- 1School of Engineering, Newcastle University, Newcastle upon Tyne, United Kingdom

- 2School of Geography, Politics and Sociology, Newcastle University, Newcastle upon Tyne, United Kingdom

- 3School of Engineering, University of Birmingham, Birmingham, United Kingdom

- 4Department of Strategy and International Business, University of Birmingham, Birmingham, United Kingdom

- 5School of Civil Engineering, University of Leeds, Leeds, United Kingdom

Sustainable Development Goal 11 calls for inclusive, safe, resilient and sustainable cities. Urban areas comprise interconnected infrastructure systems that deliver services that support all aspects of daily life. Despite their important contribution to modern life current infrastructure business models typically under-estimate the long-term economic, social and environmental benefits of infrastructure. Therefore, new infrastructure business models are required that: (i) target urban areas or regions at a local scale where there is the greatest scope for innovation, (ii) target specific challenges or needs (i.e., where there is a clear driver for innovation), and (iii) tackle the issue of the flawed economic cost-benefit model for assessing the viability of infrastructure investments. This paper presents a framework that promotes multiple stakeholders to working together, and by focusing on outcomes to develop alternative infrastructure solutions and business models that deliver multiple values to multiple stakeholders. By explicitly mapping these values over time and space, the interdependencies between infrastructures are revealed, along with an expanded perception of the value being brought about by that infrastructure. Moreover, the broader consideration of value also increases the number of stakeholders beneficiaries, the value network, and subsequently identify how they can support the infrastructure intervention by formulating alternative funding and financing mechanisms. A series of case studies to achieve resilience, sustainability and regeneration outcomes are used to show how the framework can be utilized to unlock investment in infrastructure in situations where traditional approaches have failed.

Introduction

Sustainable Development (SDG) Goal 11 sets a global ambition for cities and human settlements to be inclusive, safe, resilient and sustainable. Central to realizing this is the infrastructure that supports and influences our health, wealth, security and wellbeing; the prefix infra-means below, under or beneath—so literally infrastructure refers to an underlying structure. We define infrastructure as: “the artifacts and processes of the inter-related systems that enable the movement of resources in order to provide the services that mediate (and ideally enhance) security, health, economic growth and quality of life at a range of scales” (Bryson et al., 2014).

Improvements to infrastructure have been identified as a priority internationally for both service delivery and economic growth to achieve SDG11 (Oxford Economics, 2017; Chester and Allenby, 2019; Rozenberg and Fay, 2019). The challenges and opportunities of climate change and the unprecedented growth of cities, especially in emerging economies and developing countries, require increased investment and a range of different infrastructure business model (or service delivery model) to initiate, deliver and maintain sustainable and resilient infrastructure that are tailored for local contexts. However, around the world, infrastructure is conceived, planned, financed, and managed differently.

In the UK, the National Infrastructure Commission provides advice on long-term infrastructure challenges and undertakes a regular National Infrastructure Assessment (National Infrastructure Commission, 2017a) to make recommendations for how infrastructure needs and priorities should be addressed. However, the UK has historically under-invested in infrastructure (Pike et al., 2019; Seidu et al., 2020) and there is insufficient public resource to fund the infrastructure needed. Consequently the private sector has played a key role in funding and financing infrastructure (Infrastructure and Projects Authority, 2017). Public-private partnerships were introduced in 1990s as a novel mechanism for financing and funding infrastructure but have had mixed results (Khoteeva and Khoteeva, 2017) and not transferred to all infrastructure sectors or project scales (Infrastructure and Projects Authority, 2017).

Prakash et al. (2020) estimated the costs to deliver SDG11 by 2030 in four countries (Bolivia, India, Malaysia and Colombia) to illustrate the value proposition of a systematic approach to model investments and business models. They showed that many of the soft costs are difficult to contextualize and quantify. This is especially the case for expenditures related to governance, planning and public investment programs. For hard investments, such as housing or roads many standards for sustainability exist. Nevertheless, they concluded that estimating the costs and benefits of achieving urban sustainability is not an exact science. Any business model and finance proposition that takes the lens of SDG 11 and wants to quantify the costs, requires a common baseline. Such baselines for least developed, developing and developed countries are very different. Expenditures in developed countries such as Sweden were geared toward advanced sustainability objectives, such as bike lanes and digital infrastructure for smart cities (Prakash et al., 2020). Sadiq et al. (2020) looked more closely into mature economies like the USA, UK and Canada. They found that the US has a chronic underinvestment in infrastructure projects which has contributed to the inadequate provision of services. The COVID-19 pandemic has further deteriorated the situation. In particular, in situations where a major source of funding is based on revenues generated by users of these infrastructure. The efficiency and capacity of infrastructure systems was shown to be compromised because of adverse conditions under climate change and the more recent challenges around the COVID pandemic (ibid).

This paper draws upon both the academic literature and practice to present a framework to support the creation of new infrastructure business models. The framework's intended contribution is to support and encourage practitioners, from a range of infrastructure contexts, to consider and evaluate the value of infrastructure differently, moving away from a purely economic justification. This “Framework for Infrastructure Business Models” is an approach that fundamentally challenges the concept of the initial idea or need for infrastructure (which is most frequently sector specific), the service it delivers (which is also traditionally sector specific) and the way in which value (of all types) is accrued, and by whom over space and time (which is dominated by economic benefit and limited temporally and geographically). The framework takes an integrated approach to value generation that is non-sector specific and not limited to economic benefits, or to a specific geography, or a point in time. Thus, the framework helps to identify both alternative (and potentially innovative) infrastructure solutions and pathways to novel funding and financing options. The paper is divided into two main sections. The first section describes the steps and potential iterations that form the Integration Framework, while the second section provides UK-based examples that demonstrate the value of particular steps in the framework with a series of case studies that cover a wide spectrum of infrastructure and related services.

Challenges for Infrastructure business Models

The term “business model” describes the ways in which a firm engages in business activities (Chesbrough and Rosenbloom, 2010) or describes the processes by which firms try to create value (Wirtz, 2011). A number of frameworks exist for business models (see Bryson et al., 2018), however, there are a number of distinctive characteristics of infrastructure systems that make them ill-suited to existing business models definitions and frameworks:

• Infrastructure life cycle: Infrastructure has a complex life cycle that covers: design, material extraction and processing, construction, finance, operation, use, maintenance, modification, decommissioning or upcycling. Each phase may require a different business model.

• Long term legacy and ‘lock-in': Many infrastructure assets are typically long-lived. A choice of a particular technology may require compatibility across the whole infrastructure system—this can lead to a path dependency, which reduces opportunities to exploit alternative technologies in the future.

• Necessity of service: Users typically depend on infrastructure services, and once a particular services ‘takes hold' it can lead to radical shifts in user behavior as they discover new ways to use it to their benefit.

• Public sector involvement: Governments are often highly proximate to infrastructure transactions. This may be via direct funding, or obtaining loans at preferential government rates. Even if the public sector does not fund the infrastructure directly, it can play a role in regulation or underwriting risks.

• Natural monopolies and exclusivity: The economies of scale can benefit from monopolistic provision of services.

• Financial profile: Infrastructure is typically capital intensive, with high upfront costs and periodic maintenance that can also be costly to ensure continued service.

• Complex value: Many infrastructures provide a direct and tangible economic return, however they also have wider indirect economic as well as social and environmental implications.

• Multiple stakeholders and agents: The number of stakeholders with an interest in infrastructure, and the nature of this interest, is considerable. These relationships and associated business models will vary over the infrastructure life cycle.

• Public good: Many infrastructure systems, such as street lighting or flood defenses, are often both non-excludable and non-rivalrous in that individuals cannot be effectively excluded from use and where use by one individual does not reduce availability to others.

Delivering the sustainable and resilient infrastructure that is a prerequisite to SDG11 faces a number of challenges. Fragmentation of urban infrastructure responsibilities between national government, local authorities and the private sector constrain the development of integrated approaches to infrastructure management. Collaboration between neighboring organizations can play an important role in enabling infrastructure to be delivered at appropriate scale (National Infrastructure Commission, 2017b). More recently, smart technology and the Internet of Things has enabled new infrastructure business models to emerge. These are often based around “platformisation” of services, for example personal transport (Uber), journey planning (CityMapper), food delivery (Deliveroo), holiday rental (AirBnB), and electric scooter (Bird). Although not always intended in this way, such approaches provide a means of greater citizen participation (Borghys et al., 2020), offering potential to introduce new actors into infrastructure business models (Crilly et al., 2020).

Around the world conventional cost-benefit and multi-criteria analyses (e.g., Asian Development Bank, 2009; HM Treasury, 2020; Australian Government, 2021) lead to under-estimation of the long-term economic, social and environmental benefits of infrastructure. The funding and financing of infrastructure inevitably focuses primarily on the economic value realized by the investment, and the returns on investment over different payback periods guide decisions in this space. This is true irrespective of whether or not the infrastructure provision in question is targeted strongly at “the public good,” and yet the value arising from infrastructure provision lies across the social, environmental and political/cultural pillars of sustainability as well as the economic pillar, as discussed hereafter.

In this context, private finance, pension and insurance funds for infrastructure are not appropriate for all scales of infrastructure project since they do not guarantee economic benefit in the short-term. Moreover, it is important that finance is appropriate to the geographic and temporal context of the projects to create not only economic value, but (often multiple) other forms of local value.

One example where this narrow view has been costly was the case of parking charges in Chicago, where upfront payment at the expense of long term lock-in Chicago raised a seemingly impressive $1.16bn in 2008 by leasing its 36,000 parking spaces for 75 years. However, parking fees in Chicago rapidly rose and the deal has created new costs for the city to compensate for periods when the meters are taken out of use, including during street works, public festivals and to offer free accessible parking. Furthermore, the deal penalizes innovation in the transport sector as implementation of any measures to improve safety or to deliver more sustainable transport options incur additional penalties (Farmer, 2014). Subsequent analysis has suggested the city substantially undervalued the deal and should have asked for over $2bn (Hoffman, 2009).

However, there are emerging successful examples of widening the focus of return on investment. The Nottingham (UK) Workplace Parking Levy (WPL) enables the City Council to levy a charge for parking spaces within certain areas of the city. The WPL is designed to tackle problems associated with traffic congestion, by both providing short-term (ring-fenced) funding for major transport infrastructure initiatives and by acting as an incentive for employers to manage their workplace parking provision. Nottingham has generated an annual income stream of ~£12 m, which has been used to part-finance the Council's contribution toward the extensions to the City's existing tram system, the redevelopment of Nottingham Rail Station and the local bus network. The Tees Valley, UK have begun to combine local pension fund investment alongside national and local resources, in order to invest in economic infrastructure and are also looking to re-use materials and waste products in new processes as part of a deliberate shift toward trying to build a “circular economy” (TVCA, 2017; Velenturf and Purnell, 2017; Sadler et al., 2018) an aspiration repeated at national level in e.g. the National Infrastructure Plan and the Industrial Strategy documents.

In order to progress and address the funding and financing gap, we argue that new infrastructure business models are required that: (i) target urban areas or regions at a local scale where there is the greatest scope for innovation, (ii) target specific challenges or needs (i.e. where there is a clear driver for innovation), and (iii) tackle the issue of the flawed economic cost-benefit model for assessing the viability of infrastructure investments (i.e. the focus of economic return on investment is too narrow).

Research Method in Developing a Framework for Infrastructure Business Models

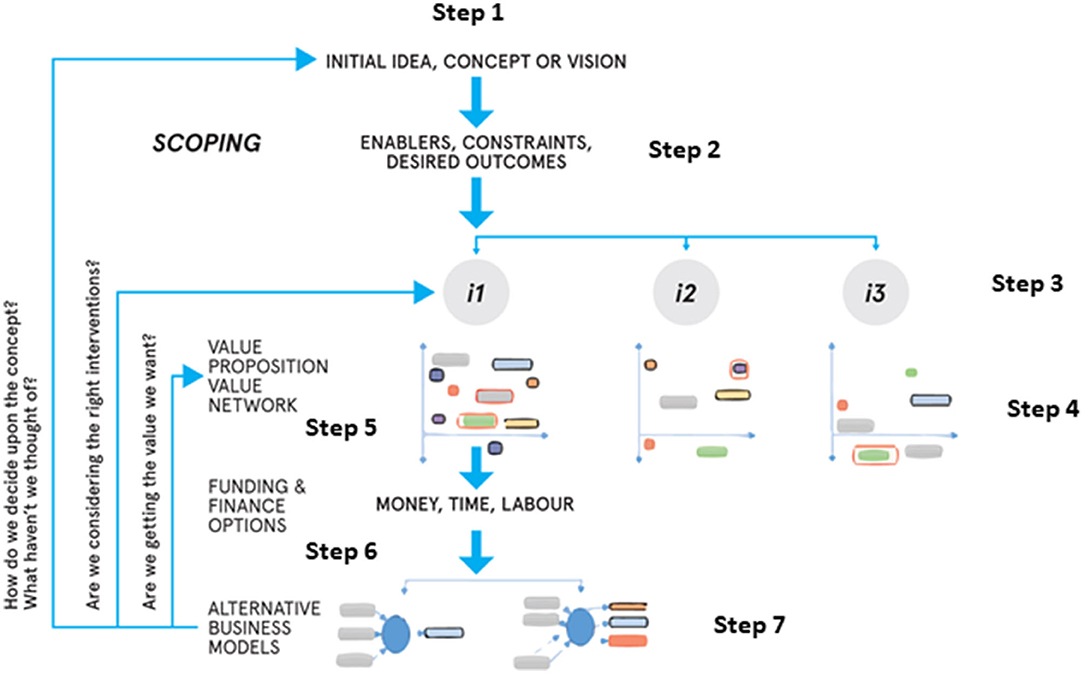

A new framework for Infrastructure Business Models (IBMs) (Figure 1) has been developed in collaboration with various stakeholders in the UK representing different infrastructure sectors.

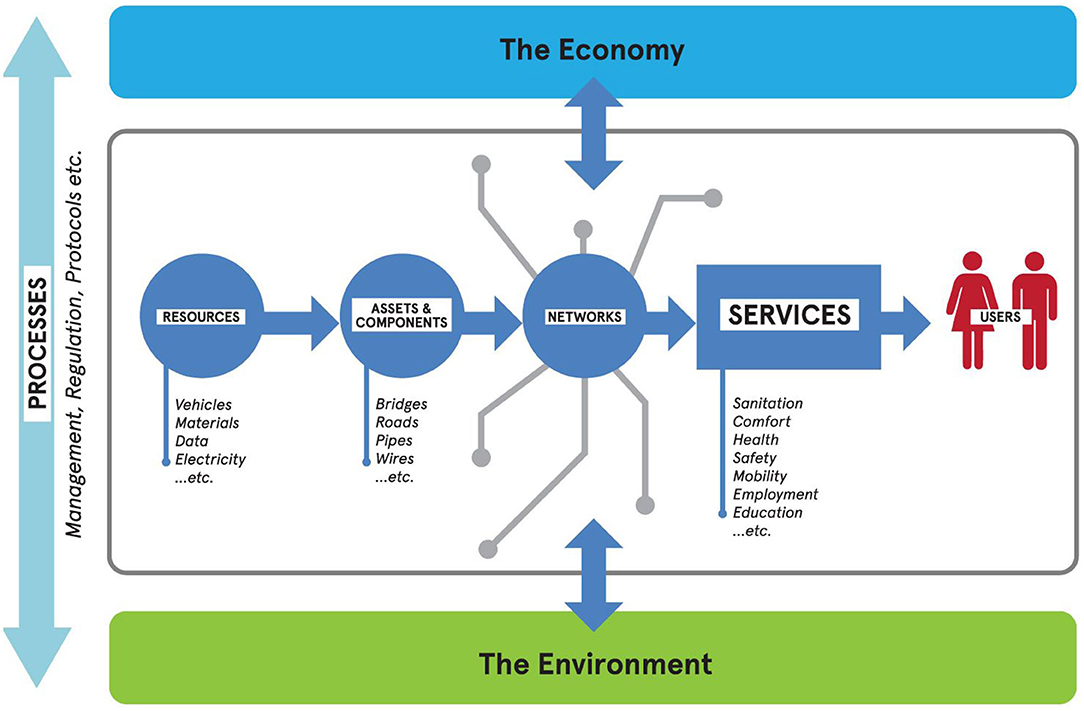

Figure 2 illustrates that infrastructure must be considered and defined as a whole systems approach. This gives rise to our definition of infrastructure business models that describes how infrastructure systems create, deliver and capture economic, social and environmental values over the whole infrastructure life cycle. Therefore, the following elements should be considered (Bryson et al., 2014):

• Assets and components: including physical links and components of infrastructure systems, e.g., pipes, cables, roads, bridges;

• Processes: including institutions, management, regulations, protocols and procedures that govern the whole lifecycle of infrastructure;

• Resources: including people, vehicles, water, power, data that are conveyed by the physical artifacts, and the materials used to construct these;

• Services: including warmth, mobility, communication, education that benefits users;

• The Economy: infrastructure funding and financing is supported by the economy, whole driving economic growth;

• The Environment: infrastructure uses natural resources, and can also mitigate environmental risks.

The IBM structures and guides infrastructure stakeholders through the process of considering and co-developing a wider suite of infrastructure business models. The process brings different stakeholders together to identify collaborative solutions and opportunities. Whereas, the framework is presented herein in a logical sequence of steps, starting with “step 1,” the nature of the framework means that the framework can be entered at any point and other sequences are possible depending on the need or the actors involved.

The framework was developed inductively, with evaluation and subsequent refinements after experiments with stakeholders. Through these experiments and testing, and ultimately its use in practice it can encompass wider perspectives and priorities, by bringing together actors from different infrastructure sectors to recognize interconnections and interdependencies across sectors, to recognize co-risks and to exploit short and long terms values.

Initial Idea and Desired Outcomes (Step 1)

The first step is to develop a common understanding of the need or desired outcome. By starting with the outcome the framework avoids the trap of focusing on a single piece of infrastructure or limited part of the system (Blockley and Godfrey, 2017). National Infrastructure Commission (2017a,b) identifies: economic growth, population and demography, climate and environment, and technology as key drivers of infrastructure services. An original idea could be conceived by an individual, group or organization, which may emerge from: an identified gap in infrastructure service provision, for example flood protection for a new housing development; a political desire, for example a high speed rail link or new airport to better position a city, region or country in the national or international landscape; or a cultural desire, for example the Garden Bridge Project in London. Each idea or project will have its own, original, intended desired outcomes, i.e., a forward-looking statement (or set of statements) of what that infrastructure is expected to enable; this effectively is the purpose of the infrastructure (Carhart et al., 2016; Dolan et al., 2016). Shaping future infrastructure requires a clear understanding of the link between the provision and the desired societal outcomes that the infrastructure is expected to support, for example a secure water supply or a reliable transport system.

Enablers and Constraints of Outcomes (Step 2)

For every outcome or potential outcome it is important to understand the enablers and constraints in order for it to be achieved. Conditions that need to be in place for the intended benefit to be realized include: policies, legislation, regulation, codes and standards (i.e., all the formal rules of governance) and individual and societal attitudes, societal norms and user behaviors (all the informal rules of governance, see Harvey et al., 2014; Rogers, 2018). By identifying which are exclusive and which are synergistic, high-level interdependencies and hence opportunities may be revealed. These enablers and constraints are often referred to within a multi-level perspective (e.g., Geels and Schot, 2007, 2010) as conditions affecting the “landscape” i.e., elements that can influence the stable regime of a system or the “regime,” the socio-technical system. Pressures or “shocks” at both levels can be an opportunity for transformation within and between infrastructure systems (Walsh et al., 2015), an example of which is later discussed in section Business Models to Enhance Resilience of Existing Infrastructure.

Possible Interventions or Solutions (Step 3)

This action identifies the possible interventions that could deliver the desired outcomes. These range between “hard” interventions such as engineering or technical interventions and “soft” interventions, such as a change in policy or practice. A comprehensive system-wide understanding of the infrastructure under consideration is key to identifying the interdependencies between systems, which offer opportunities for benefits to multiple systems and help eliminate unintended negative impacts across different infrastructures when viewed in isolation. For example, a need for a new transport route that crosses a river could be multi-modal bridge, a tunnel or a ferry service as solutions. That solution of a more efficient transport network could reduce the cost of distribution for a business, thereby increasing the amount of output that business produces. It could also provide an opportunity to co-locate another service, for example a new ICT connection and improve quality of life for those living and working either side of the river by reducing the time and cost of traveling between home and place of work, as well as provide new location opportunities for businesses. The number and reach of such additional benefits can be remarkably large.

Widening the Value Network and Value Proposition: Value Mapping (Step 4)

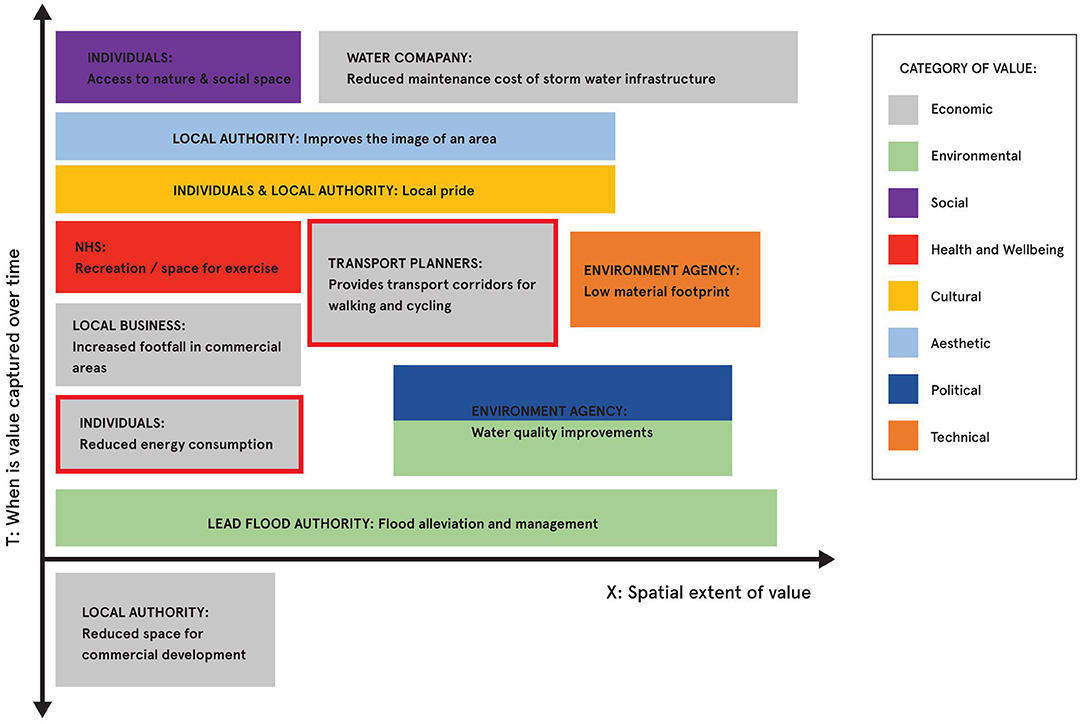

The number of people or organizations (i.e., the value network) that benefit from the value of infrastructure is usually greater than those who invest in it. Different stakeholders derive different, and sometimes multiple, types of value (i.e., the value proposition). The value captured also varies over time and space. For example, the function of a flood defense for its purpose of protecting properties or infrastructure is only realized during a flood event at the point at which it is located. In contrast, the benefit of reduced property insurance premiums catalyzed by the flood defense are felt over a longer timescale and over a larger spatial extent than any one flooding incident. Furthermore, the value of (or at least avoidance of negative value) businesses being protected from flooding is realized across a supply chain that can spread to an international scale, as well as over extended time periods.

Value mapping considers who (or what) the benefit is for, the type of value (moving beyond economic value to consider a far wider set of benefits, including but not necessarily limited to, social, environmental, cultural and political benefits and opportunities), and where and when the value is captured. These are plotted for each form of value on orthogonal axes of time (T) and special extent (X) (demonstrated by an example in later section Business Models to Enhance Resilience of Existing Infrastructure). Furthermore, this value-mapping approach can be used to identify interdependencies and opportunities provided by the synergies between infrastructure sectors. Value can also be negative, however – and the mapping approach encourages trade-offs between positive and negative values to be considered in a holistic way.

Funding and Financing Options (Step 5)

Both funding and finance are required to support infrastructure development. Funding is the primary stream of revenue required to offset costs or to support the infrastructure service. Finance is the mechanism by which the primary revenue streams are secured. Lack of funding sources has led to under-investment in infrastructure. Funding not only provides the revenue to cover the cost of borrowed capital, but also the management and running costs of the infrastructure service.

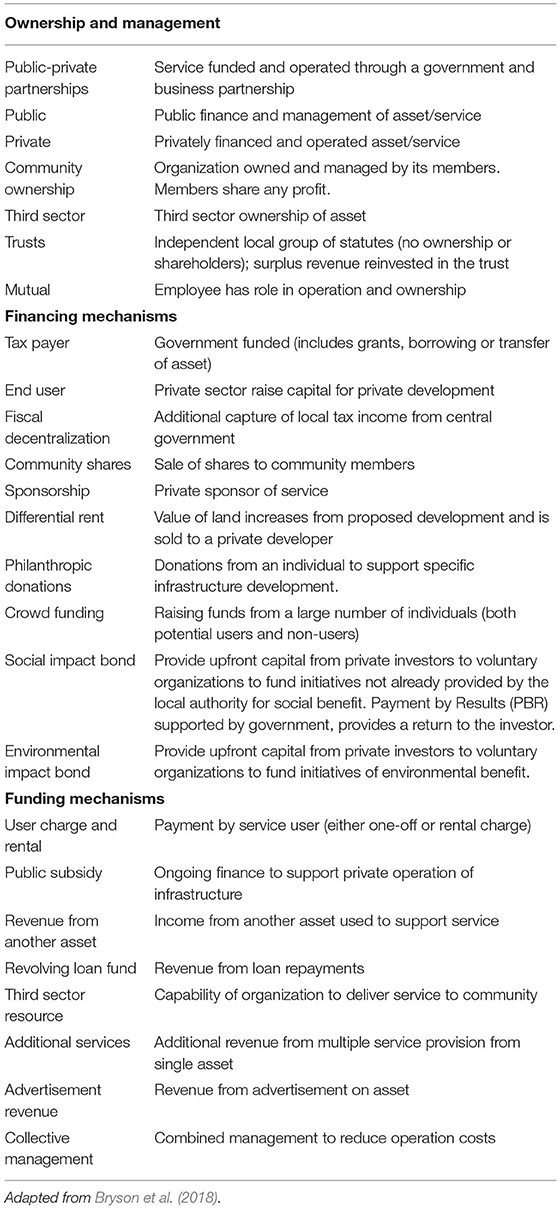

An earlier review (Bryson et al., 2018) identified a range of business models used by different infrastructure asset ownership and management arrangements, which are financed and funded by a range of mechanisms. Table 1 presents a summary of ownership and management of assets, alongside funding and financing mechanisms.

Table 1. Summary of ownership and management of assets and funding and financing mechanisms for infrastructure.

Widening the view of value over space and time is useful to evaluate and re-assess the desired outcomes (from infrastructure), and this exercise has the potential to fundamentally change the value proposition when compare to the original idea. An expanded value proposition, and hence value network, can unlock new funding and financing options (Bryson et al., 2018) that may not have been considered or been appropriate to the original concept. This is because expanding a value network has the potential to bring in individuals and/or organizations who have access to funding and financing not available to all.

Alternative Business Models (Step 6)

In addition to opening up alternative financing and funding, widening the value proposition and value network can also lead to the proposal of new governance arrangements to deliver and manage infrastructure. The framework offers an iterative approach when considering the different solutions to ensure enablers and constraints are aligned to new outcomes. It is by combining the wider non-conventional options for ownership, governance, management, funding and financing that will lead to more innovative business models.

Feedback Loops

As recommended by Taylor et al. (2017), feedback loops were embedded to encourage iteration and learning throughout via a series of iteration and learning loops:

• Inner loop: challenges users to widen the value network and proposition and to consider the broadest sources of finance and funding, alongside non-financial components.

• Middle loop: encourages consideration of how an intervention or solution may need to be adapted or radically changed to improve the business model.

• Outer loop: provokes users to revisit their original assumption and question the original idea, concept or vision.

Results and Discussion in Testing the Framework for Infrastructure Business Models

The remainder of this paper demonstrates how the framework can be used to “unlock” investment in infrastructure in cases where there is particular need. Four examples have been chosen in which there is a lack of progress in implementing infrastructure solutions because of the failure of existing business models to secure suitable funding and financing. Furthermore, these examples have been chosen to demonstrate how a wider, systemic view of the benefits, or value, of the infrastructure can be the key to bridging the gap between demonstrable need and achievable financing and funding, and illustrates how transparency can be illuminated in the process of identifying change. We will therefore illustrate and demonstrate how the framework can be used to tackle four types of infrastructure business model needs: (i) for resilience and adaptation of existing infrastructure; (ii) for upfront investment in new infrastructure; (iii) to support new technologies; and (iv) for regeneration projects in particular at the community level.

Business Models to Enhance Resilience of Existing Infrastructure

Much of the UK's infrastructure is historic: substantial parts of the rail network are over 150 years old, and while motorway construction began in the 1970's, many A, B and unclassified roads a very much older, with their spatial location sometimes dating back to Roman times or earlier. Infrastructure for managing and supplying our dirty and clean water is stretched: ~40% of London's water mains are over 100 years old, and 12% are more than 150 years old (Thames Water, 2013) leading to problems of leakage due to the degradation of supply pipes and capacity issues of storm water and waste pipes. Therefore, much of this infrastructure was not designed to meet current need and demand, has deteriorated substantially reducing its physical performance, and cannot withstand the loading now imposed (e.g., by heavier vehicles on overlying roads, more frequent and extreme weather events). Adaptation of existing infrastructure is required to ensure resilience to these demands. However, all of our major infrastructure systems are governed and operated in isolation, and business cases developed to support investment in resilience measures are made using traditional cost benefit tools. This leads to a situation in which an investment made today to provide resilience to an event in the future, with benefits limited to a single sector and for a relatively narrow range of economic measures, is often deemed to be unjustified. Therefore, it can mean that simply letting an infrastructure “fail” and fixing it at some point in the future makes “the best economic sense” according to this (flawed) model.

Step 4 is where application of the framework can be the mechanism to unlock investment in adaptation; this is where the wider benefits of the adaptation measure are identified and evaluated. If the benefits to other infrastructures (that may well be spatially co-located) are considered, along with environmental, social, cultural and political values and, critically, representation of the benefactors of these values are brought together into a wider value network (VN) then the fundamental value proposition (VP) will change. This may mean that to achieve the benefits required by all parties in the network the nature and/or design of the infrastructure intervention needs to be changed (i.e., going through a feedback loop to challenge the original idea). This may then result in the overall costs going up (though often this is not the case if innovative “design for multiple benefits” is adopted), but the overall holistic value of the intervention will have increased, as will the pool of available funding and financing options.

The 2007 UK floods affected many areas and caused damage to important national infrastructure; however this event inadvertently provided an opportunity for cross-infrastructure learning and improved co-operation to improve flood risk management (Walsh et al., 2015). Of the total estimated loss (£674 million), damage to water supply and treatment infrastructure, roads and electricity supply accounted for most (Environment Agency, 2007). Amongst the most adversely affected was a Water Treatment Works at Mythe owned by Severn Trent Water, which supplies ~160,000 properties—a population in excess of 350,000, including the towns of Gloucester, Cheltenham and Tewkesbury and a large part of rural Gloucestershire. On 22nd July 2007 flooding became inevitable and the decision was made to conduct a controlled shut down of the plant to prevent electrical failure and subsequently days of re-commissioning the works when the floodwaters receded. This then created an immediate need to supply an alternative source of drinking water and, following the event, a need to increase the resilience of the works from flood risk (Step 1 of the framework).

In terms of a drinking water supply this was urgently needed for the population usually supplied via the plant and was provided by distributing bottles and bowsers of water, while hospitals and schools were supplied by tankers. A number of other solutions were considered, including transferring water from nearby counties. However, identifying significant alternative sources of water across water company boundaries is difficult as boundaries of companies are often also aligned with hydrological catchment boundaries. Therefore, large volumes are rarely located close to boundaries and other companies have to meet their own normal demands. Distribution capacity tails off at the edge of company systems, so large diameter transfer pipework is not available. It was therefore impossible to identify routes for emergency pipelines that were practical and did not require major road closures. The carrying and pumping capacity of temporary overland pipes was difficult to install and manage over anything more than a couple of kilometers. Therefore, a value map would have been predominantly negative primarily due to high cost, technical infeasibility and impact on other infrastructure.

In terms of flood risk, a temporary 200 m of inflatable barrier was installed on 24th July to protect critical parts of the site. On 25th July, in consultation with the Government's Gold Command, a 1,000 m stone-filled semi-permanent flood barrier was completed. In time, this became a continuous flood defense barrier surrounding the Mythe Water Treatment Works, which prevents flooding from overland sources, this defense being accompanied by borehole groundwater lowering preventing structural damage from high groundwater levels and upward flooding of the site. This took place from March 2010 to May 2011, with an overall project cost of £5.5M and construction costs of £4.65M (River and Coastal and Flood Alleviation, 2012).

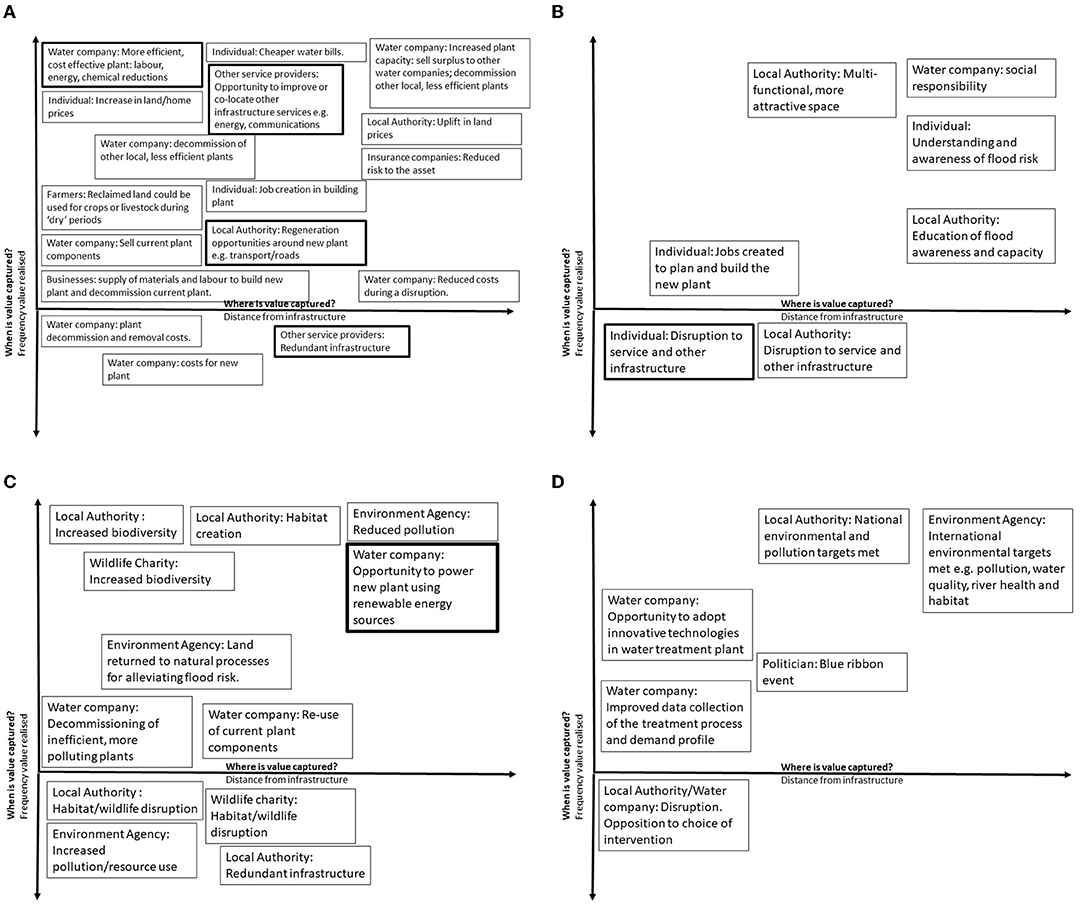

An alternative intervention to the flood barrier would have been to relocate of the plant to an area that was not at risk from flooding, leaving the current site left essentially undeveloped and reserved for more “natural” flood alleviation processes (such as temporary storage). Figure 3 presents the results of a value mapping exercise [as outlined in section Widening the Value Network and Value Proposition: Value Mapping (Step 4)] for that intervention.

Figure 3. Value maps for adaptation of existing infrastructure to deliver greater resilience for (A) economic values (B) social values (C) environmental values (D) political and technical values. Emboldened boxes indicate interdependencies with other sectors.

These value maps clearly highlight multiple values of interventions from a number of criteria; that the value proposition varies with both space and time, and the interdependencies that exist between different infrastructure sectors.

Business Models for New and Sustainable Infrastructure

Infrastructure interventions are often limited to a handful of solutions that have not changed for decades or longer and there appear to be greater constraints placed on the use of innovative solutions that have, for example, lower environmental impacts or greater aesthetic appeal. The application of the framework in a way that makes the value of the new forms of infrastructure explicit and, potentially, provides innovative forms of business model to finance and fund these infrastructures offers a route to unlocking their more widespread use.

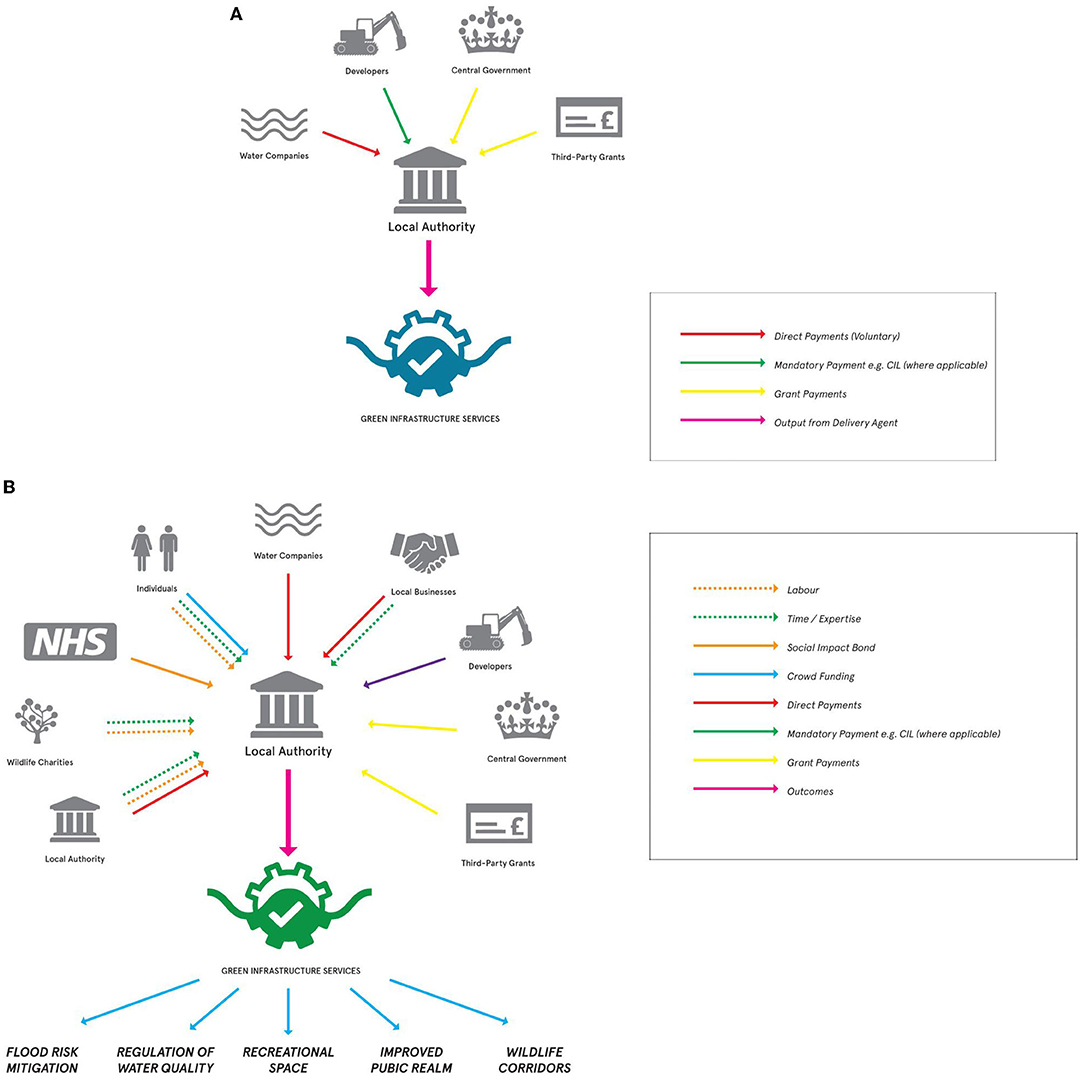

An example of this is the implementation of so-called “green infrastructure,” such as sustainable drainage systems (green spaces designed to temporarily hold or store water at the surface explain) and rain gardens for flood risk mitigation. These solutions are being trialed and considered for use on the Newcastle Helix development site in the center of the UK city of Newcastle upon Tyne and are used in numerous cities worldwide, including Portland, Singapore and Vancouver. For this example, we illustrate the importance of Step 3 of the framework—consideration of an alternative or new intervention to achieve the desired service. Traditional engineering solutions for surface water drainage are in the form of below-ground pipes and culverts. However, this form of “hard, gray” infrastructure serves only one purpose (diverting overland flows to underground and discharging the flow to a local water course). They are perceived as the cheapest viable solution. However, they offer no value other than to those inhabiting the immediate vicinity of the site (who themselves are not aware of this) and, in fact, may have a negative impact on the water quality in the river to which they discharge (having a much wider negative impact). By engaging in Step 4 of the framework and considering the wider value of using green infrastructure on the site, new revenue streams can be opened up.

Figure 4 presents an extract of a value map (T-X diagram) for urban green infrastructure. The value mapping considers who or what the benefit is for, the type of value, and where (X) and when (T) the value is captured, plotted on orthogonal axes. The map shows that spatially, green infrastructure can offer flood protection to both the same set of stakeholders (those in the immediate vicinity and on neighboring sites, including the mainline rail station in the case of the Newcastle Helix site), and a wider set of stakeholders than the piped solution. The additional values created by the green infrastructure that are not created by the traditional piped solution include local pride for individuals and the Local Authority due to the increased amenity and aesthetic value of the green infrastructure, i.e., for more than one stakeholder, including those not resident on the site. Similarly, the value proposition of avoiding adverse water quality in the water course has an environmental and a political value for the Environment Agency in terms of meeting water quality standards set by Government. The geographical reach of this solution is therefore far greater than the piped solution. The map also highlights the interdependency between drainage and energy, the natural cooling properties of green infrastructure leading to reduced energy demands for cooling from air conditioning.

Figure 5A presents the current business model for traditional surface water flood risk management infrastructure, such as storm pipes and storage tanks. A limited number of stakeholders contribute to the funding and financing of the pipes and tanks through direct grants, or mandatory or voluntary payments, channeled through the local authority. Figure 5B presents what an alternative business model for surface water flood risk management could look like if it captured value beyond purely monetary transactions to deliver a suite of functions and services.

Figure 5. (A) Current business model for surface water management. (B) Alternative business model for surface water management.

By considering green infrastructure as a potential intervention for surface water flood risk management, the steps in the framework encourage a wider set of outcomes to complement the primary purpose of merely managing surface water. The delivery of wider benefits opens up a range of alternative funding and finance options as illustrated by the colored arrows in the Figure.

Business Models to Support the Introduction of New Infrastructure Technologies

The drive toward carbon reduction has led to the development of new technologies such as electric vehicles, solar panels and reliable, high speed broadband. The widespread adoption of these technologies requires the construction of new infrastructure and, where there has been a viable business model to support its construction, this acts as an enabler to its widespread adoption. An example of this concerns solar panels, where the “Green Deal” enabled home owners to make subsidized energy-saving improvements without having to pay all of the upfront costs. The loan is paid back in full, however, with savings made on energy bills covering the loan repayments whilst lowering carbon emissions. Furthermore, excess energy produced could be sold back to a power company via a feed-in tariff. However, where there is no innovation in the business model this acts as a barrier to the adoption of new technology. Indeed, once the Green Deal ended and the feed-in tariff was reduced by the Government by 65% (Tonge, 2018), the roll-out of solar panels reduced as the payback time for the solar panels lengthened, and it was no longer viable for companies to install and maintain the solar panel systems free of charge.

Although not a new technology per se, the provision of high quality, reliable broadband in rural areas is an ongoing challenge. Mainstream methods are not deemed to be economically viable by the mainstream providers in remote areas. Broadband For The Rural North (B4RN) is a community non-profit society (or co-operative) that was founded by volunteers to provide fiber optic broadband in sparsely populated areas. In order to keep costs down, cables were laid across land owned by those benefitting from the service, thus avoiding the need to excavate in the public highway This approach had the added benefits of avoiding disruption of traffic, road infrastructure damage, adjacent buried infrastructure damage, accelerated longer-term deterioration of these assets, and local aesthetic and social disruption, reducing the amount of resources required. Moreover, cables were laid by members of the co-operative themselves (reducing costs further), who were also able to invest into the scheme and receive tax relief through the Government's Enterprise Investment Scheme (bringing members longer-term financial rewards). This alternative business model, i.e., use of volunteers' skills, rather than focussing on the economic case was the key to enable this infrastructure to be implemented. Since its initiation the scheme has grown, resulting in a wider VN and VP. B4RN now employs core technical and office staff, while reliable internet connections facilitates home working and opportunities for existing and new businesses to expand. It also meets an ongoing need for support services, such as those provided by post offices that contribute to the local community dynamics. The scheme also offers services to community assets such as schools, churches and village halls free of charge.

Business Models to Support Infrastructure for Community-Level Regeneration

Regeneration of inner cities has recently been brought into sharp focus in the UK by the fire in the Grenfell Tower block of flats in the London Borough of Kensington and Chelsea. This borough is home to some of the wealthiest people in the world and yet the local authority lacks the mechanism for levering this wealth to invest in its community housing. In other parts of London, and indeed other cities throughout the UK, the business model used to fund and finance regeneration is one that relies on attracting businesses, with local authorities recouping their investment through rents and business rates. This leads to so-called “gentrification” of areas, with local businesses and residents effectively locked out. There is a VN and VP, and Funding and Financing, but it only creates value for a subset of society, with solutions and outcomes being limited to private industry and wealthy investors.

On a larger scale this means that large cities, such as London, which can attract large businesses to relocate there, dominate over towns and smaller cities, and therefore the infrastructure (funded by rents and business rates) in London improves, whilst in smaller urban centers it does so only at a much slower rate. Tax increment financing has proved to be an innovative business model that allowed some local authorities to borrow against a percentage of future income from business rates. However, utilization of this mechanism still required new businesses to commit to locating, and in cities where it has been used, such as Newcastle-upon-Tyne, it has not delivered the changes that were envisaged due to lack of such commitment. Hence other models have had to be implemented in practice.

For example, infrastructure on the Science Central development site in Newcastle, now branded as Newcastle Helix (https://newcastlehelix.com/), has been largely developed on a “plot by plot” basis.

Plot-by-plot development has several shortcomings:

1. The piecemeal approach takes much more time to deliver: in the case of Newcastle Helix, the first building was constructed in 2014 and there were still many vacant plots yet to be developed at the start of 2019. It is difficult to maintain and deliver the vision for such an ambitious development over such an extended period, and what were once ambitious targets for sustainability become superseded and watered down by both technological and policy advances and changing governance.

2. There is no mechanism for the wider value of the constructed infrastructure to other users, particularly those off-site, to be realized.

3. The value of integrating construction, maintenance and operation operations as a result of co-locating infrastructure cannot be realized, thereby locking those who locate onto the site into outdated, and perpetuating, paradigms, i.e., they cannot be undone and will never achieve a step change in either sustainability or service delivery. For example, schemes that provide energy to multiple buildings are problematic to implement.

4. Schemes that derive greatest value from being physically joined together (such as green infrastructure) are difficult to deliver as they require a whole-site approach.

5. Businesses are required to commit to locating onto the site (and therefore be relied upon to pay business rates in the future) so that the development's supporting infrastructure can be financed. This means that much of the site is without infrastructure for extended periods while waiting for businesses to locate. It also means that there is a limit on non-business occupants, as they will not be able to provide the finance required for the infrastructure. In the case of Newcastle Helix, Newcastle University (who are a part-owner of the site) has been able to finance development of its buildings on the site but, because as a University it does not pay business rates, cannot be the member of the VN that unlocks the business model needed to finance and fund all of the infrastructure.

What is required is a business model that allows local authorities to build as much infrastructure as possible in advance of the roll-out of the master plan. This would encourage different types of business to locate on the site and to share in the vision by default, because they will utilize the infrastructure that is already there. The buildings will then be fitted to the infrastructure, rather than the other way around, so will be required to utilize the (typically) more innovative provision embraced in a visionary master plan and buy into its service model. In so doing more sustainable outcomes and improved resilience to future contextual change and/or extreme events can be designed in, rather than locked out or inefficiently retrofitted.

To an extent, this has happened with the utilization of energy centers, which deliver energy to more than one building on a site. Through their up-front construction they require developers to accommodate their infrastructure and buy into a service agreement. However, as noted by Bush et al. (2017) the wider benefits from energy centers are best delivered by a local authority. When private energy companies are involved, the uncertainty over future energy prices means that there is uncertainty over future revenue; the business or organizations considering a move, as purchasers of energy, may feel that they will get locked into an agreement that provides energy at an unfavorable rate and therefore become reluctant to locate onto the site.

Conclusions and Future Directions

Current infrastructure business models are failing to deliver the infrastructure required to achieve SDG 11. SDG11a, implicitly recognizes the wider values of infrastructure and urban form. However, although there are some examples of alternative infrastructure business models, there is much scope for greater innovation in order to maximize values to the widest possible number of stakeholders.

The paper presents a framework to develop business models that is tailored to suit the distinctive features of infrastructure compared to other business. Through examples, this approach is applied to infrastructure case studies in resilience, sustainability and regeneration. The examples show how the IBM framework takes a more integrated approach to infrastructure design and urban planning. The framework encourages multiple stakeholders to work together to identify and challenge alternative infrastructure solutions that deliver multiple values to multiple stakeholders. By explicitly mapping these values over time and space, the interdependencies between infrastructures are revealed along with an expanded understanding of the (economic and non-economic) values being brought about by that infrastructure. Furthermore, the widening of the value proposition also increases the number of stakeholders able to explicitly engage and support the infrastructure business model. The paper then demonstrates how a broader value network helps identify alternative funding and financing options for the infrastructure that are more compatible with different scales of infrastructure projects, particularly at the local, or city-scale, and which can capitalize on the interdependencies between sectors. The approach is shown to unlock investment in infrastructure in situations where traditional approaches have failed. However, current regulatory frameworks are a barrier to implementation of many of these alternative business models.

This paper has drawn upon UK examples, however, the framework approach is applicable in an international context, particularly in addressing inclusivity, resource efficiency and mitigation and adaptation to climate change (SDG11b) and in supporting lest developed countries, through highlighting better financial and technical approaches to build sustainable and resilient buildings.

Data Availability Statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author Contributions

CW: led manuscript preparation, case study analysis, method development, and writing—review and editing. SG: manuscript preparation, case study analysis, funding acquisition, method development, and writing—review and editing. RD: funding acquisition, method development, and writing—review and editing. PO'B: case study analysis, review, and editing. OH: writing—review and editing. CR: funding acquisition and writing—review and editing. JB and PP: funding acquisition and method development. All authors contributed to the article and approved the submitted version.

Funding

This work was also funded by the Engineering & Physical Sciences Research Council (Grant No. EP/N010124/1) as part of the TWENTY65: Tailored Water Solutions for Positive Impact project.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Acknowledgments

We acknowledge support of the UK Engineering and Physical Sciences Research Council (EPSRC) and the UK Economic and Social Research Council (ESRC) who funded the Infrastructure Business models, valuation and Innovation for Local Delivery (iBUILD) project (Grant No. EP/K012398/1).

References

Asian Development Bank (2009). Infrastructure for a Seamless Asia. Available online at: https://www.adb.org/sites/default/files/publication/159348/adbi-infrastructure-seamless-asia.pdf

Australian Government (2021). Reforms to Meet Australia's future infrastructure needs, 2021 Australian Infrastructure Plan. Available online at: https://www.infrastructureaustralia.gov.au/sites/default/files/2021-09/2021%20Master%20Plan_1.pdf

Blockley, D. I., and Godfrey, P. (2017). Doing it Differently: Systems for Rethinking Infrastructure. London: ICE publishing. doi: 10.1680/didse.60821

Borghys, K., van der Graaf, S., Walravens, N., and Van Compernolle, M. (2020). Multi-stakeholder innovation in smart city discourse: quadruple helix thinking in the age of “platforms.” Front. Sustain. Cities 2, 5. doi: 10.3389/frsc.2020.00005

Bryson, J. R., Mulhall, R. A., Song, M., Loo, B. P. Y., Dawson, R. J., and Rogers, C. D. F. (2018). Alternative-substitute business models and the provision of local infrastructure: alterity as a solution to financialization and public-sector failure. Geoforum 95, 25–34. doi: 10.1016/j.geoforum.2018.06.022

Bryson, J. R., Pike, A., Walsh, C. L., Foxon, T., Bouch, C., and Dawson, R. J. (2014). Infrastructure Business Models (IBM) Working Paper. Available online at: https://research.ncl.ac.uk/media/sites/researchwebsites/ibuild/BP2%20-%20Infrastructure%20business%20model%20definition_DRAFT.pdf

Bush, R. E., Bale, C. S. E., Powell, M., Gouldson, A., Taylor, P. G., and Gale, W. F. (2017). The role of intermediaries in low carbon transitions – Empowering innovations to unlock district heating in the UK. J. Clean. Product. 148, 137–147. doi: 10.1016/j.jclepro.2017.01.129

Carhart, N., Bouch, C., Walsh, C. L., and Dolan, T. (2016). Applying a new concept for strategic performance indicators. Infrastruct. Asset. Manage. 3, 143–153. doi: 10.1680/jinam.16.00016

Chesbrough, H., and Rosenbloom, R. (2010). The role of the business model in capturing value from innovation: evidence from Xerox Corporation's technology spin-off companies. Indus. Corporate Change 11, 529–555. doi: 10.1093/icc/11.3.529

Chester, M. V., and Allenby, B. (2019). Toward adaptive infrastructure: flexibility and agility in a non-stationarity age. Sustain. Resilient Infrastruct. 4, 173–191 doi: 10.1080/23789689.2017.1416846

Crilly, M., Vemury, C., Humphrey, R., Rodriguez, S., Crosbie, T., Johnson, K., et al. (2020). Common language of sustainability for built environment professionals—the quintuple helix model for higher education. Energies 13:5860. doi: 10.3390/en13225860

Dolan, T., Walsh, C. L., Cahart, N., and Bouch, C. (2016). A conceptual approach to strategic performance indicators. Infrastruct. Asset. Manage. 3, 132–142. doi: 10.1680/jinam.16.00015

Farmer, S.. (2014). Cities as risk managers: the impact of Chicago's parking meter P3 on municipal governance and transportation planning. Environ. Plan. 46, 2160–2174. doi: 10.1068/a130048p

Geels, F. W., and Schot, J. (2007). Typology of sociotechnical transition pathways. Res. Policy 36, 399–417. doi: 10.1016/j.respol.2007.01.003

Geels, F. W., and Schot, J. W. (2010). The dynamics of transitions: A socio-technical perspective, in Collaboration With FW Geels & D Loorbach, Transitions to Sustainable Development: New Directions in the Study of Long Term Transformative Change, eds J. Grin, J. Rotmans, and J. Schot (New York, NY: Routledge).

Harvey, J., Heidrich, O., and Cairns, K. (2014). Psychological factors to motivate sustainable behaviours. Proc. ICE Urban Design Plan. 167, 165–174. doi: 10.1680/udap.14.00001

HM Treasury (2020). The Green Book: Appraisal and Evaluation in Central Government. London: HM Treasury.

Hoffman, D. H.. (2009). An Analysis of the Lease of the City's Parking Meters, Office of the Inspector General. Chicago.

Infrastructure Projects Authority (2017). Analysis of the National Infrastructure and Construction Pipeline. Available online at: https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/665332/Analysis_of_National_Infrastructure_and_Construction_Pipeline_2017.pdf

Khoteeva, M., and Khoteeva, D. (2017). Public-private partnerships: A solution for infrastructure development in the UK? Case study of the London Underground public-private partnership project. Int. Rev. Manage. Market. 7, 300–308.

National Infrastructure Commission (2017a). Economic Growth and Demand for Infrastructure Services. Available online at: https://www.nic.org.uk/wp-content/uploads/2906219-NIC-Technical-Paper-Economic-Driver-v1_0A-WEBACCESSIBLE.pdf

National Infrastructure Commission (2017b). Congestion, Capacity, Carbon: Priorities for National Infrastructure. Available online at: https://www.nic.org.uk/wp-content/uploads/Congestion-Capacity-Carbon_-Priorities-for-national-infrastructure.pdf

Pike, A., O'Brien, P., Strickland, T., and Tomaney, J. (2019). Financialising City Statecraft and Infrastructure. Cheltenham: Edward Elgar Publishing. doi: 10.4337/9781788118958

Prakash, M., Kamiya, M., Ndugwa, R., and Cheng, M. (2020). Counting the costs: a method for evaluating the cost of achieving SDG 11. Front. Sustain. Cities 2, 554728. doi: 10.3389/frsc.2020.554728

River Coastal Flood Alleviation (2012). Mythe WTW Flood Alleviation Scheme. Available online at: http://www.waterprojectsonline.com/case_studies/2012/Severn_Trent_Mythe_2012.pdf

Rogers, C. D. F.. (2018). Engineering future liveable, resilient, sustainable cities using foresight. Civil Eng. Proc. Institution Civil Eng. 171, 3–9. doi: 10.1680/jcien.17.00031

Rozenberg, J., and Fay, M. (2019). Beyond the Gap: How Countries can Afford the Infrastructure They Need While Protecting the Planet. Washington: World Bank Publications. doi: 10.1596/978-1-4648-1363-4

Sadiq, R., Nahiduzzaman, K. M., and Hewage, K. (2020). Infrastructure at the crossroads–beyond sustainability. Front. Sustain. Cities 2, 593908. doi: 10.3389/frsc.2020.593908

Sadler, J. P., Grayson, N., Hale, J. D., Locret-Collet, M. G., Hunt, D., Bouch, C. J., et al. (2018). The Little Book of Circular Economy in Cities – A Short Guide to Urban Metabolism and Resource Flows. Imagination: Lancaster.

Seidu, R. D., Young, B. E., Robinson, H., and Michael, R. (2020). The impact of infrastructure investment on economic growth in the United Kingdom. J. Infrastruct. Policy Dev. 4, 217–227. doi: 10.24294/jipd.v4i2.1206

Taylor, C. A., Crick, R., Huang, S., Davies, R., and Carhart, N. (2017). Learning Frameworks for Future Infrastructure Provision. London: Proc. of International Symposium for Next Generation Infrastructure (ISNGI 2017).

Thames Water (2013). Victorian Mains Replacement: Why We Are Replacing Pipes. Available online at: Thames Water http://www.thameswater.co.uk/about-us/2689.htm

Tonge, E.. (2018). How the Feed-in-Tariff Ending in April 2019 Could Affect You. Available online at: http://www.yougen.co.uk/blog-entry/3035/How+the+Feed-in-Tariff+ending+in+April+2019+could+affect+you+/ (accessed February 28, 2018).

Velenturf, A., and Purnell, P. (2017). Moving Beyond Waste Management Towards a Circular Economy, Presentation to Valuing the Infrastructure of Cities, Regions and Nations Conference. Leeds.

Walsh, C. L., Glendinning, S., Dewberry, E., Castán Broto, V., and Powell, M. (2015). Are wildcard events on infrastructure systems opportunities for transformational change? Futures 67, 1–10. doi: 10.1016/j.futures.2015.01.005

Keywords: infrastructure, business models, values, systems, sustainability, resilience

Citation: Walsh CL, Glendinning S, Dawson RJ, O'Brien P, Heidrich O, Rogers CDF, Bryson JR and Purnell P (2022) A Systems Framework for Infrastructure Business Models for Resilient and Sustainable Urban Areas. Front. Sustain. Cities 4:825801. doi: 10.3389/frsc.2022.825801

Received: 30 November 2021; Accepted: 25 February 2022;

Published: 15 April 2022.

Edited by:

Yang Zhou, Shenzhen University, ChinaReviewed by:

Kat Lovell, University of Sussex Business School, United KingdomJoe Amadi-Echendu, University of Pretoria, South Africa

Copyright © 2022 Walsh, Glendinning, Dawson, O'Brien, Heidrich, Rogers, Bryson and Purnell. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Claire L. Walsh, Q2xhaXJlLldhbHNoJiN4MDAwNDA7bmNsLmFjLnVr

Claire L. Walsh

Claire L. Walsh Stephanie Glendinning1

Stephanie Glendinning1 Richard J. Dawson

Richard J. Dawson Oliver Heidrich

Oliver Heidrich Christopher D. F. Rogers

Christopher D. F. Rogers John R. Bryson

John R. Bryson Phil Purnell

Phil Purnell