95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

SYSTEMATIC REVIEW article

Front. Sustain. , 21 September 2022

Sec. Quantitative Sustainability Assessment

Volume 3 - 2022 | https://doi.org/10.3389/frsus.2022.920955

This article is part of the Research Topic Sustainametrics - Envisioning a Sustainable Future with Data Science View all 16 articles

Alexander R. Keeley1,2*

Alexander R. Keeley1,2* Andrew J. Chapman3

Andrew J. Chapman3 Kenichi Yoshida1

Kenichi Yoshida1 Jun Xie1

Jun Xie1 Janaki Imbulana1

Janaki Imbulana1 Shutaro Takeda2

Shutaro Takeda2 Shunsuke Managi1,2

Shunsuke Managi1,2During the past two decades, the world has seen exponential growth in the number of companies reporting environmental, social, and governance (ESG) data, and various ESG metrics have been proposed and are now in use. ESG metrics play a crucial role as an enabler of investment strategies that consider ESG factors, which are often referred to as “ESG investments”. The ESG metrics and investment market are evolving rapidly, as investors, corporations, and the public are giving more priority to the “S” in ESG, including social equity issues, such as diversity, income inequality, worker safety, systemic racism, and companies' broader role in society. In this critical, systematic review, utilizing in-depth assessments, we investigate and compare the approaches employed in major ESG metrics and studies, then, we shed light on the “S” aspect by reviewing existing approaches used to assess social equity to clarify commensurability with ESG. Through the systematic review, this paper confirms that ESG investments can be expected to provide stable and high returns especially over the long term. This paper also clarifies how elements considered in social equity studies are largely reflected in major ESG metrics.

Environmental, social, and governance (ESG) investment has become an opportunity for businesses to tap into the growing social demand for lasting change and the emerging ESG market. According to a report by the Global Sustainable Investment Alliance (Global Sustainable Investment Alliance, 2021), total global ESG investments in 2020 reached $35.3 trillion, which is an increase of 15% from 2018 and 55% from 2016. The $35.3 trillion figure represents 35.9% of the $98.4 trillion in assets managed by all of the institutional investors surveyed1. A comprehensive literature review by Camilleri (2020) confirms that the providers of financial capital are increasingly allocating funds toward positive impact and sustainable investments. Because of the growth in environmental and ethical consciousness, both consumers and investors want companies to consider these values. And the growth in such demand increases the importance of developing sound ESG metrics to evaluate ESG activities. As shown by the recent adoption of a proposal for a Directive on corporate sustainability due diligence by the European Commission on February 23, 2022 that aims to foster not just environmentally but also socially responsible corporate behavior throughout global value chains, investors, corporations, and the public are giving more priority to the “S” in ESG, including social equity issues, such as diversity, income inequality, worker safety, systemic racism, and companies' broader role in society. Despite the growing importance of ESG metrics and social aspects of ESG, there is a lack of academic scholarship investigating the commensurability of these metrics, and especially how important social elements are reflected in these metrics.

In recent years, there has been a growing awareness of the problem of the disarray of standards for disclosing ESG information, which is important in assessing the ESG initiatives of companies. The main disclosure standards for ESG information vary, depending on the purpose of the disclosure, such as the areas to be disclosed, whether it is principle or detailed based, the assumed stakeholders, disclosure channels, principles to be followed, and disclosure items. There has been a move toward the unification of standards, including a joint statement by standard-setting bodies and a proposal by the International Financial Reporting Standards Foundation to set sustainability reporting standards. Many studies have critiqued the lack of common theorization and commensurability among the ESG metrics mainly used in the market (Chatterji et al., 2016). Some studies have pointed out that the divergence of ESG ratings is mostly due to the differences in the scope, measurement, and weights of the metrics (Berg et al., 2022), but a critical analysis of ESG metrics and studies that have employed the metrics is required to solve the lack of common theorization and commensurability. We conduct this critical analysis in this study through a systematic review and a detailed examination of ESG metrics, and we investigate and compare the assessment approaches employed in the major ESG metrics and studies. Through the systematic review, we also examine the impact of ESG performance on financial performance and how the results differ among studies using different ESG metrics for the analyses. Additionally, to further examine how the major ESG metrics incorporate important social elements, we shed light on the “S” aspect by reviewing existing approaches used to assess social equity and examine how the elements considered in existing approaches are reflected.

Through the systematic review, this paper confirms that ESG investments can be expected to provide stable and high returns especially over the long term. Regarding the commensurability of the metrics, based on accessible methodology descriptions for four leading ESG metrics widely used in academic research, and business, this paper finds that the elements assessed have a significant divergence across the metrics: only four elements are common among all four ESG metrics, with the ratios of exclusive elements being 37.3, 38.1, 4.4, and 7.1% for the four metrics. This paper also clarifies how the elements considered in the social equity studies are reflected in the major ESG metrics. Some of the common factors that we find in the studies that evaluated social equity quantitatively are the concept of employment, such as relations, unemployment ratios and age groups, as well as income and education, which are also important elements in ESG metrics (e.g., gender balance, salary, and training). This paper also clarifies that access is a factor that can be quantified and used frequently in social equity studies, including access to energy, transportation, and essential facilities, whereas quantifying access is hardly observed in the major ESG metrics. The results of this paper contribute to advancing the research community's and practitioners' knowledge by providing a detailed examination of commensurability of the major ESG metrics, and how the ESG metrics capture important social elements.

The remainder of this paper is structured as follows. Section Systematic review of the literature that has employed ESG metrics provides the results of the systematic review of the ESG and social equity literature. Section ESG metrics and social equity: A closer look at the methodology and elements assessed provides a closer look at the major ESG metrics and critical elements of social equity studies. The discussion and conclusions, which are based on the systematic review and a detailed examination of the elements assessed, are presented in Section Discussion and conclusion.

This section provides the result of the systematic review of the ESG and social equity literature to capture the trends in the literature, such as investigated issues, geographical region, industries, and research fields.

The ESG articles reviewed in this study are collected from Scopus, Thomson Reuters' Web of Science, and the top-ranked journals in finance. Considering the fact that ESG studies have been increasingly undertaken in the past decades, we set the search period from January 1, 2000 to December 31, 2021. Following the keywords in previous systematic reviews, the keywords of the ESG topic include “CSR,” “corporate social responsibility,” “ESG,” and “environmental social* governance” (Kong et al., 2020; Widyawati, 2020), where the * stands for any other patterns of the word. The keywords of the ESG database include “MSCI,” “KLD,” “Kinder Lydenberg Domini,” “Refinitiv,” “Thomson Reuters Asset4,” “Bloomberg,” “FTSE Russell,” and “Arabesque S-Ray,” which are the major ESG data providers in the global market (Escrig-Olmedo et al., 2019). Keywords of financial performance that usually appear in the literature include “CFP,” “financial performance,” “stock return,” “ROA,” “ROE,” and “Tobin's Q.” We perform two search strategies in both Scopus and Web of Science2. Strategy 1 is keywords of ESG topic and financial performance, and Strategy 2 is keywords of ESG topic and ESG database. After filtering research articles in English and highly cited or hot papers on the Web of Science, Strategy 1 found 90 results, and Strategy 2 found 18 results. Moreover, after combining Strategies 1 and 2, 932 results were found on Scopus. We then searched for papers in the top-ranked journals in finance (Journal of Banking and Finance, Journal of Corporate Finance, Journal of Finance, Journal of Financial Economics, and Review of Financial Studies) to supplement the results from Scopus and Web of Science. This screening process was conducted by one author and verified by another author.

Figure 1 presents the screening procedure, starting from original articles in Scopus, Web of Science, and top-ranked journals in finance. After removing duplicated articles, we identified 1,293 articles. We manually checked all articles to filter out empirical studies that used the ESG database we are focusing on, and we had 239 articles. Figure 2 presents the number of publications in the selected empirical studies. Most of the studies that used ESG metrics were in the field of corporate finance, followed by specialized CSR journals. We then listed studies that discussed the impact of ESG activities on corporate financial performance. ESG activities are proxied by ESG scores or any specific ESG indicators in the ESG databases. Corporate financial performance is proxied by ROA, ROE, Tobin's Q, and other indicators of market return. After excluding studies that are not our focus, the final sample is 80 articles.

Regarding the social equity literature, following the review process for the ESG literature, the articles reviewed are from Scopus and Thomson Reuters' Web of Science, with the search period set from January 1, 2000 to December 31, 2021. As one of the main objectives of this study is to investigate how the elements considered in social equity evaluation studies are reflected in major ESG metrics, the keywords for this systematic review are “social equity,” “assessment/evaluation,” and “quantitative.” The screening procedure is presented in Figure 3. Initially, there were 29 papers from the Web of Science and 170 papers from Scopus. After dropping duplicates, we obtained 172 articles. To identify papers with high impact, we employed a selection strategy where the databases were grouped by publication year—Group 1 ends in 2015; Group 2 is from 2016 to 2020, and Group 3 is 2021. In Group 1, papers whose citation count is less than the 50% average level are excluded. In Group 2, papers whose citation count is less than the 25% level are excluded. Regarding papers in 2021, all articles reflected the time-function nature of citations. After filtering out using our citation count quota approach, 128 articles were left. Finally, after excluding studies that did not focus on social equity evaluation, we had 24 articles and 26 case studies for the review.

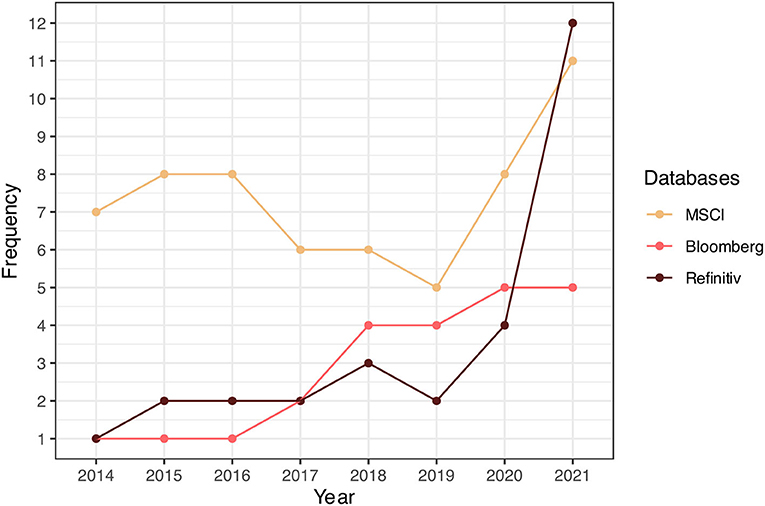

Based on the final articles selected from 2014 to 2021, we review how the conclusions and implications change across different topics and databases. Figure 1 depicts how the frequency of using ESG metrics increased in the reviewed period. Three databases that are mostly used in the literature are MSCI, Bloomberg, and Refinitiv. The number of publications increased in 2014 after MSCI's ESG database became available and kept growing in subsequent years. Initially, MSCI's ESG database was the most used. However, the number of studies that use Refinitiv's ESG database surged in 2021, becoming comparable to that of MSCI's ESG database. The use of Bloomberg's ESG database had a steady growth in the past 5 years (Figure 4).

Figure 4. The frequency of using ESG metrics in reviewed papers. This figure shows the frequency of using ESG databases from 2014 to 2021. There are several studies using multiple databases.

Table 1 presents four panels that focus on different topics about the effect of ESG factors on corporate performance. In all panels, ESG factors (overall or each factor) are used as independent variables. Table 1A summarizes studies that used accounting measures, such as ROA, ROE, and EBITDA, as dependent variables; Table 1B summarizes studies that used market evaluation Tobin's Q, that is, firm value as dependent variables; Table 1C summarizes studies that used stock return as dependent variables; Table 1D summarizes studies that used the cost of capital and risk indicators as dependent variables.

We now discuss the systematic review results. Table 1 uses the notation “positive (negative),” “mostly positive (negative),” “partially positive (negative),” “mixed,” or “not significant” for the conclusion of each study. Most of the studies considered in this systematic review estimated the relationship between dependent and independent variables multiple times under various models, with minor changes, to test for robustness. In Table 2, positive (negative) means that a “positive (negative)” coefficient value is observed in all the estimation models in each of the papers. In addition, “mostly” indicates a case in which most of the estimation models are positive (negative), whereas “partially” indicates a case in which positive (negative) results are reported in a few of the estimation models. However, “mixed” refers to cases where the study had different trends (positive and negative) depending on the estimation model. The square frames in Table 2 mean that the enclosed variables are estimated using the same formulas, and the variables enclosed in this square frame contain interaction terms. In this study, to simplify the discussion, the results are considered “mixed” even when the variables in the framework lack consistent trends (positive and negative) due to the influence of specific elements. In addition, for independent variables, most of the studies employed variables in which the greater the value, the higher the degree of ESG management. In contrast, some studies used non-ESG management variables (e.g., CSR concern, negative CSR, toxic firm dummy, and SIN stock), where the greater the value, the lower the degree of ESG management. Finally, the following discussion captures the whole trend of individual papers. If the same study reports both positive and negative trends, we count it as mixed. For studies that report both positive (negative) and non-significant trends, we count them as positive (negative). However, studies that employ more than two ESG metrics are excluded from the count. We also present the results of the reviewed studies on selected dependent variables in the form of heatmaps in Figure 5 (ROA, ROE, and EBITDA), Figure 6 (Stock Return), and Figure 7 (Tobin's Q). To show the trend in more simple way, “mostly positive” and “partially positive” results are presented as positive in the heatmaps and “mostly negative” and “partially negative” are presented as negative, while in the case of “mixed”, one count is added to both positive and negative. The heatmaps presents the breakdown of the results by showing the count for ESG, E, S, G (and the combinations) as explanatory variables.

Regarding the relationship between ESG and profitability (see Table 1A; Figure 5), the results are mixed. We find that seven studies used Bloomberg as ESG metrics, among which three studies reported a positive relationship; one study found a non-significant relationship; two studies reported a mixed relationship, and one study reported a negative relationship. Similarly, seven studies used Refinitiv or Asset4 as ESG metrics, among which four studies reported a positive and significant trend, two mixed, and one negative. However, 17 studies used MSCI or KLD as ESG metrics, among which four studies suggested a negative relationship; nine studies suggested a positive relationship, and the remaining four studies found a mixed relationship. From the heatmap, we can observe that for ROA, ROE, and EBITDA “Positive” ≥ “Nagative” holds in all of the cases except for EBITDA with overall ESG score as explanatory variable. However, there are still statistically non-significant results and negative results that cannot be neglected. Thus, in the short term, it is hard to prove the positive effects of ESG factors on profitability.

Regarding Tobin's Q (see Table 1B; Figure 6), the studies revealed that ESG factors have a positive effect on firm value. Among the 20 studies that used MSCI and KLD as ESG metrics, all reported positive trends, except for six studies that reported a mixed result. This trend is also similar for studies that used Bloomberg, Refinitiv, and Thomson Reuters' Asset4 as ESG metrics, which generally confirms a positive direction, except for two studies that did not find statistical significance and five studies that reported a mixed trend. Figure 6 shows that “Positive” > “Nagative” holds in all of the cases. Therefore, regardless of the type of ESG metrics for Tobin's Q, it is confirmed that the most recent studies report a positive direction. In summary, ESG factors are found to have robust and positive effects on corporate performance in the long term.

Table 1C summarizes the effect of ESG factors on stock return. Refinitiv's Thomson Reuters Asset4 was used in five studies, among which three reported a positive direction; one suggested a mixed trend, and one did not find any significant result. However, 12 studies used MSCI and KLD as ESG metrics, among which seven reported positive effects; two reported a negative result; two suggested a mixed trend, and the remaining one reported a non-significant relationship. Based on these results, studies that used Refinitiv's Thomson Reuters Asset4 tend to have positive results, whereas those that used MSCI and KLD found more complicated results. From the heatmap, as shown in Figure 7, “Positive” ≥ “Negative” holds in most of the cases. However, the impact of ESG factors on stock returns naturally depends on the research period, samples, and other environmental factors. In Table 1C, studies that used interaction models mostly had complicated results, indicating the external contingency of ESG factors. Some studies focused on the time trend of negative shocks to the stock prices of many firms, but it is not necessary to compare this in an analysis that focuses on normal stock returns. We recognize these limitations, but we do not generalize and make comparisons for discussion.

Regarding the cost of equity and other risks (see Table 1D), the studies revealed a negative trend, which means that ESG factors are effective in reducing financial risk and cost. In the 12 studies that used MSCI and KLD as ESG metrics, almost all of them reported negative trends, except one study that reported a positive trend and another study that did not find statistical significance. This trend is also similar in the case of studies that used Bloomberg, Refinitiv, and Thomson Reuters Asset4 as ESG metrics, which generally found a negative direction, except one study that reported a mixed trend. Therefore, regardless of the type of ESG metrics employed, most recent studies have reported a negative effect, implying that engaging in ESG activities leads to robust and favorable results. If other conditions, such as free cash flow, are constant, the lower the value of the cost of capital, the greater the firm's value. Therefore, the robust trends observed in Tables 1B,D can be interpreted as an improvement in the firm's value assessment as a result of risk reduction due to ESG management.

Regarding social equity studies, based on articles selected from 2013 to 2021, we review the investigated issues, critical factors, geographical regions, and research fields, as presented in Table 3. Compared with qualitative theoretical analysis, quantitative analysis of social equity is a relatively new research area. The reviewed articles mostly appeared in the last 5 years. Social equity issues have been discussed worldwide, and quantitative analysis has been applied to a number of case studies in both developed and developing countries and regions.

In terms of the research field, social equity issues in transportation are the most studied topics. Accessibility of horizontal and vertical equity was used as an indicator to assess the extent to which residents can access the job market (El-Geneidy et al., 2016) and facilities (Yuan et al., 2017; Chen et al., 2018; Guo et al., 2020), as well as to discuss transportation design problems (Caggiani et al., 2017; Ruiz et al., 2017; Camporeale et al., 2019; Henke et al., 2020). Regarding transdisciplinary fields, social equity estimation is an essential part of the social sustainability index (Shaker and Sirodoev, 2016; Silva et al., 2018; Larimian and Sadeghi, 2021). Income gap has also been used as an indicator of social equity (Kangmennaang et al., 2017; Su et al., 2017). Regarding environmental issues, some studies have investigated the dissimilarity in costs or benefits and natural resources among different entities or protected areas (Halpern et al., 2013; Gurney et al., 2015) and constructed a social equity score that integrates energy issues (Chapman et al., 2021). Section Social equity will discuss the critical factors used in social equity evaluation in detail.

This section first provides the details of the ESG metrics, with a brief background, methodology, and composition of the elements assessed. Then, the details of social equity evaluation studies are presented using the same procedure.

Corporate sustainability reporting and rating, which are expected to impact individual corporations' behavior, surged in the last two decades (Scalet and Kelly, 2010). However, compared with financial reporting, which has a long history of evolution, it is still in its infancy (Tschopp and Huefner, 2015). Marlin and Marlin (2003) noted that the first phase of the corporate sustainability report in the 1970s and 1980s only focused on environmental management. Since then, CSR reporting has developed to involve multiple stakeholders and provide verifiable materials from the social auditor (the second phase is the 1990s) and has met third-party global reporting standards (the third phase is the 2000s) (Marlin and Marlin, 2003). Since then, various corporate sustainability reporting tools, such as frameworks (principles, initiatives, or guidelines) and standards, have been widely applied to evaluate corporations' efforts to achieve sustainability (Siew, 2015). Many ESG rating agencies assess corporate sustainability based on the disclosed CSR reports and provide rating reports for multiple stakeholders. In the last 10 years, new criteria have been added to the assessment models, remarkably enhancing the accuracy and robustness of ESG ratings (Escrig-Olmedo et al., 2019).

Many studies have critiqued the low convergence of ESG ratings and called for being cautious about drawing conclusions based on these ratings (Siew, 2015; Chatterji et al., 2016; Berg et al., 2022). The main problems are the lack of common theorization (different definitions of good CSR) and commensurability (different measurements) (Chatterji et al., 2016). The scope, measurement, and weights contribute to the divergence of ESG ratings (Berg et al., 2022). Moreover, only a few ESG rating agencies disclose the details of their evaluating criteria and methods, leaving a black box in the ratings. Therefore, a universal ESG accounting standard with “dynamic materiality” is needed (Eccles and Mirchandani, 2022). Based on the accessible information about the rating methods and the elements assessed, we investigate four leading ESG databases widely used in academic research, investment, and business—Thomson Reuters' Refinitiv, MSCI, Bloomberg, and Arabesque S-Ray.

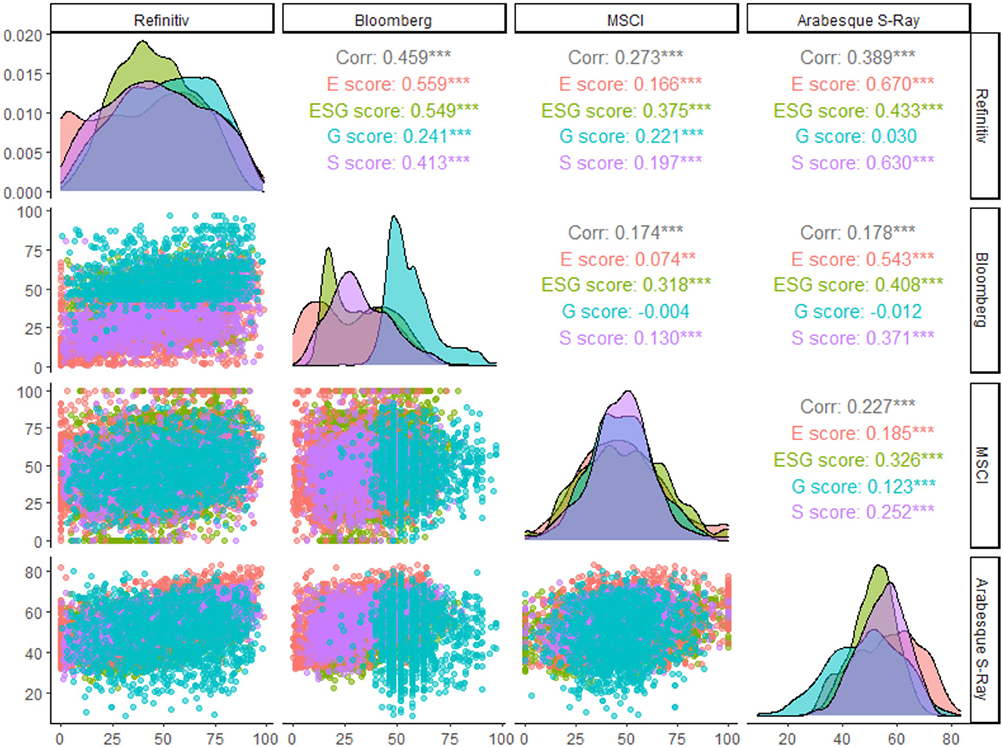

We first looked at how the ESG rating results correlate across the four databases and discuss the similarities and differences in the methodology and elements assessed in detail. Figure 8 depicts the distribution of ESG scores in each database and the correlation of scores based on the dataset in 2019. The ESG scores and the scores of the components (E, S, and G) in the MSCI database have similar distributions, which are close to a normal distribution. However, the distribution in Bloomberg's ESG database varies, with a higher average G score and a lower average E score. As for Refinitiv's ESG ratings, the G score has a right-skewed distribution, whereas the others skew to the left to different extents. The scores of ESG components in S-Ray have right-skewed distributions. As noted in previous studies, the four investigated databases have low correlations. Most of the correlation coefficients are <0.5, ranging from −0.012 to 0.670. The correlations of integrated ESG scores range from 0.318 (MSCI and Bloomberg) to 0.549 (Refinitiv and Bloomberg). Regarding the ratings of ESG components, it is hard to find strong correlations between these databases. Regarding the E and S scores, MSCI ratings have the lowest correlation with the other three databases. Compared with those of E and S scores, the correlations of G scores are weaker and even insignificant between MSCI and Bloomberg, S-Ray and Reginitiv, as well as S-Ray and Bloomberg. We assume that the inconsistency between these ratings is due to the different methodologies and elements assessed, which will be discussed in the following parts.

Figure 8. Correlation between ESG scores across different databases. This figure is based on the four databases in 2019.

In Table 2, we summarize the methodology of the four ESG databases. The final ESG ratings range from 0 to 100 points, except for MSCI, which uses 10 points as the maximum. In addition to ESG scores, Refinitiv and MSCI also provide concise and explicit ESG grade evaluations. The assessments are usually based on information individual firms disclose. Except Bloomberg, the other raters utilize media sources to construct controversies to adjust the final ESG ratings. All the four databases have a global coverage of at least 8,000 firms. Bloomberg's ESG scores are updated annually. Refinitiv and MSCI's ESG scores are updated monthly, and S-Ray's ESG score is updated daily.

Here, we follow the framework in previous studies to discuss the purpose of the evaluation (the scopes) and the rating procedure (the measures), including the method and weight (Chatterji et al., 2016; Berg et al., 2022). The purpose of the evaluation reflects how the rater defines good CSR, i.e., the theorization or scope of the assessment. In the four databases, there are mainly two directions in determining what is good CSR—information transparency and CSR performance. Bloomberg's disclosure score treats the transparency of ESG information as the most vital factor of CSR. Thus, for Bloomberg's ESG scores, higher information disclosure leads to higher rating results, without accounting for performance. Both MSCI and S-Ray's ESG ratings aim to assess performance in terms of ESG issues but from different perspectives. MSCI's ESG scores tend to evaluate the management's capability in handling both risks and opportunities. S-Ray's ESG scores account for performance, considering both long-term and short-term risks and opportunities, and the evaluation is conducted daily. Refinitiv's ESG scores evaluate both disclosure rate and relative performance among peers.

Regarding the rating process, there is no fully disclosed methodology information in these databases. Based on the accessible materials on methodology, we summarize some of the features as follows. Refinitiv has the advantage of a clear and verifiable method, as the assessment is entirely data-driven without any human intervention. Bloomberg's ESG scores only consider the degree of information disclosure, which makes the rating easy to understand and straightforward. However, MSCI's ESG scores reflect a more subjective assessment by specialists and analysts, which involves highly professional views, but the assessment is not easily understandable by users. S-Ray's ratings aim to seek a balance by combining a semi data-driven evaluation and human intervention. Regarding the weights, Refinitiv's ratings conduct inter- and intra-industry adjustment, which is a fully data-driven process that takes time. The industry classification is based on The Refinitiv Business Classifications. MSCI and Bloomberg's ratings are adjusted based on the Global Industry Classification Standard. Notably, MSCI's ratings are adjusted for risk or opportunities in each element assessed. Thus, the ratings in MSCI are not only a relative peer comparison but also an evaluation of firms' management capability in handling potential risks and opportunities.

Before comparing the detailed elements assessed, it is essential to note that the structures of ESG scores also vary across each database, as presented in Table 4. The main difference is categorizing the elements under the E, S, and G pillars. In the E pillar, the common categories are resource, emission, and innovation. Although it is given different names, all the three databases have these categories. In addition, pollution and waste are also evaluated in MSCI and S-Ray's ESG database. S-Ray also provides “environmental stewardship” and “environmental management” scores. In the S pillar, categories of human resource, community, and product responsibility are common among the three databases. Refinitiv and S-Ray have a category of “human rights,” whereas MSCI provides another category of “stakeholder opposition.” S-Ray's ESG scores provide detailed topics in the S pillar, including diversity, occupational health and safety, training and development, product access, labor rights, and compensation. In terms of the G pillar, a similar category among the three databases is corporate governance or management. Moreover, categories of shareholders, CSR strategy, corporate behavior, and business ethics are provided across the databases.

Based on accessible methodology materials of the four ESG ratings, we collect the elements assessed in each ESG database. The total number of elements assessed in all the four databases is 842. The elements assessed have a significant divergence across the four databases. The Venn diagram of Figure 9 compares all the elements assessed, in which only four elements are common among all the four ESG ratings. The ratios of exclusive elements are 37.3% in Refinitiv's ESG scores, 38.1% in MSCI's ESG scores, 4.4% in S-Ray's ESG scores, and 7.1% in Bloomberg's ESG scores. Regarding the social aspect, there are 281 total elements across the four databases, which is 33.4% of all the ESG elements. Surprisingly, there are no common items in all the databases. The number of social elements in Bloomberg and S-Ray is much less than that in Refinitiv and MSCI. The observed significant divergence in the assessed elements across the four databases emphasizes the importance of developing a universal ESG accounting standard with “dynamic materiality”, elaborated by Eccles and Mirchandani (2022).

Here, when we refer to social equity, we are referring to a metric used to evaluate the equitability of various energy and environment issues, as well as the social aspects of sustainability. Energy-related social equity has its roots in the energy justice movement, which is based on environmental justice (Pettit, 2004) and climate justice (Bulkeley et al., 2013), focusing on energy issues and environmental benefits (Jenkins, 2018). Energy justice focuses on three key tenets—distributional justice (the distribution of costs and benefits), recognition justice (identifying who benefits or is burdened), and procedural justice [open access and engagement in policy decision-making processes (Jenkins et al., 2016)]. Social equity evaluations have been used for energy policy, energy emissions, energy law, energy finance, climate policy, and, most recently, energy transitions (McCauley and Heffron, 2018; Chapman et al., 2019).

Regarding energy-related sustainability evaluations, most of the studies focused on the more easily quantified environmental and economic aspects, or when considering social equity, they place more emphasis on qualitative rather than quantitative factors (Evans et al., 2009; Chapman et al., 2016).

In studies that evaluate sustainability and social equity quantitatively, a number of common factors come to the fore. Among them is the concept of employment, including relations (Valizadeh and Hayati, 2021), unemployment ratios and age groups (Farber et al., 2014; El-Geneidy et al., 2016; Caggiani et al., 2017; Yuan et al., 2017; Camporeale et al., 2019; Emrich et al., 2020; Chapman et al., 2021), and how different policies and technological shift affect employment outcomes. Moreover, income and education, which are often closely correlated, are also considered important in the literature (Farber et al., 2014; Oswald Beiler and Mohammed, 2016; Silva et al., 2018; Shigetomi et al., 2020; Chapman et al., 2021). Access is another factor of social equity that can be quantified, including access to energy, transportation, and essential facilities (Farber et al., 2014; Shigetomi et al., 2020; Chapman et al., 2021; Larimian and Sadeghi, 2021). Furthermore, recognizing that there is often a gap not only between nations but also within nations, some studies also investigate the urban–rural divide and the gaps between genders and different age groups (Farber et al., 2014; Oswald Beiler and Mohammed, 2016; Ruiz et al., 2017; Su et al., 2017; Yuan et al., 2017; Chen et al., 2018; Silva et al., 2018; Guo et al., 2020; Karakoc et al., 2020). Generally, the literature includes distributive, recognition, and procedural aspects of social equity evaluations, with some focusing on this aspect quantitatively (Bennett et al., 2020). As the concept of social equity is still in its nascent phase, the overlap of concepts is not consistent, and to enable quantitative evaluations of social aspects, economic and environmental factors are co-opted when considered socially important.

From a regional perspective, Europe is strongly represented in the literature along with the United States and with some case studies on Southeast Asia. Global studies are only beginning to emerge in the most recent literature, which is largely due to the relatively recent emergence of concepts and data limitations.

As the ESG market is expanding rapidly, with total global ESG investments of $35.3 trillion in 2020, ESG rating providers play an increasingly important role in the investment process through their assessments of companies across various ESG metrics. However, the lack of common theorization (different definitions of good CSR) and commensurability (different measurements), which has been pointed out in various studies (Chatterji et al., 2016) and examined in detail in this paper, highlights the improvements required in the field of ESG assessment to provide clear and transparent information to investors and to reduce confusion among companies that are trying to enhance their ESG performance.

Considering the effect of ESG factors on corporate performance, in summary, we find that the overall trend of the short-term effect on profitability is unclear. The effect on ROA or ROE is still far from conclusive. In terms of stock return, the results vary, as they utilize different ESG metrics. Multiple factors, such as samples from different markets and periods, could also be a reason for the inconsistent results. However, most of the current ESG evaluations do not reflect the financial impact, accounting measures, and short-term market returns sufficiently. The trend is robust and favorable when testing the effect on Tobin's Q, cost of equity, or other risks, which indicate the nature of ESG activities, thereby enhancing corporate sustainability in the long term. Although it is out of scope of this paper, future research could focus on the difference between ESG metrics and conduct an in-depth analysis of the metrics that impact upon financial outcomes.

To have a closer look at the ESG metrics, we first investigate how the results of the ESG ratings correlate across the four widely used databases (Thomson Reuters' Refinitiv, MSCI, Bloomberg, and Arabesque S-Ray). The results reveal that the four investigated databases have low correlations, with the correlations of integrated ESG scores ranging from 0.318 (MSCI and Bloomberg) to 0.549 (Refinitiv and Bloomberg). Moreover, regarding the ratings of the ESG components, it is also difficult to find strong correlations between these databases. Based on the accessible methodology materials of the four ESG ratings, we also collect the elements assessed in each ESG database and present the significant divergence of the elements assessed across the four databases. The ratios of exclusive elements are 37.3% in Refinitiv's ESG scores, 38.1% in MSCI's ESG scores, 4.4% in S-Ray's ESG scores, and 7.1% in Bloomberg's ESG scores. Regarding the social aspect, there are 281 elements in all the four databases, which is 33.4% of all the ESG elements. There are no common items in all the databases. The number of social elements in Bloomberg and S-Ray is much lower than that of Refinitiv and MSCI. Although the ESG metrics and the investment market are evolving rapidly, with investors, corporations, and the public giving more priority to the “S” in ESG, which includes social equity issues, such as diversity, income inequality, workers' safety, systemic racism, and companies' broader role in society. There is significant divergence among the different ESG databases in the elements assessed under the social category.

To provide a suitable yardstick for the assessment of social aspects, we investigated existing approaches used for social equity evaluations through a systematic review and closely examined the key elements assessed in these studies. Some of the common factors that we find in the studies that evaluated sustainability and social equity quantitatively are the concept of employment, such as relations, unemployment ratios and age groups, as well as income and education, which were also found to be important elements in ESG metrics (e.g., gender balance, salary, and training). In social equity studies, access is a factor which is considered important and which can be quantified, including access to energy, transportation, and essential facilities, whereas quantifying access is rarely observed in the major ESG metrics. Due to the influence of ESG metrics, the differences in the rating methodologies and the level of transparency in the rating decisions, which also incorporate qualitative judgments, are critical to understanding the resilience of the ESG financial intermediation chain. The results of this paper contribute to advancing the research community's and practitioners' knowledge by providing a detailed examination of commensurability of major ESG metrics, and whether these ESG metrics capture critical social elements. Furthermore, the results of this paper reveals the importance of promoting the transparency and comparability of scoring methodologies of established ESG rating providers and indices, as well as highlighting the importance of investigating studies and practices that quantitatively assess sustainability and social equity issues to ensure the overall veracity and quality of ESG metrics, as well as providing some evidence for their future expansion and improvement.

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

AK, AC, KY, JX, JI, and ST carried out the analyses and wrote the manuscript with support from SM. AK and SM supervised the project. All authors contributed to the article and approved the submitted version.

This research is supported by JSPS KAKENHI Grant Number JP20H00648 and the Environment Research and Technology Development Fund (JPMEERF20201001) of the Environmental Restoration and Conservation Agency of Japan.

We would like to thank Mr. Okita and Mr. Ike from Vector Group for providing their insights and expertise on ESG investment market during number of discussions.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Any opinions, findings, and conclusions expressed in this paper are those of the authors and do not necessarily reflect the views of the funding agencies.

1. ^GSIA has surveyed institutional investors in the five regions: Europe; the US; Canada; Australia; NZ; and Japan.

2. ^The search date is January 6th 2022.

Alareeni, B. A., and Hamdan, A. (2020). ESG impact on performance of US S&P 500-listed firms. Corp. Governance Int. J. Bus. Soc. 20, 1409–1428. doi: 10.1108/CG-06-2020-0258

Albarrak, M. S., Elnahass, M., and Salama, A. (2019). The effect of carbon dissemination on cost of equity. Bus. Strategy Environ. 28, 1179–1198. doi: 10.1002/bse.2310

Albuquerque, R., Koskinen, Y., and Zhang, C. (2019). Corporate social responsibility and firm risk: theory and empirical evidence. Manage. Sci. 65, 4451–4469. doi: 10.1287/mnsc.2018.3043

Atif, M., Hossain, M., Alam, M. S., and Goergen, M. (2021). Does board gender diversity affect renewable energy consumption? J. Corp. Financ. 66, 101665. doi: 10.1016/j.jcorpfin.2020.101665

Avramov, D., Cheng, S., Lioui, A., and Tarelli, A. (2021). Sustainable investing with ESG rating uncertainty. J. Financ. Econ. 145, 642–664 doi: 10.1016/j.jfineco.2021.09.009

Bae, K.-H., El Ghoul, S., Gong, Z., and Guedhami, O. (2021). Does CSR matter in times of crisis? Evidence from the COVID-19 pandemic. J. Corp. Financ. 67, 101876. doi: 10.1016/j.jcorpfin.2020.101876

Bardos, K. S., Ertugrul, M., and Gao, L. S. (2020). Corporate social responsibility, product market perception, and firm value. J. Corp. Financ. 62, 101588. doi: 10.1016/j.jcorpfin.2020.101588

Bátae, O. M., Dragomir, V. D., and Feleagá, L. (2021). The relationship between environmental, social, and financial performance in the banking sector: a European study. J. Clean. Prod. 290, 125791. doi: 10.1016/j.jclepro.2021.125791

Becchetti, L., Ciciretti, R., and Hasan, I. (2015). Corporate social responsibility, stakeholder risk, and idiosyncratic volatility. J. Corp. Financ. 35, 297–309. doi: 10.1016/j.jcorpfin.2015.09.007

Bennett, N. J., Calò, A., Di Franco, A., Niccolini, F., Marzo, D., Domina, I., et al. (2020). Social equity and marine protected areas: perceptions of small-scale fishermen in the Mediterranean Sea. Biol. Conserv. 244, 108531. doi: 10.1016/j.biocon.2020.108531

Berg, F., Koelbel, J., and Rigobon, R. (2022). Aggregate confusion: The divergence of ESG ratings. Review of Finance. 2022:rfac033. doi: 10.1093/rof/rfac033

Bhandari, A., and Javakhadze, D. (2017). Corporate social responsibility and capital allocation efficiency. J. Corp. Financ. 43, 354–377. doi: 10.1016/j.jcorpfin.2017.01.012

Boesso, G., Favotto, F., and Michelon, G. (2015). Stakeholder prioritization, strategic corporate social responsibility and company performance: further evidence. Corp. Soc. Respons. Environ. Manage. 22, 424–440. doi: 10.1002/csr.1356

Bolton, P., and Kacperczyk, M. (2021). Do investors care about carbon risk? J. Financ. Econ. 142, 517–549. doi: 10.1016/j.jfineco.2021.05.008

Boone, A., and Uysal, V. B. (2020). Reputational concerns in the market for corporate control. J. Corp. Financ. 61, 101399. doi: 10.1016/j.jcorpfin.2018.08.010

Borghesi, R., Houston, J. F., and Naranjo, A. (2014). Corporate socially responsible investments: CEO altruism, reputation, and shareholder interests. J. Corp. Financ. 26, 164–181. doi: 10.1016/j.jcorpfin.2014.03.008

Bose, S., Minnick, K., and Shams, S. (2021). Does carbon risk matter for corporate acquisition decisions? J. Corp. Financ. 70, 102058. doi: 10.1016/j.jcorpfin.2021.102058

Boubakri, N., Guedhami, O., Kwok, C. C. Y., and Wang, H. (2019). Is privatization a socially responsible reform? J. Corp. Financ. 56, 129–151. doi: 10.1016/j.jcorpfin.2018.12.005

Breuer, W., Müller, T., Rosenbach, D., and Salzmann, A. (2018). Corporate social responsibility, investor protection, and cost of equity: a cross-country comparison. J. Bank. Financ. 96, 34–55. doi: 10.1016/j.jbankfin.2018.07.018

Brogi, M., and Lagasio, V. (2019). Environmental, social, and governance and company profitability: Are financial intermediaries different? Corp. Soc. Respons. Environ. Manage. 26, 576–587. doi: 10.1002/csr.1704

Brower, J., and Dacin, P. A. (2020). An institutional theory approach to the evolution of the corporate social performance – corporate financial performance relationship. J. Manage. Stud. 57, 805–836. doi: 10.1111/joms.12550

Bu, L., Chan, K. C., Choi, A., and Zhou, G. (2021). Talented inside directors and corporate social responsibility: a tale of two roles. J. Corp. Financ. 70, 102044. doi: 10.1016/j.jcorpfin.2021.102044

Buchanan, B., Cao, C. X., and Chen, C. (2018). Corporate social responsibility, firm value, and influential institutional ownership. J. Corp. Financ. 52, 73–95. doi: 10.1016/j.jcorpfin.2018.07.004

Bulkeley, H., Carmin, J. A., Castán Broto, V., Edwards, G. A. S., and Fuller, S. (2013). Climate justice and global cities: mapping the emerging discourses. Global Environ. Change 23, 914–925. doi: 10.1016/j.gloenvcha.2013.05.010

Byun, S. K., and Oh, J.-M. (2018). Local corporate social responsibility, media coverage, and shareholder value. J. Bank. Financ. 87, 68–86. doi: 10.1016/j.jbankfin.2017.09.010

Caggiani, L., Camporeale, R., and Ottomanelli, M. (2017). Planning and design of equitable free-floating bike-sharing systems implementing a road pricing strategy. J. Adv. Transport. 2017, 1–18. doi: 10.1155/2017/3182387

Cahan, S. F., Chen, C., Chen, L., and Nguyen, N. H. (2015). Corporate social responsibility and media coverage. J. Bank. Financ. 59, 409–422. doi: 10.1016/j.jbankfin.2015.07.004

Cai, L., Cui, J., and Jo, H. (2016). Corporate environmental responsibility and firm risk. J. Bus. Ethics 139, 563–594. doi: 10.1007/s10551-015-2630-4

Cai, X., Gao, N., Garrett, I., and Xu, Y. (2020). Are CEOs judged on their companies' social reputation? J. Corp. Financ. 64, 101621. doi: 10.1016/j.jcorpfin.2020.101621

Camilleri, M. A. (2020). The market for socially responsible investing: a review of the developments. Soc. Respons. J. 17, 412–428. doi: 10.1108/SRJ-06-2019-0194

Camporeale, R., Caggiani, L., and Ottomanelli, M. (2019). Modeling horizontal and vertical equity in the public transport design problem: a case study. Transport. Res. Part A Policy Pract. 125, 184–206. doi: 10.1016/j.tra.2018.04.006

Chang, C.-H., Chen, S.-S., Chen, Y.-S., and Peng, S.-C. (2019). Commitment to build trust by socially responsible firms: evidence from cash holdings. J. Corp. Financ. 56, 364–387. doi: 10.1016/j.jcorpfin.2019.03.004

Chapman, A., Fraser, T., and Dennis, M. (2019). Investigating ties between energy policy and social equity research: a citation network analysis. Soc. Sci. 8, 135. doi: 10.3390/socsci8050135

Chapman, A., Shigetomi, Y., Ohno, H., McLellan, B., and Shinozaki, A. (2021). Evaluating the global impact of low-carbon energy transitions on social equity. Environ. Innovat. Societal Trans. 40, 332–347. doi: 10.1016/j.eist.2021.09.002

Chapman, A. J., McLellan, B., and Tezuka, T. (2016). Proposing an evaluation framework for energy policy making incorporating equity: applications in Australia. Energy Res. Soc. Sci. 21, 54–69. doi: 10.1016/j.erss.2016.06.021

Chatterji, A. K., Durand, R., Levine, D. I., and Touboul, S. (2016). Do ratings of firms converge? Implications for managers, investors and strategy researchers. Strategic Manage. J. 37, 1597–1614. doi: 10.1002/smj.2407

Chen, Y, Bouferguene, A., Li, H. X., Liu, H., Shen, Y., and Al-Hussein, M. (2018). Spatial gaps in urban public transport supply and demand from the perspective of sustainability. J. Clean. Prod. 195, 1237–1248. doi: 10.1016/j.jclepro.2018.06.021

Chen, Y., Fan, Q., Yang, X., and Zolotoy, L. (2021). CEO early-life disaster experience and stock price crash risk. J. Corp. Financ. 68, 101928. doi: 10.1016/j.jcorpfin.2021.101928

Cheung, A. (2016). Corporate social responsibility and corporate cash holdings. J. Corp. Financ. 37, 412–430. doi: 10.1016/j.jcorpfin.2016.01.008

Choy, S. K., Lai, T.-K., and Ng, T. (2017). Do tax havens create firm value? J. Corp. Financ. 42, 198–220. doi: 10.1016/j.jcorpfin.2016.10.016

Cornett, M. M., Erhemjamts, O., and Tehranian, H. (2016). Greed or good deeds: An examination of the relation between corporate social responsibility and the financial performance of U.S. commercial banks around the financial crisis. J. Bank. Financ. 70, 137–159. doi: 10.1016/j.jbankfin.2016.04.024

Dai, R., Liang, H., and Ng, L. (2021). Socially responsible corporate customers. J. Financ. Econ. 142, 598–626. doi: 10.1016/j.jfineco.2020.01.003

Devie, D., Liman, L. P., Tarigan, J., and Jie, F. (2020). Corporate social responsibility, financial performance and risk in Indonesian natural resources industry. Soc. Respons. J. 16, 73–90. doi: 10.1108/SRJ-06-2018-0155

Di Ciommo, F., and Lucas, K. (2014). Evaluating the equity effects of road-pricing in the European urban context – The Madrid Metropolitan Area. Appl. Geograp. 54, 74–82. doi: 10.1016/j.apgeog.2014.07.015

Di Giuli, A., and Kostovetsky, L. (2014). Are red or blue companies more likely to go green? Politics and corporate social responsibility. J. Financ. Econ. 111, 158–180. doi: 10.1016/j.jfineco.2013.10.002

Ding, W., Levine, R., Lin, C., and Xie, W. (2021). Corporate immunity to the COVID-19 pandemic. J. Financ. Econ. 141, 802–830. doi: 10.1016/j.jfineco.2021.03.005

Doukas, J. A., and Zhang, R. (2021). Managerial ability, corporate social culture, and M&As. J. Corp. Financ. 68, 101942. doi: 10.1016/j.jcorpfin.2021.101942

Duque-Grisales, E., and Aguilera-Caracuel, J. (2021). Environmental, social and governance (ESG) scores and financial performance of multilatinas: moderating effects of geographic international diversification and financial slack. J. Bus. Ethics 168, 315–334. doi: 10.1007/s10551-019-04177-w

Dutordoir, M., Strong, N. C., and Sun, P. (2018). Corporate social responsibility and seasoned equity offerings. J. Corp. Financ. 50, 158–179. doi: 10.1016/j.jcorpfin.2018.03.005

Eccles, R. G., and Mirchandani, B. (2022). We Need Universal ESG Accounting Standards. Harvard Business Review. Available online at: https://hbr.org/2022/02/we-need-universal-esg-accounting-standards (accessed March 15, 2022).

El Ghoul, S., and Karoui, A. (2017). Does corporate social responsibility affect mutual fund performance and flows? J. Bank. Financ. 77, 53–63. doi: 10.1016/j.jbankfin.2016.10.009

El-Geneidy, A., Levinson, D., Diab, E., Boisjoly, G., Verbich, D., and Loong, C. (2016). The cost of equity: Assessing transit accessibility and social disparity using total travel cost. Transport. Res. Part A Policy Pract. 91, 302–316. doi: 10.1016/j.tra.2016.07.003

Emrich, C. T., Tate, E., Larson, S. E., and Zhou, Y. (2020). Measuring social equity in flood recovery funding. Environ. Hazards 19, 228–250. doi: 10.1080/17477891.2019.1675578

Ertugrul, M., and Marciukaityte, D. (2021). Labor unions and corporate social responsibility. J. Bank. Financ. 125, 106061. doi: 10.1016/j.jbankfin.2021.106061

Escrig-Olmedo, E., Fernández-Izquierdo, M., Ferrero-Ferrero, I., Rivera-Lirio, J., and Muñoz-Torres, M. (2019). Rating the raters: evaluating how ESG rating agencies integrate sustainability principles. Sustainability 11, 915. doi: 10.3390/su11030915

Evans, A., Strezov, V., and Evans, T. J. (2009). Assessment of sustainability indicators for renewable energy technologies. Renewable Sustain. Energy Rev. 13, 1082–1088. doi: 10.1016/j.rser.2008.03.008

Farber, S., Bartholomew, K., Li, X., Páez, A., and Nurul Habib, K. M. (2014). Assessing social equity in distance based transit fares using a model of travel behavior. Transport. Res. Part A Policy Pract. 67, 291–303. doi: 10.1016/j.tra.2014.07.013

Fauver, L., McDonald, M. B., and Taboada, A. G. (2018). Does it pay to treat employees well? International evidence on the value of employee-friendly culture. J. Corp. Financ. 50, 84–108. doi: 10.1016/j.jcorpfin.2018.02.003

Feng, Z.-Y., Chen, C. R., and Tseng, Y.-J. (2018). Do capital markets value corporate social responsibility? Evidence from seasoned equity offerings. J. Bank. Financ. 94, 54–74. doi: 10.1016/j.jbankfin.2018.06.015

Ferrell, A., Liang, H., and Renneboog, L. (2016). Socially responsible firms. J. Financ. Econ. 122, 585–606. doi: 10.1016/j.jfineco.2015.12.003

Gao, L., and Zhang, J. H. (2015). Firms' earnings smoothing, corporate social responsibility, and valuation. J. Corp. Financ. 32, 108–127. doi: 10.1016/j.jcorpfin.2015.03.004

Garel, A., and Petit-Romec, A. (2021). Investor rewards to environmental responsibility: evidence from the COVID-19 crisis. J. Corp. Financ. 68, 101948. doi: 10.1016/j.jcorpfin.2021.101948

Global Sustainable Investment Alliance. (2021). Global Sustainable Investment Review 2020. Available online at: http://www.gsi-alliance.org/wp-content/uploads/2021/08/GSIR-20201.pdf

Griffin, D., Guedhami, O., Li, K., and Lu, G. (2021). National culture and the value implications of corporate environmental and social performance. J. Corp. Financ. 71, 102123. doi: 10.1016/j.jcorpfin.2021.102123

Guo, M., Liu, B., Tian, Y., and Xu, D. (2020). Equity to urban parks for elderly residents: perspectives of balance between supply and demand. Int. J. Environ. Res. Public Health 17, 8506. doi: 10.3390/ijerph17228506

Gurney, G. G., Pressey, R. L., Ban, N. C., Álvarez-Romero, J. G., Jupiter, S., and Adams, V. M. (2015). Efficient and equitable design of marine protected areas in Fiji through inclusion of stakeholder-specific objectives in conservation planning. Conserv. Biol. 29, 1378–1389. doi: 10.1111/cobi.12514

Halpern, B. S., Klein, C. J., Brown, C. J., Beger, M., Grantham, H. S., Mangubhai, S., et al. (2013). Achieving the triple bottom line in the face of inherent trade-offs among social equity, economic return, and conservation. Proc. Nat. Acad. Sci. 110, 6229–6234. doi: 10.1073/pnas.1217689110

Hannah, S. T., Sayari, N., Harris, F. H., de, B., and Cain, C. L. (2021). The direct and moderating effects of endogenous corporate social responsibility on firm valuation: theoretical and empirical evidence from the global financial crisis. J. Manage. Stud. 58, 421–456. doi: 10.1111/joms.12586

Harrison, J. S., and Berman, S. L. (2016). Corporate social performance and economic cycles. J. Bus. Ethics 138, 279–294. doi: 10.1007/s10551-015-2646-9

Hawn, O., and Ioannou, I. (2016). Mind the gap: the interplay between external and internal actions in the case of corporate social responsibility. Strategic Manage. J. 37, 2569–2588. doi: 10.1002/smj.2464

Henke, I., Carten,ì, A., Molitierno, C., and Errico, A. (2020). Decision-making in the transport sector: a sustainable evaluation method for road infrastructure. Sustainability 12, 764. doi: 10.3390/su12030764

Hoang, T., Przychodzen, W., Przychodzen, J., and Segbotangni, E. A. (2020). Does it pay to be green? A disaggregated analysis of U.S. firms with green patents. Bus. Strategy Environ. 29, 1331–1361. doi: 10.1002/bse.2437

Hoi, C. K., Wu, Q., and Zhang, H. (2018). Community social capital and corporate social responsibility. J. Bus. Ethics 152, 647–665. doi: 10.1007/s10551-016-3335-z

Jenkins, K. (2018). Setting energy justice apart from the crowd: lessons from environmental and climate justice. Energy Res. Soc. Sci. 39, 117–121. doi: 10.1016/j.erss.2017.11.015

Jenkins, K., McCauley, D., Heffron, R., Stephan, H., and Rehner, R. (2016). Energy justice: a conceptual review. Energy Res. Soc. Sci. 11, 174–182. doi: 10.1016/j.erss.2015.10.004

Jha, A., and Cox, J. (2015). Corporate social responsibility and social capital. J. Bank. Financ. 60, 252–270. doi: 10.1016/j.jbankfin.2015.08.003

Jia, J., and Li, Z. (2020). Does external uncertainty matter in corporate sustainability performance? J. Corp. Financ. 65, 101743. doi: 10.1016/j.jcorpfin.2020.101743

Kangmennaang, J., Kerr, R. B., Lupafya, E., Dakishoni, L., Katundu, M., and Luginaah, I. (2017). Impact of a participatory agroecological development project on household wealth and food security in Malawi. Food Secur. 9, 561–576. doi: 10.1007/s12571-017-0669-z

Karakoc, D. B., Barker, K., Zobel, C. W., and Almoghathawi, Y. (2020). Social vulnerability and equity perspectives on interdependent infrastructure network component importance. Sustain. Cities Soc. 57, 102072. doi: 10.1016/j.scs.2020.102072

Kim, Y., Li, H., and Li, S. (2014). Corporate social responsibility and stock price crash risk. J. Bank. Financ. 43, 1–13. doi: 10.1016/j.jbankfin.2014.02.013

Kong, Y., Antwi-Adjei, A., and Bawuah, J. (2020). A systematic review of the business case for corporate social responsibility and firm performance. Corp. Soc. Respon. Environ. Manage. 27, 444–454. doi: 10.1002/csr.1838

Kumar, K., Boesso, G., and Michelon, G. (2016). How do strengths and weaknesses in corporate social performance across different stakeholder domains affect company performance? Bus. Strategy Environ. 25, 277–292. doi: 10.1002/bse.1874

Kuzey, C., Uyar, A., Nizaeva, M., and Karaman, A. S. (2021). CSR performance and firm performance in the tourism, healthcare, and financial sectors: do metrics and CSR committees matter? J. Clean. Prod. 319, 128802. doi: 10.1016/j.jclepro.2021.128802

Larimian, T., and Sadeghi, A. (2021). Measuring urban social sustainability: scale development and validation. Environ. Plan. B Urban Anal. City Sci. 48, 621–637. doi: 10.1177/2399808319882950

Liang, H., Renneboog, L., and Vansteenkiste, C. (2020). Cross-border acquisitions and employment policies. J. Corp. Financ. 62, 101575. doi: 10.1016/j.jcorpfin.2020.101575

Lins, K. V., Servaes, H., Tamayo, A., Begley, T., Clubb, C., Cocco, J., Cooper, M., et al. (2017). Social capital, trust, and firm performance: the value of corporate social responsibility during the financial crisis. J. Financ. 72, 1785–1824. doi: 10.1111/jofi.12505

Liu, Y., Lei, L., and Buttner, E. H. (2020). Establishing the boundary conditions for female board directors' influence on firm performance through CSR. J. Bus. Res. 121, 112–120. doi: 10.1016/j.jbusres.2020.08.026

Lu, H., Oh, W.-Y., Kleffner, A., and Chang, Y. K. (2021). How do investors value corporate social responsibility? Market valuation and the firm specific contexts. J. Bus. Res. 125, 14–25. doi: 10.1016/j.jbusres.2020.11.063

Lueg, K., Krastev, B., and Lueg, R. (2019). Bidirectional effects between organizational sustainability disclosure and risk. J. Clean. Prod. 229, 268–277. doi: 10.1016/j.jclepro.2019.04.379

Luffarelli, J., Markou, P., Stamatogiannakis, A., and Gonçalves, D. (2019). The effect of corporate social performance on the financial performance of business-to-business and business-to-consumer firms. Corp. Soc. Respons. Environ. Manage. 26, 1333–1350. doi: 10.1002/csr.1750

Lys, T., Naughton, J. P., and Wang, C. (2015). Signaling through corporate accountability reporting. J. Account. Econ. 60, 56–72. doi: 10.1016/j.jacceco.2015.03.001

Marlin, A., and Marlin, J. T. (2003). A brief history of social reporting. Business Respect. Available online at: http://www.cityeconomist.com/images/A_brief_history_of_social_reporting-2003.doc

McCauley, D., and Heffron, R. (2018). Just transition: Integrating climate, energy and environmental justice. Energy Policy 119, 1–7. doi: 10.1016/j.enpol.2018.04.014

Moura-Leite, R. C., Padgett, R. C., and Galán, J. I. (2014). Stakeholder management and nonparticipation in controversial business. Bus. Soc. 53, 45–70. doi: 10.1177/0007650310395547

Naseem, T., Shahzad, F., Asim, G. A., Rehman, I. U., and Nawaz, F. (2020). Corporate social responsibility engagement and firm performance in Asia Pacific: the role of enterprise risk management. Corp. Soc. Respons. Environ. Manage. 27, 501–513. doi: 10.1002/csr.1815

Ng, A. C., and Rezaee, Z. (2015). Business sustainability performance and cost of equity capital. J. Corp. Financ. 34, 128–149. doi: 10.1016/j.jcorpfin.2015.08.003

Nguyen, P., and Nguyen, A. (2015). The effect of corporate social responsibility on firm risk. Soc. Respons. J. 11, 324–339. doi: 10.1108/SRJ-08-2013-0093

Nguyen, P.-A., Kecskés, A., and Mansi, S. (2020). Does corporate social responsibility create shareholder value? The importance of long-term investors. J. Bank. Financ. 112, 105217. doi: 10.1016/j.jbankfin.2017.09.013

Oh, H., Bae, J., and Kim, S.-J. (2017). Can sinful firms benefit from advertising their CSR efforts? Adverse effect of advertising sinful firms' CSR engagements on firm performance. J. Bus. Ethics 143, 643–663. doi: 10.1007/s10551-016-3072-3

Oswald Beiler, M., and Mohammed, M. (2016). Exploring transportation equity: development and application of a transportation justice framework. Transport. Res. Part D Transport Environ. 47, 285–298. doi: 10.1016/j.trd.2016.06.007

Pettit, J. (2004). Climate justice: a new social movement for atmospheric rights. IDS Bull. 35, 102–106. doi: 10.1111/j.1759-5436.2004.tb00142.x

Ruiz, M., Segui-Pons, J. M., and Mateu-LLad,ó, J. (2017). Improving bus service levels and social equity through bus frequency modelling. J. Transport Geogr. 58, 220–233. doi: 10.1016/j.jtrangeo.2016.12.005

Saleem, I., Khan, M. N. A., Hasan, R., and Ashfaq, M. (2021). Corporate board for innovative managerial control: implications of corporate governance deviance perspective. Corp. Governance Int. J. Bus. Soc. 21, 450–462. doi: 10.1108/CG-04-2020-0151

Scalet, S., and Kelly, T. F. (2010). CSR rating agencies: what is their global impact? J. Bus. Ethics 94, 69–88. doi: 10.1007/s10551-009-0250-6

Shahzad, A. M., and Sharfman, M. P. (2017). Corporate social performance and financial performance: sample-selection issues. Bus. Soc. 56, 889–918. doi: 10.1177/0007650315590399

Shaker, R. R., and Sirodoev, I. G. (2016). Assessing sustainable development across Moldova using household and property composition indicators. Habitat Int. 55, 192–204. doi: 10.1016/j.habitatint.2016.03.005

Shigetomi, Y., Chapman, A., Nansai, K., Matsumoto, K., and Tohno, S. (2020). Quantifying lifestyle based social equity implications for national sustainable development policy. Environ. Res. Lett. 15, 084044. doi: 10.1088/1748-9326/ab9142

Shiu, Y. M., and Yang, S. L. (2017). Does engagement in corporate social responsibility provide strategic insurance-like effects? Strategic Manage. J. 38, 455–470. doi: 10.1002/smj.2494

Siew, R. Y. J. (2015). A review of corporate sustainability reporting tools (SRTs). J. Environ. Manage. 164, 180–195. doi: 10.1016/j.jenvman.2015.09.010

Silva, J. F. B. A., Rebouças, S. M. D. P., Abreu, M. C. S., de Ribeiro, M., and da, C. R. (2018). Construção de um índice de desenvolvimento sustentável e análise espacial das desigualdades nos municípios cearenses. Revista de Administração Pública 52, 149–168. doi: 10.1590/0034-7612163114

Su, S., Liu, Z., Xu, Y., Li, J., Pi, J., and Weng, M. (2017). China's megaregion policy: performance evaluation framework, empirical findings and implications for spatial polycentric governance. Land Use Policy 63, 1–19. doi: 10.1016/j.landusepol.2017.01.014

Taylor, J., Vithayathil, J., and Yim, D. (2018). Are corporate social responsibility (CSR) initiatives such as sustainable development and environmental policies value enhancing or window dressing? Corp. Soc. Respons. Environ. Manage. 25, 971–980. doi: 10.1002/csr.1513

Tebini, H., M'Zali, B., Lang, P., and Perez-Gladish, B. (2016). The economic impact of environmentally responsible practices. Corp. Soc. Respons. Environ. Manage. 23, 333–344. doi: 10.1002/csr.1383

Tong, L., Wang, H., and Xia, J. (2020). Stakeholder preservation or appropriation? The influence of target CSR on market reactions to acquisition announcements. Acad. Manage. J. 63, 1535–1560. doi: 10.5465/amj.2018.0229

Tsang, A., Wang, K. T., Liu, S., and Yu, L. (2021). Integrating corporate social responsibility criteria into executive compensation and firm innovation: international evidence. J. Corp. Financ. 70, 102070. doi: 10.1016/j.jcorpfin.2021.102070

Tschopp, D., and Huefner, R. J. (2015). Comparing the evolution of CSR reporting to that of financial reporting. J. Bus. Ethics 127, 565–577. doi: 10.1007/s10551-014-2054-6

Valizadeh, N., and Hayati, D. (2021). Development and validation of an index to measure agricultural sustainability. J. Clean. Prod. 280, 123797. doi: 10.1016/j.jclepro.2020.123797

Vomberg, A., Homburg, C., and Bornemann, T. (2015). Talented people and strong brands: the contribution of human capital and brand equity to firm value. Strategic Manage. J. 36, 2122–2131. doi: 10.1002/smj.2328

Wang, Z., and Sarkis, J. (2017). Corporate social responsibility governance, outcomes, and financial performance. J. Clean. Prod. 162, 1607–1616. doi: 10.1016/j.jclepro.2017.06.142

Widyawati, L. (2020). A systematic literature review of socially responsible investment and environmental social governance metrics. Bus. Strategy Environ. 29, 619–637. doi: 10.1002/bse.2393

Xie, J., Nozawa, W., Yagi, M., Fujii, H., and Managi, S. (2019). Do environmental, social, and governance activities improve corporate financial performance? Bus. Strategy Environ. 28, 286–300. doi: 10.1002/bse.2224

Yu, E. P., Guo, C. Q., Luu, B., and Van. (2018). Environmental, social and governance transparency and firm value. Bus. Strategy Environ. 27, 987–1004. doi: 10.1002/bse.2047

Yuan, Y., Xu, J., and Wang, Z. (2017). Spatial equity measure on urban ecological space layout based on accessibility of socially vulnerable groups—A case study of changting, China. Sustainability 9, 1552. doi: 10.3390/su9091552

Keywords: ESG metrics, social equity, systematic review, sustainability index, sustainable investment

Citation: Keeley AR, Chapman AJ, Yoshida K, Xie J, Imbulana J, Takeda S and Managi S (2022) ESG metrics and social equity: Investigating commensurability. Front. Sustain. 3:920955. doi: 10.3389/frsus.2022.920955

Received: 15 April 2022; Accepted: 30 August 2022;

Published: 21 September 2022.

Edited by:

Dingsheng Li, University of Nevada, Reno, United StatesReviewed by:

Elena Escrig Olmedo, University of Jaume I, SpainCopyright © 2022 Keeley, Chapman, Yoshida, Xie, Imbulana, Takeda and Managi. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Alexander R. Keeley, a2VlbGV5LnJ5b3RhLmFsZXhhbmRlci40MTZAbS5reXVzaHUtdS5hYy5qcA==

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.