94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Anim. Sci., 17 December 2020

Sec. Product Quality

Volume 1 - 2020 | https://doi.org/10.3389/fanim.2020.552386

This article is part of the Research TopicFrontiers in Animal Science – Highlights From Its First Year.View all 10 articles

Livestock traceability has increasingly become a focus for the USDA, the National Cattlemen's Beef Association, high-volume beef-exporting states, and other beef industry stakeholders. The focus on traceability within the United States (U.S.) began after several international animal disease outbreaks and continues to be of importance with highly infectious diseases spreading across the globe. Mitigating adverse future disease outbreaks and food safety events, as well as maintaining export markets through a positive international perception of U.S. beef has become a top priority. Implementing a national animal identification (ID) and traceability program would enable the industry to track and reduce the potential losses due to an outbreak or event. However, such a system comes at a cost, mainly to cow-calf producers. This study utilizes a partial equilibrium model to determine the impacts of a beef cattle animal ID and traceability system in the United States. Utilizing an economic model allows us to provide a comparison of how the various beef sectors would need to respond to offset the costs of a national animal ID and traceability program. Assuming no changes in domestic and international demand for U.S. beef, producers at the wholesale, slaughter, and feeder levels lose $475 million, $1,143 million, and $1,291 million, respectively, in a 10-year discounted cumulative producer surplus. A 17.7 and 1.9% increase in international and domestic beef demand would be required to completely offset the producer costs of CattleTrace, respectively.

The United States (U.S.) is relatively “behind” other countries in implementing a national animal identification (ID) and traceability program. Other large beef exporters, including Argentina, Australia, Canada, European Union, New Zealand, and Uruguay, all have government mandated systems (Schroeder and Tonsor, 2012). Despite the lack of a national animal ID and traceability program, U.S. beef has remained internationally competitive and generally accepted as a safe source. This, along with fear of increased cost and other long-term implications, has led some industry stakeholders to disapprove of potential government-mandated animal ID and traceability programs (Golan et al., 2004).

Beef production in the United States is highly segmented, which causes livestock to have several changes of ownership between birth and slaugher. The principal product of cow-calf operations is weaned calves, which are subsequently sold to stockers, backgrounders, or feedlots. Some calves from cow-calf operations are transferred directly to feedlots at, or around, the time of weaning, in which case, they are referred to as “calf-feds” that remain in the feedlot prior to being harvested (Drouillard, 2018). The largest share of the calf population, usually 60% or more, is first placed into a backgrounding or stocker operation, or a combination thereof (USDA, 2018). Most cattle pass through a feedlot at some point before reaching slaughter. The segmentation, production differences, and geographical disbursement further complicates the tracing and tracking system.

In addition, there are over 103 million head of cattle in the United States, with 192,000 head and over 2.6 billion pounds of beef exported in 2018 (USDA-NASS, 2018a,b). This high volume of production and global demand for U.S. beef complicates the ability to trace, or physically track a product, through the typical U.S. beef supply chain.

Several studies, including Coffey et al. (2005), have assigned an opportunity cost to the expected impact of a disease outbreak, specifically BSE (bovine spongiform encephalopathy), in the United States. These studies support the positive impact that a traceability program could have on the U.S. beef industry in avoiding lost export markets and loss of inventory. Measuring the potential impacts of an outbreak has been considered from many different perspectives and all suggest a significant negative impact to the industry; so much so that the National Cattlemen's Beef Association included traceability in their Long-Range Plan for 2016–2020 (National Cattlemen's Beef Association, 2017). However, determining the true costs and impacts of a traceability program within the United States is difficult due to the nature of the U.S. supply chain, but is crucial as a national animal ID and traceability program is eminent. Understanding the potential economic impact of a traceability program is important, especially in a large beef producing state such as Kansas. In addition, it is important to recognize which segments of the industry may be affected the most.

The objective of this study is to analyze the economic impacts of an animal ID and traceability system. Specifically, we calculate the direct costs of implementing an animal ID and traceability system, called CattleTrace, for each segment in the U.S. beef industry. Next, we incorporated the cost estimates into a partial equilibrium model of the U.S. livestock and meat industry to determine the short- and long-run economic impacts to the various segments of the U.S. beef industry.

In 2018, a pilot program, called CattleTrace, was launched with the support of industry stakeholders to begin directing the beef industry toward a cohesive traceability program. In January 2020, a new initiative, U.S. CattleTrace, combined the efforts of CattleTrace, which includes multiple partners, including the Kansas Livestock Association and others in Kansas, Missouri, Oklahoma, Kentucky, Oregon, and Washington, as well as traceability pilot projects underway in Florida and Texas (U.S. CattleTrace, 2020). The CattleTrace program extends from beginning-to-end of the beef industry and includes participants from all segments of production. Current participation from beef industry stakeholders includes many cow-calf producers, 12 livestock markets, 2 backgrounders, 16 feedlots, and 3 major packers (4 locations). While the CattleTrace program began in Kansas, multiple states are now part of the system with various private and public organizations establishing partnerships in an effort to illustrate how a national animal ID and traceability program may look in the future. The following analysis is based on the cost estimation of implementing a national animal ID and traceability program structured as CattleTrace.

CattleTrace is a voluntary program where cattle producers from all segments (cow/calf, backgrounders and stockers, sale barns, feedlots, and packers) can select to participate. At the cow/calf level, producers must implement the use of UHF identification for all calves leaving the premises, and depending on size of the operation (economies of scale) either a wand tag reader or panel reader is required. Increased labor costs, tag costs, and reader costs are all taken into consideration as well as a large body of assumptions on animal injury, human injury, and more. Backgrounders and stockers are assumed to need replacement tags as well as readers (wand or panel depending on economics of scale) to meet the CattleTrace requirements. Sale barns will require panel readers, with a higher quantity of panels required for larger facilities (economies of scale assumption). Feedyards are also expected to implement the use of panel readers and replacement tags if needed. All of these segments of the industry cost estimations make assumptions about labor requirements, injuries, and more based on an extensive literature review and industry discussion. At the packer level, software implementation and panel readers are the biggest initial costs for the segment. All data is stored and managed by CattleTrace in a secure location.

An annual multi-market partial equilibrium model of the U.S. livestock and meat industry was employed to estimate the economic impacts of industry costs incurred through the adoption of CattleTrace. In general, as additional costs are incurred throughout a vertically-related marketing chain, livestock, and meat prices and quantities are impacted. Furthermore, changes in prices at the retail level for beef will influence the demand for substitute products (e.g., pork, poultry, and lamb). A traceability system could also positively influence domestic and international demand for U.S. beef. However, the extent of these potential changes is difficult to forecast.

The economic model utilized in this study is an updated version of the multi-market partial equilibrium model documented in Pendell et al. (2010), Pendell et al. (2013) and Dennis et al. (2018). An equilibrium displacement model (EDM) allows for the estimation of the potential impact of a particular shock on the market, in this case, how implementing an animal ID and traceability program will impact prices and quantities on the livestock and meat markets. Such a model allows for changes in both supply and demand across multiple markets, in this case between beef, pork, poultry, and lamb.

The EDM contains an underlying set of structural demand and supply functions. After totally differentiating the structural demand and supply functions and converting to an elasticity form, the result is an EDM of the U.S. livestock and meat industry (see Appendix Equations A1–A30). After solving for the changes in the endogenous prices and quantities, changes in consumer and producer surplus can be calculated using equations (1, 2), respectively:

CS and PS are defined as the consumer surplus and producer surplus, respectively. P and Q indicate price and quantity, respectively. E represents a relative change operator. z and w are the exogenous demand and supply shifters, respectively. The superscript i denotes the market level [r = retail, w = wholesale (processor/packer), s = slaughter (feeding), and f = feeder (farm)] and subscript k denotes the species (B = beef, K = pork, L = lamb, and Y = poultry).

The exogenous shock to the EDM model is the implementation of CattleTrace. The cost of implementing CattleTrace was estimated for each segment of the industry and took into account economies of scale. The EDM model also relies on given elasticity estimates to properly estimate how the markets will respond to changes in supply and demand. The base year price and quantity data are from 2018 and reported in Table 1 (Livestock Marketing Information Center, 2019). Table A1 provides the remaining market parameters, including the supply and demand elasticities for the different commodities across the various sectors, which were retained as defined in Pendell et al. (2010) and Dennis et al. (2018).

The five segments of the U.S. beef industry in this study include: cow/calf, backgrounder/stocker, sale barn, feedlot, and packer. The total cost estimates for each segment are $129.82 million (cow/calf), $7.67 million (backgrounder/stocker), $6.44 million (sale barn), $9.64 million (feedlot), and $0.51 million (packer) (Shear et al., 2019; Table 2). The five group subtotals were summed to obtain the annual total cost for the entire beef cattle industry of adopting CattleTrace, $154.09 million. Costs associated with the cow/calf and sale barns sectors are aggregated in the feeder cattle sector, backgrounder and feedlots are aggregated in the slaughter cattle sector, and packer costs are referred to as wholesale costs in this economic analysis.

The annual beef industry CattleTrace costs are distributed as: $0.51 million to the wholesale beef sector, $17.31 million to the slaughter cattle production sector and $136.26 million to the farm sector (Table 2). Using 2018 average prices and quantities for each market level, these cost estimates represent the following percentage increases in CattleTrace costs relative to total value at each sector: 0.0009% at the wholesale beef level, 0.0333% at the slaughter cattle level, and 0.2548% at the farm level (Table 2). The percentage changes in costs at each market level are estimated in a similar manner for all scenarios.

Four scenarios are considered when quantifying the economic impacts of CattleTrace. The first two scenarios differ in the proportion of costs borne by the producer. The final two scenarios focus on U.S. beef demand responses by domestic and international consumers. It is assumed that 100% of producers would adopt CattleTrace.

The scenarios are separated into four areas:

1) Effects of CattleTrace Costs with No Benefits

The impacts of increased costs resulting from CattleTrace are simulated. This simulation assumes both domestic and international consumer demand for U.S. beef is unaffected by CattleTrace. In other words, we estimate the impacts of the costs associated with 100% adoption of CattleTrace assuming that no benefits accrue to the U.S. beef industry.

2) Effects of a Government Cost-Share of CattleTrace Costs with No Benefits

According to recent research by Mitchell et al. (2019), “results show that policies would be most effective at reducing costs at the cow-calf level or offering cost-shares for feedlot producers who want to procure cattle with electronic traceability.” Similar to Scenario 1, we simulate the impacts of increased costs resulting from CattleTrace. However, we assume 1/3 of the costs for RFID ear tags and electronic readers are borne by the producer while the government is responsible for the remaining 2/3 of those costs. Like Scenario 1, this simulation assumes both domestic and international consumer demand for U.S. beef is unaffected by CattleTrace. In essence, we measure how a government cost-share program for CattleTrace would impact the U.S. beef industry.

3) Increases in International Beef Demand Needed to Offset CattleTrace Costs

Adoption of CattleTrace, or any other animal identification and traceability system, could increase foreign consumer confidence in the U.S. beef system. We estimate the increase in U.S. beef export demand (assuming constant domestic demand) that would be needed to offset producer costs of CattleTrace adoption costs.

4) Increases in Domestic Beef Demand Needed to Offset CattleTrace Costs

Similar to Scenario 3, we estimate how much of a domestic beef demand enhancement would be required (assuming constant export demand) to offset producer costs of CattleTrace adoption costs.

As expected, changes in prices and quantities for the U.S. beef industry were much larger when compared to the pork, poultry, and lamb industries. This is because the U.S. beef industry is the only industry with an increase in costs as a result of CattleTrace. All changes in prices and quantities within the beef industry are consistent with an increase in CattleTrace costs at the wholesale, slaughter and farm levels. An increase in costs at the farm, slaughter, and wholesale levels shifts both the primary and derived supply functions, as well as, derived demand functions at the slaughter and farm levels. This results in retail and wholesale level beef prices to increase by 0.43 and 0.42%, respectively, while quantities decline by 0.16 and 0.41%. Imported and exported wholesale beef, slaughter, and feeder cattle prices and quantities all decline. Slaughter cattle prices and quantities decline by 0.15 and 0.34%, respectively, while feeder cattle prices and quantities fall by 0.08 and 0.26%. Pork, poultry and lamb prices and quantities all increase, except for export quantities, by a small amount, as consumers substitute away from beef to relatively cheaper protein sources in response to increased retail beef prices.

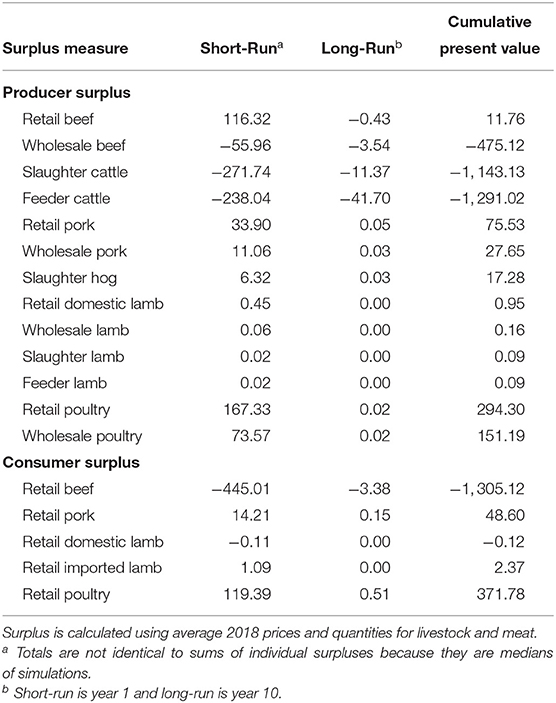

Table 3 presents producer surplus impacts due to the costs implementing CattleTrace. As expected, the short-run impacts (year 1) are much larger than the long-run impacts (year 10) as producers are able to adjust to these changes in the long-run. In the short-run, the slaughter and feeder cattle sectors experience the largest losses at $271.7 and $238.0 million, respectively. The wholesale level loses $56.0 million. In the long-run, the feeder and slaughter cattle sectors lose $41.7 and $11.4 million, respectively, while the wholesale level lose $3.5 million in producer surplus. The cumulative discounted present value of producer surplus losses over 10-years for the feeder cattle, slaughter cattle and wholesale beef sectors are $1,291 million, $1,143 million and $475 million, respectively.

Table 3. Changes in producer and consumer surplus resulting from adopting cattletrace with no benefits (million $).

Results are similar to the scenario when producers bear all CattleTrace costs, except the impacts are smaller in magnitude. This results in retail and wholesale level beef prices to increase by 0.27 and 0.27%, respectively, while quantities decline by 0.10 and 0.26%. Imported and exported wholesale beef, slaughter, and feeder cattle prices and quantities all decline. Slaughter cattle price and quantity fall by 0.10 and 0.22%, respectively, while feeder cattle price and quantity fall by 0.07 and 0.16%. Pork, poultry, and lamb prices and quantities all increase, except for export quantities, by a small amount, as consumers substitute away from beef to relatively cheaper protein sources in response to increased retail beef prices.

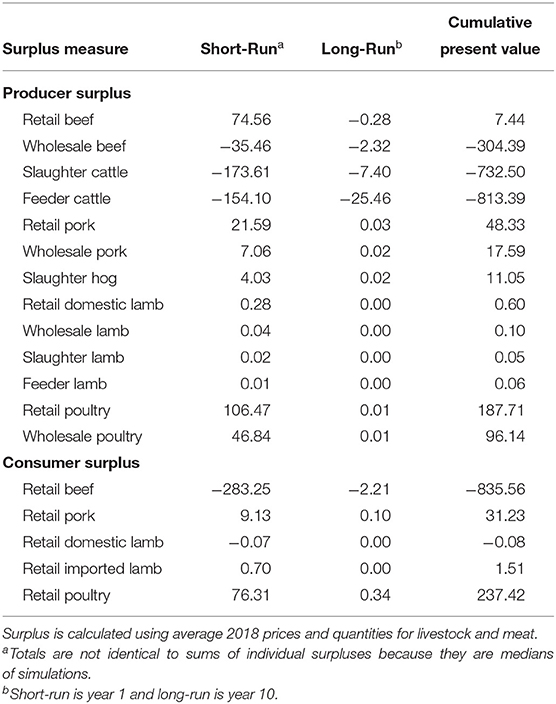

Table 4 presents producer surplus impacts due to the costs implementing CattleTrace. Similar to the previous scenario, the short-run impacts are much larger than the long-run impacts. In the short-run, the slaughter and feeder cattle sectors experience the largest losses at $173.6 and $154.1 million, respectively, while the wholesale level lose $35.5 million. In the long-run, the feeder and slaughter cattle sectors lose $7.4 and $25.5 million, respectively, while the wholesale level lost $2.3 million in producer surplus. The cumulative discounted present value of producer surplus losses over 10-years for the feeder cattle, slaughter cattle and wholesale beef sectors are $813 million, $733 million, and $304 million, respectively.

Table 4. Changes in producer and consumer surplus resulting from a government cost share of cattletrace costs (million $).

As most major exporting countries have traceability systems, implementing a national traceability program could open new markets or allow for quicker entry back into the market after a disease outbreak. This scenario was performed to determine the increase in international beef demand needed so that the U.S. beef producer sectors do not lose any producer surplus. A permanent 17.7% increase (equivalent to 558 million lbs.) in international demand for U.S. beef would be needed such that producers do not lose any surplus. To put this value into perspective, the quantity of U.S. beef exports varied from an increase of 21 to a 12% decrease between 2009 and 2018 (LMIC 2019). Furthermore, 28% (885 million lbs.), 20% (638 million lbs.), and 14% (449 million lbs.) of U.S. beef exports went to Japan, South Korea, and Mexico, respectively, in 2018 (Livestock Marketing Information Center, 2019). Thus, maintaining market access to a single export market could completely offset U.S. beef producer costs of CattleTrace.

As demand for transparency by U.S. consumers continues to increase, implementing a national animal ID and traceability program could potentially have a positive impact on consumer demand for beef. This scenario was performed to determine the increase in domestic beef demand needed so that the U.S. beef producer sectors do not lose any producer surplus. A permanent 1.9% increase (or 356 million lbs.) in domestic demand for U.S. beef would be needed such that producers do not lose any surplus. Between 2009 and 2018, annual domestic retail beef demand, on average, varied between an increase of 4.14% to a decrease of 4.10% from the previous year. Thus, a modest increase in domestic consumer demand for beef needed to offset the costs of CattleTrace has been experienced recently.

When considering economies of scale, the cost of implementing CattleTrace ranged from $2.84 to $6.06/head for cow/calf producers. For backgrounders, the cost of implementing CattleTrace ranged from $0.41 to $0.83/head. The average cost for sale barns was $0.14/head, and the cost of implementing CattleTrace for feedlots ranged from $0.33 to $0.55/head. The average cost to packers ranged from $0.02 to $0.18/head. The overall direct cost to the beef industry was estimated to be $154.09 million.

A partial equilibrium model of the U.S. livestock and meat sector was used to evaluate the impacts of adopting CattleTrace on producers. Assuming no changes in domestic and international demand for U.S. beef, producers at the wholesale, slaughter, and feeder levels lose $475 million, $1,143 million, and $1,291 million, respectively, in 10-year discounted cumulative producer surplus. If a government cost share program is implemented (i.e., 1/3 of the costs of ear tags and readers are borne by the producers while the other 2/3 of the costs are borne by the government), the producers losses are smaller; feeder, slaughter and wholesale levels lose $813 million, $733 million, and $304 million, respectively. With a possibility of increasing consumer demand as a result of traceability, two simulations evaluated the increase in international and domestic demand required to offset the costs of CattleTrace to U.S. cattle producers. A 17.7% and 1.9% increase in international and domestic beef demand would be required to completely offset the producer costs of CattleTrace, respectively.

This analysis is an overview of the costs and economic impacts of implementing CattleTrace, a ultra-high frequency based radio frequency identification (UHF-RFID) technology-based traceability program. The main objectives of this analysis was to provide an estimate of the direct cost to the industry for implementing CattleTrace, as well as, estimate the economic impact of a national animal identification (ID) and traceability program for the beef industry. Determining the direct costs to the industry required estimating costs within each industry sector.

This analysis suggests that your ‘typical' small fluctuations in domestic and international beef demand on average could offset the direct costs to producers and the industry as a whole. These results may encourage more industry support for a national animal ID and traceability program; however some concerns, such as data management, cannot be addressed in this model and, therefore, remain as hurdles to the implementation of a national program.

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

HS and DP contributed to the conception and design of the study. HS compiled a rough draft of the manuscript, incorporating the results section compiled by DP. Both authors contributed to manuscript revision, read, and approved the submitted version.

The authors acknowledge the financial assistance provided by Kansas Department of Agriculture. The views expressed herein are those of the authors and should not be attributed to KDA.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fanim.2020.552386/full#supplementary-material

Coffey, B., Mintert, S., Fox, S., Schroeder, T., and Valentine, L. (2005). The Economic Impact of BSE on the U.S. Beef Industry: Product Value Losses, Regulatory Costs, and Consumer Reactions. Kansas State University Agricultural Experimental Station and Cooperative Extension Service. Report No. MF-2678, Manhattan, NY.

Dennis, E. J., Schroeder, T. C., Renter, D. G., and Pendell, D. L. (2018). Value of metaphylaxis in U. S. cattle industry. J. Agric. Resour. Econ. 43, 233–250. Available online at: https://digitalcommons.unl.edu/ageconfacpub/181

Drouillard, J. S. (2018). Current situation and future trends for beef production in the United States of America - a review. Asian Austr. J. Anim. Sci. 31, 1007–1016. doi: 10.5713/ajas.18.0428

Golan, E., Krissoff, B., Kuchler, F., Calvin, L., Nelson, K., and Price, G. (2004). Traceability in the U.S. Food Supply: Economic Theory and Industry Studies. ERS Agricultural Economic Report No. 830. USDA, Washington, DC.

Livestock Marketing Information Center (2019). Various Reports and Data. LMIC Lakewood, CO. Available online at: https://lmic.info/ (accessed May 20, 2019).

Mitchell, J. L., Tonsor, G. T., and Schultz, L. L. (2019). Comparing Willingness to Supply and Willingness to Pay for Cattle Traceability: A Novel Assessment of Both Supply and Demand Factors Driving Provision of Production Practice Information in Modern Food Systems. Available online at: https://econpapers.repec.org/paper/agsaaea19/291158.htm (accessed November 7, 2019).

National Cattlemen's Beef Association (2017). Long-Term Strategic Plan. January: National Cattlemen's and Beef Association. Available online at: https://www.ncba.org/CMDocs/BeefUSA/AboutUS/LRP_2-Page_Rev_2_Jan_2018_FULL.pdf (accessed April 1, 2020).

Pendell, D. L., Brester, G. W., Schroeder, T. C., Dhuyvetter, K. C., and Tonsor, G. T. (2010). Animal identification and tracing in the United States. Am. J. Agric. Econ. 92, 927–940. doi: 10.1093/ajae/aaq037

Pendell, D. L., Tonsor, G. T., Dhuyvetter, K. C., Brester, G. W., and Schroeder, T. C. (2013). Evolving beef export market access requirements for age and source verification. Food Policy 43, 332–340. doi: 10.1016/j.foodpol.2013.05.013

Schroeder, T., and Tonsor, G. (2012). International cattle ID and traceability: competitive implications for the US. Food Policy 37, 31–40. doi: 10.1016/j.foodpol.2011.10.005

Shear, H. E., Kniebel, C., Pendell, D. L., and White, B. (2019). Implementation & Economic Impacts of a Traceability Program on Beef Industry Stakeholders. Kansas State University Extension. Available online at: https://ce853749-be7e-4795-a797-ecf423bafffe.filesusr.com/ugd/35e859_8f41fcb7ac014ff89f2256cee823eb1b.pdf

U.S. CattleTrace (2020). Cattle Disease Tracebility Continues Advancing. US CattleTrace. Available online at: https://www.uscattletrace.org/post/cattle-disease-traceability-continues-advancing (accessed January 22, 2020).

USDA (2018). Cattle Inventory Report. Available online at: https://usda.library.cornell.edu/concern/publications/h702q636h?locale=en (accessed April 12, 2020).

USDA-NASS (2018a). Cattle Yearly Totals. USDA-NASS. Available online at: https://www.ers.usda.gov/data-products/livestock-and-meat-international-trade-data/ (accessed April 12, 2020).

USDA-NASS (2018b). Beef and Veal Yearly Totals. USDA-NASS. Available online at: https://www.ers.usda.gov/data-products/livestock-and-meat-international-trade-data/ (accessed April 12, 2020).

Keywords: animal identification, beef production, partial equilibrium model, traceability, welfare analysis

Citation: Shear HE and Pendell DL (2020) Economic Cost of Traceability in U.S. Beef Production. Front. Anim. Sci. 1:552386. doi: 10.3389/fanim.2020.552386

Received: 29 September 2020; Accepted: 25 November 2020;

Published: 17 December 2020.

Edited by:

Marzena Helena Zajac, University of Agriculture in Krakow, PolandReviewed by:

Paul Crosson, Teagasc, IrelandCopyright © 2020 Shear and Pendell. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Hannah E. Shear, aGVzaGVhckBrc3UuZWR1

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.