- 1Department of Mathematical Modeling, Kaunas University of Technology, Kaunas, Lithuania

- 2School of Management and Law, Institute of Wealth and Asset Management, Zurich University of Applied Sciences, Winterthur, Switzerland

- 3Department of Economics and Modelling, West University of Timisoara, Timisoara, Romania

- 4Faculty of Statistic Studies, Complutense University of Madrid, Madrid, Spain

- 5Faculty of Computer Science and Engineering, Ss. Cyril and Methodius University in Skopje, Skopje, North Macedonia

- 6Complexity Science Hub Vienna, Vienna, Austria

- 7Division of Firms and Industrial Economics, Research Center in Applied Economics for Development, Algiers, Algeria

- 8Department of International Trade and Finance, Kadir Has University, Istanbul, Türkiye

Building an investment portfolio is a problem that numerous researchers have addressed for many years. The key goal has always been to balance risk and reward by optimally allocating assets such as stocks, bonds, and cash. In general, the portfolio management process is based on three steps: planning, execution, and feedback, each of which has its objectives and methods to be employed. Starting from Markowitz's mean-variance portfolio theory, different frameworks have been widely accepted, which considerably renewed how asset allocation is being solved. Recent advances in artificial intelligence provide methodological and technological capabilities to solve highly complex problems, and investment portfolio is no exception. For this reason, the paper reviews the current state-of-the-art approaches by answering the core question of how artificial intelligence is transforming portfolio management steps. Moreover, as the use of artificial intelligence in finance is challenged by transparency, fairness and explainability requirements, the case study of post-hoc explanations for asset allocation is demonstrated. Finally, we discuss recent regulatory developments in the European investment business and highlight specific aspects of this business where explainable artificial intelligence could advance transparency of the investment process.

1 Introduction

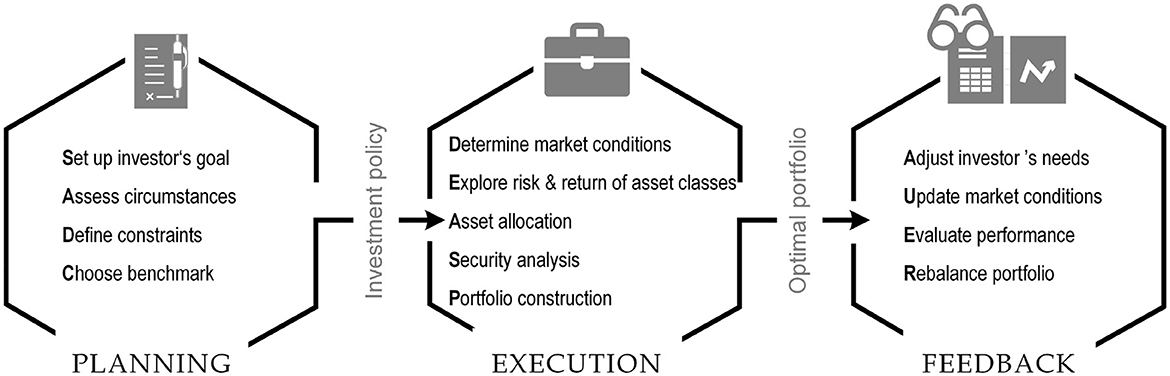

Portfolio management is a continuous process of creating portfolios based on an investor's preferred level of risk and reward and then adjusting it over time to maximize returns. This process includes three subsequent layers, namely planning, execution, and feedback (see Figure 1) (Baker and Filbeck, 2013). The first layer of the process is the planning layer. The asset owner—an institutional client like a pension fund or a wealth management client—mandates an asset manager to manage a specific portfolio according to an investment policy. The investment policy defines this mandate. It contains the client's needs, circumstances, and constraints to achieve a particular reward goal at a given risk level. Strategic asset allocation (SAA) is part of this investment policy. Typically, the SAA is defined as upper and lower boundaries for the asset class allocation. The risk tolerance and risk capacity also need to be defined. The second layer of the portfolio management process is the execution layer. The execution starts with determining the overall macroeconomic conditions across countries and asset classes, exploring the risk-and-return characteristics of asset classes. This analysis determines the capital allocation across countries and asset classes (“tactical asset allocation”). Security analysis enables the cross-sectional selection of single securities within each asset class to construct the overall portfolio and execute the necessary trades. Finally, after the portfolio experienced the market dynamics of an investment period, the feedback layer evaluates past performance, updates the market conditions, checks if the investment policy still holds or needs to be adjusted, and finally rebalances the portfolio (Bailey et al., 2007; Horn and Oehler, 2020).

Portfolio construction has been a significant task since 1952 when Markowitz introduced the mean-variance model. This model inspired many researchers, leading to numerous research papers proposing its extensions to overcome the shortcomings that neglected real-life problems. However, the continuously changing market environment, globalization, and integration of financial markets have generated new challenges in portfolio management, such as high systemic risk, spillover effect, contagion channels, and geopolitics risk.

In recent years, artificial intelligence (AI) has disrupted most industries, including the financial sector. AI techniques can contribute to portfolio management in many ways, improving the shortcomings of classical portfolio construction techniques and extending the opportunities to generate additional alpha. For instance, machine learning (ML) can create systems that learn from experience and be used for asset price prediction. Reinforcement learning (RL) is one of the most promising tools for developing a sequential and dynamic portfolio optimization theory. Text mining and sentiment analysis can enhance portfolio management with fresh news from the market. Dimensionality reduction methods can detect latent factors of a broad range of asset prices, which improves the construction of a well-diversified portfolio. Deep learning can optimize an investment portfolio directly or establish a portfolio that mimics an index with a small set of assets.

AI can produce better asset return and risk estimates and solve portfolio optimization problems under complex constraints, resulting in better out-of-sample AI-based portfolio performance than traditional approaches. From a technical point of view, the key players in the financial sector are embracing AI as a tool for automating and enhancing operational efficiency, processing vast amounts of data, improving risk management, and suggesting solutions that better suit investors' needs and accommodate risk. On the other hand, AI-based portfolio management often means that the decision is generated from a black-box model instead of mathematical equations trained on some database. This raises additional challenges in explaining and interpreting the decisions made by AI to earn the trust of various stakeholders, such as shareholders, investors, or portfolio managers.

The principal goal is to identify and evaluate published papers that propose AI-based methods for portfolio construction. To accomplish this, we focus on key considerations within this field, focusing on three main portfolio management steps (see Figure 1). The strengths and limitations of popular approaches used for portfolio construction are reviewed during the analysis, addressing these considerations. Moreover, to emphasize the need for transparency and fairness of decisions, laminable artificial intelligence (XAI) area approaches are briefly reviewed, and a case study of post-hoc explanations for portfolio construction is presented. Notably, the current review extends the most recent survey (Bartram et al., 2021) that focused on ML approaches and empirical results relevant to active portfolio management. In their paper, the authors considered using ML for signal generation, NLP applications, and several applications of reinforcement learning. Additionally, active AI-driven ETFs could be an excellent example of growing investor interest. However, the questions concerning portfolio optimization, portfolio evaluation and rebalancing, and post-hoc explainability of portfolio performance have not been addressed. Another review (Bartram et al., 2020) recently published by CFA mainly focuses on AI applications for asset classification and forecasting. Additionally, the use of NLP for automatic analysis of corporate annual reports, news articles and Twitter posts is presented. Examples of evolutionary algorithms and artificial neural networks are provided for portfolio optimization tasks, accommodating the flexibility to solve complex multi-objective asset allocation problems. Another example of a literature review (Nuzzo and Morone, 2017) outlined the main advances in using experimental techniques to study financial markets. Their work is not directly related to portfolio management but presents the relevant issues about information release and market structure, explores some stylized facts of the distribution of returns, and considers the role of market institutions in trading activity. Comparatively, the extensions of a mean-variance framework have long been an area of particular interest to many researchers, based on which some reviews (Elton and Gruber, 1997; Steinbach, 2001) have been published.

2 Investment portfolio management in a nutshell

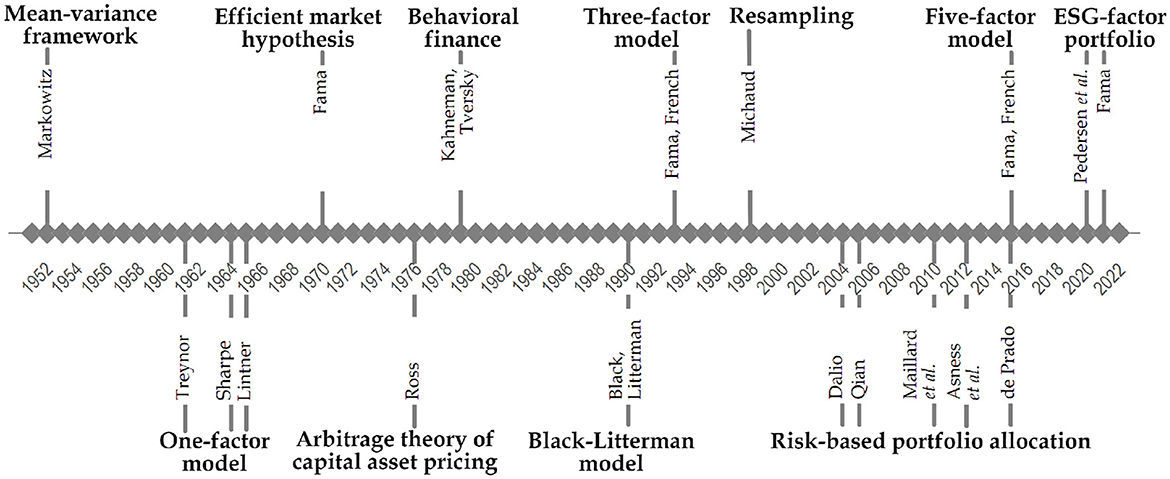

Hally, we could distinguish some famous frameworks and theories that remarkably impacted the way of thinking and modeling how to construct an investment portfolio and initiated the literature strands accordingly (see Figure 2).

Markowitz (1952, 1959) marks the birth of modern portfolio theory (MPT) by introducing the mean-variance efficient frontier framework. As the name suggests, the mean and variance have been employed to measure a portfolio's expected return and risk. The main message was that the investments should not be selected by combining multiple individual securities with preferable risk and return characteristics but by determining how they contribute to the overall portfolio. The efficient frontier concept was formulated based on two distributional measures, namely mean and variance, from which the investor could choose the preferred asset allocation. Notably, the derivation of the mean-variance framework was based on several essential assumptions (Elton and Gruber, 1997; Wilford, 2012). Despite criticism, the mean-variance theory remains crucial. Like other breakthroughs, it has been extended in various directions.

Inspired by Markowitz work, Treynor (1962), Sharpe (1964), and Lintner (1965) independently introduced a factor model, named as Capital Asset Pricing Model (CAPM). Specifically, CAPM is the instance of the one-factor model, which describes the relation between systematic risk and expected returns. Technically, CAPM decomposes an asset's return into factors common to all assets and factors specific to a particular asset. However, one factor is not enough to quantify risk and returns adequately. This resulted in so-called multi-factor models generalized by Ross (1976); Roll and Ross (1980), known as Arbitrage Pricing Theory (APT). The primary difference between CAPM and APT is how a systematic investment risk is defined. CAPM includes a single, market-wide risk factor, while APT advocates several factors which capture market-wide risks.

The efficient market hypothesis (EMH) is one of the milestones in the MPT development (Vamvakaris et al., 2017). Its roots go back to the period of 1963–1965, with the appearance of some works published by Fama (1963), Fama (1965), and Samuelson (1965). According to the Delce (2019) and Lo (2017b), Fama suggested the concept of an efficient market known for its best formulation: “A market in which prices always fully reflect available information is called efficient” (Fama, 1970). Comparatively, Samuelson's contribution to the development of EMH is less well-known, but his role is no less important as he provided a solid theoretical basis for this hypothesis. Since then, many studies have been published on examining whether the EMH is valid in different markets, for example, stock market (Lee et al., 2010; Sánchez-Granero et al., 2020), energy market (Lee and Lee, 2009; Liu et al., 2020), currency market (Potı̀ et al., 2020). The idea behind testing EMH is to measure whether a random market walk is related to price predictability. For this purpose, different kinds of tests for market efficiency have been proposed addressing the concept of random walk (Frunza, 2016). However, there exists enough evidence to infer that the existence of an efficient market seems to be a utopia in practice. Instead, it is more realistic to anticipate relative efficiency, identifying periods with varying degrees of efficiency influenced by changing market conditions over time (Campbell et al., 1998; Kim et al., 2011; Alvarez-Ramirez et al., 2012).

The main alternative to CAPM is the three-factor model (Fama and French, 1993), which become widely used by academics and practitioners. This model included two additional factors, proxy size and value, for estimating cross-sectional equity returns. Two decades later, this model has been extended to the five-factor model (Fama and French, 2015), which includes profitability and investment of the firm in addition to market factor, firm size and value, aiming to describe better the variation in equity prices that the three-factor model does not capture. Over a considerable time, these models have been extensively tested empirically by numerous studies aiming to adequately price the equity returns in both developed and emerging markets (Kubota and Takehara, 2018; Lalwani and Chakraborty, 2019; Mosoeu and Kodongo, 2020). The evidence shows, for example, (Mohanty, 2019), that each market is unique in its composition and trend even over a long time horizon, and hence, a generalized asset pricing model cannot be adopted across all the markets.

The other stream entails the problems arising from the assumptions of “homo economicus”. The field of behavioral finance occurred in the late 1970s as a response to emerging failures of the core pricing models to explain anomalies in financial markets (Kahneman and Tversky, 1979; Kumar, 2016). Behavioral finance indicates that when making decisions like investing, people are not nearly as rational as traditional finance theory assumes. Similarly, Shiller (2003) provides an insight into the changes in the approaches and focuses on the weaknesses of the efficient market hypothesis, trying to explain the financial markets better by understanding and incorporating the inefficiencies and biases in the models. Later, Thaler (1999) extends the idea of behavioral finance of incorporating psychological components to be included in all financial models in the future, as otherwise would be irrational. Lo (2004) and Lo (2017a) suggest that behavioral aspects in the portfolio decision-making process align with an evolutionary model with a perspective of adaptation, and this new approach combining economy and psychology is called the “Adaptive Market Hypothesis”.

In the past decade, there has been a surge in work exploring AI applications across various domains, including investment portfolio management. However, there is no widely acknowledged what could have been the first attempts of AI employment for asset allocation tasks. Considering the current taxonomy of AI approaches, for example, (Schmid et al., 2021), we believe that the Black-Litterman model (Black and Litterman, 1991) could be a potential candidate. In particular, their model suggests a framework for combining market equilibrium information with subjective investors' views by exploiting a Bayesian methodology. The computational evidence shows that the Black-Litterman model produces more stable and better-diversified portfolios than those constructed under Markowitz framework (Rebonato and Denev, 2014).

An alternative to address estimation uncertainty parametrically is Monte Carlo resampling (Michaud, 1998), a procedure to determine portfolio weights as average weights from MPT results derived from bootstrapped market returns. In institutional active portfolio management, leveraged risk-based multi-asset allocations without return estimations are popular, namely Risk Parity (Qian, 2005; López de Prado, 2016; Dalio, 2004), Equal Risk Contribution (Maillard et al., 2010), and inverse-volatility weighting (Asness et al., 2012). A significant milestone is the Hierarchical Risk Parity (HRP) approach (López de Prado, 2016) aimed to improve the robustness of Risk Parity schemes in markets with fluctuating covariances. In the first step, HRP sorts markets via a single-linkage clustering procedure. In the second step, market weights are allocated using a bisection of the covariance matrix.

Environmental, social and governance (ESG) factors and socially responsible investments (SRI) examine how conscious the companies invested are in these areas. Another angle of portfolio optimization in recent years is ESG and SRI evaluation. They become more critical and create a new perspective for investors as the maximization of shareholder value is changing to the maximization of welfare (Fama, 2021). For example, a recent paper Pedersen et al. (2020) designed an ESG-efficient frontier with the highest Sharpe ratio for the ESG-adjusted CAPM, where the choice may lead to a positive, negative or neutral outcome.

3 Artificial intelligence approaches for signal generation

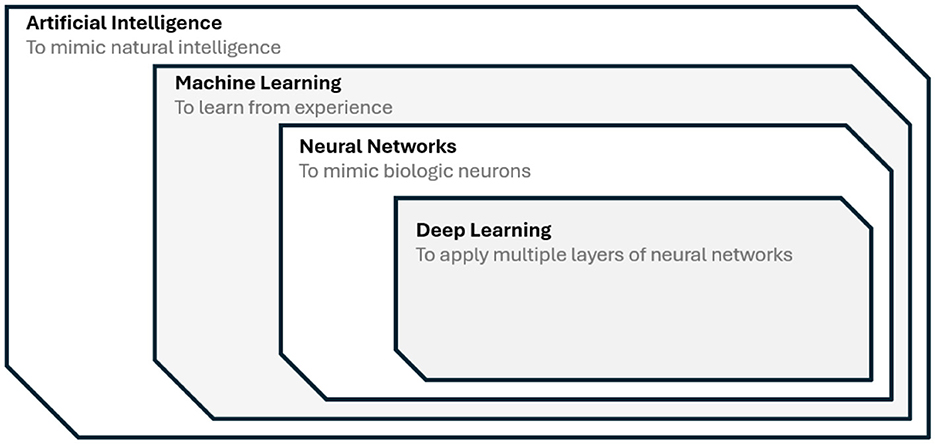

AI techniques can be considered decision tools with a straightforward application to the different stages of portfolio execution (see Figure 3). The ability to describe underlying market structures, process vast amounts of structural and non-structural information, or capture the non-linearity between different variables makes AI a key role in handling market complexity. AI tools guide the portfolio manager through the entire process, from visualizing the market to identifying assets, constructing the portfolio, executing trades, and interpreting results. This contributes toward achieving trust in AI-driven portfolio management systems. This section introduces AI techniques beneficial for various subtasks in portfolio management, contributing to trust in AI-driven systems.

3.1 High-dimensional forecasting and predictors selection based on linear models

Two conventional dimensionality reduction techniques that help the portfolio manager tackle the market complexity are Principal Component Regression (PCR) and Partial Least Square (PLS), regression-based procedures designed to forecast time series parsimoniously. The first is a two-step procedure that involves constructing the principal components using Principal Components Analysis (PCA) and then using these components as the predictors explaining most of the variance in a linear regression model. The first principal component can be taken as a proxy of the market factor. The study in Stock and Watson (2002) provides a notable example of simplifying a high-dimensional forecasting problem with numerous predictors by modeling time series variability using a small number of latent factors. Feasible forecasts are asymptotically efficient, and, more importantly, the estimated factors remain consistent, even in the presence of time variation in the factor model. The link between portfolio optimization models and PCA is straightforward, as explained in Meucci (2009); Partovi and Caputo (2004). The more natural choice of uncorrelated risk for a portfolio is by a PCA decomposition of the return covariance Σ, i.e.,

where the diagonal matrix Λ ≡ diag(λ1, ..., λN) contains the eigenvalues of Σ, sorted in decreasing order. In this way, the complexity of portfolio selection is reduced if there are no correlations among the assets.

Comparatively, PLS regression reduces dimensionality by incorporating the forecasting objective or response. The linear combinations maximize the covariance between the target variable and each standard component obtained from the predictors (Groen and Kapetanios, 2016). Kelly and Pruitt (2013) is one of the first attempts to apply PLS regression to finance. In Kelly and Pruitt (2015), the three-pass regression filter (3PRF) was proposed, which has been proven to be consistent for the infeasible best forecast when both the time dimension and cross-section dimension become large. Unlike PLS, the 3PRF enables the selection of additional disciplining variables based on economic theory.

PCR and PLS are techniques that merge the set of predictors from dimension D to a much smaller number of L linear combinations. Comparatively, Ridge, LASSO and Elastic net methods focus more on shrinkage, moving the model coefficients to zero. Ridge penalizes the square sum of coefficients called l2, reducing the variance compared with Ordinary Least Square (OLS). LASSO regularization penalizes the absolute sum of coefficients called l1 shrunk toward zero, achieving a selection of the predictors, which outperforms OLS as well (Messmer and Audrino, 2020). Elastic net includes a regularization that combines l1 and l2, handling the weight of each by a hyper-parameter. Specifically, LASSO, a form of regularized regression, combines variable selection and regularization to improve prediction accuracy. It automatically selects the most predictive input factors from a set (Feng et al., 2017; Freyberger et al., 2018), enabling the exploration of lead-lag relationships between asset groups. This approach is crucial in determining influential predictors, such as industry or market output, preventing overfitting, and controlling model complexity in machine learning methods (Li, 2015; Gu et al., 2020).

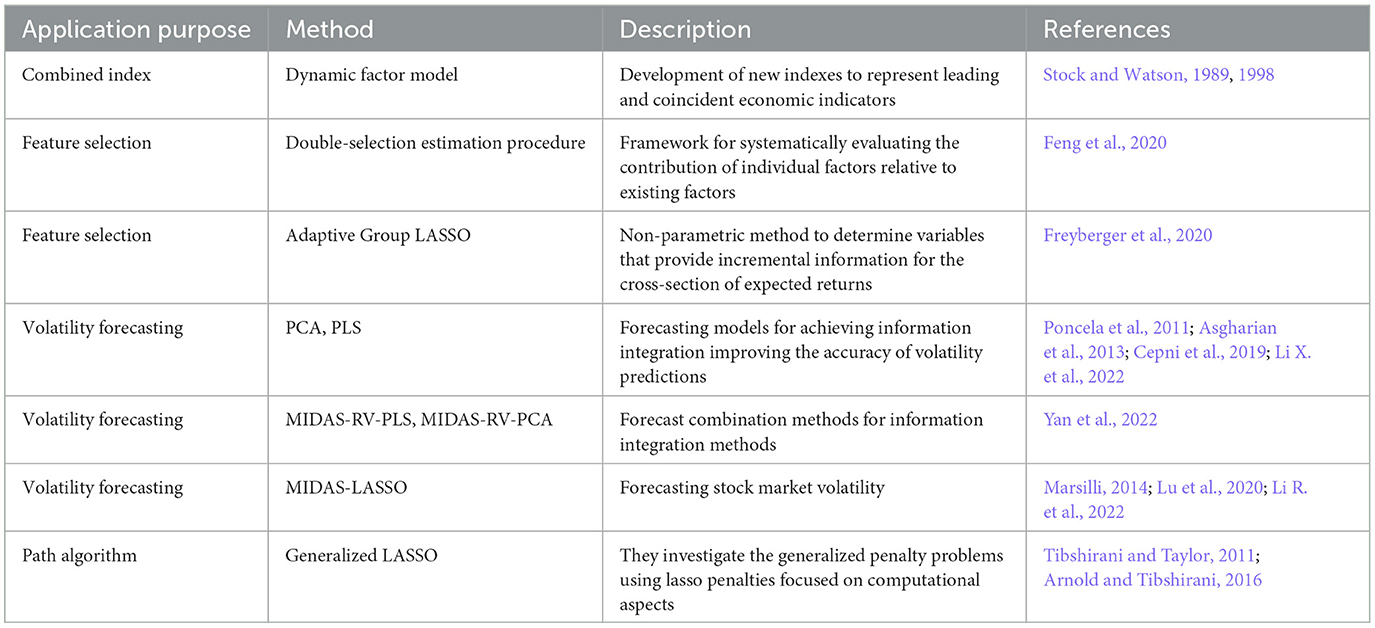

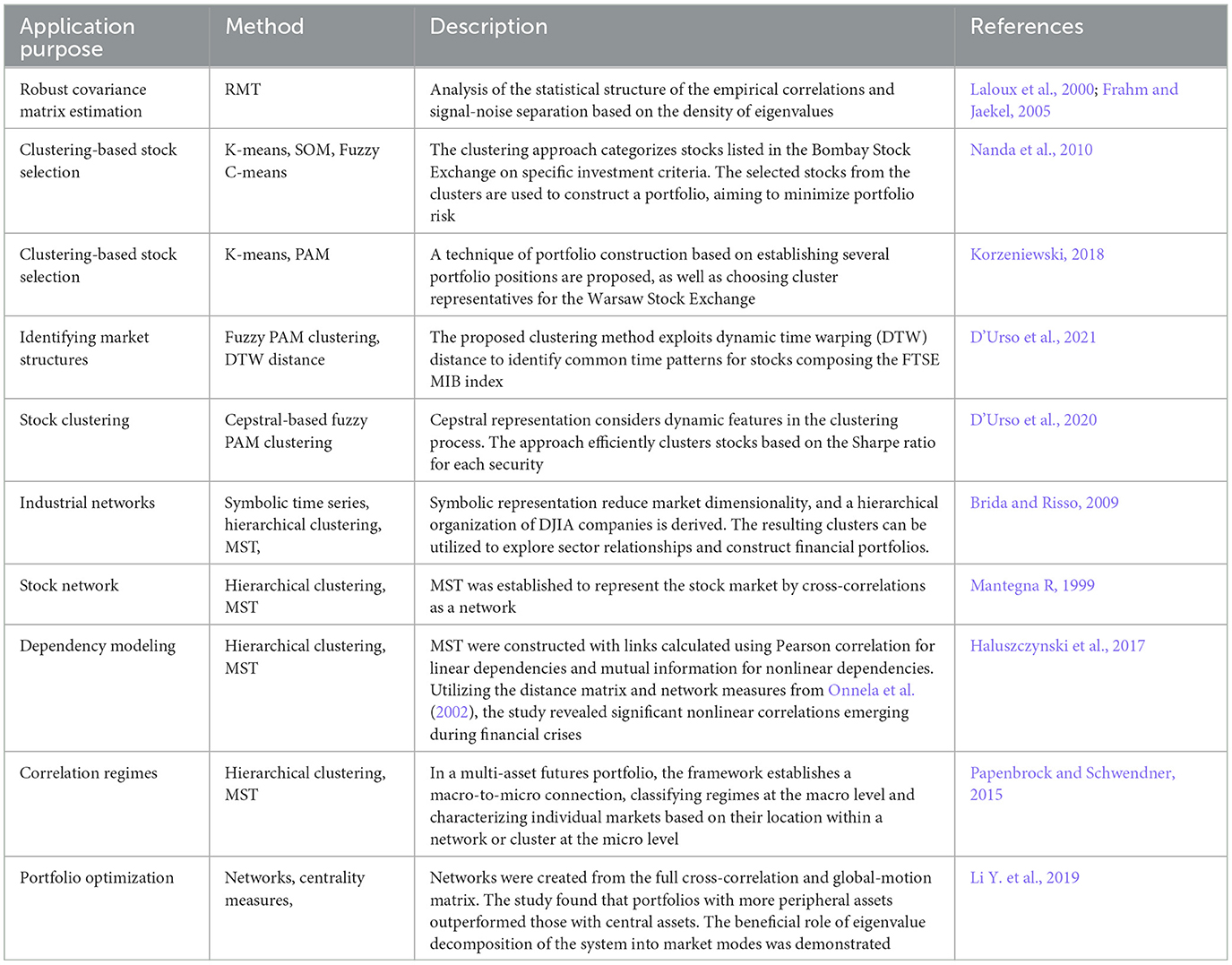

Table 1 gives good examples of selecting significant predictors.

3.2 Time series forecasting

Time series forecasting is important in any portfolio management task. AI algorithms have performed significantly better than traditional methods, especially in recent years with the introduction of deep learning methods. For example, one algorithm that could be considered traditional for this matter is Autoregressive Integrated Moving Average (ARIMA), which has already been outperformed by a large margin by LSTM (Siami-Namini et al., 2018). Other approaches used for forecasting that give state-of-the-art results are Gated Recurrent Unit (GRU) (Sadon et al., 2021), Seq2Seq (Mootha et al., 2020; Dash et al., 2023) combined with other deep learning approaches such as LSTM. Other deep learning-based forecasting methods have also prevailed in recent literature. One example is Generative Adversarial Networks combined with Gramian Angular Fields (Ghasemieh and Kashef, 2023). Convolutional Neural Networks (CNNs), traditionally employed for images and videos, find application in forecasting financial time series data (Kirisci and Cagcag Yolcu, 2022). They demonstrate superior performance compared to older, non-neural network-based methods. Deep learning-based methods for time series forecasting are prevalent in the literature and will continue to give state-of-the-art results in the foreseeable future.

3.3 Correlations, clustering, and network analysis

The multitude of market constituents and their interrelationships, coupled with specific structures, motivate the application of unsupervised machine learning techniques. These methods reveal underlying structures, simplify visualization, and introduce a form of ordering in the market space. While traditional market representation often relies on the risk-return relation for different asset classes, data-mining techniques, including complex information filtering, clustering, and graph theory supported by various machine learning methods, offer new approaches for diversification.

In the classical Mean-Variance approach to portfolio allocation, the optimal portfolio seeks to minimize the variance (σP) while maintaining a specified portfolio return. Reliable empirical determination of a correlation matrix becomes challenging for financial markets when T < N or T approaches N, where the correlation matrix can become ill-conditioned and random to a large extent. As a result, the out-of-sample risk of an optimized portfolio exceeds the in-sample risk. Random Matrix Theory (RMT) (Mantegna and Stanley, 1999; Bouchaud and Potters, 2003; Kwapień and Drożdż, 2012) is a mathematical tool that allows us to analyze the dispersion of correlation matrix when applied to the financial market. The objective is to mitigate bias in future risk estimates (Potters et al., 2005) by simplifying the large correlation matrices (Bun et al., 2017). This is achieved by extracting the systematic part of a signal hidden in the correlation data. Giudici et al. (2022) extended the application of RMT, a minimum spanning tree (MST), and portfolio optimization techniques to ETF markets, assisted by robot advisors as a FinTech innovation.

Cluster analysis, a well-established unsupervised classification method, has proven valuable across various fields, including finance. It aids in visually positioning assets by revealing underlying similarities. From a different perspective, clustering simplifies markets by reducing dimensionality and complexity, facilitating portfolio optimization. Two main clustering algorithms are hierarchical and partitional, with hierarchical identifying nested clusters and partitional finding clusters simultaneously. However, a common challenge lies in the need for cluster validation and the lack of cluster stability (Tan et al., 2005).

The grouping methods used in the partitional clustering process are the classical K-means and the PAM (Partitioning Around Medoids) algorithm, which picks one stock from each cluster with the highest Sharpe ratio. Duarte and De Castro (2020) segment the assets into clusters of correlated assets, allocate resources for each cluster and then within each cluster by different partitional clustering algorithms (K-medoids PAM and Fuzzy clustering). Khedmati and Azin (2020) include K-means and K-medoids but also spectral and hierarchical clustering considering transaction costs for different data sets. Soleymani and Vasighi (2020) addresses a large portfolio dataset to find the most and least riskiest K-means clusters of stocks based on VaR and CVaR measures and working only on financial returns. In unsupervised learning, specifically within partitional clustering and using diverse time-series representations, a significant research direction involves applying fuzzy clustering to economic time series. For instance, D'Urso et al. (2013) and D'Urso et al. (2016) utilized a model-based approach with various fuzzy cluster variations and different distance metrics in financial markets. As an alternative to ultrametric spaces clustering methods, the Self-Organized Map (SOM) method was employed to cluster DJIA and NASDAQ100 portfolios, focusing on non-linear correlations between stocks (Zherebtsov and Kuperin, 2003). The authors concluded that the SOM method is more relevant and promising for clustering large, ill-structured databases requiring nonlinear processing.

The correlation matrix of financial time series can be used to arise hierarchical tree structures, taking the correlations ρij as similarity measurement. The correlation-based clustering represented by network graphs allows for easy market visualization. On the standard methodology to build trees, for each pair i, j of assets, the distance d

is computed, where ρij describes the correlation between log-return time-series. Having di, j, we can compute MST or, equivalently, the Single Linkage Clustering Algorithms (SLCA) by using, for instance, Kruskal's algorithm. Such clustering analysis for portfolio optimization was explored by Tola et al. (2008). Marti et al. (2017) provides an in-depth overview of the state-of-the-art hierarchical clustering of financial time series. The hierarchical tree structure corresponds to diversification aspects in portfolio optimization models, where assets in the classic Markowitz portfolio are consistently located on the outer leaves of the tree (Onnela et al., 2002).

Network representation of complex financial markets offers a profound understanding of the underlying processes in the economic system, enhancing the information available to decision-makers. Analyzing stock market dynamics through network analysis can yield valuable insights and sound indicators for portfolio management (Battiston et al., 2016; Niu et al., 2021). The pioneering work on representing stocks as networks was published by Mantegna R (1999) where an MST was constructed based on the correlation among the stock prices for the DJIA and S&P 500 indices. Subsequent studies by the same group, summarized in Bonanno et al. (2004), extended MST applications to various stock markets and indices, exploring correlations with different time horizons. The concept of MST was further developed into dynamic MSTs in Onnela et al. (2002, 2003), revealing a scale-free property. During market crises, two network properties, normalized tree length and mean occupation layer from a central node (highest degree), decreased, indicating increased centralization. Additionally, stocks in optimal portfolios with minimal risks, as per the Markowitz model, tended to be in the network periphery, suggesting using network peripherality as an optimality indicator.

An alternative filtering approach for creating correlation-based Planar Maximally Filtered Graph (PMFG) was introduced in Tumminello et al. (2005), which produced graphs with a richer structure than MST, and further studied in Tumminello et al. (2006). The Directed Bubble Hierarchical Tree (DBHT) approach (Song et al., 2012) was explored in financial markets in Nicolo Musmeci and Tomaso (2014) and compared with MST and PMFG. Lower risk and better returns for more peripheral portfolios were demonstrated in Pozzi et al. (2013) using both MSTs and PMFG. This conclusion was reaffirmed more systematically in Peralta and Zareei (2016), introducing a ρ-based strategy for portfolio management that balances between the systematic (centrality) and individual properties of assets, confirming the performance of diversified portfolios with more considerable network distances. In Ren et al. (2017), peripheral portfolios perform better in stable periods with a drawdown in the investment horizon. In contrast, centrality-based portfolios are better for situations with a drawup in the selection horizon.

A particular case of applications is using network science and machine learning to build an HRP model (López de Prado, 2016). HRP models, part of the hierarchical approach, demonstrate robust out-of-sample properties without requiring a positive-definite return covariance matrix—a notable weakness in mean-variance-based portfolios. Different variants of this approach are proposed by Alipour et al. (2016); Raffinot (2017) improving the original HRP. Conceptually, HRP computes inverse-variance weights for groups of similar assets using an iterative process involving a correlation matrix. Additional steps include quasi-diagonalization, a rearrangement of the covariance matrix, and recursive bisection.

Recent stock market data analyses have employed Graph Neural Networks (GNN), enabling time-series data to be processed in a networked form within a deep learning pipeline. In Pacreau et al. (2021), portfolio management is formulated as a supervised learning problem using a multi-relational graph representation with sector, correlation, and supply-chain information. The authors employ various graph neural network architectures to solve this problem. A general framework for combinatorial optimization using graph neural networks is presented in Schuetz et al. (2022), which discusses its application to portfolio management. In works like Matsunaga et al. (2019); Chen Y. et al. (2018), graph neural networks are employed to incorporate companies' relationship data for stock price prediction, contributing to more informed decisions in portfolio management.

Additional applications for different purposes within this topic are described in Table 2.

3.4 Exploring the risk-and-return characteristics of asset classes

Asset allocation strategy involves forecasting risk-and-return characteristics for different asset classes or risk premiums. It includes determining the allocation percentages for each asset class in the portfolio. ML techniques offer a more efficient means for portfolio managers to handle expected values based on various forecasting models for risk and returns, considering for each case different risk measurements that distinguish downside from upside risk (Kuan et al., 2009; Harris et al., 2019; Liu and Wang, 2021; Mariani et al., 2022). The predictive models should be adapted depending on the target group of assets, considering traditional stocks, bonds or alternative investments (Fu et al., 2018). At this point, we mention the controversy in the literature about the evidence that there are real out-of-sample benefits to investors when relay on predictive models (Welch and Goyal, 2007; Johannes et al., 2014).

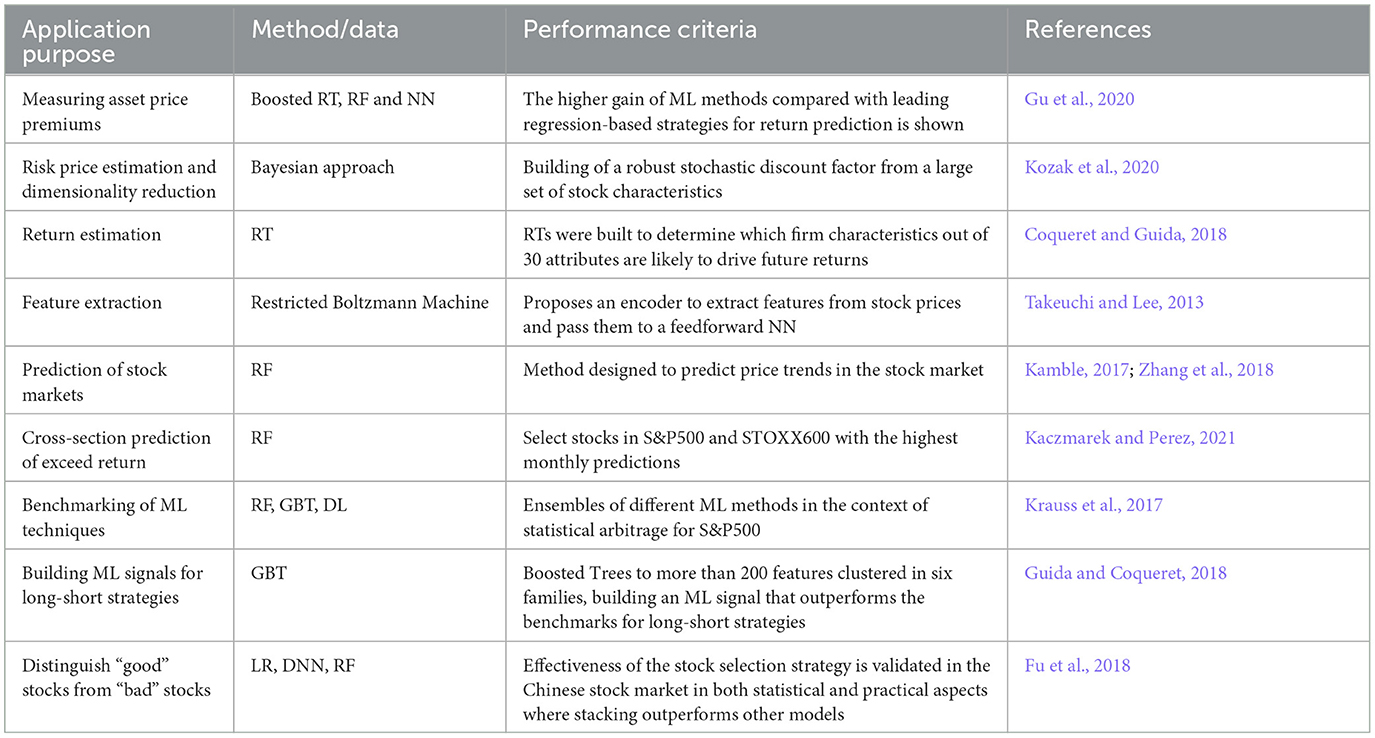

ML methods, with their high-dimensional nature, encompass diverse techniques, from traditional statistical learning methods like Gradient-Boosted Trees and Random Forest (RF) to the latest and popular algorithms such as Deep Learning (DL) or Deep Neural Networks (DNN). These methods use learning algorithms to identify the best-performing assets based on profitability and risk for a specific period. The goal of all of these methods is to approximate best the conditional expectation , where ri, t+1 is an asset's return over the risk-free, and is the actual and observable information set of market participants. Portfolio efficiency, gauged in profitability, is enhanced when assets are preselected based on return predictability, with the prominent application of ML techniques (Ballings et al., 2015; Kaczmarek and Perez, 2021). The most promising ML applications focus on finding predictive signals among the noise and capturing the alphas (Mirete-Ferrer et al., 2022). So, the goal is to achieve good indicators proven to detect successful companies in terms of stock-level signals combining different scores. In this way, the high amount of potentially good factors as signal makes ML effective for various reasons:

• ML is specially designed for forecasting purposes;

• It can cope with a large number of predictors and overcome the high dimensionality of the problem by combining many weak sources of information;

• Detection of nonlinear and complex relations and specially designed to mitigate overfitting;

• High sensitivity to low signal-to-noise ratios on the data;

• Avoiding crowded trades for highly correlated signals on different investors.

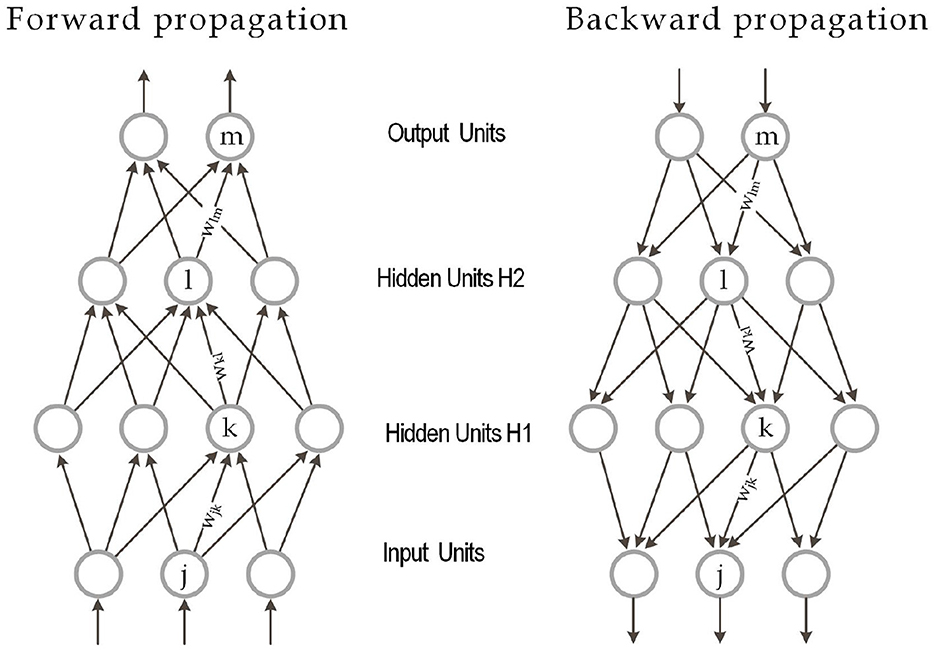

Deep Learning or deep neural networks algorithms refer to models represented in Figure 4 that consist of L layers or stages of nonlinear information. Each hidden layer takes the output from the previous layers and transforms it into an output as follows using the standard terminology stated in Lee et al. (2017); Hayou et al. (2019) for a fully connected random neural network of depth L, widths (Nl)1 ≤ l ≤ L, weights . For some input a ∈ ℝd, the propagation of this input through the network is given for an activation function ϕ:ℝ → ℝ:

Figure 4. Multilayer neural network with forward and backpropagation and two hidden layers. Source: LeCun et al. (2015).

Indeed, an activation function ϕ decides whether a neuron should be activated and whether the input is important. Typically ϕ takes the rectified linear form Φ(x) = ReLU(xk) = max(xk, 0).

The more common activation functions besides ReLU are the following:

and they have shown their utility in complex non-linear associations and, more generally, in selection problems.

These algorithms have demonstrated the potential to improve the implementation of different portfolio management strategies (Heaton et al., 2016; Grace, 2017) mapping data into the value of returns outperforming very different benchmark index, we can see an excellent example in Huang (2022) applying which is called Multitask Learning (MTL) for value extraction of hundreds of accounting terms in financial statement. The family of DL algorithms applied for portfolio construction is broad (Emerson et al., 2019; Ozbayoglu et al., 2020), and they are used in different stages of portfolio management.

We anticipate that Deep Learning, Reinforcement Learning, and Deep Reinforcement Learning applications in portfolio optimization will be specifically treated when we explain optimal portfolio construction techniques.

Random Forest (RF) is an ensemble ML algorithm introduced by Breiman (2001), employing a majority vote across individual decision tree learners. These non-metric models make no assumptions about data distribution and have fewer parameters to optimize compared to many other ML models. RF effectively handles complex signals like excess returns or risk premia, providing a good variance-bias trade-off and being reported as highly accurate learning algorithms. Additionally, RF models mitigate the impact of noise and changing relationships in past data between predictors and target variables, such as excess returns. Another popular approach is Gradient Boosting Trees (GBT), which builds trees sequentially, with each new tree aiming to correct the errors of the combined ensemble of the previous trees. GBT is typically applied to construct portfolios by leveraging their ability to predict asset returns and optimizing the portfolio based on those predictions. More examples of ML used for portfolio construction are displayed in Table 3.

3.5 Enriching feature set by natural language processing

Natural Language Processing (NLP) coupled with Sentiment Analysis (SA) can assess the polarity of market signals in textual content from social media platforms—indicating whether sentiment is positive, negative, or neutral. Sentiment is used qualitatively and quantitatively to reflect opinions, attitudes, moods, or emotions toward securities, assets, companies, or the market. Some studies leverage existing sentiment indicators, while others calculate sentiment indexes. Data sources for sentiment analysis include news channels and social media, and approaches range from text representation methods to artificial intelligence classifiers (Mishev et al., 2020).

Microblogging services, like StockTwits, have become popular as investor-based social networks where users share investment opinions through microblogs. Evidence suggests that these opinions influence stock price movements, contributing to collective market sentiment. Additional sentiment analysis data sources include StockFluence sentiment data, aggregating opinions from various media channels, and Glassdoor, offering business outlook ratings from employee reviews. Twitter and Google are commonly used sentiment analysis data sources, with alternatives including sentiments extracted from Intrinio, Thompson Reuters, and Bloomberg news articles.

Another strand of literature covers the use of cutting-edge NLP approaches to process and distill the public mood, which may include polarity detection, micro text analysis, aspect extraction or sarcasm detection in different levels of granularity like entity level, sentence, document or context. In general, NLP-based sentiment analysis methods could be divided into two categories. First, NLP combined with traditional machine learning like SVM (Long et al., 2019), LightGBM (Wu et al., 2020), XGBoost and RF (Jourovski et al., 2020; Petropoulos and Siakoulis, 2021). Evidence supports that financial news or social media information can provide an additional advantage in predicting price or market turbulence trends. This approach often entails constructing numerous features before inputting them into the ML model. Alternatively, some studies explore DL techniques, which can automatically extract features from news or social media. For instance, a self-regulated generative adversarial network was proposed to enhance generalization and overcome stochasticity in predicting stock movements based on financial news and historical price data (Xu et al., 2022). Comparatively, a hybrid data analytics framework, integrating CNN and bidirectional LSTM, was created to predict stock trends by estimating the impact of news events and sentiment trends converging with historical financial data. Unlike other studies, LSTM was trained to automatically generate an asset allocation strategy using historical lagged data and public mood (Malandri et al., 2018). Similarly, in Xing et al. (2018), sentiment information is mapped to market views using a neural network design based on an ensemble of evolving clustering and LSTM. These views are integrated into modern portfolio theory through a Bayesian approach, and the portfolio's performance is analyzed for aspects like portfolio stability, sentiment time series computation, and profitability in simulations.

Financial sentiment analysis faces challenges due to specialized language and a lack of labeled data. The advent of ULMFit (Howard and Ruder, 2018) has facilitated effective transfer learning in NLP. For example, Feinberg (Bidirectional Encoder Representations from Transformers for financial data) is a pre-trained NLP model designed explicitly for sentiment analysis in financial text (Araci, 2019). Comparatively, Zhao et al. (2020) proposed a RoBERTa as a pre-trained model, which exploits different fine-tuning methods for sentiment analysis and critical entity detection in online financial texts. SEntFiN 1.0 is the most recent publicly available example of a human-annotated dataset of news headlines containing multiple entities (Sinha et al., 2022). The authors concluded that deep bidirectional pre-trained language models such as domain-specific BERT fine-tuned to SEntFiN outperform state-of-the-art learning schemes significantly.

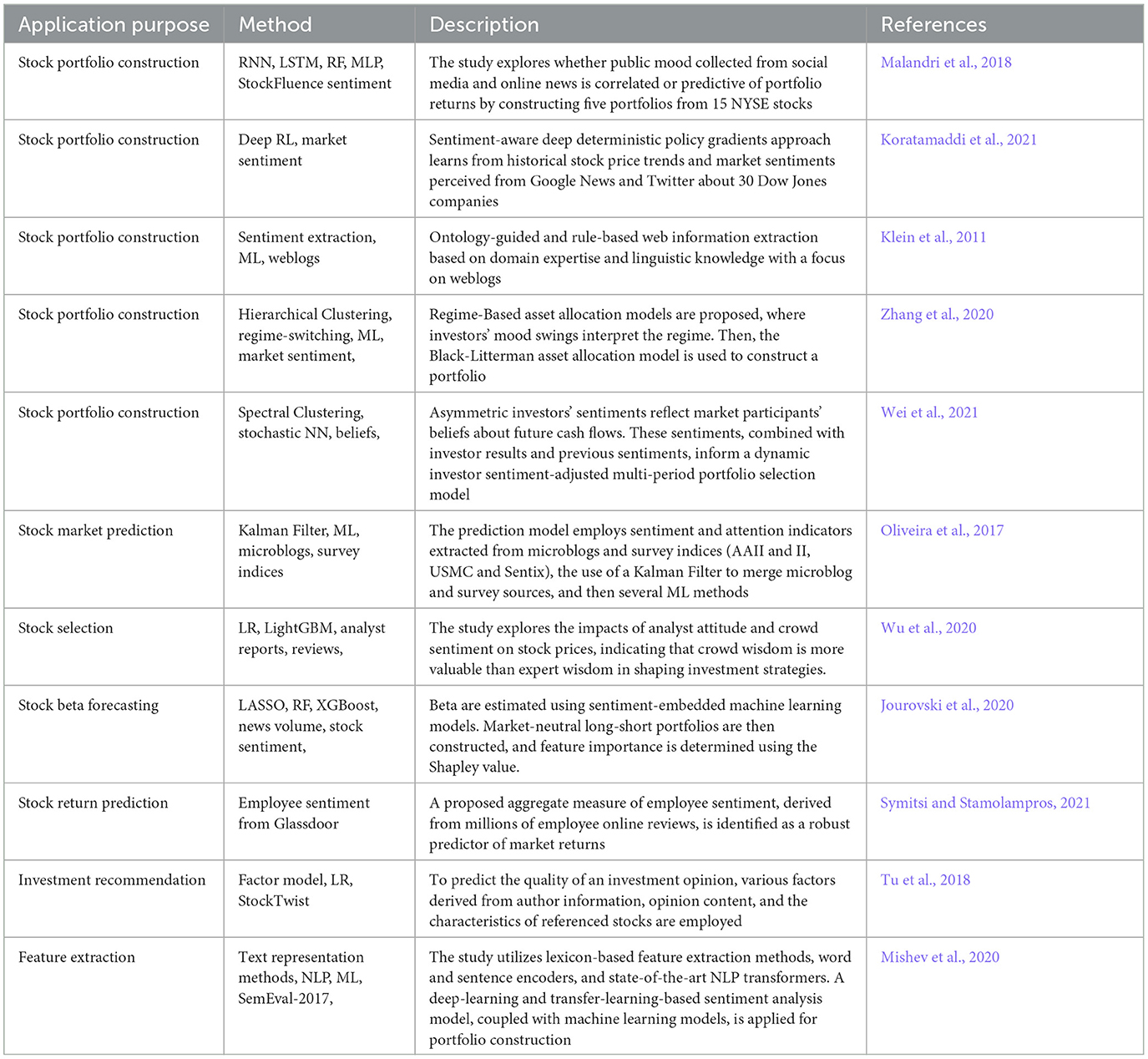

Table 4 provides examples of papers focusing on sentiment signal generation for asset allocation.

3.6 Examining the interrelation between ML and market efficiency

In classical economic theory, economists explore models with market frictions, where price competition may be dampened, leading to potential unemployment of resources. AI holds significant potential to enhance efficiency by reducing search frictions (Milgrom and Tadelis, 2018). AI aids in understanding market environments, identifying patterns that enhance customer experience, and improving forecasting to promote more efficient market operations. Indeed, determining evolving market conditions is mainly linked to capturing market inefficiencies to identify future performance. This is where the usefulness of the application of AI arises. Many studies demonstrate the superiority of AI over traditional ones. However, the question is how the massive use of information-based systems, for instance, supported by cloud services, can change the price discovery process. Unequal access to AI technology among financial actors may lead to smaller providers' limited participation, posing a concentration risk among more prominent players (Duan et al., 2019).

AI, particularly in High-Frequency Trading (HFT), generally introduces greater complexity to conventional algorithmic trading, notably in highly automated markets such as equities and FX. AI and HFT contribute to enhanced liquidity provision and enable the execution of large orders with low market impact. From a risk perspective, AI allows order flow management, reducing inefficiencies. HFT serves as a significant source of liquidity, so any disruption in their operation results in liquidity being pulled out, especially when AI techniques are widely deployed. At this point, we have to distinguish two significant impacts of the massive application of AI on the financial markets that result in two sides of the same coin. First, AI impacts information efficiency by reducing the marginal cost of information acquisition and processing for portfolio managers. Second, the question is how AI is going to replace human decision, as the machines process much more information faster, making the markets more efficient (Barbopoulos et al., 2021), but at the same time with a higher risk of market manipulation by using spoofing schemes as 2010 Flash Crash (U.S. Department of Justice Office of Public Affairs, 2015) being a source of non-financial risk.

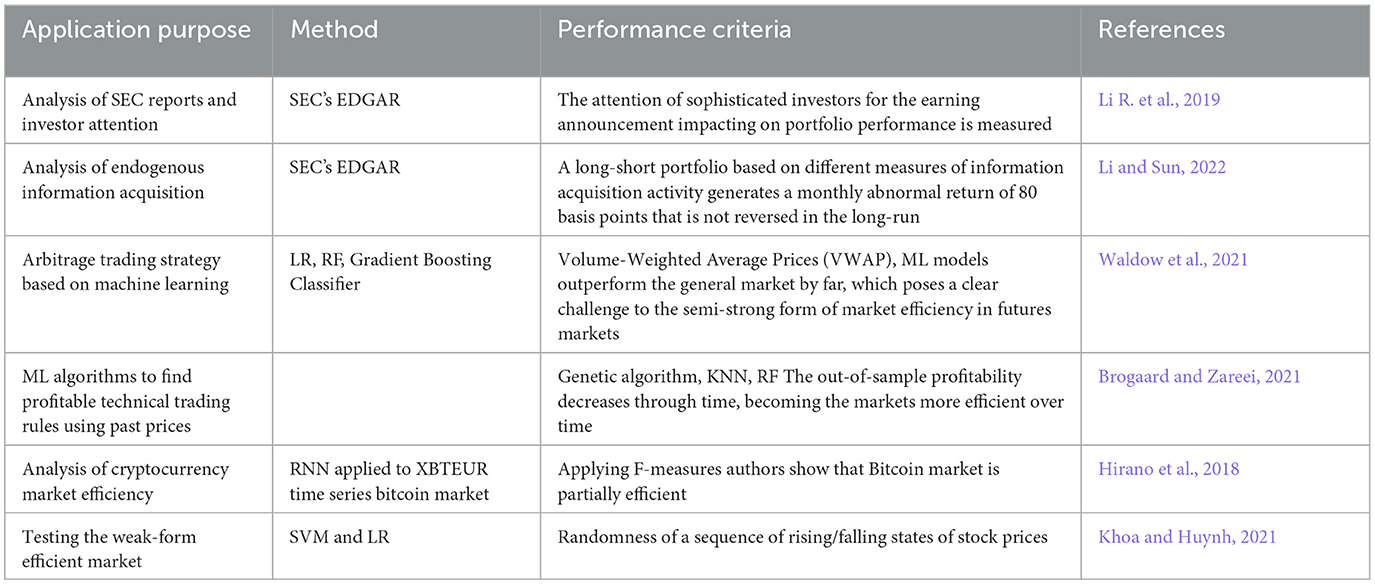

In particular, analyzing the interrelation between AI and market conditions and how this relation changes sophisticated investors' behavior has just begun (Chen Y. et al., 2020). Regarding the first point, consider the quarterly annual reports for the Russell 3000 Index, which includes around 3000 of the largest U.S. companies, resulting in ~12,000 documents in a fiscal year. Managing such a vast amount of information is challenging for humans. An important distinction between humans and machines is that humans tend to pay more attention to large and value firms, whereas AI accesses information more uniformly (Barbopoulos et al., 2021). The studies on the interaction between information and potential impacts on market efficiency have to rely on accurate metrics. For instance, the Security and Exchange Commission's (SEC) Electronic Data Gathering and Retrieval (EDGAR) website allows researchers to measure with automatic algorithms how the stock market responds at the time of earning announcements. All internet search traffic of the EDGAR system is accessible to researchers, including the user's IP addresses and the user requesting the information. The impact of our trading decisions on the market and queries made through the SEC exchange requesting information from companies is observable. Table 5 provides the examples of paper, where the interrelation between AI and market efficiency was analyzed.

3.7 Selection of particular assets using multiple criteria

Modern portfolio theory initially considered mean and variance as the sole criteria for portfolio selection. However, over the past 60 years, more sophisticated methodologies and techniques have been proposed, incorporating utility/desirability functions (Scott and Horvath, 1980; Neves et al., 2017), expectation-risk (Konno and Yamazaki, 1991; Speranza, 1993), requirements for higher moments of portfolio (Cvitanić et al., 2008), stochastic dominance (McNamara, 1998), etc. Furthermore, fundamental analysis (Greig, 1992; Mukherji et al., 1997) and technical analysis (Pinches, 1970; Austin, 1986; Chou et al., 1997; Yao et al., 1999), followed by factor analysis (Hui and Kwan, 1994) and attribute clustering (Huang and Jane, 2009), are sources for multi-criteria decision making (MCDM) (Colson, 1985).

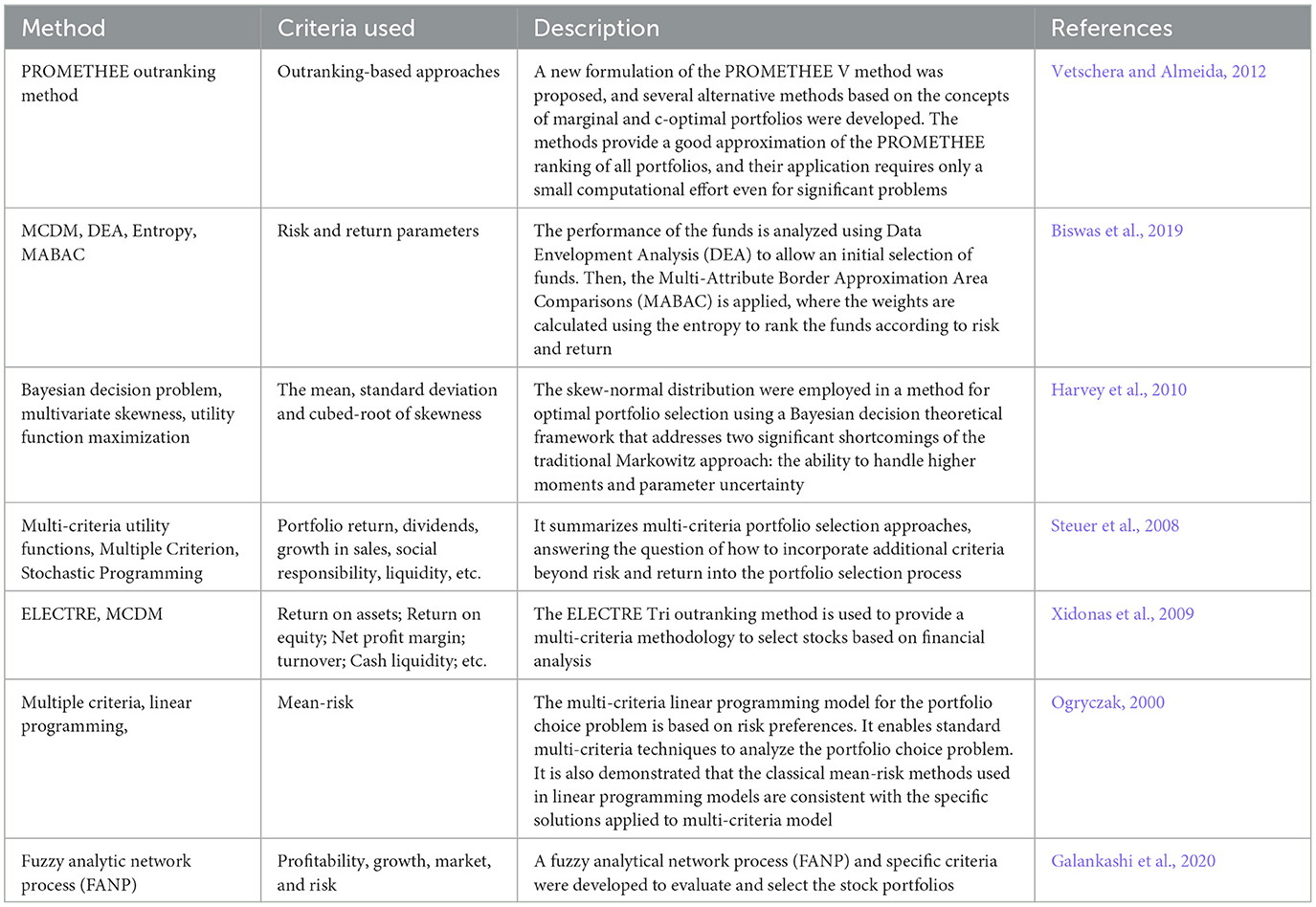

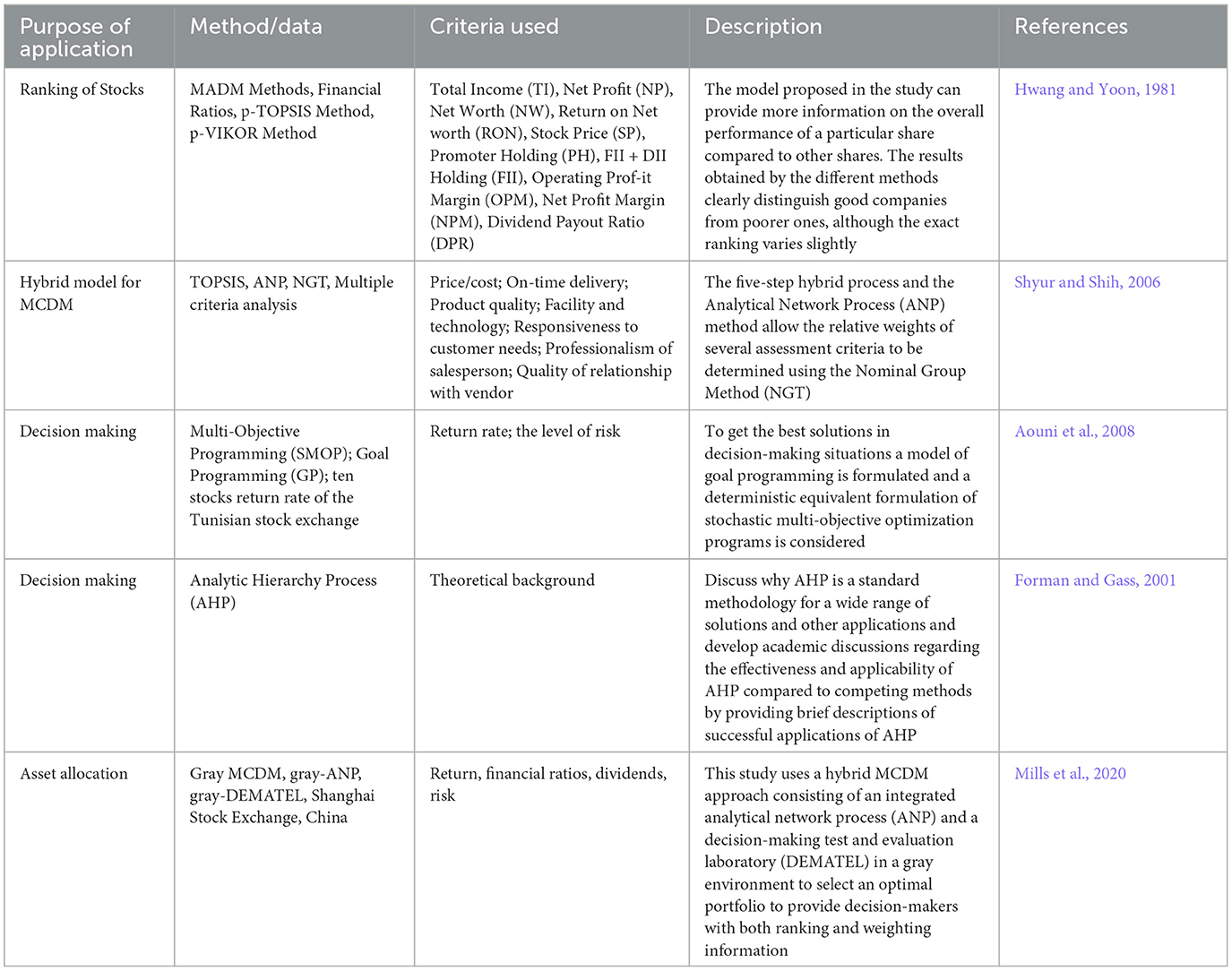

One notable paper on multi-criteria portfolio selection is by Zopounidis (1999), where the author reviews decision-aid methods, their structure, and processes existing at that time. The paper also briefly explains how MCDM works in financial management. Comparatively, a significant analysis was presented by Aouni (2009), where the author linked portfolio optimization with multiattribute portfolio selection. In his further research (Aouni, 2010; Aouni et al., 2008), the author gave more examples of how goal programming can be used in portfolio selection. A comprehensive review of MCDM techniques was presented in the study Mardani et al. (2015), where a list of publications (more than 460) with different applications in many fields of science, engineering and management was provided. Among them are such techniques as AHP (Forman and Gass, 2001), PROMETHEE (Brans, 1982), ELECTRE (Roy, 1968), TOPSIS (Hwang and Yoon, 1981), ANP (Saaty, 1996), VIKOR (Yu, 1973), and hybrid MCDM (Shyur and Shih, 2006). However, they found only one publication, namely (Vetschera and Almeida, 2012), related to the portfolio selection problem. Later, Munhoz Arantes and Cesar Ribeiro Carpinetti (2019) published a review (with more than 110 papers cited) of how MCDM can be used for risk assessment. It has been emphasized that MCDM, coupled with the generalization of fuzzy sets, is gaining popularity among decision-makers and researchers. Specifically, Mohagheghi et al. (2019) suggested how MCDM should deal with uncertainty-related issues and which optimization techniques could be useful for project portfolio construction. Moreover, they reviewed real-world applications and case studies, excluding the financial portfolio selection problem. However, Liesiö et al. (2021) linked general project portfolios to financial portfolio selection and introduced so-called portfolio decision analysis techniques.

The abovementioned methods and techniques can help solve financial portfolio selection problems as alternatives to AI black-box techniques. Furthermore, Galankashi et al. (2020) provided a list of potentially attractive criteria and reviewed related works. Moreover, they applied fuzzy ANP and showed the entire decision-making process. Such a technique could be helpful in ANN's training phase.

Optimization-based approaches traditionally use technical and fundamental indicators to determine portfolio composition. Demand and supply of stock shares and market patterns are studied using technical analysis (Achelis, 2000). The basic indicators are based on information from each company's financial reports. Silva et al. (2015) applied evolutionary algorithms using several fundamental indicators [debt ratio, ROE (return on equity) and P/E ratio] together with technical indicators to generate optimal portfolios.

The repeatability of data patterns, the visual signals of indicators and oscillators, and the graphical representation of the evolution of assets are the sources for financial technical analysis (Turcaßs et al., 2016). Portfolio selection based on technical analysis implies the idea that prices move up (i.e., bullish), down (i.e., bearish), and sideways (i.e., trading) in a trend and that these trends ultimately influence the movement of financial assets.

Table 6 summarizes papers on MCDM and emphasizes the method, criteria used and application field.

Table 7 emphasizes the purpose of the MCDM application. However, the method and criteria also are indicated.

In general, MCDMs are transparent decision-making tools compared to most AI techniques. However, it is heavily dependent on the decision-makers and pre-selected criteria.

4 Constructing the optimal portfolio

The most popular criteria in academic literature for constructing optimal portfolios are mean and variance of returns. However, such an approach leads to a quadratic optimization problem if constraints are no more complex than quadratic. Some authors suggested maximizing skewness (e.g., Konno and Suzuki, 1995) together with maximizing means and minimizing variance, which resulted in the optimization problem becoming much more complex as the utility function became cubic. Furthermore, some authors suggest using a utility function of even higher order (see Harvey et al., 2010 or Levy and Hanoch, 1970). The other approach is related to multi-criteria utility functions (see Steuer et al., 2008 or Ogryczak, 2000). Such types of utility functions lead to linear optimization problems. However, preparations require much more decision-maker involvement as criteria weighting is time-consuming. Moreover, the result is very subjective and may be biased as every decision maker may assign different weights (see Steuer et al., 2008, Galankashi et al., 2020). It is worth mentioning that many authors recommend including historical portfolio return, various security and systematic risk measures, dividends, liquidity, turnover, P/E, P/B, ROA, ROE, workforce, etc. Unsurprisingly, the factors mentioned above come from fundamental and technical analysis.

The following subsections discuss metaheuristics and ML optimization techniques used in portfolio optimization.

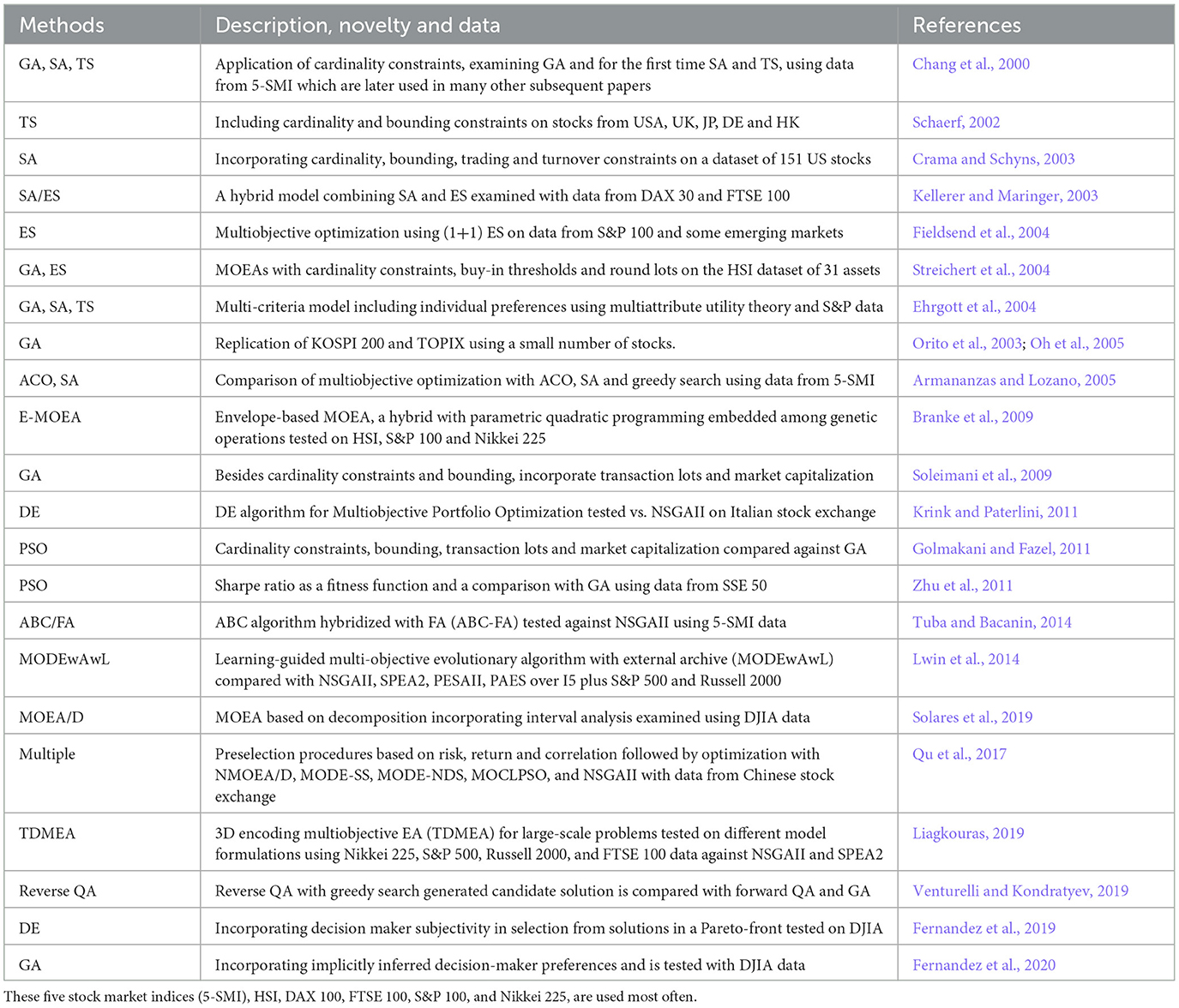

4.1 Metaheuristics for portfolio optimization

Portfolio construction, optimization, and management challenges have been extensively tackled using various metaheuristics, offering more flexibility in problem formulation than classical optimization approaches. Unlike the mean-variance model (Markowitz, 1959), these models can have a richer structure, and the optimization problem may be non-convex. While heuristic methods may compromise solution optimality, they often optimize more efficiently than classical methods. However, their effectiveness is problem-dependent, and formulating a more realistic model with numerous constraints, such as limiting the total number of assets or specifying bounds on each asset's quantity, can be relatively complex. An extensive survey of classical and heuristic optimization methods for portfolio optimization can be found in Mansini et al. (2014). Conversely, metaheuristic algorithms have a general problem-independent structure, although they may require tailoring to specific problems. Advances in parallel computing over the last decade have facilitated practical implementations of computationally intensive metaheuristic methods for large-scale complex problems. Metaheuristic algorithms can be categorized based on various aspects, including population-based or single-solution, naturally inspired, mimic evolution (evolutionary algorithm—EA), utilize swarm intelligence, involve global or local search, etc. These categories may overlap, and some algorithms are hybrid, incorporating techniques from multiple algorithm types. A broad introduction to various metaheuristic algorithms can be found in Talbi (2009). We will consider many of the metaheuristic algorithms, such as genetic algorithms (GA), evolutionary strategy (ES), differential evolution (DE), particle swarm optimization (PSO), ant colony optimization (ACO), artificial bee colony (ABC), simulated annealing (SA), quantum annealing (QA), and tabu search (TS). Some models have a single objective, like minimizing the variance, while others have multiple, like minimizing variance and maximizing return, which require an application of multi-objective evolutionary algorithms (MOEAs).

Table 8 summarizes some of the most critical applications of metaheuristic methods in portfolio optimization. For a comprehensive overview of MOEAs applied in portfolio management before 2012, the reader can refer to Metaxiotis and Liagkouras (2012). A recent survey on swarm intelligence techniques in portfolio optimization is available in Ertenlice and Kalayci (2018). Additionally, Doering et al. (2019) offers a broad survey covering various types of metaheuristic methods for both portfolio optimization and risk management.

4.2 Deep learning, reinforcement learning, and deep reinforcement learning in portfolio optimization

DL concept has been used lately to manage portfolios in diverse conditions based on neural networks (Becker et al., 2019; Andersson and Oosterlee, 2021). Thus, numerous variants of DNN may function as independent evaluators to optimize the algorithm. The cryptocurrency market is often used in this type of research to evaluate the effectiveness of the DNN-based strategy compared to traditional portfolio management strategies (Sun et al., 2021). Some authors add fuzzy neural networks to the market forecasting when conditions change (Ghahtarani, 2021) dramatically. In other recent papers, a finite-time q-power RNN applied to solve the uncertain portfolio model is considered an improvement of classic NN (Ma and Yang, 2021).

Another solution to overcome the limitations of traditional and generic portfolio strategies considered in the recent literature is reinforcement learning (RL) using neural networks. This research direction argues for implementing RNN and conventional NN in reinforcement learning architecture to support investment decisions. The main element in this theory is the connection between agents and the environment (Sutton and Barto, 2018). As a fundamental component of the ML process, in RL theory, the agents are supported by NN to memorize and predict optimal decisions based on present information for an infinite number of actions and states (Wu et al., 2021). The environment then estimates the rewards from these actions to help agents learn for future decisions. This process can define specific models to gradually improve overall performance based on experiences gained with several trial and error steps.

In addition to this research direction, some authors claim that deep reinforcement learning (DRL) can be successfully used to capture the dependencies between the main features of some financial indicators, such as risk aversion, portfolio-specific characteristics and previous portfolio allocations (Benhamou et al., 2021b). At the same time, in deep consolidation learning, network composition and appropriate rewards significantly influence learning transactions in financial time series, using high-frequency data decomposed as input (Lee et al., 2021). A previous paper stipulated that portfolio management requires prior decisions as input to consider the effects of transaction costs, market impact or taxes, and this temporal dependence on the system's state involves reinforcement versions of standard recurrent learning algorithms (Moody et al., 1998). In another approach, DRL deals with low, high, and close prices through a designed depth convolution for these three characteristics. The classic methods cannot accurately estimate the critical time, so a three-dimensional warning gating network is used, giving greater importance to rising moments. Thus, deep-reinforcement learning tools obtain more substantial returns and improve profit indicators while reducing risk (Weng et al., 2020).

In other research, recurrent consolidation learning has successfully optimized portfolios. It memorizes up-to-date market conditions and constantly rebalances the portfolio's content based on classic performance indicators (Aboussalah and Lee, 2020). In some models, a compromise parameter is introduced to adjust the portfolio's optimism level, and learning algorithms evaluate market fluctuations and provide information to generate forecast hyperparameters. The main advantage of using these more complex methods is that the effectiveness and robustness of the portfolios obtained with their help significantly exceed the return and risk indicators obtained with the classical techniques (Min et al., 2021). Other methods study the relationships between financial instruments, which are considered to vary over time. These relationships are studied with the help of CNN, in which the market operator learns and applies an investment behavior that is constantly re-evaluated. Thus, the permanent reallocation of the assets from the portfolio is ensured to optimize the yield indicators (Soleymani and Paquet, 2021).

Recently, a new research direction has combined reinforcement learning and its applications with Python or similar programming languages coding to support understanding portfolio optimization mechanisms. These codes use dedicated open-source software as data processing media for programming (Graesser and Keng, 2019; Dixon et al., 2020). These research methods can integrate portfolio selection with portfolio optimization using multicriteria algorithms. The advanced programming languages with dynamic semantics allow every optimization step to be followed in detail, from the data entry to the extraction of the results (Sarmas et al., 2020). A significant advantage of using these methods is that free cloud-based platforms for programming effectively run the necessary programs (Rather, 2021). Thus, according to an increasing number of authors, Python or other programming languages can be used to build an efficient portfolio based on multiple optimization techniques to improve portfolio performance. Numerous results showed that the prediction models efficiently obtained high accuracy and enhanced yields (Ta et al., 2020).

As seen from the above, regardless of the method proposed for research, most papers cited conclude that optimizing portfolios based on DL, RL, or DRL have significantly better results than traditional algorithms. The generally accepted assertion is that these modern tools are superior to even the most advanced methods based on classical instruments. Moreover, using advanced programming languages, such as Python, supported by powerful open-source software and free cloud-based platforms, leads to superior results in optimizing portfolios, increasing returns and reducing risk.

5 Portfolio execution

This section focuses on executing portfolio orders and aligning them with investor objectives while considering market impact and asset price dynamics. Execution orders are a crucial element in portfolio management, closely linked to preceding portfolio rebalancing decisions. This integrated approach involves two interconnected facets. The application of established machine learning techniques, such as supervised and unsupervised learning (e.g., clustering, LASSO, Bayesian networks, and SVMs), becomes increasingly relevant. These techniques apply to portfolio execution, managing multiple variables such as order size, trade-quote relationships, order book imbalances, and spreads.

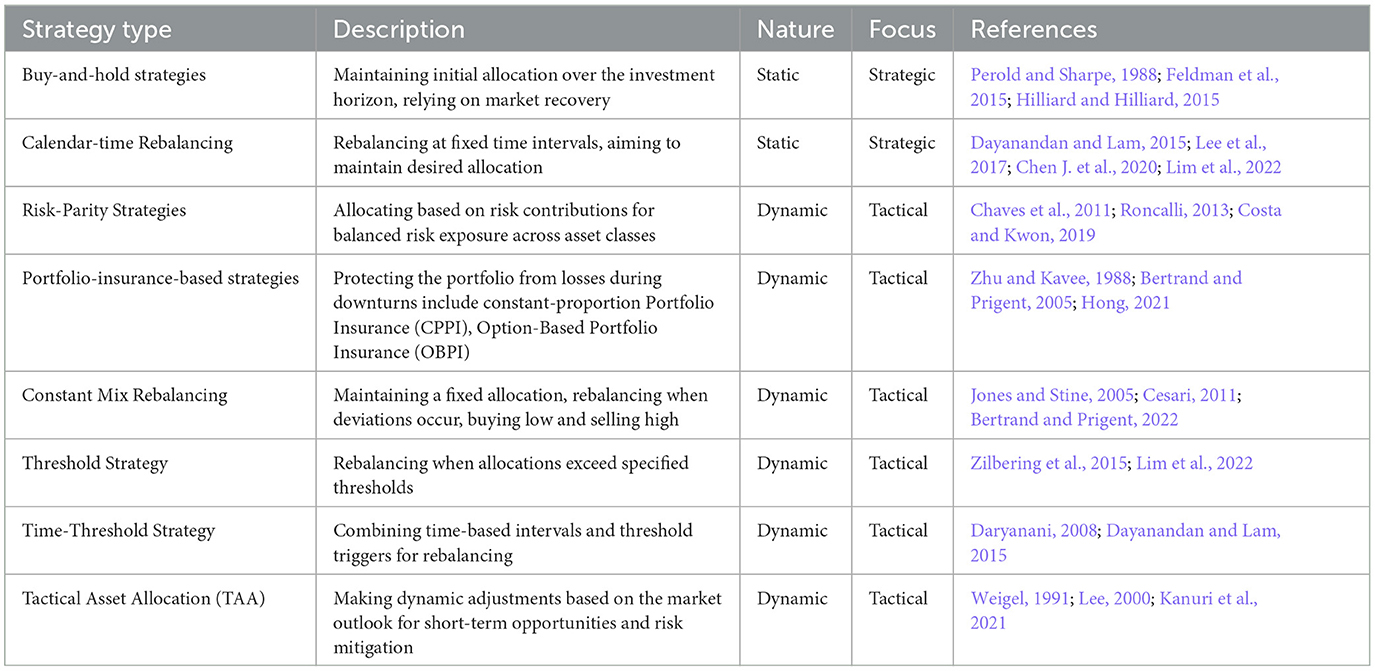

5.1 Rebalancing technique

Rebalancing, a crucial aspect of portfolio management, entails adjusting asset weights to maintain desired allocations or manage risk levels. This involves diverse strategies, from widely adopted to less conventional approaches. This comprehensive review explores these strategies, analyzing their characteristics, advantages, and limitations. The term “rebalancing” emphasizes adjusting asset weights to realign with chosen allocations or risk levels over time, without the necessity of adhering to a 50/50 stock and bond split (Tokat and Wicas, 2007; Kitces, 2015; Hong, 2021). Whether targeting a 50/50, 70/30, or 40/60 allocation, portfolio rebalancing involves reshuffling assets to achieve a predefined composition (Chen J. et al., 2020). Recognizing the diversity of rebalancing methods is crucial; some strategies are well-documented for their simplicity and effectiveness, while others, though less familiar, offer innovative perspectives. The table below summarizes and categorizes these types.

Assessing risk and return within a target asset allocation often relies on a rebalancing strategy. This approach considers the frequency of portfolio reviews, acknowledging it as a factor influencing whether the portfolio's actual performance aligns with its intended asset allocation. The core objective of rebalancing is to manage risk concerning the target asset allocation, prioritizing risk management over solely maximizing returns. Investors typically choose a rebalancing strategy based on their risk tolerance about expected returns, factoring in rebalancing costs (Zilbering et al., 2015). There isn't a universally optimal rebalancing frequency or threshold, as risk-adjusted returns tend to exhibit minimal differences among various rebalancing strategies (Tsai, 2001; Eakins and Stansell, 2007; Zilbering et al., 2015; Gruszka and Szwabiński, 2020).

Acknowledging the diversity of rebalancing methods is crucial; some strategies are well-documented in the literature for their simplicity and effectiveness, while others, though less familiar, offer innovative perspectives. Table 9 summarizes and categorizes these types.

Rebalancing strategies have been a subject of interest in various studies and research efforts. Perold and Sharpe (1988) categorized these strategies into four distinct approaches: buy-and-hold, constant mix, constant-proportion portfolio insurance (CPPI), and option-based portfolio insurance (OBPI). CPPI gained widespread adoption due to its ability to align asset allocation decisions with predetermined minimum dollar values (Zandieh and Mohaddesi, 2019). Moving ahead, Daryanani (2008); Zilbering et al. (2015); Dayanandan and Lam (2015) emphasized fundamental strategies, which included: (i) time rebalancing, (ii) threshold rebalancing, and (iii) a time-threshold rebalancing. These studies collectively underscored the significance of maintaining simplicity and consistency in portfolio maintenance.

Recently, Chen J. et al. (2020) introduced a structured framework categorizing rebalancing strategies into three primary approaches: calendar rebalancing, constant-mix strategy with bands, and CPPI. Calendar rebalancing involves periodic adjustments at fixed intervals, such as monthly or quarterly, regardless of market conditions. In contrast, corridor strategies set thresholds or bands around target allocations, prompting rebalancing when assets deviate beyond these bounds. Additionally, more recent research by Lim et al. (2022) has expanded the discussion by considering transaction costs, identifying two distinct approaches: complete portfolio rebalancing and gradual portfolio rebalancing. Complete portfolio rebalancing targets swift asset reallocation within a single trading day, while gradual rebalancing spreads adjustments across multiple trading days to minimize costs.

Customizing rebalancing strategies to consider specific factors like time constraints, transaction costs, and allowable deviations is vital. One adaptable method is threshold rebalancing, using range-based mechanisms to reallocate assets when they exceed predefined thresholds swiftly. Combining periodic and threshold strategies results in a hybrid approach that selectively rebalances portfolios when predetermined thresholds are breached. In the context of range rebalancing applied to portfolio benchmarks, asset classes are returned to their target allocations when they fall outside rebalancing bands. This approach underscores the importance of regular portfolio review and rebalancing only when asset allocations surpass a predetermined minimum rebalancing threshold. Moreover, rebalancing can also respond to tactical tail-risk models, highlighting the need for flexible portfolio management approaches (Packham et al., 2017).

5.2 Dynamic portfolio rebalancing with the help of AI/ML

The term “dynamic” denotes a strategy's ability to adapt swiftly to changing market conditions, asset performance, or specific triggers, diverging from predetermined time intervals (Perold and Sharpe, 1988, 1995; Bansal et al., 2004). Dynamic rebalancing, as articulated by Ilmanen and Maloney (2015), is an active investment approach where investors adjust their portfolios not confined to fixed schedules or specific percentage deviations. Instead, they realign portfolios with desired risk levels based on real-time market conditions. Diverging from traditional rebalancing methods, dynamic rebalancing is flexible and responsive, utilizing monthly market trends to dictate when and how much to rebalance while emphasizing exceptional signals in different asset classes. This approach aims to optimize investment performance while effectively managing risk (Gaivoronski et al., 2005).

There are both established and emerging techniques in dynamic portfolio rebalancing. Well-established methods include CPPI, OBPI, time-Threshold Strategy, and TAA, which have demonstrated their ability to enhance portfolio performance regarding risk-adjusted returns over many years.

The advent of AI/ML tools has ushered in a new era of dynamic portfolio rebalancing strategies. These emerging techniques harness the power of artificial intelligence and machine learning, offering innovative solutions. They encompass dynamic portfolio rebalancing through reinforcement learning (RL), utilizing its algorithms to maximize portfolio returns, and applying lag-optimized trading indicators in conjunction with genetic algorithms. To provide a practical glimpse into dynamic rebalancing, Jiang et al. (2020) developed a framework that integrates machine learning models into portfolio rebalancing, focusing on risk-aversion adjustment. This approach outperformed benchmarks in terms of returns and risk. Lim et al. (2022) employed an RL agent, introducing four distinct combinations of portfolio adjustments and price prediction models: (1) complete portfolio balancing without the Long Short-Term Memory (LSTM) prediction model, (2) complete portfolio balancing with the LSTM prediction model, (3) gradual portfolio balancing without the LSTM prediction model, and (4) gradual portfolio balancing with the LSTM prediction. Therefore, portfolio rebalancing utilizing the Recurrent RL (RRL) method and an adjusted objective function considering transaction costs and market risk aligns to develop efficient learning algorithms in RL, as discussed by Szepesvári (2010). Furthermore, RL has diverse applications in finance, including optimizing insurance pricing, bank marketing, portfolio management, and trading, as highlighted by Lim et al. (2022). Additionally, Jiang et al. (2020) integrated machine learning models into a portfolio rebalancing framework, adapting risk levels based on market trend predictions and consistently surpassing benchmark performance.

Nonetheless, it's essential to note that the effectiveness of these strategies may vary depending on factors such as portfolio size, investment objectives, and prevailing market conditions. Among the most recent and relevant studies Yeo et al. (2023) introduced two rule-based dynamic portfolio rebalancing algorithms: Tactical Buy and Hold (TBH), utilizing the forecasted Moving Average Convergence Divergence Histogram (fMACDH) indicator and risk differences and Rule-Based Business Cycle (RBBC), leveraging market sector performance variations across business cycles.

6 Portfolio evaluation: measurement, attribution, and appraisal techniques

6.1 Measurement

While the early literature on portfolio performance evaluation dates back to the 1960s, recent decades have witnessed a proliferation of novel methodologies, techniques, and empirical research in this field. These metrics effectively gauge the returns generated by a managed portfolio compared to the performance of a designated benchmark portfolio over a specific assessment period. Consequently, the benchmark portfolio must serve as a viable investment alternative for the managed portfolio under scrutiny (Brinson et al., 1995; Aragon and Ferson, 2006). However, Grinblatt and Titman (1989) introduces a comprehensive model designed to offer a nuanced perspective on diverse aspects of portfolio performance measurement. Within this model, a critical examination of various performance metrics unfolds, shedding light on their multiple criticisms. These criticisms encompass challenges like selecting an appropriate benchmark portfolio, the potential overestimation of risk due to market-timing skills, and the paradox of informed investors not realizing positive risk-adjusted returns due to growing risk aversion. Notably, the article contends that these significant issues should not be considered insurmountable obstacles in performance evaluation.

Portfolio performance evaluation assesses how a managed portfolio has performed compared to a specified benchmark. The methods for performance evaluation can be broadly categorized into conventional and risk-adjusted methods. Benchmark comparison and style comparison are prominent traditional methods, while risk-adjusted methods, including the Sharpe ratio, Treynor ratio, Jensen's alpha, Modigliani and Modigliani, and Treynor Squared, adjust returns to consider variations in risk levels between the managed portfolio and the benchmark portfolio. Preference is often given to risk-adjusted methods over conventional ones (Modigliani and Modigliani, 1997; Samarakoon and Hasan, 2013, 2022; Tamplin, 2023).

The conventional method, encompassing benchmark and style comparisons, assesses investment portfolio performance against a broader market index. Outperformance is determined if the portfolio's return exceeds that of the benchmark index over the same periods (Brinson et al., 1991; Samarakoon and Hasan, 2022). However, Aragon and Ferson (2006); Dor and Jagannathan (2002) have emphasized limitations, pointing out that this method may not consider variations in risk levels between the two portfolios. The portfolio might seem superior due to higher risk, leading to potential validity issues in a straightforward comparison.

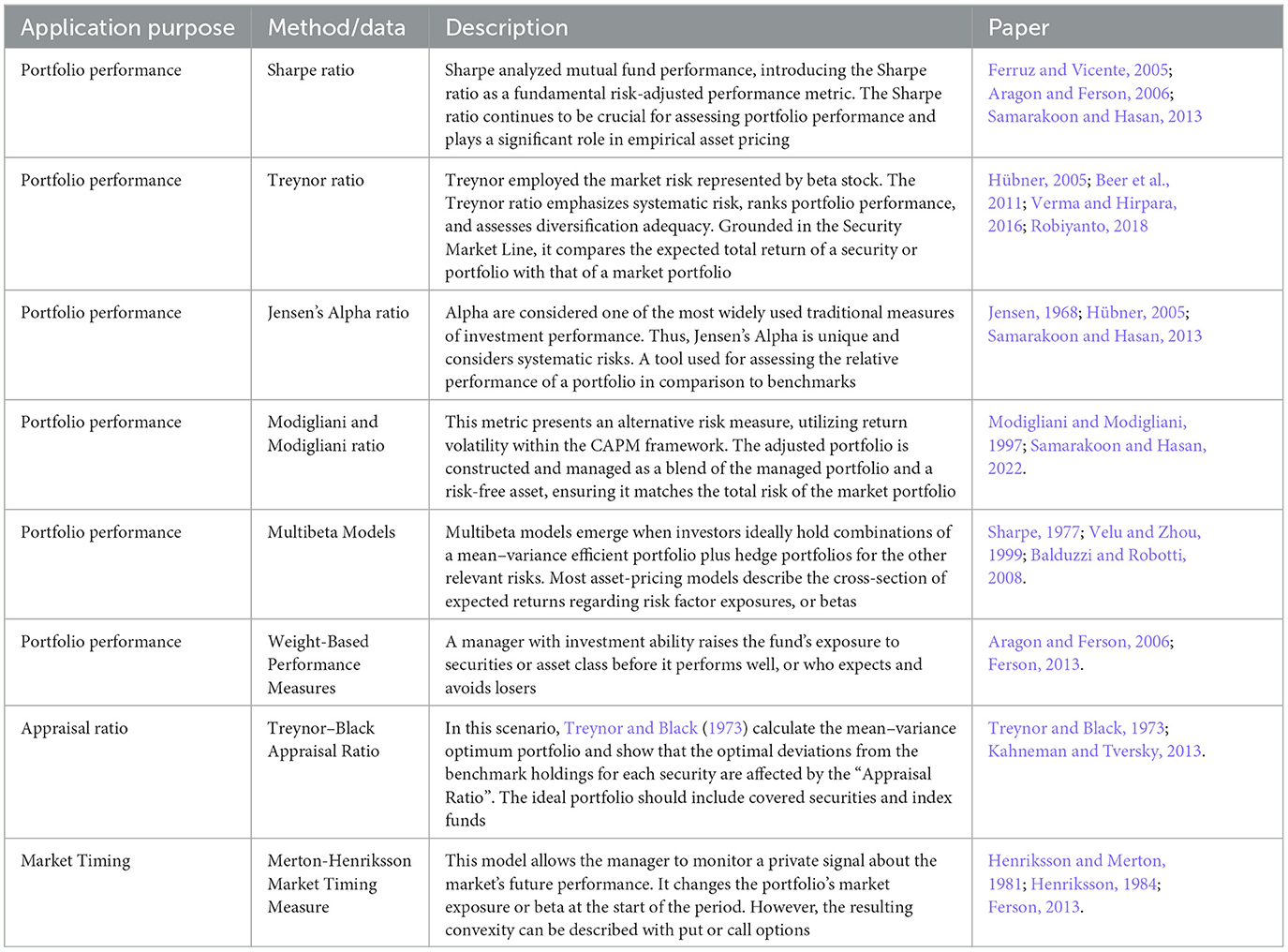

Risk-adjusted approaches commonly alter returns to account for variations in risk levels between the managed and benchmark portfolios. As previously mentioned, we distinct, in the following, the most known and used approaches (see Table 10).

6.2 Attribution

The field of performance attribution provides valuable insights for delineating investment responsibilities and measuring the contributions of various activities within the investment management process. Performance attribution seeks to clarify portfolio performance relative to a benchmark and pinpoint the origins of excess returns attributable to active decisions made by the portfolio manager. Bacon (2019) traces its evolution, beginning with Fama decomposition in the 1970s and progressing through subsequent developments, including multiperiod and multicurrency attribution in the 1990s, to contemporary models focused on fixed-income and risk-adjusted attribution. Bacon's comprehensive examination encompasses various attribution methods, such as returns-based, holdings-based, and transaction-based approaches, alongside considerations of money-weighted attribution and advancements related to notional funds.

In this historical context, Brinson and Fachler (1985) along with Brinson et al. (1995) established the basis for equity performance attribution, distinguishing excess returns into asset allocation, security selection, and interaction elements, ensuring they collectively constitute the active return. Extending this framework, Ankrim and Hensel (1994) incorporated currency management effects, introducing terms for currency forward premiums and surprise effects. These decomposition models remain relevant, as exemplified in Chen F. et al. (2018) examination of managerial skills.

Moreover, Fisher and DAlessandro (2019) introduced a novel risk-adjusted performance attribution analysis that integrates risk measures with Brinson models. This approach decomposes excess portfolio return into risk, allocation, and net selection components, ensuring additivity and consistency with financial theory. The risk adjustment can utilize either the traditional beta for Jensen's alpha calculation or Fama's beta, incorporating unsystematic risk while relying on relative standard deviations for risk adjustment in the Brinson attribution analysis.

6.3 Appraisal techniques

AI-based portfolio appraisal techniques offer several advantages, including optimizing trade timing, project performance evaluation, cognitive bias reduction, and improved decision-making. Some specific methods encompass Equal Weighted Portfolio (EWP), which assigns equal weight to each stock in a portfolio, irrespective of its company size, to reduce concentration risk and increase diversification (Malladi and Fabozzi, 2017; Lee, 2020). Inverse Volatility Portfolio (IVP) is another technique that helps in risk-adjusted allocations, performance evaluation using extensive data analysis, real-time detection and mitigation of decision-making biases, and the analysis of fundamental and alternative datasets to identify fresh investment prospects (Hallerbach, 2015; Rao, 2021).

Moreover, Thethi et al. (2021) recommends using LSTM for stock market prediction, surpassing traditional methods in performance. Shukla et al. (2022) focuses on improving financial portfolios through machine learning, considering the user's risk profile and employing ML for stock selection and capital allocation. Boudabsa and Filipović (2022) introduces a simulation approach for dynamic portfolio valuation and risk management, leveraging machine learning with kernels, demonstrating favorable outcomes in extensive dimensions. Kaczmarek and Perez (2021) illustrates that portfolio optimization techniques, such as Markowitz mean-variance and HRP optimizers, can enhance the risk-adjusted return of portfolios constructed with stocks preselected using ML.

In the context of real estate portfolio appraisal, Viriato (2019); Kok et al. (2017) exemplifies how Automated Valuation Models (AVM) have garnered substantial technological investment. These models can swiftly appraise many assets, streamline processes like property selection, expand investor access, facilitate efficient tax assessments, and improve understanding of value determinants. With the ongoing advancement of ML techniques, as demonstrated by Conway (2018), investors can leverage more precise valuation algorithms, effectively navigating a broad spectrum of opportunities.

7 Post-hoc explanations using XAI to build trust for portfolio management

7.1 Transparency and explainable AI on financial markets

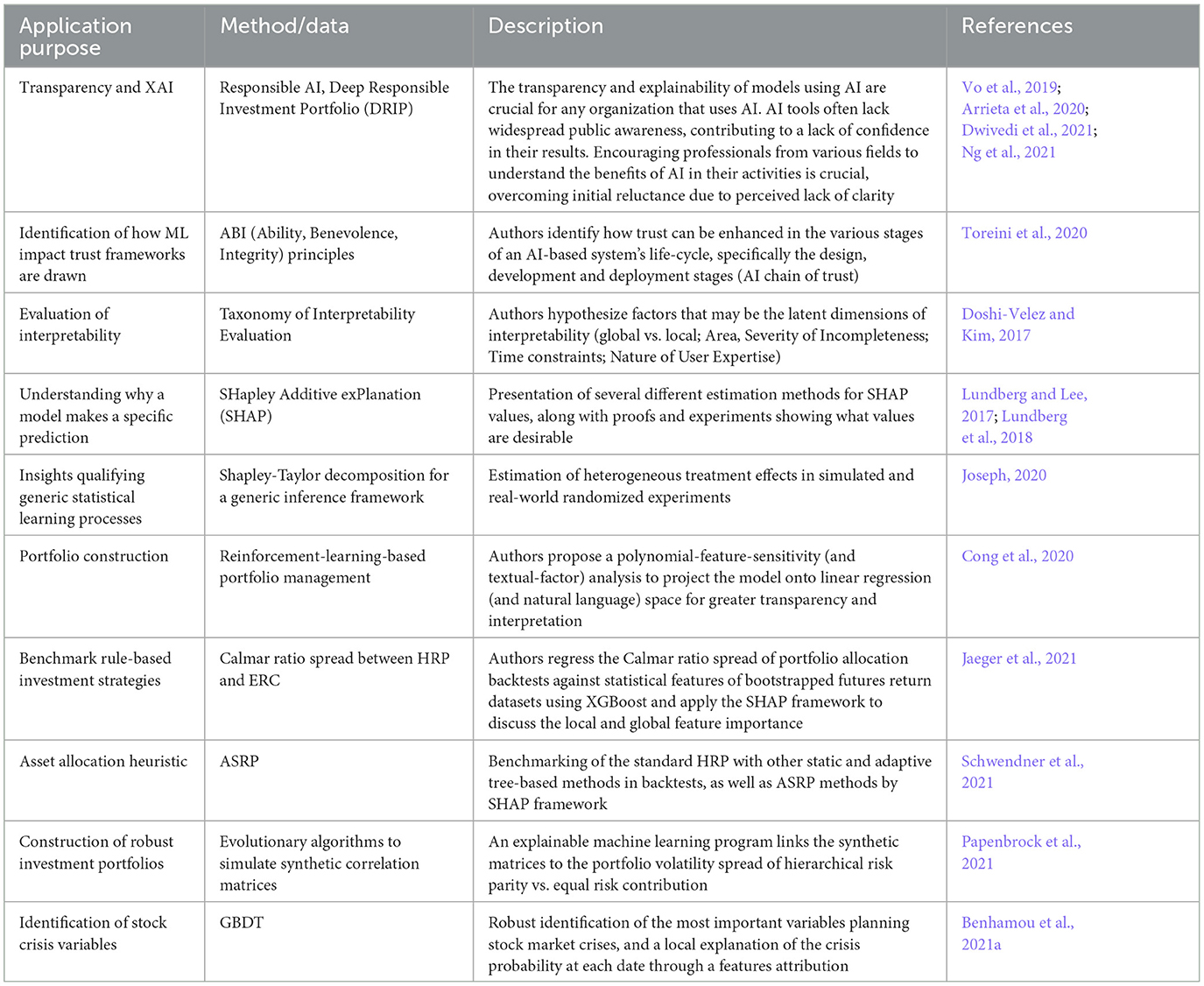

The transparency and clarity of models using artificial intelligence are hotly debated. It is crucial for financial institutions, banks, governments or any other body that uses AI to trust the tools provided by researchers (Dwivedi et al., 2021; Ng et al., 2021). The AI tools and methods are not yet widely known to the general public, leading to a lack of confidence in the results obtained. Thus, it is trying to reach the concept of Responsible Artificial Intelligence as a methodology for the widespread implementation of AI methods in real life with correctness, explainability and responsibility (Arrieta et al., 2020). Deep reinforcement learning has recently been introduced to support socially responsible investments and portfolio optimization to achieve superior financial performance and a significant social impact (Vo et al., 2019). It is increasingly clear that the development of research in this area is closely linked to the capacity to ensure the transparency and explainability of the proposed models.

The increasing application of ML techniques to build portfolios and the concern in parallel on the ethical dimension of AI increases the interest in understanding how the different features interact and impact the model portfolio performance. At this point, XAI ensures the acceptance and adoption of AI-driven services and products. Still, it is only one of the four categories of trustworthiness technologies for machine learning, namely Fairness, Explainability, Auditability and Safety (FAES) (Toreini et al., 2020). At this stage, the starting point is the map of social sciences concepts such as ability, benevolence, integrity or predictability and linking these with AI framework showing their behavior in understandable terms for humans (Doshi-Velez and Kim, 2017). In this way, XAI helps compare different models and create rules for decision-making in which the underlying model can be explained to the users.