94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

SYSTEMATIC REVIEW article

Front. Sustain. Cities, 14 October 2022

Sec. Smart Technologies and Cities

Volume 4 - 2022 | https://doi.org/10.3389/frsc.2022.978818

This article is part of the Research TopicTowards 2030: A Sustainable Cities Perspective on Achieving Sustainable Development Goal 9 – Industry, Innovation, and InfrastructureView all 4 articles

Alfonso Pellegrino1*

Alfonso Pellegrino1* Masato Abe2

Masato Abe2The restrictions that have been implemented due to the COVID-19 pandemic have highlighted the growing importance of digital financing. While traditional banking services have been limited by social distancing, reduced work hours, and lockdowns, digital financial services can deal effectively with those restriction measures while facilitating governments to channel relief and stimulus funds to micro, small and medium-sized enterprises (MSMEs). This paper analyzes, by using the bibliometric review approach along with the VOSviewer, a data visualization software, 629 Scopus journal articles relevant to the key components of digital financing for SMEs under the pandemic. Based on the review, it identifies the most crucial policy areas for digital financing. The paper presents policy implications on how digital financial services can support MSMEs in dealing with COVID's challenges.

JEL classification codes: G21, G23, G28, G32.

To contain the spread of COVID-19, governments worldwide have enforced various restriction measures, such as social distancing, school closures, workplace closures, cancellation of public events, travel bans, and total lockdown. These measures have increased unemployment, decreased investments, and worsened economic conditions (Béland et al., 2020). As a result, micro, small and medium-sized enterprises (MSMEs) have been particularly vulnerable because they tend to exhibit weaker capacities (e.g., smaller capital reserves, smaller assets, and lower productivity) than larger enterprises (OECD Secretary-General, 2020). With all these negative consequences, many MSMEs have been forced to furlough their staff, creating a precarious workforce (Gourinchas et al., 2020). Among the possible tools examined by government to solve MSMEs' issues caused by the pandemic emerge digitalization, which is the process of converting text, images, or audio into a form that can be processed by a computer. A common application of digitalization is through digital financing, this term refers to the delivery of traditional financial services via digital devices, such as computers, tablets, and smartphones (Zhong-Brisbois and Adriaens, 2020). Digital financing can often offer tangible solutions for MSMEs' challenges especially in times of crisis (Chan et al., 2019). Financial digitalization, enacted through fintech1 companies, can provide financial services for underserved MSMEs which are not supported by the traditional banking and financial sector therefore alleviating their liquidity constraints specially during demand and supply shocks caused by the COVID-19 pandemic.

Currently traditional financial service providers, such as banks, insurance companies and governments have the opportunity to use and implement digital financing tools. Against this background, there is an ongoing discussion on how traditional financial intermediaries can go about handling FinTechs applications and whether competitive approaches acquisitions and alternatively engaging those firms as service providers is compatible with more traditional financing business models (Lai, 2020; Suprun et al., 2020; Vučinić, 2020). On top of that highly innovative firms exhibited a propensity for building a business network to achieve sustainable performance. Firms achieving sustained performance do so by applying effective business networks and flexible capacities. A holistic and systematic approach is suggested for achieving sustainable performance through the dynamic capacities of businesses (Abbas Khan et al., 2019).

This study has the objective to contribute to the literature on digital financing by studying the linkage between digital financing tools for supporting MSMEs especially in time of crisis. The bibliometric study visualized the overall research work on digital financing in the Scopus database, it also examines the evolution of digital financing through a detailed work of literature review. The review provides guidelines that could assist governments in developing policy measures on enhancing digital financing for MSMEs under the post-COVID-19 environment and also help scholars interested in the topic identifying potential avenues of future research. Based on a bibliometric review, the paper delves into the most popular fintech applications and their relationships with MSME financing. It then proposes policy measures to promote digital financing for MSMEs and future research avenues for scholars interested in the topic.

The global crisis had devastating effects on MSMEs. In 2020, global trade decreased by 10.2% and foreign direct investment fell by 40%, generating significant supply chain disruptions (OECD Secretary-General, 2020). Large reductions in private spending resulted in dramatic increases in company insolvencies and bankruptcies in 2021 (which were halted in 2020 due to exceptional government support), particularly in industries severely impacted by nationwide lockdowns. The impact differed from country to country. However, with few exceptions, the greater the decline in demand, the greater the decline in output (OECD Secretary-General, 2020). MSMEs were overrepresented especially in the sectors most impacted by the economic downturn, including wholesale and retail commerce, air transportation, housing and food services, real estate, professional services, and other personal services. In a large-scale study of the World Bank SME's performed between February 2020 and May 2021, 51% of respondents claimed that late payments constrained their cash during the COVID-19 crisis, compared to only 39% in 2019. In addition, the proportion of MSMEs that had to accept lengthier payment terms than they were comfortable with increased significantly (World Bank, 2021). On both the supply and demand sides, the coronavirus pandemic had multiple effects on micro, small and medium-sized enterprises. Enterprises incurred a decrease in labor supply because workers were ill or had to care for children or other dependents when schools were closed and transportation restricted. The disease-containment measures of lockdowns and quarantines resulted in additional and more significant declines in capacity utilization. In addition, supply chain disruptions resulted in shortages of components and intermediate items. On the demand side, a drastic and unexpected decline in demand and revenue for MSMEs had a significant impact on their ability to function and produced serious financial constraints. In addition, consumers endured income loss, fear of contagion, and increased uncertainty, which affected spending and consumption. These consequences were exacerbated by layoffs and the inability of companies to pay salaries. Some industries, such as tourism and transportation, were disproportionately impacted, adding to diminished business and consumer confidence.

Another common challenge faced by MSMEs were financing problems due to information asymmetries and the possibility of adverse selection. MSMEs access to bank loans is usually more constrained in time of crisis (Neuberger and Räthke, 2009; Cao and Leung, 2020). Dierkes et al. (2013) emphasized that due to the lack of information on MSME balance sheets, their credit risk is typically greater than those of large businesses. Nevertheless, for growth and survival, MSMEs relied heavily on external financing, the vast bulk of which came from government relief funds (Gupta and Gregoriou, 2018). Moreover, MSMEs financing was frequently concentrated at a single institution, given the small loan amounts that MSMEs needed (Petersen and Rajan, 1994; Sapienza, 2002). In most cases, MSMEs value creation system is highly dependent on its customers, suppliers, staff, and resource providers. The disruption caused by the pandemic propagated swiftly upstream and downstream within the value generation cycle, negatively affecting nearly every member with minimal variation.

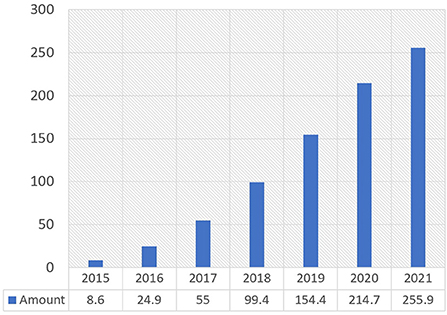

Financial digitalization emerged as a sustainable way to enhance MSMEs' access to finance and respond to their liquidity issues in time of crisis. During a loan application process, for instance, fintech tools can help financial institutions capture, validate, and assess the creditability of their MSME customers. Artificial intelligence (AI) and machine learning (ML) algorithms can also enhance the approval process for MSMEs' loan applications, easing the cumbersome collection of needed financial data and documents. Automation, big data, and distributed ledger technology are just a few other examples of technological trends that are accelerating innovation in financial services (IFC., 2020). New entrants, such as mobile network operators, payment service providers, merchant aggregators2, online retailers, alternative lenders3, and super platforms4, are just some of the fintech players that add to the competitive landscape for conventional banking and financial systems (Hendrikse et al., 2019). Financial digitalization offers solutions to increase efficiencies, lower transaction costs, enhance security and expand financial services to the underserved MSME sector. Digital financing provides MSMEs with a vast array of new financial services such as cryptocurrencies and crypto-assets, peer-to-peer lending, crowdfunding, online marketplaces and aggregators, smart-devices linked and index-based insurance (United Nations., 2020). A well-established network of fintech applications can optimize payments and settlement of securities and back-office functions by reducing costs and enabling direct business-to-business (B2B) transactions, bypassing the conventional intermediaries. It can replace many conventional financial services offered by the banking and financial sectors, such as retail banking, foreign exchange, wealth management, investment advice, stockbroking, spread-betting, corporate banking and lending, and loan brokerage. It can also make those conventional financial services speedier, flexible, and personalized. Under lockdowns, many MSMEs across the globe have been forced to close their workplaces or retail shops. Therefore, to survive, fintech applications became fundamental for their daily operations, i.e., receiving payments, putting orders, transferring money, paying tax, and gaining access to credits (Sahay et al., 2020). For example, the volume of mobile payment transactions in the world has risen from US$ 8.6 billion in 2015 to US$ 255.9 billion in 2021 (Figure 1). Top contributors for mobile payments in the area include, among others, Alipay and WeChat Pay in China, MobiCash in Bangladesh and Paytm in India (Li et al., 2018; Sinha et al., 2019; Liao and Yang, 2020). Countries in Asia and the Pacific dominated the global uptake of e-wallets and mobile POS payments. Worldpay's 2021 Global Payment Report forecasts that e-wallets will account for nearly half of all POS payments in the Asia-Pacific region, at 47.9%, while the usage of debit and credit cards is forecasted to decrease steadily (Global Payments Reports., 2021). Many least developed countries (LDCs) in the region have also experienced the same upward trends on digital payments5. Consequently, emerging digital payment applications have caused a rapid decline in cash transactions which are predicted to drop from 19.2% in 2020 to only 10.8% in 2024 in the Asia-Pacific region (Agur et al., 2020).

Figure 1. Mobile payment transactions in Asia and the Pacific from 2015 to 2021 The United States billion dollars. Source: The authors' compilation based on McKinsey (2021) available at the following link: https://www.mckinsey.com/~/media/mckinsey/industries/financial%20services/our%20insights/the%202021%20mckinsey%20global%20payments%20report/2021-mckinsey-global-payments-report.pdf.

Under the ongoing crisis, when investors try to minimize their risk exposure in the traditional banking and financial sector, new fintech applications and digital platforms have been developed to channel alternative capital flows to MSMEs (Lewis and Liu, 2020). Large online banks widely adopted online lending. For example, MYbank in China, in partnership with Ant Group, offers “no contact micro-loans” to SMEs (Yang and Zhang, 2020)6. The bank has actively encouraged its SME customers to move to digital finance by teaching them how to use online services (Toh and Tran, 2020). Another example is PayPal, which promotes contactless fintech services through QR codes, allowing SMEs to receive loans and make transactions while minimizing health risks related to COVID-19 (Remolina, 2020). Barriers faced by SMEs under the pandemic have provided opportunities for new business models to offer innovative financial products (Lewis and Liu, 2020). Those fintech firms have also analyzed MSME borrowers' creditworthiness through online financial and social data and ML systems (Ghosh, 2020). Their limited credit history has historically disadvantaged SMEs' credit rating, a common problem among Asia-Pacific developing countries that typically lack extensive coverage of credit bureaus and credit registries (Abe et al., 2012). In this vein, online data became essential for fintech firms to prioritize the provision of loans (Wang F. et al., 2019).

The study's objective is to identify strategies to properly utilize emerging digital financing applications that could offer much-needed support to MSMEs' access to finance during time of crisis. The study specifically attempts to answer the following research questions:

i) What drives digital financing for MSMEs?

ii) Which factors have impacted the development of digital finance amid the COVID-19 pandemic?

iii) What are policy implications?

This research is based on a bibliometric review, an ICT-based technique of carrying out a literature review to trace the relationships of academic journal citations. The bibliometric review can analyze citation indices and assess the popularity and influence of articles, authors, sources, and keywords. The review employs data mining, science mapping, social network analysis, and identification of frequently appearing words (Van et al., 2017). It is also a quantitative way of assessing academic research that compares studies' impact more easily than peer reviews, which may be arbitrary. The procedure of a bibliometric literature review is straightforward, and the results can be replicated using the same method (ibid.). An advantage of the bibliometric literature review is its ability to identify structural frameworks among key issues and players to form a comprehensive knowledge base (Zupic and Cater, 2015). The bibliometric review can distinguish itself from conventional literature reviews because it does not address findings or subsets of literature but rather looks at the literature in its entirety to draw broader conclusions on select topics.

This study was conducted in February 2022 using Scopus' database, a leading journal platform of Elsevier7, to search relevant journal articles with defined keywords in peer-reviewed journals. The VOSviewer, a bibliometric mapping software, visually identified relations among keywords, articles, authors, and sources, utilizing the preferred reporting items for systematic reviews and meta-analysis (PRISMA) approach (Moher et al., 2010; Van et al., 2017). The PRISMA is an evidence-based meta-analysis that reports a wide variety of systematic reviews (Liberati et al., 2009). Accordingly, this research undertook the following four steps: (i) selection of keywords; (ii) literature search; (iii) analysis on keyword co-appearances; and (iv) co-keyword mapping. Those steps are elaborated.

First, the study identified relevant keywords. As the search queries, this study chose the following keywords: “digital transfer*” or “digitalization” or “fintech” or “digital finance*” or “financial tech*” or “business”, and “MSMEs” or “COVID8.” Those keywords are chosen to find materials to synthesize the main trends of MSMEs' financial digitalization properly and adequately. Then, it moved to digitalization and digital financing linked to either MSMEs or COVID. To broaden the scope of the research and obtain a richer dataset, other keywords, namely digital transformation, fintech, financial technologies, and business, were added.

Second, relevant documents were extracted from Scopus. As of February 15, 2022, Scopus encompasses 36,377 scholarly titles, 22,794 active titles, and 13,583 inactive titles from 11,678 publishers, of which 34,346 are top-level peer-reviewed publications in subject fields: life sciences, social sciences, physical sciences, and health sciences. Three kinds of literature are included: book series, journal papers, and trade journals. All relevant articles in the Scopus database were reviewed to maintain high-quality standards (Kulkarni et al., 2009; Van et al., 2017). The database produced 665 documents: 325 are journal articles, 212 are conference papers, 79 are books or book chapters, and 49 are reviews9. Only English articles were retained under the screening process to exclude ineligible articles. Then, the remaining 644 articles' relevance was verified by reviewing their titles, abstracts, and keywords. Additional 15 articles were excluded as fintech was only mentioned as background information or the articles were not relevant to SMEs financing, leaving the final number of articles at 629.

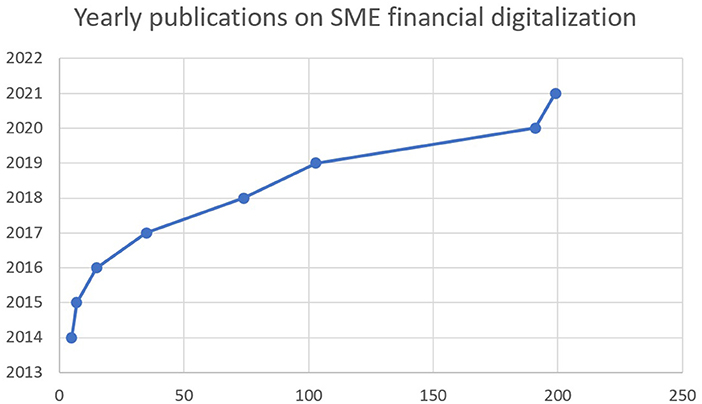

The results search suggested that literature on MSMEs digital financing slowly grew from 2014 until 2017, that only 67 articles were published during the 4 years (Figure 2). From 2017 to 2021, however, increased interest was observed as 563 articles, conference papers, and reviews were published on the topic for 4 years. The exponential increase in scholarly articles on MSME digital financing could be due to the increasingly widespread diffusion of fintech applications (Krugman, 2007; Breidbach et al., 2019).

Figure 2. Scholarly publications on SME financial digitalization, number by year. Source: The authors.

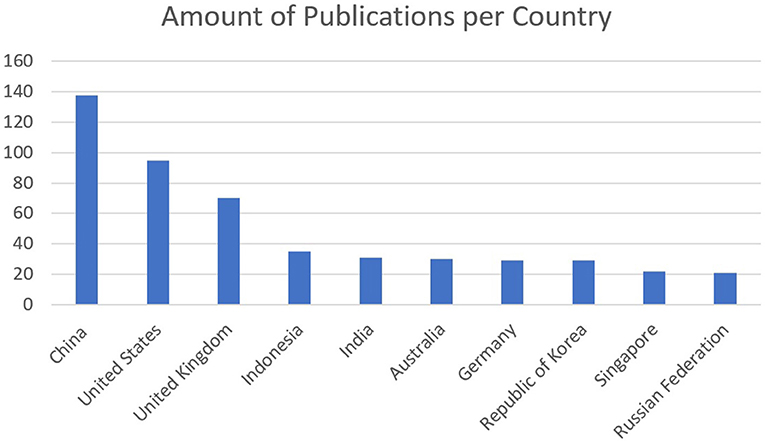

The geographical distribution of scholarly articles on MSMEs digital financing is presented in Figure 3. The most productive countries are China (135), the United States (97), the United Kingdom (69), and Indonesia (37), which account for 53.7 per cent of the scholarly articles considered in this bibliometric analysis. While Anglo-American scholars dominate academic works on the topic, China and South-East Asia (i.e., Indonesia and Malesia) seem to be relatively advanced.

Figure 3. Geographical distribution of scholarly literature on SME financial digitalization, number of publications. Source: The authors.

Figure 4 shows the distribution of literature disciplines. The top discipline is business and management (257 articles), followed by economics (118 articles) and computer science (80 articles), accounting for 70 per cent of the entire literature. Other minor disciplines include social science, engineering, and mathematics and decision science.

Third, VOSviewer was deployed to analyze keyword co-appearances in the identified literature (N = 629). A keyword co-appearance analysis is a technique that establishes relations by counting co-appearing keywords that co-appear more frequently within a certain database of documents (Zupic and Cater, 2015). This study aimed to build and understand the cognitive structures of a theoretical concept or an emerging framework of digital financing for MSMEs's digital financing during the COVID-19 pandemic (Börner et al., 2003; Suri and William, 2016).

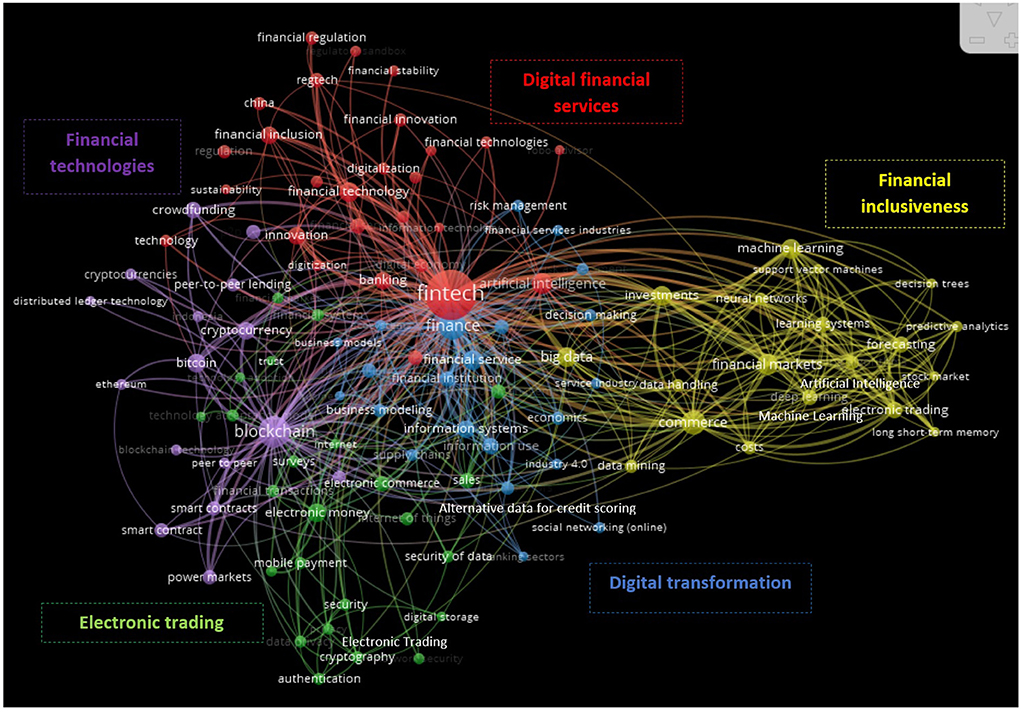

Finally, VOSviewer created a co-keyword map that provided a semantic analysis of the most frequently appearing keywords and their relationships (Figure 5). A total of 625 co-appearing keywords were found, whereas only 125 keywords respected the threshold of at least eleven co-appearances. Five clusters emerged as the major elements of the framework of MSMEs financial digitalization under the COVID-19 pandemic. Those are: (i) digital financial services; (ii) financial inclusiveness; (iii) digital transformation; (iv) electronic trading; and (v) financial technologies.

Figure 5. A bibliometric map on MSMEs digital financing under the COVID-19 pandemic. Source: The authors, based on the VOSviewer analysis.

The first cluster on “digital financial services” (in red) suggests that MSMEs' digital financing is an integral part of the growing digital economy phenomenon adopting emerging fintech applications. Scholars in this cluster have been studying the impact of digitalization and financial innovation on MSMEs' access to finance and how regulations can enhance MSME digital financing (Arner et al., 2016; Anagnostopoulos, 2018; Batunanggar, 2019). The most frequently appearing co-keywords are fintech, digitalization, and financial innovativeness (e.g., Saksonova and Kuzmina-Merlino, 2017; Qamruzzaman and Wei, 2019; Sestino et al., 2020; Taula, 2020; Yang and Zhang, 2020).

The second cluster on “financial inclusiveness” (in yellow) addresses how big data algorithms can improve MSMEs' access to financial services. The drivers behind this cluster are multiple such as AI, ML, and predictive analysis (Wang F. et al., 2019)10. Given those emerging technologies, MSMEs customers are now interacting with their banks more digitally, and their behaviors and expectations have been changed. That means that personal interactions have been reduced, but at the same time, it is possible to collect financial and non-financial data in an automated way and therefore analyze a large amount of data to propose more tailored services to MSME (Dubey et al., 2020). Such technological evolutions, lead to larger amounts of data handling due to the rise of the Internet of things (IoT)11 and new biometric authentication12, which have played a critical role in the usage of big data analysis (Dupas and Jonathan, 2013; Pejić et al., 2019; Liao and Ling-Ling, 2020).

The third cluster on “digital transformation” (in blue) focuses on systematic changes and upgrades in the financial sector. Main keywords include information systems and information usage, which have been pivotal in digitally transforming the financial services' sector more effectively (Gomber et al., 2018). According to the literature belonging to this cluster, the influence of digitalization and automation has resulted in opportunities for more cost-effective operations, rapid actions, on-time delivery, and increased customer and employee engagements that help financial institutions stand out among competitors (Gomber et al., 2018). Enhanced information systems and effective information usage assist financial institutions in compliance, accounting, and financial management while minimizing human errors and risks by developing robust portfolio strategies and policies (Hurley and Julius, 2016; Engert and Ben, 2017; Puschmann, 2017; Zhong et al., 2017). The fourth cluster on “electronic trading” (in green) is about studying digital payments and electronic trading tools and how they can be protected through cybersecurity13 and data management. One key reason electronic trading is at greater risk than ever before from cyberattacks is that there is a massive rise in the number of people using online trading platforms. While this rise has dramatically increased individuals' willingness to invest globally, it has also opened up many opportunities for frauds like hacking. In the literature belonging to this cluster, therefore, there is an emphasis on how cybersecurity software can help protect electronic trading transactions (Broeders et al., 2017). Important co-keywords include electronic payments, mobile payments, and data security (Puschmann, 2017; Saksonova and Kuzmina-Merlino, 2017; Wonglimpiyarat, 2017; Iman, 2018; Masood and Paul, 2020).

In the fifth and last cluster on “financial technologies” or “fintech” (in violet), there are co-keywords that relate to emerging financing technologies. In this cluster, the literature stresses the important role of new fintech tools, especially for MSMEs (Fenwick et al., 2018). New fintech applications such as peer-to-peer (P2P) lending, crowdfunding, and mobile money provide MSMEs with access to finance and allow them to make and receive electronic payments, secure financial products, and have a chance to build a credit record or history. Another important keyword is blockchain (Dara, 2018; Fenwick et al., 2018; Gao et al., 2018; Cong and Zhiguo, 2019; Dorfleitner and Braun, 2019; Toh and Thao, 2020). Table 1 summarizes the top 10 keywords by the frequency of appearance and describes them in detail. They consist of the major elements of the MSME digital finance framework under the COVID-19 pandemic. The table provides their definitions, benefits, challenges, and major articles. The table also illustrates the most popular emerging concepts and technologies for policymakers to facilitate MSMEs' access to digital finance in the post-COVID era (Wang H. et al., 2019).

In addition to those top 10 elements, other co-keywords include: “information system” (seven appearances starting from 2013), “financial services” (15 appearances starting from 2014) and “financial technologies” (eight appearances starting from 2014). More recent co-keywords include “machine learning” (three appearances in 2020), “blockchain technologies” (three since 2019), “digitalization” (four since 2019), “crowdfunding” (three from 2019), and “Ethereum”14 (four from 2019).

The knowledge base in the database started to appear in the academic production around 2014, but it was not until 2017 that the interest in digital financing topic took off. The greater interest may be due to the higher popularity of emerging technologies; such as the usage of digital financing tools as mobile banking app which started to boom around 2015.

The paucity of works from African countries as well as from the Middle East is on the first sight not explainable with the data at hand and the software package used. However, an explanation might be given by the fact that they have in relative terms fewer academic institutions than Western or Asian countries. Figure 3 shows an increasing number of publications coming from Asia, a trend which is likely to continue. Furthermore, we can deduct from the country analysis figure that a high interest in the last couple of years around innovation in digital financing tool comes from China and Anglo-American societies which both contributed the most to the knowledge base.

In the red cluster named “digital financial services” the keywords digital economy and fintech were the most frequently occurring and majority of the studies revolved on how to digitalize countries' economies and in particular on how to sustain MSMEs after the first 2020 pandemic waves. During the past 2 years' governments have put in place measures aimed at improving MSMEs financial liquidity issues, introducing cash transfer scheme to regulate timely payments, reaching the correct beneficiaries, improving accounting reports of cash transactions, and strengthening accountability by providing a reliable audit trail. In the same clusters the following papers (Wollschlaeger et al., 2017; Bansal et al., 2018; Bejaković and Mrnjavac, 2020; Milenkova and Lendzhova, 2021; Reddy et al., 2021) highlighted the importance of population becoming digitally literate in order to be able to use proficiently digital tools. In fact a paramount challenge for governments trying to help MSMEs with innovative tools concerns digital financial literacy which is a burning issue to solve as digital skills and know-how gaps require awareness campaigns showcasing the advantages of using digital technologies.

In the cluster named financial inclusiveness the keywords Artificial intelligence (AI) and machine learning (ML) were most predominant and frequently occurring. The following studies in the clusters (How, Wenzlaff, 2017; Ongsulee et al., 2018; Ghoddusi et al., 2019; Verma and Gustafsson, 2020; Cheah et al., 2021; Goodell et al., 2021; Cao, 2022), showed how critical Fintech platforms specialized in financial predictive analyses using AI and ML can be in order to support MSMEs financing purposes. Adopting digital financing platforms enhanced by AI and ML hold enormous potential for MSMEs. Enterprises faced numerous financing issues both during and after the pandemic. Limited access to funding was critical as MSMEs tended to be informal, young, have less publicly accessible information and operated in unfamiliar sectors, all of which contributed to higher asymmetries and risks deterring traditional bank lending. Often, these businesses did not have ample reserves that could be used as collateral. In addition, MSMEs can find it too expensive to be listed in the stock markets. Even if they are listed, they can then struggle to attract sufficient funding from the capital market, as investors in these markets prefer big, less risky companies with more liquidity (Abraham and Schmukler, 2017). During the pandemic, efforts to adopt digital technologies have grown exponentially. However, this growth has been primarily on digital transactions i.e., contactless payments (see Table 1). Only a few countries have used the totality of tools currently provided by fintech entities. China, for example, utilized Ant financial, a subsidiary under Alibaba, to provide digital transfers, management of digital wealth and online loans for MSMEs. In Zimbabwe the leading payments platform, EcoCash, with the support of digital investor exchange IEX and UNCDF, has launched a world-first stock exchange that draws on automatically generated payments data from businesses to provide robust due diligence and credit ratings for prospective listings. It hopes to provide a much-needed debt and equity financing window for fast growing and innovative Zimbabwean MSMEs. Additionally, another relevant trend emerged within the same cluster highlighted in the following articles Makina (2019), Al Nawayseh (2020), Beck (2020), Demir et al. (2020), Senyo and Karanasios (2020) that showed how to extend Financial Inclusiveness with using Innovative measures linked with AI and big data. Other articles (Ardian, 2020; Ingves, 2020; Bala and Singhal, 2022) focused especially on how national ID systems provided digital authentication and helped boost financial inclusiveness. Governments by implementing these measures could better help digital finance service providers to carry out credit score and due diligence. Digital IDs, however, come with citizens' privacy risks which need to be managed to build trust and enhance the benefits of identification. Major risks include data leakage and misuse. An important mitigation factor, apart from strong laws and regulations, is incorporating data protection and privacy laws in the design of digital ID systems.

In the cluster named Digital Transformation the keyword “Industry 4.0” appeared often, the following articles Bukht and Richard (2017), Autenrieth et al. (2020), Mhlanga (2020), Azadi et al. (2021), illustrated which are some of the most needed technological infrastructures upgrades. Governments reforms in certain areas need to enhance digital infrastructure as basic as internet which requires a reliable supply of electricity. There is a need to fix infrastructure limitations in the energy sector securing investments, if necessary, from foreign investors.

In the cluster named Electronic Trading the articles talked about measures implemented by governments to facilitate and support MSMEs and population leveraging digital channels. The following articles Bachas et al. (2018), Ramírez de la Cruz et al. (2020), Klüver et al. (2021), described the reduction of transaction costs implemented by governments as a response to help MSMEs affected by the pandemic. The cost of transactions is a major problem to adopt digital financing services (Wazurkar et al., 2017; Bertola and Jose, 2018; Agur et al., 2020). Opening fees for digital bank accounts and minimum balance requirements in some cases prevent smaller firms from opening bank accounts and often this leads to MSMEs from having adequate access to subsidies (Dupas and Robinson, 2013). By reducing transaction fees, digital finance can improve MSMEs' access to financial services (Suri and Jack, 2016) since the use of cash for a G2B and G2P reliefs requires massive transaction costs. An excellent example comes from the Bank of Indonesia which has waived the fees for businesses and individuals making or receiving payments through the Quick Response Code Indonesian Standard (“QRIS”). Launched in 2017, the QRIS has now been used for all electronic payments that use QR codes (e.g., server-based electronic money, electronic wallet or mobile banking) in Indonesia. QRIS offers secure and convenient transactions through mobile phones. QRIS transactions are profitable for merchants and customers due to efficient payments through one QR code that can be used for all mobile phone payment applications. Lastly, QRIS transactions are processed in real time, thereby supporting the uninterrupted operation of the payment system.

In the cluster named financial technologies commonly mentioned keywords were “blockchain”, “cryptocurrency”, “crowdfunding” and “P2P lending”. The following articles in the clusters (Leong et al., 2018; Belanche et al., 2019; Ali et al., 2020; Dutta et al., 2020; Murakami et al., 2020) were talking about how to provide secure retail digital payment system that could enhance the financing possibilities for MSMEs. According to Jagtiani and John (2018) regulating central banks partnership with financial institutions and fintech to provide digital payment systems is an optimal condition that would allow real-time, secure, and interoperable digital payment systems able to disburse funds to SMEs. If this were implemented governments could reduce the cost of distributing funds, increasing the speed and reliability of payments by adopting fintech services.

The pandemic has induced supply-side disruptions and depressed aggregate demand, and the “lockdown” measures have shut down many businesses temporarily. The sudden, substantial loss of revenues has caused significant liquidity stress on businesses. According to some of the most highly cited studies in the database (Crehan, 2020; Jeasakul, 2020; Song et al., 2020; Chen et al., 2021; D'Orazio, 2021), the most effective macro-economic objective combined with newer technologies is increasing company liquidity. A cost-effective way to do so is using digital fintech tools which can mitigate the negative economic impact of COVID-19. Businesses in fact, even if they remain viable in the long term, need liquidity to survive through the crisis. Digital financial services to support MSMEs, (Couppey-Soubeyran, 2020; Lagoarde-Segot, 2020; Prat and Walter, 2021), highlighted the role of governments in issuing debt securities—bonds, treasury bills or commercial papers—and provided “drone” money, which is the digital version of helicopter money. By using this new technology to distribute funds governments were able to distribute basic money relief funds directly to MSMEs, rather than through banks and financial markets. Some examples come from the United States, where the Federal Reserve launched the Main Street Business Lending Program (English and Liang, 2020), which sets up a special purpose vehicle (SPV), partly backed by the Treasury, to acquire corporate loans extended by banks under the program. In the euro area the central banks have provided term funding to banks to lend to firms and households. Such lending is supported by credit guarantees provided by governments and existing public schemes.

Spreading digital literacy is another noteworthy implication that arise from the literature contained in the database; governments can promote relevant knowledge training in local communities, setting up ICT training centres and facilities for SMEs; this could be done to enable business owners to engage in the digital revolution while avoiding frauds and costly errors. Trust is also essential to enhance and adopt correct digital behaviours, therefore coherent digital security infrastructure, privacy policies and online customer protection are critical issues that will need to be dealt with.

Governments embedding fintech applications using AI and ML algorithms will unlock lots of data found in traders', banks', logistics databases etc. These predictive algorithms can provide risk management advice that helps unlock MSMEs financing and are solutions that should be explored by local governments. Credit scoring using AI and ML models can allow MSMEs financing which in the past was unavailable. Governments can ultimately help MSMEs receiving more financing by allowing fintech to provide customized digital products and services to MSMEs, helping them to digitalize their operations. APIs can also be used to provide trustworthy digital identity solutions for customer identification/verification at onboarding land for authenticating customer identity to authorize access to the customer's account (Qamruzzaman and Jianguo, 2019).

Digital transaction and digital loans processes simplification is another trend worthy to be explored by governments. For example, the digitalization efforts for financing made in Cambodia which launched an online soft loan scheme called “Cambodian Shared Switch” enabled MSMEs to receive loans and to make inter-agency transactions through payment service providers. The tool facilitated users and financial institutions, to receive loans in a timely manner and in a totally digital way speeding up the time to provide a loan and reducing intermediaries (Royal Government of Cambodia., 2016). Also, the Bakong project by the National Bank of Cambodia in 2019 enabled payment transactions across networks and improving interoperability, using blockchain technology. These initiatives could be replicated also in other LDCs to improve access to digital financing for MSMEs. Indonesia launched an unconditional Cash Transfer application (Bantuan Langsung Tunai/BLT) for ultra-micro and micro enterprises. South Korea spent KRW 5.1 trillion this year on big data platforms, artificial intelligence and fifth-generation telecommunication services, called “New Deal projects”, on which the government, on 1 June 2021, pledged to invest KRW 76 trillion over the next 5 years to help MSMEs digitalization.

Regularizing new financial technologies can help data collection for more effective policy formulation. Regulations should facilitate the establishment of P2P and crowdfunding platforms, payment gateways, and Points of Sale (PoS) terminals. Simultaneously, laws on cybersecurity controlling digital financing activities and ensure safety, efficiency, and reliability of DFS should be drafted and implemented. Laws must guarantee that new technologies can be used appropriately and safely. Electronic signature rules, contract compliance, insolvency, intellectual property laws, KYC standards, and cross-border remittances are other fields that are worthy of attention. AI regulation, especially how AI can fit into established regulatory frameworks require new frameworks to be created, and it is a subject that will continue to gain prominence soon. To tackle the challenges identified so far, governments need to provide an enabling regulatory and policy framework, while banks and fintech firms need to work together to establish expertise in initiating fintech solutions. Consequently, modern regulations should include strict, built-in security protections to drastically minimize the incidence of payment fraud and to guarantee the confidentiality of users' financial information, which is particularly important for online money transfer. Before making a transfer, a combination of at least two independent factors, such as a physical item—a card or mobile phone—and a password or biometric feature, such as fingerprints should be required.

This paper has identified number of research gaps that can be explored for future research:

Firstly, among informal and innovative sources of financing, crowdfunding, ICOs, and social capital have been identified as novel topics, while capital market interventions, IPOs, participatory financing, and venture capital finance have been recognised as emerging topics worthy of future research attention among formal financial resources. Contemporary MSMEs financing research has found utility in entrepreneurial, institutional, and sustainability theories, which represent a set of trending theories that we strongly encourage future authors to consider. However, the theoretical foundations of conventional finance can still be employed in novel ways by future research in conjunction with new trends in MSME financing behaviour.

Secondly, MSMEs financing in Africa and the Middle East has received minimal study attention in the top journals dedicated to this field of knowledge. Future study is strongly encouraged to shed light on MSME finance in emerging and developing economies where MSMEs play a vital role in driving economic growth and employment.

Thirdly, the majority of MSMEs financing research is designed for theory testing; therefore, it is necessary to revisit and debate existing theories through theory application and elaboration efforts, as well as to conceive new theories through theory building, in order to expand our understanding of MSMEs financing in novel and meaningful ways. The majority of research on MSME finance relies on archival data and empirical approaches. Even if these methodological choices are reasonable, we encourage future study to investigate alternative research designs and data collection and analysis methodologies in order to increase the diversity of the research findings. Case studies, experiments, and field investigations are therefore strongly encouraged.

The authors expect development, to be incremental and to concentrate on establishing practical requirements for the application of AI to specific cases for regulators (e.g., regulating the use of AI in credit screenings, regulating the use of chat bots etc.). Digital financing tools could be the lifeblood of MSMEs, especially during critical times such as the present COVID-19 pandemic.

The COVID-19 pandemic continues to have growing influence on the global economy while strongly impacting the financial survivability of SMEs in the Asia-Pacific region. Because of the extraordinary nature of the crisis, legislatures, financial regulators, central banks and fintech companies face the challenges of sustaining well-functioning financial markets, ensuring adequate liquidity in the economy and maintaining the financial stability of SMEs. Even though COVID-19 has slowed down business for many SMEs and has caused many of them to shut down, digital financial services could offer a speedier relief to them. Traditional financial institutions and fintech companies are attempting to leverage data-driven financial solutions to solve the challenges derived from the pandemic. Despite their potential benefits, digital finance solutions for SMEs looks challenging in the post-pandemic era. Making an adequate balance of different regulatory objectives would be crucial for SMEs' sustainable recovery.

There are methodological limitations in this study, which may be addressed in future research. The study first examined only one database, Scopus, which restricted article research; other resources such as Web of Science and SciDirect can be recommended in upcoming bibliometric studies. Second, this study may foresee future research based on the source or subject of the publication which may contribute to a broader understanding of financial technology for MSMEs.

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

AP contributed to the download and analysis of the keywords. MA checked the structure and style of the write up. All authors contributed to the article and approved the submitted version.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

1. ^The etymology of fintech derives from the combination of two English words: finance (financial services) and technology (information technology; Gimpel et al., 2018).

2. ^Merchant aggregators are service providers through which e-commerce or mobile merchant services can process their payment transactions (Taula, 2020).

3. ^Alternative lending refers to any lending practice that happens outside a traditional banking or financial institution. Examples could be crowdfunding and peer to peer lending (Di Pietro, 2020).

4. ^A super platform is a type of digital financial solutions which bundle together, in one platform, multiple different fintech services. An example of super platforms is Ant from Alibaba (Van Uytsel, 2020).

5. ^Among LDCs in Asia and the Pacific, Cambodia in November 2020 eased the registration process for e-commerce companies, passing an e-commerce law (Deloitte, 2020). Kiribati also introduced digital solutions in March 2020 to tackle the spread of COVID-19 to leverage ICT and e-commerce growth (UNCTAD, 2020). Myanmar's COVID-19 relief strategy also features e-commerce (UNCTAD, 2020).

6. ^This is a digitized loan that involves online applications and does not entail any direct human contact. The loan scheme, launched in China in April 2020, provides financial support to 10 million SMEs around China in the resumption of work and production in the wake of the coronavirus (Yang and Zhang, 2020).

7. ^Visit https://www.scopus.com/ for details.

8. ^The asterisk is a symbol that broadens a search by finding words that start with the same letters but may end differently, e.g., digital finance, digital financing, etc.

9. ^When the keyword “COVID-19” was excluded from the research queries, no significant difference was observed in the bibliometric results. This could be due to a small number of relevant academic literature relating to COVID-19 have been so far published.

10. ^Predictive analysis is the use of data, statistical algorithms and machine learning techniques to identify the likelihood of future outcomes based on historical data (Wazurkar et al., 2017). The goal is to assess what will happen in the future.

11. ^Internet of Things (IoT) refers to the networking of objects via Internet (Madakam and Ramaswamy, 2015). IoT works by connecting and analyzing all the data coming from different platforms and devices belonging to a financial institution. In this way, banks can allocate and better customize their services to customers, the most significant advantage of IoT in the banking sector.

12. ^Biometrics is a form of measuring physical characteristics to verify one's identity, new ways like face, iris, and fingerprint scanners have been employed to verify customers' identity when using digital financial services.

13. ^Cybersecurity is the practice of protecting systems, networks, and programs from digital attacks. These cyberattacks are usually aimed at accessing, changing, or destroying sensitive information; extorting money from users; or interrupting normal business processes.

14. ^Ethereum is an open-source platform that uses blockchain technology to create and run decentralized digital applications, that enable users to conduct transactions directly with each other to buy, sell, and trade goods and services without a middleman.

Abbas Khan, K., Zaman, K., Shoukry, A. M., Sharkawy, A., Gani, S., Ahmad, J., et al. (2019). Natural disasters and economic losses: controlling external migration, energy and environmental resources, water demand, and financial development for global prosperity. Environ. Sci. Pollut. Res. 26, 14287–14299. doi: 10.1007/s11356-019-04755-5

Abe, M., Troilo, M., Juneja, J., and Sailendra, N. (2012). Entrepreneurship Development in Asia and Pacific. New York, NY: United Nations publication, copyright@ United Nations.

Abraham, F., and Schmukler, S. (2017). Addressing the SME finance problem. World Bank Res. Policy Briefs 120333, 4.

Agur, I., Soledad, M. P., and Celine, R. (2020). Digital financial services and the pandemic: opportunities and risks for emerging and developing economies. Int. Monet. Fund Spec. Ser. COVID-19 Trans. 1, 2–1.

Al Nawayseh, M. K. (2020). Fintech in COVID-19 and beyond: what factors are affecting customers' choice of fintech applications?. J. Open Innov. Technol. Mark. Compl. 6, 153. doi: 10.3390/joitmc6040153

Ali, M., Alam, N., and Rizvi, S. A. R. (2020). Coronavirus (COVID-19)—an epidemic or pandemic for financial markets. J. Behav. Exp. Finan. 27, 100341. doi: 10.1016/j.jbef.2020.100341

Anagnostopoulos, I. (2018). Fintech and regtech: impact on regulators and banks. J. Econ. Bus. 100, 7–25. doi: 10.1016/j.jeconbus.2018.07.003

Ardian, A. (2020). Sistem imformasi manajemen lelang kendaraan berbasis mobile (Studi Kasus Mandiri Tunas Finance). Jurnal Teknologi Dan Sistem Informasi 1, 10–16.

Arner, D. W., Janos, B., and Ross, P. B. (2016). FinTech, RegTech, and the reconceptualization of financial regulation. Nw. J. Int'l L. Bus.37, 371.

Autenrieth, L. K., Asselmann, E., and Pané-Farré, C. A. (2020). Lockdown, quarantine measures, and social distancing: associations with depression, anxiety and distress at the beginning of the COVID-19 pandemic among adults from Germany. Psychiatry Res. 293, 113462. doi: 10.1016/j.psychres.2020.113462

Azadi, M., Moghaddas, Z., Farzipoor Saen, R., and Hussain, F. K. (2021). Financing manufacturers for investing in Industry 4.0 technologies: internal financing vs. external financing. Int. J. Prod. Res. 2021, 1–17. doi: 10.1080/00207543.2021.1912431

Bach, M., Krstić, Ž., Seljan, S., and Turulja, L. (2019). Text mining for big data analysis in financial sector: a literature review. Sustainability 11, 1277.

Bachas, P., Gertler, P., Higgins, S., and Seira, E. (2018). “Digital financial services go a long way: transaction costs and financial inclusion,” in AEA Papers and Proceedings. vol. 108 (New York, NY), pp. 444–448. doi: 10.1257/pandp.20181013

Bachmann, A., Alexander, B., Daniel, B., Michel, H., Frank, K., Mark, L., et al. (2011). Online peer-to-peer lending-a literature review. J. Internet Bank. Commer. 16, 2.

Bala, S., and Singhal, P. (2022). “Digital financial inclusion through FinTech,” in Gender Perspectives on Industry 4.0 and the Impact of Technology on Mainstreaming Female Employment (Pennsylvania: IGI Global), 77–90. doi: 10.4018/978-1-7998-8594-8.ch004

Bansal, S., Philip, B., Olivier, D., Madhav, G., and Marc, N. (2018). Global Payments 2018: A Dynamic Industry Continues to Break New Ground. Philadelphia, PA: Global Banking McKinsey.

Batunanggar, S. (2019). Fintech Development and Regulatory Frameworks in Indonesia (No. 1014). ADBI Working Paper Series. 3, 14–29.

Bejaković, P., and Mrnjavac, Ž. (2020). The importance of digital literacy on the labour market. Empl. Relat. Int. J. 42, 5455. doi: 10.1108/ER-07-2019-0274

Belanche, D., Luis, V. C., and Carlos, F. (2019). Artificial intelligence in FinTech: understanding robo-advisors adoption among customers. Ind. Manag. Data Syst. 2019, 5. doi: 10.1108/IMDS-08-2018-0368

Béland, L. P., Brodeur, A., and Wright, T. (2020). The short-term economic consequences of Covid-19: exposure to disease, remote work and government response. PLoS ONE. 21, 155-191.

Bertola, E. G., and Jose, J. V. (2018). Financial integration, financial development, and global imbalances. J. Polit. Econom. 117, 371–416. doi: 10.1086/599706

Bertola, P., and Teunissen, J. (2018). Fashion 4.0. Innovating fashion industry through digital transformation. Res. J. Text. Apparel 22, 352–369. doi: 10.1108/RJTA-03-2018-0023

Bordo, M. D., and Andrew, A. T. (2017). Central Bank Digital Currency and The Future of Monetary Policy. Cambridge, MA: National Bureau of Economic Research. Available online at: https://www.nber.org/system/files/working_papers/w23711/w23711.pdf

Börner, K., Chaomei, C., and Kevin, W. B. (2003). Visualizing knowledge domains. Ann. Rev. Inform. Sci. Technol. 37, 179–255. doi: 10.1002/aris.1440370106

Breidbach, C. F., Byron, W. K., and Chiehyeon, L. (2019). Fintech: research directions to explore the digital transformation of financial service systems. J. Serv. Theory Pract. 30, 79–102. doi: 10.1108/JSTP-08-2018-0185

Broeders, D., Erik, S., Bart van der, S., Rosamunde van, B., Josta de, H., and Ernst, H. B. (2017). Big data and security policies: towards a framework for regulating the phases of analytics and use of big data. Comput. Law Sec. Rev. 33, 309–323. doi: 10.1016/j.clsr.2017.03.002

Bukht, R., and Heeks, R. (2017). Defining, conceptualising and measuring the digital economy. Development Informatics Working Paper, 68. doi: 10.2139/ssrn.3431732

Bukht, R., and Richard, H. (2017). Defining, conceptualising and measuring the digital economy. Development Informatics Working Paper, 68.

Cao, L. (2022). AI in finance: challenges, techniques, and opportunities. ACM Comput. Surv. 55, 1–38. doi: 10.1145/3502289

Cao, S., and Leung, D. (2020). Credit constraints and productivity of SMEs: evidence from Canada. Econ. Model. 88, 163–180. doi: 10.1016/j.econmod.2019.09.018

Chan, C. M. L., Say, Y. T., Adrian, Y., and Gary, P. (2019). Agility in responding to disruptive digital innovation: case study of an SME. Inform. Syst. J. 29, 436–455. doi: 10.1111/isj.12215

Cheah, S. L. Y., Ho, Y. P., and Li, S. (2021). Search strategy, innovation and financial performance of firms in process industries. Technovation 105, 102257. doi: 10.1016/j.technovation.2021.102257

Chen, H., Ryan-Collins, J., and van Lerven, F. (2021). Finance, climate-change and radical uncertainty: towards a precautionary approach to financial policy. Ecol. Econ. 183, 106957. doi: 10.1016/j.ecolecon.2021.106957

Choi, D., and Kyungho, L. (2018). An artificial intelligence approach to financial fraud detection under IoT environment: a survey and implementation. Sec. Commun. Netw. 2018, 5483472. doi: 10.1155/2018/5483472

Choi, Y. S., and Lee, W. J. (2018). Audit pricing of shared leadership. Emerg. Mark. Finan. Trade 54, 336–358. doi: 10.1080/1540496X.2017.1348292

Cong, L. W., Beibei, L., and Tony, Z. (2019). Alternative data for FinTech and business intelligence. SSRN. doi: 10.2139/ssrn.3521349

Cong, L. W., Li, Y., and Wang, N. (2022). Token-based platform finance. J. Finan. Econom. 144, 972–991. doi: 10.1016/j.jfineco.2021.10.002

Cong, L. W., and Zhiguo, H. (2019). Blockchain disruption and smart contracts. Rev. Finan. Stud. 32, 1754–1797. doi: 10.1093/rfs/hhz007

Couppey-Soubeyran, J. (2020). European Banks and the Covid-19 Crash Test, No. 30. Paris: EconPol Policy Brief.

Cowling, M., Ross, B., and Augusto, R. (2020). < ? covid19?> Did you save some cash for a rainy COVID-19 day? The crisis and SMEs. Int. Small Bus. J. 38, 593–604. doi: 10.1177/0266242620945102

Crehan, P. (2020). Reflections on a Revision of the Definition of the EU SME. Luxembourg: Publications Office of the European Union.

Cruz, A. L. D., Patel, C., Ying, S., and Pan, P. (2020). The relevance of professional skepticism to finance professionals' socially responsible investing decisions. J. Behav. Exper. Finan. 26, 100299. doi: 10.1016/j.jbef.2020.100299

Dara, N. N. (2018). The global digital financial services: a critical review to achieve for digital economy in emerging markets. Int. Res. J. Hum. Resour. Soc. Sci. 5, 141–163.

Deloitte. (2020). Flattening the Curve Impact on the Indian Banking and Capital Market Industry. Available online at: https://www2.deloitte.com/content/dam/Deloitte/in/Documents/financial-services/in-fs-flattening-the-curve-impact-on-the-indian-banking-and-capital-markets-noexp.pdf (accessed May 4, 2022).

Demir, E., Bilgin, M. H., Karabulut, G., and Doker, A. C. (2020). The relationship between cryptocurrencies and COVID-19 pandemic. Eurasian Econ. Rev. 10, 349–360. doi: 10.1007/s40822-020-00154-1

Di Pietro, F. (2020). Crowdfunding for Entrepreneurs: Developing Strategic Advantage Through Entrepreneurial Finance. Routledge.

Dierkes, M., Erner, C., Langer, T., and Norden, L. (2013). Business credit information sharing and default risk of private firms. J. Bank. Finan. 37, 2867–2878. doi: 10.1016/j.jbankfin.2013.03.018

D'Orazio, P. (2021). Towards a post-pandemic policy framework to manage climate-related financial risks and resilience. Clim. Policy 21, 1368–1382. doi: 10.1080/14693062.2021.1975623

Dorfleitner, G., and Braun, D. (2019). “Fintech, digitalization and blockchain: possible applications for green finance,” in The Rise of Green Finance in Europe (Cham: Palgrave Macmillan), 207–237. doi: 10.1007/978-3-030-22510-0_9

Dorfleitner, G., and Diana, B. (2019). “Fintech, digitalization and blockchain: possible applications for green finance,” in The Rise of Green Finance in Europe (New York, NY: Springer).

Dubey, R., Angappa, G., Stephen, J. C., David, J. B., Mihalis, G., Cyril, F., et al. (2020). Big data analytics and artificial intelligence pathway to operational performance under the effects of entrepreneurial orientation and environmental dynamism: a study of manufacturing organisations. Int. J. Prod. Econ. 226, 107599. doi: 10.1016/j.ijpe.2019.107599

Dupas, P., and Jonathan, R. (2013). Savings constraints and microenterprise development: evidence from a field experiment in Kenya. Am. Econ. J. Appl. Econ. 5, 163–192.

Dupas, P., and Robinson, J. (2013). Savings constraints and microenterprise development: evidence from a field experiment in Kenya. Am. Econ. J. Appl. Econ. 5, 163–192. doi: 10.1257/app.5.1.163

Dutta, A., Das, D., Jana, R. K., and Vo, X. V. (2020). COVID-19 and oil market crash: Revisiting the safe haven property of gold and Bitcoin. Resour. Policy 69, 101816. doi: 10.1016/j.resourpol.2020.101816

Engert, W., and Ben, S.-C. F. (2017). Central bank digital currency: motivations and implications. Bank of Canada Staff Discussion Paper.

English, W. B., and Liang, J. N. (2020). Designing the main street lending program: challenges and options. J. Finan. Crises 2, 1–40.

Eyal, I. (2017). Blockchain technology: transforming libertarian cryptocurrency dreams to finance and banking realities. Computer 50, 38–49. doi: 10.1109/MC.2017.3571042

Fenwick, M., Joseph, A. M., and Erik, P. M. V. (2018). “Fintech and the financing of SMEs and entrepreneurs: from crowdfunding to marketplace lending,” in The Economics of Crowdfunding (New York, NY: Springer). doi: 10.1007/978-3-319-66119-3_6

Fosso, W., Samuel, J. R. K. K., Ransome, E. B., and John, G. K. (2020). Bitcoin, blockchain and fintech: a systematic review and case studies in the supply chain. Prod. Plan. Control 31, 115–142. doi: 10.1080/09537287.2019.1631460

Friedman, L. M. (1969). Legal culture and social development. Law Soc Rev. 4, 29–44. doi: 10.2307/3052760

Galloway, I. (2009). Peer-to-peer lending and community development finance. Commun. Invest. 21, 19–23.

Gao, G. X., Zhi-Ping, F., Xin, F., and Yun, F. L. (2018). Optimal Stackelberg strategies for financing a supply chain through online peer-to-peer lending. Eur. J. Oper. Res. 267, 585–597. doi: 10.1016/j.ejor.2017.12.006

Gelb, A., and Anna, D. M. (2018). Identification Revolution: Can Digital ID be Harnessed for Development? Washington, DC: Brookings Institution Press.

Ghoddusi, H., Creamer, G. G., and Rafizadeh, N. (2019). Machine learning in energy economics and finance: a review. Energy Econ. 81, 709–727. doi: 10.1016/j.eneco.2019.05.006

Gimpel, H., Rau, D., and Röglinger, M. (2018). Understanding FinTech start-ups-a taxonomy of consumer-oriented service offerings. Elect. Market. 28, 245–264. doi: 10.1007/s12525-017-0275-0

Global Payments Reports. (2021). Available online at: https://ec.europa.eu/economicaffairs/ (accessed April 07, 2022).

Gomber, P., Robert, J. K., Chris, P., and Bruce, W. W. (2018). Financial Information Systems and the Fintech Revolution. Milton Park: Taylor and Francis. doi: 10.1080/07421222.2018.1440778

Goodell, J. W., Kumar, S., Lim, W. M., and Pattnaik, D. (2021). Artificial intelligence and machine learning in finance: identifying foundations, themes, and research clusters from bibliometric analysis. J. Behav. Exp. Finan. 32, 100577. doi: 10.1016/j.jbef.2021.100577

Gourinchas, P. O., Ṣebnem, K. Ö., and Veronika P, Nick, S. (2020). COVID-19 and SME Failures. Cambridge, MA: National Bureau of Economic Research.

Gupta, J., and Gregoriou, A. (2018). Impact of market-based finance on SMEs failure. Econ. Model. 69, 13–25. doi: 10.1016/j.econmod.2017.09.004

Hendrikse, R., Michiel van, M., and David, B. (2019). Strategic coupling between finance, technology and the state: cultivating a Fintech ecosystem for incumbent finance. Environ. Plan. A Econ. Space 52, 654–674. doi: 10.1177/0308518X19887967

IFC. (2020). Report to on Digital Financing Tools. Available online at: https://www.ifc.org/topics/digital-financing.pdf (accessed May 4, 2022).

Iman, N. (2018). Is mobile payment still relevant in the fintech era? Elect. Comm. Res. Appl. 30, 72–82. doi: 10.1016/j.elerap.2018.05.009

Ingves, S. (2020). The Monetary Policy Toolbox. Stockholm: Swedish Economics Association (Speech). Available online at: https://www.riksbank.se/globalassets/media/tal/engelska/ingves/2020/themonetary-policy-toolbox.pdf (accessed May 5, 2022).

Jagtiani, J., and John, K. (2018). Fintech: the impact on consumers and regulatory responses. J. Econ. Bus. 100, 1–6. doi: 10.1016/j.jeconbus.2018.11.002

Jeasakul, P. (2020). “Considerations for designing temporary liquidity support to businesses,” in Monetary and Capital Markets COVID-19 Special Series Note (May 8) (Washington, DC: International Monetary Fund).

Jenik, I., Timothy, L., and Alessandro, N. (2017). Crowdfunding and financial inclusion. CGAP (Consultative Group to Assist the Poor) Working Paper.

Kauffman, R. J., Clemons, E. K., Dewan, R. M., and Weber, T. A. (2017). Understanding the information-based transformation of strategy and society. J. Manag. Inform. Syst. 34, 425–456. doi: 10.1080/07421222.2017.1334474

Kemp, M. T., Nikolian, V. C., Williams, A. M., Jacobs, B. N., Wilson, J. K., Mulholland, M. W., et al. (2018). Pilot study to evaluate the safety, feasibility, and financial implications of a postoperative telemedicine program. Ann. Surg. 268, 700–707. doi: 10.1097/SLA.0000000000002931

Klüver, H., Hartmann, F., Humphreys, M., Geissler, F., and Giesecke, J. (2021). Incentives can spur COVID-19 vaccination uptake. Proc. Natl. Acad. Sci. 118, e2109543118. doi: 10.1073/pnas.2109543118

Kulkarni, A. V., Brittany, A., Iffat, S., and Jason, W. B. (2009). Comparisons of citations in Web of Science, Scopus, and Google Scholar for articles published in general medical journals. JAMA 302, 1092–1096. doi: 10.1001/jama.2009.1307

Lagoarde-Segot, T. (2020). Financing the sustainable development goals. Sustainability 12, 2775. doi: 10.3390/su12072775

Lai, K. P. (2020). “FinTech: the dis/re-intermediation of finance?,” in The Routledge Handbook of Financial Geography (New York, NY: Routledge), 440–457. doi: 10.4324/9781351119061-24

Langley, P., and Leyshon, A. (2017). Platform capitalism: the intermediation and capitalization of digital economic circulation. Finan. Soc. 3, 11–31. doi: 10.2218/finsoc.v3i1.1936

Lasi, H., Peter, F., Hans-Georg, K., Thomas, F., and Michael, H. (2014). Industry 4.0. Bus. Inform. Syst. Eng. 6, 239–242. doi: 10.1007/s12599-014-0334-4

Leong, K., Sung, A. Y. M., Ostrowska-Dankiewicz, A., da Silva, P. M. L., and Martynyuk, V. (2018). “Academic integrity and debt literacy of finance students: A cross-national study,” in 21st Annual International Conference of Enterprise and competitive Environment (Brno: Mendel University), 167–176.

Lewis, M., and Liu, Q. (2020). “The COVID-19 outbreak and access to small business finance. 1. 1 Managing the risks of holding self-securitisations as collateral 2. 11 Government bond market functioning and COVID-19 3. The Economic Effects of Low Interest Rates and Unconventional 21 Monetary Policy 4,” in Retail Central Bank Digital Currency: Design Considerations, Rationales (Canberra: Reserve Bank of Australia), 58.

Lewis, M., and Qiang, L. (2020). “The COVID-19 outbreak and access to small business finance. 1. 1 Managing the risks of holding self-securitisations as collateral 2. 11 Government bond market functioning and COVID-19 3. The economic effects of low interest rates and unconventional 21 monetary policy 4,” in Retail Central Bank Digital Currency: Design Considerations, Rationales, (Canberra: Reserve Bank of Australia) 58.

Li, S., François, C., and Martin, R. (2018). Lessons from China's digital battleground. MIT Sloan Manag. Rev. 59, 1–6.

Liao, L., and Yang, J. (2020). Angry borrowers: negative reciprocity in a financial market. PBCSF-NIFR Research Paper.

Liao, S. H., and Ling-Ling, Y. (2020). Mobile payment and online to offline retail business models. J. Retail. Consum. Serv. 57, 102230. doi: 10.1016/j.jretconser.2020.102230

Liberati, A., Douglas, G. A., Jennifer, T., Cynthia, M., Peter, C. G., John, P. A. I., et al. (2009). The PRISMA statement for reporting systematic reviews and meta-analyses of studies that evaluate health care interventions: explanation and elaboration. J. Clin. Epidemiol. 62, e1–e34. doi: 10.1016/j.jclinepi.2009.06.006

Lin, X., Xiaolong, L., and Zhong, Z. (2017). Evaluating borrower's default risk in peer-to-peer lending: evidence from a lending platform in China. Appl. Econ. 49, 3538–3545. doi: 10.1080/00036846.2016.1262526

Lu, T., Zhang, Y., and Li, B. (2019). “The value of alternative data in credit risk prediction: Evidence from a large field experiment,” in ICIS 2019 Proceedings. Available online at: https://aisel.aisnet.org/icis2019/data_science/data_science/10

Madakam, S., and Ramaswamy, R. (2015). “100 New smart cities (India's smart vision),” in 2015 5th National Symposium on Information Technology: Towards New Smart World (IEEE), 1–6.

Makina, D. (2019). “A survey of microfinance institutions and informal finance in Africa,” in Extending Financial Inclusion in Africa (New York, NY: Academic Press), 113–135. doi: 10.1016/B978-0-12-814164-9.00006-2

Mannaro, K., Pinna, A., and Marchesi, M. (2017). “Crypto-trading: Blockchain-oriented energy market,” in 2017 AEIT International Annual Conference (IEEE), 1–5.

Masood, T., and Paul, S. (2020). Industry 4.0: adoption challenges and benefits for SMEs. Comput. Ind. 121, 103261.

Masood, T., and Sonntag, P. (2020). Industry 4.0: adoption challenges and benefits for SMEs. Comput. Ind. 121, 103261. doi: 10.1016/j.compind.2020.103261

McKinsey (2021). Survey: Global B2B Decision-Maker Response to COVID-19 Crisis. New York, NY: McKinsey and Company. Available online at: https://www.mckinsey.com/business-functions/marketing-and-sales/our-insights/survey-global-b2b-decision-maker-response-to-covid-19-crisis-2021 (accessed May 10, 2022).

Mhlanga, D. (2020). Industry 4.0 in finance: the impact of artificial intelligence (ai) on digital financial inclusion. Int. J. Finan. Stud. 8, 45. doi: 10.3390/ijfs8030045

Milenkova, V., and Lendzhova, V. (2021). Inequities in first education policy responses to the COVID-19 crisis: a comparative analysis in four Central and East European countries. Eur. Educ. Res. J. 20, 543–563. doi: 10.1177/14749041211030077

Moher, D., Alessandro, L., Jennifer, T., and Douglas, G. A. (2010). Preferred reporting items for systematic reviews and meta-analyses: the PRISMA statement. Int. J. Surg. 8, 336–341. doi: 10.1016/j.ijsu.2010.02.007

Mollick, E. (2014). The dynamics of crowdfunding: an exploratory study. J. Bus. Vent. 29, 1–16. doi: 10.1016/j.jbusvent.2013.06.005

Murakami, E., Satoshi, S., and Eiji, Y. (2020). Projection of the effects of the COVID-19 pandemic on the welfare of remittance-dependent households in the Philippines. Econ. Disast. Clim. Change 5, 1–14. doi: 10.1007/s41885-020-00078-9

Narayanan, A., Joseph, B., Edward, F., Andrew, M., and Steven, G. (2016). Bitcoin and Cryptocurrency Technologies: A Comprehensive Introduction. Princeton, NJ: Princeton University Press.

Neuberger, D., and Räthke, S. (2009). Microenterprises and multiple bank relationships: the case of professionals. Small Bus. Econ. 32, 207–229. doi: 10.1007/s11187-007-9076-8

Nopper, T. (2020). Alternative Data and The Future of Credit Scoring. Available online at: https://www.filesforprogress.org/pdfs/alternative-data-future-credit-scoring.pdf

Norboyeva, N. (2020). The role of the digital economy in the development of information and communication technologies. 3, 21.

Noyes, C. (2016). Bitav: fast anti-malware by distributed blockchain consensus and feedforward scanning. arXiv [Preprint] arXiv,:1601.01405. 16(1), 14–25.

OECD Secretary-General (2020). Report to G20 Leaders. Available online at: https://www.oecd.org/g20/topics/taxation/oecd-secretary-general-tax-report-g20-leaders-july2020.pdf (accessed May 3, 2022).

Ongsulee, P., Chotchaung, V., Bamrungsi, E., and Rodcheewit, T. (2018). “Big data, predictive analytics and machine learning,” in Proceedings of the 16th International Conference on ICT and Knowledge Engineering (ICTandKE), (Bangkok: IEEE), 1–6. doi: 10.1109/ICTKE.2018.8612393

Óskarsdóttir, M., Cristián B, Carlos, S., Jan, V., and Bart, B. (2019). The value of big data for credit scoring: enhancing financial inclusion using mobile phone data and social network analytics. Appl. Soft Comput. 74, 26–39. doi: 10.1016/j.asoc.2018.10.004

Pejić, B., Mirjana, Ž. K., Sanja, S., and Lejla, T. (2019). Text mining for big data analysis in financial sector: a literature review. Sustainability 11, 1277. doi: 10.3390/su11051277

Petersen, M. A., and Rajan, R. G. (1994). The benefits of lending relationships: evidence from small business data. J. Finan. 49, 3–37.

Prat, J., and Walter, B. (2021). An equilibrium model of the market for bitcoin mining. J. Polit. Econ. 129, 2415–2452. doi: 10.1086/714445

Qamruzzaman, M., and Jianguo, W. (2019). SME financing innovation and SME development in Bangladesh: an application of ARDL. J. Small Bus. Entrep. 31, 521–545. doi: 10.1080/08276331.2018.1468975

Qamruzzaman, M., and Wei, J. (2019). SME financing innovation and SME development in Bangladesh: an application of ARDL. J. Small Bus. Entrep. 31, 521–545.

Qi, Y., and Xiao, J. (2018). Fintech: AI powers financial services to improve people's lives. Commun. ACM 61, 65–69. doi: 10.1145/3239550

Reddy, K., Qamar, M. A. J., Mirza, N., and Shi, F. (2021). Overreaction effect: evidence from an emerging market (Shanghai stock market). Int. J. Manag. Finan. 17, 9132. doi: 10.1108/IJMF-01-2019-0033

Remolina, N. (2020). Towards a data-driven financial system: the impact of Covid-19. SMU Centre for AI and Data Governance Research Paper, 08. doi: 10.2139/ssrn.3660874

Royal Government of Cambodia. (2016). Financial Infrastructure Program. Cambodia: Royal Government of Cambodia

Sahay, R., Ulric, E., von, A., Amina L, Purva, K., Sumiko, O., Majid, B., et al. (2020). The Promise of Fintech; Financial Inclusion in the Post COVID-19 Era. Bretton Woods, NH: International Monetary Fund.

Saksonova, S., and Kuzmina-Merlino, I. (2017). Fintech as financial innovation–the possibilities and problems of implementation. Eur. Res. Stud. J. doi: 10.1021/ja00368a049

Sapienza, P. (2002). The effects of banking mergers on loan contracts. J. Finan. 57, 329–367. doi: 10.1111/1540-6261.00424

Senyo, P. K., and Karanasios, S. (2020). How Do Fintech Firms Address Financial Inclusion? Atlanta, GA: Association for Information Systems.

Sestino, A., Maria, I. P., Luigi, P., and Gianluigi, G. (2020). Internet of things and big data as enablers for business digitalization strategies. Technovation 98, 102173. doi: 10.1016/j.technovation.2020.102173

Shastry, G. K., Cole, S., and Paulson, A. (2014). Smart money? The effect of education on financial outcomes. Rev. Finan. Stud. 27, 2022–2051. doi: 10.1093/rfs/hhu012

Singhal, B., Gautam, D., and Priyansu, S. P. (2018). How Blockchain Works. Beginning Blockchain. New York, NY: Springer. doi: 10.1007/978-1-4842-3444-0_2

Sinha, A., Mishra, S., Sharif, A., and Yarovaya, L. (2019). Does green financing help to improve environmental & social responsibility? Designing SDG framework through advanced quantile modelling. J. Environ. Manag. 292, 112751. doi: 10.1016/j.jenvman.2021.112751

Song, H., Yang, Y., and Tao, Z. (2020). How different types of financial service providers support small-and medium-enterprises under the impact of COVID-19 pandemic: from the perspective of expectancy theory. Front. Bus. Res. China 14, 1–27. doi: 10.1186/s11782-020-00095-1

Suprun, E., Sahin, O., Salim, H., Richards, R., MacAskill, S., Heilgeist, S., et al. (2020). Developing a preliminary causal loop diagram for understanding the wicked complexity of the COVID-19 pandemic. Systems 8, 20. doi: 10.3390/systems8020020

Suri, T., and Jack, W. (2016). The long-run poverty and gender impacts of mobile money. Science 354, 1288–1292. doi: 10.1126/science.aah5309

Suri, T., and William, J. (2016). The long-run poverty and gender impacts of mobile money. Science 354, 6317, 1288–1292.

Taskinsoy, J. (2019). “Asian Miracle, Asian Tiger, or Asian Myth?,” in Financial Sector and Risk Assessment through FSAP Experience: Enhancing Bank Supervision in Thailand.

Taula, L. (2020). Bartering with big tech: a theoretical application of GST to the digital economy. Victoria University of Wellington Legal Research Paper, 9. doi: 10.2139/ssrn.3563892

Toh, Y. L., and Thao, T. (2020). How the COVID-19 pandemic may reshape the digital payments landscape. Payments Syst. Res. Brief. 2020, 1–10.

Toh, Y. L., and Tran, T. (2020). How the COVID-19 pandemic may reshape the digital payments landscape. Payments Syst. Res. Brief. 2020, 1–10.

UNCTAD. (2020). The Coronavirus Shock: A Story of Another Global Crisis Foretold and What Policymakers Should be Doing About it. Available online at: https://unctad.org/en/PublicationsLibrary/gds_tdr2019_update_coronavirus.pdf (accessed May 7, 2022).

United Nations. (2020). Digital Financing Report for 2020. Available online at: https://www.un.org/topics/taxation/digital-financing-repor2020.pdf (accessed May 3, 2022).

Van Uytsel, S. (2020). “Horizontal shareholding among fintech firms in Asia: A preliminary competition law assessment,” in Regulating FinTech in Asia (Singapore: Springer), 177–203.

Van, E., Nees, J., and Ludo, W. (2017). Citation-based clustering of publications using CitNetExplorer and VOSviewer. Scientometrics 111, 1053–1070. doi: 10.1007/s11192-017-2300-7

Verma, S., and Gustafsson, A. (2020). Investigating the emerging COVID-19 research trends in the field of business and management: a bibliometric analysis approach. J. Bus. Res. 118, 253–261. doi: 10.1016/j.jbusres.2020.06.057

Vučinić, M. (2020). Fintech and financial stability potential influence of FinTech on financial stability, risks and benefits. J. Central Bank. Theory Pract. 9, 43–66. doi: 10.2478/jcbtp-2020-0013

Wang, F., Lihui, D., Hongxin, Y., and Yuanjun, Z. (2019). Big data analytics on enterprise credit risk evaluation of e-Business platform. Inform. Syst. e-Bus. Manag. 2019, 1–40.

Wang, H., Chunxiao, L., Bin, G., and Wei, M. (2019). Does AI-Based Credit Scoring Improve Financial Inclusion? Evidence from Online Payday Lending. Hebei: Springer.

Wang, R., Zhangxi, L., and Hang, L. (2019). Blockchain, bank credit and SME financing. Qual. Quant. 53, 1127–1140. doi: 10.1007/s11135-018-0806-6

Wazurkar, P., Robin, S. B., and Dhananjai, B. (2017). “Predictive analytics in data science for business intelligence solutions,” in The proceedings of 7th International Conference on Communication Systems and Network Technologies (CSNT) (Nagpur: IEEE). doi: 10.1109/CSNT.2017.8418568

Wenzlaff, K. (2017). Civic Crowdfunding–Finanzierung von öffentlichen Gütern. Crowd Entrepreneurship. New York, NY: Springer. doi: 10.1007/978-3-658-17031-8_12

Wollschlaeger, M., Thilo, S., and Juergen, J. (2017). The future of industrial communication: automation networks in the era of the internet of things and industry 4.0. IEEE Ind. Elect. Mag. 11, 17–27. doi: 10.1109/MIE.2017.2649104

Wonglimpiyarat, J. (2017). FinTech Banking Industry: A Systemic Approach. Washington, DC: foresight. doi: 10.1108/FS-07-2017-0026

World Bank. (2021). Education Finance Watch 2021 (English). Washington, DC: World Bank Group. Available online at: http://documents.worldbank.org/curated/en/226481614027788096/Education-Finance-Watch-2021

Yang, L., and Youtang, Z. (2020). Digital financial inclusion and sustainable growth of small and micro enterprises—evidence based on China's new third board market listed companies. Sustainability 12, 3733. doi: 10.3390/su12093733

Yang, L., and Zhang, Y. (2020). Financing mode of energy performance contracting projects with carbon emissions reduction potential and carbon emissions ratings. Energy Policy 144, 111632. doi: 10.1016/j.enpol.2020.111632

Zaffar, M. A., Kumar, R. L., and Zhao, K. (2019). Using agent-based modelling to investigate diffusion of mobile-based branchless banking services in a developing country. Decis. Support Syst. 117, 62–74. doi: 10.1016/j.dss.2018.10.015

Zavolokina, L., and Schwabe, G. (2016). The FinTech phenomenon: antecedents of financial innovation perceived by the popular press. Finan. Innov. 2, 1–16. doi: 10.1186/s40854-016-0036-7

Zhong, R. Y., Xun, X., Eberhard, K., and Stephen, T. N. (2017). Intelligent manufacturing in the context of industry 4.0: a review. Engineering 3, 616–630. doi: 10.1016/J.ENG.2017.05.015