and blockchain something different has emerged – blockchain is a new sharing mechanism between firms – one that is about sharing production and innovation abilities without need to merge with one another nor internalizing the associated transaction costs. While these previous versions of technologies are merely an increase in the speed and type of information sharing, blockchain is a step-change because it creates a new transaction mechanism. This has direct impact on both the vertical and horizontal boundaries of the firm and holds the potential to influence interfirm, intrafirm and seller-buyer interactions in ways the internet has not. For while the internet links individuals and units across value chains, corporate offices, and countries, thus impacting how value-adding units within a firm coordinate their activities (Afuah and Tucci, 2000), blockchain now allows for the co-ordination across companies – this will ultimately affect firm co-ordination activities. In fact, as we discuss below, blockchain has now become a mechanism for boundary spanning.

Boundary Spanning

The interaction of companies with their environment is one that has attracted some attention within literature. In fact, a firm’s boundaries and its interactions across those boundaries are the defining characteristic of organizations – what differentiates it from the market in which it operates: “A minimal defining characteristic of a formal organization is the distinction between members and non-members, with an organization existing to the extent that some persons are admitted, while others are excluded, thus allowing an observer to draw a boundary around the organization” (Aldrich and Herker, 1976). A company, however, must also interact with its environment – e.g., its competitors, customers, its market and its regulator. At the same time, in order to ensure sustained longevity, companies must look beyond existing boundaries to see general market conditions and how the economy may be developing. Companies, therefore, have developed “boundary spanning roles” that act as the “link between the environment and the organization” (Aldrich and Herker, 1976). Within existing literature, there are two existing types of functions that are covered – those that are internal and those that are external boundary spanning roles (Birkinshaw et al., 2017).

Traditionally, external boundary spanning roles have focused on how to “mediate the flow of information between relevant actors in a focal organizational unit and its task environment” (Birkinshaw et al., 2017). Previously boundary roles have been viewed as being specific individuals or units who mediate between the external task environment and the focal organization (Thompson, 1967; Tushman and Katz, 1980). Boundary spanners are viewed as organizational units on the periphery (Bartlett and Ghoshal, 1989; Nohria and Ghoshal, 1997) or as those parts of the organization that mediate the flow of information across the corporation such as a multinational corporation (MNC) itself – e.g., between headquarters and regional units (Birkinshaw et al., 2017). Digital technologies since the advent of the internet have done little to shift these roles – rather they have speeded up those interactions or allowed boundary spanners greater access to information resources.

With blockchain some of these boundary roles change fundamentally – often to roles that are more deeply embedded in activities that are normally considered core business. A key characteristic of blockchain is the fact that it creates a new form of technology-enabled boundary spanning that allows the companies in question to do much more than share information; they are also able to hold data collectively and to a certain extent merge innovation and production processes in ways that were not possible with previous generations of digital technologies. Therefore, a technology-enabled interface such as blockchain shifts boundary roles from the mere handling of a source of information to the embedding of business activities themselves across those boundaries – from innovation to management, processing and storing of business-critical transactions.

Where previously boundary spanning has been an activity mostly for large MNC’s– both internally and externally across geographical boundaries (Birkinshaw et al., 2017), through blockchain technology, boundary spanning is now an activity for many smaller firms to engage in as well. A critical aspect is that we need to understand how digital technologies are both enabling the larger number of MNCs that we see, but also creating new technically enabled boundary spanning solutions (i.e., the technology allows the MNCs to work with smaller companies, smaller companies to work together, etc.) and create new forms of market behavior as a result. They are not the same legal entity and they retain different risk profiles for, e.g., insurance but parts of their business processes have become more tightly entwined – this may increase with new technologies such as 5G, which are so expensive that they require joint investments but moreover require the use of joint infrastructure between the companies that are using that infrastructure. Blockchain has become one of the first examples of boundary spanning for infrastructure creation and development.

Blockchain also moves the definitions of boundary spanning beyond just the transfer of information (Tushman and Katz, 1980; Tushman and Scanlan, 1981), or the combination of expert knowledge, personal power and trust (Fleming and Waguespack, 2007; Schotter and Beamish, 2011) or a mediation role between units and the rest of an organization or the organization and the outside world itself (Ancona and Caldwell, 1992; Meznar and Nigh, 1995). It perhaps relates most to the entrepreneurial quality outlined by Kirzner (1973) and Shane and Venkataraman (2000) where individuals or units within a firm are collaborating across the industry in order to better mediate opportunities to managing the market together with competitors and others in the ecosystem (Birkinshaw et al., 2017).

Firms are therefore creating a strategic response to the current era of increasingly globalization that expands the boundary spanning roles to include embedding blockchain into, for example, production processes: firms are therefore now collaborating to do, rather than just to coordinate around information.

While previously boundary spanning roles have been linked to activities such as information gathering, a new form of boundary spanning is emerging linked to the technical capabilities of blockchain that allows companies using it to inhabit the space between fully private and fully public goods – a good that permits collective production, ownership and consumption arrangements (Buchanan, 1965).

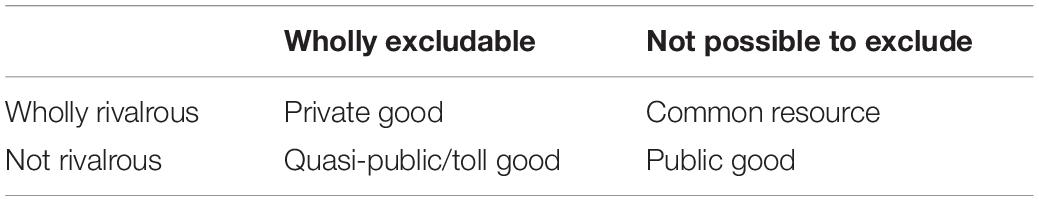

Public and Private Goods

As discussed, we have typified blockchains into two main types; public and private. A public blockchain allows anyone to read, write, and the opportunity to join the network while a private blockchain restricts access to its members and may further restrict operating rights. A further type – hybrid – combines some aspects of both when may be required for oversight or regulatory purposes. From an economic perspective, this public/private dichotomy of blockchains may be perceived as reminiscent of discussions around, and theorizing based on, the concepts of private and public goods (Samuelson, 1954); the well-known binary distinction, based on the attributes of rivalrous-ness and excludability (Cornes and Sandler, 1996; Kaul, 2001). Briefly, a good or service can be described as private if it is rivalrous – where one person’s use of a good precludes another’s use of it; and excludable – if someone can restrict access to a good completely. A public good or service is neither rivalrous nor excludable – classic examples are municipal street lighting and municipal streets, or a lighthouse (Buchanan, 1965), illustrated below in Table 1.

Although this simple binary distinction is useful for exposition and discussion, it does not always adequately represent reality, especially in times of dynamic disruption when clear boundaries are often difficult to define (Malkin and Wildavsky, 1991; Cornes and Sandler, 1996). This is the case with several technologies gaining traction in corporate circles today – such as IoT installations in smart cities or some forms of Artificial Intelligence – often these technologies represent a new way for companies to collaborate digitally – often fundamentally altering the transaction boundary of companies and markets in ways the internet has not done previously. Blockchain, however, displays unique properties as it is neither perfectly private nor perfectly public. In order to fully understand the role that this technology is playing, therefore, this is a need to explore the larger spread of goods than just public and private. Within this paper, we focus solely on blockchains impact on boundary spanning and the investigation of its classification between public and private good is left to other papers.

Discussion

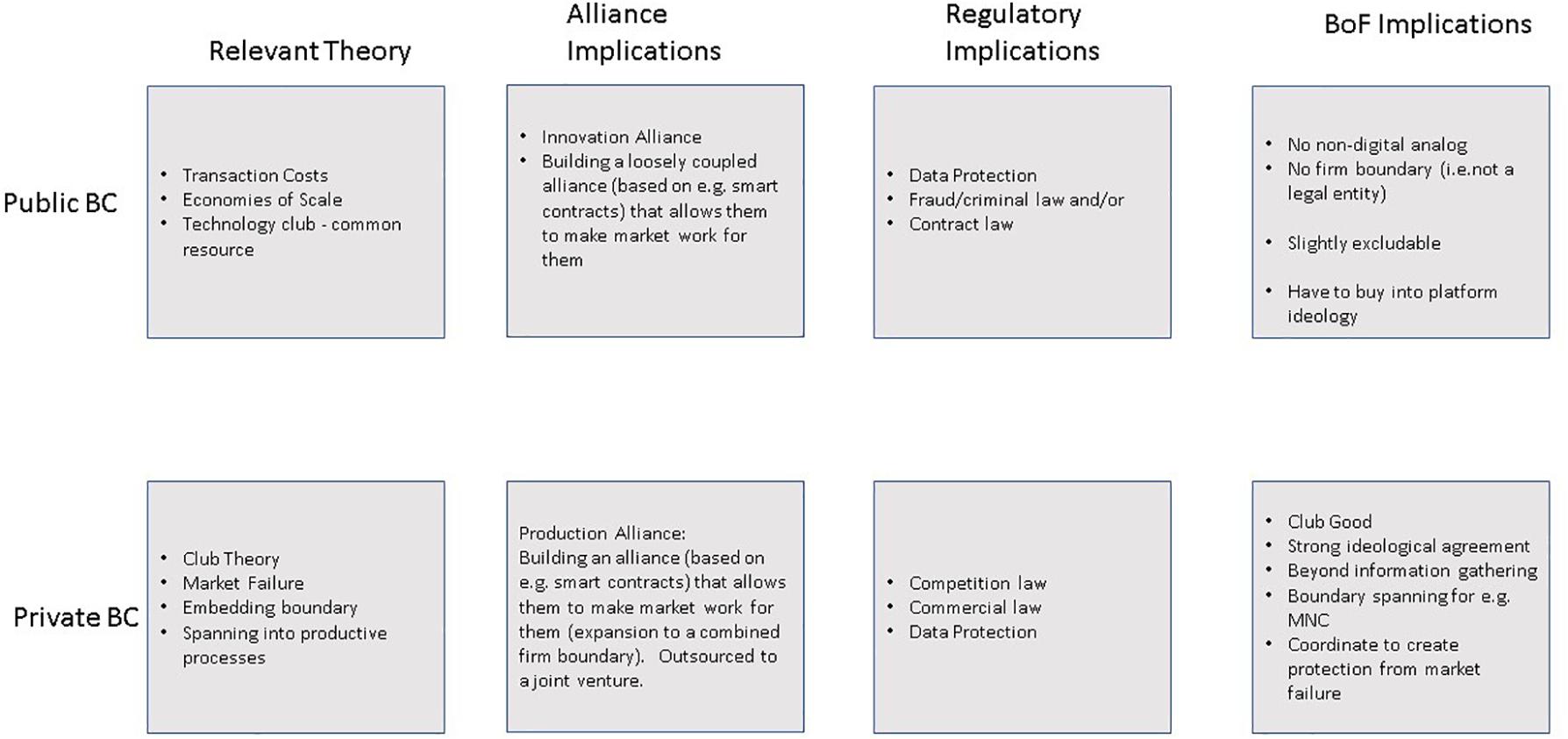

Blockchain allows the creation of boundary-spanning technology-based consortia that allow companies to cordon off part of the market without fully internalizing the transaction costs. This is furthering the development of alliances – where firms can utilize technology to manage and control the most efficient boundaries – specifically, we posit a new boundary for transaction costs that firm strategies are indicating – the digitally enabled consortia, as illustrated in Figure 2 below.

Through the formation of a consortium, firms can continue to interact with the market as per normal, but they have also created a new more loosely coupled technology-based market control mechanism. We argue that blockchain is a significant force and enabler, over and above the internet itself, in blurring of boundaries between firms, the market, consumers and regulators. This is achieved by blockchain replacing siloed data with shared data in business-critical production processes, and through being a technical layer sitting on top of the internet that is able to create store and transfer value securely, peer to peer without the need for the transaction costs or trust issues associated with today’s intermediaries or technology platforms. Additionally, the flexibility of blockchain mechanisms means that companies can select from a few different types of consortia mechanisms in order to achieve their desired aims. Blockchain therefore changes the nature of the transaction costs as we have understood them during the internet era:

• Externally, the internet has lowered research and communication costs, but done little to reduce the need of control of contractors. Firms today still need to go through the process of checking the actual provision of the service and/or the good that is ordered externally. There are also cost of managing contracts, setting tenders, etc. With blockchains, some of this cost could disappear, thus reinforcing the incentive to outsource;

• Internally, management refers to the need to manage workers, organize services, etc. With blockchain, this cost could be lowered if some or part of the company is “plugged” to a blockchain and is driven through smart contracts, thus reducing the need to outsource.

In this context, the anticipated effect of blockchain is ambiguous, because it lowers both internal and external costs. This is exactly where this technology is different to the internet because it doesn’t shift the frontier between price mechanism on one side, and internal management on the other side. Indeed, if you look at consortium blockchain, they can be construed as some kind of “general outsourcing” of certain functions (e.g., stock management, supply chain, traceability, etc.), to a dedicated technological solution – in this case a blockchain but at the same time as the maintenance of the function inside the firm, but with some communalization with other industry operators. This is because it is not outsourcing to an external operator, but the sharing of function of production across a consortium of companies. Private blockchains are therefore a way to preserve firm-specific resources by sharing them with a limited number of partners rather than outsourcing them and losing the ability to perform totally.

This is where consortium blockchain are particularly interesting; they are a way to maintain blockchain as a sort of “back office” system, used only to manage their internal services and their contractors. The blurring of firm boundaries occurs at this stage, because the difference between what is done internally, or with contractors, or even as a cooperation with competitors, will no longer matter. However, these companies seek to preserve their front office, their client base, their access to market. Consortium blockchain are therefore a way to protect a “club” of large companies enjoying access to market and prevent other types of blockchain to allow unknown operators to propose services directly to clients.

While network and “webs” of companies or ecosystems have often been the focus of a new organizational boundary, this still focuses on the concept of firms competing with one another in order to capture the “rents.” In a blockchain alliance, firms are not competing to capture rents – they are working together to achieve a voice (Laver, 1976), within an uncertain market. Blockchain also connects business units together via production processes rather than just in a loosely competing network. Membership of one blockchain usually excludes participating in another one for the same thing (through technical and strategic reasons). In this context, there are four main strategies that we can see as a response to the blockchain, namely:

Strategy 1: “Back office blockchainization” of classical businesses: blockchain here is used to cooperate between businesses, improve quality, traceability and increase transparency and security with contractors (e.g., in a supply chain);

Strategy 2: “Landlord strategy”: Creation of business/consortium blockchains in a strategy of territorial occupation in order to extract profits but also maintain a degree of control. These strategies can include, e.g., ancillary services such as managing people’s passwords.

Strategy 3: “Blockchain platform”: to launch a “blockchained version” of an existing product and/or service, by applying all or parts of blockchain principles (for example investment, insurance, traceability/geolocalization services) etc.;

Strategy 4: “Community” activity: develop new services and new cooperation directly on blockchain and proposed/sold on the blockchain.

Blockchains may provide the first real-world example of a technology-driven form of alliances. Blockchains that are used by or for enterprises can be split into two main types – those that are publicly driven and those that are driven through private consortia. Both have separate implications for the boundaries of the firm that require investigation. Examples of boundary spanning activities using blockchains can be seen in the Carrier Blockchain Network1, that brings together mobile operators to create a new market boundary for fraud detection and allows for dynamic price negotiations about network interchange across a blockchain based solution. Through implementing this solution, companies are able to manage complex interactions with one another through digitally enabled means, rather than through complex individual negotiations. Other examples include the previously mentioned IBM’s Food Trust that is enacted across the food supply chain in the United States.

We summarize the differences between public blockchain and private blockchain and their impact on the boundaries of the firm in Figure 3 below.

Public Blockchains

A public blockchain, such as Bitcoin or Ethereum, is clearly a common resource, or an impure public good. At its purest, it is open to anyone as a user or operator, and my use of it does not impinge upon yours. However, there is an argument that a degree of technical awareness and or embrace of disintermediation motivations means that it is by default partially excludable.

Public blockchains can develop smart contracts and other applications allowing increasingly complex transactions to occur on them. This may provide opportunities for a more fundamental change in the economy, which is a questioning of the very necessity of the firm as a structure managing workers, or at least shrink the boundaries of a firm significantly. This may in turn impact the strategy of existing firms in relations to their own workers.

In the meantime, public blockchains, at least in theory, could allow the creation of “headless firms” – known as “Distributed Autonomous Organizations” (DAOs) in the technology world – effectively putting together individuals that wish to remain independent contracts but could find a way to work together without having to submit to any kind of management (be it an actual boss, or the more elusive subordination to a platform in the context of the “gig economy”). Public blockchain in theory provide for these types of consortia but they have yet to be realized in the real-world in the same way as consortia blockchains such as in banking or supply chain management.

Public blockchains are those that any person can access, contribute code to and anyone can read any of the transactions in the blockchain. Public blockchains, such as Ethereum or Bitcoin are co-developed as open source software projects that allow separate companies to co-develop a common technical platform. In this sense, separate individuals or companies form a technology collaboration that co-creates a common resource for usage and benefit Nakamoto, 2008). Those benefits are usually separately accrued (i.e., when a company creates something on top of Ethereum it is unlikely that the other companies who developed the platform also earn benefit from the product or service).

These forms of blockchain consortia therefore are closely associated with Dunning’s (1995) concept of innovation. Companies are building a loosely coupled alliance based on, e.g., smart contracts that allows them to make the market work for them – they are creating a virtual firm boundary via the platform development but without any legal or transactional boundary.

These are therefore strongly associated with asset specificity and economies of scale except that these are done outside of the normal boundaries of the firm. There are few non-digital analog examples that conform to these types of systems. These platforms are to some extent non-rivalrous but are to a certain extent excludable – to co-create such a system, companies or individuals must buy into the overall blockchain platform ideology (e.g., dis-intermediation, prevention of censorship). Those that do not do that either are not able to join the platform or must develop their own project; this explains to some extent the plethora of new types of public blockchain from a variety of different technology consortia; those that believe in blockchain for IoT (IOTA) or blockchain for AI among others.

Private Blockchains

A consortia blockchain is clearly a form of alliance formation to overcome some form of endemic market failure – with sharing of data and costs and members characteristics and data in some cases designed to help the consortia manage/control the market mechanisms in a better way. Smart contracts provide a mechanism for control and co-ordination. Consortia blockchains bear only little resemblance to public blockchain; the technology behind may be similar, but the governance principles are very different. Since a consortium blockchain is held by a handful of companies, the question of determining responsibilities and tracking transactions is much less an issue than with public blockchain. However, setting up a consortium blockchain could be a very efficient way to organize cooperation between already existing firms, notably because it reduces coordination costs greatly. Of greater importance to such consortia, therefore, are the rules of engagement, voting mechanisms and how transparency is implemented toward, e.g., the regulatory authority.

Private blockchains, however, require a different approach –to effectively develop such a platform, companies need to form a consortium that is often spun out as a joint venture between all of them. Private blockchains therefore moving the boundary spanning mechanisms of MNCs beyond information sharing into the actual production processes themselves. Firms form such consortium to control or manage market failure (Hirschman, 1970); companies form an alliance based on smart contracts and through working together to create a combined firm boundary that allows all of them to benefit and make the market work better for them. Within such consortia there is strong ideological agreement around the issues that affect proper market functioning.

Limitations and Implications for Future Research

In order to keep our analysis focused, we have concentrated solely on the impact of blockchain on the boundaries of the firm and the creation of a new type of boundary mechanism that needs further analysis and empirical testing. In addition, the types of forms of governance mechanisms most effectively used within blockchains is an area that will provide critical insights into their management and operators for strategy scholars and practitioners. Furthermore, while blockchain is often touted to improve trust, the role of blockchain trust mechanisms within marketplaces – does the fact that blockchain changes the way companies are “trusting” one another change market or firm performance? We have not had space to analyze how blockchain affects the existing types of relationships such as networks or ecosystems – empirical testing of the difference in transaction cost effects of these different market structures may provide fruitful insight for scholars.

Implications for Managers

There are several implications for managers as a result of our analysis. Firstly, the choice of whether to use blockchain is more complicated than it first appears – in order to glean the highest value from such an activity it is critical to ensure that a sufficient number of other companies are able to join the consortium in order to ensure sufficiently low cost of membership versus benefits gained. Managers need to decide if a public or private consortium blockchain is the correct one for their needs and if so, which boundaries are the best ones to blur for their particular product or service delivery. Selection of consortium partners will also be critical. In contrast to other technical solutions, the legal design of the blockchain in question needs to precede any implementation work.

Ostensibly much of blockchain may appear to be about reducing transaction costs, but it is often about a strategic response to a perceived market failure and an attempt to make the market work better for all the companies in question through consortia; managers working with blockchain therefore also have to recognize that companies are better able to work with companies in consortia that have similar competencies rather than as usual compete. This is very different to established strategic theories around, e.g., ecosystems or “networks” of companies.

Finally, where strategy has often relied on building resources from the inside out – i.e., focusing on the industry as the environment that the company must organize its resources to respond to, in blockchain alliances strategy is something that must be built from the outside in together with competitors and others in the market.

Implications for Regulation

We hypothesize that there is regulatory divergence between the production and innovation alliances. They cannot be regulated on a per firm basis – blockchains may require sectoral regulation.

Focusing on our two cases, namely, private vs. public blockchains, the implications of the technology on the boundaries of the firm is different for these two cases. Private or consortium blockchains, so far, are composed of already existing and established companies, which are associated with a service company developing the blockchain. So, sectoral regulation applies, because generally, member companies are of the same sector. For example, banking regulation should apply to R3, or transport regulation should apply to supply chain consortia.

This reasoning may, however, not apply to consortium blockchains that integrate an industrial sector both horizontally and vertically. When firms acting at different stages of the market participate in one single blockchain infrastructure, discrepancies between legal and economic status may render sectoral regulation inefficient and require the introduction of blockchain-specific rules, the application of more generally applicable legal provisions, or a combination of the two.

Another issue for regulation is the determination of legal liability. In a private or consortium blockchain, companies could be collectively responsible, rather than individually, for certain functions of their global operation. Does this amount to collusion between autonomous undertakings or is there joint market risk created from blockchain consortia? This is something regulators may need to provide clarity on.

Author Contributions

CM is lead author and has worked in the space of blockchain/transaction costs. PG is an extremely close collaborator and contributed in depth to the work in this manuscript. AB is a close collaborator and has contributed in depth to the work in this manuscript. All authors contributed to the article and approved the submitted version.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Acknowledgments

The authors would like to acknowledge Dr. Z. Gurguc for discussions on boundaries of the firm. Any views or opinions are purely personal and do not represent those of the author’s employer.

Footnotes

References

Afuah, A. (2003). Redefining firm boundaries in the face of the internet: are firms really shrinking? Acad. Manag. Rev. 28, 34–53. doi: 10.5465/amr.2003.8925207

Afuah, A., and Tucci, C. L. (2000). Internet Business Models and Strategies: Text and Cases. New York, NY: McGraw-Hill Higher Education.

Aldrich, H., and Herker, D. (1976). Boundary spanning roles and organization structure. Acad. Manag. Rev. 2, 217–230. doi: 10.2307/257905

Ancona, D. G., and Caldwell, D. F. (1992). Bridging the boundary: external activity and performance in organizational teams. Adm. Sci. Q. 37, 634–666. doi: 10.2307/2393475

Antonopoulos, A. M. (2014). Mastering Bitcoin: Unlocking Digital Cryptocurrencies. Sebastopol, CA: O’Reilly.

Bakos, J. Y. (1997). Reducing buyer search costs: implications for electronic marketplaces. Manag. Sci. 43, 1727–1732. doi: 10.1287/mnsc.47.12.1727.10244

Barney, J. (1991). Firm resources and sustained competitive advantage. J. Manag. 17, 99–120. doi: 10.1177/014920639101700108

Bartlett, C. A., and Ghoshal, S. (1989). The Transnational Solution. Boston: Harvard Business School.

Beck, R., Avital, M., Rossi, M., and Thatcher, J. B. (2017). Blockchain technology in business and information systems research. Bus. Inf. Syst. Eng. 59, 381–384. doi: 10.1007/s12599-017-0505-1

Benkler, Y. (2006). The Wealth of Networks : How Social Production Transforms Markets and Freedom. New Haven, HN: Yale University Press.

Birkinshaw, J., Ambos, T. C., and Bouquet, C. (2017). Boundary spanning activities of corporate HQ executives insights from a longitudinal study. J. Manag. Stud. 54, 422–454. doi: 10.1111/joms.12260

Braendgaard, P. (2018). Personal Look at the Early Days of the Internet vs Blockchain Today. Available online at: https://medium.com/@pelleb/personal-look-at-the-early-days-of-internet-vs-blockchain-today-590a98cb009f, (accessed May 30, 2020).

Brynjolfsson, E., Malone, T. W., Gurbaxani, V., and Kambil, A. (1994). Does information technology lead to smaller firms? Manag. Sci. 40, 1628–1644. doi: 10.1287/mnsc.40.12.1628

Catalini, C., and Gans, J. S. (2017). Some Simple Economics of the Blockchain, Rotman School of Management Working Paper and MIT Sloan Research Paper. Cambridge, MA: National Bureau of Economic Research.

Catalini, C., and Gans, J. S. (2018). Initial Coin Offerings and the Value of Crypto Tokens, Discussion Paper, National Bureau of Economic Research. Cambridge, MA: National Bureau of Economic Research.

Chiles, T., and McMackin, J. (1996). integrating variable risk preferences, trust, and transaction cost economics. Acad. Manag. Rev. 21, 73–99. doi: 10.5465/amr.1996.9602161566

Coase, R. (1937). The nature of the firm. Economica 4, 386–405. doi: 10.1111/j.1468-0335.1937.tb00002.x

Cornes, R., and Sandler, T. (1996). The Theory of Externalities, Public Goods, and Club Goods. Cambridge, MA: Cambridge University Press.

Cretin, A. (2018). It’s 2018 and Blockchain is on its Way to Become the New Internet. Available online at: https://medium.com/@andrewcretin/its-2018-blockchain-is-on-it-s-way-to-become-the-new-internet-7055ed6851ec, (accessed May 30, 2020).

Cusumano, M. A., Gawer, A., and Yoffie, D. B. (2019). The Business of Platforms: Strategy in the Age of Digital Competition, Innovation, and Power. New York, NY: Harper Business.

De Filippi, P., and Wright, A. (2018). Blockchain and the Law : The Rule of Code. Cambridge, MA: Harvard University Press.

Dunning, J. (1995). Reappraising the eclectic paradigm in an age of alliance capitalism. J. Int. Bus Stud. 26, 461–491. doi: 10.1057/palgrave.jibs.8490183

Fleming, L., and Waguespack, D. M. (2007). Brokerage, boundary spanning, and leadership in open innovation communities. Organ. Sci. 18, 165–180. doi: 10.1287/orsc.1060.0242

Fukuda, K. (2020). Science, technology and innovation ecosystem transformation toward society 5.0. Int. J. Produc. Econ. 220:107460. doi: 10.1016/j.ijpe.2019.07.033

Grossman, S. J., and Hart, O. D. (1986). The costs and benefits of ownership: a theory of vertical and lateral integration. J. Polit. Econ. 94, 691–719. doi: 10.1086/261404

Halaburda, H. (2018). Blockchain revolution without the blockchain. Commun. ACM 1, 27–29. doi: 10.2139/ssrn.3133313

Henderson, R., and Cockburn, I. (1994). Measuring competence? Exploring firm effects in pharmaceutical research. Strateg. Manag. J. 15, 63–84. doi: 10.1002/smj.4250150906

Hill, C. W. (1990). Cooperation, opportunism, and the invisible hand: Implications for transaction cost theory. Acad. Manag. Rev. 15, 500–513. doi: 10.5465/amr.1990.4309111

Kaplan, S., and Sawhney, M. (2000). E-hubs: the new B2B (business-to-business) marketplaces. Harv. Bus. Rev. 78, 214.

Kaul, I. (2001). “Public goods: Taking the Concept to the 21st Century,” in The Market of the Public Domain, eds D. Drache, (London: Psychology Press).

Kharif, O. (2018). Walmart Ready to Mandate Blockchain for Certain Food Suppliers. Available online at: https://www.insurancejournal.com/news/national/2018/09/27/502246.htm (accessed May 30, 2020).

Laver, M. (1976). Exit, voice and loyalty revisited: the strategic production and consumption of public and private goods. Br. J. Polit. Sci. 6, 463–482. doi: 10.1017/s0007123400000855

Malkin, J., and Wildavsky, A. (1991). Why the traditional distinction between publica and private goods should be abandoned. J. Theor. Polit. 3, 335–378. doi: 10.1177/0951692891003004001

Malone, T. W., Yates, J., and Benjamin, R. I. (1987). Electronic markets and electronic hierarchies. Commun. ACM 30, 484–497. doi: 10.1145/214762.214766

Mayer-Schönberger, V., and Ramge, T. (2018). A big choice for big tech: share data or suffer the consequences. Foreign Affairs 97, 48–54.

Meznar, M. B., and Nigh, D. (1995). Buffer or bridge? Environmental and organizational determinants of public affairs activities in American firms. Acad. Manag. J. 38, 975–996. doi: 10.5465/256617

Miller, D., and Shamsie, J. (1996). The resource-based view of the firm in two environments: the Hollywood film studios from 1936 to 1965. Acad. Manag. J. 39. 519–543. doi: 10.5465/256654

Monteverde, K. (1995). Technical dialog as an incentive for vertical integration in the semiconductor industry. Manag. Sci. 41, 1624–1638. doi: 10.1287/mnsc.41.10.1624

Monteverde, K., and Teece, D. (1982). Supplier switching costs and vertical integration in the automobile industry. Bell J. Econ. 13, 206–213. doi: 10.2307/3003441

Nakamoto, S. (2008). BitcoinA Peer-to-Peer Electronic Cash System?. Available online at: https://bitcoin.org/bitcoin.pdf (accessed July 16, 2020).

Nohria, N., and Ghoshal, S. (1997). The Differentiated Network: Organizing Multinational Corporations for Value Creation. San Francisco, CL: Jossey-Bass Publishers.

Peteraf, M. A. (1993). The cornerstones of competitive advantage: a resource-based view. Strateg. Manag. J. 14, 179–191. doi: 10.1002/smj.4250140303

Piore, A. (2018). New Internet: Blockchain Technology Could Help Us Take Back Our Data from Facebook, Google and Amazon, Newsweek Magazine 2018. Available online at: https://www.newsweek.com/2018/11/16/new-internet-blockchain-technology-could-help-us-take-back-our-data-facebook-1222860.html (accessed July 16, 2020).

Samuelson, P. A. (1954). The pure theory of public expenditure. Rev. Econ. Stat. 36, 387–389. doi: 10.2307/1925895

Schotter, A., and Beamish, P. W. (2011). Performance effects of MNC headquarters–subsidiary conflict and the role of boundary spanners: the case of headquarter initiative rejection. J. Int. Manag. 17, 243–259. doi: 10.1016/j.intman.2011.05.006

Shane, S., and Venkataraman, S. (2000). The promise of entrepreneurship as a field of research. Acad. Manag. Rev. 25, 217–226. doi: 10.5465/amr.2000.2791611

Sharma, T. (2018). Why people are Referring to Blockchain as the New Internet, EU Blockchain Council. Available online at: https://www.blockchain-council.org/blockchain/why-are-people-referring-to-blockchain-as-the-new-internet/, (accessed May 30, 2020).

Stiglitz, J. E. (2002). Globalization and its discontents. Econ. Notes 32, 123–142. doi: 10.1046/j.0391-5026.2003.00107.x

Szabo, N. (1997). Formalizing and securing relationships on public networks. First Monday 2, 2–3. doi: 10.5210/fm.v2i9.548

The Economist (2015). The Trust Machine: The technology Behind Bitcoin could Transform how the Economy Works. Available online at: http://www. economist.com/news/leaders/21677198technology-behind-bitcoin-could-trans form-how-economy-works-trust-machine (accessed July 16, 2020).

Thompson, J. D. (1967). Organizations in Action: Social Science bases of Administrative Theory. New York, NY: McGraw-Hill.

Tushman, M., and Anderson, A. (1986). Technological discontinuities and organizational environments. Adm. Sci. Q. 31, 439–465. doi: 10.2307/2392832

Tushman, M. L., and Katz, R. (1980). External communication and project performance: an investigation into the role of gatekeepers. Manag. Sci. 26, 1071–1085. doi: 10.1287/mnsc.26.11.1071

Tushman, M. L., and Scanlan, T. J. (1981). Boundary spanning individuals: their role in information transfer and their antecedents. Acad. Manag. J. 24, 289–305. doi: 10.5465/255842

Williamson, O. E. (1975). Markets and Hierarchies: Analysis and Antitrust Implications: A Study in the Economics of Internal Organization, University of Illinois at Urbana-Champaign’s Academy for Entrepreneurial Leadership Historical Research Reference in Entrepreneurship. New York, NY: Free press.

Williamson, O. E. (1979). Transaction-cost economics: the governance of contractual relations. J. Law Econ. 22, 233–261. doi: 10.1086/466942

Williamson, O. E. (1981). The economics of organization: the transaction cost approach. Am. J. Sociol. 87, 548–577. doi: 10.1086/227496

Keywords: blockchain, strategic alliances, transaction costs, boundary spanning, digitalization

Citation: Mulligan C, Godsiff P and Brunelle A (2020) Boundary Spanning in a Digital World: The Case of Blockchain. Front. Blockchain 3:37. doi: 10.3389/fbloc.2020.00037

Received: 06 November 2019; Accepted: 17 July 2020;

Published: 22 September 2020.

Edited by:

Martin Zeilinger, Abertay University, United KingdomReviewed by:

John G. Keogh, University of Reading, United KingdomMarcus O’Dair, University of the Arts London, United Kingdom

Copyright © 2020 Mulligan, Godsiff and Brunelle. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: C. Mulligan, Yy5tdWxsaWdhbkB1Y2wuYWMudWs=

C. Mulligan

C. Mulligan P. Godsiff

P. Godsiff A. Brunelle

A. Brunelle