- 1School of Management, Guangzhou University, Guangzhou, China

- 2Research Center for High-Quality Development of Modern Industry, Guangzhou University, Guangzhou, China

- 3School of International Trade and Economics, University of International Business and Economics, Beijing, China

- 4School of Mathematics and Information Science, Guangzhou University, Guangzhou, China

This study aims to analyze the factor affecting the urban industry development in Guangzhou. Based on push-pull-mooring theory, we explain the reasons for choosing the above indicators and use order parameters to analyze their impact on the urban industrial development. The results show that: (1) Environment has an obvious promoting effect on the urban industrial development. This shows that the current environment and the urban industrial development have reached a balance. (2) Technology has a positive impact on the urban industrial development, but it needs to go through the technology running in period smoothly. (3) Different from other factors, finance has a crowding out effect on industrial development. However, the development of finance will promote the rapid development of industry in Guangzhou. (4) The impact of finance, technology and green on UID is applicable to different development stages of UID, that is, these variables are related. Lastly, we provided development suggestions for Guangzhou. This will lay a foundation for promoting its industry.

1. Introduction

The development potential of the industry is huge (Dou et al., 2021a), and its productivity growth is relatively high, which can drive the development of other industries (Haraguchi et al., 2017). Especially, it is the fundamental support for economic development (Szirmai and Verspagen, 2015). Through its advantages, this industry can have a spillover effect on the country's overall economy (Jia et al., 2020) and drive the common development of other industries. The improvement of manufacturing competitiveness is an inevitable stage of national economic development in the advanced stage. However, Guangzhou's (GZ) industry is facing the double squeeze of “high-end press” in developed countries and “medium and low-end diversion” in developing countries. Based on this, it is important to study the urban industry development (UID) in GZ. It can not only effectively find the disadvantages in the industry, but also promote economic development (Dou et al., 2021b).

At present, it is particularly important for developing countries to achieve urban industrial transformation. It is an inevitable choice for the sustainable development of urban industry to shift from the traditional single economic factor driven development to the innovation driven and green driven development. Therefore, UID should focus on economic growth, industrial technological innovation (Li and Liu, 2022), and environmental pollution in the development process (Hu et al., 2019). The UID mainly focuses on three levels, namely environment, technology, and finance.

(1) The bottom line of industrialization development cannot be ignored is the environmental problem. It is the road to its sustainable development. The traditional industrial development mode has caused serious pollution to the surrounding environment, which has reduced its carrying and repair capacity with each passing year. Environmental problems have become an important reason to inhibit UID (Pei and Lu, 2019). As the environment and resources cause great damage and consumption, all countries begin to attach importance to ecological environment protection at the same time of UID, that is, they cannot damage the ecological environment by improving economic benefits. Yuan et al. (2019) believed that developing countries should learn from the experience of developed countries. By learning from their experiences and lessons, developing countries can make rational use of energy and take the path of sustainable development. It can avoid waste of resources in the production process. At the same time, failure to control pollution will also affect industrial development. For example, Cheng (2016) found that environmental pollution would inhibit the agglomeration of manufacturing industry. Therefore, various scholars began to pay attention to the impact of environment on industry. Wang et al. (2018) found that environmental regulation can promote industrial agglomeration, thereby promoting industrial economic efficiency. Zhai and An (2020) believed that the government should consider issuing appropriate environmental policies to promote the green industry, to achieve economic growth.

(2) Intelligent development is one of the main directions for UID. As a driving force for a new round of industrial reform, Intelligent technology has become a driving force for manufacturing (Dou et al., 2021c). It can promote the development of traditional industries (Dogan and Birant, 2021), such as the ecological marketing (Kuzior and Lobanova, 2020) and the data driven (Tao and Qi, 2018), which has greatly promoted UID. In a sense, the development of intelligent technology in the future will bring changes to the traditional industry. For example, Liu et al. (2020) discussed the impact of intelligent technology on manufacturing. The faster the development of intelligent technology, the better the development of manufacturing industry. Novotná et al. (2020) found that technology investment has an impact on the production efficiency of industry enterprises, both low-tech enterprises and high-tech enterprises. He et al. (2022) found that digital technology can promote the sustainable development of marine equipment manufacturing industry. Shao and Wu (2022) believed that intelligent development has a significant role in promoting industrial economy. Industry can achieve development through R&D technology investment and technology diffusion. Therefore, technology can empower industry, adjust and optimize industrial structure, so as to realize UID.

(3) The UID is inseparable from financial development. Industrial transformation needs a lot of financial support, especially financial financing support. However, industry often cannot get timely financing support, and most of them can only rely on internal financing and their own funds to ensure the continuous production and operation. The above views have been demonstrated by scholars. Zhong (2017) found that finance, as an important part of the economy, has gradually become the source of economic growth and industrial upgrading. Wang (2022) found that China's equipment manufacturing enterprises are facing serious financing constraints, which affects the development of enterprises. Kong et al. (2021) analyzed the current situation of China's manufacturing global value chain from the perspective of financing constraints. The results show that financial constraints may hinder the impact of import technology complexity on the upgrading of manufacturing value chain status. Therefore, the premise of promoting UID is to improve financing efficiency. In this context, the development of digital finance can give full play to the role of financial support to UID. Shen et al. (2022) believed that digital finance can effectively improve the efficiency of financial services and broaden the coverage, and is an important tool to promote finance to better serve the industry.

The mainstream theories of industrial development are as follows. Pest theory (Lu et al., 2018; Da Silva et al., 2021) is based on the analysis of external environment of the research object, such as political, economic, social and technological factors. This theory analyzes the influencing factors of the research object from the macro perspective. By evaluating the research object as a whole, the enterprise formulates relevant development strategies. SWOT theory (Pournabi et al., 2021; Almutairi et al., 2022) is based on the analysis of various aspects of the research object, such as strengths, weaknesses, opportunities and threats. This theory lists the factors closely related to the research object through investigation. According to the idea of system analysis, these factors are matched and analyzed, and the corresponding enlightenment is obtained. Diamond theory (Shi et al., 2021; Constantin et al., 2022) is based on the internal and external factors affecting the research object, such as factor conditions, demand conditions, related industries, and industrial strategy. This theory demonstrates the conditions for a certain industry in a region to form strong competitiveness. It believes that whether an industry has competitiveness depends on macro elements. These elements are interrelated and affect each other. However, most of the existing theories focus on finding the factors of industrial development, while ignoring the dynamics of industrial development and its influencing factors. Therefore, we use the push-pull-mooring (PPM) theory to explore the UID and its affecting factor, that is, environmental pollution finance and technology. Also, we use the new structural economics (NSE) theory to further discuss the impact of different factors on the development stage of UID.

To address this knowledge gap, this paper holds that the UID is a complex system. Based on PPM and NSE theory, we describe the impact principle factor on the UID. Meanwhile, to deeply understand the factor affecting the UID, we use the order parameter method as the research method. (1) Study UID dynamic process from a multi-dimensional perspective, rather than separating the influencing factors. Although the empirical results can also prove that environment, technology and finance have an impact on UID, it cannot capture the evolution track characteristics of the UID dynamic process and reflect the impact trend of different factors from a systematic perspective. (2) On this basis, supplement and improve the development characteristics of UID at different stages. That is, consider the decisive factors of UID and the influence over time. The impact of finance, technology and environment on UID has a progressive relationship with different development stages. (3) In particular, we study UID in the context of cities. The theories and methods used are applicable to all prefecture-level cities in China and foreign cities of the same level, providing a research basis for the further study of UID.

The rest of the paper is arranged as follows: Section 2 summarizes the literature review. Section 3 puts forward the methodology, including variable selection and method. The experiment and analysis are presented in the next section. Then the theoretical and practical implications are discussed. Lastly, we present the conclusion.

2. Literature review

2.1. Influencing factors of industry

The development of industry is a research hotspot, which has attracted considerable attention. With the manufacturing development, it is inevitable to face three major problems: environmental pollution, technology and finance. Therefore, we mainly summarize the influencing factors based on the following.

(1) Environment plays an important role in the UID. In the early stage, China's industry excessively relied on the extensive development mode of “high consumption, high emission, and high pollution.” It not only brought prosperity to the industrial economy, but also paid a huge price for ecological deterioration and environmental pollution. The frequent occurrence of environmental pollution events is an important factor restricting the UID. In terms of environmental pollution, scholars have made the following research contributions. Wang et al. (2018) found that environmental regulation can stimulate the manufacturing industry to obtain a more agglomeration economy. The government should strengthen environmental supervision to improve the economic effect of manufacturing agglomeration. Cheng (2016) studied the interaction between environmental pollution and manufacturing agglomeration. They found environmental pollution inhibits agglomeration. Yuan et al. (2017) found the manufacturing economy and environment depend on a reasonable level of environmental regulation. Lena et al. (2022) studied the impact of environmental regulation on manufacturing productivity growth based on 13 Italian manufacturing industries. The result showed that environmental regulation has no negative effect in most of industries. Afzal and Hanif (2022) believed that environmental pollution and natural resource consumption made manufacturing enterprises have to undergo significant changes. The results show that green supply chain management has a significant impact on the performance of manufacturing enterprises.

(2) Technology plays an important role in the UID. It not only subverts the traditional manufacturing model, production organization mode and industrial form, but also promotes the improvement of industrial efficiency, accelerates the transformation of traditional industries. In terms of technology, scholars have made the following research contributions. Nimawat and Gidwani (2021) used analytic hierarchy process and network analysis to explore the priority of adopting industry 4.0 in the Indian industry. Dalenogare et al. (2018) studied the potential impact of “industry 4.0” related technology on industrial performance. It is found that industrial 4.0 technologies are considered to have the prospect of industrial performance. Dos Santos et al. (2020) studied collaborative technologies closely related to industrial performance, which will help managers pay better attention to the “industry 4.0” technology. Bravi and Murmura (2021) analyzed the impact of “Industry 4.0” on Italian manufacturing companies to understand the motivation for implementing it. The results show that the benefits of “Industry 4.0” to the industry outweigh the related costs, that is, the advantages outweigh the disadvantages. Jimeno-Morenilla et al. (2021) believed that “Industry 4.0” could completely change the production planning and process of traditional manufacturing, thus promoting the scientific and technological progress of traditional industries. In addition, the impact of technology on industry can also be reflected in labor demand. Xie et al. (2021) found that technological innovation reduced the relative demand for low skilled labor in all regions of China. With the increase of industrial technology intensity, the relative demand for highly skilled labor force is also growing.

(3) Finance plays an important role in the UID. With the continuous development and improvement of the financial system, financial services can effectively alleviate and solve the problems of information asymmetry and transaction costs. This can stimulate capital accumulation and scientific and technological innovation, and promote industrial structure optimization and economic development. Specifically, by reducing the access threshold of financial services and promoting the free development of the capital market, it can effectively improve the efficiency of economic operation and growth vitality. Han and Fu (2020) found that finance has a positive regulatory effect on manufacturing innovation performance. However, Liu et al. (2021) study found that the financial structure can promote the scale of the real economy, but the impact on the structure is not obvious. Therefore, it is necessary to further study the impact of finance on the industry. Chen and Zhang (2021) found that digital finance can promote the service-oriented manufacturing industry by increasing the intensity of innovation and improving the level of digitalization. Xu and Pal (2022) studied the impact of Indian finance on its industrial productivity. The results show that financial policy can significantly improve the productivity of industry.

In summary, these reviews fully illustrate the importance of environment, technology and finance to the UID.

2.2. Related theory

By reviewing the existing literature, these theories can provide a basis for this study. In terms of PEST theory, Alava et al. (2018) took PEST as a prerequisite and applied it to a case study of the food industry. Barbara et al. (2017) conducted risk analysis on the European insurance industry through this theory. Chen (2018) used PEST theory to deeply analyze China's orchid cultural industry, further improving the development strategy of the industry. Du (2016) systematically analyzes the development environment of China's auto parts industry through PEST theory, aiming to provide some suggestions for relevant enterprises. Khatami et al. (2022) studied the impact of globalization convergence on food industry based on pest theory. The results show that society and technology can make significant contributions to the food industry, while the global economy and politics are negatively related to the food industry. In terms of SWOT theory, Zhao et al. (2019) combined PEST and SWOT to explore China's e-commerce industry. Al-Refaie et al. (2016) used SWOT to determine the factors affecting the success of cosmetics companies and choose feasible strategies accordingly. Wang et al. (2017) used SWOT to analyze the factors affecting the new energy vehicle industry, and formulated strategic measures to obtain an international competitive advantage. Beraud et al. (2022) proposed the development strategy of China's manufacturing industry transformation using SWOT analysis to achieve a sustainable environment consistent with carbon neutral policies. In terms of Diamond theory, Liu et al. (2016) studied the Chinese automobile industry under the guidance of Diamond theory and put forward reasonable development suggestions. Dou et al. (2021b) based on Diamond theory, studied the main factors that affect the development level of international competitiveness of manufacturing industry in G20 countries. The results show that intellectual property only has a positive and significant effect on manufacturing in developed countries. Wu and Young-myung (2022) analyzed the international competitiveness of China's environment friendly automobile industry based on the diamond theory.

The existing literature provides rich theoretical value and reference significance for the study of UID. However, the existing theories focus on the factors affecting UID and provide strategic suggestions based on the analysis of different factors. It often ignores the dynamics of UID and its development characteristics at different stages. To address this knowledge gap, the PPM theory and NSE theory are used as the framework to study UID.

(1) Firstly, by referring to the concept of population migration in PPM theory, we dynamically analyze the impact of mooing factor, push factor and pull factor on UID. This will help us understand the development trend and law of UID, to lay a foundation for improving the level of it. The two concepts of “push” and “pull” in PPM theory originated in 1885 and were put forward by the British scholar Ravenstein. They belong to the field of population migration. At first, it explained the laws related to population migration. The pull factor is a positive factor for population migration, which mainly refers to the positive factors that promote the migration of a population from its original residence to a new destination. The push factor, contrary to the pull factor, is a negative factor in population migration, which mainly refers to the negative reason for the forced departure of the population from their original place of residence. The concept of “mooring” is used to describe the role of individual factors in migration decision-making. It is the key factor affecting migration. Although PPM theory originated from sociology to study population migration (Jung and Han, 2017), the theoretical framework has also been widely used in other disciplines. For example, Ghufran et al. (2022) relies on the PPM theoretical framework to test consumers' conversion intention from traditional food to organic food. Hussain et al. (2022) reveals the antecedents of customers' switching intentions in the electricity market through the PPM theoretical framework. These studies analyze variable factors through the PPM framework, to determine the influence factors on the research subject. This reflects the strong theoretical support characteristics of the PPM.

(2) Secondly, by referring to the concept of NSE theory, we divide the factors affecting UID according to development stages. The NSE theory is based on the principle of mutual transformation of time, level and traditional three-dimensional space to study the law of economic development, predict the trend of economic development, carry out economic spatial layout, adjust industrial spatial structure, achieve economic scale benefits, and achieve sustainable economic development. It is the intermediate link in the transformation from structural economics to development economics. The NSE theory makes development economics a science. Specifically, the theory takes the factor endowment and its structure of the economy at each time point and over time as the starting point. Based on this, it can study the determinants and impact stages of this economy and its changes. This theoretical framework has also been widely used in other disciplines. For example, based on the perspective of NSE theory, Lin (2021a) reviews the various stages of China's State-owned enterprise reform, summarizes the main characteristics of different stages, and puts forward suggestions for deepening State-owned enterprise reform. Lin (2021b) also believes that this framework adopts the neoclassical approach to study the determinants of economic structure and its evolution in a country's economic development. Xu and Deng (2022) uses the NSE theory to analyze the reasons for the growth of urban green total factor productivity and verify the theoretical inference. These studies are based on the NSE framework to identify the main influencing factors of each stage on the research object. This reflects the strong theoretical support characteristics of the NSE.

In view of this, this paper firstly attempts to use PPM theory and NSE theory to jointly analyze UID and its development stages.

2.3. Order parameter method

Considering the interaction between UID and its influencing factors, it is transformed from the traditional linear relationship into a dynamic feedback loop process. The order parameter method can effectively capture the characteristics of the evolution track of the dynamic process and reveal its internal evolution process. Therefore, the order parameter method is suitable for this study. The research method is also widely used. Li and Hu (2020) established the order parameter equation of big data industrial system. This method not only effectively reveals the evolution mechanism of big data industry, but also provides theoretical reference for analyzing the development and change laws of big data industry in China. Yang et al. (2021) used the order parameter method to analyze the development trend of manufacturing industry in Guangdong Hong Kong Macao Greater Bay Area. The results show that with the continuous development of manufacturing industry, its environmental pollution will limit its development. Su et al. (2021) used the order parameter method to study the evolution law of regional knowledge innovation system. Xiong and Fan (2022) used the order parameter method to explore the collaborative evolution process of China's financial technology and green manufacturing industry. The results show that there is a synergistic effect between them. Jin et al. (2022) used the order parameter method to investigate the characteristics of group structure and enterprise behavior in the industry, to provide assistance for enterprise strategic management in the modern industrial development environment. The existing research on order parameter proves that the order parameter method can effectively capture the dynamic relationship between variables. Among them, determining the order parameter generally gives a few important variables, from which the order parameter can be determined by using the Haken model. Since the determination of the order parameter equation of the binary Hacken model has been discussed clearly and perfectly in synergetics, this method is easy to find the order parameter (Wu et al., 2016). The above research provides guidance for this paper to use the order parameter model to study the influencing factor of UID.

3. Methodology

3.1. Variable selection

The PPM theory has strong theoretical support characteristics. To determine the influence behavior of various factors on the research object, the variable factors can be analyzed by PPM theory. In essence, it explains the process of a research subject from a bad environment to a better and more sustainable environment. This is very consistent with the high-quality development of the urban industry in the study area, and can objectively and scientifically reflect the dynamics of industrial transformation and upgrading (Dou et al., 2021d). Through the application of PPM theory, the UID can be better promoted. The PPM framework of the UID is shown in Figure 1.

The level of industrialization can well reflect UID. Zheng et al. (2020) used the proportion of industrial added value in GDP to reflect the level of local industrialization. Therefore, we take it as the indicator basis to reflect the UID.

Push refers to the development of research subjects from a bad environment to a good place due to adverse factors. The serious industrial pollution led to severe challenges to environmental carrying capacity. When pollution is serious, it will restrict the development of the local industry. Namely, the push factor is the environment. The PM2.5 average concentration can effectively reflect the local environmental pollution level (Li et al., 2020). Regional air pollution dominated by PM2.5 has become the most urgent and prominent environment problem in China (Zhu et al., 2019; Zhang et al., 2020). The PM2.5 as the main pollutant accounts for 60% of the total pollution days (Song et al., 2019). The extensive development of a large number of traditional industries has caused industrial pollution, high load, serious water pollution in the basin, and severe challenges to the environmental carrying capacity. Under environmental regulation, the problem of environmental development has restricted UID. By managing the environment, it can become a rigid constraint and a driving force to reverse UID. Therefore, we take it as an indicator of environment variables.

The mooring factor is the key factor affecting the UID. Only when the development level of technology in a region is continuously improved can the development advantages of the industry in that region be effectively guaranteed. That is, technology can promote the production efficiency of the manufacturing industry, which is an important support to promote the UID. Namely, the mooring factor is technology. Bravo-ortega and Marin (2011) used the proportion of internal research and development (R&D) investment in the total value of the industry to reflect the level of local R&D intensity, i.e., technical level. R&D intensity is one of the main ways to improve technological innovation (Han et al., 2014). The improvement of technological innovation ability depends to a large extent on the continuous growth of R&D investment intensity. By continuously improving the intensity of R&D investment, industry can continuously gather human and material resources to provide more appropriate R&D conditions for technological innovation. In addition, Choi and Lee (2020) found that R&D investment will help to adjust the industrial structure and maintain the advantage of economic growth. Therefore, we take it as an indicator of technology.

Pull refers to the positive factors that lead the research subject to the destination, that is, a good place. A good financial development environment will bring economic agglomeration, thus having a positive effect on the UID. Namely, the pull factor is finance. An inclusive finance index can effectively reflect financial development (Guo et al., 2020). Campbell and Asaleye (2016) believed that the development of manufacturing industry cannot be separated from financial support. As a financial infrastructure, digital finance also provides a basis for industrial transformation. Digital finance realizes the deep coupling between the Internet and financial functions, which can reduce the cost of financial services, and expand the effective boundary of financial services. Based on this, it improves the ability of financial services to affect the real economy in a wider range. With the help of digital finance, UID can achieve its goals better. Therefore, we take it as an indicator of finance.

In short, the indicators are summarized in Table 1.

3.2. Research method

Given the interaction between the development of the urban industry and its influencing factors, it belongs to a dynamic feedback cycle process. The order parameter method effectively captures the evolution track characteristics of the dynamic process and reveals its internal evolution process. It mainly includes three steps:

(1) Mathematize the problem. That is to establish mathematical expressions of various relationships in the system. It is not only necessary to conduct linear stability analysis, but also to distinguish between stable variables and unstable variables.

(2) Fast variables are eliminated by adiabatic approximation. Specifically, the unstable change of slow variable causes the system structure to be reorganized, while the change of fast variable can be basically ignored. Therefore, the change rate of fast variable is 0, and the order parameter is obtained.

(3) The order parameter equation is used to describe the system evolution. From adiabatic approximation, the order parameter equation is obtained by re-integrating the system state equation.

The specific steps are as follows:

Step 1: Mathematize the problem. The hypothesis E1 is the internal cause of a subsystem and its parameters. E2 is controlled by the internal cause. The motion equation of the system is as follows:

Where, E1, E2 are the state variables, a, b, c, d, β1, β2 are the control variables. When a is a negative value, E2 has a blocking effect on E1. Also, c reflects the synergistic effect of E1 on E2. When b, d are positive, it means that with the development of time. b, d have a certain degree of blocking effect on E1, E2. The β1, β2 reflect the ordered state of the system. When β1 is positive, it indicates that E1 presents a positive feedback mechanism, which can enhance the order degree of the system. When β2 is negative, it indicates that the E2 subsystem has established a negative feedback mechanism of order enhancement.

Step 2: Eliminate fast variables. If the “adiabatic approximation hypothesis” (AAH) holds, let Ė2= 0. Then, we can get . E1 is the order parameter. The evolution equation of the system is obtained as follows:

Where, E1 determines E2, and E2 changes with the change of E1. Therefore, E1 is the order parameter of the system and dominates the co-evolution process of the system.

Step 3: The order parameter equation is obtained. The potential function of the system can be obtained by integrating Ė1 in the opposite number, that is, the formula 4, which can effectively judge the state of the whole system.

In this way, the order parameters of the system can be identified and the cooperation level of the whole system can be evaluated.

4. Experiment and analysis

4.1. Data sample and source

GZ is the capital of Guangdong Province and one of the important central cities in China. After more than 40 years of reform and opening up, the economy has developed rapidly with a perfect manufacturing system. Its manufacturing industry has a solid foundation, complete categories, and the development level is in the forefront of the country. In recent years, GZ's industrial structure, technological innovation ability, economic development vitality and green development have been greatly improved, and its industry is steadily moving toward high-quality development. With the deepening of the integration of the Greater Bay Area, the scope and fields of industrial cooperation between GZ's industry and the Greater Bay Area, and even South China, have been expanding and deepening. In addition, it has also become one of the pilot demonstration cities of the Ministry of Industry and Information Technology for manufacturing strategy. Table 2 shown that the industrial added value and the proportion of industrial added value in GZ. Therefore, GZ is selected as the case study in this paper.

The data were from the statistical yearbook of Guangdong Province, the digital finance research center of Peking University and Washington University in St. Louis.

4.2. Data processing

Because different indicators have different units, to eliminate the impact of different dimensions, it is necessary to normalize the indicators. The relative value obtained after processing is used to replace the original value, so that the indicators of different units and orders of magnitude are comparable. The calculation formula is as follows:

Positive index:

Reverse index:

Assuming that there are n samples in the evaluation system, and each sample has m indicators, Xij represents the original value of the j-th indicator of the i-th sample; Xij' represents the standard value after processing.

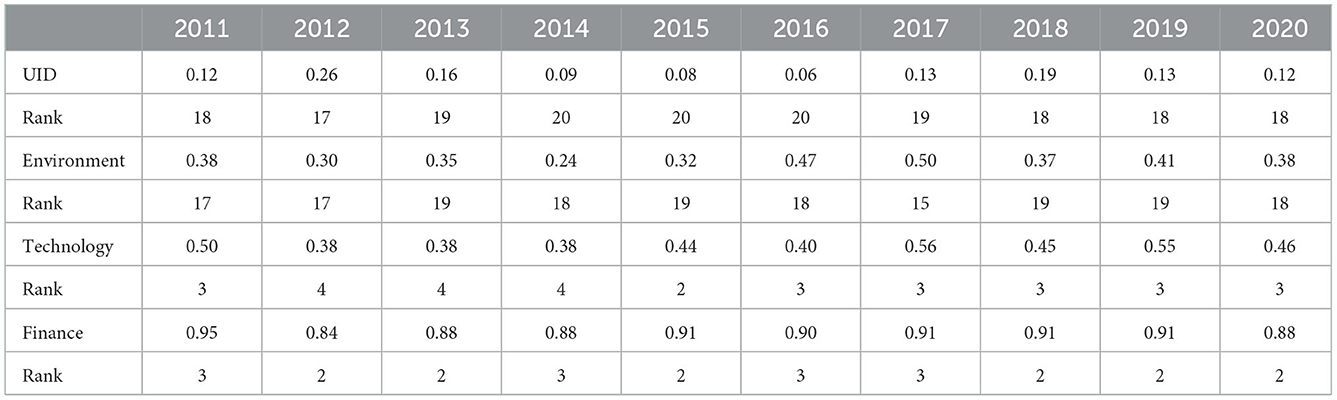

Data processing results are shown in Table 3. By comparing with other prefecture-level cities in GD, we can know the ranking of UID, environment, technology, and finance in GZ in recent 10 years. It can be seen from Tables 2, 3 that even though the proportion of industrial added value in Guangzhou is high in the province, its UID level is low. The reason is that GZ is a comprehensive city. Although the total amount of industry is strong, its development diversification leads to a low degree of overall industrialization of the city. In terms of the environment, as a large city, it has a high degree of development and a relatively high total amount of pollution emissions, so its environmental ranking is relatively backward. In terms of technology, its investment is above the medium level, indicating that GZ still pays attention to technological innovation and technological R&D. Ranked second in finance, indicating that GZ is facing industrial transformation, and the overall industry is shifting from real industry to virtual industry, especially the focus to the tertiary industry.

4.3. Results and analysis

Referring to formula (1) and formula (2), the continuous differential equations of the order parameters are constructed as follows:

Where the formula (7) and formula (8) are expressed as order parameters of the environmental system. The E1, e represents the environmental state variables, The E2, g represents the state variables of UID.

Where the formulas (9) and (10) are expressed as order parameters of the technological system. E1, t represents the technological state variables.

Where the formulas (11) and (12) are expressed as order parameters of the financal system. E1, f represents the financial state variables.

The linear term coefficient represent the growth rate of the variable itself. The positive represents the self-growth effect, and the negative represents the self attenuation effect. The cross-term coefficient indicate the interaction between linear terms. Take environmental system as a example, if the cross-term coefficient of Ė1, e is positive, it indicates that the environment has a positive impact on the UID. If it is negative, there is a negative effect between them. Similarly, if the cross term coefficient of Ė2, e is negative, it indicates that it harms the UID. The coefficient of the square term indicate the influence degree caused by the change of the variable itself. If it is a positive number, it means that it will bring positive promotion to itself with the development of time. On the contrary, it has a certain degree of blocking effect on UID.

According to the adiabatic approximation principle, in the case of E2, e ≠ 0, we let Ė2, e = 0 and express the fast variable from the slow variable E1, e as . After substituting it into formula (7), the equation conforming to the evolution process of logistics. By introducing the function v(E1, e), make it satisfy -∂V1, e/∂E1, e = dE1, e/dt, Based on this, the potential function formula can be deduced:

Similarly, the potential function formula of technology and finance can be deduced, respectively:

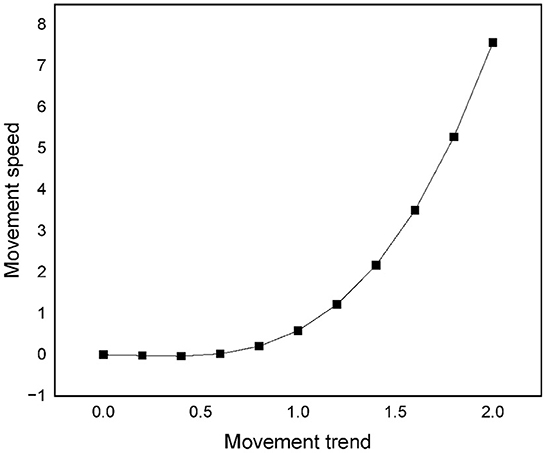

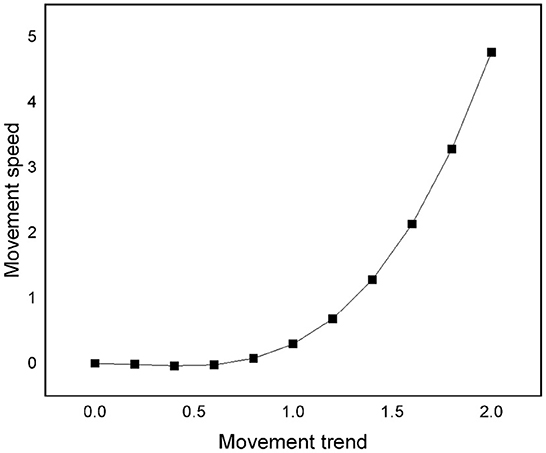

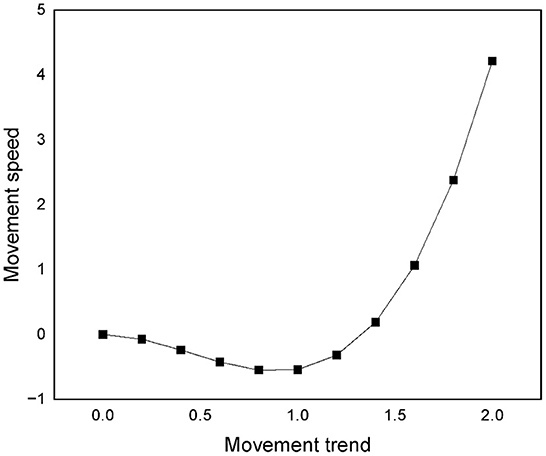

Through the simulation of potential function v1, e, v1, t, v1, f, the motion trajectories of virtual particles of E1, e, E1, t, and E1, f can be obtained respectively (see Figures 2–4).

As shown in Figure 2, the overall growth rate of potential function parameters gradually increases with time. The environment has a significant positive effect on UID. This shows that the current environment and industrial development have reached a balance, making industrial growth and green sustainable development coordinated. This is more in line with reality. GZ attaches importance to the green development of industry and attaches great importance to strengthening industrial pollution prevention and environmental protection. In other words, in the process of UID, through the continuous improvement of industrial pollution control, it can enter a period of rapid development.

As shown in Figure 3, the potential function parameters change smoothly in the initial stage. With time, the overall growth rate of order parameters increases gradually. This shows that GZ attaches importance to technology, especially technological innovation and scientific progress. This has had a positive impact on the industry and accelerated the UID process. However, since the industry needs a running-in period at the initial stage of transformation, UID will develop slowly at the initial stage, and even have no promotion effect. After the running-in period, the impact of technology on UID will increase significantly. With the continuous development of technology, its role in promoting UID is more obvious. In other words, with the continuous innovation of technology and the mastery of key technologies, the industry can enter a period of rapid development.

As shown in Figure 4, in the initial stage, the overall decline rate of the potential function parameter gradually slows down with time. With time, the barrier effect of Finance on the industry will gradually highlight and form a dissipative structure. This has an obvious crowding out effect on industrial development. Financial problems have become the bottleneck restricting the UID. GZ's UID will gradually get into trouble. In other words, the current financial model is not suitable for the UID. The UID will gradually fall into difficulties with the obstruction of the financial model, and the balance needs to be broken through new order parameters. Therefore, when the system develops to a certain extent, the potential function parameters begin to rise, and its growth rate gradually increases. This shows that cities are facing financial risks and financing difficulties in the early stage of UID. This needs to change the current financial development model and overcome the existing shortcomings through diversified development. When the reform of the financial model is successful, it can promote the rational and rapid development of the industry. On the whole, especially in the middle and later stages of development, finance can significantly promote UID to enter a period of rapid development.

Summary, the financial impact is first restrained and then promoted. In the middle and later stages of development, the emergence of new financial models will promote the UID. The promotion effect of technology investment is the second, and it will develop significantly after the running-in period. Environment plays the most significant role in the UID, and it has reached the equilibrium point.

4.4. Comprehensive analysis

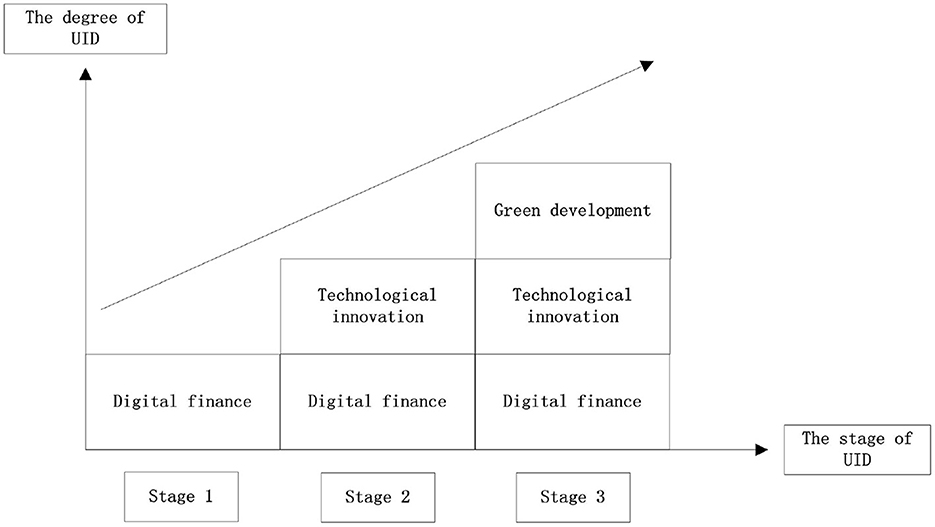

Although the three factors will eventually promote UID, the degree of promotion and change trend is slightly different. On this basis, with the perspective of new structural economics, we study the impact of different factors on UID according to time and level. The determinants and effects of UID change over time. In other words, the impact of finance, technology and environment on UID is indivisible, and it should be regarded as a duplicate effect, as shown in Figure 5.

Stage 1: Finance as an essential factor in the initial stage of UID. When UID is constrained by financing, it will reduce the sustainable input of factor resources. At the same time, its business management, technological innovation, scale development and strategic choice will be restricted to varying degrees. The development of digital finance can reduce the cost of financial services and expand the effective boundary of financial services. It can improve the ability of financial services to affect UID in a wider range. It can effectively alleviate UID's financing difficulties by increasing industrial financing channels. Under this background, industrial enterprises will invest more funds in R&D and improve business vitality, thus having a positive impact on productivity. On the other hand, digital finance can improve the mismatch of resources in the market and optimize the efficiency of resource allocation. This can avoid the waste of resources, reduce the transaction and time costs of industrial financing, and thus promote UID.

Stage 2: Technological innovation is the main development direction of UID. On the basis of digital financial support, the industry will get more capital resources, so that there will be enough funds to introduce advanced technology and independent R&D, which will improve the technical capacity. The effect of technological innovation is shown in that technology expands the boundary line of knowledge creation, maximizes the use of limited resources, and realizes efficient production. This is conducive to improving the product upgrading and organizational innovation of enterprises, and boosting the improvement of the position of the industrial value chain. On the other hand, with the development of information and communication technology, the fixed costs and transaction costs of enterprises in information collection, organizational reform, participation in global trade and division of labor continue to decrease, leading to a decline in the production costs of enterprises.

Stage 3: Green development concept is the future trend of UID. When the industry has accumulated sufficient financial and technical capacity, it will realize green innovation and development of the industry by increasing green technology investment, developing green production technology and producing green products. Specifically, under the concept of green development, industrial enterprises can maximize the use of renewable materials and clean energy for environmentally friendly and low-carbon production by reasonably optimizing resource allocation. It can reduce the unexpected output of industrial wastewater, industrial waste gas, industrial smoke and dust, and prevent the emission of pollutants from the source. This can enable industrial enterprises to meet government environmental management standards and avoid severe punishment. On the other hand, in recent years, consumers' demand for environmentally friendly products is growing, and UID is facing the transformation of green development. The production of green products can better meet consumers' current preferences, and help enterprises expand market share in the fierce market competition, improving green production and operation performance.

5. Discussion

With the continuous development of the manufacturing industry, it inevitably faces the influence of two factors, namely environmental pollution and technology. By studying the synergy between environmental pollution and technology on UID, it is helpful to deeply understand the development of manufacturing. Therefore, based on the PPM and NSE theory, this paper analyzes the impact of the above factors on the UID. The theoretical implication and the practical implication are as follows.

5.1. Theoretical implication

Most of the previous literatures were studied UID from a single perspective, such as finance (Xu and Pal, 2022), environment (Afzal and Hanif, 2022; Lena et al., 2022) and technology (Dos Santos et al., 2020; Xie et al., 2021). Few scholars study UID from multi-dimensions. Basic of the perspective of PPM theory, we build a complex system with three dimensions of the industry to analyze the UID, namely, environment, technology and finance. It can intuitively understand the impact of environmental pollution, technology creation and financial support to the UID. This provides an innovative perspective for the research of UID and enriches the relevant literature.

Many scholars have confirmed that finance promotes technology (Jiang et al., 2022), finance promotes green development (Li et al., 2022; Yin, 2022), and technology promotes green development (Liang et al., 2022). However, few scholars regard financial, technological and environmental factors as a duplicate effect to study their promotion to UID. On the basis of order parameters results, this paper makes a comprehensive analysis of UID in combination with NSE theory. Through further discovering the relationship between variables, we can deeply understand the phased characteristics of UID. It is helpful to put forward targeted development suggestions to UID.

5.2. Practical implication

The results found that not only intuitively reflects the important role of environmental regulation and technology in the UID, but also proves that, financial support has a greater impact on UID in the fusion process. There is an obvious trend that finance first inhibits UID and then promotes UID in the relationship between finance and industry. It is helpful to put forward targeted development suggestions UID. Based on this, we propose different development strategies in combination with UID development stage. The details are as follows:

(1) The financing channels should be improved in the first stage of UID. Due to its long development cycle, slow capital recovery and difficult financing, the shortage of funds has become one of the problems restricting UID. Solving the problem of investment and financing has become the key to industrial development. Therefore, UID puts forward higher and more comprehensive requirements for financial needs. First, expand financial support to industrial enterprises, especially industrial enterprises of specific size and development stage. The second is to solve the problem of high financing cost of industrial enterprises. Third, actively encourage and support the improvement of the multi-level financial system and help improve the financing channels of industrial enterprises. Fourth, promote financial facilitation of industrial enterprises. These will ease the rupture pressure of industrial capital flow and promote the sustainable and stable of UID.

(2) The technical level should be improved in the second stage of UID. Technological innovation is the fundamental power of UID. However, technological breakthrough requires a lot of experiments, which requires capital investment and corresponding infrastructure. The government should speed up the investment in industrial technology innovation, formulate corresponding development plans and relevant institutional policies, so as to vigorously support the technology innovation of UID. In addition, UID should be based on the development pattern of the new era dominated by the domestic big cycle. The government encourages and supports the production technology cooperation and linkage among various industrial sectors, and deepens the exchange and cooperation of technological innovation. In this way, technology integration can be applied to relevant upstream, midstream and downstream enterprises to create channels in all aspects. Finally, new technological formats can be cultivated to promote the coordinated development of regional industrial technological innovation.

(3) Achieving green development is the third stage of UID. Considering that green development is a long-term project, local governments should implement supporting incentive policies. By strengthening the implementation of environmental protection subsidies, the government helps enterprises get through the green transformation in the difficult financing stage. Secondly, encourage enterprises to increase production and research and development of green manufacturing, guide enterprises to research and develop technologies and products that are more in line with the low-carbon lifestyle. To promote the successful transition of enterprises into the process of green innovation and development, the government should increase the promotion of green production mode until industrial enterprises take green production as a normal business mode. In addition, enterprises should also grasp the green innovation trend of competitors in the industry, inject green value into products and services, to meet consumers' demand for green products. In this way, green innovation can be used to increase the differentiation advantage and market competitiveness of enterprises, thus promoting the green development of industry.

6. Conclusion

Lack of in-depth research on the phenomenon of promoting or hindering the UID. Therefore, to understand the potential influencing factors of the UID, this study takes GZ as an example. Based on the PPM, we discuss the impacts of the environment, technology and finance on the UID. It provides a reference for the related research of the UID. The results show that:

(1) Environment has an obvious promoting effect on the UID. This shows that the current environment and the UID have reached a balance. GZ should continue to maintain the existing environmental regulatory measures to coordinate industrial growth with green and sustainable development and promote the rapid growth of UID.

(2) Technology has a positive impact on the UID, but it needs to go through the technology running-in period smoothly. Specifically, in the initial stage, the technical impact on the UID is relatively slow and even not reflected. After the running-in period, the impact of technology on the UID will increase significantly. With the continuous development of technology, its role in promoting the UID is more obvious. GZ should adopt new technologies to promote industrial growth.

(3) Different from other factors, finance has a crowding-out effect on industrial development. That is, the current financial model is not suitable for the development of industrialization. The UID will gradually fall into difficulties with the obstruction of the financial development, and the balance needs to be broken through new order parameters. According to the experimental results, in the middle and later development stage, the emergence of new financial models will promote the UID.

(4) The impact of finance, technology and green on UID is applicable to different development stages of UID, that is, these variables are related. Finance can help UID obtain resources and improve resource allocation, and indirectly support technological innovation and green development. Continuous technology investment and innovation can help UID improve its value chain status and green transformation. Green development can enable UID to meet government standards and market consumer requirements, thereby improving green business performance.

Although this study is limited to a specific city, it can be expanded and verified on a global scale through further research. For example, different countries and regions have different raids. However, in most countries and regions, environmental, technological, and financial progress is the inevitable trend of UID. Therefore, this case study is about GZ, but is not limited to this. In terms of the scale, it is also very useful for Michigan and Tennessee in the United States, Ruhr Industrial Zone in Germany, and all prefecture-level cities in China.

Data availability statement

The datasets presented in this study can be found in online repositories. The names of the repository/repositories and accession number(s) can be found at: The data in this paper are from the Statistics Bureau of Guangdong (http://stats.gd.gov.cn); the Digital Finance Research Center of Peking University (https://idf.pku.edu.cn/yjcg); Washington University in St. Louis (https://sites.wustl.edu/acag).

Author contributions

ZD and YS: conceptualization. ZD: methodology. ZD and CW: software and formal analysis. YS: validation and supervision. BW: investigation and visualization. ZD and BW: writing—original draft preparation. ZD, YS, and CW: writing—review and editing. All authors have read and agreed to the published version of the manuscript.

Funding

This research was funded by the National Natural Science Foundation Project under grant number 52275479, the Guangdong Province Key Research and Development Project under grant number 2020B0101050001, and the Special Fund for Science and Technology Innovation Strategy of Guangdong Province under grant number pdjh2021b0405.

Acknowledgments

The authors thank the editor and reviewers for their numerous constructive comments and encouragement that have improved our paper greatly. Also, thank the members of the research center for their suggestions.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Afzal, N., and Hanif, A. (2022). The impact of green supply chain management practices on firm performance: evidence from manufacturing industry. Global Bus. Rev. 1–18. doi: 10.1177/09721509221125576

Alava, R., Murillo, J., Zambrano, R., et al. (2018). PEST analysis based on neutrosophic cognitive maps: a case study for food industry. Neutrosophic Sets Syst. 21, 84–92.

Almutairi, K., Dehshiri, S., Dehshiri, S., et al. (2022). Determination of optimal renewable energy growth strategies using SWOT analysis, hybrid MCDM methods, and game theory: a case study. Int. J. Energy Res. 46, 6766–6789. doi: 10.1002/er.7620

Al-Refaie, A., Sy, E., Rawabdeh, I., et al. (2016). Integration of SWOT and ANP for effective strategic planning in the cosmetic industry. Adv. Prod. Eng. Manag. 11, 49–58. doi: 10.14743/apem2016.1.209

Barbara, C., Cortis, D., Perotti, R., et al. (2017). The European insurance industry: a PEST analysis. Int. J. Financ. Stud. 5, 14. doi: 10.3390/ijfs5020014

Beraud, J., Zhao, X., and Wu, J. (2022). Revitalization of Chinese's manufacturing industry under the carbon neutral goal. Environ. Sci. Pollut. Res. 29,66462–66478. doi: 10.1007/s11356-022-20530-5

Bravi, L., and Murmura, F. (2021). Industry 4.0 enabling technologies as a tool for the development of a competitive strategy in Italian manufacturing companies. J. Eng. Technol. Manage. 60, 101629. doi: 10.1016/j.jengtecman.2021.101629

Bravo-ortega, C., and Marin, A. (2011). R&D and productivity: a two way avenue? World Dev. 39, 1090–1107. doi: 10.1016/j.worlddev.2010.11.006

Campbell, O., and Asaleye, A. (2016). Financial sector reforms and output growth in manufacturing: empirical evidence from Nigeria. Am. Int. J. Contemp. Res. 6, 112–125.

Chen, M. (2018). “Research on strategies for the development of national orchid culture industry based on PEST analysis,” in 3rd International Conference on Judicial, Administrative and Humanitarian Problems of State Structures and Economic Subjects (JAHP) (Domodedovo), 642–647.

Chen, S., and Zhang, H. (2021). Does digital finance promote manufacturing servitization: Micro evidence from China. Int. Rev. Econ. Finance. 76, 856–869. doi: 10.1016/j.iref.2021.07.018

Cheng, Z. T. (2016). The spatial correlation and interaction between manufacturing agglomeration and environmental pollution. Ecol. Indic. 61, 1024–1032. doi: 10.1016/j.ecolind.2015.10.060

Choi, E., and Lee, J. (2020). The current state of regional R&D investment and its contribution to regional economic growth. J. Korean Data Anal. Soc. 22, 1201–1212. doi: 10.37727/jkdas.2020.22.3.1201

Constantin, M., Sacala, M., Dinu, M., et al. (2022). Vegetable trade flows and chain competitiveness linkage analysis based on spatial panel econometric modelling and porter's diamond model. Agronomy Basel. 12, 2411. doi: 10.3390/agronomy12020411

Da Silva, R., Naas, I., Dos Reis, J., et al. (2021). Factors that impact on broiler production management: Pestel and Swot approach. Revista Cubana De Ingenieria. 12, e291.

Dalenogare, L., Benitez, G., Ayala, N., et al. (2018). The expected contribution of industry 4.0 technologies for industrial performance. Int. J. Prod. Econ. 204, 383–394. doi: 10.1016/j.ijpe.2018.08.019

Dogan, A., and Birant, D. (2021). Machine learning and data mining in manufacturing. Expert Syst. Appl. 166, 114060. doi: 10.1016/j.eswa.2020.114060

Dos Santos, L. M. A. L., da Costa, M. B., Kothe, J. V., Benitez, G. B., Schaefer, J. L., Baierle, I. C., et al. (2020). Industry 4.0 collaborative networks for industrial performance. J. Manu. Technol. Manag. 32, 245–265. doi: 10.1108/JMTM-04-2020-0156

Dou, Z., Sun, Y., Wang, T., Wan, H., and Fan, S. (2021d). Exploring regional advanced manufacturing and its driving factors: a case study of the Guandong–Hong Kong–Macao greater bay area. Int. J. Environ. Res. Public Health. 18, 5800. doi: 10.3390/ijerph18115800

Dou, Z., Sun, Y., Wu, Z., et al. (2021c). The architecture of mass customization-social internet of things system: current research profile. ISPRS Int. J. Geo-Inform. 10, 653. doi: 10.3390/ijgi10100653

Dou, Z., Sun, Y., Zhang, Y., et al. (2021a). Regional industry demand forecasting: a deep learning approach. Appl. Sci. 11, 6199. doi: 10.3390/app11136199

Dou, Z., Wu, B., Sun, Y., et al. (2021b). The competitiveness of manufacturing and its driving factors: a case study of G20 participating countries. Sustainability. 13, 1143. doi: 10.3390/su13031143

Du, X. (2016). “Macro-environmental analysis of auto parts industries' development of China based on PEST method,” in 2nd International Conference on Economy, Management, Law and Education (Moscow), 7–10.

Ghufran, M., Ali, S., Ariyesti, F., et al. (2022). Impact of COVID-19 to customers switching intention in the food segments: the push, pull and mooring effects in consumer migration towards organic food. Food Qual. Prefer. 99, 104561. doi: 10.1016/j.foodqual.2022.104561

Guo, F., Wang, J., Wang, F., et al. (2020). Measuring China's digital financial inclusion: index compilation and spatial characteristics. China Econ. Q. 19, 1401–1418.

Han, D., and Fu, Y. (2020). Internet finance and marine industry transformation: an exploratory study. J. Coast. Res. 106, 209–212. doi: 10.2112/SI106-049.1

Han, X., Hui, N., and Song, W. (2014). Can informantization improve the technology innovation efficiency of Chinese industrial sectors. China Ind. Econ. 2014, 70–82. doi: 10.19581/j.cnki.ciejournal.2014.12.006

Haraguchi, N., Cheng, C., and Smeets, E. (2017). The importance of manufacturing in economic development: has this changed? World Dev. 93, 293–315. doi: 10.1016/j.worlddev.2016.12.013

He, X., Ping, Q., and Hu, W. (2022). Does digital technology promote the sustainable development of the marine equipment manufacturing industry in China? Marine Policy. 136, 104868. doi: 10.1016/j.marpol.2021.104868

Hu, W., Jin, T., and Liu, Y. (2019). Effects of environmental regulation on the upgrading of Chinese manufacturing industry. Environ. Sci. Pollut. Res. 26, 27087–27099. doi: 10.1007/s11356-019-05808-5

Hussain, S., Seet, P., Ryan, M., et al. (2022). Determinants of switching intention in the electricity markets - an integrated structural model approach. J. Retail. Consum. Serv. 69, 103094. doi: 10.1016/j.jretconser.2022.103094

Jia, F., Ma, X., Xu, X., and Xie, L. (2020). The differential role of manufacturing and non-manufacturing TFP growth in economic growth. Struct. Chang. Econ. Dyn. 52, 174–183. doi: 10.1016/j.strueco.2019.10.006

Jiang, S., Liu, X., Liu, Z., et al. (2022). Does green finance promote enterprises' green technology innovation in China? Front. Environ. Sci. 10, 981013. doi: 10.3389/fenvs.2022.981013

Jimeno-Morenilla, A., Azariadis, P., Molina-Carmona, R., et al. (2021). Technology enablers for the implementation of Industry 4.0 to traditional manufacturing sectors: a review. Comput Ind. 125, 103390. doi: 10.1016/j.compind.2020.103390

Jin, Z., Zhao, X., and Jiang, Z. (2022). Study on order parameter analysis method of industrial structure and environment. Operat. Res. Manag. Sci. 31, 74–80.

Jung, J., and Han, H. (2017). Travelers' switching behavior in the airline industry from the perspective of the push-pull-mooring framework. Tourism Manag. 59, 139–153. doi: 10.1016/j.tourman.2016.07.018

Khatami, F., Ricciardi, F., Cavallo, A., et al. (2022). Effects of globalization on food production in five European countries. Br. Food J. 124, 1569–1589. doi: 10.1108/BFJ-03-2021-0301

Kong, Q., Shen, C., Sun, W., et al. (2021). KIBS import technological complexity and manufacturing value chain upgrading from a financial constraint perspective. Finance Res. Lett. 41, 101843. doi: 10.1016/j.frl.2020.101843

Kuzior, A., and Lobanova, A. (2020). Tools of information and communication technologies in ecological marketing under conditions of sustainable development in industrial regions. J. Risk Finan. Manag. 13, 1–20. doi: 10.3390/jrfm13100238

Lena, D., Pasurka, C., Cucculelli, M., et al. (2022). Environmental regulation and green productivity growth: evidence from Italian manufacturing industries. Technol. Forecast. Soc. Change. 184, 121993. doi: 10.1016/j.techfore.2022.121993

Li, B., and Liu, Z. (2022). Measurement and evolution of high-quality development level of marine fishery in China. Chin. Geogr. Sci. 32, 251–267. doi: 10.1007/s11769-022-1263-7

Li, G., Fang, C., and He, S. (2020). The influence of environmental efficiency on PM2.5 pollution: Evidence from 283 Chinese prefecture-level cities. Science of The Total Environment. 748, 141549. doi: 10.1016/j.scitotenv.2020.141549

Li, G., Zhang, R., Feng, S., et al. (2022). Digital finance and sustainable development: evidence from environmental inequality in China. Bus. Strategy Environ. 31, 3574–3594. doi: 10.1002/bse.3105

Li, Q., and Hu, Y. (2020). Research on evolution mechanism of China's big data industry based on haken model. J. Ind. Technol. Econ. 39, 125–131.

Liang, S., Yang, J., and Ding, T. (2022). Performance evaluation of AI driven low carbon manufacturing industry in China: an interactive network DEA approach. Comput. Ind. Eng. 170, 108248. doi: 10.1016/j.cie.2022.108248

Lin, J. (2021a). State-owned enterprise reform in China: the new structural economics perspective. Struct. Chang. Econ. Dyn. 58, 106–111. doi: 10.1016/j.strueco.2021.05.001

Lin, J. (2021b). New structural economics: a framework of studying government and economics. J. Gov. Econ. 2, 100014. doi: 10.1016/j.jge.2021.100014

Liu, J., Chang, H., Forrest, J., et al. (2020). Influence of artificial intelligence on technological innovation: evidence from the panel data of China's manufacturing sectors. Technol. Forecast. Soc. Change. 158, 120142. doi: 10.1016/j.techfore.2020.120142

Liu, X., Yin, K., and Cao, Y. (2021). Contribution of the optimization of financial structure to the real economy: evidence from China's financial system using TVP-VAR Model. Mathematics. 9, 2232. doi: 10.3390/math9182232

Liu, X., Zhang, S., and Feng, X. (2016). “Comparative analysis of international competitiveness of Chinese - American automobile industry,” in 2nd International Conference on Economics, Management Engineering and Education Technology (Sanya), 149–153.

Lu, W., Chen, K., Xue, F., et al. (2018). Searching for an optimal level of prefabrication in construction: an analytical framework. J. Clean. Prod. 201, 236–245. doi: 10.1016/j.jclepro.2018.07.319

Nimawat, D., and Gidwani, B. (2021). Prioritization of barriers for industry 4.0 adoption in the context of Indian manufacturing industries using AHP and ANP analysis. Int. J. Comput. Int. Manufact. 34, 1139–1161. doi: 10.1080/0951192X.2021.1963481

Novotná, M., Volek, T., Rost, M., and Vrchota, J. (2020). Impact if technology investment on firm's priduction factor in manufacture. J. Bus. Econ. Manag. 22, 1–21. doi: 10.3846/jbem.2020.13635

Pei, Q., and Lu, J. (2019). Brand synergy technology progress promoting high quality development of China's manufacturing industry. Modern. Manag. 39, 18–21. doi: 10.19634/j.cnki.11-1403/c.2019.04.005

Pournabi, N., Janatrostami, S., Ashrafzadeh, A., et al. (2021). Resolution of internal conflicts for conservation of the hour Al-Azim wetland using AHP-SWOT and game theory approach. Land Use Policy. 107, 105495. doi: 10.1016/j.landusepol.2021.105495

Shao, W., and Wu, T. (2022). Intelligence, factor market and high-quality development of industrial economy. Inq. Econ. Issues. 2, 112–127.

Shen, Y., Guo, X., and Zhang, X. (2022). Digital inclusive finance, factor mismatch and industrial smart manufacturing. J. Ind. Technol. Econ. 41, 13–20.

Shi, X., Wang, Y., Zhuang, H., et al. (2021). Global hierarchy of maritime clusters: Stability and reconstruction. J. Transp. Geogr. 96, 103205. doi: 10.1016/j.jtrangeo.2021.103205

Song, J., Wang, B., Fang, K., et al. (2019). Unraveling economic and environment implications of cutting overcapacity of industries: a city-level empirical simulation with input-output approach. J. Clean. Prod. 222, 722–732. doi: 10.1016/j.jclepro.2019.03.138

Su, Y., Liu, B., and Jiang, X. (2021). Evolution of regional knowledge innovation system based on enhanced brusselator reaction. R&D Manag. 33, 1004–8308. doi: 10.13581/j.cnki.rdm.20191854

Szirmai, A., and Verspagen, B. (2015). Manufacturing and economic growth in developing countries, 1950-2005. Struct. Chang. Econ. Dyn. 34, 46–59. doi: 10.1016/j.strueco.2015.06.002

Tao, F., and Qi, Q. (2018). New IT driven service-oriented smart manufacturing: framework and characteristics. IEEE Transact. Syst. Man Cybernet. Syst. 49, 81–91. doi: 10.1109/TSMC.2017.2723764

Wang, X. (2022). Research on the impact mechanism of green finance on the green innovation performance of China's manufacturing industry. Manage Decis. Econ. 43, 2678–2703. doi: 10.1002/mde.3554

Wang, X., Li, C., Shang, J., et al. (2017). Strategic choices of china's new energy vehicle industry: an analysis based on ANP and SWOT. Energies. 10, 537. doi: 10.3390/en10040537

Wang, Y., Yan, W., Ma, D., et al. (2018). Carbon emissions and optimal scale of China's manufacturing agglomeration under heterogeneous environmental regulation. J. Clean. Prod. 176, 140–150. doi: 10.1016/j.jclepro.2017.12.118

Wu, B., and Young-myung, Y. (2022). A study on enhancing national competitiveness of china's eco-friendly automobile industry: focusing on the porter's diamond model. J. Econ. Stud. 40, 149–168. doi: 10.30776/JES.40.2.6

Wu, D., Sun, Y., and Ding, R. (2016). Evolution model for the integration of informatization and industrialization under the transformation and upgrading of manufacturing enterprise: based on the method of choosing order parameters from the principal components. Syst. Eng. 34,44–51.

Xie, M., Ding, L., Xia, Y., et al. (2021). Does artificial intelligence affect the pattern of skill demand? evidence from Chinese manufacturing firms. Econ. Model. 96, 295–309. doi: 10.1016/j.econmod.2021.01.009

Xiong, X., and Fan, J. (2022). Synergistic evolution mechanism between fintech and manufacturing green transformation and regional synergistic differences: an empirical analysis based on haken model. Sci. Technol. Prog. Policy. 39, 63–73.

Xu, Y., and Deng, H. (2022). Green total factor productivity in Chinese cities: measurement and causal analysis within a new structural economics framework. J. Innov. Knowled. 7, 100235. doi: 10.1016/j.jik.2022.100235

Xu, Z., and Pal, S. (2022). The effects of financial liberalization on productivity: evidence from India's manufacturing sector. J. Manag. Sci. Eng. 7, 578–588. doi: 10.1016/j.jmse.2022.04.001

Yang, F., Sun, Y., Zhang, Y., and Wang, T. (2021). Factors affecting the manufacturing industry transformation and upgrading: a case study of Guangdong–Hong Kong–Macao Greater Bay Area. Int. J.Environ. Res. Public Health. 18, 7157. doi: 10.3390/ijerph18137157

Yin, Y. (2022). Digital finance development and manufacturing emission reduction: an empirical evidence from China. Front. Public Health. 10, 973644. doi: 10.3389/fpubh.2022.973644

Yuan, B., Ren, S., and Chen, X. (2017). Can environmental regulation promote the coordinated development of economy and environment in China's manufacturing industry?-a panel data analysis of 28 sub-sectors. J. Clean. Prod. 149, 11–24. doi: 10.1016/j.jclepro.2017.02.065

Yuan, X., Li, C., and Li, Z. (2019). Present situation, perplexity and prospect of high-quality development of Chinese economy. J. Xi'an Jiaotong Univ. 39, 30–38. doi: 10.15896/j.xjtuskxb.201906005

Zhai, X., and An, F. (2020). Analyzing influencing factors of green transformation in China's manufacturing industry under environmental regulation: a structural equation model. J. Clean. Prod. 251, 119760. doi: 10.1016/j.jclepro.2019.119760

Zhang, M., Sun, X., and Wang, W. (2020). Study on the effect of environmental regulations and industrial structure on haze pollution in China from the dual perspective of independence and linkage. J. Clean. Prod. 256, 120748. doi: 10.1016/j.jclepro.2020.120748

Zhao, J., Liu, H., and Xue, W. (2019). PEST embedded SWOT analysis on China's E-commerce industry development strategy. J. Electron. Commer. Organ. 17, 55–68. doi: 10.4018/JECO.2019040105

Zheng, S., Wang, R., Mak, T. M. W., Hsu, S.-C., and Tsang, D. C. W. (2020). How energy service companies moderate the impact of industrialization and urbanization on carbon emissions in China? Sci. Total Environ. 751, 141610. doi: 10.1016/j.scitotenv.2020.141610

Zhong, Z. (2017). Study about the relationship between scientific and technological finance of emerging industries and economic growth. Agro Food Ind. Hi Tech. 28, 1381–1384.

Keywords: urban industry development, environment, technology, finance, order parameter

Citation: Dou Z, Sun Y, Wu B and Wu C (2023) Exploring the influencing factor of urban industry development: An order parameter method. Front. Sustain. Cities 4:1050915. doi: 10.3389/frsc.2022.1050915

Received: 22 September 2022; Accepted: 21 December 2022;

Published: 12 January 2023.

Edited by:

Yang Zhou, Shenzhen University, ChinaReviewed by:

Xin Zhao, Anhui University of Finance and Economics, ChinaLinlin Wang, Tsinghua University, China

Haitao Du, University of Glasgow, United Kingdom

Copyright © 2023 Dou, Sun, Wu and Wu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Yanming Sun,  c3VueWFubWluZ0Bnemh1LmVkdS5jbg==

c3VueWFubWluZ0Bnemh1LmVkdS5jbg==

Zixin Dou1,2

Zixin Dou1,2 Yanming Sun

Yanming Sun