- 1School of Management Science and Engineering, Shandong University of Finance and Economics, Jinan, China

- 2Jinan Rural Commercial Bank Co., Ltd., Jinan, China

COVID-19 has affected China's financial markets; accordingly, we investigate the effect of COVID-19 on the risk spillover between fintech and traditional financial industries. Using data from April 25, 2012 to April 22, 2022, which we divide into two parts (before and during the COVID-19 periods), we model the dynamic risk spillover relationship following the DCC-GARCH-BEKK and MMV-MFDFA methods. The results show that: (1) The dynamic relationship between fintech and traditional finance is almost positive most of the time, and the dynamic correlations between fintech and realty (real estate development and operation) are the largest. The dynamic linkage between fintech and traditional finance declines after the COVID-19 outbreak. (2) There exists a risk spillover from fintech to every type of bank before and during the COVID-19 periods. Notably, the risk spillover effect of fintech to large state-owned banks and city commercial banks is the largest separately before and during the COVID-19 periods. Meanwhile, there exist a two-way risk spillover between fintech and almost all other traditional financial industries before and during the COVID-19 periods. (3) Owing to the COVID-19 pandemic, the risk spillover relationship, which is in pairs and in the system become more complex. (4) Regarding the whole system, the correlation in the system is anti-persistent most of the time. Moreover, there are large fluctuations and more complex characteristics during the COVID-19 outbreak. However, the whole system was smooth most of the time before the outbreak of the COVID-19 pandemic.

Introduction

Fintech plays an important role in China's financial innovation, which is of great significance to the development of China's financial industry and the construction of digital China. Traditional financial institutions have gradually become an important subject of fintech innovation. Fintech enhances linkages among financial institutions, and increases the possibility of risk contagion. Fintech makes multiple risks such as traditional financial risk, new technology risk and systemic risk intertwined. Their abruptness, complexity, intersectionality and infectivity are also more prominent. And the initial shocks from fintech will have a greater probability to evolve into systemic risk.

The COVID-19 outbreak poses a serious threat to human life and health, disrupts the trajectory of economic development and threatens the stability of the financial system (1). Financial markets are volatile under the effect of the COVID-19 pandemic. China's Shanghai Composite Index fell by 7.72% on February 3, 2020, which was the largest one-day drop in nearly 5 years after the stock market crash. Fintech has become a major part of China's financial market. Therefore, the effect of COVID-19 may not only increase risks in fintech and traditional financial markets but also change risk spillovers between financial markets and the entire financial system. It is crucial to study the effect of COVID-19 on risk spillovers in fintech and traditional financial markets, which can help prevent and resolve major risks and further improve market resilience in the face of various unexpected events.

Scholars have examined the effect of public emergencies on economic and financial operations. COVID-19 has significantly affected the financial system. Some scholars examine the effect of the pandemic on financial markets, including Chinese stock markets and their various stock sectors indices. Bouri et al. (2) examine the structure change of return connectedness across various assets due to the occurrence of COVID-19. Syed et al. (3) investigate the asymmetric volatility spillover among Chinese stock market sectors during the outbreak of the COVID-19. Abuzayed et al. (4) investigate systemic distress risk spillover between the global stock market and individual stock markets in the countries most affected by the COVID-19. Topcu and Gulal (5) found that the negative effect of COVID-19 on emerging stock markets is gradually diminishing. From a regional perspective, emerging stock markets in Asia are the most negatively affected, whereas those in Europe are the least affected. Goodel (6) analyzes how COVID-19 affect financial markets and institutions, both directly and indirectly. Regarding the relationship between COVID-19 and financial risks, Rizwan et al. (7) evaluate the changes in systemic risk in eight countries, including Canada, during the global financial crisis and COVID-19 periods, and conclude that systemic risk values rose significantly in March, 2020 and peaked in mid-to-late March in all countries during the COVID-19 pandemic, and there are many other scholars explored the effects of COVID-19 on markets (8–18). Some scholars examine the relationship between fintech/cryptocurrencies and financial markets around the COVID-19 outbreak. Muhammad et al. (19) consider bitcoin as a haven for Australia's main stock index during the first and second waves of the COVID-19. Federico (20) studies the impact of bank investment in fintech companies on stock returns. Kumar et al. (21) investigate how cryptocurrencies interact and whether they have clear leaders, paying particular attention to differences in investment horizons and how relationship structures evolve in time. Man et al. (22) study the asymmetric efficiency of cryptocurrency. The COVID-19 epidemic has adversely affected the efficiency of the four cryptocurrencies. Bouri et al. (23) reveal the hedging and safe-haven nature of eight cryptocurrencies against declines in the S&P 500 and its 10 stock sectors. Le et al. (24) investigated whether COVID-19 changes spillover patterns between fintech and other asset classes; the results demonstrate that innovative technology products, as represented by a financial technology index (KFTX) and Bitcoin, were highly susceptible to external shocks.

Many scholars have examined risk spillovers in traditional finance. However, few have examined the risk spillover of fintech. Peer-to-peer lending, electronic payments, crowdfunding, cryptocurrency, and other technological financial innovations are all included in the fintech industry. Fintech and traditional finance compete and collaborate in similar market segments and business areas (25–27). Specifically, fintech hinders the improvement of the banking industry's cost efficiency and promotes the credit supply of micro enterprises in banks; however, it has heterogeneous effects on the profitability of different types of commercial banks (28, 29). Based on the above research, the risk transmission of fintech has also been studied further, mainly including internal and external transmission. Regarding the internal transmission mechanism of fintech risk, the rapid expansion of the fintech industry has driven the emergence of new risks (30). Some scholars have conducted qualitative studies on potential risk types in the fintech industry (31), such as credit, liquidity and operational risk (32), new fraud risk (33), network security, and privacy risk (34). Regarding quantitative analysis, Guo et al. (35) conducte a quantitative study on the credit risk of P2P lending market based on transaction data. Ma et al. (36) analyze the default risk of P2P loans based on mobile phone usage data. Troster et al. (37) predicte the risk of bitcoin cryptocurrency. The risks in the fintech industry are higher than those in traditional and Internet finance (38), and heterogeneity exists among different types of fintech platforms (39). Regarding fintech risk external transmission mechanism, fintech activities may exacerbate risk contagion and asset volatility in the financial system, thereby undermining financial stability. When Internet finance is at extreme risk, there is an obvious risk spillover effect on traditional finance (40). There are multiple connections between fintech companies and traditional financial institutions. Furthermore, the inherent risks of fintech companies may spillover to traditional financial institutions, causing systemic risks. Li et al. (41) assert that the degree of spillover of American fintech companies on the systemic risk of financial institutions is positively correlated with the increase in the systemic risk of financial institutions. Fintech has a heterogeneous effect on the risk-taking behavior of commercial banks (42–45). Le et al. (46) examine the network connectivity and spillover effects between fintech and green bonds and cryptocurrency.

According to the method, the multivariate GARCH model can be used to not only evaluate the fluctuation aggregation characteristics of multiple time series but also effectively evaluate the correlation between different variables. Engle (47) proposed the DCC-GARCH model, which can be used to examine the dynamic time-varying correlation between different time series, accurately captures the correlation between time series, and effectively evaluates the long-term change of correlation. The main advantages of the DCC-GARCH model are the positive definiteness of the conditional covariance matrices and the model's ability to estimate time-varying volatilities, covariances, and correlations among the assets in a parsimonious way (10). DCC-GARCH has been widely used (48–50). We employ DCC-GARCH model to study the dynamic correlation between fintech and traditional financial industry. In order to measure the size and direction of risk spillovers, we further employ GARCH-BEKK model to study the risk spillover between fintech and traditional finance. Many scholars use GARCH-BEKK model to study risk spillover (51–53). The MMV-MFDFA method which is newly proposed by Fan et al. (54) measures the internal fluctuation of the system from the time and fluctuation dimensions, and it is also used in stock market (55, 56).

According to the above discussion, there is no information on the effect of COVID-19 on the risk spillover of fintech and the entire system. This study makes the following contributions: This is the first study to investigate the risk spillover between fintech and traditional finance, the risk spillover in pairs in the system, and the risk spillover of the whole system before and during COVID-19, expanding the existing research boundary; this study aims to investigate the effect of COVID-19 on the risk spillover of fintech and the entire financial system. We further categorize banks to examine the risk spillover of fintech to different types of banks. The findings demonstrate that fintech has different risk spillover effects on different types of banks. In terms of supervision practice, we can monitor and give warning according to the calculation results of risk spillover intensity. This is also the first study on risk spillover in fintech and traditional financial system that follows the new MMV-MFDFA method. The results obtained from this study not only help enrich the research on the mechanism of public emergencies affecting financial stability, but also provide suggestions for regulators to prevent systemic financial risks.

The rest of this article is organized as follows: Section Methodology describes the DCC-GARCH-BEKK and MMV-MFDFA methods. Section Data describes the data, Section Empirical analysis focuses on the empirical analysis results and presents related discussions, and Section Conclusion and implications presents the conclusions.

Methodology

DCC-GARCH-BEKK

The DCC-GARCH model is expressed as follows.

The yield vector of variable i at point t is λi, t=(λ1, t... λk, t), the information set at t-1 is It−1, the variance-covariance matrix is Ht, the diagonal matrix composed of standard deviations calculated by the GARCH model is Dt, and the dynamic correlation coefficient matrix is Rt. The multivariate dynamic heteroscedasticity is

The unconditional correlation coefficients of the DCC model are αm and θn, the lag order is m and n, the influence of the product of lag m-order residuals on the dynamic correlation coefficient is αm, and the conditional heteroscedasticity coefficient of the lag n-phase is θn. A positive characterization of Ht can be guaranted if the conditions of αm ≥ 0, θn ≥ 0 and are satisfied.

Engle and Kroner (57) proposed the GARCH-BEKK model after a positive qualitative adjustment of the matrix, which is mainly used to examine the dynamic distribution of the covariance matrix of various financial markets.

Vector RXt= (RAt, RLt) represents the level of the t period of the two return sequences, u1 and u2 are the intercept terms of each model, α1i, α2i... ε1t and ε2t are the corresponding coefficients and residuals of the two mean equations, respectively, and n is the lag order.

For BEKK-GARCH model, the change process of Ht is:

The parameter matrix represents the lower triangular constant matrix and the coefficient matrix of the ARCH and GARCH terms, corresponding to the short-term and long-term fluctuation components, respectively.

MMV-MFDFA

(x1k, x2k, …, xjk, …, xpk) are multivariate time series, k = 1, …, N, and j = 1, …, p, where p denotes the number of variables, and N denotes the length of each variate.

Determine the profile of the jth variate

where 〈x(j)〉 is the average of the time series for i = 1, 2, …, N and j = 1, 2, …, p.

Divide the time series into Ns = int[N/s] non-overlapping subintervals; all s have the same length. The same procedure is followed for the inverse of the time series to obtain the 2NS subintervals.

For each subinterval v, we employed the least-squares method to fit the polynomial function. For v = 1, 2, …, 2Ns, the local detrended covariance function is

(i=1,2......p) represents the fitting polynomial corresponding to the ith variable in subinterval v, ||•|| represents the Euclidean norm, and

The q-order fluctuation function F(q,s) of the multivariate time series is calculated as follows, when q is a real number and does not equal zero,

When q=0, the fluctuation function is reported as follows.

Calculate the fluctuation function Fq(s) corresponding to the different time scales s. The fluctuation function Fq(s) and time scale s have the following power law relationship:

We calculated the q-order fluctuation function Fq(s) of the points in each window and a quasi-continuous variation in Hxy(q) with scale s, which is represented by the binary function Hxy(q). The graph of this binary function is the Hurst surface, and the height of each point represents the value of the generalized cross-correlation index Hxy(q) corresponding to (q,s). As the center (average scale) and window range of the sliding fitting window change constantly, s=(a+b)/2 is used to represent the fitting window s to better display the Hurst surface. Therefore, the generalized dependent Hurst surfaces are defined as:

where F(q,s) is the q-order fluctuation function for the points falling into the window. As the fluctuation functions F(q,s) are presented in log-log coordinates, the moving fitting window expands logarithmically.

Data

We use the daily closing prices of the fintech and traditional financial indices, covered from Apr 25, 2012 to Apr 22, 2022. We divide the sample into two parts: the data from Jan 20, 2020 to Apr 22, 2022, as the sample during COVID-19, and the rest as the sample before COVID-19. Data is obtained from the Wind database. We calculate the returns of the fintech and traditional financial industries using the logarithmic difference in the daily closing prices:

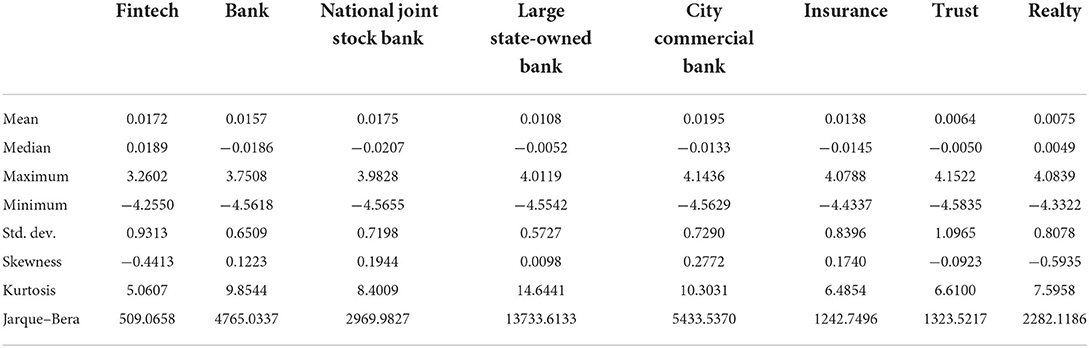

Table 1 shows the descriptive statistics of all the indices. The mean values of the seven samples are close to 0 and the standard deviations are larger than 0. The minimum values of all the returns are close to−4, and the maximum value of fintech is close to 3, while that of traditional finance is close to 4. The skewness values of the returns are not 0, and the kurtosis values are all larger than 3. The Jarque-Bera test rejects the null hypothesis of a normal distribution.

Empirical analysis

Impulse response

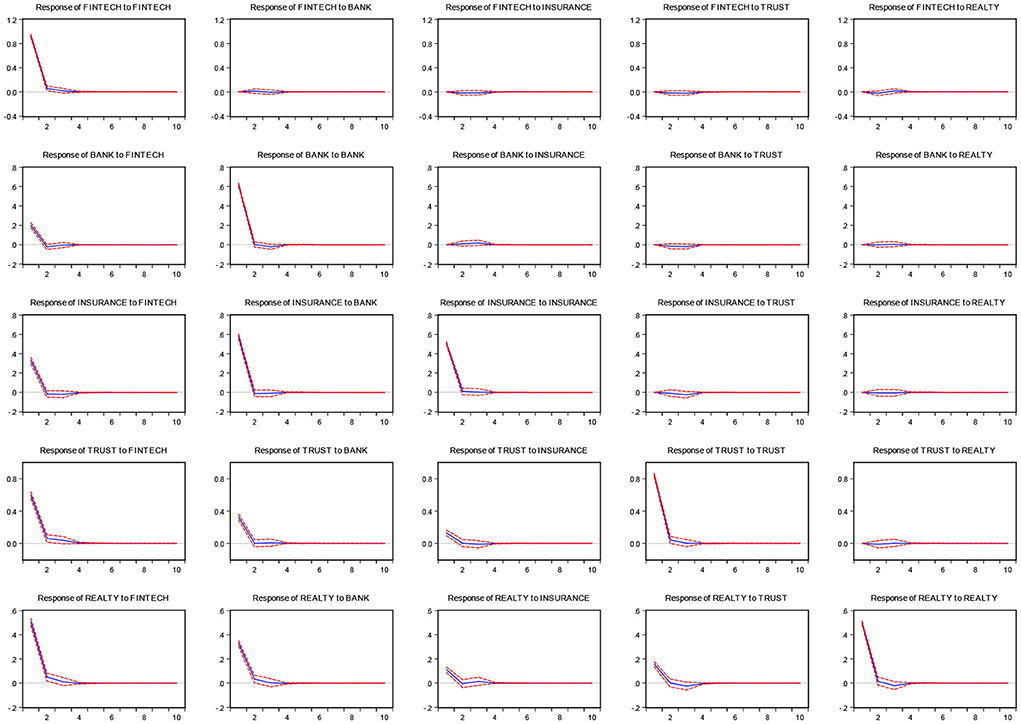

Figure 1 shows the impulse response results for the entire sample period. The figure shows that the responses of fintech to traditional financial industries are small. While the responses of traditional financial industries to fintech are large, the response of realty to fintech is the largest. There are deviations of nearly 2, 4, 0.6, and 6 units in the first phase for the responses of banks, insurance, trust, and realty, respectively. The response of banks to insurance is also large, with a deviation of nearly 6 units in the first phase. The response of trust to banks and insurance is small, with a deviation of nearly 0.4 and 0.2 units, respectively, in the first phase. There are also some responses of realty to bank, insurance, and trust—a deviation of nearly 4, 2, and 2 units, respectively, in the first phase.

The dynamic correlation analysis

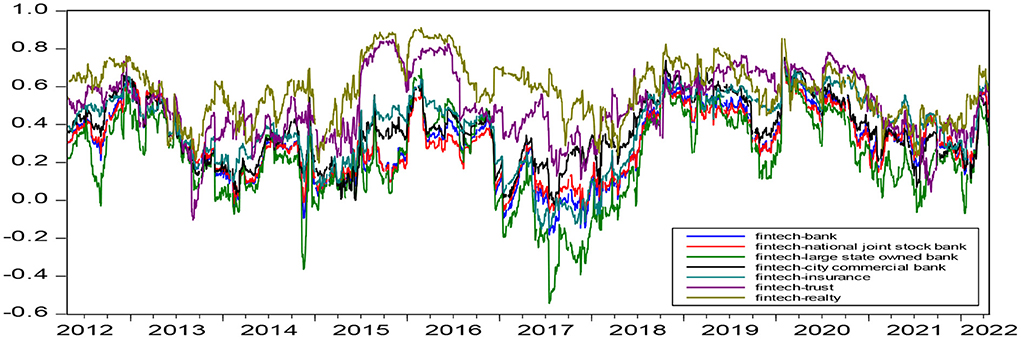

Figure 2 shows that: (1) The dynamic correlation coefficient trend between fintech and each traditional financial industry is generally significantly similar, especially for the trend of fintech and national joint stock banks, fintech and large state-owned banks, and fintech and city commercial banks, which are highly consistent with those of fintech and banks. During the dynamic correlations between fintech and the three kinds of banks, that of city commercial banks is the largest and that of large state-owned banks is the smallest before the COVID-19 period. City commercial banks and national joint stock banks are basically consistent and still larger than those of large state-owned banks during the COVID-19 period. (2) The dynamic relationship between fintech and traditional finance is almost positive for most of the time. (3) Among all dynamic correlations, that between fintech and realty is the largest. (4) The dynamic linkage between fintech and traditional finance declined after the COVID-19 outbreak.

Risk spillover analysis

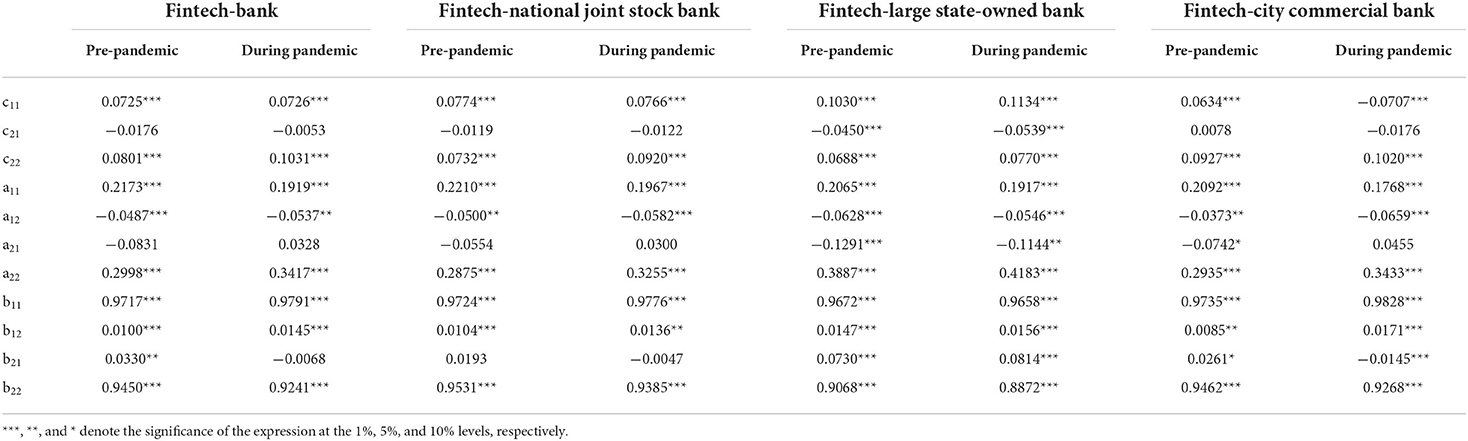

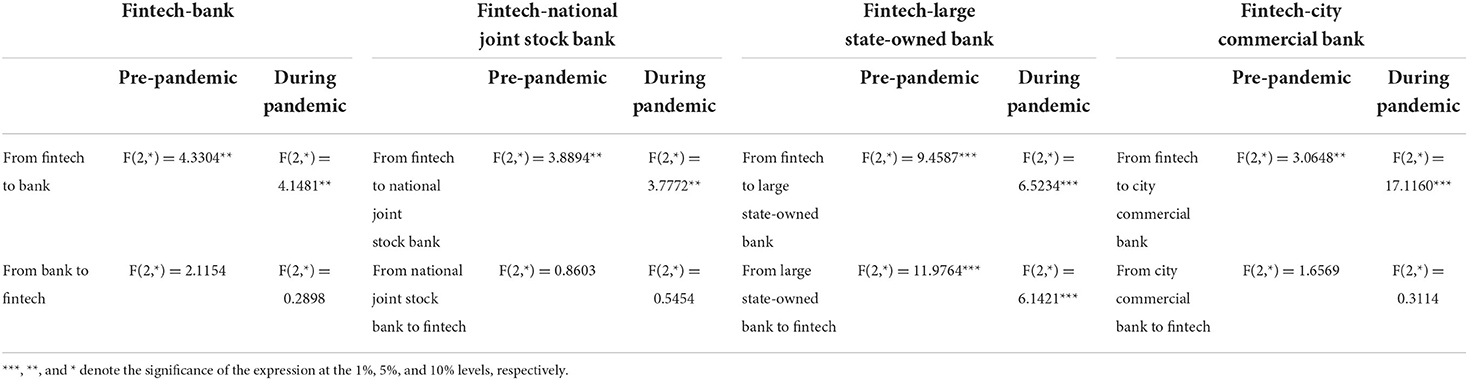

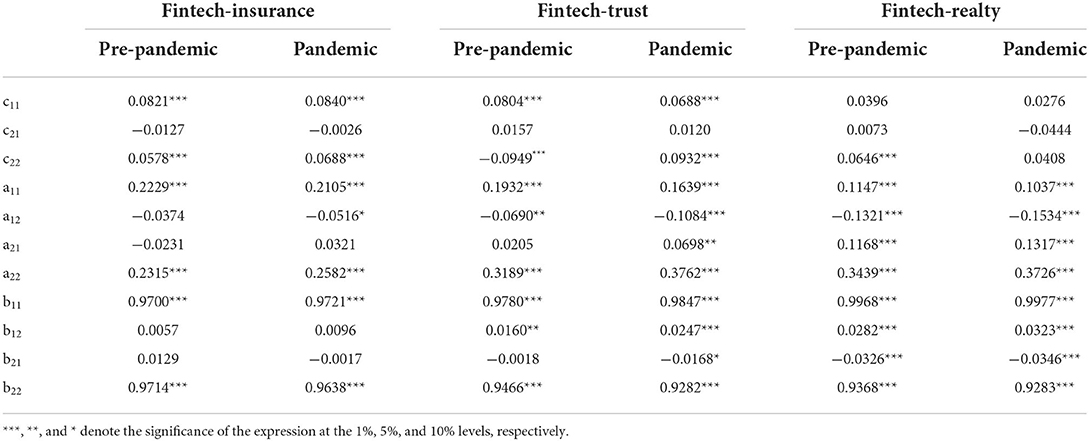

We divide the entire sample into two parts, pre-pandemic and during-pandemic, and examine the risk spillover between fintech and traditional finance during the two periods separately using the GARCH-BEKK method to further examine the effect of COVID-19 on risk spillover. Tables 2–5 show the results.

Table 4. Conditional variance estimation between fintech and other traditional financial industries.

Tables 2, 3 show the results of the conditional variance estimation and risk spillover, respectively. The results show that there exists a risk spillover from fintech to the banking industry before and during the COVID-19 outbreak. Moreover, the risk spillover effect does not change significantly. Further, we classify the bank industry into three categories, national joint stock banks, large state-owned banks, and city commercial banks, and investigate the risk spillover between fintech and the three types of bank industries. Regarding the risk spillover between fintech and national joint stock banks, there exists only a risk spillover from fintech to the national joint stock bank before and during the COVID-19 pandemic. However, it does not change significantly. There further exists a two-way risk spillover between fintech and large state-owned banks; the risk spillover effect decreases before the COVID-19 outbreak. There also exists risk spillover from fintech to city commercial bank before and during the COVID-19 pandemic; the risk spillover increases during the period before COVID-19.

Further, we compare the risk spillover effect of fintech on the three types of banks before and during the pandemic. Fintech has the largest risk spillover to large state-owned banks. The effect on state-owned joint stock banks and city commercial banks have insignificant difference before the pandemic. Among the three types of banks, fintech has the largest risk spillover to city commercial banks during the COVID-19 pandemic. Only state-owned banks have a risk spillover effect on fintech; therefore, we did not compare the risk spillover sizes of various banks on fintech before and during the pandemic.

This is mainly because fintech has formed a deep integration with various banks in business cooperation, technology outsourcing, and data sharing. Fintech risk spillover on to various banks to different degrees through these channels. First, the risk spillover from fintech to large state-owned banks is greater owing to their larger size and stronger business ties with the fintech industry. After the COVID-19 outbreak, large state-owned banks have more transparent information disclosure, a higher degree of supervision, a better risk assessment mechanism, a more rational application of fintech, and reduce the risk spillover of fintech to large state-owned banks. Second, COVID-19 has severely damaged market confidence, aggravated social panic, aggravated asset price volatility, worsened investment returns, and increased risk-taking by banks. Meanwhile, COVID-19 has negatively affected household consumption, and a large number of banks have launched consumer loans. However, large state-owned banks have more sufficient economic resources for the application and deployment of fintech and have a stronger ability to deeply integrate information technology and better identify risky customers. Some high-risk projects and customers turn to small and medium-sized banks, such as city commercial banks; therefore, the risk spillover from fintech to city commercial banks is the largest after the pandemic. Third, large state-owned banks have extensive physical outlets and numerous customers, and most of their customers are state-owned enterprises and large customers with low flexibility in deposit interest rates (58). However, the customer groups of small and medium-sized banks and the fintech industry relatively overlap. Moreover, most of them are small and micro enterprises and long-tail groups with high interest rate sensitivity. Finally, the large business lines of big state-owned banks, integrated with the diversified ways in which big banks supplement their capital, give them relatively strong bargaining power over the cost of capital. Therefore, after the COVID-19 outbreak, compared with large state-owned banks, the risk spillover of fintech to small and medium-sized banks, such as city commercial banks, is greater.

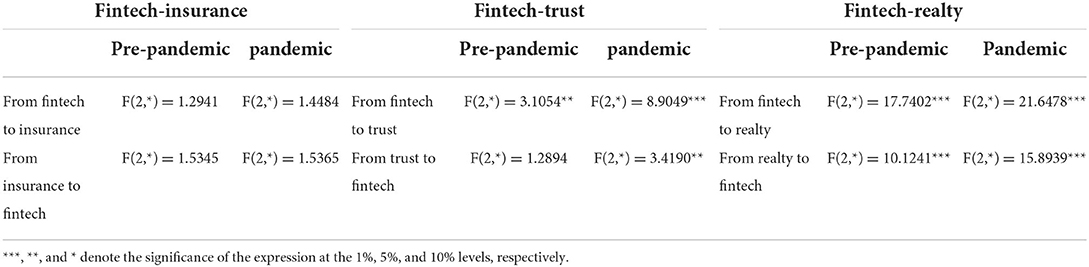

Tables 4, 5 clearly show that there is no risk spillover between fintech and insurance, both before and during COVID-19 pandemic. The tables show that there exists risk spillover from fintech to trust before the COVID-19 pandemic and that there exists two-way risk spillover between fintech and trust during the COVID-19 pandemic. They further show that the effect of fintech on trust increase during the COVID-19 pandemic than before the outbreak of the pandemic. There also exists two-way risk spillover between fintech and realty before and during the COVID-19 pandemic. Moreover, the effect between them increases during the COVID-19 pandemic than before the outbreak of the pandemic.

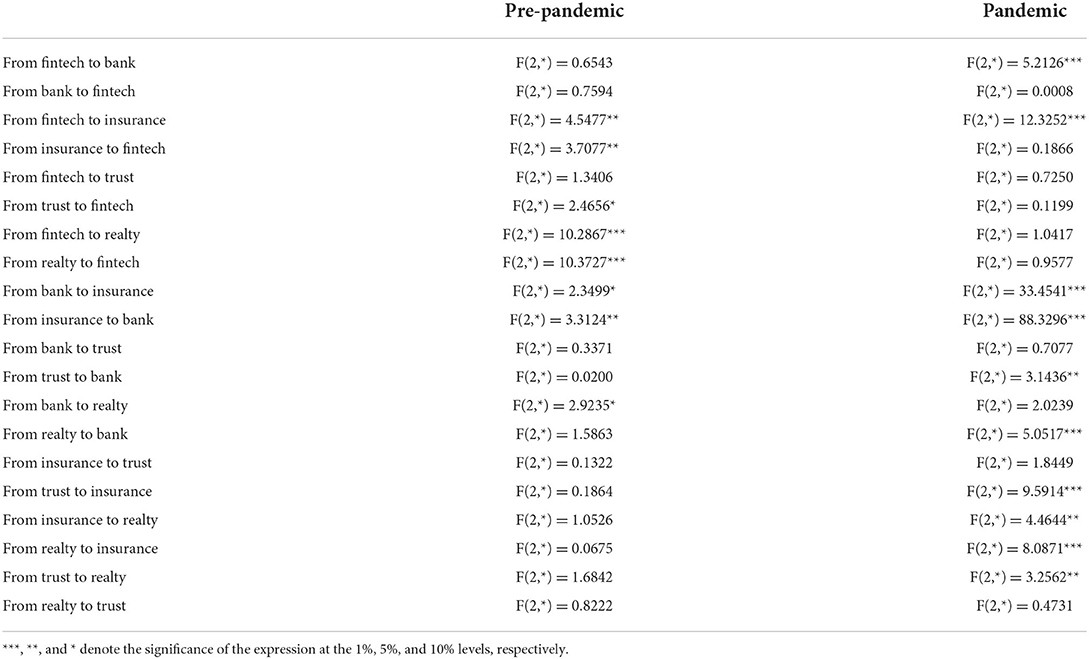

Risk spillover in pairs in the system

Table 6 shows the results of the risk spillover in pairs in the system. We deleted the conditional variance estimation table due to lack of space. The table clearly shows that there exists two-way risk spillover between fintech and insurance, fintech and realty, and banks and insurance before the COVID-19 outbreak. There also exists a one-way risk spillover from trust to fintech and from bank to realty before the COVID-19 outbreak. However, the risk spillover relationship in pairs in the system has changed. Only the risk spillover relationships between insurance and banks, insurance and realty are two-way. There exists one-way risk spillover from fintech to banks, from fintech to insurance, from trust to realty, from trust to insurance, from realty to banks and from trust to banks. Owing to the COVID-19 pandemic, the risk spillover relationship has become more complex.

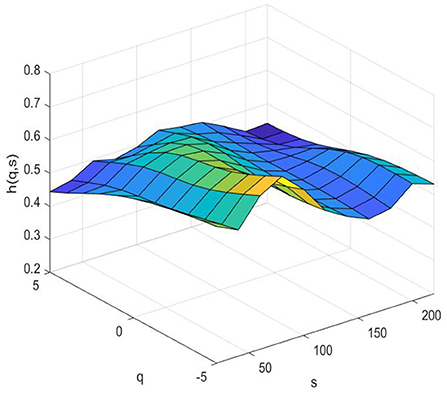

Risk spillover of the system

Figure 3 (pre-pandemic) and 4 (pandemic) show the systemic risk associated with fintech in terms of multifractals by MMV-MFDFA. The Hurst surface fluctuates with changes in the time scale s and fluctuation q dimensions. Figure 3 shows that the Hurst surface is smooth most of the time, and the Hurst exponents fluctuate around 0.5, which demonstrates that the system associated with fintech fluctuates between persistent and anti-persistent with a few small fluctuations before the COVID-19 period. Whereas Figure 4 shows that the Hurst surface has large fluctuations. During the COVID-19 pandemic, most of the Hurst exponents are smaller than 0.5, both in the short and long term, indicating that the correlation in the system is anti-persistent most of the time. It fluctuates considerably, regardless of large or small fluctuations in the system. Volatility is greater in the short term than that in the long term. The reason is that the short-term behavior of the fintech system are susceptible to the influence of external factors such as the COVID-19. The findings also demonstrates that the fintech system is relatively stable when the market environment is relatively stable, However, once there are external emergencies with relatively large influences, the fintech system will fluctuate greatly or even change fundamentally. In other words, the correlation between fintech and traditional financial industries is quite sensitive to external shocks.

Conclusion and implications

This study adopts DCC-GARCH-BEKK and MMV-MFDFA to explore the risk spillover between the fintech and traditional financial industries in pairs and in the system. The chosen data sample covers the period from April 25, 2012 to April 22, 2022. Our conclusions are summarized as follows.

The dynamic relationship between fintech and traditional finance is almost positive for most of the time and the dynamic correlations between fintech and realty are the largest. We further investigate the risk spillover between fintech and traditional financial industries, risk spillover in pairs in the system, and risk spillover of the entire system before and during the COVID-19 pandemic. The results demonstrate that there exists a risk spillover from fintech to every type of bank before and during the COVID-19 period, while the risk spillover effect of fintech to large state-owned banks and city commercial banks is the largest before and during the COVID-19 period separately. However, only large state-owned banks have a risk spillover to fintech before and during the COVID-19 outbreak. Meanwhile, there exists two-way risk spillover between fintech and other traditional financial industries before and during the COVID-19 pandemic. Owing to the COVID-19 pandemic, the risk spillover relationship in pairs in the system has become more complex. Regarding the entire system, the correlation in the system is anti-persistent most of the time. Moreover, there are large fluctuations and more complex characteristics during the COVID-19 outbreak, whereas the entire system is smooth most of the time before the COVID-19 outbreak.

This findings have important implications for policymakers and researchers. First, owing to the dynamic linkage between fintech and traditional finance, appropriate policies should be implemented in time for individual financial markets to reduce risk contagion caused by the existence of related mechanisms when shocks such as the COVID-19 pandemic occur. Meanwhile, research should consider vulnerable markets more, to reduce the uncertainty of the entire financial system owing to the increased risk in one market. Second, the risk spillover of fintech to city commercial banks is the largest after the pandemic. Accordingly, regulators should reduce the pressure on fintech deployment of small and medium-sized banks, such as city commercial banks, and improve intelligent risk control ability. Third, fintech has a risk spillover effect on most traditional financial industries. Accordingly, regulatory authorities should consider fintech more, improve the construction of supporting regulations, reinforce relevant tracking research and risk assessment, determine risks, seek countermeasures in advance as far as possible, and reduce the time lag of supervision. Finally, the regulatory authorities should make full use of the advantages of big data, reinforce the risk information disclosure and sharing mechanism, and ensure that the development of fintech is limited within the basic framework of serving the real economy, to avoid systemic financial risks and prevent the occurrence of systemic financial risks. Last but not the least, for investors, innovative asset represented by fintech index has been proved to increase by the volatility spillovers from other assets during the covid-19 pandemic, so they should not be regarded as safe havens. The results provide important significance for designing effective diversification strategies; These findings provide preliminary evidence that fintech companies are more sensitive to the impact of the COVID-19 pandemic.

Simultaneously, there are some limitations in the research. For example, we did not analyze the dynamic linkage and risk spillover relationship between fintech and rural commercial banks on account of data's unavailability. While rural commercial banks are also an important part of China's banking system. In subsequent studies, we could further extend bank sample size and make more comprehensive and accurate research.

Data availability statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author/s.

Author contributions

HZ: conceptualization, methodology, data curation, software, formal analysis, and writing-original draft preparation. SL: supervision, validation, investigation, methodology, and writing-review and editing. All authors contributed to the article and approved the submitted version.

Funding

This research was funded by Shandong Province Key Research and Development Program (Soft Science Project) (No. 2021RKY03052).

Conflict of interest

Author HZ was employed by Jinan Rural Commercial Bank Co., Ltd.

The remaining author declares that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

References

1. Falagiarda M, Khler-Ulbrich P, Maqui E. Drivers of firms' loan demand in the Euro area: what has changed during the COVID-19 pandemic. Econ Bull. (2020) 5.

2. Bouri E, Cepni O, Gabauer D, Gupta R. Return connectedness across asset classes around the COVID-19 outbreak. Int Rev Financ Anal. (2021) 73:101646. doi: 10.1016/j.irfa.2020.101646

3. Shahzad S, Naeem MA, Peng Z, Bouri E. Asymmetric volatility spillover among chinese sectors during COVID-19. Int Rev Financ Anal. (2021):101754. doi: 10.1016/j.irfa.2021.101754

4. Abuzayed B, Bouri E, Al-Fayoumi N, Jalkh N. Systemic risk spillover across global and country stock markets during the COVID-19 pandemic. Econ Anal Policy. (2021) 71:180–97. doi: 10.1016/j.eap.2021.04.010

5. Topcu M, Gulal OS. The impact of COVID-19 on emerging stock markets. Finance Res Lett. (2020) 36:101691. doi: 10.1016/j.frl.2020.101691

6. Goodell JW. COVID-19 and finance: agendas for future research. Finance Res Lett. (2020) 35:101512. doi: 10.1016/j.frl.2020.101512

7. Rizwan MS, Ahmad G, Ashraf D. Systemic Risk: the impact of COVID-19. Finance Res Lett. (2020) 36:101682. doi: 10.1016/j.frl.2020.101682

8. Mike KPS, Amanda MYC, Thomas WCC. Impacts of the COVID-19 pandemic on financial market connectedness. Finance Res Lett. (2021) 38:101864. doi: 10.1016/j.frl.2020.101864

9. Yousaf I, Ali S. Discovering interlinkages between major cryptocurrencies using high-frequency data: new evidence from COVID-19 pandemic. Financial Innov. (2020) 6:45. doi: 10.1186/s40854-020-00213-1

10. Yousaf I, Ali S. Linkages between stock and cryptocurrency markets during the covid-19 outbreak: an intraday analysis. Singap Econ Rev. (2021) 1–20. doi: 10.1142/S0217590821470019

11. Yousaf I, Yarovaya L. Static and dynamic connectedness between NFTS, defi and other assets: portfolio implication. Glob Finance J. (2022) 53:100719. doi: 10.1016/j.gfj.2022.100719

12. Yousaf I, Nekhili R, Gubareva M. Linkages between defi assets and conventional currencies: evidence from the COVID-19 pandemic. Int Rev Financ Anal. (2022) 81:102082. doi: 10.1016/j.irfa.2022.102082

13. Amar AB, Bélad F, Youssef AB, Guesmi K. Connectedness among regional financial markets in the context of the COVID-19. Appl Econ Lett. (2020) 1789–96. doi: 10.1080/13504851.2020.1854434

14. Zhang D, Hu M, Ji Q. Financial markets under the global pandemic of COVID-19. Finance Res Lett. (2020) 36:101528. doi: 10.1016/j.frl.2020.101528

15. Yousaf I, Ali S. The covid-19 outbreak and high frequency information transmission between major cryptocurrencies: evidence from the var-dcc-garch approach. Borsa Istanb Rev. (2020) 20:S1. doi: 10.1016/j.bir.2020.10.003

16. Goldstein I, Koijen RSJ, Mueller HM. COVID-19 and its impact on financial markets and the real economy. Rev Financ Stud. (2021) 34:5135–48. doi: 10.1093/rfs/hhab085

17. Yousaf I. Risk transmission from the COVID-19 to metals and energy markets. Resour Policy. (2021) 73:102156. doi: 10.1016/j.resourpol.2021.102156

18. Yousaf I, Yarovaya L. Spillovers between the islamic gold-backed cryptocurrencies and equity markets during the COVID-19: a sectorial analysis. Pacific Basin Finance J. (2022) 71:101705. doi: 10.1016/j.pacfin.2021.101705

19. Kamran M, Butt P, Abdel-Razzaq A, Djajadikerta HG. Is Bitcoin a safe haven? Application of FinTech to safeguard Australian stock markets. Stud Econ Finance. (2022) 39:386–402. doi: 10.1108/SEF-05-2021-0201

20. Carlini F, Gaudio B, Porzio C, Previtali D. Banks, Fintech and stock returns. Finance Res Lett. (2021) 45:102252. doi: 10.1016/j.frl.2021.102252

21. Kumar A, Iqbal N, Mitra SK, Kristoufek L, Bouri E. Connectedness among major cryptocurrencies in standard times and during the COVID-19 outbreak. J Int Financ Mark Inst Money. (2022) 77:101523. doi: 10.1016/j.intfin.2022.101523

22. Naeem MA, Bouri E, Peng Z, Shahzad SJH, Vinh X. Asymmetric efficiency of cryptocurrencies during COVID-19. Phys A Stat Mech Appl. (2020) 565:125562. doi: 10.1016/j.physa.2020.125562

23. Bouri E, Shahzad SJH, Roubaud D. Cryptocurrencies as hedges and safe-havens for us equity sectors. Q Rev Econ Finance. (2020) 75:294–307. doi: 10.1016/j.qref.2019.05.001

24. Le LT, Yarovaya L, Nasir MA. Did COVID-19 change spillover patterns between Fintech and other asset classes? Res Int Bus Finance. (2021) 58:101441. doi: 10.1016/j.ribaf.2021.101441

25. Dorfleitner G, Hornuf L, Schmitt M, Weber M. The FinTech market in Germany. Cham: Springer International Publishing. (2017) 4. doi: 10.1007/978-3-319-54666-7_4

26. Kommel KA, Sillasoo M, Lublóy Á. Could crowdsourced financial analysis replace the equity research by investment banks? Finance Res Lett. (2018) 29:280–4. doi: 10.1016/j.frl.2018.08.007

27. Romānova I, Kudinska M. Banking and FinTech: a challenge or opportunity? Contemp Stud Econ Financial Anal. (2016) 98:21–35. doi: 10.1108/S1569-375920160000098002

28. Yao Y, Li J, Sun X. Measuring the risk of Chinese Fintech industry: evidence from the stock index. Finance Res Lett. (2021) 39:101564. doi: 10.1016/j.frl.2020.101564

29. Yao M, Di H, Zheng X, Xu X. Impact of payment technology innovations on the traditional financial industry: a focus on China. Technol Forecast Soc Change. (2018) 135:199–207. doi: 10.1016/j.techfore.2017.12.023

30. Ng AW, Kwok BKB. Emergence of Fintech and cybersecurity in a global financial center: strategic approach by a regulator. J Financial Regul Compliance. (2017) 25:422–34. doi: 10.1108/JFRC-01-2017-0013

31. Lee I, Shin YJ. FinTech: ecosystem, business models, investment decisions, and challenges. Bus Horiz. (2018) 61:35–46. doi: 10.1016/j.bushor.2017.09.003

32. Gai K, Qiu M, Sun X A. survey on Fintech. J Netw Comput Appl. (2018) 103:262–73. doi: 10.1016/j.jnca.2017.10.011

33. Hua X, Huang Y, Zheng Y. Current practices, new insights, and emerging trends of financial technologies. Ind Manag Data Syst. (2019) 119:1401–10. doi: 10.1108/IMDS-08-2019-0431

34. Milian EZ, Spinola MM, Carvalho MM. Fintechs: a literature review and research agenda. Electron Commer Res Appl. (2019) 34:100833. doi: 10.1016/j.elerap.2019.100833

35. Guo Y, Zhou W, Luo C, Liu C, Xiong H. Instance-based credit risk assessment for investment decisions in P2P lending. Eur J Oper Res. (2016) 249:417–26. doi: 10.1016/j.ejor.2015.05.050

36. Ma L, Zhao X, Zhou Z, Liu Y. A new aspect on P2P online lending default prediction using meta-level phone usage data in China. Decis Support Syst. (2018) 111:60–71. doi: 10.1016/j.dss.2018.05.001

37. Troster V, Tiwari A K, Shahbaz M, Macedo D N. Bitcoin returns and risk: a general GARCH and GAS analysis. Finance Res Lett. (2019) 30:187–93. doi: 10.1016/j.frl.2018.09.014

38. Li C. Quantitative measurement and analysis of FinTech risk in China. Econ Res Rep. (2021) 4:1–9. doi: 10.1080/1331677X.2021.1970606

39. Chen R, Chen H, Jin C, Wei B, Yu L. Linkages and spillovers between internet finance and traditional finance: Evidence from China. Emerg Mark Finance Trade. (2020) 56:1196–210. doi: 10.1080/1540496X.2019.1658069

40. He D, Leckow RB, Haksar V, Griffoli TM, Jenkinson N, Kashima M, et al. Fintech and financial services: initial considerations. Discuss Notes. (2017).

41. Li J, Li J, Zhu X, Yao Y, Casu B. Risk spillovers between FinTech and traditional financial institutions: evidence from the US. Int Rev Financial Anal. (2020) 71:101544. doi: 10.1016/j.irfa.2020.101544

42. Wang R, Liu J, Luo H. Fintech development and bank risk taking in China. Eur J Finance. (2021) 27:397–418. doi: 10.1080/1351847X.2020.1805782

43. Banna H, Hassan M K, Rashid M. Fintech-based financial inclusion and bank risk-taking: Evidence from OIC countries. J Int Financial Mark Inst Money. (2021) 75:101447. doi: 10.1016/j.intfin.2021.101447

44. Zhang A, Wang S, Liu B, Liu P. How Fintech impacts pre-and post-loan risk in Chinese commercial banks. Int J Finance Econ. (2022) 27:2514–29. doi: 10.1002/ijfe.2284

45. Hua X, Huang Y. Understanding China's fintech sector: development, impacts and risks. Eur J Finance. (2021) 27:1–13. doi: 10.1080/1351847X.2020.1811131

46. Le TL, Abakah EJA, Tiwari AK. Time and frequency domain connectedness and spillover among Fintech, green bonds and cryptocurrencies in the age of the fourth industrial revolution. Technol Forecast Soc Change. (2021) 162:120382. doi: 10.1016/j.techfore.2020.120382

47. Engle RF, Kroner KF. Multivariate Simultaneous Generalized ARCH. Econ Theory. (1995) 11:122–50. doi: 10.1017/S0266466600009063

48. Hkiri B, Hammoudeh S, Aloui C, Shahbaz M. The interconnections between US financial CDS spreads and control variables: New evidence using partial and multivariate wavelet coherences. Int Rev Econ Finance. (2018) 57:237–57. doi: 10.1016/j.iref.2018.01.011

49. Sakti MRP, Masih M, Saiti B, Ali MT. Unveiling the diversification benefits of Islamic equities and commodities: Evidence from multivariate-GARCH and continuous wavelet analysis. Manag Finance. (2018) 44:830–50. doi: 10.1108/MF-08-2017-0278

50. Jaffar Y, Dewandaru G, Masih M. Exploring portfolio diversification opportunities through venture capital financing: evidence from MGARCH-DCC, Markov switching, and wavelet approaches. Emerg Mark Finance Trade. (2018) 54:1320–36. doi: 10.1080/1540496X.2016.1277420

51. Xie Q, liu R, Qian T, Li J. Linkages between the international crude oil market and the Chinese stock market: A BEKK-GARCH-AFD approach. Energy Econ. (2021) 102. doi: 10.1016/j.eneco.2021.105484

52. Yu L, Zha R, Stafylas D, He K, Liu J. Dependences and volatility spillovers between the oil and stock markets: New evidence from the copula and VAR-BEKK-GARCH models. Int Rev Financial Anal. (2020) 68:101280. doi: 10.1016/j.irfa.2018.11.007

53. Li S. Volatility Spillovers in the CSI300 Futures and Spot Markets in China: Empirical Study Based on Discrete Wavelet Transform and VAR-BEKK-bivariate GARCH Model. Procedia Comput Sci. (2015) 55:380–7. doi: 10.1016/j.procs.2015.07.085

54. Fan Q, Liu S, Wang K. Multiscale multifractal detrended fluctuation analysis of multivariate time series. Phys A Stat Mech Appl. (2019) 532:121864. doi: 10.1016/j.physa.2019.121864

55. Li SP, Li JF, Lu XS, Sun YH. Exploring the dynamic nonlinear relationship between crude oil price and implied volatility indices: a new perspective from MMV-MFDFA. Phys A Stat Mech Appl. (2022) 603:127684. doi: 10.1016/j.physa.2022.127684

56. Cui Y, Yan R, Sharma R, Saha T, Horrocks N. Realizing multifractality of smart meter data for household characteristic prediction. Int J Electr Power Energy Syst. (2022) 139:108003. doi: 10.1016/j.ijepes.2022.108003

57. Engle R F. Dynamic conditional correlation: A simple class of multivariate GARCH models. J Bus Econ Stat. (2002) 20. doi: 10.1198/073500102288618487

Keywords: COVID-19, risk volatility, fintech, traditional finance, MMV-MFDFA

Citation: Zhou H and Li S (2022) Effect of COVID-19 on risk spillover between fintech and traditional financial industries. Front. Public Health 10:979808. doi: 10.3389/fpubh.2022.979808

Received: 28 June 2022; Accepted: 10 August 2022;

Published: 07 September 2022.

Edited by:

Chi Lau, Teesside University, United KingdomReviewed by:

Baogui Xin, Shandong University of Science and Technology, ChinaFang Qu, Xihua University, China

Elie Bouri, Lebanese American University, Lebanon

Imran Yousaf, Air University, Pakistan

Copyright © 2022 Zhou and Li. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Shuping Li, bGlzaHVwaW5nQHNkdWZlLmVkdS5jbg==

Haiyang Zhou1,2

Haiyang Zhou1,2 Shuping Li

Shuping Li