- Department of Accountancy, College of Business and Economics, University of Johannesburg, Johannesburg, South Africa

Introduction: Sustainability reporting has become increasingly important to stakeholders, and therefore, there is a growing need for a global set of standards for sustainability reporting. The International Sustainability Standards Board (ISSB) has recently published new sustainability standards under the International Financial Reporting Standards (IFRS) Foundation. The consolidation of integrated reporting <IR> into the IFRS Foundation creates the problem of whether there is still a need for <IR> principles in the future of sustainability reporting and how these principles will be applied in the standard setting of the ISSB in future. This study provides insights into the similarities and differences between the <IR> Framework and the ISSB's draft IFRS S1 standard and clarifies the role that <IR> could play in the future of sustainability reporting within the context of the newly issued IFRS S1 standard.

Methods: The study uses thematic content analysis on the two frameworks and comment letters submitted to the ISSB as part of the standard-setting process to understand the relevance of integrated reporting in sustainability reporting and to identify important principles contained within <IR> that can contribute to the ISSB standard-setting process in future.

Results: The study identified that there is a largely positive sentiment toward <IR> in developing sustainability standards within the IFRS Foundation. The study also identified important aspects where <IR> can play a significant role in standard development, such as the connectivity of information, integrated thinking, and the six capitals that can assist organizations in understanding the significant sustainability-related risks and opportunities.

Conclusion: The research points out pertinent sustainability principles that could be useful for the ISSB in future standard settings. Furthermore, the research adds to the existing literature on <IR> and can act as an impetus for further research on the use of <IR> principles in the standard-setting processes of the ISSB.

1. Introduction

1.1. Background

Sustainability reporting has been a focal point in corporate reporting for many years and is increasing in importance (Mori et al., 2014; Laine et al., 2022). There are many sustainability reporting frameworks used worldwide to assist preparers of corporate reports to provide disclosure about sustainability issues. The wide variety of reporting frameworks prompted many stakeholders in the capital market to request a global set of standards for sustainability reporting (Delarue, 2021). Integrated Reporting <IR> concepts are used worldwide by more than 2,500 organizations across 70 countries (IIRC, 2020). <IR> is well established and has been regarded as an important tool for corporate reporters in the last decade and has grown in prominence (de Villiers and Dimes, 2023). This is also true from a South African perspective (de Villiers and Unerman, 2014; du Toit, 2017).

However, in late 2021, the International Financial Reporting Standards Foundation (IFRS) announced the formation of the International Sustainability Standards Board (ISSB) and published a prototype of disclosures at the UN Climate Change Conference (COP26). The formation of the ISSB meant that the Value Reporting Foundation (VRF), which houses the <IR> Framework, was consolidated into the IFRS Foundation in 2022 (Value Reporting Foundation, 2021). With the consolidation, Barckow and Faber (2022) explained that there is a role that <IR> and integrated thinking will play in the development of future sustainability standards that the ISSB will publish but did not clarify what the specific role would be. This raises a question regarding the role that <IR> and integrated thinking principles will play in corporate sustainability reporting as the ISSB would lead the development of sustainability standards in the future. This question ties into the question raised by de Villiers and Dimes (2023) whether <IR> will cease to exist with the formation of the ISSB. These authors furthermore identified the uncertainty in terms of the role that <IR> will play in sustainability reporting in the future as their recent research points out that the ISSB does not embrace <IR> as a concept. The problem therefore created is whether <IR> is still regarded as relevant in the future standard-setting practices of the ISSB and how these principles can be applied as part of the standard-setting practices of the ISSB.

Sustainability reporting has evolved significantly since the outbreak of the COVID-19 pandemic in 2020 (KPMG, 2020). In recent years, there has been a substantial increase in policy developments concerning organizational accountability's impact on climate change and sustainable development issues (Adams and Mueller, 2022). Stakeholder capitalism has gained more popularity and interest because of its promotion by one of the more influential reporting bodies, the Word Economic Forum (WEF) (de Villiers and Dimes, 2023). The WEF is also collaborating with the ISSB to assist with best practices in adopting the ISSB standards that create even more stature in the new sustainability standards development (WEF, 2023). With the issue of new sustainability standards under the umbrella of the ISSB, the ISSB will currently also take responsibility of <IR>, with the International Integrated Reporting Council (IIRC) currently only performing a consultation and guidance role. In May 2022, the IFRS Foundation released further guidance to address the issue of the future of <IR> entitled “Integrated Reporting: Articulating a Future Path.” In the guidance, Barckow and Faber (2022) optimistically provided some clarity on how <IR> will be used. However, it was also stated that the IFRS Foundation and ISSB will position <IR> initially only as a “voluntary resource” for the preparation of corporate sustainability reports. Even though this provides some direction, it still casts doubt on the relevance of <IR> in the future of sustainability reporting and the role it may play due to <IR> being a voluntary resource, similar to the findings of Pigatto et al. (2023).

This study responds to the research question by meeting the following objectives. First, the research aimed to provide an understanding of the similarities and differences between the <IR> Framework and the ISSB's draft IFRS S1 standard through an analysis of both these documents. Secondly, the research aims to clarify the role that <IR> could play in the future of sustainability reporting within the context of the newly drafted IFRS S1 standard. The second objective is achieved through qualitative analysis of the comment letters submitted to the ISSB as part of the standard development process for the IFRS S1 standard.

1.2. Literature review

In the following literature review, sustainability reporting is discussed by way of a brief overview of its history and the benefits and criticisms of sustainability reporting in general. Thereafter, a focus is placed on <IR>, including the main principles, benefits, and critique of <IR> as a method of sustainability reporting.

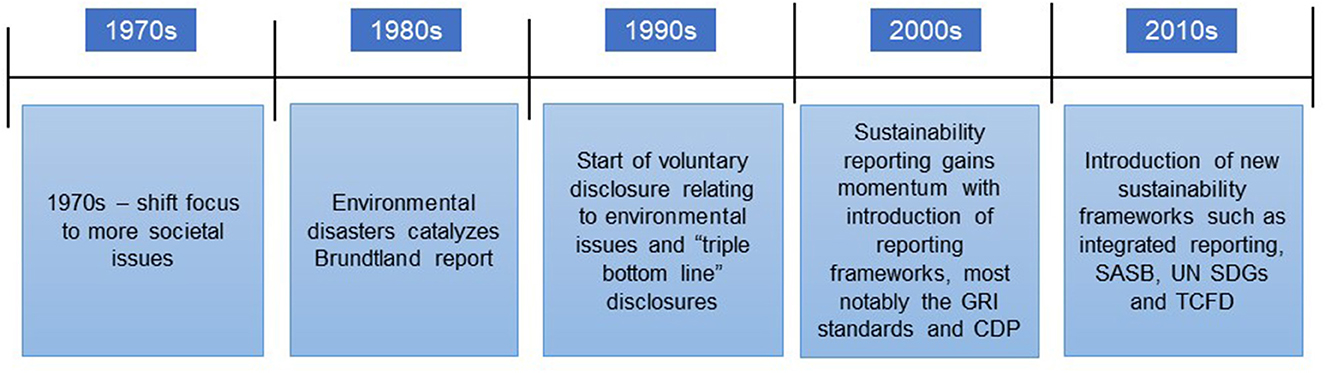

1.2.1. An overview of the historical development of sustainability reporting

Corporate reporting has evolved significantly over the past few decades as is illustrated in Figure 1, which shows the timeline of the evolution of corporate reporting until the COVID-19 pandemic. Originally, companies only prepared corporate reports with a focus on financial reporting. However, this did not include the interests of all the stakeholders that contribute to the value of a company. In the 1970s, companies initially started to shift focus to social issues, such as human resources, fair practices, and the impact on the broader communities (Laine et al., 2022). Environmental events in the 1980s, such as the Chernobyl disaster, the Exxon oil spill, and the publication of the Brundtland report, introduced discussions around environmental issues in sustainability that led to the practice of voluntary disclosure relating to environmental issues in the 1990s (Laine et al., 2022). In the late 1990s, the concept of triple bottom line (TBL) reporting emerged with Elkington (1999) explaining that TBL aims to report on an organization's economic, social, and environmental impacts.

Figure 1. An overview of the development of sustainability reporting until COVID-19. Source: Authors' analysis.

In the 2000's the Global Reporting Initiative (GRI) was introduced, which is still regarded as the most established sustainability reporting framework among companies (Laine et al., 2022). According to Kolk (2004), the guidance of the GRI has provided the much needed impetus within sustainability reporting by providing improved “quality, rigor, and utility of sustainability reporting in the 2000s by developing sets of performance indicators on environmental, social, and economic factors”. The Carbon Disclosure Project (CDP) also emerged in 2000 and focuses on corporate disclosure on environmental impacts. According to Ben-Amar and McIlkenny (2015), the CDP, with the support of major institutional investors, employs a voluntary standard questionnaire to request this information directly from companies regarding response to environmental issues, which include climate change.

Over the past decade, other significant role players entered sustainability reporting. In 2010, the International Integrated Reporting Council (IIRC) was established and supported by the then Prince of Wales, HRH Prince Charles, and the GRI through the Accounting for Sustainability movement. The IIRC was tasked to implement <IR> in the sustainability realm. In 2011, the SASB, a US-based independent organization, introduced industry-specific standards for environmental, social, and governance (ESG) issues. The Task Force for Climate-related Financial Disclosure (TCFD) was formed in 2015 to provide a framework for reporting the financial implications of climate-related risks, opportunities, and dependencies. The TCFD (2017) recommended that preparers of climate-related financial disclosures provide these disclosures in their annual financial reports that are published to the public, which indicates the key investor focus of the recommendations and the focus to improve capital allocation for climate-related matters. The TCFD recommendations have become increasingly popular over recent years with many organizations adopting the framework as part of their journey to respond to climate change and reporting of it in sustainability reports (Arvidsson and Dumay, 2022). The structure and rigor of the requirements were also adopted by the ISSB as the basis for the standards issued in 2023, which is discussed in more detail within the Section 3.

In 2015, the 17 United Nations (UN) Sustainable Development Goals (SDGs) were also introduced to support sustainable development. These goals are not necessarily a framework used to report on, but many governments, companies, and civil society groups have adopted the use of SDGs as a way of measuring their contribution to sustainable development. Sustainability frameworks can play a significant role in enhancing organizations' contribution to the SDGs and sustainable development (Adams, 2017). Laine et al. (2022) have pointed out that one of the most useful aspects of the SDGs is the fact that the goals and the issues are interrelated in nature.

Even though sustainability reporting became more frequent, there was still criticisms about sustainability in terms of the large volume of information provided in the reports (Laine et al., 2022) as well as the lack of connectivity between financial reports and the strategic focus of a company (Mans-Kemp and van der Lugt, 2020). Furthermore, Slack and Campbell (2016) raised a concern that the silo approach when reporting on sustainability does not provide a holistic picture of a company. Clayton et al. (2015) also raised a similar problem, citing that sustainability reports fail to make the connection between the organization's strategy, its financial performance, and its performance on environmental, social, and governance issues. This also raised the question as to how these elements contribute to the value creation of the company.

The introduction of <IR> through the publication of the <IR> Framework by the IIRC aimed to respond to the shortcomings of sustainability frameworks at that time. International Integrated Reporting Council (IIRC) (2013) had the vision that <IR> would become the corporate reporting norm. It was also the aim of the IIRC that <IR> would provide improved quality of information to the providers of financial capital who are connected and support integrated thinking. The next section discusses <IR> in more detail and assesses the benefits and critique of <IR> within sustainability reporting.

1.2.2. Integrated reporting as a sustainability reporting framework

The purpose of an integrated report is to provide information of how a company creates value in the short, medium, and long term [International Integrated Reporting Council (IIRC), 2013]. International Integrated Reporting Council (IIRC) (2013, p. 8) defined an integrated report as a “concise communication about how an organization's strategy, governance, performance, and prospects, in the context of its external environment, lead to the creation of value in the short, medium and long term”. A very important feature of integrated reporting is that it takes a stakeholder-inclusive approach, which is aligned with King IV (IoDSA, 2016). The IoDSA (2016) goes further by explaining that stakeholders' interests are embedded in the six capitals of <IR> (i.e., financial, manufactured, human, intellectual, social and relationship, and natural). The six capitals are fundamental to <IR> as they aim to provide insights into how the capitals relate to one another in order to create value [International Integrated Reporting Council (IIRC), 2013]. A very important distinguishing factor for <IR>, in comparison with other sustainability reports, is the connectivity of information, showing the interrelation and interdependencies of the different capitals [International Integrated Reporting Council (IIRC), 2013; Barth et al., 2017]. Integrated reports tend to be highly connected and emphasize stakeholder perspectives better than another type of sustainability reports (Lueg and Lueg, 2021).

The role and implementation of connectivity have become an important research focus in the context of the formation of the ISSB and the future of <IR> concepts (de Villiers and Dimes, 2023). The concept of connectivity is supported through integrated thinking and is described by International Integrated Reporting Council (IIRC) (2013, p. 2) as the “active consideration by an organization of the relationships between its various operating and functional units and the capitals that the organization uses or affects. Integrated thinking leads to integrated decision-making and actions that consider the creation of value in the short, medium, and long term”. Integrated thinking is considered to be important for long-term strategy development in order to create value (Adams, 2017). Adams (2017) further also suggests that integrated thinking can also support sustainable development. Chartered Institute of Management Accountants (CIMA) (2016) emphasized that integrated thinking leads to better decision-making that is more agile and gives leadership within organizations the ability to make strategic links to organizations' business model. However, a study by Rossi and Luque-Vílchez (2020) has determined that integrated thinking is not always triggered by the implementation of <IR> principles but is often embedded as part of the organization's corporate culture.

As there are many benefits to <IR>, International Integrated Reporting Council (IIRC) (2013, p. 3) has a vision that <IR> would increase the quality of information to investors and enhance accountability and stewardship across the six capitals. Baboukardos and Rimmel (2016) concluded that integrated reports facilitate the interaction between financial and non-financial information, which also links financial and sustainability performance. Based on a study by Bernardi and Stark (2018), a positive association existed between Bloomberg's environmental, social, and governance (ESG) scores and analyst earnings forecast accuracy for 40 South African companies where <IR> was mandatory. The Bloomberg ESG scores are a set of ratings that measure the sustainability and ethical performance of companies. The scores are based on a range of criteria, including environmental impact, labor practices, corporate governance, and social issues such as building strong communities. Furthermore, <IR> assists market participants in understanding the risk management of current and future risks in a company (Baboukardos and Rimmel, 2016). <IR> has a forward-looking approach, which speaks to the need for more forward-looking information (Dumay, 2016) and moves away from a historical view in annual reports. Vitolla and Raimo (2018) found that the adoption of <IR> provides benefits internally by being more inclusive and also externally by improving relationships with significant stakeholders. This also speaks to the value derived from the internal processes leading up to the actual report and not the report itself (Stacchezzini et al., 2023). One of the most profound benefits is that Barth et al. (2017) determined that there is a positive relationship between integrated reporting quality and organizational value, which includes liquidity, prediction of future cash flows, and investment efficiency. Vitolla et al. (2020) found that quality-integrated reports also reduce the cost of equity.

Even though there are many benefits in using <IR>, there has also been a well-known critique from many scholars over the past decade. The first area of criticism is that <IR> is not necessarily considered to be a sustainability report (Flower, 2015) as it focuses on value creation and primarily on the providers of financial capital—the investors. In more recent research, Dumay et al. (2023, p. 188) affirms the position of Flower (2015) by stating that, after a decade of integrated reporting, nothing has changed, and the same “rhetoric” of capitalism remains. de Villiers and Sharma (2020) also pointed out that the <IR> Framework suggests that a value-to-investors principle is taken within the framework. That being said, de Villiers and Sharma (2020) also pointed out that the term “value” can be interpreted in different ways, suggesting that it could also mean “value to society,” “value to stakeholders,” or even “value to present and future generations,” which is aligned to the norms of sustainability reporting. However, Montecalvo et al. (2018) have contrasting views to that of Flower (2015), following a study performed in New Zealand, which confirmed that <IR> can align with the needs of stakeholders and not only investors. Baboukardos and Rimmel (2016) also noted that integrated financial and sustainability information has a negative effect on the cost of capital. Other research carried out by de Villiers and Sharma (2020) and Mans-Kemp and van der Lugt (2020) noted that <IR> has not necessarily lived up to the expectation of being the corporate reporting norm. Dumay et al. (2023) also pointed out that, over a decade, no significant changes were made to the <IR> Framework even though there were widespread criticisms toward the framework.

From the literature above, it can be derived that <IR> had key benefits but did not speak to sustainability due to a clear investor's focus. According to de Villiers and Dimes (2023), <IR> would align with the new ISSB standards as both these frameworks have an investor's focus in terms of reporting. Based on the research problem earlier, there is still much uncertainty regarding the role that <IR> would play in the standard setting of the ISSB. Research pointed out that this is an area that should be investigated by academics [International Integrated Reporting Council (IIRC), 2013; Dumay et al., 2023].

2. Research methodology

2.1. Research method

The research objective will be achieved by following a content analysis research method of qualitative data. Content analysis is a renowned research method used by many scholars within corporate reporting (Reuter and Messner, 2015; Mhlanga, 2022). Bamber and McMeeking (2016) have used content analysis to analyze comment letters as part of the standard-setting process of the International Accounting Standards Board (IASB) as part of lobbying research performed. Furthermore, many researchers have used this method in studies within sustainability reporting (Pitrakkos and Maroun, 2020). Terblanche and De Villiers (2019) have used content analysis to analyze intellectual capital disclosures within integrated reports and compare them across different organizations.

Content analysis has its own criticism in that it could lack sufficient rigor as part of the basic design of the analysis (Dumay, 2014). However, the manner in which content analysis was applied in this study was not only to count words (Terblanche and De Villiers, 2019) but also to find the meaning and interpretation of “words” (Reuter and Messner, 2015).

The study furthermore focuses on an inductive method in order to explore the text within the documents and to develop themes and relationships. The study applies concepts of initial coding, theme developments, recoding, and the re-analyses of themes as part of the iterative process described below (Nowell et al., 2017). This process tends to have a rich amount of data due to the iterative process followed and not only for counting words but for creating meaning out of the data (Creswell and Creswell, 2018).

2.2. Data population and collection process

In the first part of the study, the authors analyzed both the <IR> Framework published by the IIRC and the ISSB's exposure draft on the IFRS S1 standard (exposure draft) that was open for comment during 2022. The purpose of the analysis was to identify not only aspects of both documents where there were significant differences but also areas where there were similarities between the exposure draft and the <IR> Framework. The starting point was to identify specific themes based on the various questions raised by the ISSB in the exposure draft and to map these themes to the <IR> Framework. This was performed by analyzing and coding the identified themes in both documents in ATLAS.ti 23 for further analysis.

In the second part of the study, the authors analyzed the comment letters received by the ISSB on the exposure draft. Napier and Stadler (2020) pointed out that the use of comment letters may create bias because the authors of these comment letters would want to influence the standard-setting process through lobbying. This has been identified as a limitation of the study and is also discussed as part of the conclusion.

The ISSB received 735 comment letters that were posted on the IFRS Foundation website page relating to the exposure draft. These documents were downloaded from the website and imported into ATLAS.ti 23 for coding and further analysis. Any duplicate submissions were removed from the population. The process of analysis was performed using a three-step approach, as illustrated in Figure 2.

The first step was to perform a word search in the documents to identify instances where there were references made to integrated reporting and integrated thinking using keywords similar to the approach Mhlanga (2022) used in his study. For the purposes of this study, the authors used “integrated” and “IR” as keywords in the search. These quotations were then coded as “IR.”

The second step of the approach was to analyze the text of each of the quotations and understand the sentiment and meaning of the comments made by the authors who submitted the comment letters to the ISSB. In this phase, the authors coded the sentiment in the quotation as either positive, negative, or uncertain. There were quotations that did not fall under any of these three sentiments, which were not assigned further coding. Examples of these quotations were references of contextual nature to provide a background of the organization that submitted the comment letters and also references made to the academic literature that uses <IR> in the title of the literature.

The third step of the approach was to evaluate the text further and identify themes (illustrated in Figure 2) within the three basic sentiments identified in the second step. It is important to note that the authors did go through an iterative process of recoding the initial codes to ensure consistency and completeness of the themes identified, similar to Terblanche and De Villiers (2019). These themes were then contrasted and compared across the sentiments to understand the different viewpoints of comment letters submitted and to evaluate which aspects of <IR> were deemed significant in the future of sustainability reporting (Nowell et al., 2017).

3. Analysis of results

The analysis of the results is structured in two sections. First, the similarities and differences between the <IR> Framework and the exposure draft were analyzed. Second, the analysis of the sentiments from respondents in the comment letters was analyzed in detail.

3.1. Similarities and differences between the <IR> framework and the exposure draft

Both frameworks deal with the concept of fair presentation. The fair presentation comes from IFRS standards and has been inherent in the exposure draft. It deals with faithful representation (i.e., complete, neutral, and free from material error). The <IR> framework does not deal with the same terminology but embeds the concept in the guiding principles of the <IR> framework. Notably, the <IR> framework does go into detail about completeness and is free from material errors. The neutrality aspect is dealt with in terms of the “balance” of information to ensure that there is not a bias for more positive information in comparison with negative information. The <IR> framework also deals with issues such as cost vs. benefit and information that may compromise “competitive advantage.” A difference is that the exposure draft provides specific guidance on how to identify sustainability-related risks and responsibilities including SASB, CDSB, and other relevant industry-related standards, which the <IR> framework does not explain explicitly.

The objective of the two frameworks was not necessarily aligned. Even though both frameworks focus on information, a key difference is that <IR> focuses on how value is being created whereas the exposure draft focuses on the assessment of enterprise value and the risk and opportunities of sustainability. A key question to ask is whether the enterprise value considers all the capitals and stakeholders. It seems as if the definition of enterprise value is focused on the equity market capitalization and based on expected cash flows in the context of a risk profile of a company and therefore more shareholder focused. This is contrary to the stakeholder approach taken by the <IR> framework and the role the six capitals play in the value creation story of each organization through the business model. The exposure draft focuses on the value chain that has characteristics of the business model approach taken in the <IR> framework but needs more explanation and guidance in terms of what is meant by it.

One of the important similarities is the fact that the exposure draft explains the concept of connecting financial and non-financial information. As mentioned earlier, the concept of connectivity is what makes integrated reporting different. This explains the positive sentiment received in the comment letters in the sections below.

Another key area of similarity is the core areas of the new exposure draft, which include governance, strategy, risks and opportunities, and metrics inherited from the TCFD framework. Even though the <IR> does not follow the same structure, these elements are embedded in the guiding principles and content elements of <IR>. However, there are differences. The exposure draft has a key difference from a strategic perspective that it requires companies to show how the risks and opportunities will influence the financial position, performance, and cash flows, including investment plans and resources to fund certain strategies. The <IR> framework discusses the effect more broadly and is principle based, using connectivity and tradeoffs that forced financial capital to address sustainability-related issues.

In terms of the concept of materiality, both frameworks refer to the use of judgment as part of the determination of materiality. The purpose of materiality is also similar in both frameworks. It was noted though that there were no clear guidelines provided in the exposure draft analyzed, which is explained better in <IR>. A difference between the frameworks is that the exposure draft focuses on the impact it has on the decision-making of the users of the reports whereas <IR> deals with the relevant matters that are material to value creation in the short, medium, and long term. The exposure draft also focuses on enterprise value instead of the broad term “value creation” used by <IR>.

Reporting entity definition is mostly aligned between the frameworks. However, <IR> goes further with the reporting boundary, which also discusses the effects of companies beyond the reporting entity that may have an impact on the value creation of a company. The exposure draft is not that explicit.

In terms of the frequency or timing of the reports, integrated reports are published after financial statements have been published; however, the new exposure draft wants alignment between the sustainability reports and the general-purpose financial statements.

The similarities and differences were also discussed in terms of the role that <IR> should play in the future of sustainability standard setting by the ISSB as part of the section below.

3.2. Analysis of the comment letters received by the ISSB

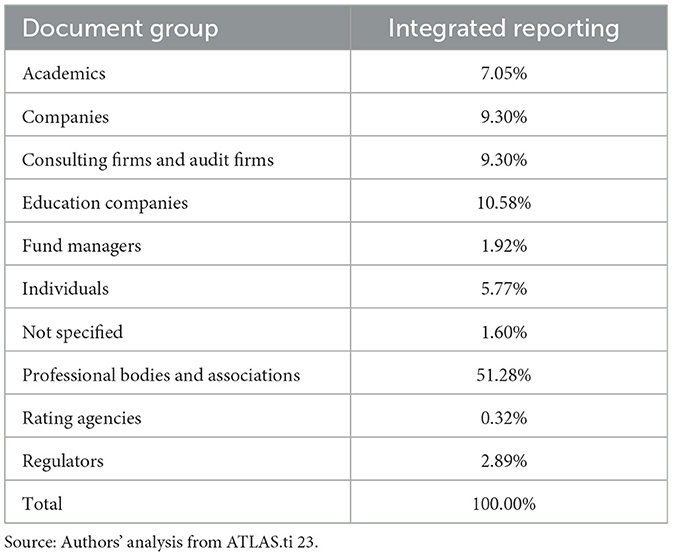

The analysis indicated that, of the total of 615 documents analyzed as part of the process, 130 comment letters referred to <IR> principles within the comment letter. The authors created document groups for each class of respondent that submitted a comment letter to the IASB. The code distribution for meaningful <IR> references across the different document groups is shown in Table 1.

Table 1 illustrates that there was a reasonable distribution across the different classes of respondents to the ISSB. The most significant number of <IR> references (51.28%) was from both local and global professional bodies within the accounting profession.

As mentioned within the methodology section of the article, organizations may use comment letters to lobby for a certain outcome as part of the standard-setting process, which could explain the reason for such a high level of responses from professional bodies and associations.

Other significant groups that commented were educational companies within sustainability reporting (10.58%), companies (9.3%), audit and consulting firms (9.3%), and academics (7.05%).

The following section will address the second layer of coding (refer to Figure 2).

3.2.1. The sentiment of integrated reporting

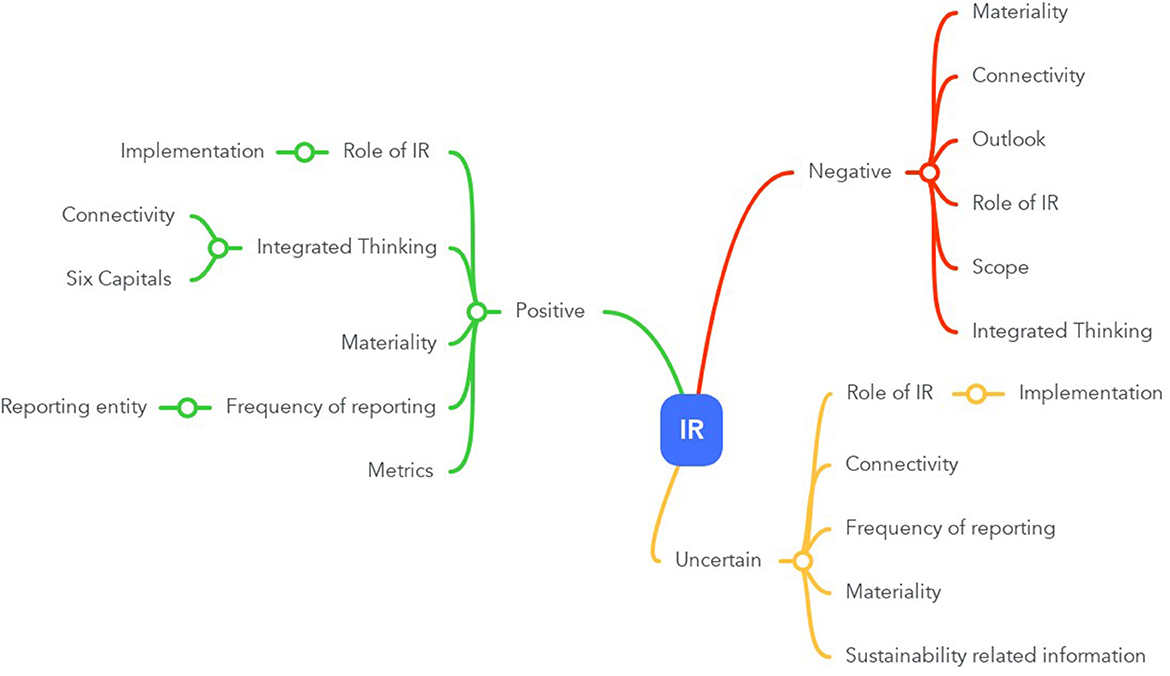

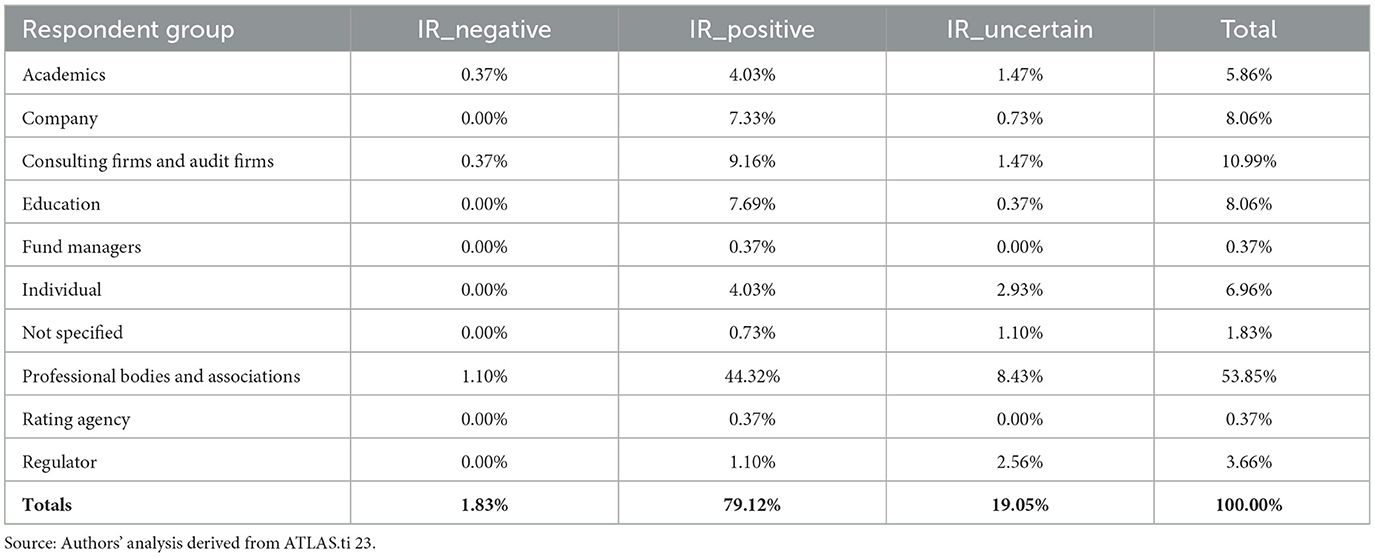

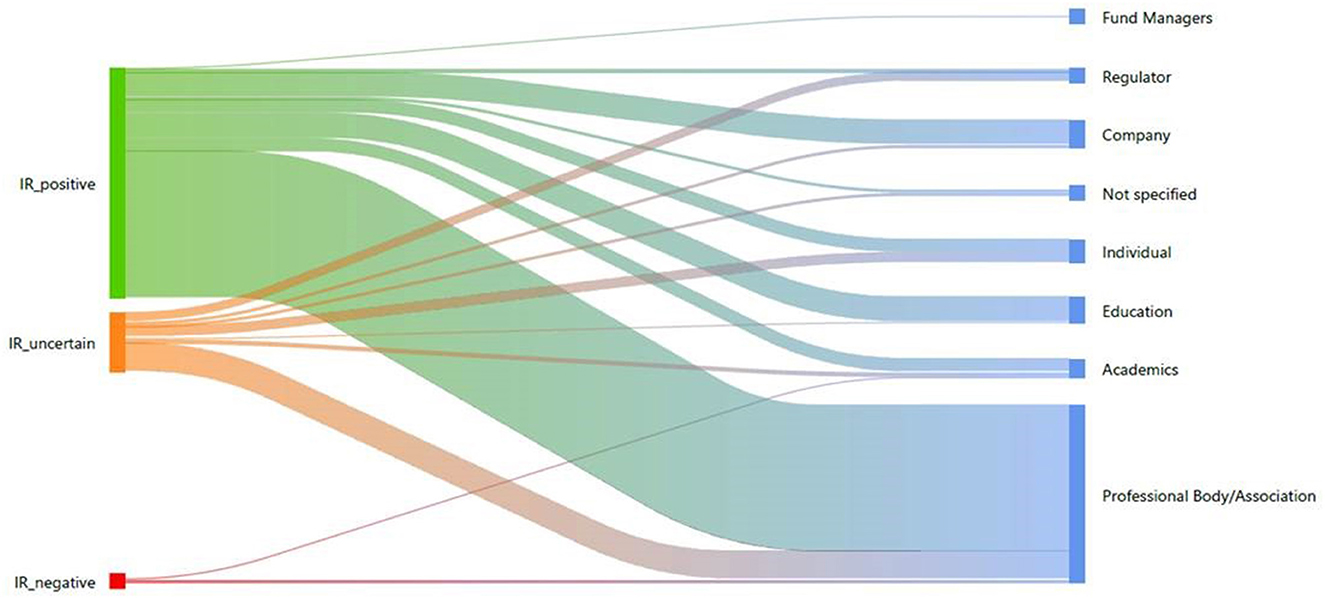

The second level of analysis was performed to identify the sentiment of respondents in the comment letters submitted to the ISSB. In terms of the methodology section above, the authors manually coded the references to <IR> as either positive, negative, or uncertain. The code distribution across the document groups is illustrated in Table 2 and Figure 3.

Figure 3. Analysis of sentiments toward <IR> among respondents. Source: Authors' analysis derived from ATLAS.ti 23.

In line with the view of Napier and Stadler (2020) on comment letter bias, the authors did identify that the coding illustrates that a significant majority of the references to <IR> (79.12%) were positive in nature. Table 2 illustrates that most of the positive sentiments came from professional bodies and accounting associations, which could indicate that these bodies are advocating for the use of <IR> in future sustainability standards setting projects. The remaining positive commentary was reasonably distributed among the other groups.

In contrast, the analysis showed there was an insignificant amount of negative sentiment (1.83%). Uncertainty regarding the way forward for <IR> was also evident from the analysis, albeit at a lower rate of 19.05%. Uncertainty was noted among professional bodies and associations, regulators, academics, and some individual respondents.

The relevant themes from each of these sentiments will be analyzed in the next section as part of the final level of the qualitative analysis.

3.2.2. Positive themes emerging from the analysis

In the final phase of the analysis, the various positive, negative, and uncertain sentiments were further evaluated to understand the meaning of the underlying text and to identify themes that emerge from the analysis.

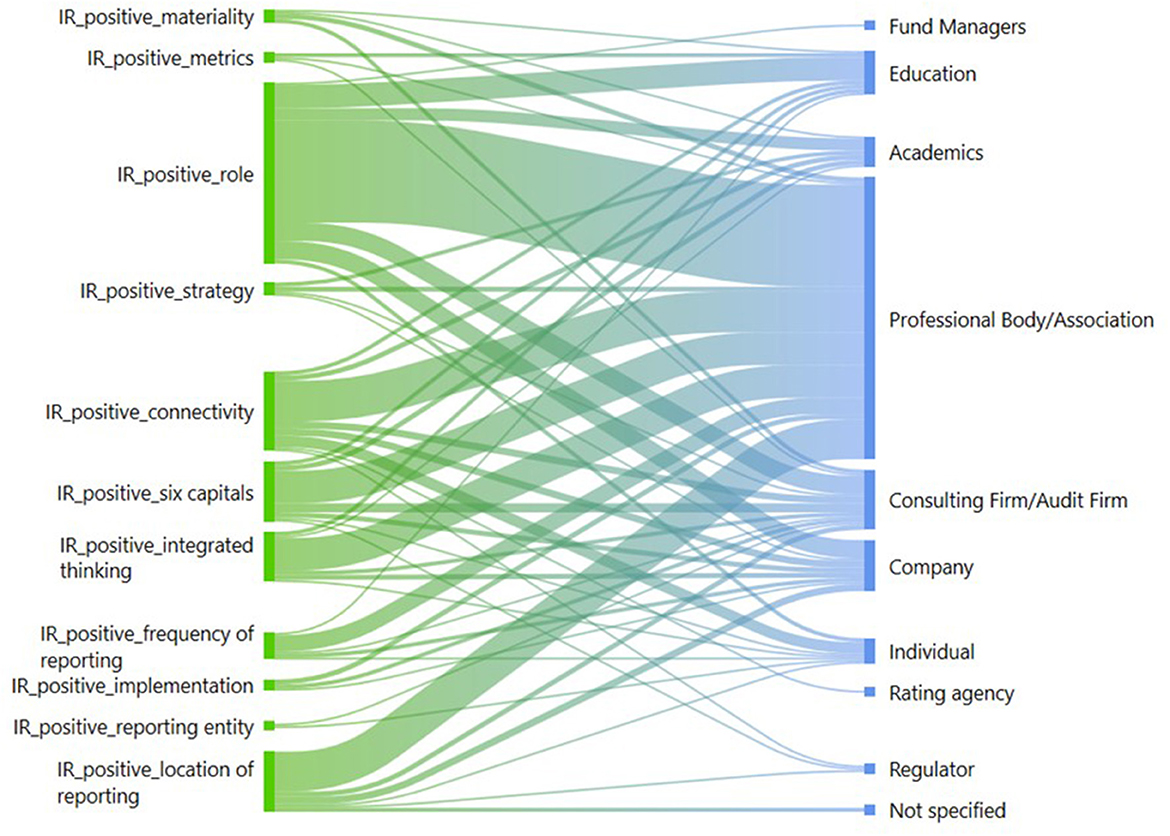

Positive sentiments possibly point out where <IR> can still be relevant in the future of sustainability reporting and the ISSB's standard-setting processes. The themes that emerged under positive sentiments are illustrated in Table 3 and Figure 4.

Figure 4. Themes emerging from positive sentiments from respondents based on document groups. Source: Authors' analysis derived from ATLAS.ti 23.

The most significant theme that emerged from the positive sentiment was the role of integrated reporting with a frequency of 45.83%. Within the role of <IR>, the authors considered the concept of value creation in <IR> versus enterprise value in the exposure draft; the scope of reporting; and the location of reporting. The need for a conceptual framework and additional guidance was discussed in the comment letters, and many respondents advised that <IR> may best be suited for this purpose using integrated thinking, the six-capitals approach, and value creation as the established principles in the <IR> framework would provide good conceptual guidance.

Many respondents advocated the role of <IR> of providing information in one location with reference to other reports for further information, thus ensuring that information is connected. There were also recommendations to include a definition for sustainability based on the six capitals to improve the current definition in the exposure draft and embrace stakeholder capitalism. Added to that, respondents also pointed out that the current focus of enterprise value in the exposure draft excludes significant stakeholders from the scope of users of the reports because it draws focus to general-purpose financial reports.

Another key theme that emerged was the use of the six capitals, which was briefly discussed under the role of <IR>. The importance of the six capitals as part of the wider sustainability and not focusing on only financial capital and financial information was quite evident in the responses. Many respondents mentioned that intellectual capital is currently not addressed in the exposure draft and forms a crucial element of sustainability. In addition, the lack of workforce or human capital-related aspects in the ISSB exposure draft was addressed in comment letters. Human capital plays a critical role in the supply chain and the development of new technologies to be more sustainable in future.

The role of connectivity was also frequently discussed (16.67%) by respondents. Connectivity is also closely linked with the use of the six capitals, which was also frequently raised by respondents (12.50%). Many respondents were satisfied with the use of the term “connected information” in the exposure draft and highlighted how important it is to breach the gap between financial and non-financial information. However, some respondents did also point out that connectivity is more than just linking but should also consider tradeoffs between the capitals. The Integrated Reporting Association Turkey (ERTA) made the following comprehensive statement regarding connectivity and tradeoffs:

Connectivity in a broad sense is of paramount importance if sustainability reporting standards are to lead to more resilient capital markets and better long-term decision-making in businesses. This thus extends beyond connecting financial information with non-financial information, quantitative information with qualitative information, and connecting different sections of a report together in a presentational sense. Connecting externally-reported information with information used internally for decision-making, and understanding the interdependencies and trade-offs between different integrated reporting capitals, therefore deserve greater emphasis.

Connectivity, tradeoffs, and the use of the six capitals are closely related to the concept of integrated thinking, and therefore, integrated thinking was also considered to be significant (12.50%) in the responses analyzed. In line with the research carried out by Chartered Institute of Management Accountants (CIMA) (2016), respondents highlighted that integrated thinking would lead to better information for improved strategic decision-making and breakdown silos within organizations. The Integrated Reporting Committee of South Africa (IRCSA) made the following statement about integrated thinking that supports the importance of this concept in sustainability reporting:

Without integrated thinking, it is more difficult for the entity, and thus its investors, to understand the complete sustainability-related risks and opportunities it faces over the short, medium, and long term.

From this statement above and many others, it seems as if the process of integrated thinking is the glue that keeps all the sustainability components connected and that is necessary to truly understand risks and opportunities that would influence sustainable strategies in the future.

Materiality was also discussed in the comment letters. Respondents noted that the IFRS Foundation and the ISSB should undertake a separate project to streamline the process of materiality determination. Within this project, respondents noted that the materiality determination principles in <IR> were considered to be sound and that the ISSB should leverage from that.

There were also important comments made regarding the frequency of reporting, which indicated that respondents wanted financial statements and sustainability reports to be published at the same time to promote the connectivity of information (financial vs. non-financial) as mentioned earlier in this analysis.

In terms of continuity and implementation of the new exposure draft, it was noted that <IR> would assist organizations, especially using materiality principles from the <IR> framework.

The use of metrics through the six capitals was raised by respondents; however, there were also contradicting views from other respondents, which are discussed below with reference to negative and uncertain sentiments.

3.2.3. Themes of uncertainty and negativity emerging from the analysis

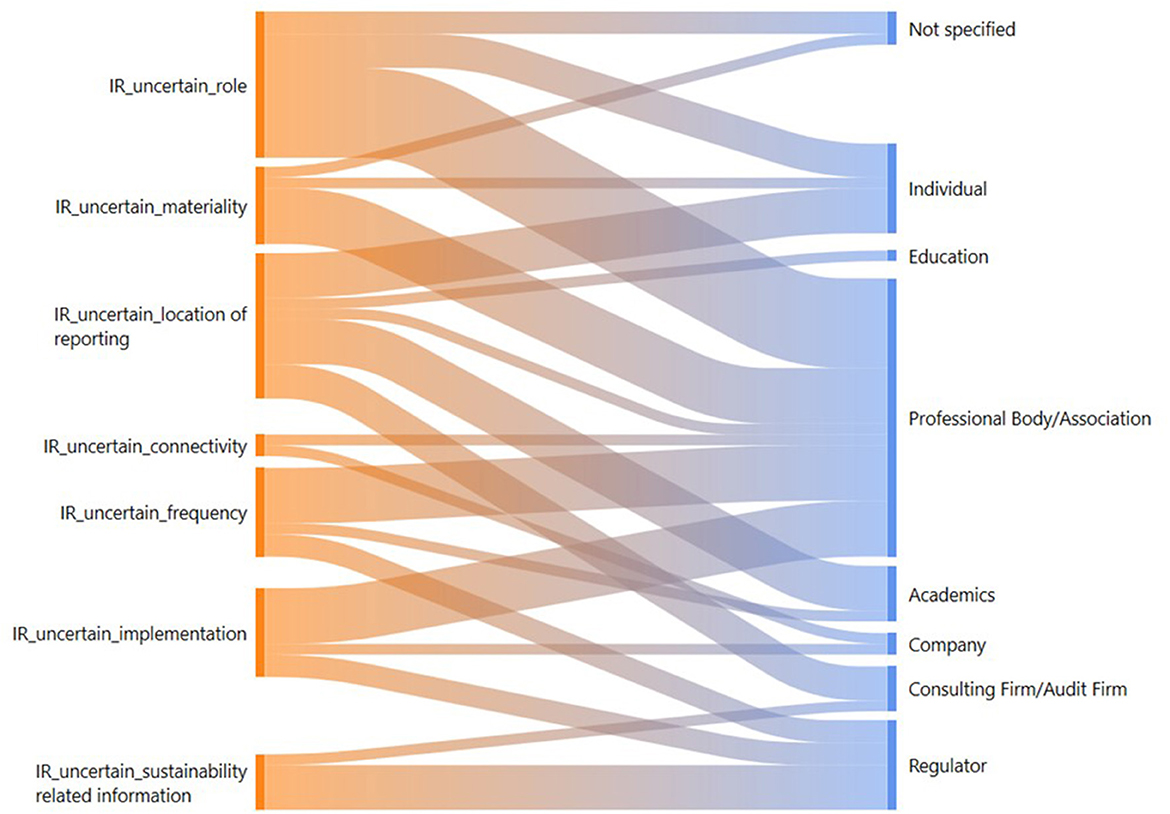

Even though most of the sentiments were positive in nature, there were also areas of uncertainty and negativity, albeit to a lesser extent. The themes that emerged under uncertain or negative sentiments are illustrated in Figure 5.

Figure 5. Themes emerging from sentiments of negativity and uncertainty from respondents. Source: Authors' analysis derived from ATLAS.ti 23.

Uncertainty was most evident from respondents in terms of the role that <IR> will play in future ISSB standards. This contradicts the largely positive sentiment regarding the role of <IR> above, but comments were made to a far lesser extent. Most respondents made statements regarding the uncertainty of how the <IR> framework will be used by the ISSB, and more guidance will be needed from the ISSB. There were also references made to the uncertainty of the location of the integrated report. EY, a Big Four audit firm, mentioned that <IR> will solve the problem regarding cross-referencing of information but until that time, the ISSB needs to be clear in terms of how referencing will be applied.

There was also an indication of uncertainty regarding the frequency of reporting and the implementation of the exposure drafts. Respondents related the uncertainty of the frequency of reporting to the practical obstacles in providing sustainability reports at the same time as financial statements, and this could necessitate changes to legislation in certain jurisdictions, such as Japan.

Questions were raised regarding implementation, and more specifically, concerning how the retrospective approach of the ISSB will work and when the actual effective date would be. Respondents made mention of integrated reporters that could have an advantage over other reporters. However, the Johannesburg Stock Exchange (JSE) mentioned that, in South Africa, companies are well established in using <IR>, but it could be difficult to apply the new ISSB S1 standard as it is built on the TCFD model. Concerns were also raised in terms of capacity building and costs to ensure effective implementation for these companies.

The concept of materiality was debated among some of the respondents saying that there is no clear and consistent definition of materiality and that clearer guidance would be necessary to ensure consistent application. However, there was also an instance where a group of respondents disagreed with how materiality is defined and used in <IR>, and thus, more structure is needed.

Another area of uncertainty is the definition of sustainability in the exposure draft. There are many permutations of what sustainability entails, including triple bottom line, ESG, UN SDGs, and the six capitals of <IR>. Respondents have asked for a refinement of this to ensure consistent application. Once again, there was one group of respondents who mentioned that sustainability is broad and that the <IR> model was mostly focused on enterprise value, which was problematic. This view is largely contradictive to the views shared under positive sentiments.

There were also contradicting views to the largely positive sentiments regarding connectivity. Some respondents raised the question of how connectivity will be assured by audit firms, which is a valid question to raise. The South African Institute of Chartered Accountants (SAICA) also raised a concern that connectivity in the context of the ISSB should not be different from the <IR> principles as it could cause additional disclosures and therefore should be clarified and aligned. One particular respondent (a company) mentioned that they believed that connectivity (linked with tradeoffs) was impractical and unworkable in terms of <IR>. This could, however, be regarded as an isolated comment given the largely positive sentiment above.

4. Discussion

Integrated reporting, which is part of the VRF, is a well-established sustainability reporting framework globally. The IFRS Foundation established the ISSB in 2021, which was tasked to create a global baseline for sustainability reporting by publishing exposure drafts on two sustainability standards (IFRS S1 and IFRS S2). However, with the formation of the ISSB, the VRF was consolidated into the IFRS Foundation. This raised the question of what the role of <IR> will be in future of sustainability standards and the relevance of <IR> as part of the standards that will be developed by the ISSB in future.

This research used a two-stage content analysis approach by first analyzing the differences and similarities between the <IR> framework and the exposure draft in general sustainability reporting. The second stage was the analysis of the comment letters that have been submitted to the ISSB. The analysis was performed in three steps. First, instances of reference to <IR> were identified. The second step was to analyze these instances deeper to understand whether the sentiment in the comment letter was positive, negative, or uncertain with regard to <IR>. Third, the codes were analyzed and coded for certain themes that arose from the analysis within each of the sentiments.

The analysis of the two frameworks highlighted that the concept of connectivity was a significant alignment between the two frameworks. The four core areas of the exposure draft also aligned with the <IR> framework although the <IR> framework does not structure it exactly in that format but rather embeds the ease of components in the guiding principles and the content elements. A key difference is the focus of the two frameworks. The new exposure draft focuses on sustainability-related information to assess the impact on enterprise value, whereas the <IR> framework focuses on value creation in the short, medium, and long term. There is uncertainty regarding the definition of sustainability-related information in the exposure draft and whether it considers all the stakeholders of an organization and not only the shareholders' perspectives.

The most significant respondents with references to <IR> were local and global professional bodies (51.28%), which could indicate that these bodies will use their stature to lobby for the use of <IR> in future standard settings. Other significant respondents were sustainability reporting (10.58%), companies (9,3%), audit and consulting firms (9.3%), and academics (7.05%). The analysis of the comment letters revealed that there was a significant positive sentiment (79.12%) from respondents that submitted comment letters that referred to <IR>. There were also comments of uncertainty and negativity but to a far lesser extent.

The role of <IR> in the future of the ISSB's standards was the most significant positive theme from the analysis to ensure good conceptual guidance to standard setters. Respondents also highlighted the use of the integrated report as a standalone report that can link to the other sustainability information in sustainability reports. This ties into the argument of de Villiers and Dimes (2023) that there is still a need for a stand-alone and concise report to report to a wide range of stakeholders. However, there were also respondents that indicated uncertainty regarding the role of <IR> in the future. Other significant positive themes were connectivity, integrated thinking, and the use of the six capitals of integrated reporting, which are also very closely related. This also supported the literature that these elements distinguished <IR> from other sustainability reporting frameworks (Barth et al., 2017). It could mean that, even though an integrated report may fall away, organizations can still use the principles of connectivity and integrated thinking to be able to respond to risks more effectively and align strategies. This could also be the reason why the IFRS Foundation instituted the Integrated Reporting and Connectivity Council as an advisory body to the IFRS Foundation to assist how the IASB and the ISSB can be integrated and include <IR> principles and concepts into their standard setting in the future. There was also uncertainty regarding the frequency of reporting and how it will be practically implemented. There was also uncertainty about what sustainability-related information means in terms of the exposure draft and if it takes into account the six capitals of <IR>.

Given the findings above, the limitation of the case study is that there is an element of positive bias from respondents who refer to <IR> as part of their responses and could overemphasize the importance of <IR>. This is in line with the study from Napier and Stadler (2020), which highlights the bias from respondents to influence the standard-setting process.

5. Conclusion

The need for a global baseline for sustainability reporting standards has become increasingly important in recent years. The role of <IR> was substantial across many organizations and jurisdictions before its consolidation into the IFRS Foundation. With the consolidation, questions arose as to how <IR> will be used as part of the standard-setting policies of the IFRS Foundation and the ISSB. The main findings are illustrated as part of Figure 4 showing key aspects of <IR> that respondents to the ISSB have submitted as part of the standard-setting process.

The study contributes to academic literature as this is one of the first studies, to the knowledge of the authors, that analyzed comment letters on the exposure draft of the IFRS S1 standard that the ISSB has published. The study furthermore contributes to the literature by emphasizing the importance of <IR> and the role that important concepts such as connectivity, integrated thinking, and the six capitals can play in the future standard-setting processes of the ISSB.

One of the main limitations is the bias from respondents in the comment letters as respondents worked with <IR> directly. Furthermore, the analysis of the comment letters does not provide the authors an opportunity to seek clarification on certain statements made, which could lead to subjectivity in the coding and analysis. However, with the limitations being noted, there are opportunities for future research. Future studies can focus on other frameworks and how these can be used for future sustainability standards. Another important possible study would be to analyze the final issued standards from the ISSB to identify how comment letters have influenced the standard setting of the ISSB. Another way to obtain richer data is to use interviews and focus groups to obtain an understanding of how <IR> principles are used as part of the implementation of the new sustainability standards.

The practical implication of this research is that it highlights key aspects of <IR> and integrated thinking principles that the IFRS Foundation together with the ISSB can use as part of the standard-setting process and other reporting guidelines on the new sustainability standards. Furthermore, the study enforces some of the principles in <IR> that organizations can apply as part of their implementation of the new sustainability standards.

From a theoretical perspective, the research offers insights into the role that <IR> played within organizations in preparing integrated reports and which principles are paramount in the standard-setting process of the IFRS Foundation and the ISSB. It adds to the body of knowledge that can promote further research within sustainability reporting with a focus on integrated thinking and <IR> principles and how these principles are applied in sustainability reporting.

Based on the study's findings, it can be argued that <IR> still has a very important role to play in the new IFRS Foundation era by incorporating many of the principles of <IR> and integrated thinking as part of the standard-setting process within the IFRS Foundation.

Data availability statement

The datasets presented in this study can be found in online repositories. The names of the repository/repositories and accession number(s) can be found below: https://www.ifrs.org/projects/work-plan/general-sustainability-related-disclosures/exposure-draft-and-comment-letters.

Author contributions

MW has performed the initial literature, data collection, and analysis. GE functioned as a reviewer of the work conducted and checked the coding and assertions to certify clearness and that the purpose is fulfilled and assisted with deeper analysis and evaluation of the themes from the data collected. Both authors contributed to the article and approved the submitted version.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Adams, C. A. (2017). “The Sustainable Development Goals, integrated thinking and the integrated report,” in IIRC and ICAS. Available online at: http://integratedreporting.org/resource/sdgs-integrated-thinking-and-the-integrated-report/ (accessed December 13, 2022).

Adams, C. A., and Mueller, F. (2022). Academics and policymakers at odds: the case of the IFRS Foundation Trustees' consultation paper on sustainability reporting. Sustain. Account. Manag. Policy J. 13, 1310–1333. doi: 10.1108/SAMPJ-10-2021-0436

Arvidsson, S., and Dumay, J. (2022). Corporate ESG reporting quantity, quality and performance: where to now for environmental policy and practice? Bus. Strat. Environ. 31, 1091–1110. doi: 10.1002/bse.2937

Baboukardos, D., and Rimmel, G. (2016). Value relevance of accounting information under an integrated reporting approach: a research note. J. Account. Public Policy 35, 437–452. doi: 10.1016/j.jaccpubpol.04004

Bamber, M., and McMeeking, K. (2016). An examination of international accounting standard-setting due process and the implications for legitimacy. Br. Account. Rev. 48, 59–73. doi: 10.1016/j.bar.2015.03.003

Barckow, A., and Faber, E. (2022). Integrated Reporting—articulating a future path. Available online at: https://www.ifrs.org/news-and-events/news/2022/05/integrated-reporting-articulating-a-future-path/?utm_medium=emailandutm_source=website-follows-alertandutm_campaign=immediate (accessed June 13, 2023).

Barth, M. E., Cahan, S. F., Chen, L., and Venter, E. R. (2017). The economic consequences associated with integrated report quality: capital market and real effects. Account. Org. Soc. 62, 43–64. doi: 10.1016/j.aos.08005

Ben-Amar, W., and McIlkenny, P. (2015). Board effectiveness and the voluntary disclosure of climate change information. Bus. Strat. Environ. 24, 1840. doi: 10.1002./bse.1840

Bernardi, C., and Stark, A. W. (2018). Environmental, social and governance disclosure, integrated reporting, and the accuracy of analyst forecasts. Br. Account. Rev. 50, 16–31. doi: 10.1016/j.bar.2016.10.001

Chartered Institute of Management Accountants (CIMA) (2016). Joining the Dots—Decision Making for a New Era. London: CIMA: And New York: American Institute of CPAs.

Clayton, A. F., Rogerson, J. M., and Rampedi, I. (2015). “Integrated reporting vs. sustainability reporting for corporate responsibility in South Africa,” in Bulletin of Geography. Socio-economic Series. Nicolaus Copenicus University Press.

Creswell, J. W., and Creswell, D. J. (2018). Research Design (5th ed.). Los Angeles, CA: SAGE Publications.

de Villiers, C., and Dimes, R. (2023). Will the formation of the international sustainability standards board result in the death of integrated reporting? J. Account. Org. Change 19, 279–295. doi: 10.1108/JAOC-05-2022-0084

de Villiers, C., Rinaldi, L., and Unerman, J. (2014). Integrated reporting: insights, gaps and an agenda for future research. Account. Audit. Account. J. 27, 1042–1067. doi: 10.1108/AAAJ-06-2014-1736

de Villiers, C., and Sharma, U. (2020). A critical reflection on the future of financial, intellectual capital, sustainability and integrated reporting. Crit. Perspect. Account. 70, 101999. doi: 10.1016/j.cpa.2017.05.003

Delarue, M. L. (2021). Now is the time to establish globally consistent standards for the reporting of non-financial information. Available online at: https://www.ey.com/en_gl/climate-change-sustainability-services/why-there-are-growing-calls-for-global-sustainability-standards (accessed May 24, 2021).

du Toit, E. (2017). The readability of integrated reports. Meditari Account. Res. 25, 629–653. doi: 10.1108/MEDAR-07-2017-0165

Dumay, J. (2014). 15 years of the Journal of Intellectual Capital and counting A manifesto for transformational IC research. J. Intell. Cap. 15, 2–37. doi: 10.1108/JIC-09-2013-0098

Dumay, J. (2016). A critical reflection on the future of intellectual capital: from reporting to disclosure. J. Intell. Cap. 17, 168–184. doi: 10.1108/JIC-08-2015-0072

Dumay, J., Zambon, S., and Magnaghi, E. (2023). Guest editorial: integrated reporting and change: what are the impacts after more than a decade of integrated reporting? J. Account. Organ. Change 19, 185–190. doi: 10.1108/JAOC-05-2023-213

Flower, J. (2015). The international integrated reporting council: a story of failure. Crit. Perspect. Account. 27, 1–17. doi: 10.1016/j.cpa.07002

IIRC (2020). 10 Years of the IIRC. Available online at: https://www.integratedreporting.org/10-years/10-years-summary/#:~:text=Today%2C%20the%20concept%20of%20integrated,in%20more%20than%2070%20countries. (accessed April 21, 2023).

International Integrated Reporting Council (IIRC) (2013). Available online at: The International<IR > Framework. https://integratedreporting.org/wp-content/uploads/2013/12/13-12-08-the-international-ir-framework-2-1.pdf. (accessed April 21, 2023).

IoDSA (2016). King IV Report. Available online at: http://www.iodsa.co.za/?page=KingIVEndorsers (accessed April 21, 2023).

Kolk, A. (2004). A decade of sustainability reporting: developments and significance. In J. Environ. Sustain. Develop. 3, 51–64. doi: 10.1504/IJESD.2004.004688

KPMG (2020). Sustainability Reporting During COVID-19 Pandemic. Available online at: https://assets.kpmg.com/content/dam/kpmg/in/pdf/2020/05/sustainability-reporting-during-covid-19-pandemic.pdf (accessed February 27, 2023).

Laine, M., Tregidga, H., and Unerman, J., (eds.) (2022). Sustainability Accounting and Accountability, 3rd Edn. New York, NY: Routledge.

Lueg, K., and Lueg, R. (2021). Deconstructing corporate sustainability narratives: a taxonomy for critical assessment of integrated reporting types. Corporate Soc. Respons. Environ. Manag. 28, 1785–1800. doi: 10.1002/csr.2152

Mans-Kemp, N., and van der Lugt, C. T. (2020). Linking integrated reporting quality with sustainability performance and financial performance in South Africa. South Af. J. Econ. Manag. Sci. 23, 1–11. doi: 10.4102/sajems.v23i1.3572

Mhlanga, D. (2022). The role of financial inclusion and FinTech in addressing climate-related challenges in the industry 4.0: lessons for sustainable development goals. Front. Clim. 4, 9178. doi: 10.3389/fclim.2022.949178

Montecalvo, M., Farneti, F., and De Villiers, C. (2018). The potential of integrated reporting to enhance sustainability reporting in the public sector. Public Money Manag. 38, 365–374. doi: 10.1080/09540962.2018.1477675

Mori, R., Best, P. J., and Cotter, J. (2014). Sustainability reporting and assurance: a historical analysis on a world-wide phenomenon. J. Business Ethics 120, 1–11. doi: 10.1007/s10551-013-1637-y

Napier, C. J., and Stadler, C. (2020). The real effects of a new accounting standard: the case of IFRS 15 Revenue from Contracts with Customers. Account. Business Res. 50, 474–503. doi: 10.1080/00020201770933

Nowell, L. S., Norris, J. M., White, D. E., and Moules, N. J. (2017). Thematic analysis: striving to meet the trustworthiness criteria. Int. J. Qual. Methods 16, 3847. doi: 10.1177./1609406917733847

Pigatto, G., Cinquini, L., Dumay, J., and Tenucci, A. (2023). A critical reflection on voluntary corporate non-financial and sustainability reporting and disclosure: lessons learnt from two case studies on integrated reporting. J. Account. Org. Change 19, 250–278. doi: 10.1108/JAOC-03-2022-0055

Pitrakkos, P., and Maroun, W. (2020). Evaluating the quality of carbon disclosures. Sustain. Account. Manag. Policy J. 11, 81. doi: 10.1108./SAMPJ-03-2018-0081

Reuter, M., and Messner, M. (2015). Lobbying on the integrated reporting framework: an analysis of comment letters to the 2011 discussion paper of the IIRC. Account. Audit. Account. J. 28, 365–402. doi: 10.1108/AAAJ-03-2013-1289

Rossi, A., and Luque-Vílchez, M. (2020). The implementation of sustainability reporting in a small and medium enterprise and the emergence of integrated thinking. Meditari Account. Res. 29, 966–984. doi: 10.1108/MEDAR-02-2020-0706

Slack, R., and Campbell, D. (2016). Meeting Users' Information Needs: The Use and Usefulness of Integrated Reporting. Available online at: https://www.Users/mhvanwyk/Downloads/pi-use-usefulness-ir.pdf (accessed February 5, 2023).

Stacchezzini, R., Florio, C., Sproviero, A. F., and Corbella, S. (2023). Reporting challenges and organisational mechanisms of change: a Latourian perspective on risk disclosure of a pioneer company in integrated reporting. J. Account. Orga. Change 19, 226–249. doi: 10.1108/JAOC-05-2021-0064

TCFD (2017). Recommendations of the Task Force on Climate-related Financial Disclosures. Available online at: https://www.fsb-tcfd.org/recommendations/ (accessed June 26, 2023).

Terblanche, W., and De Villiers, C. (2019). The influence of integrated reporting and internationalisation on intellectual capital disclosures. J. Intellectual Cap. 20, 40–59. doi: 10.1108/JIC-03-2018-0059

Value Reporting Foundation (2021). IFRS Foundation announces International Sustainability Standards Board. Available online at: https://www.valuereportingfoundation.org/news/ifrs-foundation-announcement/ (accessed May 5, 2022).

Vitolla, F., and Raimo, N. (2018). Adoption of integrated reporting: reasons and benefits—A case study analysis. Int. J. Business Manag. 13, 244. doi: 10.5539/ijbm.v13n12p244

Vitolla, F., Salvi, A., Raimo, N., Petruzzella, F., and Rubino, M. (2020). The impact on the cost of equity capital in the effects of integrated reporting quality. Busin. Strat. Environ. 29, 2384. doi: 10.1002./bse.2384

WEF (2023). World Economic Forum and ISSB Partner to Compile Learnings on Early Sustainability Reporting Efforts. Available online at: https://www.weforum.org/press/2023/06/world-economic-forum-and-issb-partner-to-compile-learnings-on-early-sustainability-reporting-efforts (accessed July 16, 2023).

Keywords: stakeholders, integrated reporting, integrated thinking, <IR> framework, IFRS S1, International Sustainability Standards Board, sustainability, sustainability reporting

Citation: van Wyk M and Els G (2023) The relevance of integrated reporting in future standard setting of the International Sustainability Standards Board. Front. Sustain. 4:1218985. doi: 10.3389/frsus.2023.1218985

Received: 08 May 2023; Accepted: 07 August 2023;

Published: 04 September 2023.

Edited by:

Ateekh Ur Rehman, King Saud University, Saudi ArabiaReviewed by:

M. Suresh, Amrita Vishwa Vidyapeetham University, IndiaMuhammad Farooq, University of Engineering and Technology, Lahore, Pakistan

Copyright © 2023 van Wyk and Els. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Milan van Wyk, bWh2YW53eWtAdWouYWMuemE=

†These authors have contributed equally to this work and share senior authorship

Milan van Wyk

Milan van Wyk Gideon Els†

Gideon Els†