- 1Faculty of Economics and Business, University of Groningen, Groningen, Netherlands

- 2Faculty of Business and Economics, University of Göttingen, Göttingen, Germany

Introduction: Firms use various forms of equity-based compensation to allow employees to participate in their success.

Methods: We examine how an unannounced profit-sharing distribution (PSD) affects participation in Employee stock purchase plans (ESPPs), which offer discounted shares. Using panel data from a multinational firm, we find counterbalancing effects of the PSD.

Results: While it attracts new participants to the ESPP, a similar share of former participants exit the program after receiving the distribution. This latter effect is particularly pronounced in countries characterized by higher average levels of prosociality.

Discussion: Our findings suggest that unexpected profit sharing can have heterogeneous effects on ESPP participation across different cultural contexts.

1 Introduction

Employee stock purchase plans (ESPPs) are a popular form of employee compensation (Babenko and Sen, 2014, 2016; Cohen, 2009; Guay et al., 2003; Poterba, 2003), as they can align employee interests with those of shareholders. ESPPs have been linked to significant productivity effects (Blasi et al., 2018; Bryson and Freeman, 2019; Jones and Kato, 1995; Kim and Ouimet, 2014) and reduced turnover (Hennig et al., 2023; Sengupta et al., 2007), similar to bonding contracts (Peterson, 2023). Despite their potential benefits, ESPPs often suffer from low participation rates (Engelhardt and Madrian, 2004; Pendleton, 2010). For example, Babenko and Sen (2014) report only 30 percent ESPP participation in their sample, and 2019 data show participation rates of just 37 percent in the US and 39 percent in Europe (Anderson et al., 2020). This raises the question of how other forms of equity-based compensation might affect employees' willingness to participate in ESPPs.

Our paper investigates this by analyzing unique data from a multinational company that distributed an unannounced profit-sharing distribution (PSD) to its employees. Our panel data allow comparing ESPP participation in the year after the PSD to prior years with no profit sharing. The timeline is: (1) Employees make their annual ESPP participation decision, (2) The firm distributes the PSD to all employees worldwide, (3) Employees decide whether to participate in the ESPP again. We find the PSD has limited net impact on participation due to offsetting effects - it attracts many new participants but also leads to a substantial number of former participants leaving. Although the PSD draws in previous non-participants, this is counterbalanced by an almost equal number of former participants exiting after receiving the distribution.

Further analysis reveals systematic differences across countries in how the PSD affects participation. Using global preference data from Falk et al. (2018), we find distinct patterns based on country-level prosociality measures. In countries with higher average prosociality scores, former participants are more likely to exit the ESPP after receiving the PSD, while the distribution simultaneously attracts new participants who had not previously joined the program. This suggests that cultural context may influence how employees respond to profit-sharing distributions. We explore several potential explanations for these cross-country patterns. One possibility is that different cultural contexts affect how employees interpret and respond to monetary rewards (Bénabou and Tirole, 2003, 2006; Bowles and Polania-Reyes, 2012). Alternatively, the results could reflect systematic cross-country variations in portfolio rebalancing decisions or risk preferences. As a robustness check, we show that these patterns vary with country-level financial literacy. The relationship between country-level prosociality and post-PSD program exits is weaker in countries with higher average financial literacy scores, aligning with Babenko and Sen (2014)'s finding that financial education supports ESPP participation.

Our paper contributes to the literature on ESPPs (Babenko and Sen, 2014; Cohen, 2009; Guay et al., 2003) and employee share ownership (Jones and Kato, 1995). Using novel field data on employees' ESPP participation history, we provide new evidence on how profit-sharing distributions affect subsequent participation decisions. We contribute to research on compensation and cultural context (Bénabou and Tirole, 2003; Gneezy et al., 2011) by demonstrating that responses to profit-sharing can vary systematically across countries with different social preference profiles. This suggests firms should consider cultural context when designing and implementing share-based compensation programs. The moderating role of country-level financial literacy further suggests that educational initiatives might help firms maintain ESPP participation rates when implementing profit-sharing distributions.

2 Materials and methods

2.1 ESPP and profit sharing distribution

Our primary data source is internal data collected from an international, highly diversified industrial firm headquartered in Europe. The firm operates in eight distinct three-digit SIC codes. For more than 10 years, the firm has been offering an ESPP to nearly all employees worldwide. The ESPP is centrally administered from the firm's headquarters, with consistent communication throughout all countries. Participation in the worldwide homogeneous program is confidential. That is, neither higher-level managers nor peers can see whether other employees are participating. It implies that employees' reasons for participation are based on voluntary motives. Once a year, within a one-month election window, the firm's employees can choose to participate in the program and invest 0 to 5 percent of their salary in the firm's shares. After a one-year investment phase, followed by a two-year vesting period, employees get one additional matching share for every three shares they hold. Any investment in the last 10 years was highly beneficial, demonstrating the program's attractiveness and further explaining why employees may perceive ESPPs as a gift from the employer (Bryson and Freeman, 2019). In the investment phase, the employees invest parts of their income in (fractional) shares on a monthly basis. The term “beneficial” is defined from a financial perspective as an increase in dividends and returns, including low administrative costs. From a financial perspective, employees have incentives to hold their shares until the vesting period expires. Beyond the vesting period, the importance of the financial gains recedes.

Besides the ESPP, the firm decided that employees should participate in the firm's success via a variable profit sharing program, which had not been distributed so far. The program can be seen as a financial gain, since employees participate in the firm's success. That is because the board of directors can decide to deposit a variable amount of stocks, not known in advance to the employees, into a financial pool. When the pool reaches a pre-defined threshold, the Board can divide the pool between the employees. After the threshold was met for the first time in the spring of 2018, the firm distributed a three-digit million amount in the form of free shares to all employees below the senior management level, independently of whether they had participated in the previous ESPP sign-up tranche. As a result, each employee participated in the profit sharing distribution (PSD) and received shares. As the PSD was not previously announced and the employees did not know in advance when the pool would be distributed, the PSD constitutes a positive exogenous shock from the employees' perspective. More precisely, the free shares are perfectly tangible. Thus, they correspond to a money transfer to the employees, as they could sell the stocks obtained by the PSD immediately, turning them directly into cash. Therefore, the PSD cannot be seen as a direct substitute to the ESPP. How many company shares an employee ultimately wishes to hold after receiving the PSD naturally depends on their investment preferences. For instance, an employee who already kept the desired amount of company stocks would have sold the PSD and not re-invested the money. By contrast, if an employee had the preference to maintain the new total number of company shares after receiving the PSD, then he/she should have sold the PSD shares and acquired new shares that would later be matched through the highly profitable ESPP.

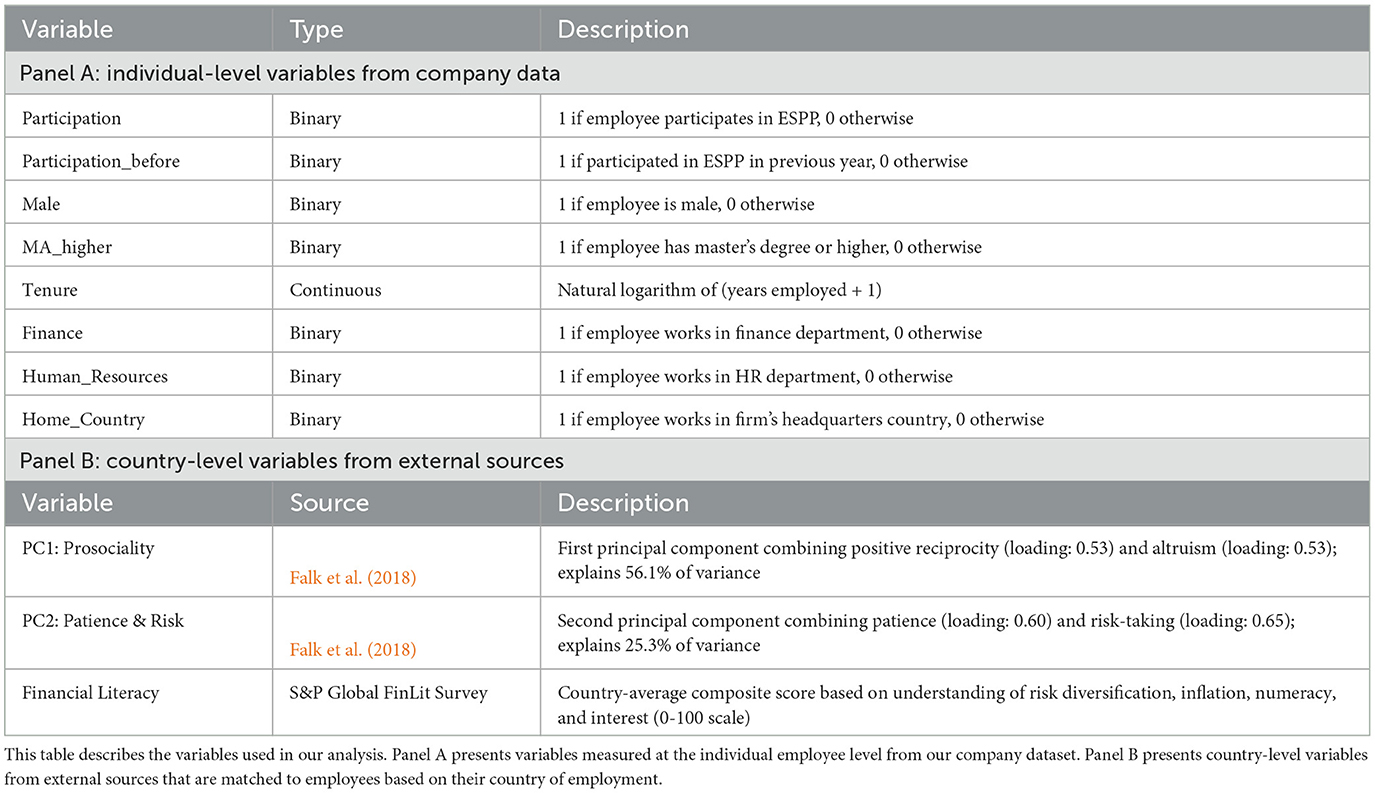

To analyze our research question, we employ a set of variables measured at both the individual and country level. Table 1 provides detailed descriptions of all variables used in our analysis. Our key individual-level variables come from the company's internal data, while our country-level measures are derived from external sources. Specifically, we match our employee data with the global preference data of Falk et al. (2018) who elicited individual preferences in 76 countries. To identify specific types of relevant preference combinations, we conduct a principal component analysis (pca) on their preference measures, excluding negative reciprocity due to its limited relevance in our context. For our financial literacy analysis, we use country-level data from the Standard and Poor's Global Financial.

2.2 Sample

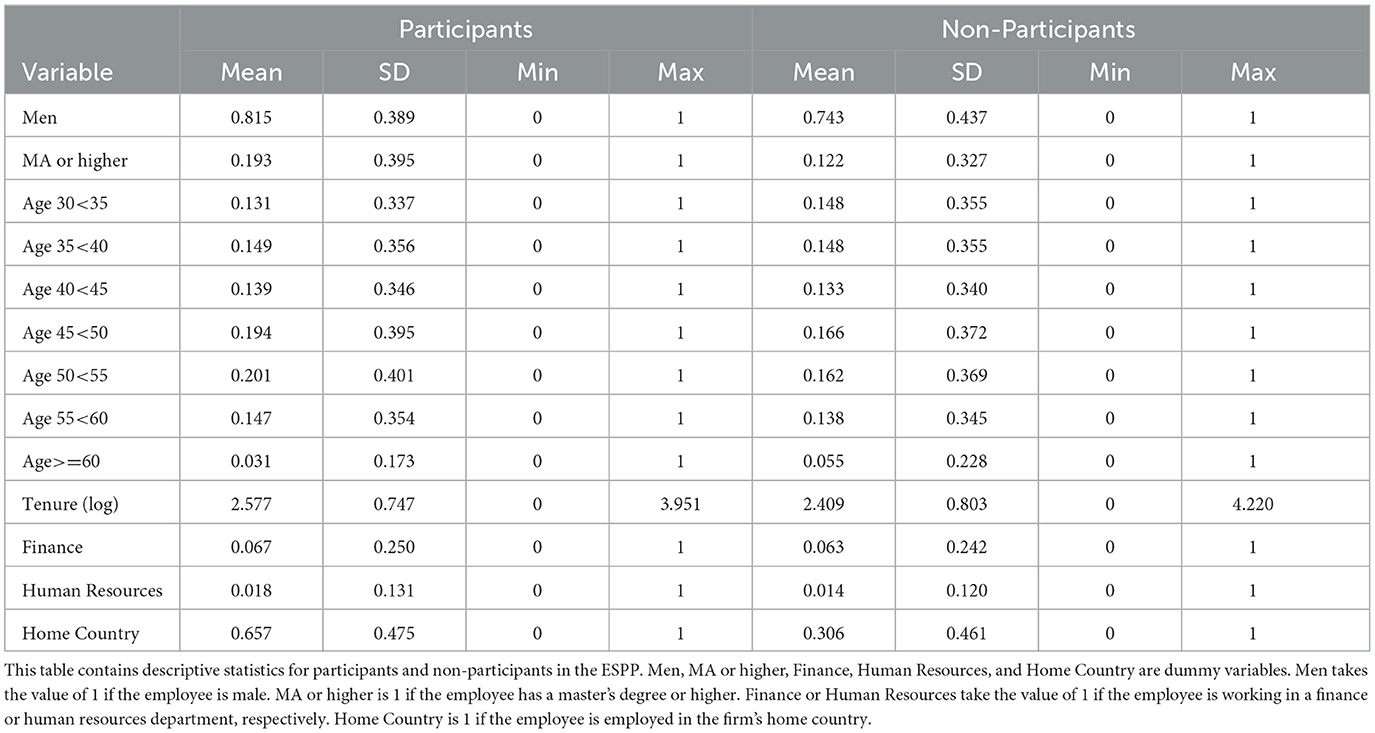

Sample characteristics for our main variables are presented in Table 2, which shows descriptive statistics conditional on participants and non-participants in the ESPP. To investigate the effects of the PSD on subsequent ESPP participation, we primarily focus on employees' change in behavior from 2017 to 2018, thus covering the ESPP participation before and after the PSD. This results in 262,824 employees from 36 countries for which we have data for 2017 and 2018. In our subsequent regression analyses, we focus on the period between 2014 and 2018, as we complement the 2017/2018 sample by a control group, consisting of employee behavior in these years. Note that we are interested in the changes in employee behavior. Thus, we require data of one employee, for example, for the years 2014 and 2015 to determine a change in behavior. The observation of 2015, thus, captures the change from 2014 to 2015. Our final sample consists of 939,471 employee observations, capturing potential changes in ESPP participation from one year to the following year. In addition to employees' ESPP participation choices, the data include rich information on employees' characteristics (i.e., age, gender, tenure, occupation, level of education, and country). Table 2 shows the descriptive statistics of all variables used in the empirical analysis, conditional on participants and non-participants in the ESPP.

2.3 Timeline of events

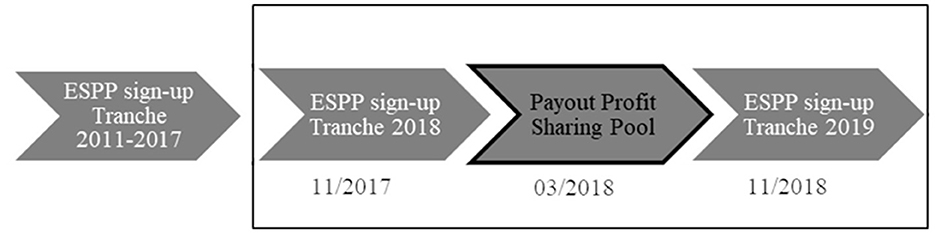

To illustrate the temporal sequence of our study, Figure 1 displays the chronological order of events. The frame box shows the two ESPP sign-up windows that we compare in our study: one before and one after the PSD. In November 2017, employees could sign up for participation in the 2018 ESPP. Four months later, in March 2018, employees received free shares through the PSD. Eight months after that, in November 2018, the next sign-up period for the 2019 ESPP began.

Figure 1. Temporal classification of the profit sharing distribution. This figure displays the chronological order of the events. The frame box shows the two ESPP sign-up windows (one before and one after the PSD) that we compare in our study. In November 2017, the employees could sign up for participation in the 2018 ESPP. Four months later, in March 2018, the employees were gifted free shares in the frame of a PSD. Eight months later, in November 2018, the next sign-up period for the 2019 ESPP started.

3 Results

3.1 Summary statistics

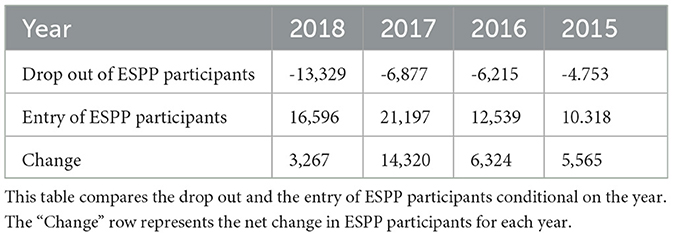

The main focus of our analysis is on changes in ESPP participation following the 2018 PSD. To examine these changes, we first present summary statistics comparing participation patterns in the year after the PSD (2018) to previous years (2015, 2016, and 2017) when no PSD was distributed. Table 3 provides an overview of the changes in ESPP participation across these years.

The data show that the 2018 PSD was followed by substantial changes in participation patterns. The net change in program participation was 3,267, resulting from 16,596 new participants joining the program while 13,329 former participants exited. This net change was the lowest compared to previous years. Moreover, the number of participants leaving the program in 2018 was unprecedented in our sample period, suggesting a distinct shift in participation patterns following the PSD distribution.

Result 1: Following the 2018 PSD, we observe counterbalancing changes in ESPP participation: while the distribution was followed by substantial new program entry, it coincided with unprecedented levels of program exit among previous participants.

Next, we employ regression analyses to assess the influence of employee heterogeneity. Specifically, we consider the role of employees who exhibit an intrinsic motivation as a factor when examining participation behavior in the following ESPP wave, after receiving the PSD.

3.2 Empirical strategy

To analyze the effect of the PSD on ESPP participation, we estimate the following panel probit model:

where i indexes individual employees, j indexes countries, and t indexes years. Participationijt is a binary variable indicating whether employee i from country j participates in the ESPP in year t. Participation_beforeijt indicates participation in the previous year, and Year2018PSDt is a dummy for observations after the PSD. The country-level variables Prosocialityj and PatienceRiskj are principal components derived from Falk et al.'s (2018) preference measures. Specifically, we conduct a principal component analysis (PCA) on the country-level preference variables from Falk et al. (2018), excluding negative reciprocity due to its limited relevance in our context. The first principal component Prosocialityj (eigenvalue: 2.810) combines positive reciprocity and altruism with equal factor loadings of 0.53, capturing 56.1% of the total variance. The second principal component PatienceRiskj (eigenvalue: 1.265) loads primarily on patience (0.60) and risk-taking (0.65), explaining an additional 25.3% of the variance. Together, these two components account for 81.4% of the total variance in the preference measures. Xijt is a vector of individual-level controls including gender, education, tenure, department, and age. Φ represents the cumulative distribution function of the standard normal distribution.

3.3 Regression results

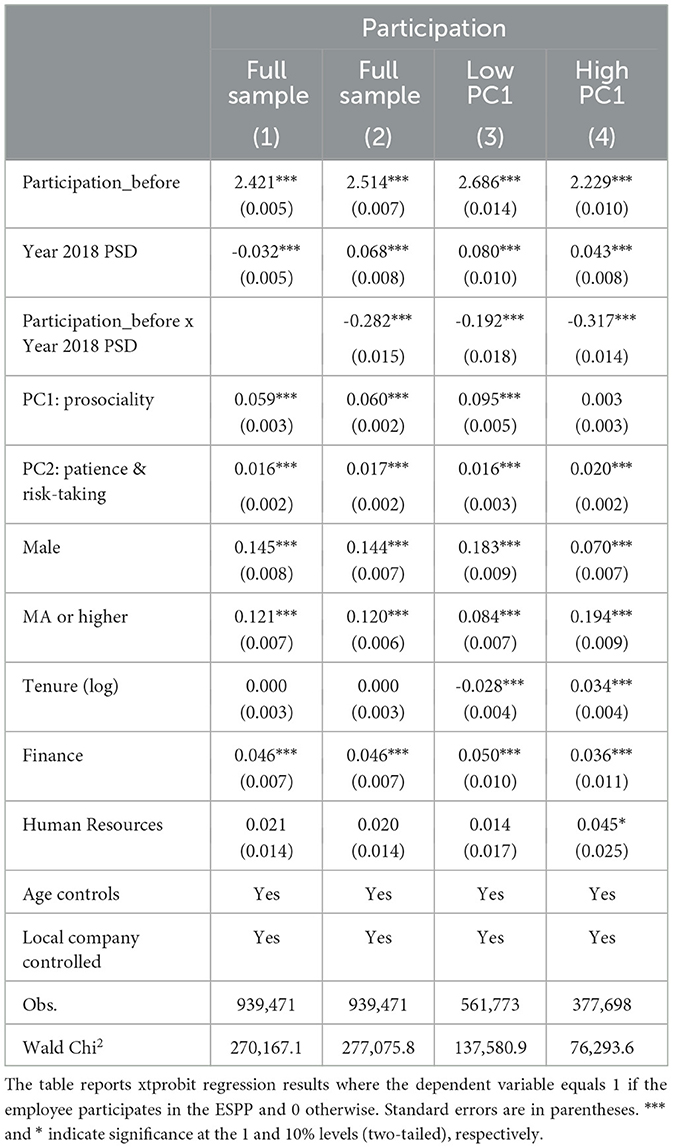

Table 4 showcases panel probit models that investigate the probability of an ESPP participation following the reception of the PSD. Our data start in 2014 and end in 2018. Moreover, the dependent variable is defined between 2015 and 2018, since we focus on employees' decisions to participate in the next year. Our dependent variable is “1,” ("0") if employees participated (not participated) in the ESPP wave of the next year. In all our models, we include a dummy “participation_before” that is “1” ("0"), if participants participated (not partcipated) in the ESPP the year before. To identify the effect of the PSD, we include a dummy (Year 2018 PSD) that is positive for the data of the year 2018. Moreover, we employ an interaction term (participation_before x Year 2018 PSD) to test for the effect of the PSD on former participants' likelihood to participate in the next year after they received the PSD.

To examine how cultural context might influence participation patterns, we match our employee data from 36 countries with country-level preference measures from Falk et al. (2018). Their survey provides preference data for 76 countries, allowing us to characterize the cultural environment in which our sample's employees work. We focus on their measures of positive reciprocity and altruism to capture country-level prosociality, and include their risk and time preference measures to account for cross-country differences in investment attitudes. Using principal component analysis (PCA), we construct two country-level indices that capture distinct aspects of cultural preferences.

Finally, all models include a gender dummy (male). Furthermore, we include the following dummies: MA higher, which is positive when employees' highest level of education is a master's degree or higher, finance is positive when the employee is working in a finance department, human resources is positive when the employee is working in an HR department. We also add employees' tenure (measured by the natural logarithm of the tenure in years +1). We also control for employees' age (measured at 5-year intervals, e.g., aged between 30 and 35) and add a dummy (home country), which is positive if the employee works in the country where the firm's headquarters is located (indicated in the table by “local company controlled"). Models (1)–(2) focus on the full sample, whereas models (3)–(4) focus on samples that were split based on a median split of PC1.

It can be seen that “Participation_before” has a significant positive coefficient in all models. Thus, we generally find that subjects who already participated in former years are more likely to participate in the subsequent years. Importantly, in model (1), we find that “Year 2018 PSD” is negative and highly significant. Thus, subjects are significantly less likely to participate in the year 2018 after they received a PSD. In model (2), the highly significant negative coefficient of the interaction of Participation_before x Year 2018 PSD highlights that especially former participants are less likely to participant again in the ESPP in the year 2018 after they received a PSD. At the same time, the coefficient of “Year 2018 PSD” becomes positive.

Furthermore, model (4) highlights that this effect is especially pronounced among subjects in countries with a high PC1, indicating a strong degree of prosociality. Specifically, the negative coefficient of the interaction term is 1.65 times higher in model (4) than in model (3), which focuses on the sample of subjects in countries with a low PC1. A Wald test examining the difference in coefficients between the two probit regression models revealed a statistically significant difference, with a test statistic of 28.91 and a p-value < 0.001. Overall, we find that PC1 and PC2 always have positive coefficients, indicating that prosocial behavior, patience and risk tolerance are generally positively related with program participation. The only exception occurs in model (4) for subjects in countries characterized by a high degree of prosociality. Here, the coefficient of PC1 becomes insignificant. We summarize our findings below.

Result 2: Former participants are significantly more likely to leave the program in 2018 after receiving the PSD. This effect is more pronounced in countries characterized by higher average levels of prosociality.

3.4 Country-level financial literacy as a moderating factor

In this section, we examine whether country-level financial literacy moderates our main findings. Our previous results showed that both prior program participation and country-level prosociality are associated with post-PSD participation patterns. Given that the ESPP offers favorable investment terms, particularly for those with prior participation experience, we investigate whether the country-level financial environment influences these patterns.

We match our employee data with country-level financial literacy scores from the Standard & Poor's Global Financial Literacy Survey, which was conducted in cooperation with Gallup, Inc. The data are based on over 150,000 interviews with representative adults in more than 140 economies. This survey measures understanding of basic financial concepts (risk diversification, inflation, numeracy, and interest compounding) across countries. Prior research suggests that higher financial literacy at both individual and country levels is associated with more consistent investment behavior (Behrman et al., 2012; Bellofatto et al., 2018; Hermann et al., 2019). In the context of ESPPs specifically, Babenko and Sen (2014) find that financial education supports program participation.

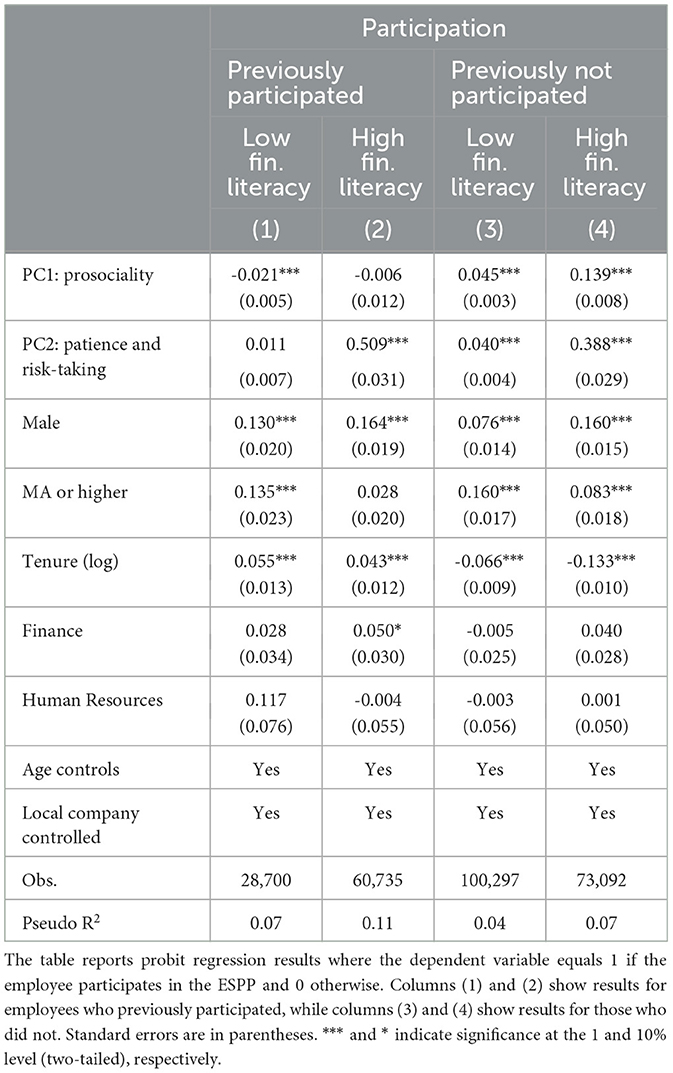

To get more insights on the robustness of the effects of the PSD, Table 5 presents four probit regressions that focus on the period 2017–2018 regarding the potential change in ESPP participation (after the PSD). The regressions split this sample into different groups. Specifically, the regressions account for varying levels of financial literacy - both low and high - as well as for subjects who participated in the ESPP prior to receiving the PSD and those who had not participated beforehand.

Table 5. Probit regressions on employee participation in the ESPP after receiving free shares (conditional on low vs. high financial literacy).

Comparing models (1) and (2) reveals that the relationship between country-level prosociality and post-PSD participation varies systematically with country-level financial literacy. In countries with lower average financial literacy (model 1), we find a significant negative coefficient for PC1: prosociality. In contrast, this coefficient becomes insignificant in countries with higher average financial literacy (model 2). This suggests that the cultural context, as measured by country-level prosociality, has less influence on post-PSD participation decisions in countries where financial literacy is higher.

This moderating effect of country-level financial literacy appears specifically relevant for previous program participants. For employees who had not participated in the ESPP before the PSD (models 3 and 4), we find no such differential effect - the positive coefficient of PC1 remains stable and significant regardless of the country's financial literacy level. The individual-level control variables show consistent effects across all specifications, with gender, education, and tenure maintaining their significance as found in Table 4.

Result 3: The negative relationship between country-level prosociality and post-PSD program participation is weaker in countries with higher average financial literacy scores. This moderating effect of financial literacy is particularly evident for previous program participants.

4 Conclusion

This study examines how an unexpected profit-sharing distribution affects subsequent ESPP participation using large-scale data from a multinational firm. Our results demonstrate counterbalancing effects on participation patterns following the PSD. Moreover, our findings highlight how these effects vary systematically across countries with different cultural characteristics and financial environments. We find that former program participants are less likely to continue their participation after receiving the PSD, with this pattern being particularly pronounced in countries with higher average levels of prosociality. While our analysis suggests that cultural context plays an important role in how employees respond to profit-sharing distributions, we acknowledge several alternative explanations for the observed patterns. These include cross-country differences in portfolio rebalancing practices, variation in personal financial circumstances, different approaches to risk management, or systematic differences in financial decision-making across cultural contexts.

We conclude that responses to profit-sharing distributions can vary substantially across different cultural and financial environments. The relationship between country-level prosociality and post-PSD participation patterns, moderated by country-level financial literacy, suggests that cultural and institutional contexts matter for the effectiveness of share-based compensation programs. However, we caution against interpreting these results as definitive evidence of a single causal mechanism. The complex interplay of cultural preferences, financial literacy, and organizational practices likely contributes to the observed patterns in ways that warrant further investigation.

Our study yields two key policy implications. First, firms operating across multiple countries should consider how their compensation practices may be received differently in various cultural contexts. Our findings suggest that profit-sharing distributions can have varying effects on ESPP participation depending on the cultural environment, particularly regarding levels of prosociality. This implies that global firms might benefit from adapting their share-based compensation strategies to local contexts. For instance, firms might consider tailoring their communication strategies around profit-sharing distributions to align with local cultural preferences and norms.

Second, our results on the moderating role of country-level financial literacy suggest that educational initiatives could be valuable when implementing profit-sharing programs. The weaker relationship between country-level prosociality and program exit in countries with higher financial literacy suggests that financial education might help firms maintain ESPP participation rates when distributing profit shares. Companies can support this through knowledge-building activities, such as information campaigns regarding the risks and opportunities of shareholding. These educational activities may have positive spillover effects for other financial decisions besides ESPPs, such as retirement plan decisions (Duflo and Saez, 2003). Higher levels of financial education may also increase overall ESPP participation (Babenko and Sen, 2014), which is crucial given the documented benefits of these programs, including increased employee commitment and reduced turnover (Hennig et al., 2023).

A key limitation of our study is that social preferences are measured at the country level rather than the individual level. While this allows us to identify broad patterns across cultural contexts, it likely provides conservative estimates of the true relationship between prosociality and ESPP participation decisions. Individual-level variation in social preferences within countries may lead to stronger effects than we can detect with our country-level measures. Additionally, our analysis cannot fully isolate the mechanisms through which cultural context affects participation decisions. Future research could address these limitations through natural field experiments that measure individual-level attitudes and preferences. Such studies could help identify the specific channels through which profit-sharing distributions affect ESPP participation across different cultural and institutional settings.

Data availability statement

The data underlying this article cannot be shared publicly due to a non-disclosure agreement with the collaborating firm and high sensitivity of our personal employee data. The data will be shared on reasonable request to the corresponding author.

Ethics statement

Ethical review and approval was not required for the study on human participants in accordance with the local legislation and institutional requirements. Written informed consent from the participants was not required to participate in this study in accordance with the national legislation and the institutional requirements.

Author contributions

JH: Conceptualization, Data curation, Formal analysis, Investigation, Methodology, Project administration, Resources, Software, Supervision, Validation, Visualization, Writing – original draft, Writing – review & editing. RH: Conceptualization, Data curation, Formal analysis, Investigation, Methodology, Project administration, Resources, Software, Supervision, Validation, Visualization, Writing – original draft, Writing – review & editing. HR: Conceptualization, Data curation, Formal analysis, Investigation, Methodology, Project administration, Resources, Software, Supervision, Validation, Visualization, Writing – original draft, Writing – review & editing. MW: Conceptualization, Data curation, Formal analysis, Investigation, Methodology, Project administration, Resources, Software, Supervision, Validation, Visualization, Writing – original draft, Writing – review & editing.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Acknowledgments

We acknowledge that we used the AI technology “Claude.ai 3.5 Sonnet” in terms of improving some writing process.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/frbhe.2024.1484468/full#supplementary-material

References

Anderson, D., Kramarsch, M., and Muntermann, M., (eds.). (2020). Surveys and Reports. Global Equity Insights.

Babenko, I., and Sen, R. (2014). Money left on the table: an analysis of participation in employee stock purchase plans. Rev. Fin. Stud. 27, 3658–3698. doi: 10.1093/rfs/hhu050

Babenko, I., and Sen, R. (2016). Do nonexecutive employees have valuable information? evidence from employee stock purchase plans. Manag. Sci. 62, 1878–1898. doi: 10.1287/mnsc.2015.2226

Behrman, J. R., Mitchell, O. S., Soo, C. K., and Bravo, D. (2012). How financial literacy affects household wealth accumulation. Am. Econ. Rev. 102, 300–304. doi: 10.1257/aer.102.3.300

Bellofatto, A., D'Hondt, C., and De Winne, R. (2018). Subjective financial literacy and retail investors' behavior. J. Bank. Fin. 92, 168–181. doi: 10.1016/j.jbankfin.2018.05.004

Bénabou, R., and Tirole, J. (2003). Intrinsic and extrinsic motivation. Rev. Econ. Stud. 70, 489–520. doi: 10.1111/1467-937X.00253

Bénabou, R., and Tirole, J. (2006). Incentives and prosocial behavior. Am. Econ. Rev. 96, 1652–1678. doi: 10.1257/aer.96.5.1652

Blasi, J., Kruse, D., and Freeman, R. B. (2018). Broad-based employee stock ownership and profit sharing: history, evidence, and policy implications. J. Participat. Employee Owner. 1, 38–60. doi: 10.1108/JPEO-02-2018-0001

Bowles, S., and Polania-Reyes, S. (2012). Economic incentives and social preferences: substitutes or complements? J. Econ. Literat. 50, 368–425. doi: 10.1257/jel.50.2.368

Bryson, A., and Freeman, R. B. (2019). The role of employee stock purchase plans-gift and incentive? evidence from a multinational corporation. Br. J. Indus. Relat. 57, 86–106. doi: 10.1111/bjir.12420

Cohen, L. (2009). Loyalty-based portfolio choice. Rev. Fin. Stud. 22, 1213–1245. doi: 10.1093/rfs/hhn012

Duflo, E., and Saez, E. (2003). The role of information and social interactions in retirement plan decisions: evidence from a randomized experiment. Quart. J. Econ. 118, 815–842. doi: 10.1162/00335530360698432

Engelhardt, G. V., and Madrian, B. C. (2004). Employee stock purchase plans. Natl. Tax J. 57, 385–406. doi: 10.17310/ntj.2004.2S.02

Falk, A., Becker, A., Dohmen, T., Enke, B., Huffman, D., and Sunde, U. (2018). Global evidence on economic preferences. Quart. J. Econ. 133, 1645–1692. doi: 10.1093/qje/qjy013

Gneezy, U., Meier, S., and Rey-Biel, P. (2011). When and why incentives (don't) work to modify behavior. J. Econ. Perspect. 25, 191–210. doi: 10.1257/jep.25.4.191

Guay, W., Kothari, S., and Sloan, R. (2003). Accounting for employee stock options. Am. Econ. Rev. 93, 405–409. doi: 10.1257/000282803321947425

Hennig, J. C., Ahrens, C., Oehmichen, J., and Wolff, M. (2023). Employee stock ownership and firm exit decisions: a cross-country analysis of rank-and-file employees. Account. Org. Soc. 104:101390. doi: 10.1016/j.aos.2022.101390

Hermann, D., Mußhoff, O., and Rau, H. A. (2019). The disposition effect when deciding on behalf of others. J. Econ. Psychol. 74:102192. doi: 10.1016/j.joep.2019.102192

Jones, D. C., and Kato, T. (1995). The productivity effects of employee stock-ownership plans and bonuses: evidence from japanese panel data. Am. Econ. Rev. 1995, 391–414.

Kim, E. H., and Ouimet, P. (2014). Broad-based employee stock ownership: motives and outcomes. J. Fin. 69, 1273–1319. doi: 10.1111/jofi.12150

Pendleton, A. (2010). Employee participation in employee share ownership: an evaluation of the factors associated with participation and contributions in save as you earn plans. Br. J. Manag. 21, 555–570. doi: 10.1111/j.1467-8551.2008.00622.x

Peterson, J. R. (2023). Employee bonding and turnover efficiency. J. Econ. Manag. Strat. 32, 223–244. doi: 10.1111/jems.12499

Poterba, J. M. (2003). Employer stock and 401 (k) plans. Am. Econ. Rev. 93, 398–404. doi: 10.1257/000282803321947416

Keywords: employee stock purchase plans, profit sharing, financial incentives, intrinsic motivation, social preferences

Citation: Hennig JC, Hullmann R, Rau HA and Wolff M (2025) The effects of profit-sharing distributions on employee stock purchase plan participation. Front. Behav. Econ. 3:1484468. doi: 10.3389/frbhe.2024.1484468

Received: 21 August 2024; Accepted: 06 December 2024;

Published: 04 February 2025.

Edited by:

Andrew McGee, University of Alberta, CanadaReviewed by:

Wanda Mimra, ESCP Europe, FranceJohn Lightle, Virginia Commonwealth University, United States

Copyright © 2025 Hennig, Hullmann, Rau and Wolff. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Holger A. Rau, aG9sZ2VyLnJhdUB1bmktZ29ldHRpbmdlbi5kZQ==

Jan C. Hennig

Jan C. Hennig Rieke Hullmann2

Rieke Hullmann2 Holger A. Rau

Holger A. Rau