94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Behav. Econ., 03 May 2024

Sec. Behavioral Microfoundations

Volume 3 - 2024 | https://doi.org/10.3389/frbhe.2024.1381080

This article is part of the Research TopicPsychology of Financial ManagementView all 11 articles

Introduction: Saving is a journey, beginning with the critical decision to initiate the process, take that pivotal first deposit step, and persistently commit to ongoing savings. However, a lot of saving plans fail already before any deposit is made, and even if the first deposit is made, long-run success of savings is far from guaranteed. In this study, we investigate both individual and saving-goal-specific determinants of successful savings.

Method: We use real-life savings data (N = 2,619 saving goals of 808 individuals) from a FinTech company in Sweden that helps individuals save for their goals. In addition, we collect a wide range of individual characteristics related to financial behavior: individuals' objective and subjective financial knowledge, self-control, and information avoidance.

Results and discussion: Our analysis uncovered distinctive patterns at different stages of the saving process. While objective financial knowledge didn't correlate with how much one saves, it was significantly related to the likelihood of making the first deposit. Furthermore, individuals with high self-control exhibited greater savings, though self-control was not related to the initiation of saving. Interestingly, subjective financial literacy and information avoidance showed no significant association with overall savings behavior. Additionally, our study indicated that the attainability of goals plays a crucial role in depositing funds, with more achievable goals having higher deposit likelihoods. Conversely, ambitious goals, despite their challenging nature, tended to attract more substantial savings. Our findings, grounded in real-life data, provide valuable insights into the intricate mechanisms influencing successful saving behaviors, shedding light on the complexities of financial decision-making and goal pursuit.

The advantages of savings for our wellbeing are widely recognized (Shim et al., 2012). Savings serve as a buffer against negative financial shocks, contribute to financial security in retirement, empower the pursuit of personal aspirations, and enhance financial and overall wellbeing (García-Mata and Zerón-Félix, 2022). Moreover, saving money has been associated with positive lifestyle choices, including abstaining from smoking and engaging in regular exercise (van Rooij et al., 2012; Białowolski et al., 2019; Anvari-Clark and Ansong, 2022). Despite the widely recognized benefits of savings, a notable proportion of individuals do not incorporate saving practices into their financial habits (Financial Conduct Authority, 2023). Understanding the mechanisms influencing (un)successful saving behaviors is thus of utmost importance to help individuals save. While savings behavior has been extensively studied (see studies cited in the next section), this study makes a distinctive contribution to the existing literature by separating different motivational stages of saving and analyzing behavior using a unique dataset that combines survey-based measures of individual characteristics with real-life saving behavior.

In what follows, we use the words savings and discretionary savings interchangeably. Discretionary savings are goal-oriented: one needs to decide to put away money to reach a specific goal. In addition to discretionary savings, Katona (1975) distinguished two more types of savings: residual savings and contractual savings. Residual savings are defined as the excess of income over consumption over a certain period. Residual savings are passive, individuals do not need to make any active decisions. Contractual savings are regular contributions made in accordance with an agreement, such as through life insurance plans or a mortgage repayment. Individuals might choose contractual savings as a method of self-discipline. These saving types are not equivalent and different factors may affect each of them. In this study, we solely focus on discretionary savings with clearly defined saving goals.

Saving is a journey; one needs to decide to start saving, make the first deposit, and keep on saving. A lot of saving plans fail already before any saving deposit is made. And even if the first deposit is successfully made, this does not guarantee the long-run success of savings. While there is a lot of room for setbacks, successful savings require all stages of this process to be completed. Previous research found that the factors influencing individuals' decision to start a new behavior are distinct from those that influence their decision to continue that behavior (Rothman, 2000). The choice to initiate a certain behavior is expected to be influenced by optimistic expectations about future results, while the choice to maintain the behavior is influenced by satisfaction with the outcomes experienced so far. Thus, achieving a goal may sometimes require a long-term process which can be conceptually separated into initiation and habit-formation stages (Gardner and Rebar, 2019).

By using data from a savings app, the purpose of this study is to investigate the role of both individual- and saving-goal-specific determinants of successful savings at different stages of the saving process. We surveyed users of a Swedish FinTech app that helps individuals save for their goals. The individuals in our dataset have already created at least one saving goal, thus taking the first step in the saving process. We investigate what factors make it more likely to make the first deposit (initiation stage) and what factors are related to how much savings one has accumulated (habit-formation stage). Our dataset consists of survey data on individual characteristics related to financial behavior: individuals' objective and subjective financial knowledge, self-control, and information avoidance as well as real-life data on saving including characteristics of savings goal. This comprehensive dataset allows us to better understand the determinants of successful saving at each stage of the saving process.

Our study connects to the literature exploring factors contributing to the intention-behavior gap related to saving. For example, Rabinovich and Webley (2007) showed that successful savers exhibited higher levels of self-control and engaged in more effective mental accounting strategies compared to individuals who struggled to adhere to their saving plans. Similarly, Gargano and Rossi's (2020) showed that individuals who set specific saving goals saved more on average than those without such saving goals. The current study explores in more detail the factors associated with savings behavior, considering both goal-related factors and individual characteristics. Furthermore, we adopt a more nuanced approach to saving, recognizing it as a non-linear process comprising distinct stages.

Saving behavior is a multifaceted phenomenon, influenced by a complex interplay of psychological, behavioral, and situational factors. The cycle of savings process typically involves several distinct stages, each characterized by different behaviors, goals, and considerations. While individual circumstances may vary, three stages of the discretionary savings process are particularly prominent. First, is the planning stage wherein individuals or households set specific savings goals based on short-term needs (e.g., emergency fund, vacation) and long-term objectives (e.g., retirement, education, homeownership). Then follows the initiation stage, wherein individuals make the first pivotal deposit to a specific saving goal (mental or financial account). Lastly, there is the habit-formation stage wherein individuals form a routine of consistently setting aside a portion of income for achieving savings goals.

Early economic theories of savings tried to model how savings change with time. The life-cycle hypothesis as postulated by Modigliani and Brumberg (1954) forms a cornerstone in the understanding of savings behavior. This theory posits that people seek to maintain the same level of consumption over the course of their lifetimes. To achieve this, individuals will dissave (or borrow money) early and late in life when their income is relatively low and save during middle age when their income is relatively high. However, empirical evidence has shown that the model does a poor job of explaining real-life behavior. For example, contrary to the predictions of the life-cycle hypothesis, consumption tends to decrease post-retirement, and wealth often remains unspent, being transferred as inheritance (Bernheim, 1987; Börsch-Supan and Stahl, 1991). In addition, the life-cycle hypothesis assumes that individuals are farsighted planners without self-control problems. In turn, it has been shown that individuals struggle with self-control (Baumeister, 2002), are present biased (Laibson, 1997), and disconnected from their future self (Hershfield et al., 2011), contributing to savings behavior that is not in line with life-cycle hypothesis.

Building on the foundations of the life-cycle hypothesis, Shefrin and Thaler (1988) developed the behavioral life-cycle hypothesis incorporating behavioral anomalies. This model acknowledges that self-control is difficult and costly to execute, and individuals are frequently tempted to prioritize immediate consumption over savings. This creates a conflict between short-sighted “doer” and far-sighted “planner”—different selves that have different utility-maximization goals. Furthermore, individuals do not treat money as fungible, and are more likely to spend money from what they earmark as “current income” vs. “current assets” or “future income.” The model takes into account that saving is a complex task that requires careful planning and self-control to succeed.

There is a substantial literature on factors that help people save. Self-control emerges as a critical element (Laibson et al., 1998), essential for deferring immediate gratification in favor of long-term goals. As described, the importance of self-regulatory capacity for achieving consistent saving behavior has a prominent role in the behavioral life-cycle model. In addition, Strömbäck et al. (2017) showed that individuals with higher self-control are more financially savvy and have higher financial wellbeing.

Problems with self-control stem from time-inconsistent, present-biased preferences, which lead individuals to increasing the weight put on the earlier event as it approaches, when making trade-off between future events (Loewenstein and Thaler, 1989). As a result, individuals with time-inconsistent preferences may initially choose a larger later reward over a smaller sooner reward when both are in the distant future. But once the smaller sooner reward gets closer, individuals will prefer the smaller sooner reward. Similarly, they may initially choose a smaller sooner cost over a larger later cost when both are in the distant future. But once the smaller sooner cost gets closer, individuals will prefer the larger later cost.

O'Donoghue and Rabin (1999) introduced a classification of individuals based on their awareness of their self-control problems. They identified time-consistent individuals, who have perfect self-control and are aware of it, sophisticates who have poor self-control and are aware of it, and naifs, who have poor self-control but are not aware of it. Sophisticates seek ways to prevent self-control issues, such as through pre-commitment, while naifs expect perfect self-control which often leads to failure in achieving long-term goals (Ariely and Wertenbroch, 2002). Ashraf et al. (2006) found that sophisticated individuals are more likely to use saving commitment devices leading to successful saving results. Furthermore, Mandel et al. (2017) tested two strategies to improve self-control: pre-commitment and visualizing potential future outcomes. Their findings suggest that the effectiveness of these strategies depends on people's level of awareness regarding their own self-control.

The success of saving can be improved by small changes in the decision environment. Changwony et al. (2021) found that having defined savings goals was associated with more long-term savings. This is in line with goal-setting theory, suggesting that setting a specific goal motivates individuals to reach it (Locke and Latham, 1990). Furthermore, in line with mental accounting, savings goals might alleviate the problem of self-control by making savings less accessible and thus less tempting for immediate consumption (Thaler, 1999; Gathergood and Weber, 2014). In a similar vein, different saving goals can be considered as separate mental accounts and thus money saved for one purpose (e.g., a vacation) cannot be spent on another purpose (e.g., to buy a car).

In today's digital era, there is a growing number of mobile applications designed to assist individuals in improving their behavior (e.g., eating more healthy and nutritious meals, exercising more, saving money). Previous research indicates that using health-related apps has been associated with increased motivation to pursue and maintain healthy behaviors (Rabbi et al., 2015; West et al., 2017). In the financial domain, the FinTech companies offer a wide variety of tools for setting and attaining financial goals. Gargano and Rossi (2020) found that individuals who used a FinTech app and set specific saving goals were more successful at building up savings compared to those without specific goals.

Using apps to set and achieve long-term goals suggests that individuals are sophisticated in their awareness of the internal conflict between long-term goals and immediate gratification. They choose tools to help mitigate their self-control problems. Previous studies have shown that the awareness and valuation of future outcomes greatly impact individuals' savings (Hershfield et al., 2011; Bartels and Urminsky, 2015). This indicates that visualization can be a powerful tool in improving savings. Potentially, creating a mental (and digital) image of one's saving goal can increase motivation and help achieve financial goals, be it long- or short-term. In addition, being able to self-monitor progress has been found to successfully motivate individuals to reach their set goals (Gargano and Rossi, 2020).

In addition to self-control, there is ample evidence that financial literacy is linked to sound financial behaviors including accumulation of retirement saving and wealth (van Rooij et al., 2011, 2012) and higher returns on saving (Deuflhard et al., 2019). Financial literacy has been previously defined as the knowledge and understanding of relevant information concepts and risks as well as skills, motivation, and confidence to apply this knowledge (OECD, 2017). Lind et al. (2020) confirmed that not only objective, but also subjective financial knowledge (i.e., financial confidence) can explain sound financial behavior and financial well-being.

A new line of research within behavioral finance explores the impact of information processing on sound financial behavior. Barrafrem et al. (2024) introduced the concept of Financial Homo Ignorans (FHI) which represents individuals' tendency to avoid, neglect, and distort financial information which may be crucial for sound financial decisions. People might, for instance, avoid information about how much money they spent, or what is the cost of their debts. Theory suggests that this type of ignorant behavior happens because people want to protect their identity-based beliefs (Tinghög et al., 2023). Empirically, Barrafrem et al. (2024) found that high financial ignorance was positively related with the take-up of high-cost loans and negatively correlated with sound financial behaviors and financial wellbeing.

In addition, the characteristics related to saving goals can also contribute to its success or failure.

People's saving decisions might be affected by utilitarian and hedonic considerations depending on the type of good they are saving for. Utilitarian goods are typically instrumental and fulfill a specific function (Dhar and Wertenbroch, 2000). Household appliances are one example of goods with strong utilitarian attributes. In turn, hedonic goods are more experiential, purchased out of desire rather than necessity. Vacation trips are one example of goods with strong hedonic attributes. Dhar and Wertenbroch (2000) found that consumers are more likely to give up on a utilitarian good than a hedonic good if they have to forfeit it and more likely to give up on a hedonic good than a utilitarian good if they acquire it. This suggests that if individuals consider their savings goals as a way of acquisition, they will be more successful in reaching utilitarian goals. In turn, if they visualize their savings goals as successfully completed, they will be more successful in reaching hedonic goals.

Furthermore, Kast et al. (2018) found that people who save in groups, i.e., when their goals are publicly observed by others who can also monitor their progress and give non-financial rewards, save more than individuals saving individually. This finding aligns with prior research that found that peer effects play a role in financial decisions, including investment (Bursztyn et al., 2014) and retirement savings (Duflo and Saez, 2002).

In collaboration with a FinTech company in Sweden, we conducted a study with their app users in January 2020. Users were invited by email to an online survey. The collected data from the survey was merged with users' real-life saving behavior (up until December 2019). The FinTech company provides an app that gives individuals tools to save for their goals. In the app, all individuals set up specific saving goals with target value and goal deadlines and start saving by depositing as much money as they wish and whenever they want to different goals/accounts. In the app, users are offered different tools to facilitate savings. For instance, they can create group goals, i.e., an individual together with their peers can choose to save for a specific goal (such as a vacation trip). Everyone from the group saves individually to progress toward a common goal, but everyone can see how much each of the individuals in the group has saved toward the goal. In addition, individuals using the app receive tips and recommendations on how to save more. At the time when we conducted the study, the app was free of charge. In total, we collected information from 808 customers who created 2,619 saving goals (77.6% female, mean-age = 34.1 SD-age = 10.6).

Kickstarted

We created a dummy variable that took value 1 if a person made at least one transaction to a saving goal and 0 otherwise. This was used as an outcome variable to identify the determinants of kickstarting one's savings (i.e., making the first deposit).

Net savings

We used total net amount saved (i.e., deposits – withdrawals) for a goal to measure one's savings.

Days remaining

This variable measures how many days are left until the self-imposed deadline for the savings goal.

Target amount

This variable represents what is the savings goal (in Swedish kronor).

Group goal

Individuals could create group savings goals (e.g., for a vacation trip together). This meant that each person had their individual target amount, but one could observe goal progression of other participants in the savings goal. We use a binary variable to indicate if a saving goal was a group goal (=1) or not (=0).

Category

Savings goals were classified into one of the following categories: beauty, celebrations, culture, debt, education, family, fashion, gifts, home, savings, sports, tech, travel, vehicles, and unknown. We created a categorical variable that indicates if a goal belongs to hedonic category (beauty, celebrations, culture, fashion, gifts, sports, tech, travel), the utilitarian category (debts, education, family, home, savings, vehicles), or could not be categorized (unknown) using the distinction made by Dhar and Wertenbroch (2000).

All scales used in this study can be found in the Supplementary material.

Self-control

We assessed self-control using five items from the Brief Self-Control Scale (Tangney et al., 2004), and the four items from the Short-Term Future Orientation Scale (Petrocelli, 2003; Antonides et al., 2011). Participants responded to statements such as: “I get distracted easily” on a scale from one to five (1 = completely disagree, 5 = completely agree). We measured self-control as the average of the answers to all nine items. The Cronbach's alpha was 0.85 for self-control.

Information avoidance

We used an eight-item measure of people's tendency to avoid learning information developed by Howell and Shepperd (2016). We adapted the scale to fit financial decision-making. The Cronbach's alpha was 0.82 for information avoidance.

Objective financial literacy

We assessed objective financial literacy using four knowledge-based questions that assessed participants' knowledge about compound interest, inflation, risk diversification, and relationship between bond prices and the interest rate (van Rooij et al., 2012). The financial literacy variable can thus take values between 0 (low financial literacy) and 4 (high financial literacy). The mean number of correct responses was 2.19 (SD = 1.07) and 7.1% of all participants responded correctly to all four questions.

Subjective financial literacy

To assess subjective financial knowledge participants were asked to rate their own financial knowledge on a scale from 1 to 7 (1 meaning very low, and 7 meaning very high; Lind et al., 2020). On average participants rated their subjective financial knowledge as 3.89 (SD = 1.35). The correlation between the objective and the subjective financial knowledge was 0.50, suggesting that the two measures of financial knowledge were related but not identical. However, we use each of these measures in separate regression to avoid multicollinearity.

In addition, we collected information about respondent's age, gender, income, and whether they completed higher education.

After removing 25 individuals who answered the survey multiple times, the dataset consisted of 2,619 saving goals from 808 individuals. In the analysis, we used only savings goals that had a goal deadline in the future (i.e., we removed 409 finished goals from the dataset). Another 57 saving goals didn't have a specified target amount for their goal and hence were excluded as missing data. The remaining sample consisted of 2,153 saving goals from 781 individuals.

We conducted logistic panel regressions with clustered standard errors at the individual level to explain whether an individual kickstarted their savings (i.e., whether they made at least one deposit). Furthermore, we conducted panel linear regressions with clustered standard errors at the individual level to explain net savings conditional on having positive savings.1 We conducted a series of hierarchical models in which the unit of observation was a saving goal (individuals had between 1 and 35 distinct saving goals). We explained the outcome variables with (i) saving-goal characteristics, (ii) saving-goal characteristics + individual characteristics, and (iii) saving-goal characteristics + individual characteristics + demographics. The complete regression models are as follows:

Where each of the regressors used are explained in section 3.2, ui is a subject-specific error term, and εig is the error term for individual i and saving goal g.

Table 1 presents descriptive statistics for all variables used in the study. The FinTech company responsible for the app is most popular among younger women and this is also visible in our dataset (Mean age: 34.1; 77.6% females). In addition, we found that Net savings, Days remaining, and Target amount were highly skewed and hence we conducted logistic transformation on these three variables. Furthermore, as the correlation between logarithmized Days remaining and Target amount was high (Pearson r = 0.65), we decided to use only logarithm of Target amount in the regressions.

As a first step in the analysis we conducted Hausman tests to verify that random-effects models produced consistent estimators (i.e., that the individual characteristics were not correlated with the regressors). We did not find evidence to reject the null hypothesis about consistent estimators in either of the random-effects models in our analysis [χ2 = 5.18, p = 0.269 for the regression explaining Kickstarted and χ2 = 4.06, p = 0.398 for the regression explaining ln (Net savings)].

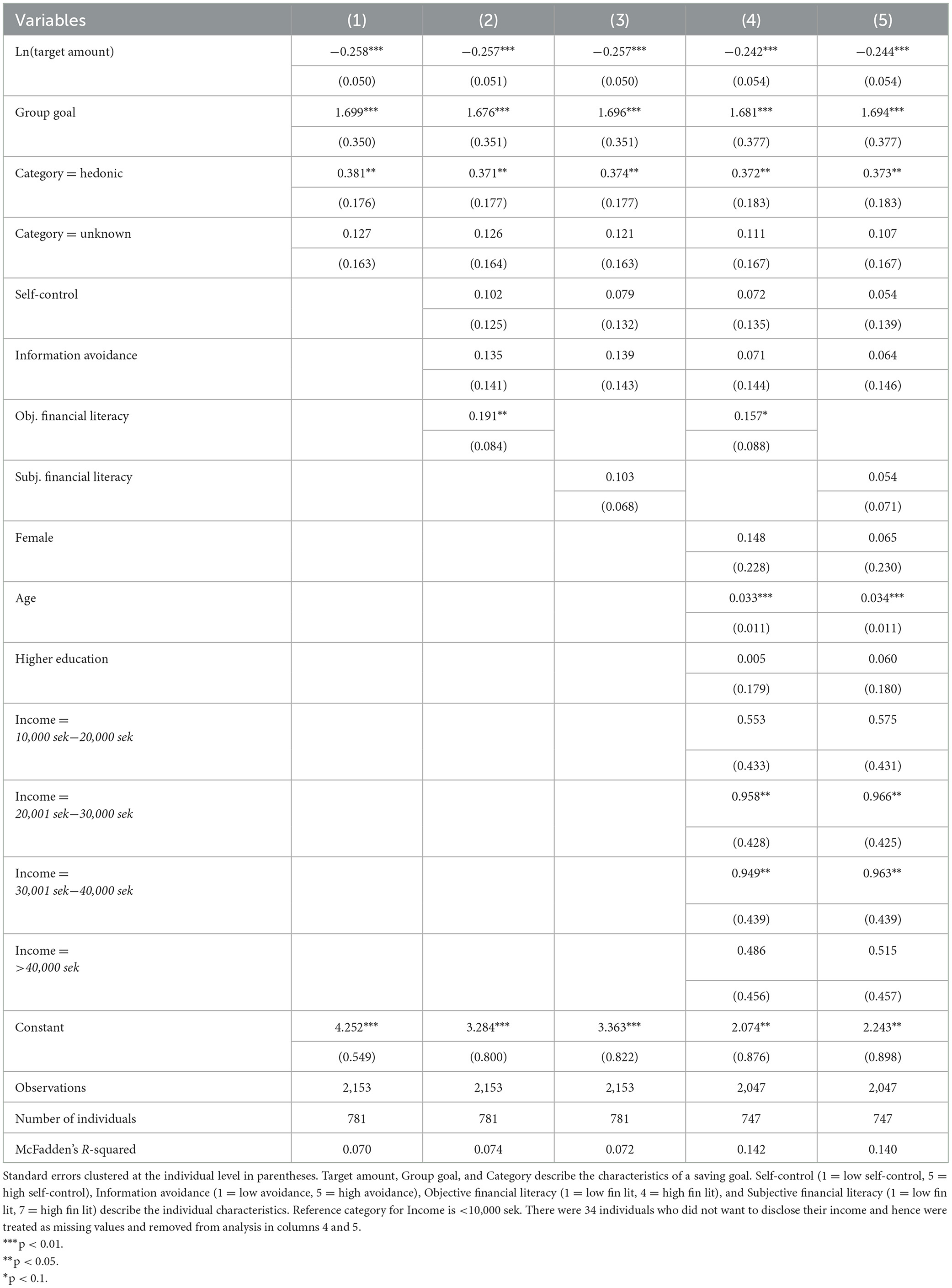

Table 2 presents the regression results explaining the likelihood of making a deposit (i.e., Kickstarted = 1) to a defined saving goal. The likelihood of kickstarting one's savings was negatively associated with the chosen target amount. Thus, individuals who set saving goals that are more difficult to achieve are less likely to approach them. Furthermore, saving with a group of friends increased the likelihood of making the first deposit. Choosing a hedonic rather than a utilitarian goal also increased the likelihood of making a first deposit. We find that only objective financial literacy was positively and significantly associated with making the first deposit (column 2), but this relationship weakens once we controlled for demographic variables. Older individuals were more likely to make a first saving deposit.

Table 2. Panel logistic regression with random effects explaining the likelihood of making a first deposit toward a saving goal.

Once an individual starts saving, it is necessary to keep saving to reach savings goals.

Table 3 presents the regression results explaining the amount of savings (i.e., logarithm of net savings) to a defined saving goal. The amount of savings was positively associated with the chosen target amount; a 1% increase in the target amount was associated with a 37.6% increase in savings. Furthermore, saving with a group of friends increased the amount of savings; group goals, in comparison to individual goals, accumulate about 53.4% more savings [exp(0.428) = 1.534]. Hedonic goals accumulated more savings. Hedonic goals, in comparison to utilitarian goals, attract 32.6% more savings [exp(0.282) = 1.326]. Individuals with higher self-control saved more; a one-unit increase on the self-control scale was associated with a 37.4% increase in savings (exp(0.318) = 1.374). Older individuals saved more, with a 1-year increase in age associated with an increase in savings by 1.7% [exp(0.017) = 1.017].

In this study we analyzed which characteristics of a saving goal and individual differences are associated with successful saving behavior. We used data on saving to pre-defined saving goals from a Swedish FinTech company dedicated to enhancing individuals' willingness to save money. We find that the characteristics of a saving goal, such as the target amount, a common goal, or goal category, are important for an individual's success in saving. While a higher target amount might make a saving goal difficult to achieve and decrease the likelihood to kickstart saving, it may also motivate individuals who already made the first deposit, to save more.

Our study also highlights the importance of peer effects on saving success. We find that individuals are more likely to start saving and save more when their friends are saving for the same goal. This is in line with Kast et al. (2018) who found that individuals who participated in a peer group savings program saved almost twice as much as individuals who did not participate in this program.

Furthermore, we find that hedonic goals, as opposed to utilitarian goals, were more successful. This result is in line with Dhar and Wertenbroch (2000) who demonstrated that when people make forfeiture decisions, they are more likely to give up on a utilitarian good rather than a hedonic one. Together with the findings from the current study, this suggests that it is easier for people who already visualized their savings goal to give up on utilitarian goals rather than hedonic ones. In addition, decisions regarding hedonic goods are typically driven by emotional wants rather than functional needs and can be considered affect-rich. Consequently, when people's decisions are more influenced by emotions, saving for a hedonic goal might still be more appealing than immediate consumption. This holds for both the initiation and habit-formation stage. In light of previous research on the hierarchy of saving motives, this result suggests that it is more difficult to save to cover most basic needs, in comparison to the needs of esteem or self-actualization.

Our study also contributes to previous research on the on the importance of self-control in sound financial behavior (Shefrin and Thaler, 1988; Strömbäck et al., 2017, 2020). While previous research has established that self-control is an important factor in saving decisions in general, we were able to isolate its influence on the different stages of saving. While self-control played little role in kickstarting one's savings, it's effect on the accumulated savings was substantial.

We find that objective financial literacy is positively associated with the likelihood of making the first deposit, however this relationship is much weaker once we control for demographic variables. In addition, there is no significant association between financial literacy and accumulated savings. This result suggests that while financial literacy is relevant for formulating a savings strategy, it may not be necessarily important for successfully executing and adhering to the savings strategy. Previous research has found that individuals with higher financial literacy accumulate more wealth for retirement (Lusardi and Mitchell, 2007; van Rooij et al., 2012). The difference between these studies and ours is that, in general, the participants in our study tend to use the app for smaller and more short-term saving goals than saving for retirement. While it is likely that higher financial literacy helps people make plans for long-term savings that they will consume during their retirement, the role of financial literacy in achieving smaller financial goals is likely to be less pronounced.

Although we our dataset is a unique one, it should be acknowledged that it includes only individuals who have an intention to save. The users of the Fintech app have already set up at least one specific saving goal, i.e., they took the first step to start saving. In addition, our sample consists mainly of young females, a social group that might significantly differ in their financial behavior and wellbeing from the “average population.” For instance, Lusardi (2019) found that women and younger generations have significantly lower financial wellbeing than men and older generations. In addition, previous studies show a persistent gender gap in financial literacy (Tinghög et al., 2021).

In addition, our dataset captures only savings in the app. It is likely that individuals have more savings in other channels (e.g., traditional banks). Consequently, it is possible that the users of the app feel more motivated to save for hedonic goals with the help of the app, while they save for their utilitarian goals (e.g., paying off debts) somewhere else.

The process of saving can be complex, and individuals may encounter struggles at various stages of this process. Theoretical models, like the life-cycle hypothesis, have traditionally emphasized long-term smoothing over a lifetime perspective, neglecting the fact that saving can also serve short- and intermediate-term objectives. Individuals are rarely as far-sighted as the life-cycle hypothesis assumes and a life cycle is likely to consist of numerous short- and intermediate-saving cycles. In turn, each saving cycle consists of distinct motivational stages: the saving planning stage, the saving initiation stage, and the saving habit-formation stage. The understanding of what motivates people at each stage, of the saving cycle is essential to design more effective policy interventions that will aim to help people save more. For instance, the findings of this study suggest that financial education (i.e., increasing financial literacy) may not be sufficient to help people increase their savings and we need to find ways to help people learn how to control their spending impulses and how to set specific financial goals to increase the likelihood of success.

The datasets presented in this article are not readily available because authors cannot share the company data. Requests to access the datasets should be directed to a2luZ2EuYmFycmFmcmVtQGxpdS5zZQ==.

Ethical approval was not required for the study involving humans in accordance with the local legislation and institutional requirements. Written informed consent to participate in this study was not required from the participants or the participants' legal guardians/next of kin in accordance with the national legislation and the institutional requirements.

KB: Conceptualization, Data curation, Formal analysis, Funding acquisition, Visualization, Writing – original draft, Writing – review & editing. GT: Supervision, Writing – review & editing. DV: Project administration, Supervision, Writing – review & editing.

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. This work was partially supported by the Wallenberg AI, Autonomous Systems and Software Program–Humanity and Society (WASP-HS) funded by the Marianne and Marcus Wallenberg Foundation and the Marcus and Amalia Wallenberg Foundation.

We would like to thank Elin Helander and Stina Söderqvist for help with data collection.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/frbhe.2024.1381080/full#supplementary-material

1. ^Note that it is possible that someone made the first deposit (Kickstarted = 1) but the net savings are equal to zero if the savings have been withdrawn from the savings goal. In this case, such saving goal will not be accounted for in the regression explaining net savings.

Antonides, G., Manon de Groot, I., and Fred van Raaij, W. (2011). Mental budgeting and the management of household finance. J. Econ. Psychol. 32, 546–555. doi: 10.1016/j.joep.2011.04.001

Anvari-Clark, J., and Ansong, D. (2022). Predicting financial well-being using the financial capability perspective: the roles of financial shocks, income volatility, financial products, and savings behaviors. J. Fam. Econ. Issues 43, 730–743. doi: 10.1007/s10834-022-09849-w

Ariely, D., and Wertenbroch, K. (2002). Procrastination, deadlines, and performance: self-control by precommitment. Psychol. Sci. 13, 219–224. doi: 10.1111/1467-9280.00441

Ashraf, N., Karlan, D., and Yin, W. (2006). Tying odysseus to the mast: evidence from a commitment savings product in the philippines*. Q. J. Econ. 121, 635–672. doi: 10.1162/qjec.2006.121.2.635

Barrafrem, K., Västfjäll, D., and Tinghög, G. (2024). Financial Homo Ignorans: Development and validation of a scale to measure individual differences in financial information ignorance. J. Behav. Exp. Financ. doi: 10.1016/j.jbef.2024.100936

Bartels, D. M., and Urminsky, O. (2015). To know and to care: how awareness and valuation of the future jointly shape consumer spending. J. Consum. Res. 41, 1469–1485. doi: 10.1086/680670

Baumeister, R. F. (2002). Yielding to temptation: self-control failure, impulsive purchasing, and consumer behavior. J. Consum. Res. 28, 670–676. doi: 10.1086/338209

Bernheim, B. D. (1987). “Dissaving after retirement: testing the pure life cycle hypothesis,” in Issues in Pension Economics, eds Z. Bodie, J. B. Shoven, and D. A. Wise (Chicago, IL: University of Chicago Press), 237–280.

Białowolski, P., Weziak-Białowolska, D., and VanderWeele, T. J. (2019). The impact of savings and credit on health and health behaviours: an outcome-wide longitudinal approach. Int. J. Public Health 64, 573–584. doi: 10.1007/s00038-019-01214-3

Börsch-Supan, A., and Stahl, K. (1991). Life cycle savings and consumption constraints: theory, empirical evidence, and fiscal implications. J. Popul. Econ. 4, 233–255. doi: 10.1007/BF00602431

Bursztyn, L., Ederer, F., Ferman, B., and Yuchtman, N. (2014). Understanding mechanisms underlying peer effects: evidence from a field experiment on financial decisions. Econometrica 82, 1273–1301. doi: 10.3982/ECTA11991

Changwony, F. K., Campbell, K., and Tabner, I. T. (2021). Savings goals and wealth allocation in household financial portfolios. J. Bank. Financ. 124:106028. doi: 10.1016/j.jbankfin.2020.106028

Deuflhard, F., Georgarakos, D., and Inderst, R. (2019). Financial literacy and savings account returns. J. Eur. Econ. Assoc. 17, 131–164. doi: 10.1093/jeea/jvy003

Dhar, R., and Wertenbroch, K. (2000). Consumer choice between hedonic and utilitarian goods. J. Mark. Res. 37, 60–71. doi: 10.1509/jmkr.37.1.60.18718

Duflo, E., and Saez, E. (2002). Participation and investment decisions in a retirement plan: The influence of colleagues' choices. J. Public Econ. 85, 121–148. doi: 10.1016/S0047-2727(01)00098-6

Financial Conduct Authority (2023). Financial lives 2022 survey. Available online at: https://www.fca.org.uk/data/financial-lives-2022-early-survey-insights-vulnerability-financial-resilience (accessed January 25, 2024).

García-Mata, O., and Zerón-Félix, M. (2022). A review of the theoretical foundations of financial well-being. Int. Rev. Econ. 69, 145–176. doi: 10.1007/s12232-022-00389-1

Gardner, B., and Rebar, A. L. (2019). Habit Formation and Behavior change. Oxford: Oxford University Press. doi: 10.1093/acrefore/9780190236557.013.129

Gargano, A., and Rossi, A. G. (2020). Goal setting and saving in the fintech era. Available at SSRN 3579275. doi: 10.2139/ssrn.3579275

Gathergood, J., and Weber, J. (2014). Self-control, financial literacy and the co-holding puzzle. J. Econ. Behav. Organ. 107, 455–469. doi: 10.1016/j.jebo.2014.04.018

Hershfield, H. E., Goldstein, D. G., Sharpe, W. F., Fox, J., Yeykelis, L., Carstensen, L. L., et al. (2011). Increasing saving behavior through age-progressed renderings of the future self. J. Mark. Res. 48(SPL), S23–S37. doi: 10.1509/jmkr.48.SPL.S23

Howell, J. L., and Shepperd, J. A. (2016). Establishing an information avoidance scale. Psychol. Assess. 28, 1695–1708. doi: 10.1037/pas0000315

Kast, F., Meier, S., and Pomeranz, D. (2018). Saving more in groups: field experimental evidence from chile. J. Dev. Econ. 133, 275–294. doi: 10.1016/j.jdeveco.2018.01.006

Laibson, D. (1997). Golden eggs and hyperbolic discounting*. Q. J. Econ. 112, 443–478. doi: 10.1162/003355397555253

Laibson, D. I., Repetto, A., Tobacman, J., Hall, R. E., Gale, W. G., Akerlof, G. A., et al. (1998). Self-control and saving for retirement. Brookings Pap. Econ. Act. 1998, 91–196. doi: 10.2307/2534671

Lind, T., Ahmed, A., Skagerlund, K., Strömbäck, C., Västfjäll, D., Tinghög, G., et al. (2020). Competence, confidence, and gender: the role of objective and subjective financial knowledge in household finance. J. Fam. Econ. Issues 41, 626–638. doi: 10.1007/s10834-020-09678-9

Locke, E. A., and Latham, G. P. (1990). A Theory of Goal Setting and Task Performance. Hoboken, NJ: Prentice-Hall, Inc.

Loewenstein, G., and Thaler, R. H. (1989). Anomalies: intertemporal choice. J. Econ. Perspect. 3, 181–193. doi: 10.1257/jep.3.4.181

Lusardi, A. (2019). Financial well-being of the millennial generation: an in-depth analysis of its drivers and implications. Stanford, CA: Global Financial Literacy Excellence Center, 1–7.

Lusardi, A., and Mitchell, O. S. (2007). Baby boomer retirement security: the roles of planning, financial literacy, and housing wealth. J. Monet. Econ. 54, 205–224. doi: 10.1016/j.jmoneco.2006.12.001

Mandel, N., Scott, M. L., Kim, S., and Sinha, R. K. (2017). Strategies for improving self-control among naïve, sophisticated, and time-consistent consumers. J. Econ. Psychol. 60, 109–125. doi: 10.1016/j.joep.2016.12.003

Modigliani, F., and Brumberg, R. (1954). Utility analysis and the consumption function: an interpretation of cross-section data. Franco Modigliani 1, 388–436.

O'Donoghue, T., and Rabin, M. (1999). Doing it now or later. Am. Econ. Rev. 89, 103–124. doi: 10.1257/aer.89.1.103

Petrocelli, J. V. (2003). Factor validation of the consideration of future consequences scale: evidence for a short version. J. Soc. Psychol. 143, 405–413. doi: 10.1080/00224540309598453

Rabbi, M., Pfammatter, A., Zhang, M., Spring, B., and Choudhury, T. (2015). Automated personalized feedback for physical activity and dietary behavior change with mobile phones: a randomized controlled trial on adults. JMIR Mhealth Uhealth 3:e42. doi: 10.2196/mhealth.4160

Rabinovich, A., and Webley, P. (2007). Filling the gap between planning and doing: psychological factors involved in the successful implementation of saving intention. J. Econ. Psychol. 28, 444–461. doi: 10.1016/j.joep.2006.09.002

Rothman, A. J. (2000). Toward a theory-based analysis of behavioral maintenance. Health Psychol. 19(1, Suppl), 64–69. doi: 10.1037/0278-6133.19.Suppl1.64

Shefrin, H. M., and Thaler, R. H. (1988). The behavioral life-cycle hypothesis. Econ. Inq. 26, 609–643. doi: 10.1111/j.1465-7295.1988.tb01520.x

Shim, S., Serido, J., and Tang, C. (2012). The ant and the grasshopper revisited: the present psychological benefits of saving and future oriented financial behaviors. J. Econ. Psychol. 33, 155–165. doi: 10.1016/j.joep.2011.08.005

Strömbäck, C., Lind, T., Skagerlund, K., Västfjäll, D., and Tinghög, G. (2017). Does self-control predict financial behavior and financial well-being? J. Behav. Exp. Finance 14, 30–38. doi: 10.1016/j.jbef.2017.04.002

Strömbäck, C., Skagerlund, K., Västfjäll, D., and Tinghög, G. (2020). Subjective self-control but not objective measures of executive functions predicts financial behavior and well-being. J. Behav. Exp. Finance 27:100339. doi: 10.1016/j.jbef.2020.100339

Tangney, J. P., Baumeister, R. F., and Boone, A. L. (2004). High self-control predicts good adjustment, less pathology, better grades, and interpersonal success. J. Pers. 72, 271–324. doi: 10.1111/j.0022-3506.2004.00263.x

Thaler, R. H. (1999). Mental accounting matters. J. Behav. Decis. Mak. 12, 183–206. doi: 10.1002/(SICI)1099-0771(199909)12:3<183::AID-BDM318>3.0.CO;2-F

Tinghög, G., Ahmed, A., Barrafrem, K., Lind, T., Skagerlund, K., Västfjäll, D., et al. (2021). Gender differences in financial literacy: the role of stereotype threat. J. Econ. Behav. Organ. 192, 405–416. doi: 10.1016/j.jebo.2021.10.015

Tinghög, G., Barrafrem, K., and Västfjäll, D. (2023). The good, bad and ugly of information (un)processing; homo economicus, homo heuristicus and homo ignorans. J. Econ. Psychol. 94:102574. doi: 10.1016/j.joep.2022.102574

van Rooij, M. C. J., Lusardi, A., and Alessie, R. J. M. (2011). Financial literacy and retirement planning in the netherlands. J. Econ. Psychol. 32, 593–608. doi: 10.1016/j.joep.2011.02.004

van Rooij, M. C. J., Lusardi, A., and Alessie, R. J. M. (2012). Financial literacy, retirement planning and household wealth. Econ. J. 122, 449–478. doi: 10.1111/j.1468-0297.2012.02501.x

Keywords: saving, saving goals, financial decision-making, behavioral finance, self-control, financial literacy

Citation: Barrafrem K, Tinghög G and Västfjäll D (2024) Behavioral and contextual determinants of different stages of saving behavior. Front. Behav. Econ. 3:1381080. doi: 10.3389/frbhe.2024.1381080

Received: 02 February 2024; Accepted: 15 April 2024;

Published: 03 May 2024.

Edited by:

Gerrit Antonides, Wageningen University and Research, NetherlandsReviewed by:

Jesse Matheson, The University of Sheffield, United KingdomCopyright © 2024 Barrafrem, Tinghög and Västfjäll. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Kinga Barrafrem, a2luZ2EuYmFycmFmcmVtQGxpdS5zZQ==

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.