- Department of Psychological and Behavioural Science, London School of Economics and Political Science, London, United Kingdom

The disposition effect is one of the most prominent and widely studied behavioral biases observed among investors. It describes the tendency to close out winning investments prematurely while holding on to losing ones for too long and is generally associated with reduced investment returns. Researchers have explored various debiasing strategies and interventions to mitigate the disposition effect and its detrimental impact on returns. We summarize a between-subject experiment with n = 132 UK participants testing the impact of an informational feedback-like intervention to mitigate the disposition effect, informing participants about the disposition effect. Moreover, we re-examine our intervention's impact in the follow-up measurements which are 2 weeks and again 3 months after the first measurement. We find our intervention to have a significant impact, reducing the disposition effect in the first measurement. In addition, we still find a significant impact of the intervention, reducing the disposition effect after 2 weeks, while no significant impact is observed at the 3-month point. While we find a higher disposition effect to be associated with lower returns for one measurement, the opposite is true for the other two measurements. Moreover, the intervention had a return reducing impact for one measurement and no significant impact for the other two. Overall, our study shows a promising intervention that may be readily deployed among retail investors with a somewhat lasting impact to mitigate the disposition effect. However, our study also shows that the relationship between the disposition effect and investment returns is nuanced.

1 Introduction

Over the past decades, retail investors have taken increasingly active roles in managing their personal financial investments (Barber and Odean, 2001). While 10% of all U.S. equity trading volume was attributed to retail investors in 2010, their share almost doubled to 19.5% in the first half of 2020 (Osipovich, 2020). Similar increases have been witnessed in the United Kingdom, Australia, and Canada (Fleming et al., 2021; Rapaport, 2021; Withers and Cohn, 2021). Given the increasing participation of retail investors in the stock market, it is important to understand how behavioral biases impact investment decisions and returns in the context of retail investors.

While previous literature has shown that various types of investors are susceptible to behavioral biases (Odean, 1998; Grinblatt and Keloharju, 2001; Barber et al., 2007; Chen et al., 2007) that negatively affect trading returns, this is particularly the case for retail investors. One of the most prominent and widely studied behavioral biases observed among retail and other investors is the disposition effect. It refers to the tendency to close out winning investments prematurely while holding on to losing ones for too long and is associated with reduced investment performance (Odean, 1998; Aspara and Hoffmann, 2015a; Koestner et al., 2017).

Given the negative implications of the disposition effect on investment returns—in the absence of mean-reversion (Guenther and Lordan, 2023)—researchers have explored various debiasing strategies and interventions to mitigate the disposition effect (e.g., Weber and Camerer, 1998; Frydman and Rangel, 2014; Fischbacher et al., 2017). However, the majority of the studies have been conducted with student participants and—to the best of our knowledge—have not investigated whether their intervention has a lasting impact on decision making in the absence of the intervention. In our paper we aim to contribute to a better understanding of the impact of an informational intervention in the context of retail investors as well as the potential longevity of the effect of the intervention by measuring the effect 2 weeks and 3 months after the intervention.

1.1 Literature review

1.1.1 Theoretical foundations of the disposition effect

The disposition effect is a manifestation of potential suboptimal choices in the context of trading. While the disposition effect is well-documented, the underlying mechanisms remain subject to debate (Ahn, 2022). The propensity to sell winners too soon and the reluctance to realize losses cannot be explained by rational reasons such as tax saving, portfolio rebalance, private information, or transaction costs (Shefrin and Statman, 1985; Odean, 1998). Many studies, therefore, “…acknowledge investors' psychological biases and heuristics…” (Jiao, 2017, p. 29) as a source of the disposition effect.

Shefrin and Statman (1985), who coined the disposition effect, used prospect theory as a theoretical framework for analyzing the bias. Prospect theory is a prominent behavioral science theory developed by Kahneman and Tversky (1979). Prospect theory suggests that decisions under uncertainty are influenced by an individual's perception of gains and losses relative to a reference point, and that individuals tend to be risk-averse in the gain and risk-seeking in the loss domain. In the context of investing, this suggests that investors have a higher propensity to sell winning investments to lock in gains (risk aversion) while being reluctant to sell losing investments (risk seeking). In addition to prospect theory, mental accounting, first developed by Thaler (1980), describes how individuals tend to segregate different gambles into different separate mental accounts and make decisions for each account individually without considering the aggregate or portfolio. In the context of trading, this means that investors establish a mental account for each stock as opposed to treating their positions in aggregate as a portfolio.

However, prospect theory is descriptive in nature and thus unable to explain the underlying psychological drivers (Sunstein, 2002). Shefrin and Statman (1985) propose that the disposition effect involves the emotions of regret and pride which has also been supported by Fogel and Berry (2006). They suggested that the emotion of regret emerges when the stock price plummets leading investors to delay the loss-realization to avoid the feeling of regret while wishfully thinking the price will recover. In contrast, when facing gains, investors are inclined to realize the gains sooner to claim victory for having made the right decisions at the beginning. Similarly, Summers and Duxbury (2012) suggested that prospect theory alone is not sufficient to explain the disposition effect, and that regret and elation are necessary causes for the disposition effect. Aspara and Hoffmann (2015a) propose that the disposition effect can be partly attributed to an investor assuming responsibility for a winning investment but not for a losing one. This skewed sense of responsibility prompts individuals to prematurely cash in on winning positions to validate their personal choices, while simultaneously postponing the closure of losing positions.

Another potential explanation is the (rational or non-rational) belief in mean-reversion, meaning the belief that “…today's losers will outperform later and the winners will underperform” (Talpsepp et al., 2014, p. 32). While Weber and Camerer (1998) and Kaustia (2010) cast doubt on mean-reversion as an explanation for the disposition effect, it is supported by the findings of Jiao (2017) in a lab experiment, Brooks et al. (2012) using functional magnetic resonance imaging (the “fMRI”), as well as Goulart et al. (2013) measuring psychophysiological characteristics.

The disposition effect can also be seen from a goal systems theory (Kruglanski et al., 2002) point of view, considering the impact of goal attainment on motivation to pursue a specific goal. Aspara and Hoffmann (2015b) applied this theory in an investment context where an investor could regard a winning stock as positive progress toward their goal of making a profit. This positive progress would decrease an individual's motivation to put in extra effort to attain the goal. Conversely, in the case of a losing stock, an investor could be motivated to devote more effort to reversing the losing stocks to profit, thus delaying loss realization.

1.1.2 Evidence of the disposition effect

Our work is related to the growing body of literature evidencing the existence of the disposition effect in different populations. Odean (1998) analyzed trading records of 10,000 retail investors at a major U.S. discount brokerage house from 1987 to 1993, demonstrating a strong tendency among retail investors to sell winners sooner than losers, thus exhibiting the disposition effect. Similarly, Dhar and Zhu (2006) confirmed the disposition effect exists among individual investors, using trading data of 50,000 individual investors from 1991 to 1996. Pelster and Hofmann (2018) leveraged the trading records of 354,817 traders from the eToro social trading platform between 2012 and 2015. While they found the disposition effect among retail traders in general, it was more pronounced among the leaders who gave trading guidance to their followers. Similarly, Ahn (2022) and Zhang et al. (2022) find consistent evidence that retail investors are subject to the disposition effect.

The disposition effect has also been documented in other international markets, for example, Finland (Grinblatt and Keloharju, 2001), Taiwan (Barber et al., 2007; Cheng et al., 2013), Korea (Ahn, 2022), Estonia (Talpsepp et al., 2014), China (Feng and Seasholes, 2005; Jin et al., 2021), and Israel (Shapira and Venezia, 2001). Furthermore, investor demographics, financial attitudes, and financial literacy have been shown to be associated with the quality of financial decisions (Fünfgeld and Wang, 2009; Lind et al., 2020). However, evidence has been inconclusive and contradictory regarding gender and age effects as shown by Feng and Seasholes (2005) as well as Grinblatt and Han (2005). Lastly, trading experience is a strong predictor concerning the magnitude of the disposition effect (Feng and Seasholes, 2005; Shumway and Wu, 2005; Heimer, 2016).

1.1.3 Mitigating the disposition effect

As the disposition effect has been shown to be detrimental to investment returns (Odean, 1998; Aspara and Hoffmann, 2015a; Koestner et al., 2017), financial and behavioral literature has explored ways to mitigate the disposition effect and its detrimental impact on investment returns. Existing papers have successfully deployed and investigated various techniques and approaches more general to reduce the magnitude of the disposition effect across different populations. These interventions include automatic or pre-determined position closeouts, feelings of responsibility for a position as well as informational interventions.

1.1.3.1 Automatic close-out and limit order interventions

In an early study conducted by Weber and Camerer (1998) with n = 103 German university students, participants made a series of buy and sell decisions for six risky assets spanning a total of 14 trading periods. In one of the conditions, all positions were sold automatically at the end of each trading period and participants—if they wanted to continue holding a position in a specific asset—had to re-establish this position again by buying the asset. The authors found a significant reduction in the disposition effect in the automatic sale condition compared to the condition without it.

Ploner (2017) conducted a lab experiment with n = 159 students and found that the disposition effect can be reversed when a contingent plan of investment decisions is pre-defined depending on the future price development. This result is supported by Fischbacher et al. (2017) who tested a very similar intervention, where the authors found that stop-loss/take-gain orders1 mitigated the disposition effect. The authors noted, however, that their intervention only had a significant impact in reducing the disposition effect in the case of binding orders whereas reminders of the intention to close out their position did not.

1.1.3.2 Purchase price salience and personal responsibility

Frydman and Rangel (2014) identified in an experimental trading market with n = 58 Caltech participants that the disposition effect can be attenuated by reducing the salience of the purchased price. Aspara and Hoffmann (2015a) found that investors who feel their prior investment losses were attributed to their fault and their prior gains attributed to external factors display the disposition effect to a lesser degree.

Furthermore, the nature of the investments, whether they are delegated assets2 such as mutual funds, can also influence the magnitude of the disposition effect. When compared to non-delegated investments, such as individual stocks, investors generally exhibit a lower level of the disposition effect. For delegated investments, individuals can reduce cognitive dissonance avoiding to admit that past investments were bad investments in the case of poor investment outcomes. Delegation allows investors to blame the poor results on their fund managers (Chang et al., 2016). Similarly, Lee et al. (2008) found a lower disposition effect in individuals who were imagining making investment decisions on behalf of someone else, and Summers and Duxbury (2012) noted that whether or not stocks are owned through an investor's own choice influenced the magnitude of the disposition effect.

1.1.3.3 Informational interventions

Providing information about the disposition effect, its detrimental impact on investment returns, and potential emotional drivers of the disposition effect has also been shown to be a successful debiasing strategy. For example, Dobrich et al. (2014) found that informing investors about the negative impacts of the disposition effect on investment returns and recommending investment practices is an effective strategy to not only reduce but even reverse the disposition effect. In their between-subject experiment with n = 223 private investors that followed the procedure of Weber and Camerer (1998), participants were either exposed to one of three treatment conditions or the control condition. In the three treatment conditions, the participants were shown an informational text about the disposition effect and its detrimental impact on investment return with either an instructive warning (rational debiasing), an appeal to emotions feelings and emotions (emotional debiasing), or both combined (combined rational and emotional debiasing). Their participants were recruited across German-speaking Europe via university lectures, investment clubs, and bankers' academies. While the participants in the control condition exhibited, on average, a significant disposition effect, the participants across all three treatment conditions exhibited a significant average reverse disposition effect. Their study shows that informational interventions can be a powerful way to mitigate the disposition effect, however, it remains unclear if such an intervention has a lasting effect or if the impact is short-lived.

Similarly, Guenther and Lordan (2023) showed that the disposition effect can be reduced among professional traders by presenting a related informational intervention about the existence of the disposition effect before traders make trading decisions. In their within-subject online study with n = 193 mostly UK-based professional traders, they found the intervention to significantly reduce the disposition effect. The authors also investigated the impact of the intervention on the subsets of mean reverting and non-mean reverting securities. Drawing from their findings, they emphasize the significance of deploying a disposition effect reducing intervention within specific contexts. They highlight that while reducing the disposition effect can be advantageous for non-mean reverting securities, it may prove disadvantageous for mean reverting securities.

1.2 Study goal, hypotheses, and contribution

Given the negative implications of the disposition effect on investment returns, researchers have explored various debiasing strategies and interventions to mitigate the disposition effect. Our objective is to add to the growing body of literature by investigating the existence of the disposition effect amongst UK retail investors as well as testing an informational intervention similar to Dobrich et al. (2014). We hypothesize that: (i) investors exhibit the disposition effect, (ii) providing information about the disposition effect and its potential negative investment consequences, reduces the magnitude of it which ultimately improves investment returns, and (iii) that our intervention has a lasting impact on reducing the disposition effect even in the absence of the intervention.

Our study adds to the existing research on (informational) intervention to reduce the disposition effect among investors. Expanding on the study by Dobrich et al. (2014) we assess the impact of a very similar intervention in a different context. In contrast to Dobrich et al. (2014) our study was conducted with UK residents—as opposed to German-speaking residents in Europe. In addition, we deploy a different experimental set-up from Guenther and Lordan (2023) as well as a slightly different framing of the intervention. Instead of simply providing information about the disposition effect, and its potential detrimental consequences of the disposition effect, we structure our intervention in a manner that appears to be personalized feedback to participants' previous behaviors. Feedback has been shown to be a valuable tool to improve decision-making in various contexts (Ben-David et al., 2018). Furthermore, we are extending the study of Guenther and Lordan (2023) by shifting the focus from professional traders to retail investors. This alteration in the target population is made because retail investors, who generally have lower financial sophistication, are more vulnerable to trading biases (Dhar and Zhu, 2006; Chen et al., 2007) and would benefit from feedback.

The proposed intervention is also related to the broader literature around just-in-time education3 which has been found to improve the quality of financial decision making. Just-in-time education is highly relevant to a specific decision or circumstance, and it is delivered at the moment when people are about to make a decision and need the information most (Fernandes et al., 2014). In contrast to formal financial education delivered in schools, just-in-time education minimizes forgetting while people can immediately apply the knowledge to financial decisions. Furthermore, The United States Senate Special Committee on Aging (2022) showed that while a significant share of the U.S. population has low levels of financial literacy to make sound decisions on their lives and retirement, just-in-time education could be a supporting system for people to navigate financial decisions over their lifetimes.

By assessing the longevity of the effect of our intervention after 2 weeks and 3 months, we also add to the discussion on the long-term efficacy of behavioral intervention. Chater and Loewenstein (2023) assert the limited long-term effectiveness of behavioral intervention focusing on individuals while advocating more resources should be devoted to interventions that target a systematic change of rules and regulations. Hagger and Hamilton (2023) suggest that well-designed individual-oriented interventions can produce sustained behavioral change.

2 Material and methods

2.1 Participants

In the first instance, we conducted an online between-subject experiment with a total of n = 132 UK participants recruited via Prolific Academic in June 2023 which serves as the Measurement 1. Out of the participants, 61.3% self-reported to be female and the age of the qualified participants in our sample ranged from 18 to 76 years (M = 38.8, SD = 12.0). Notably, about 30% of participants belonged to the age group of 26–35 while 27% of them were in the age group of 36–45. Furthermore, participants in our sample self-reported investment experience ranging from 0 to 20 years (M = 1.9, SD = 4.4). Particularly, ~66% of survey participants indicated they had no self-directing investment experience. The median completion time of the participants was 6.1 min (SD = 3.7 min). For further participant details by study please refer to Supplementary Table S1.

To further assess the lasting impact of the intervention in mitigating the disposition effect, we conducted two follow-up measurements. The first follow-up measurement (Measurement 2) took place 2 weeks after Measurement 1 while the second follow-up measurement (Measurement 3) took place 3 months after Measurement 1. For both follow-up measurements, we re-invited all the n = 132 participants of Measurement 1. In the case of Measurement 2, a total of n = 118 participants (or 89%) followed our invitation to take part in it. For the Measurement 3, a total of n = 108 participants (or 82%) re-engaged in this round of experiment. The study was conducted in accordance with the ethics procedures of researchers' institution (ethics approval number: 229648).

2.2 Procedure

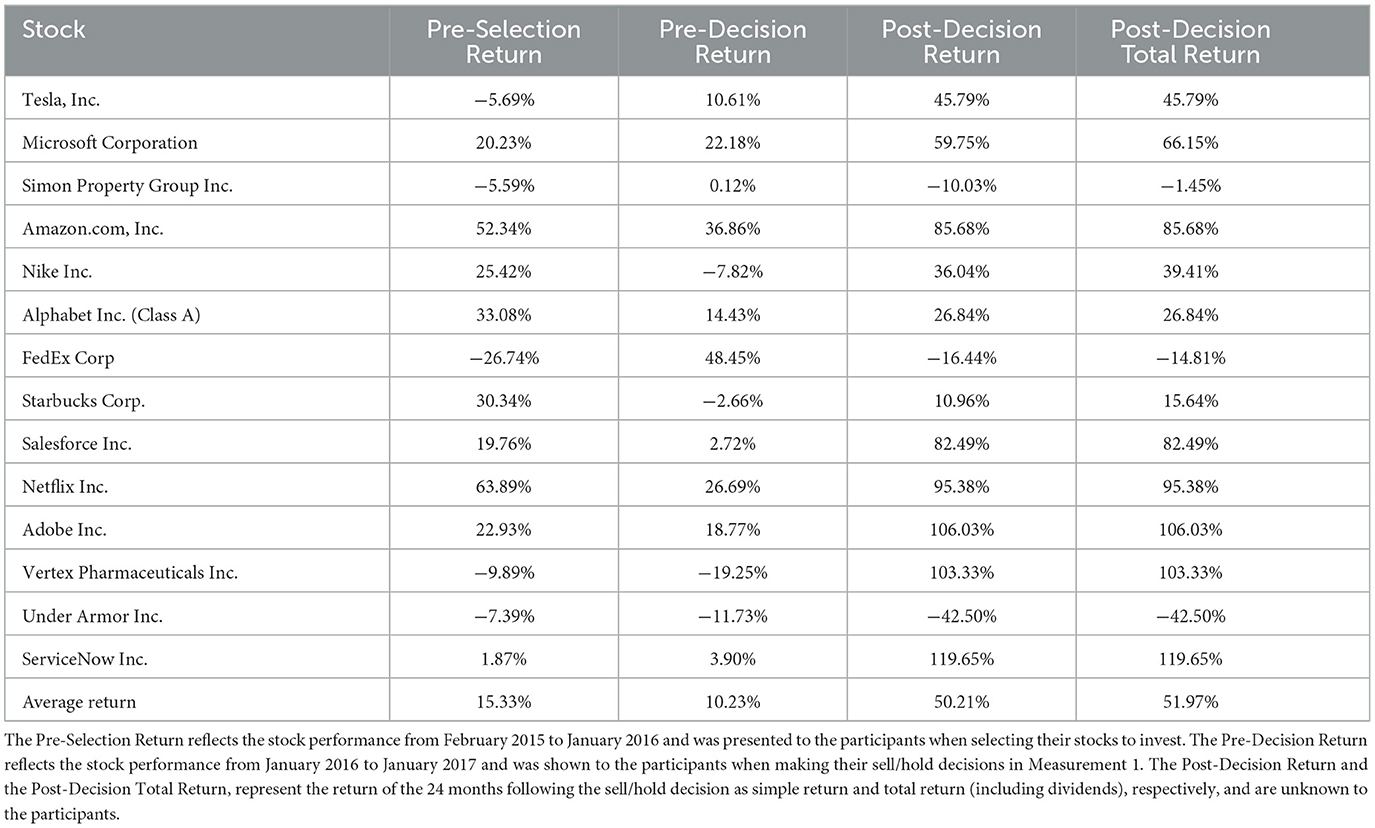

Similar to Guenther and Lordan (2023), the participants for Measurement 1 were put in a hypothetical trading situation and presented with a total of 14 candlestick charts of actual tradable stocks4 in random order (refer to Supplementary Figure S1 for an example). For each stock 50 trading periods (weeks) were displayed while the identity of the underlying stock was disguised. Participants were then asked to choose 10 of the stocks to buy (invest in) allocating an equal amount of $10,000 to each stock with the task of maximizing their return over a 2-year period (experimental instructions including information about the stocks can be found in Supplementary Figure S2; Supplementary material S1.1–S1.3; details of the stocks are summarized in Table 1). Participants were remunerated in line with Prolific guidelines and additionally incentivized with a payment of 20 GBP for the participant with the highest portfolio return. After making their selection of stocks, participants were presented with the trading data for their ten chosen stocks (in random order) for an additional 50 periods and asked for each stock whether they would like to keep this specific position or close it out. After making the sell or hold decision for the second stock, participants were randomly allocated to either see the following informational intervention (treatment) or a text of similar length about the history of stock markets (control; see Supplementary material S1.4):

Information for Maximizing Your Investment Performance

YOU may be subject to the disposition effect, which is evidenced to be detrimental to long-term investment return according to a number of behavioral finance studies. The disposition effect is featured in two behaviors:

1. Closing out winning positions too early,

2. Holding losing positions for too long.

Existing studies indicate that it is generally advantageous to hold winning positions longer and to limit losses by closing losing positions earlier to improve your investment return. This is because winning stocks generally continue to outperform but losing investment people tend to hold on to continue to underperform.

The sell or hold decisions from then onwards form the basis of the disposition effect calculations for the respective participant in line with Odean (1998) procedure as the difference between the proportion of gains realized and the proportion of losses realized. The informational intervention is provided after the participants have made decisions for two stocks, just before the decision for the third stock. This timing and phrasing of the intervention is deliberate to appear as feedback based on the decisions made for the prior two stocks while keeping as many data points as possible for evaluation of the disposition effect. Notably, the feedback is not a true reflection of each individual's disposition effect; instead, it is pseudo-feedback that appears to be personalized to the individual participant. At the end of the survey, we also asked the participants to report on a number of demographic information such as age, gender, and trading experience which have been shown to be associated with inter-individual differences in the context of the disposition effect.

In the follow-up measurements the participants were asked to make sell or hold decisions on ten stocks which were presented in random order and based on similar information to Measurement 1. In contrast to the first measurement, the participants did not make a stock selection in the first step. Instead, the participants were informed, similarly to Guenther and Lordan (2023), that they had a portfolio consisting of ten stocks5 which were different from the ones in Measurement 1 (refer to Supplementary Tables S2, S3 for the stock details). While it has been shown that personal responsibility for a position is important for individuals to display the disposition effect (Summers and Duxbury, 2012), we assigned positions to the individuals as we were mostly interested in the impact of the intervention. We also decided to assign new positions (as opposed to using the stocks from Measurement 1 that participants decided to hold) to ensure we have a big enough number of stocks for the analysis.

Again, the participants were remunerated in line with Prolific wage guidelines, and a bonus payment of GBP 20 was paid to the participant with the highest investment return. Notably, there was no intervention in both Measurement 2 and Measurement 3 as the aim was to investigate whether the intervention of Measurement 1 had a lasting impact, and we could still detect a significant difference between the treatment and control group of Measurement 1 in the follow-up measurements.

2.2.1 Dependent variable—The disposition effect

The primary variable of interest in our experiment is the disposition effect, which captures the propensity with which individuals realize gains compared to losses. Specifically, we use the method proposed by Odean (1998) where the disposition effect is calculated based on the difference between the proportion of realized gains and the proportion of realized losses. The formulas are as follows:

The realized gains (losses) refer to the number of trades in which winning (losing) investments are sold and the paper gains (losses) refer to the winning (losing) investments that are still held in the portfolio. By definition, the disposition effect is continuous and ranges from minus one to plus one. Particularly, the range from zero to one (zero not included) indicates an individual exhibiting the disposition effect, realizing gains more frequently than losses. Conversely, in the case of zero, individuals have an equal propensity to sell winners and losers, exhibiting no disposition effect. Lastly, if the measure is below zero an individual is said to exhibit the reverse disposition effect, implying a greater inclination to sell losing stocks compared to winning stocks.

3 Results

3.1 Disposition effect and effectiveness of the intervention

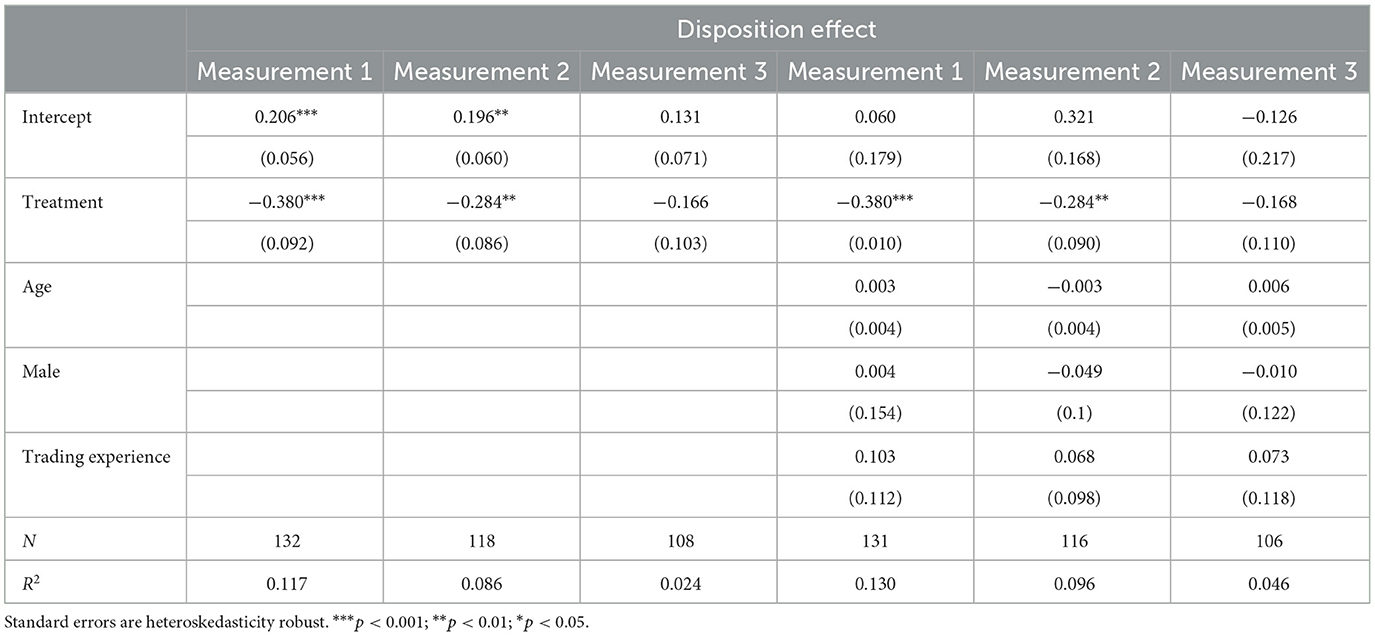

In Measurement 1, we tested the mean disposition effect of both the control group and the treatment group. Notably, we observe the disposition effect (DE = 0.206, SE = 0.056, p < 0.001) in the control group, while we observe the reverse disposition effect (DE = −0.174, SE = 0.073, p = 0.020) in the treatment group. In other words, our intervention yields a highly significant reduction of the disposition effect as displayed in Table 2 (b = −0.380, SE = 0.092, p < 0.001), confirming the intervention's effectiveness in reducing the magnitude of the disposition effect.

Measurement 2 paints a very similar picture for the control group, where we observe a comparable magnitude of the disposition effect (DE = 0.196, SE = 0.060, p = 0.002). While we still observe a significant impact of our intervention (b = −0.284, SE = 0.086, p = 0.001), the treatment group does not display a statistically significant reverse disposition effect (DE = −0.087, SE = 0.0615, p = 0.162). In the case of Measurement 3, we neither find a significant disposition effect in the control group nor do we find a significant impact of our intervention. However, it is important to note that the effect of the intervention is also negative—as in the other measurements—and that all reported significance levels are based on two-sided testing. As we expected the intervention to reduce the disposition effect, using one-sided testing could be justified, resulting in marginally significant treatment effect for Measurement 3 (b = −0.166, SE = 0.103, pone−sided = 0.054). The impact of the intervention across the measurements was robust when controlling for age, gender, and trading experience.

Our findings are also robust with regard to the calculation method of the disposition effect. As can be seen from Supplementary Table S4, following the procedure of Weber and Camerer (1998) yields the same qualitative results6. We do not find any significant differences in the disposition effect based on gender, age, or trading experience. Notably, the reduction in the disposition effect was solely driven by an increase in the propensity to realize losing stocks while the propensity to realize winning stocks remained unchanged (refer to Supplementary Tables S5, S6 for further detail). This finding is in line with previous literature that found the same asymmetrical impact of their interventions (Fischbacher et al., 2017; Ploner, 2017). Given our sample included a large number of participants without prior investment experience, we also performed regression analysis including only the participants who self-reported having prior investment experience, the results of which are displayed in Supplementary Table S7. Interestingly—and despite the small sample size, we find a significant impact of the intervention, reducing the disposition effect not only in Measurement 1 and Measurement 2 but also in Measurement 3.

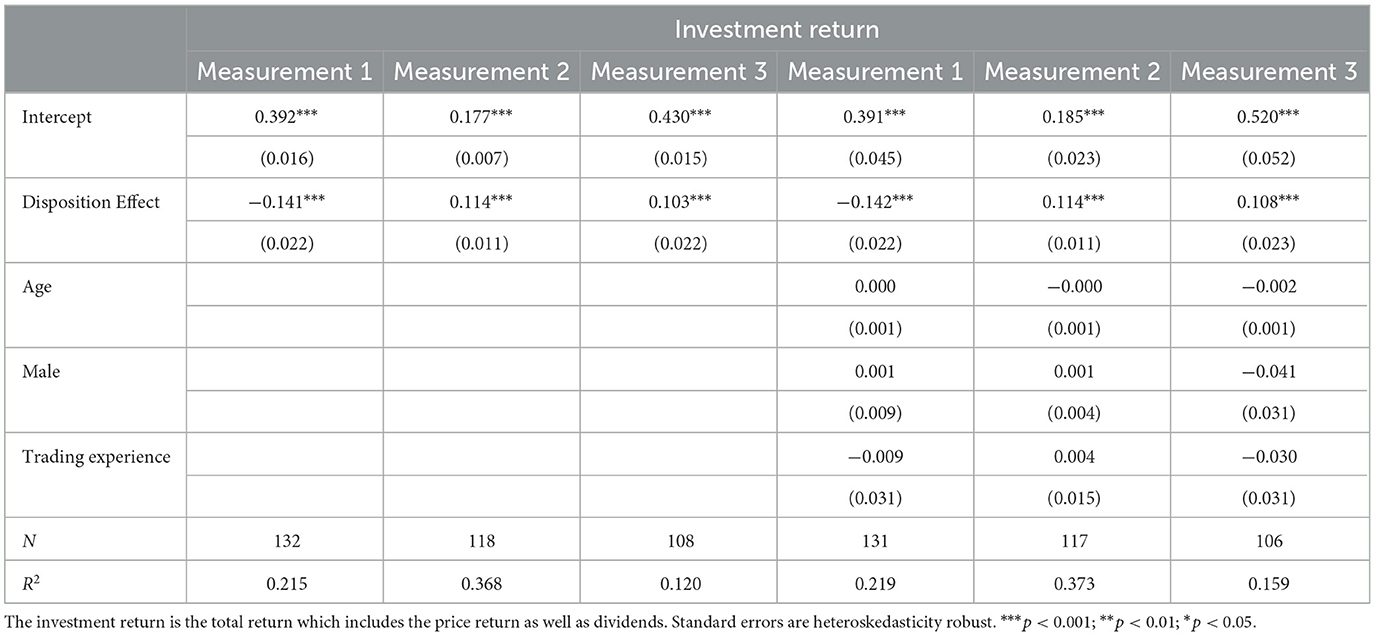

3.2 The disposition effect and investment returns

While our intervention as well as a large body of literature investigated the potential to mitigate the disposition effect, the ultimate aim remains to improve investor returns. We therefore also analyze the relationship between the disposition effect and investment returns across the three measurements. Our findings are mixed. As displayed in Table 3, we find a negative relationship between the disposition effect and investment returns for Measurement 1. In other words, a higher disposition effect is associated with reduced trading returns in line with the majority of previous studies (Odean, 1998; Goetzmann and Massa, 2008; Seru et al., 2010). However, the opposite is true for Measurement 2 and Measurement 3 where we find that a higher disposition effect is associated with higher investment returns. These results are robust when controlling for age, gender, and trading experience. It is important to note that the measurements involved a relatively small number of stocks, and the returns include a lot of noise, thus the results with regards to returns have to be assessed with caution.

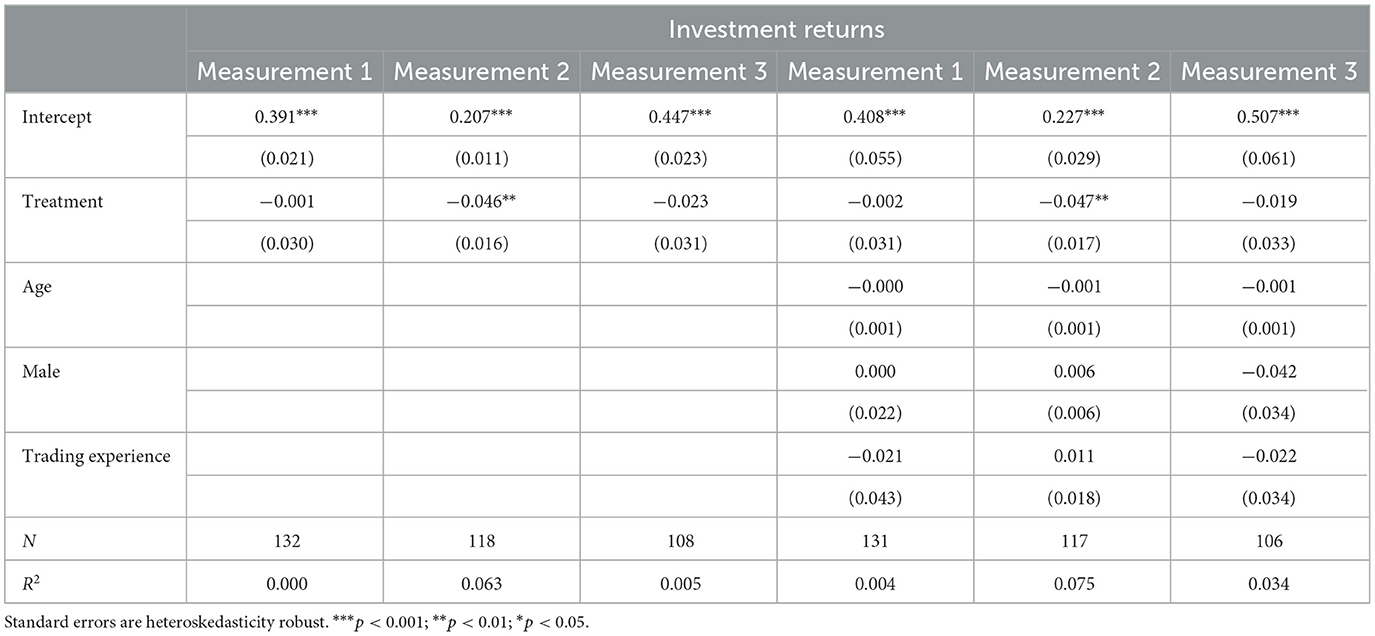

3.3 The impact of the intervention on the investment returns

Turning to the direct impact of the intervention on investment returns, we find that the treatment only has a significant impact in the case of Measurement 2. In other words, the intervention does not statistically significantly alter investment returns for Measurement 1 and Measurement 2. Moreover, the impact of the intervention for Measurement 2 is return reducing as opposed to return enhancing as displayed in Table 4. This is a very noteworthy result highlighting that in this particular context the intervention has a detrimental impact on investment returns. It is important to remember at this point that Measurement 2 and 3 differ slightly from Measurement 1 as the participants of the follow-up measurements did not actively select the stocks as was the case of Measurement 1, but the stocks were assigned to them.

4 Discussion

In this study, we investigated the disposition effect in the context of retail investors and evaluated the mitigation potential of a feedback-like information intervention as well as its lasting impact across three between-subject measurements. Moreover, we examined the relationship between the disposition effect and investment returns as well as the direct relationship between the intervention and investment returns.

We note a number of limitations of our study, in particular with regard to its external validity given the nature of a controlled experiment. These include a limited universe of stocks to choose from as well as non-discretionary choice options and a single portfolio rebalancing point. In the real world, there is a large universe of stocks, bonds, funds, and other assets for investors to choose from. Moreover, the investors can trade almost continuously and allocate any given percentage of their funds to a certain investment. In our experiment, we constrained the investment universe artificially and significantly reduced the trading frequency as well as the choice of asset allocation. Another implication of a small set of stocks are the idiosyncratic returns of individual stocks that could introduce noise to the analysis of investment returns. In other words, a significant investment return of an individual stock could dominate the investment returns of the entire portfolio.

Another limitation is due to the choice of the incentive structure for the experiment. The tournament-like incentive structure used in this study can potentially lead to increased risk-taking (Kirchler et al., 2018) compared to a real-world investment decision. While this structure was arguably more appropriate in Guenther and Lordan (2023) study context mimicking bonus incentive structures, we conducted a randomized controlled experiment, so that the impact would be equal across the two experimental conditions and conclusions with regards to the effectiveness of the intervention still hold.

Overall, our results can be summarized in three key findings. First, we found evidence that retail investors, on average, exhibit the disposition effect. However, the magnitude of the disposition effect decreased across the measurements. We observed the disposition effect on average in Measurement 1 among the control group, it was then less pronounced in Measurement 2 and finally not statistically significant in Measurement 3. It is noteworthy that in Measurement 2 and Measurement 3, the participants did not actively choose their stocks in the first phase (like in Measurement 1), but the stocks were assigned to them as we were most interested in the intervention impact. It is therefore possible that the participants did not feel sufficiently responsible for their choices which has been shown to impact the magnitude of the disposition effect (Summers and Duxbury, 2012; Aspara and Hoffmann, 2015a).

Second, our proposed feedback-like intervention, educating the participants about the disposition effect and its potentially detrimental impact on returns, significantly reduced the magnitude of the disposition effect. Notably, the intervention only affected the participants' loss realization behavior. We also found evidence of the intervention having a somewhat lasting impact even when it was no longer available. Specifically, we conducted two follow-up measurements 2 weeks and 3 months after the participants had received the intervention. While the intervention was statistically significant in Measurement 1 and Measurement 2, we did not find any statistically significant impact in Measurement 3, suggesting that the impact had diminished over time.

Third, we found mixed evidence regarding the relationship between the disposition effect and investment returns. Only in Measurement 1, we found the disposition effect to be detrimental to the participants while we found it to be beneficial for the participants in Measurement 2 and Measurement 3. The finding of Measurement 1 is aligned with the majority of the literature to date (Odean, 1998; Weber and Camerer, 1998; Shumway and Wu, 2005; Aspara and Hoffmann, 2015a) who attributed the disposition effect to reduced trading returns. The findings of Measurement 2 and Measurement 3, on the other hand, resemble the findings of Guenther and Lordan (2023). Further investigating the return patterns of the different measurements in this study, we note that the stocks in Measurement 1 were trending, meaning the average post-decision return across the stocks had the same sign as the returns of the previous phases (see Table 1). In the case of Measurement 2 and Measurement 3, however, the stocks were mean-reverting, meaning that the sign of the average return differed pre- and post-decision (see Supplementary Tables S2, S3). In both cases, two stocks dominated the post-decision returns (Apple and Goldman Sachs for Measurement 2; Nvidia and Disney in the case of Measurement 3) which happened to be mean reverting. When investigating the direct impact of the intervention on investment returns, we found evidence that the intervention was detrimental to returns in one case and had no statically significant impact in the other two cases.

In conclusion, we found confirming evidence that retail investors, on average, exhibit the disposition effect. Moreover, we contribute to existing literature on debiasing the disposition effect, where our feedback-like intervention had a significant and somewhat lasting mitigating impact on the disposition effect. Extending Dobrich et al. (2014) and Guenther and Lordan (2023) which leverage informational interventions to reduce the bias, our study enhances the intervention by structuring the informative warning in a feedback-like manner. Second, we investigated the longevity of the effect of the intervention. Our results suggest the impacts of the intervention has a somewhat lasting impact but diminishes over weeks. Third, we provide further insights into the impact of behavioral interventions aimed at reducing the disposition effect on investment returns.

Considering that the intervention is a very simple message informing individuals about the disposition effect, the intervention can be a cost-effective option with a potentially lasting impact in reducing the disposition effect. The proposed intervention could easily be rolled out by online brokerage firms on a regular basis, such as monthly or quarterly statements, and provide the investor with information about their trading behavior including the disposition effect. However, we found mixed evidence about the relationship between the disposition effect and investment returns, depending on the mean-reversion properties of the stocks. This finding highlights that the impact of the disposition effect is context specific and reducing it—in the wrong context—can have an unintended detrimental impact on investment returns.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Ethics statement

The studies involving humans were approved by London School of Economics Research Ethics. The studies were conducted in accordance with the local legislation and institutional requirements. The participants provided their written informed consent to participate in this study.

Author contributions

LH: Conceptualization, Data curation, Formal analysis, Funding acquisition, Methodology, Writing – original draft, Writing – review & editing. BG: Conceptualization, Methodology, Supervision, Writing – review & editing.

Funding

The author(s) declare that financial support was received for the research, authorship, and/or publication of this article. The authors would like to thank the London School of Economics for funding the publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/frbhe.2024.1345875/full#supplementary-material

Footnotes

1. ^The stop-loss/take gain order allows investors to specify an upper limit and a lower limit when purchasing an asset. When the price of the asset reaches either limit, the assets will automatically be sold, these orders are also called limit orders.

2. ^Delegated asset refers to investment assets that investors delegate the day-to-day management to investment experts.

3. ^Just-in-time education refers to a decision support system that provide the necessary knowledge and feedback to people at the time of making decisions.

4. ^These stocks were selected with the following considerations: (1) Stocks were chosen for the measurements without experimenters' prior knowledge of post-decision prices and returns to prevent unconsciously cherry-picking certain stocks given stocks' post-decision price development. (2) Stocks should be well-known, representative stocks commonly chosen in real-life scenarios. (3) The inclusion of both winning and losing stocks aimed to enable participants to deal with winning and losing stocks.

5. ^These stocks were selected based on the same considerations as for Measurement 1 as stated above.

6. ^The calculation of the disposition effect proposed by Weber and Camerer (1998) is based on the difference of the number of realized winners SW and the number of realized losers SL divided by the total number of realized positions: DEWeber&Camerer = (Sw – SL)/(Sw + SL).

References

Ahn, Y. (2022). The anatomy of the disposition effect: which factors are most important? Finan. Res. Lett. 44:102040. doi: 10.1016/j.frl.2021.102040

Aspara, J., and Hoffmann, A. O. I. (2015a). Cut your losses and let your profits run: how shifting feelings of personal responsibility reverses the disposition effect. J. Behav. Exp. Finan. 8, 18–24. doi: 10.1016/j.jbef.2015.10.002

Aspara, J., and Hoffmann, A. O. I. (2015b). Selling losers and keeping winners: how (savings) goal dynamics predict a reversal of the disposition effect. Mark. Lett. 26, 201–211. doi: 10.1007/s11002-013-9275-9

Barber, B. M., Lee, Y.-T., Liu, Y.-J., and Odean, T. (2007). Is the aggregate investor reluctant to realise losses? Evidence from Taiwan. Eur. Finan. Manag. 13, 423–447. doi: 10.1111/j.1468-036X.2007.00367.x

Barber, B. M., and Odean, T. (2001). The Internet and the Investor. J. Econ. Perspect. 15, 41–54. doi: 10.1257/jep.15.1.41

Ben-David, I., Birru, J., and Prokopenya, V. (2018). Uninformative feedback and risk taking: evidence from retail forex trading. Rev. Finan. 22, 2009–2036. doi: 10.1093/rof/rfy022

Brooks, A. M., Capra, C. M., and Berns, G. S. (2012). Neural insensitivity to upticks in value is associated with the disposition effect. Neuroimage 59, 4086–4093. doi: 10.1016/j.neuroimage.2011.10.081

Chang, T. Y., Solomon, D. H., and Westerfield, M. M. (2016). Looking for someone to blame: delegation, cognitive dissonance, and the disposition effect. J. Finan. 71, 267–302. doi: 10.1111/jofi.12311

Chater, N., and Loewenstein, G. (2023). The i-frame and the s-frame: how focusing on individual-level solutions has led behavioral public policy astray. Behav. Brain Sci. 46:e147. doi: 10.1017/S0140525X22002023

Chen, G., Kim, K. A., Nofsinger, J. R., and Rui, O. M. (2007). Trading performance, disposition effect, overconfidence, representativeness bias, and experience of emerging market investors. J. Behav. Decis. Mak. 20, 425–451. doi: 10.1002/bdm.561

Cheng, T. Y., Lee, C. I., and Lin, C. H. (2013). An examination of the relationship between the disposition effect and gender, age, the traded security, and bull–bear market conditions. J. Emp. Finan. 21, 195–213. doi: 10.1016/j.jempfin.2013.01.003

Dhar, R., and Zhu, N. (2006). Up close and personal: investor sophistication and the disposition effect. Manage. Sci. 52, 726–740. doi: 10.1287/mnsc.1040.0473

Dobrich, C., Wollersheim, J., Sporrle, M., and Welpe, I. M. (2014). Letting go of your losses: experimental evidence for debiasing the disposition effect in private investment decisions. J. Manag. Strat. 5:p1. doi: 10.5430/jms.v5n4p1

Feng, L., and Seasholes, M. S. (2005). Do investor sophistication and trading experience eliminate behavioral biases in financial markets? Rev. Finan. 9, 305–351. doi: 10.1007/s10679-005-2262-0

Fernandes, D., Lynch, J. G., and Netemeyer, R. G. (2014). Financial literacy, financial education, and downstream financial behaviors. Manage. Sci. 60, 1861–1883. doi: 10.1287/mnsc.2013.1849

Fischbacher, U., Hoffmann, G., and Schudy, S. (2017). the causal effect of stop-loss and take-gain orders on the disposition effect. Rev. Financ. Stud. 30, 2110–2129. doi: 10.1093/rfs/hhx016

Fleming, T., Passmore, M., and Tracey, M. (2021). Self-Directed Investors: Insights and Experiences. Toranto, ON: Ontario Securities Commission.

Fogel, S. O., and Berry, T. (2006). The disposition effect and individual investor decisions: the roles of regret and counterfactual alternatives. J. Behav. Finan. 7, 107–116. doi: 10.1207/s15427579jpfm0702_5

Frydman, C., and Rangel, A. (2014). Debiasing the disposition effect by reducing the saliency of information about a stock's purchase price. J. Econ. Behav. Org. 107(Pt B), 541–552. doi: 10.1016/j.jebo.2014.01.017

Fünfgeld, B., and Wang, M. (2009). Attitudes and behaviour in everyday finance: evidence from Switzerland. Int. J. Bank Market. 27, 108–128. doi: 10.1108/02652320910935607

Goetzmann, W. N., and Massa, M. (2008). Disposition matters: volume, volatility, and price impact of a behavioral bias. J. Portf. Manag. 34, 103–125. doi: 10.3905/jpm.2008.701622

Goulart, M. N. D. Jr., Santos, A., Takase, E., and Silva, S. D. (2013). Psychophysiological correlates of the disposition effect. PLoS ONE 8:e54542. doi: 10.1371/journal.pone.0054542

Grinblatt, M., and Han, B. (2005). Prospect theory, mental accounting, and momentum. J. Financ. Econ. 78, 311–339. doi: 10.1016/j.jfineco.2004.10.006

Grinblatt, M., and Keloharju, M. (2001). What makes investors trade? J. Finan. 589–616. doi: 10.1111/0022-1082.00338

Guenther, B., and Lordan, G. (2023). When the disposition effect proves to be rational: experimental evidence from professional traders. Front. Psychol. 14:1091922. doi: 10.3389/fpsyg.2023.1091922

Hagger, M. S., and Hamilton, K. (2023). Optimizing behavior change through integration of individual- and system-level intervention approaches. Behav. Brain Sci. 46:e157. doi: 10.1017/S0140525X23001012

Heimer, R. Z. (2016). Peer pressure: social interaction and the disposition effect. Rev. Financ. Stud. 29, 3177–3209. doi: 10.1093/rfs/hhw063

Jiao, P. (2017). Belief in mean reversion and the disposition effect: an experimental test. J. Behav. Finan. 18, 29–44. doi: 10.1080/15427560.2017.1274754

Jin, X., Li, R., and Zhu, Y. (2021). Could social interaction reduce the disposition effect? Evidence from retail investors in a directed social trading network. PLOS ONE 16::e0246759. doi: 10.1371/journal.pone.0246759

Kahneman, D., and Tversky, A. (1979). Prospect theory: an analysis of decision under risk. Econometrica 47, 263–291. doi: 10.2307/1914185

Kaustia, M. (2010). Prospect theory and the disposition effect. J. Finan. Quant. Anal. 45, 791–812. doi: 10.1017/S0022109010000244

Kirchler, M., Lindner, F., and Weitzel, U. (2018). Rankings and risk-taking in the finance industry. J. Finan. 73, 2271–2302. doi: 10.1111/jofi.12701

Koestner, M., Loos, B., Meyer, S., and Hackethal, A. (2017). Do individual investors learn from their mistakes? Zeitschrift Betriebswirtschaft 87, 669–703. doi: 10.1007/s11573-017-0855-7

Kruglanski, A. W., Shah, J. Y., Fishbach, A., Friedman, R., Woo Young, C.hun, and Sleeth-Keppler, D. (2002). “A theory of goal systems,” in Advances in Experimental Social Psychology, Vol. 34 (Cambridge, MA: Academic Press), 331–378.

Lee, H.-J., Park, J., Lee, J.-Y., and Wyer, R. S. (2008). Disposition effects and underlying mechanisms in E-trading of stocks. J. Market. Res. 45, 362–378. doi: 10.1509/jmkr.45.3.362

Lind, T., Ahmed, A., Skagerlund, K., Strömbäck, C., Västfjäll, D., and Tinghög, G. (2020). Competence, confidence, and gender: the role of objective and subjective financial knowledge in household finance. J. Fam. Econ. Issues 41, 626–638. doi: 10.1007/s10834-020-09678-9

Odean, T. (1998). Are investors reluctant to realize their losses? J. Finan. 53, 1775–1798. doi: 10.1111/0022-1082.00072

Osipovich, A. (2020). Individual-Investor Boom Reshapes U.S. Stock Market. Wall Street Journal. available online at: https://www.wsj.com/articles/individual-investor-boom-reshapes-u-s-stock-market-11598866200 (accessed November 13, 2023).

Pelster, M., and Hofmann, A. (2018). About the fear of reputational loss: social trading and the disposition effect. J. Bank. Finan. 94, 75–88. doi: 10.1016/j.jbankfin.2018.07.003

Ploner, M. (2017). Hold on to it? An experimental analysis of the disposition effect. Judg. Decis. Mak. 12, 118–127. doi: 10.1017/S1930297500005660

Rapaport, E. (2021). The Unstoppable Rise of the Self Directed Investor. Morningstar. Available online at: https://www.morningstar.com.au/insights/stocks/213294/the-unstoppable-rise-of-the-self-directed-investor (accessed June 14, 2023).

Seru, A., Shumway, T., and Stoffman, N. (2010). Learning by trading. Rev. Finan. Stud. 23, 705–739. doi: 10.1093/rfs/hhp060

Shapira, Z., and Venezia, I. (2001). Patterns of behavior of professionally managed and independent investors. J. Bank. Finan. 25, 1573–1587. doi: 10.1016/S0378-4266(00)00139-4

Shefrin, H., and Statman, M. (1985). The disposition to sell winners too early and ride losers too long: theory and evidence. J. Finan. 40, 777–790. doi: 10.2307/2327802

Shumway, T., and Wu, G. (2005). Does Disposition Drive Momentum? SSRN Scholarly Paper 771486. doi: 10.2139/ssrn.771486

Summers, B., and Duxbury, D. (2012). Decision-dependent emotions and behavioral anomalies. Organ. Behav. Hum. Decis. Process. 118, 226–238. doi: 10.1016/j.obhdp.2012.03.004

Sunstein, C. R. (2002). Probability neglect: emotions, worst cases, and law. Yale Law J. 112, 61–107. doi: 10.2307/1562234

Talpsepp, T., Vlcek, M., and Wang, M. (2014). Speculating in gains, waiting in losses: a closer look at the disposition effect. J. Behav. Exp. Finan. 2, 31–43. doi: 10.1016/j.jbef.2014.04.001

Thaler, R. (1980). Toward a positive theory of consumer choice. J. Econ. Behav. Org. 1, 39–60. doi: 10.1016/0167-2681(80)90051-7

The United States Senate Special Committee on Aging (2022). Financial Literacy in Retirement: Providing Just-in-Time Information and Assistance for Older Americans and People with Disabilities. The United States Senate Special Committee on Aging. Available online at: https://www.congress.gov/117/crpt/srpt54/CRPT-117srpt54.pdf (accessed November 19, 2023).

Weber, M., and Camerer, C. F. (1998). The disposition effect in securities trading: an experimental analysis. J. Econ. Behav. Org. 33, 167–184. doi: 10.1016/S0167-2681(97)00089-9

Withers, I., and Cohn, C. (2021). Pandemic Have-a-Go Investors Force Shake-Up in UK Wealth market. Reuters. Available online at: https://www.reuters.com/markets/europe/pandemic-have-a-go-investors-force-shake-up-uk-wealth-market-2021-12-16/ (accessed June 14, 2023).

Keywords: disposition effect, behavioral finance, trading biases, retail investors, investment decision-making

Citation: Huang L and Guenther B (2024) Information and context matter: debiasing the disposition effect with lasting impact. Front. Behav. Econ. 3:1345875. doi: 10.3389/frbhe.2024.1345875

Received: 28 November 2023; Accepted: 28 March 2024;

Published: 11 April 2024.

Edited by:

Thomas Post, Maastricht University, NetherlandsReviewed by:

Jaakko Aspara, Hanken School of Economics, FinlandSergio Da Silva, Federal University of Santa Catarina, Brazil

Copyright © 2024 Huang and Guenther. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Benno Guenther, Yi5ndWVudGhlckBsc2UuYWMudWs=

Lingxi Huang

Lingxi Huang Benno Guenther

Benno Guenther