- 1Postgraduate Program in Business Administration, Federal University of Santa Maria, Santa Maria, Brazil

- 2Graduate in Production Engineering, Federal University of Santa Maria, Santa Maria, Brazil

This study aimed to analyze the relationship between circular business model innovation and business performance in Brazilian industrial chemical companies. This is a quantitative study carried out through a survey with Brazilian industrial companies. Based on a homogeneity analysis (Homals), the results showed that the high degree of innovation in business models from the adoption of circular economy (CE) strategies in the analyzed companies confirms that a significant change leads to superior performance, especially in market, production, economic and financial, and social.

Introduction

Although products are becoming more resource-efficient, increasing consumption levels and the linear nature of the economic system have notably increased resource use and waste, consequently leading to environmental degradation. The negative effects of dominant production models based on collecting, manufacturing, and using resources and goods threaten natural ecosystems and affect human health and well-being (Braungart et al., 2007; Stahel, 2016). Hence, in the search for alternatives to unsustainable resource use, industrial ecology has provided the basis for a circular economy (EC).

The CE envisions achieving a more effective and resource-efficient economic system by intentionally narrowing, slowing, and closing material and energy flows (Ellen Macarthur Foundation, 2015; Bocken et al., 2016). In this sense, companies engaged in this circular process should extend their concerns with economic-financial viability to strategies aimed at perpetuating the business and concern with society and the environment; therefore, organizations must adopt a business model that meets circularity precepts (i.e., they must consider adopting a business model that meets the CE).

The adoption of practices that lead to CE requires significant changes and investments to modify existing linear models in planning, production, and management of the supply chain (Fusion, 2014). This also implies a shift from material-intensive business models to service-based business models and the improvement of more collaborative partnerships (Fonseca et al., 2018).

For this, companies have to be aware of this new paradigm to attract new business opportunities. According to Aboulamer (2018), the shift in consumer attitudes toward a product-to-service paradigm provides companies an excellent opportunity to gain financial resources and move from a linear to a circular business model. Circular business models often capitalize on new revenue sources from the product or material cycle, such as selling company waste or byproducts or reducing procurement costs for raw materials when replaced by secondary materials (Moreno et al., 2016). Companies can also capitalize on post-consumer markets and capturing value by repairing and reselling products or reusing and upgrading them. In fact, moving toward the CE may contribute to superior business performance, that is, better performance compared to companies in the same sector, and some studies expect the CE to have a positive impact on both the environment and economic growth in the coming years (Ellen Macarthur Foundation, 2013; Lehmann et al., 2014; European Environment Agency, 2016; Geissdoerfer et al., 2017; Masi et al., 2017).

Given this context, the chemical industry plays a vital role as a technological innovation agent for several upstream and downstream production chains and, therefore, has great potential to enable CE guidelines (Tavares, 2018). In addition, the chemical industry occupies the third position in the ranking of contribution to the transformation industry, being responsible for the control of various types of inputs (ABIQUIM, 2018). With this, the scope of the chemical industry through the consumption of chemical products in several sectors of the economy becomes evident. Therefore, upon realizing the benefits not only for the environment, but also for economic and social reasons, the adoption of CE's precepts in their business could impact several business sectors.

For this reason, the new business models adopted by industrial companies in the chemical sector can promote the closure of material cycles in order to achieve circularity and, thus, promote superior business performance. Therefore, this study aims to analyze the relationship between circular business model innovation and business performance in Brazilian industrial chemical companies.

Circular Business Model

The literature on the business model has significantly grown since the 1990s; the business model can be understood as a representation of how the company does business (i.e., how it creates and delivers value to the customer to generate revenue and achieve a sustainable competitive position) (Taran et al., 2015). Osterwalder et al. (2005) described the business model as a conceptual tool that helps understand how the company operates and can be used to analyze, compare, and evaluate performance, management, communication, and innovation in the business environment. In general, business model structures converge around the logic of value generation of a reference system (e.g., organization, value chain, industry sector), which can be represented by different elements (Wirtz et al., 2016).

The fierce competitiveness of companies in an industry challenged to meet the needs of increasingly demanding consumers has required new ways of doing business. Taran et al. (2015) pointed out that global competition has forced companies to rethink their business models more frequently, given that innovating exclusively in new products and serving local markets is not enough to sustain competitiveness and ensure the company's survival. Therefore, business model innovation has become a considerable challenge for companies. Although many managers are eager to consider more radical changes in their business model, they often do not know how to articulate the existing or desired business model and, even less, understand the possibilities of innovating it (Taran et al., 2015).

Innovative business models (IBMs) can take two forms: designing an entirely new business model or reconfiguring the elements of an existing one (Zott and Amit, 2010). By changing the business model elements, an organization can change how it is connected to external stakeholders and engages in economic exchanges to create value for its partners (Zott and Amit, 2008). Innovating the business model can help coordinate technological and organizational innovations that engage stakeholders within the value network (Zott et al., 2011). The dynamic process of the IBM can occur at different intensities and is related to the degree of novelty introduced (i.e., “new to the firm” or “new to the industry”) or the scope of changes (i.e., individual components or systemic/architectural structure) (Foss and Saebi, 2017). Furthermore, different internal or external triggers, such as changes in the competitive environment or legislations, can stimulate changes in the business model.

Pieroni et al. (2019) recently highlighted that IBM is receiving increasing attention in specific areas (e.g., sustainability, CE, servitization, and digitization). In addition to generating superior customer value to gain competitive advantage and capture economic value, a sustainability-oriented business model also seeks to contribute positively to the environment and society (Stubbs and Cocklin, 2008; Lüdeke-Freund, 2010). In order to achieve a more sustainable business model, the CE can provide a path for business managers, and circular business models can enable economically viable ways to continuously reuse products and materials by using renewable resources wherever possible (Bocken et al., 2016).

A circular business model can be defined as the logic of how an organization creates, delivers, and captures value with and within closed material loops (Mentink, 2014). The idea is that an IBM does not need to close material cycles within its internal system boundaries, but it can also be part of a system of business models that, together, close a material cycle that can be considered circular (Mentink, 2014). Circular business model innovations are by nature networked: they require collaboration, communication, and coordination within complex networks of interdependent but independent actors or stakeholders (Antikainen and Valkokari, 2016).

Circular business models will gain an increasing competitive advantage in the coming years because they create more value from each resource unit than the traditional and linear “provide-discard” model. Hence, accelerating scaling may lead to substantial macroeconomic benefits and open up new opportunities for corporate growth (Ellen Macarthur Foundation, 2014). As a response to growing pressure on our natural resources, the CE aims to create various types of value with the ultimate goal of achieving a more effective and resource-efficient economic system (Ellen Macarthur Foundation, 2015). In this sense, companies must modify their business models to contribute to circularity; an innovative CE-oriented business model incorporates CE principles or practices as guidelines for business model design (Pieroni et al., 2019). This integration can take place, as explained by Urbinati et al. (2017), through downstream circular changing capture and delivery from new revenue and customer interface schemes, for example, with pay-per-use models, upstream circular changing value creation systems, for example using reverse logistics, or combining upstream and downstream principles.

Business model innovation is the new way of creating, delivering, and capturing the value achieved by changing one or several components of the business model (Osterwalder and Pigneur, 2010). In this sense, it becomes evident that radical innovations and disruptive business models are required to address current challenges and move toward the CE model (Boons et al., 2013). From a strategic perspective, large companies already understand the need for business model innovations to ensure survival and growth as they deal with the external threat of continuous innovation (Blank, 2013). The CE requires managers to think differently: instead of thinking about the product itself, they need to think about systems around products and reinvent the way they generate revenue, creating and maintaining value over time (Bakker et al., 2014).

Aminoff et al. (2017) proposed a framework based on the assumption that business model innovation plays a critical role in creating new (disruptive) business ecosystems and opening new markets for a CE, where business model co-innovation is identified as crucial for the system-level changes required for CE. The authors offer a categorization and division of business model innovation into value creation innovation, new proposition innovation, and value capture innovation (Aminoff et al., 2017). Nußholz (2018) suggested examples of innovating the business model to achieve circularity from the three dimensions of business model values: value proposition, value creation and delivery, and value capture. The author developed a tool to help design business models that maintains and capitalizes on the value embedded in products for as long as possible, integrating business model thinking with circular principles to support business model planning throughout a product's life cycle (Nußholz, 2018).

In another study, Lüdeke-Freund et al. (2019) analyzed 26 circular economy business models (CEBMs), starting with defining their key business model dimensions and identifying the specific characteristics of these dimensions. These authors identified a wide range of business model design options and proposed six main CEBM patterns with the potential to support closing resource cycles: repair and maintenance, reuse and redistribution, refurbishment and remanufacturing, recycling, cascading and reuse, and organic feedstock business model patterns (Lüdeke-Freund et al., 2019). Similarly, Geissdoerfer et al. (2020) sought to contribute to reducing the conceptual lack of clarity and mapping the research landscape, providing a more solid foundation for the emerging field of circular business model innovation and contributing to greater clarity and simplicity in communicating what circular business models are and how they are innovated. Following the formalized value logic from value proposition, value creation and delivery, and value capture, the authors relied on strategies to circulate, extend, intensify, and dematerialize (Geissdoerfer et al., 2020).

Business Performance

To measure business performance, organizations use indicators that, in most cases, are represented by quantifiable measures. Business performance indicators seek to evaluate the results achieved by companies from the established strategies to develop new plans and/or improvement proposals. Performance is a parameter used to quantify the efficiency and/or effectiveness of past actions and “the ability of the organization to achieve its goals by using its resources efficiently” (Neely et al., 2002; Daft and Marcic, 2004, p.10).

Several studies support that circular activities lead to better company performance (Zhu et al., 2010; Khan et al., 2020; Scarpellini et al., 2020). In the study by Gusmerotti et al. (2019), for example, the different advantages for companies that adopt the CE principles were identified, including the improvement of the brand and customer satisfaction (Ambec and Lanoie, 2008; Darnall and Sides, 2008), that we can associate with market performance, reduced environmental impact (Manninen et al., 2018; Nußholz, 2018), associated with environmental performance, increased competitive performance (Iraldo et al., 2009), related to market performance, and reduced dependence on the supply of raw materials together with less exposure to the risk associated with it (Winn and Pogutz, 2013; Kalaitzi et al., 2018), which can be related to production performance.

The Ellen Macarthur Foundation (2015) also cites that the CE drives innovation and that the benefits of a more innovative economy include high rates of technological development, improvement in processes and materials, efficient use of energy, and opportunities for financial gains for businesses companies.

For companies, the CE provides the opportunity for new products and ventures, or even new business models (Korhonen et al., 2018), in addition to a more sustainable image, which can be favorable to the company's marketing (Leitão, 2015; Korhonen et al., 2018). In addition, the CE can contribute to reducing the cost of waste disposal and environmental risks (Ellen Macarthur Foundation, 2015; Leitão, 2015; Korhonen et al., 2018), contributing to production performance and, consequently, a financial performance.

However, Ritzen and Sandstrom (2017) state that companies are reluctant to invest in the transition to the CE, as they consider the return to be uncertain and, mainly, because this return is not immediate.

Evaluating business performance requires defining the parameters that will be adopted. Indicators are instruments that help measure business performance and consist of one or more variables that, when associated, reveal broader meanings about the phenomena to which they refer, allowing the company's interests to be monitored and the planning of actions aimed at improving performance (Callado, 2010; Villas Bôas, 2011). In one of the most widely adopted models in research on innovation and sustainability, Gunday et al. (2011) highlighted the effects of innovation on different dimensions of business performance: innovation, production, market, and financial performance, revealing the positive effects of innovations on business performance.

As far as sustainable performance is concerned, the proposal developed by the Global Reporting Initiative (GRI) represents one of the most comprehensive scopes, being known and used by companies worldwide for sustainability reporting purposes. The GRI is an international non-governmental organization founded in 1997 and headquartered in the Netherlands, and its guidelines consist of the most widely used standard for sustainability reporting (Brown et al., 2009; Prado-Lorenzo et al., 2009; Rasche, 2009; Skouloudis et al., 2009; Tsang et al., 2009; Levy et al., 2010; Marimon et al., 2012).

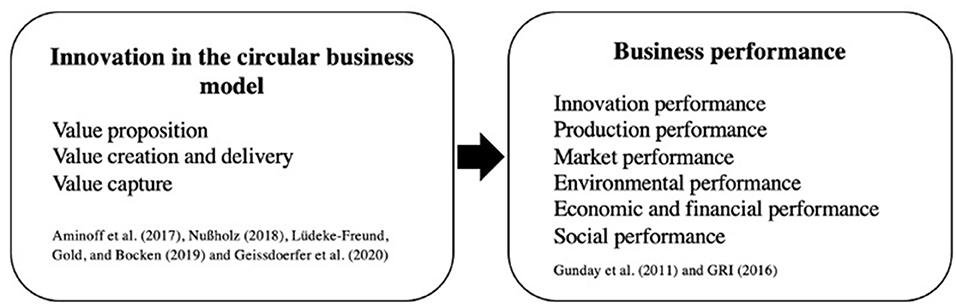

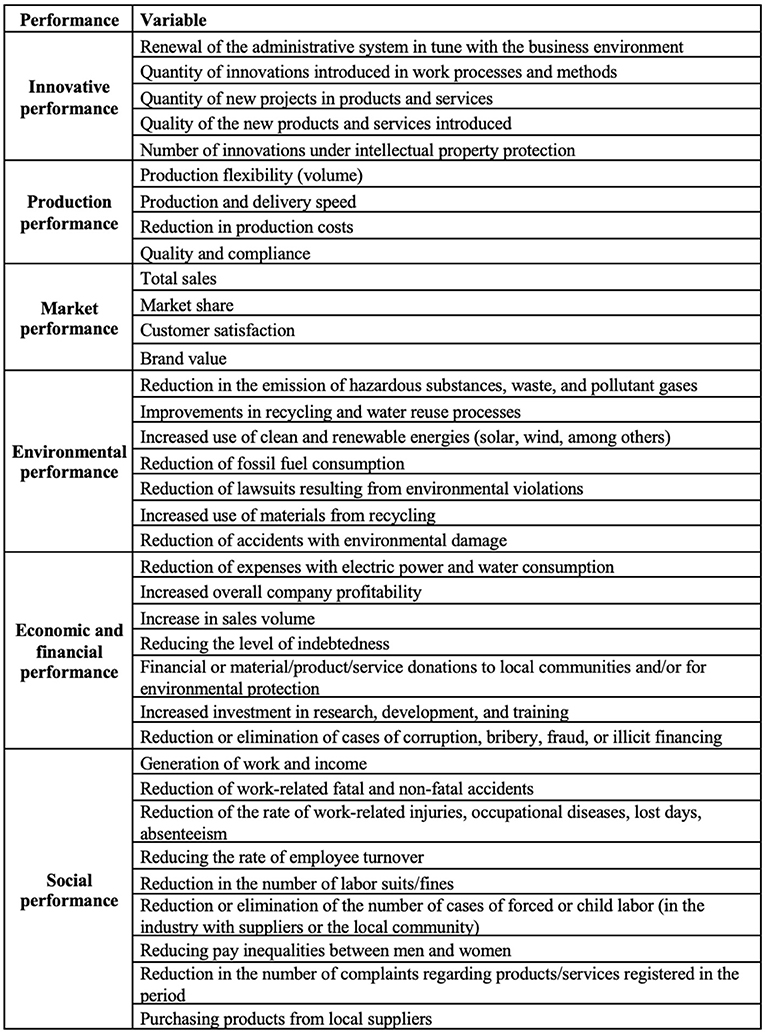

The GRI guidelines are divided into economic, environmental, and social categories, and each category includes information on management approach and a corresponding set of core and additional performance indicators. The core indicators consider aspects relevant to most organizations, and the additional indicators represent emerging practices or address issues that may be relevant to certain organizations (Global Reporting Initiative, 2016). With regard to the CE, the prevailing research emphasizes that by adopting a CE approach, organizations can achieve benefits by simultaneously and holistically addressing the economic, environmental, and social dimensions of sustainable development (Fonseca et al., 2018). Currently, the focus of these discussions has shifted from simplistic arguments about why CE is good to understanding more theoretically sophisticated justifications for the results achieved by implementing circular business models (Lahti et al., 2018). The proposal of Gunday et al. (2011) and Global Reporting Initiative (2016) are presented in Figure 1.

Figure 1. Proposal of Gunday et al. (2011) and Global Reporting Initiative (2016).

Therefore, it is worth investigating whether the implementation of new business models on the pillars of the CE can generate financial gains and thus contribute to issues related to business performance.

Study Methods

This study proposes to analyze the relationship between circular business model innovation and business performance in Brazilian industrial chemical companies. The research is characterized as descriptive, quantitative in nature and designed through a survey with Brazilian chemical companies. Descriptive research aims to describe the characteristics of certain populations or phenomena (Gil, 2008) and is used to estimate the proportion of these characteristics or behaviors to verify the relationship between variables (Mattar, 1997). For Malhotra (2006), quantitative research seeks to quantify data and generally applies some form of statistical analysis, while the survey is a method of collecting primary data from individuals who report their attitudes and behavior through questionnaires or interviews (Adams and Lawrence, 2019).

According to the objectives presented herein, the variables analyzed were grouped into two key dimensions: circular business model and business performance. The circular business model was analyzed to identify the degree of business model innovation based on the CE strategies adopted. As for business performance, in turn, this paper proposes to analyze financial, innovative, production, market, and socio-environmental performance based on Gunday et al. (2011) and Global Reporting Initiative (2016).

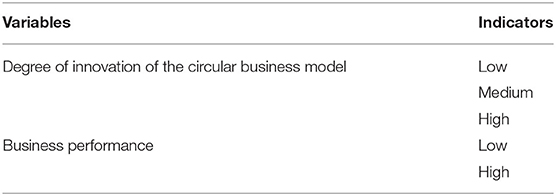

The questionnaire consisted of closed questions and a Likert scale in which respondents indicated the score that best reflects their agreement with the degree of innovation of the circular business model, ranging from 1 (incremental) to 5 (radical) and, in relation to business performance, ranging from 1 (lowest degree of agreement) to 5 (maximum degree of agreement). These variables were ordered from lowest to highest value and reclassified as low, medium, and high degree of modification in the business model and for low and high business performance. The conceptual research model is defined by identifying interdependent relationships between the degree of innovation in the circular business model and business performance (Figure 2).

Questionnaires were sent to the companies using SurveyMonkey software (cloud-based online survey development software) and an invitation letter clarifying the study's objectives. Telephone and social networking contacts were also made with the companies to clarify the purpose and importance of the survey. The target population consisted of 256 companies associated with the Brazilian Chemical Industry Association (ABIQUIM, 2018). In September 2020, first, ABIQUIM was contacted and the associated chemical companies were asked to contact the research. Subsequently, all member companies were contacted by telephone in order to identify the most appropriate person in charge to answer the questionnaire. From there, the questionnaire was sent via e-mail and subsequent calls were made requesting the answers. In the end, in June 2021, 57 questionnaires were received, representing 22.3% of the population surveyed. Although the rate of return is not considered high, the results obtained allow for a specific analysis of the characteristics and behavior of the companies studied. The evidence found cannot be extrapolated to the research universe considered.

The data collected were tabulated using the Microsoft Excel and Statistical Package for the Social Sciences (SPSS) software and analyzed using univariate analysis via descriptive analysis of the categories and variables that made up such multivariate categories using multiple correspondence analysis. Homals (homogeneity analysis) was used to perform the correspondence analysis, which is a technique applied to study the relationship between two or more nominal or ordinal variables (Pestana and Gageiro, 2008). The homogeneity analysis seeks to ascertain, through the interactions established between the multiple categories, positioned in a defined space as a function of the crossing of dimensions, if distinct groups are defined (Carvalho, 2004). If so, the intention is to find out how the groups are configured and positioned with each other. Categories close to the origin indicate that they are not important for defining the dimensions of the analysis plan (Carvalho, 2004). This method allows the results to be visualized through a perceptual map and the correspondence between the variables to be identified; Homals allows the interest in proving that the association between the degree of innovation in business models and sustainable innovation practices is illustratively and reliably satisfied, and revealing which groups of business performance variables are associated with a low, medium, or high degree of innovation of the circular business model. After explaining the methodological procedures used, we will analyze and discuss the results below.

Analysis and Discussion of the Results

The results of the study are analyzed below. The data on the characterization of the sample are first presented, followed by the descriptive statistics of the categories and variables that make up the degree of innovation in the circular business model and business performance. Finally, a multiple correspondence analysis (Homals) is performed to verify the relationship between the degree of innovation in the circular business model and business performance.

Sample Characterization

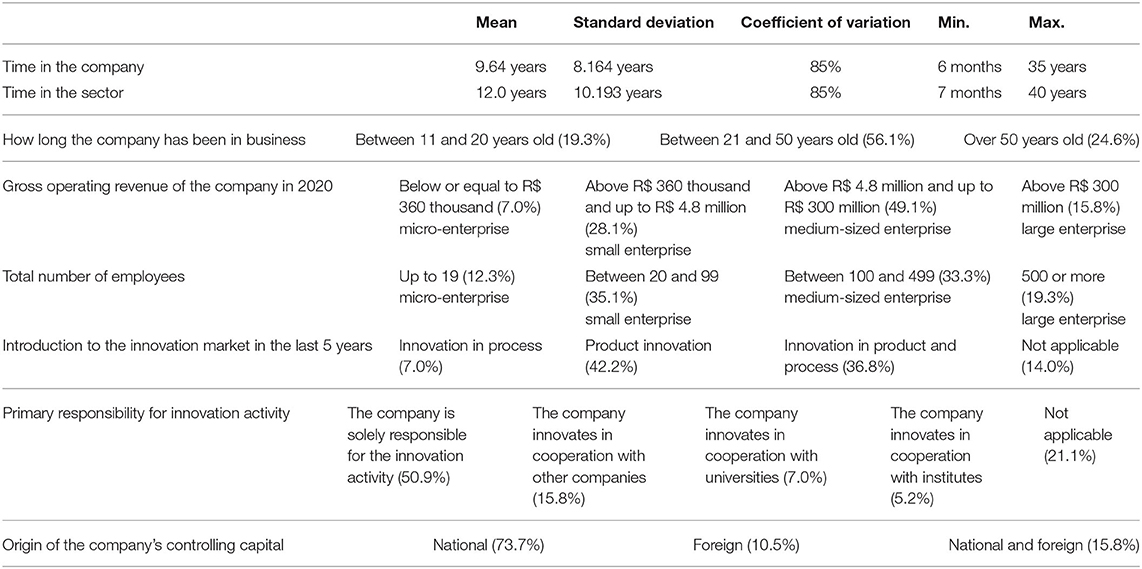

The data from the sample studied are listed in Table 1. The data that characterize the companies surveyed indicate that, in relation to the profile of the respondents, the average time of work of the respondents in the company and sector is approximately 9 and 13 years, respectively. This data shows the high experience of the professionals interviewed despite the considerable data variability.

The length of time companies have been in existence suggests traditional and conservative perceptions, considering that 80.7% of the companies are over 21 years old. The companies studied can be classified as micro-enterprises, small enterprises, medium-sized enterprises, and large enterprises. These data reflect that the sample comprises companies of all sizes. Therefore, understanding corporate behavior in relation to the degree of innovation of the circular business model and corporate performance in the sample studied can contribute to disseminating practices that provide greater corporate competitiveness for different realities of the sector in Brazil. By analyzing innovation-related characteristics, the data revealed that organizations have introduced product and process innovations in the last 5 years, evidencing that product innovation is linked to processes, contributing to greater business competitiveness. Regarding the primary responsibility for the innovation activity, there is a division between internal and external responsibility, since approximately half of the companies analyzed are the main funders of the innovative activity, while the other half work in partnership with other companies, universities, and institutes. From the characterization of the sample, the mean, standard deviation, and coefficient of variation of the categories and variables studied are further analyzed.

Descriptive Analysis of Categories and Variables

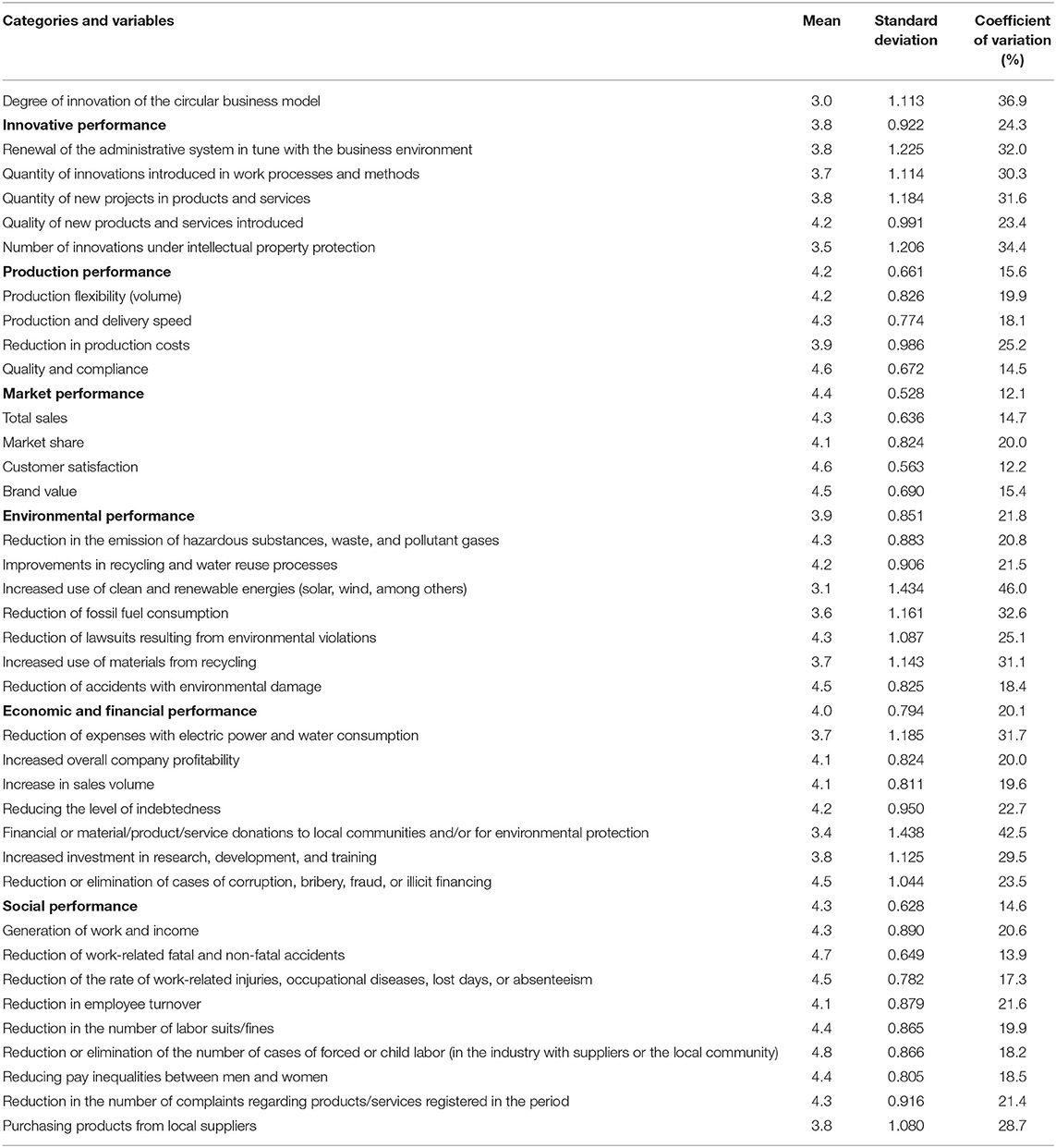

The mean, standard deviation, and coefficient of variation of the seven categories and variables that make up each one in relation to the variable reflecting the degree of innovation of the companies' circular business model and business performance are presented in Table 2. The variables were measured using a five-point Likert scale for the degree of business model innovation and for those related to business performance.

The results showed that business model innovation toward the CE had an average score of 3, which implies that the impact ranges from medium to high. In addition, this variable showed acceptable variability, revealing that this reality is uniformly present among the industrial chemical companies analyzed.

As for business performance, the most outstanding performance values among the analyzed companies were market, social, and production performance. Regarding market performance, customer satisfaction and brand value stood out. Social performance was driven by the reduction or elimination of the number of cases of forced or child labor with suppliers and the local community, the reduction in the number of fatal and non-fatal accidents at work, the reduction of injuries, illnesses, and absenteeism, the reduction in the number of labor lawsuits or fines, and the reduction of wage inequalities between men and women. Finally, in production performance, quality and compliance, and production and speed of delivery stood out.

Other dimensions, including environmental performance and economic and financial performance, despite presenting lower means than the others, also had outstanding variables, such as the reduction of accidents with environmental damage and reduction of lawsuits resulting from environmental damage (environmental performance), and the reduction or extinction of cases of corruption, bribery, fraud, or illicit financing (economic and financial performance).

Nevertheless, performance variables such as increased use of clean and renewable energy (environmental performance) and financial or material/product/service donations to local communities and/or environmental protection (economic and financial performance) presented the lowest means. Moreover, all variables and dimensions of business performance presented coefficients of variation with low or moderate response variability (below 50%). Finally, the relationship between the degree of innovation in the circular business model and business performance is verified through multiple correspondence analyses.

Correspondence Analysis of the Categories

The relationship between the degree of business model innovation from circular strategies and business performance was analyzed by multiple correspondence analysis (homals). The initial analysis model was formed by the categories associated with the variable representing the degree of innovation of the circular business model and the categories of business performance. These new variables were then divided into indicators (Table 3).

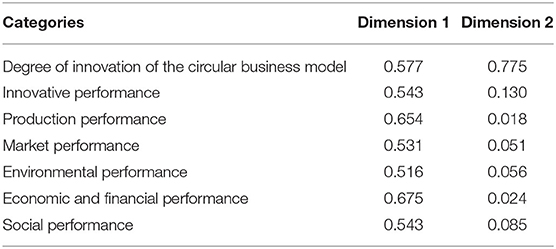

By applying the multivariate analysis technique (homals), dimension 1 showed eigenvalues of 4.04, whereas dimension 2 had a value of 1.138. The values enabled us to identify the clear disaggregation of different categories, separating each variable and forming differentiated groups of variable categories. The discrimination measures of the variables according to the dimensions are listed in Table 4.

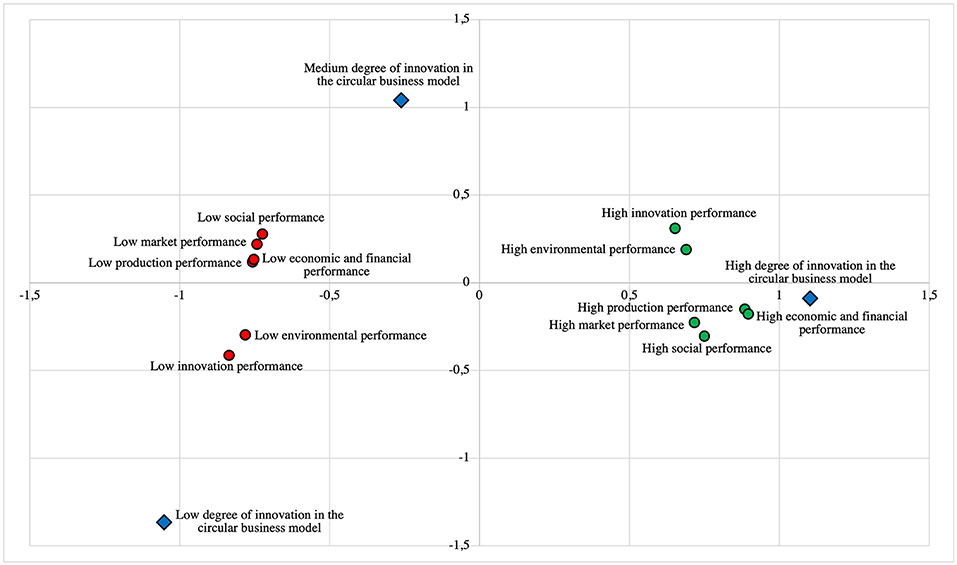

The correspondence relations among the categories of variables and indicators analyzed are presented in Figure 3.

The data presented allow us to make some considerations about the relationship between the degree of innovation in the companies' circular business model and business performance:

(1) The high degree of innovation in the circular business model is associated with high market, production, economic and financial, and social performance.

(2) The medium degree of innovation in the circular business model is associated with low market, production, economic and financial, and social performance.

(3) The low degree of innovation in the circular business model is associated with low innovation and environmental performance.

The results revealed that a high degree of innovation in the circular business model indicates a high market performance (total sales, market share, customer satisfaction, and brand value); high production performance (production flexibility, production and delivery speed, reduction in production costs, and quality and compliance); high economic-financial performance (reduction of expenses with electric power and water consumption, increased overall company profitability, increase in sales volume, reducing the level of indebtedness, financial or material/product/service donations to local communities and/or for environmental protection, increased investment in research, development, and training, and reduction or elimination of cases of corruption, bribery, fraud, or illicit financing); and high social performance (generation of work and income, reduction of work-related fatal and non-fatal accidents, reduction of the rate of work-related injuries, occupational diseases, lost days, or absenteeism, reduction in employee turnover, reduction in the number of labor suits/fines, reduction or elimination of the number of cases of forced or child labor, reducing pay inequalities between men and women, reduction in the number of complaints regarding products/services registered in the period, and purchasing products from local suppliers). These results corroborate the findings of some authors (Leitão, 2015; Korhonen et al., 2018) who report that the CE provides the opportunity a more sustainable image, which can be favorable to the company's marketing, and to reducing the cost of waste disposal and environmental risks. According to these reports, superior market and production performance can be explained from a greater degree of innovation toward a circular business model.

Another result revealed in our study was that innovation in the circular business model also contributes to economic and financial performance. This finding agrees with some studies (Ellen Macarthur Foundation, 2013; Lehmann et al., 2014; European Environment Agency, 2016; Geissdoerfer et al., 2017; Masi et al., 2017), which reported that the direction of the CE could contribute for superior business performance, as some studies predict that the CE will positively affect the environment and economic growth. However, a high degree of innovation in the circular business model does not contribute to high environmental performance as expected.

For companies with a medium degree of innovation in their circular business model, a behavior geared toward low market performance, low production performance, low economic and financial performance, and low social performance was observed. Companies with a low degree of business model innovation, on the other hand, exhibit low innovative performance (renewal of the administrative system in tune with the business environment, quantity of innovations introduced in work processes and methods, quantity of new projects in products and services, quality of new products and services introduced, and number of innovations under intellectual property protection) and low environmental performance (reduction in the emission of hazardous substances, waste, and pollutant gases, improvements in recycling and water reuse processes, increased use of clean and renewable energies (solar, wind, among others), reduction of fossil fuel consumption, reduction of lawsuits resulting from environmental violations, increased use of materials from recycling, and reduction of accidents with environmental damage).

Conclusions

According to our findings, the analyzed industrial chemical companies have medium to high degrees of business model innovation toward the CE, despite high response variability. These companies showed outstanding market performance with customer satisfaction and brand value, social performance, low forced or child labor, accidents and injuries, labor lawsuits, gender pay gaps, and improved production performance with quality, compliance, and delivery speed.

In addition, when analyzing the relationship between the degree of innovation in the circular business model and business performance in the Brazilian chemical industries, it was evident that a more proactive stance in their business model toward the CE is related to better market and productive performance, economic and financial, and social. This confirms that a significant shift from linear economic logic to a more innovative logic such as CE is associated with superior business performance.

When it comes to companies with a medium degree of innovation in the circular business model, a behavior directed toward low environmental and low economic and financial performance is observed, revealing the need for a more radical change in the way of doing business as opposed to the production system linear, since a partial shift to a circular business model was not related to high performance rates. Likewise, the low degree of innovation in the circular business model represented low innovative performance and low environmental performance. Analyzing environmental performance and innovative performance, the results show that a high degree of innovation in the business model is not associated with a high environmental performance and a high innovative performance, however, a low degree of innovation in the business model it was associated with a low environmental performance and a low innovative performance. This means that the chemical industries analyzed that changed their business model toward the CE did not present better environmental and innovative results, while the chemical industries that did not change their business model toward circularity presented worse environmental and innovative performance than the others. In other words, only the renunciation or low adherence to a circular business model is related to environmental performance and innovative performance.

Based on the data here, it is recommended that managers and decision makers of executive companies strategically and proactively insert innovation and the CE into their business models. However, this study found several limitations, including an inability to generalize the superior and discussed results. Therefore, as a suggestion for future research, we recommend expanding this study to other realities and even to other business sectors to assess the relationship between the degree of innovation of the circular business model and business performance.

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author Contributions

FM: data analysis. CG: general orientation. JK: construction of the framework and the study method. AP: construction of the framework and the study method. LD: data collection. TL: data collection. All authors contributed to the article and approved the submitted version.

Funding

This work was funded by CNPq, CAPES, and FAPERGS.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

ABIQUIM (2018). Associação Brasileira da Industria Química – ABIQUIM. Available online at: https://abiquim.org.br/includes/pdf/indQuimica/livreto-de-dados-2016-paginas.pdf (accessed August 15, 2021).

Aboulamer, A. (2018). Adopting a circular business model improves market equity value. Thunderbird Int. Bus. Rev. 60, 765–769. doi: 10.1002/tie.21922

Adams, K. A., and Lawrence, E. K. (2019). Research Methods, Statistics, and Applications, 2nd Edn. Thousand Oaks, CA: Sage Publications.

Ambec, S., and Lanoie, P. (2008). Does it pay to be green? A systematic overview. Acad. Manage. Perspect. 22, 45–62. doi: 10.5465/amp.2008.35590353

Aminoff, A., Valkokari, K., Antikainen, M., and Kettunen, O. (2017). “Exploring disruptive business model innovation for the circular economy,” in 4th International Conference on Sustainable Design and Manufacturing (Bologna), 525–536. doi: 10.1007/978-3-319-57078-5_50

Antikainen, M., and Valkokari, K. (2016). A framework for sustainable circular business model innovation. Technol. Innov. Manage. Rev. 6, 5–12. doi: 10.22215/timreview/1000

Bakker, C., Den Hollander, M., Van Hinte, E., and Zijlstra, Y. (2014). Products That Last: Product Design for Circular Business Models. Delft: TU Delft Library.

Blank, S. (2013). Why the lean start-up changes everything. Harv. Bus. Rev. 91, 63–72. Available online at: https://hbr.org/2013/05/why-the-lean-start-up-changes-everything

Bocken, N. M. P., De Pauw, I., Bakker, C., and Van Der Grinten, B. (2016). Product design and business model strategies for a circular economy. J. Ind. Product. Eng. 33, 308–320. doi: 10.1080/21681015.2016.1172124

Boons, F., Montalvo, C., Quist, J., and Wagner, M. (2013). Sustainable innovation, business models and economic performance: an overview. J. Clean. Prod. 45, 1–8. doi: 10.1016/j.jclepro.2012.08.013

Braungart, M., McDonough, W., and Bollinger, A. (2007). Cradle-to-cradle design: creating healthy emissions-a strategy for eco-effective product and system design. J. Clean. Prod. 15,1337–1348. doi: 10.1016/j.jclepro.2006.08.003

Brown, H. S., De Jong, M., and Levy, D. L. (2009). Building institutions based on information disclosure: lessons from gri's sustainability reporting. J. Clean. Prod. 17, 571–580. doi: 10.1016/j.jclepro.2008.12.009

Callado A. L. C. (2010). Modelo de Mensuração de Sustentabilidade Empresarial: Uma Aplicação em Vinícolas Localizadas na Serra Gaúcha. Doctoral thesis, Federal University of Rio Grande do Sul, Porto Alegre.

Carvalho, H. (2004). Análise Multivariada de Dados Qualitativos - Utilização da HOMALS com SPSS. Lisboa: Edições Silabo.

Darnall, N., and Sides, S. (2008). Assessing the performance of coluntary environmental programs: does certification matter? Policy Stud. J. 36, 95–117. doi: 10.1111/j.1541-0072.2007.00255.x

Ellen Macarthur Foundation (2013). Towards the Circular Economy Vol. 1: An Economic and Business Rationale for an Accelerated Transition. Available Online at: https://www.ellenmacarthurfoundation.org/assets/downloads/publications/Ellen-MacArthur-Foundation-Towards-the-CircularEconomy-vol.1.pdf (accessed January 15, 2019).

Ellen Macarthur Foundation (2014). Towards the Circular Economy: Accelerating the Scale-Up Across Global Supply Chains. EMF. Available online at: https://ellenmacarthurfoundation.org/towards-the-circular-economy-vol-3-accelerating-the-scale-up-across-global (accessed January 15, 2019).

Ellen Macarthur Foundation (2015). Towards a Circular Economy: Business Rationale for an Accelerated Transition. EMF. Available online at: https://ellenmacarthurfoundation.org/towards-a-circular-economy-business-rationale-for-an-accelerated-transition (accessed January 15, 2019).

European Environment Agency (2016). Circular Economy in Europe: Developing the Knowledge Base. EEA. Available online at: https://www.eea.europa.eu/publications/circular-economy-in-europe (accessed January 15, 2019).

Fonseca, L. M., Domingues, J. P., Pereira, M. T., Martins, F. F., and Zimon, D. (2018). Assessment of circular economy within Portuguese organizations. Sustainability 10, 2521. doi: 10.3390/su10072521

Foss, N. J., and Saebi, T. (2017). Fifteen years of research on business model innovation. J. Manage. 43, 200–227. doi: 10.1177/0149206316675927

Fusion (2014). The Circular Economy and Europe's Small and Medium Sized Businesses. Fusion Observatory Report. Chatham, UK. Available online at: https://www.kent.gov.uk (accessed January 15, 2019).

Geissdoerfer, M., Pieroni, M., Pigosso, D., and Soufani, K. (2020). Circular business models: a review. J. Clean. Prod. 277, 123741. doi: 10.1016/j.jclepro.2020.123741

Geissdoerfer, M., Savaget, P., Bocken, N. M. P., and Hultink, E. J. (2017). The circular economy - a new sustainability paradigm? J. Clean. Prod. 143, 757–768. doi: 10.1016/j.jclepro.2016.12.048

Global Reporting Initiative. (2016). GRI 101: Foundation 2016. GRI. Available online at: https://www.globalreporting.org/how-to-use-the-gri-standards/gri-standards-english-language/ (accessed Mar 13, 2019).

Gunday, G., Ulusoy, G., Kilic, K., and Alpkan, L. (2011). Effects of innovation types on firm performance. Int. J. Product. Econ. 133, 662–676. doi: 10.1016/j.ijpe.2011.05.014

Gusmerotti, N. M., Testa, F., Corsini, F., Pretner, G., and Iraldo, F. (2019). Drivers and approaches to the circular economy in manufacturing firms. J. Clean. Product. 230, 314–327. doi: 10.1016/j.jclepro.2019.05.044

Iraldo, F., Testa, F., and Frey, M. (2009). Is an environmental management system able to influence environmental and competitive performance? The case of the ecomanagement and audit scheme (EMAS) in the European Union. J. Clean. Product. 17, 1444–1452. doi: 10.1016/j.jclepro.2009.05.013

Kalaitzi, D., Matopoulos, A., Bourlakis, M., and Tate, W. (2018). Supply chain strategies in an era of natural resource scarcity. Int. J. Operat. Product. Manage. 38, 784–809. doi: 10.1108/IJOPM-05-2017-0309

Khan, O., Daddi, T., and Iraldo, F. (2020). The role of dynamic capabilities in circular economy implementation and performance of companies. Corp. Soc. Respons. Environ. Manage. 27, 3018–3033. doi: 10.1002/csr.2020

Korhonen, J., Honkasalo, A., and Seppälä, J. (2018). Circular economy: the concept and its limitations. Ecol. Econ. 143, 37–46. doi: 10.1016/j.ecolecon.2017.06.041

Lahti, T., Wincent, J., and Parida, V. (2018). A definition and theoretical review of the circular economy, value creation, and sustainable business models: where are we now and where should research move in the future? Sustainability 10, 2799. doi: 10.3390/su10082799

Lehmann, M., Leeuw, B., Fehr, E., and Wong, A. (2014). Circular Economy: Improving the Management of Natural Resources. Bern: Swiss Academies of Arts and Sciences.

Leitão, A. (2015). Economia circular: uma nova filosofia de gestão para o séc. XXI. Portug. J. Finan. Manage. Account. 1, 149–171. Available online at: http://u3isjournal.isvouga.pt/index.php/PJFMA/article/view/114/52

Levy, D. L., Szejnwald, B. H., and De Jong, M. (2010). The contested politics of corporate governance the case of the global reporting initiative. Bus. Soc. 49, 88–115. doi: 10.1177/0007650309345420

Lüdeke-Freund, F. (2010). “Towards a conceptual framework of business models for sustainability,” in Knowledge Collaboration and Learning for Sustainable Innovation ERSCP-EMSU Conference, Proceedings of ERSCP-EMSU Conference, (Delft), 1–28.

Lüdeke-Freund, F., Gold, S., and Bocken, N. M. P. (2019). A review and typology of circular economy business model patterns. J. Indust. Ecol. 23, 36–61. doi: 10.1111/jiec.12763

Malhotra, N. K. (2006). Pesquisa de Marketing: Uma Orientação Aplicada, 4th Edn. Porto Alegre: Bookman.

Manninen, K., Koskela, S., Antikainen, R., Bocken, N., Dahlbo, H., and Aminoff, A. (2018). Do circular economy business models capture intended environmental value propositions? J. Clean. Prod. 171, 413–422. doi: 10.1016/j.jclepro.2017.10.003

Marimon, F., Alonso-Almeida, M. D. M., Rodríguez, M. D. P., and Alejandro, K. A. C. (2012). The worldwide diffusion of the global reporting initiative: what is the point? J. Clean. Prod. 33, 132–144. doi: 10.1016/j.jclepro.2012.04.017

Masi, D., Day, S., and Godsell, J. (2017). Supply chain configurations in the circular economy: a systematic literature review. Sustainability 9, 1602. doi: 10.3390/su9091602

Mentink, B. (2014). Circular Business Model Innovation - A Process Framework and a Tool for Business Model Innovation in a Circular Economy. Dissertation, Delft University of Technology and Leiden University, Delft.

Moreno, M., De los Rios, C., Rowe, Z., and Charnley, F. (2016). A conceptual framework for circular design. Sustainability 8, 937. doi: 10.3390/su8090937

Neely, A., Adams, C., and Kennerley, M. (2002). The Performance Prism: The Scorecard for Measuring and Managing Business Success. London: Prentice Hall.

Nußholz, J. L. K. (2018). A circular business model mapping tool for creating value from prolonged product lifetime and closed material loops. J. Clean. Prod. 197, 185–194. doi: 10.1016/j.jclepro.2018.06.112

Osterwalder, A., Pigneur, Y., and Tucci, C. (2005). Clarifying business models: origins, present, and future of the concept. Commun. Assoc. Inform. Syst. 16, 1–25. doi: 10.17705/1CAIS.01601

Pestana, M. H., and Gageiro, J. N. (2008). Análise de Dados Para Ciências Sociais: A Complementaridade do SPSS, 5th Edn. Lisboa: Edições Silabo.

Pieroni, M. P., McAloone, T., and Pigosso, D. A. C. (2019). Business model innovation for circular economy and sustainability: a review of approaches. J. Clean. Prod. 215, 198–216. doi: 10.1016/j.jclepro.2019.01.036

Prado-Lorenzo, J. M., Gallego-Alvarez, I., and Garcia-Sanchez, I. M. (2009). Stakeholder engagement and corporate social responsibility reporting: the ownership structure effect. Corp. Soc. Respons. Environ. Manage. 16, 94–107. doi: 10.1002/csr.189

Rasche, A. (2009). Toward a model to compare and analyze accountability standards - the case of the UN global compact. Corp. Soc. Respons. Environ. Manage. 16, 192–205. doi: 10.1002/csr.202

Ritzen, S., and Sandstrom, G. O. (2017). Barriers to the circular economy - integration of perspectives and domains. Proc. CIRP 64, 7–12. doi: 10.1016/j.procir.2017.03.005

Scarpellini, S., Marín-Vinuesa, L. M., Aranda-Uson, A., and Portillo-Tarragona, P. (2020). Dynamic capabilities and environmental accounting for the circular economy in businesses. Sustain. Account. Manage. Pol. J. 11, 1129–1158. doi: 10.1108/SAMPJ-04-2019-0150

Skouloudis, A., Evangelinos, K., and Kourmousis, F. (2009). Development of an evaluation methodology for triple bottom line reports using international standards on reporting. Environ. Manage. 44, 298–311. doi: 10.1007/s00267-009-9305-9

Stubbs, W., and Cocklin, C. (2008). Conceptualizing a “sustainability business model”. Organ. Environ. 21, 103–127. doi: 10.1177/1086026608318042

Taran, Y., Boer, H., and Lindgren, P. (2015). A business model innovation typology. Decis. Sci. 46. doi: 10.1111/deci.12128

Tavares, A. S. (2018). A Cadeia Produtiva da Indústria Química no Contexto da Economia Circular. Dissertation, Universidade Federal do Rio de Janeiro, Rio de Janeiro.

Tsang, S., Welford, R., and Brown, M. (2009). Reporting on community investment. Corp. Soc. Respons. Environ. Manage. 16, 123–136. doi: 10.1002/csr.178

Urbinati, A., Chiaroni, D., and Chiesa, V. (2017). Towards a new taxonomy of circular economy business models. J. Clean. Prod. 168, 487–498. doi: 10.1016/j.jclepro.2017.09.047

Villas Bôas, H. C. (2011). A Indústria Extrativa Mineral e a Transição Para o Desenvolvimento Sustentável. CETEM/MCT/CNPq, Rio de Janeiro.

Winn, M. I., and Pogutz, S. (2013). Business, ecosystems, and biodiversity: new horizons for management research. Organ. Environ. 26, 203–229. doi: 10.1177/1086026613490173

Wirtz, B. W., Pistoia, A., Ullrich, S., and Göttel, V. (2016). Business models: origin, development and future research perspectives. Long Range Plann. 49, 36–54. doi: 10.1016/J.LRP.2015.04.001

Zhu, Q., Geng, Y., and Kee-hung, L. (2010). Circular economy practices among Chinese manufacturers varying in environmental-oriented supply chain cooperation and the performance implications. J. Environ. Manage. 91, 1324–1331. doi: 10.1016/j.jenvman.2010.02.013

Zott, C., and Amit, R. (2008). The fit between product market strategy and business model: implications for firm performance. Strat. Mgmt. J. 29, 1–26. doi: 10.1002/smj.642

Zott, C., and Amit, R. (2010). Business model design: an activity system perspective. Long Range Plann. 43, 216–226. doi: 10.1016/j.lrp.2009.07.004

Keywords: circular economy, innovation, business model, chemical industry, business performance

Citation: Motke FD, Gomes CM, Kneipp JM, Perlin AP, Damke LI and Lamberti TB (2022) Circular Business Model Innovation and Its Relationship With Business Performance in Brazilian Industrial Chemical Companies. Front. Sustain. 2:766696. doi: 10.3389/frsus.2021.766696

Received: 29 August 2021; Accepted: 20 December 2021;

Published: 14 January 2022.

Edited by:

Minelle E. Silva, Excelia Business School, FranceReviewed by:

Gustavo Dias, Federal University of Piauí, BrazilValentina Gomes Haensel Schmitt, University of Lima, Peru

Copyright © 2022 Motke, Gomes, Kneipp, Perlin, Damke and Lamberti. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Francies Diego Motke, ZmRtb3RrZUBnbWFpbC5jb20=

Francies Diego Motke

Francies Diego Motke Clandia Maffini Gomes

Clandia Maffini Gomes Jordana Marques Kneipp

Jordana Marques Kneipp Ana Paula Perlin

Ana Paula Perlin Luana Inês Damke

Luana Inês Damke Tatiane Balbinot Lamberti

Tatiane Balbinot Lamberti