- 1College of Accounting and Auditing, Guangxi University of Finance and Economics, Guangxi Accounting Research Institution, Nanning, China

- 2Department of Finance, Chung Yuan Christian University, Taoyuan, Taiwan

The increased uncertainty caused by a sudden epidemic disease has had an impact on the global financial market. We aimed to assess the primary healthcare system of universal health coverage (UHC) during the coronavirus disease (COVID-19) pandemic and its relationship with the financial market. To this end, we employed the abnormal returns of 68 countries from January 2, 2019, to December 31, 2020, to test the impact of the COVID-19 outbreak on abnormal returns in the stock market and determine how a country's UHC changes the impact of a sudden pandemic on abnormal returns. Our findings show that the sudden onset of an epidemic disease results in unevenly distributed medical system resources, consequently diminishing the impact of UHC on abnormal returns.

Introduction

The first death due to the coronavirus disease (COVID-19) occurred on January 11, 2020, in China. Subsequently, the COVID-19 outbreak spread rapidly worldwide in early 2020. Thailand reported a confirmed case on January 13, 2020, the first case outside China. On August 5, 2021, the largest proportionate increase in new cases was reported by the Americas (14%) and the Western Pacific Region (19%), with 1.3 million and over 375,000 new cases reported, respectively (1). The recent delta variant of COVID-19 is creating global concern, highlighting the risks faced by people who do not have access to primary healthcare via universal health coverage (UHC). This system enables everyone to obtain fair access to health services, including prevention and treatment, with no extra cost incurred, especially during the COVID-19 crisis period.

The spread of COVID-19 in over 190 countries has prompted an in-depth look at the various health effects and responses to COVID-19 in the marketplace due to long-ignored global health risks. Every country has begun focusing on the defense against novel viruses by providing full access to the medical system during the COVID-19 outbreak (2). Strong health systems, based on primary health care and UHC, are the foundation for an effective response to COVID-19. Specifically, where health coverage is linked to employment, an economic shock that leads to a loss of formal sector jobs also has negative consequences for the financial market. Therefore, in countries that have historically relied on contributory, employment-linked coverage, it is essential to inject general budget revenues into the system to reduce the system's vulnerability to job losses and ensure that the essential actions needed to respond to COVID-19 can be implemented.

Regarding panic selling, the sudden, large-scale sale of securities caused a significant decline in stock prices in the short term. The COVID-19 outbreak has also directed scholarly attention to exploring the impact of macroeconomic factors on stock returns, especially in the short term. Goodell and Huynh (3) and Shahzad et al. (4) suggest that the COVID-19 outbreak had a major impact on the financial market, which has been identified as having negative abnormal returns. Additionally, many scholars have empirically shown a link between major events and stock returns. In turn, they have revealed stock price fluctuations related to a specific event, such as an election (5), terrorist attacks (6), and disease outbreaks, specificallyanimal diseases, severe acute respiratory syndrome (SARS), and Ebola (7–9). He et al. (10), Alam et al. (11), and Mazur et al. (12) showed that the United States, Australia, and China all had negative abnormal returns in the stock market due to the COVID-19 outbreak. Liu et al. (13), Alali (14), and Singh et al. (15) examined multiple severely infected countries, finding that COVID-19 caused abnormal returns, not only in the examined country but also influencing numerous others.

Dongarwar and Salihu (16) reported that the COVID-19 death rate in a country with UHC is twice as low as that in a country without UHC. Apergis and Apergis (17) and Song et al. (18) used the growth rate of confirmed COVID-19 cases as a proxy and found that when the number of confirmed cases increased, the market index in China and America decreased. Ashraf (19) and Khan et al. (20) proved that an increase in the number of confirmed cases also affects the market index of each country. Concurrently, the worldwide rate of unexpected confirmed COVID-19 cases is increasing; the Centers for Disease Control and Prevention (CDC) reported that the infection and transmission rates of COVID-19 are much higher than expected. An influenza carrier can infect up to 1.3 people, while a COVID-19 carrier can infect 5–6 people (21). As a result of the increased number of confirmed COVID-19 cases, medical resources will be unevenly distributed, which will eventually affect the stock market.

This study aims to test the response of abnormal returns to a sudden pandemic disease and how the national UHC of a country changes the impact of sudden pandemic diseases on abnormal returns. Unlike previous studies that only examined specific events and their effects on the stock market in the short term, our study considers the UHC's effects on the stock market in relation to the COVID-19 outbreak in the long term. Consistent with the studies of Goodell and Huynh (3) and Shahzad et al. (4), the results suggest that the COVID-19 outbreak had a major impact on the financial market. This fills a gap in the current literature by providing an empirical framework demonstrating the healthcare system's connection to a sudden pandemic disease and its effects on the stock market in the long term.

The remainder of this paper is organized as follows. Section 2 discusses the Relevant Literature, and Section 3 presents the Data and the Methodology used. Section 4 discusses the Empirical Results of the findings. Finally, Section 5 concludes the study.

Relevant Literature

The Correlation Between the COVID-19 Outbreak and Abnormal Returns

Efficient market theory states that stock prices reflect all information, and consistent alpha generation is impossible. The sensitivity of any information and unexpected events in the stock market will eventually reflect or force stock prices upward or downward. Since the COVID-19 outbreak was confirmed in 2019, various stock market indices have collapsed and intensified worldwide (10, 22, 23). It was revealed that, after China officially notified the WHO of the epidemic's outbreak on January 23, 2020, both Shanghai A shares and Shenzhen A shares had negative abnormal stock returns, especially in the transportation, mining, entertainment, and tourism industries. In addition, similar results were found after the first confirmed case was discovered in Australia on February 27, 2020, and after the announcement of COVID-19 as a global pandemic in the United States on March 11, 2020 (11, 12).

Alali (14) examined the top five Asian stock market indices (Shanghai Composite Index, Nikkei 225, Mumbai Sensitive 30 Index, Hang Seng Index, and South Korea Composite Stock Index) to test their reaction to the WHO's announcement of COVID-19 as a global pandemic. The empirical results show that the announcements have a significantly negative relationship with the cumulative abnormal returns in all stock market indices. In addition, Heyden and Heyden (24) and Bash (25) studied Europe and the United States and the top 30 countries most severely impacted by confirmed cases of COVID-19, finding negative abnormal returns in the stock markets. Moreover, Liu et al. (13) studied 21 significantly infected countries, and Singh et al. (15) studied 20 badly affected countries and found that the pandemic had a negative impact on their respective stock markets and generated negative abnormal returns.

Recently, Pandey and Kumari (26) collected 49 stock indices from both developed and emerging markets worldwide and found significant negative abnormal returns on global stock markets after the WHO declared COVID-19 a public health emergency of international concern. Among these, Asian stock markets fared the worst among the 49 stock indices.

Prior studies indicate that a sudden pandemic disease is followed by negative abnormal returns in a certain country or region (5, 6, 8, 9). Bouri et al. (27) that assets' connectedness of returns varied before and after the COVID-19 outbreak. Similarly, negative abnormal returns occurred in each country after its first confirmed case was reported, and when the WHO declared COVID-19 a global pandemic on March 11, 2020 (10–12, 14). Consequently, this study considers the COVID-19 outbreak a global pandemic, confirmed by the WHO, which eventually spread globally and generated negative abnormal returns in stock markets worldwide. Thus, we construct Hypothesis 1 as follows:

Hypothesis 1: The spread of the COVID-19 outbreak worldwide generates negative abnormal returns in global stock markets.

The Correlation of Abnormal Returns With COVID-19 and Universal Health Coverage

Broad coverage from a good healthcare system improves health indicators, reduces health inequalities, and enhances economic development. The COVID-19 outbreak has amplified the progress of the establishment of strong and resilient health care systems. A recent study by 16 indicated that countries with UHC had a lower number of confirmed COVID-19 cases. The study by Djilali et al. (28) has evidently shown that vaccination is a strategy to limit the spread of the COVID-19 disease; the high number of vaccination rates can decrease the infection and fatality rates, as does UHC. Additionally, the World Health Organization (2) announced that UHC allows governments to effectively address hazards caused by COVID-19 worldwide, either directly or indirectly. Such a significant market response is not mirrored in the instance of a reduction in cases. Empirical evidence by Benjamin (29), McKibbin and Fernando (30), Banik et al. (31), and Bentout et al. (32) show that a robust and resilient healthcare system helps mitigate the exposure risk to COVID-19. This is because a healthcare system has a greater positive impact on the spread of the virus in less developed, high population-density countries and decreases fatality rates in countries with high infection rates. The healthcare system is consistent with a statement from Bill Gates, co-chair of the Bill & Melinda Gates Foundation, who said that a multi-specialty Global Epidemic Response and Mobilization (GERM) team helps to strengthen health systems in an effort to build a resilient system that will help reduce the damage of the next pandemic. So, the capacity to produce billions of vaccines has been initiated; the funding to pay for them and the systems to deliver them everywhere are vital to the global fight against the pandemic.

Additionally, recent studies have revealed that a well-organized healthcare system can mitigate the negative outcomes of COVID-19 (29–31). Few previous studies have investigated the impact of UHC on the stock market or tested the correlation effect; hence, this study develops the following hypothesis:

Hypothesis 2: UHC is positively correlated with abnormal returns.

The Effect of a High Rate of Confirmed COVID-19 Cases on UHC and Its Link to Abnormal Returns

When an epidemic occurs, the basic healthcare system is disrupted or damaged by the sudden influx of numerous patients. Therefore, medical treatment no longer fulfills the needs of society or individuals to maintain their daily lives. Chaos and panic ensue because of insufficient or limited resources. Liu et al. (13) stated that an increase in confirmed COVID-19 cases enhances investors' pessimistic emotions toward the stock market and creates market uncertainty, which, in turn, affects stock prices and generates negative abnormal returns. A study by Ashraf (19) involving 64 countries also showed that the impact of the number of confirmed cases on stock prices was greater than that of the number of deaths. Once the number of confirmed COVID-19 cases showed an upward trend, the volatility of stock prices followed a downward trend. Khan et al. (20) also discovered that the growth rate of new weekly diagnoses was significantly negatively correlated with stock prices. As the number of new diagnoses rises by 1% in a week, stock market returns fall by 0.24%.

Apergis and Apergis (17) and Saif-Alyousfi (33) studied the increase in confirmed cases or deaths as proxy variables for COVID-19; they found that an increase in confirmed cases or mortalities was significantly negatively correlated with stock returns in China. Moreover, Song et al. (18) reported that an increase in diagnoses was significantly negatively correlated with stock returns in the United States, especially in the catering industry. Furthermore, Pandey and Kumari (26) found that the total number of confirmed cases and fatalities has a negative impact on cumulative abnormal returns in developed and emerging markets.

With the increased number of confirmed COVID-19 cases, UHC as the primary healthcare system will, due to a sudden and large increase in the number of patients, eventually affect the stock market negatively. The increase in the number of confirmed COVID-19 cases is based on the theory of insufficient resource allocation. The public will panic and cause the collapse of the medical system, and the UHC function may also be weakened by abnormal returns. Thus, a strategy of either the government issuing public interventions, such as a lockdown (33), or a full coverage of vaccines for people is needed to reduce the epidemic damage that could be brought by the serious COVID-19 outbreak as well as to stop the virus spreading to others (34, 35). Based on the results of prior studies, we expect an increase in the diagnoses of COVID-19 to overwhelm the UHC and weaken its positive impact; therefore, the study constructs the following hypothesis:

Hypothesis 3: A high number of COVID-19 diagnoses will affect the impact of UHC on abnormal returns.

Data and Methodology

Data

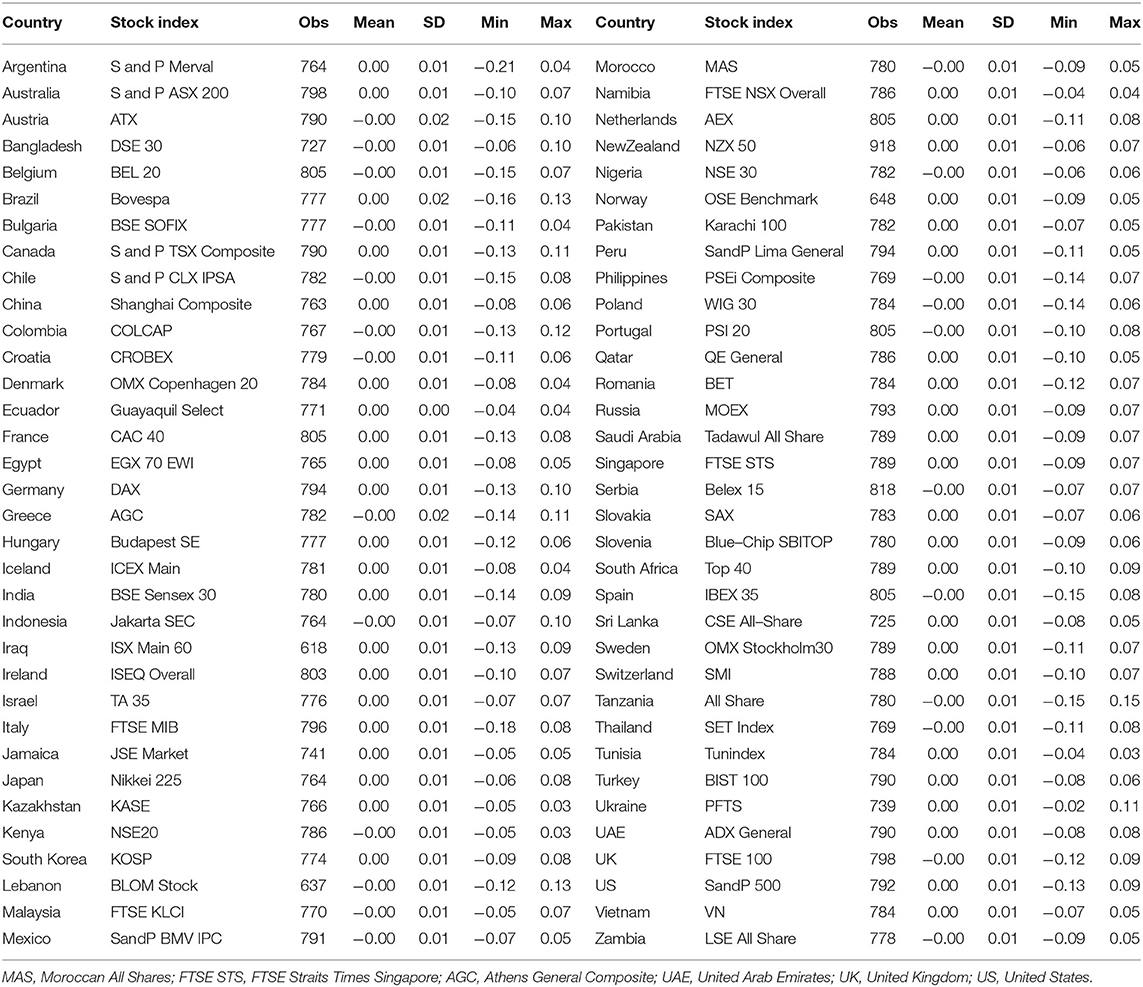

This study collected major global stock indices divided by region, namely Asia, Europe, America, Africa, and Oceania, as shown in Table 1. The stock market index in Europe was weighted as 35%. Asia, America, Africa, and Oceania are weighted as 33, 14, 16, and 2%, respectively, excluding those countries whose data were not fully available1. Table 1 represents the stock indices in 68 countries, and it was decided to use these indices to investigate the influence of the COVID-19 outbreak.

The study employed a market model to calculate abnormal returns in each region. Therefore, the MSCI All-Country World Equity Index, an international benchmark index representing global market performance, was used to calculate the abnormal returns of all the stock markets listed in Table 1. Daily closing prices were collected from the website investing.com, which offers free historical data from January 2, 2019, to December 31, 2020, in all regions' indices.

Methodology

In this study, we adopted event study method to evaluate stock reaction to a specific event. Thus, in order to precisely capture the effect of UHC during the COVID-19 outbreak, we have adopted a short-term (5 days), mid-term (10–60 days), and long-term (180 days) to test stock movement. By doing so, this study is aiming to precisely capture the volatility of stock abnormal returns during COIVD-19 outbreak.

Universal Health Coverage Definition

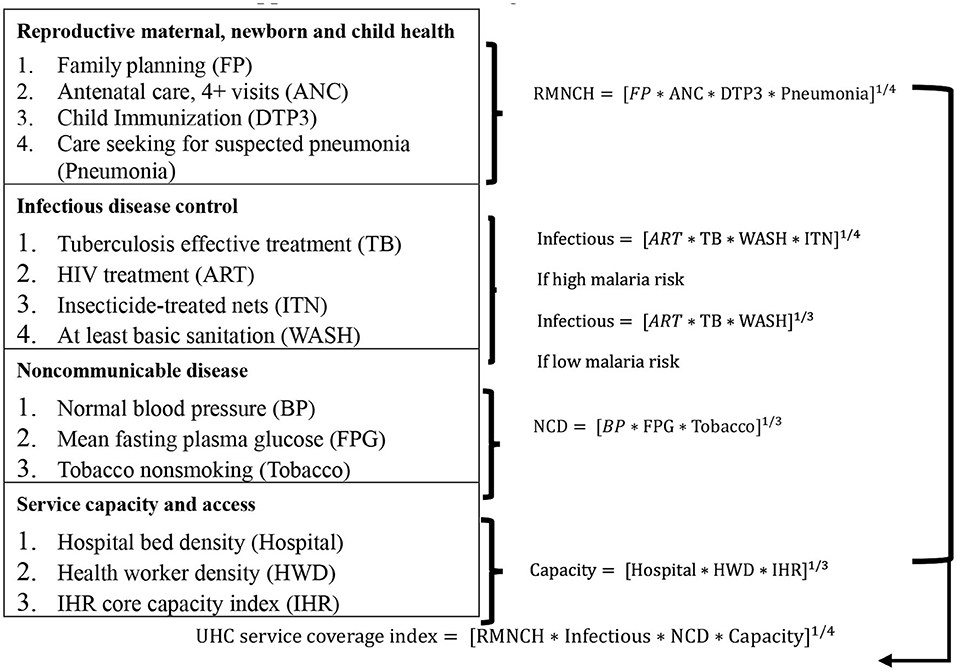

Universal health coverage service coverage index, established by the WHO, aims to ensure that people receive adequate healthcare without an undue burden on their finances. This study uses the WHO UHC database to collect UHC data for 68 countries. The 34 provides the following explanation for UHC:

“The goal of universal health coverage is threefold:

Equity in access: everyone who needs health services should receive them, not only those who can pay for services.

Sufficient quality: health services should be of sufficient quality to improve the health of those receiving the services.

No undue financial risk: the cost of using health services should not put people at risk of financial harm.” (p. 2)

The UHC calculation approach is shown in Figure 1.

Event Study

Many methodologies have been used to model event studies to evaluate abnormal returns. However, the event study method used to examine the impact of COVID-19 on the volatilities of all affected countries is the most suitable for capturing stock price movements. Previous studies used event studies to test the impact of certain events, such as initial public offerings, seasoned equity offerings, and stock splits on a company's stock (36, 37). Nevertheless, in recent years, an increasing number of scholars have used the event study method to capture the impact of unexpected events, such as SARS, Ebola, and Middle East Respiratory Syndrome (MERS), on stock prices (8, 9).

Bash (25) and Heyden and Heyden (24) stated that a single event day in the market could not accurately capture the influence of COVID-19 on abnormal returns. Therefore, they used the first confirmed case in each country as an event day to test for abnormal returns. Nevertheless, Alali (14) found that, after the WHO's official declaration, stock prices fell sharply compared to that of 30 days before and after the report of the first confirmed case in each country. To precisely capture the impact of stock movement on COVID-19, this study adopted the official WHO declaration of COVID-19 as a global pandemic on March 11, 2020, as an event day to test the response of global stock markets.

Measure of Returns and Hypothesis

Market Model of Abnormal Returns

ARi, t and Ri, t are the abnormal return and the real return of stock market i on day t, respectively; Rm, t is the market return of the MSCI all-country world equity index on day t, with α0 and α1 as the coefficients of the ordinary least squares (OLS) from the estimation period (−150, −1). In the stock market, the accurate event date or time of abnormal return is difficult to define; thus, a period of observation is needed to define the event date or time of abnormal return. Hence, cumulative abnormal return (CAR) is where stock market i from t0 to t1 is calculated based on Equation (2) to verify whether COVID-19 leads to negative abnormal returns:

where t1 is defined as the event days of 5, 10, 30, 60, and 180.

Universal Health Coverage Impact on Abnormal Returns

This study mainly aims to examine the relationship between UHC and abnormal returns and whether there was a positive relationship between UHC and abnormal returns during the COVID-19 outbreak. Therefore, the study expects a positive (θ1 > 0) relationship between UHC and CAR by testing Equation (3), as follows:

is the CAR during a specific period before and after the event day with N for (0, 5), (0, 15), (0, 30), (0, 60), and (0, 180). UHCi denotes that country i has UHC; Xi is defined as the control variables, such as log (gross domestic product), uncertainty avoidance index, net domestic credit divided by gross domestic product (GDP), log (population), political stability and no violence, and regulatory requirements. Log (GDP) and Credit/GDP are taken from the World Bank Open Data, and they measure the level of economic development (38). The uncertainty avoidance index is taken from the study by Hofstede et al. (39) on cross-country differences in national culture and measurement of the degree of investor uncertainty aversion.

Log (population) is taken from the World Bank Open Data and measures the size of each stock market (20). Both political stability and no violence and regulatory requirements, which also represent the quality of political safety, are taken from the World Bank's GOV Data 360 (20). These control variables jointly capture the cross-broader differences in stock market returns caused by country governance or macroeconomic differences between countries. εi is the residual.

Impact of High COVID-19 Infection Rates With UHC on Abnormal Returns

To verify the impact of high rates of COVID-19 infection on CARs, we modified the baseline regression to examine the indirect impact of UHC on abnormal returns as Equation (4) to investigate Hypothesis 3: whether the severity of COVID-19 weakens the positive impact of UHC on abnormal returns.

where TCi is the cumulative confirmed cases of stock market i from the date of diagnosis of the first patient in each country to that of the research event. Total confirmed cases are taken from the website Our World in Data, which discloses the number of fatalities and confirmed cases in all countries globally. The interaction term UHCi × TCi is a dummy variable that divides the total confirmed cases into three groups, which is lowest, medium, and largest, and then sets the highest equal to 1 and the others equal to 0. The main variable of θ3 denotes UHC reactions to abnormal returns in relation to the total number of confirmed COVID-19 cases. Thus, the expectation of the relationship between the interaction variable of θ3 and CAR is negative (θ3 < 0).

Empirical Results

Description of Samples

Table 2 presents the descriptive statistics of the stock market index variables for all the sample countries. This study analyzed a sample of 68 countries. The mean variable of stock market indices is either 0.00 or −0.00, which indicates that all sample countries had zero present returns in stock markets, which is consistent with the random walk property of stock market returns (19). In addition, the minimum and maximum values of all 68 countries ranged from −0.21 to 0.15, which indicates that all sample returns were from −21 to 15% during the COVID-19 outbreak. Among these, Argentina, Italy, and Brazil had the lowest stock returns of −0.21, −0.16, and −0.18, respectively.

Results of Abnormal Returns and the COVID-19 Outbreak

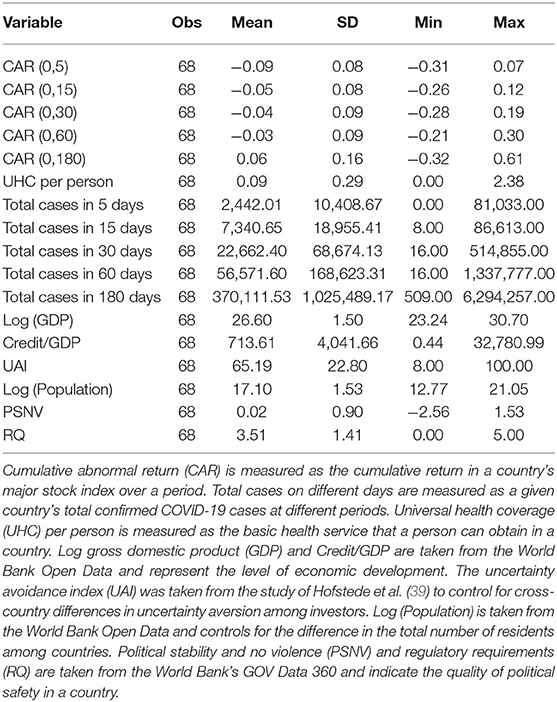

Table 3 reports the summary CARs statistics over 5, 15, 30, and 60 days during the COVID-19 outbreak. Among these, the mean of CAR (0, 5), CAR (0, 15), CAR (0, 30), and CAR (0, 60) were all negative (−0.09, −0.05, −0.04, −0.03) during the outbreak. The evidence shows that the impact of a sudden disease outbreak is longer for a period and also gives investors a negative sign in terms of investment. However, a half year after the coronavirus outbreak, the stock market began to recover by itself where the mean of CAR (0,180) became positive at 0.09.

The standard deviation values of CAR (0, 5), CAR (0, 15), CAR (0, 30), CAR (0, 60), and CAR (0,180) were 0.08, 0.08, 0.09, 0.09, and 0.16, respectively, where CARs (0, 180) had the highest fluctuation between positive and negative abnormal returns. The minimum and maximum values of abnormal returns were −0.32 and 0.61, showing that CARs ranged from −32 to 61% and that negative CARs will return to normal within half a year after the COVID-19 outbreak.

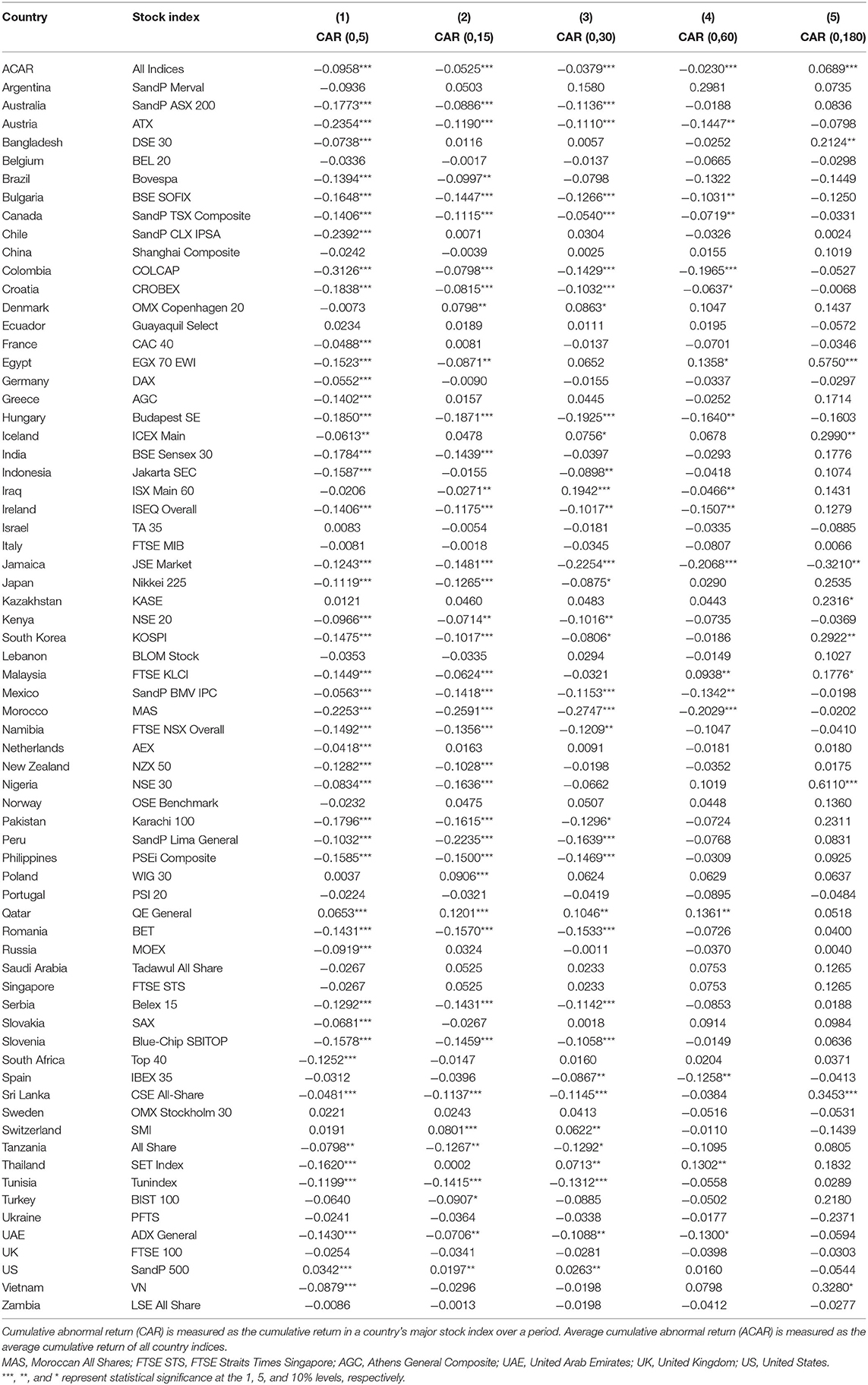

Table 4 illustrates the CAR results of the global stock market indices measured in different event windows. It also indicates that most CARs are significantly negative in the short term and insignificant in the long term, highlighting that COVID-19 generates negative CARs, supporting Hypothesis 1 in this study. The study results are consistent with the findings of previous studies that stock markets respond negatively to COVID-19 outbreaks because the spread of the virus encourages social distancing, causing the shutdown of financial markets. Furthermore, the high uncertainty regarding the degree of severity of the outbreak could lead to a flight to safety among investors (13, 14, 40, 41).

In addition, the result of CAR (0, 60) in Table 4 verifies that the stock market recovery time is six months after the spread of COVID-19. The results appear to be the same in Bangladesh (coefficient = 0.2124; p < 0.05), Egypt (coefficient = 0.5750; p < 0.01), Iceland (coefficient = 0.2990; p < 0.05), South Korea (coefficient = 0.2922; p < 0.05), and Nigeria (coefficient = 0.6110; p < 0.01), where their CARs are all significant and positive. However, the Jamaican market shows the opposite result of CAR (0, 180), which is negative and significant (coefficient = −0.321; p < 0.05). As the Jamaican healthcare system has worsened during the COVID-19 outbreak, the government has adopted a stricter lockdown policy to prevent its spread (42, 43).

A few countries had no significant CARs during our selected data period, including Argentina (S&P Merval), Belgium (BEL 20), China (Shanghai Composite), Ecuador (Guayaquil Select), Israel (TA 35), Italy (FTSE MIB), Lebanon (BLOM Stock), Norway (OSE Benchmark), Portugal (WIG 30), Saudi Arabia (Tadawul All Share), Singapore (FTSE STS), Sweden (OMX Stockholm 30), Ukraine (PFTS), and the United Kingdom (FTSE 100). Consistent with the study by Ashraf (19), there were 14 countries in our sample that had been affected by COVID-19 before the event day of March 11, 2020. Therefore, CARs were not significant in these countries.

To test whether the spread of COVID-19 had negative abnormal returns in global stock markets, this study took the average CARs and examined whether COVID-19 led to negative abnormal returns in market indices. Our empirical results showed that COVID-19 generated negative returns for half a year after the outbreak, verifying Hypothesis 1.

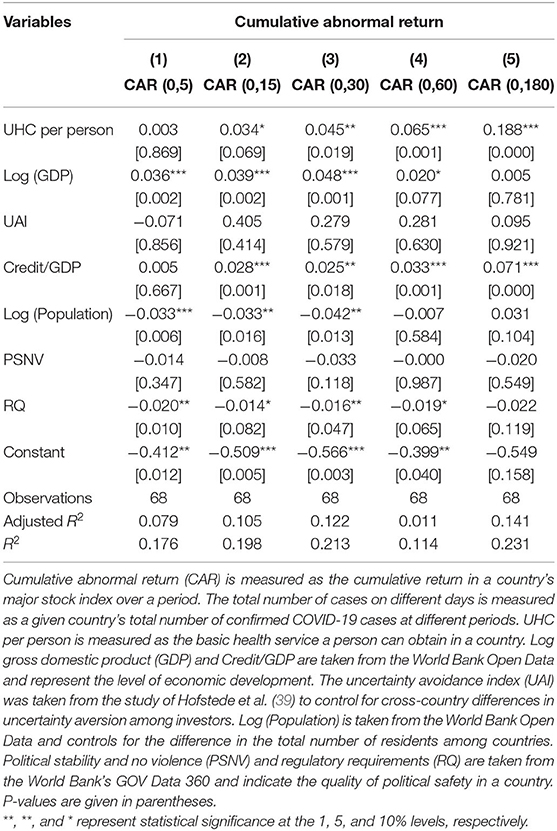

Results of the Relationship Between UHC and CARs

Table 5 reports the estimation result of Equation (3) regarding the relationship between CARs and UHC. We expected a positive and significant relationship between UHC and CARs. As shown in Table 5, the UHC per person variable was positive and significant at CAR (0, 15) (coefficient = 0.034; p < 0.1), CAR (0, 30) (coefficient = 0.045; p < 0.05), CAR (0, 60) (coefficient = 0.065; p < 0.01), and CAR (0,180) (coefficient = 0.188; p < 0.01). The exception was CAR (0, 5), which was longer than the previous period. The results have proven that CAR is positively correlated with a person who has access to adequate basic health care, consistent with Hypothesis 2. While CAR (0, 5) is not significant, the other four periods are significant and positive in relation to UHC. The empirical evidence shows that the UHC healthcare system is effective in its impact on sudden disease outbreaks in a country.

McKibbin and Fernando (30) indicated that countries that invest more in the public health system could reduce the negative impact of COVID-19, especially in countries with insufficient public health systems and high population density. Table 5 also shows that CARs react positively to the health system during an epidemic. The health system is a protective influence for a country in its fight against the virus and usually shows its effectiveness several days after an outbreak.

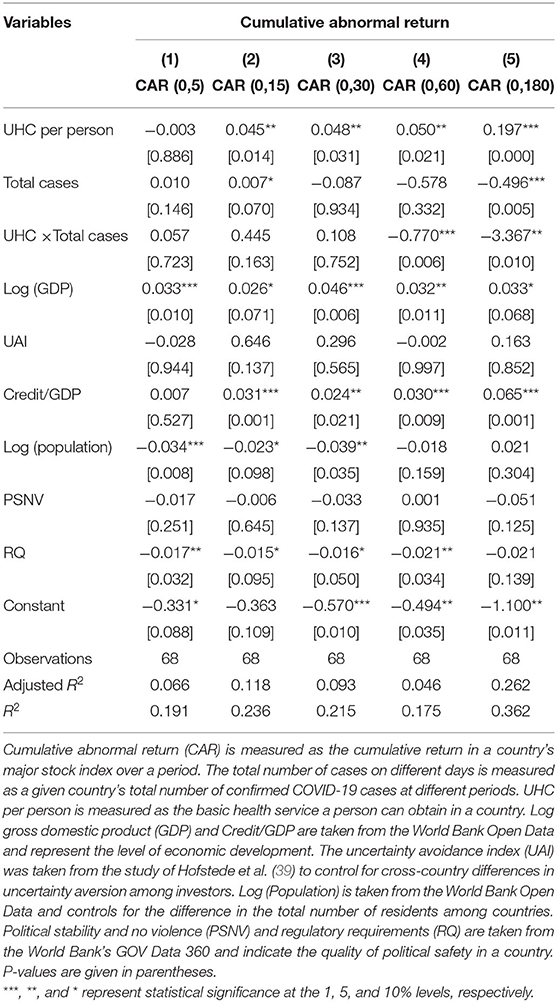

Results of Confirmed Cases and CARs During the COVID-19 Outbreak

Table 6 presents the total confirmed cases and the interaction variable of UHC × total cases, along with other control variables, to test the moderating effects of high rates of COVID-19 infection and its connection with CARs and UHC. In this study, the total number of cases in a country is used as a proxy to denote high- and low-infected countries. The regression results in the interaction term of UHC × total cases had a negative and significant effect on CAR (0, 60) (coefficient = −0.770; p < 0.01) and CAR (0, 180) (coefficient = −3.367; p < 0.05). The results indicate that the positive impact of health coverage on CAR diminishes as the number of cases diagnosed in a country increases. The negative and significant coefficient on the interaction variable of UHC × Total cases also confirms Hypothesis 3 that the high number of diagnoses of COVID-19 may affect the impact of UHC on abnormal returns. The empirical evidence is consistent with that of Baker and Wurgler (44), Chen et al. (45), Yu and Yuan (46), and Narayan (47). They conclude that high numbers of confirmed cases will have a negative impact on markets because the increased number of cases overwhelms the primary UHC healthcare system, unevenly distributing its resources and eventually affecting the stock market in the long term.

Conclusion

To the best of our knowledge, this is the first study that adopted the healthcare system to evaluate its effect during the COVID-19 outbreak on the stock market. The ongoing COVID-19 pandemic has attracted attention in every country with regard to its impact on people's daily lives. The UHC healthcare system enables everyone to avoid risk exposure, including prevention and treatment in the COVID-19 crisis period. In particular, a significant shock in the stock market is often triggered by an event that significantly reduces trust in investors in a security market because major global events or crises have impacted the global economy and financial markets (48). Our findings addressed the important points of the correlation between healthcare system and stock prices' movement by showing how a country's UHC responds to a sudden disease outbreak through abnormal returns and makes it more susceptible to citations from the academic literature.

The empirical results of this study reveal that each country's stock index had significantly negative abnormal returns in the short term but not in the long term. Thus, the CAR reacted significantly at the beginning of the pandemic. This is because people may lose confidence or panic because of the shock of the sudden outbreak of a pandemic, incurring negative investor sentiment in the stock market. However, once the UHC is working optimally, the negative reaction to the stock market will disappear in the long term. We also examined the direct and indirect impact of health coverage on CARs during the pandemic. To this end, we ran an OLS regression to calculate the correlation between UHC and CARs on the event days of 5, 10, 30, 60, and 180. The results showed that the effectiveness of UHC remained positive and strongly significant after a period of the COVID-19 outbreak. Nevertheless, the impact was reversed in countries with a higher number of confirmed cases. In reality, when the healthcare system can no longer fulfill the needs of society or individuals to maintain their daily life, chaos and panic ensue due to insufficient or limited resources.

The findings of this study provide several perspectives on financial markets. CARs emerge at the early stages of the pandemic, signifying that the strategy of investment as a sudden reaction to the outbreak is normally at the beginning of the pandemic and that a well-organized UHC system is a key factor in avoiding the risk of damage to stock markets as a result of a sudden outbreak. Further, the results also show that UHC can gradually reduce CARs in the long term, whereas the COVID-19 outbreak has a negative impact on stock markets in the short term.

Although our analysis reveals some important insights into the correlation of UHC and abnormal returns in a short-term response during a pandemic disease, it disregards the effects of lockdown, vaccination coverage in a population, its connection with stock markets in a long-term reaction, and the impact on socio-economics as well. This limitation can be addressed in future studies to assess various measures used to limit the spread of COVID-19, and relieve the pressure on health care systems, travel, consumption and investment, and logistics, causing so-called socio-economic impacts at the market.

Data Availability Statement

The original contributions presented in the study are included in the article/supplementary material, further inquiries can be directed to the corresponding author.

Author Contributions

C-HT contribution is reflected in the choice of specialized literature, the definition of research hypotheses, investigation, writing-original draft preparation, visualization, and editing. Y-HL contribution is reflected in the definition of the sample, testing of hypotheses, statistical data processing, resources, and discussion. WL contribution is reflected in the data collection, formal analysis, and conclusions. LW helps to organize the literature review. Y-HL and WL contributed in interpretation of results. All authors have read and agreed to the published version of the manuscript.

Funding

The authors acknowledge this study was supported by Guangxi First Class Discipline-the Statistics construction project fund. This study was also supported by the Center of Econometric Application in Accounting and Finance.

Conflict of Interest

The authors declare that the research was conducted in the absence of any commercial or financial relationships that could be construed as a potential conflict of interest.

Publisher's Note

All claims expressed in this article are solely those of the authors and do not necessarily represent those of their affiliated organizations, or those of the publisher, the editors and the reviewers. Any product that may be evaluated in this article, or claim that may be made by its manufacturer, is not guaranteed or endorsed by the publisher.

Footnotes

1. ^This study did not include indices from countries whose data were not fully available or whose data were not completely publicly available (e.g., a country that is not a member of the WHO, such as Taiwan, Bahrain, Uganda, etc.).

2. ^Universal Health Coverage Index encompasses two values: SDG indicator 3.8.1 and SDG indicator 3.8.2. However, WHO (2) only gave the formula for the first indicator; therefore, the calculation of UHC was not revealed entirely.

References

1. World Health Organization. Weekly epidemiological update on COVID-19 10 August 2021. (2021). Available online at: https://www.who.int/publications/m/item/weekly-epidemiological-update-on-covid-19-−10-august-2021 (accessed September 14, 2021).

2. World Health Organization. Primary Health Care on the Road to Universal Health Coverage. (2019). Available online at: https://www.who.int/healthinfo/universal_health_coverage/report/2019/en/ (accessed march 20, 2021).

3. Goodell JW, Huynh TLD. Did congress trade ahead? Considering the reaction of US industries to COVID-19. Finance Res Lett. (2020) 36:101578. doi: 10.1016/j.frl.2020.101578

4. Shahzad SJH, Bouri E, Kristoufek L, Saeed T. Impact of the COVID-19 outbreak on the US equity sectors: evidence from quantile return spillovers. Financ Innov. (2021) 7:14. doi: 10.1186/s40854-021-00228-2

5. Wagner AF, Zeckhauser RJ, Ziegler A. Company stock price reactions to the 2016 election shock: trump, taxes, and trade. J Financ Econ. (2018) 130:428–51. doi: 10.1016/j.jfineco.2018.06.013

6. Brounen D, Derwall J. The impact of terrorist attacks on international stock markets. Eur Financial Manage. (2010) 16:585–98. doi: 10.1111/j.1468-036X.2009.00502.x

7. Park M, Jin Y, Bessler D. The impacts of animal disease crises on the korean meat market. Agric Econ. (2008) 39:183–95. doi: 10.1111/j.1574-0862.2008.00325.x

8. Chen MH, Jang S, Kim WG. The impact of the SARS outbreak on Taiwanese hotel stock performance: an event-study approach. Int J Hosp Manag. (2007) 26:200–12. doi: 10.1016/j.ijhm.2005.11.004

9. Ichev R, Marinč M. Stock prices and geographic proximity of information: evidence from the ebola outbreak. Int Rev Financial Anal. (2018) 56:156–66. doi: 10.1016/j.irfa.2017.12.004

10. He P, Sun Y, Zhang Y, Li T. COVID-19's impact on stock prices across different sectors—an event study based on the Chinese stock market. Emerg Mark Finance Trade. (2020) 56:2198–212. doi: 10.1080/1540496X.2020.1785865

11. Alam MM, Wei H, Wahid AN. COVID-19 outbreak and sectoral performance of the australian stock market: an event study analysis. Aust Econ Pap. (2020) 60:482–95. doi: 10.1111/1467-8454.12215

12. Mazur M, Dang M, Vega M. COVID-19 and the March 2020 stock market crash. Evidence from SandP1500. Finan Res Lett. (2021) 38:101690. doi: 10.1016/j.frl.2020.101690

13. Liu HY, Manzoor A, Wang CY, Zhang L, Manzoor Z. The COVID-19 outbreak and affected countries stock markets response. Int J Environ Res Public Health. (2020) 17:2800. doi: 10.3390/ijerph17082800

14. Alali MS. Risk velocity and financial markets performance:measuring the early effect of COVID-19 pandemic on major stock markets performance. Int J Econ Financial Res. (2020) 6:76–81. doi: 10.32861/ijefr.64.76.81

15. Singh B, Dhall R, Narang S, Rawat S. The outbreak of COVID-19 and stock market responses: an event study and panel data analysis for G-20 countries. Glob Bus Rev. (2020) 1:1–26. doi: 10.1177/0972150920957274

16. Dongarwar D, Salihu H. COVID-19 pandemic: marked global disparities in fatalities according to geographic location and universal health care. Int J Matern Child Health AIDS. (2020) 9:213–6. doi: 10.21106/ijma.389

17. Apergis N, Apergis E. The role of COVID-19 for Chinese stock returns: evidence from a GARCHX model. Asia-Pac J Account Econ. (2020) 27:1–9. doi: 10.1080/16081625.2020.1816185

18. Song HJ, Yeon J, Lee S. Impact of the COVID-19 pandemic: evidence from the U.S. restaurant industry. Int J Hosp Manag. (2021) 92:102702. doi: 10.1016/j.ijhm.2020.102702

19. Ashraf BN. Stock markets' reaction to COVID-19: cases or fatalities? Res Int Bus Finance. (2020) 54:101249. doi: 10.1016/j.ribaf.2020.101249

20. Khan K, Zhao H, Zhang H, Yang H, Shah MH, Jahanger A. The impact of COVID-19 pandemic on stock markets: an empirical analysis of world major stock indices. J Asian Finance Econ Bus. (2020) 7:436–74. doi: 10.13106/jafeb.2020.vol7.no7.463

21. Forbes. The COVID-19 Coronavirus Disease May Be Twice As Contagious As We Thought. (2020). Available online at: https://www.forbes.com/sites/tarahaelle/2020/04/07/the-covid19-coronavirus-disease-may-be-twice-as-contagious-as-we-thought/?sh=67fa11cf29a6 (accessed April 1, 2021).

22. Abuzayed B, Bouri E, Al-Fayoumi N, Jalkh N. Systemic risk spillover across global and country stock markets during the COVID-19 pandemic. Econ Anal Policy. (2021) 71:180–97. doi: 10.1016/j.eap.2021.04.010

23. Gupta R, Subramaniam S, Bouri E, Ji Q. Infectious diseases-related uncertainty and the safe-haven characteristic of the US treasury securities. Int Rev Econ Finance. (2021) 71:289–98. doi: 10.1016/j.iref.2020.09.019

24. Heyden KJ, Heyden T. Market reactions to the arrival and containment of Covid-19: an event study. Finance Res Lett. (2020) 38:101745. doi: 10.1016/j.frl.2020.101745

25. Bash A. International evidence of COIVD-19 and stock market returns: an event study analysis. Int J Econ Financial Issues. (2020) 10:34–8. doi: 10.32479/ijefi.9941

26. Pandey DK, Kumari V. Event study on the reaction of the developed and emerging stock markets to the 2019-nCoV outbreak. Int Rev Econ Finance. (2021) 71:467–83. doi: 10.1016/j.iref.2020.09.014

27. Bouri E, Cepri O, Gabauer D, Gupta R. Return connectedness across asset classes around the COVID-19 outbreak. Int Rev Financial Anal. (2021) 73:101646. doi: 10.1016/j.irfa.2020.101646

28. Djilali S, Bentout S, Kumar S, Touaoula TM. Approximating the asymptomatic infectious cases of the COVID-19 disease in Algeria, and India using a mathematical model. Int J Model Simul Sci Comput. (2021) 2250028. doi: 10.1142/S1793962322500283. [Epub ahead of print].

29. Benjamin GC. Ensuring health equity during the COVID-19 pandemic: the role of public health. Infrastructure. (2020) 44:1–4. doi: 10.26633/RPSP.2020.70

30. McKibbin W, Fernando R. The global macroeconomic impacts of COVID-19: seven scenarios. Asian Econ Pap. (2021) 20:1–30. doi: 10.1162/asep_a_00796

31. Banik A, Nag T, Chowdhury SR, Chatterjee R. Why do COVID-19 fatality rates differ across countries? An explorative cross-country study based on selected indicators. Global Bus Rev. (2020) 21:607–25. doi: 10.1177/0972150920929897

32. Bentout S, Tridane A, Djilali S, Touaoula TM. Age-structured modeling of COVID-19 epidemic in the USA, UAE and algeria. Alex Eng J. (2021) 60:401–11. doi: 10.1016/j.aej.2020.08.053

33. Saif-Alyousfi AYH. The impact of COVID-19 and the stringency of government policy responses on stock market returns worldwide. J Chin Econ Foreign Trade Stud. (2022) 15:87–105. doi: 10.1108/JCEFTS-07-2021-0030

34. Bentout S, Chekroun A, Kuniya T. Parameter estimation and prediction for coronavirus disease outbreak 2019 (Covid-19) in Algeria. AIMS Public Health. (2020) 7:306–18. doi: 10.3934/publichealth.2020026

35. Bouri E, Naeem MA, Nor SM, Mbarki I, Saeed T. Government responses to COVID19 and industry stock returns. Econ Res Ekon IstraŽ. (2021). doi: 10.1080/1331677X.2021.1929374

36. Ritter JR. The long-run performance of initial public offerings. J Finance. (1991) 47:3–27. doi: 10.1111/j.1540-6261.1991.tb03743.x

37. Spiess DK, Affleck-Graves J. Underperformance in long-run stock returns following seasoned equity offerings. J Financ Econ. (1995) 38:243–67. doi: 10.1016/0304-405X(94)00817-K

38. Desai H, Jain PC. Long-run common stock returns following stock splits and reverse splits. J Bus. (1997) 70:409–33. doi: 10.1086/209724

39. Cao JX, Cumming D, Qian M, Wang X. Cross-Border LBOs. J Bank Finance. (2015) 50:69–80. doi: 10.1016/j.jbankfin.2014.08.027

40. Hofstede G, Hofstede GJ, Minkov M. Cultures and Organizations: Software of the Mind. New York, NY: McGraw-Hill (2010).

41. Ozili PK, Arun T. Spillover of COVID-19: impact on the global economy. SSRN Electron J. (2020) 84:155–166. doi: 10.2139/ssrn.3562570

42. Al-Awadhi AM, Alsaifi K, Al-Awadhi A, Alhammadi S. Death and contagious infectious diseases: impact of the COVID-19 virus on stock market returns. J Behav Exp Finance. (2020) 27:100326. doi: 10.1016/j.jbef.2020.100326

43. Tsobo L. Market wrap: JSE muted as COVID-19 thitd wave weighs on sentiment. (2021). BusinessLIVE. Available online at: https://www.businesslive.co.za/bd/markets/2021-06-25-market-wrap-jse-muted-as-covid-19-third-wave-weighs-on-sentiment/ (accessed march 21, 2021).

44. Changole A. South Africa Stocks Flat as Rising COVID-19 Cases, Lockdowns Weigh. Bloomberg (2021). Available online at: https://www.bloomberg.com/news/articles/2021-06-28/s-africa-stocks-flat-as-rising-covid-19-cases-lockdowns-weigh

45. Baker M, Wurgler J. Investor sentiment and the cross-section of stock returns. J Finance. (2006) 61:1645–80. doi: 10.1111/j.1540-6261.2006.00885.x

46. Chen C, Liu L, Zhao N. Fear sentiment, uncertainty, and bitcion price dynamics: the case of COVID-19. Emerg Mark Finance Trade. (2020) 56:2298–309. doi: 10.1080/1540496X.2020.1787150

47. Yu J, Yuan Y. Investor sentiment and the mean-variance relation. J Financ Econ. (2011) 100:367–81. doi: 10.1016/j.jfineco.2010.10.011

Keywords: coronavirus disease (COVID-19), abnormal return, universal health coverage, total confirmed cases, global stock market

Citation: Tang C-H, Lee Y-H, Liu W and Wei L (2022) Effect of the Universal Health Coverage Healthcare System on Stock Returns During COVID-19: Evidence From Global Stock Indices. Front. Public Health 10:919379. doi: 10.3389/fpubh.2022.919379

Received: 13 April 2022; Accepted: 27 May 2022;

Published: 12 July 2022.

Edited by:

Salih Djilali, University of Chlef, AlgeriaReviewed by:

Soufiane Bentout, Centre Universitaire Ain Temouchent, AlgeriaElie Bouri, Lebanese American University, Lebanon

Copyright © 2022 Tang, Lee, Liu and Wei. This is an open-access article distributed under the terms of the Creative Commons Attribution License (CC BY). The use, distribution or reproduction in other forums is permitted, provided the original author(s) and the copyright owner(s) are credited and that the original publication in this journal is cited, in accordance with accepted academic practice. No use, distribution or reproduction is permitted which does not comply with these terms.

*Correspondence: Chia-Hsien Tang, MjAxOTEyMDAxNEBneHVmZS5lZHUuY24=; Yen-Hsien Lee, eWhAY3ljdS5lZHUudHc=

Chia-Hsien Tang

Chia-Hsien Tang Yen-Hsien Lee

Yen-Hsien Lee Win Liu2

Win Liu2