- 1Department of Civil Engineering, Kyushu University, Fukuoka, Japan

- 2Urban Institute, Kyushu University, Fukuoka, Japan

- 3Industrial Ecology Consultants, Newton, MA, United States

The coronavirus (COVID-19) pandemic has affected society in immeasurable ways, including investment. As the pandemic has impacted society's values, it has proven to be a major turning point for environmental, social, and governance (ESG) investment. This investment approach, which evaluates a company's ESG ratings alongside traditional financial metrics, was already “coming off a banner year,” and its reach continues to expand. Although numerous studies have investigated the impact of ESG scores on financial returns and the trend in ESG investment strategies, only a limited number of studies have attempted to capture the key players in ESG investment. Therefore, to determine the most influential investors in the ESG investment field, the cumulative impacts are calculated based on the ESG scores of invested companies, the total market price of invested companies, and the investor history portfolio report. We perform an iteration of calculation to convey the impacts that the invested companies have on the ultimate investors, and we identify the major players in the field and differences in the trend by type of investor and country.

Introduction

Through more than 20-years history of sustainable finance, there has been significant surge in ESG investment, ESG metrics, and related studies in the last few years. The 2020 Global Sustainable Investment Review (GSIR) published by the Global Sustainable Investment Alliance (GSIA) reports that sustainable investments across five markets, including the United States (the US) and the European Union, have reached US Dollar (USD) 35.3 trillion in assets under management, which is equivalent to 36% of all professionally managed assets in these markets. The US market alone grew 42% from 2018 to 2020, reaching USD 17.1 trillion (Global Sustainable Investment Alliance, 2021). Furthermore, the GSIA concluded that the most common sustainable investment strategy is “ESG integration, followed by negative screening, corporate engagement and shareholder action, norms-based screening and sustainability-themed investment” (Global Sustainable Investment Alliance, 2021). The coronavirus (COVID-19) pandemic has severely affected companies in the global supply chain, and studies have found that firms' governance and supply chain management ability are important in responding to adverse events (Khan et al., 2021a,b). Moreover, the ESG performances of firms have been considered a key to the resiliency of firms' financial performance (Yoo et al., 2021). As the pandemic has impacted society's values, it has proven to be a major turning point for ESG investment. In June 2020, the Morningstar report found that there were approximately 3,432 sustainable funds on the market, comprising a mix of newly formed and revamped or rebranded funds (MorningStar, 2022). This represents an increase of 50% in the total number of sustainable funds over the past three years (Bryan et al., 2020). Furthermore, studies assessing ESG ratings are increasing. For instance, if the term “ESG ratings” is searched on Google Scholar, it produces 1,500 results from 2021. The increased interest in ESG has also resulted in an increased influence on financial decisions, asset prices, and corporate policies, with potentially far-reaching effects on political and economic events, such as the Russia–Ukraine war (Funk and Hento, 2022).

Over the past decade, numerous studies have focused on the relation between ESG investment and financial performance, demonstrating that ESG portfolio tilting and integration of ESG factors can impact portfolio and corporate financial performance in various ways (OECD, 2021). Whereas, some studies have demonstrated that integrating ESG criteria has no significant impact on portfolio return (Bauer et al., 2007; Cortez et al., 2009); many studies have found that it has a positive effect on returns by comparing equity portfolios with high and low ESG scores (Widyawati, 2020). Widyawati (2020) conducted a systematic review on socially responsive investment (SRI) and ESG metrics and asserted that ESG metrics play a role of an enabler in the SRI market.

In addition, there has been growing interest in the study of the relation between the ESG strategy and actual ESG portfolio allocation. Brandon et al. (2021) calculated the direct ESG ownership scores of institutional investors and investigated whether institutional investors' public commitments to responsible investing and higher reported levels of ESG incorporation result in more sustainable portfolio allocations. The findings revealed that the Principles for Responsible Investment (PRI) signatory institutions have better ESG scores in general but not in the US. To examine the ownership and control structure of large shareholders, relevant studies have examined the ultimate ownership of companies by mostly tracking portfolio and total market price data. For example, La Porta et al. (1999) investigated the control chains of a sample of 30 firms in 27 countries and identified the ultimate controlling owners. Similarly, Claessens et al. (2000) examined 2,980 listed companies in nine East Asian countries, revealing that a large percentage of stock market capitalization in the investigated countries is owned by a small number of investors. Faccio and Lang (2002) analyzed the ownership structure using the ultimate ownership data of 5,232 listed Western European corporations. Their research found that financial and large firms were more likely to be widely held, whereas nonfinancial and small firms were more likely to be privately owned. These aforementioned studies on ultimate ownership provide insight into patterns by the type of investor and nation–state political boundaries in the context of direct and indirect ownership chains. In the case of ESG ownership, previous studies have mostly used direct ownership scores of ESG at the portfolio level using the ESG portfolio data, total market price data, and ESG scores provided by leading ESG rating agencies. To capture the ownership structure of ESG investment, it is crucial to consider both direct and indirect ownership. Notably, while most studies on ESG ownership emphasize institutional investor, intercorporate investment also plays a critical role in the ESG investment field as investments in financial assets and associates and business combinations (Silver et al., 2021). Intercorporate investment can occur when a company invests in another company. These types of investments can be considered in different ways depending on the investment. In general, the archetypes of ownership stake by percentage fall into three categories—minority passive (<20% ownership), minority active (20–50% ownership), and controlling interest (over 50% ownership) (Kenton et al., 2021).

This study addresses these research gaps and investigates the ultimate ESG ownership, considering both direct and indirect ownership of investors, including institutional investors and corporations, following the ultimate ownership analysis framework employed by Faccio and Lang (2002). We identify the major players in the field in terms of the ultimate ESG ownership score and provide insight into patterns by the type of investor and nation–state political boundaries in the context of direct and indirect ownership chains. By expanding the study by Brandon et al. (2021), we also re-examine whether the PRI signatory institutions and corporations demonstrate better ESG ownership scores and confirm that the PRI signatory investors have better ESG ownership score in general. Furthermore, our study contributes to extant literature examining fund flow reactions to ESG ratings (Hartzmark and Sussman, 2019) by providing the evidence that it is difficult to target the actual flow and ownership structure of ESG investment through ESG ratings of the investors themselves. In addition, this study reports that the top 10% investors own approximately 98% of the total ultimate ESG ownership score, showing that ESG investment is led by relatively small number of investors. Furthermore, the results of the study confirm the important role of corporations in ESG investment, which owns the most global shares (85.77%) measured by the ESG ownership score considering both direct and indirect ownership chains.

The remainder of this paper is structured as follows. Section Data and Methods outlines the data and analytical methods employed in this study. Section Results discusses the results of the ultimate ESG ownership analysis, and Section Discussion and Conclusion presents the discussion and conclusion.

Data and Methods

Data

ESG Score

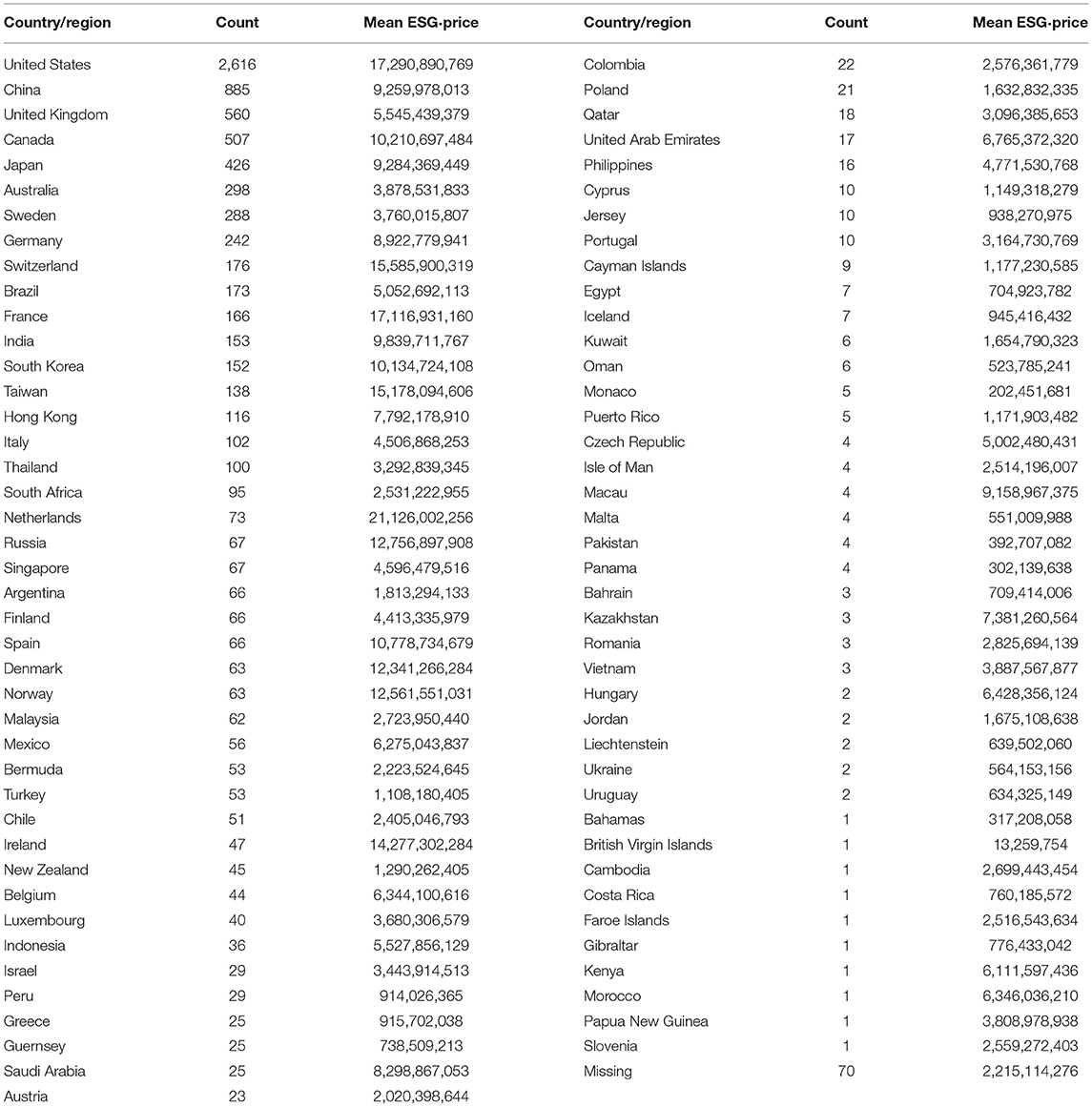

To obtain the ESG scores of important companies across the world, we use the data management system of Refinitiv Eikon to download the records of 30,857 companies. As Refintiv Eikon does not gather all the data of these companies, we acquire the ESG combined scores of 8,662 companies. Companies that can be used in the analysis have to provide their ESG combined scores and the total market price. In this study, we employ the latest ESG combined scores in 2020. The ESG combined scores range from 0 to 1. Additionally, although the ESG combined scores of several companies are not listed on the summary page, they present their ESG reports, comprising the rankings of their ESG combined scores. The rankings are from “A+” to “D-,” that is, 12 levels. According to the official statements from Refintiv, the raw ESG scores are converted into a numeric format, from 1 (12/12) to 0.0833 (1/12). The companies with ESG scores are from 83 countries or regions. Most companies in our dataset are based in the US, China (Mainland), and the UK, having 2,616, 885, and 560 companies, respectively (detailed information is presented in Appendix Table A).

Investor History Portfolio Reports

The investors' data, which are the investor history portfolio reports of each investor company, are also from Refinitiv Eikon. These reports capture the shares of the investors in the invested company. We assume that the shares represent the voice of the ESG strategies of the investors in the invested companies. The most recent data, generally for the first quarter of 2021, are employed in this study. To cover the invested companies with ESG scores, 43,482 investors, including investment companies and individual investors, are investigated and 12,258 investor history portfolio reports are downloaded. The investment share of a specific investor is recorded in the investor history portfolio. For example, the investor history portfolio of the investor company Storebrand Kapitalforvaltning AS is 0.04% of Apple Inc., 0.04% of Microsoft Corp., 0.03% of Amazon.com Inc., and others. In this case, 0.04% of the ESG investment results of Apple Inc. should be attributed to Storebrand Kapitalforvaltning AS. The investor history portfolios are the critical data set to link the invested and investing companies.

Total Market Price of Companies With ESG Reports

Furthermore, the total market prices of the aforementioned invested companies are from Refinitiv Eikon. The total market price varies in real time. We secured all the available data within a week—the last week in December 2021. After several downloading waves, we retrieved the total market prices of 8,662 companies with the ESG combined scores. The currency unit of the total market price is the USD, which is converted by the Refinitiv Eikon system directly. The total market price represents the value of the invested company. A summary of the total market values of the companies is reported in Table 1.

Methods

To detect the most influential investors in the ESG investment field, the cumulative impacts are calculated based on the ESG scores of invested companies, total market prices of invested companies, and investor history portfolio reports. The basic logic of calculating the cumulative impacts is to accumulate the products of the ESG scores and total market prices of the invested companies. However, in the real world, some large investors also invest in small investors. Therefore, we iterate the calculation to convey the impacts of invested companies on the ultimate investors. The cumulative impacts are calculated as follows:

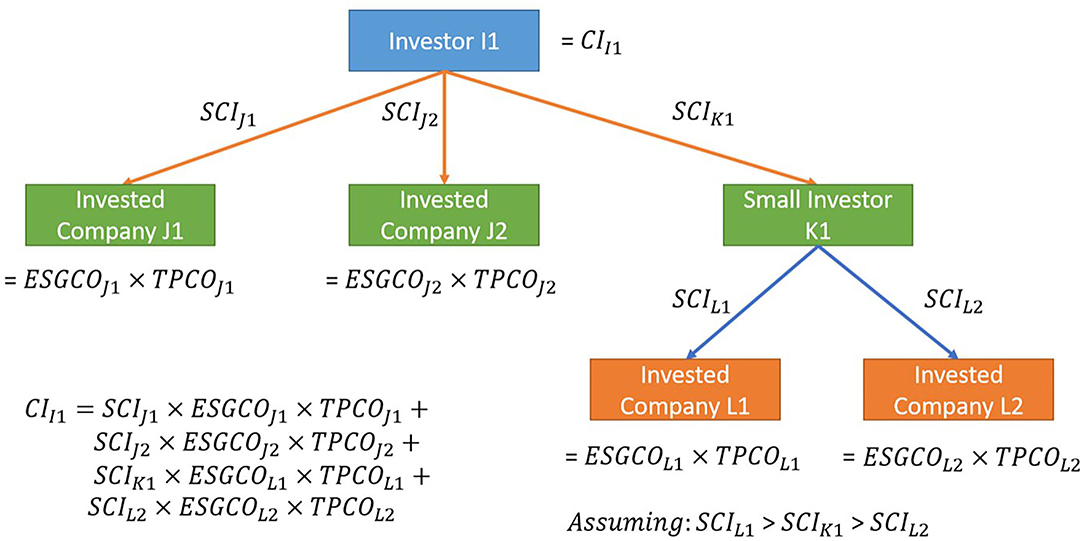

where CIi denotes the cumulative impacts of investor i; SCIj indicates the shares of investor i in invested company j; ESGCOj represents the ESG scores of invested company j; TPCOj denotes the total market price of invested company j; m indicates the number of companies investor i has invested in; SCIk is the shares of investor i (a large investor) in small investor k; SCIl is the shares of small investor k in invested company l; ESGCOl denotes the ESG scores of invested company l; TPCOl represents the total market price of invested company l; n denotes the number of small investors that investor i has; and p indicates the number of companies that small investor k has invested in. We provide a simple example of the calculation process in Figure 1.

Results

Based on the evaluations of the ultimate ESG ownership scores of investors, including institutional investors and corporations, this section presents the results by first revealing the patterns of the ESG ownership structure by the type of investor and nation–state political boundaries, followed by the results of the relation between the calculated ESG ownership scores and investors' ESG performances (e.g., PRI signatory status and investors' ESG ratings).

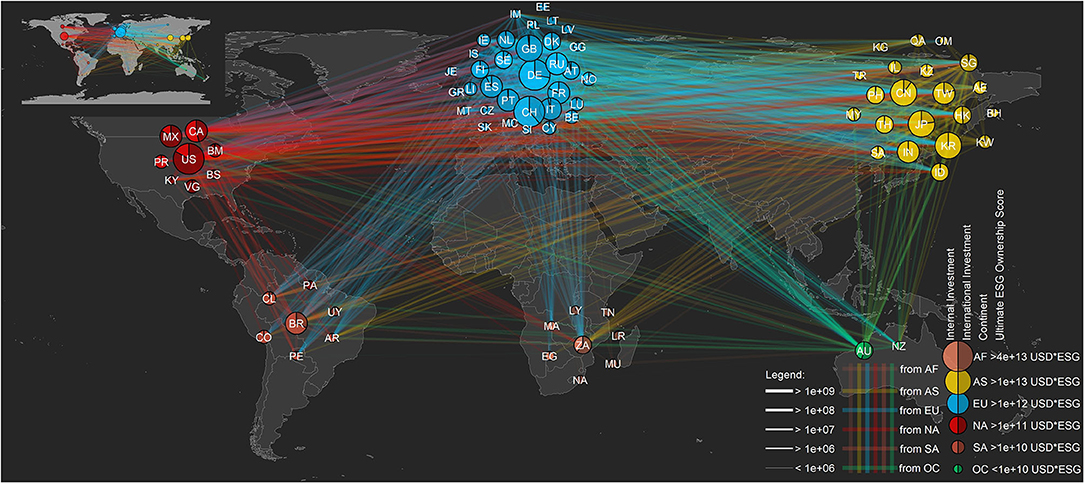

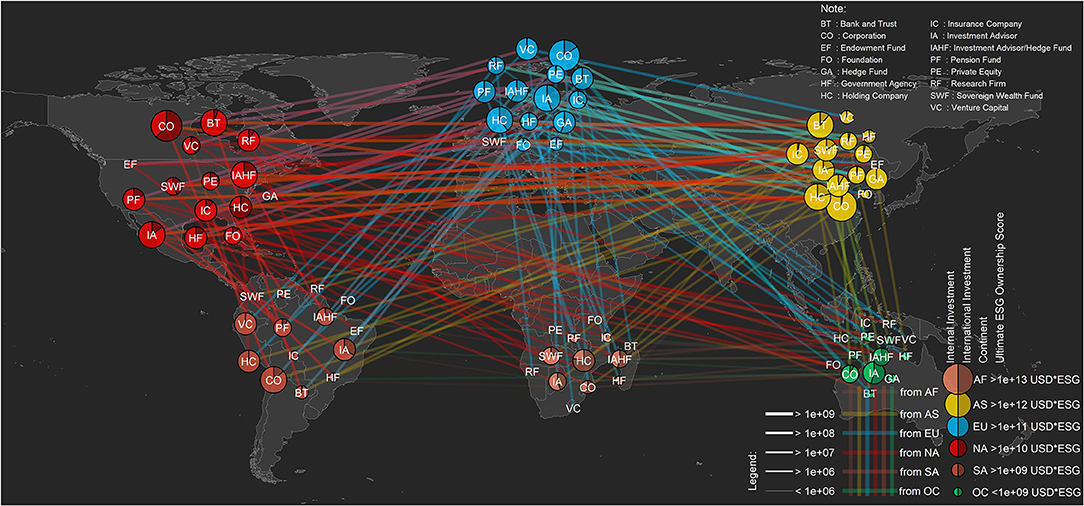

Ultimate ESG Owner: Trend by Country Level

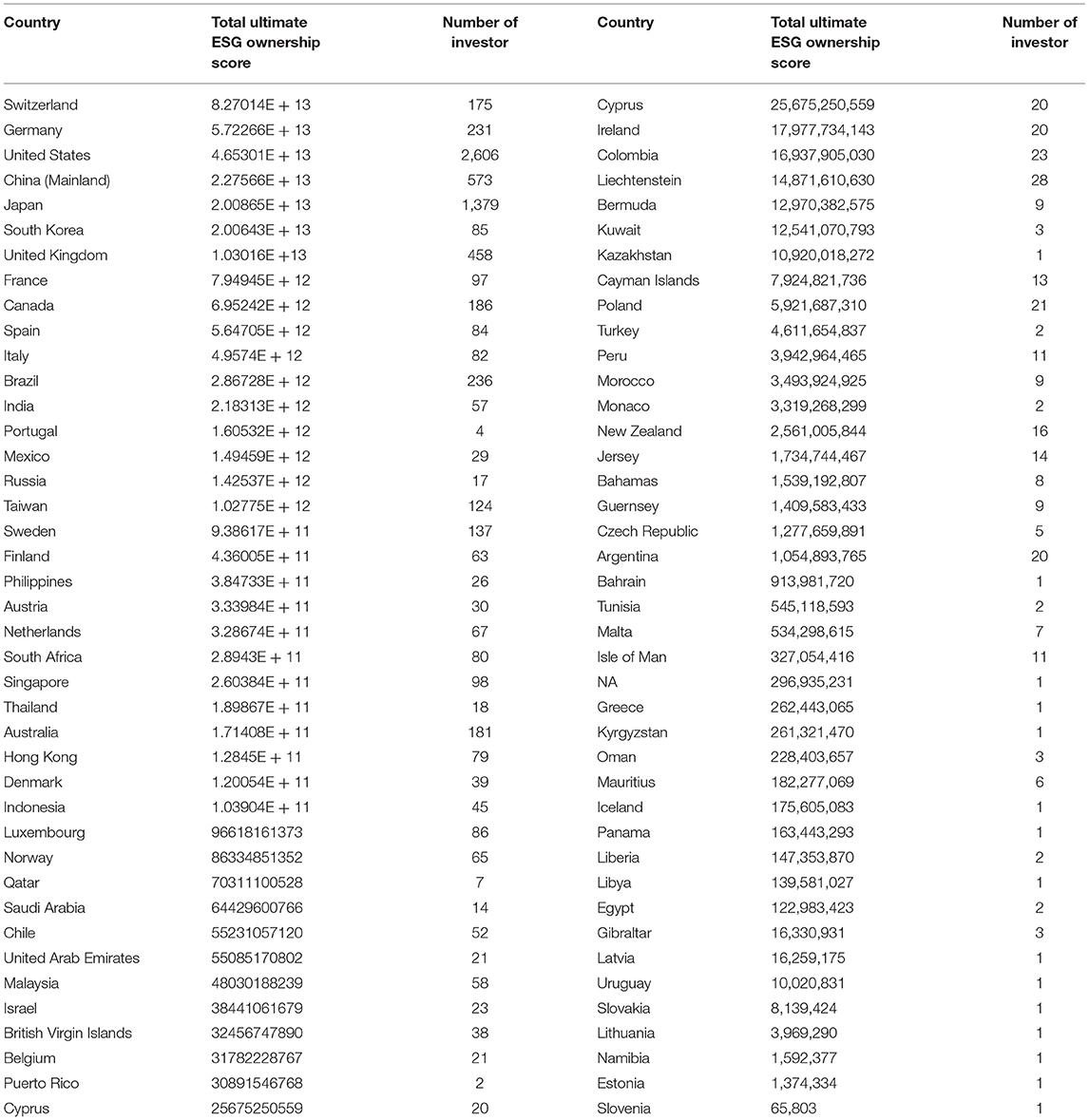

Based on the cumulative ESG ownership calculated using the methods discussed in Section Data and Methods, Table 2 reports the results of the total ultimate ESG ownership score of 7,957 investors at the country level (the investors' country distribution map is illustrated in Figure A of the Appendix). The investors' country-level ESG ownership network map is presented in Figure 2. Figure 2 presents the share of the internal ESG investment and international ESG investment volumes in bubbles and denotes outflow investments through lines colored by the continent level. The size of the bubble represents the volume of the cumulative ultimate ESG ownership score.

As illustrated in Figure 2, the international ESG investment volume is much larger than the internal ESG investment volume in most North American countries, whereas the internal ESG investment volume has the largest share in Asia. The network figure demonstrates that the link between North American and Asian countries is especially strong. The strong link between European and Asian countries, with a stronger link from European to Asian countries, is noteworthy. The links from Asian to European countries are stronger than the links from Asian to other countries.

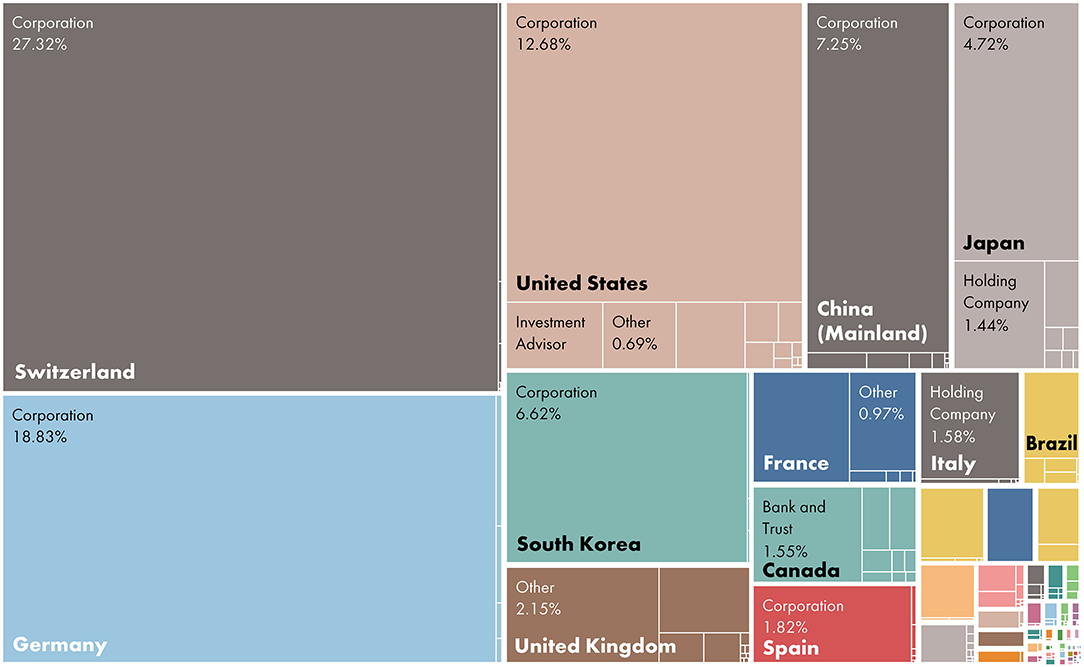

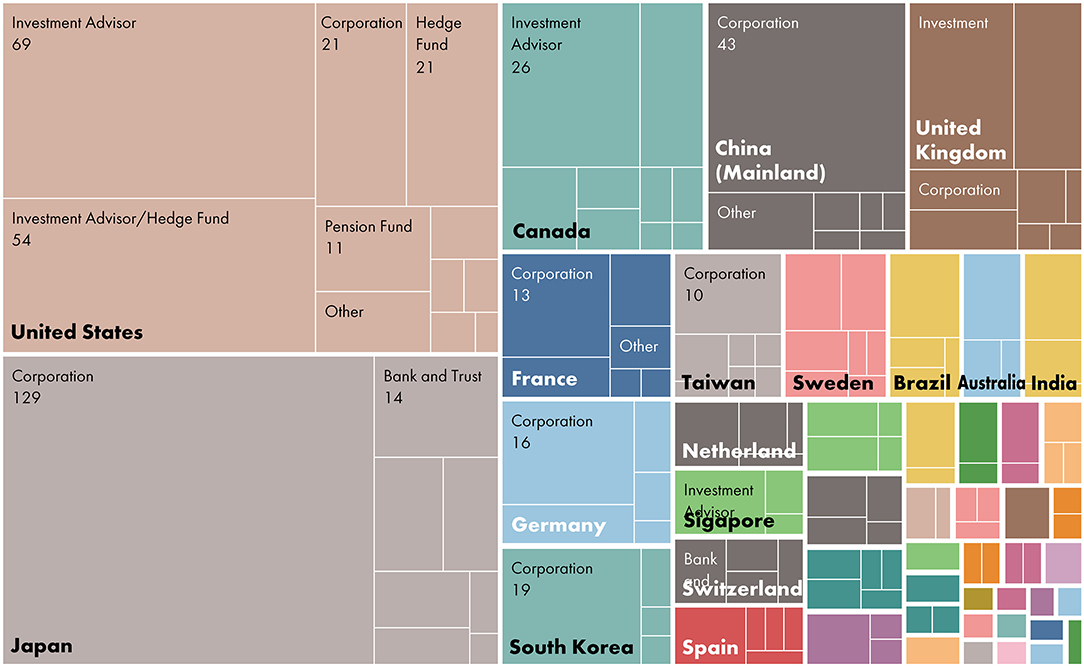

Figure 3 presents the total ultimate ESG ownership by country, with the size of the box representing the volume of the share of the total ultimate ESG ownership score. According to the results, Switzerland, Germany, and the US are the leading countries in terms of the volume of the share of the total ultimate ESG ownership score. In addition, the results reveal that the top 10% investors own approximately 98% of the total ultimate ESG ownership score. The number of investors in the top 10% by country is another important perspective to interpret the result, which is presented in Figure 4. Regarding the number of investors in the top 10%, the US, Japan, and China are the leading countries. Among the leading countries, there are differences in the types of investors leading (non-financial firms, such as corporations, and financial firms, including investment advisors, insurance companies, as well as banks and trusts). In the US, financial firms are the major players, whereas non-financial firms are the major players in Japan and China. Switzerland is not among the top countries in terms of the number of investors in the top 10% as the two leading investors in Switzerland (Novartis AG and Nestle SA) have a 27.3% share of the total ultimate ESG ownership score.

Ultimate ESG Owner: Trend by Investor Type and Industry

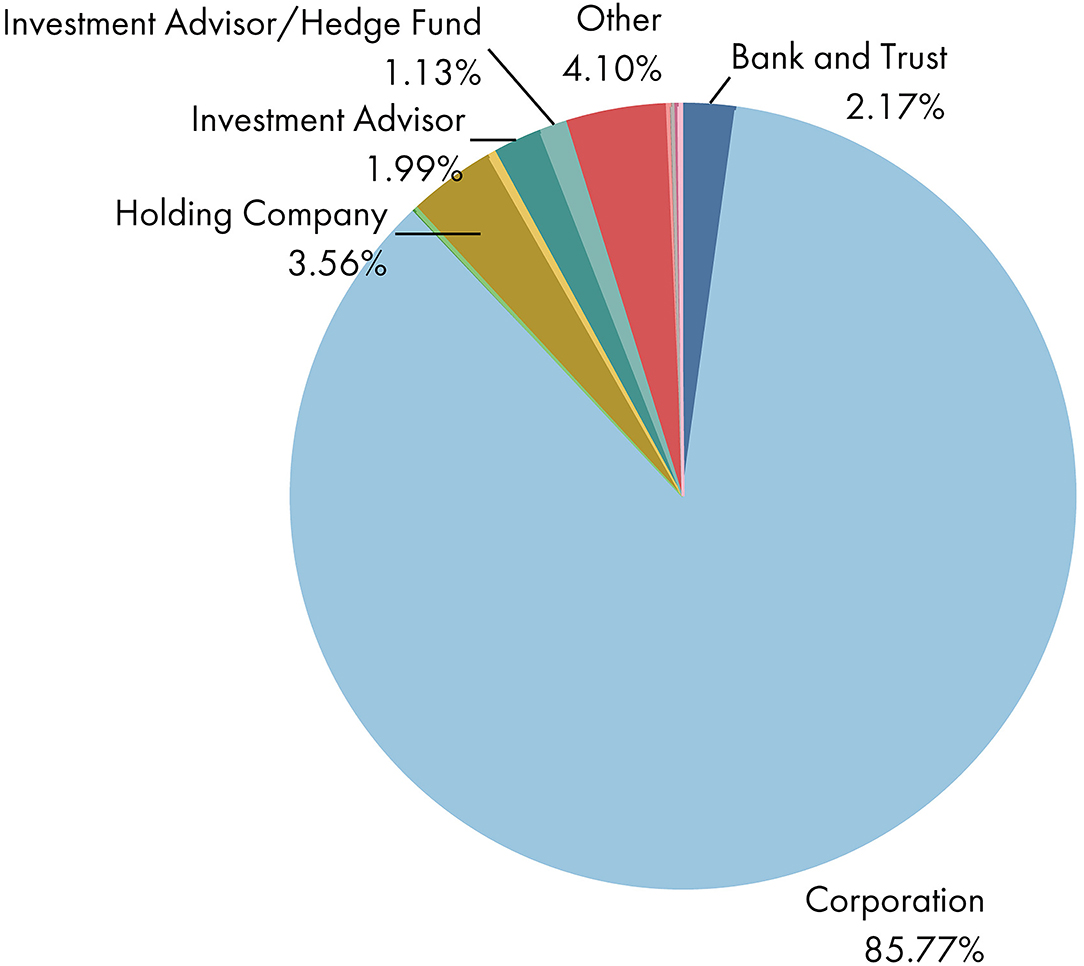

Based on the Refinitiv Business Classification, investors are classified into one of the following: corporation (CO), holding company (HC), insurance company, investment advisor (IA), bank and trust (BT), endowment fund, government agency (GA), foundation (FO), hedge fund, sovereign wealth fund (SWF), investment advisor/hedge fund (IAHF), venture capital (VC), research firm (RF), pension fund (PF), and private equity. Figure 5 reports the share of the total ultimate ESG ownership by investor type. CO, HC, and IA are the three top investor types, but as depicted in the figure, CO has the most global shares (85.77%).

We observe different trends among the continents in terms of the cross-continent and internal ESG investment volumes, as presented in Figure 6. In Asian countries, the internal ESG investment comprises the most ESG investment volume, especially for CO, GA, and VC. However, in North America, the cross-continent ESG investment volume is larger than the internal volume for CO; in Europe, GA and PF actively conduct cross-continent investment, whereas CO has more internal ESG investment volume. Similar to the country-level network map presented in Figure 2, we observe strong links from North American investors to Asian companies, whereas between Europe and Asia, the links are more bidirectional. The links from European investors are relatively more diversified than those from other regions, with slightly stronger links to Asia.

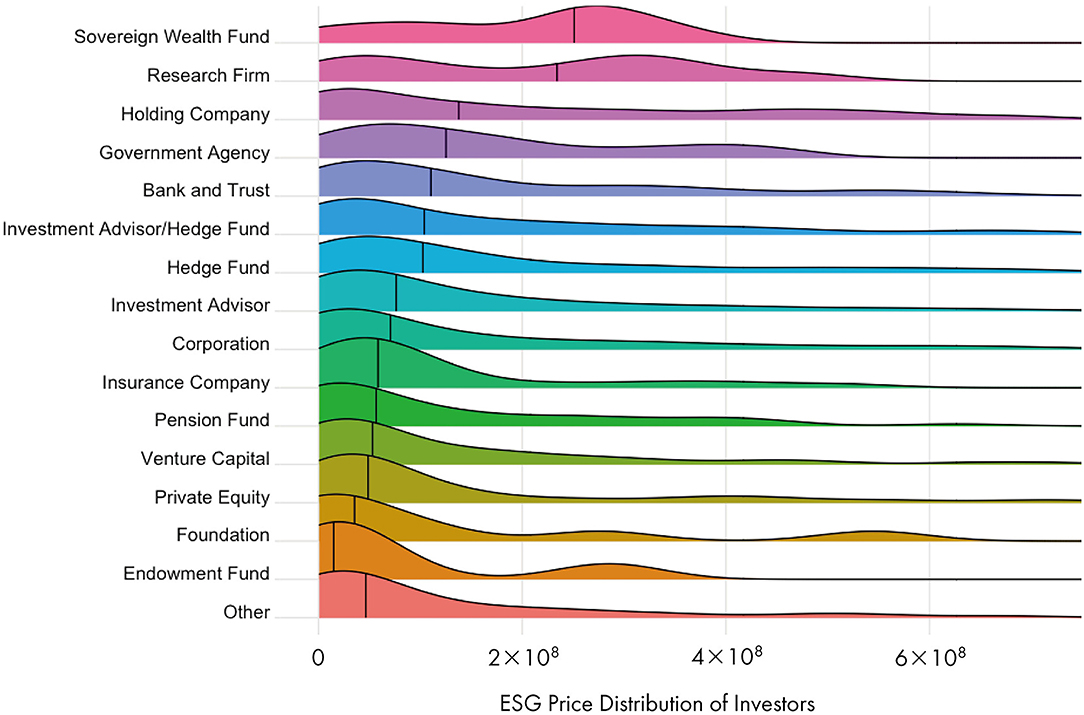

Figure 7 illustrates the density ridgeline plots by the investor type, revealing that, on average, SWF and RF are performing better.

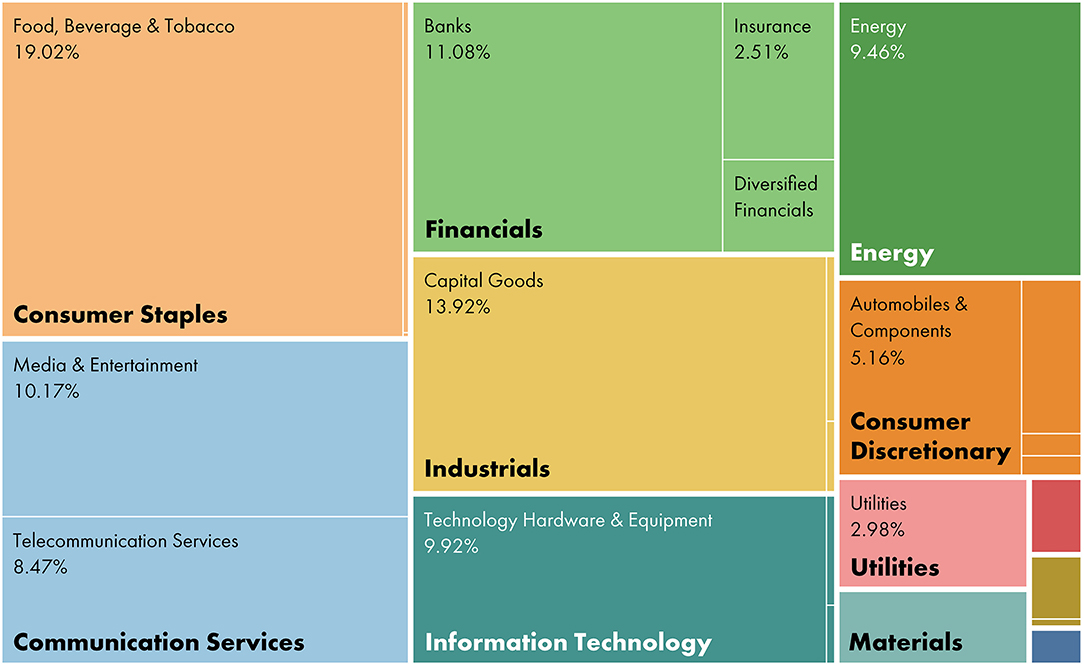

We provide a closer look of the leading industries in Figure 8. Each investor is classified into an industry group based on the Global Industry Classification Standard. As Figure 8 demonstrates, consumer staples, financials, and industrials are the leading industry groups in terms of the volume of the share of total ultimate ESG ownership.

ESG Tendency: Total Market Price Adjusted ESG Ownership

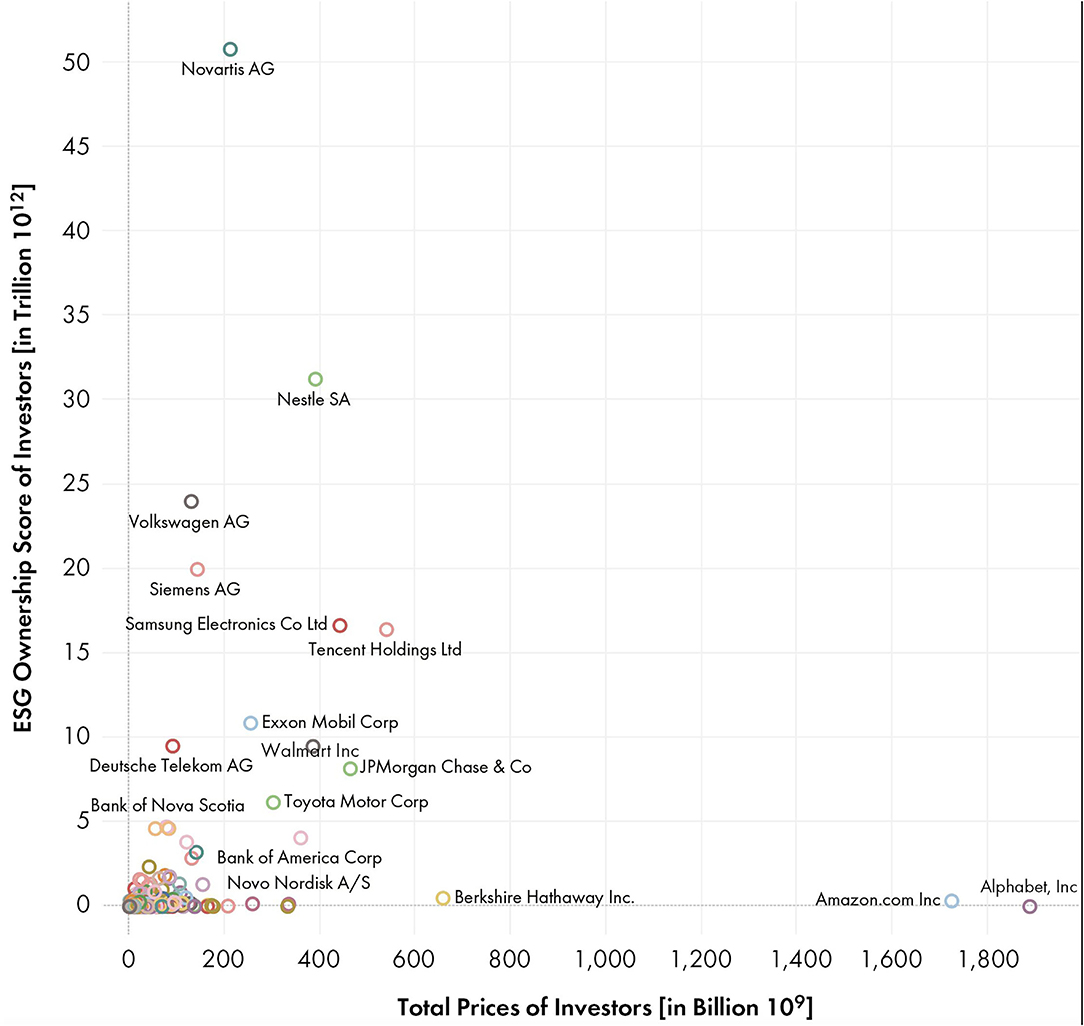

As an investor with a larger total market price can make more investments than smaller investors, its ultimate ESG ownership score can be affected by investors' total market prices. However, as shown in Figure 9, the total market prices of the investors and their ultimate ESG ownership scores have a very weak correlation. The Pearson correlation is performed to analyze the relationship, and the correlation strength is defined as a correlation coefficient (R-value) of 0.27 (p ≤ 0.001).

Although the correlation between the total market prices of investors and their ultimate ESG ownership scores is very weak, to reduce the potential bias owing to the size of the investor, we calculate the ESG tendency score by dividing the ultimate ESG ownership score by the total market price of each investor.

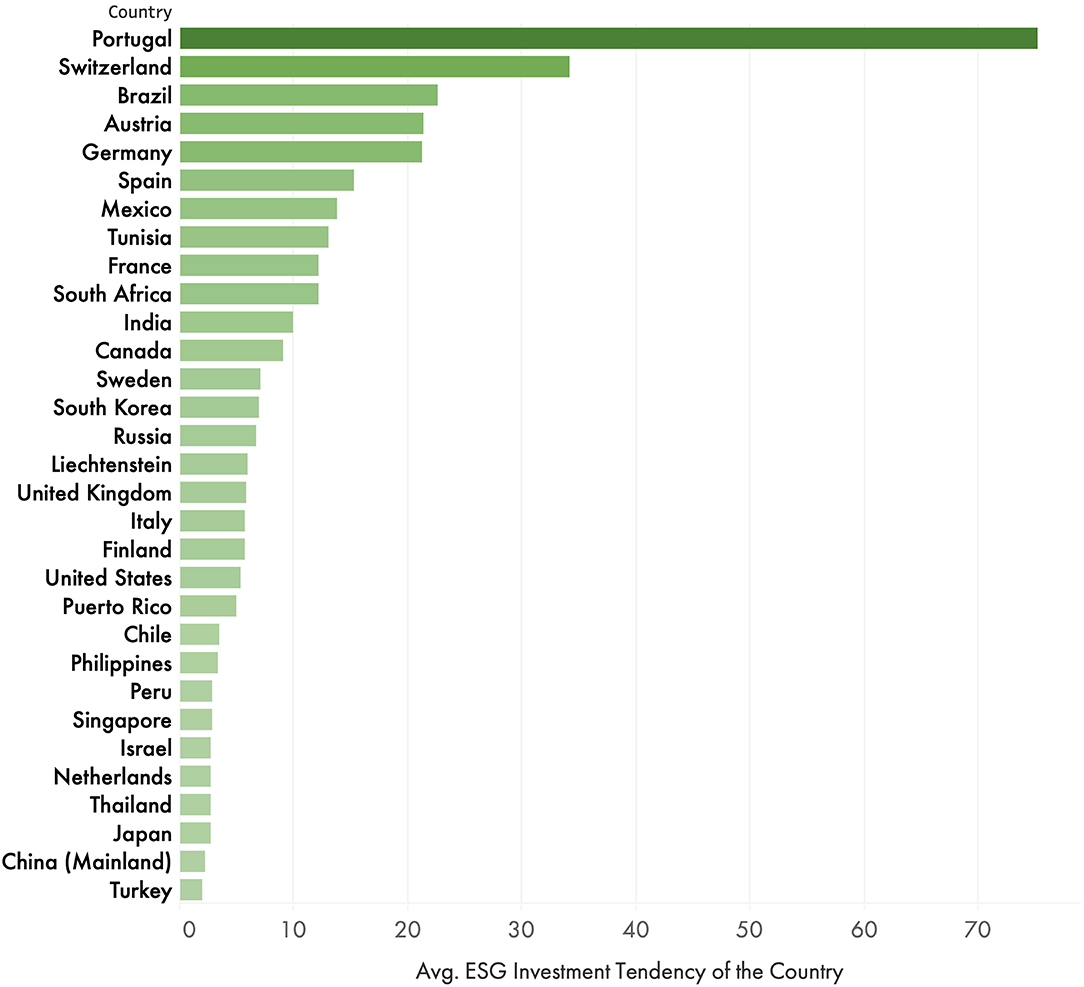

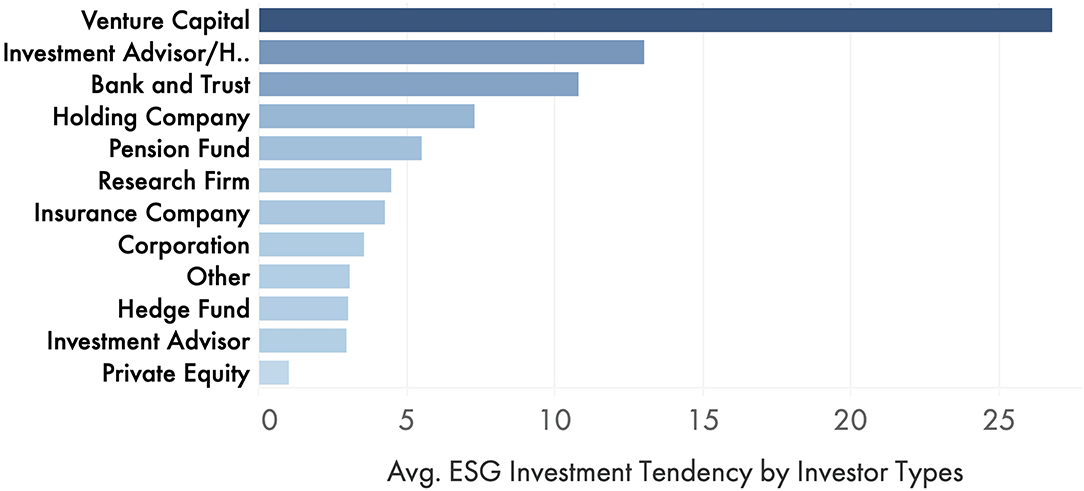

Figures 10, 11 report the results of the ESG tendency by country and investor type based on 1,716 investors. Here, two outliers (Aditya Birla Sun Life AMC Limited [2048] and Schweizerische Nationalbank [588]) are removed. By country, Portugal, Switzerland, and Brazil are the top countries, whereas in terms of the accumulated total ultimate ESG ownership score of the 7,957 investors, several leading countries, such as the US, Japan, and China, have low average ESG tendency. Figure 11 demonstrates an interesting trend among the investor type—the average ESG tendency is high in VC, IAHF, and BT, whereas it is low in CO, which owns the most global shares.

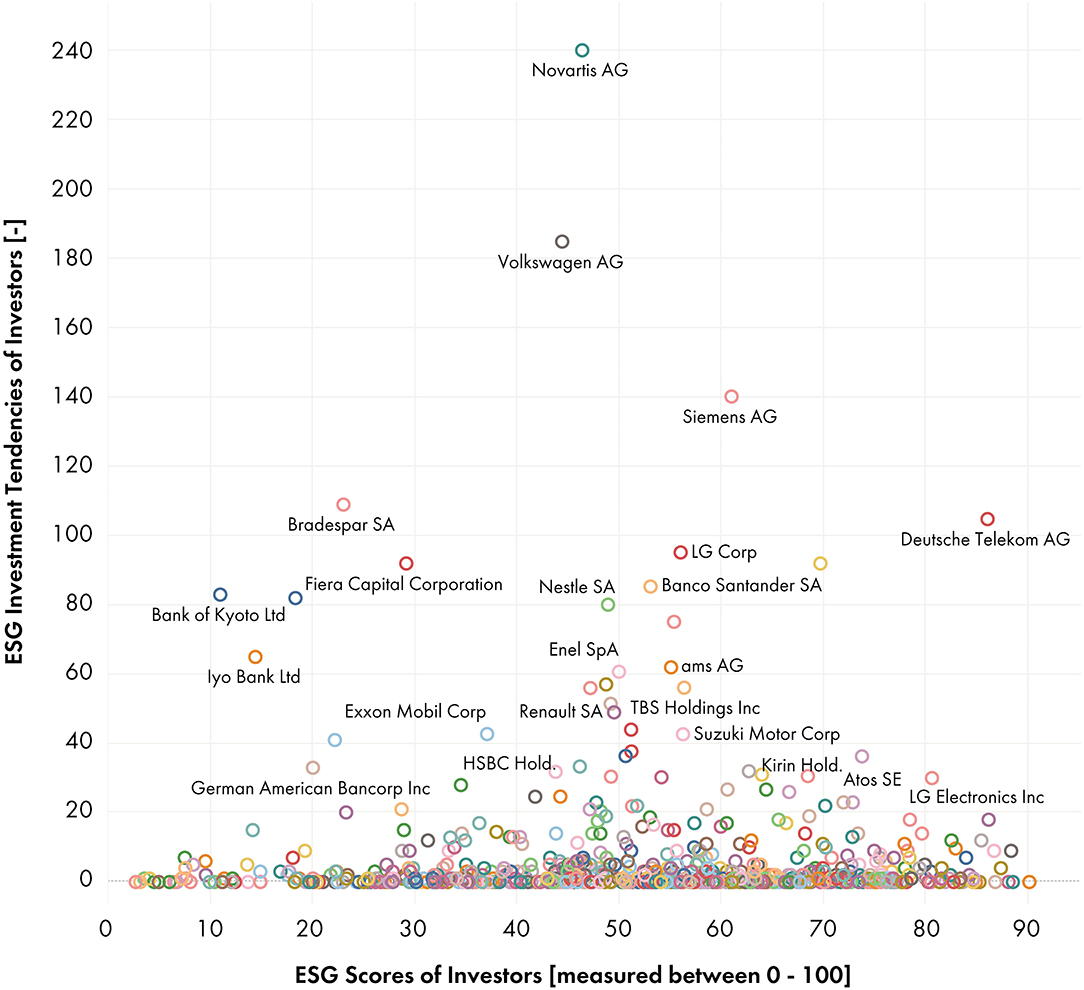

Using the calculated ESG tendency score, Figure 12 illustrates the relation between investors' ESG tendency and their own ESG score rated by Refinitiv. The Pearson correlation is performed to analyze the relation between investors' ESG tendency and their own ESG score, and the correlation strength is defined as a correlation coefficient (R-value) of −0.05 (p ≤ 0.155). Figure 12 shows that some investors, such as Siemens AG, Deutsche Telecom AG, Novartis AG, and Volkswagen AG, have relatively high ESG scores and a high ESG tendency. However, overall, the figure and results reveal that investors with high ESG ratings do not necessarily have higher incorporation of ESG investment strategies.

ESG Ownership and PRI Signatory

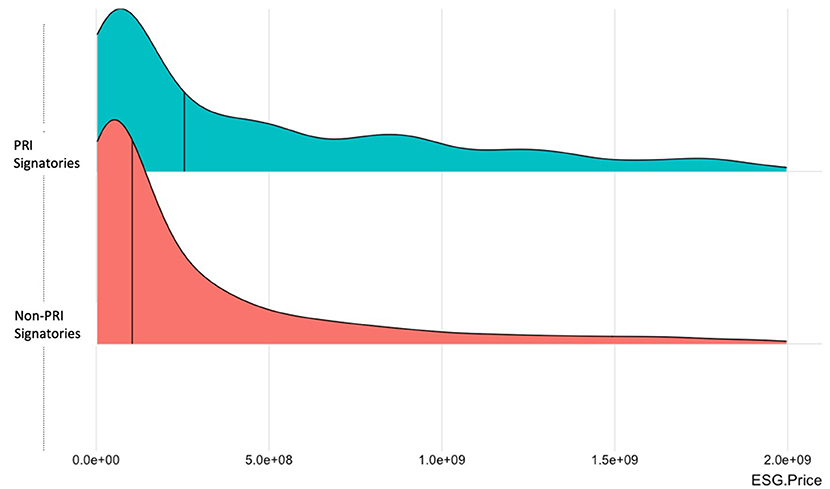

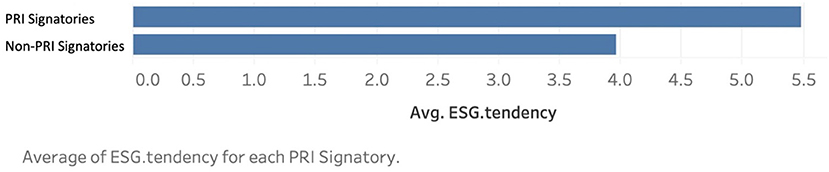

To examine the relation between the PRI signatory status and ESG ownership, we classify the investors into PRI and non-PRI signatory investors based on the PRI (2022). Figure 13 reveals that the PRI signatories have higher ESG ownership with higher mean value, and Figure 14 reveals that, on average, the PRI signatories' average ESG tendency, that is, the total market price adjusted ESG ownership, is higher than that of the non-PRI signatories.

In addition, we perform the Welch two-sample t-tests to determine if the PRI signatory investors' ultimate ESG ownership scores differ significantly from those of the non-PRI signatory investors. The results of the two-sample t-test reveal statistically significant difference in the mean ultimate ESG ownership score of the PRI and non-PRI signatory investors, with t(df = 7609) = −3.23, p = 0.0012, 95% CI as the difference in means [−5.24e10, −1.28e10]. The figures and result imply that investors who commit to invest responsibly certainly do so in practice. This result is mostly consistent with the recent study of Brandon et al. (2021), which revealed that, overall, signatory investors have better portfolio-level ESG scores, barring the US.

Discussion and Conclusion

Businesses are increasingly expected to understand and manage their exposure to ESG risks associated with their investments in financial assets, strategic partners, and business portfolio interests. Although numerous studies have investigated the impact of the ESG scores of companies on their financial returns and the trend in the ESG investment strategies, studies that identify the major players and regional trend in ESG investment by considering the direct and indirect ownership structure are scarce. Faccio and Lang's (2002) framework considers the cumulative impacts of ownership using the total market price of invested companies and investor history portfolio report by iterating the calculation to convey the impacts of invested companies to ultimate investors. The study expands this comprehensive approach to the field of ESG investment to address the research gap and detects the most influential investors in the ESG investment field and the ownership structure by considering the direct and indirect ESG ownership.

Based on the results, the patterns by the type of investor and nation–state political boundaries in the context of direct and indirect ownership chains are examined. We identify strong links between several countries, such as a strong link between North America and Asian countries, and differences in the pattern of ESG investment in terms of regional inflow and outflow (i.e., the international ESG investment volume is much larger than the internal ESG investment volume in most North American countries, whereas the internal ESG investment volume has the largest share in Asia). Through the analysis, we find that the top 10% investors own approximately 98% of the total ultimate ESG ownership score and the key players differ among the leading countries. In the US, financial firms are the major players, whereas non-financial firms are the major players in Japan and China. Furthermore, the results of the study confirm the important role of corporations in ESG investment, which owns the most global shares (85.77%) measured by the ESG ownership score, considering the direct and indirect ownership chains. Even minority shareholders may be directly linked to adverse environmental and social impacts directly or indirectly caused by investee companies in their portfolios (PRI, 2017). Therefore, it is important for investors to undertake ESG risk-based due diligence and consider ESG risks in their investment processes. Moreover, investors can manage and influence the responsible business conduct of the investee companies through direct and indirect ownership (OECD, 2017). The results of this study highlight the need of wider implementation of investments considering ESG risks.

Using the results of the ultimate ESG ownership analysis, this study also investigated the relation between the calculated ESG ownership score and Investor's ESG commitment and ESG performance (i.e., the PRI signatory status, investors' ESG ratings). The study by Brandon et al. (2021) showed that the PRI signatory institutional investors have better ESG ownership score (calculated based on the direct ownership data) in general, barring the US. Our analysis includes institutional investors and other financial and non-financial corporations, and the results demonstrating that the PRI signatory investors have better ESG ownership score than non-signatory investors are consistent with Brandon et al. (2021). The analysis of the relation between the calculated ESG ownership scores and investors' ESG performances (ESG ratings provided by Refinitiv) reveals that investors with high ESG ratings do not necessarily have higher incorporation of the ESG investment strategies. This result supports the findings of previous studies examining fund flow reactions to ESG ratings (Hartzmark and Sussman, 2019) by providing the evidence that it is difficult to target the actual flow and ownership structure of ESG investment through ESG ratings of the investors themselves.

Although evaluating the ESG ownership score by considering the direct and indirect ESG ownership structure and covering both institutional investors and other corporations expand the literature on ESG investment and ownership structure in various ways, our study only evaluates the score of the latest year owing to difficulties in data collection and the time required to calculate the scores for multiple years. Future studies can address this issue by constructing the ESG ownership score as time-series data, which would help in investigating the causal relationship between the ESG ownership score and investors' ESG performances, such as the PRI signatory status and investors' ESG ratings, more accurately.

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author Contributions

AK and CL carried out the experiment. ST conducted additional analyses using the calculated data. AK, CL, ST, and TG wrote the manuscript with support from SM. All authors contributed to the article and approved the submitted version.

Author Disclaimer

Any opinions, findings, and conclusions expressed in this paper are those of the authors and do not necessarily reflect the views of the funding agency.

Conflict of Interest

TG was employed by Industrial Ecology Consultants.

The remaining authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Acknowledgments

We would like to express our gratitude toward Mr. Okita and Mr. Ike from Vector Group for providing their insights and expertise on the ESG investment market during our discussions. This paper is based on results obtained from a project, JPNP14026, commissioned by the New Energy and Industrial Technology Development.

Supplementary Material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/frsus.2022.909239/full#supplementary-material

References

Bauer, R., Derwall, J., and Otten, R. (2007). The ethical mutual fund performance debate: new evidence from Canada. J. Bus. Ethics. 70, 111–124. doi: 10.1007/s10551-006-9099-0

Brandon, R. G., Glossner, S., Krueger, P., Matos, P., and Steffen, T. (2021). “Do responsible investors invest responsibly?,” in ECGI Working Paper Series in Finance, (Brussels: European Corporate Governance Institute).

Bryan, A., Choy, C. F. A. J., Lamont, K., and Sanzgiri, Z. (2020). Passive Sustainable Funds: The Global Landscape 2020 - Choice Expands as Products and Assets Double in Three Years. Chicago, IL: Morningstar.

Claessens, S., Djankov, S., and Lang, L. H. P. (2000). The separation of ownership and control in East Asian corporations. J. Financ. Econ. 58, 81–112. doi: 10.1016/S0304-405X(00)00067-2

Cortez, M. C., Silva, F., and Areal, N. (2009). The performance of European socially responsible funds. J. Bus. Ethics. 87, 573–588. doi: 10.1007/s10551-008-9959-x

Faccio, M., and Lang, L. H. (2002). The ultimate ownership of Western European corporations. J. Financ. Econ. 65, 365–395. doi: 10.1016/S0304-405X(02)00146-0

Funk, C. M., and Hento, E. (2022). ESG Implications of the Russia-Ukraine War [Commercial Sector]. State Street Global Advisors–Insights. Available online at: https://www.ssga.com/se/en_gb/institutional/ic/insights/esg-implications-of-the-russia-ukraine-war (accessed March 13, 2020).

Global Sustainable Investment Alliance (2021). Global Sustainable Investment Review 2020. Available online at: http://www.gsi-alliance.org/wp-content/uploads/2021/08/GSIR-20201.pdf

Hartzmark, S., and Sussman, A. (2019). Do investors value sustainability? A natural experiment examining ranking and fund flows. J. Fin.74, 2789–2837. doi: 10.1111/jofi.12841

Kenton, W., James, M., and Kvilhaug, S. (2021). What Is Intercorporate Investment? Investopedia. Available online at: https://www.investopedia.com/terms/i/intercorporate-investment.asp (accessed March 12, 2021).

Khan, S. A. R., Ponce, P., Tanveer, M., Aguirre-Padilla, N., Mahmood, H., and Shah, S. A. A. (2021a). Technological innovation and circular economy practices: business strategies to mitigate the effects of COVID-19. Sustainability 13:8479. doi: 10.3390/su13158479

Khan, S. A. R., Yu, Z., Umar, M., and Tanveer, M. (2021b). Green capabilities and green purchasing practices: a strategy striving towards sustainable operations. Bus. Strategy Environ. 31, 1719–1729. doi: 10.1002/bse.2979

La Porta, R., Lopez-de-Silanes, F., and Shleifer, A. (1999). Corporate ownership around the world. J. Fin. 54, 471–518. doi: 10.1111/0022-1082.00115

MorningStar (2022). Country Risk. Available online at: https://connect.sustainalytics.com/hubfs/INV%20-%20Reports%20and%20Brochure/Product%20Brochures/Country%20Risk%20Rating.pdf

OECD (2017). Responsible Business Conduct for Institutional Investors: Key Considerations for Due Diligence Under the OECD Guidelines for Multinational Enterprises. Paris: OECD.

OECD (2021). ESG Investing and Climate Transition: Market Practices, Issues and Policy Considerations. Paris: OECD.

PRI (2017). Managing ESG Risk in the Supply Chains of Private Companies and Assets. London: PRI. https://www.unpri.org/download?ac=1894

PRI (2022). Signatory Directory. Available online at: https://www.unpri.org/signatories/signatory-resources/signatory-directory (accessed March 2022).

Silver, C., Chen, J., and Kagan, J. (2021). Accounting for Intercorporate Investments: What You Need to Know. Investopedia. Available online at: https://www.investopedia.com/articles/fundamental-analysis/11/accounting-intercorporateinvestment.asp# (accessed March 13, 2021).

Widyawati, L. (2020). A systematic literature review of socially responsible investment and environmental social governance metrics. Bus. Strategy Environ. 29, 619–637. doi: 10.1002/bse.2393

Keywords: environmental, social, governance, ultimate ownership structure, network analysis, socially responsible investing, sustainable investment

Citation: Keeley AR, Li C, Takeda S, Gloria T and Managi S (2022) The Ultimate Owner of Environmental, Social, and Governance Investment. Front. Sustain. 3:909239. doi: 10.3389/frsus.2022.909239

Received: 31 March 2022; Accepted: 03 June 2022;

Published: 08 July 2022.

Edited by:

Syed Abdul Rehman Khan, Tsinghua University, ChinaReviewed by:

Muhammad Tanveer, Prince Sultan University, Saudi ArabiaUsama Awan, Lappeenranta University of Technology, Finland

Copyright © 2022 Keeley, Li, Takeda, Gloria and Managi. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Alexander R. Keeley, a2VlbGV5LnJ5b3RhLmFsZXhhbmRlci40MTZAbS5reXVzaHUtdS5hYy5qcA==

Alexander R. Keeley

Alexander R. Keeley Chao Li1

Chao Li1 Shutaro Takeda

Shutaro Takeda Tom Gloria

Tom Gloria Shunsuke Managi

Shunsuke Managi