95% of researchers rate our articles as excellent or good

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.

Find out more

ORIGINAL RESEARCH article

Front. Behav. Econ. , 16 March 2023

Sec. Behavioral Microfoundations

Volume 2 - 2023 | https://doi.org/10.3389/frbhe.2023.1120448

This article is part of the Research Topic What do we say? The content of communication in strategic interactions View all 5 articles

J. Jobu Babin*†

J. Jobu Babin*† Haritima S. Chauhan†

Haritima S. Chauhan†Theory suggests a first-mover advantage in many strategic bargaining situations, yet often the first to make an offer is not the first to communicate. We report the results of experimental trust games conducted on mobile devices allowing free-flow computer-mediated communication (CMC) rather than pre-play. Free-flow CMC leads to increased trust and overall welfare, where the majority of increased benefit goes to second movers. Using timestamps in chat logs, we find that first-movers most often initiate communication, but there is no direct benefit to doing so. Linguistic analysis of chat logs reveals significant bargaining and screening/signaling content.

JEL codes: C78, C91, C92, D8, D63, D71.

This article explores the impact of free-flow computer-mediated communication (CMC) in trust-oriented bargaining and investigates the incentives to initiate discourse. CMC—typically in the form of electronic chat or notation—is becoming the norm to the relative discount of face-to-face. Looking at this type of discourse is very important given the movement in society toward CMC. Previous studies almost universally demonstrates that introducing communication to bargaining games encourages socially beneficial actions and improves overall welfare (Xiao and Houser, 2005; Buchan et al., 2006; Charness and Dufwenberg, 2006; Fiedler and Haruvy, 2009; Bicchieri et al., 2010; Andreoni and Rao, 2011; Ben-Ner et al., 2011; Chen and Chen, 2011). While a handful of recent studies look at modern communication modes (Greiner et al., 2012; Abatayo et al., 2017; Babin, 2020), few explore free-flow CMC explicitly as observed in the real world (see Omilion-Hodges and Ackerman, 2018).

This study aims to answer three economic questions. First, does free-flow, electronic messaging impact trust and related gains compared to no communication? Second, does one's role in a bargaining game impact the decision to initiate CMC? Finally, are there benefits related to the initiation of CMC, and if so, who realizes them? Our vehicle for answering these questions is an experimental “Investment game” (Berg et al., 1995) (henceforth “trust game”) allowing continuous chat until the final player action. This structure yields intuitive measures of trust, trustworthiness, and welfare and allows for the modeling of numerous interactions that require conditional judgment and reciprocity. A limitation of restricting communication to a pre-play condition is that the design will camouflage any informational gain associated with a first- or second-mover advantage. Free flow of communication makes more sense in a trust game and allows the researcher to examine the roles of discourse sequence and signaling content. We use the timestamps in chat logs to identify initiators and determine the impact of starting a chat on trust and welfare. The quality of our chat data is poor, made up of broken textspeak and emojis, and given the sample size, we cannot use contemporary NLP methods for textual analysis. Instead, we categorized our chats and found a significant number with cheap talk deals and screening content.

There is some reason to hypothesize that the first mover in a game would be the one to open a chat, even if mere cheap talk. Hernandez-Lagos (2019) finds that in settings with costless, free-form, and pre-play communication, players often cooperate with initiators (in a stag hunt). However, that study does not involve a sequential game nor allow freeform CMC during the process of committing to strategic actions. Before any strategic action occurs, the information environment can be awkward for decision-makers. When an agent decides on a choice of “words” in any communication mode, they implicitly decide how to position themselves in relation to a counterpart (Graham, 2015). One story paints CMC as a screening/signaling (s/s) mechanism. Studies show there is a demand-side effect for such information in trust games, as agents condition their actions to the expectations of counterparts (Eckel and Wilson, 2004; Wilson and Eckel, 2006; Eckel and Petrie, 2011). This hypothesis means that players may statistically discriminate counterparts as “favorable” or “unfavorable” types (e.g., Eckel and Grossman, 1998; Buchan et al., 2008; Delavande and Zafar, 2015; Capraro and Kuilder, 2016; Brañas-Garza et al., 2018; Babin, 2020) or may provide a signal to elicit a preferable stereotype. Screening helps to set payoff expectations, but not in the same way as receiving a financial offer or cheap talk statement of intent. Information about a counterpart's type (e.g., gender, race, cultural origin, or affective state) (1) may support the credibility of a promise or (2) serve as a substitute for a statement of intent, thus, inducing prosocial behavior in the trust game. If true, an implication of this notion is that the “trust game” often used in the lab is perceived by subjects as a Bayesian game (i.e., involving incomplete information).

Sequences in a conversation typically relate to who desires the discourse the most.1 If trust is conditioned on a linguistic signal (e.g., a person's type), it is reasonable to expect first-movers (Investors) to initiate more frequently than second-movers (Responders). Second-movers may also be interested in information about the first to position themselves as trustworthy. However, in the trust game, sub-game perfection dictates there should be no amount of currency passed, and increased surplus can only occur when Investors send a positive amount. Therefore, any informational signal embedded in communication should be more valuable to the first-mover—the player with more to lose. The choice to initiate a chat may be a strategic action.

We find that trust increases dramatically with the introduction of free-flow CMC to one-shot interactions (consistent with the pre-play literature). First-movers are far more likely to be the first to send a message compared to second-movers. While there are no explicit benefits to initiating a chat, the average payoff gains in communication settings appear to go to second movers.

This study contributes in several ways. We illustrate how the initiation of a free-flow chat (and potential signaling content) impacts allocation. Each player in a trust game has the incentive to garner information via communication, assuming agents condition their actions on the judgments of their counterparts. Allowing free-flow chat into the trust game, we can identify the most likely initiator and isolate welfare gains by player roles. Our results support the previous findings that communication augments trust and welfare (e.g., Charness and Dufwenberg, 2006) while expanding beyond those settings. Additionally, we use mobile devices in the lab setting, adding a “taste of the field” to the design.

Our primary inquiries are whether free-flow electronic chat has any significant correlation with the roles of the players in the trust game, who initiates communication, and whether there are notable gains from being that player. Thus, we must compare trust and welfare measures with linguistic sequences in electronic chat logs.

We use a one-shot dual endowment trust game (Figure 1) following Aksoy et al. (2018) to eliminate inequality aversion as a factor. The game yields intuitive measures of trust as amounts sent, trustworthiness as a percentage of the amount returned, and welfare as payoffs in currency terms. Imposing sub-game perfection, the unique Nash equilibrium predicts no money is exchanged. In reality, this equilibrium is seldom seen in experimental settings, with payoffs being indicative of players seeking Pareto improvements from the Nash.

To isolate the effect of free-flow chat on the trust measures, we executed an experiment, allowing analysis of actions, chat logs by role and sequence, and subject characteristics. Students participated in a 1 x 2 between-subject design with random assignment: a baseline group (B1) plays a one-shot trust game with no communication and a treatment group (T1) plays a one-shot trust game with the ability to use CMC, including text chat and emojis. Previous studies have focused on “pre-play” messaging. Alternatively, we allowed for free-flow communication throughout the interaction in T1, ceasing at the final action. Subjects were unaware of the different treatment conditions of the experiment. They also completed an MPL risk aversion measure (Holt and Laury, 2002) and filled out a demographic questionnaire.

All components of the study were completed using the subjects' own mobile devices. When subjects arrived at a scheduled lab session, they signed a consent form and were instructed on how to connect to the instrument. Assistants seated subjects spaced apart and directed them not to converse. They were, however, given permission to text message or browse the Internet only until sessions were about to begin – intended as both a priming device and to minimize loss of control. Oral instructions were read aloud and projected onto an overhead screen; on a post-experiment questionnaire, 98.1% of participants indicated that the instructions were clear.

Subjects were paid in a separate room from the session and redeemed virtual earnings for cash at a ratio of 10 vc: US $1, plus the $5 participation fee. The study was carried out over seven sessions, ranging from 23 to 67 subjects, and took 35 min on average. The mean earnings per subject were $13.35; the study paid out a total of $4125. There was no deception throughout. The design is structured to test the following hypotheses:

H1: Trust (in the form of amounts sent) will increase on average with free flow CMC in T1, relative to B1, against N1: no difference.

H2: Mean payoffs will increase in T1 with CMC, relative to B1, against N2: no difference.

H3: Being a first-mover in the trust game will be significantly correlated with initiation of CMC, against N3: no relationship.

H4: Being a first-mover in the trust game initiating CMC will be significantly correlated with gains within the treatment, against N4: no explicit relationship with gains.

H1 and H2 are tested to confirm treatment effects and put into the context of existing literature. H3 suggests certain individuals are more likely to initiate CMC, while H4 suggests initiation of chat carries some benefit or penalty; to test these, we restrict the analysis to the treatment, look at the time stamp of an initial message sent, then determine the role the initiator had in the trust game.

We recruited 270 volunteers from undergraduate classes at the University of Memphis. A characteristic breakdown of the sample is given in Table 1. Subjects were randomized into dyads. One observation of an Investor in treatment was dropped due to data collection errors. Out of 269 observations, 110 were in the control (55 dyads), 159 were in the treatment (79 dyads), and 1 Responder whose investor counterpart was dropped. Ten observations (5 dyads) involved no communication. Thus, our primary analysis involves 149 (74 dyads that communicated and 1 Responder whose Investor counterpart was dropped).

An underlying dimension of this study is the mobile device expertise of the subjects. Cross-platform matches presented a concern in that text and emoji images sent sometimes do not look exactly the same across different mobile platforms. This was not a common occurrence; over the entire sample. Three subjects raised concerns about technical limitations occurring with their devices. These subjects were paid the $5 participation fee and dismissed; they are not in the dataset.

Result 1: There are significant increases in trust associated with free-flow CMC.

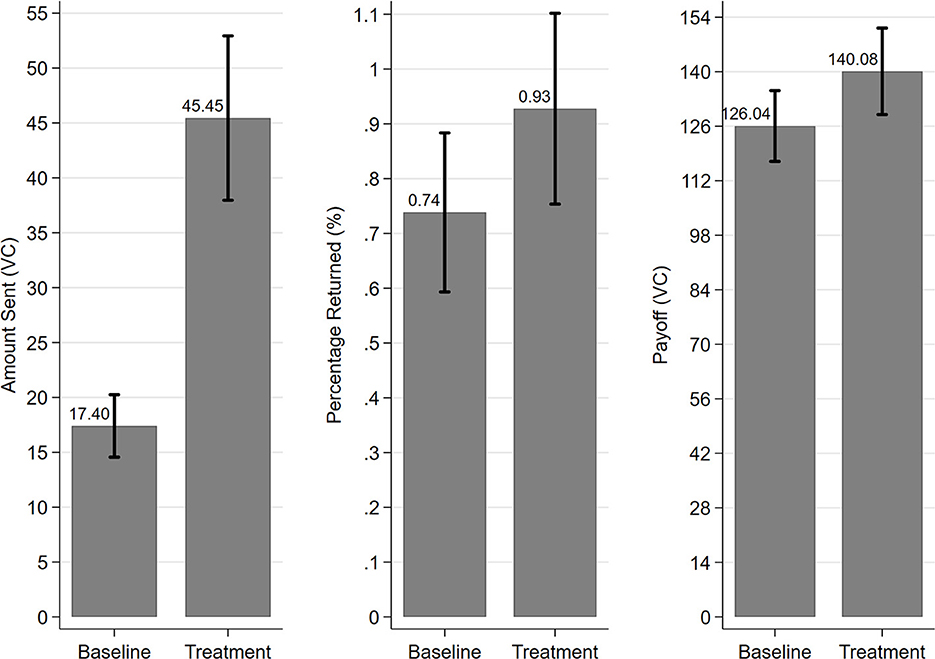

Figure 2 depicts the treatment effects across the trust variables. Allowing free-flow chat results in vc 28 ($2.80) more sent on average compared to the baseline (Mann-Whitney, p < 0.001). These results allow us to reject the null N1. Trustworthiness is roughly 22% higher in the CMC treatment; however, that difference is not significant.

Figure 2. Treatment Effects of CMC Baseline (B1, no communication allowed); Treatment (T1, communication allowed); n = 269 with baseline = 110 and treatment = 159; Panel 1 for Amount Sent (vc): n = 134 Investors (baseline = 55 and treatment = 79); Panel 2 for Percentage Returned (%): n = 123 Responders (baseline = 50 and treatment = 73); Panel 3 for Payoff (vc): n = 269 (baseline = 110 and treatment = 159); The 123 Responders exclude 12 players that received zero from their counterparts and include 1 Responder whose Investor counterpart was dropped (data collection error).

Result 2: There are significant welfare gains associated with free-flow CMC

A result expected from the increased trust levels, the average payoffs are vc 26.60 greater with free-flow CMC, compared to the baseline without (Mann-Whitney, p=0.006), allowing us to reject the null that they are unchanged. However, this nonparametric analysis makes it challenging to see the distribution of gains across roles in the trust game. The Appendix provides a summary table of welfare gains by roles and initiation of communication.

To estimate treatment effects, we employed a Tobit regression scheme, as suggested by Moffatt (2015). Table 2 details estimates for the trust variables and payoffs across the pooled sample. Subjects in the CMC treatment send vc 32.27 ($3.22, p < 0.001) and earn vc 48.62 ($4.86), p < 0.001) more on average than those without the ability to chat. However, second-movers do not return a higher percentage compared to the baseline. As a result, first-movers see significantly reduced payoffs of vc 47.19 ($4.71, p < 0.001) in the trust game overall and incur an additionally decreased payoff of vc 43.77 ($4.37, p < 0.001) when chat is an option, for a total net effect of vc –90.96 ($9.09). These results suggest that Investors (perhaps optimistically) send more with CMC while Responders tend toward the subgame Nash of returning nothing.

Result 3: First-movers initiate CMC significantly more often than second-movers

For a deeper understanding of the incentives to initiate CMC, we explore the likelihood of a subject starting a chat.2 We hypothesized that Investors would be more likely to initiate as a potential screening device. Table 3 details fixed effects logit estimates (dyad level) of the log odds of initiating a chat, conditional on being in the CMC treatment. The dependent variable takes the value of 1 if time stamps in the chat log indicate the player was the first to send a message. The model predicts that Investors are far more likely to initiate chat than second-movers, supporting a screening story. Women initiate chat slightly more often compared to men. Because women are no more likely than men to be first-movers (given random assignment and the balance observed in the sample), we included an interaction term to isolate the effect of female Investors (with no significant effect). Women appear more open to using communication as a social tool than males, perhaps less willing to explore the trust decision—or more reluctant to be deceived. As one becomes more risk-tolerant, they are more likely to initiate and may reflect subjects' attitudes toward strangers and “social risk” (Eckel and Wilson, 2004). These findings allow us to reject N3, and we continue to explore whether initiation leads to specific gains.

Result 4: There is no explicit benefit or penalty to initiating a chat

Table 4 details the effects of initiating chat on trust variables, conditional on the subject being in CMS treatment. First-movers see a vc 91.75 ($9.17, p < 0.001) unit penalty to their role with free-flow chat, accounting for the average differential illustrated in Figure 2, yet we cannot reject N4. We observe no explicit benefit nor penalty to initiating a chat, which applies to Investors and Responders alike. The total effect of the coefficients suggests that, while Investors are far more likely to start a chat, there is no realized incentive.

One downside of freeflow communication using mobile devices (and perhaps our young student subjects) is that it leads to chat data that is not as rich as that in written pre-play. The overall richness of our chat data is poor, made up of broken textspeak and emojis, allowing for little practical text analysis. Furthermore, given the sample size, there are not enough data to process using contemporary pre-trained NLP methods. The numerous instances of emojis and broken spelling complicate word frequency analysis. We also note that, unlike many studies, we only advised subjects that a chat function was available but did not instruct them how to exploit it.

Charness and Dufwenberg (2006) famously employ pre-play message categorization and find evidence that ex-ante, unenforceable “statements of intent” enhance trustworthy behavior and resulting gains. The driver of such behavior is guilt aversion which forces players in the trust game to fulfill their promises. We note that in the pre-play setting, such cheap talk “promises” cannot receive a response and, thus, do not constitute an agreement. In contrast, free-flow communication facilitates the potential for the terms of an unenforceable bargain to be struck and observed by the investigator. For example,

Investor: Hello

Responder: Sup, send me 50

Investor: That was my plan too

Freeflow CMC also allows for dyads to readily explore characteristics of each other (screening and signaling) to statistically discriminate. One upside of our data is numerous instances of emojis that incorporate skin tone or affective content, which serve as signals (see Babin, 2020). We see numerous examples of chat that suggest screening or signaling. For example,

Investor: I don't want this to be random. All you a boy or a girl? [SIC]

Responder: Can I get something? Boy

Investor: What color is your hair?

Responder: I'm black. What are you?

Investor: I'm black too!

We did our best to follow a categorization method in the mindset of Charness and Dufwenberg (2006). Three evaluators were contracted to code the overall theme or context of dyadic messaging as consisting of a deal, screening/signaling (s/s) content, a mix (deal and s/s), empty talk (gibberish or nonaccepted offers), or no communication. Table 5 details the chat log breakdown. The dynamic nature of these chats meant we could not effectively include this information in regression analysis. Only 11 (13.92%) of the 79 dyadic chats could be reasonably viewed as exclusively cheap talk deals. Some messages involved proposals and few were accepted. Twenty-eight (35.4%) dyadic chats had distinct s/s content, suggesting that players were extremely interested in identifying information about their random partner or signaling something about themselves. On the suggestion of a reviewer, we tried to isolate the differential impacts of screening chat on Investor payoffs. Average Investor payoffs (vc) by chat group are as follows: Deal, 131.27 (sd 27.75); Mix, 102.59 (26.05); s/s, 98.38 (18.37); Empty, 85.97 (39.28). However, we cannot demonstrate the statistical significance of differences across chat types by using t or Kruskal-Wallis H tests.3 Of the 79 Investors in the CMC treatment, 23 (29.1%) had final payoffs greater than the initial endowment. We do observe some instances of the terms of deals being violated. Thus, deals cannot fully account for all gains for Investors, which suggests some degree of benefit from screening. However, we do not identify an initiation effect in regression analysis, muting the screening story somewhat.

The goal of this experiment was to identify how incorporating free-flow electronic messaging (CMC) can affect behavior in the trust game, isolate associated welfare gains, and identify the role most likely to initiate chat. Using sequential linguistic analysis of dyadic chats, we found a significant number has cheap talk deals and screening or signaling content. We show that levels of trust and average payoffs increase with the inclusion of CMC.

The first main takeaway is that free-flow communication matters in trust decisions leading to welfare gains. Ultimately, those windfalls go to second-movers. This accents the current state of the literature. Second, first-movers initiate chats far more often than second-movers. However, few benefits are directly tied to being the initiator of discourse. Both parties in a dyadic trust relationship have important strategic considerations and move conditional on the expectations of others. A priori beliefs typically guide these expectations, but so will any information obtained. However, communication is not required but rather volunteered. Thus, we believe that this is a screening story in which cheap talk rules. However, there are two other role dependent explanations: (1) by the nature of their first-mover status in the trust game, Investors may perceive a cognitive imperative to be the leader in discourse, and (2) less cooperative Responders do not initiate as they do not want to commit to an action; thus Investors are forced to initiate. There might be disutility associated with the absence of discourse, and the Investors take it upon themselves to alleviate the awkwardness.

We considered that the first to chat might be an attempt to “misrepresent” themselves as a player type generally considered a preferable counterpart, muting the screening effect of initiation. At the same time, much of the banter involves more traditional cheap talk bargaining (unaccepted offers). Exploring these concurrent exchanges would require a deeper analysis of chat logs (such as using NLP) from a far larger sample, and we leave these concerns to future research.

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

The studies involving human participants were reviewed and approved by University of Memphis Institutional Review Board, #PRO-FY2017-5. The patients/participants provided their written informed consent to participate in this study.

All authors listed have made a substantial, direct, and intellectual contribution to the work and approved it for publication.

We are grateful for the support and methodological insights from Catherine Eckel, Rick K. Wilson, Andrew Hussey, Jamin Speer, David Blake Johnson, Sage Graham, Steven Kistler, and editors and two reviewers, which greatly improved the manuscript. This article was presented at the 2017 Economic Science Association and Southern Economic Association Meetings; thank you to all the participants for the thoughtful comments.

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/frbhe.2023.1120448/full#supplementary-material

1. ^In linguistics, discourse analysis aims to reveal an agent's socio-psychological characteristics by studying the sequence of their “words”—spoken, texted, emojis, gestures, etc. The social implications of communication are discussed in Dawes et al. (1977), while linguistic views relating CMC to the projection of identity are found in Crystal (2004) and Graham (2015). One's choice of electronic “words” is inexorably linked to the “self” one chooses to project, and such projections influence economic actions.

2. ^Table 6 in the Appendix tabulates payoffs by player role and by who initiated the chat.

3. ^We observe a comparable level of empty talk to that in Charness and Dufwenberg (2006), some of which might suggest disinterest in the study or in the replies of counterparts.

Abatayo, A. L., Lynham, J., and Sherstyuk, K. (2017). Facebook-to-facebook: online communication and economic cooperation. Appl. Econ. Lett. 25, 762–767. doi: 10.1080/13504851.2017.1363857

Aksoy, B., Harwell, H., Kovaliukaite, A., and Eckel, C. (2018). Measuring trust: a reinvestigation. South Econ. J. 84, 992–1000. doi: 10.1002/soej.12259

Andreoni, J., and Rao, J. M. (2011). The power of asking: How communication affects selfishness, empathy, and altruism. J. Public Econ. 95, 513–520. doi: 10.1016/j.jpubeco.2010.12.008

Babin, J. J. (2020). Linguistic signaling, emojis, and skin tone in trust games. PLoS ONE 15, e0233277. doi: 10.1371/journal.pone.0233277

Ben-Ner, A., Putterman, L., and Ren, T. (2011). Lavish returns on cheap talk: two-way communication in trust games. J. Sociol. Econ. 40, 1–13. doi: 10.1016/j.socec.2010.09.009

Berg, J., Dickhaut, J., and McCabe, K. (1995). Trust, reciprocity, and social history. Games Econ. Behav. 10, 122–142. doi: 10.1006/game.1995.1027

Bicchieri, C., Lev-On, A., and Chavez, A. (2010). The medium or the message? communication relevance and richness in trust games. Synthese 176, 125–147. doi: 10.1007/s11229-009-9487-y

Bra nas-Garza, P., Capraro, V., and Rascon-Ramirez, E. (2018). Gender differences in altruism on mechanical turk: expectations and actual behaviour. Econ. Lett. 170, 19–23. doi: 10.1016/j.econlet.2018.05.022

Buchan, N. R., Croson, R. T., and Solnick, S. (2008). Trust and gender: an examination of behavior and beliefs in the investment game. J. Econ. Behav. Organ. 68, 466–476. doi: 10.1016/j.jebo.2007.10.006

Buchan, N. R., Johnson, E. J., and Croson, R. T. (2006). Let's get personal: an international examination of the influence of communication, culture and social distance on other-regarding preferences. J. Econ. Behav. Organ. 60, 373–398. doi: 10.1016/j.jebo.2004.03.017

Capraro, V., and Kuilder, J. (2016). To know or not to know? looking at payoffs signals selfish behavior, but it does not actually mean so. J. Behav. Exp. Econ. 65, 79–84. doi: 10.1016/j.socec.2016.08.005

Charness, G., and Dufwenberg, M. (2006). Promises and partnership. Econometrica 74, 1579–1601. doi: 10.1111/j.1468-0262.2006.00719.x

Chen, R., and Chen, Y. (2011). The potential of social identity for equilibrium selection. Am. Econ. Rev. 101, 2562–2589. doi: 10.1257/aer.101.6.2562

Dawes, R. M., McTavish, J., and Shaklee, H. (1977). Behavior, communication, and assumptions about other people's behavior in a commons dilemma situation. J. Pers. Soc. Psychol. 35, 1. doi: 10.1037/0022-3514.35.1.1

Delavande, A., and Zafar, B. (2015). Stereotypes and madrassas: experimental evidence from pakistan. J. Econ. Behav. Organ. 118, 247–267. doi: 10.1016/j.jebo.2015.03.020

Eckel, C., and Grossman, P. (1998). Are women less selfish than men?: evidence from dictator experiments. Econ. J. 108, 726–735. doi: 10.1111/1468-0297.00311

Eckel, C., and Wilson, R. K. (2004). Is trust a risky decision? J. Econ. Behav. Organ. 55, 447–465. doi: 10.1016/j.jebo.2003.11.003

Eckel, C. C., and Petrie, R. (2011). Face value. Am. Econ. Rev. 101, 1497–1513. doi: 10.1257/aer.101.4.1497

Fiedler, M., and Haruvy, E. (2009). The lab versus the virtual lab and virtual field–an experimental investigation of trust games with communication. J. Econ. Behav. Organ. 72, 716–724. doi: 10.1016/j.jebo.2009.07.013

Graham, S. L. (2015). “Relationality, friendship, and identity in digital communication,” in The Routledge Handbook of Language and Digital Communication, Vol. 1974 (London: Routledge), 305.

Greiner, B., Güth, W., and Zultan, R. (2012). Social communication and discrimination: a video experiment. Exp. Econ. 15, 398–417. doi: 10.1007/s10683-011-9305-5

Hernandez-Lagos, P. (2019). Cooperative initiative through pre-play communication in simple games. J. Behav. Exp. Econ. 80, 108–120. doi: 10.1016/j.socec.2019.04.002

Holt, C. A., and Laury, S. K. (2002). Risk aversion and incentive effects. Am. Econ. Rev. 92, 1644–1655. doi: 10.1257/000282802762024700

Moffatt, P. G. (2015). Experimetrics: Econometrics for Experimental Economics. London: Palgrave Macmillan.

Omilion-Hodges, L. M., and Ackerman, C. D. (2018). From the technical know-how to the free flow of ideas: exploring the effects of leader, peer, and team communication on employee creativity. Commun. Q. 66, 38–57. doi: 10.1080/01463373.2017.1325385

Wilson, R. K., and Eckel, C. C. (2006). Judging a book by its cover: beauty and expectations in the trust game. Polit. Res. Q. 59, 189–202. doi: 10.1177/106591290605900202

Xiao, E., and Houser, D. (2005). Emotion expression in human punishment behavior. Proc. Natl. Acad. Sci. U.S.A. 102, 7398–7401. doi: 10.1073/pnas.0502399102

Keywords: free-flow communication, CMC, trust games, chat mining, experiment, mobile devices

Citation: Babin JJ and Chauhan HS (2023) Initiating free-flow communication in trust games. Front. Behav. Econ. 2:1120448. doi: 10.3389/frbhe.2023.1120448

Received: 10 December 2022; Accepted: 20 February 2023;

Published: 16 March 2023.

Edited by:

Emmanuel Dechenaux, Kent State University, United StatesReviewed by:

Puja Bhattacharya, University of Arkansas, United StatesCopyright © 2023 Babin and Chauhan. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: J. Jobu Babin, amotYmFiaW5Ad2l1LmVkdQ==

†ORCID: J. Jobu Babin orcid.org/0000-0001-6022-0089

Haritima S. Chauhan orcid.org/0000-0003-4397-4166

Disclaimer: All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article or claim that may be made by its manufacturer is not guaranteed or endorsed by the publisher.

Research integrity at Frontiers

Learn more about the work of our research integrity team to safeguard the quality of each article we publish.