- 1Economics Department, University of Malawi, Zomba, Malawi

- 2North-West University, Department of Economics, Potchefstroom, South Africa

- 3European and Developing Countries Clinical Trials Partnership, Medical Research Council, Cape Town, South Africa

- 4Clinical Research Education and Management Services (CREAMS), Lilongwe, Malawi

- 5Global Health Department, Epidemiology and Statistics Unit, Stellenbosch University, Stellenbosch, South Africa

- 6National AIDS Commission, Executive Management Division, Lilongwe, Malawi

Background: Increased taxation on alcohol and tobacco is among the cost-effective measures used to deal with the burden of noncommunicable diseases (NCDs) globally. Despite adopting such efforts, the impacts of taxation on alcohol and tobacco are yet to be fully understood.

Objective: The study's objective is to find empirical evidence regarding changes in the NCD mortality rate associated with changes in the tax rates of tobacco and alcohol.

Methods: The study adopted the System Generalized Method of Moments (SGMM) to explore the relationship between levels of taxes and NCD mortality rates. The SGMM allowed the inclusion of the dependent variable as an explanatory variable, assuming reverse causality was assumed.

Results: There appears to be a negative relationship between increased taxes and the rates of NCDs. Specifically, we provide empirical evidence supporting the negative association between taxes on alcohol and tobacco cigarettes and the mortality rates from NCDs, which aligns with the propositions advocated by the World Health Organization (WHO). Additionally, the interaction between alcohol taxes on spirits and beer indicates a possibility of complementarity, consistent with taxation principles. Notably, we also observed that higher tobacco cigarette prices are negatively associated with NCD mortality rates.

Conclusion: The results indicate that increasing taxes on major health risk factors is necessary to reduce non-communicable diseases (NCDs). Implementing these tax increases will likely help achieve Sustainable Development Goal 3.4, which aims to reduce NCD mortality by one-third by the year 2030.

Introduction

Classical production theory postulates that labor and capital are vital to production (1). Of much significance is the fact that labor uses capital for production processes. Noncommunicable diseases (NCDs) may affect production by reducing labor productivity (2, 3). NCDs have negative health implications and are significant contributors to reduced economic progress and productivity. NCDs result in long-term health issues as they lead to reduced quality of life, require long-term treatment and care among sufferers, introduce lifestyle changes, or, in some extreme conditions, necessitate palliative care, which also has negative implications on careers. This is a threat to economic progress as human productivity is negatively affected due to lost income that consequently temporarily or permanently cripples the labor force of the economy (4).

Global statistics show that NCDs are the leading cause of death and disability worldwide (5). NCDs are responsible for 74% of global deaths, claiming the lives of 15 million people prematurely between the ages of 30 and 70 (5). Since each death results in a loss of income, NCDs have a significant economic cost (3, 6). Without effective interventions, the World Health Organization (WHO) predicts that the number of NCD-related deaths will sharply increase to 55 million by 2030 (5).

Regarding their effect on productivity, NCDs have surpassed infectious diseases in the African Region, making up about 37% of the total disease burden (5). The Sub-Saharan region experiences an epidemiological change in the disease burden, with a sharp 67% increase between 1990 and 2017 (37). Unlike communicable diseases that arise due to a germ (viral, bacterial, or fungal) infection, few NCDs are genetically inherited, while most of them occur due to lifestyle or environmental factors (7). Among lifestyle factors, long-term use of tobacco and alcohol is identified as one of the main risk factors that are associated with the burden of NCDs (5).

The WHO has implemented a comprehensive Global Action Plan for the Prevention and Control of NCDs that runs from 2013 to 2030, aiming to ease the burden of NCDs. Specifically, the third objective of this plan focuses on addressing risk factors and underlying social determinants. To achieve this, the plan emphasizes the reduction of tobacco and alcohol use, as they both significantly contribute to the prevalence of NCDs. The proposed plan aims to contribute to achieving global targets of a 30% reduction in tobacco use and a 10% reduction in harmful alcohol consumption. One of the effective measures to reduce the demand for these products is increased tax imposition to reduce affordability (38).

Global statistics indicate that more than half of the 3 million annual deaths attributable to alcohol use are from NCDs, including cancer. Tobacco accounts for over 8 million deaths every year. More than 7 million of those deaths are the result of direct tobacco use, while around 1.2 million are the result of non-smokers being exposed to passive or second-hand smoke (5). The principle of heavily taxing tobacco products and alcohol is to reduce consumption, thereby lowering these risk factors that bring about NCDs (5). The issue of taxing tobacco goes way back to when classical economist Adam Smith in his book “The Wealth of all Nations”, posits that “Sugar, rum, and tobacco, are commodities which are nowhere necessaries of life, which have become objects of almost universal consumption, and which are, therefore, extremely proper subjects of taxation,” (8). The rationale for taxing tobacco in these primary days was to raise government revenue. The literature identifies other proposed reasons for taxing tobacco, one of which, among the many, is to promote public health by reducing morbidity and mortality effects associated with smoking. This exciting context reflects how the debate on tobacco taxation has evolved (9).

The WHO implemented the Framework Convention on Tobacco Control (FCTC) as a commitment to deal with the global tobacco epidemic and prioritize public health and wellbeing (5). MPOWER stands for; Monitor tobacco use and Prevention policies; Protect people from tobacco smoke; Offer help to quit tobacco use; Warn about the dangers of tobacco; Enforce bans on tobacco advertising, promotion, and sponsorship and; Raise taxes on tobacco, has been introduced as a technical package designed to help countries implement demand-reduction measures for tobacco.

Now, the nexus between NCDs and taxation is dynamic. According to the WHO Steps Surveillance (5), tobacco use imposes a risk of developing cancer, especially lung cancer, heart disease, stroke, and diabetes. It becomes a threat to passive smokers, who are between 20% and 30% at risk of developing lung cancer and other chronic respiratory diseases. A recent study conducted on the “Global Burden of Cancer” reports that alcohol consumption accounts for 4% of specific cancers (40). Since these products are sold in a market governed by the forces of demand and supply, tampering with their prices through taxation reduces their purchase. This implies that the consumption of these products will be lowered, as will the risk of developing NCDs like lung cancer, diabetes, hypertension, and chronic respiratory diseases. Furthermore, lowered risk will be reflected in lower NCD mortality rates (10–13).

There has been an interest in this research nexus in the past. Most of it has been from not within the African region but the Western countries, with most of them concluding that the taxes are effective in reducing NCD mortality rates (6, 39–43). Mustapha et al. (14) researched the effects of increased tobacco taxation and pricing on smoking prevalence in Africa. The authors found that increased taxation and pricing have significant negative effects on the prevalence of smoking. The former had a negative effect on the prevalence of smoking by 0.25% to 0.36%, while the latter had a negative effect on the prevalence of smoking by 0.11–0.14% (14, 15). Similarly, extensively researched the tax structure and prices of cigarette excise. The study demonstrates that more superficial tax structures would be much more effective in reducing cigarette smoking than tax structures that are more complicated, as there is a greater likelihood to switch to cheaper brands whenever a tax increase is imposed. In addition to the aforementioned, it was found that alcohol taxation consistently reduces consumption. Alcohol prices and taxes are inversely related to drinking (16).

Alcohol control strategies mirror those of tobacco control; however, there is little empirical evidence on the possible effects of increased alcohol taxation on preventing NCD deaths. The present study builds from gaps in the literature above to find empirical evidence regarding changes in the NCD mortality rate associated with changes in the tax rates of tobacco and alcohol. From this primary objective, we specifically sought; to assess the association between tobacco tax and NCDs mortality rates; assess the association between alcohol tax and NCDs and lastly; investigate the persistence of past NCDs mortality rates. We used data from five Sub-Saharan African countries to determine whether increased or heavy taxation breathes new hope into these countries' efforts to combat NCDs as we approach the Sustainable Development Goal (SDG) 2025 target of a 25% global reduction in NCD mortality rates.

Undertaking this study is important. With the current statistics on NCDs, there is a high possibility that the target to reduce NCD mortality by one-third by 2030 might not be achieved (SDG 3.4 target). Deaths related to NCDs affect SDG8 of economic growth, in particular target 8.2, because of the long-term health effects that impede productivity. This has implications for the poverty levels in the economy and SDG1 of no poverty target 5. A failure to reduce poverty will likely bring inequalities among communities as per SDG10.2.

Methods

We used the System Generalized Methods of Moments (SGMM) to estimate and assess the relationship between changes in the death rate from NCDs in five Sub-Saharan countries relative to the changes in tax rates on alcohol and tobacco products, tobacco cigarette prices, and screening rates. Urban growth and income per capita have been used as instruments to control for potential endogeneity and the validity of the estimates. Furthermore, SGMM allows for the dependent variable to be included as an explanatory variable if there are any suspicions of reverse causality. Furthermore, GMM does not rely on assumptions about the normality of the data distribution. It can be applied to a wide range of linear and nonlinear models without being limited by specific distributional assumptions (17–20). We specify the following relationship below:

Where Kit is the vector of the controlled variable, and α0 is the intercept.

NCDMit is the mortality rate of noncommunicable diseases and is expressed in percentages.

Taxit is the excise tax on the most sold brands of tobacco cigarettes, and alcohol specifically beer and spirits.

Kit is the vector of control variables including; tobacco cigarette prices, screening rates, urban growth rate, and income per capita.

β1−β3 are coefficients of explanatory variables.

εit is the error term.

Data

The data used in this study was sourced from the World Health Organization Database, World Bank Database, and WHO Health Observatory. The data spans from 2008 to 2022 and includes information on NCD mortality rate, income per capita, urban growth rate, and health taxes. The NCD mortality rate, income per capita, and urban growth rate for each of the five nations are based on data from the World Bank, while the health tax information is extracted from the WHO Database. The WHO Health Observatory Data Base (health taxes) contains information on alcohol and tobacco cigarette taxes and prices. The tax used in this study is the excise tax from the most sold brand of these products. While alcohol taxes only cover 2022, tobacco cigarette taxes and prices go from 2008, 2010, 2012, 2014, 2016, 2018, 2020, and 2022.

For analysis, we assumed that the tobacco cigarette tax data and prices remained in effect for the other years for which there was no data, assuming they haven't been changed. Alcohol taxes have not been proposed because the data only covers a single period. A dummy variable representing screening rates was established to supplement the independent variables. The dummy variable is categorical, with values of 1 for lower screening rates, 2 for medium screening rates, and 3 for high screening rates.

Results

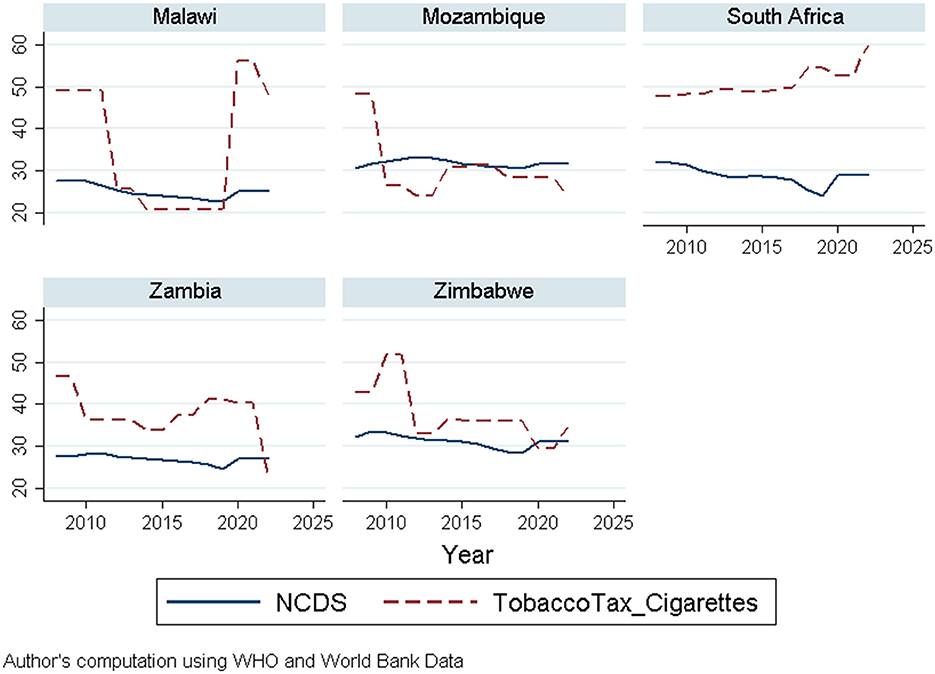

The visual presentation of NCD mortality and taxes on tobacco cigarettes within the implementation period of the tax (2008–2022) in Figure 1 below shows a rise and fall in NCD mortality and tax rates on tobacco cigarettes over the years. Malawi and Mozambique exhibit the same pattern; however, Malawi's graph indicates a drastic increase in tobacco cigarette tax around 2020. Zambia and Zimbabwe show fluctuations in both NCDs and tax rates, while South Africa depicts a stable tax rate but rising NCDs, suggesting consistency in tax policy implementation.

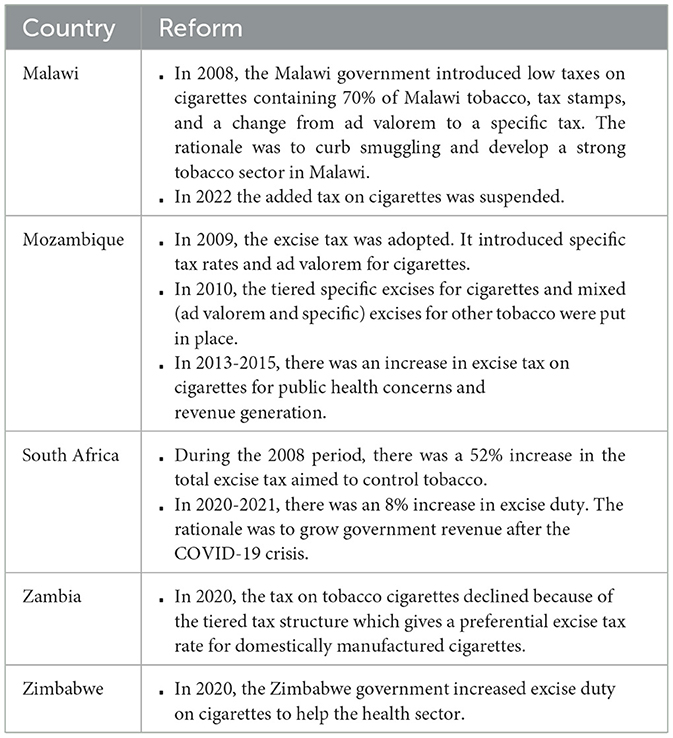

As much as these countries are members of the WHO Framework Convention on Tobacco Control (FCTC) which aims to fight the tobacco pandemic, the fluctuations in the graph of tax on tobacco cigarettes may not solely be attributed to the desire to reduce the burden of NCDs mortality rates. Policy reforms are among the various factors that alter tax changes. The policy reforms that might have influenced cigarette taxation during the 2008 to 2022 period are summarized in Table 1.

Descriptive statistics

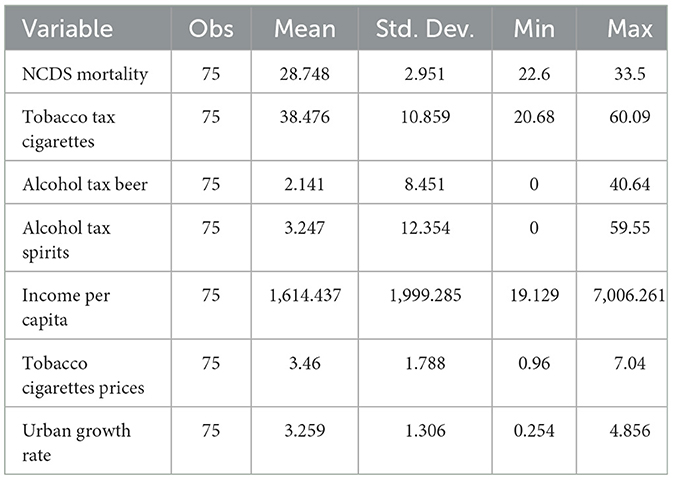

Descriptive statistics reflect the distribution and diversity of variables. The statistics give insight into the average value, variability, and range of each variable. Table 2 displays descriptive statistics for all variables.

The variation in NCD mortality rates across the five countries is minimal. There is higher variability in cigarette tax rates with a standard deviation of 10.859, indicating a higher dispersion around the mean. The minimum and maximum values show a wide range of tax rates for cigarettes with a minimum of 20.68 and a maximum of 60.9. Alcohol tax on beer shows a considerable variation in beer taxes. The standard deviation of alcohol tax on spirits suggests significant variation across countries. There are wide disparities in income per capita across countries. However, there is moderate variability in tobacco cigarette prices and urban growth rate.

Econometric findings

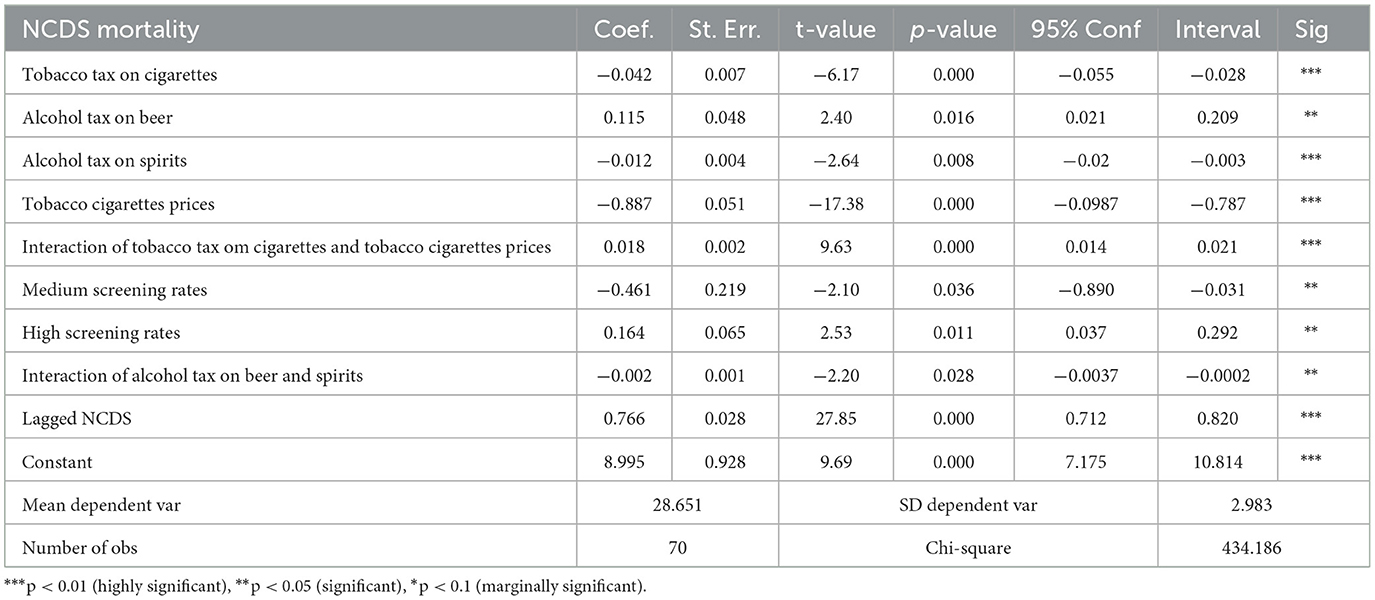

After conducting all the necessary diagnostic tests, the analysis investigated the changes in NCD mortality rate relative to the changes in tax rates of alcohol and tobacco products using the system SGMM estimator. The lagged dependent variable has been included as a regressor to account for any persistence correlation. Urban growth and income per capita have been used as instruments and are certified valid by the Sargan Test. They help to account for endogeneity and improve the validity of estimates. The results in Table 3 display the SGMM output.

A one percent increase in tobacco-cigarette tax is associated with a decrease in NCD mortality rates by 0.0416%, holding all other factors constant. The coefficient is statistically significant at 5%. This conforms to public health goals, as higher cigarette prices can discourage smoking and reduce health risks that are attributed to NCDs. The negative results may also reflect the issues of elasticity as WHO reports indicate that the elasticity of tobacco cigarettes ranges from 5 to 8% in low- and middle-income countries, while in high-income countries, it is about 4%. A positive coefficient of alcohol tax on beer implies that a one percent increase in excise tax on beer is associated with an increase in NCD mortality by 0.1152%, holding all other factors constant.

The coefficient is statistically significant under the 5% level. This finding is intriguing and might warrant further investigation, as it could derive from other factors related to beer consumption. A negative coefficient of alcohol tax on spirits suggests that a one percent increase in excise tax on spirits is associated with lower NCDS mortality rates by 0.0116%, all things being equal. The coefficient is statistically significant at the 5% level. The negative result may also imply that spirits tend to have higher alcohol content, so this result might reflect differences in alcohol consumption patterns. A negative coefficient of tobacco cigarette prices indicates that higher prices are associated with lower NCD mortality rates by 0.08868%. The coefficient is statistically significant.

The joint effect of alcohol tax on beer and spirits is associated with a decrease in NCD mortality rates by 0.002%. The coefficient is significant at a 5% level. The negative association might also be attributed to whether these products are complements. The combined effect of increasing both cigarette tax and prices is associated with an increase in the NCD mortality rate by 0.018%. The coefficient is significant at the 5% level.Medium screening rates are negatively associated with NCD mortality rates. Higher screening rates are positively associated with NCD mortality rates as opposed to lower and medium screening rates. The result is expected mainly in disease epidemiology; when screening tools are introduced, or the old ones are improved, there is an increment in the death rate of the disease. This increase is due to the introduction of new tools. This suggests that in the past, the diseases were present in their respective countries, but no one picked them up. Both screening rates for dummies are significant at a 5% level. Past NCDs have a positive association with current NCDs by 0.7664%. This suggests a prevalence in NCD mortality rates. They are significant at the 5% level. The constant value of 8.9948 represents the expected NCD mortality rates when all other variables are zero. It is statistically significant.

Discussions

This study empirically investigated the relationship between NCD mortality rates relative to changes in tax rates on tobacco cigarettes and alcohol (beer and spirit) while controlling for tobacco cigarette prices, screening rates, income per capita, and urban growth rates. This was done by collecting data for five sampled Sub-Saharan countries from 2008 to 2022. The tax data used is about the excise tax on the most sold brands extracted from the World Health Organization. We find that increased taxes on tobacco or alcohol or both seem to have a negative significant association with NCDs.

The empirical evidence of the negative association of alcohol and tobacco cigarette taxes on the mortality rates of NCDs confirmed the propositions that have been advocated by the WHO (36). Also, the use of the fiscus in dealing with the NCDS scourge has been reported in several studies to be effective and a negative relationship has also been found (21, 22). Furthermore, the negative association was reported in the Caribbean (23), Nepal (24), Peru (25), and many developed countries such as those in Europe (42).

The interaction of alcohol tax on spirits and beer tax conforms to the principles of taxation and reflects a possibility of complementarity. On the other hand, the interaction of tobacco tax on cigarettes and tobacco cigarette prices is counterintuitive. One interesting finding of these results is the significance of the intercept, indicating the presence of additional factors that may have a significant association with NCD mortality.

We also noticed that increased tobacco cigarette prices have a negative association with NCD mortality rate. This finding also agrees with the finding of Pearl et al. (12), who conducted a study on the effects of tobacco taxation and pricing on smoking behavior in high-risk populations. The effect may probably come from the substitution effect as people may switch to consuming healthy goods. This may be given that the household budget may be effectively reduced in relative terms due to the price increase (26). This supports rational choice theories, in which people weigh the benefits of a decision and opt for the option that yields the most beneficial outcome that maximizes utility (27).

Related to NCD screening, the categorical screening rates dummy variables imply that high screening rates unravel some NCD mortality rates that have not been picked up due to potential underdiagnosis. The importance of NCD screening in similar scenarios was reported among healthcare workers in South Africa (28) and for hypertension in Malawi (29). The screening may be an essential preventive strategy in areas like the countries analyzed. This comes about because these countries' have low capacity to adopt a curative approach due to a lack of adequate facilities and low budget (30), except for South Africa, which may finance a large part of its health budget (31). Furthermore, the study showed that using lagged NCD mortality rates as an explanatory variable hints that previous NCD mortality rates may influence present or future NCDs. This is likely to be influenced by policy interventions that would impact the outcome of NCDs' present or future mortality rates.

Having said the above, it is imperative to indicate that the success of the tax intervention depends on taking a holistic approach. Such is the case because people trade-off, and there is a temporary or permanent coping mechanism as humans are rationing and responding to price incentives, a phenomenon that was already observed in Malawi, where alcohol consumption overcrowded the consumption of other household commodities (32). Consequently, the alcohol or smoke addicts reduce the consumption of other necessities (44). To model the demand for these products, addiction-related issues must be taken into consideration because people with addiction would rather modify their spending in other areas to make up for the decrease in their present consumption than alter their behavior in the face of higher taxation. Further, different stakeholder perceptions may matter as they may jeopardize the policy process- a finding established in Nepal (22).

Since there is no one-size-fits-all solution, differential taxes that target particular populations may be considered. In nations such as South Africa, where a varied range of racial backgrounds predominate, it is customary for individuals to smoke and drink alcohol (33–35). Effective implementation of tax interventions requires consideration of all these factors. In addition, since these levies provide the government with income, there should be consideration that the tax revenue generated should be channeled toward funding health initiatives related to NCDs and the treatment of current NCDs.

There are possible solutions for improving the effectiveness of these interventions, but there are also potential blind spots. Alcohol and tobacco products are taxed in the formal sector but not in the unregulated informal sector, where government supervision is minimal. This poses a challenge in some countries analyzed here, which comprise a large informal sector. Furthermore, WHO proposes taxes on the most sold brands of tobacco products and alcohol. An intervention that might compel people to switch to local brands if a tax hike makes these products costly. It is important to bear in mind that the goal of tax interventions is to ensure that the consumption of these goods is reduced to the point where there are no viable substitutes while balancing the impact on household income for countries like Malawi where these products, specifically tobacco has economic significance, without compromising public health goals. In addition, differences in tax distribution across countries might also yield significant differences in the reduction of modifiable risk factors.

Conclusion

Our interest was to assess the effect of tax and noncommunicable diseases attributable to tobacco and alcohol consumption in five Sub-Saharan African Countries. On our first objective, we successfully established a negative significant association between tobacco tax and noncommunicable diseases (NCDs), indicating that increased tobacco taxation is linked to the reduction of NCDs mortality rates. Regarding the second objective,our analysis revealed a substantial negative association between alcohol tax and NCDs, demonstrating that higher alcohol taxation is associated with decreased NCDs. As for the last objective -to investigate the persistence of NCDs, we incorporated NCDs as a regressor in the model. The results show a positive significant association between past and current NCDs, thereby confirming the persistence of NCDs.

The results of this study call for more research to address some problematic areas raised, such as variations in demand responsiveness to price changes. In addition, the intercept in the regression analysis of this study shows a strong association with the dependent variable. The research should assist policymakers in investigating other factors influencing NCDs. This also includes the reaction of the tobacco and alcohol industries to increased taxation. This will be extremely important when creating interventions.

Data availability statement

The datasets presented in this study can be found in online repositories. The names of the repository/repositories and accession number(s) can be found in the article/Supplementary material.

Author contributions

MM: Conceptualization, Data curation, Formal analysis, Investigation, Methodology, Resources, Validation, Visualization, Writing – original draft, Writing – review & editing. GC: Conceptualization, Data curation, Formal analysis, Investigation, Methodology, Supervision, Validation, Visualization, Writing – original draft, Writing – review & editing. TN: Formal analysis, Supervision, Validation, Visualization, Writing – review & editing. BM: Formal analysis, Supervision, Validation, Visualization, Writing – review & editing.

Funding

The author(s) declare financial support was received for the research, authorship, and/or publication of this article. We are thankful to Centre for Resilient Agri-Food Systems (CRAFS) project from the University of Malawi for funding us to finalize writing our paper.

Acknowledgments

This article utilized Stata Software for data analysis and used Grammarly for language checks.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's note

All claims expressed in this article are solely those of the author and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Supplementary material

The Supplementary Material for this article can be found online at: https://www.frontiersin.org/articles/10.3389/fpubh.2024.1464897/full#supplementary-material

References

2. Debapriya C, Daphne WC, Prabhat J. Exploring the labour market outcomes of the risk factors for non-communicable diseases: a systematic review. SSM Popul Health. (2023) 25:101564. doi: 10.1016/j.ssmph.2023.101564

3. Lawana N, Booysen F, Tsegaye A, Hongoro C. Lifestyle risk factors, non-communicable diseases and labour force participation in South Africa. Dev South Afr. (2020) 37:446–61. doi: 10.1080/0376835X.2019.1678459

4. Folland S, Goodman AC, Stano M, Danagoulian S. The Economics of Health and Health Care. London: Routledge. (2024).

6. Lawana N, Kapingura FM, Tsegaye A. The impact of non-communicable diseases on employment status in South Africa. Cogent Econ Finan. (2023) 11:2246005. doi: 10.1080/23322039.2023.2246005

7. Ian HR, Roberta C, Selvi JM, Silvana L, Anselm HJM. The rising burden of non-communicable diseases in the Americas and the impact of population aging: a secondary analysis of available data. Lancet Region Health–Am. (2023) 21. doi: 10.1016/j.lana.2023.100483

9. U. S. National Cancer Institute and World Health Organization. The Economic of Tobacco and Tocco Control. (2016).

10. Ahmed MU, Pulok MH, Hashmi R, Hajizadeh M, Nargis N. Price and income elasticities of cigarette smoking demand in Bangladesh: evidence from urban adolescents and young adults. Nicotine Tobacco Res. (2022) 24:826–33. doi: 10.1093/ntr/ntab270

11. Guindon GE, Abbas U, Trivedi R, Garasia S, Johnson S, John RM. Socioeconomic differences in the impact of prices and taxes on tobacco use in low-and middle-income countries–a systematic review. PLOS Global Public Health. (2023) 3:e0002342. doi: 10.1371/journal.pgph.0002342

12. Pearl B, David B, Roberta, F. Effects of Tobacco Taxation and Pricing on Smoking Behavior in High Risk Populations. (2011).

13. Skeete J, Connell K, Ordunez P, DiPette DJ. Approaches to the management of hypertension in resource-limited settings: strategies to overcome the hypertension crisis in the post-COVID era. Integr Blood Press Control. (2020) 13:125–133. doi: 10.2147/IBPC.S261031

14. Mustapha I, Michael BK, Abdul IA. The Effects of Tobacco Taxation and Pricing on the Prevalence of Smoking in Africa. (2021).

15. Mustapha I, Abdul IA, Michael BK. Does taxation of harmful products influence population health? Evidence from Africa using the dynamic panel system. In: GMM Model. (2020).

16. Alexander WC, Mathew SJ, Kelli KA. Effects of Beverage Alcohol Price and Tax Levels on Drinking: a Meta-Analysis of 1003 Estimates from 112 Studies. (2009).

17. Baltagi BH. A Companion to Econometric Analysis of Panel Data. Hoboken NJ: John Wiley & Sons. (2009).

18. Bun MJG, Windmeijer F. The weak instrument problem of the system GMM estimator in dynamic panel data models. Econom J. (2010) 13:95–126. doi: 10.1111/j.1368-423X.2009.00299.x

19. Cameron AC, Trivedi PK. Microeconometrics: Methods and Applications. Cambridge: Cambridge University Press. (2005). doi: 10.1017/CBO9780511811241

20. Hsiao C. Analysis of Panel Data (Issue 64). Cambridge: Cambridge University Press. (2022). doi: 10.1017/9781009057745

21. Guillermo PR, Prabhat J, William S, Alan F. Taxation of tobacco, alcohol, and sugar-sweetened beverages: reviewing the evidence and dispelling the myths. BMJ Glob Health. (2023) 8:e011866. doi: 10.1136/bmjgh-2023-011866

22. Elliott LM, Dalglish SL, Topp SM. Health taxes on tobacco, alcohol, food and drinks in low- and middle-income countries: a scoping review of policy content, actors, process and context. Int J Health Policy Manag. (2022) 11:414–28. doi: 10.34172/ijhpm.2020.170

23. Althea F, La Charmaine M, Samuel G, Ewan S, Karl T, Christine L. The potential for using alcohol and tobacco taxes to fund prevention and control of noncommunicable diseases in Caribbean Community countries. Revista Panamericana de Salud Pública. (2018) 42:192. doi: 10.26633/RPSP.2018.192

24. Yubraj A, Vipassana K, Uttam P, Supriya J, Ramesh G, Shiva AR. Perceptions of key stakeholders on taxes on tobacco and alcohol products in Nepal. J BMJ Global Health. (2023) 8:e012040. doi: 10.1136/bmjgh-2023-012040

25. Mario Z, Silvana L-P, Melissa M, Jaime Z-D. Political and socioeconomic factors that shaped health taxes implementation in Peru. BMJ Global Health. (2023) 8:8.

26. Ross H, Tesche J, Vellios N. Undermining government tax policies: Common legal strategies employed by the tobacco industry in response to tobacco tax increases. Prev Med. (2017) 105:S19–22. doi: 10.1016/j.ypmed.2017.06.012

27. Kauder E. History of Marginal Utility Theory (Vol. 2238). Princeton: Princeton University Press. (2015).

28. Elelwani M, Irene RT, Melitah RM. Importance of utilizing non-communicable disease screening tools; ward-based community health care workers of south africa explain. Int J Environ Res Public Health. (2024) 21:263. doi: 10.3390/ijerph21030263

29. Alberto C, Fabrice K, Peter-Hans K, lliana KV. Health screening for emerging non-communicable disease burdens among the global poor: evidence from sub-Sahar. J Health Econ. (2021) 75:102388. doi: 10.1016/j.jhealeco.2020.102388

30. Alungile Q, Kin S, Phakama S. Health capital and economic performance in selected Southern African development Community (SADC) countries. Cogent Econ Finance. (2024) 12:2337479. doi: 10.1080/23322039.2024.2337479

31. John AE. The Impact of Financing Health Services on Income Inequality in an Unequal Society: The Case of South Africa. (2021).

32. Jolex A, Kaluwa B. Crowding out effects of alcohol consumption expenditure on household resource allocation in Malawi. PLoS ONE. (2022) 17:E0263330. doi: 10.1371/journal.pone.0263330

33. Alireza J, Abdolhalim R, Mahdi A-G, Nooshin P, Mehrsadat M, Hadi T. National, regional, and global prevalence of cigarette smoking among women/females in the general population: a systematic review and meta-analysis. Environ Health Prev Med. (2021) 26:1–13. doi: 10.1186/s12199-020-00924-y

34. Matanje Mwagomba BL, Nkhata MJ, Baldacchino A, Wisdom J, Ngwira B, Acharya Y, et al. Socioeconomic differences in the impact of prices and taxes on tobacco use in low-and middle-income countries–a systematic review. BMJ Global Health. (2022) 8:102388. doi: 10.1186/s12889-018-5833-7

35. Neo MK, Emeka DW, Isidore OS, Charles PDH. Alcohol consumption, harms and policy developments in sub-Saharan Africa: the case for stronger national and regional responses. Drug Alcohol Rev. (2021) 40:402–19. doi: 10.1111/dar.13247

37. African Centre for Disease and Control (Non Communicable Diseases Injuries Prevention and Control and Mental Health Promotion Strategy 2022–26 (2022). Available at: https://africacdc.org/download/africa-cdc-non-communicable-diseases-injuries-prevention-and-control-and-mental-health-promotion-strategy-2022-26/

38. World Health Organization. Global Action Plan for the Prevention and Control of Noncommunicable Diseases 2013–2020. World Health Organization (2013). Available at: https://www.who.int/publications/i/item/9789241506236

39. Kilian C, Rovira P, Neufeld M, Ferreira-Borges C, Rumgay H, Soerjomataram I, et al. Modelling the impact of increased alcohol taxation on alcohol-attributable cancers in the WHO European Region. Lancet Reg Health Eur. (2021) 11:100225. doi: 10.1016/j.lanepe.2021.100225

40. Rumgay H, Shield K, Charvat H, Ferrari P, Sornpaisarn B, Obot I, et al. Global burden of cancer in 2020 attributable to alcohol consumption: a population-based study. Lancet Oncol. (2021) 22:1071–80. doi: 10.1016/S1470-2045(21)00279-5

41. Neufeld M, Rovira P, Ferreira-Borges C, Kilian C, Sassi F, Veryga A, et al. Impact of introducing a minimum alcohol tax share in retail prices on alcohol-attributable mortality in the WHO European region: a modelling study. Lancet Reg Health Eur. (2022) 15:100325. doi: 10.1016/j.lanepe.2022.100325

42. Manthey J, Gobina I, Isajeva L, Neneman J, Reile R, Štelemėkas M, et al. The Impact of Raising Alcohol Taxes on Government Tax Revenue: Insights from Five European Countries. Appl Health Econ Health Policy. (2024) 22:363–74. doi: 10.1007/s40258-024-00873-5

43. Morris D, Angus C, Gillespie D, Stevely AK, Pryce R, Wilson L, et al. Estimating the effect of transitioning to a strength-based alcohol tax system on alcohol consumption and health outcomes: a modelling study of tax reform in England. Lancet Public Health. (2024) 9:e719–28. doi: 10.1016/S2468-2667(24)00191-9

Keywords: fiscal policy, non-communicable diseases, WHO best buys, health promotion, tobacco taxation, alcohol taxation, Malawi

Citation: Moyo M, Chirwa GC, Nyirenda T and Matanje BL (2025) Tax and noncommunicable diseases attributable to tobacco and alcohol consumption in 5 Sub-Saharan African countries. Front. Public Health 12:1464897. doi: 10.3389/fpubh.2024.1464897

Received: 15 July 2024; Accepted: 11 December 2024;

Published: 10 January 2025.

Edited by:

Ali-Farid Safi, Craniologicum - Center for Craniomaxillofacial Surgery, SwitzerlandReviewed by:

Diego Nocetti, University of Tarapacá, ChileAbubakr Abdelraouf Alfadl, University of Science and Technology, Yemen

Copyright © 2025 Moyo, Chirwa, Nyirenda and Matanje. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Machiru Moyo, bmFtY2hpcnVrYUBnbWFpbC5jb20=; Gowokani Chijere Chirwa, Z293b2thbmlAZ21haWwuY29t

Machiru Moyo

Machiru Moyo Gowokani Chijere Chirwa

Gowokani Chijere Chirwa Thomas Nyirenda3,4,5

Thomas Nyirenda3,4,5 Beatrice Lydia Matanje

Beatrice Lydia Matanje