- 1Urban Economics Chairgroup, Wageningen University, Wageningen, Netherlands

- 2Netherlands Tax and Customs Administration, Utrecht, Netherlands

Introduction: Self-employed people without personnel mostly behave like consumers in managing their business finances, frequently leading to ill-management of the company finances. Ill-management may lead to inability to fulfill important financial obligations and making financial arrangements for the future. Here, we investigate the hypothesis that financial management is related to tax compliance.

Methods: We use having an overview of expenses, making ends meet, occurrence of a business bank overdraft, and how long the business could survive without income, as indicators of financial management. Four measures of tax compliance, i.e., the OECD measure of tax compliance, measures taken by the tax administration, enforced tax compliance, and voluntary tax compliance, and two measures of social security, i.e., pension and disability arrangements, are included. We use survey data from a sample of 1,191 Dutch self-employed people without personnel, roughly equally divided between starters (≤3 years in business) and non-starters (>3 years in business).

Results: We found both significant direct and indirect effects of mental budgeting on tax compliance and social security arrangements, thus showing incomplete mediation effects of financial management.

Discussion: The mediation effects of having an overview of expenses were relatively strong for the OECD and voluntary compliance measures, whereas the mediation effects of not making ends meet and bank overdrafts were relatively strong for measures taken by the tax administration and enforced compliance, thus indicating different financial management processes matching different motivations of tax compliance.

1 Introduction

Managing money has been an important topic of research in economic psychology because ill-management may lead to incapacity to fulfill one's financial obligations, not making ends meet, and even problematic debts (e.g., Lea et al., 1995; Burgoyne and Kirchler, 2008; Van Raaij et al., 2020). Several psychological concepts and processes have been offered as explanations for ill-management, including incorrect understanding of financial transactions, time preference leading to too much spending, or borrowing in the short run (Agarwal and Mazumder, 2013; Achtziger et al., 2015).

Money management mainly has been studied among consumers and households. However, ill-management of a company may have more widespread effects on society, e.g., on employees, stakeholders, and tax revenues, than on the individual entrepreneur, thus possibly leading to financial problems on a larger scale. Although financial processes in larger companies often are formalized by means of financial departments, financial statements, and auditors, smaller companies more often rely on informal money management. Especially self-employed entrepreneurs without personnel (SwoP) may show similar financial behaviors as private households and employees (Koh et al., 2021). Their financial knowledge is about equally moderate (Natani et al., 2020; Rostamkalaei et al., 2022), often leading to financial ill-management, including high-cost borrowing and poor retirement planning. Alizadeh and Meredith (1997) show that Australian SwoP use only little information in making major decisions. Dawson et al. (2014) show overoptimism among British SwoP. The population of SwoP in the Netherlands comprised 12.5% of the employed labor force in 2020. However, despite the growing number of SwoPs, little is known about the financial management of such small companies.

Here, we study the financial management of SwoP in relation to their ability to fulfill important financial obligations, i.e., paying taxes, and making financial arrangements for the future, i.e., pension and work disability insurance. Both these obligations and arrangements are different than in the case of employees, where the employer often takes care of it (Koh et al., 2021), and demand careful financial planning and foresight, which is often difficult in the case of the complex business environment. In the past decades, the theory of mental budgeting has been developed, which implies simplifications of financial management by means of categorizing expenses. Mental budgeting implies setting budgets for expenses in particular categories (Heath, 1995). Although setting budgets is part of economic accounting, mental budgeting is associated with the way monetary transactions are carried out using these budgets (Thaler, 1999), hence is considered conceptually different. We aim at showing how mental budgeting facilitates financial management of SwoP, thus leading to improved ability to fulfill financial obligations and making financial arrangements for the future.

Previous studies relating mental budgeting to financial management and tax compliance have focused exclusively on the direct effects of mental budgeting. A policy-relevant question is whether the effects of mental budgeting on financial behaviors are fully or partly mediated by financial management. If so, policy instruments designed to enhance financial management skills should have the potency to bring out desirable financial outcomes such as tax compliance (cf. Keele et al., 2015). This study focuses on the mediation issue using a survey of Dutch self-employed without personnel (SwoP), including several tax-compliance measures, and indicators of pension and disability arrangements. First, we briefly present research on the financial management of SwoP, tax compliance and financial arrangements for the future, and the role of mental budgeting in facilitating financial management. Next, we describe the survey among 1,192 SwoP and the results of analysis. The discussion section concludes.

1.1 Financial management

Several attempts have been made to study financial management of consumers and companies. Financial management is generally considered an important aspect of financial capability (OECD, 2005; HM Treasury, 2007), capturing impulse spending, being financially organized, and preferences for buying on credit. Managing money includes making ends meet (keeping up with bills, running out of money at the end of the month, bank overdrafts and using credit cards for day-to-day spending, borrowing money, and saving money), keeping track of spending (checking receipts, statements, and balance, frequency of checking balance, accuracy of current money position, keeping records of cash withdrawals and daily spending), and planning ahead (e.g., having some provision to cover a loss of income, making adequate provision for retirement) (Atkinson et al., 2006, 2007; Consumer Financial Protection Bureau, 2022).

The performance of self-employed people and small businesses is also related to the experience and competencies of the owners in financial management, e.g., regarding planning for the future, record keeping, obtaining external finance, and professional advice, in addition to factors in the environment in which they operate (Kennedy and Tennent, 2006). Beaver (2003, p. 115) mentions “independence with an acceptable income at a ‘comfort-level' of activity” as a measure of small-business success. Beaver and Jennings (2001) list inadequate accounting systems, lack of capital budget, incompetence, lack of experience, poor record keeping, and reckless money management, as factors in small-business failure, among other factors. The Participant Guide of the Financial Education Curriculum of the U.S. Small Business Administration (SBA, 2016) mentions budgeting, bookkeeping, cash flow projections, profit and loss statements, business financing, and loans, as key points in business decision making. Newberger et al. (2015) mention knowledge of financing products, credit experiences, and financial planning and management, as factors in small-business financial health.

Apparently, financial management constitutes an important factor in small-business financial performance, in addition to other factors not playing a role in consumer financial management. Still, small businesses operate differently than big businesses, due to several environmental factors. Welsh and White (1981) state that small businesses operate in highly fragmented industries, are relatively much influenced by external forces, the owner's salary represents a much larger fraction of revenues than in a big business, and they can often not afford accounting and bookkeeping services. So, small businesses tend to operate somewhere in between the way consumers and larger businesses do, with self-employed businesses without personnel possibly operating even more like consumers than other small businesses.

Since financial management usually deals with future expenses, it may affect several behaviors taking place in the near or the distant future. For this reason, we focus on the payment of taxes, and on planning for pension and work disability insurance, to be considered next.

1.2 Tax compliance

Tax compliance involves paying taxes, including both income tax and value-added tax, which is an important obligation of self-employed entrepreneurs that is often not completely fulfilled (Andreoni et al., 1998). “Tax compliance refers to taxpayers' decision to comply with tax laws and regulations by paying tax timely and accurately” (Youde and Lim, 2019). Tax non-compliance includes either lawful minimization of tax liabilities, i.e., tax avoidance, or illegal evasion of taxes (Balashov and Sanina, 2016). Although previous research has often focused on (in)correct tax declarations and tax evasion (e.g., Andreoni et al., 1998), tax compliance also includes taxpayers' registration in the system, timely filing requisite taxation information, and timely tax payments (OECD, 2004). The latter aspects are important because they tend to save tax collection costs of the tax administration.

In the Netherlands, starting companies (< 3 years in business) are overrepresented in tax filing and tax payment arrears, comprising 46% of all such cases (NTA, 2017). The Netherlands Tax Administration uses the 3-year criterion to distinguish starting from non-starting companies. It is considered a reasonable time for a company to grow from starting to more established (including more tax knowledge). To increase tax compliance among starting companies, the Netherlands Tax Administration puts much effort in helping them with tax-related issues including a dedicated website for starting entrepreneurs and information services, varying from webinars (less personal) to physical information desks (most personal). Different motivations for tax compliance have been shown in taxation research, including fear of tax evasion being detected and fined, (anticipated) guilt and shame of detection, and fairness of tax payments (Allingham and Sandmo, 1972; Andreoni et al., 1998), leading to different types of tax compliance.

Kirchler et al. (2008) have distinguished voluntary and enforced tax compliance, respectively instigated by taxpayers' perceived trust in and perceived power of authorities. Voluntary compliance is based on an intrinsic motivation to cooperate, excluding tax avoidance or tax evasion. Enforced compliance is based on fear of being monitored and being fined for tax non-compliance (Kirchler and Wahl, 2010). A hypothetical experiment with self-employed taxpayers showed positive relationships of tax compliance intentions with perceptions of trustworthy and powerful authorities. Also, voluntary compliance was positively related with trustworthiness and enforced compliance was positively related with perceived power of the authorities (Wahl et al., 2010). Voluntary compliance motivations are considered as more relevant in explaining tax compliance than the (perceived) probability of non-compliance detection and the size of penalties (Kirchler et al., 2008). Kirchler and Wahl (2010) state that enforced and voluntary compliance are unrelated, although both should be negatively correlated with tax evasion. In the above-cited literature, the distinction between intrinsic motivations (fairness, cooperation) and extrinsic motivations (fear, guilt) appears clearly. For an overview of economic-psychological tax compliance research, see Kirchler et al. (2008).

1.3 Pension and work disability arrangements

Dutch SwoP have to privately arrange their pension accrual and work disability insurance, often leading to less-than-desired take up of such arrangements, causing severe financial problems in case of retirement or disability. The proportion taking life annuity among SwoP has decreased from 13.3% in 2011 to 9.6% in 2017; the proportion paying disability premiums has decreased from 23.3% to 18.6% in the same period (Statistics Netherlands, 2022). Affordability was the main reason for not having such arrangements (54% for life annuity; 37% for disability arrangements). These statistics suggest that financial management, especially the availability of enough income, may be related to making such arrangements.

1.4 Mental budgeting

Mental budgeting is the part of mental accounting that is related to financial management (Antonides and Ranyard, 2018), and consists of the categorization of expenses, making budgets for each of the expense categories, booking and assigning expenses to the set budgets, and making reservations for delayed expenses (Henderson and Peterson, 1992; Heath and Soll, 1996; cf. Antonides and De Groot, 2022).

Mental budgeting is considered as a self-control mechanism, based on precommitment to the budgets assigned to the expense categories (Thaler, 1980). Also, it tends to simplify decision making by narrowing choice problems to the defined expense categories. Hence, mental budgeting has been found to improve money management by increasing a consumer's overview of expenses, and to better make ends meet.

1.5 Model

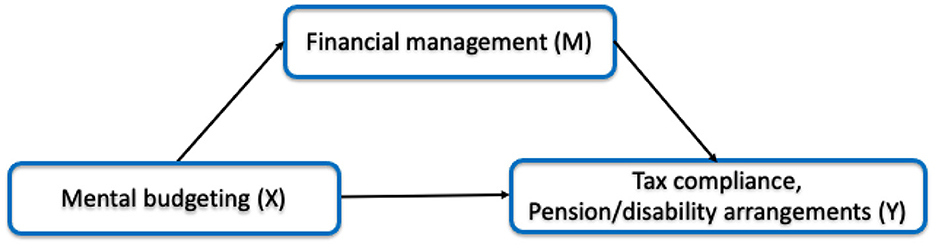

Previous studies have focused on the direct relationships between mental budgeting and tax compliance (Olsen et al., 2019; Antonides and De Groot, 2022). However, mental budgeting may facilitate financial control (Thaler, 2015), e.g., having an overview of expenses, and making ends meet (Antonides et al., 2011). In turn, keeping records and good cash flow management is known to increase tax compliance (OECD, 2004). We may consider these behaviors as a goal hierarchy in a means–end approach (Pieters et al., 1995), in which financial management is considered the focal goal, tax compliance is a superordinate goal, and mental budgeting is a means to attain these goals. “Why” questions may be asked to discover the means– to–end chain. “Why” questions ask for reasons, causes, antecedents, and consequences. “How” questions may be asked to reveal the end–to–means chain. “How” questions ask about the way one tries to achieve a goal. Thus, the question of why mental budgeting is applied may be answered by “to achieve sound financial management and to be able to pay taxes.” However, if we ask why sound financial management is important, the answer will not be “because of mental budgeting.” Likewise, a question of how sound financial management will be achieved, may be answered by stating (the usefulness of) mental budgeting, but not vice versa. The goal hierarchy also shows that mental budgeting may be considered as a means and financial management as the focal goal, hence they are considered as different concepts.

Given the rationale described above, financial management may mediate the relationship between mental budgeting and tax compliance in the goal hierarchy. In other words, financial management indicators, such as having an overview of expenses, and making ends meet, may be directly related to the capacity of planning for future payments. In addition to the indirect effects via financial management, mental budgeting may still have direct effects on tax compliance and planning for the future. In this case, the mediating effect of financial management is incomplete.

The theoretical model is shown in Figure 1. We expect that mental budgeting (independent variable X) is related to financial management indicators (mediator variables M), and that each of the financial management indicators (partly) mediates the effects of mental on tax compliance and pension/disability arrangements (dependent variables Y).

Figure 1. Theoretical model of financial management mediating effects of mental budgeting on tax compliance and pension/disability arrangements.

2 Method

2.1 Sample

Respondents have been recruited via a survey agency's research panel and additional arbitrary recruitment of SwoP from the Dutch Chamber of Commerce data base. They then participated in the survey via Computer Assisted Web Interviewing after receiving an email with a link to the questionnaire. The respondents were not paid for their participation. The intended net sample size was 1,000 SwoP, equally distributed over starters (3 years or less in business, according to the definition of the NTA, 2017) and non-starters (over 3 years in business).

In the spring of 2015, 9,400 SwoP were invited to participate in the survey, resulting in responses of 547 starting entrepreneurs, and 644 SwoP who were over 3 years in business. Non-response was due to not having a business, telephone numbers not in use, not being available during the fieldwork period, language problems, and straight rejections. The net sample size was 1,191 SwoP (12.7% of approached SwoP). The entrepreneurs completed the online survey anonymously. The average completion time was 20 min. The average score for clarity of the survey on a 5-point clear–unclear scale was 2.24, with 8% scoring 4 or 5 (unclear). The partial non-response for the survey was negligible.

2.2 Measures

2.2.1 Mental budgeting

Each respondent was randomly assigned to one of 10 different orders of 29 mental budgeting items that were included in the questionnaire. Ten of the 29 items in the survey were equal to the ones included in the 13-item scale (items 1–4, 11–14, and 19) developed in Antonides and De Groot (2022) and were measured on a five-point Likert-type scale. We used the 10-item scale in our analysis with composite reliability (CR) of 0.86 (Raykov, 1997). This scale is more general, and less focused on tax issues, than the ones used in Olsen et al. (2019), and Kirchler and Wahl (2010).

2.2.2 Financial management

We calculated four indicators of financial management, adapted from Atkinson et al. (2006, 2007). Having an overview of expenses was measured by three items, including “Planning my business expenses is easy,” “I know exactly what my business earnings are,” and “I know exactly what my business expenses are,” answered on a 5-point Likert-type scale (CR=0.84). Making ends meet was measured by two items, including “In my business I often have to make ends meet,” and “It happens frequently that I spend more for my business than I had planned” (r=0.34), answered on a 5-point Likert-type scale. Two aspects of planning ahead were measured. The occurrence of a business bank overdraft (indicating lack of planning) was measured by one item: “Do you ever overdraw your business account?” (1=Yes and sometimes for an amount higher than the income I expect in the short term, 2=Yes but usually for an amount lower than the income I expect in the short term, 3=No I never overdraw my business account), which was answered only by the 1,049 SwoP who had such an account. We also measured how long a business could survive without income, asking: “If the earnings from your business drop out entirely from tomorrow, how long will you be able to continue your business?” (Answers: < 1 week, 1 week−1 month, 1–3 months, 3–6 months, 6–12 months, >12 months. Answers were converted into months). The latter items had 154 missing observations which were imputed by multivariate imputation by chained equations (MICE, see Van Buuren, 2018). Although some of the variables were measured on simple scales to make them easier to answer, the variation in the answers was large enough to make statistical analysis meaningful.

2.2.3 Tax compliance

In empirical research on tax compliance, several measures of tax compliance have been developed (Braithwaite, 2003; Kirchler and Wahl, 2010), including scales related to voluntary and enforced tax compliance, tax avoidance, and tax evasion. The Netherlands tax administration (NTA) has derived indicators of tax compliance as measures taken against failures of tax compliance (NTA, 2012), including fines, demand notices, distress warrants, and attachments, capturing the notion of enforced compliance. The NTA also uses a scale measuring the taxpayer's perceived importance of the OECD indicators mentioned above (2004). This scale measures the taxpayer's morale toward several aspects of tax compliance, and the taxpayer's attitudes toward the tax administration.

We calculated four measures of tax compliance. The OECD measure (2004) comprised the question: “How important or unimportant do you think it is that: (1) The tax administration receives the company's tax return in time?, (2) The tax administration receives correct and complete tax returns?, (3) If money has to be paid, the tax administration receives the money before the term expires?,” answered on a 5-point importance scale (CR = 0.92).

We adapted three items from Kirchler and Wahl (2010) on voluntary compliance: “I would also pay taxes if there were no audits,” “I consider paying taxes as the natural thing to do,” I pay taxes because I regard it as my duty,” and “I pay taxes to contribute to society,” answered on a 5-point Likert-type scale (CR = 0.85). Both the OECD measure and the voluntary compliance measure may reflect internal motivations of the SwoP taxpayers caused by internal norms and ethical considerations.

A (non)compliance measure commonly used by the NTA included the questions: “Has the tax administration fined your company in the past 3 years because of (1) late payment? (2) late filing of the tax return? (3) a mistake in the tax return?” (1 = Yes, 0 = No), and “What measures of the tax administration have been applied to your company in the past 3 years: (4) demand notice, (5) distress warrant, (5) attachment” (1 = Yes, 0 = No). The “Yes” answers were added up (CR=0.89, based on the polychoric correlations of the binary variables).

Finally, we adapted three items from Kirchler and Wahl (2010) on enforced compliance: “I feel enforced to pay my taxes,” “I pay taxes because the risk of being audited is too high,” and “I pay taxes because tax evasion is punished severely,” answered on a 5-point Likert-type scale (CR=0.82). Both the NTA measure and the enforced compliance measure may reflect external motivations caused by fines and sanctions imposed by the tax administration.

2.2.4 Pension and disability arrangements

We used the following indicators of arrangements for pension and disability: “Have you made arrangements for your pension?” and “In the past, have you made arrangements for possible work disability?” (1 = No, 2 = Yes).

2.2.5 Business background variables

In addition to the indicators in the theoretical model, several control variables relating to the business were included: business age, business sector, turnover, profit, business performance in the last year, financial and fiscal management by entrepreneur, income from business, other sources of income, payment arrangement with the tax administration in the past 3 years.

2.2.6 Respondent background information

Personal information about the entrepreneur included gender, level of education, entrepreneurship, book-keeping, accounting, and long-term and short-term time orientation. In addition, we used the time of completing the survey and the score for unclear questions as control variables.

2.3 Analysis strategy

We used the abovementioned scales for each of the theoretical concepts in the model of Figure 1. Since the correlations between mental budgeting and the financial management indicators were relatively low (their absolute values all below 0.374) we considered mental budgeting and financial management as independent concepts. Since the correlations between the financial management indicators were relatively low, varying from 0.12 to 0.27, we considered them as parallel mediators, using Hayes' (2017) Model 4. Because the indicator for bank overdrafts was based on substantially less observations (because it was only reported by those having a business account), we ran a separate mediation analysis for this indicator. Also, in line with Kirchler and Wahl (2010) who stated that tax compliance based on trust is unrelated to tax compliance based on power, and relatively low correlations between the four tax compliance indicators in our study—varying from 0.04 to 0.34—, we conducted a separate mediation analysis for each of the compliance indicators rather than considering the indicators as representing one tax compliance dimension, and each of the pension and disability arrangement indicators. We used Hayes PROCESS macro (2017) to calculate the direct and indirect effects in the mediation models, using bootstrapping (including 5,000 samples) for calculating 95% confidence intervals for the indirect effects, thus avoiding assumptions about the distribution of the coefficients. Preacher and Hayes (2004) show that bootstrapping is especially useful in the estimation of the indirect effect, which may not be normally distributed. If the confidence interval lied above zero and the positive coefficient for the standardized indirect effect lied within or above the confidence interval, we considered the indirect effect statistically significant at least at the 5% level (the criterion is reversed for a negative coefficient). To avoid collinearity, in the mediation analysis the time orientation variables were excluded because in previous research (Antonides et al., 2011; Antonides and De Groot, 2022) they served as instrumental variables for mental budgeting.

In conducting the imputation procedure for the missing observations of survival time for the business, we used all control variables but not mental budgeting, no other financial management indicators, no tax compliance indicators, and no pension and disability arrangement indicators. Using SPSS-27′s missing value analysis procedure, we took the modal value of 20 independent imputations (each with 50 iterations) as the imputed value.

3 Results

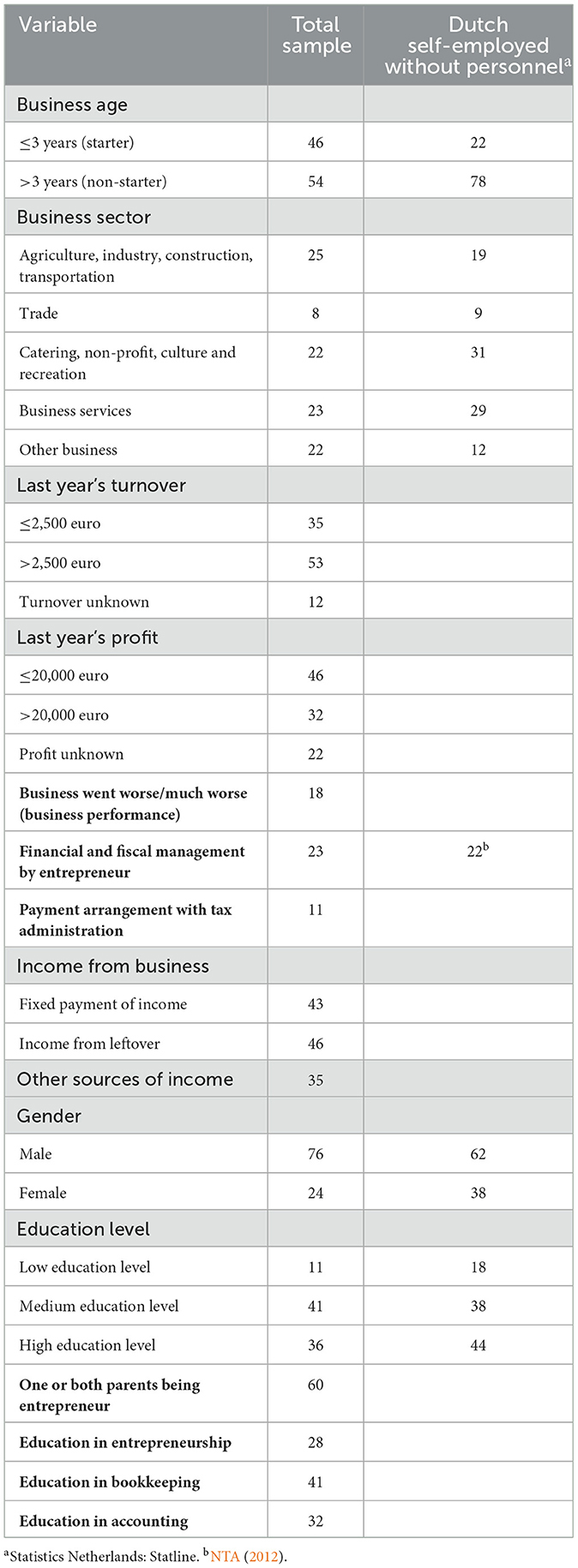

The sample characteristics, which also served as control variables, are compared with the available national statistics in Table 1. It appeared that the sample characteristics did not deviate much from the national statistics. The distribution of starting and older companies differed from the national statistics because starting entrepreneurs were oversampled.

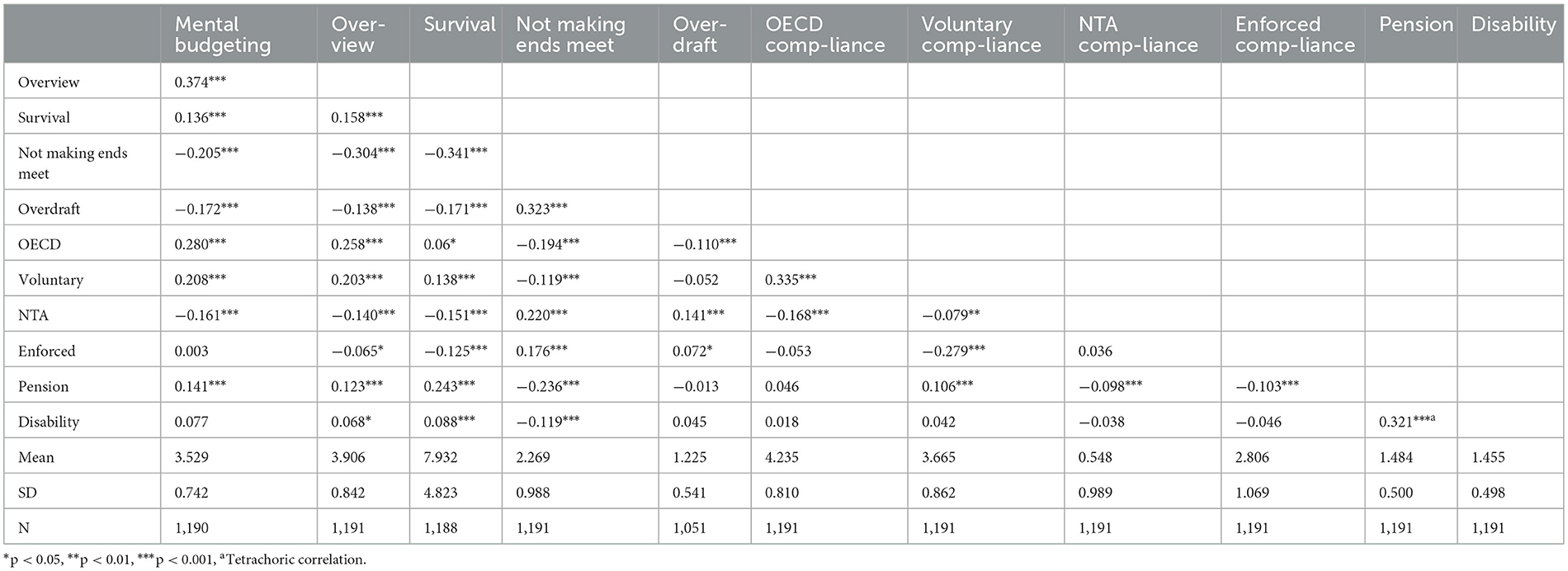

Table 2 shows the correlations between the variables in the mediation model, and their means and standard deviations. The averages of the mental budgeting and the expenses overview items were slightly above the mid-point of the 5-point scale. Not making ends meet and bank overdrafts were below the midpoints of their respective scales. OECD and voluntary compliance scores were above the midpoints of their respective scales, whereas enforced compliance score was below the midpoint. The average of the number of measures taken by the NTA in the past 3 years was only 0.5. About half of the SwoP had made pension or disability arrangements.

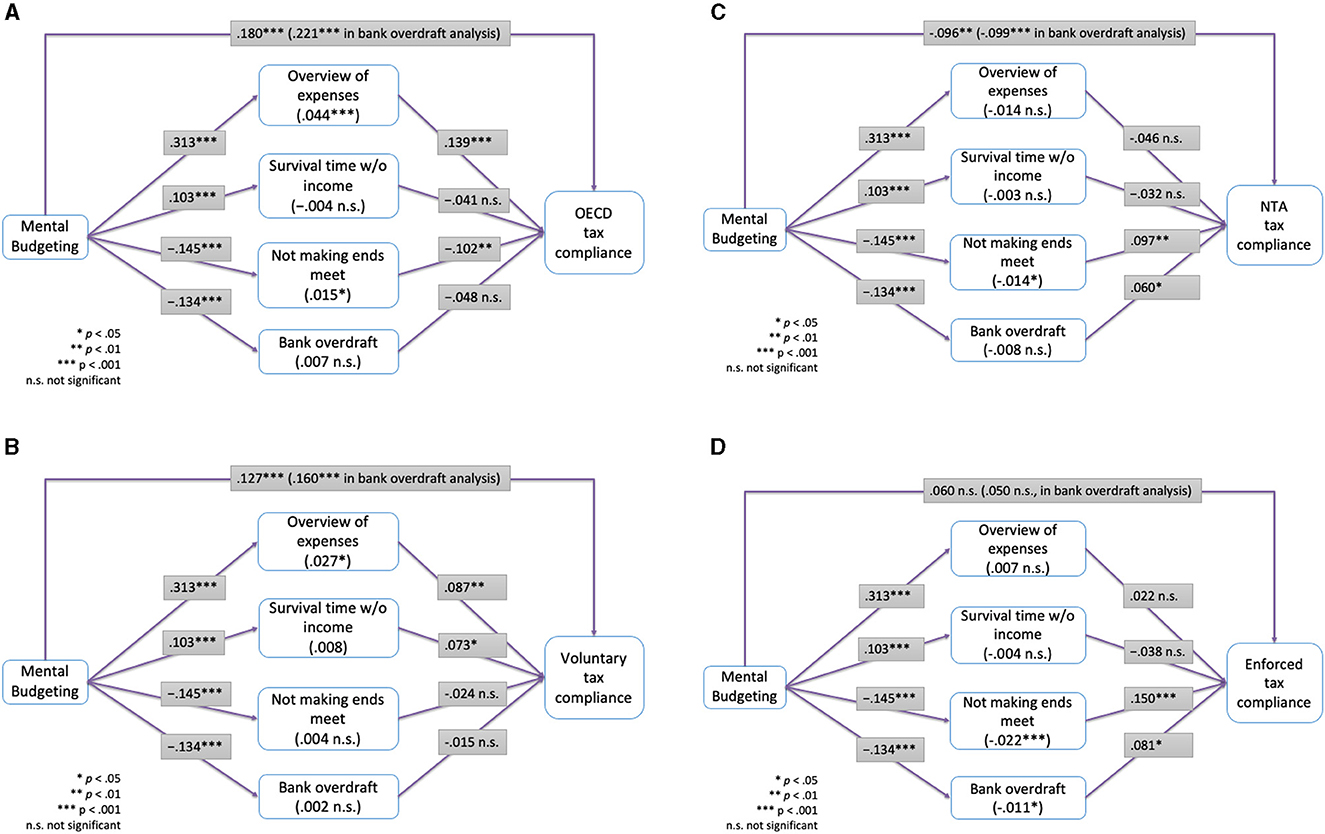

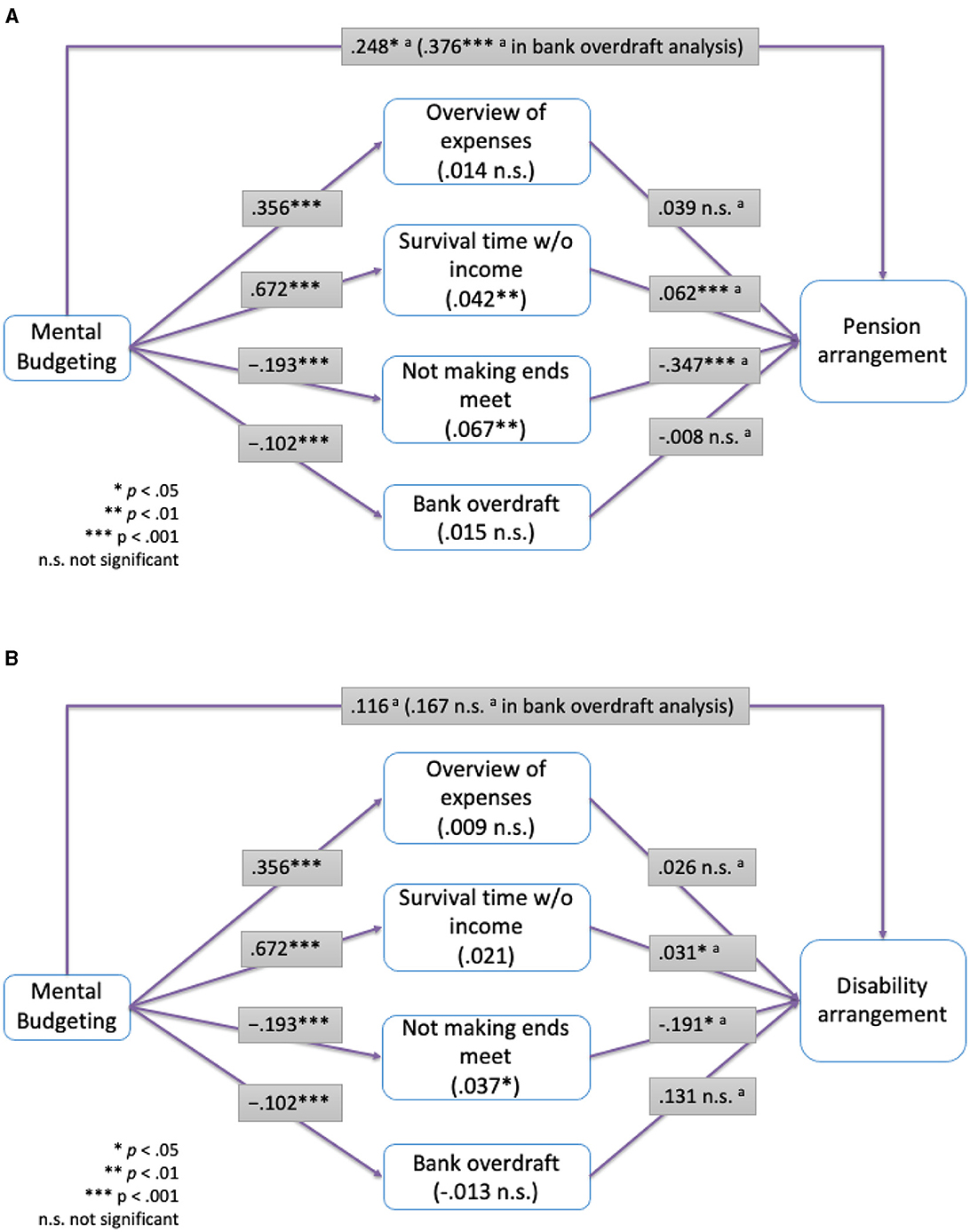

The standardized results of mediation analysis are shown graphically, apart from the effects of control variables. The unstandardized full results, including control variables are shown in Appendices A, B.

Figure 2 shows significant direct effects of mental budgeting on each of the financial management indicators, which are the same in each panel. Furthermore, having payment arrangements with the tax administration, or not knowing if there are such arrangements, was negatively related to all indicators of good financial management. Having other sources of income was positively related to the survival of the business in case of no income, and making ends meet (see Supplementary Table B1).

Figure 2. Mediation results for tax compliance measures. (A) Mediation results for OECD tax compliance. (B) Mediation results for voluntary tax compliance. (C) Mediation results for measures taken by the NTA. (D) Mediation results for enforced compliance. Note: all coefficients are standardized; coefficients for indirect effects are shown in parentheses. The mediation effects of bank overdrafts are based on a separate analysis.

Figure 2A shows that overview of expenses and not making ends meet both were significantly related to the OECD tax compliance measure, resulting in significant indirect effects of mental budgeting via these mediators. Having an overview of expenses shows the largest indirect effect. Survival time of the business without income and business bank overdrafts were not significantly related to OECD tax compliance, so could not be considered mediators. In addition to the indirect effects, mental budgeting had a substantial direct effect on OECD tax compliance.

Figure 2B shows that overview of expenses was significantly related to voluntary tax compliance, resulting in a significant indirect effect of mental budgeting via this mediator. Survival time, not making ends meet and business bank overdrafts were not significantly related to voluntary tax compliance. In addition, mental budgeting had a significant direct effect on voluntary compliance.

It appeared that having an overview of expenses was positively related to both the OECD and the voluntary compliance measures. The internal motivations to comply associated with these measures seemed to match the mental discipline required in the administration and awareness of expenses, rather than the external motivations instigated by the possibility of sanctions.

With respect to measures taken by the NTA (Figure 2C), not making ends meet had a significant positive effect on this measure of non-compliance. The negative direct effect of mental budgeting on not making ends meet resulted in a significant negative indirect effect of mental budgeting on NTA tax compliance. In addition, mental budgeting had a relatively small negative effect on NTA tax compliance. These results might be explained from the concept of power, defined as “having the discretion and the means to asymmetrically enforce one's will over others” (Sturm and Antonakis, 2015). If an entrepreneur cannot make ends meet, the tax administration can exert power by the possibility of taking sanctions in case of tax non-compliance. However, if the entrepreneur can make ends meet, the possibility of sanctions may affect the entrepreneur's behavior less.

Finally, both not making ends meet and bank overdrafts had positive direct effects on enforced compliance (Figure 2D), meaning that these factors contributed to tax compliance because the SwoP perceived the threat of punishment and the risk of being audited as deterrence. Since mental budgeting had negative direct effects on not making ends meet and bank overdrafts, the indirect effect of mental budgeting on enforced compliance was negative.

Both not making ends meet and facing bank overdrafts were positively related to the NTA and enforced compliance measures, whereas having an overview of expenses was unrelated to these measures, thus suggesting different financial management processes involved in different measures of tax compliance, in line with Kirchler and Wahl's contention (2010).

Figure 3 shows the results of mediation analysis on reported pension and disability insurance arrangements. Figure 3A shows significant direct effects of business survival time without income and making ends meet on reported pension arrangements, indicating that the financial position, both in the short-run and in the long-run, was important in this respect. Mental budgeting had positive effects on these mediators, thus leading to positive indirect effects. In addition, mental budgeting had a positive direct effect on pension arrangements. Furthermore, being a starting SwoP was negatively related to pension arrangements, whereas making a substantial profit was positively related (see Supplementary Table C1).

Figure 3. Mediation results for pension and disability arrangements. (A) Mediation results for pension arrangements. (B) Mediation results for disability arrangements. Direct effects of mental budgeting on financial management indicators are standardized; effects of financial management indicators on pension and disability arrangements are shown in log-odds. Coefficients for indirect effects are shown in parentheses. The mediation effects of bank overdrafts are based on a separate analysis. acoefficient shows log-odds.

Similar results were obtained for disability arrangements (see Figure 3B). Again, financial position appeared important, but mental budgeting had no significant direct or indirect effects on reported disability arrangements.

Several control variables were related to financial management, tax compliance, and pension/disability arrangements (see Appendices A, B), notably payment arrangements with the tax administration and having other sources of income. Also, the time to complete the survey and the score for unclear questions were related to both OECD and voluntary compliance measures.

Starting entrepreneurs and those in business for >3 years did not differ in their mental budgeting scores (t = 1.509, n.s.), although the effects of mental budgeting on both NTA compliance and bank overdrafts were more negative (but in the same direction) for experienced than for starting entrepreneurs.

4 Discussion

4.1 Main results

We have found highly significant (direct) relations between mental budgeting and each of our four financial management indicators, showing similar results for SwoP as for regular citizens (see Antonides et al., 2011). This result shows that mental budgeting is related to performing good financial management of the businesses of SwoP. Furthermore, in addition to direct effects of mental budgeting, we have found significant mediation effects of financial management on various measures of tax compliance, and pension and disability arrangements. Interestingly, the effects differed across the outcomes. The direct effects of mental budgeting were stronger for OECD and voluntary compliance indicators than for the NTA measures and enforced compliance. Also, the mediating effects of having an overview of expenses were relatively strong for OECD and voluntary compliance, whereas the mediating effects of not making ends meet and bank overdrafts were relatively strong for the NTA measures and enforced compliance, thus indicating different financial management processes matching different motivations of tax compliance.

We believe that the different mediation effects may be explained from different motivations involved in financial management and tax compliance, as described in Self-Determination Theory (Ryan and Deci, 2000). Both mental budgeting and having an overview of expenses suggest a motivation to perform satisfactory financial management, thus matching the assumed intrinsic motivation underlying OECD and voluntary compliance but not matching the extrinsic motivation underlying NTA and enforced compliance. The intrinsic motivational match may explain both the direct effect of mental budgeting and the mediation effect of having an overview of expenses.

Both (not) making ends meet and bank overdrafts may indicate the SwoP's inability of efficient financial management or lack of intrinsic motivation for it. In this case, extrinsic motivation may be necessary to avoid punishments for not meeting their tax obligations (cf. Di Domenico et al., 2022). Such punishments may include fines and sanctions, the fear of which may lead to enforced tax compliance. Hence, the inability to pay taxes may lead to a higher extrinsic motivation to comply with tax rules. Alternatively, the extrinsic motivation may crowd out the intrinsic motivation to comply (Gneezy et al., 2011). Furthermore, the direct effect of mental budgeting is lower than for the intrinsically motivated tax compliance, for similar reasons.

The different direct and indirect effects of mental budgeting support the idea that trust and power are unrelated processes leading to tax compliance (Wahl et al., 2010). Consequently, to increase tax compliance, mental budgeting might be aimed at different aspects of financial management for SwoP in financial hardship (that is those with bank overdrafts and less ability to survive without income) than for SwoP in more favorable financial situations.

We have found stronger effects of mental budgeting on making pension arrangements than on making disability arrangements. In both cases, making ends meet and survival time of the business without income were positively related to making such arrangements. The latter effects seem plausible because over half of SwoP believe such arrangements are too expensive. This is even more likely in case of financial hardship; making substantial profit tended to increase the probability of making such arrangements.

Apart from the effects described above, mental budgeting may have wider implications for financial behaviors, e.g., financial investments, reactions to price increases and price decreases, advanced and delayed payments. Also, because of mediating financial management aspects, there may be implications for profit making (as shown in Nagel et al., 2019) and debts. Even wider implications might exist with respect to taking holidays, advanced or delayed retirement, and wellbeing. De Bruijn and Antonides (2020) found significant negative effects of making ends meet and having a financial buffer on financial worry and rumination. We leave the investigation of these wider implications for future research.

4.2 Implications

The results of this study show that mental budgeting is significantly related to all four aspects of financial management. The finding that different aspects of financial management are positively related to different measure of tax compliance tentatively implies the following: when focusing on enhancing tax compliance among taxpayers (here: SwoP) one should first take into account what type of tax compliance is targeted (which of the four) and, second, what aspects of financial management are able to elicit changes for that specific type of compliance. For example, the results show that both the OECD measure of compliance and voluntary tax compliance are positively related to “overview of expenses.” This finding suggests that the documentation of expenses is related to the SwoP's internal motivation to comply with the tax rules.

In contrast, enforced tax compliance is positively related to “not making ends meet” and “bank overdraft.” This finding suggests that such financial management indicators signal the need for fines and sanctions in case the SwoP fail to comply with their tax obligations. Muehlbacher et al. (2011) state that voluntary compliance motivations may be more effective in meeting tax obligations than enforced compliance motivations. Our research suggests that having an overview of expenses is more in line with voluntary than with enforced compliance.

A similar reasoning applies to the two types of arrangements. Pension arrangements are related to different aspects of financial management than disability arrangements. Although we believe our interpretation of the findings is plausible, it should be considered with caution because causal relations cannot be assumed.

4.3 Limitations

Since our data is cross-sectional, we do not claim strong causal effects of mediation, although previous research has shown that reverse causal effects or influence of third variables are unlikely, by using either instrumental variable techniques or experimental methods (Antonides et al., 2011; Nagel et al., 2019; Antonides and De Groot, 2022). Also, following the “why” and “how” questioning in the means–end chain methodology, we believe it is more plausible that mental budgeting leads to good financial management and tax compliance than the reverse. The finding that mental budgeting is related to several personality characteristics, formed in early childhood (Muehlbacher and Kirchler, 2019) seems to support this line of reasoning. Further causal evidence may be obtained via field experiments or the use of panel data. All our measures are based on self-reports, which may be less reliable than objective measures of tax compliance. However, in this respect, self-reported data such as actual measures taken by the tax administration, and pension and disability arrangements, may be considered somewhat more reliable than pure attitude measures, i.e., OECD, voluntary and enforced compliance measures. Furthermore, the control variables survey duration and score of unclear questions were related to both OECD compliance and voluntary compliance (but not for NTA compliance and enforced compliance), suggesting that underlying factors of conscientiousness and misunderstanding were related to these measures. Finally, our results pertain to SwoP, which may not be valid for other company types such as small businesses with employees.

Data availability statement

The datasets presented in this article are not readily available because of confidentiality required by the Netherlands Tax Administration. Requests to access the datasets should be directed to IG, SU0uZGUuR3Jvb3RAYmVsYXN0aW5nZGllbnN0Lm5s.

Ethics statement

Ethical approval was not required for the studies involving humans because of our institutes' guidelines that state that no specific approval by the Ethical Committee is needed when the general procedure is carefully followed. Data collection was conducted under the Dutch Code of Conduct for Research and Statistics for responsible handling of personal information of respondents. The studies were conducted in accordance with the local legislation and institutional requirements. The participants provided their written informed consent to participate in this study.

Author contributions

GA: Conceptualization, Data curation, Formal analysis, Methodology, Writing – original draft, Writing – review & editing. IG: Conceptualization, Data curation, Writing – review & editing.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/frbhe.2024.1307894/full#supplementary-material

References

Achtziger, A., Hubert, M., Kenning, P., Raab, G., and Reisch, L. (2015). Debt out of control: The links between self-control, compulsive buying, and real debts. J. Econ. Psychol. 49, 141–149. doi: 10.1016/j.joep.2015.04.003

Agarwal, S., and Mazumder, B. (2013). Cognitive abilities and household financial decision making. Am. Econ. J. 5, 193–207. doi: 10.1257/app.5.1.193

Alizadeh, Y., and Meredith, G. G. (1997). Financial management for self-employed owners. J. Small Busi. Strat. 8, 97–120.

Allingham, M. G., and Sandmo, A. (1972). Income tax evasion: a theoretical analysis. J. Public Econ. 1, 323–338. doi: 10.1016/0047-2727(72)90010-2

Antonides, G., and De Groot, I. M. (2022). Mental budgeting of the self-employed without personnel. J. Behav. Exp. 98:101852. doi: 10.1016/j.socec.2022.101852

Antonides, G., De Groot, I. M., and Van Raaij, W. F. (2011). Mental budgeting and the management of household finance. J. Econ. Psychol. 32, 546–555. doi: 10.1016/j.joep.2011.04.001

Antonides, G., and Ranyard, R. (2018). “Mental accounting and economic behavior,” in Economic Psychology, ed. R. Ranyard (Chichester, UK: Wiley–Blackwell), 123–138.

Atkinson, A., McKay, S., Collard, S., and Kempson, E. (2007). Levels of financial capability in the UK. Public Money Manage. 27, 29–36. doi: 10.1111/j.1467-9302.2007.00552.x

Atkinson, A., McKay, S., Kempson, E., and Collard, S. (2006). Levels of Financial Capability in the UK: Results of a Baseline Study. London: Financial Services Authority.

Balashov, A., and Sanina, A. (2016). “Tax evasion,” in Global Encyclopedia of Public Administration, Public Policy, and Governance, ed. A. Farazmand (Cham: Springer).

Beaver, G. (2003). Small business: success and failure. Strate. Change 12, 115–122. doi: 10.1002/jsc.624

Beaver, G., and Jennings, P. (2001). Human resource development in small firms. Entrepreneurs. Innov. 2, 93–101. doi: 10.5367/000000001101298837

Braithwaite, V. (2003). “Dancing with tax authorities: motivational postures and non-compliant actions,” in Taxing Democracy. Understanding Tax Avoidance and Tax Evasion, ed. V. Braithwaite (Aldershot, UK: Ashgate), 15–39.

Burgoyne, C., and Kirchler, E. (2008). “Financial decisions in the household,” in Psychology and Economic Behavior, ed. A. Lewis (Cambridge: Cambridge University Press), 132–154.

Consumer Financial Protection Bureau (2022). “Making ends meet in 2022,” in CFPB Office of Research Publication No. 2022–9.

Dawson, C., De Meza, D., Henley, A., and Arabsheibani, G. R. (2014). Entrepreneurship: cause and consequence of financial optimism. J. Econ. Manage. Strat. 23, 717–742. doi: 10.1111/jems.12076

De Bruijn, E.-J., and Antonides, G. (2020). Determinants of financial worry and rumination. J. Econ. Psychol. 76:102233. doi: 10.1016/j.joep.2019.102233

Di Domenico, S. I., Ryan, R. M., Bradshaw, E. L., and Duineveld, J. J. (2022). Motivations for personal financial management: a self-determination theory perspective. Front. Psychol. 13:977818. doi: 10.3389/fpsyg.2022.977818

Gneezy, U., Meier, S., and Rey-Biel, P. (2011). When and why incentives (don't) work to modify behavior. J. Econ. Perspect. 25, 191–209. doi: 10.1257/jep.25.4.191

Hayes, A. F. (2017). Introduction to Mediation, Moderation, and Conditional Process Analysis: A Regression-Based Approach. New York, NY: Guilford Publications.

Heath, C. (1995). Escalation and De-escalation of commitment in response to sunk costs: the role of budgeting in mental accounting. Organ. Behav. Hum. Decis. Process. 62, 38–54. doi: 10.1006/obhd.1995.1029

Heath, C., and Soll, J. B. (1996). Mental budgeting and consumer decisions. J. Cons. Res. 23, 40–52. doi: 10.1086/209465

Henderson, P. W., and Peterson, R. A. (1992). Mental accounting and categorization. Organ. Behav. Hum. Decis. Process. 51, 92–117. doi: 10.1016/0749-5978(92)90006-S

HM Treasury (2007). Financial Capability: The Government's Long-Term Approach. Norwich, UK, HM Treasury.

Keele, L., Tingley, D., and Yamamoto, T. (2015). Identifying mechanisms behind policy interventions via causal mediation analysis. J. Policy Analy. Manage. 34, 937–963. doi: 10.1002/pam.21853

Kennedy, J., and Tennent, B. (2006). Financial management practices in small businesses: Regional and metropolitan. Small Enterp. Res. 14, 55–63. doi: 10.5172/ser.14.1.55

Kirchler, E., Hoelzl, E., and Wahl, I. (2008). Enforced versus voluntary tax compliance: the ‘slippery slope' framework. J. Econ. Psychol. 29, 210–225. doi: 10.1016/j.joep.2007.05.004

Kirchler, E., and Wahl, I. (2010). Tax compliance inventory TAX-I: designing an inventory for surveys of tax compliance. J. Econ. Psychol. 31, 331–346. doi: 10.1016/j.joep.2010.01.002

Koh, B. S. K., Mitchell, O. S., and Fong, J. H. (2021). Trust and retirement preparedness: evidence from Singapore. J. Econ. Age. 18:100283. doi: 10.1016/j.jeoa.2020.100283

Lea, S. E. G., Webley, P., and Walker, C. M. (1995). Psychological factors in consumer debt: money management, economic socialization, and credit use. J. Econ. Psychol. 16, 681–701. doi: 10.1016/0167-4870(95)00013-4

Muehlbacher, S., and Kirchler, E. (2019). Individual differences in mental accounting. Front. Psychol. 10:2866. doi: 10.3389/fpsyg.2019.02866

Muehlbacher, S., Kirchler, E., and Schwarzenberger, H. (2011). Voluntary versus enforced tax compliance: empirical evidence for the “slippery slope” framework. Eur. J. Law Econ. 32, 89–97. doi: 10.1007/s10657-011-9236-9

Nagel, H., Huber, L. R., Van Praag, M., and Goslinga, S. (2019). The effect of a tax training on tax compliance and business outcomes of starting entrepreneurs: evidence from a field experiment. J. Busin. Vent. 34, 261–283. doi: 10.1016/j.jbusvent.2018.10.006

Natani, M., Riding, A., and Orser, B. (2020). Self-employment, gender, financial knowledge, and high-cost borrowing. J. Small Busin. Manage. 58, 669–706. doi: 10.1080/00472778.2019.1659685

Newberger, R., Longworth, S., Everett, C., and Onyeagoro, C. (2015). Measuring small business financial health. ProfitWise News Views 2, 1–19.

Olsen, J., Kasper, M., Kogler, C., Muehlbacher, S., and Kirchler, E. (2019). Mental accounting of income tax and value added tax among self-employed business owners. J. Econ. Psychol. 70, 125–139. doi: 10.1016/j.joep.2018.12.007

Pieters, R., Baumgartner, H., and Allen, D. (1995). A means–end chain approach to consumer goal structures. Int. J. Res. Mark. 12, 227–244. doi: 10.1016/0167-8116(95)00023-U

Preacher, K. J., and Hayes, A. F. (2004). SPSS and SAS procedures for estimating indirect effects in simple mediation models. Behav. Res. Meth., Instrum. Comp. 36, 717–731. doi: 10.3758/BF03206553

Raykov, T. (1997). Estimation of composite reliability for congeneric measures. Appl. Psychol. Measure. 21, 173–184. doi: 10.1177/01466216970212006

Rostamkalaei, A., Nitani, M., and Riding, A. (2022). Self-employment, financial knowledge, and retirement planning. J. Small Busin. Manage. 60, 63–92. doi: 10.1080/00472778.2019.1695497

Ryan, R. M., and Deci, E. L. (2000). Self-determination theory and the facilitation of intrinsic motivation, social development, and well-being. Am. Psychol. 55, 68–78. doi: 10.1037/0003-066X.55.1.68

SBA (2016). “Financial management for a small business. Participant Guide,” in U.S. Small Business Administration. Available online at: https://www.slideshare.net/tecbizplan/financial-management-participant-guide (accessed October 19, 2022).

Statistics Netherlands (2022). Statline. Available online at: https://www.cbs.nl/nl-nl/faq/zzp/hebben-zzp-ers-een-voorziening-voor-arbeidsongeschiktheid-of-pensioen-j (accessed October 21, 2022).

Sturm, R. E., and Antonakis, J. (2015). Interpersonal power: a review, critique, and research agenda. J. Manage. 41, 136–163. doi: 10.1177/0149206314555769

Thaler, R. H. (1980). Toward a positive theory of consumer choice. J. Econ. Behav. Organiz. 1, 36–90. doi: 10.1016/0167-2681(80)90051-7

Thaler, R. H. (2015). Misbehaving: The Making of Behavioral Economics. New York, NY: W.W. Norton & Co.

Van Raaij, W. F., Antonides, G., and De Groot, I. M. (2020). The benefits of joint and separate financial management of couples. J. Econ. Psychol. 80:102313. doi: 10.1016/j.joep.2020.102313

Wahl, I., Kastlunger, B., and Kirchler, E. (2010). Trust in authorities and power to enforce tax compliance: an empirical analysis of the “slippery slope framework.” Law Policy 32, 383–406. doi: 10.1111/j.1467-9930.2010.00327.x

Welsh, J. A., and White, J. E. (1981). A Small Business is Not a Little Big Business. Brighton, MA: Harvard Business Review, 2–12.

Keywords: self-employed, tax compliance, financial management, mediation analysis, mental budgeting

Citation: Antonides G and de Groot IM (2024) Relationships of mental budgeting of the self-employed without personnel with tax compliance, pension, and disability arrangements. Front. Behav. Econ. 3:1307894. doi: 10.3389/frbhe.2024.1307894

Received: 05 October 2023; Accepted: 22 July 2024;

Published: 14 August 2024.

Edited by:

Emin Karagözoglu, Bilkent University, TürkiyeReviewed by:

Daniel Schnitzlein, Leibniz University Hannover, GermanyMatthias Kasper, University of Vienna, Austria

Copyright © 2024 Antonides and de Groot. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Gerrit Antonides, R2Vycml0LkFudG9uaWRlc0B3dXIubmw=

Gerrit Antonides

Gerrit Antonides I. Manon de Groot2

I. Manon de Groot2