- 1Department of Environmental Science, University of South Africa (UNISA), Pretoria, South Africa

- 2Gordon Institute of Business Science, University of Pretoria, Pretoria, South Africa

Despite rolling blackouts, high electricity prices, a favorable climate and the size of the South African economy, rooftop photovoltaic (PV) solar products have low levels of middle-income residential market penetration. This study sought to establish the reasons for this. It was found, firstly, that households opt rather for demand side management (DSM) tools such as energy-efficient lamps or inverters. Secondly, they switch to gas (at least for cooking) or a generator rather than solar. This is because rooftop PV is expensive, in part due to costly batteries and inverters, but also as support measures such as feed-in tariff funding, tax rebates and subsidies are non-existent. In addition, South African banks are reluctant to finance rooftop PV, as return on investment (ROI) is extremely long term, and there are few, if any, bank-accredited PV suppliers. There is also no political pressure on banks to provide attractive PV financing. Furthermore, middle-income consumers struggle to understand PV technology and do not trust the suppliers thereof. For instance, rooftop PV companies seldom market themselves or their products adequately, and most do not sell PV with a maintenance service plan or offer credit. It is recommended that rooftop PV companies work with banks offer innovative, cost-effective modular PV packages, and build their brand to create a relationship of trust with the community to increase sales.

Introduction

South Africa is facing a cost and supply dilemma in terms of electricity (Parsons et al., 2015). For the South African residential consumer, the cost of electricity increased by 753%, between 2007 and 2021, or, quintupled over a span of 14 years (ESKOM, 2021). The price increases can mostly be attributed to exorbitant costs and massive debt accumulated by ESKOM, South Africa's über-dominant, state-owned power utility. ESKOM is poorly maintaining its power stations, has exploding operational costs, is massively overspending on building new plants, and seems unable to prevent corruption associated with its supply chain management (David, 2015; Stone, 2021). Thus, residential consumers are dealing with rising electricity costs as well as an intermittent and unreliable electricity supply (Aklin et al., 2014; Sikonathi and Charlotte, 2015). Such electricity supply issues are not uncommon across the African continent (Farquharson et al., 2018). This has opened a window of opportunity for providers of alternatives (Obama, 2017).

Among the renewable energy sources, solar energy is one of the largest and most abundant potential energy source in the world. Notably, South Africa's solar resources are the third largest internationally (Semelane et al., 2021); however, low efficiencies of the technology, and high costs make solar power economically unviable (Esram et al., 2008). That said, efficiencies of solar power have shown significant improvement over the last few years (Sahu, 2015). As a result, solar costs are declining at a rate of 20% to 30% annually (Borenstein, 2017). Pricewise, solar has become more attractive over time, a situation enhanced when the high electricity tariffs charged by ESKOM and South Africa's municipalities are taken into consideration (Slabbert, 2018).

Within this context, between 2008 and 2014, solar geysers were partly subsidized by the South African national government. As geysers account for up to 40% of a household's total electricity bill, solar geysers can lower electricity demand and offer hot water during power outages. Unfortunately, after almost half a million solar geysers were installed, the programme was terminated, as it was deemed ineffective in stimulating demand (Steyn, 2015; Kritzinger and Covary, 2016). The subsidy scheme was part of South Africa's alternative sources of energy strategy, which included hydro, gas, solar, nuclear, centralized solar plants and wind (Department of Energy (DoE), 2013). But this was suspended for a long time, although recently revived (Moyo, 2016; Khumalo, 2018). Therefore, renewable energy policies are a driver of solar adoption (Keeley and Matsumoto, 2018).

South Africa unfortunately lacks formal, national policies that foreground household PV or permit feed-in to the utility grid (Kusakana, 2018). This is also true for other developing countries such as the Sudan and India (Ahmed et al., 2022; Chandel et al., 2022). This situation is diametrically opposed to that in some countries who promote renewable energy with financial incentives such as tax breaks on the capital expenditure (Martin and Rice, 2018). Other nations have “feed-in tariff” (FIT) policies that encourage consumers and investors to switch to solar power and sell additional electricity generated to the utility grid. This has enabled good financial returns (Palm and Tengvard, 2011).

In countries that allow this, the grid-tied system is the most popular. This system includes panels, inverters and other components, but no battery storage (a significant cost saver, as batteries are expensive). FIT policies, however, do come with challenges, as governments and national utility companies alike must ensure a balance between energy supplied by them and energy generated independently, such that financial viability prevails for all parties (Hinz et al., 2018).

Interestingly, in some countries the PV market, supported by a FIT policy, has been so successful for individual consumers, that it now threatens the financial viability of the utilities, as households become net generators (Say and John, 2021). Consequently, financial incentives have been scaled back, unsettling the solar manufacturing and supply market, while reducing consumer enthusiasm (Dijkgraaf et al., 2018). Japan and Germany are examples of this (Li et al., 2021). In Japan there are conflicting interests between renewable energy and fossil fuel energy stakeholders. Additionally, Japanese monopolistic utility companies are not obliged to give any priority access to renewable energy suppliers, nor are they obliged to expand the grid to accommodate renewable companies. Lastly, large energy companies own the energy transmission, distribution and retail businesses, making it difficult for renewable suppliers to influence the market (Bermudez, 2018). There are concerns that a similar situation may exist in South Africa.

Methodology

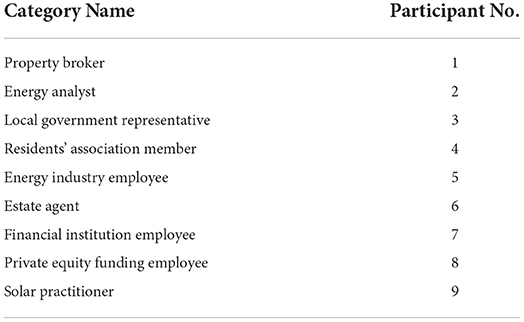

This study sought to establish the drivers and barriers to residential, middle-income adoption of rooftop PV in South Africa. Nine unstructured, in-depth interviews were conducted with specifically selected individuals who had personal and professional experience in the middle-income, residential, renewable energy sector (an energy analyst and a financing specialist, for example), as well as participants who represent households and household communities such as municipal councilors, a middle-income community leader and various specialists—all with an interest in addressing residential electricity challenges (see Table 1). Participants were encouraged to speak freely, with occasional probing on points raised by the interviewees. A critical incident technique (CIT) was used to ensure that the most valuable information was extracted from the participants (Hughes et al., 2007).

The CIT approach to questioning makes use of participants' experiences, rather than having conceptual discussions. Furthermore, the application of CIT theory recorded positive and negative experiences from the participants' perspectives, and themes were developed from the feedback. The interviews were typically 45–60 min long. The coding assisted in identifying relevant themes, and ATLASti software was used (Saunders et al., 2012). Ethical clearance was granted by the University of Pretoria. The study was, therefore, exploratory in nature, as little has been published on the topic of middle-income solar uptake in South Africa, but future studies could survey residents, more estate agents, financiers and solar power providers.

Results

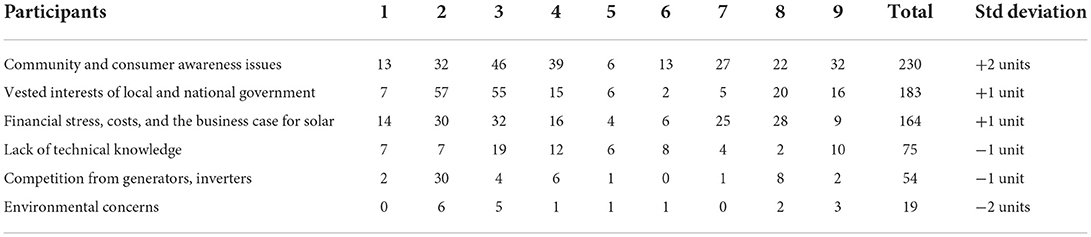

Table 2 presents the distribution of themes that emerged from the interviews, and then ranks them in order of importance. This was based on the number of mentions by the interviewees. These themes are an indication of what the participants felt were key issues in the adoption (or lack thereof) in terms of solar PV. To determine the overall importance of the emerging themes, standard deviation was used to group the themes. On this note, +2 units represents two units above the mean, whereas −2 units is two units below the mean. On this basis, the most important theme was (1) community and consumer awareness and attitudes toward cost increases and blackouts (two units above the mean). This was followed by (2) vested interests of government, and (3) financial issues. Environmental concerns (at two units below the mean), were the least important. The various themes will now be discussed.

Table 2. Themes relating to the adoption/lack of adoption of solar PV by number of mentions per person per interview.

Theme 1: Community and consumer awareness and attitudes toward cost increases and blackouts

The participants felt that due to load shedding being intermittent, once a period of load shedding was over, people tended to forget the inconvenience [Participants 2, 3, 5, 9]. Additionally, weak domestic demand for electricity, poor economic growth and better management of the electricity supply had helped reduce outages [Participants 2, 4, 9]. Consequently, Participant 3 felt that “if you could have a really bad period of power outages, I reckon you would get a lot more [to adopt]”. That is, outages are not severe enough, or often enough, to push people to adopt alternatives [Participant 3]. Participant 4 noted that, initially, people “grumbled” about outages and bought candles and torches. Only much later would people acquire a generator or inverter. Thereafter, some may say, “let's go solar”. So, while load shedding did spur some households to adopt solar, most did not [Participant 3]. Still, “people's responses have matured quite a lot, because there are now those of us who can say ‘I have solar',” so there is hope that things will change in the future.

Although electricity costs rise each year, participants felt that the increments were relatively slow and not large enough to invoke immediate consumer behavioral change, or the adoption of solar. They felt that outages and rising costs needed to combine in a sizable, short-term way, to overcome consumer inertia: “Society needs a shock to the system to make the change, and if it is too incremental then South Africans tend to just absorb the cost and poor service” [Participant 6]. The short term “pain” of price increases needs to be “severe” [Participant 9]—for example: “if electricity costs were to go up by 50% immediately it would influence the awareness and adoption” [Participant 6]. Supporting these comments was Participant 7, who noted the following: “As people experience more discomfort, more will be motivated to do something”. Participant 3 noted that consumers usually reacted to cost increases by reducing consumption through demand side management (DSM) tools: “People become vigilant about their power usage, more disciplined about looking at how much wattage a light bulb or kettle is.” While the price of electricity has increased, people mitigated it by using candles, gas for cooking, geyser timers, and installing energy efficient lights, for example. Overall, the switch from reliance on ESKOM or the municipality is slow, in part because many South Africans live in the hope that “ESKOM will come right” or feel that “coal will be around for many more decades” [Participants 2, 3]. Overall, the consensus was that most middle-income households will only adopt solar if the current technology becomes untenably expensive or completely unreliable [Participants 1, 7].

That said, planned rolling blackouts (known colloquially as load shedding) or unplanned outages (due to cable theft, cable failure or substation problems) are often poorly communicated, making it difficult for South Africans to plan around them. As a result, a hugely successful, privately run, free-of-charge community App, known as ESKOM Se Push, was created by two South African web developers to assist frustrated citizens. This App notifies you when a loadshedding event will occur in your location (Naik, 2020).

Some participants did think that electricity supply issues, ongoing since 2008, would eventually cause some households to adopt solar energy. As Participant 3 noted, with solar, the “convenience and the peace of mind of not having to worry about your power going off is worth an enormous amount”. Participant 6 stated: “I think with what is going on with ESKOM, there is already an open market to adopt alternative technology”. Outages thus have a “positive” impact on the adoption of solar energy: “Outages kicked me into going solar” [Participant 4]. “For me, we had two outages this year, [so we went solar] for peace of mind” [Participant 3]. It may be that solar can help households reduce the distress of intermittent power supply [Participant 7]. Furthermore, load shedding makes people angry, causing some to make an emotional (rather than a financial) decision to actively seek out ways to go off grid, as they “no longer want to rely on anything produced by the government, as many opt for private education, health care, security and technology, the move to solar is just another part of that” [Participant 6].

Theme 2: The vested interests of national and local government

Although South Africa has a three-tiered system of government, the participants placed a great deal of emphasis on the bottom tier (local or municipal) and the top tier (national) government. Participant 2 felt that local government was unsupportive of solar power. This participant pointed out that if households adopted solar energy, their electricity bills would decline, and this would reduce revenue for cities: “Government is already worried … suburbs and businesses are the main ones who pay for electricity …if middle income households start reducing usage this will make under-recovery even worse” [Participant 4]. Crucially, any decline in electricity sales will negatively impact on the bottom line of municipalities. South African municipalities are in a difficult position in that they must provide electricity (and other services) to many poor households, despite their inability to pay. Additionally, local electricity sales represent a sizeable chunk of municipalities' budgets, as it is difficult to raise money from the sale of other municipal services. Money generated from electricity sales is therefore used to cross-subsidize other municipal services and costs. As most municipalities are already in a poor fiscal position, municipalities have a vested financial interest to inhibit the uptake of solar [Participant 2].

In terms of national government, concerns were raised about poor policy and lack of subsidies or feed-in tariffs [Participants 5, 8]. The lack of regulations at national level was also an issue: “the regulatory framework [must] be in place and I do not think the regulatory framework is concentrating on the domestic level yet” [Participant 9]. In other words, national policy relating to the adoption of rooftop solar, the subsidization thereof (with rebates or feed-in tariffs) and regulation of the emerging rooftop solar industry, is absent [Participant 5]. Participant 9 did, however, think that the carbon tax, implemented in June 2019, could foster solar power adoption, as it will increase the price of electricity. Furthermore, the National Department of Energy (DoE) seemed reluctant to drive solar adoption through subsidies; for example: “there are other things the government wants to do with tax revenue, so I do not know if the government is ready to subsidize it,” noted Participant 2. As the government is ultimately responsible for ESKOM, a State Owned Enterprise (SOE), participants were concerned that residential subsidies by national government would worsen ESKOM's financial woes, which in turn would negatively affect the State—as the State guarantees ESKOM's debts [Participant 8]. Participant 6 also felt that poor management at ESKOM itself was a hurdle. That is, ESKOM is so badly run that ESKOM could not subsidize solar even if ESKOM wanted to (Gilder and Rumble, 2020). Participants 2, 3, 5 and 9 highlighted the financial death spiral that ESKOM faces, namely as consumers go offline, reduce consumption, and the economy weakens, fewer and fewer can or will pay ESKOM. ESKOM also faces exorbitant costs associated with coal and diesel procurement, to debt, salaries and maintenance. In the short term, ESKOM is raising electricity tariffs to survive, but this creates a vicious circle where an increasing number of consumers reduce their consumption or go off grid. Ultimately, ESKOM may be left with very costly power stations that are, effectively, stranded assets (Burton et al., 2016).

On the positive side, however, the solar PV industry has begun to create their own regulations to informally regulate the industry: “the industry will govern itself in the future, the standards that they are setting, they will eventually start forcing a regulation through the insurance companies as an example” [Participant 9]. While the DoE does not have a subsidy policy, it does have a “renewable energy IPP programme” [Participant 2], which was viewed as a positive driver for solar adoption. In addition, credit was given to South Africa's energy regulator, NERSA: “NERSA are in a different league compared to other regulatory authorities in South Africa, they stand up, they do the right thing” [Participant 8]. That said, one participant was certain that competition for ESKOM would come: “I do believe that our government will have some kind of green energy alignment, just like all European countries” [Participant 5]. None, however, believed that this would be implemented in the short term.

Theme 3: Financial considerations

Participants felt that complex financial issues played a role in the slow adoption of solar energy. Overall, the South African economy is “weak” and “money is tight” [Participants 7, 9]. This has been made worse by COVID-19 and the associated lockdown, combined with the knock-on effects of the Russia-Ukraine war. Even middle-income households struggle to afford solar, as they have many other monthly expenses such as school fees, car repayments, medical aid, insurance, and rent/mortgages, for example [Participants 2, 9]. As a result, only a few adopt solar, and, even then, take “baby steps… a modular route which can be scaled up over time to a full system” [Participant 3]. The über wealthy, however, to avoid astronomical electricity bills and load shedding, are adopting full solar systems as a luxury item [Participants 1, 8].

Within this theme of financial considerations, several sub-themes emerged:

Sub-theme 3.1: A weak business case for household rooftop solar

Cost is a significant hurdle: “Individuals, in general, do not have the capex to install a system on their roofs, especially for something which they are used to paying for as a basic consumable” [Participant 8]. Adopting rooftop solar requires considerable upfront capital, as batteries and inverters are costly [Participants 1, 9]. Battery technologies therefore need to become cheaper and scalable, to increase solar adoption: “I think scaling up battery manufacturing will bring down the price and change battery technology eventually”. Currently, for many South African households, solar is not a good short-term financial investment. Return on investment (ROI) takes many years to come to fruition. Within this context is the issue of late, missed, incomplete or inaccurate electricity billing. Consequently, a homeowner may do multiple things to reduce electricity consumption, but not see a financial gain as their municipal electrical account may not be a true reflection of actual consumption (Thovhakale et al., 2011). That said, it was recognized that there will come a point when the cost of solar is on a par with (or even lower than) fossil fuel generation sources. This will be hastened with the annual increases that ESKOM is demanding (up to 25% per annum in some years) [Participant 4].

The business case for residential solar in South Africa is therefore weak [Participants 2, 9]. The situation is different in other countries. Participant 3, for example, noted: “In France, if you wanted to put solar in, you go to the bank, you get an interest free loan to cover it,… and the installation of it, comes off, so you pay for the material, the installation comes off your bill, you get a rebate on your property tax and the sales tax, instead of you paying 20 or 21% odd, it comes down to about 5 or 6%”. This was true for Germany as well, as Participant 2 noted: “There are feed-in tariffs for residential users that are highly subsidized by government”. Here in South Africa, however, Participant 2 said: “Government is not prepared to subsidize it; Government do not have the money and I just do not think that that business model or feed-in tariffs at a subsidized price is going to really fly”.

This situation differs with solar geysers, which enjoyed a better uptake—in part due to rebates, as well as a stronger business case. Geysers are heavy consumers of electricity, so taking them offline can make a substantial impact on overall reliance on ESKOM or the municipality, and reduce bills considerably [Participants 4, 5, 8]. For example, at a cost of between R15 000 and R25 000 (between 1000 and 1500 USD), a solar geyser can save a household roughly R500 (30 USD) a month in electricity costs (a ROI of roughly 3 to 4 years) (Hohne et al., 2019). It should be noted, however, that solar geysers are not without their problems and must compete with more reliable gas geysers.

Another challenge is that installed solar panels do not increase property valuations in South Africa. Participant 1 noted that, currently, “Solar panels and geysers are going to cost R200 0001, but it is not going to make your house more attractive to sell. So, it is quite difficult to give a quantity or a quantitative figure as to what your actual realtor value increase is, but if people go and buy a house, they have tick boxes, and this is one”. At best, it will make the house more sellable, more attractive to a buyer, the home will sell quicker, and the seller will not have to drop the price that much [Participant 4]. Concerningly, then, there is a real risk that the capital outlay will not be recouped (Private Property Reporter, 2021).

The business case for commercial and retail operators in South Africa is significantly different [Participant 9]. As businesses are open during the day (when the sun is shining, so batteries and inverters are not necessary), there is a strong financial case to adopt solar to mitigate the financial losses of outages and load shedding: “All the biggest installations in South Africa, like up to like 1.5 megawatts now, all of them are on big retail stores” [Participant 8]. Furthermore, as electricity tariffs rise, the incentive to install solar on commercial properties increases. It is also easier for commercial operators to install solar, as they have “maintenance managers who are responsible for the electricity and the electrical and the pipes and the water and all this stuff, so you have got some level of technical competence” [Participant 9]. They can also deduct the cost of the solar power system from their tax, as it is a depreciation expense although, even then, inaccurate billing is still an issue (Private Property Reporter, 2021).

Sub-theme 3.2: Weak access to expensive finance

For financial institutions, renewable energy is very topical. A financial institution representative reported: “From the banks' perspective alternative energy is a very popular category, we also know it is very socially-relevant; it will remain a top priority for us” [Participant 7]. Despite this sentiment, banks are extremely cautious in financing alternatives [Participants 1, 3, 4, 9]. For example, financial institutions often suggest that homeowners opt for fewer panels, or a cheaper installation, to keep costs down—if they even recommend it at all. Middle-income clients have many other expenses and high levels of indebtedness, making banks reluctant to lend them more money [Participants 1, 9], and, as stated by Participant 3, “the risk and credit teams within the banks look at these things from traditional and perhaps conservative perspectives”. Another challenge appears to be the National Credit Act 34 of 2005, which force financial institutions to adhere to strict affordability rules [Participants 1, 3]. This Act seems to be inhibiting the banking sector from proactively creating rooftop solar financing products and selling them to clients.

Lastly, there are no special credit vehicles for solar power. Banks only offer standard loan offerings, such as personal loans, credit cards, mortgage finance or overdrafts—none of which are easy to obtain, and most are at interest rates well above prime [Participants 1, 3]. Participant 4 noted that “we do not have a specific loan proposition for solar”. This inhibits the adoption of solar PV. Participant 7 stated: “Taking it up is not mainstream yet, the volumes there are low”. Participant 5 suggested that banks manage solar adoption in the same way they manage plumbers and electricians who do household insurance claims. This, they thought, would help deal with the financial issues. Overall, it was clear that the financial sector felt that rooftop solar for households is overpriced, not a good investment, and demand for it is weak [Participants 7, 8]. If demand were to increase, then perhaps banks would consider creating financing plans. Overall, banks are not proactively driving the purchase of rooftop solar [Participants 1, 7, 8]. Notably, however, Ooba, a bond originator, is now offering to help homeowners secure a mortgage, specifically to install rooftop solar, having teamed up with a sola provider, namely Hohm.2

Theme 4: Technical incompetence and weak awareness

Another challenge inhibiting the uptake of solar was poor understanding of solar technology. Households are uninformed [Participants 1, 2, 5, 9]. Participant 3 summarized this: “you need solar panels, batteries, battery chargers and inverters. This is too technical for a household. Most have no capability to manage the system properly or maintain it to ensure it is always working”. Participant 5 supported this: “South Africans do not possess the technical mindset and competence”. Participant 9 concurred. The impact of poor technical know-how was exacerbated by solar practitioners who do not make it easier for residential consumers to understand it [Participant 3]: “The biggest ‘joke' in the solar industry is that 90% of our clients do not understand our quotations”. The solar industry itself must therefore educate its customers if they want to secure a purchase [Participant 9].

Another critical issue was the unprofessionalism and poor service quality offered by some rooftop solar panel installers [Participants 2, 7, 9]. The image of solar has thus been damaged by fly-by-night installers who sell substandard products, overcharge, fail to provide after-sales service or maintenance, go out of business, or relocate to another area. Additionally, providers do not always come across as efficient, knowledgeable, professional or “on the ball” [Participant 2]. Unfortunately, then, households tend to not trust these service providers, negatively affecting sales [Participant 5]. Others noted that many installers were engineers and so did not know how to talk to clients. They cannot explain in layman's terms, or even market their product [Participants 5, 9]. Promoting the reliability of the product to overcome negative perceptions, and help households understand how the panels will save money, is crucial [Participants 1, 3, 7]. Additionally, some do not tell their customers that going off grid in South Africa is complicated. South Africa is “a regulated environment. It may be your house, but one has to comply with the statutory requirements of the Occupational Health and Safety Act and the regulations thereto, one of which is the code or practice for the wiring of premises.” Participant 1 suggested that service providers focus on “building their brand” to improve trust, whereas Participants 5 and 9 suggested that a “service-level agreement” would boost sales. Importantly, solar entrepreneurs need to recognize that households want a solution, not necessarily a product; thus, it was suggested that solar companies look at innovative solutions such as leasing the panels [Participant 9].

Theme 5: Competition from generators, inverters

Due to the high cost of rooftop solar solutions, and the need to finance it, many consumers opt for cheaper alternatives such as candles, gas stoves, inverters, outside solar lights, and generators. Solar entrepreneurs thus need to recognize that they are not only competing with ESKOM and other solar panel companies; they are also competing with generators, gas solutions and inverters. For example: “Over a longer period of time a generator is more expensive, but to the average person who is not going to get finance on solar, they would rather get a generator or an inverter” [Participant 8]. Importantly, solar panels alone will not protect a household from load shedding or give them electricity at night. For that, a battery and an inverter are required. Installing batteries and an inverter without solar panels is therefore a much cheaper way to overcome load shedding [Participants 5, 8, 9]. Participant 9 felt that solar entrepreneurs should capitalize on the negatives of generators—the significant levels of air and noise pollution for example. They are also a target for thieves, break down easily and need maintenance. Gas also has its challenges: gas leaks can be lethal, gas supply shortages are not unknown, and gas is becoming expensive. Gas also requires investment in equipment such as gas stoves and geysers (Ayub et al., 2021).

Theme 6: Environmental issues

The least important issue was that of the environment. The participants all felt that environmental considerations had little to no impact on solar panel purchasing decisions. As stated by Participant 4, “I do not think South Africans are aware of green electricity”. Usually, households use environmental issues to justify their purchase, rather than inspire it. One participant stated: “Reducing coal pollution or something, is an ‘after the fact' justification” [Participant 1]. Participant 3 said “that it is environmentally more friendly, is a cherry on top”. Another claimed: “I do not think we are aware of green issues; unlike Europe where people are very, very, very aware” [Participant 3].

It is important to build consumer awareness around solar [Participant 9]. For example, the Parkhurst Residents and Business Association (PRABOA) decided to approach solar energy with a “Go Green” initiative. This is a renewable energy project that encourages, educates and makes renewable energy sources affordable and available to Parkhurst residents (Claire., 2015). The stated vision of the “Go Green” initiative is to “have solar panels on every single roof in Parkhurst with a finance company that will fund this, maybe even sell power back to the grid or their neighbors” [Participant 4]. The PRABOA elected to create opportunities for residents to “access the information and how to assess the information” on solar [Participant 4]. This was in part an attempt to convince people that solar was not just for “tree hugging hippies” [Participant 3]. This initiative does, however, seem to have stalled.

Discussion

Overall, the South African State is doing little to raise awareness around rooftop solar, let alone support households to adopt it. In fact, local and national government policies, regulations, and decisions are hindering the adoption of rooftop solar (De Jongh et al., 2014). But, poor financial management, massive cost overruns, corruption, sabotage, and a bloated workforce means that ESKOM and municipalities are ramping up electricity costs whilst becoming less reliable in terms of supply (Mbomvu et al., 2021). Furthermore, as both rely on revenue from residential consumers, they have no incentive whatsoever to subsidize or offer feed-in tariffs (Mayr et al., 2015; Kelly and Geyer, 2018). Consequently, disenchantment with the inconvenience of load shedding and rising electricity costs are becoming strong motivators for the adoption of solar (Folly, 2021). Additionally, the business case for solar will improve as panels and batteries come down in price. Therefore, South Africa may soon reach a tipping point where consumers elect to adopt solar anyway.

However, the high costs of rooftop solar, high interest rates, lack of innovative financing, no subsidies, no feed-in tariffs, no tax rebates, no soft loans, coupled with onerous credit checks and application processes are significant problems (Yamamoto, 2017). Worse is that rooftop PV needs to be installed alongside energy-efficient appliances, batteries, and inverters if households want to go fully off grid. Currently, then, residential consumers are trapped between high monthly costs but erratic electricity supply, and rooftop solar installations and associated appliances costing hundreds of thousands of rands in upfront costs. So, installing rooftop solar is an expensive decision with many “unknowns”, making it seem risky (Woessner, 2016).

Thus, the private sector, that is solar companies and banks, need to be proactive. Rooftop solar should be marketed as a solution to load shedding and high electricity prices, with providers speaking less “tech” and work on building trust in their products and systems. Banks should not wait for demand to rise before they elect to service this “niche” market. Rather they can set up the kinds of relationships they currently have with plumbers, electricians (regarding insurance claims and the like) or with car dealers, to enable solar entrepreneurs to sell a bundled finance-and-product deal, as well as provide assurance to buyers that there is quality control and guarantees in place.

Conclusion and policy implications

This small-scale case study found limited understanding of, and confidence in, residential rooftop solar technology. Additionally, the policies and practices of various organs of State, as well as of ESKOM, the dominant supplier of electricity in South Africa, inhibit uptake. Added to this are the significant cost of residential rooftop PV. With the post COVID-19 lockdown South African economy is in a fragile state, worsened by an unstable power supply, many people and companies are looking to reduce their dependence on ESKOM. Thus, a timely, cost-effective solution to expensive yet unstable electricity provision is needed. In that regard subsidized provision of residential rooftop solar power could help provide electricity in an efficient and sustainable manner. As this is unlikely to be implemented, it is suggested here that increased adoption of residential rooftop solar lies with the industry players and banks. Together they can focus on building their brands, offering excellent customer service such as service-level agreements, facilitate finance options, educate their clients, and be price competitive with a modular approach, leasing options or bundled finance packages.

Data availability statement

The datasets presented in this article are not readily available because ethics application did not include the sharing of raw data. Requests to access the datasets should be directed to bWNrYXl0am1AdW5pc2EuYWMuemE=.

Ethics statement

The studies involving human participants were reviewed and approved by University of Pretoria. The patients/participants provided their written informed consent to participate in this study.

Author contributions

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

Acknowledgments

Thanks to H Winkler of UJ, Milton Milaras and Gwen McKay for their useful insights and comments on drafts of this paper, as well as Marlette van der Merwe for her editing skills. Thanks also to the participants who made this study possible.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1. ^Around 12000 USD.

2. ^See https://solar.ooba.co.za/ and https://www.hohmenergy.co.za/.

References

Ahmed, T. Z., Braeckman, J. P., Damo, U. M., and Hassan, M. G. (2022). The potential for rooftop solar photovoltaics to meet future electricity demand in Khartoum, Sudan. World J. Eng. Res. Technol. 8, 1–32. https://eprints.soton.ac.uk/467595/2/1656551937.pdf

Aklin, M., Bayer, P., Harish, S., and Urpelainen, J. (2014). Information and energy policy preferences: a survey experiment on public opinion about electricity pricing reform in rural India. Econ. Govern. 15, 305–327. doi: 10.1007/s10101-014-0146-5

Ayub, H. R., Ambusso, W. J., Manene, F. M., and Nyaanga, D. M. (2021). A review of cooking systems and energy efficiencies. Am. J. Energy Eng. 9, 1–7. doi: 10.11648/j.ajee.20210901.11

Bermudez, V. (2018). Japan, the new “El Dorado” of solar PV? J. Renew. Sustain. Energy 10:020401. doi: 10.1063/1.5024431

Borenstein, S. (2017). Private net benefits of residential solar PV: the role of electricity tariffs, tax incentives, and rebates. J. Assoc. Environ. Resour. Econ. 4, S85–S122. doi: 10.1086/691978

Burton, J., Caetano, T., Hughes, A., Merven, B., Ahjum, F., and McCall, B. (2016). The Impact of Stranding Power Sector Assets in South Africa Using a Linked Model to Understand Economy-Wide Implications. Available online at: https://www.africaportal.org/publications/the-impact-of-stranding-power-sector-assets-in-south-africa-using-a-linked-model-to-understand-economy-wide-implications (accessed June 19, 2022).

Chandel, R., Chandel, S. S., and Malik, P. (2022). Perspective of new distributed grid connected roof top solar photovoltaic power generation policy interventions in India. Energy Policy 168, 113122, doi: 10.1016/j.enpol.2022.113122

Claire. (2015). Joburg Suburb to Get Electricity Off-Grid. Available online at: https://powertime.co.za/online/joburg-suburb-to-get-electricity-off-grid (accessed July 12, 2022).

David, R. (2015). R 230 Billion Eskom Funding Shortfall Threatens Job Creation. Press Releases (p. 2). Democratic Alliance. Available online at: https://www.da.org.za/2015/05/r-230-billion-ESKOM-funding-shortfall-threatens-job-creation/ (accessed April 9, 2018).

De Jongh, D., Ghoorah, D., and Makina, A. (2014). South African renewable energy investment barriers: an investor perspective. J. Energy South. Afr. 25, 15–27. doi: 10.17159/2413-3051/2014/v25i2a2665

Department of Energy (DoE) (2013). Integrated Resource Plan for Electricity 2010-2030 – Updated. Pretoria. Available online at: http://www.doe-irp.co.za/content/IRP2010_updatea.pdf (accessed April 9, 2018).

Dijkgraaf, E., Van Dorp, T. P., and Maasland, E. (2018). On the effectiveness of feed-in tariffs in the development of solar photovoltaics. Energy J. 39, 81–89. doi: 10.5547/01956574.39.1.edij

ESKOM (2021). Customer Care. Tariffs and charges. Available online at: https://www.ESKOM.co.za/CustomerCare/TariffsAndCharges/Pages/Tariffs_And_Charges.aspx (accessed July 26, 2021).

Esram, T., Krein, P. T., Kuhn, B. T., Balog, R. S., and Chapman, P. L. (2008). Power electronics needs for achieving grid-parity solar energy costs, in Energy 2030 Conference, 2008. ENERGY 2008. IEEE, 1–5. Available online at: http://ieeexplore.ieee.org/abstract/document/4781075/?reload=true (accessed March 24, 2018). doi: 10.1109/ENERGY.2008.4781075

Farquharson, D., Jaramillo, P., and Samaras, C. (2018). Sustainability implications of electricity outages in sub-Saharan Africa. Nat. Sustain. 1, 589–597. doi: 10.1038/s41893-018-0151-8

Folly, K. A. (2021). Chapter 20: Competition and Restructuring of the South African Electricity Market, in Local Electricity Markets Academic Press (Cambridge: Academic Press), 355–366. doi: 10.1016/B978-0-12-820074-2.00002-2

Gilder A. and Rumble, O. (2020). South Africa: a global air pollution hotspot? TAXtalk 81, 92–95. https://hdl.handle.net/10520/EJC-1f06f05a4d

Hinz, F., Schmidt, M., and Möst, D. (2018). Regional distribution effects of different electricity network tariff designs with a distributed generation structure: the case of Germany. Energy Policy 113, 97–111. doi: 10.1016/j.enpol.2017.10.055

Hohne, P. A., Kusakana, K., and Numbi, B. P. (2019). Optimal energy management and economic analysis of a grid-connected hybrid solar water heating system: a case of Bloemfontein, South Africa. Sustain. Energy Technol. Assess. 31, 273–291. doi: 10.1016/j.seta.2018.12.027

Hughes, H., Williamson, K., and Lloyd, A. (2007). Critical incident technique. Expl. Meth. Inform. Liter. Res. 28, 49–66. doi: 10.1016/B978-1-876938-61-1.50004-6

Keeley A. R. and Matsumoto, K. I. (2018). Investors' perspective on determinants of foreign direct investment in wind and solar energy in developing economies – review and expert opinions. J. Clean. Prod. 179, 132–142. doi: 10.1016/j.jclepro.2017.12.154

Kelly P. J. and Geyer, H. S. (2018). The regulatory governance of retail electricity tariff setting in South Africa. Reg. Sci. Policy Pract. 10, 203–220. doi: 10.1111/rsp3.12126

Khumalo, S. (2018). Jeff Radebe Signs R56bn Contract with Renewable Power Producers. FIN24. Available online at: https://www.fin24.com/Economy/ESKOM/jeff-radebe-signs-long-delayed-renewable-power-deals-20180404 (accessed April 9, 2018).

Kritzinger, K., and Covary, T. (2016). Review of South Africa's solar water heating rebate programme. Conference: IEPPEC Amsterdam. Available online at: https://www.researchgate.net/publication/308168429_Review_of_South_Africa's_Solar_Water_Heating_Rebate_Programme (accessed April 2, 2018).

Kusakana, K. (2018). “Impact of different South African demand sectors on grid-connected PV systems' optimal energy dispatch under time of use tariff,” in Sustainable Cloud and Energy Services ed. W. Rivera (Cham, Switzerland: Springer), 243–260. doi: 10.1007/978-3-319-62238-5_10

Li, H. X., Zhang, Y., Li, Y., Huang, J., Costin, G., and Zhang, P. (2021). Exploring payback-year based feed-in tariff mechanisms in Australia. Energy Policy 150, 112–133. doi: 10.1016/j.enpol.2021.112133

Martin N. and Rice, J. (2018). Solar feed-in tariffs: examining fair and reasonable retail rates using cost avoidance estimates. Energy Policy 112, 19–28. doi: 10.1016/j.enpol.2017.09.050

Mayr, D., Schmid, E., Trollip, H., Zeyringer, M., and Schmidt, J. (2015). The impact of residential photovoltaic power on electricity sales revenues in Cape Town, South Africa. Util. Policy 36, 10–23. doi: 10.1016/j.jup.2015.08.001

Mbomvu, L., Hlongwane, I. T., Nxazonke, N. P., Qayi, Z., and Bruwer, J. P. (2021). Load Shedding and its Influence on South African Small, Medium and Micro Enterprise Profitability, Liquidity, Efficiency and Solvency. Business Re-Solution Working Paper BRS/2021/001. doi: 10.2139/ssrn.3831513

Moyo, A. (2016). Top Investor Suspends SA's Green Energy Potential, IT Web. Available online at: https://www.itweb.co.za/content/KwbrpOMg2De7DLZn (accessed April 9, 2018).

Naik, S. (2020). The Story Behind the Eskom Se Push App and Founders' Struggles. IOL News. Available online at: https://www.iol.co.za/news/south-africa/the-story-behind-the-eskom-se-push-app-and-founders-struggles-40405793 (accessed July 30, 2021).

Obama, B. (2017). The irreversible momentum of clean energy. Science. 355, 126–129. doi: 10.1126/science.aam6284

Palm J. and Tengvard, M. (2011). Motives for and barriers to household adoption of small-scale production of electricity: examples from Sweden. Sustain. Sci. Pract. Policy 7, 6–15. doi: 10.1080/15487733.2011.11908061

Parsons, R., Krugell, W., and Keeton, G. (2015). ESKOM's Further Application for a Tariff Increase. Submission to NERSA. Available online at: http://cloud.chambermaster.com/userfiles/UserFiles/chambers/2215/File/SubmissiontoNERSAonESKOMtariffincrease-ProfR.ParsonsW.KrugellG.Keeton.pdf (accessed April 9, 2018).

Private Property Reporter (2021). The Cost Benefits of Solar Power in South Africa. Available online at: https://www.privateproperty.co.za/advice/property/articles/the-cost-benefits-of-solar-power-in-south-africa/8075 (accessed July 27, 2021).

Sahu, B. K. (2015). A study on global solar PV energy developments and policies with special focus on the top ten solar PV power producing countries. Renew. Sustain. Energy Rev. 43, 621–634. doi: 10.1016/j.rser.2014.11.058

Saunders, M., Lewis, P., and Thornhill, A. (2012). Research Methods for Business Students, 7th Edn. London: Pearson Education.

Say K. and John, M. (2021). Molehills into mountains: transitional pressures from household PV-battery adoption under flat retail and feed-in tariffs. Energy Policy 152:112213. doi: 10.1016/j.enpol.2021.112213

Semelane, S., Nwulu, N., Kambule, N., and Tazvinga, H. (2021). Economic feasibility assessment of manufacturing solar panels in South Africa – a case study of Steve Tshwete Local Municipality. Sustain. Energy Technol. Assess. 43:100945. doi: 10.1016/j.seta.2020.100945

Sikonathi, M., and Charlotte, M. (2015). Learn to Live with Load Shedding, says ESKOM. BDlive Print Article 2. Available online at: http://www.bdlive.co.za/business/energy/2015/01/16/learntolivewithloadsheddingsaysESKOM?service=print (accessed April 9, 2018).

Slabbert, A. (2018). Nersa to Consider Three ESKOM Tariff Increases. Moneyweb. Available online at: https://www.moneyweb.co.za/news/south-africa/nersa-to-consider-three-eskom-tariff-increases/ (accessed March 24, 2018).

Steyn, L. (2015). ESKOM Hands Over the Reins of Solar Power Geyser Initiative Mail and Guardian 19 January 2015. Available online at: https://mg.co.za/article/2015-01-19-ESKOM-hands-over-the-reins-of-solar-power-geyser-initiative (accessed March 24, 2018).

Stone, S. (2021). Supply Chain Officials are Under Siege' from Corrupt Officials. City Press, 13 March 2021. Available online at: https://www.news24.com/citypress/news/supply-chain-officials-are-under-siege-20210313 (accessed July 26, 2021).

Thovhakale, T. B., McKay, T. M., and Meeuwis, J. (2011). Retrofitting to lower energy consumption: comparing two buildings, in Proceedings of the 20th International Domestic Use of Energy Conference. Available online at: https://researchgate.net/publication/255717411_Retrofitting_to_lower_energy_consumption_comparing_two_buildings (accessed April 22, 2019).

Woessner, C. M. (2016). Solar panels: Lighting our future path (Master's thesis). (New York: Fordham University). Available online at: https://research.library.fordham.edu/environ_2015/31

Keywords: solar energy, photovoltaic, finance, policy, entrepreneurship

Citation: McKay T and Hendricks D (2022) Pitiful rooftop solar uptake in sunny South Africa: A policy, funding and service delivery perspective. Front. Sustain. Cities 4:969040. doi: 10.3389/frsc.2022.969040

Received: 14 June 2022; Accepted: 23 August 2022;

Published: 20 September 2022.

Edited by:

Bheru Lal Salvi, Maharana Pratap University of Agriculture and Technology, IndiaReviewed by:

Gustav Visser, Stellenbosch University, South AfricaRhythm Singh, Indian Institute of Technology Roorkee, India

Copyright © 2022 McKay and Hendricks. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Tracey McKay, bWNrYXl0am1AdW5pc2EuYWMuemE=

Tracey McKay

Tracey McKay Donavan Hendricks2

Donavan Hendricks2