- 1Department of Social Medicine, School of Public Health, Harbin Medical University, Harbin, Heilongjiang, China

- 2Department of Health Economy and Social Security, College of Humanities and Management, Guilin Medical University, Guilin, China

Background: Catastrophic disease sufferers face a heavy financial burden and are more likely to fall victim to the “illness-poverty-illness” cycle. Deeper reform of the medical insurance system is urgently required to alleviate the financial burden of individuals with catastrophic diseases.

Methods: Data were obtained from a cross-sectional questionnaire survey conducted in Heilongjiang in 2021, and logistic regression and restricted cubic spline model was used to predict the core factors related to medical insurance that alleviate the financial burden of people with catastrophic diseases.

Results: Overall, 997 (50.92%) medical insurance-related professionals negatively viewed financial burden relief for people with catastrophic diseases. Factors influencing its effectiveness in relieving the financial burden were: whether or not effective control of omissions from medical insurance coverage (OR = 4.04), fund supervision (OR = 2.47) and degree of participation of stakeholders (OR = 1.91). Besides, the reimbursement standards and the regional and population benefit package gap also played a role. The likelihood of financial burden relief increased by 21 percentage points for each unit increase in the level of stakeholder discourse power in reform.

Conclusion: China’s current medical insurance policies have not yet fully addressed the needs of vulnerable populations, especially the need to reduce their financial burden continuously. Future reform should focus on addressing core issues by reducing the uninsured, enhancing the width and depth of medical insurance coverage, improving the level and capacity of medical insurance governance that provides more discourse power for the vulnerable population, and building a more responsive and participatory medical insurance governance system.

Introduction

There is a kind of social disease in the world whose name called the disease of poverty. Poverty is one of the major obstacles to stable and sustainable social development. The number of people living in extreme poverty (with an income of less than $1.90 per day) went from 36% in 1990 to 10% in 2015, 9.2% in 2017, 8.4% in 2019, and 9.1–9.4% in 2020 (1, 2). It shows that the pace of global poverty eradication has slowed recently. A number of factors are to blame, but the COVID-19 pandemic may be particularly responsible for reversing decades of progress. One thing seems to have stayed the same - expensive health care continues to impoverish people. A survey of 89 countries by the World Health Organization (WHO) found that the proportion of people suffering severe financial hardship because of diseases was growing at an annual rate of 11 per cent (3). Among a large number of sick people, the most vulnerable are those with catastrophic diseases, who are more likely to suffer severe financial burdens due to prolonged, expensive treatment and regular drug maintenance. It was estimated that 150 million people experience catastrophic health expenditure (CHE) each year due to healthcare costs (4). In Burkina Faso, an increase by one illness among adults significantly increased the probability of CHE from 1.5 to 1.7 times (5). The proportion of households experiencing CHE in India increased between 1993 and 2014, especially among households with older adults (6). A subgroup of households in sub-Saharan Africa may encounter CHE when utilizing medical services, with the incidence rising and generally being greater between 2010 and 2020 (7). A national survey shows that the percentage of Malaysian households suffering from CHE is 2.8% and increasing (8). In China, disease is the main cause of people’s poverty (9, 10). According to the statistical bulletin released by China’s National Bureau of Statistics, among the causes of poverty in rural China, poverty caused by disease accounts for 44.1%, involving nearly 20 million people, including 7.34 million people suffering from catastrophic and chronic diseases (11).

The financial burden of catastrophic diseases has become a pressing issue for the global medical insurance system to address. Medical insurance acts as a third-party payer between patients and providers to tackle the high cost of healthcare. It is an essential mechanism for managing health risks and addressing the risk of financial loss. Several studies have empirically tested the potential burden-reducing effects of medical insurance. Among them, Medicaid in the United States has lifted at least 2.6 million people out of poverty by subsidizing direct medical costs and reducing out-of-pocket medical costs from $871 to $376 per beneficiary (12). Actually, the burden-reducing effect of medical insurance has been positively demonstrated in countries such as China, South Korea, India, and Ghana (13–16). However, some studies have argued against the effectiveness of medical insurance in reducing the burden (9), especially for socially disadvantaged groups (17), such as the older people, the very sick, and the rural population (18–20). In addition, as shown in an empirical study of the PMJAY, a national publicly funded medical insurance program in India, and the incidence of out-of-pocket, CHE, PMJAY did not reduce the financial burden of access to quality medical services for the poor and vulnerable (21). A study conducted in China also found that medical insurance plans did not actually reduce the risk of catastrophic medical expenditure, with the highest rates of CHE and poverty due to cancer, chronic respiratory diseases, and diabetes (22). The picture is also bleak for rare diseases, with medical and drug expenditures for rare disease patients in Taiwan, China increasing dramatically over the past decade. In 2014, drug expenditures accounted for 88.75% of rare diseases’ medical expenditures. With the development of rare disease drugs and their newer iterations, drug expenditures were likely to increase further (23). All of the above studies showed the failure of medical insurance to alleviate the financial burden of vulnerable populations such as those with catastrophic diseases. Scholars had different opinions on this. Some considered that the rapid increase in medical care costs has undermined the true effectiveness of insurance (24); others argued that vulnerable populations such as those with chronic diseases, have an increasing demand for medical services and that these groups are at constant risk of financial hardship and poor health in the absence of effective protection mechanisms (25, 26).

This study built on the above research by focusing on the impact and effect of medical insurance system design, problems, and reform measures on the financial burden of people with catastrophic diseases. Most current research on medical insurance and financial burden still focused on the impact of the presence or absence of medical insurance and the type of insurance on the overall population burden. There were also studies of the impact of individual medical insurance on the burden of disease in specific populations (22, 27–29). Several studies analyzed the benefits of medical insurance integration measures in terms of enrollee satisfaction and CHE (30–32). Although a great deal of research has been done on medical insurance and the burden of diseases, there is a little in-depth exploration into the medical insurance system itself. Questions such as how medical insurance can focus on key issues and implement effective reforms to reduce the financial burden of people with catastrophic diseases still need to be answered. In addition, it is necessary to understand the views of medical insurance-related professionals on the relationship between medical insurance policies and the financial burden of people with catastrophic diseases. They are the architects and implementers of medical insurance policies. This study drew on the experience of a large number of medical insurance-related professionals. It aimed to understand how medical insurance-related professionals perceive the effectiveness and weaknesses of China’s medical insurance in alleviating the financial burden of people with catastrophic diseases. Also, to quantify the related medical insurance issues and governance measures and explore the determinants that may affect the effectiveness and provide reference evidence for deepening the reform of the medical insurance system and sustaining the promotion of medical insurance poverty alleviation.

Methods

Data source and sampling method

A cross-sectional questionnaire survey was conducted in 2021. Respondents were selected by multi-stage stratified cluster random sampling. We conducted the first-stage sampling of 12 cities, including Harbin, Qiqihar, and Daqing, in Heilongjiang Province. The second-stage sampling was conducted at the institutional level by cluster sampling of staff in medical insurance administrative agencies, other relevant departments, medical institutions and third-party institutions such as universities and research institutes. All staff members included were invited to participate in the survey, such as medical insurance administrators, handling staff, accounting staff of medical institutions, and university experts and scholars engaged in medical insurance-related departments, for the questionnaire survey. Due to the sporadic outbreak of COVID-19 and the dynamic zero-COVID policy adopted in China, this survey was conducted online, using the Questionnaire Star platform to upload and disseminate the questionnaire. The entire survey lasts approximately 65 days from January to March 2021. To ensure the quality of the data, we asked the respondents to read a questionnaire introduction note before completing the questionnaire, when respondents complete the electronic questionnaire, four questionnaire auditors from Harbin Medical University perform quality control. They excluded questionnaires that did not meet the study as well as quality requirements. Specific exclusion criteria: (1) Questionnaire completion time less than 500 s. (2) Age less than 16 years. (3) Greater consistency in the choice of answers to questionnaire entries. (4) The IP belonged to a place other than Heilongjiang. (5) There are other situations that violate the normal answer logic. A total of 2054 respondents completed the questionnaire, after review, those unqualified questionnaires were excluded. The final sample size we included in the analysis was 1958.

Variables

Dependent variable

Distinct from conventional studies of the financial burden of diseases, our survey did not apply the widely used objective indicators such as CHE, impoverishing medical expenditures (IME), and out-of-pocket expenses (OOPE). It must be acknowledged that these indicators fail to account for indirect costs like lost wages due to missed work or transport for medical appointments, as well as the intangible costs associated with a person’s lower quality of life due to illness, unmeasured emotional stress, and shortened lifespan. We believe that subjective evaluations by medical insurance-related professionals based on a policy evaluation may provide a different perspective on disease burden research. The dependent variable of this paper was the evaluation of medical insurance-related professionals on the medical insurance’s effectiveness in financial burden alleviation for people with catastrophic diseases. The response options were based on a five-point Likert scale (1 = no relief, 2 = slight relief, 3 = average relief, 4 = larger relief, 5 = very large relief). To comply with the modeling requirements of logistic regression, we divided the respondents’ choices into two categories: unrelieved = 0 (including no relief, slight relief, and average relief); and relieved =1 (including larger relief and very large relief).

Independent variables

We drew on the independent variables addressed in previous relevant studies (10, 18, 30, 33) and further consulted with medical insurance experts to avoid omitting important variables. The main independent variables of this paper: (1) existing design problems of the medical insurance scheme that may influence the alleviation effect (including medical insurance reimbursement standards for patients, regional and population differences in benefit package of medical insurance due to the different levels of economic development, etc.); (2) the management issues that may lead to the fund waste of medical insurance unchecked and therefore affect its alleviation ability (including payment method’s capacity to control the cost of medical insurance, medical insurance fund supervision, leakage control, etc.); (3) the respondents were asked to evaluate the extent to which medical insurance governance measures were achieved (including the level of participation and voice of medical insurance stakeholders in reform and governance, etc.).

Control variables

We controlled the confounding effects of respondents’ demographic and socioeconomic characteristics (age, gender, education, etc.).

Statistical analysis

The data were analyzed using STATA 16.0 and R 4.1.3. Statistical descriptions (percentages and frequency) were used to describe the sample. We conducted the Chi-square and Mann–Whitney U test/t-test to determine the relationship between each variable and the evaluation of medical insurance-related professionals on the effectiveness of financial burden alleviation for people with catastrophic diseases. We then constructed a model that included the variables that showed significance in the univariate analysis (α = 0.05). Immediately after, we included variables that did not show a relationship in the univariate analysis but were considered to be related by medical insurance experts in the model for consideration. For example, although the variable “capacity to control the cost of medical insurance payment methods “did not show any association, it was included in the regression model for further testing and analysis as suggested by medical insurance experts. We also used restricted cubic splines to flexibly model the relationship between the variable “level of stakeholders’ involvement in the process of medical insurance reform and governance” and the evaluation of medical insurance-related professionals on the effectiveness of financial burden alleviation for people with catastrophic diseases. The system automatically generated reference values and the four knots were used to draw the restricted cubic spline.

Results

Basic information of the interviewee

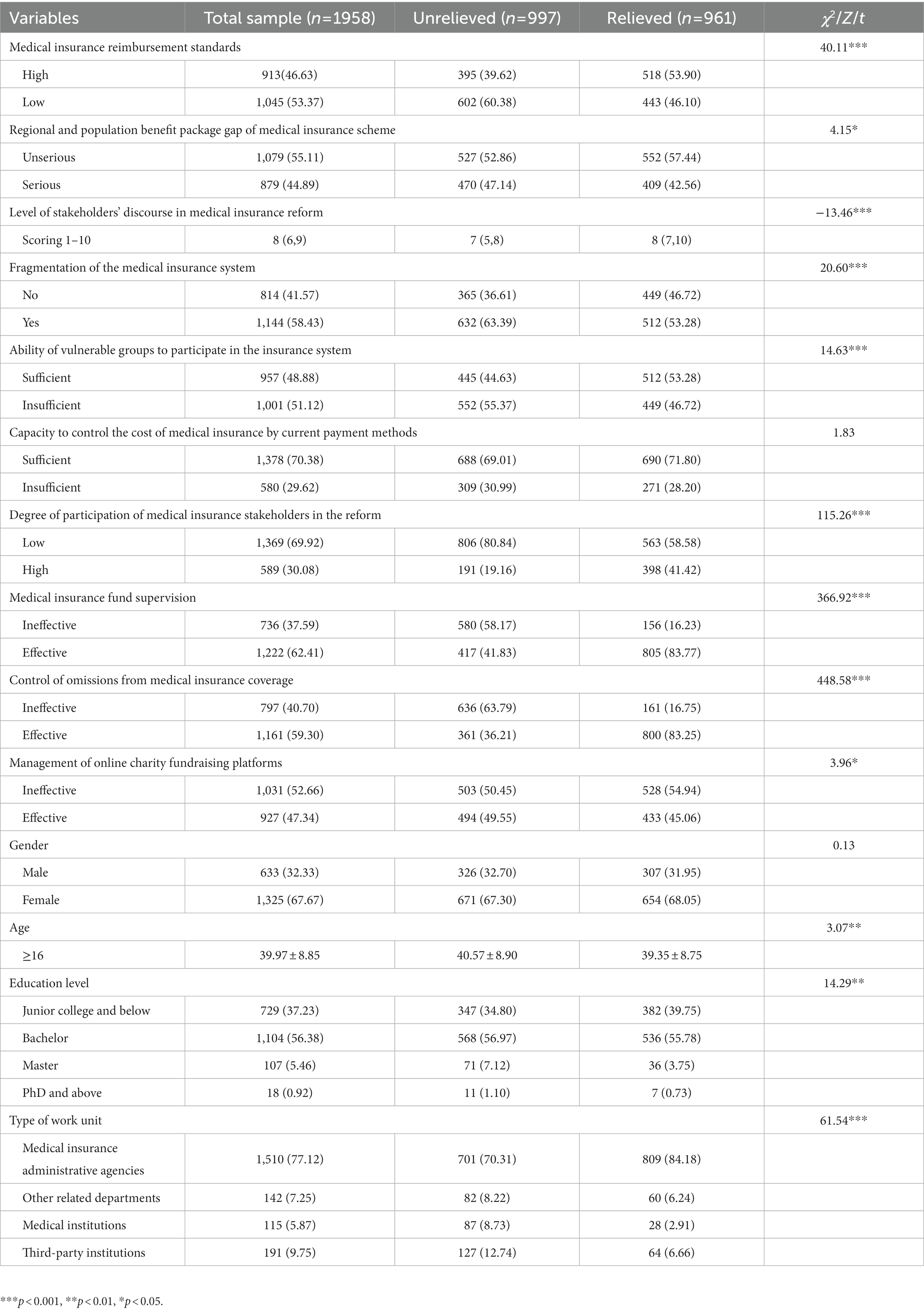

The overall characteristics of each respondent were shown in Table 1. They were mostly female (67.67%) and between the ages of 31 and 48. The majority (62.76%) held a bachelor’s degree or higher. Additionally, 77.12% of the respondents had positions in divisions that dealt with medical insurance. We surveyed their opinions on the issues with medical insurance, the efficiency of the measures, and its management. In the opinion of 53.37% of the respondents, patient medical insurance reimbursement requirements are still woefully inadequate to help patients fight catastrophic diseases. The majority of respondents (62.41%) said that the supervision of medical insurance funds was efficient. However, 69.92% of the respondents believed that there was insufficient stakeholder participation in the various medical insurance reforms.

Analysis of differences

As shown in Table 1, more than half (50.92%) of the respondents evaluated the effect of alleviating the financial burden of people with catastrophic diseases as unsatisfactory. Univariate statistical analysis showed that medical insurance reimbursement standards, regional and population benefit package differences of medical insurance were factors that influence the evaluation of medical insurance-related professionals, besides, the level of the stakeholders’ involvement in medical insurance and its governance reform, fragmentation of the medical insurance system, and the ability of vulnerable groups to participate in the insurance system also play a role. Respondents who perceived a high degree of stakeholders’ participation in the reform of medical insurance and the effectiveness of supervision of medical insurance funds tended to believe that the degree of financial burden relief for the catastrophic disease population was better. Those who showed negative perceptions about the management of online charity fundraising platforms were more likely to disagree that the financial burden was alleviated.

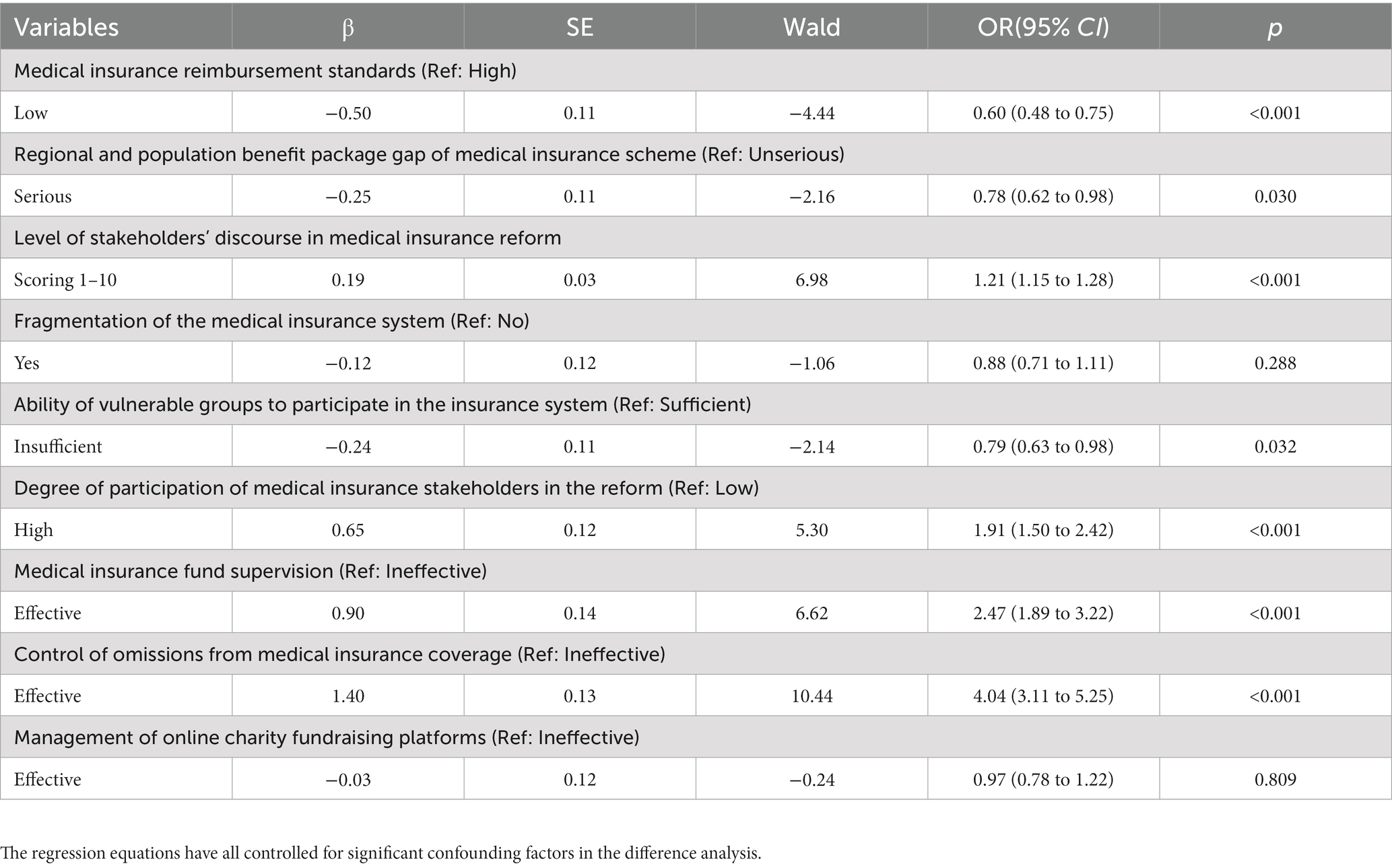

Logistic regression model

Further exploring the effects of the above-mentioned factors on their impact on the degree of financial burden relief for people with catastrophic diseases, a multiple logistic regression analysis was conducted with seven significant predictors (p < 0.05) identified. Including (1) the medical insurance reimbursement standards (OR = 0.60). (2) The regional and population benefit package gap of medical insurance scheme (OR = 0.78). (3) The level of stakeholders’ discourse in medical insurance reform (OR = 1.21). (4) The ability of vulnerable groups to participate in the insurance system (OR = 0.79). (5) The degree of participation of medical insurance stakeholders in the reform (OR = 1.91). (6) The effectiveness of medical insurance fund supervision (OR = 2.47). (7) The effectiveness of the control of omissions from medical insurance coverage (OR = 4.04). For details, see Table 2.

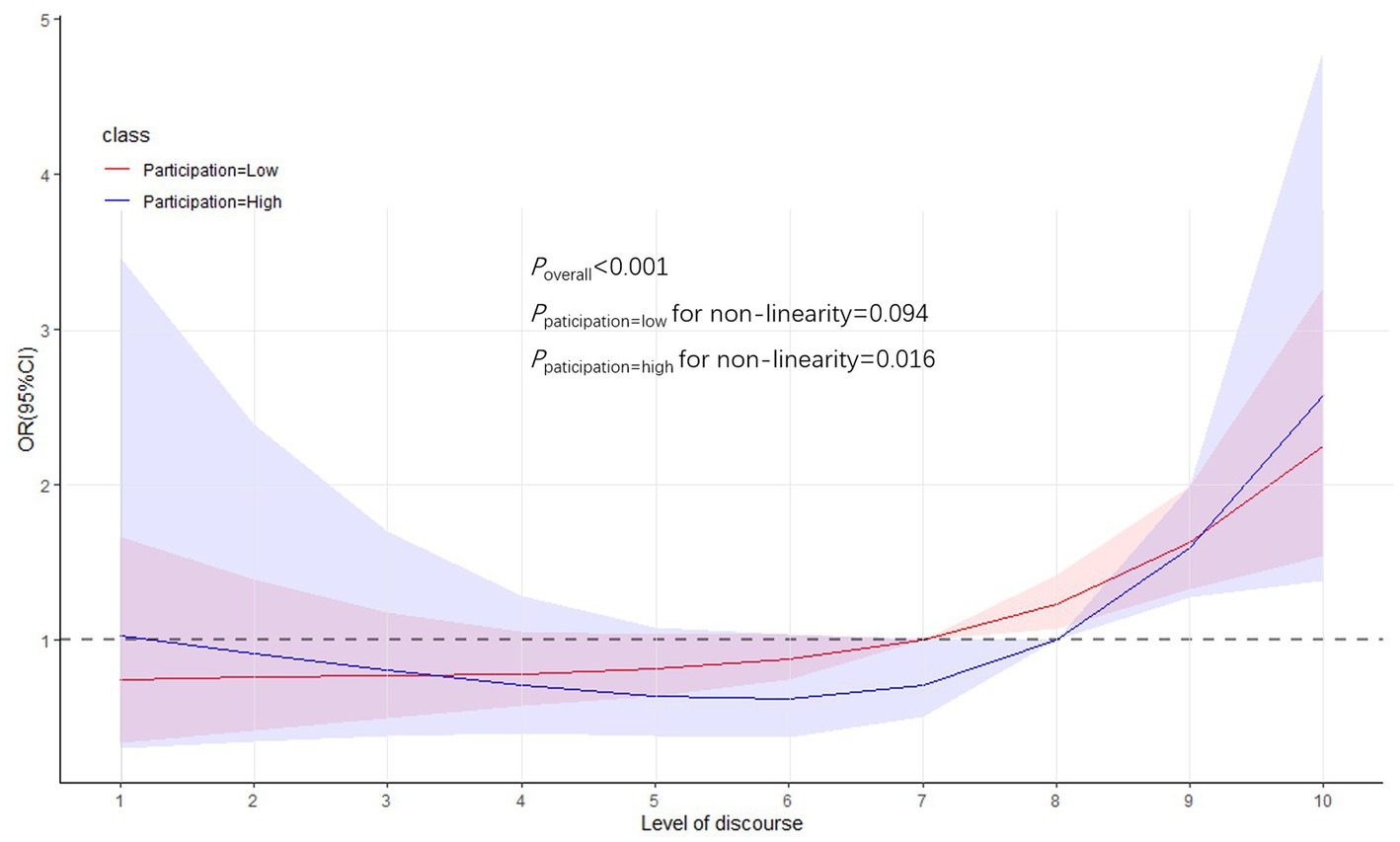

A possible non-linear relationship between the effectiveness of financial burden alleviation for people with catastrophic diseases and the level of stakeholders’ discourse

Flexible models using restricted cubic spline curved to visualize the relationship between the level of stakeholders’ discourse and the evaluation on the effectiveness of financial burden alleviation for people with catastrophic diseases. The results indicated a significant relationship between the two (Poverall < 0.001). Two scenarios were viewed. When the participation of medical insurance stakeholders in the reform is low, this relationship was linear (P for non-linearity = 0.094). That is, the likelihood of a positive evaluation of disease burden mitigation effects increased with increasing discourse degree scores. When stakeholder involvement in medical insurance reform is high, the relationship is similar to a flat “U” curve (P for non-linearity = 0.016). Further analysis of the high level of stakeholders’ participation. When the discourse degree score was less than “5″, the likelihood of a positive evaluation of disease burden relief decreased gradually with its increase; when the discourse degree score was greater than “7″, the likelihood of a positive evaluation of disease burden relief increased gradually with its increase. In particular, the likelihood of positive evaluation of disease burden relief tended to increase rapidly when the discourse degree score was greater than “8” Figure 1.

Figure 1. The graph illustrates the relationship between the level of discourse of medical insurance stakeholders and the evaluation on the effectiveness of financial burden alleviation for people with catastrophic diseases, showing specific trends in low and high levels of stakeholder involvement in medical insurance reform, respectively. The red line indicates the linear relationship between the two when stakeholders’ participation is low. The blue line indicates the non-linear relationship when stakeholders’ participation is high. The red and blue shades indicate the respective confidence intervals. The restricted cubic spline model adjusts for the influences of variables such as age, gender, education level, type of work unit, and medical insurance reimbursement standards, etc.

Discussion

China has now basically achieved full coverage of basic medical insurance, and the level of medical protection for the whole society has been improved substantially. However, the phenomenon of a vicious circle between poverty and diseases still exists. This study investigated the evaluation of medical insurance-related professionals on the effect of financial burden relief for people with catastrophic diseases from a subjective perspective, which combined with their review and reflection on the possible impact of current medical insurance policies. We expect to explore the problems of the current medical insurance system in alleviating the financial burden of people with catastrophic diseases and to find strategies for governance. The following sections summarize the medical insurance-related factors found in this study that affect the financial burden of people with catastrophic diseases:

The financial burden remains high for people with catastrophic diseases

In our survey, 50.92% of medical insurance professionals believed that the financial burden of people with catastrophic diseases has not yet been alleviated. China has continued to promote the reform of its medical insurance system and has made breakthroughs in recent years in tackling the problems of “difficult” and “expensive” access to medical care. However, China still faces disparities in the financial burden of medical care across regions and medical insurance systems, with relatively low protection against financial risk compared to developed countries (34). In Korea, around 20% of the population could incur a catastrophic financial burden (35). Catastrophic diseases were characterized by the high treatment costs and out-of-catalog expenses (36). Some patients with catastrophic diseases sometimes reflected a heavier burden. Data from The Lancet in 2011 showed that the incidence of CHE in China was 12.7%, which meant that 173 million people were in financial trouble paying for expensive medical treatment (37). In addition, in 2016, the figure was still 8.94% (38). Medical expenses due to illness were still a major cause of poverty for a large proportion of the population. Most families spent between 100,000 and 300,000 RMB on their children’s leukemia treatment. However, 63.03% of families could only get less than half of the reimbursement from medical insurance. This is related to the fact that 5.72% of respondents are uninsured, that there is a cap on reimbursement and that imported medicines are often used and not covered by medical insurance (39).

Universal medical insurance coverage is critical

There are still some people with catastrophic diseases who are not covered by medical insurance (40). China has reached a milestone success in achieving the goal of universal health coverage. According to the Sixth National Medical Services Statistical Survey Report, China’s basic medical insurance coverage rate was about 96.8%, but there were still nearly 446 million uninsured people, and the rate increased by only 1.7 percentage points in 5 years compared with 2013. In some low-income countries, there remained significant barriers to achieving further increasing in coverage and providing essential financial protection to people with catastrophic diseases (3, 41). It should be noted that basic medical insurance alone cannot fundamentally address the financial burden of people with catastrophic diseases and that other supplementary medical insurance is needed to compensate for this. For example, major medical insurance and medical assistance (42–44). In contrast, supplemental medical insurance required a series of strict vetting processes and high admission criteria, and there were certain barriers for vulnerable people with catastrophic diseases to enter their coverage. Some studies have shown that major medical insurance has reduced the financial burden of patients with catastrophic diseases to some extent, and its coverage has been expanded compared to that of the basic medical insurance, but the coverage was still relatively small (20). Expanding medical insurance coverage coincided with Hallman’s proposed measures to address CHE and medical coverage for catastrophic diseases (45, 46).

Insufficient medical insurance reimbursement standards

China’s basic medical insurance followed the principle of “wide population coverage and relatively low reimbursement level,” which mainly aimed at achieving rapid population coverage in the first phase of its development, but gradually led to the problem of unbalanced and insufficient development of the system. The inadequate design of the medical insurance system in terms of its financing, reimbursement levels, and relatively narrow benefit packages has led to a heavier financial burden for those vulnerable groups who suffer catastrophic diseases when medical insurance could not provide additional and preferential subsidies for vulnerable groups and effective compensation for catastrophic diseases (47). It has been reported that few households would incur CHE if out-of-pocket expenditure were reduced to 15% or less of total health expenditure (48). China has limited reimbursement for most people due to inconsistent levels of regional economic development (49–51).

Differences in the benefit package of medical insurance scheme

It was unfair that each region set different limits and reimbursement rates, which often resulted in huge differences in insurance benefits between regions (52). Benefits in the eastern region of China were higher than in the central and western regions (51, 53). A study shows that the financial burden of healthcare in the south-eastern provinces is much lower than in other regions, allowing for better reimbursement of healthcare for local people (34).

Governance-related measures to address above mentioned problems should be developed and implemented

Building a medical insurance governance system is necessary to reduce the financial burden of people with catastrophic diseases. This study was concerned with three main points. The first point is that governance is distinct from management, and the core of governance is “multiple participation” (54, 55). More medical insurance stakeholders involved in major reforms appeared to reduce the financial burden for the catastrophic disease population. The financial burden of catastrophic diseases was not only the cost of medical services but also the indirect financial burden such as lost wages, escort costs and transportation costs, as well as the hidden financial costs such as time and mental stress of the sick families. The medical insurance sector alone cannot achieve the goal of alleviating the financial burden of people with catastrophic diseases but requires multi-sectoral consultation and joint management (56, 57). The study has shown that geographically unstable and remote families, even if insured, tend to forgo medical care due to the time, difficulty, and cost associated with reaching a medical facility (58). This is where the transportation sector, medical institutions, and infrastructure sector should be involved in medical insurance efforts. The government of Taiwan province has led the way in this regard by coordinating organizations that assist people with rare diseases when they encounter problems with schooling, employment, or life support with the assistance of the Rare Diseases Foundation, schools, civic groups, and the mass media (23).

The second point is fund regulation. It is another aspect of governance. The World Bank’s Global Governance Indicators, published annually, cover the dimension of regulatory quality (59). Effective fund regulation can reduce the financial burden on people with catastrophic diseases. We suspect there are several reasons for this. Firstly it holds insurers accountable for their actions. Secondly it has been demonstrated that government regulation affects the length of stay of Medicare-covered patients (60) and that the presence or absence of medical insurance regulation makes a difference in the behavior of medical care providers in utilizing medical care resources (61). A unified approach to regulation is the best way to ensure fairness and efficiency in terms of financial solvency, consumer protection and equity (55).

The third point is more power to stakeholders outside of the government. Notably, the likelihood of financial burden relief for the catastrophic disease population increased by 18 percentage points for each unit increase in the level of medical insurance stakeholder involvement in reform discourse. Furthermore, in the grouped restricted cubic spline plot, the level of medical insurance stakeholder participation in reform discourse showed a relationship of positive contribution to the degree of financial burden relief for the population of the catastrophic disease, regardless of whether the level of major reform participation by medical insurance stakeholders was high or low. We believe that the distribution of discourse power is one of the key points of multi-subject cooperation, and the government should give more discourse power to each subject, while broadly mobilizing social forces to participate in the financial security of people with catastrophic diseases, so as to better play the function of the market. The government’s role gradually changed to that of rule maker, guide and regulator. As Sussex et al. suggested, the government should actively guide social forces to participate in the livelihood security of the sick through the timely introduction of relevant policies, and encourage social charity forces to play a greater role in the field of medical assistance (62). It has been demonstrated that there are rapidly growing policy-making advantages that result from an equal partnership between the government and social welfare organizations in the field of medical charity (63). Government should intervene moderately in the insurance market by finding a new mix of insurance market roles and government roles (64). Overall, the decentralization of government is likely to positively affect the relationship where medical insurance alleviates the financial burden of people with catastrophic diseases.

Limitations

This paper was based on self-reported subjective perception data and cognitive information based on a certain recall period. Therefore, the judgments of the relevant entries may be inaccurate due to recall bias. Our sample may not be nationally representative, and caution should be exercised when quoting facts that apply to the whole country. In addition, our findings were related to personal affective experiences, and caution was needed in generalizing the findings to the same meaning of financial burden, etc., as indicated by objective indicators.

Conclusion

China’s current medical insurance policies have not yet fully addressed the needs of vulnerable populations, and multidimensional health risks add to the financial burden of people with catastrophic diseases. China still faces challenges such as relatively insufficient coverage for vulnerable populations, inadequate depth of coverage, and the gap in treatment differences between different systems and regions. To further alleviate the financial burden of people with catastrophic diseases and improve China’s medical insurance governance capacity, the government should encourage the participation of multiple subjects in the significant reform process of medical insurance. Then increase the level of discourse on the market and social subjects, and give a certain degree of equal consultation rights, while government departments should act more as rule-makers and regulators to control the overall situation.

Data availability statement

The raw data supporting the conclusions of this article will be made available by the authors, without undue reservation.

Author contributions

PG and RW drafted the manuscript. YQ performed the data processing and analysis. LS guided the manuscript framework. JLi and JLiu performed the image drawing and preliminary review. KW, HS, and HL performed the literature search. YL, YH, YC, and ZK performed quality control and review of the manuscript. QW revised the manuscript and gave critical suggestions. All authors contributed to the article and approved the submitted version.

Funding

This work was supported by the National Social Science Foundation of China (Grant No.19AZD013).

Acknowledgments

We thank all the authors for their outstanding contributions. We are also very grateful to the reviewers for their dedication and valuable comments.

Conflict of interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher’s note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

2. World Bank. Poverty and shared prosperity 2020: reversals of fortune. Washington: The World Bank (2020).

3. World Health Organization. The world health report: Health systems financing: The path to universal coverage: Executive summary. Geneva: World Health Organization (2010).

4. Xu, K, Evans, DB, Carrin, G, Aguilar-Rivera, AM, Musgrove, P, and Evans, T. Protecting households from catastrophic health spending. Health Aff. (2007) 26:972–3. doi: 10.1377/hlthaff.26.4.972

5. Van Doorslaer, E, O'Donnell, O, Rannan-Eliya, RP, Somanathan, A, Adhikari, SR, Garg, CC, et al. Effect of payments for health care on poverty estimates in 11 countries in Asia: an analysis of household survey data. Lancet. (2006) 368:1357–64. doi: 10.1016/S0140-6736(06)69560-3

6. Pandey, A, Ploubidis, GB, Clarke, L, and Dandona, L. Trends in catastrophic health expenditure in India: 1993 to 2014. Bull World Health Organ. (2018) 96:18–28. doi: 10.2471/BLT.17.191759

7. Eze, P, Lawani, LO, Agu, UJ, and Acharya, Y. Catastrophic health expenditure in sub-Saharan Africa: systematic review and meta-analysis. Bull World Health Organ. (2022) 100:337–351J. doi: 10.2471/BLT.21.287673

8. Sayuti, M, and Sukeri, S. Assessing progress towards sustainable development goal 3.8. 2 and determinants of catastrophic health expenditures in Malaysia. PLoS One. (2022) 17:e0264422. doi: 10.1371/journal.pone.0264422

9. Wagstaff, A, and Lindelow, M. Can insurance increase financial risk?: the curious case of health insurance in China. J Health Econ. (2008) 27:990–05. doi: 10.1016/j.jhealeco.2008.02.002

10. Zheng, LL, and Peng, LJ. Effect of major illness insurance on vulnerability to poverty: evidence from China [article]. Front Public Health. (2021) 9:14. doi: 10.3389/fpubh.2021.791817

11. Wang, PA. Implement the healthy poverty alleviation project to prevent the rural poor from returning to poverty due to illness. Guangming Net. (2017)

12. Sommers, BD, and Oellerich, D. The poverty-reducing effect of Medicaid. J Health Econ. (2013) 32:816–2. doi: 10.1016/j.jhealeco.2013.06.005

13. Jung, J, and Liu, SJ. Does health insurance decrease health expenditure risk in developing countries? The case of China. South Econ J. (2015) 82:361–84. doi: 10.1002/soej.12101

14. Jung, H, and Lee, J. Estimating the effectiveness of national health insurance in covering catastrophic health expenditure: evidence from South Korea [article]. PLoS One. (2021) 16:e0255677. doi: 10.1371/journal.pone.0255677

15. Mahapatro, SR, Singh, P, and Singh, Y. How effective health insurance schemes are in tackling economic burden of healthcare in India [article]. Clin Epidemiol Glob Health. (2018) 6:75–82. doi: 10.1016/j.cegh.2017.04.002

16. Aryeetey, GC, Westeneng, J, Spaan, E, Jehu-Appiah, C, Agyepong, IA, and Baltussen, R. Can health insurance protect against out-of-pocket and catastrophic expenditures and also support poverty reduction? Evidence from Ghana's National Health Insurance Scheme [article]. Int J Equity Health. (2016) 15:11. doi: 10.1186/s12939-016-0401-1

17. Wang, N, Xu, J, Ma, M, Shan, L, Jiao, M, Xia, Q, et al. Targeting vulnerable groups of health poverty alleviation in rural China—what is the role of the new rural cooperative medical scheme for the middle age and elderly population? Int J Equity Health. (2020) 19:1–13. doi: 10.1186/s12939-020-01236-x

18. Ma, M, Li, Y, Wang, N, Wu, Q, Shan, L, Jiao, M, et al. Does the medical insurance system really achieved the effect of poverty alleviation for the middle-aged and elderly people in China? Characteristics of vulnerable groups and failure links. BMC Public Health. (2020) 20:435. doi: 10.1186/s12889-020-08554-3

19. Zhou, Q, Liu, GG, and Krumholz, S. Is Chinese National Health Insurance Effective in the face of severe illness? A perspective from health service utilization and economic burden. Soc Indic Res. (2017) 132:1307–29. doi: 10.1007/s11205-016-1330-5;

20. Li, Y, Duan, GF, and Xiong, LP. Analysis of the effect of serious illness medical insurance on relieving the economic burden of rural residents in China: a case study in Jinzhai County [article]. BMC Health Serv Res. (2020) 20:9. doi: 10.1186/s12913-020-05675-8

21. Garg, S, Bebarta, KK, and Tripathi, N. Performance of India s national publicly funded health insurance scheme, Pradhan Mantri Jan Arogaya Yojana (PMJAY), in improving access and financial protection for hospital care: findings from household surveys in Chhattisgarh state. BMC Public Health. (2020) 20:949. doi: 10.1186/s12889-020-09107-4

22. Xia, Q, Wu, L, Tian, W, Miao, W, Zhang, X, Xu, J, et al. Ten-year poverty alleviation effect of the medical insurance system on families with members who have a non-communicable disease: evidence from Heilongjiang Province in China. Front Public Health. (2021) 9:705488. doi: 10.3389/fpubh.2021.705488

23. Hsu, JC, Wu, H-C, Feng, W-C, Chou, C-H, Lai, EC-C, and Lu, CY. Disease and economic burden for rare diseases in Taiwan: a longitudinal study using Taiwan’s National Health Insurance Research Database. PLoS One. (2018) 13:e0204206. doi: 10.1371/journal.pone.0204206

24. Liu, X, Sun, X, Zhao, Y, and Meng, Q. Financial protection of rural health insurance for patients with hypertension and diabetes: repeated cross-sectional surveys in rural China. BMC Health Serv Res. (2016) 16:481. doi: 10.1186/s12913-016-1735-5

25. Chandoevwit, W, and Phatchana, P. Inpatient care expenditure of the elderly with chronic diseases who use public health insurance: disparity in their last year of life. Soc Sci Med. (2018) 207:64–70. doi: 10.1016/j.socscimed.2018.04.042

26. WHO. Designing health financing systems to reduce catastrophic health expenditure. Geneva: World Health Organization (2005).

27. Gao, D, Jing, SH, Wu, J, and Wu, G. Economic burden and medical insurance impact of the different dialysis for end-stage renal diseases [article]. Iran J Public Health. (2018) 47:1675–80.

28. Zhang, H, Chao, JQ, Wang, SY, and Liu, P. The impact of health insurance on economic burden for hepatitis B inpatients in China [letter]. Iran J Public Health. (2016) 45:107–8.

29. Yang, C, Huang, Z, Sun, KX, Hu, YH, and Bao, XY. Comparing the economic burden of type 2 diabetes mellitus patients with and without medical insurance: a cross-sectional study in China [article]. Med Sci Monitor. (2018) 24:3098–02. doi: 10.12659/MSM.907909

30. Shan, L, Zhao, M, Ning, N, Hao, Y, Li, Y, Liang, L, et al. Dissatisfaction with current integration reforms of health insurance schemes in China: are they a success and what matters? Health Policy Plan. (2018) 33:345–4. doi: 10.1093/heapol/czx173

31. Wang, J, Zhu, H, Liu, H, Wu, K, Zhang, X, Zhao, M, et al. Can the reform of integrating health insurance reduce inequity in catastrophic health expenditure? Evidence from China. Int J Equity Health. (2020) 19:49. doi: 10.1186/s12939-020-1145-5

32. Liu, H, Zhu, H, Wang, J, Qi, X, Zhao, M, Shan, L, et al. Catastrophic health expenditure incidence and its equity in China: a study on the initial implementation of the medical insurance integration system. BMC Public Health. (2019) 19:1–12. doi: 10.1186/s12889-019-8121-2

33. Korenman, SD, and Rernler, DK. Including health insurance in poverty measurement: the impact of Massachusetts health reform on poverty [article]. J Health Econ. (2016) 50:27–35. doi: 10.1016/j.jhealeco.2016.09.002

34. Dou, GS, Wang, Q, and Ying, XH. Reducing the medical economic burden of health insurance in China: achievements and challenges [article]. Biosci Trends. (2018) 12:215–9. doi: 10.5582/bst.2018.01054

35. Lee, W-Y, and Shaw, I. The impact of out-of-pocket payments on health care inequity: the case of national health insurance in South Korea. Int J Environ Res Public Health. (2014) 11:7304–18. doi: 10.3390/ijerph110707304

36. Kim, Y, and Yang, B. Relationship between catastrophic health expenditures and household incomes and expenditure patterns in South Korea. Health Policy. (2011) 100:239–6. doi: 10.1016/j.healthpol.2010.08.008

37. Wagstaff, A, Flores, G, Smitz, MF, Hsu, J, Chepynoga, K, and Eozenou, P. Progress on impoverishing health spending in 122 countries: a retrospective observational study [article]. Lancet Glob Health. (2018) 6:E169–81. doi: 10.1016/s2214-109x(17)30486-2

38. Ma, XC, Wang, ZY, and Liu, XY. Progress on catastrophic health expenditure in China: evidence from China family panel studies (CFPS) 2010 to 2016 [article]. Int J Environ Res Public Health. (2019) 16:11. doi: 10.3390/ijerph16234775

39. Chen, T, Zhou, Y, Zheng, L, and Liu, Y. A Report on the living conditions of children diagnosed with leukemia in rural China Chinese Red Cross Foundation (2013) available at: https://crcf-website-photo.oss-cn-beijing.aliyuncs.com/attachment/20200413/19df9e4a481e411ba697b14904568047.pdf (accessed 15th March, 2022).

40. Garrett, L, Chowdhury, AMR, and Pablos-Méndez, A. All for universal health coverage. Lancet. (2009) 374:1294–9. doi: 10.1016/S0140-6736(09)61503-8

41. Mtei, G, and Mulligan, J. Community health funds in Tanzania: a literature review. Ifakara: Ifakara Health Research and Development Centre (2007).

42. Gharibi, F, Imani, A, and Dalal, K. The catastrophic out-of-pocket health expenditure of multiple sclerosis patients in Iran. BMC Health Serv Res. (2021) 21:1–8. doi: 10.1186/s12913-021-06251-4

43. Leng, A, Jing, J, Nicholas, S, and Wang, J. Catastrophic health expenditure of cancer patients at the end-of-life: a retrospective observational study in China. BMC Palliat Care. (2019) 18:1–10. doi: 10.1186/s12904-019-0426-5

44. Soofi, M, Arab-Zozani, M, Kazemi-Karyani, A, Karamimatin, B, Najafi, F, and Ameri, H. Can health insurance protect against catastrophic health expenditures in Iran? A systematic review and meta-analysis. World Med Health Policy. (2021) 13:695–4. doi: 10.1002/wmh3.425

45. Hallman, GV. True catastrophe medical expense insurance. J Risk Insur. (1972) 39:1–16. doi: 10.2307/251646

46. Aregbeshola, BS, and Khan, SM. Determinants of catastrophic health expenditure in Nigeria. Eur J Health Econ. (2018) 19:521–2. doi: 10.1007/s10198-017-0899-1

47. Yi, H, Zhang, L, Singer, K, Rozelle, S, and Atlas, S. Health insurance and catastrophic illness: a report on the new cooperative medical system in rural China. Health Econ. (2009) 18:S119–27. doi: 10.1002/hec.1510

48. Xu, K, Evans, DB, Kawabata, K, Zeramdini, R, Klavus, J, and Murray, CJ. Household catastrophic health expenditure: a multicountry analysis. Lancet. (2003) 362:111–7. doi: 10.1016/S0140-6736(03)13861-5

49. Wang, J, Qi, X, Shan, L, Wang, K, Tan, X, Kang, Z, et al. What fragile factors hinder the pace of China’s alleviation efforts of the poverty-stricken population? A study from the perspective of impoverishment caused by medical expenses. BMC Health Serv Res. (2022) 22:1–13. doi: 10.1186/s12913-022-08237-2

50. Fu, X-Z. The comparison of catastrophic health expenditure and its inequality between urban and rural households in China. Heal Econ Rev. (2022) 12:19. doi: 10.1186/s13561-022-00365-z

51. Ren, Y, Zhou, Z, Cao, D, Ma, BH, Shen, C, Lai, S, et al. Did the integrated urban and rural resident basic medical insurance improve benefit equity in China? Value Health. (2022) 25:1548–58. doi: 10.1016/j.jval.2022.03.007

52. Xu, Y, Zhang, T, and Wang, D. Changes in inequality in utilization of preventive care services: evidence on China’s 2009 and 2015 health system reform. Int J Equity Health. (2019) 18:1–10. doi: 10.1186/s12939-019-1078-z

53. Han, J, and Meng, Y. Institutional differences and geographical disparity: the impact of medical insurance on the equity of health services utilization by the floating elderly population-evidence from China. Int J Equity Health. (2019) 18:1–14. doi: 10.1186/s12939-019-0998-y

54. Baez Camargo, C, and Jacobs, E. A framework to assess governance of health systems in low income countries (2011). Basel Institute on Governance. Basel Institute on Governance Working Paper Series No 11 1–22.

55. Savedoff, WD, and Gottret, PE. Governing mandatory health insurance: learning from experience. Washington: World Bank Publications (2008).

56. Kruk, ME, Gage, AD, Arsenault, C, Jordan, K, Leslie, HH, Roder-DeWan, S, et al. High-quality health systems in the sustainable development goals era: time for a revolution. Lancet Glob Health. (2018) 6:e1196–252. doi: 10.1016/S2214-109X(18)30386-3

57. Debie, A, Khatri, RB, and Assefa, Y. Successes and challenges of health systems governance towards universal health coverage and global health security: a narrative review and synthesis of the literature. Health Res Policy Syst. (2022) 20:50. doi: 10.1186/s12961-022-00858-7

58. Fiestas Navarrete, L, Ghislandi, S, Stuckler, D, and Tediosi, F. Inequalities in the benefits of national health insurance on financial protection from out-of-pocket payments and access to health services: cross-sectional evidence from Ghana. Health Policy Plan. (2019) 34:694–5. doi: 10.1093/heapol/czz093.31539034

59. World Health Organization. Health systems governance for universal health coverage action plan: Department of health systems governance and financing. Geneva: World Health Organization (2014).

60. Zhang, C-Y, and Hashimoto, H. How do patients and providers react to different incentives in the Chinese multiple health security systems? Chin Med J. (2015) 128:632–7. doi: 10.4103/0366-6999.151661

61. Si, L, and Jiang, Q-C. Challenges to the Chinese health insurance system: users’ and service providers’ perspectives. Beijing: Chinese Medical Journals Publishing House Co., Ltd.

62. Sussex, J, Feng, Y, Mestre-Ferrandiz, J, Pistollato, M, Hafner, M, Burridge, P, et al. Quantifying the economic impact of government and charity funding of medical research on private research and development funding in the United Kingdom. BMC Med. (2016) 14:1–23. doi: 10.1186/s12916-016-0564-z

63. Wilson, PA. Faith-based organizations, charitable choice, and government. Admin Soc. (2003) 35:29–51. doi: 10.1177/0095399702250343

Keywords: medical insurance, people with catastrophic diseases, financial burden, influencing factors, China

Citation: Guo P, Qin Y, Wang R, Li J, Liu J, Wang K, Li Y, Kang Z, Hao Y, Liu H, Sun H, Cui Y, Shan L and Wu Q (2023) Perspectives and evaluation on the effect of financial burden relief of medical insurance for people with catastrophic diseases and its influencing factors. Front. Public Health. 11:1123023. doi: 10.3389/fpubh.2023.1123023

Edited by:

Antonio Giulio de Belvis, Catholic University of the Sacred Heart, ItalyReviewed by:

Zhong Li, Nanjing Medical University, ChinaTang Shangfeng, Huazhong University of Science and Technology, China

Copyright © 2023 Guo, Qin, Wang, Li, Liu, Wang, Li, Kang, Hao, Liu, Sun, Cui, Shan and Wu. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Linghan Shan, bGluZ2hhbnNoYW5AMTI2LmNvbQ==; Qunhong Wu, d3VxdW5ob25nQDE2My5jb20=

†These authors have contributed equally to this work and share first authorship

Pengfei Guo

Pengfei Guo Yinghua Qin

Yinghua Qin Rizhen Wang1†

Rizhen Wang1† Jiacheng Li

Jiacheng Li Kexin Wang

Kexin Wang Ye Li

Ye Li Zheng Kang

Zheng Kang Yanhua Hao

Yanhua Hao Huan Liu

Huan Liu Linghan Shan

Linghan Shan Qunhong Wu

Qunhong Wu