- 1Haskayne School of Business, University of Calgary, Calgary, AB, Canada

- 2Faculty of Business, University of Athabasca, Athabasca, AB, Canada

Introduction: Downsizing, and the mass layoff upheavals that ensue, has been euphemistically referred to as a short-term pain, long-term gain strategy. But is that so? Do its financial outcomes over time justify the short-run harm? And, to what extent has its adoption been driven by economic or social rationales over time?

Methods: To examine these questions, we conducted the most comprehensive meta-analysis on downsizing-financial performance relationships to date, summarizing a total of 905 effect sizes. Using a new meta-analytic method multi-level longitudinal meta-analysis (MLLMA) we analyze temporal dimensions of these relationships.

Results: Results for downsizing adoption suggest shifting rationales over time, from a defensive response to decline in the 1980s, to a socially legitimate management convention in the 1990s, and back to a defensive response in the 2000s. Short-run market outcomes mirror these shifting rationales, with more negative reactions to defensive downsizing. Across a diverse range of lead/lag times and moderators, we find many negative and heterogeneous performance outcomes. Most importantly, little long-term gain is found.

Discussion: Our MLLMA helps to address prior criticisms on the lack of temporality in extant downsizing research, while many equivocal relationships, despite almost 40 years of downsizing research, illustrate that considerable avenues for future research remain.

Introduction

Downsizing, the intentional reduction of a firm's workforce to improve future financial performance (Datta et al., 2010), is a ubiquitous cost-reduction strategy adopted by countless firms. Its resultant layoffs often make headlines and can number in the tens of thousands, whether they be result of collapsing commodity prices (Cattaneo, 2016), global restructuring in some of the largest multi-national enterprises (Riley and Horowitz, 2019), or the global coronavirus pandemic—where they numbered in the hundreds of millions (McKeever, 2020). Layoffs generate detrimental economic and/or psychological outcomes for affected employees—which include not only those who lose their jobs, but also those who remain (Kets de Vries and Balazs, 1997). Most dire is the decreased life expectancy, such as through suicide (Milner et al., 2014), estimated at an overall 1.5-year reduction for those laid off at 40 (Sullivan and Von Wachter, 2009). The ongoing prevalence of downsizing, despite detrimental outcomes for affected employees, typify it as a necessary evil in today's organizations (Molinsky and Margolis, 2005), whereby downsizing's short-run harm is deemed necessary for the greater good of the firm long term. As such, downsizing has been referred to as a short-term pain, long-term gain strategy in research (e.g., Cascio et al., 1997) and euphemistically in practice.

But what greater good is offered? Is it a financial gain, whereby downsizing's long-run outcomes justify the short-run harm to employees? Or is it simply a mitigation of financial losses in the face of decline? There is considerable controversy over downsizing's ability to achieve firms' financial objectives (Cascio, 1993; Datta and Basuil, 2015). Ostensibly, downsizing adoption is driven by economic factors, particularly a means of avoiding complete firm failure, where all employees would lose their jobs instead of just an unfortunate few. However, this can be simply a palatable justification as downsizing can be driven by not only economic factors, but also by social ones such as taken-for-granted managerial beliefs (McKinley et al., 2000) or the socially endorsed legitimacy that comes with complying to standard management practices (Budros, 1997). For example, Pfeffer described the 120,000 plus people that the tech industry laid off (e.g., Amazon, Meta, and Google) in 2022–2023 as being due to “imitative behavior” instead of financial reasons (De Witte, 2022). Consequently, how downsizing is perceived and the acceptability of these social factors can change (e.g., the Overton Window), just as the stock market's reaction to firms' downsizing announcements are reflective of prevailing market beliefs at any point in time.

Questionable financial outcomes and the possibility of changing social or market beliefs over time raises several temporally grounded research questions. Over time, to what extent has downsizing adoption been driven by economic or social rationales? Has the market's reaction to downsizing changed? And do the long-run financial outcomes of downsizing generally justify the short-run harm? To examine these temporal questions, we conducted the most comprehensive meta-analysis on downsizing-financial performance relationships to date using a new method called multi-level longitudinal meta-analysis.

Multi-level longitudinal meta-analysis: the rationale

Our decision to meta-analytically review this literature was motivated by several factors. First, downsizing's pervasiveness in practice and the controversy surrounding it has generated a considerable research corpus over the better part of four decades (Datta et al., 2010). Second, there is little consensus as to the overall strength and direction of financial performance's relationship with downsizing, despite several literature reviews over the years (e.g., Cascio, 1993; Datta et al., 2010; Gandolfi and Hansson, 2011; Datta and Basuil, 2015). These reviews need to be refreshed (Cooper, 2015), with more recent research available. Third, existing meta-analyses (Capelle-Blanchard and Couderc, 2007; Allouche et al., 2008) primarily focus upon the stock market's immediate (~1 day) reactions to downsizing announcements, while other lead/lag times and types of financial performance have yet to be examined. Likewise, existing meta-analyses in the related field of employee turnover tend not to distinguish firm-initiated downsizing from other types of voluntary or involuntary turnover with cause (e.g., Hancock et al., 2017) and we are unaware of any prior meta-analyses examining the determinants of downsizing, aside from Park and Shaw (2013). However, their Reduction-In-Force (RIF) analyses was a small subset of their overall investigation into turnover and can be considered tangential, being based on only 11 correlates (~1% of the present investigation). Fourth, many downsizing studies construct panel datasets from large samples of secondary data that contain longitudinal findings advantageous to further temporal examination.

Lastly, efforts to meta-analyze the temporal aspects of downsizing-financial performance relationships have historically been hampered by two factors. First, there is the lack of reported intercorrelations across financial performance measures at different points in time within the body of research. Second, there is the assumption of independent effects required in traditional meta-analytic methods. The former violates boundary conditions for methods traditionally used to assess temporality or casual paths, such as meta-analytic structural equation modeling (MASEM) or cross-lagged designs (Bergh et al., 2016), while the latter requires calculating single composite effect size per study (Steel et al., 2021), which removes much of the temporal detail available in any given study (Mitchell and James, 2001).

Fortunately, recent developments in multi-level techniques have improved longitudinal meta-analysis and a method now exists that allows the coding of repeated measures at different points in time from within a single study (Gucciardi et al., 2021), which we refer to as multi-level longitudinal meta-analysis (MLLMA). MLLMA accounts for variance in effect sizes both within and between studies with an accuracy similar to multivariate meta-analysis (Van den Noortgate et al., 2013). Although bivariate in nature, this method leverages the fundamental principle that causal relationships require the first variable to precede the other in time. Due to time's arrow, what happens after cannot cause what happens before, thus enabling a more rigorous meta-analytic examination of temporal dimensions within a body of research (Bullock et al., 1994). MLLMA allows us to assess financial performance lead (lag) times before (after) downsizing and the historical context within which these relationships occur, thus aligning with our research questions. This new technique enabled us to meta-analyze almost a thousand effect sizes.

Our MLLMA helps to address prior criticisms on the lack of temporality in extant downsizing research. It challenges the short-term pain/long-term gain perspective of downsizing and questions whether the greater good of downsizing in the long run can ever be known, particularly when downsizing is adopted to mitigate a firm's losses and not in pursuit of an absolute financial gain. In the sections that follow, we outline two of the dominant theoretical perspectives in research on downsizing-financial performance relationships and present our MLLMA methodology. After presenting our results, we highlight knowledge gaps and offer directions for future research.

The institutional perspective on downsizing

Many theories have been used to explain the relationships between downsizing and financial performance, or vice-versa (McKinley et al., 2000). Much of this research tends to fall within one of two primary domains: an institutional perspective or an economic perspective. The institutional perspective proposes that managers adopt downsizing strategies to gain the social legitimacy that comes with mimicking others under conditions of uncertainty or conforming to standard management practice (DiMaggio and Powell, 1983). Downsizing became a standard management practice with the proliferation of downsizing across many firms in the 1990's (Budros, 1997). The strategy now possesses a taken-for-granted quality, whereby managers often believe downsizing is effective because this dominant perception has become reified and socially reinforced over time (McKinley et al., 2000).

Historical context and adoption of downsizing strategies

Under the institutional perspective, the historical context within which downsizing occurs will influence the relationship between prior financial performance and adoption of downsizing. In the 1980's, downsizing was in its infancy and synonymous with decline (Freeman and Cameron, 1993). It did not garner the social legitimacy it holds today, signaled serious economic trouble at the firm (Budros, 2002; Hyman, 2018), and was often viewed with disrepute by stakeholders (Ahmadjian and Robinson, 2001). As such, we expect:

Hypothesis 1: Prior financial performance and the adoption of downsizing should be significantly and negatively related in the historical context of 1980's.

In the 1990's, downsizing lost its stigma and was no longer primarily a response to decline. The elimination of existing labor was seen as a legitimate way of increasing short-run profits (Dencker, 2012), and its adoption became more widespread across many firms, regardless of their prior level of financial performance (Budros, 1997; McKinley et al., 2000; Hyman, 2018). Management consulting firms, exemplified by McKinsey, emphasized “reengineering” and “overhead value analysis,” which were widely adopted and inevitably led to downsizing (Hyman, 2018; Markovits, 2020). Consequently, this decade is generally referred to as the downsizing era (Datta et al., 2010), with a widely held view of firms as having to be lean and mean at the time (Budros, 2002). Even individual downsizing enthusiasts, exemplified by Al “Chainsaw” Dunlap, were often celebrated (Byrne, 1999). As such, we expect:

Hypothesis 2: Prior financial performance and the adoption of downsizing should not be significantly or substantively related in the historical context of 1990's.

In the historical context of this millennium, there is considerably less theorizing and research on the influence of social beliefs upon downsizing adoption. Downsizing is now widespread and retains its status as a legitimate management practice, yet its risks and uncertain outcomes are also better known. Downsizing is fraught with reputational concerns (Schulz and Johann, 2018) and there is plenty of mixed evidence on downsizing's effectiveness (Datta and Basuil, 2015), including increased risk of bankruptcy (Zorn et al., 2017). Reputational risks and questionable effectiveness suggest that downsizing's legitimacy has waned over time. If so, firms in recent decades will be more reluctant to downsize without a legitimate economic rationale, such as a prior decline in performance. As such, we expect:

Hypothesis 3: Prior financial performance and the adoption of downsizing should be significantly and negatively related in the historical context of the 2000's.

Historical context and market reactions to downsizing

An institutional perspective also proposes that stock market reactions to downsizing will reflect of prevailing beliefs held by the market at the time the downsizing announcement is made. The market's beliefs about downsizing effectiveness in general will influence, inter alia, its expectation of future performance in any given firm. Chatrath et al. (1995) found more negative stock market reactions to downsizing announcements in the 1980's, while they were more positive in the 1990's. We expect to replicate this finding in the extant body of research.

In the historical context of this millennium, there is less institutional research on changing stock market reactions to downsizing announcements, with a few noticeable but contradictory exceptions (Cascio et al., 2021; Shin et al., 2022). In particular, Shin et al. (2022) found that the 2000's marked a notable shift in market reactions—toward more stakeholder capitalism and less shareholder capitalism. Because downsizing prioritizes shareholders' interests over employees' interests, this recent shift toward stakeholder capitalism might suggest that the market responds less favorably to downsizing in recent years. Therefore, we expect:

Hypothesis 4: The association between downsizing and market performance reactions in the historical context of the 1980's and the 2000's are more negative than that of the 1990's.

The economic perspective of downsizing

The economic perspective of downsizing primarily argues that downsizing reduces compensation costs, which increases a firm's financial performance when human resources are utilized more efficiently (Cascio, 1993; Pfeffer, 1998). Under the economic perspective, firms adopt defensive downsizing strategies as a reactive response to performance decline (Freeman and Cameron, 1993), while those not facing decline may adopt an offensive downsizing strategy to enhance current levels of financial performance (Lee, 1997). Firm financial performance is typically divided into two major groups: accounting and marketing (Richard et al., 2009; Datta et al., 2010). Accounting measures are derived from a firm's financial statements and focus on historical performance. These include Return on Assets, Equity, or Investment and Net Profit Margin. Marketing measures are derived from the stock market and consequently are forward looking, indicating expected performance. These include Market Capitalization, Price-Earning Ratio, Dividend Yield and Total Shareholder Return.

When faced with a decline in accounting performance, firms often focus upon cost-reduction strategies like downsizing, more so than revenue-enhancing strategies, because a firm's future costs are more predictable that its future revenues (Cascio, 1993). When faced with poor market performance, stock market pressures and investors' earning expectations can provoke adoption of a downsizing strategy in firms (Jung et al., 2015; Schulz and Wiersema, 2018). In turn, the market uses firms' downsizing announcements as a signal of future firm performance—evaluating them in the context of prior performance to modify its subsequent valuation of a firm (Worrell et al., 1991; Lee, 1997).

Lead time to adoption of downsizing

Lead time to adoption of a downsizing strategy is typically assessed relative to the onset of performance decline, yet there is a paucity of downsizing research on how long it takes for a prior decline to impact adoption of the strategy. A few have argued that downsizing is a quick, automatic reaction to short-run market decline (Morrow et al., 2004)—characterizing it as being a short-sighted strategy (Bruton et al., 1996; Gandolfi and Littler, 2012), where decision-makers in firms choose actions that have immediate results visible to the market and with less concern for long-run outcomes (Huy, 2001). Although some firms are likely to downsize quickly, we do not expect this to be the prevailing meta-analytic trend, as market prices regularly rise and fall, while adoption of downsizing remains a comparatively infrequent firm event. As such, we expect:

Hypothesis 5: Prior market performance and adoption of a downsizing strategy is non-significant or negligibly related when the lead time is short.

In contrast to the quick reflexive view of downsizing, research in the related field of retrenchment strategies illustrates how downsizing can be a last resort strategy—with long lead times to downsizing adoption. It can take a considerable amount of time for a firm's top management team to even perceive a decline, let alone respond to it (Trahms et al., 2013). The presence of overly positive illusions such as hubris, unrealistic optimism, and other self-enhancing biases amongst senior managers can inhibit perceptions of performance decline at its initial onset (Taylor and Brown, 1988; Hiller and Hambrick, 2005). Once a decline is perceived, the threat it poses can generate considerable stress (Staw et al., 1981), which simultaneously increases managers' information search activities, decreases their information overload threshold, and tightens their need for managerial control. These factors contribute to inertia or rigidity in firms facing decline (Staw et al., 1981; Barbero et al., 2017), thus increasing the lead time to a defensive action. As such, we expect:

Hypothesis 6: Prior market performance and the adoption of a downsizing strategy should be significantly and negatively related when the lead time is long.

Time lags to downsizing's market performance outcomes

Considerable research exists on the stock market's reactions at the time of a public downsizing announcement. Several studies have found negative stock reactions to downsizing announcements at the time immediately surrounding the event (e.g., Lee, 1997), while others have found a positive relationship (e.g., Chalos and Chen, 2002). The strength and direction of the stock market's reaction immediately following a downsizing announcement can also vary based on the firm's performance prior to downsizing. If a firm is already facing a performance decline, an announcement of downsizing further confirms that the firm is facing difficulties and the market is likely to react negatively (Palmon et al., 1997; Franz et al., 1998). For firms not already facing a decline in performance, a downsizing announcement can signal reorganization or efficiency-seeking, which can result in a positive market response (Franz et al., 1998; Chalos and Chen, 2002). Given that prior meta-analyses on 1 day stock returns find generally negative market responses (Capelle-Blanchard and Couderc, 2007; Allouche et al., 2008), we expect to replicate the short-term pain of downsizing via an overall significant, negative association with a firm's market performance at the time of a downsizing announcement. However, we also expect this association to vary based on the firm's prior level of performance, whereby downsizing that is defensive has a significant, negative association with immediate stock market reactions, while offensive downsizing has a positive association. Consequently:

Hypothesis 7: Negative stock market reactions to a firm's downsizing announcement should be moderated by whether the downsizing is perceived to be defensive or offensive.

Time lags to downsizing's accounting performance outcomes

The economic perspective tends to focus upon downsizing's compensation cost savings, while the direct costs of downsizing in the short run, such as severance pay or benefits extensions, are often underestimated (Gandolfi and Hansson, 2011). Identifying which employees to remove and which to retain is a difficult task and potentially fraught with biases (Kalev, 2014). Removing too many or the wrong employees can disrupt existing routines (Brauer and Laamanen, 2014), further deplete a firm's stock of resources (Hambrick and D'Aveni, 1988), and hurt employee productivity and morale (Armstrong-Stassen, 2002)—all of which suggest negative post-downsizing performance in the short-term. Although some downsizing strategies will inevitably succeed and others will fail, we expect the general meta-analytic trend to align with the short-term pain perspective of downsizing in extant research, specifically:

Hypothesis 8: Accounting performance and the adoption of a downsizing strategy is significantly and negatively related in the short term.

Longer-term, the relationship between downsizing and post-downsizing accounting performance becomes more uncertain, with many equivocal results across studies to date (Datta et al., 2010). The economic argument tends to view employees as a cost to be minimized and not a source of value creation and competitive advantage (Pfeffer, 1994). Emphasizing costs may fail to consider productivity losses amongst those who remain (Greenhalgh et al., 1988; De Meuse et al., 1994), a reduction in a firm's total compensation rate does not necessarily equate to the same reduction in total labor cost (Pfeffer, 1998). Even if productivity gains are achieved, doing too much with too few people is not sustainable in the long run. Overworked employees may experience burnout (Harney et al., 2018), while turnover amongst remaining employees may increase (Trevor and Nyberg, 2008). The economic perspective also tends to assume that firms have and will have human resource slack (i.e., excess or inefficient employees), which may or may not be the case. Removing HR slack can lower costs, generate efficiencies, and create a refocused firm (Love and Nohria, 2005), but HR slack is also needed for a firm to adapt to changing conditions and innovate, while still executing existing work (March, 1991; Lecuona and Reitzig, 2014). These direct and indirect costs of downsizing in the long run could counteract any financial performance improvement. With conflicting theoretical arguments and equivocal empirical evidence in prior literature reviews, we question the long-run gain of downsizing and expect:

Hypothesis 9: Accounting performance and the adoption of a downsizing strategy is non-significant or negligibly related in the long term.

Methodology

Transparency and openness

All search syntax, article list, meta-analytic data and associated statistical scripts are kept in an Open Science repository (https://osf.io/6x2br/?view_only=00614954cf8b49138bd39b185b091a51), with specific links to subsections in our Data Transparency Appendix. Data were analyzed using R, version 4.2.0 (R Core Team, 2022). This study's design and its analysis were not preregistered.

Literature search and inclusion criteria

Published literature was broadly searched (see Data Transparency Appendix 1), yielding 8,010 potential sources that were imported into the HubMeta (Steel et al., 2023) online platform. Reference sections in prior literature reviews, related meta-analyses, and subsequently coded articles were also searched, yielding an additional 55 sources. After removing duplicates, 6,088 sources remained for further review (see Data Transparency Appendix 2). Four initial inclusion criteria were applied, two for downsizing (downsizing had to be specific to employment and a focus of the study) and two for firm performance (firm performance outcomes had to be financial and measured at firm/establishment level). After this title and abstract screening process, 530 sources remained for full-text screening. Full-text screening applied six additional inclusion criteria. First, the articles had to include quantitative data. Second, the operationalization of the downsizing measure in the study had to isolate involuntary layoffs without cause. Studies that explicitly included voluntary turnover, involuntary turnover with cause, or aggregate measures of total/collective turnover within the downsizing measure were excluded. Third, studies with subjective measures of perceived firm performance were excluded due to their reliance upon retrospective views of downsizing, which can vary greatly in their temporal aspects, thus creating validity concerns. Fourth, studies specific to CEO departures were not deemed to be downsizing strategies and were excluded. Fifth, to ensure a sufficiently large sample size, the number of firms in any given study had to exceed 10 (Jenkins and Quintana-Ascencio, 2020). Sixth, quantitative studies reporting only beta coefficients or threshold significance levels were excluded due to a lack of information from which a univariate correlation could be coded. Application of these inclusion criteria yielded 114 sources for subsequent coding (see Data Transparency Appendix 3).

Correlation coding procedures

If a study reported a correlation matrix, the zero-order correlation between the variables of interest was captured. In the absence of a correlation matrix, descriptive statistics were used to calculate a correlation using the online meta-analytic calculator by Wilson (2023). Coding of sample sizes was based on the number of firms, which is the unit of measurement most commonly used in this body of research. All zero-order correlations were coded twice, with any discrepancies between the two sets of coding resolved by referring to the original source document. Financial performance coding captured each financial performance measure by its lead/lag time relative to downsizing, as reported in the source study. This coding was then synthesized into higher-order constructs by type of financial performance with similar lead/lag times. For example, accounting performance lead times included: accounting performance <1 year prior, accounting performance 1 to <2 years prior, and accounting performance 2 or more years prior to downsizing. Lag times after downsizing were categorized similarly. Constructs for market performance adopted additional temporal categories, due to the availability of daily returns, which ranged from stock returns at days 0, 1, 2–5, 6–10, 11–29, days 30–364, 1 to <2 years, and 2 or more years pre-/post-downsizing. These coding procedures resulted in a total of 905 recorded correlations for the 114 articles.

Moderator coding procedures

The moderating influence of different types of financial performance, i.e., accounting vs. market performance, and different lead/lag times were inherent to the chosen meta-analytic coding structure. Additional coded moderators included: the historical context of the study, within- vs. between-firm effects, and whether downsizing was offensive or defensive to a prior performance decline. Historical context of the study was coded using the mean year of the study's sampling period, which was then categorized as either the 1980's, 1990's, or 2000's. While some samples inevitably crossed more than one decade, the average range of sampling periods in our study was 6 years, meaning a 10-year span reasonably captures changes across different historical contexts. Correlations that represented within-firm effects (those sampling only downsizing firms to examine performance declines/improvements within downsizing firms) were coded and distinguished from correlations that represented between-firm effects (those sampling both downsizing and non-downsizing firms to compare levels of performance between firms who downsize and those who do not). There is also no standard measure for offensive or defensive downsizing, with existing studies often relying upon qualitative coding of text in press releases to assess firms' downsizing motives. Taking a content validation approach, the first author qualitatively coded any downsizing motives reported in extant studies into defensive or offensive downsizing categories, which were then double coded by the second author. Any discrepancies between the two sets of codes were discussed until a consensus was reached (see Data Transparency Appendix 4). The complete measurement structure, comprising of 357 variables (e.g., Profit Margin) organized into two three-level hierarchies, are provided in the first tab (i.e., Dictionary) of the data file (see Data Transparency Appendix 5).

Meta-analytic procedures

To account for our coding of repeated measures in the same study, we adopted the multilevel meta-analytic modeling approach of Gucciardi et al. (2021). All HubMeta coding was exported to a data file and segmented into two datasets (see Data Transparency Appendix 5)—one for within-firm samples and the other for between-firm samples to avoid confounding these two different effects (Certo et al., 2017). The two datasets were then divided further into before and after downsizing segments, reflecting lead and lag times accordingly. Effect sizes with lead/lag times immediately surrounding and/or simultaneous to the downsizing measure were deemed to be at the time downsizing and analyzed separately. Immediate lead/lag times were defined as −1 day through to +1 day in studies reporting daily stock market data, and <1 year (+/-) in the remaining studies. In total, this process created six overall meta-analytic effects—before/at/after downsizing within-firms and before/at/after downsizing between firms. For each of the six meta-analytic effects, an overall pooled effect was first calculated in R using a REML model, followed by an assessment of the moderating effect of historical context and lead/lag times (see Data Transparency Appendix 6). Because the focal body of research relied upon secondary data from firm financial reporting or press releases, when Cronbach's alpha was not reported it was estimated at 1.0 (i.e., financial data is typically reported without error).

In addition to the conventional credibility interval, Q-statistic, and overall heterogeneity (I2) calculations, both within-study () and between-study () heterogeneity were calculated. A considerable percentage of the total heterogeneity in the results that follow is accounted for by the variance both within and between coded studies. Tests comparing the fit of the multi-level models against models where the within/between study variance was constrained at zero lent support for our chosen multi-level meta-analytic approach (Gucciardi et al., 2021). Within- and between-source variances were tested for their level of significance, as was the fit of the multi-level model over that of a model with sampling variance alone. The effect of outliers was evaluated via both residuals exceeding three standard deviations and Cook's distance >3 times the mean. Results that follow appear robust to outliers, with effects changing by no more than (+/-) 0.02 when outliers were removed (see Data Transparency Appendix 7).

A multi-faceted approach was adopted to assess publication bias, as the “usefulness of the other methods or approaches for [assessing publication bias in] meta-analysis involving dependent effects currently remains unknown” (Gucciardi et al., 2021, p. 13). Publication bias was assessed using moderator tests, specifically whether publication status and sample size moderated relationships, a multi-level version of Egger's symmetry test (Fernández-Castilla et al., 2021), and visual inspection of funnel plots. Published vs. unpublished status did not moderate any of the reported effects, lending initial support for a lack of publication bias. Sample size did not moderate the reported effect sizes in five of the six analyses, while four of the six analyses passed Multilevel Egger's tests. Visual inspection of funnel plots for the remaining analyses (before/after downsizing between firms) suggested a lack of publication bias within the extant body of research.

Results

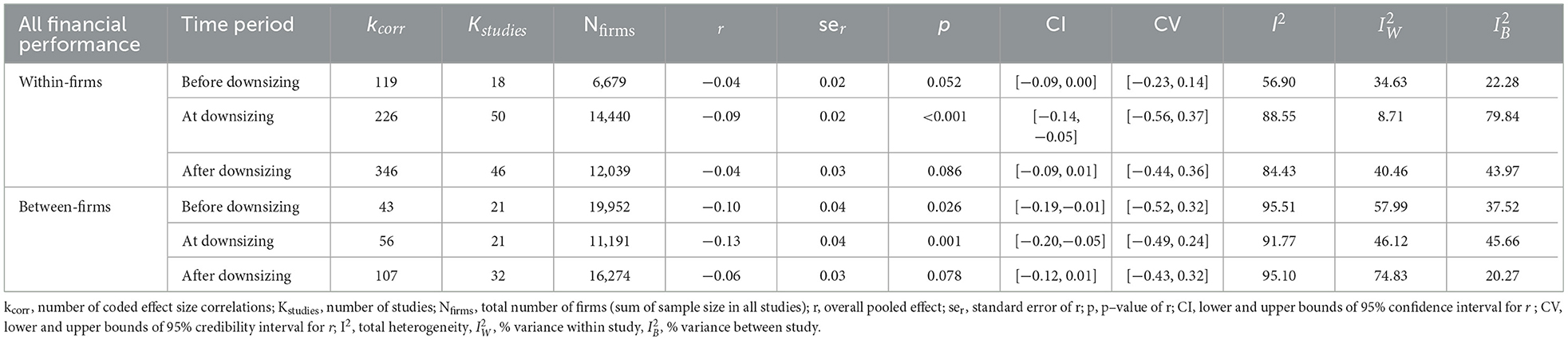

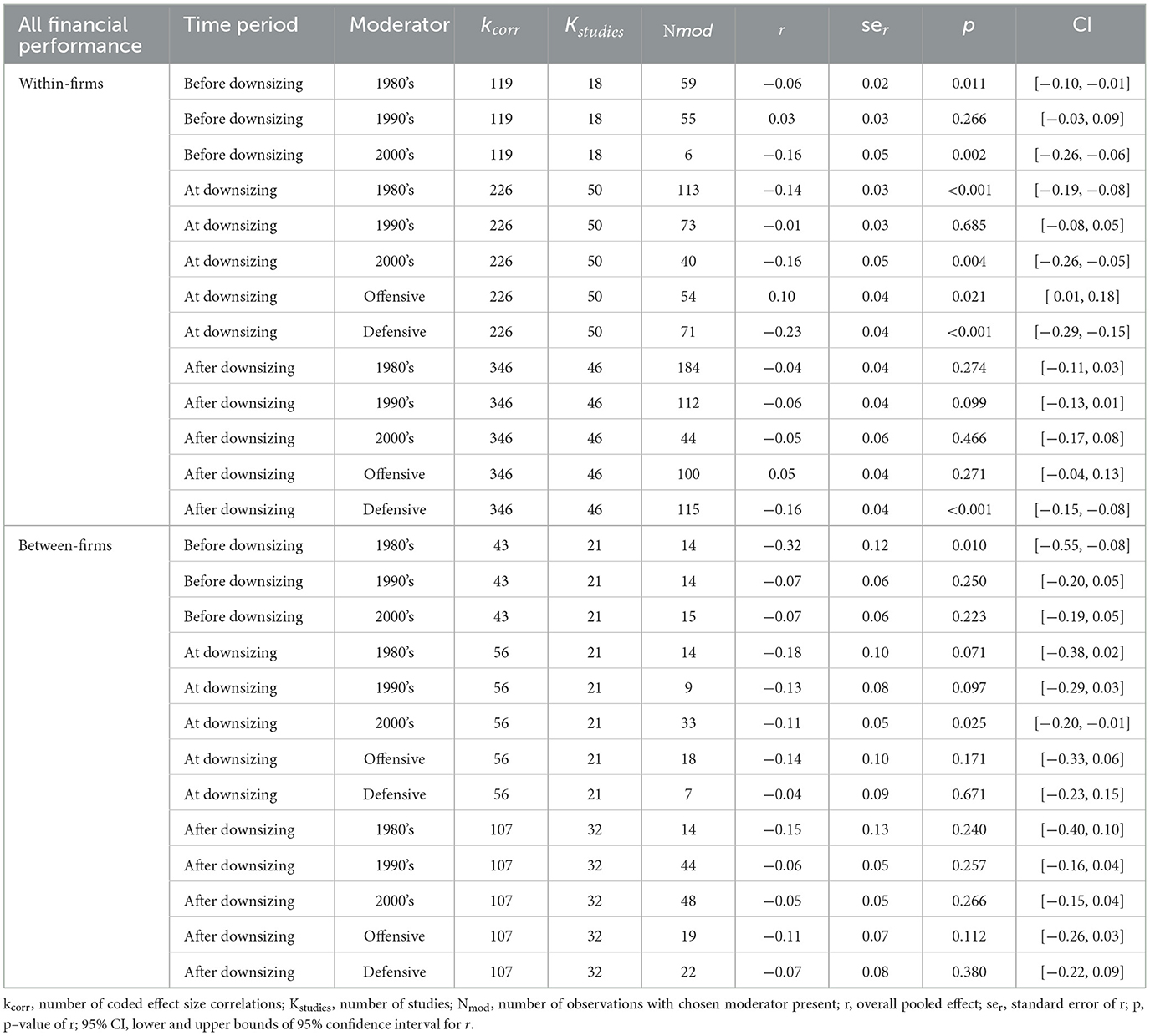

Table 1 presents results for the six overall meta-analytic effects, while Table 2 illustrates the moderating influence of historical context. In support of Hypothesis 1, significant negative relationships exist in the 1980's (Table 2) for both within-firm changes in financial performance (r = −0.06, CI = [−0.10, −0.01]) and levels of performance between downsizing and non-downsizing firms (r = −0.32, CI = [−0.55, −0.08]), the latter being the largest absolute effect size found in the entire meta-analysis. In support of Hypothesis 2, no significant effects are found in the 1990's. In the 2000's, we found mixed support for Hypothesis 3. There was a significant negative relationship for within-firm-performance (r = −0.16, CI = [−0.26, −0.06]), but not for between firms. In sum, these results suggest that downsizing in the 1980's was more so a defensive response to low performance relative to other firms, while that of the 2000's is primarily a defensive response to within-firm performance decline. No significant relationship in the 1990's suggests that firms engaged in more offensive downsizing relative to other time periods, albeit not exclusively so.

Table 2. Historical context and prior performance as moderators of downsizing–financial performance relationships.

In terms of the historical context and market reactions, as per Hypothesis 4, we expected more negative market responses to downsizing announcements in the 1980's and 2000's, relative to the 1990's. Within-firm samples in Table 2 at the time of downsizing present these results. Significant negative relationships are found for within-firm performance change in both the 1980's (r = −0.14, CI = [−0.19, −0.08]) and 2000's (r = −0.16, CI = [−0.26, −0.05]), while no significant relationship is found in the 1990's. Of the 226 correlations that comprise these results, 199 captured market performance outcomes. Robustness checks excluding any accounting performance correlations coded at the time of downsizing, yielded very similar results.

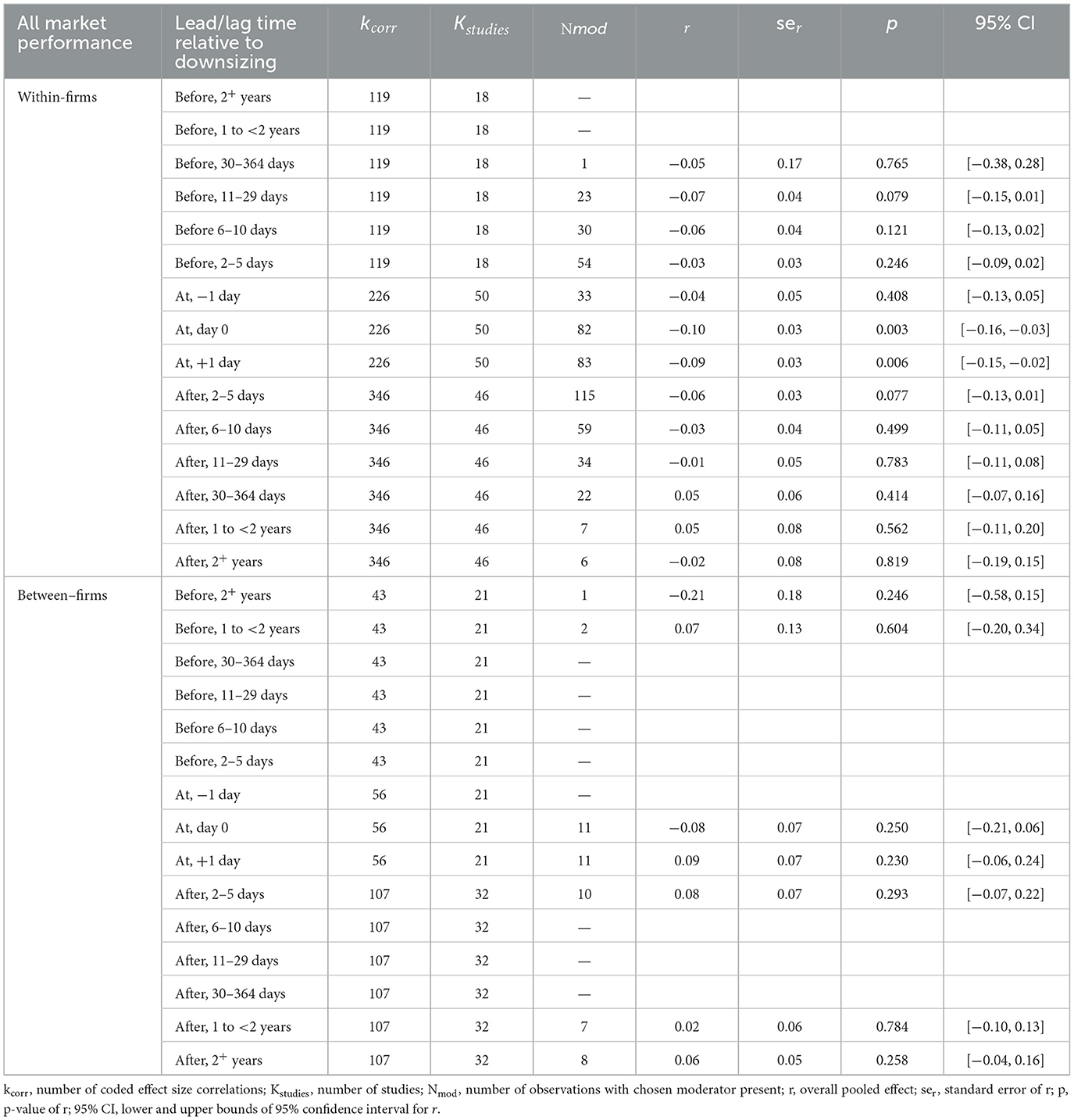

As per Hypothesis 5 and 6, we expected to find a significant, negative association between prior market performance and adoption of a downsizing strategy when the lead time is long instead of short. Table 3 presents the moderating influence of lead/lag times upon downsizing-market performance relationships. None of the relationships for market performance before downsizing was significant, suggesting downsizing as a quick reaction to poor market performance is not an overarching trend, consistent with Hypothesis 5. This result is primarily based upon lead times ranging from −2 to −29 days prior to downsizing, as there are very few studies of market performance with longer lead times. On the other hand, there were also no significant relationships at +2 days or more post downsizing, even over 2 years afterwards, inconsistent with Hypothesis 6.

Table 3 demonstrates a significant, negative association for within-firm market performance changes at the time of a downsizing announcement (r = −0.10, CI = [−0.16, −0.03] at day zero) and/or the following day (r = −0.09, CI = [−0.15, −0.02] at day one). As per Hypothesis 7, we expected this short-run negative reaction to vary based on the firm's prior financial performance, whereby market reactions would be negative for downsizing that is defensive to prior financial decline and positive for downsizing in the absence of decline. Within-firm results in Table 2 at the time of defensive (r = −0.23, CI = [−0.29, −0.15]) and offensive downsizing (r = 0.10, CI = [0.01, 0.18]) are consistent with this expectation. Notably, the latter is the only significant positive effect size found in our meta-analysis of this literature.

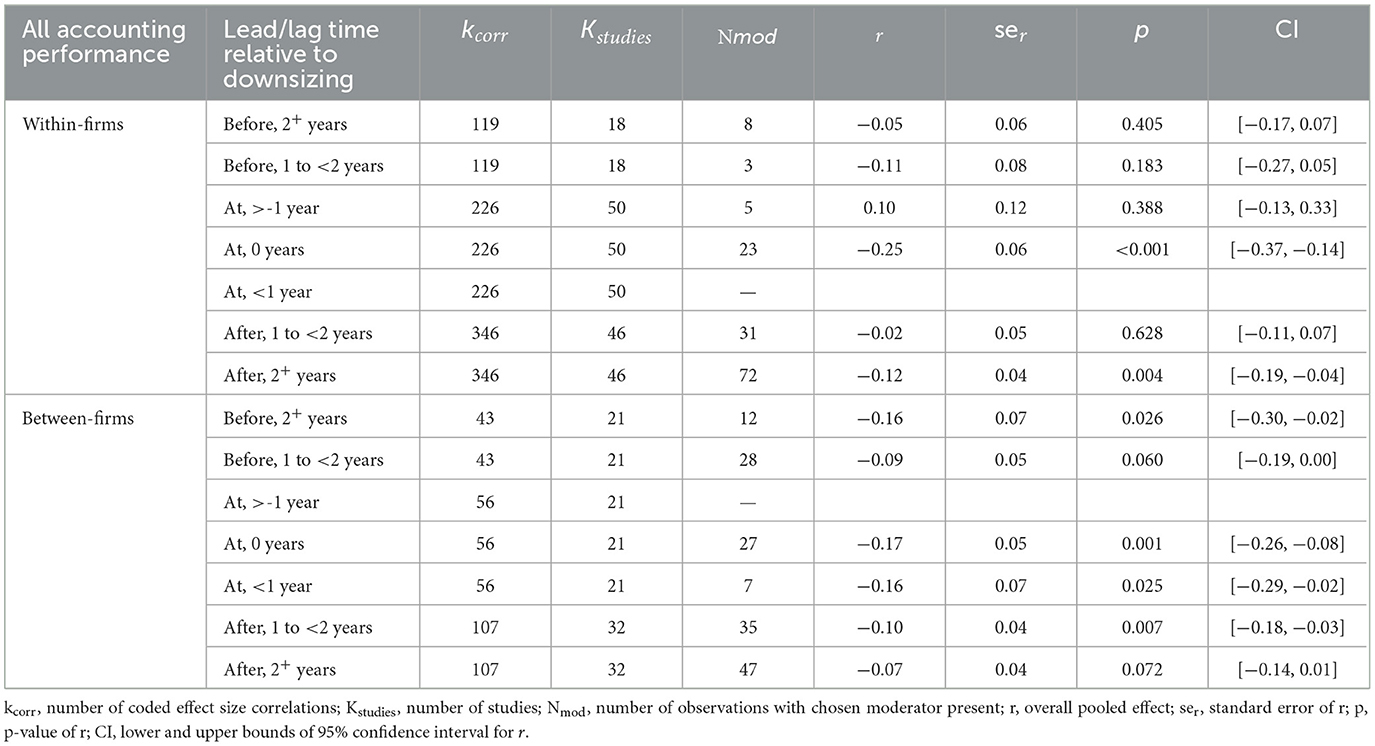

Table 4 presents results for the moderating influence of lead/lag times upon downsizing-accounting performance relationships. As per Hypothesis 8 and 9, we expected to find a significant, negative association between downsizing and a firm's accounting performance in the short-run, and a non-significant relationship in the long-run. Given that extant research often uses annual accounting performance measures, studies with time lags <1 year often suffer from simultaneity with the downsizing measure. Thus, we adopted the view that short-run accounting performance outcomes occur in the period 1 year to <2 years post-downsizing, while long-run accounting performance outcomes occur 2 or more years later. Consistent with our expectation, Table 4 illustrates that between-firm accounting performance is negative (r = −0.10, CI = [−0.18, −0.03]) in the short-run and not significant (r = −0.07, CI = [−0.14, 0.01]) in the long run. This suggests that downsizing firms have lower performance relative to non-downsizing firms shortly after downsizing but are less likely to differ from non-downsizing firms after 2 years. Contrary to our expectation, however, within-firm accounting performance change is not significant in the short run (r = −0.02, CI = [−0.11, 0.07]) and negative (r = −0.12, CI = [−0.19, −0.04]) in the long run. This suggests that the profitability in downsizing firms may either increase or decrease in the short run, but, over the long run, downsizing firms generally see declines in their level of profitability.

Finally, the available data for prior accounting performance has a longer timeframe than does market performance, allowing us to reinvestigate Hypothesis 6. If the adoption of downsizing is more defensive, it should be more likely after an extended period of poor performance. The results are mixed. Between-firm results with a lead time of 2 or more years are consistent with our expectation (r = −0.16, CI = [−0.30, −0.02]), while no such effects are found for within-firm performance. This result suggests that adoption of a downsizing strategy is more likely the result of a prolonged period of lower financial performance relative to others, than a prolonged within-firm decline over the same period.

Discussion

Our primary aim was to examine several temporally grounded questions related to downsizing-financial performance relationships, relationships that continue to engender debate and controversy both in research and practice. We extend institutional research on rationales for downsizing adoption into the new millennium, while also replicating those found for the 1980's and 1990's in prior research. Since the 2000's, the dominant rationale for downsizing has shifted back to primarily a defensive response to decline, driven by economic factors. It suggests layoffs are largely undertaken to mitigate firm losses and less so in pursuit of opportunistic firm gains, as was seen more often in the 1990's. The dominant rationale appears now to be downsizing as the lesser-of-two-evils, with the loss of some jobs a means of avoiding the loss of all jobs should the company not survive a decline. It is less so the necessary evil of the 1990's where employees were sacrificed in an attempt to maximize firm gains and exploit efficiencies. This shift in the dominant rationale may suggest that organizations are now more wary of downsizing's taken-for-granted status and recognize both its reputational risks and uncertain outcomes.

Although downsizing remains prevalent in practice as does too the detrimental employee impacts, our results suggest that contemporary firms are more likely to scrutinize downsizing decisions and/or see them as a last resort strategy. Firms are less likely to adopt downsizing as a quick (and questionable) financial tactic that comes at the cost of people's livelihoods and wellbeing. As such, contemporary downsizing decisions appear to take a broader range of stakeholders' interests into account, which aligns with Shin et al. (2022) who similarly found that the early 2000's marked the beginning of a reversal in the dominant shareholder orientation, whereby CEOs are now more likely to be penalized, not rewarded, by the market for downsizing.

We find that immediate market reactions to downsizing also change over time, mirroring the dominant rationales for downsizing adoption, from generally negative market reactions to defensive downsizing in the 1980's and 2000's, to variable market reactions in 1990's when both declining and more non-declining firms downsized. Our findings align with prior research demonstrating the market's immediate reactions to downsizing are generally negative for declining firms and positive for non-declining firms. Both negative and positive market responses, which vary based on prior financial performance decline or not (r = −0.23 and 0.10, respectively), is consistent in direction with prior meta-analytic findings by Allouche et al. (2008; r = −0.04 and 0.07, respectively), albeit the strength of the negative relationship is considerably stronger in the present study. The difference likely reflects our inclusion of studies published more recently, as we find more recent historical contexts have more negative stock market reactions. Our findings are also consistent with the direction of the overall effect found prior meta-analyses on 1 day stock returns (Capelle-Blanchard and Couderc, 2007; Allouche et al., 2008). However, the strength of our effect at day 1 (r = −0.09), is weaker than that (r = −0.23) found by Capelle-Blanchard and Couderc (2007) and slightly stronger to that (r = −0.07) of Allouche et al. (2008). The former appears to have coded multiple observations per study, without adopting methods to account for effect size dependency, as we have done here, while the latter only includes 15 studies in its analysis, which may explain the differences in effect sizes.

Regardless of whether downsizing is defensive to a prior financial decline or not, the stock market effects of downsizing appear to be short-lived, with significant relationships disappearing after only 2 days. Fleeting stock market improvements raise both economic and ethical questions on the use of offensive downsizing as a market signaling strategy to improve a firm's stock price (Gandolfi and Hansson, 2011). As such, we find scant evidence for the short-run market gain perspective of downsizing.

Although firms in recent decades appear less likely to downsize with an opportunistic rationale, the shift in rationale does not address whether the strategy's long-run outcomes justify the short-run harm. While downsizing's short-run harm to individual employees has been evident for quite some time, the results of our study show that the short-run harm of downsizing can also be financial in nature. The financial short-run harm comes in two forms—market performance declines at the time surrounding defensive downsizing announcements and lower accounting-performance relative to non-downsizing firms. These financial outcomes add further fuel to the short-term pain of downsizing. Likewise, we find little evidence of long-run gains via downsizing. While we expected to find a heterogenous and non-significant relationship between downsizing and accounting performance in the long run, we found that only to be the case on a between-firm basis. Within firms, the meta-analytic trend suggests that accounting performance in downsizing firms actually declines over the long run.

Declines in post-downsizing accounting performance can occur for a variety of reasons. Downsizing is known to negatively impact the actions, attitudes, and emotions of employees remaining in the organization (Brockner et al., 1985) and it is, ultimately, these survivors who will drive post-downsizing firm outcomes (Brockner, 1992). If the productivity of remaining employees declines and/or a firm's best performing employees leave voluntarily post-downsizing, the long-run indirect costs of downsizing may exceed its short-run compensation cost benefits. Short-run compensation cost benefits may also be offset by the direct costs of severance packages or other deferred compensation arrangements for dismissed employees over time. Similarly, the long-run costs of replacing employees may not be considered. These include the direct costs of recruiting, onboarding, and training new employees as well as the indirect costs of lost productivity from lengthy learning curves, errors/waste, and work disruption amongst the new employees' coworkers, which can be considerable (Hinkin and Tracey, 2000). The post-downsizing profitability declines found in this study could be a case of wrongly equating labor rates with total labor costs—as decreasing direct compensation costs can actually increase a firm's total labor costs if their effect on subsequent productivity is not taken into account (Pfeffer, 1998). Overall, these explanations align with the view that the loss of strategic human capital hurts firm performance (Stern et al., 2021).

Our findings also illustrate the importance of time to relationships between downsizing and financial performance in extant research. Different historical contexts and when financial performance is measured relative to downsizing and can change the strength and direction of the effect. In general, the field of management/organizational research has been criticized for its relative lack of temporality—an oversight whereby the temporal aspects of many relationships remain largely implicit, are often overlooked, and/or generally assumed to be immediate (Huy, 2001; Mitchell and James, 2001). Research on the relationships between downsizing and financial performance have not been immune to this oversight. A prevailing assumption of downsizing as an event, and not a process that unfolds over time, has been the subject of critique since the 1990's (Freeman and Cameron, 1993)—with calls for more research on the temporality of downsizing even 20 years later (Datta et al., 2010). Some have previously criticized downsizing research for the considerable variation in temporal measurements of either accounting and/or market performance relative to the occurrence of downsizing (Datta et al., 2010). We see this not as a weakness, but rather an opportunity to explicitly examine different lead/lag times and historical contexts. Thus, our study provides a unique temporal perspective on downsizing financial performance relationships within the extant body of research.

Limitations and future research directions

Despite the importance of time to downsizing research, certain lead/lag times and historical contexts are notably lacking or too few from which to draw meta-analytic conclusions. For example, little research exists on market performance with lead/lag times of (+/–) 30 days or more, which future research is encouraged to explore. There is also comparatively much less accounting performance research with short lead/lag times to downsizing (i.e., within the year), with many studies capturing accounting performance simultaneous to the downsizing measure. This simultaneity makes it difficult to assess whether downsizing exacerbates further decline or the decline-downsizing relationship is simply indicative of a downward spiral in declining firms (Hambrick and D'Aveni, 1988). More research with short, yet non-simultaneous, lead times would enable better meta-analytic assessments of downsizing as a quick knee-jerk reaction to short-run decline (Morrow et al., 2004). Although we find in this study that lower performance over the long run drives downsizing adoption, adding more short-run perspectives to the body of research would enable better comparisons in future.

Our findings also provide further evidence on the importance of sampling periods to downsizing studies and the possible role of time when explaining performance inconsistencies across the large body of downsizing research (Cascio et al., 2021). Future research is encouraged to adopt more recent datasets, particularly those within the last decade. An overwhelming amount of existing downsizing research adopts older data. The average gap between publication year and mean sampling year in our dataset was 10.2 years. More recent data will enable future meta-analytic comparisons of temporal effects between the first and second decades of the current millennium and beyond.

Despite finding different within- and between-firm effect sizes, the focus of downsizing research has primarily been upon within-firm changes in financial performance. Future research examining both effects within the same study and/or making further comparisons would be beneficial. New and more detailed conceptualizations of downsizing motives would also be useful. To date, the presence (absence) of prior performance decline is the most prevalent categorization of defensive (offensive) downsizing. More nuanced operationalizations of decline could be developed and tested in future research, while the role of anticipated future decline to downsizing decisions should also be a consideration. The reliance upon qualitative coding of downsizing motives in extant research makes it more difficult to compare across studies. Our coding of defensive and offensive motives was also qualitative and thus a limitation within our research design. Future research is encouraged to develop valid and reliable measures of downsizing motives to both improve methodological consistency and enable better comparisons going forward.

Like any meta-analysis, explorations of the strength, direction, and moderators of any effect(s) are limited to what exists within the current body of research. A limitation in the current body of downsizing research is that one can neither know the financial outcomes of not downsizing in a downsizing firm, nor those of downsizing in a non-downsizing firm. Thus, it is difficult to say whether decreases in financial performance leave a downsizing firm better or worse off than they would have been had they not downsized. Likewise, as with all research on downsizing's firm-level outcomes, the findings within this meta-analysis might contain artifacts of survivor bias, as financial performance can only be measured in firms that continue to exist. Higher likelihood of bankruptcy has been found within the relatively small body of research on post-downsizing firm survival (Smith, 2010; Powell and Yawson, 2012; Zorn et al., 2017). Any survivor bias within the extant body of downsizing research could mean effect sizes for post-downsizing firm performance are more negative than reported here. Future downsizing research is encouraged to report not only financial performance outcomes for surviving firms, but also firms' post-downsizing likelihood of dropping out of the sample.

To effectively make some causal conclusions from longitudinal data, we need not only association (i.e., correlation) and direction (i.e., temporal precedence) but also isolation (Bullock et al., 1994), that is the ruling out of extraneous variables. The greater the number of plausible moderators we can rule out, the stronger any causal conclusion can be. While our primary focus was an examination of temporal dimensions of downsizing, we coded many other moderators available in extant downsizing research as part of our methodology, none of which yielded any substantive meta-analytic effects. These included organizational moderators such as firm size, geographic location, and ownership structure, as well as methodological moderators related to how downsizing was measured (dichotomous event vs. continuous rate) and the source of the data (public announcements vs. actual decreases in number of employees). It suggests an entire field of research that, despite almost 40 years of prior efforts (Datta et al., 2010), has been unable to isolate what moderates downsizing via extant data and methods.

Future studies that look deeper into firms' downsizing processes—specifically who leaves the firm, what work remains/is removed, and how organizational structures change are important considerations. Also, at present, the field of downsizing research is dominated by large scale, cross-industry studies of public firms using historical secondary data. For this reason, results of this study may not fully generalize to small, non-public firms, or those in specific industries facing unique contextual conditions.

We believe the MLLMA method adopted in this study provides an alternative methodological path for meta-analysis within the field of management research more broadly. MLLMA offers a solution when other meta-analytic methods, such as MASEM, become infeasible based on the data available in primary studies (Bergh et al., 2016). While the non-experimental nature of most management/organizational research impairs any “conclusive causal inferences” (Bergh et al., 2016, p. 479), the longstanding use of longitudinal data confers it with the unique advantage of multiple observations over time either within or across studies. This allows the temporality of a variable like financial performance to be accounted for within a meta-analysis and leverages the fact that certain observations will precede each other in time. It enables a bivariate meta-analysis to move one step forward on the temporal path, instead of exacerbating its prior accusation of taking two steps back.

Practical implications

The practice of downsizing has become widespread as a means of reducing costs for many organizations. While the “stated goal in employee downsizing is generally the reduction of payroll costs and the enhancement of organizational efficiency toward making a firm more competitive in the marketplace” (Datta and Basuil, 2015, p. 199), institutional perspectives say there is also conventional wisdom in practice that downsizing is good for performance (Budros, 1997; McKinley et al., 2000). However, our research suggests that the widespread adoption of downsizing does not necessarily lead to favorable financial outcomes. Despite its perceived benefits, such as reducing payroll costs and increasing organizational efficiency, downsizing has been criticized for its painful consequences for employees and managers alike, and for often producing unclear results in terms of financial performance.

In the past, downsizing was used as an offensive strategy to improve financial performance. Today, it is primarily (though certainly not exclusively) employed as a defensive measure in response to declining circumstances. Managers are faced with a difficult dilemma: whether to engage in downsizing to mitigate the effects of decline or to preserve the values and reputation of the organization by retaining their workforce. Despite its continued prevalence, alternative approaches that prioritize long-term employment and no-layoff policies are often seen as unconventional and risk-prone.

This raises the question of whether there is room in the current economy for values and traditions of past organizations, where a commitment to long-term employment and no-layoff policies could offer a competitive advantage and enhance legitimacy. The outcome of such an inquiry is a subject of ongoing research.

Conclusion

Downsizing's short-run harm toward individual employees has been deemed necessary for the greater good of the firm long term. Our results suggest that this greater good is generally not a financial gain in the long run, at least not in absolute terms. Instead, downsizing is more often an attempt to mitigate losses in the face of decline. This makes it much more difficult to answer the question of whether downsizing's long run outcomes, in the financial sense, justify the considerable short-run harm to employees. Because the outcomes of the employment status quo can never be known in a firm once the decision to downsize is taken, questions surrounding the long run financial justifications for downsizing are likely to endure. While the greater good downsizing offers to the firm remains elusive, the pain that comes with it—whether it be psychological or financial, short-term or long-term—remains evident.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author contributions

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Ahmadjian, C. L., and Robinson, P. (2001). Safety in numbers: downsizing and the deinstitutionalization of permanent employment in Japan. Admin. Sci. Quart. 46, 622–654. doi: 10.2307/3094826

Allouche, J., Laroche, P., and Noël, F. (2008). Restructurations et performances de l'entreprise: Une méta-analyse. Fin. Contrôle Stratégie 11,105–146.

Armstrong-Stassen, M. (2002). Designated redundant but escaping lay-off: a special group of lay-off survivors. J. Occup. Org. Psychol. 75, 1–13. doi: 10.1348/096317902167603

Barbero, J. L., Di Pietro, F., and Chiang, C. (2017). A rush of blood to the head: temporal dimensions of retrenchment, environment and turnaround performance. Long Range Plan. 50, 862–869. doi: 10.1016/j.lrp.2017.02.004

Bergh, D. D., Aguinis, H., Heavey, C., Ketchen, D. J., Boyd, B. K., Su, P., et al. (2016). Using meta-analytic structural equation modeling to advance strategic management research: guidelines and an empirical illustration via the strategic leadership-performance relationship. Strat. Manag. J. 37, 477–497. doi: 10.1002/smj.2338

Brauer, M., and Laamanen, T. (2014). Workforce downsizing and firm performance: an organizational routine perspective. J. Manag. Stud. 51, 1311–1333. doi: 10.1111/joms.12074

Brockner, J. (1992). Managing the effects of layoffs on survivors. Calif. Manag. Rev. 34, 9–28. doi: 10.2307/41166691

Brockner, J., Davy, J., and Carter, C. (1985). Layoffs, self-esteem, and survivor guilt: motivational, affective, and attitudinal consequences. Org. Behav. Hum. Decision Process. 36, 229–244. doi: 10.1016/0749-5978(85)90014-7

Bruton, G. D., Keels, J. K., and Shook, C. L. (1996). Downsizing the firm: answering the strategic questions. Acad. Manag. Execut. 10, 38–45. doi: 10.5465/ame.1996.9606161553

Budros, A. (1997). The new capitalism and organizational rationality: the adoption of downsizing programs, 1979-1994. Soc. Forc. 76, 229–250. doi: 10.2307/2580324

Budros, A. (2002). The mean and lean firm and downsizing: causes of involuntary and voluntary downsizing strategies. Sociol. For. 17, 307–342. doi: 10.1023/A:1016093330881

Bullock, H. E., Harlow, L. L., and Mulaik, S. A. (1994). Causation issues in structural equation modeling research. Struct. Eq. Model. 1, 253–267. doi: 10.1080/10705519409539977

Byrne, J. A. (1999). Chainsaw: the Notorious Career of Al Dunlap in the Era of Profit-at-Any-Price. New York, NY: HarperBusiness New York.

Capelle-Blanchard, G., and Couderc, N. (2007). How Do Share Holders Respond to Downsizing? A Meta-analysis (Working Paper 952768). Rochester, NY: Social Science Research Network.

Cascio, W. F. (1993). Downsizing: what do we know? What have we learned? Acad. Manag. Execut. 7, 95–104. doi: 10.5465/ame.1993.9409142062

Cascio, W. F., Chatrath, A., and Christie-David, R. A. (2021). Antecedents and consequences of employee and asset restructuring. Acad. Manag. J. 64, 587–613. doi: 10.5465/amj.2018.1013

Cascio, W. F., Young, C. E., and Morris, J. R. (1997). Financial consequences of employment-change decisions in major US corporations. Acad. Manag. J. 40, 1175–1189. doi: 10.2307/256931

Cattaneo, C. (2016). Jobless in Alberta: Tens of Thousands of Energy Professions Are Out of Work and Out of Hope. Financial Post. Available online at: http://business.financialpost.com/news/energy/jobless-in-alberta-tens-of-thousands-of-energy-professionals-are-out-of-work-and-out-of-hope (accessed June 5, 2023).

Certo, S. T., Withers, M. C., and Semadeni, M. (2017). A tale of two effects: using longitudinal data to compare within-and between-firm effects. Strat. Manag. J. 38, 1536–1556. doi: 10.1002/smj.2586

Chalos, P., and Chen, C. J. P. (2002). Employee downsizing strategies: market reaction and post announcement financial performance. J. Bus. Fin. Account. 29, 847–870. doi: 10.1111/1468-5957.00453

Chatrath, A., Ramchander, S., and Song, F. (1995). Are market perceptions of corporate layoffs changing? Econ. Lett. 47, 335–342. doi: 10.1016/0165-1765(94)00543-B

Cooper, H. (2015). Research Synthesis and Meta-analysis: A Step-by-Step Approach, Vol. 2. Los Angeles, CA: Sage Publications.

Datta, D. K., and Basuil, D. A. (2015). “Does employee downsizing really work? The empirical evidence,” in Human Resource Management Practices, eds. M. Andresen and C. Nowak (Cham: Springer), 197–221.

Datta, D. K., Guthrie, J. P., Basuil, D., and Pandey, A. (2010). Causes and effects of employee downsizing: a review and synthesis. J. Manag. 36, 281–348. doi: 10.1177/0149206309346735

De Meuse, K. P., Vanderheiden, P. A., and Bergmann, T. J. (1994). Announced layoffs: their effect on corporate financial performance. Hum. Resour. Manag. 33, 509–530. doi: 10.1002/hrm.3930330403

De Witte, M. (2022). Why Are There So Many Tech Layoffs, and Why Should We Be Worried? Stanford Scholar Explains. Stanford News. Available online at: https://news.stanford.edu/2022/12/05/explains-recent-tech-layoffs-worried/ (accessed June 5, 2023).

Dencker, J. C. (2012). Who do firms lay off and why? Industr. Relat. 51, 152–169. doi: 10.1111/j.1468-232X.2011.00666.x

DiMaggio, P. J., and Powell, W. W. (1983). The iron cage revisited: institutional isomorphism and collective rationality in organizational fields. Am. Sociol. Rev. 48, 147–160. doi: 10.2307/2095101

Fernández-Castilla, B., Declercq, L., Jamshidi, L., Beretvas, S. N., Onghena, P., and Van den Noortgate, W. (2021). Detecting selection bias in meta-analyses with multiple outcomes: a simulation study. J. Exp. Educ. 89, 125–144. doi: 10.1080/00220973.2019.1582470

Franz, D. R., Crawford, D., and Dwyer, D. J. (1998). Downsizing, corporate performance, and shareholder wealth. Mid-Am. J. Bus. 13, 11–20. doi: 10.1108/19355181199800001

Freeman, S. J., and Cameron, K. S. (1993). Organizational downsizing: a convergence and reorientation framework. Org. Sci. 4, 10–29. doi: 10.1287/orsc.4.1.10

Gandolfi, F., and Hansson, M. (2011). Causes and consequences of downsizing: towards an integrative framework. J. Manag. Org. 17, 498–521. doi: 10.5172/jmo.2011.17.4.498

Gandolfi, F., and Littler, C. R. (2012). Downsizing is dead; long live the downsizing phenomenon: conceptualizing the phases of cost-cutting. J. Manag. Org. 18, 334–345. doi: 10.5172/jmo.2012.18.3.334

Greenhalgh, L., Lawrence, A. T., and Sutton, R. I. (1988). Determinants of work force reduction strategies in declining organizations. Acad. Manag. Rev. 13, 241–254. doi: 10.2307/258575

Gucciardi, D. F., Lines, R. L., and Ntoumanis, N. (2021). Handling effect size dependency in meta-analysis. Int. Rev. Sport Exerc. Psychol. 15, 1–27. doi: 10.1080/1750984X.2021.1946835

Hambrick, D. C., and D'Aveni, R. A. (1988). Large corporate failures as downward spirals. Admin. Sci. Quart. 33, 1–23. doi: 10.2307/2392853

Hancock, J. I., Allen, D. G., and Soelberg, C. (2017). Collective turnover: an expanded meta-analytic exploration and comparison. Hum. Resour. Manag. Rev. 27, 61–86. doi: 10.1016/j.hrmr.2016.06.003

Harney, B., Fu, N., and Freeney, Y. (2018). Balancing tensions: buffering the impact of organisational restructuring and downsizing on employee well-being. Hum. Resour. Manag. J. 28, 235–254. doi: 10.1111/1748-8583.12175

Hiller, N. J., and Hambrick, D. C. (2005). Conceptualizing executive hubris: the role of (hyper-) core self-evaluations in strategic decision-making. Strat. Manag. J. 26, 297–319. doi: 10.1002/smj.455

Hinkin, T. R., and Tracey, J. B. (2000). The cost of turnover: putting a price on the learning curve. Cornell Hotel Restaur. Admin. Quart. 41, 14–21. doi: 10.1177/001088040004100313

Huy, Q. (2001). Time, temporal capability, and planned change. Acad. Manag. Rev. 26, 601–623. doi: 10.2307/3560244

Hyman, L. (2018). Temp: How American Work, American Business, and the American Dream Became Temporary. New York, NY: Penguin Random House.

Jenkins, D. G., and Quintana-Ascencio, P. F. (2020). A solution to minimum sample size for regressions. PLoS ONE 15:e0229345. doi: 10.1371/journal.pone.0229345

Jung, D. K., Aguilera, R., and Goyer, M. (2015). Institutions and preferences in settings of causal complexity: Foreign institutional investors and corporate restructuring practices in France. Int. J. Hum. Resour. Manag. 26, 2062–2068. doi: 10.1080/09585192.2014.971843

Kalev, A. (2014). How you downsize is who you downsize: biased formalization, accountability, and managerial diversity. Am. Sociol. Rev. 79, 109–135. doi: 10.1177/0003122413518553

Kets de Vries, M. F. R., and Balazs, K. (1997). The downside of downsizing. Hum. Relat. 50, 11–50. doi: 10.1177/001872679705000102

Lecuona, J. R., and Reitzig, M. (2014). Knowledge worth having in “excess”: the value of tacit and firm-specific human resource slack. Strat. Manag. J. 35, 954–973. doi: 10.1002/smj.2143

Lee, P. M. (1997). A comparative analysis of layoff announcements and stock price reactions in the United States and Japan. Strat. Manag. J. 18, 879–894. doi: 10.1002/(SICI)1097-0266(199712)18:11<879::AID-SMJ929>3.0.CO;2-V

Love, E. G., and Nohria, N. (2005). Reducing slack: the performance consequences of downsizing by large industrial firms, 1977-93. Strat. Manag. J. 26, 1087–1108. doi: 10.1002/smj.487

March, J. G. (1991). Exploration and exploitation in organizational learning. Org. Sci. 2, 71–87. doi: 10.1287/orsc.2.1.71

Markovits, D. (2020). How McKinsey Destroyed the Middle Class: Technocratic Management, No Matter How Brilliant, Cannot Unwind Structural Inequalities. The Atlantic. Available online at: https://www.theatlantic.com/ideas/archive/2020/02/how-mckinsey-destroyed-middle-class/605878/ (accessed June 5, 2023).

McKeever, V. (2020). The Coronavirus Is Expected to Have Cost 400 Million Jobs in the Second Quarter, UN Labor Agency Estimates. CNBC. Available online at: https://www.cnbc.com/2020/06/30/coronavirus-expected-to-cost-400-million-jobs-in-the-second-quarter.html (accessed June 5, 2023).

McKinley, W., Zhao, J., and Rust, K. G. (2000). A sociocognitive interpretation of organizational downsizing. Acad. Manag. Rev. 25, 227–243. doi: 10.2307/259272

Milner, A., Page, A., Morrell, S., Hobbs, C., Carter, G., Dudley, M., et al. (2014). The effects of involuntary job loss on suicide and suicide attempts among young adults: evidence from a matched case-control study. Austral. N. Zeal. J. Psychiat. 48, 333–340. doi: 10.1177/0004867414521502

Mitchell, T. R., and James, L. R. (2001). Building better theory: time and the specification of when things happen. Acad. Manag. Rev. 26, 530–547. doi: 10.2307/3560240

Molinsky, A., and Margolis, J. (2005). Necessary evils and interpersonal sensitivity in organizations. Acad. Manag. Rev. 30, 245–268. doi: 10.5465/amr.2005.16387884

Morrow, J. L. Jr., Johnson, R. A., and Busenitz, L. W. (2004). The effects of cost and asset retrenchment on firm performance: the overlooked role of a firm's competitive enrivonment. J. Manag. 30, 189–208. doi: 10.1016/j.jm.2003.01.002

Palmon, O., Sun, H. L., and Tang, A. P. (1997). Layoff announcements: stock market impact and financial performance. Fin. Manag. 26, 54–68. doi: 10.2307/3666213

Park, T. Y., and Shaw, J. D. (2013). Turnover rates and organizational performance: a meta-analysis. J. Appl. Psychol. 98, 268–309. doi: 10.1037/a0030723

Powell, R., and Yawson, A. (2012). Internal restructuring and firm survival. Int. Rev. Fin. 12, 435–467. doi: 10.1111/j.1468-2443.2012.01151.x

R Core Team (2022). R: A Language and Environment for Statistical Computing (Version 4.2.0) [Computer Software] (4.2.0). R Foundation for Statistical Computing. Available online at: https://www.rproject.org/ (accessed June 5, 2023).

Richard, P. J., Devinney, T. M., Yip, G. S., and Johnson, G. (2009). Measuring organizational performance: towards methodological best practice. J. Manag. 35, 718–804. doi: 10.1177/0149206308330560

Riley, C., and Horowitz, J. (2019). Layoffs Have Started at Deutsche Bank. 18,000 Jobs Are Going. CNN. Available online at: https://www.cnn.com/2019/07/08/investing/deutsche-bank-layoffs/index.html (accessed June 5, 2023).

Schulz, A. C., and Johann, S. (2018). Downsizing and the fragility of corporate reputation: an analysis of the impact of contextual factors. Scand. J. Manag. 34, 40–50. doi: 10.1016/j.scaman.2017.11.004

Schulz, A. C., and Wiersema, M. F. (2018). The impact of earnings expectations on corporate downsizing. Strat. Manag. J. 39, 2691–2702. doi: 10.1002/smj.2925

Shin, S., Lee, J., and Bansal, P. (2022). From a shareholder to stakeholder orientation: evidence from the analyses of CEO dismissal in large U.S. firms. Strat. Manag. J. 43, 1233–1257. doi: 10.1002/smj.3369

Staw, B. M., Sandelands, L. E., and Dutton, J. E. (1981). Threat rigidity effects in organizational behavior: a multilevel analysis. Admin. Sci. Quart. 26, 501–524. doi: 10.2307/2392337

Steel, P., Beugelsdijk, S., and Aguinis, H. (2021). The anatomy of an award-winning meta-analysis: recommendations for authors, reviewers, and readers of meta-analytic reviews. J. Int. Bus. Stud. 52, 23–44. doi: 10.1057/s41267-020-00385-z

Steel, P., Fariborzi, H., and Hendijani, R. (2023). “An application of modern literature review methodology: finding needles in ever-growing haystacks,” in Sage Research Methods: Business. Thousand Oaks, CA: SAGE Publications, Ltd. Available online at: https://methods.sagepub.com/case/applicationliterature-methodology-finding-needles-haystacks

Stern, I., Deng, X., Chen, G., and Gao, H. (2021). The “butterfly effect” in strategic human capital: mitigating the endogeneity concern about the relationship between turnover and performance. Strat. Manag. J. 42, 2493–2510. doi: 10.1002/smj.3324

Sullivan, D., and Von Wachter, T. (2009). Job displacement and mortality: an analysis using administrative data. Quart. J. Econ. 124, 1265–1306. doi: 10.1162/qjec.2009.124.3.1265

Taylor, S. E., and Brown, J. D. (1988). Illusion and well-being: a social psychological perspective on mental health. Psychol. Bullet. 103, 193–210. doi: 10.1037/0033-2909.103.2.193

Trahms, C. A., Ndofor, H. A., and Sirmon, D. G. (2013). Organizational decline and turnaround: a review and agenda for future research. J. Manag. 39, 1277–1307. doi: 10.1177/0149206312471390

Trevor, C. O., and Nyberg, A. J. (2008). Keeping your headcount when all about you are losing theirs: downsizing, voluntary turnover rates, and the moderating role of HR practices. Acad. Manag. J. 51, 259–276. doi: 10.5465/amj.2008.31767250

Van den Noortgate, W., López-López, J. A., Marín-Martínez, F., and Sánchez-Meca, J. (2013). Three-level meta-analysis of dependent effect sizes. Behav. Res. Methods 45, 576–594. doi: 10.3758/s13428-012-0261-6

Wilson, D. B. (2023). Practical Meta-Analysis Effect Size Calculator (Version 2023.11.27). Available online at: https://www.campbellcollaboration.org/escalc/html/EffectSizeCalculator-Home.php (accessed June 5, 2023).

Worrell, D. L., Davidson, W. N., and Sharma, V. M. (1991). Layoff announcements and stockholder wealth. Acad. Manag. J. 34, 662–678. doi: 10.2307/256410

Zorn, M. L., Norman, P. M., Butler, F. C., and Bhussar, M. S. (2017). Cure or curse: does downsizing increase the likelihood of bankruptcy? J. Bus. Res. 76, 24–33. doi: 10.1016/j.jbusres.2017.03.006

Appendix

Data Transparency Appendix

1. A supplementary file with the full search syntax is anonymously available on Open Science Framework (OSF) at OSF link 1.

2. A supplementary file with a PRISMA diagram is anonymously available at OSF link 2.

3. A supplementary file containing all bibliographic references for coded studies is anonymously available at OSF link 3.

4. A supplementary file with dual coding of offensive/defensive thematic categories is anonymously available at OSF link 4.

5. A supplementary file with all HubMeta data/coding is anonymously available at OSF link 5.

6. Copies of all six R scripts are anonymously posted at OSF link 6.

7. Copies of all six R output files, containing full details of outlier tests, multilevel model fit, Q statistics, and publication bias are anonymously available at OSF link 7.

Keywords: downsizing, financial performance, meta-analysis, lead/lag times, longitudinal

Citation: Steel P and House A (2024) Short-term pain for long-term gain? A longitudinal meta-analysis of downsizing-financial performance relationships. Front. Behav. Econ. 3:1237750. doi: 10.3389/frbhe.2024.1237750

Received: 12 October 2023; Accepted: 18 June 2024;

Published: 16 July 2024.

Edited by:

Peter McGee, University of Arkansas, United StatesReviewed by:

Huanren Zhang, University of Southern Denmark, DenmarkDaniel Gucciardi, Curtin University, Australia

Copyright © 2024 Steel and House. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Piers Steel, steel@ucalgary.ca

Piers Steel

Piers Steel Alyson House

Alyson House