94% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Environ. Econ. , 09 January 2024

Sec. Ecological Economics

Volume 2 - 2023 | https://doi.org/10.3389/frevc.2023.1266745

The “dual-carbon” strategy was first written into China's “Government Work Report” in 2021, bringing green low-carbon development and green innovation to an unprecedented height. At the financial policy level, the Chinese government actively promotes the development of a green financial system represented by green bonds, green insurance, science and technology insurance, and green credit. Existing literature studies on green insurance and science and technology insurance mainly focus on the relevant legal system, the impact on corporate and risk management system, insurance types and service models, subsidy policies, and the problems and challenges they face. However, existing studies have studied the impact of green insurance and science and technology insurance on corporate' green innovation. In particular, the impact of their interaction on corporate' green innovation is rarely mentioned. From the perspective of green insurance and science and technology insurance to promote corporate' green innovation, based on the data sample of Shanghai and Shenzhen A-share listed companies from 2014 to 2015, this paper comprehensively investigated and analyzed the impact of green insurance and science and technology insurance on corporate' green innovation, and analyzed the interaction effect of the two. The research perspective of enterprise green innovation is expanded. The analysis conclusion of this paper provides new ideas and empirical evidence for Chinese corporate to realize faster and more efficient green transformation, which is conducive to stimulating the vitality of enterprise green innovation and development.

Green innovation is imminent in the context of high-quality economic development. The core of the dual-carbon strategy is green innovation, which mainly promotes ESG balance, which aims to change the status quo of high consumption, high pollution and high cost, and achieve sustainable development through the dual carbon strategy of energy conservation and emission reduction. There are three aspects of green innovation: technological innovation, institutional innovation and cultural consciousness innovation. Furthermore, Green innovation is the systematic and systematic procedure of starting and implementing unorthodox ideas, technologies, and execution within the domains of industry and business. their main purpose is to significantly decrease the environmental footprint, increase sustainability, and create a balanced accord between economic growth and ecological wellbeing. An elementary commitment to reducing resource depletion, minimizing environmental influence, and promoting ecological balance are the main drivers behind it, thus playing a role in the unfolding of a circular, low-carbon, and environmentally responsible economic system. Green innovation tries to transform and ameliorate various aspects of production, consumption, and management, striving to achieve not only economic prosperity but also environmental and ecological resilience. In 2021, the General Office of the State Council issued the “Guiding Opinions on Accelerating the Establishment of a Sound Green, Low-Carbon, and Circular Development Economic System.” The “Guiding Opinions” clearly state that “establishing and improving a green, low-carbon, and circular development economic system to promote comprehensive green transformation of economic and social development is the fundamental strategy to address China's resource, environment, and ecological issues.” “Germany's Industry 3.0,” it is projected that the global green technology market will reach 44,000 billion euros by 2025. Additionally, China's green technology organization predicts that the value of China's green technology market could amount to 500 billion US dollars, which highlights the significant potential of green innovation in unleashing a massive green technology market.

Green innovation does not come without its limitations such as high barriers, considerable uncertainty, heightened risks, substantial resource investments, and protracted development cycles. These challenges originate from the complex interplay between technology, policy, and market forces. It requires a comprehensive approach, encouraging comprehensive changes in product design, manufacturing techniques, supply chain management, and business models. The green technology innovation ability of domestic corporate is weak. Compared with the development level of green innovation in developed countries, China's overall green innovation level is still low, mainly reflected in the breakthrough of green innovation technology has not substantively leap, most corporate R & D stability is not strong, technical characteristics are imitation and peripheral, core technology is difficult to break through. The root cause of the lack of core technology is that the enterprise's green R & D innovation ability is weak, and the lack of stable high-tech talent reserve and R & D independent innovation ability at the green technology level. Compared with other innovations, green innovation has the characteristics of high barriers, high uncertainty, high risk, high input and long cycle.

The insurance rate of domestic green insurance and science and technology insurance is significantly lower than that of foreign countries. Taking Guizhou Province as an example, as of August 2021, only 53 enterprises have been insured in the pilot environmental pollution compulsory liability insurance in Guizhou Province, and 489 enterprises have been included in the pilot list of environmental pollution compulsory liability insurance in the province, with an insurance rate of only 10.84%. By contrast, countries such as the United States, Germany, Brazil and India have long made environmental liability insurance mandatory; Since the establishment of science and technology insurance, there have been hundreds of innovative enterprises participating in science and technology insurance, but the proportion of high-tech enterprises in our country is still very small. In Zhongshan City, Guangdong Province, the earliest pilot of science and technology insurance, for example, as of 2017, there were < 150 high-tech enterprises insured, accounting for < 9% of the city's 1,700 high-tech enterprises. Many domestic enterprises have to choose to give up green insurance and science and technology insurance due to insufficient information channels, subsidy application procedures are too cumbersome, subsidy ratio, subsidy ceiling is too low, the continuity of subsidy policy issuance is not enough, premiums are higher than other insurance varieties, reduce enterprise costs and expenses.

The research objectives of this paper are as follows: First, to clarify the impact of the interaction between green insurance and technology insurance on the green innovation of enterprises. This is not only conducive to the company's shareholders to make insurance decisions, but also conducive to the government to provide theoretical support for promoting regional green innovation and implementing technology insurance and green insurance subsidy policies. Second, this paper mainly focuses on the positive and negative external duality of “environmental protection-pollution” of green innovation by enterprises purchasing technology insurance to improve their risk exposure level and purchasing green insurance to enhance their social responsibility, which is conducive to enriching the research of enterprise risk management and enterprise innovation management. Third, based on the Porter hypothesis hypothesis and the positive and negative external duality of green innovation “environmental protection-pollution”, this paper introduces green insurance and technology insurance into the production function, and adds the interaction terms between technology insurance and green insurance to construct a new model. An empirical analysis of the impact of green innovation output was carried out from four dimensions: explanatory variables, explanatory variables, mediation variables and control variables. This not only provides reference experience for improving the green innovation power of enterprise managers, but also helps to improve the penetration rate of green insurance and technology insurance in Chinese enterprises, which is of great practical significance.

At present, domestic and foreign scholars' researches on green insurance mainly focus on the relevant legal system (Shu Dan, 2022), the impact on enterprises and risk management system, and the innovation of green insurance types and service modes (Zhao and Mu, 2023). The existing literature holds that green insurance can effectively manage and supervise the production and operation activities of high-polluting enterprises, thus reducing the negative externalities of production and improving the environmental risk management level of enterprises. Secondly, the existing literature on science and technology insurance mainly focuses on the subsidy policy of science and technology insurance (Liu et al., 2022), problems, challenges and countermeasures (Liu and Hu, 2022; Ren and Zhao, 2023).

Technology insurance refers to insurance products that guarantee all kinds of risks in the production and operation of science and technology enterprises, covering risks of personnel, property, liability and other aspects of innovation research and development, production and operation, transfer of scientific and technological achievements, intellectual property protection, product sales and after-sales service (Xu, 2022). The typical domestic science and technology insurance mainly includes: “the first major technology equipment insurance (set), the first application of new materials insurance, and the first edition of software science and technology insurance” (Xu, 2022). At present, the first set of insurance, new material insurance and software first edition technology insurance are still in the pilot, and have not been used on a large scale (Ren et al., 2021).

The term “technology insurance” is not commonly used in foreign countries. The attention toward technology insurance in China can be traced back to the 1990s. During that time, the rapid development of high-tech industries accompanied the growth of the economy and advancements in science and technology. Intense market competition led to frequent product iterations, and the inherent difficulty in technological innovation research and development resulted in increased volatility and complexity of research risks. The combined factors made technological risk a major obstacle in the path of technological innovation's development, highlighting the significance of technology insurance (Xie, 1996). This indicates that the development of high-tech industries can promote continuous progress in the insurance sector, and insurance can provide risk protection for high-tech industries (Xiong et al., 2022). There is a positive correlation between insurance and the development of high-tech corporate, and they complement each other. Therefore, the management of high-tech corporate should pay sufficient attention to technology insurance and strengthen risk prevention for technological risks (Zhao and Wang, 1997). Technology insurance can be defined in both narrow and broad senses. In the narrow sense, technology insurance is regarded as a special financial instrument aimed at promoting scientific and technological development. In the broad sense, the scope of technology insurance is expanded to include insurance products that cover risks in various stages of technological innovation, such as technology loan guarantee insurance and technology innovation asset securitization products (Xu, 2018). From the perspective of characteristics and functions, the main purpose of technology insurance is to reduce the risks associated with technological innovation and compensate for the losses incurred from innovation failures. High-tech corporate often face various risks that can lead to property damage and personal injuries during their operational processes (Yang and Yang, 2021). By having technology insurance, the insurance company can cover the civil liability risks that would otherwise be borne by the enterprise itself (Zhou, 2015). Generally, the government supports technological innovation projects of corporate through six methods: investing in technology insurance, technology credit, incubators, angel investments, venture capital, and funds. Among these methods, technology insurance is the most effective way to manage enterprise innovation risks. Technology insurance is a novel financial tool for managing technological innovation risks (Cai, 2015). In summary, the definition of technology insurance in this paper is as follows: it is a special financial instrument that targets the technological risks faced by high-tech corporate during their innovation activities and seeks compensation from the insurance company in case of technological innovation insurance incidents.

Green innovation is a complicated concept comprising technological advancements, process improvements, and structural transformations that resonates with a broader societal change toward more sustainable, resource-efficient, and ecologically responsible practices. This innovative approach accepts that the traditional models of economic development must be assessed and modified to address issues related to resource scarcity, environmental degradation, and ecological conservation. Green insurance is a financial instrument for environmental governance arranged at the government policy level (Table 1). From a macro perspective, green insurance aims to alleviate the environmental pollution issues arising from economic development in China and support the transition of the country's economy toward green and sustainable development (Wang and Cao, 2018). From a micro perspective, green insurance can effectively address long-term and incremental environmental risks and serves as an effective mechanism for mitigating frequent environmental damages. Green insurance is a systematic solution designed to address global warming and support global environmental governance. It is a comprehensive approach aimed at tackling issues related to irreversible environmental damage, energy revolution, and other domains (Wang et al., 2019). From a broader perspective, green insurance encompasses the green utilization of insurance funds, reflecting a concentrated effort to implement the principles of green and sustainable development through the application of insurance as a specialized financial instrument for effective environmental risk management (Zhou, 2019). The specific impact is shown in Table 2.

From a foreign perspective, green insurance is mainly discussed in terms of its impact on businesses, emphasizing its role in environmental risk management. From the perspective of businesses, environmental risk is a potential, high-loss risk that can lead to significant negative externalities. Once it occurs, it can cause irreparable damage to a company's reputation and external environment. Therefore, businesses purchase green insurance to distribute this difficult-to-estimate and avoidable environmental loss among all policyholders, thereby reducing the economic losses caused by environmental risks (Wernick, 2002). Green insurance is regarded as a special financial instrument used by hazardous production corporate in their risk management process to avoid being affected by environmental pollution arising from their production activities (Misheva, 2016).

In China, green insurance generally refers to Environmental Pollution Liability Insurance, hereafter referred to as Environmental Liability Insurance. By purchasing Environmental Liability Insurance, businesses can share the risk of environmental pollution with all policyholders, reducing their own compensation liability and thereby releasing and alleviating their cash flow burden. With more free cash flow, businesses have the opportunity to invest more, which helps to mitigate the constraint on innovation funding from within the company. Moreover, the risk transfer function of Environmental Liability Insurance can elevate the risk-bearing capacity of management, thereby motivating them to engage in innovative activities. This is primarily because Environmental Liability Insurance effectively mitigates the risk of bankruptcy resulting from environmental damage, compensation losses, and cash flow disruption, ensuring the continuity of business operations and creating a conducive environment for innovation within the enterprise and its management. Additionally, Environmental Liability Insurance serves as an emerging governance mechanism with external supervisory capabilities. Effective corporate governance can significantly promote innovation within companies (Wang and Zhao, 2015). The foundation for insurance companies to offer Environmental Liability Insurance lies in their long-term underwriting experience and professional actuarial capabilities, which enable them to effectively assess the environmental governance risks of insured corporate. Assuming that insurance companies, as professional financial institutions, adhere to the rational economic agent hypothesis, after signing insurance contracts with corporate, they will seek to avoid transferring the burden of environmental pollution losses. Consequently, insurance companies will exert their external governance function and actively participate in the production and operation of insured corporate, implementing strict supervisory measures. By doing so, insurance companies motivate corporate to reduce negative externalities in their production activities and encourage them to adopt green innovation as a means to achieve sustainable development. This not only addresses the fundamental issue of environmental pollution for the corporate but also enhances their competitiveness while curbing opportunistic behavior by management.

Green innovation indeed involves longer cycles, more uncertainties, and higher sunk costs, making it inherently riskier than conventional innovation. Risk-taking is a crucial factor that management must carefully consider during the decision-making process and investment choices. As the main body of enterprise investment decision, senior executives have an important impact on the level of enterprise risk taking (Hong et al., 2023).

The extent to which a company bears risks is largely determined by its top management, and to some extent, it can be reflected in the enthusiasm and degree of risk-taking attitude exhibited by the company's executives. When the risk-taking level of top management increases, the company's decisions tend to be more daring and aggressive. Studies have shown that companies with higher risk-taking levels in their decision-making process tend to achieve more innovation. This is because the management of companies with higher risk-taking levels is more tolerant of projects with greater uncertainty and potential risks. Even in the face of potential failures, such management is more likely to yield greater innovative outcomes compared to companies with lower risk-taking levels (Li and Tang, 2010). Innovation activities are generally characterized by long cycles, high uncertainty, significant sunk costs, and demanding technological requirements (Li et al., 2021). The risk preference level of a company's management plays a crucial role in determining the scale of its innovation investment. Risk-seeking management is more willing to allocate more resources to innovation projects (Chen and Shu, 2021). However, in situations of information asymmetry, top management may exhibit self-serving behavior, mainly driven by profit pursuit, reputation protection, anti-takeover measures, and career planning considerations. Under these circumstances, they often choose risk avoidance, leading to a overly cautious risk preference for the company, which is not conducive to innovation.

Technology insurance serves to disperse the decision-making risks of management, thereby promoting the development of corporate green innovation. The risk dispersion mechanism of technology insurance is demonstrated by its concentration on various internal and external uncertainties in the process of enterprise technological R&D (including innovation failures, termination of innovations, and failure to achieve expected outcomes). These uncertainties are shared among all insured parties through the collection of premiums. Through this mechanism, technology insurance achieves effective spatial and temporal dispersion and dilution of technological risks (Liu, 2010).

In summary, technological innovation is a high-risk, long-term, and high-sunk-cost endeavor. For corporate, especially small and medium-sized ones, a failed innovation can potentially impact the company's cash flow and erode external investor confidence, thus intensifying financing constraints. On the other hand, allocating funds to research and development means crowding out resources from other productive activities, which can affect the company's overall performance. Management's performance is often tied to the company's revenue and net profits. If the uncertainty of innovation exceeds the management's expectations, they are likely to reduce long-term planning activities, such as innovation, based on self-interest motivation, and may overlook the importance of the company's sustainable development, such as green innovation. As shown in Figure 1, corporate that have not purchased technology insurance are fully exposed to the risk of technological innovation failure. This not only affects the company's operational activities and financing constraints but also leads to short-sightedness driven by self-interest motivation among the management. As a result, both high-risk ordinary innovation and sustainable development innovation are suppressed.

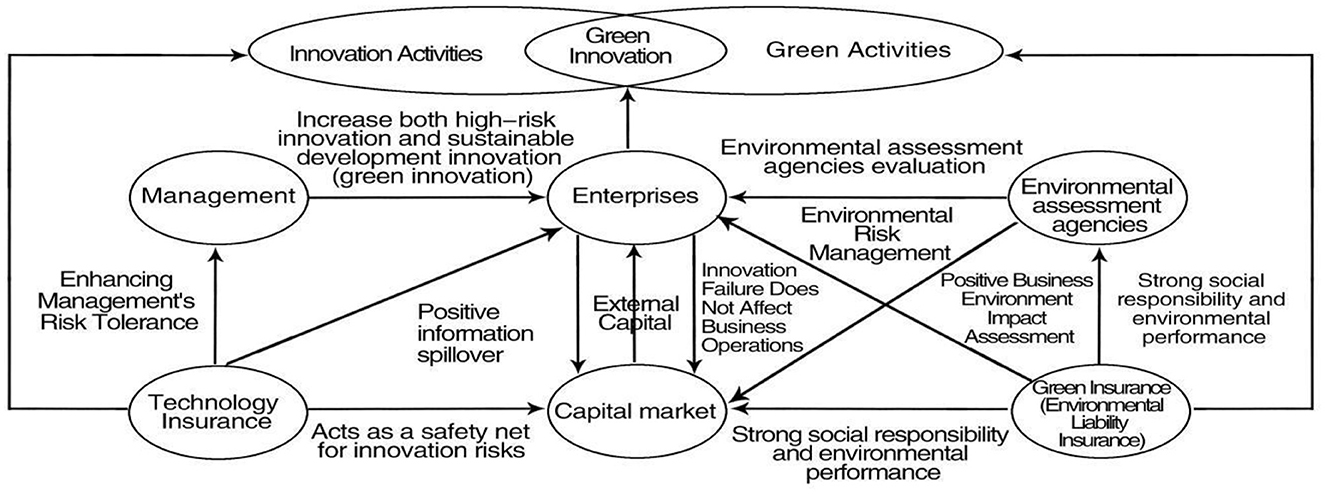

As shown in Figure 2, companies that purchase technology insurance are more likely to produce innovative products. However, the innovation outcome may not necessarily be green innovation; it could also be ordinary innovation. The main reason for this lies in the influence of the company's innovation motivation. corporate with weak negative externalities tend to purchase technology insurance to increase ordinary innovation and enhance their competitiveness. On the other hand, corporate with strong negative externalities, due to the internalization of negative externalities, are inclined to purchase technology insurance to increase green innovation output and reduce production costs. The specific pathway through which technology insurance influences enterprise innovation is as follows: Technological innovation activities often come with high returns but also high risks of failure. Investors are attracted by the expected returns from innovation activities but are also deterred by the significant risk of innovation failure. Indeed, technology insurance can provide a safety net for enterprise innovation. Even in the event of innovation failure, the insurance compensation can help offset a portion of the R&D investment losses, thereby smoothing out the impact on the company's profits. When a company's profits and cash flow are not affected by innovation losses, external capital will feel more confident in investing in innovative corporate. On the other hand, allocating funds for research and development means crowding out resources for other production factors. The basis for management to allocate funds into innovation and green innovation activities lies in the assurance that potential losses from innovation will not impact their own performance commitments. Technology insurance can hedge against potential losses and opportunity costs resulting from innovation failures, thereby increasing management's willingness to take on risks. Exactly, in summary, purchasing technology insurance can indeed promote enterprise innovation activities. However, the nature of the innovation output, whether it is regular innovation or green innovation, depends mainly on the extent of negative externalities produced by the enterprise in its production processes.

Research on Environmental Liability Insurance, both domestically and internationally, has primarily focused on a micro-level perspective. The impact of Environmental Liability Insurance on corporate mainly revolves around two aspects: environmental risk management and the capital market. In recent years, with the increasing frequency of environmental pollution incidents, environmental risks faced by corporate have garnered significant attention from various stakeholders in society. Regarding environmental risk management and governance, the emphasis lies in how Environmental Liability Insurance can enhance the effectiveness of environmental assessments conducted by corporate. Environmental Liability Insurance plays a crucial role in effectively managing and supervising the production and operational activities of highly polluting corporate, thus mitigating their negative externalities and enhancing their environmental risk management capabilities. Furthermore, it serves as a robust mechanism to oversee the ESG (Environmental, Social, and Governance) evaluation process and outcomes conducted by third-party rating agencies, leading to an overall improvement in assessing corporate environmental impacts (Liu and Luan, 2014). From the perspective of the impact of Environmental Liability Insurance on corporate image in the capital market, it is noteworthy that external investors generally perceive companies with such insurance as being more socially responsible, exhibiting lower business volatility, and facing reduced risks of bankruptcy. Consequently, these insured companies receive higher evaluations and more favorable responses from external investors. When making investment decisions, external investors not only consider a company's financial performance but also take its environmental performance into account (Zhao et al., 2018). Research conducted by scholars in foreign countries has revealed that the capital market assesses companies with different environmental performances differently, leading to varying market reactions. For instance, the Bhopal gas leak incident at the Union Carbide (India). Limited caused not only a significant drop in the company's stock price but also severe spill-over effects, impacting the stock prices of other companies in the chemical industry as well. On the contrary, if a company exhibits strong positive externalities and excels in its environmental performance, the capital market tends to lean toward making investment choices and responding positively (Blacconiere and Patten, 1994). Generally, companies recognized for their environmental achievements are met with more favorable responses from the capital market (Klassen and McLaughlin, 1996).

The information asymmetry between companies and investors is the primary factor leading to financing premiums. This information asymmetry makes it difficult for investors to accurately judge the success rate and returns of research and development projects. Additionally, innovation activities in companies often involve advanced and specialized technologies, making it challenging for investors without sufficient knowledge background to effectively supervise these activities. As a result, investors must exercise greater caution when selecting innovative projects, reducing investment uncertainty and ultimately leading to suboptimal investment efficiency for companies (Liu and Zang, 2021). Moreover, compared to regular innovation investments, green innovation often involves more advanced technologies. Green patents, as intangible assets of companies, face greater challenges as collateral for external funding due to inadequate pledging and more severe information asymmetry. This may lead to more severe adverse selection and moral hazard issues in companies' green innovation activities, further exacerbating their financing constraints (Core, 2000). In conclusion, the fundamental solution to alleviate corporate green innovation's financing constraints lies in reducing the information asymmetry arising from adverse selection and moral hazard issues in companies.

Environmental Liability Insurance plays a crucial role in effectively managing and supervising the production and operational activities of highly polluting corporate, thus mitigating their negative externalities and enhancing their environmental risk management capabilities. The specific impact mechanism is as follows: Firstly, companies that purchase Environmental Liability Insurance shift the burden of investor losses resulting from environmental pollution incidents to the insurance company. The probability of insurance claims and the environmental governance and litigation risks of the insured companies are closely related. This creates an information spillover effect through an increase in the insured amount stipulated in the insurance contract. Insurance companies tend to sign stricter insurance terms with companies that have poor internal risk management and lower environmental governance standards, forcing the management to improve the company's environmental governance (Zhao and Liang, 2022). On the contrary, if a company's environmental governance level is high and its risk management is excellent, the insurance company will customize more relaxed terms and reduce the insured amount accordingly. It can be observed that the purchase of Environmental Liability Insurance exposes the company's actions and information to the supervision of the insurance company to some extent. This supervisory effect can transmit a positive signal of effective governance to the outside world—indicating that the company has strong social responsibility and environmental performance. This is beneficial in reducing information asymmetry and investment concerns among external stakeholders, thereby improving the accessibility of external financing and alleviating financing constraints. Therefore, Environmental Liability Insurance helps companies alleviate financing constraints and obtain more funds to support corporate green innovation.

In conclusion, as shown in Figure 3, companies that have not purchased Environmental Liability Insurance are perceived by environmental assessment agencies to have weaker social responsibility and environmental performance. The environmental assessment agencies convey negative evaluations of the company's environmental impact to the capital market. Since companies find it challenging to transmit fair and objective information to the capital market, the capital market often relies on evaluations from third-party rating agencies. Consequently, the lack of Environmental Liability Insurance, especially for highly polluting companies, can exacerbate financing constraints and hinder corporate green innovation.

As shown in Figure 4, companies that purchase Green Insurance (Environmental Liability Insurance) tend to exhibit stronger social responsibility and environmental performance. This is mainly attributed to the signaling effect of Environmental Liability Insurance, which provides environmental risk management for the companies. As a result, environmental assessment agencies give higher ratings to these companies, leading to a positive evaluation of their environmental impact by the capital market. For the capital market, the purchase of Environmental Liability Insurance by companies signifies lower environmental risks and reduced fluctuations in future production and operational risks. The active information spillover from companies attracts more external capital, thereby promoting corporate green innovation activities. Additionally, the supervisory role of Environmental Liability Insurance helps mitigate the negative externalities of production activities, making innovation production more environmentally friendly. The increase in green innovation further enhances companies' social responsibility and environmental performance, ultimately creating a virtuous cycle.

(1) Existing studies mostly focus on the independent net effect of green insurance or technology insurance on enterprise innovation and development, but ignore the interactive effect of the two, and lack the comprehensive mechanism of action of the two on enterprise green innovation from the overall perspective. There is a close relationship between green insurance, science and technology insurance, corporate financing constraints, corporate risk appetite and commitment, and corporate green innovation. Integrating the above factors into the same theoretical framework, it is undoubtedly of important theoretical value and practical significance to discuss the impact of green insurance and science and technology insurance on corporate green innovation. This paper studies the slow-release effect of green insurance and technology insurance and their interaction on enterprise green innovation, extends the research scope of green innovation, and provides a new perspective for enterprise green innovation.

(2) Based on Porter's hypothesis, the existing literature either believes that strict environmental regulations can drive enterprises to carry out green technology innovation, and improve production efficiency and competitiveness while realizing energy conservation and emission reduction; Or the opposite view is that strict carbon regulation means that companies will face higher carbon risk, which may increase the uncertainty of future cash flows and financing costs. The academic community has not yet reached an agreement on who is right and who is not, so there is a “mystery of Porter's hypothesis”. Therefore, based on a new perspective, this paper helps to clarify the controversy about Porter's hypothesis theoretically.

(3) Existing studies lack an in-depth discussion on the slow-release effects of green insurance and technology insurance and their interaction on enterprises' green innovation in heterogeneous subjects. This paper draws on the heterogeneity perspective. For the first time, the heterogeneity of green insurance and science and technology insurance on enterprise green innovation is systematically studied from four dimensions: scale heterogeneity, equity concentration heterogeneity, property right heterogeneity, and two-in-one heterogeneity.

(4) Based on the existing literature, this paper examines the internal relationship between green insurance, science and technology insurance and green innovation from the perspective of green insurance (Figure 5). The research results provide reference experience for Chinese listed companies and large and medium-sized enterprises to purchase green insurance and enhance the manager's green innovation motivation, and provide theoretical basis and empirical evidence for enterprises to further develop high-quality green innovation.

Figure 5. The impact of technology insurance, green insurance, and their synergistic effect on green innovation.

The traditional classical economics viewpoint posits that environmental protection hinders economic development primarily because it increases the cost burden on businesses, thus reducing their competitiveness. In contrast, representatives of the new school of thought, economists Porter and VanderLinde, proposed a different perspective: appropriate regulatory measures can compel businesses to engage in technological innovation, thereby enhancing their competitiveness. This viewpoint came to be known as the “Porter Hypothesis,” which challenges the traditional economic theory that environmental protection suppresses economic growth (Porter and van der Linde, 1995). Scholars further classified the “Porter Hypothesis” into “Strong Porter Hypothesis,” “Weak Porter Hypothesis,” and “Tight Porter Hypothesis” (Jaffe and Palmer, 1997). Since the introduction of the “Porter Hypothesis,” the academic research on the effects of environmental regulations has become increasingly extensive and diverse.

The “Strong Porter Hypothesis” suggests that appropriate environmental regulations can enhance a firm's competitiveness. Existing literature primarily measures a firm's competitiveness through its productivity level (Du et al., 2019). For instance, the petroleum refining industry in Los Angeles experienced an increase in productivity after implementing quality control regulations (Berman and Bui, 2001). Similarly, using stochastic frontier analysis to calculate the total factor productivity of Chinese corporate, it was found that environmental regulations led to an increase in total factor productivity (Ai et al., 2020).

The “Strong Porter Hypothesis” suggests that appropriate environmental regulations can contribute to enhancing a firm's technological innovation level. In some European Union countries, the construction industry experienced improvements in technological equipment and innovation output after the implementation of environmental regulations (Testa et al., 2011). Similarly, A-share listed companies, after facing environmental regulations, were able to strengthen their technological innovation capabilities and innovation output by alleviating financing constraints through capital markets (Miao et al., 2019). Additionally, the introduction of carbon trading has also had a regulatory effect on corporate. Since the launch of the carbon emission trading system, China's technological innovation capacity has shown significant improvements (Liu et al., 2020).

The basis of this study is the assumption that the Porter Hypothesis holds true. The essence of the Porter Hypothesis is that the motivation for green innovation may differ from that of traditional technological innovation, as it is driven by external factors.

Green innovation possesses the dual nature of “environmental protection-pollution.” The positive externality of innovation refers to the situation where a company invests in production factors to achieve research and development outcomes, resulting in commercial profits. However, the company can only enjoy a portion of the benefits brought by the innovation while bearing all the costs incurred during the innovation process, as the public good attributes of innovative products (Jaffe and Palmer, 1997). Green innovation indeed exhibits the knowledge externality commonly associated with regular innovation. However, it goes beyond typical innovation by also providing environmentally friendly products, resulting in a duality of quality for the products associated with green innovation. The externalities generated by green innovation include both positive externalities related to environmental protection and negative externalities linked to environmental pollution. However, green innovation is an evolving process, where the negative externalities stemming from environmental pollution gradually get replaced by the positive externalities of environmental protection. This progression continues until the environmental pollution attributes of innovation are completely eliminated. Therefore, the development of green innovation involves a transition from environmental pollution negative externalities to environmental protection positive externalities, making it a process with both attributes.

From the perspective of ecological innovation, a redefinition of environmental innovation can be proposed as follows: It refers to the innovation of new or improved processes, operational systems, and products that contribute to enhancing environmental sustainability. Its fundamental essence lies in reducing the negative impact of production activities on the environment, with the ultimate goal being to achieve zero environmental impact from production (Oltra and Saint Jean, 2009). The starting point of environmental innovation involves reconciling the dual nature of “environmental protection-pollution” in green innovation. To fully grasp its attributes, green innovation needs to be compared horizontally and vertically with its own or reference objects. Consequently, green innovation exhibits relativity and temporality (Schiederig et al., 2012).

As inferred from the dual nature of “environmental protection-pollution” in green innovation, green innovation refers to new or improved processes, operational systems, and products that enhance environmental sustainability, with its essence being the reduction of negative environmental impacts from production activities—ultimately aiming for zero impact on the environment. Therefore, green innovation is often a process where environmental pollution negative externalities are gradually replaced by positive environmental protection externalities, until the innovative activities no longer produce negative impacts on the environment. As a result, the development process of green innovation exhibits both environmental pollution negative externalities and positive environmental protection externalities. When the negative externalities of pollution are more pronounced, green innovation exhibits attributes similar to ordinary innovation, where the innovation process is accompanied by strong negative externalities from production activities. However, when positive environmental protection externalities become stronger, green innovation leans toward being truly green and environmentally friendly. As the positive externalities related to environmental protection increase, the environmental impact of innovative activities gradually diminishes, eventually achieving genuine green innovation with minimal or zero negative impact on the environment.

According to Porter Hypothesis, the driving force of green innovation may be different from traditional technological innovation, and it is exogenous. The negative externalities of production activities cause corporate to bear greater social responsibility, and the negative externalities of production activities will gradually transform into endogenous losses. The lack of social responsibility caused by the increase of negative externalities of corporate will eventually form a negative signal transmission, leading external investors to reduce investment in high-polluting corporate. Meanwhile, high-polluting corporate are bound to be accompanied by high “three-carbon” emissions, and the losses caused by them will also become a risk factor for corporate and discourage investors. Because the resources of green insurance may have a crowding out effect on the production activities of corporate, the management of corporate may choose not to take out green insurance or take out less green insurance due to the self-serving tendency of the management, resulting in the weak role of green insurance. In summary, hypothesis H1a and H2a are proposed:

H1a: Companies that purchase green insurance will promote the output of corporate green innovation.

H1b: The purchase of green insurance will not have a significant impact on the output of corporate green innovation.

Based on The Risk-bearing Theory, when the risk-bearing capacity of the company's management is improved, they will be better equipped to seize investment opportunities and not easily abandon high-risk projects that could lead to significant returns. Technology insurance can mitigate the financial loss risk caused by R&D failures, allowing companies that purchase technology insurance to provide more internal resources to their management and offer ample financial guarantees and decision-making authority. This enables the management to better grasp investment opportunities. Based on the Porter Hypothesis, it is evident that the motivation for green innovation may not solely rely on internal risk-bearing capacity, as it is an exogenous factor. Corporate green innovation decisions can also be influenced by the company's social responsibility and environmental awareness. Similarly, like green insurance, the allocation of resources for purchasing technology insurance may also result in the “effectiveness of crowding out” in the company's production activities. Furthermore, based on the management's self-interest, they may choose to opt-out or reduce the purchase of technology insurance, leading to a limited impact of technology insurance. As a result, two hypotheses are proposed:

H2a: Companies that purchase technology insurance will promote the output of corporate green innovation.

H2b: The purchase of technology insurance by companies will not have a significant impact on the output of corporate green innovation.

Considering the “the dual nature of environmental protection-pollution” in green innovation, Porter Hypothesis, The Risk-bearing Theory, and the financing constraint theory, it becomes evident that simultaneous investment in both technology insurance and green insurance can encourage corporate green innovation. Technology insurance serves the purpose of risk-bearing, while green insurance enhances corporate social responsibility, ultimately leading to the gradual elimination of negative externalities associated with environmentally harmful production activities through green innovation. Based on the agency theory, it is evident that there might be a lack of understanding on the part of corporate owners compared to management, leading to blind spots in specialized knowledge and management methods. As a result, owners may struggle to effectively supervise the decision-making and actions of management, leading to biased performance evaluations and an inability to curb opportunistic behavior within the management team. Furthermore, the longer cycle, higher investment, and greater risks associated with green innovation may lead management to prefer ordinary innovation over green innovation, resulting in uncertainty regarding the attributes of innovation outcomes. Considering these factors, the following hypotheses are proposed:

H3a: Simultaneous investment in technology insurance and green insurance will promote corporate green innovation output.

H3b: Simultaneous investment in technology insurance and green insurance will not significantly affect corporate green innovation output.

Most empirical studies confirm that the Knowledge Production Function (KPF) is a compelling empirical model used to study knowledge output, corporate innovation, and their determining factors. The classical KPF is essentially a standard Cobb-Douglas production function, which has been improved and refined to become a powerful theoretical model for studying knowledge output and corporate innovation based on input-output analysis. This model suggests that the main inputs for knowledge production are R&D expenses and R&D human capital, which, under a comprehensive technological level, are transformed into valuable new knowledge and technology. The theoretical model used in this paper is based on the Griliches-Jaffe Knowledge Production Function, and its specific expression is as follows:

If insurance is distinguished into personal consumption insurance and production consumption insurance, production consumption insurance will be considered as part of the enterprise's production costs and enter the scope of production factors, driving the company's output and providing protection against economic losses in case of emergencies. Technology insurance and green insurance fall under the category of production consumption insurance. Technology insurance can stimulate the increase of technological innovation output for corporate and provide a safety net for potential R&D and dissemination failures during the innovation process. Green insurance can help eliminate negative externalities in the production process and the external oversight by insurance companies can encourage companies to adopt greener production practices, reducing the negative externalities of their innovation outcomes, ultimately leading to zero emissions and promoting the greening of technological innovation within corporate. If we assume that human capital remains relatively stable in the short term, the green innovation production function is influenced by capital, technology insurance, and green insurance inputs. Therefore, KPF is modified to reflect these inputs, and we can represent it as Y (RD, TI, GI), where TI represents the technology insurance input and GI represents the green insurance input made by the enterprise. Then, the modified KPF can be obtained as:

If the modified KPF in Equation (2-2) is transformed using logarithms, a linear model can be obtained as:

The green innovation of a company is related not only to whether it invests in technology insurance and green insurance as individual production factors but also to the interaction between technology insurance and green insurance. To capture this interaction, the current study enhances the model (2-3) by adding an interaction term between technology insurance and green insurance. Moreover, considering whether green insurance is purchased or not as a binary (0-1) dummy variable, the natural logarithmic terms are removed, resulting in the model (2-4):

where, GP represents the green innovation output of the company (company's innovative achievements); α signifies the overall technological level; RD denotes the company's investment in R&D expenditure as a measure of innovation input; TI represents the company's investment in technology insurance; GI signifies the company's investment in green insurance; i represents the sample observation unit; α, β, and φ are the output elasticities of R&D expenditure, technology insurance investment, and green insurance investment, respectively; μ represents the random disturbance term.

In the static equilibrium analysis, assuming that the modified KPF Y (RD, EP) as represented by Equation (2-3) is strictly concave, first-order homogeneous, and twice continuously differentiable. Therefore, the modified KPF should be a function of R&D investment RD and the input of insurance consumption used in production [denoted as EP(t) and considered as a cost], denoted as Y (RD, EP). The dynamic equation for capital accumulation is given as:

where δ represents the depreciation rate of RD investment, and I (t) is the investment in technology insurance, which is considered as a control variable in the model. The Penrose Effect suggests that the investment cost C (I (t)) exhibits diminishing marginal returns.

The long-term investment objective function for an RD enterprise, assuming it chooses the optimal insurance allocation based on input quantities, is defined as follows:

where w represents insurance premiums, P represents the value of innovation output, ρ is the discount rate. Additionally, it is assumed that the functions KPF, Y (RD, Ep): P0→P+, and the production function are non-decreasing and continuously differentiable with diminishing marginal returns.

The dynamic equilibrium in this context involves maximizing the present value of the company's profits under the constraint of the RD dynamic equation. The optimization process aims to achieve the optimal control of RD investment while considering the innovation output income at time t as and the insurance premium as .

Then the above problem can be formulated as the following dynamic optimization problem:

The Hamiltonian equation for this optimal control problem can be expressed as:

The costate variable λ (t) represents the marginal contribution rate of RD to profit. In order to achieve the maximization of the present value of profits, the following Hamiltonian canonical equations must be satisfied.

When the insurance product is optimally configured:

Furthermore, it can be deduced that the marginal yield of insurance at the optimal configuration is:

Finally, this implies that the insurance function about RD is

The results indicate that in the interval [0 , EP(t)], the marginal cost of insurance MCE is a monotonically increasing function, while the marginal productivity of insurance consumption VMPEP is a monotonically decreasing function. This implies that purchasing insurance will promote the corporate innovation output. However, the amount of insurance purchased by the company is positively correlated with the amount of RD investment.

Based on the theoretical model presented in Section 2.2, the empirical model is designed to examine the effects of green insurance and technology insurance on corporate green innovation. The model is specified as follows:

In the specified model, ln GPAALLi, tis the dependent variable, representing the level of green innovation for firm i in year t, measured by the total number of green patent applications. GI/TI are the explanatory variables, indicating whether firm i purchased green insurance/technology insurance in year t. Firm_Controlsi, trepresent the control variables for firm i in year t. FIRM and YEAR are dummy variables for individual firms and years, respectively, to account for firm-specific and year-specific effects. εi, t represents the random error term in the model.

Some existing literature approaches green innovation from a macro perspective at the industry level, measuring green innovation primarily based on energy consumption and the introduction of new products. In this study, we adopt a micro-level measurement method inspired by Wang et al. (2020). We use the total number of green patent applications made by a company in the current period to measure the variation in corporate green innovation activities, and in the regression model, we take the logarithm of the total number of green patent applications (LnGPA_all).

In China, green insurance concerns a particular type of insurance coverage which is mainly designed to reduce financial risks and liabilities provoked by companies in the event of environmental pollution incidents and related damages. Since it is not mandatory for companies to disclose information about Environmental Liability Insurance, comprehensive Environmental Liability Insurance data can only be obtained by consulting the list of companies that purchased such insurance disclosed by the Ministry of Ecology and Environment for the years 2014 and 2015. We set up a dummy variable for Environmental Pollution Liability Insurance. If a company purchases Environmental Pollution Liability Insurance in the current year, then GI = 1 for the subsequent years when the insurance is active; otherwise, it is 0, acting as a proxy variable for Environmental Pollution Liability Insurance.

In China, technology insurance includes policies such as “Major Equipment (First Set) Insurance” and “New Materials First Application Insurance.” However, innovation is typically considered confidential information for companies and is not disclosed freely, except when dealing with relevant investors. Existing research primarily focuses on industrial parks as the research subject for technology insurance and uses technology insurance subsidies as proxy variables. The required data is collected through questionnaire surveys. Due to the high risks involved in visiting technology parks during the pandemic, the research cannot be conducted using survey methods. Therefore, this study utilizes the effective demand for technology insurance as a proxy variable for actual demand. Following the model construction methods used by Liu (2011), Lv (2014), and Wang (2016) for technology insurance effective demand, model variables such as management's risk preference, risk perception level, technology research and development risks, and educational level of management are considered. The principal component analysis method is used to obtain the parameters for technology insurance effective demand.

Green insurance is a means of risk diversification in view of the existing technical defects, the absence of systems and the lack of cultural awareness of enterprises. It is worth mentioning that the separate effects of green insurance and technology insurance are not significant. As enterprises are the main body of insurance, they need synergy due to their chain-like structure.

The world is paying attention to green development, which is not only an economic and social issue, but also an ecological issue. Countries need not only sustainable economic development, but also sustainable ecological development. Since enterprises are the main body of wealth creation, they are responsible for environmental responsibility. Risk bearing capacity is closely related to the economic capacity of an enterprise, which is reflected in whether the enterprise's system is absent, whether the technology is missing, whether the capital is short, and whether the corresponding cultural concept is established.

Scholars both domestically and internationally have used various methods to calculate the corporate risk-bearing capacity, including annual volatility of stock returns (Zhang et al., 2015), research and development intensity: R&D investment/total assets (Coles et al., 2006), and profitability volatility: STDEV.S (asset return rate). The increase in expected profit uncertainty indicates an improvement in the corporate risk-bearing capacity. As profit volatility is a suitable variable for testing cross-sectional differences, this study selects profit volatility as the proxy variable for corporate risk-bearing capacity. The specific calculation method is as follows:

Among them, N represents the total number of companies in the industry where Company i is located, k denotes the k-th company in the industry, and t represents the year. Existing research mainly sets the observation year as t = 3. AdRoai, t represents the adjusted asset return rate of Company i in the t-th year.

Corporate environmental responsibility is a comprehensive evaluation system that considers factors such as environmental awareness, environmental investment amount, types of pollutants emitted, types of energy conservation measures, and environmental management systems. It reflects the relative performance of a company in terms of environmental investment and environmental consciousness. The data on corporate environmental responsibility are obtained from the environmental responsibility data published by Hexun Net.

To mitigate potential estimation biases caused by omitted variables, this study includes control variables that have a strong correlation with green innovation. These control variables are mainly related to corporate governance and firm characteristics. In addition to these variables, the model also controls for firm-specific effects (FIRM) and year effects (YEAR) to account for individual firm differences and year-specific factors. The definitions of the control variables are presented in Table 3.

In this study, we selected listed companies on the Shanghai and Shenzhen stock exchanges in China from 2014 to 2015 as the research objects. To ensure data reliability and validity, we performed the following steps on the initial sample: (1) Excluded companies that were listed after 2011; (2) Excluded financial companies from the sample; (3) Excluded companies with special stock codes such as ST, *ST, and delisted companies; (4) Winsorized the variables at the 1st and 99th percentiles to reduce the impact of outliers. In the end, we collected a total of 1,564 firm-year observations. The data for technology insurance was constructed based on previous research methods, using technology insurance effective demand as a proxy for actual technology insurance demand. The data for green insurance was represented by Environmental Pollution Liability Insurance, which was obtained by referring to the list of companies that purchased Environmental Pollution Liability Insurance in 2014 and 2015 from the Ministry of Ecology and Environment and manually collecting the relevant information. The data for green patents was sourced from the State Intellectual Property Office (SIPO), while other data, including firm characteristics and financial data, were obtained from the China Stock Market & Accounting Research (CSMAR) database and the annual reports of listed companies. The statistical analysis was conducted with Stata 15.1 software.

(1) The average total number of green innovation patents applied is 5.676 (Table 4), while the average number of regular patents is over 20. This indicates that green innovation currently accounts for only about 20% of the overall innovation output of the companies in the sample. This suggests that the level of attention and importance given to green innovation activities by the sampled companies is relatively low, and the prospects for their green and sustainable development may be concerning. Before taking the logarithm, the standard deviation of the total green innovation patents applied is 25.232, indicating a significant variation in green innovation levels among the sampled companies. The company with the highest number of green innovation patents applied is Gree Electric Appliances, with 715 patents applied per year, while some companies have not produced any green innovation output at all.

(2) In Table 4, the mean value of the Environmental Liability Insurance variable is only 0.045, indicating that the proportion of A-share listed companies in China that purchase Environmental Liability Insurance is still relatively low. On the other hand, the standard deviation of technology insurance effective demand is higher than that of Environmental Liability Insurance. This suggests that the number of companies purchasing technology insurance is even lower, and typically only companies with significant technological risks opt for technology insurance coverage.

(3) The descriptive statistics of the remaining control variables are all within normal levels, indicating that after Winsorize processing, the influence of outliers has been effectively mitigated (Table 5).

In this study, the fixed effects model is used to estimate the impact of technology insurance and green insurance on corporate green innovation activities, while controlling for firm-specific effects and year effects in the model. The regression results are shown in Table 6, Models 1 to 3.

In Models 1 and 2, the explanatory variables technology insurance and green insurance are not statistically significant, indicating that purchasing only green insurance or only technology insurance does not promote green innovation. This validates hypotheses H1b and H2b, suggesting that the driving force behind green innovation may differ from traditional technological innovation. It is influenced by both internal risk-taking capacity and external social responsibility. Green innovation cannot be solely determined by internal risk-taking ability, and corporate social responsibility and environmental awareness also play a role in shaping corporate green innovation decisions.

In Model 3, the interaction term between green insurance and technology insurance is significant (β = 0.8889, p < 0.01), indicating that the synergistic effect of simultaneously purchasing green insurance and technology insurance can promote corporate green innovation. This result validates hypothesis H3a. It suggests that when both green insurance and technology insurance are simultaneously utilized, technology insurance plays a role in risk-taking, while green insurance enhances corporate social responsibility, ultimately leading to the gradual reduction of environmental pollution negative externalities in innovative production activities, i.e., green innovation.

Due to the specific nature of green innovation activities, some industries may have low relevance with green innovation in their core business. Therefore, following the approach of Xiao et al. (2021), this study excludes certain industries with low relevance to green innovation from the seven major categories to perform robustness tests. The excluded industries include Education (P82), Wholesale (F51), Social Work (Q84), Retail (F52), Postal Services (G60), Healthcare (Q83), Catering Services (H62), Real Estate (K70), Accommodation Services (H61), and Culture, Sports, and Entertainment (Category R). The regression results in Model (1) are presented in Table 7. From the regression results, it is evident that the interaction term between green insurance and technology insurance remains significantly positive, indicating the robustness of the findings in this study.

Additionally, in this study, the total number of green patent authorizations is used as a replacement for the dependent variable. The regression results for Model (2) are shown in Table 7. From the regression results of Model (2), it can be observed that the interaction term between green insurance and technology insurance remains significantly positive, reaffirming the robustness of the findings in this study.

To address the issue of sample self-selection in the baseline regression, existing literature commonly employs the Heckman two-step approach. Firstly, the average values of technology insurance and green insurance purchases among other companies in the same industry (Other_TI*GI) are selected as exogenous instrumental variables to test for sample self-selection. The more companies within the same industry purchase technology insurance and green insurance, the more likely it is to stimulate the purchase of technology insurance and green insurance by the focal company. Therefore, using Other_TI*GI as instrumental variables meets the relevance requirement for instrumental variables. Furthermore, in the Heckman first-stage regression, TI & GI is set as the dependent variable and Other_TI*GI is included as an independent variable. A Probit model is used for this regression to obtain the inverse Mills ratio (IMR) using the results from the first stage. Finally, the IMR is added to the Heckman second-stage model for fitting, as shown in Models (3) and (4) in Table 7. According to the regression results, when using the total number of green patent applications as the dependent variable, the coefficient of TI & GI is positive and significant at the 1% level of significance. When using the total number of green patent authorizations as the dependent variable, the coefficient of TI & GI is positive and significant at the 5% level of significance. The significance levels and signs of the remaining control variables are similar to those in the baseline regression, confirming the robustness of the conclusions in this study.

This study divides the sample companies into large-scale and small-scale corporate based on the median total asset size of the sample. The purpose is to explore the heterogeneity in the impact of purchasing green insurance and technology insurance on green innovation across different enterprise sizes. The results from Models 1 and 2 in Table 6 show that the coefficient for large-scale corporate is significant at the 5% level and positive, indicating that the purchase of green insurance and technology insurance has a significant positive effect on the total number of green innovation patent applications in large-scale corporate. However, for small-scale corporate, the coefficient is not significant, suggesting that the impact of purchasing green insurance and technology insurance on green innovation is negligible for them. This discrepancy in effects may be attributed to differences in financial conditions and internal management conditions among companies. According to the theory of corporate life cycle, companies of different sizes may be at different stages of their life cycle, leading to varying responses to insurance purchases and their impact on green innovation. Generally, large-scale corporate are commonly in the mature stage of their life cycle. During this stage, these corporate have the advantage of securing a large portion of the market share, which provides them with substantial internal operating funds. Additionally, the lower operating risks reduce their financial constraints and enable them to access external funding more easily. The combined effect of internal and external funding increases the possibility of overinvestment for large-scale corporate. Moreover, large-scale corporate often have a higher degree of separation between ownership and management, leading to more prominent agency problems and management self-interest issues. This may result in a higher likelihood of inefficient investments. On the other hand, small-scale corporate in the growth stage often face tighter financial constraints and encounter fewer internal management issues. As a result, they tend to make cautious investment decisions to minimize inefficient investments to the greatest extent possible.

In this study, refer to the research method used by Lin et al. (2020) and use the shareholding ratio of the largest shareholder as a proxy variable for ownership concentration. Based on the median value of this variable, we categorize companies into two groups: those with concentrated ownership and those with dispersed ownership. Using this categorization as a basis, we conduct empirical analysis to explore the role of ownership concentration heterogeneity in the impact of green insurance and technology insurance on corporate green innovation. The regression results in Table 6, Models 3 and 4, indicate that the impact of green insurance and technology insurance on green innovation is only significant and positive in companies with dispersed ownership. One possible reason for this finding is that corporate green innovation is a strategic innovation activity aimed at sustainable development and long-term company performance. In companies with high ownership concentration, where the goals of managers and company owners may not align, the self-interest of managers could potentially harm the long-term interests of the company. In such cases, the large shareholders are more likely to closely monitor the actions of the management team, as their high shareholding implies a higher proportion of cash dividends, thereby deeply connecting the interests of the company and the large shareholders. In companies with dispersed ownership, there may be a lack of motivation to supervise the management team, and small shareholders often engage in “free-rider” behavior. As a result, the supervision responsibility of small shareholders becomes a monitoring cost. These companies may be in greater need of external supervision to limit the actions of the management team. By purchasing technology insurance and green insurance, the insurance companies act as external oversight forces, influencing the company's production and operational decisions, reducing negative externalities, and enhancing the company's positive externalities for sustainable development and innovation. In conclusion, companies with low ownership concentration are more motivated to purchase technology insurance and green insurance to supervise the actions of the management team. Moreover, the positive impact of purchasing green insurance and technology insurance on corporate green innovation output is more pronounced in these companies.

The use of property rights heterogeneity dummy variables is employed to examine the differential effects of green insurance and technology insurance on green innovation in state-owned corporate and non-state-owned corporate. In Model 5, the coefficient of the interaction term between green insurance and technology insurance is 2.1845, significant at the 1% level, while in Model 6, it is not significant. This indicates that the promotion effect of green insurance and technology insurance on green innovation is only significant and positive in state-owned corporate. The possible reason is that state-owned corporate are more prone to the separation of ownership and control, and they may face lower financing constraints, leading to the potential for overinvestment. Therefore, introducing green insurance and technology insurance can act as external monitoring mechanisms to mitigate the agency problems in state-owned corporate. State-owned corporate need to balance their political, positive externalities, and social objectives. Additionally, they often face lower financing constraints, which can lead to inefficient investment activities. Green insurance and technology insurance can effectively alleviate the investment inefficiencies in state-owned corporate. Technology insurance primarily enhances the risk-bearing capacity of management, enabling the company to focus on high-risk, high-return investment projects. Green insurance plays a role in promoting positive externalities, guiding state-owned corporate' overinvestment toward sustainable green innovation, and realizing their social attributes as state-owned assets.

The results from models 7 and 8 in Table 6 show the differential effects of purchasing green insurance and technology insurance on corporate green innovation for firms with unified and separated dual leadership structures. The results indicate that whether the dual leadership structure is unified or separated does not change the positive impact of technology insurance and green insurance on corporate green innovation. However, the effect is more significant when the dual leadership structure is unified. This suggests that when the roles of Chairman and CEO are combined in one person, the management has more power and authority concentrated in one individual. As a result, the firm is more motivated to purchase technology insurance and green insurance to prevent opportunistic behavior by the management, thereby promoting the implementation of corporate green innovation activities.

In Table 8, based on the previous analysis, we have concluded that both green insurance and technology insurance have a positive effect on corporate green innovation when purchased together. However, we have not yet demonstrated the specific mechanism through which green insurance and technology insurance lead to an increase in green innovation output. Therefore, in this section, we will conduct mediation effect testing to further investigate the specific promotion mechanism of technology insurance and green insurance on green innovation.

In this study, we hypothesize that technology insurance promotes corporate innovation output by increasing the level of risk-taking, while green insurance reduces negative externalities and promotes green output by enhancing corporate environmental responsibility. When both technology insurance and green insurance are purchased, the interaction between the two insurances will not affect their individual effects. Technology insurance influences innovation awareness in the company, while the increased social and environmental responsibility from green insurance leads to a greener technological output. Therefore, we will use corporate risk-taking level and environmental responsibility as mediating variables to examine the specific pathways through which technology insurance and green insurance affect green innovation. To test the mediation effects, we adopt the method proposed by Wernick (2002). The testing model is as follows:

Where Mi, t represents the mediator variable to be tested, and TI*GI represents the simultaneous purchase of technology insurance and green insurance. The mediation effect testing results are shown in Table 9. In Model (1), TIGI is significant at the 1% level, while in Model (2), it is not significant. OROA is significant at the 5% level, indicating that the corporate risk-taking level exhibits complete mediation effects. In Model (3), TIGI is significant at the 10% level, while in Model (4), it is not significant. ER is significant at the 5% level, indicating that corporate environmental responsibility exhibits complete mediation effects. Additionally, by observing the signs of the mediating variables, we find that green insurance positively promotes environmental responsibility, and technology insurance positively promotes corporate risk-taking level.

Based on the empirical results, it can be observed that under the condition of simultaneously purchasing technology insurance and green insurance, technology insurance promotes technological innovation by increasing the level of corporate risk-taking, while green insurance encourages the greening of production and innovation by enhancing corporate environmental responsibility. Specifically, as analyzed earlier, the level of risk-taking capacity of a company determines its risk preferences and investment decisions. Companies with higher risk-taking capacity are more likely to seize high-risk, high-return innovation opportunities. Environmental responsibility is a concept related to a company's sustainable development. Companies with a stronger sense of environmental responsibility tend to adopt cleaner production methods and reduce negative externalities in their production and operations. Corporate green innovation aims to continually reduce the negative externalities of innovation activities, ultimately achieving a zero-emission goal.

In recent years, green insurance and technology insurance have played a crucial role in promoting corporate green innovation by alleviating corporate financing constraints, increasing the level of risk-taking, and mitigating the costs of innovation failures. This study focused on Chinese A-share listed companies from 2014 to 2015, collecting data on technology insurance, green insurance, and green patents. Through empirical analysis, the impact of purchasing technology insurance and green insurance on green innovation was investigated, yielding the following findings: