94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Behav. Econ., 03 April 2024

Sec. Behavioral Microfoundations

Volume 3 - 2024 | https://doi.org/10.3389/frbhe.2024.1369261

This article is part of the Research TopicPsychology of Financial ManagementView all 11 articles

Introduction: Socially responsible investments (SRI) increased their popularity among investors over the last two decades. However, there is still a lack of knowledge on socially responsible investors' characteristics and motivations behind the decision to invest in SRI. The present paper aims at filling this gap by profiling current and potential sustainable investors.

Method: Cross-sectional data from a representative sample of Italian consumers (N = 1,002) was used to perform a Latent Profile Analysis (LPA), a clustering technique, and identify various sub-groups within the respondents. Subsequently, chi-square test and one-way ANOVA were performed to determine which profile(s) was mostly associated with current and potential socially responsible investing.

Results and discussion: Five profiles of consumers were identified through the LPA, each one differently associated with the likelihood of investing in socially responsible products. The profile that best describes sustainable investors is characterized by high levels of knowledge toward SRI, risk appetite, positive attitudes on SRI, personal norms, perceived behavioral control, environmental concerns, and connectedness to nature. These findings suggest that non-financial aspects, namely psychological characteristics such as attitudes and personal values, play a key role in the decision to invest responsibly as well.

With the aim to achieve global sustainability by 2030, the United Nations launched in 2015 the Sustainable Development Goals (SDGs), which represent a comprehensive framework to address global challenges (Wettstein et al., 2019), including environmental (e.g., climate change), social (e.g., world inequalities), and governance ones (e.g., war). The SDG framework has meant greater focus on the role of business in achieving sustainability, with the concept of corporate social responsibility gaining popularity. Indeed, besides financial performance, the ethical and environmental commitment of companies is getting more and more attention nowadays. Therefore, ESG criteria were created to evaluate corporates impact on environmental (E), social (S), and governance (G) domains. These ratings are frequently used as screening criteria for the development of socially responsible investment (SRI) products (Camilleri, 2021). Socially responsible investing is a strategy that combines both financial performance and social responsibility in the investment decision making process. Indeed, investors rely on both value-driven and pecuniary motives to guide their decisions. Hence, by investing in sustainable financial products, individuals can be actively engaged in the sustainable development process (Gutsche and Zwergel, 2020).

The attention of both institutional and private investors toward SRI rapidly increased over the last two decades. According to the Global Sustainable Investment Alliance (Global Sustainable Investment Alliance, 2020), in 2020 sustainable investment products under management accounted for 35.9% of the total managed funds. Globally, sustainable investment assets had a 15% increase from 2018, reaching a value of over $35 trillion. The value for socially responsible investments is expected to grow up to $50 trillion by 2025 (Bloomberg, 2021).

Literature on socially responsible investments has parallel grown in recent years, with a specific focus on comparing the financial performance of SRI to that of conventional financial assets (Beloskar et al., 2023). Besides, a recent research field involves the issue of greenwashing, focusing on both companies greenwashing behaviors (e.g., Yu et al., 2020) and the development of strategies aimed at preventing greenwashing, such as the definition of clear and standardized ESG ratings to evaluate corporate social responsibility (Arvidsson and Dumay, 2022). Indeed, as stated by recent studies (Widyawati, 2020; Gangi et al., 2022) ESG criteria show two main issues: a lack of transparency and a lack of convergent validity between various ratings. This matter could also have negative effects on investors' attitudes and trust toward socially responsible investing. For instance, ESG rating uncertainty, due to the lack of standardized rating criteria, might reduce investors' demand for socially responsible investment products (Avramov et al., 2022).

The profile of socially responsible investors and the motivations behind their decision to invest responsibly have received little attention so far (Garg et al., 2022).

Deepening the characteristics of those investing in SRI could have relevant implications. First, understanding who socially responsible investors are may help target potential sustainable investors or identify barriers that prevent socially responsible investing. Likewise, a better knowledge of the field is essential for developing investment products suited to investors' ethical values, attitudes, and preferences.

Considering the relevance of the topic and the lack of systematic research on the typical profile of sustainable investors, the present study aims at identifying the distinctive characteristics of socially responsible investors. A conceptual model, rooted in the Theory of Planned Behavior (Ajzen, 1991), was developed and investigated by adopting a person-centered approach. Specifically, a Latent Profile Analysis was performed to classify the sample in subgroups characterized by different combinations of the variables considered in the model (i.e., clusters). Since human behavior is the result of a series of factors that interact with each other, a person-centered approach is best suited to understand how specific configurations of variables are associated with the outcome. In particular, the Latent Profile Analysis divides participants into different groups, each characterized by a specific configuration of the variables under investigation. These different profiles can then be associated with an outcome variable to identify the profile(s) that best predict the desired outcome. Hence, our purposes were: (i) identifying different profiles of consumers in a representative sample of Italian consumers; (ii) verifying which profile(s) is more likely to be a current and/or potential socially responsible investor.

Findings reported in our study suggest that the decision to invest in SRI is shaped by various determinants. Specifically, it seems that classical determinants of investment decision making, such as risk appetite, are not enough to exhaustively explain socially responsible investing. Indeed, besides financial determinants, psychological antecedents (i.e., trust toward SRI, and perceived consumer effectiveness, personal norms, perceived behavioral control, environmental concern, and connectedness to nature) are also related to the decision to invest responsibly. Hence, also psychological determinants, such as values and attitudes, play a relevant role as well.

The paper is structured as follows. Section 2 describes the adopted theoretical framework and supplies the conceptual model developed in the study. Section 3 includes the methods. The results of the study are included in Section 4. Lastly, Sections 5, 6 report the discussion and conclusive remarks respectively.

Many studies aimed at defining the typical profile of socially responsible investors merely considered socio-demographic characteristics. Evidence from these studies suggested that socially responsible investors are primarily women and well-educated individuals (e.g., Rossi et al., 2019; Gutsche and Zwergel, 2020; Roos et al., 2024). There is instead a lack of agreement about the mean age of sustainable investors, as some studies suggested that older individuals are more likely to invest in SRI (e.g., Delsen and Lehr, 2019), while others reported that younger individuals prefer to invest responsibly (e.g., Bauer and Smeets, 2015).

However, socially responsible investors' profiles cannot be completely described by socio-demographic variables alone, as they have less explanatory power than attitudinal and psychological variables (Dorfleitner and Utz, 2014; Wins and Zwergel, 2016). In this direction, other studies focused instead on socially responsible investors' motivations, attitudes, and psychological characteristics (Williams, 2007; Pérez-Gladish et al., 2012; Apostolakis et al., 2016; Riedl and Smeets, 2017). On fact, the assumptions of classical financial models have been put in crisis by socially responsible investments. Sustainable investors do not behave as expected by traditional financial theories. Indeed, they are not necessarily profit oriented and do not focus merely on the financial performance of their investments. Rather than considering only risk-return tradeoffs, socially responsible investors are guided also by prosocial and pro-environmental attitudes and ethical values in their investment decisions (Bauer and Smeets, 2015; Gamel et al., 2016; Brodback et al., 2019). Evidence showed that investors are often willing to invest in accordance with their ethical values, even if it means paying higher fees or gaining lower returns on their investments (Apostolakis et al., 2018b; Gutsche and Ziegler, 2019). As well, by leveraging also on personal values and ethical dimensions, socially responsible investments might potentially attract new investors and encourage participation in capital markets (Rossi et al., 2019).

The purpose of the present study was to investigate the determinants and, specifically, which configuration of these determinants (i.e., which profile) is associated with socially responsible investing. We developed a model inspired by the Theory of Planned Behavior (TPB), which is a revisitation of the Theory of Reasoned Action (Ajzen and Fishbein, 1980). TPB has been widely used to explore and explain individual's behavior in various research fields (Kwon and Silva, 2020). According to TPB, three main variables (attitudes, subjective norms, perceived behavioral control) are responsible for the formation of behavioral intention, which in turn leads to actual behavior. Attitudes refer to the beliefs and valence of a certain behavior. Subjective norms reflect individuals' perception about social pressure and the tendency to comply with significant others' expectations. Finally, perceived behavioral control describes the extent to which individuals perceive ease or difficulties in the performance of a specific behavior (Ajzen, 1991).

Despite being one of the most common theories on consumer behavior, TPB was subject to various critiques throughout the years, such as for “being too narrow and rational, and lacking the inclusion of variables related to people's moral values” (Rozenkowska, 2023, p. 3). However, as stated by Ajzen (1991) himself, the main strength of TPB lies on its flexibility and capacity to be adapted to various research contexts and expanded by including additional constructs to better understand human behavior. Therefore, we opted for the model of TPB as theoretical framework, adapting it to the field of socially responsible investments. To the best of our knowledge, only a few studies (e.g., Apostolakis et al., 2018a) adopted TPB to explain the decision to invest responsibly.

For study purposes, we adapted and extended the Theory of Planned Behavior to explain socially responsible investing. In particular, besides the determinants suggested by the TPB (attitudes, subjective norms, perceived behavioral control), we investigate a set of different variables with the aim to also include in our framework: (1) determinants suggested by the classic literature on investment decision making; (2) determinants suggested by recent literature specifically focused on socially responsible behaviors. A brief review of the variables included in the proposed model is reported below.

Various studies (e.g., Jonwall et al., 2023) suggested a significant role of consumer' attitude on SRI and their decision to invest responsibly. For instance, Apostolakis et al. (2018a) reported that positive attitudes toward socially responsible investments predicted pension beneficiaries' intention to hold portfolios composed of socially responsible products. In the present study, two different attitudes toward socially responsible investments were investigated: perceived consumer effectiveness and consumers' trust.

Literature reported that perceived consumer effectiveness plays a key role in sustainable investment decisions (e.g., Vyas et al., 2022). This variable refers to the belief that individuals can have a positive influence and impact on the environment through their pro-environmental behaviors or sustainable consumption habits. As for SRI, perceived effectiveness reflects the extent to which consumers believe that socially responsible investments can address or resolve environmental and social issues. The association between perceived effectiveness and investing in responsible financial assets was highlighted by various authors (e.g., Wins and Zwergel, 2016; Palacios-González and Chamorro-Mera, 2018; Garg et al., 2022).

The role of trust in SRI was previously considered by a few studies, which investigated whether consumers' skepticism might prevent investors from socially responsible investing. As previously reported, there is still a lack of transparency and convergent validity between various ESG ratings, and this issue might undermine consumers' trust toward SRI. For instance, a recent study by Avramov et al. (2022) found that uncertainty about ESG ratings reduced the demand for responsible financial assets. However, studies that directly investigated perceived trust in SRI provided mixed results. While some (Nilsson, 2008; Wins and Zwergel, 2016) could not conclude that trust significantly affected the decision to invest responsibly, Gutsche and Zwergel (2020) found that distrust was a strong barrier for socially responsible investing. The role of consumers' trust toward sustainable investment products is still not completely clear. However, we argue that it could be a relevant issue for those attracted by socially responsible investments.

Even though the TPB mainly focused on subjective norms, namely the perceived social pressure to engage in a specific behavior, only a few studies (Apostolakis et al., 2018a; Gutsche et al., 2019) investigated the impact of subjective norms on socially responsible investing, suggesting a positive relationship between the two. Literature on socially responsible investors investigated mainly how personal norms influence sustainable investment decisions. Therefore, in the present study, we focused on personal norms as well. As stated by Schwartz (1973), personal norms can be conceived as a personal standard of behavior, rather than a standard from social groups, which characterizes subjective norms. Furthermore, personal norms are described as internalized social norms. Previous findings highlighted that those individuals with great altruistic, prosocial, and pro-environmental values were also more likely to invest in SRI (Garg et al., 2022; Roos et al., 2024). On the contrary, evidence suggested that materialistic and egoistic values were negatively related to socially responsible investing (Brodback et al., 2019; Singh et al., 2021; Vyas et al., 2022).

In the present study, the concept of perceived behavioral control concerns the extent to which individuals perceive control over the environment. In other words, it reflects either the belief that through our actions we can effectively tackle climate change, or a fatalistic sense of helplessness that environmental issues are beyond human control. Indeed, climate change is one of the biggest issues that mankind is going to face, and some individuals might assume negative beliefs about how humans can effectively fight it. Perceived control on the environment could prompt individuals' pro-environmental behaviors (Giefer et al., 2019; Hosta and Žabkar, 2021). For instance, Cleveland et al. (2020) found that the perception of having the ability to affect the environment motivates individuals in conservation and recycling behaviors and to adopt sustainable consumption habits. A significant association between perceived behavioral control and sustainable consumption was found by Patel et al. (2020) as well. Perceived behavioral control is thus expected to shape socially responsible investing as well.

Literature about investment decision making has stressed the importance that knowledge in the financial domain (e.g., Thomas and Spataro, 2018) and financial risk tolerance (e.g., Keller and Siegrist, 2006) have in predicting the decision to invest. For this reason, in the current study we investigated both consumers' knowledge in the financial domain in general (financial literacy) and about sustainable investments specifically (perceived knowledge on SRI), as well as consumer's risk tolerance. Since these determinants might also affect socially responsible investing (e.g., Wins and Zwergel, 2016; Riedl and Smeets, 2017), they were considered as well in our conceptual model.

Financial literacy is univocally considered one of the main predictors of investment decisions. Defined as a combination of knowledge, skills, attitude, and behavior necessary for good financial decision making (OECD, 2013), it is associated with financial market participation and significantly affects portfolio composition and diversification (Bannier and Neubert, 2016; Hsiao and Tsai, 2018; Hermansson and Jonsson, 2021). Though widely investigated in conventional investment decision making, the role of financial literacy in socially responsible investing is still quite overlooked. Some findings highlighted the key role of financial literacy in investors' information search process for socially responsible investments (Nilsson et al., 2010; Shanmugam et al., 2022). However, the relevance of financial literacy in actual investment decisions is less clear. Borgers and Pownall (2014) reported a significant effect of financial literacy in shaping the decision to invest responsibly, arguing that a lack of literacy might be a barrier, as socially responsible investments require the consideration of both financial and ethical information in the investment decision process. However, other studies reported a negative relationship between financial literacy and socially responsible investing (Rossi et al., 2019; Brunen and Laubach, 2022). Though the relevance of financial literacy in socially responsible investing is still debated, perceived knowledge on responsible investment products prompts consumers to invest in SRI (Wins and Zwergel, 2016; Jonwall et al., 2023). Gutsche and Zwergel (2020) suggested that since responsible investment products are more complex than conventional ones, individuals lacking proper knowledge would pay too high information cost. Therefore, they would be less likely to invest responsibly due to difficulties in searching for information on socially responsible investments. To measure consumers' knowledge, both financial literacy and knowledge on SRI have been considered in our model.

Another determinant influencing investment decision making refers to financial risk tolerance, as investing inherently involves assuming risks. Previous studies highlighted that risk appetite affects both financial market participation and portfolio composition (Grable, 2016). However, the influence of risk tolerance in socially responsible investing is less clear. Indeed, some studies highlighted a significant association (Bauer and Smeets, 2015; Riedl and Smeets, 2017; Gutsche et al., 2021), whereas others found that risk appetite is incapable of explaining socially responsible investing (e.g., Hafenstein and Bassen, 2016; Apostolakis et al., 2018a). Various explanations were proposed to justify these findings. Some scholars call in cause differences in consumers' risk perception of sustainable investment products. For instance, Wins and Zwergel (2016) hypothesized that investors might perceive socially responsible investment products as risky as conventional financial assets. As well, Delsen and Lehr (2019), reported that risk appetite did not significantly contribute to the understanding of sustainable investment decisions. They argued that risk tolerance could be a great predictor in the traditional investment literature, as it generally clarifies the different preferences for the risk-return tradeoff. However, its contribution to the understanding of socially responsible investing is quite marginal, since other variables, such as value orientation, could make a difference.

Literature highlighted that other variables may come into play in pro-environmental behaviors and sustainable consumption practice. Specifically, environmental concern (e.g., Tam and Chan, 2017) and a sense of connection to nature (e.g., Barbaro and Pickett, 2016) are able to stimulate environmental-friendly behaviors. Therefore, we included also these two variables as determinants of socially responsible investing. By adding these variables, we were able to get a greater focus on environmentalist attitudes, like previous studies (e.g., Seifert et al., 2022).

Concerns for environmental and climate change problems could prompt individuals to play out more sustainable behaviors and consumption habits (Yang et al., 2020). Studies showed that those more aware about environmental issues are more likely to purchase sustainable and environmental-friendly products (Lin and Niu, 2018; Zameer and Yasmeen, 2022). A similar trend could be found for socially responsible investing. An interest in environmental and social issues generally results in the decision to invest responsibly (Williams, 2007; Jansson et al., 2014; Gamel et al., 2016). Investors engaged in these topics, when they have to choose for responsible mutual funds, don't focus solely on financial aspects, like past performances and riskiness. Instead, they search for detailed information on screening criteria, or the guidelines adopted for social responsibility (Nilsson et al., 2010). Likewise, Gutsche and Ziegler (2019) reported that environmental concern was associated with the willingness to sacrifice returns by choosing responsible investment products rather than their conventional counterparts. In line with earlier findings, we included environmental concern in our conceptual model.

Connectedness to nature refers to the capacity of self-transcendence, in which individuals overcome their personal boundaries and feel a sense of connection with nature. In other words, it reflects the extent to which individuals perceive to belong to the natural world (Lengieza and Swim, 2021). Previous studies (e.g., Barbaro and Pickett, 2016) showed that a sense of belongingness to nature was associated with pro-environmental behaviors. Similarly, Dong et al. (2020) reported that a stronger feeling to be part of the natural environment led individuals to a higher likelihood of sustainable consumption behaviors. In line with the studies previously reported, this characteristic is expected to shape the decision to invest in socially responsible products as well.

Cross-sectional data stem from an online survey, developed and administered in June 2023 to a representative sample of 1,002 Italian consumers. The questionnaire (reported in the Supplementary material) was distributed via Qualtrics online survey platform. Participants were recruited through e-mail invitations and received monetary compensation (2.5€ per respondent) as an incentive for study participation. One thousand one hundred twenty individuals were originally contacted for the study, with a response rate of 89.5%. Survey completion required about 15 min. A written informed consent was obtained from respondents before they started the questionnaire. The Universitá Cattolica del Sacro Cuore Ethical Committee approved the current study, which adhered to the American Psychological Association (APA) standard ethical guidelines for research.

A quota sampling method was adopted to check sample representativeness for gender, age, education, and geographical area. The sample was equally distributed for gender (49.9% female). Participants' ages ranged from 18 to 54 years old, with a mean age of 37.19 years (SD = 10.94). As for education, 16.6% had a middle-school degree, while most respondents (52%) had a high-school diploma. The remaining 31.4% attended university. Referring to geographical area, 45.8% of participants lived in the north, specifically 26.4% in the north-west and 19.4% in the north-east. 22.4% lived in central parts of Italy, while the remaining 31.8% lived in the south. Socially responsible investors accounted for only 4.7% of the entire sample. The share of socially responsible investors within the sample is in line with previous inquiries on the Italian population (e.g., Petrillo et al., 2016).

In the present study, two attitudes toward socially responsible investments were investigated: perceived consumer effectiveness and trust.

Perceived consumer effectiveness was estimated specifically for socially responsible investments domain (e.g., “By investing in socially responsible products, every investor can have a positive impact on the environment”). Four items were developed on a Likert scale, ranging from 1 (I totally disagree) to 7 (I totally agree).

Trust on socially responsible investments was measured through a single statement representing consumers' confidence that socially responsible products consider only companies effectively respecting social and environmental sustainability (“I am confident that socially responsible products include only those companies concerned about environmental and social sustainability”). The item was developed on a seven-step Likert scale (1 = I totally disagree; 7 = I totally agree).

Personal norms were operationalized by using the GREEN Scale (Haws et al., 2014). This instrument reflects consumers' effort to adopt sustainable lifestyles and habits (e.g., “I consider the potential environmental impact of my actions when making many of my decisions”). The single-factor psychometric scale consists of six items, developed on a Likert scale ranging from 1 (I totally disagree) to 7 (I totally agree).

Perceived behavioral control was measured by four items created ad hoc for the present study (e.g., “I am convinced that my actions and behavior can make a difference in facing climate change”). The items were developed on a Likert-type agreement scale ranging from 1 (I totally disagree) to 7 (I totally agree).

Financial literacy was assessed through four questions concerning investment domain. Specifically, the “Big Three” developed by Lusardi and Mitchell (2011) were used to measure individuals' knowledge about interest rates, inflation, and risk diversification. Furthermore, an additional question was developed ad hoc to assess the understanding of the risk-return trade-off (“There is a direct link between risk and the return on a financial asset, so an investment with a high expected return is probably very risky”). Participants were asked to state whether that statement was true or false. A general index of financial literacy was then obtained by adding the number of correct answers. The total score ranged between 0 (no correct answers) and 4 (all answers correct).

Perceived knowledge on socially responsible investments was measured with a single ad hoc statement: “How would you assess your knowledge on socially responsible investments?” The item was developed on a Likert scale, ranging from 1 (I have never heard about that) to 7 (I have great knowledge about that).

Risk tolerance was measured through five items. Three out five of the items were retrieved from Kapteyn and Teppa (2011), while the remaining two items were developed ad hoc for the survey. The five items measure individuals' risk appetite specifically in financial and investment domains (e.g., “I get more and more convinced that I should take greater financial risks to improve my financial position”).

Individuals' concern for climate change issues was measured through six items developed on a seven-point Likert scale (1 = I totally disagree; 7 = I totally agree). The items were created ad hoc for the study and refer to a single factor (e.g., “Climate change is pushing the planet to a point of no return”).

To assess perceived connectedness to nature, the Illustrated Inclusion of Nature in Self scale (IINS; Kleespies et al., 2021) was adopted. The IINS is a graphical tool which consists of two circles: one represents the self, while the other stands for the natural environment. The two circles are presented gradually interconnected, metaphorically indicating the extent to which individuals feel a sense of oneness with nature. Respondents were thus asked to report the perceived degree of connection between them and the natural world.

To identify current responsible investors, respondents were required to indicate whether they owned socially responsible investment products at the time of the survey. Hence, we obtained a dummy variable (0 = not investing in SRI and 1 = currently investing in SRI). Furthermore, respondents were also asked to report their willingness to invest responsibly in future. After a brief explanation about socially responsible investments, participants had to answer this statement: “Would you consider investing your money in sustainable investment products in the next six months?” For those who were already sustainable investors, the statement was slightly different, as it was asked whether they considered additionally investing in socially responsible financial assets. Answers ranged on a seven-point Likert scale (1 = certainly not; 7 = certainly yes).

To understand which psychological profiles were associated with the decision to invest in socially responsible investments, we had to (1) identify the profiles present in our sample through a Latent Profile Analysis, and, then, (2) assess the association between these profiles and socially responsible investing decision.

Before performing the Latent Profile Analysis, Confirmatory Factor Analysis (CFA) was used to verify the theoretical model and assess the factorial structure of the scales considered in the present study. Various statistics were considered to evaluate the goodness of fit of the model(s): the Root Mean Square Error of Approximation (RMSEA), the Comparative Fit Index (CFI), and the Standardized Root Mean Square Residual (SRMR) were calculated. Scores of RMSEA and SRMR lower than 0.08 are considered acceptable, while a CFI higher than 0.90 indicates a good fit (Marsh et al., 2004). The confidence intervals (90%) of RMSEA (Little, 2013) and χ2 significance tests were checked as well, though the latter is strongly influenced by sample size (Bentler and Bonett, 1980). Furthermore, the CFA enabled us to save the factor scores of the scales and include in the Latent Profile Analysis a more reliable estimate of the variables.

To identify the groups that best describe the heterogeneity within the current sample, we performed a Latent Profile Analysis (LPA). Determinants suggested by classical literature on investment decision making (financial literacy, perceived knowledge on SRI, financial risk tolerance), determinants suggested by the TPB (perceived consumer effectiveness, trust, personal norms, perceived behavioral control), as well as determinants suggested by recent studies on socially responsible behavior (environmental concern, connectedness to nature) were included as observed indicators. We examined fit indices of measurement models, beginning with one class and adding classes incrementally. We stopped estimating additional classes when the LPA solution generated groups with a too small sample size (<5%; Masyn, 2013).

As suggested by Sorgente et al. (2019), selecting the optimal fitting model(s) was based on both inferential and descriptive relative fit indices. The statistical tests that were adopted as inferential measures of relative fit indices are the Vuong-Lo-Mendell-Rubin likelihood ratio test (VLMR-LRT; Vuong, 1989; Lo et al., 2001) and the adjusted Lo-Mendell-Rubin likelihood ratio test (adjusted LMR-LRT; Lo et al., 2001). These tests compare a (k-1)-class model with a k-class model; a statistically significant p-value suggests that the k-class model fits the data significantly better than a model with one less class. Conversely, if it is not significant, the k-class model is as good as the (k-1)-class model, so the (k-1)-class model is preferred according to parsimony criterion.

As descriptive measures of relative model fit, five information criteria (IC) were used. Specifically, the Akaike information criterion (AIC), the Consistent Akaike Information Criterion (CAIC), the Approximate Weight of Evidence (AWE), the Bayesian Information Criterion (BIC) and the Sample-size Adjusted Bayesian Information Criterion (SABIC). Smaller IC values indicate better fit.

Once the best model is selected, the quality of its classification (i.e., assignment of people to profiles) had to be evaluated (Masyn, 2013). The most common diagnostic classification is entropy (Ek), where values closer to 1 indicate a better classification of cases. Furthermore, the quality of the classification is evaluated by checking the class proportion (CPk or πk), the modal class assignment proportion (mcaPk), average posterior probability (avePPk), and odds of correct classification (OCCk). Particularly, classification can be considered good when the mcaPk for each profile is included in the 95% CI of the πk, avePPk values are equal to 0.70 or higher, and OCCk values are above 5 (Masyn, 2013; Sorgente et al., 2019).

After identifying the best solution for LPA, the factor scores of the categorical latent variable were saved, to have an observed variable indicating participants' membership to a specific latent profile. This observed variable was investigated in relation to socially responsible investing (not investing in SRI/currently investing in SRI), through a chi-square test in SPSS (version 27). As suggested by Sharpe (2015), standardized residuals were adopted to interpret chi-square test results, considering that the larger the residual, the greater the contribution of the cell to the magnitude of the resulting chi-square obtained value. Finally, a univariate analysis of variance (ANOVA) was performed to verify whether the latent profile membership affects the willingness to invest in socially responsible investment products. Post-hoc analyses were implemented using the Tukey's HSD (Honestly Significant Difference) test.

The CFA revealed good fit indices for each psychometric scale tested, thus suggesting a highly validity and reliability of the theoretical structure of the measures. Table 1 reports both the descriptive statistics and correlations for the measures included in the LPA, while Table 2 summarizes fit indices of the CFA performed for the psychometric scales. Finally, standardized factor loadings, Average Variance Extracted (AVE), and internal consistency scores (ω) are presented in Table 3.

We estimated eight different models of LPA (from 1-class to 8-class); we did not proceed with the 9-class model because both the 7- and 8-class solution presented one class with <5% of members (respectively 21 and 27 participants). As shown in Table 4, both the 5-class and the 6-class solution satisfied some fit indices. In particular, the inferential indices (the VLMR-LRT and the adjusted LMR-LRT) suggest that the 5-class solution should be preferred as it explains significantly more (p < 0.001) than solutions with less classes, while being equally good as solutions with more profiles (e.g., p = 0.39 for the 6-class solution). The descriptive indices, instead, do not offer a clear solution. They tend to decrease while the number of classes increases; the only exception is the AWE, for which the lowest value has been found for the 6-class solution. Considering that inferential indices suggest that the 6-class model is as good as the 5-class model (p = 0.39), we preferred the 5-class model according to parsimony criterion.

Consequently, the 5-class solution was investigated through classification diagnostics. As reported in Table 5, this solution satisfied all the classification–diagnostic criteria so we proceeded with the interpretation of the classes.

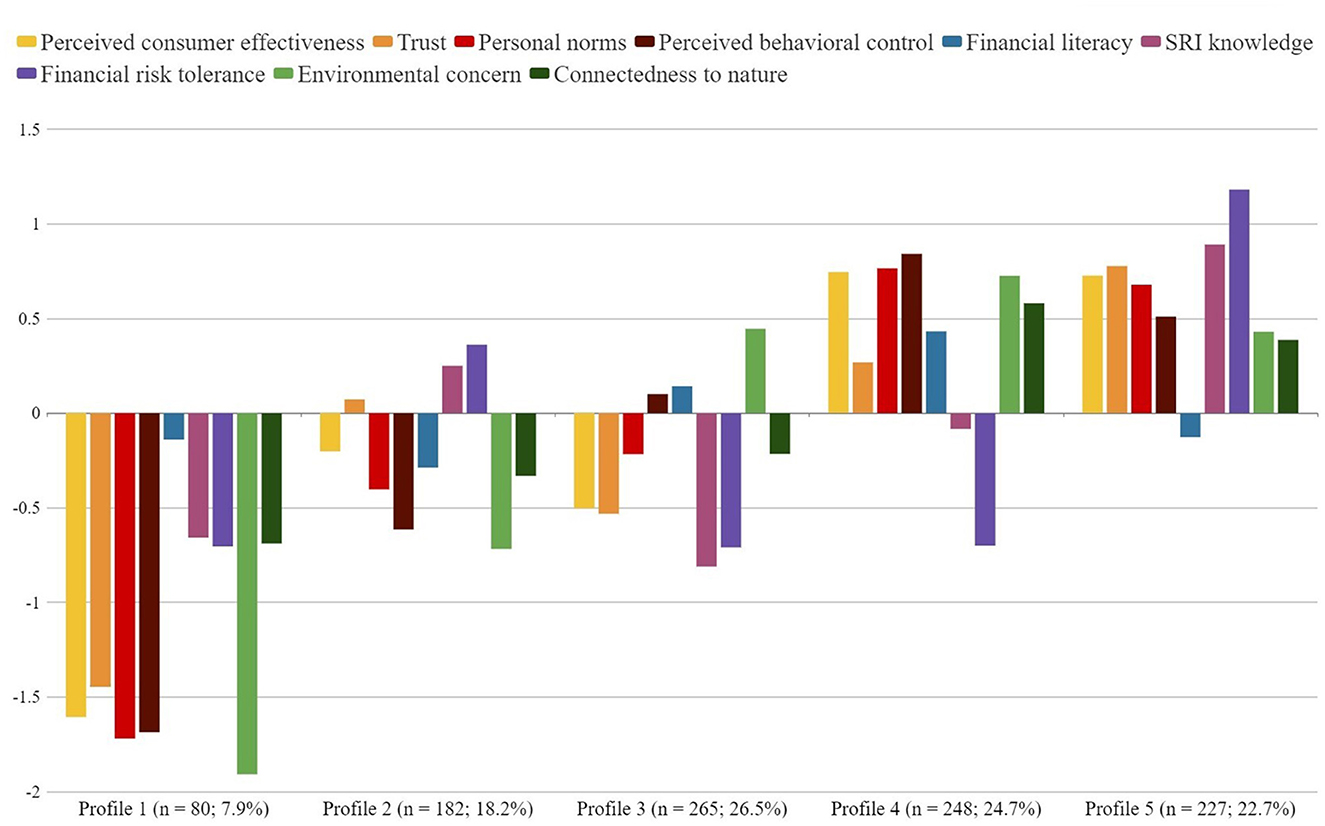

The five obtained classes (see Figure 1), representing five different patterns of determinants of SRI investment decision making, were named as follows. The first profile (n = 80; 7.9%) was named “lack of determinants” as it represents the only pattern in which all the nine investment decision determinants (financial literacy, perceived knowledge on SRI, financial risk tolerance, perceived consumer effectiveness, trust, personal norms, perceived behavioral control, environmental concern, connectedness to nature) are lower than the sample average. The second profile (n = 265; 26.5%) was named “classic determinants” because the only two indicators for which members of this group were above the sample average were perceived knowledge of SRI and financial risk tolerance. The third profile (n = 248; 24.7%) was named “environmental concern” as it was the only indicator for which participants included in this group were clearly above the sample average. The last two profiles, instead, were composed by participants who reported high levels for most of the determinants of SRI investment decision making. The most relevant difference is that members of profile 4 (n = 182; 18.2%) have a very low level of risk tolerance and an almost average level of SRI knowledge. They were indeed named “equipped but risk avoidant.” Members of profile 5 (n = 227; 22.7%) had a very high level of risk tolerance, accompanied by high levels of all the other determinants and an almost average level of financial literacy. They were indeed named “fully equipped.” Socio-demographic characteristics of the five sub-groups emerged through the LPA are reported in Supplementary Table A.1.

Figure 1. Representation of the five profiles detected in a sample of 1,002 Italian consumers. Values on the ordinate axis correspond to the factor scores mean level for the nine determinants of sustainable investment decision making.

Since the LPA solution showed sufficient levels of Entropy (Clark and Muthén, 2009), the factor scores of the obtained latent variable were saved to get an observed variable describing consumers' membership to the five profiles. This variable was then used to identify current and potential socially responsible investors. As for those currently investing in sustainable investment products, we found that the profiles were significantly associated with socially responsible investing [χ2(4) = 41.929; p < 0.001; Cramer's V = 0.205]. Specifically, as shown in Table 6, consumers belonging to the “fully equipped group” (Profile 5) were more likely to be socially responsible investors than would be expected by chance. In detail, 11.9% of this profile was currently investing in SRI, while the number of SR investors accounted for 4.7% of the total sample. On the contrary, individuals belonging to the “environmental concern” group (Profile 3) were less likely to be socially responsible investors than would be expected by chance. This sub-sample did not include any socially responsible investor. Profile 2 and profile 4 reported a percentage of SR investors almost like the whole sample (4.7%), respectively 3.4 and 5.5%.

The results from the univariate ANOVA reported differences among profiles in the likelihood of investing in socially responsible financial products. We found that the five latent profiles were significantly associated with the intention to invest in SRI in the next 6 months [F(4,997) = 107.523; p < 0.001; partial η2 = 0.301]. The partial eta squared (η2) indicated a large effect size. Furthermore, post-hoc analyses showed that the five subgroups were significantly different from each other. The highest likelihood of socially responsible investing was reported respectively by the “the fully equipped” group (Profile 5; M = 5.32; SD = 1.33) and those “equipped but risk avoidant” (Profile 4; M = 4.65; SD = 1.73). On the contrary, the lowest score of intention toward SRI was shown by members of the “environmental concern” group (Profile 3; M = 3.03; SD = 1.53). The scores of “classic determinants” group (Profile 2; M = 4.02; SD = 1.27) were quite like the sample mean (M = 4.05; SD = 1.74).

The purpose of the present study was to identify the characteristics of socially responsible investors. Using cross-sectional data of a representative sample of Italian consumers, a LPA was performed to identify different subgroups of respondents, characterized by different configuration of determinants of sustainable investment decision making. The association between the profiles emerged from our sample and the (current and potential) decision to invest in socially responsible investment products was subsequently tested through Chi-square test and ANOVA. The LPA resulted in five different profiles, though only one of them, “the fully equipped” ones (Profile 5) was significantly more likely to include socially responsible investors. On the contrary, the “environmental concern” group (Profile 3) was composed of consumers less likely to invest in socially responsible financial products. As for potential investors, the findings were quite similar, since “the fully equipped” profile (Profile 5) reported the highest willingness toward socially responsible investing, followed by the “equipped but risk avoidant” group (Profile 4). As well, profile 3 (i.e., the “environmental concern” ones) reported the lowest scores in the intention to invest in sustainable financial products.

Our results suggested that socially responsible investing is a matter of different aspects. As shown by the “classical determinants” group (Profile 2), classical determinants of investment decision making (i.e., risk tolerance and SRI knowledge) are not enough to explain the decision to invest responsibly. Furthermore, this profile reported lower levels than the average for environmental concern, and perceived behavioral control over the environment. Environmental concern alone was irrelevant as well. Indeed, the group “environmental concern” (Profile 3) was significantly less likely to include current or potential investors. It should be considered that this group was both lacking classical antecedents of investment decision making and showing negative attitudes (i.e., low levels of trust and perceived consumer effectiveness) toward SRI.

The “equipped but risk avoidant” and “fully equipped” groups (respectively, Profile 4 and 5) manifested many similarities, as they both reported positive attitudes toward SRI, together with higher levels of perceived behavioral control, environmental concern, and connectedness to nature. However, the two subgroups had also some differences. Indeed, those in the “equipped but risk avoidant” profile reported scores of financial literacy above the average, knowledge on SRI was close to the mean level and risk tolerance was significantly below the mean scores. Furthermore, this group did not manifest levels of trust toward SRI as high as the “fully equipped ones.” Conversely, the “fully equipped” ones were characterized by levels of financial literacy slightly below the average. The trend of the two groups would suggest that objective financial literacy is less relevant in the decision to invest in SRI. Various explanations can be drawn. Maybe, general knowledge is less determinant than specific knowledge on SRI. It should be also considered that knowledge on SRI was measured through a self-report item. On fact, it was a measure of perceived knowledge, rather than objective knowledge. Literature suggested a great gap between actual and self-assessed financial knowledge. Furthermore, it seems that in financial behaviors and decisions, perceived competencies might play a greater role than effective skills and knowledge themselves (Allgood and Walstad, 2016). This evidence could explain the pattern of the “fully equipped” group. Knowledge on socially responsible investments and risk appetite seem to have a key role in shaping actual sustainable investment decisions. We speculate that the reason why members of the “equipped but risk avoidant” group showed only intentions toward SRI, rather than actual investment decisions, is rooted in their lack of adequate levels of knowledge and risk appetite. Furthermore, differences between the two profiles make us suggest that environmental concern, connectedness to nature, personal norms, positive attitudes toward SRI and perceived control over the environment affect the decision to invest responsibly. At the same time, the role of classical antecedents of investment decision making should not be overlooked. Socially responsible investing is a matter of both psychological characteristics and classical antecedents of investment decisions, such as knowledge and risk appetite. In this direction, the “equipped but risk avoidant” ones might experience the so-called intention-behavior gap due to a lack of essential determinants in investment decision, in particular risk appetite.

The findings reported in the present study highlight the strengths of adopting a person-centered approach, as it allows us to estimate the effect of different configurations of the same variables on an outcome. Specifically, in the present study, socially responsible investing resulted to be shaped by a joint effect of both classical determinants of investment decisions, and non-financial aspects, such as moral values and consumers' attitudes. Our results are generally consistent with previous studies, showing that the profiles of socially responsible investors are characterized by a mixture of higher knowledge on SRI, risk appetite, positive attitudes toward SRI, personal values, perceived control over the environment, awareness on environmental issues and connectedness to nature (e.g., Apostolakis et al., 2018a; Gutsche and Zwergel, 2020; Gutsche et al., 2021; Roos et al., 2024). The profiles of potential sustainable investors are quite similar, though a subgroup of potential investors (Profile 4) reported perceived knowledge about SRI slightly below the average and a financial risk tolerance below the sample mean. We suggest that the reason why this profile includes only potential investors is rooted in the lack of relevant determinants in investment decision making (e.g., risk appetite). However, these results are in line with previous studies, which reported mixed results for the role of financial skills and risk appetite in socially responsible investing (Delsen and Lehr, 2019; Rossi et al., 2019). This matter deserves further investigation in future.

The present study is not lacking limitations. The first limit refers to the use of cross-sectional data. Since surveys rely on self-report items, data might also be somehow influenced by social desirability or other response biases. Furthermore, seen the exploratory nature of our contribution and the inclusion of Italian respondents, every kind of causal relationship and generalizability outside the Italian context should be made cautiously. Finally, despite the great number of variables included in our conceptual model, investors' motivations behind socially responsible investing were not attentioned. Nilsson (2009) suggested that people could invest in SRI for various reasons. While some may be attracted by the idea of investing in agreement with their personal values, others could conceive socially responsible investments as a way to diversify their portfolio or obtain better financial performance. Future studies should include this issue as well.

The present paper contributes to the literature on socially responsible investors by providing and testing a conceptual model in which both financial and non-financial aspects were considered as determinants of sustainable investment decision making. The increasing interest in socially responsible investments suggests that investors are not necessarily wealth maximisers, but they also aim at generating a positive impact on the environment and society. Since socially responsible investors consider also non-financial aspects, such as moral and ethical values, further investigations of the characteristics of sustainable investors and their motivations behind socially responsible investors are still needed. Moreover, understanding potential barriers preventing socially responsible investing could have relevant implications as well.

To date, literature on SRI is still lacking studies adopting behavioral models (i.e., theoretical models explaining human behavior) as theoretical framework, to systematically investigating the variables affecting the decision to invest responsibly. For this reason, the proposed framework was developed relying on the Theory of Planned Behavior, including financial (i.e., financial literacy and risk appetite) and psychological constructs, such as personal norms and attitudes, previously investigated in other studies. The purpose of our exploratory study was to explain socially responsible investing by considering different types of constructs. Hence, we contributed to literature by investigating the role of personal characteristics in socially responsible investing. Moreover, the originality of our study lies also in the adoption of a person-centered approach, by performing a clustering technique (i.e., LPA), which allowed us to define the profile(s) of socially responsible investors. While previous research (e.g., Riedl and Smeets, 2017) relied on a variable-centered approach, the novelty of the present study consists in the different perspective adopted. Indeed, by performing a clustering technique we were able to test which configurations of variables were mostly associated with the outcome.

Besides, our findings may have various practical implications. For instance, a better knowledge of socially responsible investors' characteristics might help to design investment products specifically addressed for those aiming to invest in line with their values. In this direction, socially responsible investments might make finance more inclusive, by also attracting individuals who are generally excluded by financial markets. For instance, despite the strong gender investment gap (in relation to conventional investment), literature on SRI highlighted that women are generally more interested in socially responsible investing (e.g., Rossi et al., 2019). Hence, sustainable financial products might represent a hint to promote financial market participation by leveraging on moral and ethical dimensions.

At the same time, the insights from our study may stimulate the development of ad hoc marketing campaigns to attract new potential sustainable investors. Specifically, our findings suggest that positive attitudes toward SRI are mandatory for socially responsible investing. Therefore, financial institutions should provide more information about screening criteria adopted for ESG ratings to clarify the process of corporate social responsibility evaluation. This practice could increase consumers' trust toward SRI. Similarly, our findings are consistent with previous studies in suggesting the key role of perceived consumers effectiveness. In other words, investors must perceive SRI as an effective way to face environmental and social issues. Otherwise, they could not invest in sustainable financial products. Financial institutions should develop strategies to report the concrete effects of socially responsible investing and show the impact that everyone can have through their investment decisions. Lastly, literacy on socially responsible investments should not be overlooked. Sustainable investment products are rather new and less diffused among private investors. Thus, banks and financial institutions should promote a greater knowledge specifically for SRI, as illiteracy could prevent consumers from socially responsible investments.

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

The studies involving humans were approved by Catholic University of the Sacred Hearth Ethical Committee. The studies were conducted in accordance with the local legislation and institutional requirements. The participants provided their written informed consent to participate in this study.

MR: Conceptualization, Data curation, Formal analysis, Methodology, Writing – original draft, Writing – review & editing. AS: Formal analysis, Investigation, Methodology, Writing – review & editing. PI: Conceptualization, Funding acquisition, Supervision, Writing – review & editing.

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. This study was partially supported by Flowe S.p.A., which funded data collection.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/frbhe.2024.1369261/full#supplementary-material

Ajzen, I. (1991). The theory of planned behavior. Organ. Behav. Hum. Perform. 50, 179–211. doi: 10.1016/0749-5978(91)90020-T

Ajzen, I., and Fishbein, M. (1980). Understanding Attitudes and Predicting Social Behavior. Englewood-Cliffs, NJ: Prentice-Hall.

Allgood, S., and Walstad, W. B. (2016). The effects of perceived and actual financial literacy on financial behaviors. Econ. Inq. 54, 675–697. doi: 10.1111/ecin.12255

Apostolakis, G., Kraanen, F., and Van Dijk, G. (2016). Examining pension beneficiaries' willingness to pay for a socially responsible and impact investment portfolio: a case study in the Dutch healthcare sector. J. Behav. Exp. Finance 11, 27–43. doi: 10.1016/j.jbef.2016.06.001

Apostolakis, G., Van Dijk, G., Blomme, R. J., Kraanen, F., and Papadopoulos, A. P. (2018a). Predicting pension beneficiaries' behaviour when offered a socially responsible and impact investment portfolio. J. Sustain. Finance Invest. 8, 213–241. doi: 10.1080/20430795.2018.1429148

Apostolakis, G., Van Dijk, G., Kraanen, F., and Blomme, R. J. (2018b). Examining socially responsible investment preferences: a discrete choice conjoint experiment. J. Behav. Exp. Finance 17, 83–96. doi: 10.1016/j.jbef.2018.01.001

Arvidsson, S., and Dumay, J. (2022). Corporate ESG reporting quantity, quality and performance: where to now for environmental policy and practice? Bus. Strategy Environ. 31, 1091–1110. doi: 10.1002/bse.2937

Avramov, D., Cheng, S., Lioui, A., and Tarelli, A. (2022). Sustainable investing with ESG rating uncertainty. J. Financ. Econ. 145, 642–664. doi: 10.1016/j.jfineco.2021.09.009

Bannier, C. E., and Neubert, M. (2016). Gender differences in financial risk taking: the role of financial literacy and risk tolerance. Econ. Lett. 145, 130–135. doi: 10.1016/j.econlet.2016.05.033

Barbaro, N., and Pickett, S. M. (2016). Mindfully green: examining the effect of connectedness to nature on the relationship between mindfulness and engagement in pro-environmental behavior. Pers. Individ. Differ. 93, 137–142. doi: 10.1016/j.paid.2015.05.026

Bauer, R., and Smeets, P. (2015). Social identification and investment decisions. J. Econ. Behav. Organ. 117, 121–134. doi: 10.1016/j.jebo.2015.06.006

Beloskar, V. D., Haldar, A., and Rao, S. (2023). Socially responsible investments: a retrospective review and future research agenda. Bus. Strategy Environ. 32, 4841–4860. doi: 10.1002/bse.3396

Bentler, P. M., and Bonett, D. G. (1980). Significance tests and goodness of fit in the analysis of covariance structures. Psychol. Bull. 88, 588–606. doi: 10.1037/0033-2909.88.3.588

Bloomberg (2021). ESG Assets Rising to $50 Trillion Will Reshape $140.5 Trillion of Global AUM by 2025, Finds Bloomberg Intelligence. Available online at: https://www.bloomberg.com/company/press/esg-assets-rising-to-50-trillion-will-reshape-140-5-trillion-of-global-aum-by-2025-finds-bloomberg-intelligence/ (Accessed January 9, 2024).

Borgers, A., and Pownall, R. A. (2014). Attitudes towards socially and environmentally responsible investment. J. Behav. Exp. Finance 1, 27–44. doi: 10.1016/j.jbef.2014.01.005

Brodback, D., Guenster, N., and Mezger, D. (2019). Altruism and egoism in investment decisions. Rev. Financ. Econ. 37, 118–148. doi: 10.1002/rfe.1053

Brunen, A., and Laubach, O. (2022). Do sustainable consumers prefer socially responsible investments? A study among the users of robo advisors. J. Bank. Finance 136:106314. doi: 10.1016/j.jbankfin.2021.106314

Camilleri, M. A. (2021). The market for socially responsible investing: a review of the developments. Soc. Responsib. J. 17, 412–428. doi: 10.1108/SRJ-06-2019-0194

Clark, S. L., and Muthén, B. (2009). Relating latent class analysis results to variables not included in the analysis (Unpublished paper).

Cleveland, M., Robertson, J. L., and Volk, V. (2020). Helping or hindering: environmental locus of control, subjective enablers and constraints, and pro-environmental behaviors. J. Clean. Prod. 249:119394. doi: 10.1016/j.jclepro.2019.119394

Delsen, L., and Lehr, A. (2019). Value matters or values matter? An analysis of heterogeneity in preferences for sustainable investments. J. Sustain. Finance Invest. 9, 240–261. doi: 10.1080/20430795.2019.1608709

Dong, X., Liu, S., Li, H., Yang, Z., Liang, S., Deng, N., et al. (2020). Love of nature as a mediator between connectedness to nature and sustainable consumption behavior. J. Clean. Prod. 242:118451. doi: 10.1016/j.jclepro.2019.118451

Dorfleitner, G., and Utz, S. (2014). Profiling German-speaking socially responsible investors. Qual. Res. Finance 6, 118–156. doi: 10.1108/QRFM-07-2012-0024

Gamel, J., Menrad, K., and Decker, T. (2016). Is it really all about the return on investment? Exploring private wind energy investors' preferences. Energy Res. Soc. Sci. 14, 22–32. doi: 10.1016/j.erss.2016.01.004

Gangi, F., Varrone, N., Daniele, L. M., and Coscia, M. (2022). Mainstreaming socially responsible investment: do environmental, social and governance ratings of investment funds converge? J. Clean. Prod. 353:131684. doi: 10.1016/j.jclepro.2022.131684

Garg, A., Goel, P., Sharma, A., and Rana, N. P. (2022). As you sow, so shall you reap: assessing drivers of socially responsible investment attitude and intention. Technol. Forecast. Soc. Change 184:122030. doi: 10.1016/j.techfore.2022.122030

Giefer, M. M., Peterson, M. N., and Chen, X. (2019). Interactions among locus of control, environmental attitudes and pro-environmental behaviour in China. Environ. Conserv. 46, 234–240. doi: 10.1017/S0376892919000043

Global Sustainable Investment Alliance (2020). Global Sustainable Investment Review 2020. Available online at: https://www.gsi-alliance.org/wp-content/uploads/2021/08/GSIR-20201.pdf (Accessed January 9, 2024).

Grable, J. E. (2016). “Financial risk tolerance”, in Handbook of Consumer Finance Research, ed. J. J. Xiao (Berlin: Springer eBooks), 19–31. doi: 10.1007/978-3-319-28887-1_2

Gutsche, G., León, A. K., and Ziegler, A. (2019). On the relevance of contextual factors for socially responsible investments: an econometric analysis. Oxf. Econ. Pap. 71, 756–776. doi: 10.1093/oep/gpy051

Gutsche, G., Nakai, M., and Arimura, T. H. (2021). Revisiting the determinants of individual sustainable investment—the case of Japan. J. Behav. Exp. Finance 30:100497. doi: 10.1016/j.jbef.2021.100497

Gutsche, G., and Ziegler, A. (2019). Which private investors are willing to pay for sustainable investments? Empirical evidence from stated choice experiments. J. Bank. Finance 102, 193–214. doi: 10.1016/j.jbankfin.2019.03.007

Gutsche, G., and Zwergel, B. (2020). Investment barriers and labeling schemes for socially responsible investments. Schmalenbach Bus. Rev. 72, 111–157. doi: 10.1007/s41464-020-00085-z

Hafenstein, A., and Bassen, A. (2016). Influences for using sustainability information in the investment decision making of non-professional investors. J. Sustain. Finance Invest. 6, 186–210. doi: 10.1080/20430795.2016.1203598

Haws, K. L., Winterich, K. P., and Naylor, R. W. (2014). Seeing the world through GREEN-tinted glasses: green consumption values and responses to environmentally friendly products. J. Consum. Psychol. 24, 336–354. doi: 10.1016/j.jcps.2013.11.002

Hermansson, C., and Jonsson, S. (2021). The impact of financial literacy and financial interest on risk tolerance. J. Behav. Exp. Finance 29:100450. doi: 10.1016/j.jbef.2020.100450

Hosta, M., and Žabkar, V. (2021). Antecedents of environmentally and socially responsible sustainable consumer behavior. J. Bus. Ethics 171, 273–293. doi: 10.1007/s10551-019-04416-0

Hsiao, Y. J., and Tsai, W. (2018). Financial literacy and participation in the derivatives markets. J. Bank Financ. 88, 15–29. doi: 10.1016/j.jbankfin.2017.11.006

Jansson, M., Sandberg, J., Biel, A., and Gärling, T. (2014). Should pension funds' fiduciary duty be extended to include social, ethical and environmental concerns? A study of beneficiaries' preferences. J. Sustain. Finance Invest. 4, 213–229. doi: 10.1080/20430795.2014.928997

Jonwall, R., Gupta, S., and Pahuja, S. (2023). A comparison of investment behavior, attitudes, and demographics of socially responsible and conventional investors in India. Soc. Responsib. J. 19, 1123–1141. doi: 10.1108/SRJ-08-2021-0358

Kapteyn, A., and Teppa, F. (2011). Subjective measures of risk aversion, fixed costs, and portfolio choice. J. Econ. Psychol. 32, 564–580. doi: 10.1016/j.joep.2011.04.002

Keller, C., and Siegrist, M. (2006). Investing in stocks: the influence of financial risk attitude and values-related money and stock market attitudes. J. Econ. Psychol. 27, 285–303. doi: 10.1016/j.joep.2005.07.002

Kleespies, M. W., Braun, T., Dierkes, P. W., and Wenzel, V. (2021). Measuring connection to nature—a illustrated extension of the inclusion of nature in self scale. Sustainability 13:1761. doi: 10.3390/su13041761

Kwon, H. R., and Silva, E. (2020). Mapping the landscape of behavioral theories: systematic literature review. J. Plan. Lit. 35, 161–179. doi: 10.1177/0885412219881135

Lengieza, M. L., and Swim, J. K. (2021). The paths to connectedness: a review of the antecedents of connectedness to nature. Front. Psychol. 12:763231. doi: 10.3389/fpsyg.2021.763231

Lin, S., and Niu, H. (2018). Green consumption: environmental knowledge, environmental consciousness, social norms, and purchasing behavior. Bus. Strategy Environ. 27, 1679–1688. doi: 10.1002/bse.2233

Lo, Y., Mendell, N. R., and Rubin, D. B. (2001). Testing the number of components in a normal mixture. Biometrika 88, 767–778. doi: 10.1093/biomet/88.3.767

Lusardi, A., and Mitchell, O. S. (2011). Financial literacy around the world: an overview. J. Pension Econ. Finance 10, 497–508. doi: 10.1017/S1474747211000448

Marsh, H. W., Hau, K., and Wen, Z. (2004). In search of golden rules: comment on hypothesis-testing approaches to setting cutoff values for fit indexes and dangers in overgeneralizing Hu and Bentler's (1999) findings. Struct. Equ. Modeling 11, 320–341. doi: 10.1207/s15328007sem1103_2

Masyn, K. E. (2013). “Latent class analysis and finite mixture modeling”, in The Oxford Handbook of Quantitative Methods in Psychology: Vol. 2: Statistical Analysis, ed. T. D. Little (New York, NY: Oxford University Press), 551–611. doi: 10.1093/oxfordhb/9780199934898.013.0025

Nilsson, J. (2008). Investment with a conscience: examining the impact of pro-social attitudes and perceived financial performance on socially responsible investment behavior. J. Bus. Ethics 83, 307–325. doi: 10.1007/s10551-007-9621-z

Nilsson, J. (2009). Segmenting socially responsible mutual fund investors. Int. J. Bank Mark. 27, 5–31. doi: 10.1108/02652320910928218

Nilsson, J., Nordvall, A., and Isberg, S. (2010). The information search process of socially responsible investors. J. Financ. Serv. Mark. 15, 5–18. doi: 10.1057/fsm.2010.5

OECD (2013). Financial Literacy and Inclusion: Results of OECD/INFE Survey Across Countries and by Gender. Paris: OECD Publishing.

Palacios-González, M. M., and Chamorro-Mera, A. (2018). Analysis of the predictive variables of the intention to invest in a socially responsible manner. J. Clean. Prod. 196, 469–477. doi: 10.1016/j.jclepro.2018.06.066

Patel, J. D., Trivedi, R. H., and Yagnik, A. (2020). Self-identity and internal environmental locus of control: comparing their influences on green purchase intentions in high-context versus low-context cultures. J. Retail. Consum. Serv. 53:102003. doi: 10.1016/j.jretconser.2019.102003

Pérez-Gladish, B., Benson, K. L., and Faff, R. W. (2012). Profiling socially responsible investors: Australian evidence. Aust. J. Manag. 37, 189–209. doi: 10.1177/0312896211429158

Petrillo, A., De Felice, F., García-Melón, M., and Pérez-Gladish, B. (2016). Investing in socially responsible mutual funds: Proposal of non-financial ranking in Italian market. Res. Int. Bus. Finance 37, 541–555. doi: 10.1016/j.ribaf.2016.01.027

Riedl, A., and Smeets, P. (2017). Why do investors hold socially responsible mutual funds? J. Finance 72, 2505–2550. doi: 10.1111/jofi.12547

Roos, J. M., Jansson, M., and Gärling, T. (2024). A three-level analysis of values related to socially responsible retirement investments. J. Sustain. Finance Invest. 14, 1–17. doi: 10.1080/20430795.2022.2077291

Rossi, M., Sansone, D., Van Soest, A., and Torricelli, C. (2019). Household preferences for socially responsible investments. J. Bank Finance 105, 107–120. doi: 10.1016/j.jbankfin.2019.05.018

Rozenkowska, K. (2023). Theory of planned behavior in consumer behavior research: a systematic literature review. Int. J. Consum. Stud. 47, 2670–2700. doi: 10.1111/ijcs.12970

Schwartz, S. H. (1973). Normative explanations of helping behavior: a critique, proposal, and empirical test. J. Exp. Soc. Psychol. 9, 349–364. doi: 10.1016/0022-1031(73)90071-1

Seifert, M., Gangl, K., Spitzer, F., Haeckl, S., Gaudeul, A., Kirchler, E., et al. (2022). Financial Return and Environmental Impact Information Promotes ESG Investments: Evidence from a Large, Incentivized Online Experiment. SSRN [Preprint]. doi: 10.2139/ssrn.4294495

Shanmugam, K., Vijayabanu, C., and Parayitam, S. (2022). Effect of financial knowledge and information behavior on sustainable investments: evidence from India. J. Sustain. Finance Invest. 1–24. doi: 10.1080/20430795.2022.2073958

Sharpe, D. (2015). Your Chi-Square test is statistically significant: now what? Pract. Assess. Res. Eval. 20, 1–10. doi: 10.7275/tbfa-x148

Singh, M., Mittal, M., Mehta, P., and Singla, H. (2021). Personal values as drivers of socially responsible investments: a moderation analysis. Rev. Behav. Finance 13, 543–565. doi: 10.1108/RBF-04-2020-0066

Sorgente, A., Lanz, M., Serido, J., Tagliabue, S., and Shim, S. (2019). Latent transition analysis: Guidelines and an application to emerging adults' social development. TPM - Test. Psychom. Methodol. Appl. Psychol. 26, 39–72. doi: 10.4473/TPM26.1.3

Tam, K., and Chan, H. (2017). Environmental concern has a weaker association with pro-environmental behavior in some societies than others: a cross-cultural psychology perspective. J. Environ. Psychol. 53, 213–223. doi: 10.1016/j.jenvp.2017.09.001

Thomas, A., and Spataro, L. (2018). Financial literacy, human capital and stock market participation in Europe. J. Fam. Econ. Issues 39, 532–550. doi: 10.1007/s10834-018-9576-5

Vuong, Q. (1989). Likelihood ratio tests for model selection and non-nested hypotheses. Econometrica 57:307. doi: 10.2307/1912557

Vyas, V., Mehta, K., and Sharma, R. (2022). Investigating socially responsible investing behaviour of Indian investors using structural equation modelling. J. Sustain. Finance Invest. 12, 570–592. doi: 10.1080/20430795.2020.1790958

Wettstein, F., Giuliani, E., Santangelo, G. D., and Stahl, G. K. (2019). International business and human rights: a research agenda. J. World Bus. 54, 54–65. doi: 10.1016/j.jwb.2018.10.004

Widyawati, L. (2020). A systematic literature review of socially responsible investment and environmental social governance metrics. Bus. Strateg. Environ. 29, 619–637. doi: 10.1002/bse.2393

Williams, G. (2007). Some determinants of the socially responsible investment decision: a cross-country study. J. Behav. Finance 8, 43–57. doi: 10.1080/15427560709337016

Wins, A., and Zwergel, B. (2016). Comparing those who do, might and will not invest in sustainable funds: a survey among German retail fund investors. Bus. Res. 9, 51–99. doi: 10.1007/s40685-016-0031-x

Yang, M. X., Tang, X., and Cheung, M. L. (2020). An institutional perspective on consumers' environmental awareness and pro-environmental behavioral intention: evidence from 39 countries. Bus. Strateg. Environ. 30, 566–575. doi: 10.1002/bse.2638

Yu, E. P., Van Luu, B., and Chen, C. H. (2020). Greenwashing in environmental, social and governance disclosures. Res. Int. Bus. Finance 52:101192. doi: 10.1016/j.ribaf.2020.101192

Keywords: socially responsible investments, ESG, investment decision making, behavioral finance, Theory of Planned Behavior, values, individual differences, Latent Profile Analysis

Citation: Robba M, Sorgente A and Iannello P (2024) In search of socially responsible investors: a Latent Profile Analysis. Front. Behav. Econ. 3:1369261. doi: 10.3389/frbhe.2024.1369261

Received: 11 January 2024; Accepted: 14 March 2024;

Published: 03 April 2024.

Edited by:

Thomas Post, Maastricht University, NetherlandsReviewed by:

Kenneth De Beckker, Open University of the Netherlands, NetherlandsCopyright © 2024 Robba, Sorgente and Iannello. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Matteo Robba, bWF0dGVvcGFvbG8ucm9iYmFAdW5pY2F0dC5pdA==

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.