- 1Advanced Biomedical Instrumentation Centre, Shatin, Hong Kong SAR, China

- 2Department of Biomedical Engineering, City University of Hong Kong, Kowloon Tong, Hong Kong SAR, China

- 3Department of Mechanical Engineering, The University of Hong Kong, Pokfulam, Hong Kong SAR, China

Point-of-care testing (POCT) involves conducting diagnostic tests outside the laboratory. These tests are utilized for their quick and reliable results in detecting chronic diseases and acute infections. We examined the historical market value trends of the POCT industry and projected its future growth. POCT devices offer several advantages, such as portability, no specific storage requirements, and simplicity of use. However, issues such as inaccurate results can reduce demand for POCT compared to traditional laboratory testing alternatives. While the benefits of POCT are clear, it’s important to acknowledge the challenges. The accuracy of POCT devices can be compromised due to factors such as user error, environmental conditions, and limitations in technology. Furthermore, the cost-effectiveness of these devices is often a concern, particularly in resource-limited settings. The regulatory landscape for POCT is also complex and varies by region, which can pose challenges for manufacturers and end-users. Improvements in POCT devices’ sensitivity, specificity, cost, and turnaround time for test results could enhance their utility. Enhancements to a POCT device should be considered if they are economically viable and lead to a significant increase in demand. Our financial analysis of the POCT market revealed a positive growth trend. We identified potential areas for growth that could help the industry progress and expand in line with its projected growth in the coming years. The industry could focus on integrating intelligent technologies into POCT devices and collaborating with the innovative technology sector to increase revenue. It could also develop more sensitive and accurate POCT devices for non-communicable diseases. Another potential area of growth is in diseases that require continuous patient monitoring but where conventional clinical testing is time-consuming. Enhancing the POCT devices used in these areas could revolutionize medical diagnosis and potentially save many lives, provided they meet clinical standards.

Introduction

Point-of-care testing (POCT) technology has gained worldwide recognition in the recent decade due to its increased convenience provision capability, as well as the ability of the technology to detect several diseases and conditions rapidly and accurately (Nichols, 2020) Point-of-care medical testing is the growing alternative to laboratory testing methods due to improved extraction, microfluidics, miniaturization, and data processing techniques that bring POCT test sensitivity and specificity in line with the lab-based tests (Truvian, 2023). However, POC testing has fallen short of achieving a completely accurate diagnosis and can still produce false results, lowering the overall confidence in their results (Truvian, 2023). This paper will compare POCT against lab testing to analyze its position and credibility against competition. Later, the paper shall also focus on some of the current issues relating to the POCT tests and investigate potential ways to solve the issues. The investigation will focus on experimental results from past studies performed on different POCT tests and conjointly use them to deduce some of the common problems related to POCT testing and attempt to give solutions to introduce space for future experimentation and testing. Some of the current POCT technology can produce accurate test results with occasional discrepancies, and pushing the accuracy spectrum further may increase the costs associated with the tests, reducing the convenience related to POC tests. This paper will approach POC technology from both a technological and a financial side and try to establish the groundwork for the future development of the technology.

This paper will take up an analytical approach to the field of microfluidics and delve into the current state of point-of-care technology and its progress. It will further evaluate the industry in which the POCT technology thrives and try to hypothesize the ideal characteristics that the POCT devices and the microfluidics industry must possess for this efficient technology’s continued growth.

Background

Point-of-care technology started in 1972 to provide fast results to patients in the operating rooms (Liu et al., 2019). POCT technology has globalized and rapidly developed over the past decade with the development of POCT devices for immediate evidence-based diagnosis, monitoring of patients, and making therapeutic decisions (Liu et al., 2019). Over time, point-of-care has been used to monitor the proportion of the healthy population and for intensive care, emergency medicine administration, and treatments. Technological advancements have played the lead role in the globalization of POCT technology, and heavily populated countries received the new technology as a means for rapid disease detection to contest the high demand for medical diagnosis for diseases in an already large population.

The recent COVID-19 pandemic showed the importance of point-of-care testing with rapid antigen test (RAT) kits to diagnose COVID-19 in domestic settings. RAT kits had a decent accuracy rate and helped reduce the need to go to hospitals during the pandemic, which was convenient given the contagious nature of the virus. It should be noted that the devices for point-of-care testing can be of several forms, such as basic dipsticks with urinalysis, handheld devices like glucose meters, and even complex molecular analyzers for detecting infections (Testing, 2021). Several daily electronic devices use POCT testing devices, such as heart-rate sensors and pulse oximeters. These include Apple and other sports watches and so on. Some of the most common point-of-care tests include home pregnancy tests, hemoglobin, fecal occult blood, and rapid strep, among many others, such as prothrombin time/international normalized ratio (PT/INR) for individuals who take the anticoagulant warfarin (Testing, 2021).

We can briefly examine blood glucose monitoring to explain how a POCT device works. To perform a blood glucose measurement, use a single-use lancet needle to draw blood, preferably from the patient’s fingertip. The blood is applied onto a blood glucose strip; a single drop is usually applied onto a strip already connected to the glucose meter (Pickering and Marsden, 2014). The glucose test strip contains a capillary that absorbs the blood, which reaches an enzyme electrode where the blood is mixed with a glucose oxidase enzyme. An electric current is created by the glucose meter (Diathrive, 2018). A positive direct proportionality is seen between the charge passing through the electrode and the proportion of glucose in the blood sample (Diathrive, 2018). So, if the test result had shown 90 mg/dL, that would mean 90 mg of glucose in a deciliter of the blood of the person being tested.

Point-of-care testing has developed drastically over the past decades, benefiting from rapid technological advancements. Molecular techniques such as the polymerase chain reaction (PCR) and lab-on-a-chip concept are big focuses. The target is to rapidly automate every step of a laboratory step using very small sample sizes without the need for manual handling of the sample. The eventual goal of POCT technology is to drastically reduce the need for laboratory testing and lower the overload on medical healthcare services during pandemic situations like those faced during the COVID-19 pandemic (Testing, 2021).

Recently, POC technology has evolved into fields of cancer diagnosis using biomarkers and aptamers. As published by the works of (Parihar et al., 2022) discussing the MXene-based electrochemical aptasensors for cancer biomarker detection, and (Parihar and Khan, 2023) discussing carbon nanomaterials-based electrochemical aptasensors these aptamers offer stability, ease of synthesis, good reproducibility, and high specificity, making them a potential mainstream diagnostic approach. This highly sensitive and specific method for the detection of cancer biomarkers, enabling early diagnosis and potentially reducing the mortality rate of cancer. The use of such aptamers in POC technology allows for the development of portable and rapid diagnostic devices that can be used in point-of-care settings, providing timely and accurate results.

Ideal features for the perfect point-of-care testing device

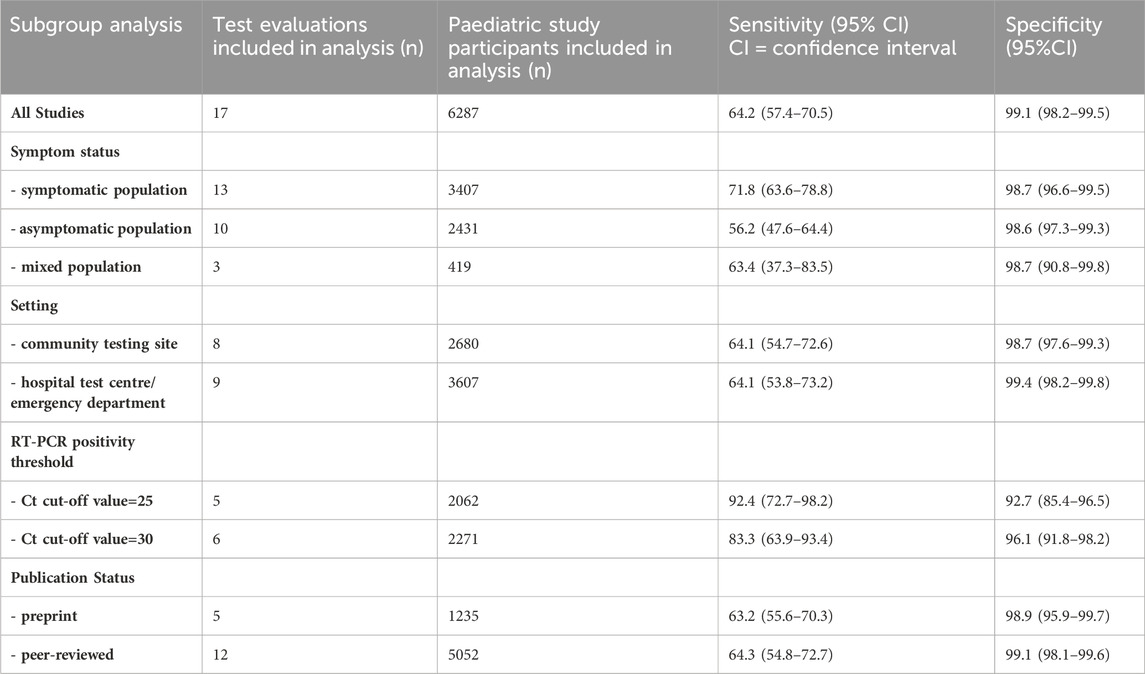

An ideal POCT device should have the following characteristics, as suggested by John and Price (St John and Price, 2014) (Figure 1).

Figure 1. Features of an Ideal POCT device (St John and Price, 2014).

It is vital for POCTs to be simple to use and have an affordable price. The primary purpose of POCT is to reduce the need for individuals to resort to laboratory testing. The devices must also produce accurate results with only occasional instances of false results (St John and Price, 2014). The lower price will help to offset the error margin in POCT and make the technology more viable and beneficial against its laboratory testing counterparts.

To better understand the characteristics desired in POCTs across demographics, we will evaluate two surveys to summarize the optimums.

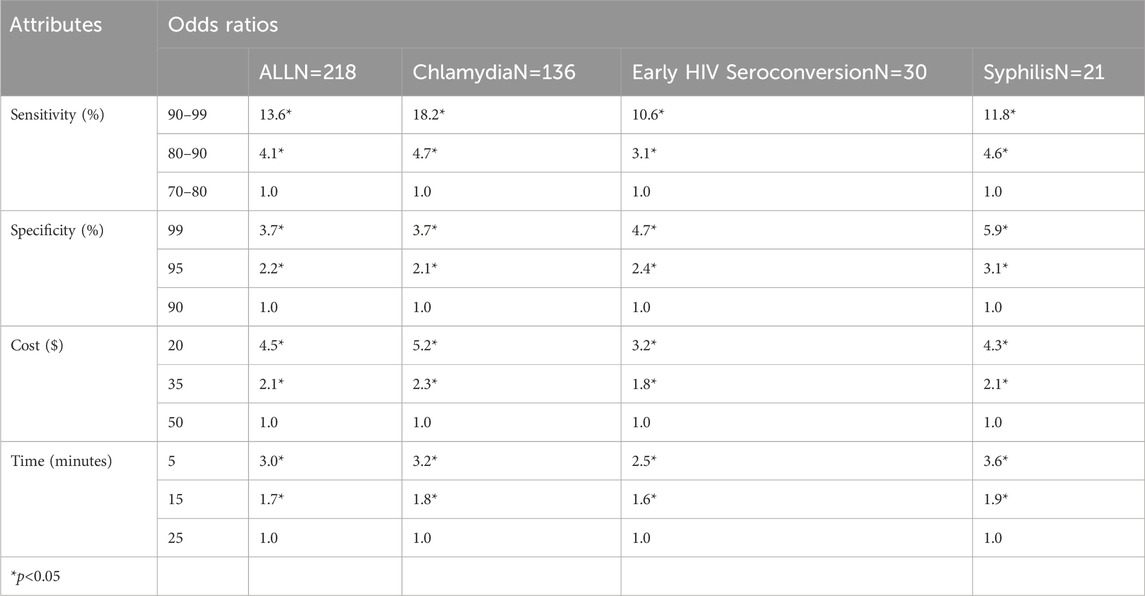

The first survey was carried out by Hsieh et al. (2011). This survey was conducted online among sexually transmitted infection (STI) experts and professionals to obtain their views on ideal POCTs. The survey was conducted on 256 subjects, among which 218 were completed. The survey was able to summarize some of the issues the experts thought could hinder the extensive usage of POCT, as well as obtain opinions on the critical aspects needed in the devices. The data from the survey has been presented in Table 1.

Table 1. STI Experts’ Ideal POC. The table was reproduced with permission (Hsieh et al., 2011). Regression Analysis of the Importance of Preference in Attributes of a New-Point-of-Care Test for Sexually Transmitted Infections by All Tests and Prioritized Test.

Table 1 suggests that a test with a higher level of sensitivity is preferred over one with a lower level of sensitivity. 90% accuracy is accepted more willingly than 70%. Furthermore, lower costs ($20) were preferred over a higher price ($50) by a difference of 3.5 odds ratio. The data becomes more interesting when the interlapping aspects are considered together. A lower level of sensitivity is preferred over a medium level of sensitivity if the POCT has a lower cost and faster turn-over-time (Hsieh et al., 2011). Furthermore, a high level of sensitivity (90%) could be traded for a medium level of sensitivity if the POCT had a higher specificity and was much cheaper. High specificity is prioritized over low specificity even if the test was in a category higher in cost and a category slower in time. This survey determined four prominent characteristics: high sensitivity, high specificity, low cost, and less testing and result time. Participants suggest a sensitivity of 90%–99%, a cost of $20, a specificity of 99%, and a turnaround time of 5 min (Hsieh et al., 2011), with sensitivity being the top priority.

The second survey was extracted from a qualitative study encompassing eight focus groups conducted from March 2008 through April 2009. It was led by Hsieh et al., 2010, and the participants included 6 STD Clinic Directors, 63 clinicians, and seven public health professionals. This survey noticed the participants using the terms “ease of use,” “test results should be easily read and interpreted with a yes or no when the test is done,” “15 s”, “the quicker, the better” and so on. Similar to the previous survey, high sensitivity and specificity (above 90%) and lower testing times were unanimous requirements for POCTs (Hsieh et al., 2010). Furthermore, more emphasis was given to POCT devices, which provided a simple “yes/no” response as participants perceived these devices as having a lower margin for error.

A study of the current POCT devices

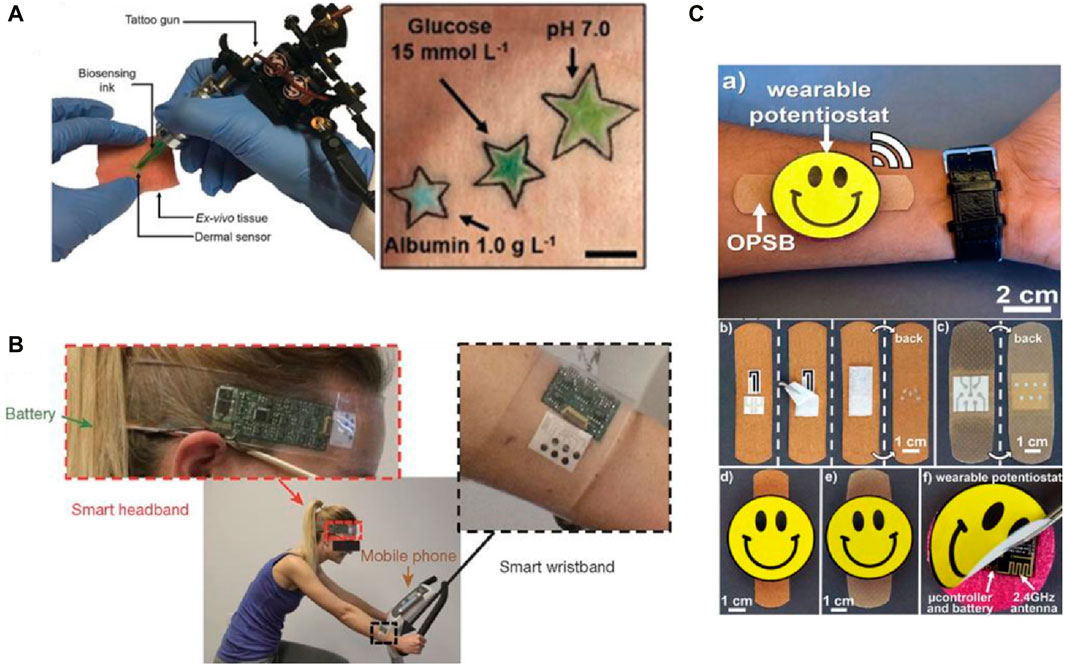

In this paper, we will focus on both the characteristics aspect of POCT and its financial growth and standpoint. Looking at some of the current POCT devices will give us an idea of the industry’s current position. A very noticeable development was observed during COVID-19 when a product was developed for PCR by Cepheid company, which could do RT-PCR in about 45 min using the Xpert Xpress SARS-CoV-2 test (Manmana et al., 2021). To further analyze the current state of development of POC technology, we can look at the current wearable POC devices. Lee et al. (2020) developed the wearable lab-on-a-patch (LOP) platform for an impedimetric biosensor for hormone cortisol determination in sweat. This device consisted of two essential parts: microfluidic devices and stretchable impedimetric biosensors. The microfluidic part was designed and fabricated with polydimethylsiloxane (PDMS) in four chambers to collect the sweat sample, store the reagent, mix the sample, and dispose of the waste. The mixing chamber was connected with the Au nanostructure-modified electrode to give the electrochemical signal at the pM level. Polyvinyl alcohol (PVA) and chitosan (CS) were used (He et al., 2020). The PVA/CS hydrogel retrieved skin interstitial fluid (ISF) from fake and rabbit skin to detect glucose. Additionally, it enabled colorimetric monitoring of the glucose content and demonstrated the ability to extract the biomarker from the ISF with less impact on the skin. A commercial glucose meter and the colorimetric results had an excellent correlation. Despite the development of numerous wearable POC equipment, these gadgets can only detect tiny biomolecules. Many new technologies in sampling techniques, sample handling, signal processing, power supply, and others need to be researched to detect more complex molecules.

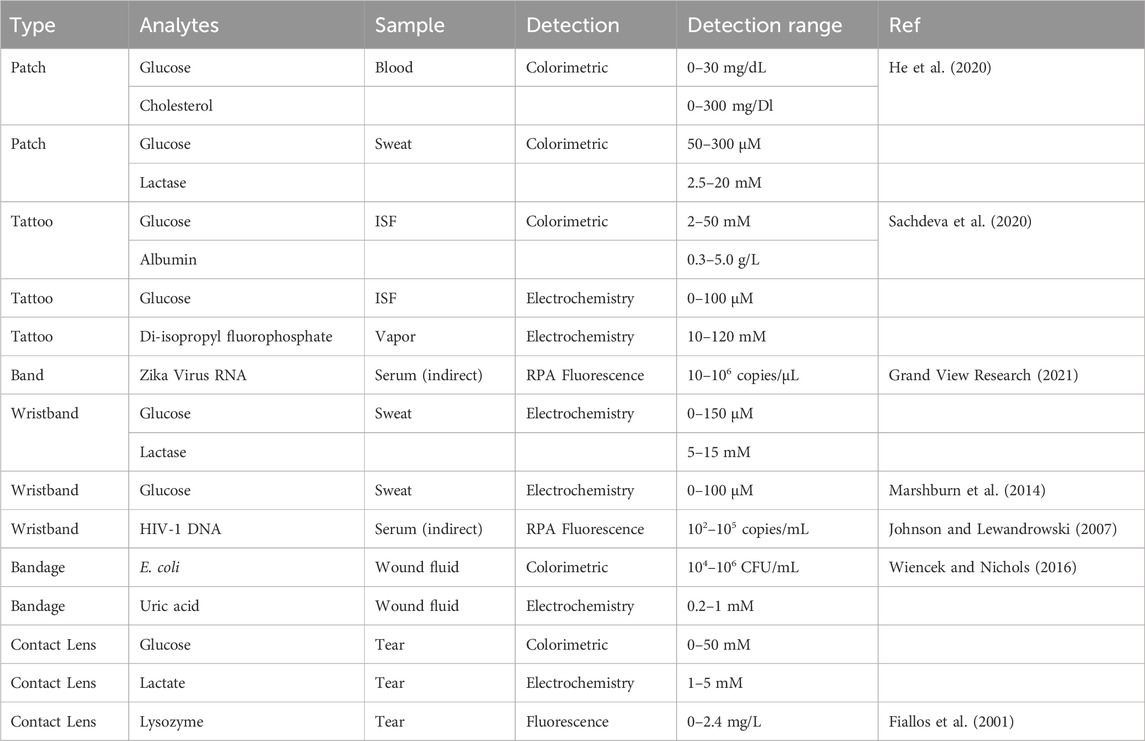

Table 2 shows some of the wearable POCT types of equipment and their detection ranges to provide an idea about the current state of POC development. As the point-of-care industry continues to grow, a pattern of demand can be used to understand which testing methods need to be improved further and which new tests can be done using POCs. This has to consider the feasibility of the test by considering factors such as the accuracy of the test, the price of the test, and most importantly, the financial revenue that can be generated through these new tests. The resources need to be allocated correctly to producing tests with high demands and high accuracy, which can also generate good financial revenue for the companies to continue producing more POCTs.

Table 2. Overview of wearable POC devices. Reproduced with permission from (Manmana et al., 2021).

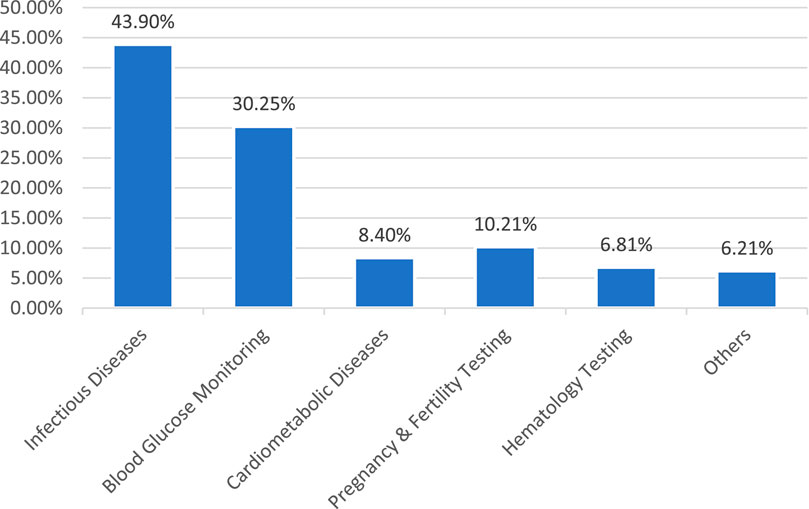

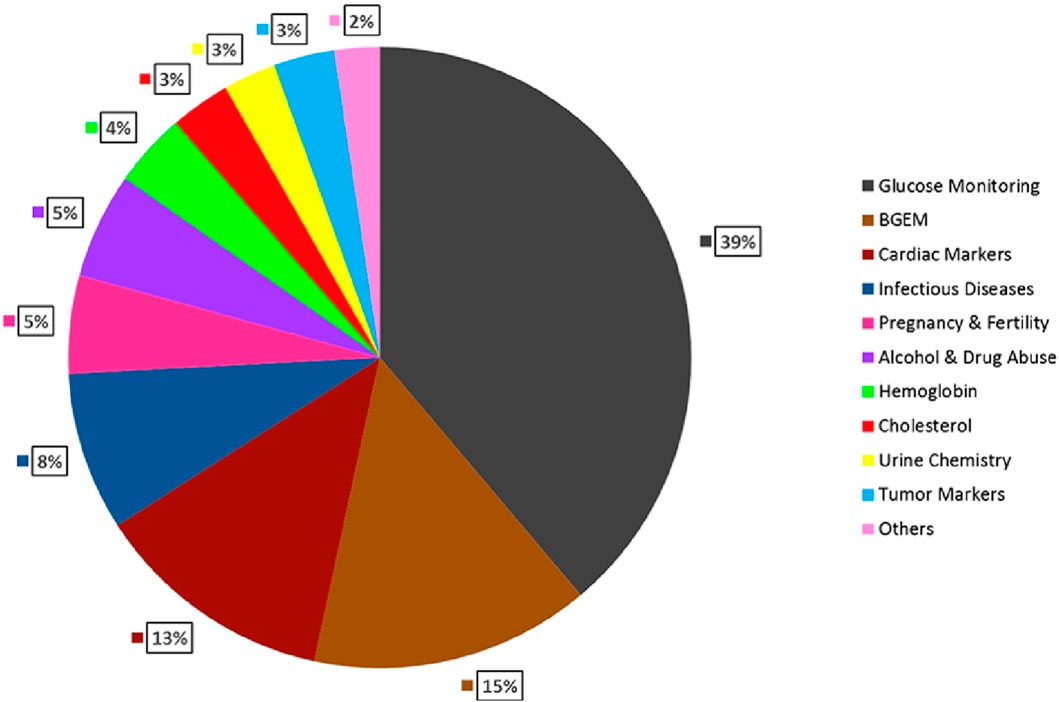

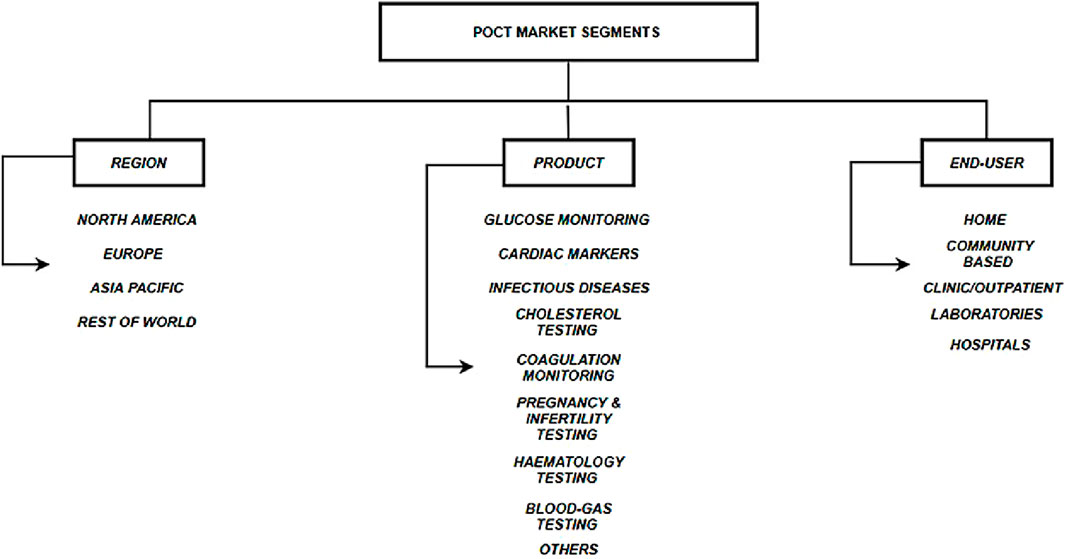

A detailed analysis of this was conducted at the School of Medicine at Stanford University by Sachdeva et al., 2020. The authors concluded that the global POCT market has three segments, as shown in Figure 2. They are the regional segment, the type of product in demand, such as glucose monitoring, cardiac markers, etc., and the end-users. They further analyzed the global anticipated revenue generation by different POCT products by the end of 2022. This can give an idea about which POCTs are predominantly generating more revenue than others and should be focused on first to check if further modifications can be made to generate revenue. This has been laid out in Figure 3.

Figure 2. (A) Tattoo gun for the injection of the colorimetric tattoo-based sensor for monitoring metabolites. (B) The smart headband and smart wristband for monitoring metabolites during stationary cycling. (C) paper-based smart bandages (OPSBs) designed to monitor the status of open chronic wounds and to detect the formation of pressure ulcers. Reproduced with permission from (Manmana et al., 2021).

Figure 3. Global anticipated revenue generation by product type in 2022 (Sachdeva et al., 2020).

Glucose Monitoring is expected to have the largest market share (39%), followed by Blood Gas Electrolyte and Metabolite (BGEM) (15%), Cardiac markers (13%), Infectious Diseases (8%), Pregnancy and fertility testing (5%), Alcohol & Drug Abuse (5%), Haemoglobin testing (4%), Cholesterol testing (3%), Urine chemistry (3%), Tumour markers (3%), Others (2%) (Sachdeva et al., 2020) Figure 4. A detailed discussion will be later conducted in this paper to deduce which POCT tests should be focused on for improvements and to have a more financially progressive industry. Still, from this figure, a small conclusion can be suggested that the first focus should be given to existing dominating POCT tests to look for improvements. If the improvements appear to be negatively proportionate to the increase in profits. In that case, the chart can be used to analyse the room for improvements to increase the financial stability of the market and used as a model to anticipate how any new POCT tests developed will be received.

Figure 4. POCT market segment (Sachdeva et al., 2020).

In addition to the above, it is crucial to acknowledge the key players in the Point of Care Technology (POCT) market. Some of the notable market players include Johnson & Johnson Services, Inc. (U.S.), Abbott (U.S.), Techno MedicaCo., Ltd. (Japan), Siemens AG (Germany), Alere Inc. (U.S.), F. Hoffmann-La Roche Ltd. (Switzerland), Instrumentation Laboratory (U.S.), Nova Biomedical (U.S.), PTS Diagnostics (U.S.), Beckman Coulter, Inc. (U.S.), Quidel Corporation (U.S), BD (U.S.), and Meridian Bioscience, Inc. (U.S). These companies have significantly contributed to the growth and development of the POCT market (Advance Market Analytics, 2021).

To further understand the regional market segments and their predicted growth, we can have a look at the regional market shares. According to a report from Grand View Research (Grand View Research, 2021), North America presented itself as a frontrunner in the POCT industry, with a market share of 43.2% in 2022. The numbers are forecasted to increase in the next decade, with North America still having a stronghold in the market revenue. A huge reason is the surge in COVID-19 cases and the notable presence of key market players in the United States and Canada.

However, as Figure 5 (Grand View Research, 2021) suggests, the Asian market is growing exponentially and has emerged as the fastest-growing region in the POCT industry. The Compound Annual Growth Rate (CAGR) being 8.1% from 2023 to 2030 makes the Asian-Pacific region one of the most lucrative markets for new startups and players. The huge growth is driven by an increasing pool of diagnostic kit and reagent suppliers in the region that provide numerous testing solutions, including testing kits for diseases like coronavirus.

Figure 5. Point of care diagnostics market trends by region (Grand View Research, 2021).

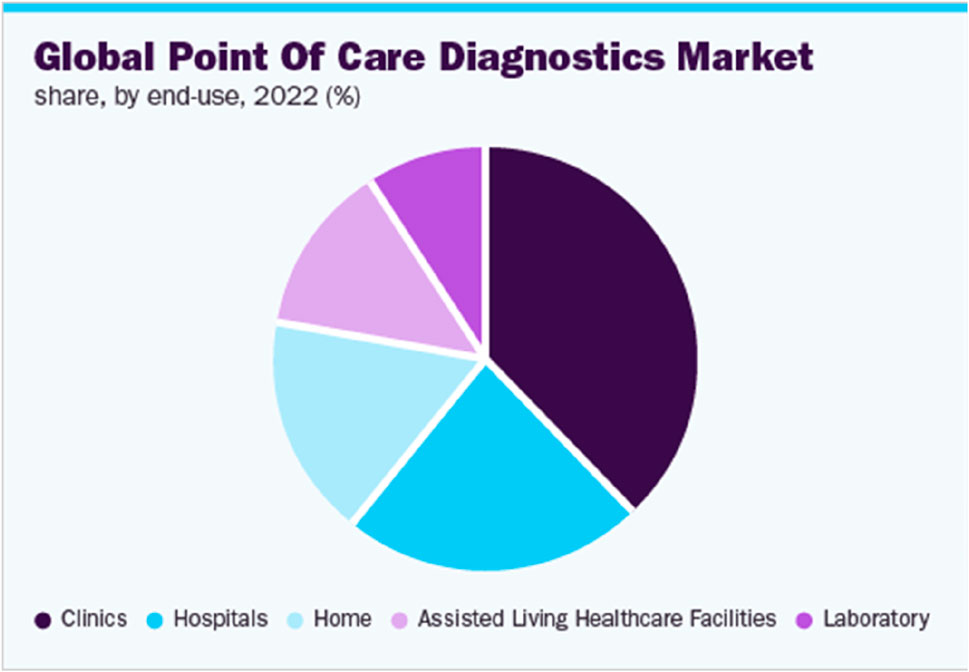

Figure 6 (Grand View Research, 2021) helps us further understand the end-user market segments in the Global point-of-care technology industry. As evident from the report (Grand View Research, 2021), clinics had the largest share, i.e., 37.91% in a $40 Billion industry in 2022. This is in-line with the initial need for POCT diagnostics requirements as this allows less-developed areas to provide efficient and cost-effective healthcare screening tools that give enough time for doctors to treat critically ill patients and take the pressure away from Hospitals and their laboratories. While hospitals also have a huge part of this market, Figure 6 accurately represents the current contribution of the POCT industry in growing access to novel diagnostic technologies, improving healthcare coverage, and affordability, which are the key factors that are expanding the applications of POC diagnostics.

Figure 6. Global Point-of-Care Diagnostic Market share by end-use (Grand View Research, 2021).

A SWOT analysis of the POCT market trend further justifies the facts presented in the manuscript. The strengths of the POCT market include the ability to provide rapid and reliable results and a wide range of applications in various settings. However, the market faces weaknesses such as the high cost of product development and stringent regulatory frameworks. Opportunities for the market lie in the continuous evolution of technology and the increasing prevalence of acute and chronic diseases. Threats to the market include intense competition from key players and a heavy reliance on technological advancements.

This critical evaluation aligns with the facts presented and provides a comprehensive understanding of the current market trends in POCT. It highlights the areas where improvements can be made and the potential challenges that need to be addressed for the continued growth and development of the POCT market. This information is crucial for stakeholders in the POCT industry to make informed decisions and strategies.

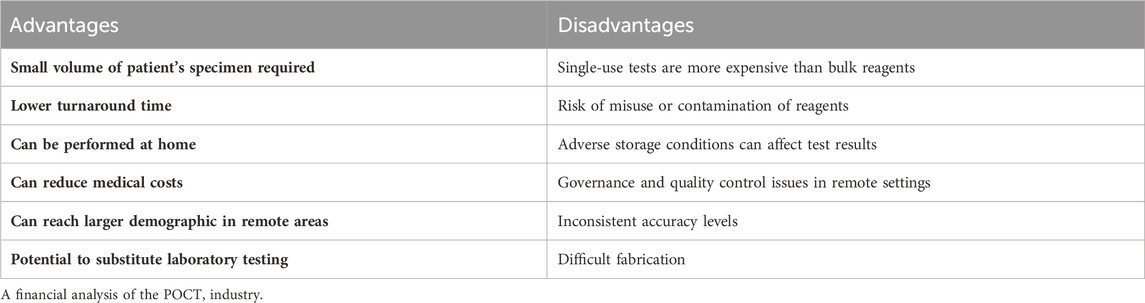

Advantages and disadvantages of POCT testing

Point-of-care testing is now performed in a variety of patient-care settings such as emergency departments, acute and critical care hospital units, disaster areas, physician offices, and even at homes (Marshburn et al., 2014; Johnson and Lewandrowski, 2007). When compared to central testing, POCT has several benefits. These devices only require a small volume of the patient’s specimen, which is advantageous for newborns, babies, patients with blood loss, and those with difficult blood draws. Furthermore, as the test can be performed on-site, the results can be obtained immediately with a lower turnaround time and sometimes, even without the need for a skilled clinician at the site of testing (Wiencek and Nichols, 2016). Several POCTs can be performed at home, and the test kits come with well-explained instruction manuals that the users can follow to conduct the tests correctly and obtain immediate results. This can help reduce the medical costs associated with diagnosis, making medical healthcare more affordable for the general demographic.

However, several challenges are presented as the POCT industry continues to grow. POCT reagents, in contrast to the central laboratory, are produced as single-use tests rather than in bulk. Comparing the price of testing with reagents used in central laboratories in high volume, unit-use test formats are more expensive (Wiencek and Nichols, 2016). Furthermore, the introduction of POCTs has resulted in more of the tests being conducted at home by non-medical users or performed in clinical settings by clinical staff with limited laboratory training and experience in conducting POCT tests correctly. They may not always be able to account for the pre-analytical, analytical, and post-analytical variables that can affect a POCT result (Wiencek and Nichols, 2016). The central laboratory staff is trained for specimen analysis, quality control, and instrument maintenance to produce quality test results (Fiallos et al., 2001; Nichols and Poe, 1999). However, in-home settings where the consumer may have no experience in POCT testing or in a nursing unit, where the clinical staff’s attention is divided between patient care and POCT testing, the POCT may receive less attention during conduction. This can result in other dependent variables affecting the specimen and the results and producing false positive or negative results (Fiallos et al., 2001; Nichols and Poe, 1999). Some POCTs require users to mix specific specimen samples with certain reagents. It is ubiquitous for misusing the reagents or contaminating unwanted particles, which can produce false results. This is made worse in a hospital or clinical setting where the air may contain several contaminants or germs that can contact the reagents and produce false results.

POCT kits are made portable. This raises another issue: exposing their reagents and testing devices to adverse storage conditions (Bamberg et al., 2005). In addition, the testing devices may be affected by light, humidity, and temperature. Exposure to high temperatures may denature enzymes present, resulting in the test producing false results. Furthermore, POCT devices such as those of glucose monitoring come with a glucose meter, an electronic device that should be protected from moisture and handled with care.

Point-of-care testing allows patients to be tested and diagnosed in remote settings by setting up POCT testing centers in remote areas (Shephard et al., 2020). However, this also raises limitations discussed in a study by Shephard et al. (2020). The paper summarized some of the issues as listed in Table 3.

Table 3. Limitations and barriers to Point-of-care testing (Shephard et al., 2020).

The paper suggested that reaching POCT devices in certain remote settings is challenging, and governance and quality control assurance are tricky in such regions. This is made worse by staff turnover, as most of the staff in remote settings are on short-term contracts (Shephard et al., 2020). Furthermore, supplying POCT devices to remote areas is also a very challenging task due to the lack of connectivity between the remote regions and industrial or urban areas with abundant supplies of POCTs. The microfluidics industry can, however, reach a larger demographic in remote areas, which usually must travel long distances to come to a hospital setting for disease diagnosis. The diagnosis expenses, compiled with the added expense of travel, make the diagnosis process an expensive one that the microfluidics industry can target. The price of the POCTs will be perceived as much lower than a hospital setting for these remote areas. If considered from a financial standpoint, the microfluidics industry’s ability to disperse to remote areas can bring greater financial benefits for both the industry itself as well as the demographic living in remote areas. This can be a source of expansion for the industry.

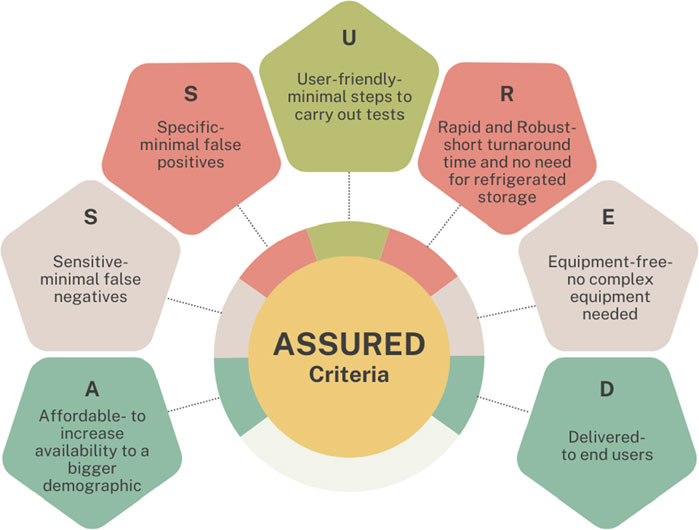

One of the major issues with POCTs is the arousal of false results during testing. To analyze this, we will look at a recent study by Fujita-Rohwerder et al., 2022, which investigated the diagnostic accuracy of rapid POCT to diagnose the current SARS-CoV-2 infections in children. They analyzed 17 studies with a total of 6355 pediatric study participants. All the studies compared antigen tests against RT-PCR. Evaluating their data can give us an idea of the sensitivity and specificity of POCTs. In total, eight antigen tests were investigated from six different brands. The pooled overall diagnostic sensitivity and specificity in paediatric populations, along with confidence intervals (CI) of 64.2% (95% CI- 57.4%–70.5%) and 99.1% (95% CI- 98.2%–99.5%), respectively. In symptomatic children, the pooled diagnostic sensitivity was 71.8% (95% CI- 63.6%–78.8%), and the pooled diagnostic specificity was 98.7% (95% CI- 96.6%–99.5%). The pooled diagnostic sensitivity in asymptomatic children was 56.2% (95% CI- 47.6%–64.4%), and the pooled diagnostic specificity was 98.6% (95% CI- 97.3%–99.3%) (Fujita-Rohwerder et al., 2022). These data are listed in Table 4.

Antigen test sensitivity estimates varied greatly between studies and were significantly lower than what manufacturers claimed. One should be aware that the majority of tests are only meant to be used on symptomatic people. As a result, performance information provided by manufacturers typically only applies to symptomatic people. For specificity estimates across studies, there was less variation and only slight deviations from performance claims made by manufacturers. No test included in this review fully complied with the minimum performance standards advised by the WHO (W. H. Emergency Prepardness, 2020) (minimum sensitivity 80% and minimum specificity 97%), the US FDA10 (Government of the US, 2020) (minimum sensitivity 80%, while a lower bound of the two-sided 95% CI above 70% is required for over-the-counter use self-tests), or the Medicines and Healthcare products Regulatory Agency (MHRA) in the UK (GOV.UK, 2023) (minimum acceptable sensitivity ≥80% with two-sided 95% CI entirely above 70% and minimum acceptable specificity of 95% with two-sided 95%CI entirely above 90%). The paper further discussed a recent laboratory study that assessed the sensitivity of 122 of these antigen tests using typical SARS-CoV-2 specimens with varying viral concentrations and found poor performance (Scheiblauer et al., 2021). A wide range of sensitivities was seen even in such ideal circumstances. At the same time, 26 tests failed to meet the study’s sensitivity standard of 75% for specimens with high SARS-CoV-2 concentrations of approximately 106 SARS-CoV-2 RNA/ml and higher, which corresponds to a CI value less than 25.

This analysis goes on to show the accuracy levels of the POCTs. The COVID-19 pandemic has resulted in an urgent need for testing kits, which tested the response of the microfluidics industry. This is a good area to be studied to analyse the response of the microfluidics industry during disease growth curves and their ability to generate new tests fast enough to have a high level of specificity and sensitivity to counter its laboratory testing competition. The study showed that none of the tests met the performance standards required to be reached, which points out another area of improvement that can be further researched and worked. Some room for error can be given in this case, considering the mutative nature of the novel coronavirus, but this gives us a possible improvement that can be brought about, which would be able to increase the accuracy levels of POCTs, especially for highly contagious diseases, which can help reduce the infection spread. This case study shows that there may also be other POCTs that may have similar inconsistent accuracies, which can be researched for potential improvements. Increasing the detection accuracy may allow a POCT to completely substitute its laboratory alternative and become the main form of testing for that infection, which will be beneficial for both the industry and consumers.

In addition to that, fabricating Point-of-Care Testing (POCT) devices presents its own set of challenges. These include:

Miniaturization: The need for portability in POCT devices necessitates miniaturization, which can be technically challenging. It involves the integration of various components such as sensors, pumps, and channels into a compact device. Material Selection: The materials used in the fabrication of POCT devices should be biocompatible, durable, and suitable for mass production. The selection of appropriate materials is crucial for the device’s performance and safety. Quality Control: Ensuring the consistency and reliability of POCT devices during mass production can be difficult. Each device must perform accurately and precisely, which requires stringent quality control measures. Regulatory Compliance: POCT devices are medical devices and therefore must comply with regulatory standards. Navigating these regulations and obtaining approval can be a complex and time-consuming process. Cost: The development and production costs of POCT devices can be high, especially when considering the need for miniaturization and the use of specialized materials.

To better summarise the pros and cons of POCT testing, the following table can be used to understand the current scope of positives and negatives in the industry (Table 5).

Before we can start discussing the improvements that can be made to the point-of-care industry and its products to yield maximum profits, we should first analyse the financial state of the market and its anticipated growth. For a technology to advance, it is necessary to analyse the market and consider the financial situation. Advancements without the consideration of the market demand will result in the making of devices that are not well sold and incur losses to the industry, which can hinder its ability to continue further industrial advancements. It is also worthwhile to investigate whether researching to improve existing tests is more beneficial than making new ones. The optimum way for the industry to grow will be to take steps favoured from both a financial and a technological standpoint. That is the main target of this section of the paper.

To get a broader idea of the current state of the POCT industry, we will look at the net values as well as the revenues generated by the industry over the course of several years. We will analyse reports from several published papers to obtain a summarized industry report over the years. John and price (St John and Price, 2014) estimated that the in-vitro diagnostics (IVD) market was worth around US $51 billion in 2011, of which approximately US $15 billion was POCT. They had projected a compound annual growth of 4% to reach US $18 billion by 2016. In 2011, the POCT market comprised 55% US, 30% Europe, and 12% Asia (Rajan and Glorikian, 2008). During that time, Yang et al., 2019 estimated that glucose testing was the largest sector of sales for POCT, followed by pregnancy tests and critical care testing. It is worth mentioning the growth of molecular testing concerning the increase in infectious disease POCT. The total molecular diagnostic market, according to John & Price (St John and Price, 2014), was estimated to be around US $4 billion in 2011 and was estimated to grow to around US $7 billion by 2016 with an approximate increase of 18% in terms of growth rates in infectious disease testing.

We were not able to find a complete report to follow up on the research conducted in the aforementioned paper by John and Price (St John and Price, 2014), but a point-of-care global market analysis conducted by Report Buyer in 2017 (Point-of-care Diagnostics Market, 2017) showed the noticeable expansion of the POCT industry into several newer areas as compared to 2011. The article clearly showed that the past years brought along definite segmentation and formatting in the industry. The POCT products were divided by product type, such as lateral flow assay tests, flow-through tests, solid phase assay tests, and agglutination assay tests. More importantly, the POCT industry had spread to entire North America (as opposed to only the big cities during 2011), as well as into Latin America. POCT was used extensively in Asia and highly populated countries such as China. Furthermore, the tests were being used in the Middle East, Australia, and Africa, regions that were previously not using the technology (Point-of-care Diagnostics Market, 2017). Despite the absence of figures and statistics, this spread of technology is proof of the expansion and growth of the industry by 2016.

We inspected further for data regarding the revenue of the point-of-care industry for consecutive years. A survey carried out by Mikulic (Mikulic, 2021) estimated the POCT industry to have generated more than 13.87 billion dollars in revenue, which would escalate the net value of the industry.

To get a better view of the whole industry, we can look at the more recent state of the industry as of the past few years. In recent years, we evaluated several reports to get an overall idea of the whole market. The values had variations from one to another, but all the values agreed within an acceptable range. Furthermore, we will also look at the market revenues of diagnostic companies, as these can be used as models to analyse the growth of the whole market. The year 2020 proved to be a financial boom as well as a big challenge for the POCT industry. The COVID-19 pandemic resulted in a massive surge in point-of-care testing devices due to the virus’s highly contagious nature, discouraging human contact and hospital visits for diagnosis (Point of Care Diagnostics Market Size & Share Report, 2023). Several diagnostic companies announced the plan to launch SARS-CoV-2 and Flu A/B Rapid Antigen Tests for professional use in markets (Point of Care Diagnostics Market Size & Share Report, 2023). Major medical firms such as F. Hoffmann-La Roche Ltd, Thermo Fisher Scientific Inc., and Quidel Corporation had drastic growths in the POCT sector in the year 2020 (Point of Care Diagnostics Market Size & Share Report, 2023). If we look at the annual report of F. Hoffmann for the year 2020, we find that the diagnostic division held 23.0% of the company’s total revenue, increasing by 6.3% from 2019. The surge of demand for POCT devices was well carried into 2021. In 2021, the same company generated a revenue of 68 million dollars, increasing by 7.7% from the prior year, the main surge still caused by the Covid tests. The report (Point of Care Diagnostics Market Research and Global Size 2030, 2023) claimed that the global POCT diagnostic market size was valued at USD 33.12 billion in 2021. Another report claimed the POCT market surpassed USD 37.1 billion in 2021 (BioSpace, 2023). A third report suggested the market size was USD 34.6 billion in 2021 (Point of Care Testing Market Share Forecasts, 2022-2030, 2023). Although there are variations between the values, the proximity of the values provides a range between which the most recent valuation of the POCT industry may lie. As 2021 fell under the COVID-19 pandemic, the major industry sales came from infectious disease tests, as shown in Figure 7.

As of 2022, there have been several estimations of this year’s (2022) POCT valuation by the year’s end and an extrapolation of the industry’s future. The global point-of-care market is expected to reach USD 43.2 billion in 2022 (GlobeNewswire, 2023), while there have been multiple estimations of the market’s future value after 5–6 years. From reports, we could estimate that the POCT industry is likely to reach around 72.0 billion USD by 2027 at a 10.8% compound annual growth rate (CAGR) (Business Wire, 2023). By 2028, the industry is estimated to grow to USD 81.37 billion (Fortune Business Insights, 2023). Furthermore, SMR (Point of Care Diagnostics Market Research and Global Size 2030, 2023) estimated that at this rate, the POCT market is estimated to reach an approximate value of USD 90.25 billion by 2030, although the CAGR they used to be a little higher than the former CAGR by 0.98%.

So far, the above data has shown a steady improvement in the point-of-care industry. However, it was easily noticed during the COVID-19 pandemic that the industry failed to supply the rapid demand for COVID-19 test kits during the 2020 pandemic, and there was a severe shortage of kits for testing. Hence, further study into how the industry can be better structured to operate effectively in the face of demand surges is essential for the structured growth and commercialization of future POC products. We will discuss these topics and speculate on what could be done, but future research on this would be beneficial for the industry.

Potential future improvement for POCT products and industry

The current trend in the POCT industry is very positive, and with the adoption of machine learning and other technologies into the POCT industry, it is likely to grow exponentially in the upcoming years. Artificial Intelligence (AI) and Machine Learning (ML) are transforming various sectors, and the Point-of-Care Testing (POCT) industry is no exception. The integration of AI/ML in POCT can lead to significant advancements in healthcare, particularly in diagnostics. AI/ML can enhance the accuracy and efficiency of POCT devices. For instance, AI algorithms can be used to analyse complex biological data and detect patterns that might be missed by human analysis (Khan et al., 2023). This can lead to more accurate diagnosis and treatment decisions. Furthermore, ML algorithms can learn from each interaction, improving their performance over time (Khan et al., 2023). AI/ML can also contribute to the development of predictive models in healthcare. These models can predict disease progression or patient outcomes based on a variety of factors, enabling early intervention and personalized treatment plans (Khan et al., 2023). Moreover, AI/ML can facilitate the integration of POCT devices with other healthcare technologies. For example, POCT devices can be connected to Electronic Health Records (EHRs) systems, allowing for real-time updating and sharing of patient data. AI can be used to analyse this data and provide insights to healthcare providers, leading to improved patient care (Wang and Kricka, 2018). Recent examples of the use of AI in POCT include AI-powered ultrasound devices used in emergency rooms. These devices, aided by AI, enable doctors to diagnose medical issues accurately and timely (POCUS, 2019). However, the integration of AI/ML in POCT also presents challenges. Data privacy and security are major concerns, as sensitive patient data is being processed and shared. Ensuring the accuracy and reliability of AI/ML algorithms is also crucial, as errors can have serious consequences in a healthcare setting (Khan et al., 2023). Despite these challenges, the potential benefits of integrating AI/ML in POCT are immense. With continued research and development, AI/ML can revolutionize the POCT industry, leading to improved healthcare outcomes and efficiency (Khan et al., 2023). Please note that while AI/ML holds great promise for the future of POCT, it’s important to approach this topic with careful consideration of ethical implications, including data privacy and the potential for algorithmic bias. As with any technology, the benefits must be weighed against potential risks and challenges (Khan et al., 2023).

Over the past years, several different technologies have been incorporated into the POCT spectrum, which can have a revolutionary influence on the future of the POCT industry. The current POCT trend strongly Favor smart devices equipped with mobile healthcare (Vashist, 2017). This has the potential to allow the POCT industry to expand dramatically into collaboration with many other industries and open ways to generate revenue from numerous sources. This would be beneficial for both the POCT industry as well as could revolutionize personalized healthcare monitoring and management for individuals. A wide range of mobile healthcare technologies have already been developed, the most promising being cell phone-based POCT technologies for the readout of colorimetric, fluorescent, chemiluminescent, electrochemical, lateral flow, and label-free assays; detection of cells, biomolecules, nanoparticles, and microorganisms; and other diagnostic applications (Vashist S. K. et al., 2014; Vashist S. et al., 2014). There are a total of around 7.4 billion cell phone users, and 70% of them are in developing countries, which are areas in dire need of advanced and more accessible POCTs (Vashist and Luong, 2016). Several cell phone-based devices and smart applications have been commercialized to monitor and manage health parameters such as blood glucose, pressure, weight, physical activity, and so on (Vashist and Luong, 2016). However, several issues are associated with these users, with data privacy and the accuracy of the devices being the most prominent. Future research and development in the POCT industry can work towards increasing the sensitivity and specificity of these devices. Suppose these POCT technologies can be made to possess sensitivity and specificity in an acceptable range. In that case, the technology can be sold to major runners in the smart technologies industry for higher prices. This will not only benefit the industry but also the broad deployment of POCT devices into mobile technology, which would make point-of-care testing much more widely accessible to a much larger demographic. This would mean that POCT testing would be available in people’s hands everywhere, and not only would this rapidly escalate the demand for the technology and nudge more technology developers to purchase the technologies, but it would also help eliminate some of the POCT demand shortage problems that come with sudden demand hikes. If several of the current most common tests, such as blood pressure tests, pulse rates, body analysis, etc., can be done by technologies installed into smart devices, this would also open up manpower that can be implemented into furnishing other POCT tests which have not yet met with the acceptable specificity levels, as well as work on more effective ways to deal with demand hikes and make cheaper and more efficient POCT devices.

To follow up on the discussion above, we looked further into potential technologies, and we traced that the implementation of new-age biosensing platforms coupled with smartphone-based technology guarantees increased sensitivity, high specificity, and a lower limit of target analyte detection, and it can find application in the development of commercialized POCT devices for wide-scale clinical utility. Biosensing is the measurement of biological or chemical reactions by generating signals proportional to the concentration of an analyte in the reaction (Bhalla et al., 2016). This is a potential path that can be adapted further for future developments (Roy et al., 2022).

A different area where further research and development can be made would be in the field of non-communicable diseases. A large number of global deaths occur from non-communicable diseases such as cardiovascular diseases, cancer, chronic respiratory illness, and diabetes. As these diseases progress, continuous monitoring becomes crucial to comprehend the treatment modality. Monitoring and analysis using conventional analytical techniques become very troublesome in these conditions, and POCT devices can become extremely advantageous under these circumstances. However, the sensitivity of POCT devices becomes a concern as the conventional tests possess a much higher accuracy level which is momentous for making critical medical decisions. Specificity and sensitivity above 90% are essential to eliminate false positives and negatives (Roy et al., 2022). Furthermore, the inadequate sensitivity of most of the assays used for the detection of cancer biomarkers limits their accuracy and reliability (Dixit et al., 2016). Increasing the sensitivity of these POC devices would bring in a new stream of revenue and would also allow for faster, life-saving decision-making opportunities in a clinical setting where the time saved through these tests could be hugely advantageous. As discussed earlier, biosensors are a promising technology that can be used to construct rapid, portable, convenient, and effective biomedical devices. This is also an aspect that can be further worked on for future advancements.

So far, we have discussed the POC devices and the industry in general and looked at the industry from a financial perspective. We had mentioned previously that the industry must invest intelligence into tests that are in high demand and look for potential improvements that would increase the usage of these tests. The industry must invest in the workforce only in tests and technologies where enhancements can be made within the financial feasibility range. What we mean by financial feasibility range is that enhancements to an existing and working test should only be made if the improvement will significantly increase the usage and accessibility of the test or if it would decrease the price of the test and hence increase demand. If the changes only derive a slight change in sales and demand, the improvement may be deemed redundant, and the intelligence can instead be invested into making newer tests or enhancing other tests where there is significant room for improvement.

We have discussed some emerging POCT fields where further research can be performed to make ground-breaking inventions. These are some of the areas where advancements are possible and would have good financial feasibility for both the industry and the customers. Many other new technologies can still be implemented into the POCT industry, which is another potential field for future research.

Conclusion

In conclusion, the findings underscore the immense potential of the point-of-care testing (POCT) industry. The market trends and future estimates indicate a promising trajectory for the industry, driven by the unique advantages of POCT devices. Their portability, lightweight nature, simple testing processes, and lack of special storage requirements make them highly desirable in various healthcare settings.

However, the issue of false positives and negatives is a significant hurdle that needs to be addressed. This problem reduces the demand for POCT devices, as they compete with laboratory testing alternatives that are often perceived as more reliable. Therefore, enhancing the sensitivity and specificity of these devices is crucial. Additionally, reducing the cost of devices and the time required to receive test results can further increase their utility and demand.

The financial feasibility of these improvements is another critical aspect that was highlighted in the findings. Any enhancements to a particular POCT device should only be pursued if they are financially viable. This approach ensures the sustainability and continued growth of the industry.

The financial analysis of the POCT industry reveals a positive growth trend, indicating a bright future for the industry. To capitalize on this growth, the industry can focus on several potential areas of expansion. These include collaborating with smart technology industries to develop smart POCT technologies, producing more sensitive and accurate POCT devices for non-communicable diseases, and enhancing POCTs for diseases that require continuous monitoring.

The collaboration with smart technology industries can lead to the development of advanced POCT devices that are more user-friendly and efficient. This collaboration can also open new revenue streams for the industry, further boosting its growth.

The production of more sensitive and accurate POCT devices for non-communicable diseases is another promising area of expansion. Non-communicable diseases are a major global health concern, and effective monitoring and management of these diseases can significantly improve patient outcomes.

Lastly, enhancing POCTs for diseases that require continuous monitoring can revolutionize medical diagnosis and patient management. Conventional clinical testing can be cumbersome for such conditions, and improved POCTs can offer a more convenient and efficient alternative.

Author contributions

AK: Investigation, Methodology, Validation, Writing–review and editing. WH: Conceptualization, Data curation, Methodology, Writing–original draft. SH: Conceptualization, Funding acquisition, Project administration, Resources, Supervision, Writing–original draft, Writing–review and editing.

Funding

The author(s) declare that no financial support was received for the research, authorship, and/or publication of this article.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

Advance Market Analytics (2021) Point of care technology comprehensive study by type, testing types, invasive, multiplexing, continuous monitoring, end user, players and region - global market outlook to 2026. Advance Market Analytics.

Bamberg, R., Schulman, K., MacKenzie, M., Moore, J., and Olchesky, S. (2005). Effect of adverse storage conditions on performance of glucometer test strips. Clin. Lab. Sci. 18, 203–209.

Bhalla, N., Jolly, P., Formisano, N., and Estrela, P. (2016). Introduction to biosensors. Essays Biochem. 60 (1), 1–8. doi:10.1042/EBC20150001

BioSpace (2023). Point of care diagnostics market size, growth, trends | report 2022-2030 | BioSpace. Available at: https://www.biospace.com/article/point-of-care-diagnostics-market-size-growth-trends-report-2022-2030/?keywords=Roche+Canada (Accessed January 26, 2023).

Business Wire (2023) Global point of care & rapid diagnostics market analysis report 2022 - forecast to 2027 - ResearchAndMarkets.com | business Wire. Available at: https://www.businesswire.com/news/home/20220419006068/en/Global-Point-of-Care-Rapid-Diagnostics-Market-Analysis-Report-2022---Forecast-to-2027---ResearchAndMarkets.com (Accessed January 26, 2023).

Diathrive (2018) How do blood glucose meters work? Diathrive. Available at: https://diathrive.com/blog/post/how-do-blood-glucose-meters-work (Accessed January 26, 2023).

Dixit, C. K., Kadimisetty, K., Otieno, B. A., Tang, C., Malla, S., Krause, C. E., et al. (2016). Electrochemistry-based approaches to low cost, high sensitivity, automated, multiplexed protein immunoassays for cancer diagnostics. Analyst 141 (2), 536–547. doi:10.1039/C5AN01829C

Fiallos, M. R., Hanhan, U. A., and Orlowski, J. P. (2001). Point-of-care testing. Pediatr. Clin. N. Am. 48 (3), 589–600. doi:10.1016/S0031-3955(05)70329-1

Fortune Business Insights (2023) POC diagnostics market worth USD 81.37 billion at 9.4% by. Available at: https://www.globenewswire.com/en/news-release/2021/09/16/2298111/0/en/POC-Diagnostics-Market-worth-USD-81-37-Billion-at-9-4-by-2028-Backed-by-Increasing-Investment-in-Development-of-POC-Kits-in-Europe-reports-Fortune-Business-Insights.html (Accessed April 06, 2023).

Fujita-Rohwerder, N., Beckmann, L., Zens, Y., and Verma, A. (2022). Diagnostic accuracy of rapid point-of-care tests for diagnosis of current SARS-CoV-2 infections in children: a systematic review and meta-analysis. BMJ Evidence-Based Med. 27 (5), 274–287. doi:10.1136/BMJEBM-2021-111828

GlobeNewswire (2023) The global point of care diagnostics market is expected to reach USD 72.0 billion by 2027 from an estimated USD 43.2 billion in 2022, at a CAGR of 10.8%. Available at: https://www.globenewswire.com/news-release/2022/03/15/2403168/0/en/The-global-point-of-care-diagnostics-market-is-expected-to-reach-USD-72-0-billion-by-2027-from-an-estimated-USD-43-2-billion-in-2022-at-a-CAGR-of-10-8.html (Accessed April 06, 2023).

Government of the US (2020) Antigen template for test developers. U.S. food and drug administration.

GOV.UK (2023) Target product profile: point of care SARS-CoV-2 detection tests - GOV.UK. Available at: https://www.gov.uk/government/publications/how-tests-and-testing-kits-for-coronavirus-covid-19-work/target-product-profile-point-of-care-sars-cov-2-detection-tests (Accessed January 26, 2023).

Grand View Research (2021) Point of care diagnostics market size, share & trends analysis report by product (infectious diseases, glucose testing, cardiac markers), by end-use (clinics, home, hospitals), by region, and segment Forecasts, 2023 - 2030.

He, R., Niu, Y., Li, Z., Li, A., Yang, H., Xu, F., et al. (2020). A hydrogel microneedle patch for point-of-care testing based on skin interstitial fluid. Adv. Healthc. Mater. 9 (4), 1901201. doi:10.1002/adhm.201901201

Hsieh, Y.-H., Gaydos, C. A., Hogan, M. T., Uy, O. M., Jackman, J., Jett-Goheen, M., et al. (2011). What qualities are most important to making a point of care test desirable for clinicians and others offering sexually transmitted infection testing? PLoS One 6 (4), e19263. doi:10.1371/journal.pone.0019263

Hsieh, Y.-H., Hogan, M. T., Barnes, M., Jett-Goheen, M., Huppert, J., Rompalo, A. M., et al. (2010). Perceptions of an ideal point-of-care test for sexually transmitted infections – a qualitative study of focus group discussions with medical providers. PLoS One 5 (11), e14144. doi:10.1371/journal.pone.0014144

Johnson, M. M., and Lewandrowski, K. B. (2007). Analysis of emergency department test ordering patterns in an urban academic medical center: can the point-of-care option in a satellite laboratory provide sufficient menu to permit full service testing. Point Care J. Near-Patient Test. Technol. 6 (2), 134–138. doi:10.1097/01.poc.0000271401.14936.40

Khan, A. I., Khan, M., and Khan, R. (2023). Artificial intelligence in point-of-care testing. Ann. Laboratory Med. 43, 401–407. doi:10.3343/alm.2023.43.5.401

Lee, H. B., Meeseepong, M., Trung, T. Q., Kim, B. Y., and Lee, N. E. (2020). A wearable lab-on-a-patch platform with stretchable nanostructured biosensor for non-invasive immunodetection of biomarker in sweat. Biosens. Bioelectron. 156, 112133. doi:10.1016/J.BIOS.2020.112133

Liu, X., Zhu, X., Kost, G. J., Liu, J., Huang, J., and Liu, X. (2019). The creation of point-of-careology. Point Care J. Near-Patient Test. Technol. 18 (3), 77–84. doi:10.1097/poc.0000000000000191

Manmana, Y., Kubo, T., and Otsuka, K. (2021). Recent developments of point-of-care (POC) testing platform for biomolecules. TrAC Trends Anal. Chem. 135, 116160. doi:10.1016/J.TRAC.2020.116160

Marshburn, T. H., Hadfield, C. A., Sargsyan, A. E., Garcia, K., Ebert, D., and Dulchavsky, S. A. (2014). New heights in ultrasound: first report of spinal ultrasound from the international space station. J. Emerg. Med. 46 (1), 61–70. doi:10.1016/J.JEMERMED.2013.08.001

Mikulic, M. (2021) Size of the global point of care testing market in 2017 and a forecast for 2026 (in billion U.S. dollars). Statista.

Nichols, J. H. (2020). Point-of-care testing. Contemp. Pract. Clin. Chem., 323–336. doi:10.1016/B978-0-12-815499-1.00019-3

Nichols, J. H., and Poe, S. S. (1999). Quality assurance, practical management, and outcomes of point-of-care testing: laboratory perspectives, Part I. Clin. Lab. Manage Rev. 13 (6), 341–350. Available at: https://pubmed.ncbi.nlm.nih.gov/10747660/(Accessed January 26, 2023).

Parihar, A., and Khan, R. (2023). Yttrium functionalized reduced graphene oxide nanocomposite-based aptasensor for ultrasensitive detection of a breast cancer biomarker. ACS Appl. Nano Mater. doi:10.1021/acsanm.3c03234

Parihar, A., Singhal, A., Kumar, N., Khan, R., Khan, M. A., and Srivastava, A. K. (2022). Next-generation intelligent MXene-based electrochemical aptasensors for point-of-care cancer diagnostics. Nano-Micro Lett. 14, 100. doi:10.1007/s40820-022-00845-1

Pickering, D., and Marsden, J. (2014). How to measure blood glucose. Community Eye Health 27 (87), 56–57. Available at: https://pubmed.ncbi.nlm.nih.gov/25918470.

Point-of-care Diagnostics Market (2017) Point-of-care diagnostics market - global industry analysis, size, share, growth, trends, and forecast 2016 – 2024. Report Buyer.

Point of Care Diagnostics Market Research, Global Size 2030 (2023). Point of care diagnostics market research, global size | 2030. Available at: https://www.strategicmarketresearch.com/market-report/point-of-care-diagnostics-market (Accessed January 26, 2023).

Point of Care Diagnostics Market Size and Share Report (2029) (2023) Point of care diagnostics market size & share report (2029). Available at: https://www.fortunebusinessinsights.com/industry-reports/point-of-care-diagnostics-market-101072 (Accessed April 06, 2023).

Point of Care Testing Market Share Forecasts 2022-2030 (2023) Point of care testing market share Forecasts 2022-2030. Available at: https://www.gminsights.com/industry-analysis/point-of-care-testing-market (Accessed January 26, 2023).

Rajan, A., and Glorikian, H. (2008). Point-of-care diagnostics: market trends and growth drivers. Expert Opin. Med. Diagnostics 3 (1), 1–4. doi:10.1517/17530050802651579

Roy, L., Buragohain, P., and Borse, V. (2022). Strategies for sensitivity enhancement of point-of-care devices. Biosens. Bioelectron. X 10, 100098. doi:10.1016/J.BIOSX.2021.100098

Sachdeva, S., Davis, R. W., and Saha, A. K. (2020). Microfluidic point-of-care testing: commercial landscape and future directions. Front. Bioeng. Biotechnol. 8, 602659. doi:10.3389/fbioe.2020.602659

Scheiblauer, H., Filomena, A., Nitsche, A., Puyskens, A., Corman, V. M., Drosten, C., et al. (2021). Comparative sensitivity evaluation for 122 CE-marked rapid diagnostic tests for SARS-CoV-2 antigen, Germany, September 2020 to April 2021. Eurosurveillance 26 (44), 2100441. doi:10.2807/1560-7917.es.2021.26.44.2100441

Shephard, M., Shephard, A., Matthews, S., and Andrewartha, K. (2020). The benefits and challenges of point-of-care testing in rural and remote primary care settings in Australia. Archives Pathology Laboratory Med. 144, 1372–1380. doi:10.5858/arpa.2020-0105-RA

St John, A., and Price, C. P. (2014). Existing and emerging technologies for point-of-care testing. Clin. Biochem. Rev. 35 (3), 155–167.

Testing (2021) Point-of-care testing. Testing.com. Available at: https://www.testing.com/articles/point-of-care-testing/(Accessed January 26, 2023).

Truvian (2023) Point-of-care testing vs. laboratory testing. Truvian. Available at: https://truvianhealth.com/blog/point-of-care-testing-vs-laboratory-testing/.

Vashist, S., Schneider, E., and Luong, J. (2014b). Commercial smartphone-based devices and smart applications for personalized healthcare monitoring and management. Diagn. (Basel) 4 (3), 104–128. doi:10.3390/DIAGNOSTICS4030104

Vashist, S. K. (2017). Point-of-Care diagnostics: recent advances and trends. Biosens. (Basel) 7 (4), 62. doi:10.3390/bios7040062

Vashist, S. K., and Luong, J. H. T. (2016). Trends in in vitro diagnostics and mobile healthcare. Biotechnol. Adv. 34 (3), 137–138. doi:10.1016/J.BIOTECHADV.2016.03.007

Vashist, S. K., Mudanyali, O., Schneider, E. M., Zengerle, R., and Ozcan, A. (2014a). Cellphone-based devices for bioanalytical sciences. Anal. Bioanal. Chem. 406 (14), 3263–3277. doi:10.1007/s00216-013-7473-1

Wang, P., and Kricka, L. J. (2018). Current and emerging trends in point-of-care technology and strategies for clinical validation and implementation. Clin. Chem. 64, 1439–1452. doi:10.1373/clinchem.2018.287052

W. H. Emergency Prepardness (2020) Antigen-detection in the diagnosis of SARS-CoV-2 infection using rapid immunoassays. World Health Organization.

Wiencek, J., and Nichols, J. (2016). Issues in the practical implementation of POCT: overcoming challenges. Expert Rev. Mol. Diagnostics 16 (4), 415–422. doi:10.1586/14737159.2016.1141678

Keywords: point of care (POC) diagnosis, medical technology (Med-Tech) innovations, healthcare, clinical diagnosis, device development

Citation: Khan AR, Hussain WL, Shum HC and Hassan SU (2024) Point-of-care testing: a critical analysis of the market and future trends. Front. Lab. Chip. Technol. 3:1394752. doi: 10.3389/frlct.2024.1394752

Received: 02 March 2024; Accepted: 05 April 2024;

Published: 13 May 2024.

Edited by:

Slawomir Jakiela, Warsaw University of Life Sciences, PolandReviewed by:

Arpana Parihar, Advanced Materials and Processes Research Institute (CSIR), IndiaTomasz R. Szymborski, Polish Academy of Sciences, Poland

Copyright © 2024 Khan, Hussain, Shum and Hassan. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Sammer Ul Hassan, c3VoYXNzYW5AaGt1Lmhr

Abdul Raffay Khan

Abdul Raffay Khan Wasif Latif Hussain

Wasif Latif Hussain Ho Cheung Shum1,3

Ho Cheung Shum1,3 Sammer Ul Hassan

Sammer Ul Hassan