- 1Department of Public Health Policy & Management, Global Center for Implementation Science, New York University School of Global Public Health, New York, NY, United States

- 2Department of Psychiatry, Altman Clinical and Translational Research Institute Dissemination and Implementation Science Center, University of California San Diego, La Jolla, CA, United States

- 3Department of Psychiatry and Behavioral Sciences, University of Washington School of Medicine, Seattle, WA, United States

Background: This study's aims are to: (1) Compare the acceptability and feasibility of five types of implementation strategies that could be deployed to increase the reach of evidence-based practices (EBPs) with revenue from policies that earmark taxes for behavioral health services, and (2) Illustrate how definitions of implementation strategies and measures of acceptability and feasibility can be used in policy-focused implementation science research.

Methods: Web-based surveys of public agency and community organization professionals involved with earmarked tax policy implementation were completed in 2022–2023 (N = 211, response rate = 24.9%). Respondents rated the acceptability and feasibility of five types of implementation strategies (dissemination, implementation process, integration, capacity-building, and scale-up). Aggregate acceptability and feasibility scores were calculated for each type of strategy (scoring range 4–20). Analyses of variance compared scores across strategies and between organizational actor types.

Findings: For acceptability, capacity-building strategies had the highest rating (M = 16.3, SD = 3.0), significantly higher than each of the four other strategies, p ≤ . 004), and scale-up strategies had the lowest rating (M = 15.6). For feasibility, dissemination strategies had the highest rating (M = 15.3, significantly higher than three of the other strategies, p ≤ .002) and scale-up strategies had the lowest rating (M = 14.4).

Conclusions: Capacity-building and dissemination strategies may be well-received and readily deployed by policy implementers to support EBPs implementation with revenue from taxes earmarked for behavioral health services. Adapting definitions of implementation strategies for policy-focused topics, and applying established measures of acceptability and feasibility to these strategies, demonstrates utility as an approach to advance research on policy-focused implementation strategies.

Introduction

Although public policy has historically been understudied in the contemporary field of implementation science in health (1, 2), it has received increased attention in recent years (3–15). Conceptual frameworks for policy-focused work in the field have been developed (16, 17) and reviews (18–20) have identified measures to characterize policy implementation processes and describe how policy functions as an outer-setting determinant of the delivery of clinical interventions. Despite these advances, research and scholarship on strategies to support policy implementation remains underdeveloped.

While several implementation strategies in the Expert Recommendations for Implementing Change (ERIC) compendium involve policies (e.g., “provide access to new funding,” “mandate change”) (21), these strategies emphasize the implementation of clinical evidence-based interventions—not the policy itself. Some qualitative work has used ERIC constructs to code strategies used to support policy implementation (22, 23), but the implementation science literature provides little guidance about how to generate evidence to inform decisions about the types of strategies perceived to be most relevant to a particular policy implementation context.

It is well-established that clinically-focused implementation strategies should be perceived as acceptable and feasible to the professionals who would use them (24–26). However, virtually no prior work has quantitatively assessed the acceptability or feasibility of strategies to support policy implementation. This Brief Research Report presents results of an exploratory study of the perceived acceptability and feasibility of potential strategies to support policy implementation. The Report also provides a methodological case example of how acceptability and feasibility can be assessed in a policy implementation study.

Policies that earmarked taxes for behavioral health services

The current study focuses on the implementation of state and local governmental policies that earmark tax revenue for behavioral health (i.e., mental health and substance use disorder) services in the United States (27). Detailed descriptions of these tax policies and the larger policy implementation study from which data are drawn are provided elsewhere (27–31). In short, an earmarked tax is one placed on a specific base (e.g., goods, property, income) for which revenue is dedicated to a specific purpose (32–34). As of 2022, a legal mapping study found that there were at least 207 policies in the United States that earmark tax revenue for behavioral health services and that the number of jurisdictions adopting these policies has increased drastically over the past two decades (30). These taxes generate a substantial amount of revenue, about $3.57 billion annually, and approximately 30% of the U.S. population lives in a jurisdiction with such a tax (30).

Through the creation of a new sustainable and dedicated source of funding, these earmarked tax policies have potential to enhance the reach (i.e., number of people served) of EBPs and the fidelity with which they are implemented (27–31, 35, 36). Professionals involved with earmarked tax policy implementation report many benefits to the financing approach (31), yet these taxes do not necessarily increase the reach of EBPs. For example, a survey of 155 professionals involved with earmarked tax policy implementation in California and Washington found that only about two-thirds strongly agreed that the tax policies increased the number of people served by behavioral health EBPs (31). Although supporting EBP implementation is just one possible goal of earmarked taxes, policy implementation strategies have potential to help achieve this goal. Assessing the acceptability and feasibility of implementation strategies in this policy context is a first step towards candidate strategies that could be deployed at scale, and evaluated in future research.

Study aims

To develop an evidence base related to implementation strategies for policies that earmark tax revenue for behavioral health, and to advance work on policy implementation strategies more broadly, the aims of this study are to:

1. Compare perceptions of the acceptability and feasibility of five types of strategies that could be deployed to support EBP implementation with revenue from policies that earmark taxes for behavioral health services; and

2. Illustrate how definitions of types of implementation strategies were adapted for survey questions focused on policy implementation and demonstrated how measures of acceptability and feasibility were used to assess perceptions of these strategies in a policy implementation context.

Method

Sample and data collection

The methods for the larger policy implementation study are detailed in the published study protocol (27). The study was approved by the MASKED Institutional Review Board (27). The data presented here come from web-based surveys of government and community organization professionals involved with oversight, decision making, and implementation policies which earmark taxes for behavioral health services. These professionals were in positions such as, but not limited to, tax coordinators, leaders of state and county behavioral health agencies, and members of county tax advisory boards. Jurisdictions with policies that earmarked taxes for behavioral health were identified through the aforementioned legal mapping study (30). The survey sample frame was created of professionals involved with earmarked tax policy implementation in seven states: California, Washington, Ohio, Illinois, Missouri, Colorado, and Kansas. The sample frame was created from contact databases maintained by practice partners (e.g., state and county behavioral health professional associations), internet searches, and databases of behavioral health officials compiled by the research team for prior studies (37–39).

Web-based surveys were e-mailed to professionals involved with earmarked tax policy implementation between September 2022 and May 2023. Up to eight personalized e-mails were sent with a unique survey link, and telephone follow-up was conducted. To capture the perspectives of professionals involved with earmarked tax policy implementation who were not included in the original sample frame, we also created an open (i.e., not unique) survey link that was circulated by our aforementioned practice partners. A $20 gift card for survey completion was offered. All four questions about the acceptability or feasibility of at least one implementation strategy (detailed below) were completed by 211 respondents. The response rate for the unique link surveys was 24.9%, consistent with recent state-wide surveys of behavioral health officials (37–39), and 81.1% of responses were from unique survey links (as opposed to the open survey link). The distribution of respondents across states was: California = 35.4%, Washington = 25.0%, Ohio = 21.7%, Illinois = 7.5%, Colorado = 5.2%, Missouri = 4.7%, Kansas = 0.5%. This distribution reflects the number of counties in each state involved with implementing an earmarked tax.

Measures

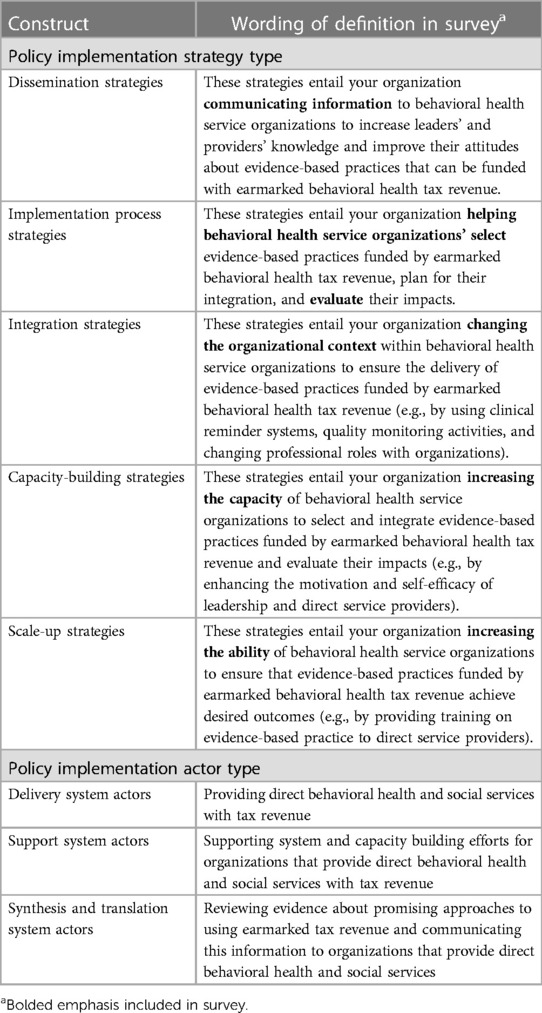

The survey questions and format are included as a Supplementary. In the survey, respondents were separately presented with adapted definitions of Leeman et al.'s five types of implementation strategies: dissemination, implementation process, integration, capacity-building, and scale-up (40). The Leeman et al.’ typology of strategies was derived from Powell et al.'s ERIC compendium (21). Definitions in the survey were adapted for the earmarked tax policy implementation context using Proctor et al.'s recommendations for specifying implementation strategies (41). The strategy actor, action, and action target (i.e., who or what was the intended target) were all anchored to the broad implementation outcome of earmarked tax policy revenue supporting the implementation of EBPs. Table 1 shows the definitions of each strategy and actor type that were provided in the survey.

Table 1. Definitions of leeman et al.'s of types of implementation strategies and actor types, adapted to focus on policies that earmark taxes for behavioral health services achieving the outcome of increasing the reach of evidence-based practices.

With the definition of each strategy separately displayed on a single web-based survey screen, respondents rated the acceptability and feasibility of each type of implementation strategy in terms of it being used by their organization to support the implementation of EBPs with earmarked tax revenue. Acceptability is defined as the perception a category of implementation strategy is agreeable, palatable, or satisfactory; whereas feasibility is defined as the extent to which a category of implementation strategy can be successfully used or carried out within a given agency or setting (25). These constructs were assessed using Weiner et al.'s measures of acceptability (four items, α = .85) and feasibility (four items, α = .89) (25). Reponses were summed to calculate aggregate acceptability and feasibility scores for each type of policy implementation strategy (possible scoring range 4–20 for each measure).

Next, respondents separately indicated all of the “actor types”—derived from Leeman et al.'s typology of organizations that can use implementation strategies—that accurately characterized all of their organization's role in earmarked tax policy implementation. Definitions of each of the actor types (i.e., delivery system actors, support system actors, synthesis and translation system actors) was provided, with wording adapted to be focused on their organization's role in earmarked tax policy implementation. Respondents were instructed to select all of the actor types that applied. The proportion of respondents endorsing each actor type was: delivery system actors 52.1%, support system actors 74.2%, and synthesis and translation system actors 40.7%.

Analysis

Cronbach's alpha was calculated for the acceptability and feasibility ratings of each policy implementation strategy. Descriptive statistics (i.e., means, standard deviations, skewness) were calculated for all acceptability and feasibility ratings. Bivariate correlations between the acceptability and feasibility ratings of each strategy were assessed. Two-tailed, paired sample t-tests assessed the statistical significance of differences in acceptability and feasibility ratings, respectively, across the implementation strategies. Separate ANOVAs compared differences in acceptability and feasibility ratings between respondents who characterized their organization according to different actor types.

Results

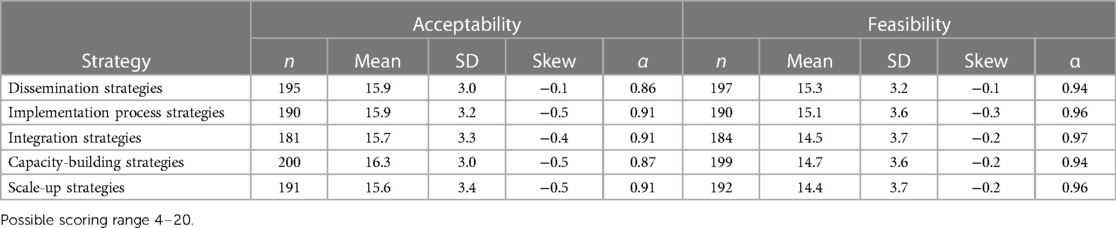

Table 2 shows descriptive statistics for the acceptability and feasibility each policy implementation strategy. For each of the five strategies, measures of acceptability (α range = 86–.91) and feasibility (α range = .94–.97) demonstrated strong internal consistency. The mean policy implementation strategy acceptability rating was highest for capacity building strategies (mean = 16.3, SD = 3.0) and lowest for scale-up strategies (mean = 15.6, SD = 3.4). The mean policy implementation strategy feasibility rating was highest for dissemination strategies (mean = 15.3, SD = 3.2) and lowest for scale-up strategies (mean = 14.4, SD = 3.7).

Table 2. Descriptive statistics of ratings of acceptability and feasibility of implementation strategies intended to increase the reach of evidence-based practices with revenue from policies that earmark taxes for behavioral health services.

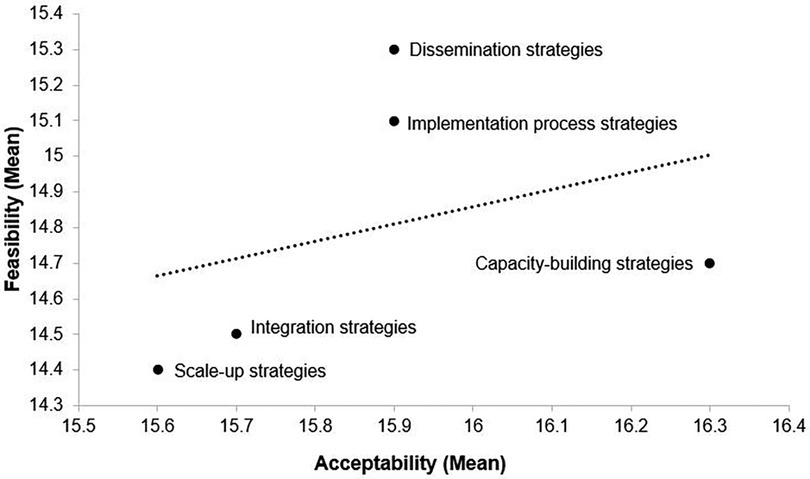

Figure 1 plots the mean acceptability and feasibility ratings for each strategy. As shown, scale-up and integration strategies were rated as least acceptable and least feasible. For each strategy, there was a statistically significant (p < .001) positive correlation between ratings of acceptability and feasibility. The mean Pearson correlation coefficient for the five strategies was 0.72 and the magnitude of correlations ranged from 0.81 for dissemination strategies to 0.50 for capacity building strategies.

Figure 1. Plot of mean ratings of acceptability and feasibility of implementation strategies intended to increase the reach of evidence-based practices with revenue from policies that earmark taxes for behavioral health services. Possible scoring range 4–20.

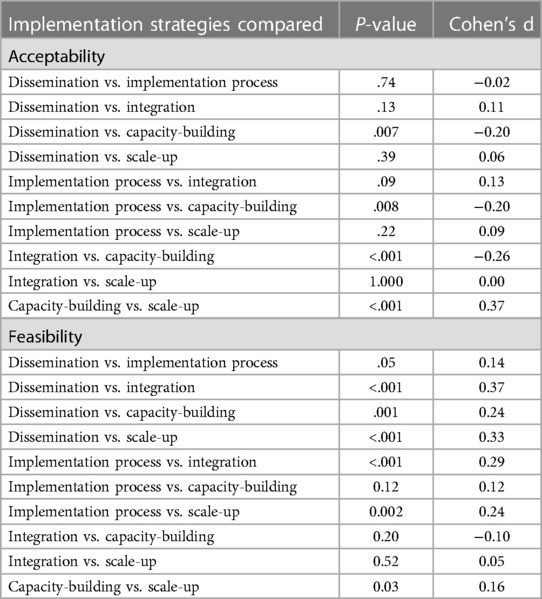

Table 3 shows the effect sizes and statistical significance of pairwise comparisons between mean ratings of each type of policy implementation strategy. For acceptability, capacity building strategies were rated as significantly (p ≤ .008) more acceptable than all four other strategies (e.g., p < .001 Cohen's D = −0.26 for capacity building strategies vs. integration strategies). For feasibility, dissemination strategies were rated as significantly (p ≤ .001) more feasible than integration, capacity building, and scale-up strategies. (e.g., p < .001 Cohen's D = 0.33 for dissemination strategies vs. scale-up strategies). There were no significant differences in acceptability or feasibility ratings when compared between respondent who classified their organization according to different actor types.

Table 3. Significance of pairwise comparisons of the acceptability and feasibility of implementation strategies intended to increase the reach of evidence-based practices with revenue from policies that earmark taxes for behavioral health services.

Discussion

This study presents a quantitative assessment of the acceptability and feasibility of policy implementation strategies. Results shed light on the types of strategies that policy actors judged to be feasible and acceptable to deploy to support the implementation of EBPs with revenue from policies that earmark taxes for behavioral health services. Capacity-building strategies were perceived as the most acceptable strategy to support the implementation of EBPs through these policies, whereas scale-up strategies were identified as least acceptable (as well as least feasible). Although capacity building and scale-up strategies both target the skills and motivation of service providers and organizational leaders, capacity building strategies—as defined in the survey—afford more autonomy to service organizations in terms of selecting EBPs. Scale-up strategies, in contrast, focus on “ensuring” that EBPs funded by tax revenue “achieve desired outcomes.” It is possible that this prescriptive language was not well-received by respondents and contributed to lower ratings of acceptability (42).

The finding that dissemination strategies were perceived as most feasible is not surprising given that asynchronous communication of information is typically not resource intensive or politically contentious (43). It is promising that organizations involved with the implementation of earmarked tax policies find dissemination strategies feasible, as well as acceptable, because responsibilities for dissemination are often unspecified in research translation pipelines (44, 45). Dissemination strategies are understudied in implementation science (46, 47), however, and research is needed to inform how organizations might develop messages that are effective at promoting the use of earmarked tax revenue to support EBP delivery.

The methods describe in this Research Brief Report illustrate how definitions of implementation strategies can be adapted for a survey focused on policy implementation. Furthermore, the Report demonstrates how widely used and pragmatic measures of acceptability and feasibility can used in policy implementation research. Weiner et al.'s measures of acceptability and feasible demonstrated strong internal consistency when used to assess policy implementation strategies. However, minimal variance between ratings of these strategies raises questions about their suitability. More in-depth psychometric testing of these measures' applicability to policy implementation strategies is warranted in future research.

Limitations

Findings should be considered within the context of the study's limitations. First, although we observed statistically significant differences in ratings of the acceptability and feasibility of policy implementation strategies, the practical significance of these differences are unclear. Mean ratings of acceptability and feasibility across all strategies were consistently high (i.e., mean ≥14.4 on 20-point scale), suggesting that none of these strategies were perceived as unacceptable or infeasible. The average effect size (Cohen's D) of statiscally significant differences between pairwise ratings of strategies was only 0.13. Relatedly, while acceptability and feasibility are considered conceptually distinct constructs in the field of implementation science research, the extent to which they were perceived as distinct by respondents is uncertain. The fact that there was a statistically significant correlation between the rating of acceptability and feasibility for each strategy suggests that respondents may not have perceived the two constructs of conceptually distinct.

Second, although the response rate of 24.9% is consistent with recent state-wide surveys of behavioral health officials (37–39), respondents may not fully reflect the perspectives of all professionals involved with behavioral health earmarked tax policy implementation. Third, definitions of all strategies were anchored to the broad policy implementation outcome of earmarked tax revenue supporting the implementation of EBPs. As noted, supporting the implementation of EBPs is just one possible goal of policies that earmark taxes for behavioral health. Interviews conducted as part of the larger policy implementation study (27) have revealed that other outcomes—such as reducing inequities in access to behavioral health services and enhancing service infrastructure—are often primary goals of the taxes. Ratings of implementation strategy acceptability and feasibility may have varied if definitions were anchored to a different policy implementation outcome. Fourth, it should be emphasized that the study focused on perceptions of the acceptability and feasibility of implementation strategies and does not shed light on the extent to which these strategies may be effective at supporting EBP implementation. Finally, the survey did not assess if, or the extent to which, respondents had actually used the implementation strategies they rated. Experiences using the strategies would likely affect rating of acceptability and feasibility.

Conclusions

Within the context of the implementation of policies that earmark taxes for behavioral health services, capacity building strategies and dissemination strategies may be well-received and deployed by organizations involved with tax policy implementation to support the implementation of EBPs. Adapting definitions of implementation strategies for policy-focused topics, and using established measures of acceptability and feasibility to elicit feedback about these strategies, demonstrates utility as an approach to advance research of policy-focused implementation strategies.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Ethics statement

The studies involving humans were approved by New York University Institutional Review Board. The studies were conducted in accordance with the local legislation and institutional requirements. The participants provided their written informed consent to participate in this study.

Author contributions

JP: Conceptualization, Data curation, Formal Analysis, Funding acquisition, Investigation, Methodology, Project administration, Supervision, Writing – original draft, Writing – review & editing. NS: Conceptualization, Methodology, Project administration, Writing – review & editing. MW: Data curation, Methodology, Writing – review & editing. SW: Conceptualization, Writing – review & editing. EB: Conceptualization, Writing – review & editing. GA: Conceptualization, Writing – review & editing.

Funding

The author(s) declare financial support was received for the research, authorship, and/or publication of this article.

The study was funded by the National Institute of Mental Health (R21MH125261).

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/frhs.2024.1304049/full#supplementary-material

References

1. Purtle J, Peters R, Brownson RC. A review of policy dissemination and implementation research funded by the National Institutes of Health, 2007–2014. Implement Sci. (2015) 11(1):1–8. doi: 10.1186/s13012-015-0367-1

2. Nilsen P, Ståhl C, Roback K, Cairney P. Never the twain shall meet?–a comparison of implementation science and policy implementation research. Implement Sci. (2013) 8:63. doi: 10.1186/1748-5908-8-63

3. Emmons KM, Gandelman E. Translating behavioral medicine evidence to public policy. J Behav Med. (2019) 42(1):84–94. doi: 10.1007/s10865-018-9979-7

4. Emmons KM, Chambers D, Abazeed A. Embracing policy implementation science to ensure translation of evidence to cancer control policy. Transl Behav Med. (2021) 11(11):1972–9. doi: 10.1093/tbm/ibab147

5. Oh A, Abazeed A, Chambers DA. Policy implementation science to advance population health: the potential for learning health policy systems. Front Public Health. (2021) 9:681602. doi: 10.3389/fpubh.2021.681602

6. Emmons KM, Chambers DA. Policy implementation science–an unexplored strategy to address social determinants of health. Ethn Dis. (2021) 31(1):133. doi: 10.18865/ed.31.1.133

7. Ashcraft LE, Quinn DA, Brownson RC. Strategies for effective dissemination of research to United States policymakers: a systematic review. Implement Sci. (2020) 15(1):1–17. doi: 10.1186/s13012-020-01046-3

8. McGinty EE, Seewald NJ, Bandara S, Cerdá M, Daumit GL, Eisenberg MD, et al. 2022. Scaling interventions to manage chronic disease: innovative methods at the intersection of health policy research and implementation science. Prevention Science, pp.1-13. doi: 10.1007/s11121-022-01427-8. [Epub ahead of print].

9. Chriqui JF, Asada Y, Smith NR, Kroll-Desrosiers A, Lemon SC. Advancing the science of policy implementation: a call to action for the implementation science field. Transl Behav Med. (2023) 13:i b a d 034.

10. Purtle J, Nelson KL, Bruns EJ, Hoagwood KE. Dissemination strategies to accelerate the policy impact of children's mental health services research. Psychiatr Serv. (2020) 71(11):1170–8. doi: 10.1176/appi.ps.201900527

11. Hoagwood KE, Purtle J, Spandorfer J, Peth-Pierce R, Horwitz SM. Aligning dissemination and implementation science with health policies to improve children’s mental health. Am Psychol. (2020) 75(8):1130. doi: 10.1037/amp0000706

12. Brownson RC, Kumanyika SK, Kreuter MW, Haire-Joshu D. Implementation science should give higher priority to health equity. Implement Sci. (2021) 16(1):1–16. doi: 10.1186/s13012-021-01097-0

13. Asada Y, Kroll-Desrosiers A, Chriqui JF, Curran GM, Emmons KM, Haire-Joshu D, et al. 2023. Applying hybrid effectiveness-implementation studies in equity-centered policy implementation science. Frontiers in Health Services, 3:1220629. doi: 10.3389/frhs.2023.1220629

14. Purtle J, Moucheraud C, Yang LH, Shelley D. Four very basic ways to think about policy in implementation science. Implement Sci Commun. (2023) 4(1):1–6. doi: 10.1186/s43058-022-00376-1

15. Cruden G, Crable EL, Lengnick-Hall R, Purtle J. Who’s “in the room where it happens”? A taxonomy and five-step methodology for identifying and characterizing policy actors. Implement Sci Commun. (2023) 4(1):113. doi: 10.1186/s43058-023-00492-6

16. Bullock HL, Lavis JN, Wilson MG, Mulvale G, Miatello A. Understanding the implementation of evidence-informed policies and practices from a policy perspective: a critical interpretive synthesis. Implement Sci. (2021) 16:1–24. doi: 10.1186/s13012-021-01082-7

17. Crable EL, Lengnick-Hall R, Stadnick NA, Moullin JC, Aarons GA. Where is “policy” in dissemination and implementation science? Recommendations to advance theories, models, and frameworks: EPIS as a case example. Implement Sci. (2022) 17(1):80. doi: 10.1186/s13012-022-01256-x

18. Allen P, Pilar M, Walsh-Bailey C, Hooley C, Mazzucca S, Lewis CC, et al. 2020. Quantitative measures of health policy implementation determinants and outcomes: a systematic review. Implementation Science, 15, pp.1-17.31900167

19. Pilar M, Jost E, Walsh-Bailey C, Powell BJ, Mazzucca S, Eyler A, et al. 2022. Quantitative measures used in empirical evaluations of mental health policy implementation: A systematic review. Implementation Research and Practice, 3, p.26334895221141116 37091091

20. McHugh S, Dorsey CN, Mettert K, Purtle J, Bruns E, Lewis CC. 2020. Measures of outer setting constructs for implementation research: a systematic review and analysis of psychometric quality. Implementation Research and Practice, 1, p.2633489520940022.37089125

21. Powell BJ, Waltz TJ, Chinman MJ, Damschroder LJ, Smith JL, Matthieu MM, et al. 2015. A refined compilation of implementation strategies: results from the Expert Recommendations for Implementing Change (ERIC) project. Implementation science, 10, pp.1-14.25567289

22. Purtle J, Borchers B, Clement T, Mauri A. Inter-agency strategies used by state mental health agencies to assist with federal behavioral health parity implementation. J Behav Health Serv Res. (2018) 45(3):516–26. doi: 10.1007/s11414-017-9581-8

23. Crable EL, Benintendi A, Jones DK, Walley AY, Hicks JM, Drainoni M-L. Translating medicaid policy into practice: policy implementation strategies from three US states’ experiences enhancing substance use disorder treatment. Implement Sci. (2022) 17(1):1–14. doi: 10.1186/s13012-021-01157-5

24. Beidas RS, Becker-Haimes EM, Adams DR, Skriner L, Stewart RE, Wolk CB, et al. 2017. Feasibility and acceptability of two incentive-based implementation strategies for mental health therapists implementing cognitive-behavioral therapy: a pilot study to inform a randomized controlled trial. Implementation Science, 12, pp.1-13.28057027

25. Weiner BJ, Lewis CC, Stanick C, Powell BJ, Dorsey CN, Clary AS, et al. 2017. Psychometric assessment of three newly developed implementation outcome measures. Implementation science, 12, pp.1-12.28057027

26. Quanbeck A, Brown RT, Zgierska AE, Jacobson N, Robinson JM, Johnson RA, et al. 2018. A randomized matched-pairs study of feasibility, acceptability, and effectiveness of systems consultation: a novel implementation strategy for adopting clinical guidelines for opioid prescribing in primary care. Implementation Science, 13, pp.1-13.29301543

27. Purtle J, Stadnick NA, Wynecoop M, Bruns EJ, Crane ME, Aarons G. A policy implementation study of earmarked taxes for mental health services: study protocol. Implement Sci Commun. (2023) 4(1):37. doi: 10.1186/s43058-023-00408-4

28. Purtle J, Stadnick NA. Earmarked taxes as a policy strategy to increase funding for behavioral health services. Psychiatr Serv. (2020) 71(1):100–4. doi: 10.1176/appi.ps.201900332

29. Purtle J, Brinson K, Stadnick NA. Earmarking excise taxes on recreational cannabis for investments in mental health: an underused financing strategy. JAMA Health Forum. (2022) 3(4):e220292. doi: 10.1001/jamahealthforum.2022.0292

30. Purtle J, Wynecoop M, Crane ME, Stadnick NA. Earmarked taxes for mental health services in the United States: a local and state legal mapping study. Milbank Q. 2023.37070393

31. Purtle J, Stadnick N, Wynecoop M, Walker SC, Bruns EJ, Aarons GA. Tale of two taxes: comparing perceptions of the implementation of policies earmarking taxes for behavioral health in California and Washington. Psychiatric Services. (2023):appips20230257. doi: 10.1176/appi.ps.20230257. [Epub ahead of print].

32. Wilkinson M. Paying for public spending: is there a role for earmarked taxes? Fisc Stud. (1994) 15(4):119–35. doi: 10.1111/j.1475-5890.1994.tb00213.x

33. Bös D. Earmarked taxation: welfare versus political support. J Public Econ. (2000) 75(3):439–62. doi: 10.1016/S0047-2727(99)00075-4

35. Dopp AR, Narcisse M-R, Mundey P. A scoping review of strategies for financing the implementation of evidence-based practices in behavioral health systems: state of the literature and future directions. Implement Res Pract. (2020) 1:2633489520939980. doi: 10.1177/2633489520939980

36. Jaramillo ET, Willging CE, Green AE, Gunderson LM, Fettes DL, Aarons GA. “Creative financing”: funding evidence-based interventions in human service systems. J Behav Health Serv Res. (2018):1–18.27507243

37. Purtle J, Nelson KL, Horwitz SMC, McKay MM, Hoagwood KE. Determinants of using children’s mental health research in policymaking: variation by type of research use and phase of policy process. Implement Sci. (2021) 16(1):1–15. doi: 10.1186/s13012-021-01081-8

38. Purtle J, Nelson KL, Horwitz SM, Palinkas LA, McKay MM, Hoagwood KE. Impacts of COVID-19 on mental health safety net services for youths: a national survey of agency officials. Psychiatr Serv. 2022;73(4):381–7. doi: 10.1176/appi.ps.202100176

39. Purtle J, Nelson KL, Henson RM, Horwitz SM, McKay MM, Hoagwood KE. Policy Makers’ priorities for addressing youth substance use and factors that influence priorities. Psychiatr Serv. (2022) 73(4):388–95. doi: 10.1176/appi.ps.202000919

40. Leeman J, Birken SA, Powell BJ, Rohweder C, Shea CM. Beyond “implementation strategies”: classifying the full range of strategies used in implementation science and practice. Implement Sci. (2017) 12(1):125. doi: 10.1186/s13012-017-0657-x

41. Proctor EK, Powell BJ, McMillen JC. Implementation strategies: recommendations for specifying and reporting. Implement Sci. (2013) 8(1):1–11. doi: 10.1186/1748-5908-8-1

42. Metz A, Jensen T, Farley A, Boaz A. Is implementation research out of step with implementation practice? Pathways to effective implementation support over the last decade. Implement Res Pract. (2022) 3:26334895221105585.37091077

43. Frieden TR. A framework for public health action: the health impact pyramid. Am J Public Health. (2010) 100(4):590–5. doi: 10.2105/AJPH.2009.185652

44. Kreuter MW, Bernhardt JM. Reframing the dissemination challenge: a marketing and distribution perspective. Am J Public Health. (2009) 99(12):2123–7. doi: 10.2105/AJPH.2008.155218

45. Brownson RC, Jacobs JA, Tabak RG, Hoehner CM, Stamatakis KA. Designing for dissemination among public health researchers: findings from a national survey in the United States. Am J Public Health. (2013) 103(9):1693–9. doi: 10.2105/AJPH.2012.301165

46. Purtle J, Marzalik JS, Halfond RW, Bufka LF, Teachman BA, Aarons GA. Toward the data-driven dissemination of findings from psychological science. Am Psychol. (2020) 75(8):1052. doi: 10.1037/amp0000721

Keywords: policy, implementation science, acceptability, feasibility, behavioral health

Citation: Purtle J, Stadnick NA, Wynecoop M, Walker SC, Bruns EJ and Aarons GA (2024) Acceptability and feasibility of policy implementation strategies for taxes earmarked for behavioral health services. Front. Health Serv. 4:1304049. doi: 10.3389/frhs.2024.1304049

Received: 28 September 2023; Accepted: 21 March 2024;

Published: 4 April 2024.

Edited by:

Karen Emmons, Harvard University, United StatesReviewed by:

Chidiebele Ojukwu, University of Nigeria, NigeriaNicola O'Brien, Northumbria University, United Kingdom

Gabriella Maria McLoughlin, Temple University, United States

© 2024 Purtle, Stadnick, Wynecoop, Walker, Bruns and Aarons. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Jonathan Purtle am9uYXRoYW4ucHVydGxlQG55dS5lZHU=

Jonathan Purtle

Jonathan Purtle Nicole A. Stadnick

Nicole A. Stadnick Megan Wynecoop1

Megan Wynecoop1 Sarah C. Walker

Sarah C. Walker Gregory A. Aarons

Gregory A. Aarons