- 1Department of Public Finance, University of Innsbruck, Innsbruck, Austria

- 2Department of Sport Science, University of Innsbruck, Innsbruck, Austria

- 3Department of Strategic Management, Marketing and Tourism, University of Innsbruck, Innsbruck, Austria

The COVID-19 crisis and the related nationwide lockdowns reduced the available types of physical activity, especially in the winter season. Besides closed indoor sports facilities, some outdoor sports were also inaccessible because of curfews and/or the closure of outdoor sports facilities. However, in Austria, the operation of alpine ski areas was permitted even during the full lockdown in the winter season 2020/21, albeit under strict hygiene requirements and capacity restrictions. This posed a challenge for ski area operators, with those heavily dependent on foreign multi-day guests facing severe declines in demand due to closed accommodation and closed borders while others were challenged by demand pressures from nearby population centers. We therefore want to examine how Austrian ski area operators managed these challenges, how they evaluated this extraordinary season and whether these new experiences and established measures can be used to improve customer experience in the future. We used a mixed-methods approach with a quantitative survey (n = 65) and follow-up qualitative interviews with managers (n = 20) of Austrian ski areas. For 75% of respondents, the reason for keeping the ski areas open, despite the fact that 95 % suffered average revenue declines of 80%, was to provide an outlet for physical activity for the local population. Respondents noticed a lot of gratitude and growing trust from local customers that could be used to increase the approval of tourism in the local population. The COVID-19 pandemic has also advanced the spread of technological innovations in the cable car industry, such as online ticketing and dynamic pricing. Furthermore, the COVID-19 crisis has continued to drive the sustainability debate around ski resorts. Customers are seeking further deceleration resulting in a stronger focus on qualitative rather than quantitative development for Austrian ski area operators.

1. Introduction

The COVID-19 pandemic fundamentally disrupted the recreation and tourism industry (Gössling et al., 2020) due to closed borders and stay-at-home orders limiting people's opportunities to engage in recreation activities (Hall et al., 2020). Further, the pandemic has led to lower psychological wellbeing and higher scores for anxiety and depression (Vindegaard and Benros, 2020). People suffering from mental illness have a lower life expectancy and poorer physical health outcomes compared to the general population (Rodgers et al., 2018). One way to counteract these circumstances lies in practicing sports (Thibaut et al., 2022).

Globally, physical inactivity has become one of the major problems facing healthcare systems (Frühauf et al., 2020). Besides increasing psychological pressure, there were concerns that the COVID-19 period would further contribute to people‘s inactivity (Violant-Holz et al., 2020), especially as individuals were not allowed to leave their homes, were having to isolate, and therefore were limited in their freedom to participate in sport (Peçanha et al., 2020).

Among all the other areas of life that were affected and limited by governments in the wake of the COVID-19 disease, country-specific regulations restricted the populations' access to PA (Frühauf et al., 2020). Austrian and Italian governments, for example, prohibited the great majority of outdoor and social activities resulting in a reduction in physical activity (PA) (Mattioli et al., 2020).

Providers of PA were among those actors suffering at the behest of COVID-19 measures. Depending on the country, many of them had to close their businesses during lockdowns or due to other COVID-19-related restrictions. Active and social recreation opportunities were drastically reduced or disbanded due to group size limitations, stay-at-home orders, and reductions in services and facilities (Son et al., 2021). Those providers of PA who were allowed to keep their businesses open were confronted with diverse challenges such as high safety and hygiene standards (Steiger et al., 2021).

The first wave of the epidemic (February-May 2020) was characterized by several international clusters originating from infected travelers hosted in ski areas (Gianfredi et al., 2021; Mayer et al., 2021). With the intention of reducing the spread of the virus, several European governments, therefore, decided to close the ski areas (Gianfredi et al., 2021). Those restrictions were maintained as a preventive measure in the majority of countries during the 2020/21 winter season, with countries like Austria and Switzerland stepping out of line. With the implementation of substantial restrictions, the ski resorts in Austria were allowed to open throughout the winter season (Gianfredi et al., 2021).

The winter season 2020/21 represented a big challenge for ski area operators in Austria due to several factors: in the media, ski areas were presented as super-spreaders of the virus (Mayer et al., 2021) potentially affecting the image of companies and destinations providing this activity. Government regulations (e.g., reduced lift capacity, closed accommodation sector, travel restrictions) heavily influenced the operation of ski areas that had to deal with the short-term implementation of regulations and the associated increase in costs. Furthermore, while ski areas with a high share of foreign visitors were confronted with unprecedented declines in demand, ski areas in the vicinity of population centers experienced high demand pressure due to a reduced offering of physical activities (Steiger et al., 2021).

The aim of this article is, therefore, to investigate how cable car companies in Austria evaluated the 2020/21 season against the backdrop of COVID-19, its consequences for this business sector and for physical activity in the future and finally, what kind of measures were implemented to meet the challenges. We conducted an online survey among Austrian ski resorts (n = 65) followed by qualitative interviews (n = 20).

2. Literature review

Besides its positive impact on physical and psychological health, practicing sports benefits social wellbeing (Eime et al., 2013; Caputo and Reichert, 2020). Physical activity (PA) defined as “any bodily movement produced by skeletal muscles that results in energy expenditure” (Caspersen et al., 1985) decreases negative feelings and symptoms of depression (McMahon et al., 2017) while helping to strengthen the immune system against viral infections (Woods et al., 2020; Thibaut et al., 2022). The frequency of PA is positively correlated with wellbeing and negatively correlated with both anxiety and symptoms of depression (McMahon et al., 2017).

As Schöttl et al. (2022) point out, the extent to which the COVID-19 period affected individual PA levels has been addressed in the literature and is complex. Many countries showed a short-term decline in PA during the initial lockdown in spring 2020 compared to the pre-COVID-19 period while, on the other hand, other studies have reported an increased frequency of PA during the initial stages of the pandemic (Schöttl et al., 2022). Some of the increase may be attributed to substitution behavior, as some activities (e.g. going to the movies or bars) were not available (Weinbrenner et al., 2021).

Sports scientists around the world debated the importance and potential of PA, arguing that sports should not be marginalized during a pandemic (Carter et al., 2020; Frühauf et al., 2020; Thibaut et al., 2022). The overall health risks associated with obesity and specific figures indicating that obesity increases COVID-19 mortality rates go against the grain of closing sports infrastructure (Carter et al., 2020), especially as Zhu et al. (2021) demonstrate that obesity rates in China increased during the COVID-19 outbreak.

The relationship between staying physically active, leisure activities and psychological wellbeing during the COVID-19 pandemic has been examined in the literature (Chtourou et al., 2020). Maintaining or increasing time spent on leisure activities, such as sports and outdoor pursuits, was linked to higher wellbeing outcomes (Morse et al., 2021). Especially time spent outdoors on activities such as exercising, going for walks, gardening or pursuing hobbies, was associated with the greatest affective benefits with respect to wellbeing during lockdown phases (Lades et al., 2020). PA during quarantine was also linked to higher scores in resilience and lower scores in depressive symptoms (Carriedo et al., 2020).

Travel plays a significant role in spreading viruses, epidemics, outbreaks, and pandemics between destinations in local communities (Hollingsworth et al., 2006; Abbas et al., 2021), such that the travel and tourism industry was one of the sectors most seriously ravaged by COVID-19 (Abbas et al., 2021; Yang et al., 2021). Most airlines canceled flights due to closed borders and lower demand (Darlak et al., 2020), hotels and tourist accommodation had to close due to falling occupancy and government restrictions (Anzolin et al., 2020) and the cancelation of (mega) events, festivals and conferences negatively affected the local economy of the host destinations (Neuburger and Egger, 2021).

The COVID-19 pandemic had a much greater destructive impact than previous crises would have suggested (Škare et al., 2021). According to the UNWTO, international arrivals in 2020 plummeted by 73 % resulting in a decrease of economic distribution from US$ 3.5 trillion in 2019 down to US$ 1.6 trillion in 2020. In 2021, international tourism experienced a 4 % increase but, with an economic distribution of US$ 1.9 trillion, was still well below the pre-pandemic value (UNWTO, 2022).

These disruptions also fueled the long ongoing argument for more sustainable tourism practices to transform the sector so that it is better prepared for large-scale future challenges like pandemics or climate change (UNWTO, 2020). However, as Hall et al. (2020) note, to assume “that things will change for the better or that economic development, including tourism, will become more sustainable, is not a foregone conclusion”.

The challenges faced by PA providers following the pandemic require greater entrepreneurship in sport to increase resilience when dealing with uncertainty and dynamic situations. Entrepreneurship in sport is made up of three components (Ratten and Dickson, 2021): innovation, marking the need for change; making use of opportunities; and risk activity that has the potential to obtain better results.

The international ski market has been stagnating for about the last 15 years, with increases in emerging markets especially in Asia, and stable or declining demand in mature markets (Steiger et al., 2019). Globally, Austria is ranked third in terms of skier visits, almost ex aequo with France (Vanat, 2020). Before the pandemic, annual lift ticket sales in Austria totaled €1.3 billion (Steiger and Scott, 2020)while the added value generated by ski tourism was estimated at €5.9 billion with 17,000 jobs in the ski areas and another 108,800 jobs in up- or downstream industries within and outside the ski destinations (Steiger et al., 2022). Therefore, a massive shock such as the pandemic not only affects the ski businesses, but also other industries and potentially entire regional economies, where a region is highly dependent on ski tourism (Steiger et al., 2020).

While in some mature markets, like the US, the number of operating ski areas has declined remarkably in the last decades, due to increasing competition and a large requirement for capital investments (Steiger et al., 2019), only very few ski areas have closed in Austria (Falk, 2012). This is surprising given that, according to a study, 55% of ski-lift operators did not record profits in the time period under review (Falk and Steiger, 2020). One potential explanation for this delayed market consolidation is the financial support received from public authorities (Falk and Steiger, 2018).

In this paper, we investigate how cable car companies in Austria managed the pandemic, if and how they changed their operations and strategies and how they perceive the future. The results will be discussed against the above-mentioned three components of entrepreneurship.

3. Method

Austria is an important player in the international ski tourism market, generating 54.2 million skier days per season in winter 2018/19 (WKO, 2019) prior to the pandemic, ranking third behind the US and almost ex aequo with France (Vanat, 2020). Gross sales generated by ski-lift users are estimated at €7.9 billion (direct, indirect and induced effects), 84% of which comes from overnight guests (Manova, 2019). Although there have been increasing efforts to foster year-round operations, especially by making the summer season more attractive (Schlemmer et al., 2021), the dominant share of turnover (85%) is generated in the winter season (WKO, 2018a). More than 95,300 jobs exist in the ski tourism industry or can be attributed indirectly to this sector, representing 2.65% of jobs in Austria (Statistik Austria., 2018; WKO, 2018b).

While skier days stagnated over a 10-year period before the pandemic (2009/10-2018/19), turnover increased by 2.9% per year (own database, based on annual publications by WKO). In the winter season 2019/20, the average number of skier days declined to 47.4 million (-12.5%) due to the abrupt end of the ski season on March 15 (WKO, 2021). Skier days in 2021/22 were still far below pre-pandemic levels, amounting to 44 million (-18%) (Seilbahnen.net., 2022).

Analyses within this study were twofold. First, a quantitative online survey was conducted among Austrian ski resorts followed by qualitative interviews with senior managers of Austrian cable car companies. The online survey and the invitation to the interviews targeted Austrian ski resorts, represented through the professional association of the Austrian chamber of commerce as well as organizations of the federal states. After pretesting the questionnaire, the quantitative study period extended from May 07, 2021 to May 22, 2021. 253 ski-lift companies are registered in Austria (WKO, 2020). For this analysis, 66 companies participated in the survey (response rate=26%) and 20 took part in the qualitative interviews (Table 1).

The questionnaire was grouped into different sections, namely company data, COVID-19 measures (changes, opening, cooperation, reduction of preparation, voluntary measures, cost, and revenue development), change process (employees, customers, cable car industry), assessment of the industry and aspects relating to the future. Ratings were measured with Likert-scales reaching from 1 (=does not correspond at all) up to 7 (=corresponds exactly).

Within the ski resorts, the study was completed by people in management positions, mainly managing directors (62.12 %), but also operations managers, marketing managers, board members and authorized officers.

The average number of employees differs between winter (108 employees) and summer (60 employees) by nearly 200 %. When it comes to total turnover the difference is even bigger, with 79.57 % of revenue generated in the winter season (November-April) and 20.43 % in summer (May-October). The average lift capacity is 21,640 persons per hour with the top station elevation averaging 2,039 m.

We defined the ski areas from a business rather than from the customer's point of view as the latter often perceive independent companies operating in an interlinked ski area as one organization. In the context of the present study, a share of 63.6 % of cable car companies operate alone within one ski area. In the remaining ski areas, there are on average 3.95 other actively operating cable car companies.

The majority of participating cable car companies were located in Tyrol (42.4 %) accounting for 49 % of the 51.8 million skiers who visit Austria (Pikkemaat et al., 2020; Statistik Austria, 2020). This was followed by the provinces of Carinthia and Vorarlberg (15.2 % each).

To classify the cable car companies in terms of annual revenue, four turnover categories were formed (UG 1: < €750,000, n = 6; UG 2: €750,000 – €4.5 m, n = 20; UG 3: €4.5 – €7.5 m, n = 12; UG 4: > €7.5 m, n = 28).

In order to gain deeper insights into the behavior of the Austrian ski area operators during the 2020/21 winter season, the quantitative results were substantiated by 20 qualitative interviews with senior managers of Austrian cable car companies. The aim of the interviews was to gain a deeper understanding of the challenges, adaptation measures during the pandemic, and changes regarding the supply and demand side while also gaining an outlook of the challenges and opportunities the interviewees expect for the future of their businesses. The majority of interviewees were located in the province of Tyrol (35 %). They talked about their actions in response to the crisis and tried to discuss the various waves of COVID-19 (Kuščer et al., 2022). Further, they shed light on potential future changes and challenges. The managers shared their perceptions about the industry changes and their own company's response to the post-COVID-19 era. This section mainly focused on the changes in CSR (Vallaster, 2017).

The quantitative data were mainly analyzed descriptively. Where necessary, correlations and group differences were calculated using Phi and ANOVA tests. Qualitative data was analyzed following the template analysis approach (King and Brooks, 2017), by transcribing, analyzing and coding the data with the data analysis software MAXQDA. Two authors conducted the coding process carrying out preliminary coding and clustering to produce an initial template.

4. Results

4.1. Management/coping strategies during the pandemic

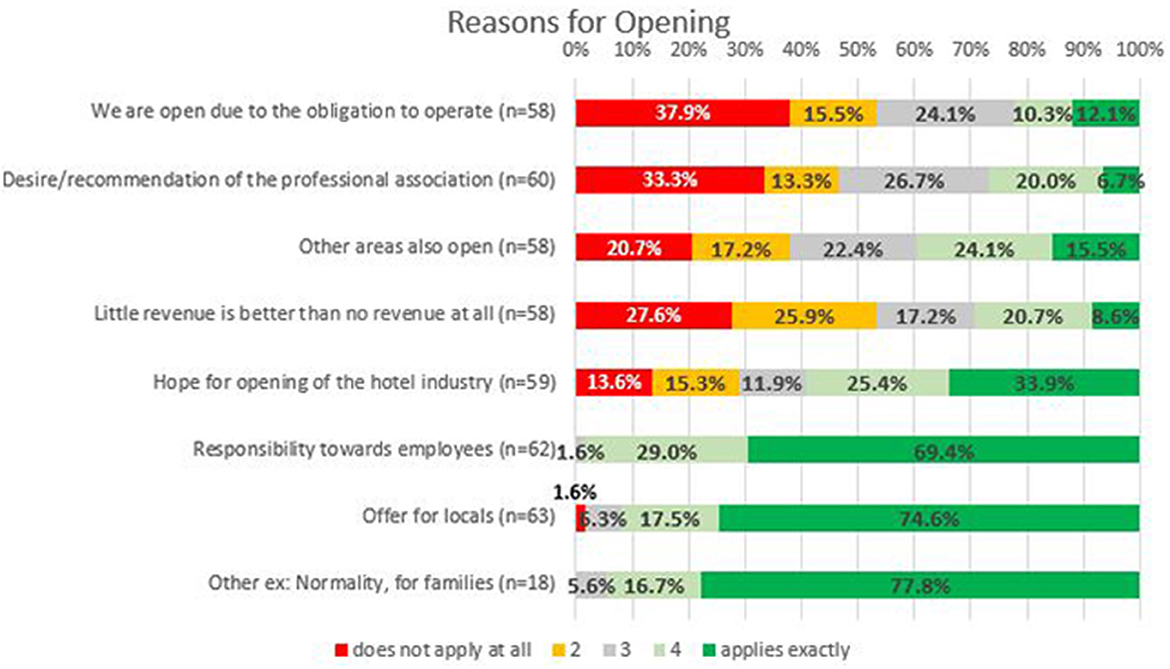

Almost all (63 out of 66) ski areas decided to open during the COVID-19 pandemic. Social responsibility was the dominant reason for this decision, i.e. to create an offering for locals, to give families a feeling of normality and provide employees with a sense of security (Figure 1). Despite massive revenue losses, 90 % do not regret this decision, due to the very positive feedback from the local population and the belief that this will positively influence the companies' image (open question).

Figure 1. Reasons for opening. In Austria, ropeways open to the public have an obligation to operate if there is sufficient snow cover. This obligation was lifted for the 2020/21 winter season in December 2020.

Customers' gratitude was highlighted within the qualitative interviews. Due to closed accommodation and travel restrictions, predominantly domestic customers experienced this positive aspect of the COVID-19 pandemic.

“I say it was basically good that we were operating. The people, the locals, thanked us for it. That was actually one of the few things that was fun. For us, it was an absolute disaster economically” (Interviewee #10).

On the revenue side, 95 % of the companies were confronted with losses averaging 78 % compared to the prior season. Only 5 % of the companies were able to increase their revenue (by 37 % on average). The latter were all very small companies boasting a high share of Austrian customers (78 %), low lift capacity and low altitude located in the federal states of Carinthia and Vorarlberg.

According to the interviews, the ongoing lockdown situation starting in March 2020 led to an economic disaster for the cable car companies. To counteract these circumstances, the cable car companies made use first and foremost of reduced working hours. In the course of the year and due to declining infection numbers during the warmer months, the summer season went quite well for the operators. New challenges then arose with the following winter season 2020/21, with capacity limitations, followed by increasing personnel costs, caused for example by the more frequent cleansing of contact surfaces, security workers having to control access to the ski areas and ensuring compliance with the regulations.

Quite a large number of companies (40.9 %) reduced their preparatory efforts for the 2021 season thus reducing costs. Some of the lifts were not prepared for operation, while snowmaking was reduced or even switched off on some slopes and other slopes were not prepared for operation at all (e.g., signposting). No statistically significant differences in the reduction of preparatory efforts could be found regarding the companies' size (i.e., total length of ski slopes), revenue or altitude. Costs for cable car companies declined in 62 % of cases compared to the 2019/20 season while increasing or stagnating costs were each reported in 19 % of cases. Cost savings were 31% on average while cost increases averaged 19 %.

Besides mandatory government COVID-19 regulations such as reduced lift capacity or closed catering, cable car companies took voluntary steps to reduce the risk of infection and to improve the visitor experience. Most frequently, the implementation of online-ticketing services, cashless payments, security, take-away food, extended opening hours and access checks to the skiing area could be found. More voluntary hygiene regulations and cashless payments were observed among all cable car companies. Ski resorts with revenues of more than €7.5 m opened their own COVID-19 testing stations significantly more often than resorts with less revenue. Testing stations were open on weekends (Phi, 0.333**, 0.008) as well as every day (Phi, 0.311*, 0.014). Correlations could also be found between revenue and online ticketing. Here, higher turnover companies were able to implement this service more often than lower turnover companies [F(3, 59) = 4.613, p = 0.006].

4.2. Perception of the future

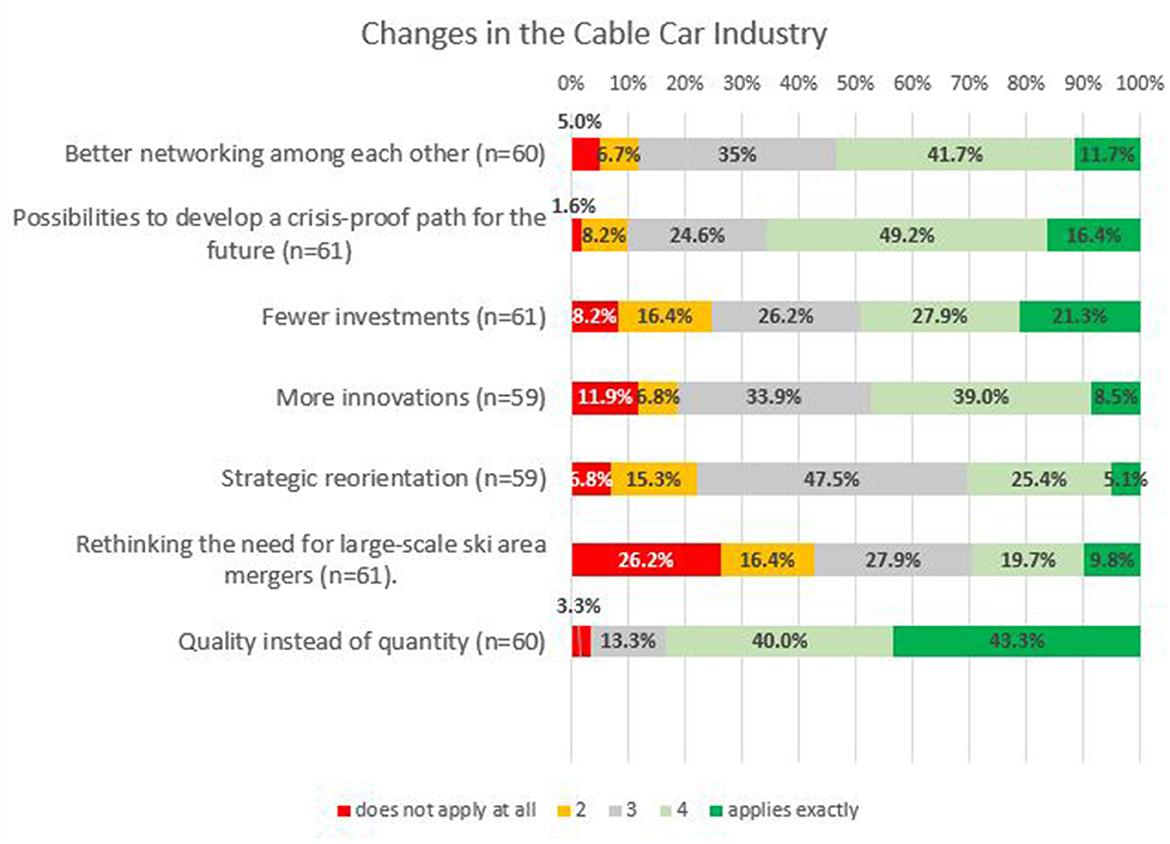

Concerning potential processes of change related to impacts of and experiences with the COVID-19 crisis, 83 % agreed that, in future, ski areas might have a stronger focus on the quality of products rather than the quantity (Figure 2). Agreement with the statement that “the provision of high-quality services is one of our main principles” was greater among higher turnover companies [F(3, 61) = 4.298, p = 0.008]. Further, respondents expected to see the creation of crisis-proof development paths and better cooperation within the industry. They would also like to see more innovation while making fewer investments.

The interviewees expressed the belief that the COVID-19 crisis would lead to further changes on the supply side, while the cable car industry would have to become more ecological, while recovering from the economic losses and dealing with social challenges.

“I believe that we will and must all face up to the issue of sustainability, the big buzzword. Of course, every company has a different approach to this” (Interviewee #20).

While larger cable car companies in particular expressed a desire to focus more on quality, the interviews revealed that smaller companies would like to see greater appreciation for the efforts that are already being made.

“I would like the clients to appreciate what is being done and the effort that is being put in, and a bit of an understanding of what is behind it” (Interviewee #11).

4.3. Challenges and opportunities

Concerning future challenges, 54.8 % agreed that ski tourism would have to work differently as regards crowding and visitor management. About a third (33.8 %) agreed that general uncertainty would affect business and long-term declines in revenues due to the slow recovery of the travel market.

When asked about their wishes for the future development of the sector, the interviewees were encouraged to think about different target groups: the local population, political representatives and the association of cable car companies. From the population, interviewees would like to see greater appreciation and consideration for their work, for instance, as regards the provision of leisure sports offerings or jobs. The interviewees would ask political representatives for more support, especially regarding financial assistance. More specifically, better predictability during the pandemic was also very high on their agenda. When approaching the professional association, they would welcome stronger cohesion and a greater sense of collaboration, e.g., through more joint press releases.

“I would like to see people in the professional association themselves stand on their hind feet and also dedicate themselves to these challenges. An industry-wide, intensive discussion of sustainability in the broader sense is absolutely necessary” (Interviewee #18).

Potential opportunities lie in improving the locals' trust in the cable car industry (87 % agree), better customer management (66 %), a stronger focus on full-year operation (60 %) and rethinking and repositioning the winter product (50 %). Especially large cable car companies, such as interviewee #5, felt that they were perceived by the local population as working for tourism purposes only.

“I simply have the feeling that part of the population takes it for granted that the cable cars are primarily there for the tourists” (Interviewee #5).

Besides pushing the online arena, potential for technological innovation was seen in visitor flow management and analysis. Further, communication with guests and employees would need to be improved. The need for employee training and greater flexibility was evident while investments in employees would need to be higher in the future, as illustrated by the following statement:

“We will have to change. We have this personnel problem. We have to invest a lot in our employees, more in the future than we have done so far. We have to see that we keep them as ambassadors in the company” (Interviewee #16).

Changes were also expected on the demand side. Interviewees still assumed that customers were more likely to avoid crowds as crowded places hold a higher risk of infection. Moreover, customers were described as seeking a more nature-based experience. Accordingly, it was noted that awareness of nature had increased and was linked to the requirement for deceleration, providing new markets for cable car companies:

“You can already tell that the guest wants something special. The hunger for this natural mountain experience certainly increased after Corona. Experience the calming, decelerating and energizing force of nature” (Interviewee #12).

5. Discussion

The quantitative and qualitative data revealed how cable car companies managed the COVID-19 crisis and which challenges and opportunities they expected for the future. The COVID-19 pandemic caused severe revenue declines among ski area operators across the board, and although resorts significantly reduced their preparation efforts and associated preparation costs, the drop in revenue was a financial disaster for operators. The fact that the Austrian ski areas were not affected by the closures meant that PA could be maintained, especially among the local population. Thus, the usual levels of PA were still available to many locals, who thanked the cable car operators by showing their gratitude.

In the following, we discuss the findings in light of the three components of entrepreneurship (Ratten and Dickson, 2021).

5.1. Innovation

Tourism has always been a phenomenon characterized by immense innovativeness (Hjalager, 2010). Crises, like the COVID-19 pandemic, can be seen as a driver for innovation in tourism (Steiger et al., 2021), as crises clearly have the potential to stimulate change processes in companies and tourism destinations. Under certain circumstances, crises stimulate companies by developing new initiatives and therefore new products or new processes (Peters and Pikkemaat, 2006). Technological innovations can play a major role when it comes to tourism development (Khudoyberdievich, 2020).

Our results show that the COVID-19 pandemic has advanced the diffusion of technological innovation in the cable car industry, such as through online ticketing. The majority of respondents expect to see an increasing necessity to manage peak demand more effectively. In the 2020/21 season, a few ski areas experiencing high demand saw the limiting of visitors by quotas and obligatory online ticketing (Steiger et al., 2021). Another opportunity for demand management is dynamic pricing, i.e. demand-driven pricing for lift tickets, allowing occupancy rates to be increased during low demand periods while demand is reduced during peak days (Malasevska and Haugom, 2018; Steiger et al., 2020). This measure is currently more or less non-existent in Austrian ski areas, and according to our sample, it is not seen as something to be pursued in the future.

Nevertheless, at the beginning of the 2022/23 winter season, some Austrian cable car companies started to implement dynamic pricing schemes, based on their previous experience with the online ticketing sector (OTS, 2022; Ötztal Tourismus/Bergbahnen Sölden, 2022; Smart Pricer, 2022). This has since reached the point where the online price is now considered the “normal price” by many. Anyone buying a ticket spontaneously on site must, therefore, pay a surcharge. The earlier the online ticket is bought, the cheaper the price. Moreover, the skier reserves a fixed time slot for skiing, as ski resorts reach their capacity limits on popular days (OTS, 2022).

Besides technical investments and development, investments in employees are likely to become more important. Improvements in communication between employees, guests and locals is a major ongoing factor. In addition, the industry must also contend with climate change. Sustainability already is and will remain the most significant catchphrase for the future.

5.2. Making use of opportunities

In the 2020/21 winter season, foreign visitors were largely excluded from visiting Austrian ski resorts because of travel restrictions and closed accommodation. Therefore, ski areas promoted the national market with a view to stimulating local and regional demand (Fecker et al., 2021). As our results show, revenues declined sharply nevertheless due to the high dependence on foreign markets. However, our respondents received a lot of gratitude and increasing trust from local customers that could be used in the future to increase the industry's resilience against shocks on foreign markets, but also to raise the acceptance of tourism within the local population and improve the basis for discussions regarding future developments. In the past, residents' attitudes toward tourism have been adversely affected by an ongoing discourse about persisting over-tourism and overcrowding (Fontanari and Berger-Risthaus, 2019)—thus, such investments can be interpreted as internal marketing efforts which contribute to providing better support for tourism in the future (Harrill, 2004).

The COVID-19 pandemic also led to a process of change in that many local winter sports enthusiasts discovered new sporting activities for themselves. As pointed out by Schlemmer and Schnitzer (2021) many recreationalists have started practicing ski touring on groomed slopes. From the cable car operators' point of view, this change process can lead to new markets that, until now, have hardly been served. In addition, with a view to the future, it is important for Austrian cable car companies to concentrate more heavily on the development of alternative markets. The potential of summer seasons has barely been exploited to date, but holds great hope for the future of cable car operators (Happ et al., 2022).

5.3. Risk activity

The majority of respondents stated that they initiated new products and projects as well as technologies during the 2020/21 season. They are also open to tackling new challenges and perceive themselves as being open to testing new ideas. They outline sustainability as an important aspect for the future. Besides deceleration, cable car operators are pointing out that quality is becoming more important than quantity. A large proportion of respondents are seeking more innovation, while at the same time almost 50 % expect fewer investments in the future. Risk activity also needs to be seen in the current context of high inflation in Europe and a potential energy crisis. Both circumstances are adding financial pressure and uncertainty in the tourism industry (STMBD, 2022).

6. Conclusion

This article provides insights into how cable car companies in Austria evaluated the 2020/21 season against the backdrop of COVID-19 and what kind of measures were implemented to meet the challenges. Furthermore, its consequences for this business sector and for physical activity in the future were discussed. By conducting an online survey among Austrian ski resorts (n = 65) and qualitative interviews (n = 20), we found that the pandemic advanced the dissemination of technological innovation in the cable car industry, especially online ticketing. Due to travel restrictions and closed accommodation, foreign visitors representing the vast majority of customers, were largely excluded from participating in the PA of skiing. Continuing ski operations despite sharp revenue declines averaging 80% was positively recognized by local customers and led to increasing gratitude and trust. Ski area operators perceive sustainability as an important aspect for the future and one that is increasingly being demanded by visitors. However, the economic pressure initiated by revenue declines during the pandemic, current high inflation and the energy crisis have reduced willingness to invest.

A question which still needs to be clarified as part of the change process relates to the consequences for PA. Improvements to visitor management may potentially lead to more satisfied customers and, therefore, to an increase in PA. These changes are likely to appear within the scope of better communication and technology usage, for example, by providing information on websites and apps, etc. An improving offering may enhance customer satisfaction and encourage more people to practice PA.

Thanks to a combination of qualitative interviews and a quantitative survey, this study provides a good overview of the situation facing the Austrian cable car industry since the COVID-19 pandemic. Nevertheless, there are also some limitations that need to be pointed out. This research only includes the providers' point of view, such that the customers' point of view was not considered. In addition, the sample is limited to Austria; in other countries, such as Italy, the COVID-19 regulations continued to apply throughout the winter season. There is a need for further research, especially in the further development of cable car companies. It remains to be seen whether the pandemic will lead to lasting changes or whether they will be short-lived. As can already be seen, some companies have already started implementing dynamic pricing, building on the changes brought about by the pandemic (OTS, 2022).

Data availability statement

The data as well as the questionnaire and the interview guideline that support the findings of this study are available from the authors upon reasonable request. Requests to access the datasets should be directed to LG, THVrYXMuR3JhaWZmQHVpYmsuYWMuYXQ=.

Ethics statement

The studies involving human participants were reviewed and approved by Institutional Review Board (IRB) of the Department of Sport Science Board for Ethical Issues (BfEI) of the University of Innsbruck. Written informed consent for participation was not required for this study in accordance with the national legislation and the institutional requirements.

Author contributions

RS and LG: writing—original draft and formal analysis. MP: conceptualization and methodology. MS: article administration and supervision. LG: data analysis. RS, MP, and MS: funding acquisition and resources. MP and MS: writing—review and editing. All authors contributed to the article and approved the submitted version.

Funding

This work was supported by the Austrian Chamber of Commerce—Division: Cable Cars. The funding body was not involved in the analysis and interpretation of data nor in the writing of the manuscript (Project Number: 346.141).

Acknowledgments

We would like to thank the Vice Rector of Research at the University of Innsbruck—Austria. Further, we would like to thank the Austrian Chamber of Commerce—Division: cable cars as well as all interview partners and fellow colleagues who helped us during the interview process.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Abbas, J., Mubeen, R., Iorember, P. T., Raza, S., and Mamirkulova, G. (2021). Exploring the impact of COVID-19 on tourism: transformational potential and implications for a sustainable recovery of the travel and leisure industry. Curr. Res. Behav. Sci. 2, 100033. doi: 10.1016/j.crbeha.2021.100033

Anzolin, E., Mason, J., and Nikolaeva, M. (2020). Canceled Bookings, Empty Rooms: Coronavirus Takes Toll on Tourism. London: Reuters.

Caputo, E. L., and Reichert, F. F. (2020). Studies of physical activity and COVID-19 during the pandemic: a scoping review. J. Phys. Act. Health 17, 1275–1284. doi: 10.1123/jpah.2020-0406

Carriedo, A., Cecchini, J. A., Fernandez-Rio, J., and Méndez-Giménez, A. (2020). COVID-19, psychological well-being and physical activity levels in older adults during the nationwide lockdown in Spain. Am. J. Geriatric Psychiat. 28, 1146–1155. doi: 10.1016/j.jagp.2020.08.007

Carter, S. J., Baranauskas, M. N., and Fly, A. D. (2020). Considerations for obesity, vitamin d, and physical activity amid the COVID-19 pandemic. Obesity (Silver Spring). 28, 1176–1177. doi: 10.1002/oby.22838

Caspersen, C. J., Powell, K. E., and Christenson, G. M. (1985). Physical activity, exercise, and physical fitness: definitions and distinctions for health-related research. Public Health Rep. 100, 126.

Chtourou, H., Trabelsi, K., H'mida, C., Boukhris, O., Glenn, J. M., Brach, M., et al. (2020). Staying physically active during the quarantine and self-isolation period for controlling and mitigating the COVID-19 pandemic: a systematic overview of the literature. Front. Psychol. 11, 1708. doi: 10.3389/fpsyg.2020.01708

Darlak, J., Lund, T., Daniel, A. C., Morland, S., Eluri, K. C., Uttaresh, V., et al. (2020). Factbox: Airlines Suspend Flights due to Coronavirus Outbreak. London: Reuters.

Eime, R. M., Young, J. A., Harvey, J. T., Charity, M. J., and Payne, W. R. A. (2013). systematic review of the psychological and social benefits of participation in sport for children and adolescents: informing development of a conceptual model of health through sport. Int. J. Behav. Nutr. Phys. Act. 10, 1–21. doi: 10.1186/1479-5868-10-98

Falk, M., and Steiger, R. (2018). An exploration of the debt ratio of ski lift operators. Sustainability. 10, 2985. doi: 10.3390/su10092985

Falk, M., and Steiger, R. (2020). Size facilitates profitable ski lift operations. Tourism Econ. 26, 1197–1211. doi: 10.1177/1354816619868117

Falk, M. A. (2012). survival analysis of ski lift companies. Tourism Manag. 36, 377–390. doi: 10.1016/j.tourman.2012.10.005

Fecker, D., Bosio, B., Nadegger, M., and Haselwanter, S. (2021). Skiing during the pandemic with masks and tests. Zeitschrift für Tourismuswissenschaft. 13, 423–443. doi: 10.1515/tw-2021-0022

Fontanari, M., and Berger-Risthaus, B. (2019). “Problem and solution awareness in overtourism: a Delphi study”, Overtourism. Oxfordshire: Routledge, 43–66. doi: 10.4324/9780429197987-4

Frühauf, A., Schnitzer, M., Schobersberger, W., Weiss, G., and Kopp, M. (2020). Jogging, nordic walking and going for a walk-inter-disciplinary recommendations to keep people physically active in times of the covid-19 lockdown in Tyrol, Austria. Curr. Issues Sport Sci. (CISS). 5. doi: 10.15203/CISS_2020.100

Gianfredi, V., Mauer, N. S., Gentile, L., Ricc,ò, M., Odone, A., Signorelli, C., et al. (2021). COVID-19 and recreational skiing: Results of a rapid systematic review and possible preventive measures. Int. J. Environ. Res. Public Health 18, 4349. doi: 10.3390/ijerph18084349

Gössling, S., Scott, D., and Hall, C. M. (2020). Pandemics, tourism and global change: a rapid assessment of COVID-19. J. Sustai. Tour. 29, 1–20. doi: 10.1080/09669582.2020.1758708

Hall, C. M., Scott, D., and Gössling, S. (2020). Pandemics, transformations and tourism: be careful what you wish for. Tourism Geograph. 22, 577–598. doi: 10.1080/14616688.2020.1759131

Happ, E., Seidl, M., Zach, F. J., and Schnitzer, M. (2022). A Look into the Crystal Ball of Ski Destination Development-the Role of Alpine Summer Parks, 1447–6770. doi: 10.1016/j.jhtm.2022.08.010

Harrill, R. (2004). Residents' attitudes toward tourism development: a literature review with implications for tourism planning. J. Planning Lit. 18, 251–266. doi: 10.1177/0885412203260306

Hjalager, A. (2010). A review of innovation research in tourism. Tour. Manag. 31, 1–12. doi: 10.1016/j.tourman.2009.08.012

Hollingsworth, T. D., Ferguson, N. M., and Anderson, R. M. (2006). Will travel restrictions control the international spread of pandemic influenza? Nat. Med. 12, 497–499. doi: 10.1038/nm0506-497

Khudoyberdievich, A. O. (2020). Innovation technologies on the tourism. Academy, 41–2. Available online at: https://cyberleninka.ru/article/n/innovation-technologies-on-the-tourism.pdf

King, N., and Brooks, J. (2017). Template Analysis for Business and Management Students. Newcastle upon Tyne, United Kingdom: SAGE, p. 104. doi: 10.4135/9781473983304

Kuščer, K., Eichelberger, S., and Peters, M. (2022). Tourism organizations' responses to the COVID-19 pandemic: an investigation of the lockdown period. Curr. Issues Tour. 25, 247–260. doi: 10.1080/13683500.2021.1928010

Lades, L., Laffan, K., Daly, M., and Delaney, L. (2020). Daily emotional well-being during the COVID-19 pandemic. Br. J. Health Psychol. 902–11. doi: 10.1111/bjhp.12450

Malasevska, I., and Haugom, E. (2018). Optimal prices for alpine ski passes. Tourism Manag. 64, 291–302. doi: 10.1016/j.tourman.2017.09.006

Manova (2019). Wertschöpfung durch die Österreichischen Seilbahnen. Available online at: https://www.wko.at/branchen/transport-verkehr/seilbahnen/Wertschoepfung-Seilbahnen-AT_2018_2019.pdf

Mattioli, A. V., Ballerini Puviani, M., Nasi, M., and Farinetti, A. (2020). COVID-19 pandemic: the effects of quarantine on cardiovascular risk. Eur. J. Clin. Nutr. 74, 852–855. doi: 10.1038/s41430-020-0646-z

Mayer, M., Bichler, B. F., Pikkemaat, B., and Peters, M. (2021). Media discourses about a superspreader destination: How mismanagement of Covid-19 triggers debates about sustainability and geopolitics. Ann. Tourism Res. 91, 103278. doi: 10.1016/j.annals.2021.103278

McMahon, E. M., Corcoran, P., O'Regan, G., Keeley, H., Cannon, M., Carli, V., et al. (2017). Physical activity in European adolescents and associations with anxiety, depression and well-being. Eur. Child Adolesc. Psychiatry. 26, 111–122. doi: 10.1007/s00787-016-0875-9

Morse, K. F., Fine, P. A., and Friedlander, K. J. (2021). Creativity and leisure during COVID-19: Examining the relationship between leisure activities, motivations, and psychological well-being. Front. Psychol. 12, 609967. doi: 10.3389/fpsyg.2021.609967

Neuburger, L., and Egger, R. (2021). Travel risk perception and travel behaviour during the COVID-19 pandemic 2020: a case study of the DACH region. Curr. Issues Tour. 24, 1003–1016. doi: 10.1080/13683500.2020.1803807

Ötztal Tourismus/Bergbahnen Sölden (2022). SKI Ticket Rates Winter 2022. Available online at: https://www.soelden.com/winter/ski-area/soelden-skipass-price-list/ski-ticket-rates-winter.html (accessed December 14, 2022).

Peçanha, T., Goessler, K. F., Roschel, H., and Gualano, B. (2020). Social isolation during the COVID-19 pandemic can increase physical inactivity and the global burden of cardiovascular disease. Am. J. Physiol. Heart Circ. Physiol. 318, H1441–H1446. doi: 10.1152/ajpheart.00268.2020

Peters, M., and Pikkemaat, B. (2006). Crisis management in Alpine winter sports resorts—the 1999 avalanche disaster in Tyrol. J. Travel Tourism Market. 19, 9–20. doi: 10.1300/J073v19n02_02

Pikkemaat, B., Bichler, B. F., and Peters, M. (2020). Exploring the crowding-satisfaction relationship of skiers: the role of social behavior and experiences. J. Travel Tour. Market. 37, 902–916. doi: 10.1080/10548408.2020.1763229

Ratten, V., and Dickson, G. (2021). “Disruptions in sport management from COVID-19: Lessons from entrepreneurship and innovation,” in Innovation and Entrepreneurship in Sport Management, Ratten, V. (ed). Cheltenham, United Kingdom: Edward Elgar Publishing, 9–21. doi: 10.4337/9781783473960.00009

Rodgers, M., Dalton, J., Harden, M., Street, A., Parker, G., Eastwood, A., et al. (2018). Integrated care to address the physical health needs of people with severe mental illness: a mapping review of the recent evidence on barriers, facilitators and evaluations. Int. J. Integr. Care. 2018, 18. doi: 10.5334/ijic.2605

Schlemmer, P., and Schnitzer, M. (2021). Research note: Ski touring on groomed slopes and the COVID-19 pandemic as a potential trigger for motivational changes. J. Outdoor Recreat. Tour. 2021, 100413. doi: 10.1016/j.jort.2021.100413

Schlemmer, P., Scholten, T., Niedermeier, M., Kopp, M., and Schnitzer, M. (2021). Do outdoor adventure park activities increase visitors' wellbeing? J. Outdoor Recreat. Tour. 35, 100391. doi: 10.1016/j.jort.2021.100391

Schöttl, S. E., Schnitzer, M., Savoia, L., and Kopp, M. (2022). Physical activity behavior during and after COVID-19 stay-at-home orders—a longitudinal study in the Austrian, German, and Italian Alps. Front. Public Health. 2022, 1579. doi: 10.3389/fpubh.2022.901763

Seilbahnen.net. (2022). Hörl: “Österreichs Seilbahnen kehren Schritt für Schritt auf einen stabilen Kurs zurück!”. Steigende Nachfrage zeugt für WKÖ-Fachverband von hoher Attraktivität – Umsatzminus reduziert sich deutlich. Available oonline at seilbahn.net.

Škare, M., Soriano, D. R., and Porada-Rochoń, M. (2021). Impact of COVID-19 on the travel and tourism industry. Technol. Forecast. Soc. Change 163, 120469. doi: 10.1016/j.techfore.2020.120469

Smart Pricer (2022). Ski amadé cooperates with Smart Pricer: Austria's largest ski pool will introduce a dynamic based online booking system in winter 22/23 (2022).

Son, J. S., Nimrod, G., West, S. T., Janke, M. C., Liechty, T., Naar, J. J., et al. (2021). Promoting older adults' physical activity and social well-being during COVID-19. Leisure Sciences 43, 287–294. doi: 10.1080/01490400.2020.1774015

Steiger, R., Peters, M., Redl, M., and Schnitzer, M. (2021). Die COVID-19 Pandemie als Treiber von Innovationen in der Tourismusbranche? Ein Fallbeispiel der niederösterreichischen Bergbahnen. Zeitschrift für Tourismuswissenschaft. 13, 405–422. doi: 10.1515/tw-2021-0030

Steiger, R., Posch, E., Tappeiner, G., and Walde, J. (2020). The impact of climate change on demand of ski tourism-a simulation study based on stated preferences. Ecol. Econ. 170, 106589. doi: 10.1016/j.ecolecon.2019.106589

Steiger, R., Posch, E., Tappeiner, G., and Walde, J. (2022). Seasonality matters: simulating the impacts of climate change on winter tourism demand. Curr. Issu. Tour. 1–17. doi: 10.1080/13683500.2022.2097861

Steiger, R., and Scott, D. (2020). Ski tourism in a warmer world: Increased adaptation and regional economic impacts in Austria. Tourism Manag. 77, 104032. doi: 10.1016/j.tourman.2019.104032

Steiger, R., Scott, D., Abegg, B., Pons, M., and Aall, C. A. (2019). critical review of climate change risk for ski tourism. Curr. Issues Tour. 22, 1343–1379. doi: 10.1080/13683500.2017.1410110

Thibaut, E., Constandt, B., Bosscher, V., de Willem, A., Ricour, M., Scheerder, J., et al. (2022). Sports participation during a lockdown. How COVID-19 changed the sports frequency and motivation of participants in club, event, and online sports. Leisure Stud. 41, 457–470. doi: 10.1080/02614367.2021.2014941

UNWTO (2020). “Sustainability As The New Normal” A Vision For The Future Of Tourism. Madrid, Spain: UNWTO.

UNWTO (2022). “Impact assessment Of The COVID-19 outbreak on international tourism,” in International Tourism On Track To Reach 65% of Pre-Pandemic Levels by the End of 2022. Madrid, Spain: UNWTO.

Vallaster, C. (2017). Managing a company crisis through strategic corporate social responsibility: a practice-based analysis. Corp. Soc. Responsib. Environ. Manag. 24, 509–523. doi: 10.1002/csr.1424

Vanat, L. (2020). International Report on Snow and Mountain Tourism: Overview of the Key Industry Figures For Ski Resorts. Available online at: https://www.vanat.ch/RM-world-report-2020.pdf

Vindegaard, N., and Benros, M. E. (2020). COVID-19 pandemic and mental health consequences: Systematic review of the current evidence. Brain Behav. Immun. 89, 531–542. doi: 10.1016/j.bbi.2020.05.048

Violant-Holz, V., Gallego-Jiménez, M. G., González-González, C. S., Muñoz-Violant, S., Rodríguez, M. J., Sansano-Nadal, O., et al. (2020). Psychological health and physical activity levels during the COVID-19 pandemic: a systematic review. Int. J. Environ. Res. Public Health 17, 9419. doi: 10.3390/ijerph17249419

Weinbrenner, H., Breithut, J., Hebermehl, W., Kaufmann, A., Klinger, T., Palm, T., et al. (2021). “The forest has become our new living room” – the critical importance of urban forests during the COVID-19 pandemic. Front. For. Glob. Change. 4, 672909. doi: 10.3389/ffgc.2021.672909

WKO (2018a). Erfreuliche Zwischenbilanz: Österreichische Bergbahnen Punkten Im Sommer Und Legen Um Mindestens 10% ZU: Umsätze und Erstzutritte in allen Bundesländern deutlich gestiegen. Ridgefield, NJ: WKO. Available online at: https://www.wko.at/Content.Node/kampagnen/Sommerbergbahnen/erfreuliche-zwischenbilanz-oesterreichische-bergbahnen.html

WKO (2018b). Tourismus Und Freizeitwirtschaft In Zahlen: Österreichische und internationale Tourismus- und Wirtschaftsdaten. Ridgefield, NJ: WKO. Available online at: https://www.wko.at/branchen/tourismus-freizeitwirtschaft/tourismus-statistiken-studien.html

WKO (2020). Seilbahnen ÖsterreichsInfos über die Bergbahn-Branche – Tourismusmagnete und Innovationsweltmeister. Ridgefield, NJ: WKO.

WKO (2021). Kassenumsatzder Seilbahnbetriebe in Österreich von der Wintersaison 2009/10 bis 2020/21. Statista.

Woods, J. A., Hutchinson, N. T., Powers, S. K., Roberts, W. O., Gomez-Cabrera, M. C., Radak, Z., et al. (2020). The COVID-19 pandemic and physical activity. Sports Med. Health Sci. 2, 55–64. doi: 10.1016/j.smhs.2020.05.006

Yang, Y., Altschuler, B., Liang, Z., and Monitoring, X. R. (2021). the global COVID-19 impact on tourism: The COVID19tourism index. Annals Tourism Res. 90, 103120. doi: 10.1016/j.annals.2020.103120

Keywords: COVID-19, cable cars, innovation, exploiting opportunities, entrepreneurship

Citation: Steiger R, Graiff L, Peters M and Schnitzer M (2023) The COVID-19 pandemic and leisure providers—Challenges, opportunities and adaptation strategies for ski area operators in Austria. Front. Sustain. Tour. 2:1136163. doi: 10.3389/frsut.2023.1136163

Received: 02 January 2023; Accepted: 22 June 2023;

Published: 13 July 2023.

Edited by:

Tachia Chin, Zhejiang University of Technology, ChinaReviewed by:

Alberto Amore, University of Oulu, FinlandTracey Jill Morton McKay, University of South Africa, South Africa

Copyright © 2023 Steiger, Graiff, Peters and Schnitzer. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Lukas Graiff, THVrYXMuR3JhaWZmQHVpYmsuYWMuYXQ=

Robert Steiger

Robert Steiger Lukas Graiff

Lukas Graiff Mike Peters3

Mike Peters3 Martin Schnitzer

Martin Schnitzer