94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Behav. Econ., 11 January 2024

Sec. Behavioral Microfoundations

Volume 2 - 2023 | https://doi.org/10.3389/frbhe.2023.1293694

This article is part of the Research TopicPsychology of Financial ManagementView all 11 articles

From an early age, children begin to make decisions about buying things they want, or refraining from buying (e.g., to save up for something better). However, it was unclear how these decisions affect their feelings about their economic resources: does buying make children feel richer or poorer? This manuscript describes three studies that address this gap, with children ages 4 through 12 in the United Kingdom and United States. Older children thought that a child who bought something was richer than a child who refrained from buying, even if the target child was still able to accomplish their goal (Study 1). And for children as young as 4, imagining buying something (compared to imagining refraining from buying) predicted and led to imagining themselves feeling richer (Studies 2–3). The magnitude of the effect of buying vs. refraining on feeling rich did not change appreciably through age 12. These findings complement previous research which looked at children's judgments of their family's social status, by showing that children's feelings about their economic resources also fluctuate in response to actions (buying vs. refraining) that impact those resources. This work contributes to an understanding of how feelings of wealth emerge in childhood and has useful implications for adults who want to support children in developing financial skills.

From a young age, children play a role in spending money. For instance, in a representative sample surveyed in the United Kingdom in 2022, 88% of 7-to-11-year-olds, and 93% of 12-to-15-year-olds, were described as involved in spending decisions (Money and Pensions Service, 2023). Families use these decisions in part to teach children to “make careful choices,” “use money for things that are worthwhile,” and “exercise self-control” (Money Advice Service, 2019, p. 20). These goals imply that parents and carers believe a key element of financial skill development is learning to make decisions both to buy things, and to refrain from buying (i.e., by exercising self-control or when the purchase is not worthwhile). However, little is known about how children feel as a result of their decisions to buy or to refrain.

This paper approaches that question by drawing on a growing area of developmental psychology research into children's beliefs about their social status. For example, Peretz-Lange et al. (2022) found that with age from four to ten, children placed their families lower on a ladder representing status in their neighborhood. This trend was explained by older children's increasing attention to what their family lacked (e.g., “we don't have a lot of money,” “we don't have like a really big house”). Whereas that work focuses on global evaluations of status that are presumably relatively stable over days or weeks, the current research examined more fleeting feelings about economic resources tied to the specific behavior of buying something or refraining.

This work makes two key contributions. First, it shows that children as young as four associate buying with feeling relatively rich, and refraining from buying with feeling relatively poor. That is, young children report that their feelings about their economic status do fluctuate in the very short term, in response to specific actions (buying or refraining) that they can often influence. Previous research with adults found that their debts and investments predicted their perceived financial wellbeing, but over and above these more stable influences, the amount of readily-available cash also predicted their financial wellbeing (Ruberton et al., 2016). The present findings suggest that young children, too, may feel better or worse off financially as a function of not only their family's relatively consistent economic resources, but also in response to their own discrete spending decisions.

Although it is unclear how long feeling rich after buying (and poor after refraining) lasts, these results have practical implications for the adults who want to support children as they develop financial skills. It is important for these adults to understand that decisions to refrain from buying when it is not “worthwhile,” or “exercising self-control” (e.g., to save for a larger, more worthy purchase) make children feel not only unhappy, but relatively poor. Adults may be able to counteract this effect by reminding children about the resources they are conserving and the wealth they are building, and doing so might make refraining from buying easier or more pleasant for children. This point is explored further in the General Discussion.

There is growing evidence that children use concepts related to wealth from an early age, and well-before the age when most children fully understand how money works (Berti and Bombi, 1981). From around age four, children prefer the wealthy when asked to choose a friend or to identify the nicer of two individuals who vary in the number or quality of their possessions (Dunham et al., 2014; Horwitz et al., 2014; Li et al., 2014; Shutts et al., 2016). The stimuli for “rich” vs. for “poor” in studies with children generally depict more vs. fewer things, larger vs. smaller things, and better vs. worse things, such as an “expensive” vs. “old-fashioned” video game console (Weinger, 1998; Newheiser and Olson, 2012); children as young as four know which type of people go with which items. Five-to-nine-year-olds in the United States spontaneously notice and remember the amount of money associated with characters they encounter (Legaspi et al., 2023). Five-year-olds use social category labels like “rich” and “poor” to make inferences about characters (Diesendruck and HaLevi, 2006). Even without the labels, children use wealth status, such as having more or fewer toys, to predict how someone will behave (e.g., how likely they will be to share); researchers have interpreted these results to signify that children as young as four “possess a conceptual understanding of wealth” (Ahl et al., 2019).

While research discussed in the previous paragraph shows that children judge others' wealth, other studies investigate how they perceive their own wealth. This work is generally presented in terms of subjective social status (SSS), but with measures emphasizing financial resources (i.e., wealth). For example, children are asked to place their families on a ladder where “at the top are the people with the most money and at the bottom are the people with the least money” (Ackerman and Elenbaas, 2023). Four-year-olds tend to put themselves high on such measures (Mandalaywala et al., 2020), and ratings decline with age such that they accurately reflect family financial resources when children are around age ten (Mistry et al., 2015; Peretz-Lange et al., 2022). Although these studies are cross-sectional rather than longitudinal, their results imply that a child's perceptions of their family's wealth changes over early and middle childhood—becoming more calibrated to the family's actual economic resources—but remains relatively stable over days and weeks in the interim. Thus, a different research method is called for to investigate how children's feelings about their own resources fluctuate in the very short term, such as in the wake of a decision to buy something or to refrain.

It is perhaps easiest to start by speculating about how these decisions would affect children's perception of others' wealth. What would children think about a person who buys something, compared to someone who refrains? Buying is a way to acquire more and better possessions, which children associate with being relatively rich (Weinger, 1998; Newheiser and Olson, 2012). Although buying reduces one's money, it shows that one is able to spend (i.e., had money at that point in time). And of course, refraining from buying contributes to having few or worse possessions, which children associate with being relatively poor (Weinger, 1998; Newheiser and Olson, 2012). Refraining may also imply that one has little money; this is arguably a simpler explanation for refraining than the possibility that someone is saving up for something better later. In sum, children should perceive a person who buys an item as wealthier than a person who refrains from buying that item.

Would buying and refraining have the same effect on children's own feelings of wealth? On one hand, perhaps these single specific decisions would have no discernible effect on children's feelings about their own wealth. Research suggests that young children tend to think about wealth and poverty as relatively fixed attributes (Diesendruck and HaLevi, 2006; del Río and Strasser, 2011), so perhaps their own feelings of wealth or poverty are relatively unaffected by a single decision to buy or refrain. On the other hand, even in adults, global judgments are shaped by fleeting experiences—for instance, adults report more satisfaction with their lives as a whole when put in a positive rather than negative or neutral mood (King et al., 2006). Children may have spent relatively little time reflecting on their feelings of wealth, making it particularly easy for these feelings to fluctuate along with the happiness of buying something and the disappointment of refraining.

It is worth noting that the direction of any such fluctuation is not necessarily obvious. In a sample of 500 American adults,1 a sizable majority (79%) completed the statement “I feel richer when I…” with “don't spend money” rather than “spend money”. Adults appear to feel richer when they have more assets (Sussman and Shafir, 2012; Browning et al., 2013), so this majority may contain respondents who recognize that objectively speaking, wealth (net worth) is lowered by most purchases because of transaction costs and resale values that fall rapidly after purchase. In contrast, the minority of adults who reported feeling wealthier after spending might be drawing on experiences of consumption surplus (Mankiw, 2020). If spending consistently results in acquiring products that one values more highly than the price paid for them, then spending could increase feelings of wealth.2 This mechanism—particularly given children's still-emerging understanding of the value of money, as opposed to the value of desirable products (Gelman et al., 2015)—is also one that could lead children, on average, to feel wealthier after buying than refraining.

Although the research on children's perceived social status focuses on global judgments, findings from that research area do hint that the act of buying might be associated with wealth, and refraining associated with relative poverty. As noted above, older children in a sample of 4-to-10-year-olds saw their family status as lower to the extent that they focused on what they did not have. The older children in this sample made more mention of what they lacked, and this tendency rather than references to any particular status cues like a house or a lifestyle, explained the decrease in ratings of their family's status (Peretz-Lange et al., 2022). Since refraining from buying may feel like a lack (of the desirable possession that was not bought), refraining may similarly lead to a decrease in feelings of wealth, albeit in the much shorter term. Moreover, children aged 8–12, who were asked several follow-up questions about how they knew where to place their family on a neighborhood wealth ladder, made references to money, spending, saving, and costs, as well as references to physical items and assets (e.g., “I do have electronics and stuff…like a tablet or like a laptop…so like a lot of smart devices”) (Ackerman and Elenbaas, 2023). While children also mentioned other cues such as education and jobs, the references to spending and possessions when judging economic status suggest that buying may be linked to wealth, and refraining from buying to relative poverty. Supporting this intuition, the most common explanation given by 10-12-year-olds for their feelings about their family's wealth referred to the family's purchasing power (Mistry et al., 2015). Since buying shows purchasing power, and refraining does not, buying could make children feel richer than refraining.

Simply because children are involved with buying, it is important to understand how they feel as a result. However, research with children often focuses on identifying age-related changes. Might age in childhood change how one feels as a result of buying vs. refraining? If so, this could happen because of cognitive and emotional development, and/or because of experiences children acquire as they get older. Each of these is considered separately.

Cognitive and emotional changes in childhood generate opposing predictions about the effect investigated here. That is, one set of changes suggests that buying vs. refraining may be associated with wealth more so for younger children. Young children (ages 4–6) are particularly inclined to use simple explanations for events they experience (Bonawitz and Lombrozo, 2012). The simplest explanation for refraining from buying something that one likes is probably inability to afford it (i.e., relative poverty). Other explanations, such as saving up to buy something better, are more complex.3 Use of multiple, or more complex explanations, appears to become more common with age (Bonawitz and Lombrozo, 2012). Thus, older children might show a weaker effect of buying vs. refraining on feelings of wealth than younger children. The same prediction could also follow from the observation that older children (age 10–12) have a relatively accurate impression of their family's economic resources (Mistry et al., 2015). This accurate knowledge might make older children relatively impervious to a small manipulation like a single imagined purchase.

However, another set of cognitive changes suggests that age in childhood could intensify, rather than weaken, an effect of buying on feelings of wealth. Specifically, recent research suggests that younger children (ages five to six) do not engage in social comparisons when making decisions, but older children (ages nine to ten) do (Herrmann et al., 2019). Social comparison processes are one reason why buying could produce feelings of wealth; buying allows people to keep up with or surpass others, whereas refraining from buying may lead to feeling poorer as one falls behind (Ordabayeva and Chandon, 2010). About a third of the children in one sample made comparisons to others when they judged their own status, and older children (10–12) were more likely to make these comparisons than younger children (8–9 years) (Ackerman and Elenbaas, 2023). If social comparison processes are an important mechanism, then a positive effect of buying (vs. refraining) on feeling richer might be exacerbated, or only be present for older children.

Finally, it is worth considering experiences that also change with age. Older children have more experience independently making buying decisions. Perhaps surprisingly, children as young as 4 do typically have some experience with money; nearly two-thirds of 4-year-olds in a large UK sample had experience paying for things in shops (Money Advice Service, 2017). Children understand how money works at around age 8 (Berti and Bombi, 1981), and at this age most are involved with decisions about how their money is saved or spent (Money Advice Service, 2017). The autonomy children have in spending money increases with age; by age 12 more than half of children reported that they decide independently whether to save money (Money Advice Service, 2017). Experience could be a key influence on feelings after buying vs. refraining. For instance, older children may have experienced how funds are depleted after a purchase but maintained after a decision to refrain. This experience may lead many older children to feel richer after refraining than buying, as was true for the majority of adults in the survey mentioned above.

In sum, the wealth of changes to both cognitive and emotional development and experience yields no clear prediction about age-related changes in any effect of buying vs. refraining on feeling rich. However, testing for such changes can provide some suggestive insight into which, if any, of these developments acts as a key mechanism for the effect. For instance, if the effect is amplified for older children, this suggests social comparison processes are a potential mechanism worth exploring further. To test for age-related changes, children ranging in age from 4 or 5 to 12 were tested in two of the three studies, in sufficient numbers to examine interaction effects of age and buying vs. refraining on feeling rich. Moreover, the design of Study 2 provides additional insight into the role of social comparisons, as discussed in the introduction to that study.

From a young age, children use money and engage with decisions about whether to buy desirable items. The activity of buying and refraining affects actual wealth, but it is unclear whether children are sensitive to these changes. Three studies test whether children judge others' wealth differently as a result of buying vs. refraining (Study 1), and whether their own buying or refraining affects their own feelings of wealth (Studies 2–3). Given the challenges inherent in manipulating children's buying, this paper uses hypothetical scenarios to ask whether children's feelings of wealth fluctuate systematically in response to imagining buying vs. refraining from buying something desirable.

There are many possible mechanisms that could explain an effect of buying on feeling rich. Given the preliminary nature of this investigation, these studies do not attempt to pinpoint them. However, Studies 2 and 3 are powered to test for age-related changes, which as noted in the prior section, can offer suggestive evidence about underlying mechanisms. Study 2 also offers additional evidence about a role of social comparison processes.

The methods sections below report how sample sizes were determined, all data exclusions, and all manipulations in each study. Each of these studies included additional exploratory measures administered after those discussed here. The full text of all study materials as well as the data are available at https://osf.io/dajsg/.

The first experiment tests the hypothesis that children will judge another child who buys something as wealthier than a child who refrains from buying. This hypothesis is tested with children aged 9–12, since previous research (Peretz-Lange et al., 2022) found that it was around age 9 or 10 when children's focus on what they lacked explained their accuracy about their family's economic resources.

Children evaluated three targets who all were described as wanting to get a present for a friend, and seeing something at a shop that their friend would like. The scenario of buying a gift was used to minimize inferences about wealth based on the quantity of the target's own possessions. In the scenarios, one target bought the item, the second did not, and the third also did not buy because their mother informed them they had this item at home already, brand-new, and could give that to their friend. Children gave their impression of each target's wealth using a scale that ranged from “a little money, like someone who's poor,” to “a lot of money, like someone who's rich.” If the first target seems wealthier than the third, it would suggest that the act of buying (and not simply “fulfilling a goal” such as obtaining a present for a friend) is a cue to wealth for children at this age.

This study was approved by the Research Ethics Committee at the London School of Economics and Political Science, Ref #000687, “BRL Junior 2.” The design and analyses were pre-registered at https://aspredicted.org/dt62p.pdf (Study 1 in this document). Data were collected in-person at a university lab in a large city southern England, during primary school class visits over a 1-week period. As specified in the pre-registration, the sample size was the maximum number of responses that could be collected in this time. There were 156 responses, 73 boys and 83 girls, ages 9 (4%), 10 (44%), 11 (50%), or 12 (2%). The design was within-subjects: Participants evaluated three targets (buy, refrain, refrain but give anyway) in randomized order.

Children were seated at a computer in a cubicle so they could not easily see other children's responses. Instructions stated: “Now you're going to read about a few different people. Then, we will ask you questions about those people. This is not like school—there are no right or wrong answers. We just want to know what you think.” They read about three targets in randomized order; boys read about male targets and girls read about female targets. Each target's description began: “[Name] wanted to get a present for her friend. She went to a shop that sold lots of good things. At the shop, she saw something she thought her friend would like.”

In the buy condition, the rest of the description read: “[Name] bought the thing she saw at the shop.”

In the refrain condition, it read: “But [Name] didn't buy anything at the shop.”

In the refrain but give anyway condition, it read: “Then her mum told her that they had the exact same thing at home already, brand new, and she could give that one to her friend. So [Name] didn't buy anything at the shop.”

Names were Jasmine, Layla, and Aliyah for girl targets, and Reuben, Isaac, and Max for boy targets, with names randomly allocated to stories across participants.

As a manipulation check, after reading about a target, children were asked: “Did [Name] buy something at the shop?” Response options were “Yes, she bought something,” “No, she didn't buy anything,” and “I'm not sure, or I don't remember.”

They then responded to two questions about the target. As a measure of happiness, they moved a slider bar to change a neutral facial expression to one ranging from very sad (1) to very happy (5), to show “how [Name] felt when she left the shop.” As a measure of perceived wealth, the key dependent variable, they were asked: “Do you think [Name] has a lot of money, like someone who's rich, or a little money, like someone who's poor, or something in the middle?” They chose one of five responses ranging from “a little money” illustrated with one stack of bills (1) to “a lot of money” illustrated with five stacks of bills (5).

The pre-registration specified that those who answered any of the three manipulation check questions incorrectly would be excluded from analyses. Because of a programming error, 50 of the 73 boys were only presented with two, rather than three, targets. Accordingly, data was analyzed for respondents who correctly answered the manipulation check questions for all the targets they had been presented, which was 108 (69%) of the 156 children. Note that because of this analytic approach, sample sizes for repeated-measures ANOVAs which compare responses across all three stories are smaller than sample sizes for the pairwise comparisons.

A repeated-measures ANOVA showed that children perceived the three target characters to differ in richness, F(2, 146) = 48.71, p < 0.001, η2 = 0.40. To maximize the sample size and inclusiveness of the analyses, follow-up tests used all respondents who passed the respective manipulation checks and had the relevant pairwise data. These analyses showed that a target who bought the item (M = 3.28, SD = 1.02) seemed richer than one who did not buy but was still able to give a gift (M = 2.75, SD = 0.98), paired-samples t(78) = 3.99, p < 0.001, d = 0.53. The target who did not buy but was able to give a gift (M = 2.70, SD = 0.97) seemed richer than one who was merely described as refraining (M = 1.99, SD = 1.00), t(85) = 4.86, p < 0.001, d = 0.72 [note that conclusions are the same if using the pre-registered criteria of only analyzing the data of children who passed manipulation checks for all three stories. Paired-sample t-tests showed that a target who bought seemed richer, t(73) = 3.99, p < 0.001, and happier, t(73) = 7.25, p < 0.001, than one who did not buy but was still able to give a gift, and this target seemed richer, t(73) = 5.88, p < 0.001, and happier, t(73) = 4.72, p < 0.001, than one who simply refrained from buying].

A second repeated-measures ANOVA showed that children perceived the three target characters to differ in happiness, F(2, 146) = 72.61, p < 0.001, η2 = 0.50. A target who bought the item (M = 4.32, SD = 0.86) seemed happier than one who did not buy but was still able to give a gift (M = 3.14, SD = 1.02), paired-samples t(78) = 7.36, p < 0.001, d = 1.25. The target who did not buy but was able to give a gift (M = 3.20, SD = 1.05) seemed happier than one who merely refrained from buying (M = 2.38, SD = 0.94), t(85) = 5.45, p < 0.001, d = 0.82. It is worth emphasizing that effects of buying on perceived happiness followed the same pattern as effects on perceived wealth, and were in fact larger. This point is returned to in Study 2.

Exploratory analyses tested whether boys and girls differed in their responses to the manipulation. Because of the missing data, this was done with three separate mixed-design ANOVAs, testing the interaction effect of participant gender (between-subjects) with two levels of target behavior (within-subjects: buy vs. refrain; buy vs. refrain but give anyway; refrain but give anyway vs. refrain). All three analyses with target perceived wealth as the outcome had nonsignificant interaction effects ps > 0.18. Moreover, there were no main effects of gender on target perceived wealth, ps > 0.21. Thus, there was no evidence that boys and girls at this age differ in their impressions of wealth based on buying vs. refraining.

Having supported the hypothesis that buying (vs. refraining) leads older children to see others as wealthier, the next studies turned to the question of how this behavior affects children's feelings about their own wealth. These studies add younger children as well, to see whether any effects of buying on feeling rich change with age.

Studies 2 and 3 test the hypothesis that buying leads children to feel richer than refraining. Given the challenges inherent in manipulating children's buying, Studies 2 and 3 used hypothetical scenarios to ask whether children's feelings of wealth fluctuate systematically in response to imagining buying vs. refraining from buying something desirable. Here, children who ranged in age from five to 12 were asked to imagine being in a shop where they saw something desirable and were randomly assigned to learn they had bought it or had not. They were asked how they would feel thereafter. Children were expected to feel happier when imagining buying than refraining, given that buying means having a new desirable possession, and previous research has documented a link between material possessions and happiness in children (Goldberg et al., 2003; Chan, 2006; Chaplin and John, 2007; Jaspers and Pieters, 2016). This was also expected in light of the effect of buying on perceived happiness of a target child observed in Study 1. The key novel hypothesis tested in Study 2 was that children would also report feeling richer when imagining buying than refraining.

As a secondary manipulation, children were told that they were with a friend, who either had or had not bought something. Including this manipulation offered insight into the relative importance of social comparisons in feeling richer from buying. If social comparisons are a key ingredient shaping feeling rich vs. poor, then imagining buying when a friend refrains should lead to feeling much richer than buying when a friend also buys. Additionally, if social comparison processes are an important mechanism, then a positive effect of imagined buying (vs. refraining) on feeling richer should be magnified for older children, who engage in these comparisons more than younger ones (Herrmann et al., 2019; Ackerman and Elenbaas, 2023). Indeed, there might be a 3-way interaction effect such that older children more than younger ones feel richest if imagining buying when a friend refrains and poorest if refraining when a friend buys.

Participants were recruited through a panel service to stratify responses across household income categories, enabling a test of how feeling rich after buying or refraining might depend on actual household economic resources. They completed the study online and without direct contact with the researcher, a method just beginning to be used in studies with children as a way to obtain large and diverse samples (Scott et al., 2017; Andrews et al., 2020; Chuey et al., 2020; Leshin et al., 2020; Sheskin et al., 2020).

This study was approved by the Research Ethics Committee at the London School of Economics and Political Science, Ref #000402, “Children's Impressions of Spending.” The study was administered via a panel provider to 417 children (196 girls, 221 boys) ages 5 through 12 (MAge = 8.87 years, SD = 2.16) residing in the USA (50%) or UK (50%) and stratified across six household income categories in each country. The panel provider sent the survey to households in their participant pool that had previously reported having a child aged 4–12; no households with 4-year-old children chose to take part.

Adults in the targeted households received the survey link and reported their net annual household income following this guidance: “This means the total income in your household minus direct taxes, and includes the value of any benefits you receive, like social security. If you're not sure, give your best estimate by adding up all the money that all the adults in your household get (after taxes are deducted) in a month, and multiply that by 12.” They answered using country-specific income categories, and quotas were set for each category to match a predetermined distribution. Participants in the U.S. had net annual household income of: < $25,000 (n = 37, 8.9%), $25,001–50,000 (n = 46, 11.0%), $50,001–75,000 (n = 39, 9.4%), $75,001–100,000 (n = 29, 7%), $100,001–150,000 (n = 32, 7.7%), more than $150,000 (n = 27, 6.5%). Participants in the U.K. had net annual household income of: < £18,500 (n = 34, 8.2%), £18,501–37,000 (n = 50, 12.0%), £37,001–55,500 (n = 40, 9.6%), £55,501–74,000 (n = 30, 7.2%), £74,001–111,000 (n = 32, 7.7%), more than £111,000 (n = 21, 5.0%). The six categories were combined across the two countries, and income was treated as an ordinal scale.

The sample size was set at 400 so that each cell of the 2 × 2 design would have 100 respondents, which is powered to detect a small to medium effect, f = 0.18 (equivalent to d = 0.36), according to a G*Power sensitivity analysis (Faul et al., 2007). An additional 35 respondents were excluded after failing an instructed-response attention check that read: “To confirm that you're paying attention, please answer Yes here and type “attention” in this box.” Participants were randomly assigned a scenario in a 2 (participant's behavior: buy, refrain) × 2 (friend's behavior: buy, refrain) between-subjects design.

The study began with informed consent. Only adults gave explicit informed consent, but they were assured: “The decision of whether or not to take part in this research is up to you and your child. Even if you agree that your child can take part, they can decide later on to stop or not to answer all of the questions.” Adults then provided their demographic information and reported the age of the child who would take part. Next, they saw this message:

At this point, please turn the computer over to your child. For the questions where children are asked how they would feel, I am interested in the honest thoughts of each child, and there are no right or wrong answers. So, I ask that you try not to influence your child's answers, even if you are sitting next to them while they take part. Of course, please do explain what words mean, or help them click on their answers, if they want help. But please try hard not to give any cues about what you think or how you would answer!

Thereafter, under an image of a toy store was the following scenario:

Imagine that you are at a store with a new friend. You both really like this store because it has so many different good toys and games and books. Your friend buys something [doesn't buy anything]. You see something that looks really good, and you buy it [but you don't buy it]. Then you leave the store together.

The italicized text about whether the friend bought something and whether the participant bought something varied independently according to condition. After advancing the page, as a manipulation check, children were asked “Did your friend buy anything at the store?” and “Did you buy anything at the store?” Response options were “yes,” “no,” and “I don't know.”

After the manipulation check questions, participants were asked: “How do you feel in this situation?” and moved a slider to change a face from very sad (1) to very happy (5), which was the measure of happiness. Then they were asked: “In this situation, do you feel like you have a lot of money (like you are rich), or a little money (like you are poor)?” and answered by choosing one of five responses ranging from “a little money, like I'm poor” illustrated with one stack of bills (1) to “a lot of money, like I'm rich” illustrated with five stacks of bills (5). This measure of feelings of wealth was the primary dependent variable.

Fifty-six participants (13.4%) did not correctly report whether they bought something, and 42 (10.1%) did not correctly report whether their friend bought something; for both questions, those who answered correctly vs. incorrectly did not differ in age, ts < 1. Participants who answered either question incorrectly were excluded from further analysis, leaving N = 339 (77–93 per condition).

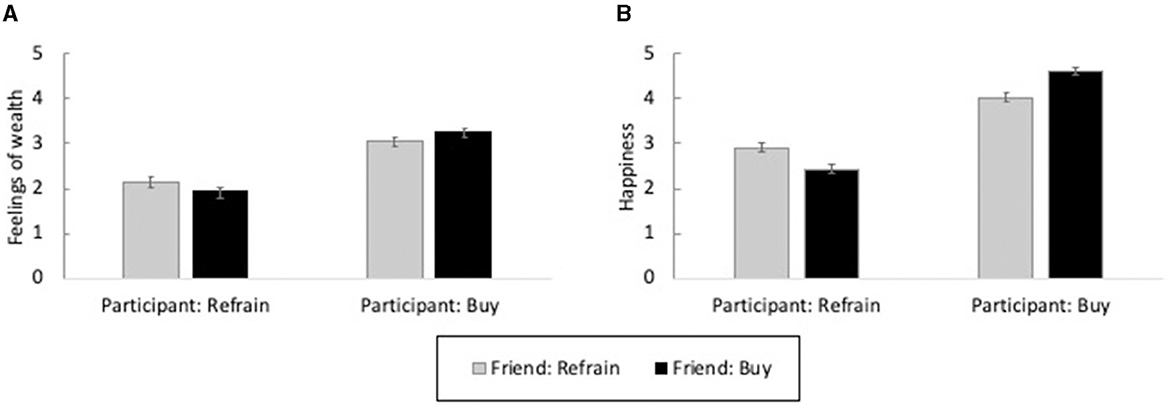

A 2 (participant's behavior: buy, refrain) × 2 (friend's behavior: buy, refrain) ANOVA tested the hypothesis that participants' imagined buying would lead to feeling richer than their refraining. Indeed, children who were told they had bought something reported feeling richer, F(1, 335) = 94.00, p < 0.001, = 0.22 (Figure 1A).

Figure 1. Estimated marginal mean values for feelings of wealth (A) and happiness (B) by condition in Study 2. In each panel, the difference between the two left-hand bars (participant imagines refraining from buying) and the two right-hand bars (participant imagines buying) shows the main effect of buying. The difference between the two outer bars and the two inner bars in each panel shows the effect of similarity. Error bars are ± 1 standard error.

There was also an interaction effect, F(1, 335) = 3.89, p = 0.05, = 0.01. However, the interaction effect appears to show the importance of similarity rather than social comparisons. Whereas social comparisons could have led children who imagined refraining to feel poorer if their friend had bought something (which was the case, see left-hand bars in Figure 1A) and children who imagined buying to feel richer if their friend refrained (which was not the case, see right-hand bars in Figure 1A), children reported imagining feeling slightly wealthier when their own decision matched their friend's decision. That is, acting like one's friend (i.e., similarity), rather than acquiring more (i.e., social comparison) translated into feeling richer. However, this effect of similarity was small in comparison to the effect of imagined buying vs. refraining, as shown in the effect sizes for the main effect of buying ( = 0.22) and the interaction effect ( = 0.01), suggesting similarity is probably only a minor influence on feeling rich.

A parallel analysis on feelings of happiness showed similar, albeit larger, effects of own behavior, F(1, 335) = 269.02, p < 0.001, = 0.45, and own behavior by friend's behavior, F(1, 335) = 27.78, p < 0.001, = 0.08. A small amount of happiness came from imagining acting similar to a friend, but much more happiness came from imagining buying something rather than refraining (Figure 1B). The effect of imagined buying was about twice as big on happiness as it had been on feeling rich. This suggests that momentary happiness fluctuates more in response to material goods than do feelings of relative wealth—although the latter also change substantially as a result of small acts like buying or not buying something desirable.

Because relatively little is known about what makes children feel rich or poor, and because imagined buying affected happiness as well as feelings of wealth, it was important to establish that the effect on feelings of wealth was not merely an artifact of the effect on happiness. Repeating the 2 (participant's behavior: buy, refrain) × 2 (friend's behavior: buy, refrain) ANOVA with feelings of wealth as a DV, adding feeling happy as a covariate, children who were told they had bought something still reported feeling richer, F(1, 334) = 15.32, p < 0.001, = 0.04, although with a much reduced effect size. Feeling happier did predict feeling richer, F(1, 334) = 28.92, p < 0.001, = 0.08. However, the continued significance of the effect of buying suggests that children's reported feelings of wealth are not merely misunderstood happiness.

Previous research with 10–12-year olds found a correlation between household income and children's ratings of their family's wealth (Mistry et al., 2015). Consistent with that research, there was a main effect of household income, F(1, 334) = 34.70, p < 0.001, = 0.09 on feeling rich. The unstandardized coefficient, b = 0.16, indicated that each increase in household income category predicted a 0.16 increase on the 5-point scale of feeling rich, suggesting that children factor their family's actual economic resources into their imagined feelings of wealth in this hypothetical scenario. However, the interaction effect of imagined buying vs. refraining by income was not significant, F(1, 334) = 1.13, p = 0.29, = 0.003, giving no evidence that these (imagined) key actions affected feelings of wealth differently for children from households with lower vs. higher incomes.

In a subsequent analysis, the interaction effect of participant's imagined behavior (buy, refrain) by age was added. This interaction effect was not significant, F(1, 334) = 0.86, p = 0.36, = 0.003, giving no evidence that the effect of imagined buying vs. refraining on feeling rich changed with age. Because the non-significant interaction effect does not allow one to conclude that there is no effect, it was followed up with equivalence testing. Using an approach called Two One-Sided Tests (TOST, Lakens, 2017), the observed interaction effect was compared to a specified effect size. Since the overall difference in feeling rich between the buy and refrain conditions was 1.1 points, if this effect were not present among the youngest (5) or oldest (12) participants, it would have to change by 0.16 points (1.1/7) with each year of age. That is, 0.16 would be the coefficient for the interaction effect (with a positive sign if the effect of spending on feeling rich increased with age, and a negative sign if it decreased). The observed coefficient for the interaction effect was −0.049 with a standard error of 0.053. Two t-tests compared this value to the lower bound interaction effect coefficient (−0.16) and upper bound interaction effect coefficient (0.16). The one-sided test with the higher p-value was t(334) = 2.09, p = 0.02, so the TOST procedure indicated that the observed interaction effect size was significantly within the equivalent bounds of b = −0.16 and b = 0.16. Any changes across age 5–12 in the effect of imagined buying on feeling rich are arguably too small to be of much interest.

As discussed above, the effect of the friend's behavior offers one way to explore the role of social comparisons. Examining changes by age is another way. Because only older children are likely to engage in social comparisons (Herrmann et al., 2019; Ackerman and Elenbaas, 2023), older children might be differently affected by acting “better” (imagining buying when the friend refrained) or “worse” (imagining refraining when the friend bought). If social comparison is a key mechanism for the effect of imagined buying on feeling rich, then there might be a 3-way interaction effect of participant's own behavior, friend's behavior, and age, such that older children but not younger ones feel richest if imagining buying when a friend refrains and poorest if imagining refraining when a friend buys. However, the 3-way interaction effect of own behavior, friend's behavior, and age was not significant, F(1, 331) = 0.02, p = 0.90, < 0.001. Thus, there is no evidence that developmental changes in the use of social comparisons change the effect of imagined buying vs. refraining on feeling rich. Considering this finding alongside the boost from similarity noted above, the effect of imagined buying vs. refraining on feeling rich seems not to be strongly driven by social comparisons.

The final study built on Study 2′s findings in four ways. First, perhaps children feel rich when imagining refraining from buying if they believe that saving money builds wealth. Maybe participants in Study 2 were unable to feel richer after imagining refraining because they had not been told that they had money to start with; children may have assumed that they refrained only if they did not have money to hand. Therefore, the next study informed participants that they had money they could spend. Second, perhaps feeling rich after imagined refraining relies on perceiving oneself as having exercised self-control (see Olson and Rick, 2014). Maybe the manipulation in Study 1 precluded this, since children were told that they had bought or refrained. Therefore, the next study allowed them to make their own decision about buying vs. refraining and then measured feelings of richness and happiness. Third, it is possible that effects on imagining feeling rich were merely a scale use bias (i.e., children marked “rich” in a similar position to where they had marked “happy”). This is somewhat unlikely since the scale for happiness used a slider, and the scale for richness did not, and since the effect of buying on feeling rich was present even controlling for happiness. Nevertheless, in the next study the direction of the scale measuring richness was reversed to ensure that effects on this measure were not due to scale use bias. Fourth, given that there was no evidence in Study 2 that the effect of buying vs. refraining depended on household income, income was not measured in Study 2 and no attempt to recruit a sample stratified by income was made. Data could therefore be collected from children in person, addressing concerns about the veracity of online responses.

To compare participants who decided to buy vs. those who decided to refrain, materials described a hypothetical situation in which buying was somewhat desirable (though not so strongly as to lead all participants to decide to buy): a situation in which participants saw something that they “kind of liked, but weren't sure about” while with a new friend who had decided to buy something (analogous to the “friend buys” conditions in Study 2). Pre-testing suggested this scenario would lead to adequate variance in the hypothetical buying vs. refraining decision.

This study was approved by the Research Ethics Committee at the London School of Economics and Political Science, Ref #000467, “Children's Impressions of Spending (2).” The study was completed by 275 children (132 girls, 143 boys) ages 4–12 (M = 8.02 years, SD = 2.14) who were visiting one of two science fairs in southern England. No further demographic information was collected.

After collecting data at the first 1-day event (n = 100) and conducting preliminary analyses, it was decided to make the sample size the maximum number of responses that could be collected by the conclusion of a second (2-day) event. This was expected to yield at least 100 children deciding to “buy” and 100 deciding to “refrain,” which provides very high power to detect an effect of similar size to that observed in Study 2 for the difference in feeling rich between buying and refraining. Although adequate power for that (key) comparison could have been obtained with fewer participants, the larger sample allowed for a test of changes with age. Eight additional children who gave incomplete responses, and 15 children who completed the study materials but were not aged 4–12, were excluded from analysis.

Adults signed an informed consent document and children gave verbal assent to participate. Children were given a large color image of a toy store to look at as the researcher read this story (the friend's gender was matched to the participant's):

Imagine that you have some pocket money and you are at a store with a new friend. You both really like this store because it has so many different good toys and games and books. You see something in the store that you kind of like, but you're not sure if you should buy it. Your friend finds something that he [she] really likes, and goes to pay for it.

Researchers read out these instructions and the subsequent questions and recorded childrens' answers on paper. Half of the children were then told that after saying whether they would buy the item, they would get to explain their answer; the other half were told that they would only answer yes or no and would not get to explain. This difference had no effect on children's answers and is not discussed further.4 After each child had indicated that they understood the instructions, they were reminded of the scenario and asked: “Do you buy the thing you saw?” (0 = no/refrain, 1 = yes/buy). Children were then asked: “How do you feel in this situation?” and pointed to one of seven faces that ranged from very sad (1) to very happy (7). They were asked: “In this situation, do you feel like you have a lot of money (like you're rich) or a little money (like you're poor)?” illustrated as described in Study 2. However, the direction of this scale was reversed so that “a lot of money” was located at the lower end, to ensure that relations between the two measures were not due to scale use tendencies. Reverse-coded values, such that higher numbers mean feeling richer, are presented below for ease of interpretation. For those who were randomly assigned to explain their decision, research assistants recorded the answer verbatim.

As intended, buying decisions in the hypothetical scenario were spread between the two options: 128 children (44%) decided to buy and 163 (56%) decided to refrain. Those who decided to buy were younger on average (MBuy = 7.26 years, SD = 2.06, vs. MRefrain = 8.60 years, SD = 1.99), t(271) = 5.46, p < 0.001.

Among those asked to explain their decision, many refrainers gave sophisticated answers: “Because I don't really like it, just a bit, so it doesn't make too much sense to buy it” or “Because when you're buying something you need to know for sure, otherwise it's a bit of a waste of money.” Some explanations for refraining even referred to saving: “I'd rather save up to get something I really want.” Thus, at least a portion of children gave answers consistent with refraining being the “appropriate” decision.

Despite these answers, on average children who decided to buy imagined feeling richer than those who decided to refrain, t(233) = 2.65, p = 0.009, d = 0.33 (MBuy = 3.37, SD = 1.32 vs. MRefrain = 2.97, SD = 1.12). Those who imagined buying also imagined feeling happier, t(245) = 6.16, p < 0.001, d = 0.75, equal variances not assumed for both tests (MBuy = 5.54, SD = 1.24 vs. MRefrain = 4.64, SD = 1.15). These findings replicate Study 2, with participants tested in-person rather than online, and by reversing the direction of the response scale, show the effect on feeling rich is not merely a scale use bias.

Next, regression analysis was used to test whether age changed the relation of buying decision to feeling rich. The interaction effect of buying by age was not significant, t(267) = 1.38, p = 0.17; as was true in Study 2, there was no evidence that the boost in feeling rich for children who decided to buy rather than refrain changed with age. However, it is worth noting that using the equivalence testing approach described in Study 2, an interaction effect large enough to be of interest (i.e., for the effect of imagined buying vs. refraining on feeling rich to not be present among the youngest or oldest participants) could not be ruled out. More generally, this study showed that even though many of the older children in the explanation condition said that refraining from buying was the right thing to do, the average child who chose to refrain still imagined feeling less rich, and again, there was no evidence that the size of this effect changed through age 12.

Despite their youth, financial decisions are highly relevant for children. For instance, in representative samples in the United Kingdom, 64% of 7-to-11-year olds, and 75% of 12-to-15-year olds, were receiving regular money, either pocket money from family members or through work (Money and Pensions Service, 2023). Nearly two-thirds of 4-year-olds had experience paying for things in shops (Money Advice Service, 2017), and by age 8, most children were involved with decisions about how their money was used (Money Advice Service, 2017). These early experiences are likely to shape later financial attitudes and beliefs, as well as buying habits (Ashby et al., 2011), making it particularly important to understand how decisions to buy or refrain make children feel.

Study 1 showed that children aged 9–12 saw a child who bought something as richer than one who refrained, even if refraining was for a reason that would still achieve an underlying goal (i.e., to give a gift to a friend). This result complements related findings on children's impressions of others. Just as they believe that people who live in bigger houses and have more and better possessions are richer (Weinger, 1998; Newheiser and Olson, 2012), children also infer that someone who makes a desirable purchase is richer than someone who refrains. This impression is likely to be consequential, since 5-year-olds use social category labels like “rich” and “poor” to make other inferences about characters (Diesendruck and HaLevi, 2006). However, in the present line of research, it was primarily a backdrop for investigating how children's own decisions might affect their feelings about their own resources.

The subsequent two studies showed that imagining buying, compared to refraining, causes (Study 2) and predicts (Study 3) children to imagine feeling richer. These studies give the first empirical evidence of how key actions that are related to becoming richer or poorer affect children feeling richer or poorer. Related research examines children's beliefs about their social status, focusing on global evaluations that are presumably relatively stable (e.g., Mistry et al., 2015; Peretz-Lange et al., 2022; Ackerman and Elenbaas, 2023). The present studies echo some of those findings, such as the link between family income and children's feelings of wealth that was present in Study 2. However, these studies show that children's feelings also fluctuate in the very short-term, in response to small (and in this case, imagined) decisions.

In these samples, there were no discernible changes in the effect of imagined buying on feeling rich between ages 4–12. Younger and older children did act differently: older children were more likely to say they would refrain from buying the item they “kind of liked” in Study 3, for instance. This result echoes previous studies that found stronger tendencies to save a limited resource for future use from ages 6 to 12 (Webley et al., 1991; Otto et al., 2006). However, there was no evidence that imagining buying vs. refraining affected younger and older children's feelings of wealth differently. The beginning of this paper outlined developmental changes that could predict both age-related increases and age-related decreases in the size of this effect. Perhaps both are at play, and somewhat cancel each other out. Or perhaps none of these changes (e.g., the tendency to use simple explanations or to make social comparisons) is a key mechanism for the effect of buying on feeling wealthy. Indeed, several results in Study 2 (i.e., effect of buying on feeling rich was not amplified if one's friend refrained from buying; older children did not respond differently than younger ones to the match between their own imagined behavior and their friend's behavior) suggested that social comparisons did not underpin the findings. Now that the present research has established the main effect, future work can dig further into underlying mechanisms.

It is interesting to consider how children should feel (i.e., richer or poorer) after buying or refraining. Of course, this issue has been studied much more in adults than in children. Among adults, as income increases, so does spending; this relationship is so robust that total expenditures have been used as an effective proxy for income (Charles et al., 2009). Thus, in the absence of other information, it is fair to guess that someone who buys an item is richer than someone who refrains, and many adults do make this inference (Kappes et al., 2021). On the other hand, holding income constant, wealth (net worth) is lowered by most purchases because of transaction costs and resale values that fall rapidly after purchase. However, resale values and the objective value of possessions are arguably beyond the scope of children's understanding of wealth. And if children tend to value the items they buy more than the prices they pay, then the consumption surplus (Mankiw, 2020) is a valid reason why buying should lead them to feel richer. These judgments about whether a purchase is worthwhile (i.e., provides value beyond the money required to acquire it) are of course at the heart of what parents want children to develop as they acquire financial capability (Money Advice Service, 2019).

Although it is unclear how long feeling rich after buying (and poor after refraining) lasts, these results have practical implications for the adults who want to support children as they develop financial skills. It is important for these adults to understand that decisions to refrain from buying when it is not “worthwhile,” or “exercising self-control” (e.g., to save for a larger, more worthy purchase) make children feel not only unhappy, but relatively poor. Potentially, adults could counteract this effect by reminding children about the resources they are conserving and the wealth they are building when they refrain from buying. This approach might be more impactful when parents pay high interest on money that children refrain from spending, a strategy suggested by experts (Sly, n.d.). It might also be useful to talk with children about how many adults become relatively rich or poor, and the role of buying vs. refraining. An investigation of adolescents' lay theories, for instance, found that some teens explained wealth and poverty by referring to buying, such as saying “They might be poor because they waste their money on junk” (Flanagan et al., 2014, p. 5). While adults should be cautious not to create or reinforce negative stereotypes of the poor, it is worth exploring whether this kind of belief makes it easier for children to engage in only “worthwhile” buying.

Each of the present studies has limitations. One is the fact that these studies described hypothetical situations, and asked children to imagine how they would feel. Providing impressions of hypothetical target characters, as in the present Study 1, is a common method in developmental psychology (for a few examples, see Diesendruck and HaLevi, 2006; Friedman and Neary, 2008; Neary et al., 2009; Ahl et al., 2019; Chuey et al., 2020; Legaspi et al., 2023). It is less common to ask children to imagine themselves doing something and report how they would feel, as in the present Studies 2 and 3. However, there are precedents. For example, Gelman et al. (2015) asked children to estimate the monetary value of a range of objects, including personal possessions. The personal possessions were hypothetical items, and participants ages 4–12 were instructed, “Let's pretend that when you were younger, you had [this item, such as] a stuffed frog. This is your stuffed frog.” Similarly drawing on the need to imagine feelings in a hypothetical situation, Cleroux et al. (2022) described hypothetical characters and asked 4-to-7-year-olds how they thought the characters felt (e.g., “Does the girl feel like the fish belongs to her?”). That research is able to draw conclusions about children's beliefs from their answers, whether or not the answers are correct (i.e., whether or not a hypothetical girl would actually feel the fish belongs to her). In an analogous fashion, the present research is informative about how children believe they would feel after buying or refraining. Even if they do not actually feel wealthier after buying, the fact that they believe they would probably influences their propensity to buy (adults often make choices to minimize the regret they believe they would feel in the future, for instance; Loomes and Sugden, 1982). Nevertheless, future research should investigate whether children do feel richer after their actual purchases.

A limitation specific to Study 2 is the administration of materials online without direct experimenter supervision. Parents were instructed as to the importance and value of recording children's own responses, and the number of respondents failing the (simple) manipulation check suggests that most children were not influenced by their adults (otherwise they should have answered these questions correctly). Indeed, “unmoderated remote research” has been identified as a way to strengthen developmental science, in part by including children from more diverse backgrounds as participants (Rhodes et al., 2020). However, in the future it would be ideal to record at least a subset of the study sessions, to verify children's uninfluenced engagement.

Another limitation of the studies is the focus on children in relatively wealthy English-speaking countries (United Kingdom, United States). These are countries where spending rises with income (Friedman, 1957; Carroll, 1997), but in other countries, the wealthy are less inclined to spend their money (Garon, 2011). It is unclear whether children raised in those cultures would also feel richer after spending than refraining. This is worth investigating. Finally, the present studies used gifts for a friend (Study 1) or an unspecified desirable item at a shop that sold “many different good toys and games and books.” There may be product categories, such as healthy foods, where buying vs. refraining does not have the effect observed here. Exploring the breadth of this effect across purchases (e.g., experiences rather than material goods) might be a way to gain further insight into the underlying mechanisms.

These studies were motivated by the real-world phenomenon of children's buying, so the attention to children rather than adults is not a limitation. However, exploring how adults feel about their economic resources after buying or refraining is a promising future direction. Many adults report buying beyond their means (Bank of England, 2020; Federal Reserve Bank of New York, 2020), and understanding how they feel after buying or refraining could inspire interventions to help. There is a large body of work that compares adults' feelings—generally happiness—after different types of purchases (e.g., a purchase for oneself vs. for someone else, Dunn et al., 2008; items to use alone or with others, Matz et al., 2016; time-saving vs. material purchases, Whillans et al., 2017; experiential or material purchases, Lee et al., 2018). But the designs of those studies, which have no “refrain” condition, do not speak to how adults feel when they buy vs. refrain. Future work adapting the present designs to adult samples could provide useful insights. More generally, people who feel happy after refraining may be better positioned to reduce their consumption, which is necessary for environmental sustainability (Parvatiyar and Sheth, 2023).

Developing financial capability involves learning to make decisions both to buy things, and to refrain from buying. The present studies showed that these decisions impact children's feelings about their economic resources.

The datasets presented in this study can be found in online repositories. The names of the repository/repositories and accession number(s) can be found below: https://osf.io/dajsg/.

The studies involving humans were approved by London School of Economics and Political Science Research Ethics Committee. The studies were conducted in accordance with the local legislation and institutional requirements. Written informed consent for participation in this study was provided by the participants' legal guardians/next of kin.

HK: Conceptualization, Formal analysis, Funding acquisition, Investigation, Project administration, Writing—original draft, Writing—review & editing.

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. Funding was received from the London School of Economics and Political Science to support participant recruitment and study administration.

Portions of this research were presented at the Boulder Summer Conference on Consumer Financial Decision Making in Boulder, Colorado (May 2017). I am grateful to Rita Astuti, Lan Nguyen Chaplin, Ori Friedman, Matteo M. Galizzi, Joe Gladstone, Andreas Kappes, Hye-young Kim, Laura Kudrna, Nikki Sullivan, and Sophie von Stumm for invaluable comments and suggestions on this line of research, to the staff at the Brighton Science Fair who helped make it possible to collect the Study 3 data, and to the research assistants who supported these studies. Huge thanks to the young people, teachers, and families who took part.

The author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

1. ^This was a single-question survey administered with Google Surveys to a representative sample of American internet users in March 2019. Respondents chose between “spend money” and “don't spend money”; the order of these response options was randomized.

2. ^Thanks to an anonymous reviewer for this observation.

3. ^This intuition is supported by a pre-study in which adults rated the simplicity of explanations for refraining from spending. Those materials and data are available at https://osf.io/dajsg/.

4. ^Forty-three percent of the children who explained their answers said they would buy, compared to 45% of those who did not explain, χ2(1) = 0.07, p = 0.80. There was also no evidence that buying versus refraining had a different relation to feeling rich depending on whether children explained their decisions. Specifically, in a two-way ANOVA with feeling rich as the dependent variable and explanation condition, buying decision, and their interaction as predictors, the interaction effect was not significant, F(1, 268) = 0.18, p = 0.67, = 0.001

Ackerman, A., and Elenbaas, L. (2023). Eight- to 12-year-old US children's emerging subjective social status identity and intergroup attitudes. Soc. Dev. 1–19. doi: 10.1111/sode.12706

Ahl, R. E., Duong, S., and Dunham, Y. (2019). Children employ wealth cues when predicting others' sharing. Dev. Psychol. 55, 303–314. doi: 10.1037/dev0000643

Andrews, J. C., Walker, K. L., and Kees, J. (2020). Children and online privacy protection: empowerment from cognitive defense strategies. J. Public Policy Mark. 39, 205–219. doi: 10.1177/0743915619883638

Ashby, J. S., Schoon, I., and Webley, P. (2011). Save now, save later?: Linkages between saving behavior in adolescence and adulthood. Eur. Psychol. 16, 227–237. doi: 10.1027/1016-9040/a000067

Bank of England (2020). Household Credit. Available online at: https://www.bankofengland.co.uk/statistics/visual-summaries/household-credit (accessed December 29, 2023).

Berti, A. E., and Bombi, A. S. (1981). The development of the concept of money and its value: a longitudinal study. Child Dev. 52, 1179–1182. doi: 10.2307/1129504

Bonawitz, E. B., and Lombrozo, T. (2012). Occam's rattle: children's use of simplicity and probability to constrain inference. Dev. Psychol. 48, 1156. doi: 10.1037/a0026471

Browning, M., Gørtz, M., and Leth-Petersen, S. (2013). Housing wealth and consumption: a micro panel study. Econ. J. 123, 401–428. doi: 10.1111/ecoj.12017

Carroll, C. D. (1997). Buffer-stock saving and the life cycle/permanent income hypothesis. Q. J. Econ. 112, 1–55. doi: 10.1162/003355397555109

Chan, K. (2006). Exploring children's perceptions of material possessions: a drawing study. Qual. Mark. Res. Int. J. 9, 352–366. doi: 10.1108/13522750610689087

Chaplin, L. N., and John, D. R. (2007). Growing up in a material world: age differences in materialism in children and adolescents. J. Consum. Res. 34, 480–493. doi: 10.1086/518546

Charles, K. K., Hurst, E., and Roussanov, N. (2009). Conspicuous consumption and race. Q. J. Econ. 124, 425–467. doi: 10.1162/qjec.2009.124.2.425

Chuey, A., Lockhart, K., Sheskin, M., and Keil, F. (2020). Children and adults selectively generalize mechanistic knowledge. Cognition 199, 104231. doi: 10.1016/j.cognition.2020.104231

Cleroux, A., Peck, J., and Friedman, O. (2022). Young children infer psychological ownership from stewardship. Dev. Psychol. 58, 671. doi: 10.1037/dev0001325

del Río, M. F., and Strasser, K. (2011). Chilean children's essentialist reasoning about poverty. Br. J. Dev. Psychol. 29, 722–743. doi: 10.1348/2044-835X.002005

Diesendruck, G., and HaLevi, H. (2006). The role of language, appearance, and culture in children's social category-based induction. Child Dev. 77, 539–553. doi: 10.1111/j.1467-8624.2006.00889.x

Dunham, Y., Newheiser, A.-K., Hoosain, L., Merrill, A., and Olson, K. R. (2014). From a different vantage: Intergroup attitudes among children from low-and intermediate-status racial groups. Soc. Cogn. 32, 1–21. doi: 10.1521/soco.2014.32.1.1

Dunn, E. W., Aknin, L. B., and Norton, M. I. (2008). Spending money on others promotes happiness. Science 319, 1687–1688. doi: 10.1126/science.1150952

Faul, F., Erdfelder, E., Lang, A.-G., and Buchner, A. (2007). G* Power 3: a flexible statistical power analysis program for the social, behavioral, and biomedical sciences. Behav. Res. Methods 39, 175–191. doi: 10.3758/BF03193146

Federal Reserve Bank of New York (2020). Quarterly Report on Household Debt and Credit. Available online at: https://www.newyorkfed.org/microeconomics/hhdc.html (accessed December 29, 2023).

Flanagan, C. A., Kim, T., Pykett, A., Finlay, A., Gallay, E. E., and Pancer, M. (2014). Adolescents' theories about economic inequality: why are some people poor while others are rich? Dev. Psychol. 50, 2512. doi: 10.1037/a0037934

Friedman, M. (1957). “The permanent income hypothesis,” in A Theory of the Consumption Function (Princeton, NJ: Princeton University Press), 20–37. Available online at: https://www.nber.org/system/files/chapters/c4405/c4405.pdf (accessed November 19, 2023).

Friedman, O., and Neary, K. R. (2008). Determining who owns what: do children infer ownership from first possession? Cognition 107, 829–849. doi: 10.1016/j.cognition.2007.12.002

Garon, S. (2011). Beyond Our Means: Why America Spends While the World Saves. Princeton, NJ: Princeton University Press.

Gelman, S. A., Frazier, B. N., Noles, N. S., Manczak, E. M., and Stilwell, S. M. (2015). How Much are Harry Potter's glasses worth? Children's monetary evaluation of authentic objects. J. Cogn. Dev. 16, 97–117. doi: 10.1080/15248372.2013.815623

Goldberg, M. E., Gorn, G. J., Peracchio, L. A., and Bamossy, G. (2003). Understanding materialism among youth. J. Consum. Psychol. 13, 278–288. doi: 10.1207/S15327663JCP1303_09

Herrmann, E., Haux, L. M., Zeidler, H., and Engelmann, J. M. (2019). Human children but not chimpanzees make irrational decisions driven by social comparison. Proc. R. Soc. B Biol. Sci. 286, 20182228. doi: 10.1098/rspb.2018.2228

Horwitz, S. R., Shutts, K., and Olson, K. R. (2014). Social class differences produce social group preferences. Dev. Sci. 17, 991–1002. doi: 10.1111/desc.12181

Jaspers, E. D., and Pieters, R. G. (2016). Materialism across the life span: an age-period-cohort analysis. J. Pers. Soc. Psychol. 111, 451. doi: 10.1037/pspp0000092

Kappes, H. B., Gladstone, J. J., and Hershfield, H. E. (2021). Beliefs about whether spending implies wealth. J. Consum. Res. 48, 1–21. doi: 10.1093/jcr/ucaa060

King, L. A., Hicks, J. A., Krull, J. L., and Del Gaiso, A. K. (2006). Positive affect and the experience of meaning in life. J. Pers. Soc. Psychol. 90, 179. doi: 10.1037/0022-3514.90.1.179

Lakens, D. (2017). Equivalence tests: a practical primer for t tests, correlations, and meta-analyses. Soc. Psychol. Personal. Sci. 8, 355–362. doi: 10.1177/1948550617697177

Lee, J. C., Hall, D. L., and Wood, W. (2018). Experiential or material purchases? Social class determines purchase happiness. Psychol. Sci. 29, 1031–1039. doi: 10.1177/0956797617736386

Legaspi, J. K., Pareto, H. G., Korroch, S. L., Tian, Y., and Mandalaywala, T. M. (2023). Do American children automatically encode cues to wealth? J. Exp. Child Psychol. 234, 105706. doi: 10.1016/j.jecp.2023.105706

Leshin, R., Leslie, S.-J., and Rhodes, M. (2020). Does it matter how we speak about social kinds? A large, pre-registered, online experimental study of how language shapes the development of essentialist beliefs. Child Dev. 92, e531–e547. doi: 10.31234/osf.io/nb6ys

Li, V., Spitzer, B., and Olson, K. R. (2014). Preschoolers reduce inequality while favoring individuals with more. Child Dev. 85, 1123–1133. doi: 10.1111/cdev.12198

Loomes, G., and Sugden, R. (1982). Regret theory: an alternative theory of rational choice under uncertainty. Econ. J. 92, 805–824. doi: 10.2307/2232669

Mandalaywala, T. M., Tai, C., and Rhodes, M. (2020). Children's use of race and gender as cues to social status. PLoS ONE 15, e0234398. doi: 10.1371/journal.pone.0234398

Matz, S. C., Gladstone, J. J., and Stillwell, D. (2016). Money buys happiness when spending fits our personality. Psychol. Sci. 27, 715–725. doi: 10.1177/0956797616635200

Mistry, R. S., Brown, C. S., White, E. S., Chow, K. A., and Gillen-O'Neel, C. (2015). Elementary school children's reasoning about social class: a mixed-methods study. Child Dev. 86, 1653–1671. doi: 10.1111/cdev.12407

Money Advice Service (2017). Financial Capability of Children, Young People and Their Parents in the UK 2016. Available online at: https://www.fincap.org.uk/en/insights/financial-capability-of-children-young-people-and-parents-in-the-uk-2016 (accessed December 29, 2023).

Money Advice Service (2019). How Families Teach Children About Money: Understanding Financial Education Within the Home. Available online at: https://maps.org.uk/en/publications/research/2019/how-families-teach-children-about-money (accessed December 29, 2023).

Money and Pensions Service (2023). MaPS Children and Young People's Fiancial Wellbeing Survey 2022. Available online at: https://maps.org.uk/en/publications/research/2023/uk-children-and-young-peoples-financial-wellbeing-survey-financial-foundations (accessed December 29, 2023).

Neary, K. R., Friedman, O., and Burnstein, C. L. (2009). Preschoolers infer ownership from “control of permission”. Dev. Psychol. 45, 873. doi: 10.1037/a0014088

Newheiser, A.-K., and Olson, K. R. (2012). White and Black American children's implicit intergroup bias. J. Exp. Soc. Psychol. 48, 264–270. doi: 10.1016/j.jesp.2011.08.011

Olson, J., and Rick, S. (2014). “A Penny saved is a partner earned: the romantic appeal of savers,” in NA — Advances in Consumer Research, Vol. 42, eds J. Cotte and S. Wood (Duluth, MN: Association for Consumer Research), 151–155.

Ordabayeva, N., and Chandon, P. (2010). Getting ahead of the Joneses: when equality increases conspicuous consumption among bottom-tier consumers. J. Consum. Res. 38, 27–41. doi: 10.1086/658165

Otto, A. M., Schots, P. A., Westerman, J. A., and Webley, P. (2006). Children's use of saving strategies: an experimental approach. J. Econ. Psychol. 27, 57–72. doi: 10.1016/j.joep.2005.06.013

Parvatiyar, A., and Sheth, J. N. (2023). Confronting the deep problem of consumption: why individual responsibility for mindful consumption matters. J. Consum. Aff. 57, 785–820. doi: 10.1111/joca.12534

Peretz-Lange, R., Harvey, T., and Blake, P. R. (2022). From “haves” to “have nots”: developmental declines in subjective social status reflect children's growing consideration of what they do not have. Cognition 223, 105027. doi: 10.1016/j.cognition.2022.105027

Rhodes, M., Rizzo, M. T., Foster-Hanson, E., Moty, K., Leshin, R. A., Wang, M., et al. (2020). Advancing developmental science via unmoderated remote research with children. J. Cogn. Dev. 21, 477–493. doi: 10.1080/15248372.2020.1797751

Ruberton, P. M., Gladstone, J., and Lyubomirsky, S. (2016). How your bank balance buys happiness: the importance of “cash on hand” to life satisfaction. Emotion 16, 575. doi: 10.1037/emo0000184

Scott, K., Chu, J., and Schulz, L. (2017). Lookit (Part 2): assessing the viability of online developmental research, results from three case studies. Open Mind 1, 15–29. doi: 10.1162/OPMI_a_00001

Sheskin, M., Scott, K., Mills, C. M., Bergelson, E., Bonawitz, E., Spelke, E. S., et al. (2020). Online developmental science to foster innovation, access, and impact. Trends Cogn. Sci. 24, 675–677. doi: 10.1016/j.tics.2020.06.004

Shutts, K., Brey, E. L., Dornbusch, L. A., Slywotzky, N., and Olson, K. R. (2016). Children use wealth cues to evaluate others. PLoS ONE 11, e0149360. doi: 10.1371/journal.pone.0149360

Sly, M. (n.d.). You Should Pay Your Kids a Really High Interest Rate On. The Parent Bank. Available online at: https://www.theparentbank.com/blog/posts/you-should-pay-your-kids-a-really-high-interest-rate-on-their-savings-here-s-why-and-how (accessed November 19 2023).

Sussman, A. B., and Shafir, E. (2012). On assets and debt in the psychology of perceived wealth. Psychol. Sci. 23, 101–108. doi: 10.1177/0956797611421484

Webley, P., Levine, M., and Lewis, A. (1991). A study in economic psychology: children's saving in a play economy. Hum. Relat. 44, 127–146. doi: 10.1177/001872679104400202

Weinger, S. (1998). Children living in poverty: their perception of career opportunities. Fam. Soc. 79, 320–330. doi: 10.1606/1044-3894.993

Keywords: children, wealth, buying, child consumer, financial socialization, consumer socialization

Citation: Kappes HB (2024) Young children associate buying with feeling richer. Front. Behav. Econ. 2:1293694. doi: 10.3389/frbhe.2023.1293694

Received: 13 September 2023; Accepted: 21 December 2023;

Published: 11 January 2024.

Edited by:

Thomas Post, Maastricht University, NetherlandsReviewed by:

Gerrit Antonides, Wageningen University and Research, NetherlandsCopyright © 2024 Kappes. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Heather Barry Kappes, aC5rYXBwZXNAbHNlLmFjLnVr

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.